Why This $5 Billion India Commitment Actually Matters

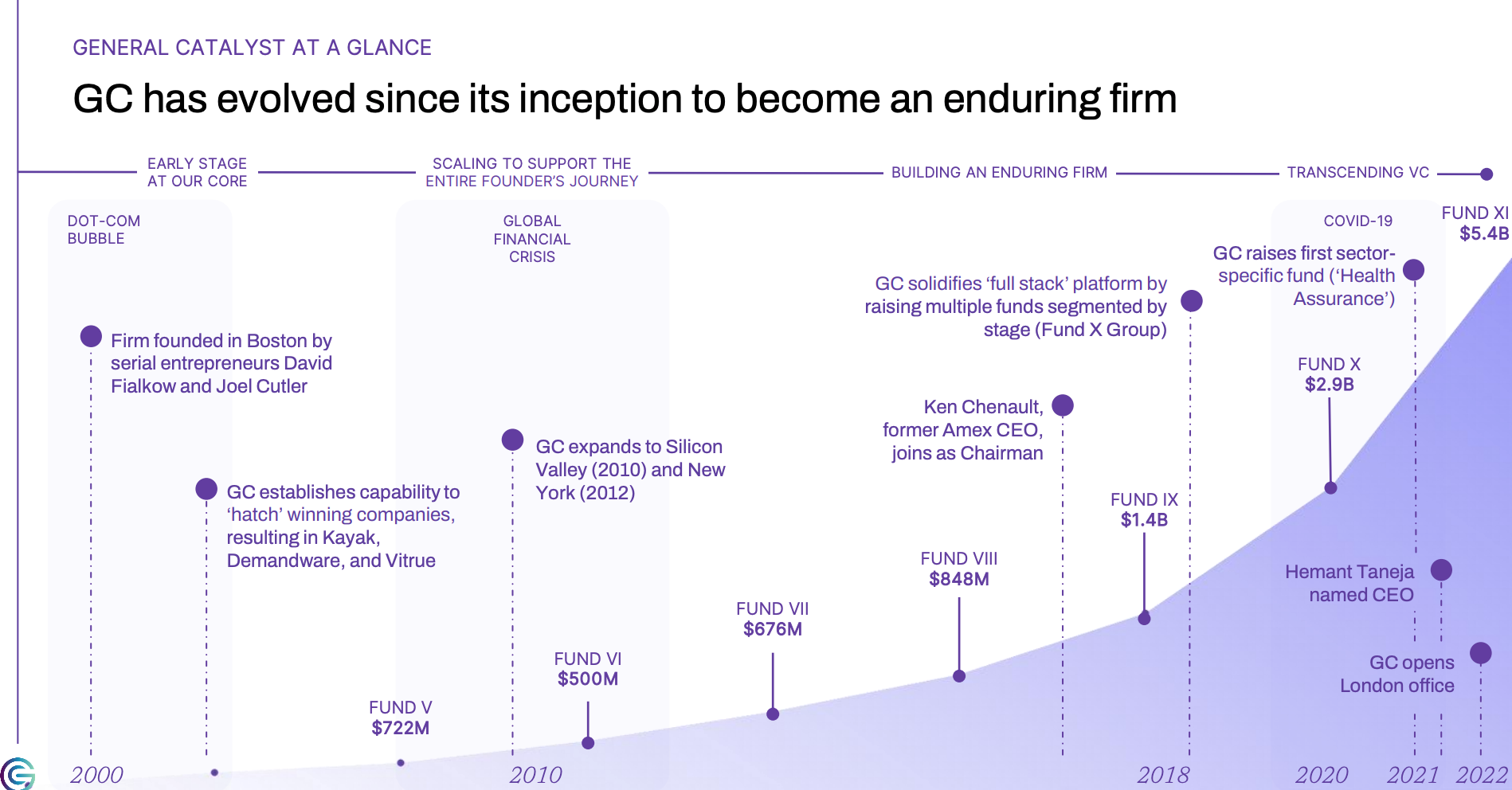

Here's something that caught my attention: General Catalyst just quadrupled its India bet.

The Silicon Valley venture firm went from earmarking

But here's the thing that actually matters more than the headline number: this isn't just about throwing money at Indian startups. It's about repositioning how global capital views India's role in the AI revolution.

When General Catalyst announced this commitment at the India AI Impact Summit in New Delhi, they weren't standing alone. Adani Group and Reliance Industries announced combined plans to invest over $200 billion in AI data center infrastructure. OpenAI partnered with Tata Group's TCS on a 100-megawatt AI data center. Amazon, Google, and Microsoft all outlined tens of billions in cloud and AI investments.

What we're witnessing is the moment when India stopped being seen as an outsourcing destination and started being seen as an infrastructure and AI deployment powerhouse. And that shift has massive implications, not just for Indian founders but for anyone building in the global tech space.

Let me walk you through what's actually happening here, why it matters, and what comes next.

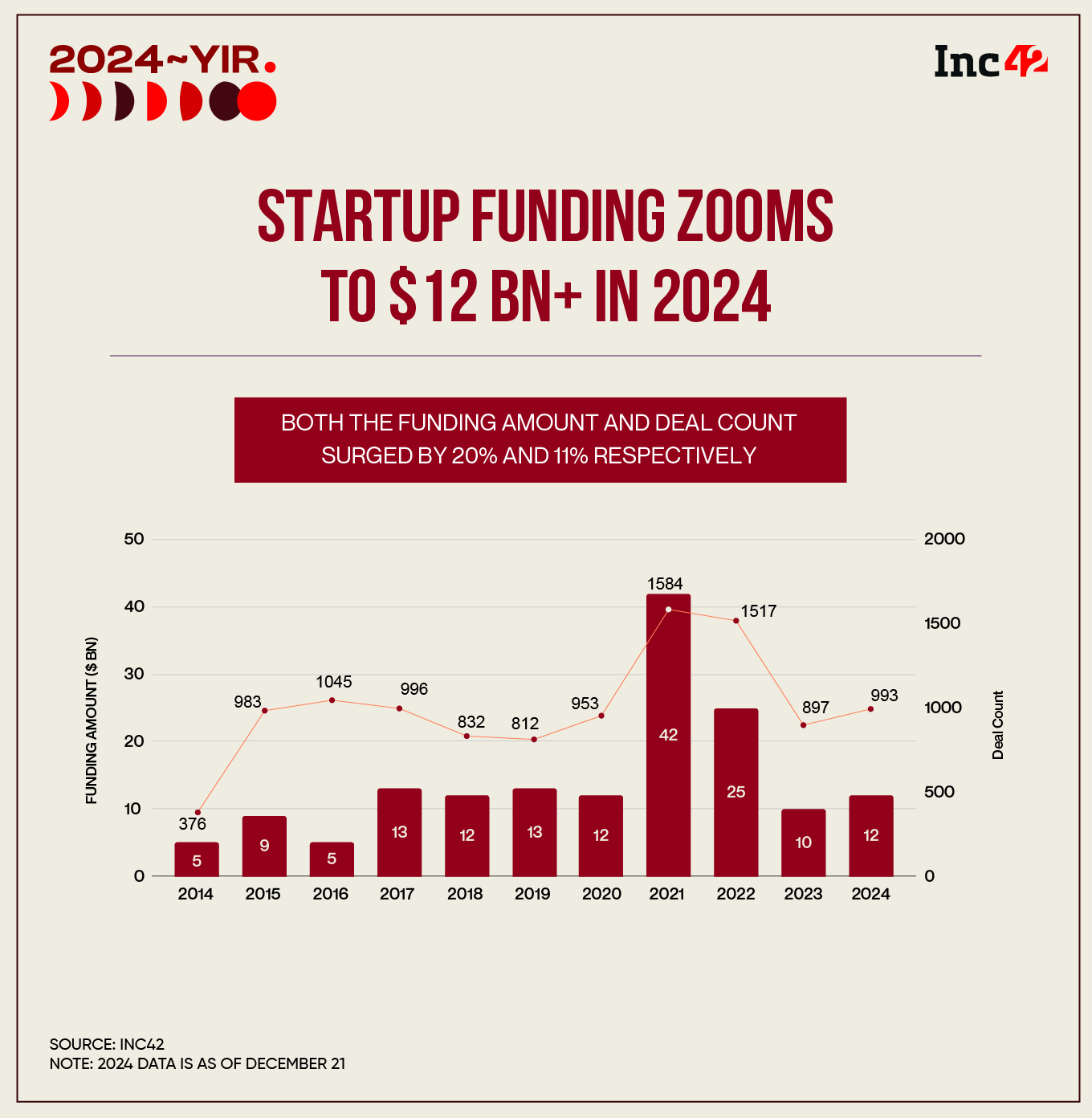

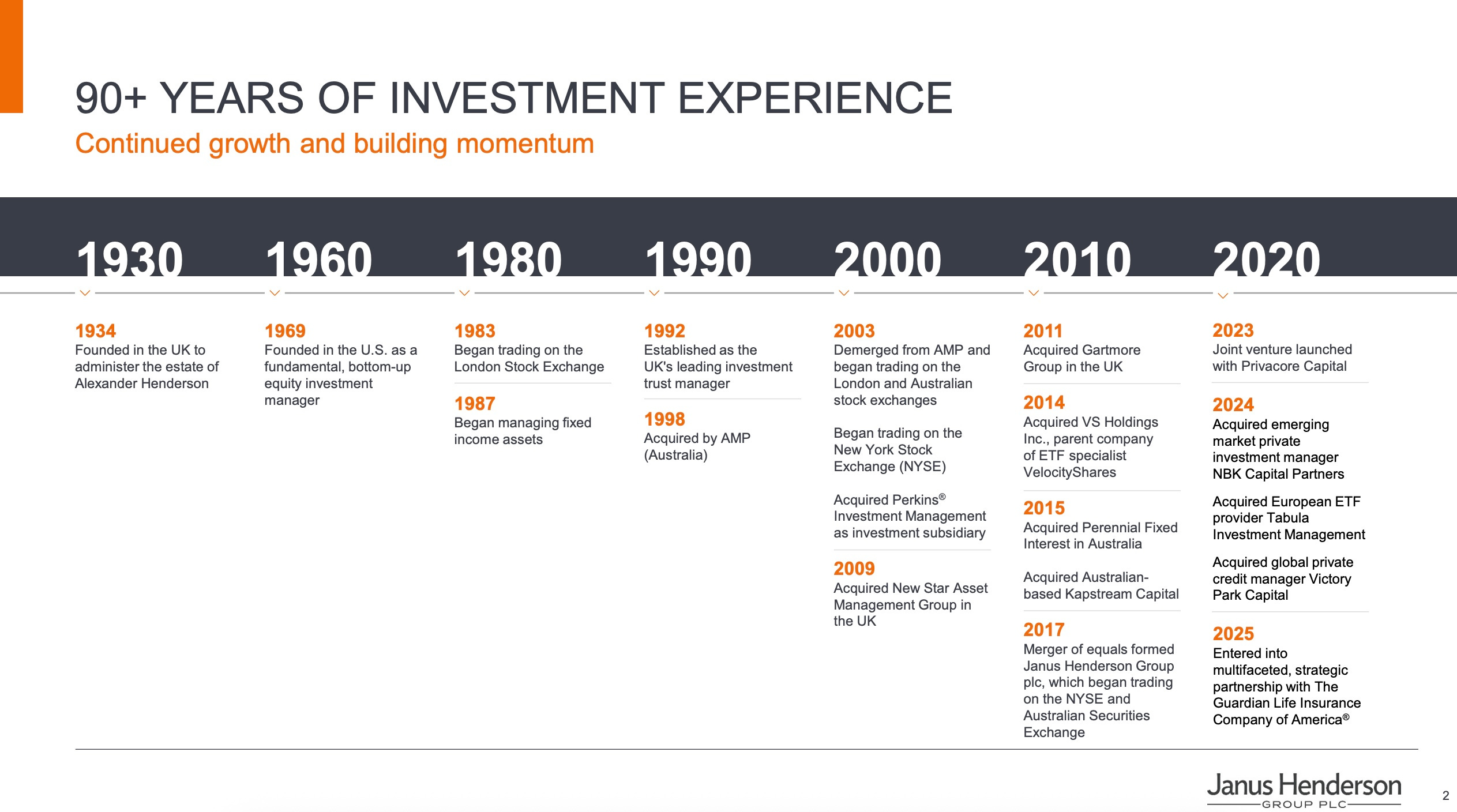

The Numbers Behind the Commitment

Let's start with the math, because the scale here is genuinely significant.

To put this in perspective, consider that early in their India push, General Catalyst merged with Venture Highway, a local venture firm. That wasn't just an acquisition. It was an admission that they couldn't build deep market knowledge fast enough without local expertise. Now they're backing that bet with unprecedented capital.

The fund currently manages

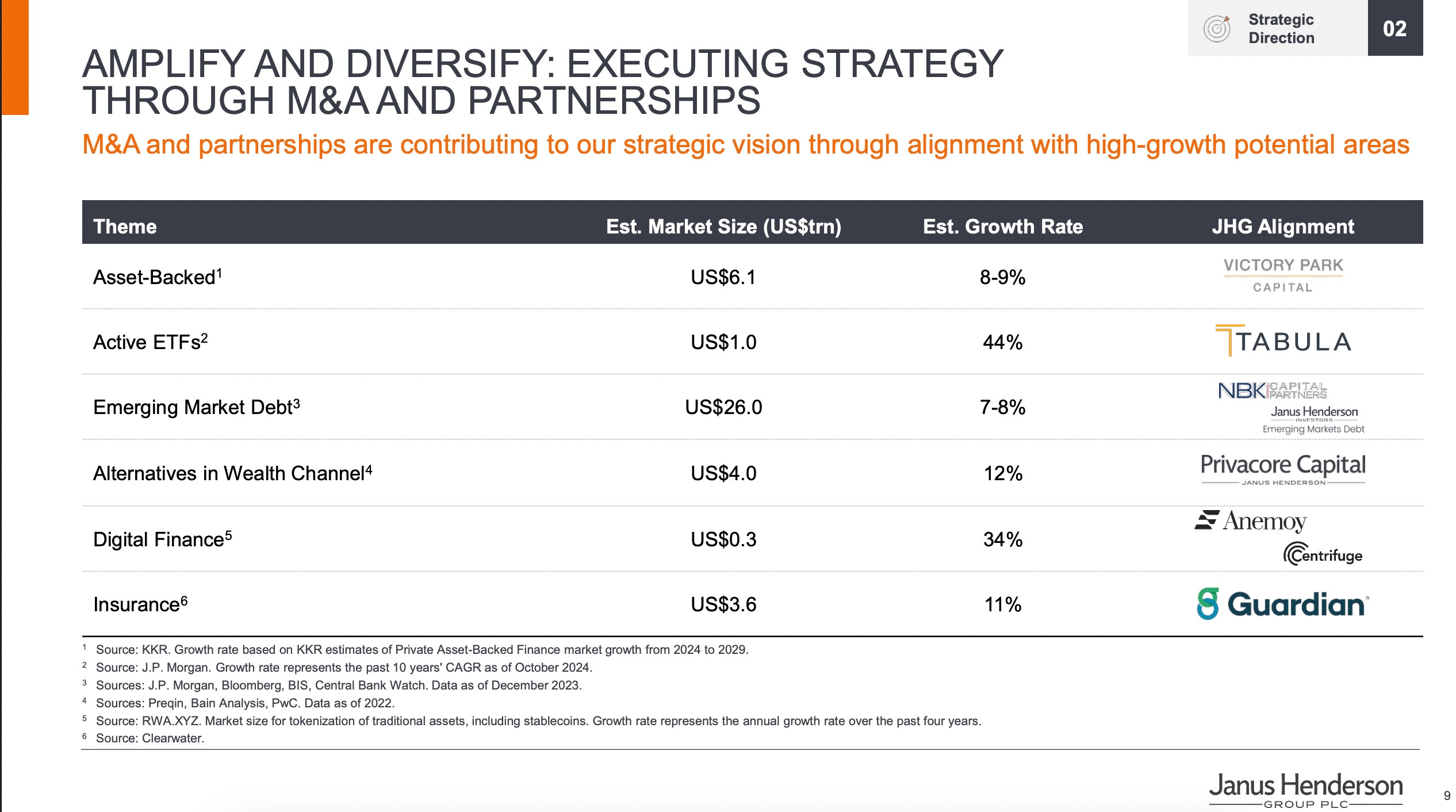

But here's where it gets more interesting. General Catalyst isn't deploying this capital randomly. They're targeting specific sectors where they believe India has structural advantages:

- Artificial Intelligence: Not just for India consumption, but for building AI infrastructure and deployment at scale

- Healthcare Technology: Serving a population of 1.4 billion with fragmented healthcare access

- Defense Technology: Supporting India's modernization initiatives

- Financial Technology: Building payment, lending, and insurance infrastructure for underbanked populations

- Consumer Technology: Companies serving the 850+ million internet users in India

Their existing portfolio tells the story. They've invested in Zepto (fast delivery), PB Health (healthcare), Raphe (defense tech), Jeh Aerospace (aerospace), Pronto (logistics), and Ayr Energy (renewable energy). These aren't moonshot bets. They're fundamental infrastructure plays.

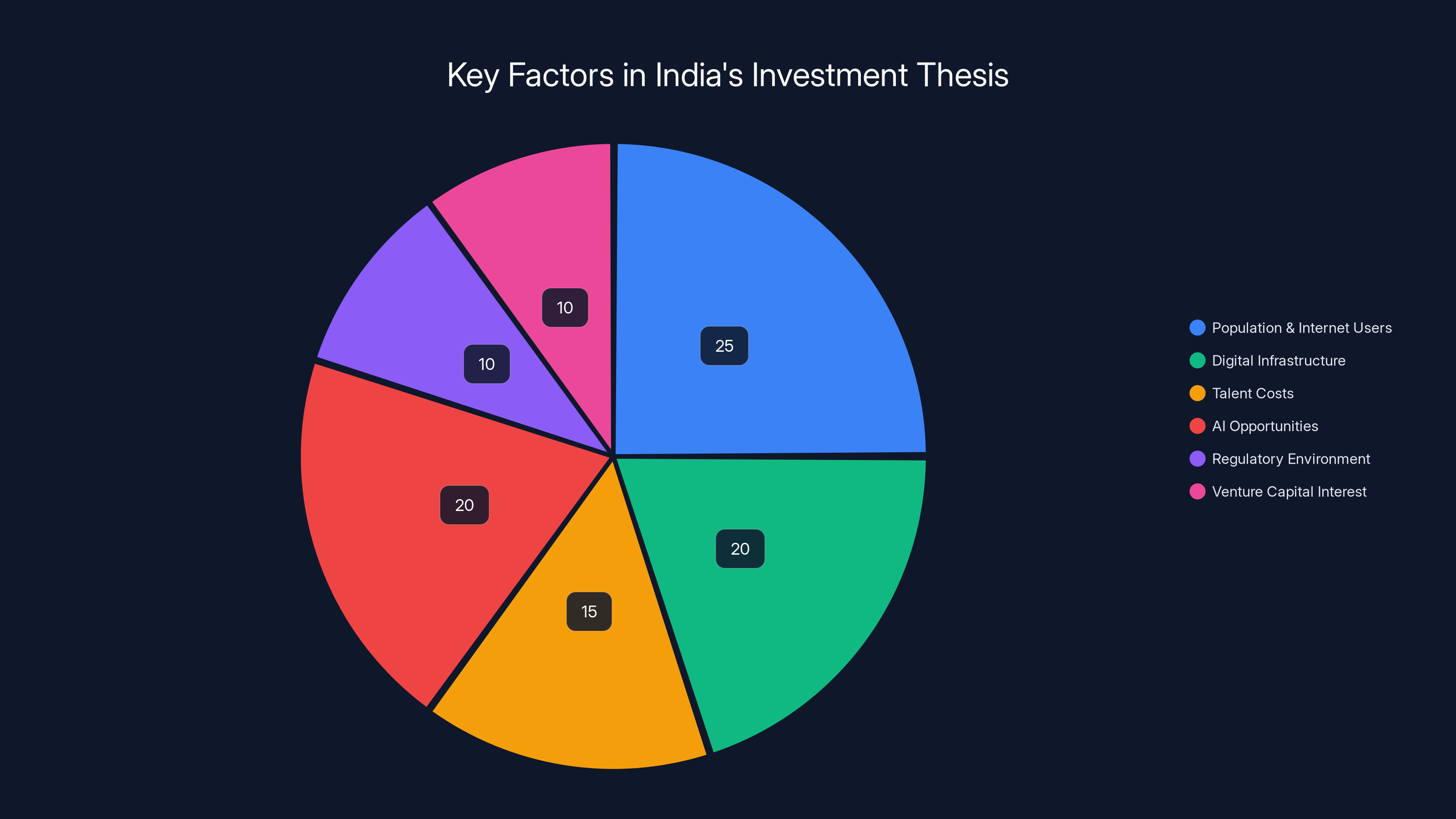

General Catalyst's $5 billion commitment to India is estimated to be distributed across key sectors, with the largest share going to Artificial Intelligence and Financial Technology. Estimated data.

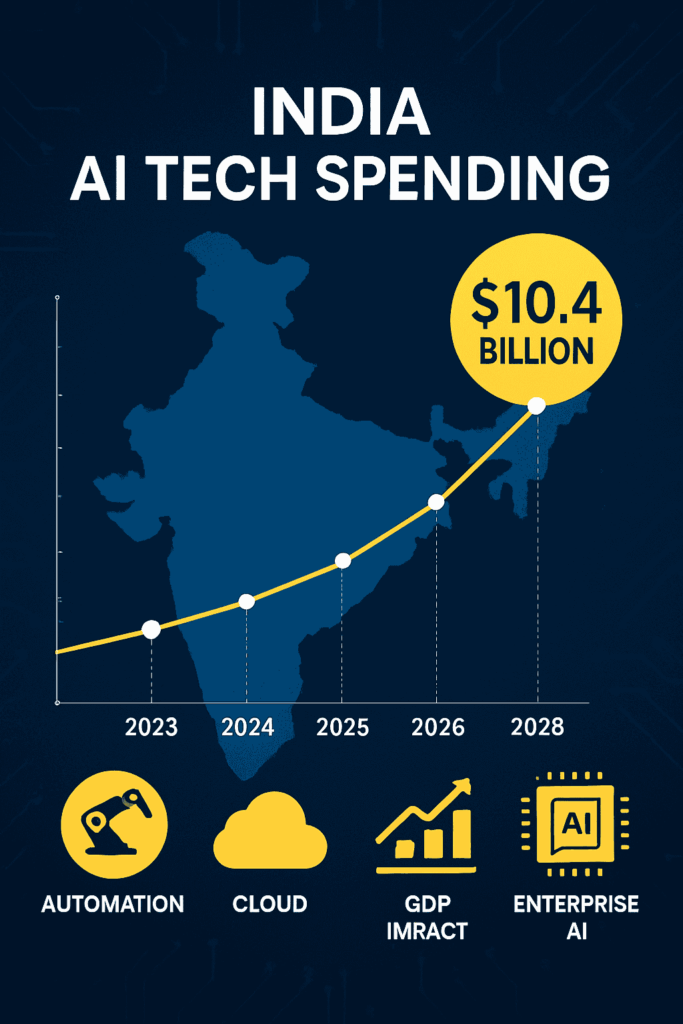

India's AI Infrastructure Moment

Here's what most people miss about India's AI ambitions: they're not trying to build frontier AI models like Chat GPT or Claude.

They're trying something arguably harder. They're trying to build the infrastructure and deployment capabilities to run AI at scale for a population of 1.4 billion people.

General Catalyst CEO Hemant Taneja was explicit about this: "India will build the next generation of global platform companies." The firm sees India's biggest AI opportunity in large-scale real-world deployment rather than frontier model development.

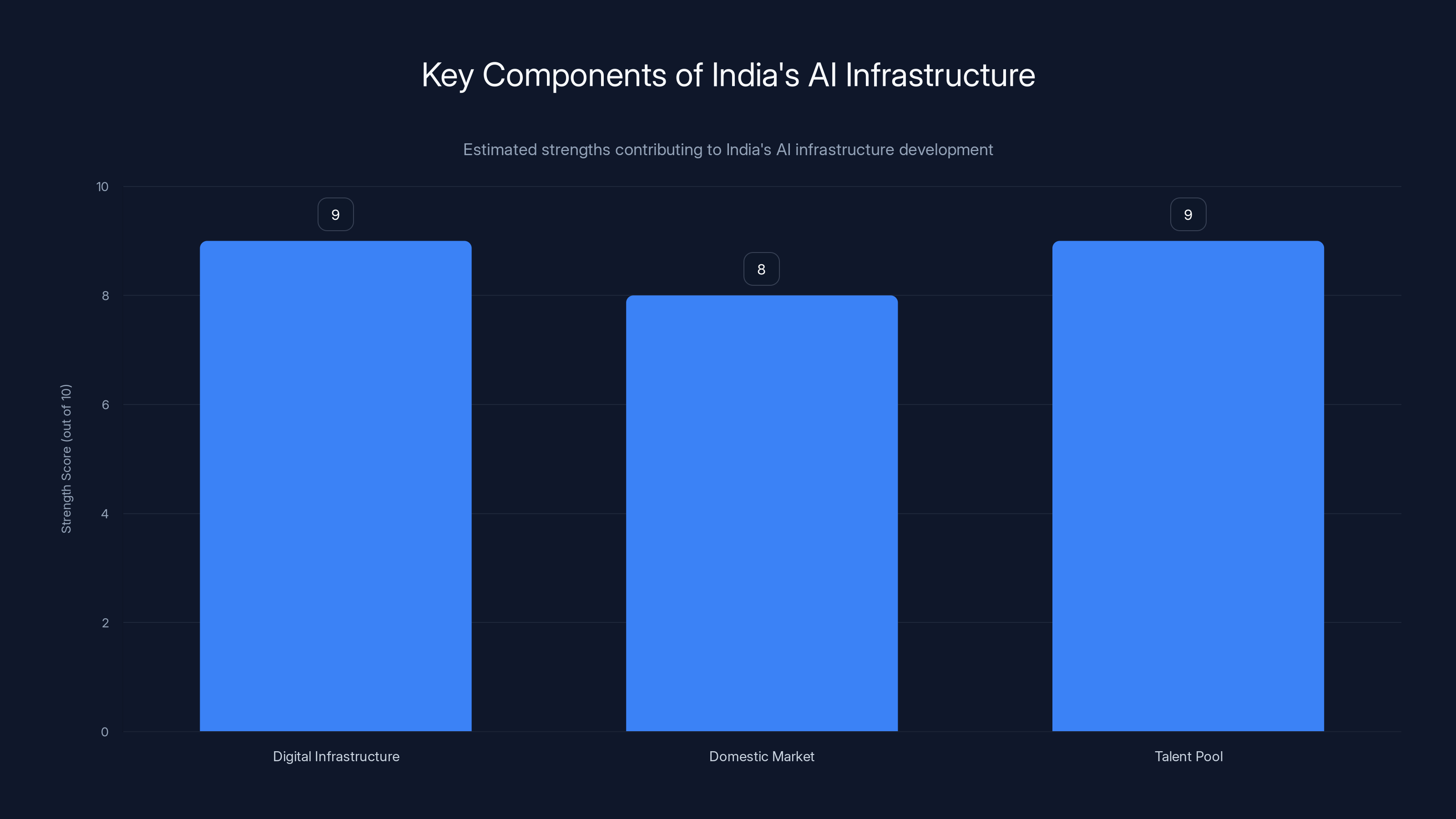

That distinction matters because it plays to India's actual strengths:

Government-Built Digital Infrastructure: India's digital ID system (Aadhaar) covers over 1.3 billion people. UPI (Unified Payments Interface) processes more than $100 billion in monthly transactions. These aren't theoretical systems. They're operating at unprecedented scale with government backing. Any AI infrastructure build in India gets to leverage this foundation.

Vast Domestic Market: With 850+ million internet users, India offers the largest addressable market for AI-powered consumer applications outside of China. Companies can test AI features with feedback from hundreds of millions of users before expanding globally.

Deep Services Talent Pool: India's IT services industry has built deep expertise in scaling technology infrastructure. TCS, Infosys, Wipro, and HCL collectively employ over 3 million people and have decades of experience building and maintaining large-scale systems for global companies. That talent pool is now turning its attention to building AI infrastructure natively.

The combination is powerful. You get a ready-made digital infrastructure, a massive market to test at scale, and an incredibly deep talent pool. That's why companies like OpenAI are partnering with TCS to build data center infrastructure rather than trying to do it independently.

The Competitive Moment We're in

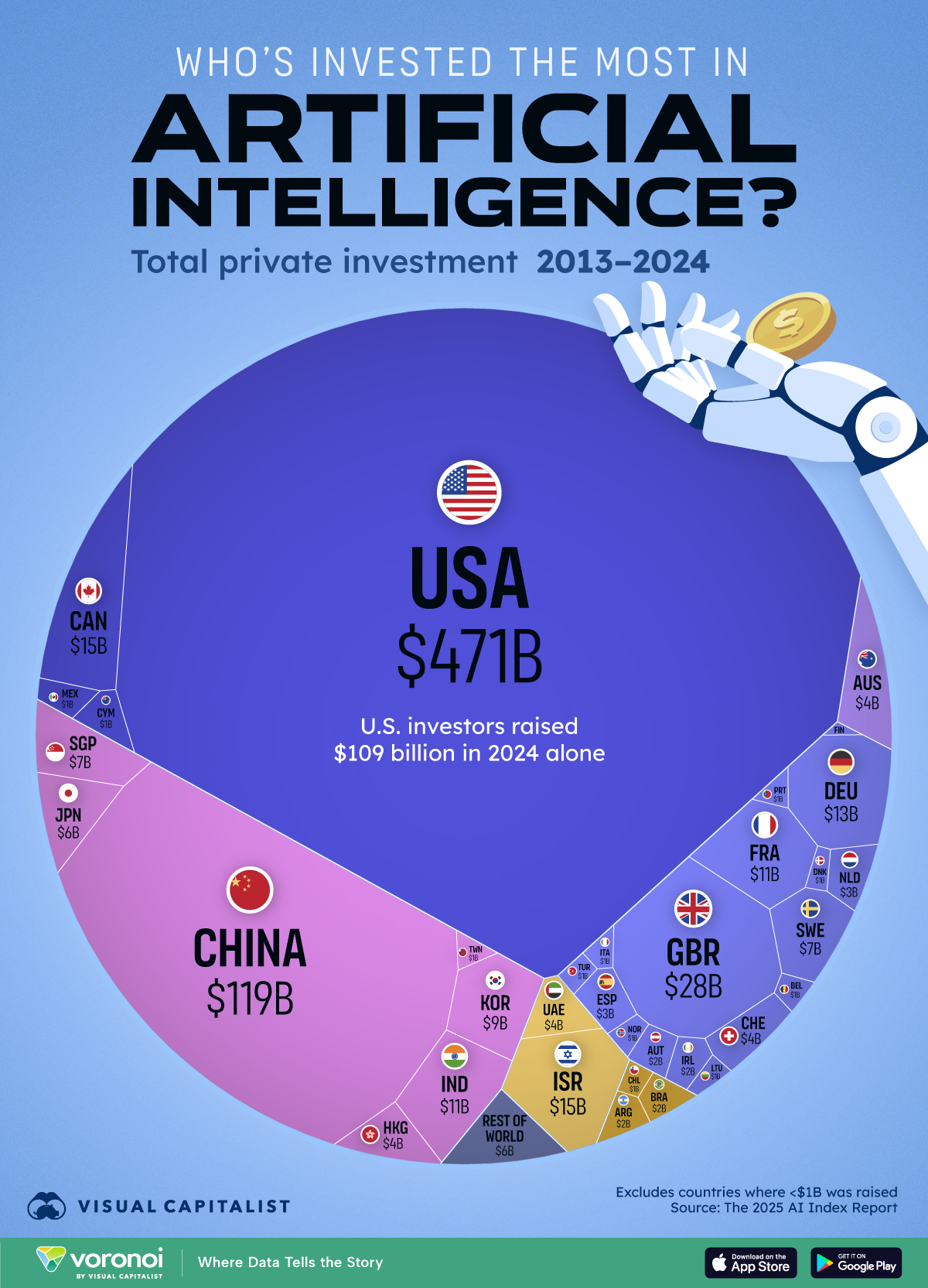

Let's be direct: this is a competitive move.

China has been betting heavily on AI infrastructure and indigenous chip development. The U. S. has concentration in California and New York with a few mega-fund players. Europe is scattered and regulatory-constrained. India sees an opening to become the third major hub for AI infrastructure and deployment.

When New Delhi set a goal to attract over $200 billion in AI infrastructure investments over two years, they weren't being casual about it. The government is backing this with regulatory clarity, tax incentives, and partnerships with major corporations.

General Catalyst's

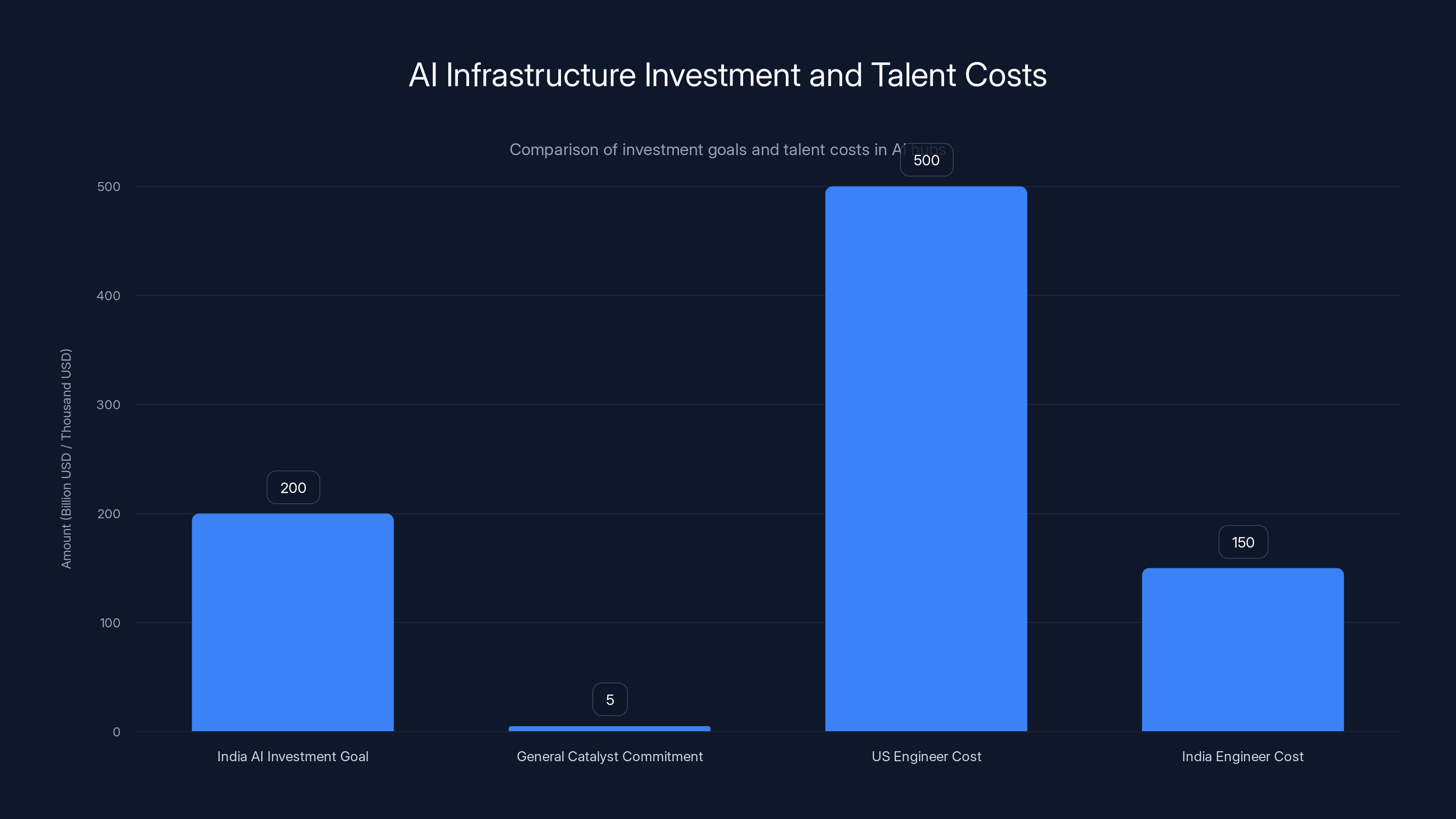

There's also a talent arbitrage at play. Build an AI infrastructure company in San Francisco, and your senior engineers cost

General Catalyst's India team, led by Neeraj Arora (CEO for India, Middle East, and North Africa), is banking on this pattern playing out. When they say the investment "allows us to operate at a different scale in India," they mean it.

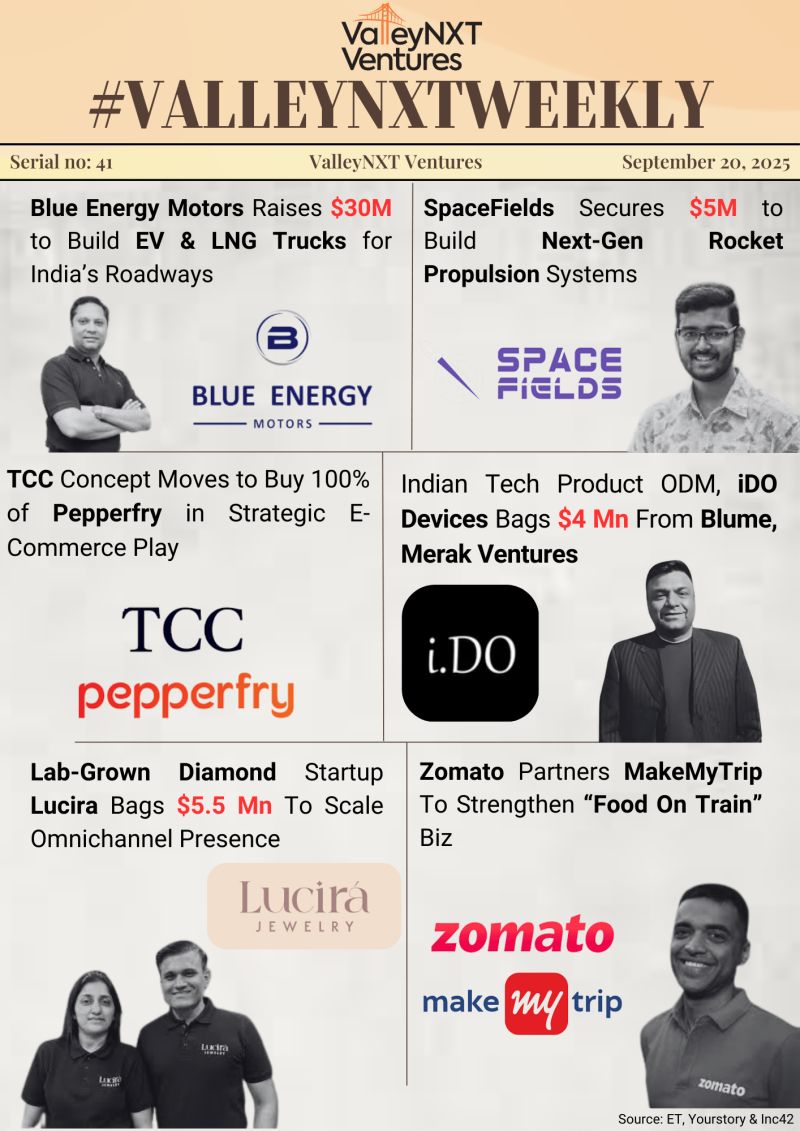

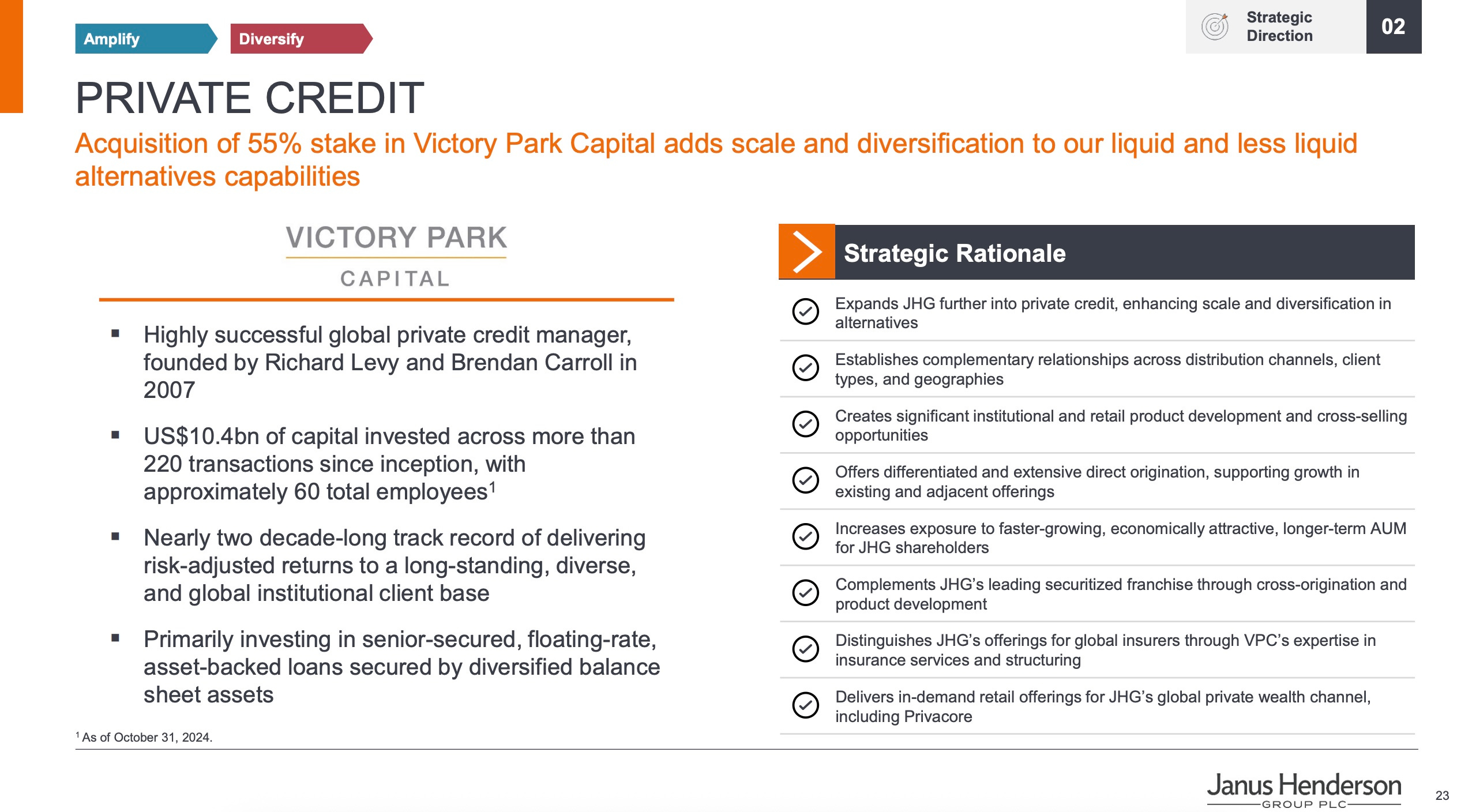

How This Changes the Startup Ecosystem

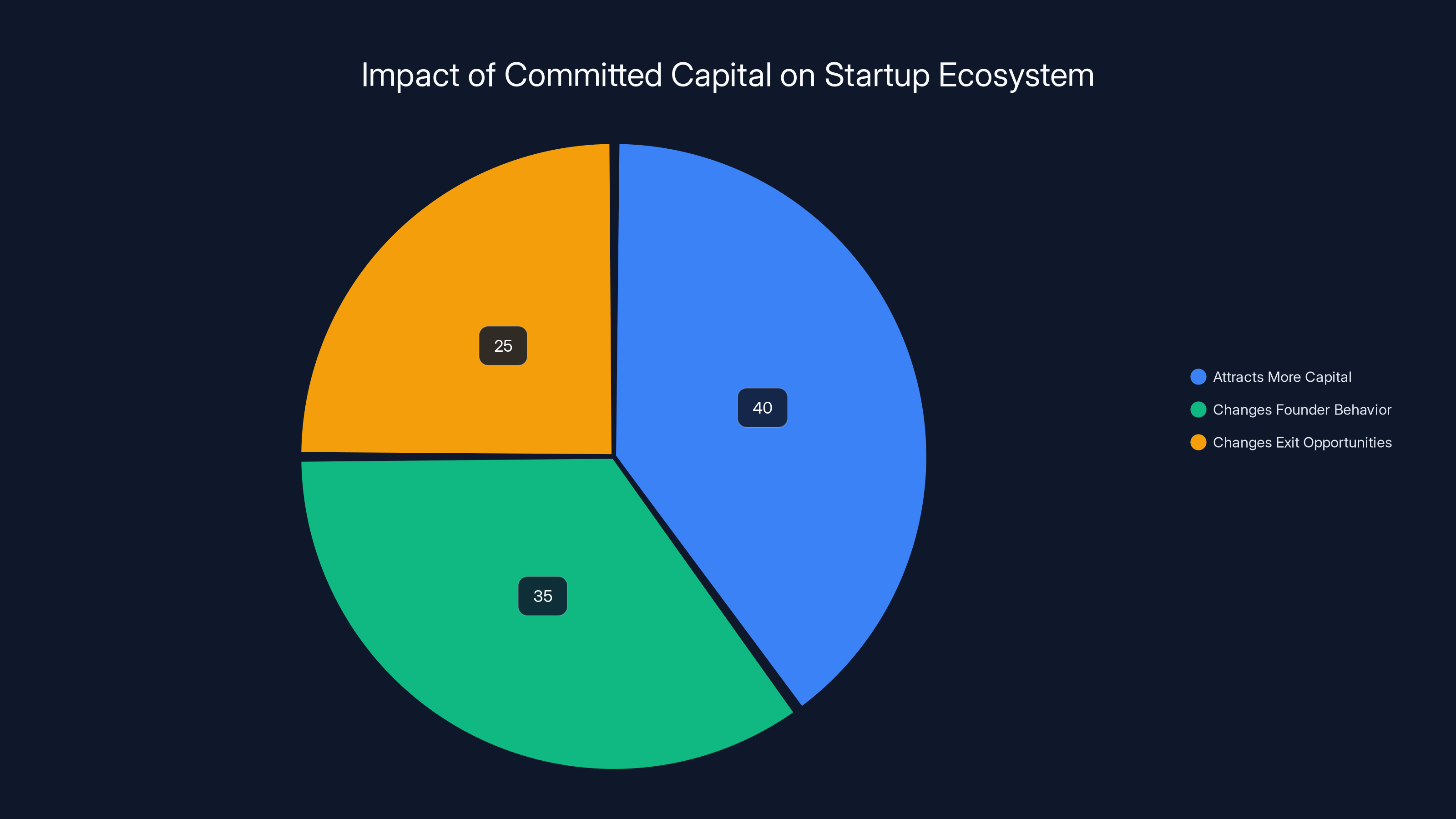

Here's what this level of committed capital actually does to an ecosystem.

First, it attracts more capital. When a firm with

Second, it changes founder behavior. Indian founders who might have previously planned to raise Series A in Silicon Valley now have a clear path to scale while staying rooted in India. That's profound. It keeps companies based in-country longer, keeps more of the value creation anchored in India, and builds deeper local ecosystems.

Third, it changes exit opportunities. When global capital is committed to India at this scale, Indian acquisitions become more likely. WhatsApp wasn't acquired for $19 billion because it was a random bet. It was acquired because by that point, it was clear India represented the most valuable market for messaging. Now you're seeing that pattern extend to infrastructure, AI, and enterprise software.

Look at the existing General Catalyst India portfolio. Zepto's latest valuation puts it in the $3.2+ billion range. PB Health is scaling across healthcare infrastructure. These companies can now raise follow-on rounds at increasingly large checks from a firm that's explicitly committed to India.

That removes a critical constraint that's historically held back Indian startups: the need to choose between staying in India (with limited capital) or relocating to the U. S. (with better capital but higher burn rates and more competition).

India's AI infrastructure is bolstered by strong digital systems, a vast domestic market, and a deep talent pool. Estimated data based on qualitative insights.

The Data Center Infrastructure Play

Everybody's focused on the venture piece, but the real structural bet is in data center infrastructure.

OpenAI building a 100-megawatt AI data center with TCS isn't random. It signals that India has the regulatory clarity, power infrastructure, and labor cost structure to be a legitimate hosting destination for AI compute.

Right now, most AI inference happens in a handful of regions: Northern California (where it's cool), Ireland (where it's cool and energy is cheap), and a few other specific hubs. The cost structure of running AI compute is heavily determined by electricity prices and infrastructure density.

India can compete on electricity costs (massive ongoing renewable energy build-out) and labor costs (expensive engineers, but cheap infrastructure operations staff). The government is backing the infrastructure investment. Suddenly, you can build a data center in Bangalore or Hyderabad and run it profitably at scales that would be marginal in the U. S.

That changes everything about where AI gets deployed. When inference becomes cheaper in India, companies naturally build features for Indian users first. They localize for Indian languages earlier. They build products for Indian use cases that might not get built otherwise.

Why $5 Billion Specifically?

There's an interesting question here: why

The number isn't random. It signals commitment without overcommitting. Spread across five years, it's $1 billion annually. That's significant enough to be credible but not so large that the fund would struggle to deploy it effectively.

General Catalyst's track record is important here. The firm has consistently generated strong returns. They're not throwing money at India hoping something sticks. They've built systematic conviction through their Venture Highway merger, through portfolio companies like Zepto showing exits, through partnerships with Indian enterprises.

The $5 billion number says: "We believe in India enough to bet this much capital, but we're also disciplined enough not to overcommit." That balance is actually reassuring to founders, other investors, and the Indian government.

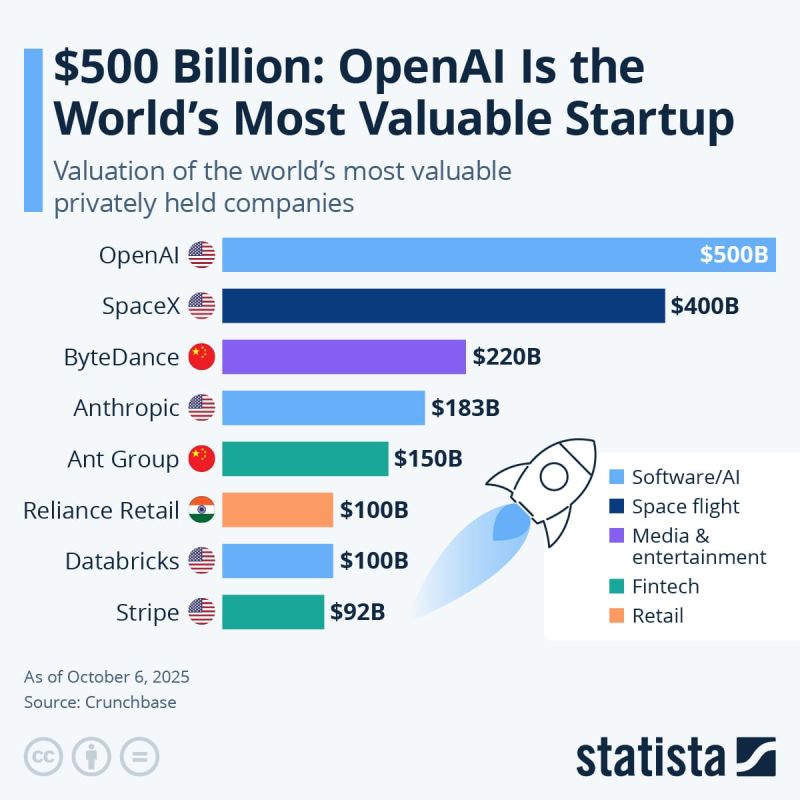

What This Means for Global AI Competition

Zoom out for a moment. What we're watching is a geographic repositioning of where AI value gets created.

For the past 15 years, the narrative was Silicon Valley or nowhere. Every serious tech company needed a California office. Every founder eventually moved to the Bay Area. The intellectual capital, the capital capital, and the startup culture were all centered there.

That's starting to fracture.

You're seeing serious AI development happening in London (DeepMind was acquired by Google, but the research culture continues). You're seeing it in Toronto (Vector Institute and a cluster of AI researchers). You're seeing it in Israel (tremendous focus on applied AI and autonomous systems). And now you're seeing it in India.

General Catalyst's bet is that the next frontier of AI isn't smarter models, it's deployment at unprecedented scale. And the only place you can actually test AI at that scale is a country with 1.4 billion people and a billion internet users.

That's not a shift happening in five years. It's happening right now. And this $5 billion commitment is one of the biggest signals yet that it's real.

The Government-Private Sector Partnership Model

Here's something that's different about India's AI infrastructure moment compared to China or the U. S.: the partnership model.

In China, infrastructure builds are government-led with private sector support. In the U. S., they're primarily private sector with light regulation. India is trying something different: coordinated public-private partnerships with clear strategic alignment.

The India AI Impact Summit itself exemplifies this. The government sets the direction (we want to be an AI leader), announces the investment targets ($200 billion in data center infrastructure), and then the private sector steps up with capital.

General Catalyst's commitment to developing "a framework to accelerate large-scale AI adoption across priority sectors" is part of this model. They're not just investing as a fund. They're also working with the government to identify which sectors benefit most from AI deployment.

That's strategic capital allocation at scale. It's not "let's fund the next 100 startups and see what sticks." It's "let's identify where AI creates the most value for India and systematically build companies in those sectors."

Factor in the General Catalyst Institute's work on government-industry partnerships, and you see a firm that's not just deploying capital but actively shaping the policy and infrastructure environment.

General Catalyst's $5 billion commitment is strategically distributed across sectors where India has structural advantages. Estimated data shows AI and Consumer Technology as top focuses.

The Existing Portfolio Tell

When you look at what General Catalyst has already invested in, you see the template for what's coming.

Zepto (fast delivery e-commerce) represents the distribution layer. If you want to serve 1.4 billion people, you need logistics and fulfillment infrastructure. Zepto's focusing on the ability to deliver almost anything within 10-15 minutes. That requires unprecedented infrastructure and AI-driven routing.

PB Health (healthcare technology) represents the digital health infrastructure layer. India's healthcare system serves 1.4 billion people with fragmented providers. Building technology infrastructure to coordinate that is a massive opportunity.

Raphe, Jeh Aerospace, and Pronto represent the manufacturing and transportation infrastructure layers. These aren't flashy, but they're fundamental. Building tech infrastructure for manufacturing, aerospace, and logistics is exactly where you'd want to be if India is industrializing rapidly.

Ayr Energy represents the clean energy layer. You can't run massive data centers without abundant clean power. India's renewable energy buildout is critical for the AI infrastructure play.

Look at this portfolio holistically: distribution (Zepto), healthcare (PB Health), manufacturing (Raphe, Jeh), transportation (Pronto), and energy (Ayr). That's not a random collection. That's a systematic approach to investing in the fundamental infrastructure layers that AI will run on top of.

If you're General Catalyst, and you believe AI will be deployed at scale across all of these sectors, then you want positions in the foundational infrastructure that enables that deployment.

The Talent Arbitrage and Brain Drain Reversal

Here's a subtle but important point: this capital commitment changes the calculus for Indian engineers and entrepreneurs.

For the past 20 years, if you were a talented engineer in India, the natural career progression was: work at a startup or established company in India, get imported by a U. S. company, eventually move to the U. S. Satya Nadella (CEO of Microsoft), Sundar Pichai (CEO of Google), and countless other Indian-origin tech leaders followed this pattern.

That's starting to reverse.

When General Catalyst is committing

That changes retention. India's been suffering from brain drain for decades. The $5 billion commitment, combined with similar moves from other firms, creates an economic incentive to stay and build in India.

Zepto's founder Kaivalya Vohra was 19 when he started the company. If he'd built something similar in 2005, he would have needed to move to San Francisco to raise Series A. In 2025, he could stay in Bangalore, and Sequoia, Accel, and now General Catalyst come to him.

That changes everything about how entrepreneurs think about founding in India.

The Defense Tech and Critical Infrastructure Angle

One part of the commitment that doesn't get enough attention: defense technology.

General Catalyst explicitly called out defense technology as a priority investment area. That's significant because it signals a shift in how venture capital thinks about critical infrastructure.

For years, defense tech was either purely government-funded (like DARPA) or taboo for venture capital. But geopolitical realities are changing that calculus. Both the U. S. and India recognize that autonomous systems, AI-powered surveillance, and drone technology will be critical to future military and security applications.

India's been investing heavily in military modernization. When a venture firm commits capital to defense tech, they're positioning Indian companies to build the software and systems that support that modernization.

That's not just economic investment. That's strategic positioning. It signals that India sees itself as a peer in critical technology development, not just a consumer of foreign technology.

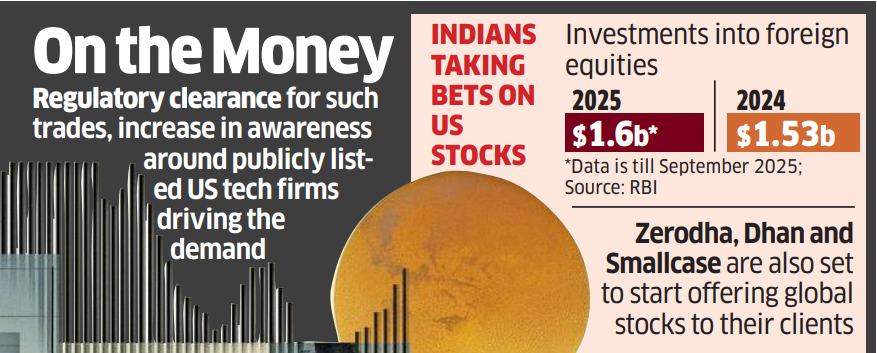

Fintech: The Cash Cow

Fintech is listed as a priority, and that's worth examining closely.

India's fintech story is already remarkable. UPI processes more transactions than all the credit card networks in the U. S. combined. Digital payment penetration is extraordinary. But there's still massive room to build on top of that infrastructure.

Lending infrastructure remains fragmented. Insurance technology is underpenetrated. Wealth management for the emerging middle class is nascent. Cryptocurrency infrastructure (despite regulatory uncertainty) continues to attract capital.

General Catalyst's fintech bets will likely focus on companies that can leverage India's digital payments infrastructure to offer lending, insurance, or wealth products to hundreds of millions of users.

The unit economics are incredible if you can serve 100 million users with 2% conversion to a lending product. That's 2 million active customers. Even at modest loan sizes, that's substantial AUM and revenue.

That's why fintech is a priority. It's not speculative like frontier AI. It's infrastructure building on proven digital foundations.

India aims for

Consumer Technology and the Platform Play

Consumer technology is the broadest category in the commitment, and rightly so.

There are roughly 850 million internet users in India. That's larger than the entire U. S. population. It's larger than all of Europe combined. Yet most of the consumer apps dominating are built elsewhere (TikTok-like apps are banned, but the demand for short-form video remains; most shopping is still on Amazon and Flipkart rather than indigenous platforms).

General Catalyst's bet is that the next generation of consumer platforms will be built in India for India, eventually expanding globally.

Why does this matter? Because platform economics mean that once you win the market in one of the world's largest countries, you have an enormous user base, an enormous data set, and enormous revenue. ByteDance became one of the most valuable companies in the world primarily because TikTok won the India market before the ban.

Imagine an Indian company building the next social platform, the next messaging app, or the next e-commerce platform. The sheer size of the addressable market means the unit economics would dwarf most U. S. startups from day one.

General Catalyst's consumer technology bets are positioning them to capture value from those potential platforms.

The Merger with Venture Highway: Strategic Foundation

The context here matters. General Catalyst didn't just open an India office. They merged with Venture Highway, an existing Indian venture firm.

That merger was critical. It gave them local relationships, local knowledge, and local decision-making authority. Neeraj Arora, who became CEO for India, MENA after the Venture Highway integration, brought deep expertise in the Indian startup ecosystem.

The $5 billion commitment is essentially backing up that operational foundation with unprecedented capital. It's saying: "We've proven we can operate effectively in India. Now let's scale the operation."

That's a different bet than a U. S. firm just opening a local office. This is building a substantial operating business in India, with capital-deployment authority and strategic independence.

What It Means for Competitive Positioning

Let's talk about the meta-game here.

When Sequoia, Accel, and other traditional VC firms see General Catalyst committing $5 billion, it creates competitive pressure. If Sequoia wants to maintain its position in India, they need to match that commitment or demonstrate superior returns. That's capital flowing into India from multiple sources simultaneously.

That's also talent competition. General Catalyst's India team now has $5 billion to deploy. That makes them one of the most powerful investors in India, period. The best deal flow goes to the biggest capital sources. Founders pitch General Catalyst first.

For other VC firms, that's a challenge. They need to specialize (fintech, healthtech, deep tech) or move downmarket (angel investing, seed funding) to find niches where they can compete.

For Indian startups, it's the opposite of a challenge. It's an opportunity. More capital competing for allocation means higher valuations, better terms, and more options.

Timeline: From Announcement to Reality

When General Catalyst says $5 billion over five years, that's a commitment with an execution timeline.

Year one ($1 billion): Likely focused on follow-on rounds for existing portfolio companies (like Zepto) and finding flagship investments in priority sectors.

Years two and three ($2-3 billion): The real firepower. Initial funds deployed and returning, creating momentum for bigger follow-on rounds and new sectors.

Years four and five ($4-5 billion): Maturation phase. Existing portfolio companies approaching Series D, E, and potentially IPO timelines. New sectors being validated.

That timeline matters because it shows this isn't a one-year push. It's a five-year commitment to systematic capital deployment. That gives founders confidence to plan long-term. It gives employees confidence to join Indian startups (you know there's capital for growth and retention equity packages).

The committed capital significantly attracts more capital (40%), influences founder behavior (35%), and enhances exit opportunities (25%) in the Indian startup ecosystem. Estimated data.

The Regulatory and Policy Environment

None of this happens without a stable policy environment.

India's government has been explicitly pro-startup and pro-technology. Startup India, a government initiative launched in 2016, has created regulatory clarity and tax incentives. The government is openly pro-AI development.

Compare that to Europe, where regulatory uncertainty around AI keeps capital deployed elsewhere. Or to China, where geopolitical tensions create uncertainty about which sectors can receive foreign capital.

India's policy environment is open and encouraging. When General Catalyst commits $5 billion, they're betting that this environment remains stable. That's not a trivial bet given political cycles, but the trend is encouraging.

Global Implications: The Three-Polar AI World

Zoom way out. What's the global implication of this move?

For the past 15 years, the narrative has been: U. S. leads AI, China catches up, Europe regulates, everyone else follows.

We're moving toward a three-polar world: U. S. (frontier model innovation), China (infrastructure and deployment at scale), and India (deployment at massive scale with private capital).

General Catalyst's bet is that the India pole becomes as valuable as the China pole over the next decade. And given the regulatory environment and talent pool, I'd take that bet.

Specific Deployment Framework: How This Capital Gets Deployed

General Catalyst mentioned they're "developing a framework to accelerate large-scale AI adoption across priority sectors." That's specific language that tells you how the capital gets deployed.

It's not "spray and pray venture capital." It's systematic.

Likely framework:

- Identify high-impact sectors (healthcare, fintech, manufacturing, agriculture, education)

- Map existing pilot projects (government and enterprise initiatives already running)

- Fund companies to scale pilots (convert proof-of-concept to full deployment)

- Provide infrastructure support (cloud credits, talent access, regulatory navigation)

- Create partnerships (between startups, government agencies, and enterprises)

- Track and measure impact (health outcomes improved, economic impact, job creation)

That's capital deployment with intention. It's not just "invest in AI companies." It's "deploy capital to solve specific problems in India at scale."

That framework is more likely to produce successful exits and valuable companies than random venture capital allocation.

The Role of the General Catalyst Institute

The General Catalyst Institute, which focuses on government-industry partnerships, is a key part of this story.

Venture capital is transactional. You invest in companies, you hope they exit at a markup, you return capital to your LPs. The Institute is structural. It builds relationships between government, industry, and academia.

Those relationships are where deals come from. If the Institute helps New Delhi establish a digital health data standard, then companies that comply with that standard get preferential government contracts. That's worth more than capital.

General Catalyst's willingness to invest in institutional relationship-building alongside pure venture capital shows they're in India for the long term. They're not just deploying capital, they're building structural advantages for their portfolio companies.

Estimated data shows population and internet users, along with AI opportunities, as major factors in India's investment appeal.

Common Skepticisms and Fair Points

Let me address some fair criticisms.

"This is just capital chasing valuations." Fair point. Early-stage valuations in India are rising fast, partly because of increased capital supply. But valuations for strong companies (like Zepto) have earned their valuation multiple through execution.

"India has regulatory risk." Also fair. Regulatory changes could affect crypto exposure, foreign capital flows, or sector-specific rules. But the trend has been increasingly pro-business and pro-startup.

"India lacks infrastructure in some areas." True in some regions, but major metros (Bangalore, Delhi, Mumbai) have world-class infrastructure. And infrastructure is improving rapidly.

**"The

These are reasonable concerns, but none of them fundamentally undermine the thesis that India is becoming a critical hub for startup infrastructure.

Investment Thesis Condensed

Here's the core investment thesis:

- India has 1.4 billion people and 850 million internet users

- Government digital infrastructure (Aadhaar, UPI) provides a foundation for rapid scaling

- Talent costs are 30-50% lower than Silicon Valley

- AI deployment opportunities are larger than anywhere else globally

- Regulatory environment is increasingly supportive

- Global venture capital is recognizing this and competing to deploy capital

- Companies built on this foundation can scale globally

That thesis justifies a $5 billion commitment. Whether it outperforms is a different question, but the logic is sound.

What This Means for Founders

If you're a founder in India, the implications are straightforward.

You have access to more capital at better terms than any time in history. Global investors are actively looking to deploy capital in Indian startups. The path to scale without relocating to the U. S. is now clear.

You need to be focused on building something with global application or serving India's 850 million internet users. You need to move fast (capital is available, talent is available). And you need to think about unit economics carefully (margins matter for sustainable businesses).

But the opportunity is genuine. This is the moment to build.

What This Means for Other VCs

For other venture capital firms, the $5 billion commitment creates both pressure and opportunity.

Pressure: Match it or specialize. You can't compete with General Catalyst on capital availability unless you're equally committed to India. That means either matching their India focus or finding niches where you compete better (specific sectors, earlier stage, regional focus).

Opportunity: There's more capital flowing into India generally. Rising tide lifts boats. Better companies get funded. Returns improve. That benefits everyone.

This is the most significant moment for India venture capital since the last wave of growth in the 2010s.

What This Means for Global Tech

For the global technology industry, this signals where the next wave of platforms will be built.

The platforms of the 2010s were built by U. S. companies (Airbnb, Uber, Slack). The platforms of the 2020s and beyond will increasingly be built in India and China.

That changes unit economics globally. It means more competition for U. S. startups. It means supply chains shift. It means talent follows opportunity.

General Catalyst's bet is that understanding this shift early and positioning capital accordingly will generate outsized returns. That's a reasonable bet.

Timeline: What to Watch Over the Next Year

Here are specific things to track as this commitment begins executing:

Months 1-3: Announcements of significant new portfolio companies (Series A and B rounds).

Months 3-6: Follow-on rounds for existing portfolio companies (Zepto, PB Health, etc.) at higher valuations.

Months 6-12: Announcement of new sector focus or partnerships with government agencies.

Year 2: First exits from the post-announcement cohort of investments (likely acquisitions, some IPOs).

Watch these milestones to track whether the capital is actually deploying effectively.

The Five-Year Outlook

Assuming execution goes reasonably well, here's what success looks like in five years.

By 2030, General Catalyst's India portfolio will likely include:

- 5-10 companies with $1 billion+ valuations

- 20-30 companies with $100 million+ valuations

- Multiple successful exits (acquisitions and IPOs)

- Demonstrated returns exceeding 2x on the $5 billion deployed

- Operational infrastructure managing a $10 billion+ AUM India fund

- Significant influence on Indian government policy around AI and startup infrastructure

That's not speculative. That's a reasonable expectation for $5 billion deployed across a decade in a rapidly growing market with proven capital partners.

The Counterargument: Why This Could Underperform

Let me play devil's advocate.

Venture capital into India could underperform if:

- Regulatory changes restrict foreign capital or create specific sector restrictions

- Geopolitical tensions between U. S. and India affect capital flows

- Competition from other global firms drives valuations too high

- Founders fail to execute at the scale required

- Infrastructure development (power, internet, logistics) doesn't keep pace with startup growth

- The global economy enters recession, reducing exit opportunities

Any of these could reduce returns. But none of them invalidate the underlying thesis that India is important. They just reduce the size of returns.

How This Relates to the AI Infrastructure Race

The broader context is the global race to build AI infrastructure.

The U. S. is focused on frontier models and compute leadership (NVIDIA, OpenAI, Anthropic). China is focused on applied AI and sovereign tech. India is focused on deployment infrastructure and talent.

Those are complementary specializations. India isn't trying to compete with OpenAI on model development. It's trying to become the place where AI actually gets deployed at scale.

General Catalyst's bet is that deployment expertise becomes as valuable as model development expertise. I'd take that bet.

Why the Five-Year Timeline

Why five years specifically? Why not 10 or 3?

Five years is the natural venture capital deployment cycle. Most funds are 10-year vehicles (dry powder for years 1-3, deployment in years 3-7, management of existing portfolio years 7-10).

A $5 billion commitment over five years keeps it within a single fund vehicle cycle. It's ambitious enough to be credible but not so massive that it creates operational strain.

It also aligns with startup maturity timelines. Companies funded in year 1 will be ready for Series B in year 3 and Series C in year 5. That gives portfolio momentum.

The Zepto Case Study

Zepto's trajectory illustrates why this bet makes sense.

Zepto started in 2021 focused on instant grocery delivery. By 2024, it had expanded to other categories (electronics, beauty, etc.) and reached a

Compare that to U. S. quick-commerce companies: most haven't reached that valuation, and the ones that have (like DoorDash) faced much longer paths to scale.

Why? Because India's user base is so much larger. Zepto can test product-market fit with millions of users instead of thousands. It can iterate faster, build deeper moats, and reach profitability at larger scale.

If Zepto can reach $3.2 billion in less than three years, imagine a fintech company or a healthcare platform or a manufacturing tech company. The math supports massive venture outcomes in India.

That's why General Catalyst is betting $5 billion.

Conclusion: Why This Moment Matters

General Catalyst's $5 billion commitment to India isn't just a financial bet. It's a statement about where value gets created in the next decade.

It signals that India is no longer just an outsourcing destination or a market for U. S. companies to sell into. It's becoming a hub for building technology that serves global audiences.

It signals that the "move to the U. S. or fail" narrative for Indian founders is changing. You can build a billion-dollar company in India without leaving.

It signals that the next wave of global platforms will be built differently—not in a single valley but across multiple regions optimized for different specializations. The U. S. builds the cutting-edge models. India deploys them at scale. China does both.

For investors, it's a moment to reconsider India exposure. For founders, it's permission to think bigger about what's possible from India. For the global tech industry, it's a signal that competition is intensifying in new geographies.

General Catalyst just made a $5 billion bet that all of this is true. Whether they're right will be clear in 10 years. But they're betting with their capital, and that's the clearest signal you can get.

FAQ

What is General Catalyst's $5 billion India commitment?

General Catalyst, a Silicon Valley venture firm with

Why is General Catalyst focusing on India specifically?

India offers several structural advantages for technology investment: 1.4 billion population with 850+ million internet users, government-built digital infrastructure (Aadhaar, UPI) that creates a foundation for rapid scaling, deep talent pools at lower costs than Silicon Valley, and regulatory environment increasingly supportive of startup development. General Catalyst believes these factors make India ideal for deploying AI at unprecedented scale rather than building frontier AI models.

How does this commitment compare to other venture capital activity in India?

This is one of the largest single commitments by a global venture firm to India. Combined with similar investments from other firms and major corporate commitments (Reliance Industries and Adani Group investing $200+ billion in AI data center infrastructure), it signals a broader recognition that India has become a critical hub for AI infrastructure and startup development. The commitment exceeds what most other individual venture firms are currently allocating to India.

What sectors are prioritized in the $5 billion allocation?

General Catalyst is targeting five primary sectors: Artificial Intelligence (infrastructure and deployment), Healthcare Technology (serving 1.4 billion people with fragmented healthcare), Defense Technology (supporting India's modernization), Financial Technology (building on UPI's foundation), and Consumer Technology (serving 850+ million internet users). These sectors represent areas where India has structural advantages and where deployment at scale creates outsized economic value.

How will this capital actually get deployed?

General Catalyst is developing a systematic framework to deploy capital: identifying high-impact sectors, mapping existing pilot projects, funding companies to scale those pilots into full deployment, providing infrastructure support (cloud credits, talent, regulatory navigation), creating partnerships between startups and enterprises, and tracking measurable impact. This is intentional capital deployment focused on solving specific problems at scale rather than random venture capital allocation.

What does this mean for Indian founders and startups?

The commitment creates significant opportunities for Indian entrepreneurs: access to more capital at better terms than ever before, the ability to scale globally without relocating to the U. S., reduced pressure to move to Silicon Valley for Series A financing, and demonstration that building billion-dollar companies in India is now viable and expected. For founders in priority sectors, this represents unprecedented access to growth capital and strategic support.

Could this commitment underperform or fail to deliver expected returns?

Yes, there are legitimate risks: regulatory changes could restrict foreign capital or specific sectors, geopolitical tensions could affect U. S.-India capital flows, competition could drive valuations too high, founders might fail to execute at required scale, or infrastructure development might not keep pace with startup growth. These risks don't invalidate the underlying thesis about India's importance but could reduce returns below expectations.

How does this fit into broader global AI competition?

This represents a shift in how global AI value gets distributed. The U. S. focuses on frontier model development (OpenAI, Anthropic), China focuses on applied AI and sovereign technology, and India is positioning itself as the deployment hub for AI at unprecedented scale. These are complementary specializations rather than direct competition, suggesting India isn't trying to replicate U. S. capabilities but rather specialize in deployment infrastructure.

What is the timeline for actual capital deployment?

General Catalyst is targeting $1 billion per year over five years. Year one likely focuses on Series A and B funding for new companies plus follow-on rounds for existing portfolio companies. Years two and three are expected to see the most significant capital deployment and portfolio momentum. Years four and five should see companies approaching Series D, E, and potential IPO stages. Success can be tracked through announcements of new portfolio companies and performance of existing investments.

How does this relate to India's own government AI initiatives?

The commitment aligns closely with India's government-led initiatives to attract $200 billion in AI infrastructure investment and position India as a major AI hub. General Catalyst's work through its Institute on government-industry partnerships suggests coordination with policy makers. This alignment reduces regulatory risk and creates preferential treatment for portfolio companies that meet government standards or solve priority problems.

Key Takeaways

- General Catalyst committed 500M-$1B allocation

- The commitment targets AI deployment, healthcare, defense tech, fintech, and consumer technology—sectors where India has structural advantages

- India's 1.4 billion population, 850M+ internet users, and government digital infrastructure (Aadhaar, UPI) create unprecedented deployment opportunities

- This signals a shift from U.S.-centric venture capital to a three-polar model: U.S. (frontier AI), China (applied AI), India (deployment at scale)

- Similar investments from Reliance ($200B+), Adani, OpenAI, and major tech firms confirm India is becoming a critical hub for AI infrastructure

Related Articles

- Neo's Low-Dilution Accelerator Model: Reshaping Founder Economics [2025]

- How HBO's The Pitt Tells AI Stories That Actually Matter [2025]

- SoftBank's $33B Gas Power Plant: AI Data Centers and Energy Strategy [2025]

- OpenAI's 850B Valuation Explained [2025]

- Why Divvy's $1B Exit Left Founders With Nothing: The Debt & Cap Table Truth [2025]

- Thrive Capital's $10B Fund: What It Means for AI and Venture Capital [2026]

![General Catalyst's $5B India Bet: What It Means for AI & Startups [2025]](https://tryrunable.com/blog/general-catalyst-s-5b-india-bet-what-it-means-for-ai-startup/image-1-1771571210415.jpg)