Tech Crunch Startup Battlefield 200: Your Complete Guide to the Arena [2026]

You've bootstrapped your MVP. Your product works. Your team believes. But nobody knows about you yet.

Enter Startup Battlefield 200.

This is where early-stage founders go to get tested. Not politely. Not in a comfortable conference room with affirming nods. I'm talking about standing on a stage in front of thousands of people, facing ruthless feedback from venture capitalists who've seen 10,000 pitches, while the entire startup ecosystem watches.

Sounds terrifying, right?

Here's the thing: terrifying is exactly right. And that's exactly why it matters.

What Is Startup Battlefield 200?

Startup Battlefield 200 is TechCrunch's flagship startup competition and showcase event. It's held during TechCrunch Disrupt, the largest startup and technology conference in the world. But calling it a "competition" undersells what actually happens here.

Battlefield isn't a speed-dating event or a generic pitch contest. It's a pressure cooker designed specifically for early-stage founders. You get roughly 6 minutes to present your company to a panel of experienced venture capitalists and angel investors. Then you face 4-6 minutes of unscripted questioning. The questions aren't softball asks. Investors press on your unit economics, your market size, your competitive moat, your ability to execute.

Then comes the part most founders don't expect: the judges critique your pitch publicly. Sometimes it's encouraging. Sometimes it's brutal. One judge might say your market is too crowded. Another might challenge your revenue assumptions. A third might identify a product gap you didn't see coming.

Why would anyone volunteer for this? Because alumni companies include Trello, Dropbox, Mint, Discord, and Fitbit. More than 1,500 startups have stood on that Battlefield stage. Many went on to raise millions. Some became industry leaders. All of them got something invaluable: real feedback from the people who fund startups.

The event itself has evolved significantly since TechCrunch started it nearly two decades ago. It's no longer just a pit where startups fight for attention. It's become a genuine ecosystem event. Thousands of investors, journalists, founders, and operators attend Disrupt specifically to find the next generation of breakout companies. Many watch Battlefield specifically to identify investment opportunities.

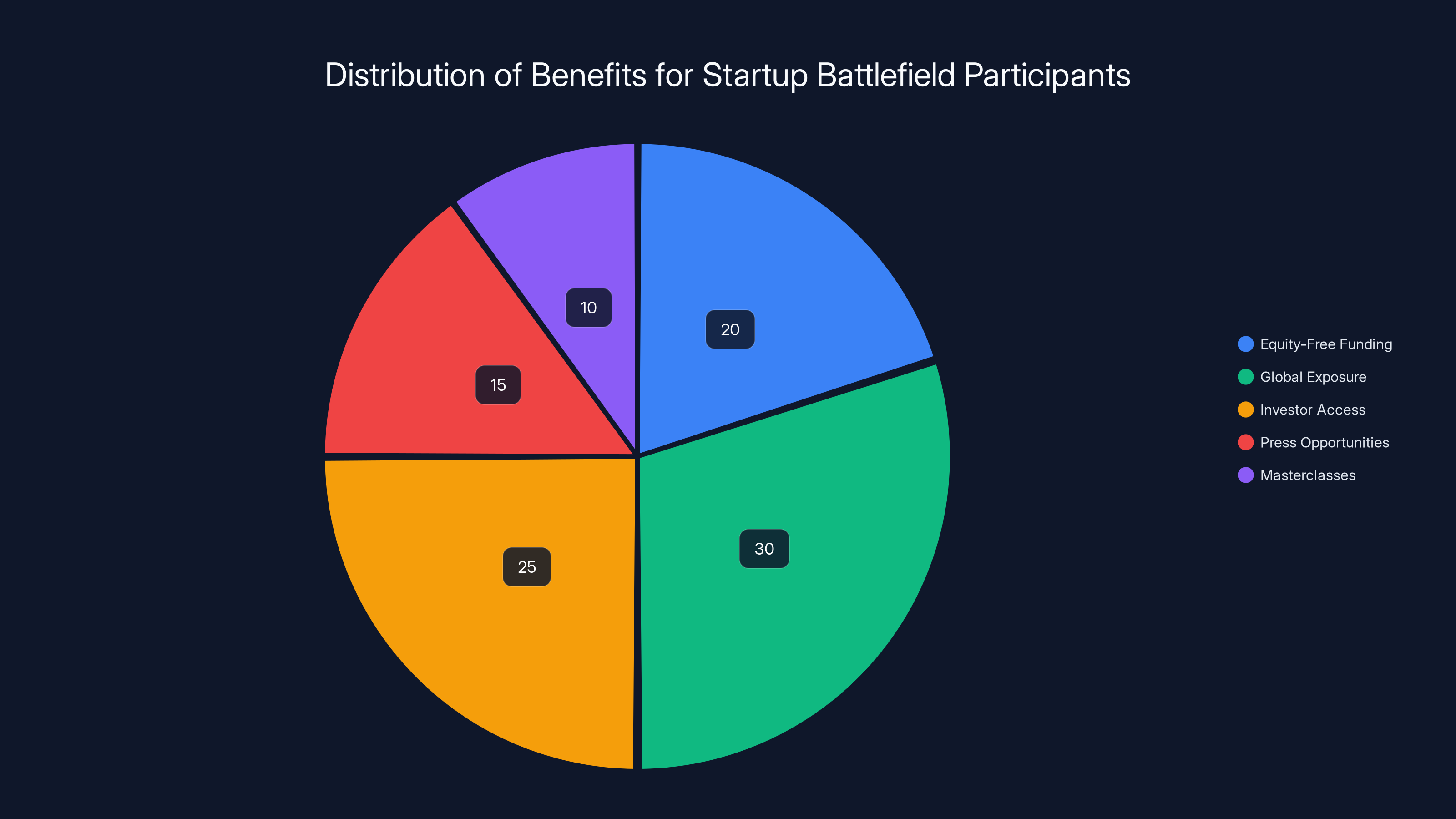

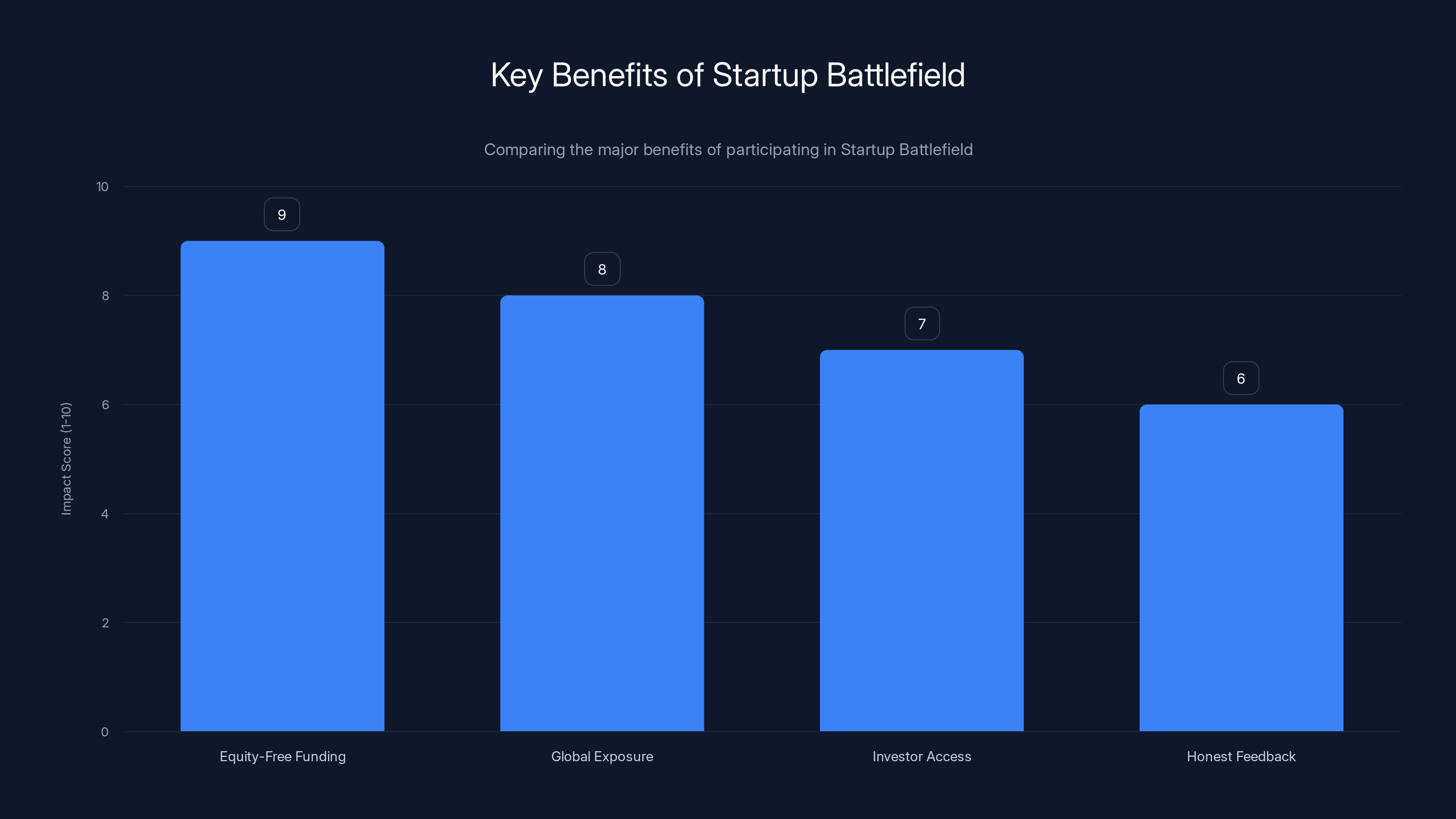

Global exposure and investor access are the most significant benefits for participants in Startup Battlefield, followed by equity-free funding. (Estimated data)

The Numbers Behind the Battlefield

Let's talk about the scale here, because numbers tell the real story.

Thousands of startups apply each year for Startup Battlefield. Last year, the number was significant—we're talking thousands of applications competing for roughly 200 final spots. That's a selection rate around 5-10% depending on application quality. For context, that's comparable to acceptance rates at top-tier universities.

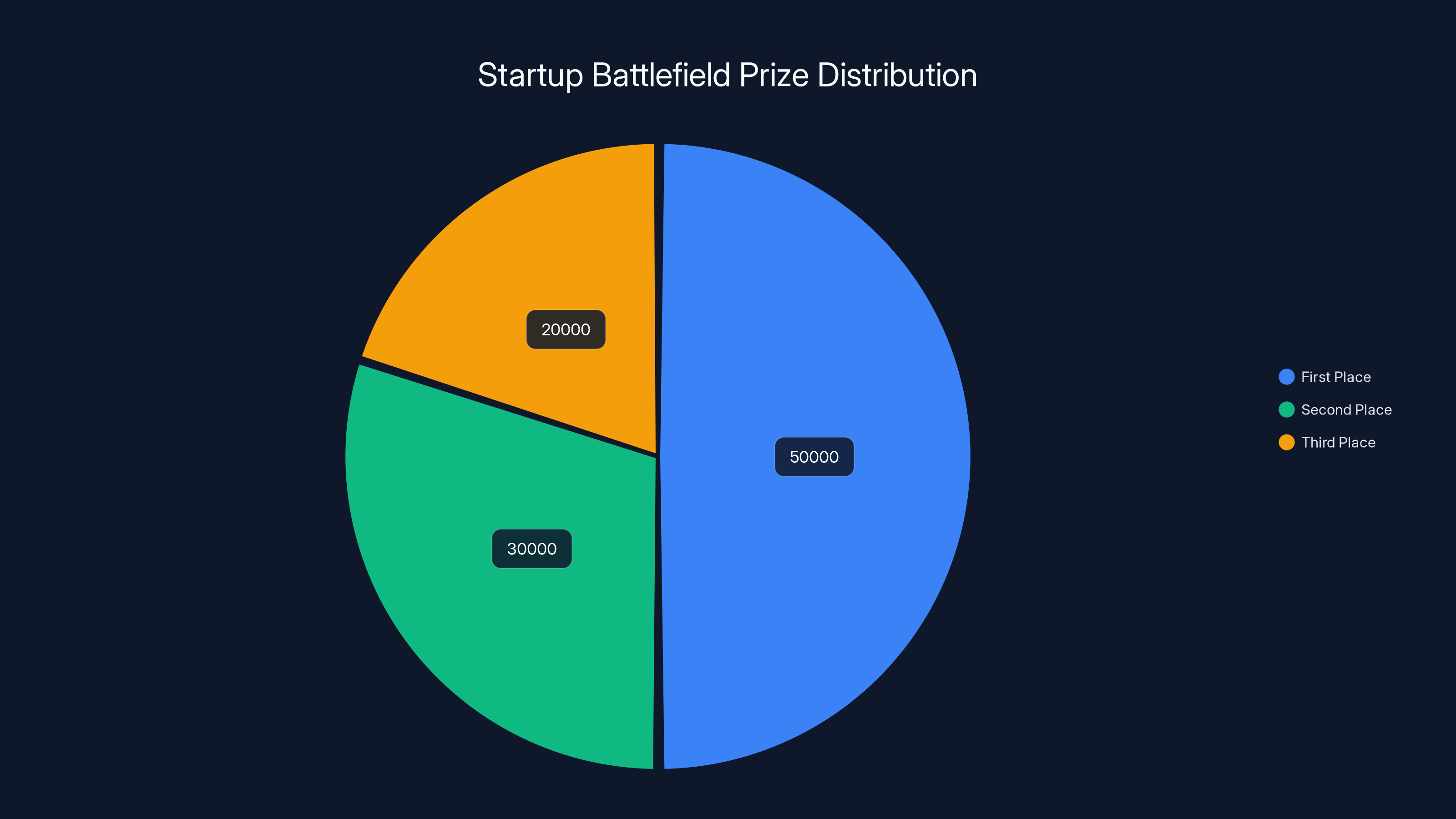

But here's what matters more: of those 200 startups, only a handful actually win the main competition. The top three winners get cash prizes totaling

Beyond the prize money, the exposure is enormous. TechCrunch has over 5 million monthly readers. Disrupt 2026 in San Francisco will draw an estimated 20,000+ attendees, including hundreds of active venture capitalists, angel investors, and startup operators. Every Battlefield startup gets press coverage. Top performers get significantly more.

The networking ROI is harder to quantify but potentially massive. Founders who perform well often receive investor interest in the weeks and months following Disrupt. Some raise their next funding rounds specifically because of Battlefield exposure. Others find early customers, business development partners, or future employees in the Disrupt crowd.

Who Can Apply? Founder Eligibility and Requirements

Not every startup qualifies for Startup Battlefield. TechCrunch looks for founders at a specific stage and with specific characteristics.

First, you need to be early-stage. The sweet spot is bootstrapped, pre-seed, or seed-funded startups. These are companies that have validated market need but haven't yet scaled significantly. You should have an MVP (minimum viable product) or at least a working prototype. Vapor is not acceptable. If your product is pure concept or whiteboard sketches, you're too early.

Second, you need to be bold. TechCrunch specifically looks for founders who are challenging the status quo. This doesn't mean you need to be revolutionizing an entire industry. It means your startup should solve a real problem in a way that's notably different from existing solutions. You're not trying to be a "better version" of something that already exists—you're trying to create something genuinely new or significantly improved.

Third, you need a vision. Your MVP might be small, but your ambition should be enormous. Judges want to see founders who think about billion-dollar markets, not founders optimizing for modest lifestyle businesses. This isn't judgment about business models—it's about whether you're thinking ambitiously.

Series A startups can sometimes qualify, but typically only if you're in a capital-intensive industry like hardware, biotech, or infrastructure. These sectors often require more runway before proving unit economics. But if you're a software or SaaS company with Series A funding, you're likely overqualified.

Geographic location doesn't matter for nomination. TechCrunch reviews startups from around the world. Previous Battlefield cohorts have included companies from Europe, Asia, South America, and Australia.

There's no age requirement, though most founders are between 25 and 45. There's no requirement about gender, race, background, or education. TechCrunch cares about the founder's ability to execute and the startup's potential.

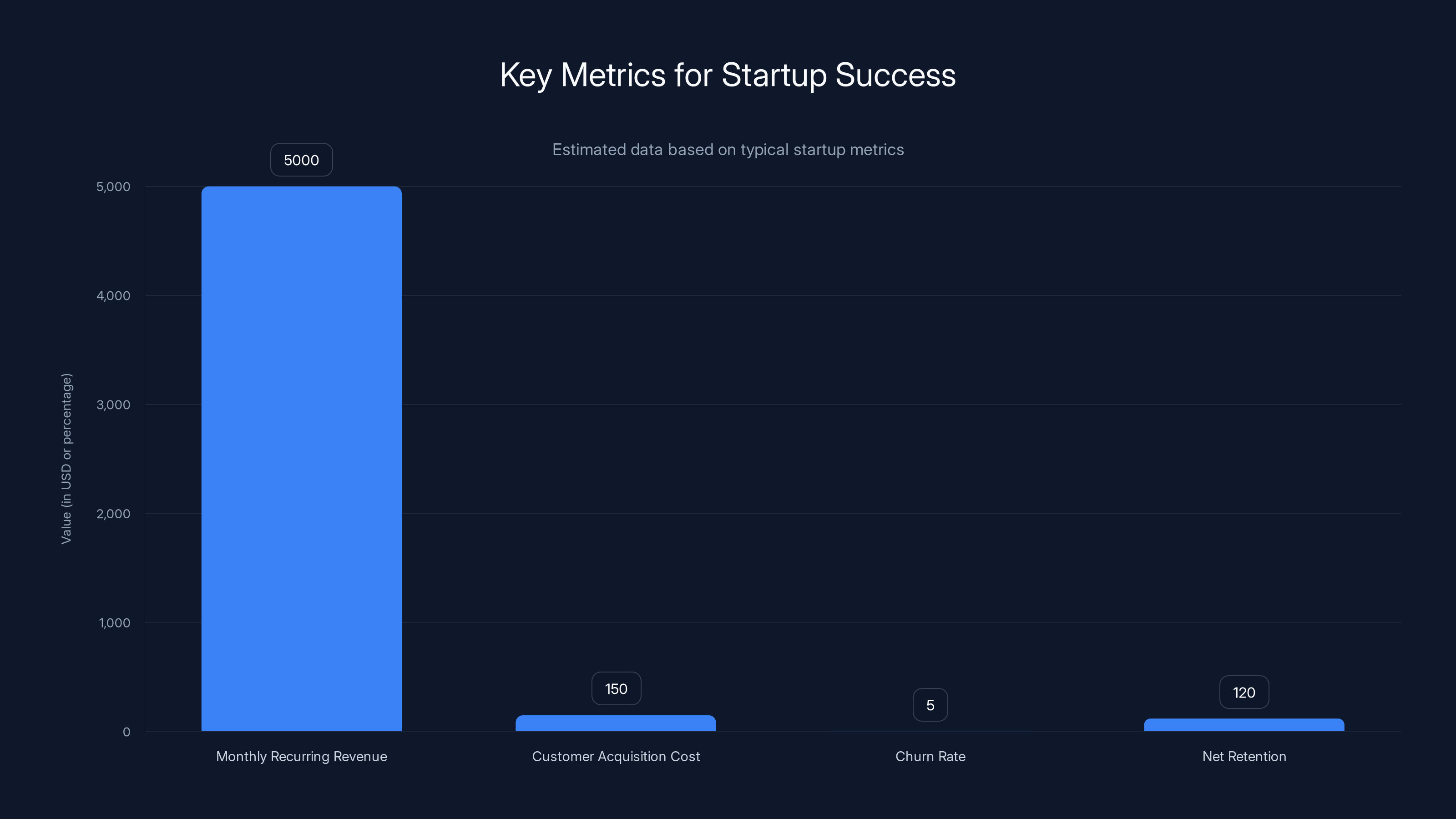

Understanding key metrics like monthly recurring revenue and churn rate is crucial for startups to succeed in competitive environments. Estimated data.

The Application Process: From Nomination to Stage

The application is straightforward but requires serious preparation.

First, you nominate yourself on the Startup Battlefield website. You provide basic company information: name, description, founding date, location, and team size. You upload a pitch video (typically 60-90 seconds). You answer specific questions about your market, your differentiation, and your traction so far.

Then TechCrunch reviews every application. Yes, every single one. A combination of TechCrunch editors and guest reviewers evaluate submissions based on several criteria: market opportunity, product quality, team composition, execution progress, and pitch quality.

This is important: early applications have a hidden advantage. If TechCrunch reviews your application in February, before the massive June application surge, you're evaluated against fewer competing applications. If you wait until May, you're competing against thousands of others. Early entry isn't just psychologically better—it's strategically advantageous.

If you're selected, you'll be notified roughly 4-6 weeks before the event. Then comes the real preparation. Most selected startups refine their pitch dramatically. They test different narratives with mentors and advisors. They prepare for likely questions. They craft their story around the 6-minute slot.

By the time you get to the stage, you've probably pitched these exact words to 50+ people. You know the response to every question. You know how long each section takes. You know where the laughs come. You know where people's eyes glaze over.

The competition itself happens over a single day. All 200 startups pitch sequentially or in batches, typically organized by industry or stage. Judges are revealed weeks ahead, so you can research them, understand their investment patterns, and maybe find hooks that resonate with their specific investment thesis.

Breakthrough Benefits: Why Apply?

Let's be direct: Startup Battlefield is work. Preparing is effort. The pitch itself is stressful. The feedback can be harsh. So why do thousands of founders apply?

$100,000 in Equity-Free Funding

This is the most obvious benefit. At pre-seed or seed stage, $100,000 can extend your runway significantly. For a lean startup, this covers 6-12 months of operations. More importantly, it's equity-free. You don't dilute your founders' ownership. You don't sign term sheets. You don't give up board seats. You get pure capital to accelerate.

Global Exposure

TechCrunch has enormous reach in the startup world. Every Battlefield company gets featured on TechCrunch's website. Top performers get dedicated articles. Winners get major coverage. This exposure brings emails from potential customers, investors, partners, and employees for months afterward.

But the live exposure is different. Twenty thousand people watching Disrupt in person. Thousands more watching the livestream. Thousands of others reading the coverage. Your company name enters the consciousness of the entire startup ecosystem.

Investor Access

Battlefield is explicitly designed as an investor showcase. Hundreds of active VCs attend Disrupt specifically to watch Battlefield. Many come prepared to invest. Even if you don't win, a strong pitch can attract investor interest. Founders report receiving follow-up emails from investors weeks and months after Battlefield.

Honest Feedback

This might sound counterintuitive as a benefit. Getting criticized is uncomfortable. But early-stage founders often exist in echo chambers. Your co-founder thinks your idea is brilliant. Your friends think your pitch is great. Your family is supportive. But investors? Investors ask hard questions. They identify holes in your logic. They spot product gaps. They challenge your assumptions.

This feedback is worth thousands of dollars in consulting fees. It's the kind of honest, experienced perspective that most early-stage founders never get.

Founder Community

You're pitching alongside 199 other founders at similar stages. Some are solving problems in your space. Some are in adjacent industries. Many become lifelong friends and collaborators. The founders who pitch at the same Disrupt often stay in touch, provide introductions, and help each other navigate the funding journey.

This network has enormous long-term value.

Tangible Conference Perks

You get a free booth at Disrupt for all three days. You get four complimentary passes (worth over $1,000 each). You get your company listed in the Disrupt app with booth location and company description. You get access to a press list for outreach. You get invitations to exclusive founder masterclasses. You get leads from attendees searching the app specifically for your company.

Strategic Preparation: How to Actually Win

Let's talk about preparation, because the startups that succeed at Battlefield don't just show up. They prepare intensely.

Start With a Killer Narrative

Your 6-minute pitch isn't a feature dump. It's a story. Great Battlefield pitches typically follow this structure: problem, personal connection to the problem, solution, traction so far, vision for the future, ask.

The best pitches make judges feel something. Not warm and fuzzy feeling. I mean the feeling of "oh, I see why this matters." The feeling of recognition. The feeling that this founder understands something important about their market.

Pick Your Lane

Your market might be big, but you can't own the whole market on day one. Pick a specific beachhead. Maybe you're not building software for all small businesses—you're building software for freelance graphic designers. Maybe you're not revolutionizing transportation—you're solving the last-mile delivery problem in dense cities.

Judges respect specificity. It signals that you understand who your customer is and where you can win first.

Know Your Metrics

You'll be asked about traction. If you have customers, be ready to discuss: monthly recurring revenue, customer acquisition cost, churn rate, net retention. If you have users without revenue, have usage metrics ready: daily active users, month-over-month growth, engagement metrics.

Judges will probe these numbers. They'll ask what they mean. They'll challenge your assumptions. Be prepared to discuss not just the current numbers but the trajectory. If you have 50 customers today, are you adding 10 per week or 2 per week? The velocity matters as much as the absolute number.

Anticipate the Hard Questions

Battlefield judges follow patterns. For a healthcare startup, they'll ask about regulatory approval timelines. For a marketplace, they'll ask about unit economics. For an AI company, they'll ask about what happens when larger competitors build similar functionality.

Make a list of 20 questions that could be asked about your company. Write out answers. Practice saying them out loud. Have mentors ask you the questions while you're standing, not sitting, so you practice the pitch stance.

Build a Pitch Deck That Stands Alone

Your pitch deck needs to work in two contexts: projected on stage for 6 minutes, and then handed to investors afterward. Slides should be visual-heavy with minimal text. Numbers should be large and clear. Branding should be clean and memorable.

One hack used by successful Battlefield founders: make your deck work as a standalone document. If someone reads it without hearing your talk, they should understand your company. This means better captions and more explanatory visuals than typical pitch decks.

Prepare for Different Judge Archetypes

Battlefield judges are usually successful investors, entrepreneurs, and operators. They come from different investment backgrounds and have different priorities.

Some judges care primarily about the team. They want to know: can these founders execute? Have they started other things? Do they have relevant domain experience?

Other judges care primarily about the market. They want to know: how big is this market? What's the total addressable market? Are you going after a market that's actually growing?

Other judges care primarily about the moat. They want to know: what makes you defensible? Why can't a larger competitor do this? What's your unfair advantage?

Your pitch needs to thread these needles. It needs to convey a strong team, address a massive market, and explain your competitive advantage. But different judges will ask follow-up questions highlighting their particular focus. Be ready to elaborate on any dimension.

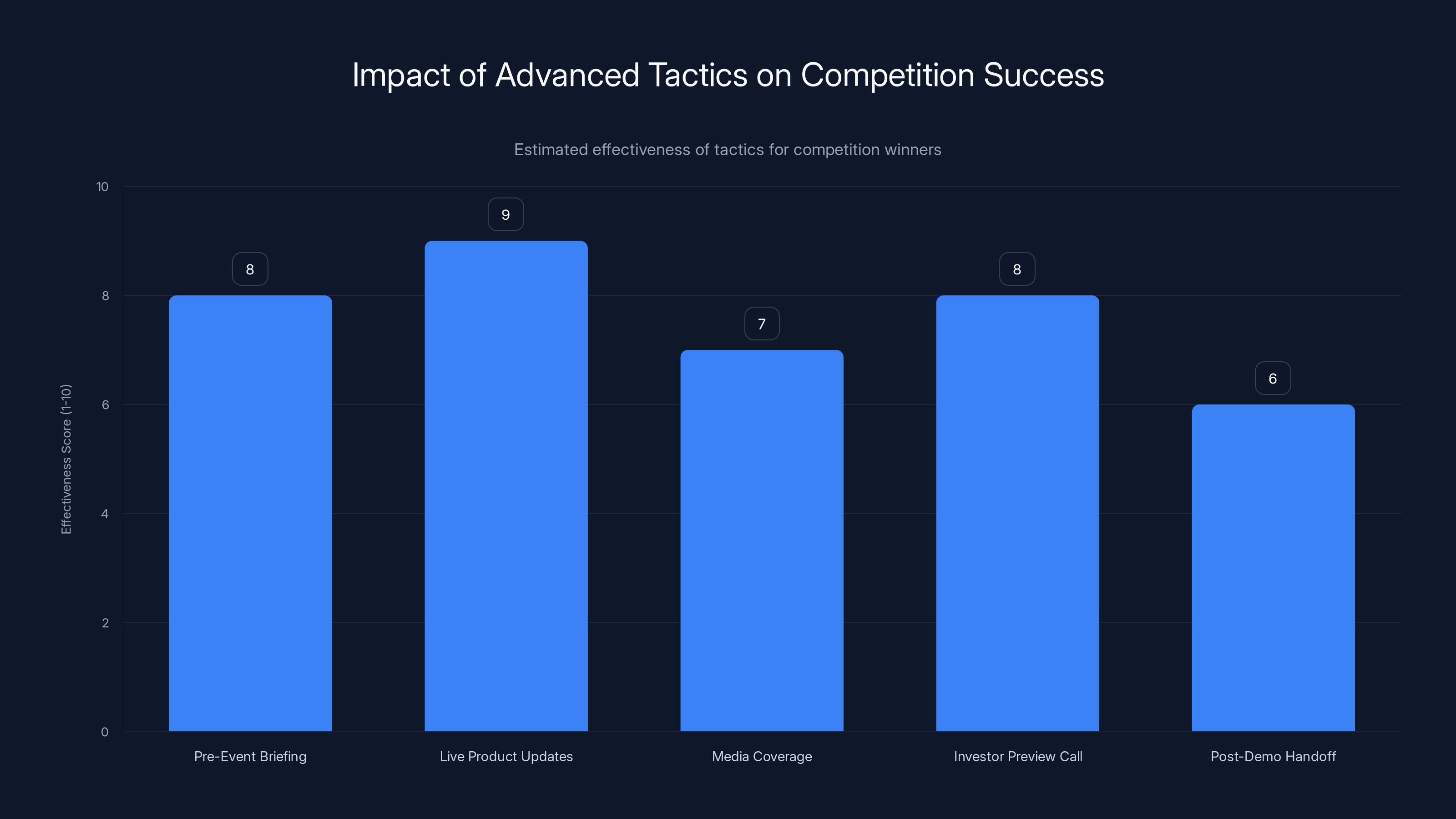

Estimated data suggests that live product updates and pre-event briefings are among the most effective tactics for standing out in competitions.

Timing and Deadlines: Strategic Application

Here's crucial information: nominations don't all close at once. TechCrunch typically keeps nominations open for a long window—often from early January through early June.

But closing dates matter. The final deadline usually offers the largest batch of applications. As we mentioned, applying early gives you a strategic advantage. You're evaluated against fewer competitors in earlier review rounds.

There's also a psychological advantage: get your acceptance notification early, and you have months to prepare the perfect pitch. Get notified in June, and you have weeks.

Other people are going to wait until March, April, May. Some will wait until the deadline in early June. If you can nominate by late February, you're ahead of the majority.

That said, TechCrunch does multiple review passes. Being nominated in May doesn't disqualify you. The selection is thorough enough that a genuinely great company nominated in May will still be selected. But all else being equal, early nomination = more preparation time = better pitch quality.

The Disrupt Experience: What to Expect

TechCrunch Disrupt is held in San Francisco in October. The 2026 event will follow the traditional format: three days at Moscone Center.

You arrive days earlier to set up your booth. You get your complimentary passes, your app listing, your badge. You meet the other founders in your Battlefield cohort.

On Battlefield day, you arrive hours early for rehearsal and technical checks. You meet your judge panel. You watch the startups pitch before you. You begin to feel the energy—thousands of people, cameras everywhere, investors taking notes.

Then it's your turn. You walk on stage. The lights are hot. You can see faces in the audience. Your 6 minutes start.

You pitch. You answer questions. The judges critique. And then it's over. You walk off stage and the next founder walks on.

After all 200 pitches, there's a break. Judges deliberate. Finalists are announced. The top three pitch again in the evening, on a bigger stage, with even more fanfare.

Then the awards. First place. Second place. Third place. Winning founders cry. Losing founders congratulate them. The startup ecosystem watches who won and speculates about future success.

But here's what's not obvious from the outside: the real value of Disrupt is the three days you spend in San Francisco talking to other founders, investors, partners, and journalists. You'll have dozens of casual conversations with people in the startup ecosystem. You'll discover product ideas. You'll find investors interested in your space. You'll meet future employees. You'll form friendships.

The Battlefield pitch is the centerpiece, but the entire three-day event is designed to connect you with the broader ecosystem.

Alumni Success Stories: Where Are They Now?

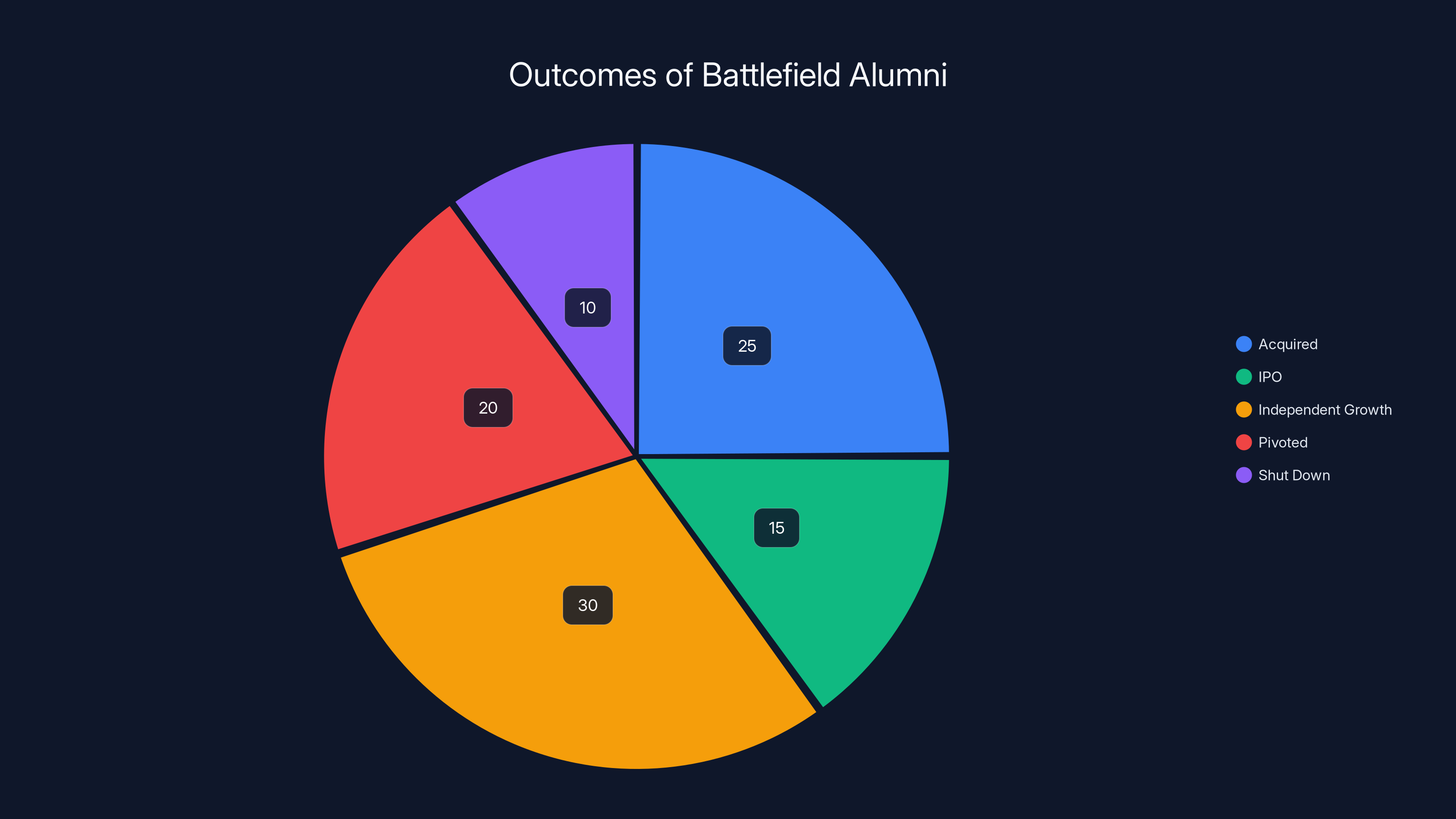

Let's look at the actual outcomes from previous Battlefield cohorts.

Trello, which was nominated in 2011, was acquired by Atlassian in 2017 for

These are the household names. But the median story is different.

Most Battlefield alumni raise follow-on funding within 6-18 months of pitching. Some raise seed rounds immediately after Disrupt. Some raise Series A rounds a year or two later. Many stay independent but accelerate their growth trajectory.

A significant percentage achieve meaningful exits or IPOs. Some become category leaders in their markets. Others pivot and become successful in different directions.

Not all Battlefield startups succeed. Some shut down. Some struggle and eventually fail. But the percentage that achieve meaningful outcomes is far higher than the baseline rate for early-stage startups. This is selection bias, of course—Disrupt and Battlefield filter for founders who are executing well and building real products.

But it's also selection toward founders who benefit from exposure, feedback, and access. That combination matters.

The top three winners of Startup Battlefield share

Common Myths About Battlefield

There's a lot of conventional wisdom about Startup Battlefield that's actually incorrect.

Myth 1: You Need to Be from Silicon Valley

This is false. Battlefield has featured successful companies from New York, Boston, Austin, Denver, Miami, London, Berlin, Toronto, Tel Aviv, Singapore, and dozens of other hubs. Geographic origin matters far less than founder quality and product-market fit.

Myth 2: You Need to Be Operating in a "Hot" Space

Yes, AI got lots of attention in 2024 and 2025. But Battlefield has featured successful companies in industrial software, fintech, healthcare, agriculture, climate tech, and dozens of other niches. Judges care about execution and market opportunity, not whether you're working on the trendiest problem.

Myth 3: You Need to Have Revenue to Be Competitive

Most early-stage startups don't have revenue yet. Judges understand this. Having early traction (users, letters of intent, pilot customers) is more important than having revenue. If you have revenue, that's great. But it's not required to be competitive.

Myth 4: Winning the Competition Guarantees Success

Winning $100,000 is nice, but it doesn't guarantee that your company will succeed. The prize is a catalyst, not a guarantee. Many Battlefield winners have struggled afterward. Many companies that didn't place in the top three have gone on to raise hundreds of millions.

The real value of Battlefield is the exposure and feedback, not the prize money itself.

Myth 5: Judges Are Looking for Polished Pitches

False. Judges are experienced enough to see through rehearsed pitch magic. They're looking for founders who understand their business deeply. If you stumble but recover with genuine insight, that's often more impressive than a seamlessly delivered pitch with shallow thinking.

Competition Strategy: How to Stand Out

You're not the only startup pitching. How do you ensure your pitch gets remembered?

Lead With the Problem, Not the Solution

Most founder pitches lead with the product: "We built a platform that..." Better pitches lead with the problem: "Every day, X million people encounter this problem, and they're wasting 20 hours per week trying to solve it manually."

When you lead with the problem, you grab attention. Judges immediately understand why your company exists. Then when you introduce your solution, it lands harder.

Tell a Personal Story

Why are you the founder solving this problem? The best Battlefield pitches include a personal connection. Maybe you were building something else and encountered this problem. Maybe you worked in this industry for a decade and saw the inefficiency. Maybe you have a personal connection to the problem—a friend or family member affected by it.

Personal stories make you memorable. They differentiate your pitch from the 50 others that day.

Show, Don't Tell

If possible, demo your product on stage. Not a slide deck. Not a video. Actual product. Live demos are risky because they can fail, but they're also incredibly powerful. Judges want to see your product working, not hear you describe how it works.

Have a Clear, Specific Ask

The best pitches end with clarity on what you're raising and what you'll do with the money. "We're raising a $500K seed round to hire two engineers and expand into the Asian market" is better than vague mentions of "looking to raise."

Clarity signals confidence and planning.

Acknowledge Your Unknowns

This might sound counterintuitive, but founders who acknowledge what they don't yet know often come across as more credible. If a judge asks a hard question and you respond "that's an assumption we need to test, here's how we'll do it," that's more impressive than pretending you have all the answers.

Founder Masterclasses: Hidden Gold

Battlefield competitors get access to exclusive founder masterclasses during Disrupt. These aren't generic talks. They're intimate sessions with successful founders and investors who have navigated the exact challenges you're facing.

Topics might include: how to raise Series A, how to build a board, how to scale your first 20 hires, how to think about pricing, how to do customer development, how to survive through tough growth periods.

Many founders report that these masterclasses are more valuable than the Battlefield pitch itself. You get to ask specific questions to people who have been where you are.

Here's the key: actually attend them. Don't skip them to work the booth. Attend multiple sessions. Take notes. Build relationships with the speakers. These connections often lead to mentorship, introductions, and opportunities that unfold over months and years.

Equity-free funding is the most impactful benefit of Startup Battlefield, followed by global exposure and investor access. Honest feedback, while challenging, is also highly valuable. Estimated data based on typical startup priorities.

Post-Battlefield: The Weeks and Months After

Your Battlefield pitch is not the end of the story. It's actually the beginning.

Investors who express interest typically want follow-up conversations within days of Disrupt. Don't wait. If an investor asks for your deck or wants a follow-up call, respond immediately. The momentum from Disrupt is real, and it fades quickly.

Many companies close funding rounds in the 3-6 months following Disrupt. Investors who watched your pitch want to see your next progress update. They want to understand what you've accomplished since the event.

Use the post-Disrupt period to execute visibly. Launch new features. Acquire new customers. Hire key team members. Achieve the metrics you promised judges you'd hit. When an investor checks in three months later, you want to be able to say "since Disrupt, we've grown from 100 customers to 300, reduced our CAC from

Also maintain relationships with the other founders you met. Exchange contact information at Disrupt. Schedule follow-up calls. Many of the most interesting collaborations and partnerships happen between founders who met at Battlefield.

Planning Your Campaign: Month-by-Month Timeline

If you're serious about competing in Startup Battlefield 200, here's the ideal preparation timeline:

January-February: Preparation Phase

During this period, refine your pitch deck. Test your narrative with mentors, advisors, and fellow founders. Get feedback on your 60-second pitch video. Refine your company description and positioning. Research previous Battlefield winners and understand what resonated.

Late February-Early March: Application Phase

Submit your nomination early. Don't wait until May. The advantages of early submission outweigh any polish you might add with more time. Your narrative and pitch are solid by this point.

March-May: Waiting Period

Continue executing on your business. This is not a passive period. Acquire more customers. Improve your metrics. Test new features. When TechCrunch is evaluating applications, you want to be a founder who's visibly executing.

June: Notification and Initial Preparation

Assuming you get selected, you'll be notified. Immediately book travel to San Francisco for October. Register for Disrupt. Start deeper pitch preparation. Watch previous Battlefield pitches on YouTube. Study the judges who will be evaluating you.

July-September: Intensive Preparation

This is your execution period. Refine your pitch to perfection. Do 50+ practice pitches with different audiences. Anticipate questions and script your answers. Get feedback from startup operators who have pitched before. Polish your demo if you're doing one live.

October: Disrupt Week

Arrive in San Francisco days early. Set up your booth. Attend masterclasses. Network with other founders. Pitch on stage. Engage investors who show interest. Build the relationships that matter.

Common Mistakes to Avoid

Not every Battlefield pitch succeeds equally. Here are the most common mistakes we see.

Mistake 1: Spending 4 Minutes on Company History

Judges don't care that you founded your company three years ago or that you quit your job to work on this. Get to the problem and solution fast. Spend 30 seconds on company background, not 2 minutes.

Mistake 2: Pitching to Everyone Instead of Specific Investors

You have 4-6 judges with different priorities. Your pitch should be broad enough that all judges understand it, but you should also tailor your follow-ups based on each judge's investment thesis. Research them. Customize your follow-up.

Mistake 3: Overselling Your Traction

If you have 50 customers, say 50. Don't say "thousands of users" if you mean 50 free accounts created. Judges will probe these numbers. If your claims don't hold up, you lose credibility.

Mistake 4: Ignoring the Audience

There are thousands of people watching your pitch. Some are investors, but many are journalists, fellow founders, potential customers, and other stakeholders. Your pitch should be comprehensible to intelligent non-experts, not just VCs. This actually makes your pitch better overall.

Mistake 5: Bombing the Q&A

Your prepared pitch matters. But the Q&A matters more. Judges are evaluating how you think on your feet. If you get a question you don't know the answer to, say "that's a great question, here's what I think" and give a genuine answer. Don't make something up.

Mistake 6: Forgetting About Booth Duty

You have a booth for three days. You need to be there. Use those three days to have 100+ conversations with attendees. Collect emails. Find potential customers. Build relationships. The booth is not a chore—it's an incredible opportunity.

Estimated data shows a diverse range of outcomes for Battlefield alumni, with many achieving significant exits or growth. Estimated data.

Advanced Tactics for Competition Winners

If you want to be in the 5% that truly stands out, consider these advanced approaches.

Pre-Event Investor Briefing

Reach out to judges weeks before Disrupt. Not asking for investment—just wanting to ensure they understand your positioning. Send them your pitch deck with a brief note: "I'm excited to pitch in Startup Battlefield and would love your feedback on my positioning." Some judges will respond with valuable feedback.

Live Product Updates

If possible, ship a significant product update or customer win in the weeks immediately before Disrupt. Then mention it in your pitch: "This week we hit

Media Coverage Before Disrupt

Generate press coverage in the months before Disrupt. Get featured on relevant industry blogs or publications. When judges Google you, they see press coverage. This signals that your story is interesting and credible.

Investor Preview Call

If any judge or investor has expressed interest before Disrupt, schedule a brief pre-event call. You're not pitching formally—you're just aligning on what you'll cover during the live pitch. This ensures they ask the right follow-up questions.

Post-Demo Handoff

If you're doing a live demo, have a printed one-pager with a product link and sandbox credentials ready to hand to interested judges immediately after your pitch. Make it easy for them to try your product themselves.

Funding After Battlefield: Expected Timelines

Many founders ask: if I pitch at Battlefield, when can I expect to raise funding?

The timelines vary dramatically:

Fast Track (1-3 months): Some Battlefield companies close seed rounds within weeks of pitching. This usually happens when the founder already had investor relationships, was actively fundraising, and Battlefield accelerated conversations.

Standard Track (3-9 months): Most Battlefield companies that raise funding do so within this window. They pitch at Disrupt, get investor introductions, have follow-up conversations, and close funding in the following months.

Extended Track (9-18 months): Some Battlefield companies take longer to raise. Maybe they're building more traction first. Maybe the investor landscape is difficult. Maybe they're being intentional about finding the right lead investor.

The key insight: Battlefield is not a guarantee of immediate funding. It's a significant boost to your fundraising prospects, but timing and execution still matter enormously.

The Global Startup Ecosystem and Battlefield

Startup Battlefield has evolved into a genuinely international event. Companies from dozens of countries pitch every year.

For non-US founders, pitching at Battlefield provides something especially valuable: access to US venture capital. Many international founders use Battlefield as their entry point to US investor networks. After pitching, they build relationships with US VCs who might invest in international rounds or help with expansion.

Conversely, US investors use Battlefield to find international expansion opportunities. If you're building a global marketplace or product, highlighting your international traction can make you especially attractive.

The ecosystem value of Battlefield extends across borders. You're not just pitching to local investors—you're pitching to a global audience.

Final Preparations: Your 30-Day Sprint

If you've been selected for Startup Battlefield and Disrupt is 30 days away, here's your final sprint plan.

Week 1: Lock Your Narrative

Your story and pitch are final. Do 10 practice pitches with different audiences. Record yourself. Watch the playback. Make final tweaks.

Week 2: Build Your Materials

Finalize your pitch deck. Print business cards. Create any physical materials for your booth. Prepare any product demos. Everything should be technically tested and working.

Week 3: Anticipate Questions

Compile 30 likely questions. Write answers. Practice delivering them. Role-play with advisors. Prepare for the ones you'll get wrong and how you'll recover.

Week 4: Logistics and Final Polish

Arrange travel and accommodations. Prepare your pitch delivery space (booth setup, demo hardware, etc.). Do final practice pitches. Get good sleep the night before.

Then go pitch.

FAQ

What is Startup Battlefield 200?

Startup Battlefield 200 is TechCrunch's flagship startup competition held at TechCrunch Disrupt in San Francisco. It's a platform where early-stage founders pitch their companies to experienced venture investors for approximately 6 minutes, followed by unscripted Q&A from a panel of judges. The competition awards $100,000 in equity-free funding to the top three winners and provides selected startups with access to thousands of investors, journalists, and industry leaders, as well as booth space, press opportunities, and founder masterclasses.

How do I apply for Startup Battlefield 200?

You apply through the TechCrunch website by submitting a nomination that includes basic company information, a 60-90 second pitch video, answers to specific questions about your market and traction, and details about your team and business. Nominations are accepted from January through early June each year. TechCrunch reviews every application and notifies selected founders 4-6 weeks before the event. Applying early provides a strategic advantage because you're evaluated against fewer competing applications in earlier review rounds.

Who is eligible to pitch at Startup Battlefield?

The ideal Battlefield founder is bootstrapped, pre-seed, or seed-funded and has an MVP or working prototype ready to demonstrate. You should be challenging the status quo with a genuinely novel solution to a real problem, not iterating on existing ideas. Series A startups qualify if they're in capital-intensive industries like hardware or biotech. Geographic location doesn't matter—TechCrunch reviews startups globally. There are no requirements regarding founder age, education, background, or gender.

What are the benefits of competing in Startup Battlefield?

Benefits include $100,000 in equity-free prize funding (if you win), global exposure to 20,000+ Disrupt attendees and millions of TechCrunch readers, access to hundreds of active venture capitalists, honest feedback from experienced investors and operators, a free booth with three passes, and inclusion in the Disrupt event app and press list. You also gain entry to exclusive founder masterclasses where you learn directly from successful founders and access to a powerful network of fellow founders pitching alongside you.

How competitive is the selection process?

Thousands of startups apply each year for approximately 200 spots, making the selection rate roughly 5-10% depending on application quality. This is comparable to acceptance rates at top universities. Among the 200 selected startups, only the top three win cash prizes. However, the real value lies in exposure and networking rather than prize money, and many non-winning companies attract investor interest and successfully raise funding in the months following the event.

When should I apply for maximum advantage?

Apply by late February or early March if possible. Early applications have a strategic advantage because they're reviewed against fewer competing submissions during earlier evaluation rounds. You also receive your acceptance notification earlier, giving you more time to prepare your pitch before Disrupt in October. While applications remain open until early June, waiting until May or June means competing against thousands of other last-minute applicants and having minimal preparation time before the event.

What happens if I don't win but still pitch?

You still receive all the substantial benefits of participation: booth space at Disrupt, complimentary passes, inclusion in the app and press list, and most importantly, exposure to investors and media. Many successful Battlefield companies didn't place in the top three. The value comes primarily from visibility, feedback, and networking rather than the prize money. Most follow-up investor conversations happen with non-winners who delivered strong pitches.

How should I prepare my pitch?

Prepare a 6-minute narrative that leads with the problem, includes a personal connection to why you're solving it, introduces your solution, shows your traction to date, and explains your vision. Build a pitch deck that's visual-heavy with minimal text. Practice the pitch 50+ times with different audiences. Anticipate 20+ likely questions and practice answering them. Research each judge's investment patterns and tailor your follow-ups accordingly. If possible, prepare a live product demo. Avoid spending excessive time on company history—judges care about execution and market opportunity, not backstory.

What happens after I pitch?

Investors who express interest typically want follow-up conversations within days of Disrupt. Respond immediately to requests for decks or calls—momentum is real and fades quickly. Use the following 3-6 months to execute visibly: launch features, acquire customers, improve metrics you discussed in your pitch, and hire key team members. Many companies close funding rounds within 3-9 months of pitching at Battlefield. Maintain relationships with other founders you meet—some of the most valuable collaborations emerge from the Battlefield community.

What were the biggest successes from past Battlefield competitions?

Notable Battlefield alumni include Trello (acquired by Atlassian for

What are the most common mistakes founders make when pitching?

Common mistakes include: spending too much time on company history instead of getting to the problem, pitching generic content to all judges instead of researching and customizing follow-ups for specific investors, overselling traction (saying "thousands of users" when you mean free accounts), assuming only VCs matter and ignoring the broader audience that includes journalists and potential customers, struggling through the Q&A portion by making up answers, neglecting booth duty, and failing to ship product updates or generate press coverage in the months before pitching. Successful pitchers lead with the problem, tell personal stories, demo product when possible, deliver clear asks, and acknowledge what they don't yet know.

How does Battlefield differ from other startup competitions?

Startup Battlefield is specifically designed as a pressure-cooker experience for early-stage founders. Pitches are unscripted Q&A with experienced judges who will challenge your assumptions. Judges provide public feedback and critique. The focus is on honest assessment rather than affirmation. TechCrunch's massive media platform ensures coverage and visibility regardless of whether you win. The three-day Disrupt conference provides continuous networking and learning opportunities beyond just the competition itself. Unlike typical pitch competitions that exist in isolation, Battlefield is integrated into an entire ecosystem event with 20,000+ attendees including investors, journalists, and industry operators.

Conclusion: Your Next Move

Startup Battlefield isn't for every founder. It's for founders who are past the point of theoretical and into the point of actual. It's for founders who have built something real and are ready to test it against expert criticism. It's for founders who understand that growth comes from feedback, exposure, and pushing yourself into uncomfortable situations.

If that's you, if you have an MVP and a vision and the courage to stand on a stage and be questioned by some of the most experienced investors in the world, then nominations are open.

The barrier to entry is low: time to prepare a strong application and video. The barrier to selection is moderate: you need real traction and a genuine differentiation. The barrier to winning is high: you need flawless execution, strategic preparation, and probably some luck.

But here's what's true regardless of where you finish: your life as a founder changes after Battlefield. You meet investors who will remember you for years. You meet fellow founders who become collaborators and friends. You get feedback that shapes your strategy going forward. You build confidence from stepping into the arena.

More than 1,500 founders have done this before you. Trello, Dropbox, Discord, and countless others have stood on that stage. Some became billion-dollar companies. Others became meaningful businesses in their niches. All benefited from the exposure, feedback, and network.

Don't wait for the perfect moment. Perfect is never coming. Apply when you're 80% ready. Prepare intensively once you're selected. Pitch with confidence knowing you've prepared better than 90% of the other founders. Then play the long game with the relationships you build.

The Battlefield is open. The question is: are you ready to enter?

Key Takeaways

- Startup Battlefield 200 is TechCrunch's premier competition for pre-seed and seed-stage startups offering $100K equity-free funding, global exposure to 20,000+ attendees, and direct access to hundreds of active venture capitalists.

- Early application (by late February) provides strategic advantage—you're evaluated against fewer competing applications and have more time to prepare your pitch if selected.

- Successful pitches lead with the problem, include personal connection to why you're solving it, show real traction, and deliver your narrative in 6 minutes while demonstrating ability to handle unscripted investor questions.

- Most Battlefield alumni raise follow-on funding within 6-18 months of pitching; the real value comes from exposure, feedback, and ecosystem access rather than prize money alone.

- Selected startups gain free booth space for three days at Disrupt, complimentary passes, inclusion in event app and press list, access to exclusive founder masterclasses, and networking with fellow founders and investors.

Related Articles

- TechCrunch Startup Battlefield 200 [2026]: Complete Guide to Pitching Success

- Hubristic Fundraising: Brex's $5.15B Acquisition & Lessons [2025]

- Rippling vs Deel Corporate Spying Scandal: DOJ Criminal Investigation

- Nvidia's India AI Startup Strategy: Building Long-Term Demand [2025]

- Anthropic's 380B Valuation Means for AI Competition in 2025

- Hauler Hero $16M Series A: AI Waste Management Software Revolution 2025

![TechCrunch Startup Battlefield 200: Complete Guide to Pitching [2026]](https://tryrunable.com/blog/techcrunch-startup-battlefield-200-complete-guide-to-pitchin/image-1-1771603739732.png)