Tech Crunch Startup Battlefield 200 [2026]: Complete Guide to Winning at Tech's Biggest Pitch Stage

If you're a founder with a vision, a working product, and the courage to stand on stage in front of thousands of investors, this is your moment.

Tech Crunch Startup Battlefield 200 is open, and it's not just another pitch competition. This is where Dropbox, Discord, Fitbit, and over 1,700 other game-changing companies got their start. You could be next.

The stakes are real. You're competing for $100,000 in equity-free funding, global media exposure, and direct access to the venture capital ecosystem that actually funds startups. But the real prize? Legitimacy. Momentum. The kind of credibility that makes subsequent fundraising conversations actually happen.

The competition is fierce though. Thousands apply every year. The judges are ruthless. The feedback is unfiltered. But winners don't emerge from comfort—they emerge from pressure.

This guide walks you through everything you need to know about Startup Battlefield 200, from nomination strategy to pitch perfection. We'll break down what actually moves the needle with judges, how to prepare a pitch that gets remembered, and why early entry matters more than you think.

Let's get into it.

TL; DR

- Nominations close mid-June 2026, so enter early for strategic positioning and feedback cycles

- You need an MVP, clear differentiation, and a story that explains why your problem matters and why you're the team to solve it

- Only pre-seed, seed, and early Series A startups qualify, though exceptions exist for capital-intensive industries

- Winners get $100K equity-free, three days of free booth space, passes, press access, and investor network access, but the real value is brand legitimacy and pipeline momentum

- Past alumni include household names like Dropbox, Discord, and Fitbit—proving this stage launches real companies

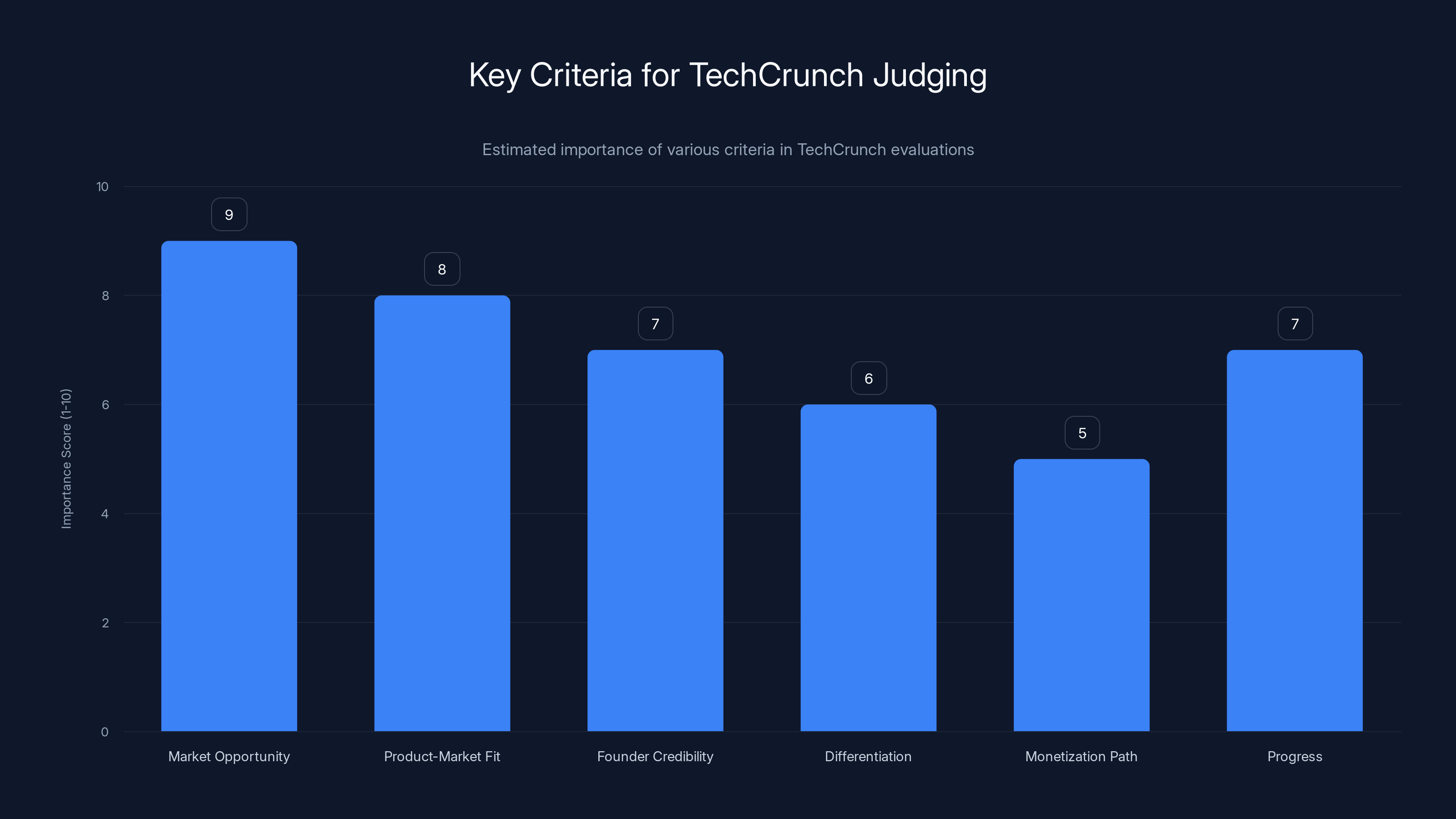

Market opportunity and product-market fit are estimated to be the most critical factors in TechCrunch judging, followed by founder credibility and differentiation. Estimated data based on typical evaluation priorities.

Understanding Startup Battlefield 200: What You're Actually Competing For

First, let's be clear about what Startup Battlefield is and what it isn't.

It's not a lottery. It's not about having the flashiest pitch deck. It's not about luck. Startup Battlefield is a meritocratic gauntlet designed to surface founders who've built something real, validated customer demand, and can articulate why their solution matters.

The format itself is brutal and brilliant. You get 6 minutes on stage. Six minutes to present your company in front of world-class venture capital judges, media, and thousands of founders watching live and online. Then 2 minutes of unscripted questions from the judges. That's it. Eight minutes total to prove you deserve $100,000 and the platform that comes with it.

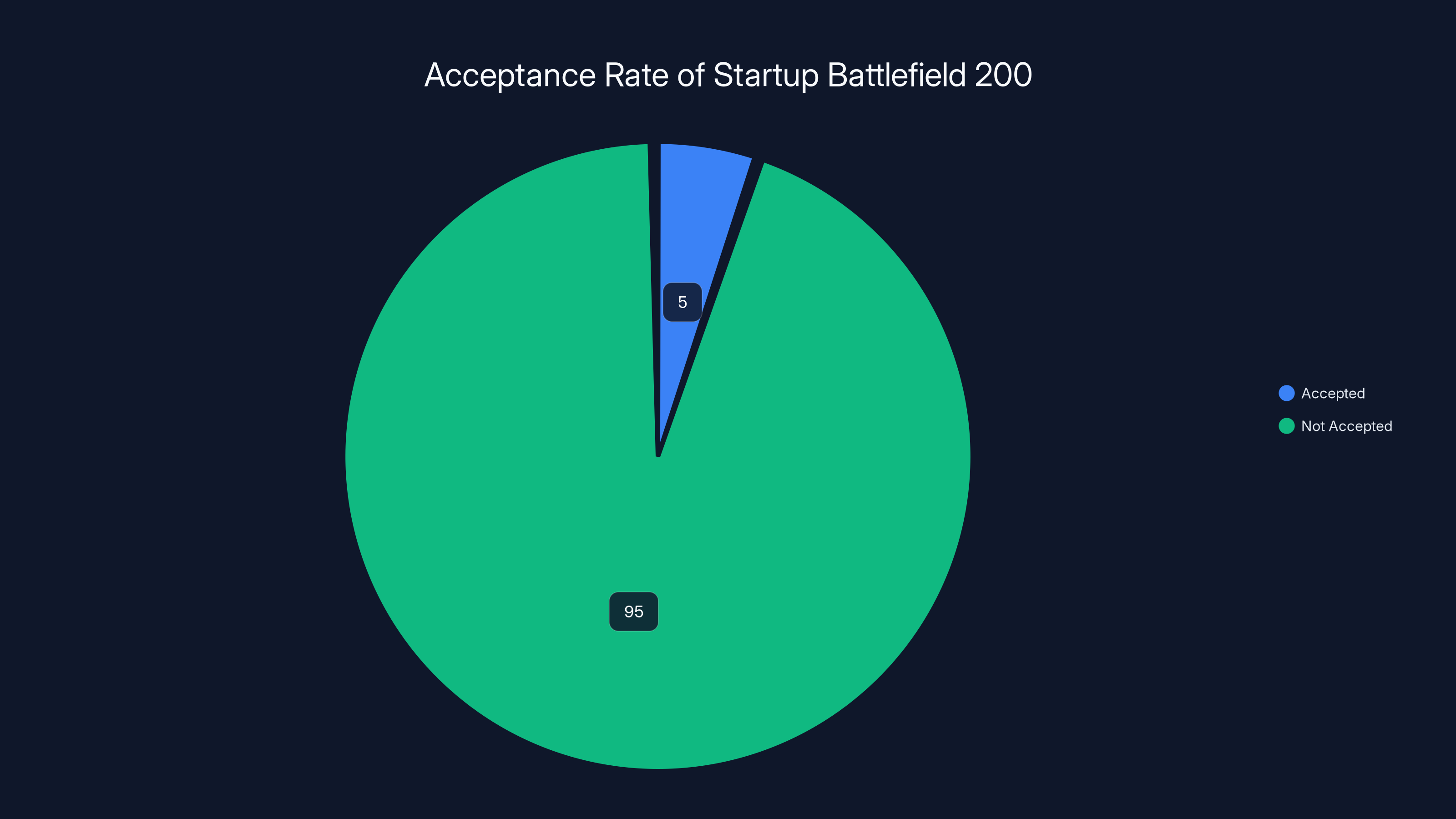

Thousands of startups apply each year for around 200 spots on the main stage. Do the math. That's roughly a 4-7% acceptance rate, depending on the year. For context, that's more selective than Harvard. More selective than Y Combinator.

But here's what makes it different from other competitions: the judges actually know what they're looking at. These aren't corporate executives playing venture capitalist for a day. These are institutional investors who've backed unicorns, shipped products that millions use, and can spot bullshit from a thousand yards away.

When they ask a question, they want a real answer. When they challenge your market size, they're checking whether you've actually done the research. When they poke at your unit economics, they're validating that you understand your business beyond the fairy tale.

And that's exactly why this competition matters. It's the intersection of distribution, credibility, and validation. You can't fake it. Well, people try, but the judges can tell.

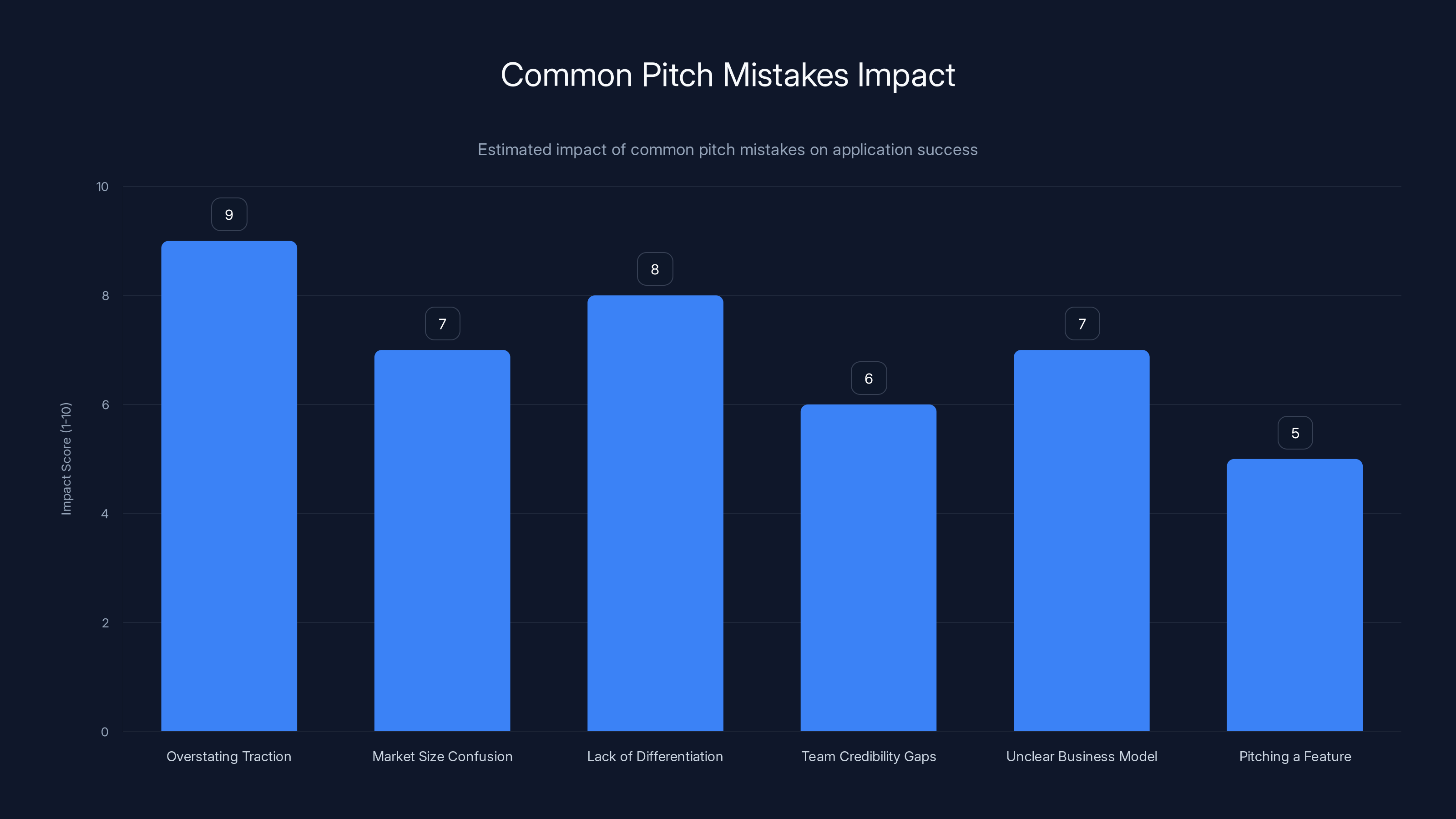

Overstating traction is the most damaging mistake with an estimated impact score of 9, while pitching a feature instead of a company is less impactful but still significant. Estimated data.

The Real Prize: Beyond the $100,000

Yes, $100,000 in equity-free funding is significant. For a pre-seed or seed stage startup, that's serious money. It's a runway extension. It's hiring your first engineer or first marketer. It's enough to ship a major feature set or enter a new market.

But the equity-free part? That's the real genius. You're not giving away cap table space. You're not signing over future control. You're getting capital with zero dilution.

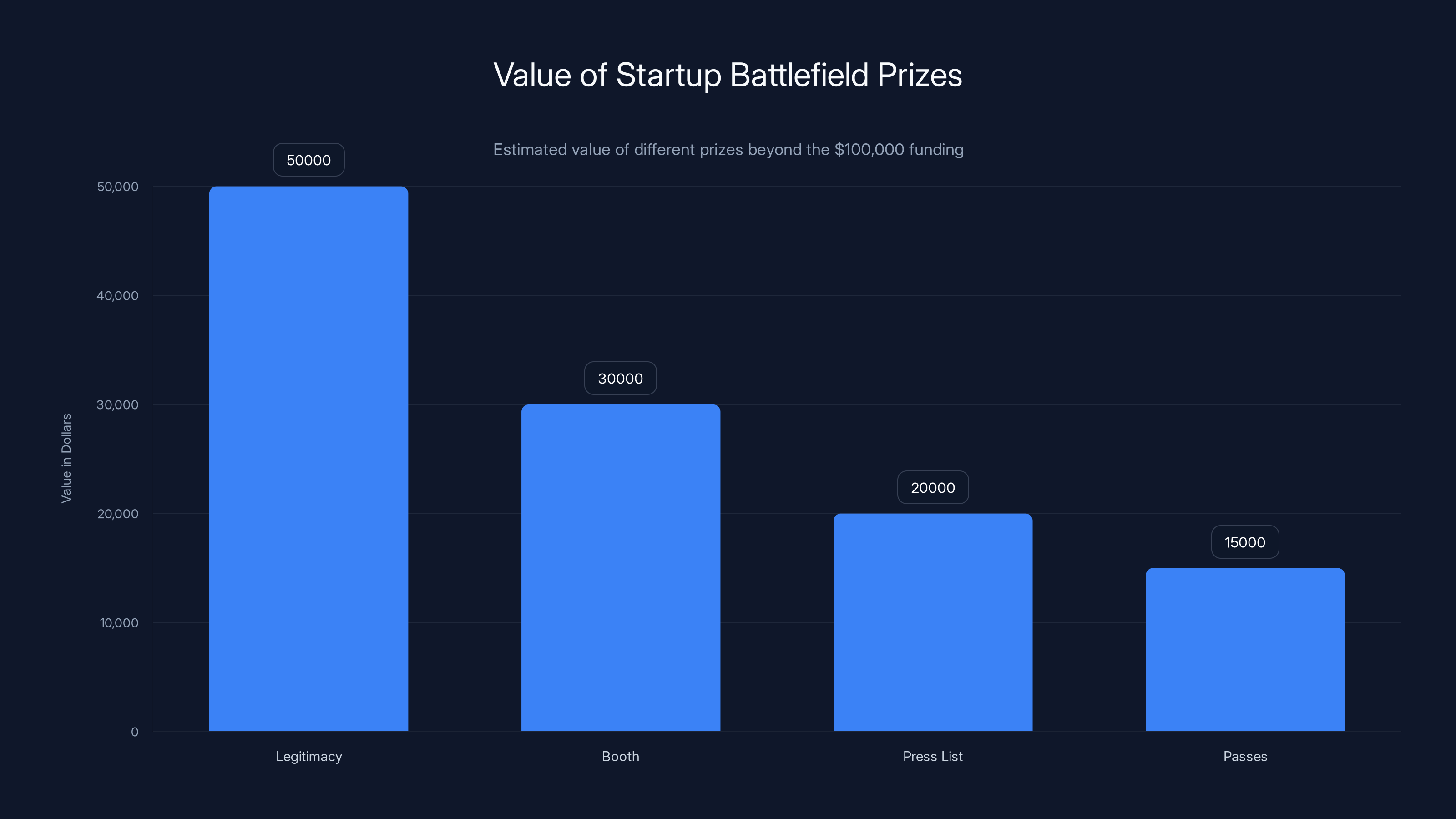

That said, the money is honestly the third prize at this competition.

First prize is legitimacy. You stood on the Disrupt stage and won. Investors remember that. Your pitch deck gets forwarded through VC networks. Reporters follow up. Your Google results get better. When you're cold-calling VCs for Series A, you lead with "Tech Crunch Startup Battlefield 200 winner." That opens doors in ways a press release never will.

Second prize is the booth. You get a free exhibit table for all three days of Tech Crunch Disrupt, the conference itself, which draws thousands of investors, founders, press, and corporate development teams. That booth is your sales office for 72 hours. You're meeting with potential customers, press, enterprise deals, potential hires. The networking value alone is worth tens of thousands in labor.

Then there's the press list. Startup Battlefield gets covered extensively. You're automatically on the press radar. Journalists call winners. VCs see the press coverage. Your Series A timeline compresses because the groundwork is already done.

And the passes. You get four complimentary Disrupt passes, which normally cost

Past winners prove the value. Dropbox, Airbnb integration partner, Mint, Discord, Fitbit. These companies are now worth billions. They didn't win Startup Battlefield because they were guaranteed to succeed. They won because they were solving real problems with real traction. The platform accelerated their success, but the fundamental business was already solid.

Eligibility Requirements: Are You Actually Eligible?

Before you start crafting your pitch, confirm you actually meet the eligibility criteria.

Startup Battlefield is designed for early-stage founders. Specifically:

Pre-seed and seed-funded startups are your sweet spot. If you've raised less than $2 million total, you're in the right place. If you're bootstrapped and generating revenue, perfect. If you haven't raised anything yet but have users or customers, you qualify.

Early Series A startups can apply, but only in specific circumstances. If you've raised Series A funding, you're not disqualified immediately. But Tech Crunch reserves the right to evaluate based on industry. Series A biotech companies with minimal traction? Probably passed over. Series A software companies generating $100K monthly recurring revenue? Might have a shot.

You need a working MVP. This isn't a business plan competition. You can't just have an idea. You need a product that customers can interact with. It doesn't need to be polished. It doesn't need to have thousands of users. But it needs to exist and function.

You need to be under the Series B threshold. If you've raised over $5 million or are approaching Series B, you're beyond the scope of what Startup Battlefield targets. That's not an absolute rule, but it's the practical boundary.

You need a founding team that can pitch. Some competitions accept pitches from non-founders. Startup Battlefield expects the actual founder or a founder-designated team member on stage. This matters because judges want to see the person who's leading the company.

One subtle thing: you need to have a company that's actually been incorporated and registered. You can't pitch a side project or a concept you're still validating with friends. It needs to be a real legal entity.

If you're borderline on any of these criteria, apply anyway. Tech Crunch reviews every submission. The worst they can say is no, and you get feedback in the process.

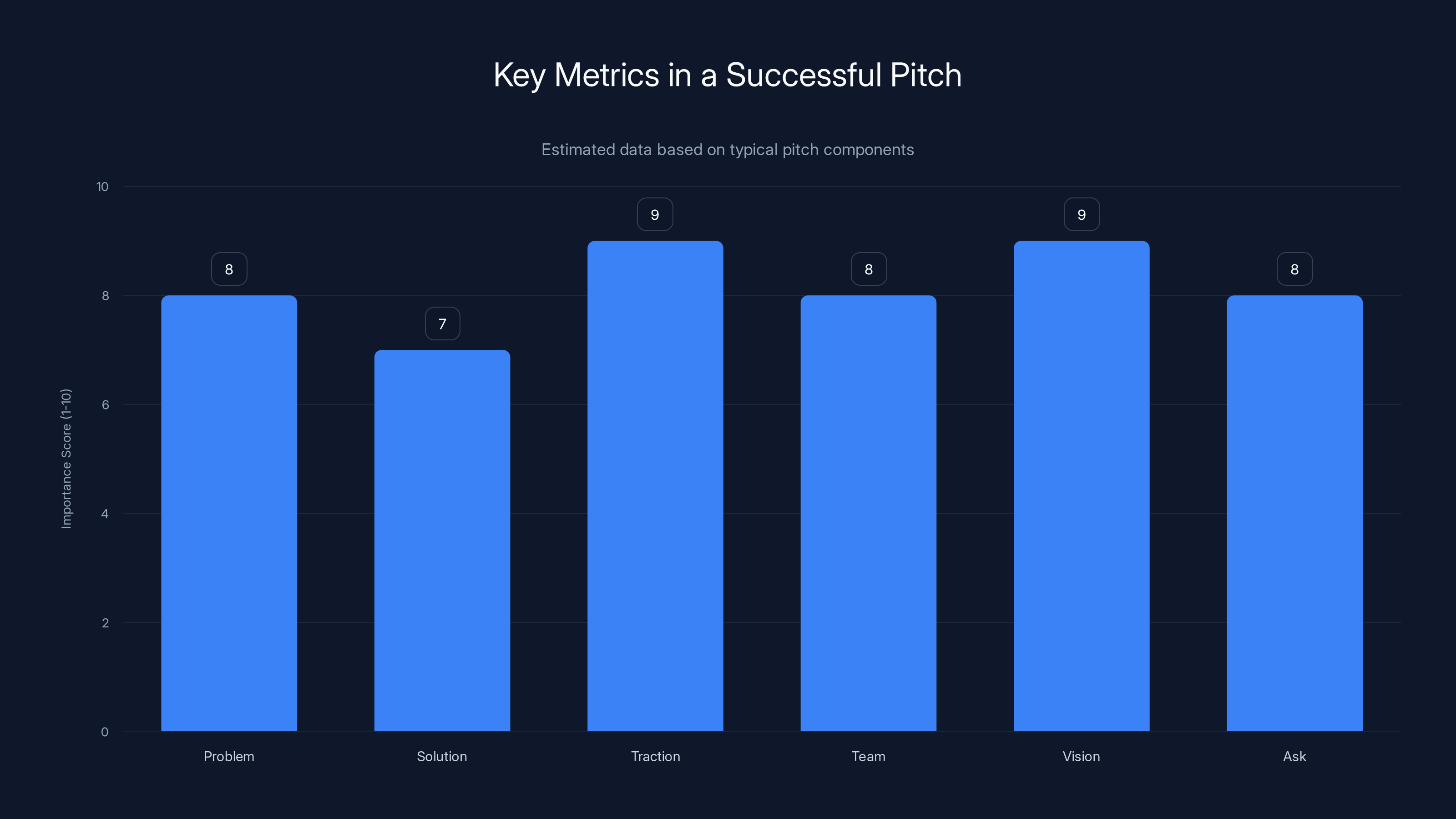

The 'Traction' and 'Vision' components are rated highest in importance for a successful pitch, emphasizing the need to demonstrate proof and future potential. Estimated data.

The Nomination Process: Getting In Front of Judges

Nominations for Startup Battlefield 200 open in February and close mid-June. That's roughly four months to prepare, apply, and potentially receive feedback before the next cycle closes.

The process itself is straightforward but requires precision.

You'll fill out a nomination form on the Tech Crunch Disrupt website. It asks for basic information: company name, founding date, location, website, description of what you're building. You'll provide links to your pitch deck, demo video (strongly recommended), and any press you've received.

Then you write a pitch narrative. Not a pitch deck. An actual 500-word narrative explaining your company, your market, your traction, and why you're different. This narrative matters more than people realize. It's your first impression with the readers who'll decide whether your application gets passed to judges.

Tech Crunch has a team that screens submissions. They're looking for pattern recognition. They see hundreds of applications. Ones that stand out usually have a clear problem, a differentiated solution, some validation (customer signups, revenue, impressive advisors), and a founder or team that's credible.

The screening process is designed to surface the most promising companies, not eliminate based on arbitrary criteria. A company with $2K in monthly recurring revenue and a strong founding team will rank higher than a company with 10,000 free signups and unclear monetization.

Once applications are screened, judges review the finalist pool. Judges are typically prominent VCs, press, and occasionally former Startup Battlefield winners or alumni. They evaluate based on market opportunity, product-market fit signals, team credibility, and pitch quality.

In late July or early August, Tech Crunch announces the 200 companies selected for the main stage. You're judging based on investment potential, innovation, and likelihood that the judge audience will find the pitch memorable.

Here's the strategic part: enter early. Not mid-June. Early. Sometime in March or April. Why? Because early submissions get preliminary feedback. They might flag something unclear about your narrative. You can adjust before the final screening. Plus, Tech Crunch remembers early applicants. If you're borderline, early entry tips the scales in your favor.

Building a Pitch Deck That Actually Works

Your pitch deck is your visual argument. It's not your presentation. It's not your narrative. It's the supporting visual evidence that makes your pitch stick in someone's brain for 6 minutes and then resonates for days after.

Bad pitch decks are packed with text. They explain things that don't need explaining. They use outdated design. They bury the key metrics in slide 12 when they should be screaming from slide 3.

Good pitch decks are sparse. They have one idea per slide. They use contrast to highlight what matters. They feel like someone designed them intentionally, not in Power Point's default template.

Here's the structure that works:

Slide 1: Title slide. Company name, tagline, founder names. That's it. Make it visually compelling. This is your first impression.

Slide 2: The problem. What problem exists? Why does it matter? Paint the picture. "Enterprise teams spend 8 hours per week managing access controls across cloud platforms." Specific. Real. Relatable.

Slide 3: The solution. Here's what we built. Show the product in action. A screenshot or quick demo. Explain it in one sentence. "Automated access governance in under 5 minutes."

Slide 4: Why now? What changed in the market that makes this solution viable today? Was there a technology breakthrough? Did regulatory requirements shift? Did adoption patterns change? This answers why your startup isn't 5 years too early or 5 years too late.

Slide 5: Market size. How many customers exist? What's their pain level? How much are they paying for competing solutions? Use TAM, SAM, SOM framework if you're estimating. But ground it in research, not fantasy.

Slide 6: Traction. This is your credibility slide. Users? Revenue? Partnerships? Pilot programs? Beta signups? Show growth curves. Show that customers are actually validating your thesis. If you're pre-launch, show progress toward product-market fit.

Slide 7: Business model. How do you make money? Subscription? Usage-based? Enterprise contracts? Be clear. Judges want to know this is a business, not a hobby.

Slide 8: Competition and differentiation. Who else is solving this? How are you different? What's your unfair advantage? Don't ignore competitors. It makes you look naive. Name them and explain why you're winning.

Slide 9: Team. Who are you? What relevant experience do you have? Who's joining you? Founder credibility is everything. If you sold your last company, shipped a product used by millions, or worked at a relevant company, now's the time to mention it.

Slide 10: Financials and ask. How much are you raising? What's the runway? Where does the money go? If you're asking for $1.5M Series A, show how you'll spend it. What milestones does that get you to?

Slide 11: Vision. Where are you going? What does success look like in 5 years? What market are you eventually dominating? Paint the inspiring picture. This is your emotional close.

Keep it to 11 slides maximum. Every slide should be readable from the back of a large auditorium. That means 24-point font minimum. Use contrast. Use white space. Use one compelling visual per slide. No bullet points longer than one line.

The deck is support, not the show. You're the show.

Startup Battlefield 200 has an estimated acceptance rate of 4-7%, making it more selective than prestigious institutions like Harvard. Estimated data.

Crafting Your Pitch Narrative: The 500-Word Goldmine

The written pitch narrative is where many founders drop the ball. They see it as an afterthought. They write it in an hour. They use generic language.

Actually, it's your first impression on the Tech Crunch reviewers. Get it right, and your application jumps the queue. Get it wrong, and you're deleted in 30 seconds.

Here's what works:

Start with the problem, not your company. "Enterprise teams waste 15 hours per week managing identity and access across cloud platforms." Concrete. Painful. Real. You just explained why your company exists before mentioning your company.

Then pivot to your solution. "We built Acme, which automates access governance across AWS, GCP, and Azure in one unified interface. Set policies once, enforce everywhere." Clear. Differentiated. Specific.

Show traction immediately. "Since launching in beta two months ago, 40 enterprise customers have signed on, with 15 in contract negotiations." Numbers move reviewers. Vague statements don't.

Explain your team in terms of credibility, not credentials. "I led infrastructure at Stripe, shipping security features used by millions. My co-founder sold his previous identity platform to a Fortune 500 company. We know this market because we built in it." Relevant experience matters.

Address the market size realistically. "Within the target segment of mid-market and enterprise companies managing cloud infrastructure, there are approximately 50,000 addressable customers, spending an average of

Briefly explain why now. "Cloud adoption accelerated 3x post-pandemic. Teams are now managing infrastructure across 5+ cloud providers and 200+ Saa S applications. Legacy access management tools were built for single-cloud architectures. We're built for the multi-cloud reality." Context matters.

Close with your ask and vision. "We're raising $1.5M to expand our go-to-market team and build support for additional cloud platforms. In 18 months, we want to be the standard for cloud access governance across the mid-market and enterprise segments." Be specific.

Keep it to 500 words. Tight writing is better writing. If you're at 700 words, you're losing the reader. If you're at 300, you didn't explain enough.

Read it out loud. If you stumble on a sentence, rewrite it. If you find yourself explaining something that seems obvious, delete it. If you use the word "leverage" or "synergy," delete it and use real words instead.

The Pitch Video: Why You Actually Need One

A demo video is optional. A pitch video isn't.

Tech Crunch reviewers want to see your actual pitch. Not your polished presentation. Not your final deck. Your actual verbal pitch. This tells them how you communicate under pressure, how you structure your argument, and whether you can hold attention with your voice and presence.

Keep it to 7-8 minutes. Record it on your laptop with decent lighting. You don't need Hollywood production. You need clear audio and video. That's it.

Structure it like you're standing in front of judges. Not like you're reading from a script. Make eye contact with the camera. Speak with conviction. Let your genuine excitement about the problem and solution come through.

Common mistakes: too polished (it feels fake), too casual (it feels unprepared), too long (attention drops after 5 minutes), reading from a teleprompter (super obvious and kills credibility).

Good pitch videos feel like someone who knows their stuff is explaining something they're genuinely passionate about. That's the vibe you're going for.

Upload it to You Tube (unlisted is fine) and link it in your application. If the video is bad, judges will know. If it's clear and compelling, it'll give you a real edge in screening.

While $100,000 is significant, the legitimacy, booth, press list, and passes offer additional estimated values, enhancing startup exposure and networking opportunities. Estimated data.

Understanding the Judging Criteria: What Moves the Needle

Tech Crunch judges evaluate companies across several dimensions. Understanding these dimensions helps you shape your pitch and company positioning.

Market opportunity and size matter. If you're solving a problem that affects 100 people worldwide, you're not getting selected. If you're solving a problem that affects millions and the TAM is

Evidence of product-market fit is critical. This looks different depending on your stage. Pre-launch? Show demand signals through waitlist signups or pilot waitlist. Early beta? Show retention, engagement, and customer enthusiasm. Launched? Show revenue growth month-over-month. Active usage metrics. Customers willing to pay. Something that demonstrates that actual humans want what you built.

Founder credibility and team composition matter enormously. A team that's shipped products before wins over a team that hasn't. A team with relevant domain expertise wins over a team that's learning the domain. A team that includes technical founders and business-oriented founders beats a team that's all technical or all business. Judges want to see people who've had real-world success.

Differentiation and defensibility. Can someone else copy what you built tomorrow? If yes, you have a distribution advantage, a network effect, technology moat, or something that makes copying hard. Judges want to understand why you'll still be winning in 2 years.

Realistic path to monetization. You don't need to be generating revenue yet. But you need a believable story for how you make money. "We'll figure it out later" doesn't work. Judges want to see that you've thought through the unit economics, pricing strategy, and sales motion.

Progress and momentum. Are you accelerating? Is the company moving faster than it was 3 months ago? Do you have more customers, more revenue, more traction? Momentum is the secret ingredient that signals execution ability.

Be honest about where you stand on these dimensions. If you're weak on revenue but strong on users, own it and explain your path to monetization. If you're strong on founder credibility but early on traction, lean into the team. Judges are sophisticated enough to evaluate companies at different stages differently. They don't expect a seed-stage company to have enterprise revenue. But they do expect to see movement.

Stage Logistics: What Happens When You Make the Cut

If you're selected as one of the 200 finalists, you'll get notified in late summer. Disrupt happens in September. That gives you about 4-6 weeks to prepare your on-stage pitch.

This is where most founders fumble. They think they can wing it.

The difference between a 6-minute pitch that lands and a 6-minute pitch that falls flat is enormous. It's not just information delivery. It's pacing, it's emphasis, it's knowing exactly when to pause for effect, it's having a transition between ideas that feels natural rather than abrupt.

You'll practice your pitch at least 50 times. Not exaggerating. You'll practice it so much that you can deliver it while someone's asking you aggressive questions. You'll practice it until you can pivot naturally between talking points. You'll practice it until timing is automatic and you're not staring at your deck worrying about what comes next.

You'll get coaching. Ideally from someone who's done this before. Someone who can tell you which anecdotes work and which ones drag. Someone who can hear you say something confusing and help you phrase it more clearly. Someone who's watched founders pitch hundreds of times and knows what moves judges.

Your first time on stage, you'll be nervous. That's normal. Every founder before you was nervous. But nerves don't excuse a pitch that's not tight. Judges expect you to be a little nervous. They don't expect you to be unprepared.

The technical setup is handled by Tech Crunch. You'll have a rehearsal slot. Use it. Go on that stage and run your entire pitch. See how your slides look on the actual screens. Hear how your voice projects. Test the microphone. Work through any tech issues before the actual performance.

On stage, you've got 6 minutes. Use every second. Don't go over. Don't fill time with filler words. Don't apologize for things. If you end at 5:30 and have time left, take the time to emphasize your key differentiator. Silence is better than filler.

Then 2 minutes of questions. Judges might ask about your market, your team, your monetization, your competition. They might challenge something you said. Stay calm. Give direct answers. If you don't know something, say so and explain how you'll find out. Judges respect honesty. They hate bullshit.

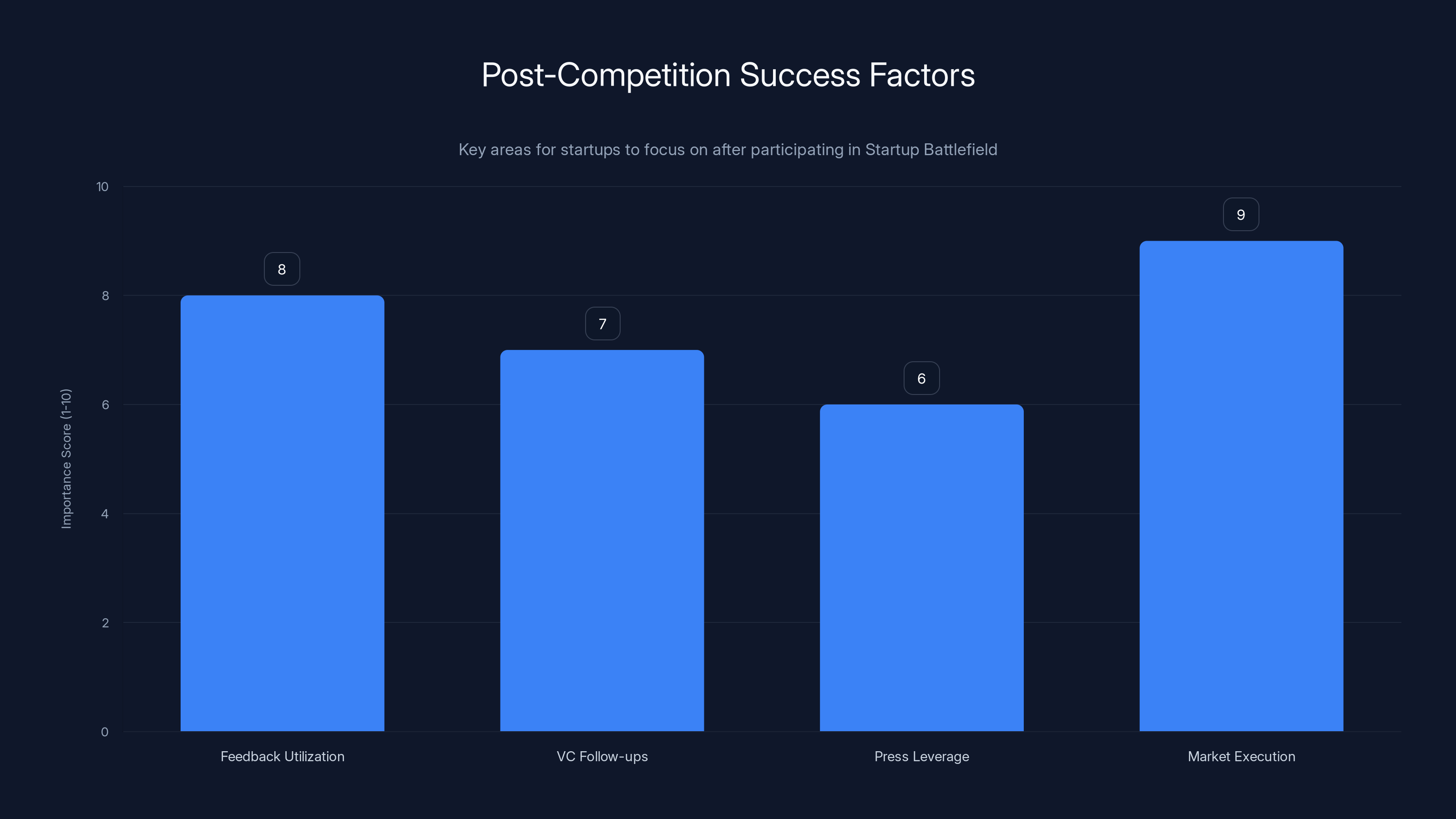

Startups should focus on market execution and feedback utilization to maximize post-competition success. Estimated data based on typical startup strategies.

Post-Competition Momentum: Winning Isn't the End, It's the Beginning

Let's be real: most companies selected for Startup Battlefield don't win. That's just math. 200 companies, 1 winner (sometimes there are multiple award categories, but still single digits).

So what happens if you don't win?

You still got massive value. You pitched in front of thousands. You got feedback from world-class investors. You networked for three days with the entire tech ecosystem. You got press. You got legitimacy. You might not have the $100K check, but you got something real.

Now what?

Use the feedback. If judges consistently asked about unit economics, that's telling you to get your financial model tighter. If they asked about customer acquisition costs, that's a signal that your go-to-market needs work. If they asked why you're different from competitor X, that's a signal that your positioning isn't clear enough. Take that feedback seriously.

Followup with VCs who approached you. If you had solid conversations with 10 investors, those are warm leads. Follow up within a week. Reference your conversation. Send your updated deck. Offer to meet. Some of those conversations turn into meetings, which turn into term sheets.

Leverage the press. You got written about. Use that article in your fundraising emails. Put it on your website. Mention it in calls. "Just pitched at Tech Crunch Disrupt" is a legitimacy signal that keeps working for months.

If you did win, congrats, but the work intensifies. You've got 4-6 weeks to execute before you're evaluated by the market. Use the booth time to actually move the needle. Sell pilot programs. Get case studies. Build momentum that extends beyond the competition.

The companies that win and then successfully raise Series A are the ones that immediately capitalize on the platform. They don't rest on the win. They use it as fuel to accelerate everything else they're doing.

Common Pitch Mistakes: What Actually Tanks Your Application

After seeing thousands of pitches, certain patterns emerge. Not all of them are deal killers, but they definitely hurt your chances.

Overstating traction is the cardinal sin. You say you have 10,000 users when you actually have 1,000. Judges will verify. They'll ask follow-up questions. When the story doesn't add up, your credibility evaporates. It's better to undersell and overdeliver. "We have 1,000 beta users with a 40% weekly retention rate and strong engagement signals" is way more compelling than "we have 10,000 users."

Confusing market size with serviceable market. You can't address your entire TAM. You can address a segment. Be honest about it. "We're going after mid-market Saa S companies with 50-500 employees, representing a

No differentiation from competitors. You'll hear "Airbnb for X" or "Uber for Y." Judges have heard it 500 times. Tell them what makes you different. Is it technology? Go-to-market? Team? Network effects? Something unique? Without differentiation, you're just a feature, not a company.

Team credibility gaps that don't make sense. If you're building a B2B enterprise security product and neither founder has shipped enterprise software before, that's a problem. You need someone on the team who knows the domain. That doesn't mean both founders need 20 years of experience. But you need credibility somewhere.

Unclear business model or revenue strategy. "We'll monetize later" doesn't work. You don't need to be generating revenue yet. But you need a plausible path to revenue that you've actually thought through. Even if you're wrong, judges want to see the thinking.

Pitching a feature, not a company. Your product is cool. But is it a business? Is there a defensible moat? Will it sustain a company? Features get copied. Companies have moats. Build and pitch the company, not the feature.

No product. You have an idea and a team. That's wonderful. Startup Battlefield is for companies that have shipped something. Come back when you've built the MVP.

Pitch deck full of text. If I can read your entire slide without you talking, your deck is working against you. The deck should support your words, not replace them.

Founder who can't articulate the vision. If you're pitching and you stumble over basic explanations, judges will worry about execution. Practice until you can explain this in your sleep.

Strategic Timing: Why Early Entry Changes Everything

Nominations open in February. They close mid-June. That's four months.

Most founders apply in the last month. It's a natural procrastination pattern. But it's a strategic mistake.

Here's why early entry matters:

First, you get preliminary feedback. Tech Crunch might reach out and ask for clarification on your pitch narrative. They might flag something unclear. You get a chance to fix it before final review. Founders who apply in June don't get this feedback.

Second, reviewers have more availability. Early in the application cycle, reviewers have more time. They read more carefully. They give your application proper consideration. Late in the cycle, they're reading hundreds of applications and making quick cuts. Your application gets 10 seconds instead of 30.

Third, you're fresher in their mind. If you apply in March and they're selecting companies in July, you've been in their head for months. If you apply in May, you're just one of hundreds in the final push. Recency bias works against you.

Fourth, you have time to iterate if you're rejected. If you apply early, get rejected, and get feedback, you can apply next year with an improved application. You're not out. You're just cycling for another round of feedback.

Apply in March. Don't overthink it. Your pitch deck doesn't need to be perfect. Your narrative doesn't need to be flawless. It just needs to be clear and compelling. You can refine it based on feedback.

Early entry is a strategic advantage that costs you nothing.

Preparation Timeline: From Nomination to Stage

If you're serious about this, here's a realistic timeline:

February-March: Prepare nomination. Get your pitch deck to 90% done. Write and rewrite your narrative. Record a practice pitch video. Get feedback from advisors. Iterate.

Late March: Submit. Apply to Startup Battlefield. Don't overthink it. Submit and move on to running your company.

March-July: Improve your company. Get more customers. Increase revenue. Improve retention. Build traction that matters. If you get selected, this traction is what wins you the competition.

Late July: Notification. If you're selected, start preparing in earnest.

August: Intensive prep. Find a pitch coach. Practice daily. Get feedback from people who've watched founders pitch. Refine your deck based on new company data. Plan your Disrupt experience: who are you meeting, what booth space strategy do you have, how are you staffing the booth?

September: Execute. Pitch on stage. Network relentlessly. Follow up with every investor you spoke to. Capture emails from booth visitors. Take meetings. Make connections.

October onwards: Capitalize. Use the momentum. Schedule investor meetings. Send updated pitches. Close customers. Convert conversations into actual business outcomes.

Don't start preparing in August. You'll be rushed. You'll be tired. You'll be shipping features to the company while trying to memorize a pitch. Give yourself space to prepare properly.

Tech Crunch Founder Summit: The Complementary Event

Before Disrupt (where Startup Battlefield happens), there's Tech Crunch Founder Summit.

It's a day-long event (June 23, 2026 in Boston) focused on growth, execution, and scaling. Over 1,100 founders come together. There are talks from operators who've built $100M+ companies. Panels on fundraising, hiring, product strategy, go-to-market. Workshops on specific tactics.

If you're serious about scaling a startup, this event is incredibly useful. It's smaller than Disrupt (hence more intimate). The signal-to-noise ratio is better.

Ticket prices start at around $2,500, but there's typically a discount if you apply early or come as a group. If you're fundraising, you should probably go. If you're in execution mode and building product, it's less critical.

The value is in the network and the tactical knowledge transfer. You'll learn from people who've been in the trenches. You'll meet other founders at similar stages. You'll get perspective on your challenges.

Attend if you can. But prioritize Disrupt if you're selected for Startup Battlefield. That's your real stage.

Alternative Pitch Competitions: Other Pathways to Capital and Credibility

Startup Battlefield isn't the only pitch competition out there. There are others. Should you consider them?

Y Combinator Startup School is free and online. It's not a competition, but it provides education and networking. Lower barrier to entry. Less prestige than Battlefield, but valuable context.

500 Global runs competitions across different geographies. Good if you're building outside the US. Smaller audience than Disrupt, but still valuable.

Regional pitch competitions exist in most metro areas. These are lower stakes but easier to win. Good for practice and local credibility building.

Shark Tank and similar TV shows have huge reach but are highly entertainment-focused. Your pitch needs to work for TV, not just investors. That changes the dynamic significantly.

The thing about Startup Battlefield is that it attracts the most sophisticated investors and founders. The quality bar is highest. The platform is biggest. If you're building something serious, Startup Battlefield should be your primary target.

But don't let other competitions distract you from shipping product and getting customers. A company with serious traction needs a pitch competition less than a company with early traction. Focus on the business first. Use competitions as validation, not as your primary growth lever.

The Reality Check: What Battlefield Actually Does and Doesn't Do

Let's be honest about what this competition can and can't do for you.

It can give you legitimacy and platform. Winning Startup Battlefield opens doors. Investors take you seriously. Media reaches out. You get press that money can't buy.

It can't guarantee funding. You win $100K, sure. But you still have to raise Series A on your own. Battlefield doesn't automatically unlock VC term sheets. It makes the pitch meetings easier, but conversion still depends on your metrics.

It can't replace product. If your product is mediocre or doesn't solve a real problem, a Disrupt stage won't fix it. The platform amplifies what's already there. If it's a weak product, amplification just fails louder.

It can't replace team. If you don't have a credible team that can execute, the platform won't help. Actually, more scrutiny on a weak team might hurt.

It can help with recruiting. Winning Startup Battlefield makes recruiting easier. Engineers want to work for companies that are winning. You're now winning (in the eyes of outsiders).

It can help with partnerships. Corporate development teams watch Disrupt. If your solution integrates with their platform, they'll potentially reach out. Partnerships can be deal-changing.

It can't replace hustle. The companies that win and then build real businesses are the ones that use the platform as fuel, not as destiny. They don't celebrate the win and then relax. They immediately capitalize.

Go in with clear eyes. Startup Battlefield is a platform. What you do with it matters more than the platform itself.

The Pitch Formula That Actually Works

If there's one formula that works across almost every successful pitch, it's this:

Problem. Solution. Traction. Team. Vision. Ask.

Problem: Something costs money, causes pain, or creates inefficiency. You quantify it. "Enterprise teams spend 15 hours per week on manual access management."

Solution: Here's what we built. One sentence. "We automated that process. It takes 5 minutes to set up."

Traction: Proof it works. "40 companies are using it. Average contract value is $50K. We've signed 5 of them. 15 are in advanced talks."

Team: Who are you? "I led infrastructure at Google for 7 years. My co-founder was an early engineer at Stripe. We've worked together for 3 years on this problem."

Vision: Where does this go? "In 5 years, we're the standard for cloud access governance. We're capturing 20% of the $100B market."

Ask: What do you want? "We're raising

That's the template. You can adjust emphasis depending on your stage, but that structure works.

Now practice it 50 times.

FAQ

What happens if my startup is rejected from Startup Battlefield 200?

First, you still get valuable feedback. Tech Crunch reviewers will often provide guidance on what would strengthen your application for future cycles. Use that feedback to improve your company and your pitch. Many founders don't get selected the first year but succeed in subsequent years after building more traction. You also still have value from the application process itself, you've clarified your thinking around your pitch and messaging, which helps with other investor conversations. The connections you make during the submission process (advisors, mentors, initial investors) often matter more than the competition outcome.

How much does it cost to apply to Startup Battlefield 200?

There is no application fee to nominate your company for Startup Battlefield 200. The nomination process is completely free. If you're selected as a finalist and choose to attend Tech Crunch Disrupt to pitch, you'll need to handle travel costs, though the event provides booth space and passes for selected companies. This is significantly more accessible than competitions that charge

Can I apply if I'm a non-technical founder without a technical co-founder?

Yes, but it's harder. Judges want to see technical execution capability on the founding team. If you're a business founder without technical co-founders, you need to demonstrate that you have a strong technical advisor or early technical hire leading product development. Alternatively, if you can show that your product is outsourced to a reputable technical partner or if you've self-taught and shipped something real, that works too. The core issue is proving that the company can actually execute on the product vision. How you prove that is flexible.

What's the difference between Startup Battlefield and attending Disrupt as a regular attendee?

Startup Battlefield competitors get free booth space, free passes for team members, automatic press attention, investor meetings, and access to an exclusive finalist network. Regular attendees pay

How should I structure my pitch if I have limited traction?

Lead with problem validation instead of customer traction. Show that you've talked to 100+ potential customers and 80% said they'd pay for your solution. Show pilot programs with letters of intent. Show advisor credibility—if respected figures in the industry believe in your problem, that's a traction proxy. Show team credibility—if you've shipped products before or have domain expertise, that matters. Show product quality—even if you have few users, if those users are extremely engaged and retained, that's a signal. Judges understand that different companies have different traction patterns. Show what you do have, not what you don't.

What's the actual probability of winning the $100,000?

It's low. Around 0.5-1% depending on the year and category. Out of 200 companies, maybe 1-3 win major prizes (the exact breakdown depends on Tech Crunch's current award structure). However, being in the top 200 is itself a massive win. You get platform, credibility, and investor access that's extremely valuable. Don't enter with the expectation of winning the money. Enter with the expectation of leveraging the platform.

Can I use Startup Battlefield as my primary fundraising strategy?

No. Use it as an amplifier of a strategy you already have. You should be pitching investors regardless. You should be building traction regardless. You should be getting advisors regardless. Startup Battlefield accelerates those processes, but it doesn't replace them. The best founders treat it as a milestone, not a make-or-break event. If you win, great, you've got $100K and a platform. If you don't, you've got investor meetings and press. Either way, you're fundraising through multiple channels simultaneously.

How do I get noticed among thousands of applications?

Show clear traction and a credible team. That's it. If you have customers, revenue, or strong engagement metrics, you stand out. If you have a team with relevant shipping experience, you stand out. If you can articulate a differentiated solution to a real problem, you stand out. Don't try to be clever. Be clear. Be specific. Show proof. That's what breaks through the noise.

Conclusion: Your Moment Is Now

Startup Battlefield 200 nominations are open. Not for long—mid-June closes the window. That gives you roughly four months to prepare your company, your pitch, and your application.

Here's what's actually at stake: legitimacy, momentum, and platform. Three things that matter enormously in the early-stage startup world.

You can spend the next decade building a company in obscurity, then suddenly blow up. Or you can spend your early months getting amplified on one of the biggest stages in tech. The outcome is the same eventually, but the timeline is different. The fundraising is easier. The recruiting is easier. The early partnerships happen faster.

That's what Startup Battlefield delivers.

But it only works if you actually apply. If you actually prepare. If you actually take it seriously.

Most founders don't. They think they'll apply next year. Or they think their company isn't ready. Or they're intimidated by the competition.

The companies that win are the ones who didn't wait. They applied. They iterated. They practiced. They showed up.

Your company doesn't need to be perfect to apply. It needs to be real. It needs to have a problem worth solving. It needs to have a team that's credible. It needs to have some evidence of validation.

If you have those things, apply. Don't overthink it. The worst they can say is no. And if they say no, you've gotten feedback and you're positioning for next year.

If they say yes? You're standing on the biggest stage in tech. Thousands of investors are watching. Journalists are covering it. VCs are taking notes.

Now go prepare. Because the battle begins when you step on that stage.

Key Takeaways

- Startup Battlefield 200 is the most prestigious early-stage pitch competition, with past winners including Dropbox, Discord, Fitbit, and Trello

- Apply early (March-April) rather than waiting until June, as early applications get preliminary feedback and reviewer attention

- The real value is platform, credibility, and network access, not just the $100K equity-free prize

- Your pitch deck, narrative, and team credibility matter more than a polished presentation; authenticity and proof of traction win

- Successful founders use the 6-month preparation window to build additional company traction, not just refine their pitch

Related Articles

- Hubristic Fundraising: Brex's $5.15B Acquisition & Lessons [2025]

- AMI Labs: Inside Yann LeCun's World Model Startup [2025]

- SaaS Revenue Durability Crisis 2025: AI Agents & Market Collapse

- AI Inference Costs: The 23% Revenue Challenge B2B Companies Face in 2025

- Duna Series A €30M: KYB Verification Platform Redefining Identity [2025]

- Own's $2B Salesforce Acquisition: Strategy, Focus & Lessons

![TechCrunch Startup Battlefield 200 [2026]: Complete Guide to Pitching Success](https://tryrunable.com/blog/techcrunch-startup-battlefield-200-2026-complete-guide-to-pi/image-1-1770647770947.jpg)