Introduction: The AI Funding Arms Race Reaches New Heights

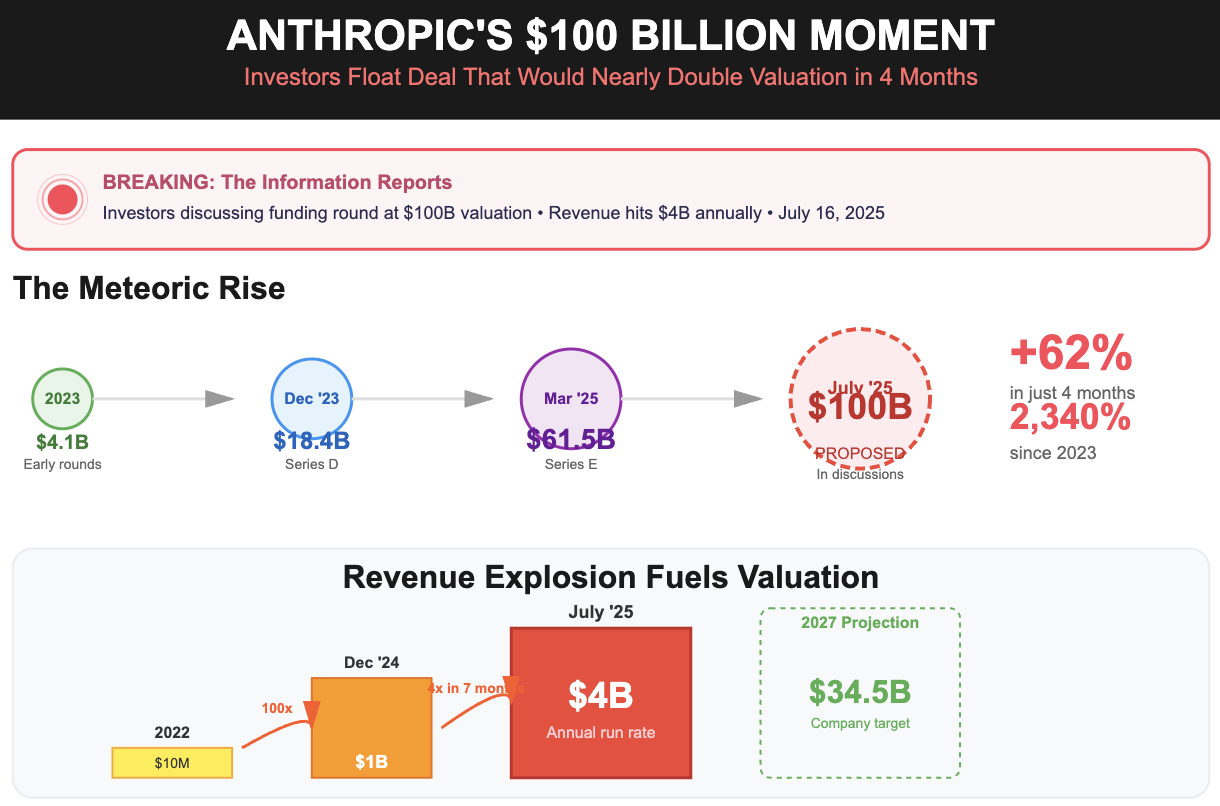

The artificial intelligence industry is experiencing a capital inflow unprecedented in the history of technology, and one funding announcement in early 2025 crystallized just how aggressive this race has become. Anthropic, the AI safety-focused company behind the Claude language model, secured

This isn't merely a financial milestone; it represents a fundamental shift in how the venture capital ecosystem values artificial intelligence companies and a dramatic acceleration in the competitive landscape between AI labs. To understand why this matters, we need to examine not just the numbers, but what they reveal about market expectations, competitive dynamics, customer demand, and the path ahead for AI development.

The funding round was led by GIC, Singapore's sovereign wealth fund, and Coatue, a prominent investment management firm, with co-leadership from D. E. Shaw Ventures, Peter Thiel's Founders Fund, and Abu Dhabi's MGX. The investor roster reads like a who's who of global capital: Accel, General Catalyst, Jane Street, Qatar Investment Authority, and numerous other institutional investors across four continents. This geographic and institutional diversity signals that the confidence in Anthropic's future isn't concentrated in Silicon Valley—it's a global phenomenon.

But here's what makes this timing particularly significant: Anthropic's massive Series G raise comes as its primary competitor, Open AI, is reportedly seeking to raise an astonishing

For entrepreneurs, developers, enterprises, and investors watching the AI space, these funding announcements carry profound implications. They signal where massive capital believes the future of computing will be built, what business models are deemed worthy of investment at scale, and perhaps most importantly, what level of capital concentration we should expect in the AI industry going forward. This article provides a comprehensive analysis of Anthropic's Series G funding, what it reveals about the broader AI market dynamics, and how these developments affect the competitive landscape.

Understanding Anthropic: The Company Behind Claude

Who Is Anthropic and Why Does It Matter?

Anthropıc was founded in 2021 by former Open AI researchers, including Dario Amodei (CEO) and Daniela Amodei (President), along with other prominent AI scientists who had worked at leading research institutions. The company was established with a specific mission: to build artificial general intelligence that is safe, beneficial, and interpretable. Unlike some AI labs that prioritize speed-to-market or feature velocity, Anthropic has positioned itself as the safety-conscious alternative in the AI development space.

The company's flagship product is Claude, a large language model available in multiple versions (Claude Opus, Claude Sonnet, and Claude Haiku) that power everything from customer service chatbots to complex analytical tasks and software development assistance. Claude competes directly with Open AI's GPT models, Google's Gemini, and other advanced language models in what has become an increasingly crowded market.

What distinguishes Anthropic in investor perception isn't just the quality of Claude's capabilities—though benchmarks suggest Claude performs at or above competitor models in numerous evaluations. Rather, it's the company's explicit focus on constitutional AI, interpretability research, and long-term AI safety. This positioning appeals to enterprises, governments, and institutional investors who view AI safety not as a luxury concern but as a fundamental business risk and ethical imperative.

The Trajectory: From Stealth to $380 Billion

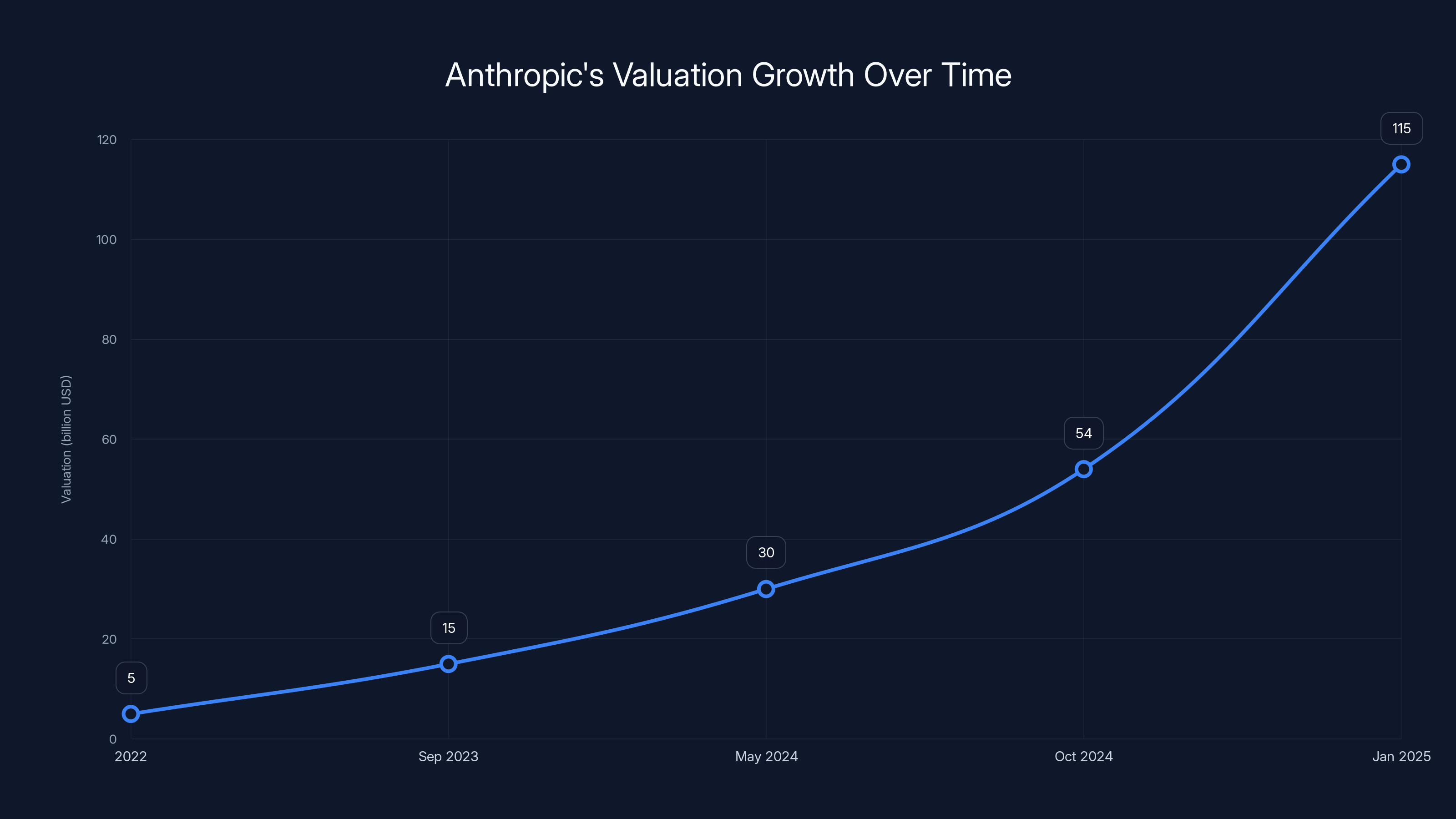

Anthropıc's journey to a

This progression is extraordinarily steep. In just three years, Anthropic went from a stealth-mode startup to a company valued at more than most Fortune 500 enterprises. For context, this valuation trajectory is far more aggressive than even Open AI's path to comparable valuations, though Open AI started from an earlier and higher baseline.

The acceleration from

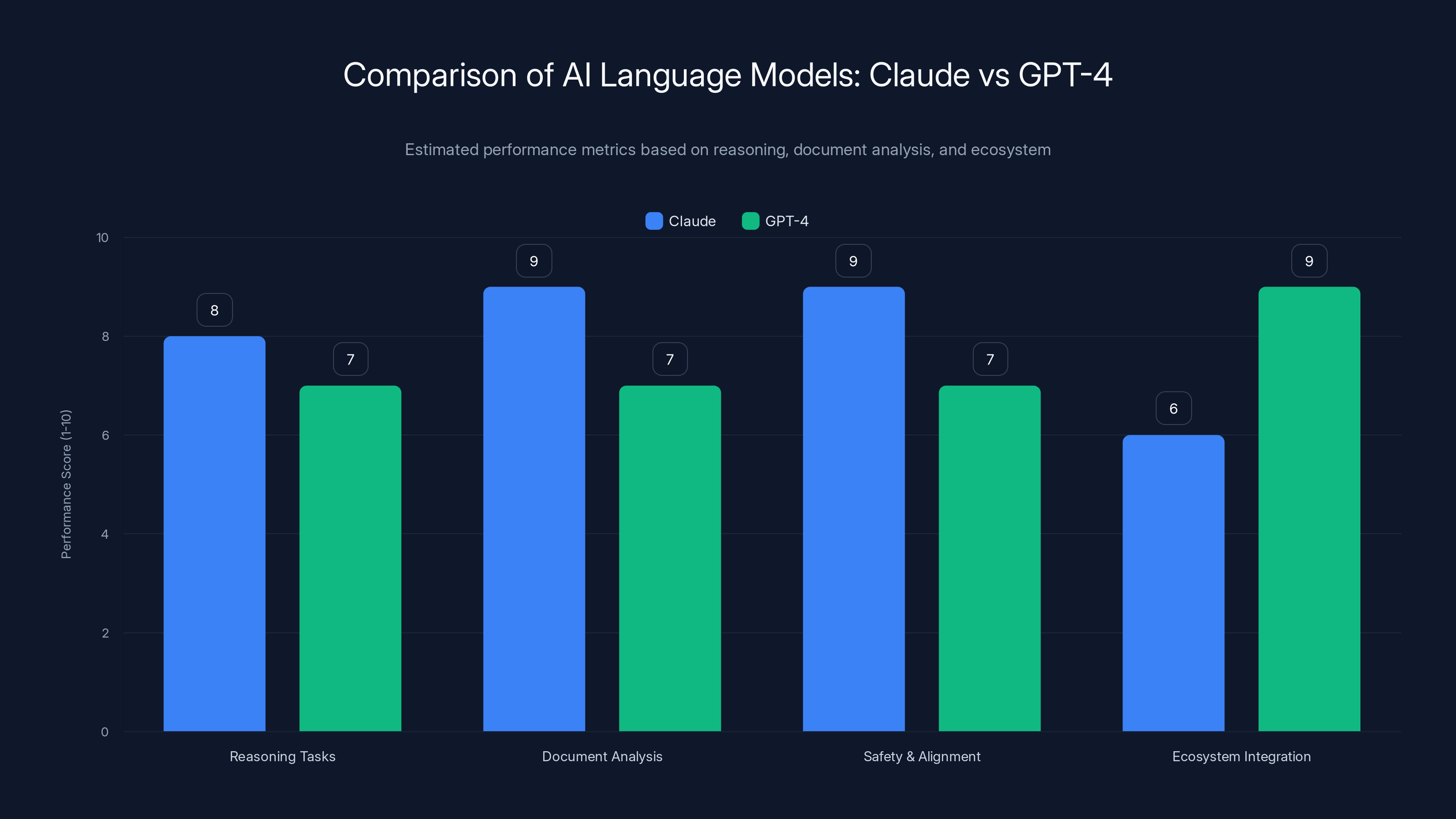

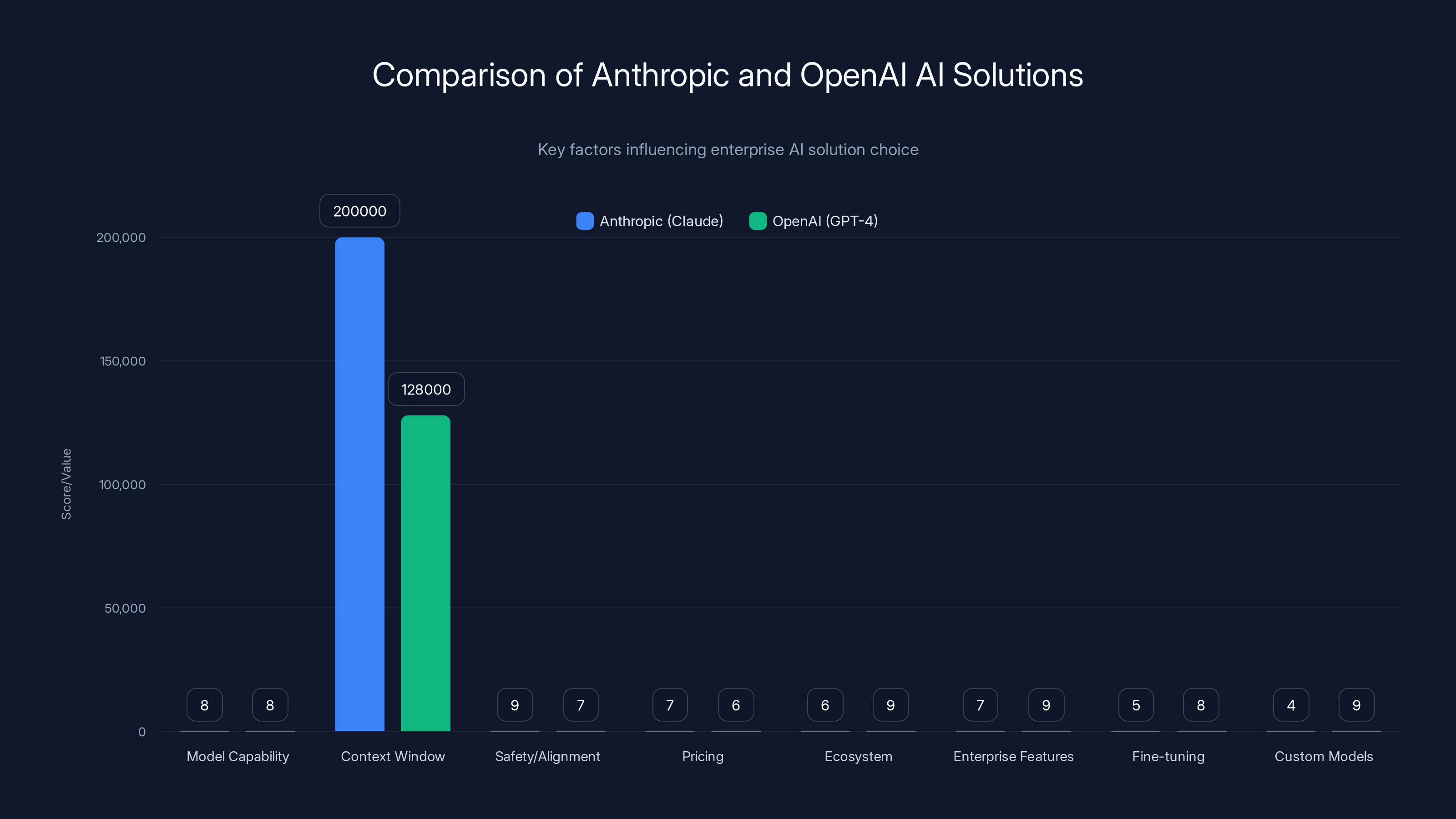

Claude excels in reasoning and document analysis due to its large context window and safety focus, while GPT-4 benefits from a strong ecosystem and integration. Estimated data based on typical model strengths.

The Capital Composition: Who's Investing and Why

Sovereign Wealth and Strategic Investors

The investor base for Anthropic's Series G reveals important patterns about how global capital views the AI opportunity. GIC, Singapore's sovereign wealth fund managing over $800 billion in assets, leading this round signals that governments and national wealth vehicles view AI not as a venture risk but as strategic infrastructure investment. Sovereign wealth funds typically make decisions based on long-term economic returns and strategic national interests, suggesting that Singapore's leadership sees Anthropic as a durable, strategically important asset.

Abu Dhabi's MGX fund, which has been aggressively building the UAE's AI ecosystem and competitive positioning, similarly indicates that regional powers are recognizing AI leadership as a component of technological sovereignty. These aren't speculative venture bets—they're strategic capital allocations aligned with national competitiveness objectives.

Established VC Dominance

Beyond sovereign wealth vehicles, the round was co-led and filled by some of the most prominent venture capital firms globally. Coatue, which has backed companies across Meta, Stripe, and other mega-cap tech successes, brings not just capital but strategic networks. Founders Fund, Peter Thiel's investment vehicle, has a historical track record of backing foundational technology companies and AI labs—their participation signals alignment with the Anthropic vision.

The presence of D. E. Shaw Ventures, the venture arm of the legendary quantitative hedge fund, indicates sophisticated financial actors see compelling value creation potential. Accel and General Catalyst, both top-tier venture firms with deep enterprise relationships, likely see Anthropic as crucial to enterprise AI adoption and revenue growth.

The Competitive Capital Response

What makes this investor composition significant is that many of these same firms have also backed Open AI, Google, and other AI labs. This isn't exclusive positioning—it's diversified bets on AI leadership across multiple companies. The presence of multiple world-class institutional investors suggests this isn't a speculative round but a competitive response to ensure the investors maintain positions in what they see as critical AI infrastructure.

The investment also likely reflects negotiations where Anthropic's management team, seeing Open AI's reported $100 billion fundraising efforts, effectively communicated that the company needed capital to compete on computing infrastructure, talent, and product development velocity.

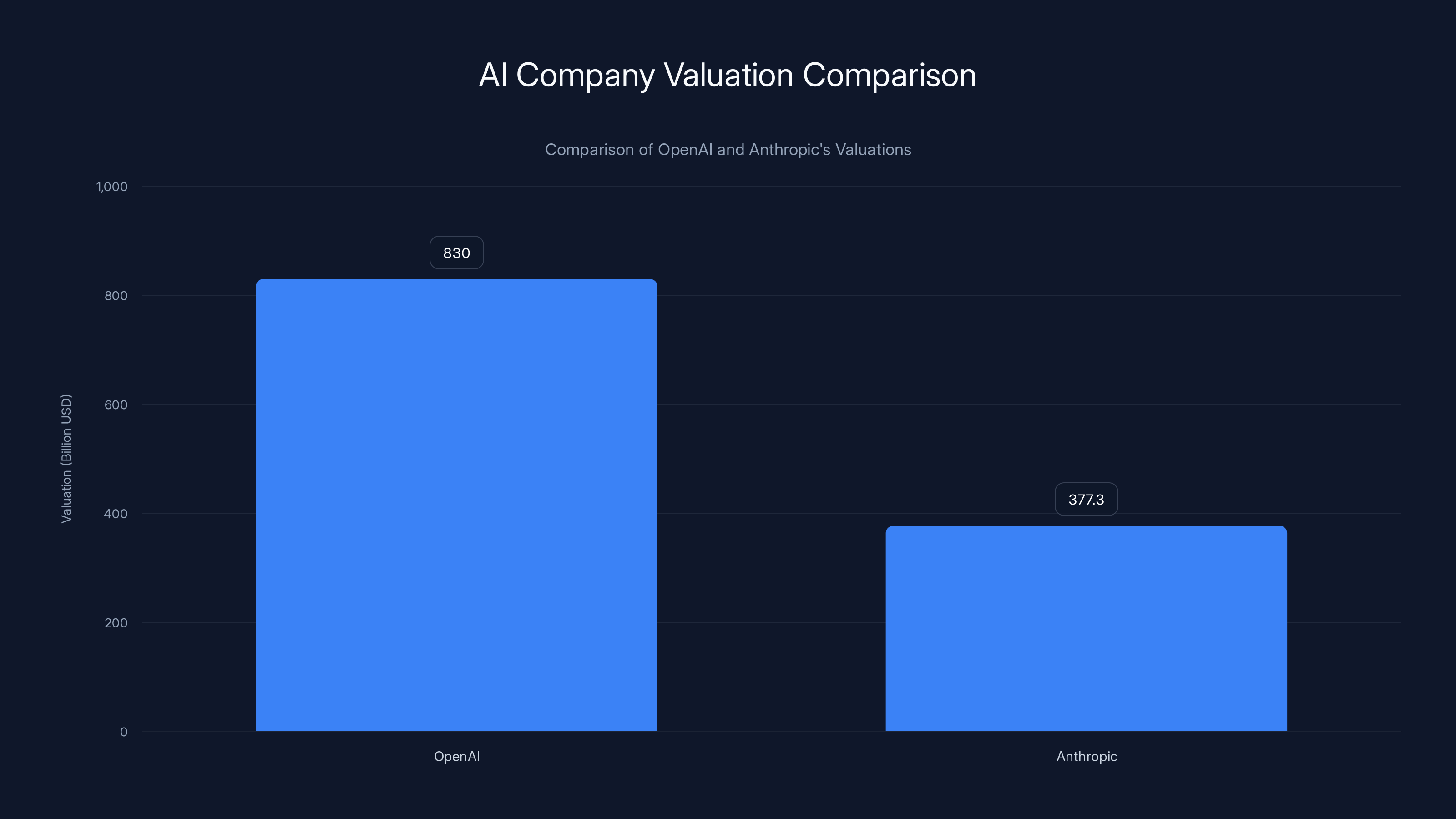

OpenAI's valuation is estimated to be 2.2 times higher than Anthropic's, driven by factors like first-mover advantage, Microsoft partnership, and network effects. Estimated data.

Enterprise Demand: The Core Growth Driver

Why Enterprises Are Choosing Anthropic

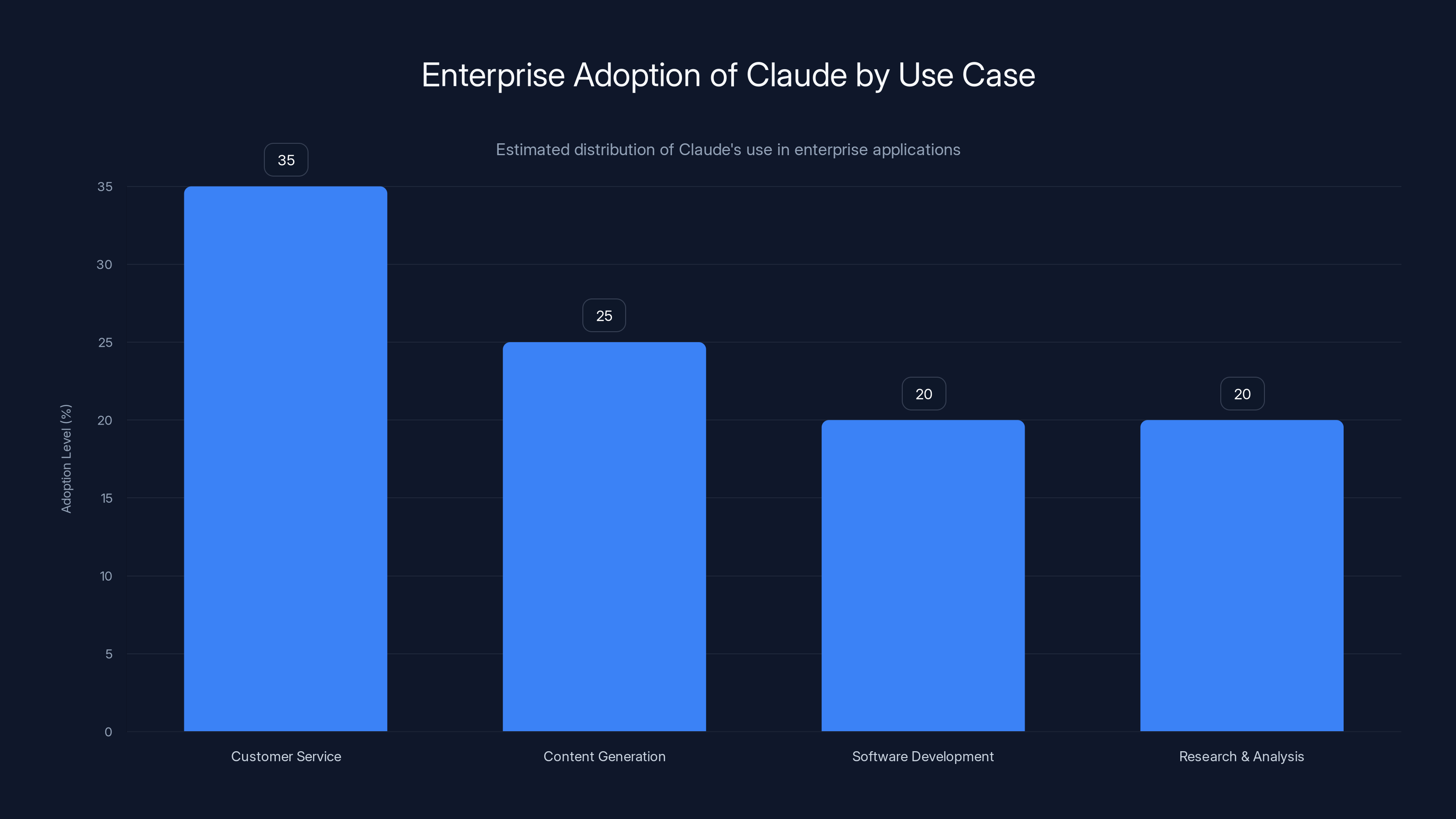

Krishna Rao, Anthropic's Chief Financial Officer, crystallized the company's growth narrative: "Whether it is entrepreneurs, startups, or the world's largest enterprises, the message from our customers is the same: Claude is increasingly becoming more critical to how businesses work."

This statement is crucial because it reveals that Anthropic's growth isn't driven by consumer adoption of a Chat GPT-like interface, but by enterprise adoption of Claude as a foundational component of business operations. This is fundamentally different from how Open AI initially grew (consumer-first adoption), and it creates a different revenue model and business defensibility.

Enterprises are adopting Claude in several key areas:

-

Customer Service Automation: Claude's nuanced language understanding makes it effective for handling complex customer inquiries that require context sensitivity, reducing both support costs and customer frustration. Companies report that Claude handles significantly more queries without escalation compared to earlier language models.

-

Content Generation and Analysis: Businesses use Claude for summarizing documents, generating reports, analyzing contracts, and creating marketing content at scale. The model's ability to maintain context across long documents (Anthropic has pushed context windows to 200,000 tokens) makes it particularly valuable for document-heavy industries like law, finance, and healthcare.

-

Software Development: Claude-powered tools help developers write code, debug issues, and accelerate software development cycles. Internal reports suggest developers using Claude-assisted tooling complete tasks 30-40% faster than those using traditional development environments, though this varies significantly by task type and developer expertise.

-

Research and Analysis: Enterprises in finance, pharmaceuticals, and technology use Claude for analyzing research, synthesizing information, and generating insights from unstructured data.

Revenue Model and Growth Implications

Unlike Open AI's dual model (consumer Chat GPT Plus subscriptions plus enterprise API access), Anthropic has emphasized enterprise API access through Claude's API and enterprise products like Claude for Slack. This model generates more predictable, recurring revenue and creates higher customer lifetime value per account.

The "critical to how businesses work" framing suggests that Claude is becoming embedded in customer workflows—not a nice-to-have tool but something operations depend on. When products reach this level of integration, customer retention increases dramatically, and expansion opportunity (upselling to more teams, more use cases) becomes substantial.

Competitive Dynamics: The Open AI Juggernaut and the AI Funding Race

The Open AI $100 Billion Elephant in the Room

While Anthropic's

Open AI's valuation would place it roughly 2.2x higher than Anthropic's, a significant gap despite Claude being competitive with GPT-4 Turbo on numerous benchmarks. What accounts for this valuation differential? Several factors:

-

First-Mover Advantage and Brand Recognition: Open AI achieved massive consumer adoption with Chat GPT before competitors launched serious competitors. This first-mover effect translates to brand power, user habits, and ecosystem effects (plugins, integrations, partnerships built on Open AI).

-

Microsoft Partnership and Distribution: Open AI's exclusive partnership with Microsoft (currently exclusive for GPT-4 in many commercial contexts) provides distribution through Microsoft products (Office 365, Copilot in Windows, Azure) that Anthropic doesn't match. This is a structural competitive advantage.

-

Installed Base and Network Effects: Open AI has more users, more integrations, and more dependencies on its APIs. Each developer who chose GPT-4 over Claude increases the switching cost for future decisions.

-

Perceived Trajectory: Investors may perceive Open AI as advancing faster toward AGI, even though independent benchmarks suggest the models are roughly comparable at current capabilities levels.

Why Both Can Be Raising Historic Amounts

The seemingly paradoxical situation of both companies raising at record levels reflects several realities:

-

Winner-Take-All Dynamics: Many investors believe that AI will concentrate into a few dominant labs, so maintaining a top-2 position (if that's where both companies are perceived) requires massive capital investment to not fall behind.

-

Compute Requirements Are Exploding: Training state-of-the-art models requires increasingly expensive compute infrastructure. Estimates suggest training Anthropic's and Open AI's latest flagship models costs tens of millions to hundreds of millions of dollars. The capital is partly for model training, not just business operations.

-

Competitive Positioning: When your primary competitor is raising

30 billion can feel like falling behind, even if $30 billion would have been considered audaciously large just 18 months ago. These funding rounds are partly about competitive positioning. -

Future Optionality: Both companies likely need capital to hedge against multiple possible futures: potential regulatory requirements, the need to build new types of hardware, acquisition of specialized talent or companies, and sustained R&D investment.

Market Validation vs. Valuation Inflation

A critical question surrounds whether these valuations represent genuine market validation of profitable business models or represent a new speculative bubble in AI. Several data points suggest this is more than hype:

-

Revenue Growth: Anthropic's revenue has grown substantially, though exact figures are private. Customer adoption among large enterprises (financial institutions, tech companies, professional services firms) is documented to be accelerating.

-

Product Maturity: Claude has matured significantly, with enterprise-grade features, safety controls, fine-tuning capabilities, and API reliability that make it genuinely useful for business-critical applications.

-

Path to Profitability Questions: Neither company has clearly demonstrated a path to profitability at current research spending levels. The capital is funding ongoing research with the bet that either (1) future models will be significantly more valuable, or (2) inference (running trained models) will be cheaper than training, allowing profitable operation even if training costs continue rising.

Customer service automation leads in enterprise adoption of Claude, followed by content generation and software development. Estimated data based on typical enterprise needs.

The Capital Deployment Strategy: Where Will $30 Billion Go?

Compute Infrastructure and GPU Procurement

A substantial portion of Anthropic's new capital will inevitably go toward compute infrastructure—purchasing or leasing H100, H200, and next-generation GPUs from NVIDIA and competing vendors. Training and running frontier language models requires massive GPU clusters. A single state-of-the-art model training run can utilize thousands of GPUs for weeks or months, costing tens of millions of dollars.

With Anthropic's expanded capital base, the company can own rather than lease compute, securing supply during periods of GPU scarcity and maintaining dedicated infrastructure for both training and serving API requests. This capital deployment has direct returns: more computation enables faster model iteration, more concurrent API serving capacity, and reduced operational costs compared to cloud rental.

Research Team Expansion and Talent Acquisition

Anthropıc will undoubtedly use capital to attract and retain top research talent. The AI talent market is brutally competitive. Top researchers and engineers can command salaries well above

Expanding research teams has non-linear returns: additional researchers enable parallel research efforts, faster iteration on model improvements, and the ability to pursue multiple research directions simultaneously.

Product Development and Enterprise Infrastructure

Beyond model training, capital will fund the unglamorous but essential work of building enterprise-grade products. This includes:

-

API Reliability and Scaling: Building infrastructure to serve millions of API requests with sub-second latency and high availability requirements.

-

Enterprise Security Features: Developing fine-grained access controls, audit logging, data residency options, and compliance certifications (SOC 2, HIPAA, etc.) that large enterprises require.

-

Safety and Alignment Infrastructure: Anthropic's brand positioning around safety requires ongoing investment in interpretability research, adversarial testing, and safety evaluation. This research doesn't directly generate revenue but is essential for long-term positioning and risk mitigation.

-

Integration and Partnership Development: Funding for business development teams to build partnerships with enterprises, system integrators, and platform providers.

Research Agendas and Ambitious Projects

Anthropıc has indicated interest in ambitious research directions:

-

Interpretability and Constitutional AI: Understanding how and why language models make decisions, and ensuring they align with specified values and constraints.

-

Multimodal AI: Extending Claude beyond text to handle images, video, audio, and other modalities at the same quality level.

-

Specialized Models: Fine-tuned or custom models optimized for specific industries or use cases (legal AI, biomedical AI, financial analysis AI, etc.).

-

Long-Context and Retrieval Integration: Extending context windows further and integrating better retrieval systems to provide models access to current information without retraining.

Each of these research directions represents years of work with large research teams, extensive experimentation, and substantial compute budgets.

Market Implications: What This Means for the Broader AI Industry

Capital Concentration in AI

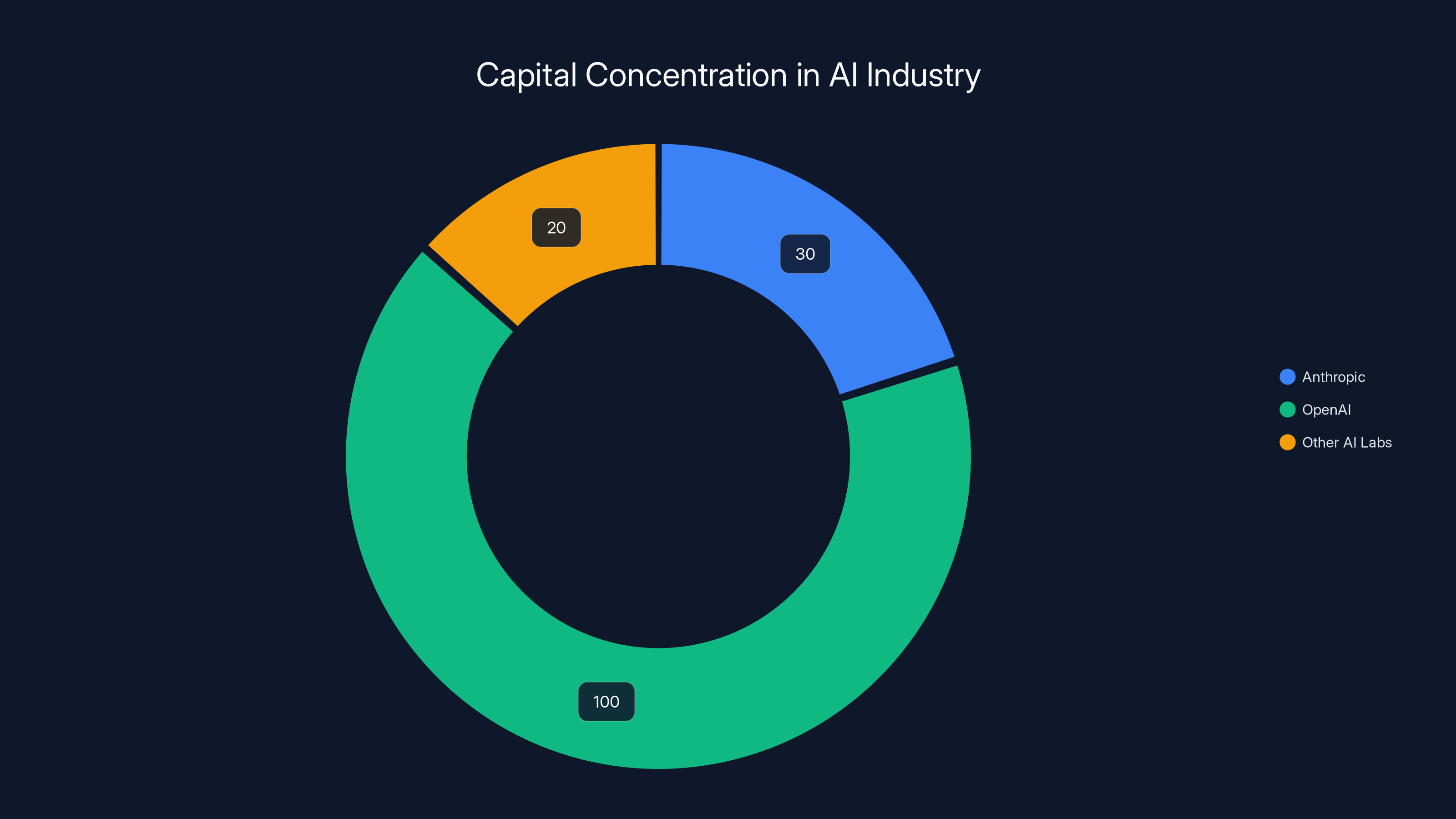

One clear implication of Anthropic's

For context, that's roughly equivalent to the total venture capital deployed across the entire US tech industry in an average year. It represents a historic concentration of capital on two companies pursuing remarkably similar missions with similar approaches.

This concentration creates both opportunities and risks:

-

Opportunities for Specialists: While capital concentrates in foundation models, there's likely to be significant capital available for companies building specialized AI applications, vertical-specific solutions, infrastructure (prompt management, model monitoring, fine-tuning platforms), and integration layers.

-

Risks of Dominance: If frontier model development requires $50-100+ billion capital raises, the barriers to entry become extraordinarily high. No new foundation model company can realistically compete with Anthropic and Open AI given current capital requirements.

Enterprise Software Market Implications

The massive capital inflows and enterprise adoption of Claude and GPT-4 signal that AI is transitioning from research artifact to mainstream business software. This has profound implications for enterprise software:

-

Acceleration of Disruption: Categories like customer service software, content management, business intelligence, and software development tools face potential disruption from AI-powered alternatives. Established vendors (Salesforce, Service Now, etc.) must either integrate frontier models or risk displacement.

-

New Pricing Models: Traditional enterprise software pricing (per-seat, per-module) may shift toward usage-based pricing (per token, per API call) as AI integration becomes more dynamic.

-

M&A and Partnership Dynamics: Expect accelerated M&A as software vendors acquire AI expertise or acquire companies with developed Claude/GPT integrations. Partnerships between foundation model providers and enterprise software vendors will intensify.

Implications for Developer Productivity and Automation

As Claude and GPT-4 models become increasingly capable, developers report substantial productivity gains. Internal reports suggest that developers using AI coding assistance complete tasks 30-40% faster, though this varies significantly by task complexity. As model capabilities improve, these productivity gains could expand.

This creates a cascade effect:

- Better AI models → higher developer productivity

- Higher developer productivity → more software features shipped faster

- More software features → greater value capture by early adopters

- Value capture → greater willingness to pay for better AI

- Greater willingness to pay → more capital available for AI development

This positive feedback loop could sustain heavy capital investment in AI even if broader economic concerns temper venture capital availability.

Anthropic and OpenAI together account for a significant portion of capital in the AI industry, raising $130 billion combined, highlighting a concentration of resources. Estimated data for other AI labs.

Competitive Positioning: Anthropic vs. Open AI vs. Others

Claude vs. GPT-4 Turbo: Capability Comparison

While detailed benchmarking requires careful methodology, published evaluations suggest Claude and GPT-4 Turbo are essentially competitive on most standard benchmarks, with each performing slightly better on specific categories:

-

Language Fluency and Instruction Following: Both models demonstrate excellent instruction-following capabilities. GPT-4 has a slight edge on some creative writing tasks; Claude matches or exceeds GPT-4 on analytical and reasoning tasks.

-

Context Length: Claude's 200,000-token context window significantly exceeds GPT-4 Turbo's 128,000-token window. This makes Claude superior for tasks requiring analysis of long documents.

-

Safety and Refusals: Claude is explicitly designed to refuse harmful requests with more consistency, while GPT-4 has more sophisticated reasoning about context and harm. Enterprises valuing predictable, conservative safety prefer Claude; those needing more nuanced reasoning prefer GPT-4.

-

Coding Capability: Both models demonstrate strong coding ability. Benchmarks are mixed, with GPT-4 showing slight advantages on some standardized coding challenges while Claude matches or exceeds on practical code generation tasks.

Differentiation Strategies

Given capability parity, both companies are pursuing differentiation strategies:

Anthropic's Approach:

- Emphasizing safety, alignment, and interpretability

- Building enterprise-grade products and compliance certifications

- Positioning as the "thoughtful" AI alternative

- Investing in long-term research (interpretability, safety)

- Building partnerships with enterprise software vendors

Open AI's Approach:

- Leveraging consumer brand and ecosystem (Chat GPT)

- Microsoft partnership and integration with Office 365, Azure

- Moving faster on product releases and new capabilities

- Building developer community and ecosystem

- Positioning as the innovation leader

Vulnerability Assessment

Each approach has vulnerabilities:

-

Anthropic's Risk: Perception as slower to innovate, smaller market reach, and possibility of acquisition or partnership where it becomes a supplier to larger platforms rather than a leading independent company.

-

Open AI's Risk: Over-reliance on Microsoft relationship could become constraining. Consumer Chat GPT subscription revenue is modest and questions remain about enterprise revenue sustainability if Claude gains parity.

The Valuation Question: Is $380 Billion Justified?

Valuation Methodology Challenges

Valuing pre-revenue or early-revenue companies at $380 billion is extraordinarily difficult because traditional valuation methodologies break down. Standard venture capital valuation approaches like comparable company analysis don't work well when there are only two meaningful comparables (Anthropic and Open AI) and neither has publicly disclosed financials.

Venture capital return potential methodology would suggest something like: If Anthropic can achieve

However, this reasoning contains multiple speculative layers:

- Will Claude maintain competitive parity as Open AI and Google improve models?

- Will enterprise customers pay prices supporting $50 billion ARR?

- Will regulations constrain AI model licensing or require expensive compliance?

- Will more efficient models (smaller, cheaper) reduce demand for frontier models?

Historical Precedent Gaps

There's limited historical precedent for $380 billion+ valuations of infrastructure software companies. Consider the context:

- Palantir Technologies: Took 20+ years to reach $100 billion valuation and still has unclear path to profitability

- Databricks: Recently valued at $43 billion (2023) and was a data platform, not foundational infrastructure

- Stripe: Reached $95 billion valuation (2021) with proven business model and clear path to profitability

Anthropıc is being valued at roughly 4x Stripe's peak valuation, but Stripe had demonstrated product-market fit, paying customers, and path to profitability. Anthropic has customer adoption but unclear profitability trajectory given research spending.

The Comparative Valuation Argument

Perhaps the strongest justification for Anthropic's valuation is comparative: If Open AI is worth

This suggests valuation is determined less by absolute fundamentals and more by relative competitive position and market share expectations. If AI computing becomes the foundational infrastructure of the 2030s economy, then being the #2 player with a massive share could justify $380+ billion.

Skeptical Perspectives

Sober skeptics point out several concerning dynamics:

-

Venture Capital Abundance: These massive rounds may reflect temporary venture capital excess rather than fundamental valuation accuracy. When capital is abundant and FOMO (fear of missing out) drives investment, valuations can exceed justified levels.

-

Unproven Revenue Models: Neither company has clearly demonstrated a sustainable path to profitability. Operating margins in AI inference can be razor-thin if customers become price-competitive.

-

Regulatory Risk: Governments worldwide are developing AI regulation. Compliance costs, licensing requirements, or usage restrictions could materially impact business models.

-

Technical Uncertainty: The path from current large language models to artificial general intelligence is unclear. If AGI is further away than investors believe, near-term business models become more important—and these are still unproven.

Anthropic's valuation has grown exponentially from

Regulatory and Risk Implications

Government Relations and Regulatory Positioning

Anthropıc's explicit focus on safety and alignment has strategic implications for regulatory positioning. As governments worldwide develop AI regulation, companies perceived as responsible and cooperative with regulators face fewer constraints. Anthropic's positioning as the "safety-conscious" alternative to Open AI may provide regulatory advantages:

-

US Regulation: Anthropic's participation in the Biden Administration's voluntary AI commitments (2023) positioned the company as cooperative and forward-thinking. As the Biden/Harris administration develops AI executive orders and Congress considers legislation, this positioning may prove valuable.

-

EU Regulation: The EU AI Act establishes requirements for high-risk AI systems, including documentation, testing, and compliance requirements. Companies perceived as aligned with safety and responsible development (like Anthropic) may face fewer barriers than those perceived as reckless.

-

International Positioning: Anthropic's investor base includes international capital (Singapore, UAE, Qatar), and this international positioning may ease regulatory navigation in multiple jurisdictions.

Competitive Risk from Regulation

Conversely, regulation could differentially impact Anthropic and Open AI:

-

Open AI's Scale Risk: If regulations impose strict safety testing requirements, data residency requirements, or specialized licensing, scaling to billions of users becomes more expensive, potentially favoring smaller, more focused players like Anthropic.

-

Anthropic's Disadvantage: If regulations create compliance costs that favor entrenched players with enterprise relationships and resources to navigate complex requirements, Open AI's Microsoft backing becomes a competitive advantage.

Unfortunately, the regulatory environment is so nascent that predicting which companies will benefit is highly uncertain.

Existential AI Risk Considerations

Anthropıc's explicit focus on long-term AI safety—ensuring that increasingly capable AI systems remain beneficial and controllable—carries both reputational and existential dimensions.

On the positive side, if the company's safety research produces genuine advances in interpretability and alignment, this could be extraordinarily valuable—both for competitive moats (better safety = greater enterprise adoption) and for humanity's long-term relationship with AI.

On the concerning side, the fact that AI safety is even a major concern suggests that current approaches to building powerful systems carry meaningful risks. Heavy capital investment in companies pursuing safety research implicitly assumes these risks exist and may materialize.

What This Means for Developers and Technology Teams

Implications for Development Workflows

Anthropıc's massive capital raise and enterprise adoption has direct implications for developers:

Claude Availability and Reliability: Increased capital enables infrastructure investment, making Claude more reliable and available. Developers can confidently build on Claude APIs knowing the company has resources to scale infrastructure and maintain service levels.

API Pricing and Terms: Capital enables companies to invest in infrastructure, which can support competitive pricing and favorable API terms. Anthropic has positioned itself as offering competitive pricing to Open AI while maintaining safety-first approach.

Feature Development: Capital enables rapid feature development. Developers should expect new capabilities, expanded context windows, improved performance, and new modalities (potentially including images, video, audio) as Anthropic invests in product development.

Integration Ecosystem: As enterprises adopt Claude more widely, the ecosystem of tools, integrations, and specialized products built on Claude will expand. Developers can expect more libraries, frameworks, and specialized tools to emerge.

Strategic Decisions for Teams

For development teams evaluating AI platforms, Anthropic's funding and competitive position offer important considerations:

-

Long-Term Viability: A well-capitalized Anthropic with demonstrated customer demand provides confidence that Claude will be a stable platform for long-term investment. Teams building on Claude can reasonably expect continued development and support.

-

Multi-Model Strategy: Rather than betting entirely on a single model, sophisticated teams likely evaluate multiple models (Claude, GPT-4, Gemini) for different use cases. Anthropic's competitive position makes Claude a serious consideration.

-

Enterprise Feature Parity: Enterprises using Claude can expect Anthropic to continue investing in enterprise features (fine-tuning, specialized models, compliance features) that keep pace with Open AI's offerings.

Anthropic's Claude excels in safety and context window size, while OpenAI's GPT-4 leads in ecosystem integration and fine-tuning capabilities. Estimated data based on qualitative descriptions.

The Broader Context: AI's Maturing into Infrastructure

From Research Curiosity to Business-Critical Infrastructure

Just three years ago, large language models were research artifacts that could generate impressive but often inaccurate text. The transformation from research novelty to business-critical infrastructure has been remarkably rapid:

- 2022: Chat GPT launches; goes viral as a consumer curiosity

- 2023: Enterprises begin serious experimentation; early adopters in content, customer service, and development

- 2024: Enterprise adoption accelerates; companies begin deploying in production workloads

- 2025: Claude and GPT-4 are embedded in enterprise workflows; switching costs increase

Capital follows this maturation. When a technology shifts from experimental to production-critical, capital investment increases because the total addressable market expands from research budgets to operational budgets.

Historical Parallels: Cloud Computing and Databases

History offers useful parallels. When cloud computing emerged in the mid-2000s, companies like AWS and later Google Cloud and Azure eventually required tens of billions in capital investment. The capital investment fueled infrastructure maturity, feature development, and ecosystem building that eventually captured massive market value.

Similarly, database companies like Mongo DB and others eventually required substantial capital to support scale, redundancy, security features, and ecosystem development that made them enterprise-grade.

AI may follow this pattern: massive capital investment (Anthropic

The Perpetual Hunger for Compute

One enduring characteristic of AI development: the demand for compute (GPU availability, processing power, data transfer) seems perpetually to exceed supply. This creates a self-reinforcing cycle:

- Capital raises → fund compute procurement

- More compute → train larger models and improve capabilities

- Better capabilities → higher demand from customers

- Higher demand → higher revenue enables next capital raise

- Next capital raise → more compute procurement

As long as this cycle continues, capital investment remains justified. Breaking this cycle would require either (1) major technical breakthroughs reducing compute requirements, (2) plateauing of model improvement, or (3) demand saturation.

None of these seem imminent, suggesting the capital intensity of AI development will remain high for years.

Alternative Perspectives: When Mega-Rounds Might Signal Caution

The Funding Bubble Argument

Some experienced technology investors and observers have raised concerns that AI funding levels may reflect bubble dynamics rather than fundamental value creation:

Argument: Venture capital has been abnormally abundant since 2020 (low interest rates, government stimulus, tech sector wealth). When capital is abundant, valuations can exceed justified levels. The AI sector, being novel and exciting, may attract disproportionate capital, inflating valuations.

Supporting Evidence:

- Many AI companies have yet to demonstrate profitable business models

- Inference (running trained models) has structurally low margins if compute costs are high

- Multiple companies pursuing nearly identical approaches (foundation models) suggests potential overcapacity

- Valuations have increased dramatically without proportional revenue growth

Counterargument: AI is genuinely transformative infrastructure; drawing parallels to past bubbles undersells the genuine utility and market demand. Enterprise adoption of Claude and GPT-4 is real and expanding, not speculative.

Regulatory Headwinds and Uncertainty

A more moderate concern: regulatory outcomes remain highly uncertain, and unfavorable regulations could substantially impact valuations:

-

Compliance Costs: If regulations impose strict testing, monitoring, or safety requirements, these increase operational costs and slow time-to-market.

-

Licensing and Access Restrictions: Some regulatory proposals have included restrictions on who can train or deploy large models. If implemented, these could significantly constrain business models.

-

Data Privacy and Licensing: Regulations around training data sourcing (copyright protection, consent requirements) could increase training costs or restrict model capabilities.

Anthropıc's safety focus may mitigate some regulatory risk, but all-in confidence seems premature given regulatory uncertainty.

The Competitive Dynamics Risk

Another consideration: while Anthropic is competitive with Open AI today, technology leads can shift quickly. If Open AI (with its larger installed base and Microsoft partnership) achieves a meaningful technical lead, or if a new competitor emerges with novel approaches, valuations could face downward pressure.

Anthropıc's strategy of emphasizing safety and long-term thinking could position it as a more durable enterprise player, but the technology sector has seen surprising reversals of competitive position.

Future Outlook: What's Next for Anthropic?

Near-Term Priorities (12-24 Months)

With $30 billion in capital, Anthropic will likely prioritize:

Product Expansion: Moving beyond text-based Claude to multimodal capabilities (vision, audio), building specialized industry models, and expanding enterprise features.

Market Expansion: Increasing enterprise sales force, building partner ecosystems, expanding international operations, and potentially building consumer products (beyond current limited direct access).

Research Acceleration: Expanding research teams, tackling interpretability and alignment challenges, and potentially publishing research advancing the field.

Infrastructure Scaling: Ensuring compute availability, building redundancy and reliability, and optimizing cost structures for sustainable unit economics.

Medium-Term Questions (2-5 Years)

Longer-term, critical questions will determine Anthropic's trajectory:

Profitability: Can Anthropic achieve positive operating margins? Enterprise software scales beautifully if customers value the product, but AI inference costs can be structurally challenging. If Anthropic cannot achieve positive margins at scale, the business model faces headwinds regardless of valuation.

Differentiation Durability: As Open AI, Google, Meta, and others improve models, can Anthropic maintain differentiation through safety focus, enterprise features, and community trust? Or does competition commoditize the space?

Integration Risk: Could Anthropic be acquired by Microsoft, Google, Amazon, or another tech giant? Or could the company remain independent? This shapes long-term value creation.

AGI Implications: If artificial general intelligence emerges sooner than expected, does this accelerate or decelerate Anthropic's value creation? These scenarios are inherently unpredictable.

Longer-Term Vision

Anthropıc's explicit mission is building "AI systems that are safe, beneficial, and understandable." If successful in this mission at scale, Anthropic could become:

- The de facto standard for enterprise AI infrastructure (similar to how AWS became cloud infrastructure standard)

- A research leader in AI safety and interpretability, shaping how future AI development proceeds

- A major profit pool in the tech economy, capturing value from AI's application across industries

Alternatively, if Anthropic fails to differentiate effectively or faces competitive displacement, the company could become an acquired asset or research subsidiary of a larger tech platform.

How Anthropic Compares to Alternative AI Solutions

Anthropic vs. Open AI: The Direct Comparison

For most enterprise use cases, the decision between Claude (via Anthropic) and GPT-4 (via Open AI) comes down to several factors:

| Factor | Anthropic (Claude) | Open AI (GPT-4) |

|---|---|---|

| Model Capability | Competitive; strong on reasoning/analysis | Competitive; strong on creativity/breadth |

| Context Window | 200,000 tokens | 128,000 tokens |

| Safety/Alignment | Explicit focus; more conservative | Capable but less conservative |

| Pricing | Competitive to slightly cheaper | Market leader pricing |

| Ecosystem | Growing but smaller | Larger; Microsoft integrated |

| Enterprise Features | Solid and improving | Comprehensive; production-proven |

| Fine-tuning | Available but limited | More mature offerings |

| Custom Models | In development | Available |

Why Teams Choose Anthropic

- Safety-Critical Applications: Healthcare, finance, governance where safety and alignment are paramount

- Long Document Analysis: Legal, financial, research where context window matters

- Interpretability Requirements: Industries requiring explaining model reasoning

- Multi-Cloud or Non-Microsoft Strategy: Teams avoiding Microsoft lock-in

Open Source and Smaller Model Alternatives

Beyond Anthropic and Open AI, several alternative approaches exist:

Open Source Models (Llama, Mistral, others):

- Advantages: No API costs, full control, no vendor lock-in, customizable

- Disadvantages: Require expertise to deploy, often lower capability than frontier models, higher operational burden

- When to Choose: Teams with deep ML expertise, specific customization needs, or cost constraints

Smaller Specialized Models:

- Advantages: Lower costs, faster inference, sufficient for specialized tasks

- Disadvantages: Lower general capability, may require domain-specific training

- When to Choose: Use case-specific applications (document classification, summarization, etc.)

Google Gemini:

- Advantages: Integrated with Google ecosystem (Workspace, Search), multimodal from start

- Disadvantages: Smaller enterprise adoption, less proven in production

- When to Choose: Google-native enterprises, specific multimodal use cases

For development teams seeking cost-effective, flexible automation solutions, alternative platforms like Runable offer AI-powered workflow automation and document generation at significantly lower costs ($9/month vs. per-API pricing), though with different capabilities and use cases suited to non-frontier model requirements.

Implementation Considerations for Adopters

Making the Case for Claude in Your Organization

If you're evaluating Claude for enterprise use, consider:

Use Case Alignment: Where does Claude provide distinctive value? Long document analysis, safety-critical applications, reasoning tasks typically play to Claude's strengths.

Cost Analysis: API costs vary by model (Opus = most capable/expensive, Haiku = least capable/cheapest). Analyze cost-benefit across your specific use cases.

Integration Effort: How deeply will Claude integrate with existing systems? API-based integration is straightforward; workflow integration requires architecture decisions.

Risk Assessment: What's the cost of model mistakes? For non-critical applications, occasional errors are tolerable; for critical applications, error handling and human-in-the-loop review is essential.

Best Practices for Claude Implementation

- Start Small, Iterate: Begin with one specific use case, validate success metrics, then expand

- Establish Monitoring: Track API costs, latency, error rates, and user satisfaction from day one

- Plan for Updates: Models improve over time; plan to periodically re-evaluate and potentially migrate to improved versions

- Implement Safety Controls: Add guardrails, content filtering, and human review where decisions impact customers or operations

- Build Cost Management: Monitor usage patterns and implement rate limiting or usage controls to prevent unexpected costs

The Broader Implications for AI Development and Competition

What Mega-Rounds Signal About Market Expectations

When venture capital flows at Anthropic's scale, it signals several things about market expectations:

1. AI as Infrastructure, Not Feature: The market has moved beyond viewing AI as a feature added to existing software. Instead, AI is increasingly viewed as foundational infrastructure that enables new software and business models.

2. Winner-Take-Most Dynamics: The enormous valuations suggest belief in winner-take-most outcomes. If two companies capture most of the value in frontier AI, capital flows concentrate accordingly.

3. Long Runway to ROI: $30 billion rounds suggest investors expect many years before profitability is achieved. This is different from venture capital's traditional focus on achieving profitability within 5-7 years.

4. Compute Economics Will Improve: Implicit in these valuations is belief that compute costs will decline (through hardware improvements or better algorithms) enabling profitable operations despite high training costs.

Implications for Smaller Players

For smaller AI companies or researchers, mega-rounds by Anthropic and Open AI create challenging dynamics:

Capital Requirements Rise: Competing in frontier model development increasingly requires billions of dollars, making it nearly impossible for startups to compete.

Specialization Becomes Critical: Smaller companies survive by specializing in specific domains, applications, or niches where they can differentiate without matching frontier model capability.

Acquisition Becomes Path to Exit: Rather than building independent companies, many AI startups will ultimately be acquired by larger platform companies or by Anthropic, Open AI, or other leaders.

Open Source Becomes Legitimate Path: As proprietary models concentrate in a few hands, open source models (improved continuously by communities) become valuable alternatives for teams wanting control and cost reduction.

Lessons from Capital Intensity in Technology

Historical Parallel: Cloud Computing

Cloud computing offers instructive parallels. In the mid-2000s, AWS required enormous sustained capital investment (AWS didn't turn profitable until years after launch). Capital intensity initially seemed like a bug, but ultimately became a feature:

- Capital as Moat: High capital requirements created barriers to competition

- Scale Economics: Capital enabled building at scale, reducing per-unit costs below competitors

- Ecosystem Gravity: Capital-funded feature development attracted developers and locked in mindshare

- Eventually Profitable: As scale increased, unit economics improved and AWS became extraordinarily profitable

AI may follow this pattern. If Anthropic's $30 billion enables it to achieve scale, compute efficiency improvements, and ecosystem lock-in, the company could eventually become extraordinarily profitable despite high current capital intensity.

However, the parallel isn't perfect. AWS benefits from network effects (more users → better service → more users). AI models don't have equivalent network effects in the same way—model quality depends on research and compute, not user count.

When Capital Intensity Becomes Unsustainable

Historically, capital-intensive industries face challenges when:

- Profitability Remains Elusive: If capital raises never lead to profitability, funding sources eventually dry up

- Competition Commoditizes: When multiple well-capitalized competitors enter, price competition can eliminate margins

- Alternative Approaches Emerge: If novel technologies (different hardware, novel algorithms) reduce capital requirements, incumbent investments become stranded assets

- Regulatory Changes Alter Economics: New regulations can increase costs or restrict profitable business models

For AI, monitoring these risk factors will be important in determining whether mega-rounds lead to sustainable value or represent speculative excess.

Key Metrics for Monitoring Anthropic's Progress

For investors, partners, and observers tracking Anthropic's development, several metrics matter:

Financial Metrics:

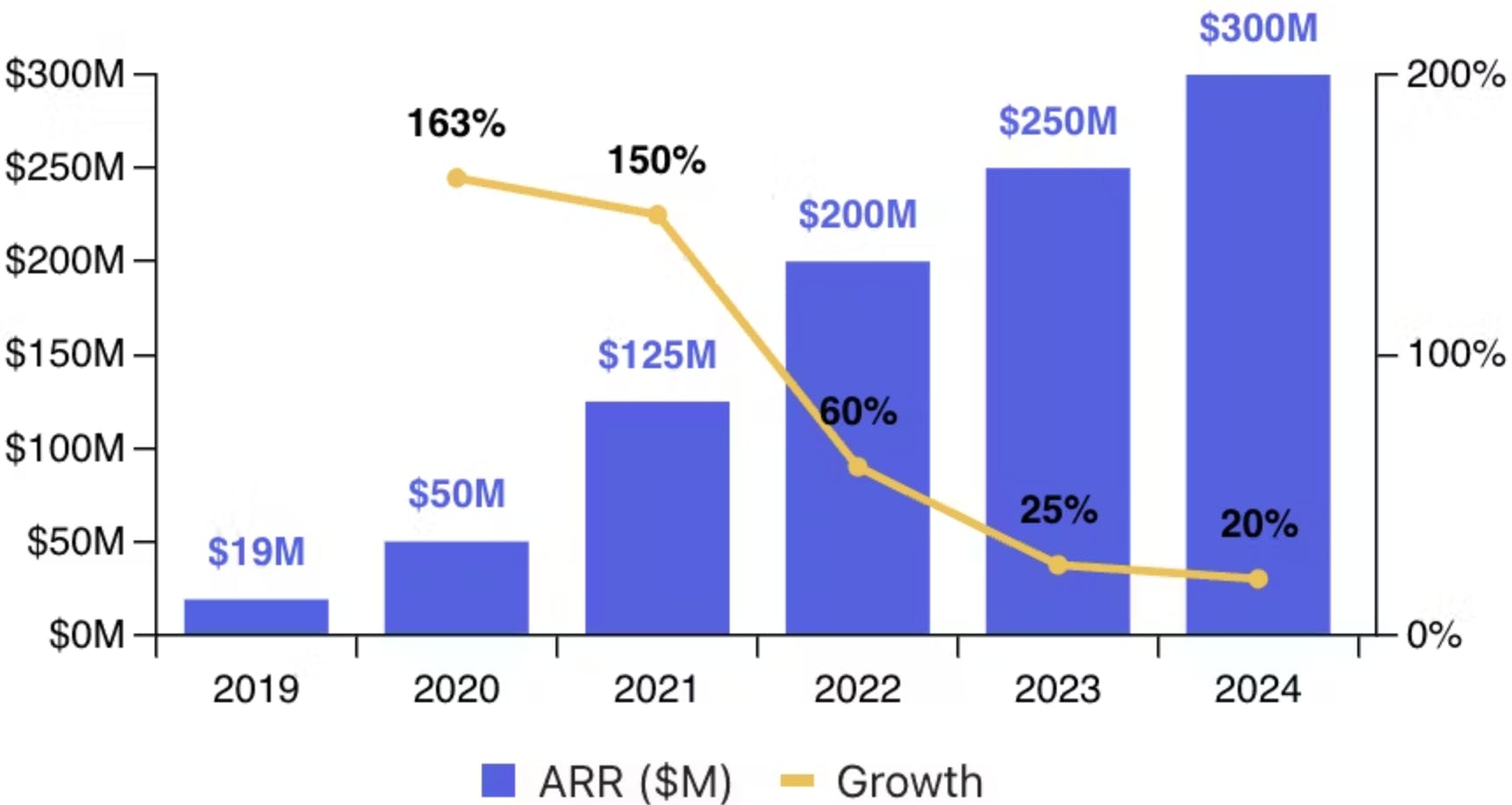

- ARR (Annual Recurring Revenue): Reported revenue or estimated based on customer counts and contract values

- Growth Rate: Month-over-month or quarter-over-quarter growth in revenue and customer counts

- Gross Margin: Percentage of revenue remaining after compute costs; critical for profitability analysis

- CAC (Customer Acquisition Cost): Cost to acquire enterprise customers; trends inform sustainability

- LTV (Lifetime Value): Expected total profit from customer relationships; should be multiples of CAC

Product Metrics:

- Claude's Capability: Performance on benchmark tests; qualitative assessments; customer feedback

- API Reliability and Performance: Uptime, latency, throughput; critical for enterprise confidence

- Feature Development Velocity: New capabilities, models, or products launched; indicates innovation speed

Competitive Metrics:

- Market Share: Estimated percentage of enterprise spending on Claude vs. alternatives

- Win Rate: In competitive deals, how often does Claude win vs. Open AI or alternatives?

- Feature Parity: How quickly Anthropic matches Open AI feature releases

Research Metrics:

- Publication Output: Academic papers from Anthropic research teams; indicates research contribution

- Talent Retention: Ability to retain top researchers; signals internal confidence

- Safety/Alignment Metrics: Progress on interpretability, alignment, safety research; harder to measure but important

Conclusion: Sizing Up a $380 Billion Question

Anthropıc's

The valuation itself—$380 billion for a company with uncertain profitability and significant competition—seems extraordinary by historical standards. Yet it's defensible if you believe (1) AI will become foundational infrastructure for the 2030s economy, (2) Anthropic will remain among the top two-three AI leaders, and (3) leaders in that space will capture enormous value.

For enterprises and developers, Anthropic's capital raise is positive news. It ensures continued product investment, research acceleration, and infrastructure maturity that makes Claude a credible long-term platform. The company's explicit focus on safety and alignment differentiates it from Open AI in ways that appeal to enterprises in regulated industries or with strong corporate values around AI safety.

For the broader tech ecosystem, Anthropic's mega-round signals that frontier AI development is becoming increasingly capital-intensive. This has consequences: it concentrates AI development in a small number of well-funded labs, it raises barriers to competition, and it makes the decisions made by Anthropic and Open AI leadership more consequential for the broader world.

The venture capital coming into Anthropic implicitly bets on several things: that Claude will remain competitive with GPT-4 and future Open AI models, that enterprises will continue to adopt Claude in business-critical workflows, that compute costs will decline enough to enable profitable operations, and that regulation won't fundamentally alter business models.

Each of these bets seems defensible, but none is certain. In that uncertainty lies both the opportunity that justifies the $380 billion valuation and the risk that future investors and observers will look back on 2025 AI funding as a case study in speculative excess.

For now, what's clear is that Anthropic has secured capital to be a serious, long-term player in AI. Whether that translates to the value captured by its investors remains an open question—but the question itself speaks to the enormous stakes involved in frontier AI development and the market's belief that whoever wins the AI infrastructure wars will win big.

FAQ

What is Anthropic and what does it do?

Anthropıc is an AI safety-focused company founded in 2021 that develops large language models, most notably Claude. The company builds artificial intelligence systems designed with explicit emphasis on safety, alignment, and interpretability. Rather than focusing solely on capability, Anthropic invests heavily in research ensuring that AI systems are beneficial and controllable as they become more powerful. Claude, Anthropic's flagship AI model, competes with Open AI's GPT-4 and is used by enterprises for customer service automation, content analysis, document processing, and software development assistance.

What does the $30 billion Series G funding mean?

Anthropıc's Series G funding round of

How does Claude compare to GPT-4 and other language models?

Claude and GPT-4 are competitive on most standard benchmarks, with each showing slight advantages in different areas. Claude excels particularly at reasoning tasks, long document analysis (thanks to its 200,000-token context window), and scenarios where safety and alignment matter most. GPT-4 benefits from a larger ecosystem, Microsoft integration, and consumer brand recognition through Chat GPT. Both models demonstrate strong capability across language understanding, code generation, creative writing, and analytical tasks. Claude typically performs slightly better on interpretability and safety-critical applications, while GPT-4 may have slight advantages in certain creative and specialized domain tasks. Open source models like Llama offer cost advantages but typically lower capability. The choice between them often depends on specific use case requirements rather than absolute capability differences.

What are the benefits of Anthropic's focus on AI safety and alignment?

Anthropıc's explicit focus on safety provides several concrete benefits for enterprises and users. First, it differentiates Claude in regulated industries (healthcare, finance, government) where AI safety is non-negotiable. Second, safety research advances our understanding of how language models work, enabling better interpretability and more predictable behavior. Third, constitutional AI (Anthropic's approach to alignment) creates more consistent and controllable AI systems that refuse harmful requests reliably. Fourth, investment in safety builds trust with enterprises concerned about AI risks, regulatory compliance, and long-term sustainability. These benefits provide durable competitive advantages beyond raw capability metrics. For enterprises valuing trustworthiness and regulatory compliance alongside performance, Anthropic's safety-first approach justifies considering Claude despite Open AI's larger ecosystem.

What is constitutional AI and why does it matter?

Constitutional AI is Anthropic's approach to training AI models to be safe and beneficial by providing explicit principles (a "constitution") that the model should follow. Rather than only using human feedback to correct bad behavior, constitutional AI trains models to evaluate their own responses against specified principles and improve accordingly. This approach is significant because it's more scalable than relying on human evaluation alone and it creates more consistent behavior aligned with explicit values. For enterprises, constitutional AI means Claude is more predictable and reliable in refusing harmful requests while remaining helpful for legitimate use cases. The approach also contributes to Anthropic's differentiation—it's a meaningful technical advance that isn't just about raw capability but about building AI systems that are more controllable and interpretable. This focus positions Anthropic as the long-term, safety-conscious alternative for enterprises building on AI infrastructure.

How will Anthropic use the $30 billion funding?

The $30 billion will be deployed across multiple priorities. A substantial portion will fund compute infrastructure—purchasing and leasing GPUs from NVIDIA and other vendors needed to train state-of-the-art models and serve API requests at scale. Significant capital will expand research teams pursuing interpretability, safety, and alignment advances. Product development funding will build enterprise-grade features, expand modalities (vision, audio), and accelerate development of specialized industry models. Business development and sales infrastructure will expand Anthropic's ability to reach enterprise customers globally. Finally, some capital will go to operational scaling—infrastructure, compliance certifications, security, and organizational maturity. The overall strategy is that capital enables Anthropic to compete on compute intensity with Open AI and Google while maintaining differentiation through research and enterprise focus.

What makes Anthropic's $380 billion valuation justified or questionable?

The valuation is justified from perspectives like comparable company analysis (if Claude reaches

Should enterprises choose Claude over GPT-4?

The choice depends on specific requirements. Claude is preferable for applications requiring long document analysis (legal contracts, research papers, policy documents), safety-critical applications where conservative behavior matters, or enterprises prioritizing interpretability and alignment. Claude also appeals to teams avoiding Microsoft lock-in or preferring a company explicitly focused on AI safety. GPT-4 is preferable for applications maximizing the existing ecosystem, leveraging Microsoft integration, prioritizing the most mature enterprise features, or where the larger community of tools and libraries matters. Many sophisticated enterprises actually use both, routing different tasks to different models based on suitability. Rather than a clear winner, consider Claude and GPT-4 as complementary solutions with different strengths. For teams seeking cost-effective AI automation with simpler deployment, alternatives like Runable provide lower-cost options for specific use cases like document and content generation.

What are the risks to Anthropic's $380 billion valuation?

Multiple risks could materially impact valuation. Technical risk: if Open AI's GPT-5 or Google's improved Gemini achieve meaningful capability advantages, Claude's differentiation erodes. Competitive risk: as multiple companies improve models, AI services may commoditize, reducing pricing power. Business model risk: if inference (running trained models) has structurally low margins due to compute costs, profitability remains elusive despite revenue growth. Regulatory risk: governments may impose requirements that increase costs or restrict model deployment in ways that favor certain players. Macro risk: if venture capital availability contracts, mega-rounds become impossible and companies face pressure to demonstrate profitability faster. Research risk: if breakthrough approaches (like novel architectures) emerge that require less compute, AI infrastructure becomes less capital-intensive, potentially stranding investments. Finally, execution risk: no company is guaranteed to execute perfectly; organizational scaling, talent retention, and strategic decisions matter enormously. These risks suggest valuations could face downward pressure if any materialize significantly.

How will AI funding rounds like Anthropic's $30B impact the broader tech industry?

Anthropıc's mega-round has cascading effects. Most directly, it accelerates the concentration of AI development in a few well-capitalized labs, raising barriers to entry for new competitors. This may actually benefit venture-backed startups building on top of Claude or GPT-4 (the applications layer), even as it becomes nearly impossible for startups to compete on foundation models. It accelerates regulatory pressure, as governments worldwide recognize AI as strategically important and move to regulate or develop competing capabilities. It attracts capital that might otherwise fund other tech sectors, potentially creating scarcity for non-AI startups. It also forces traditional enterprise software vendors to integrate AI aggressively or risk displacement. Finally, it signals that AI will be a major profit center in the tech economy, encouraging all major tech platforms (Microsoft, Google, Amazon, Meta, Apple) to invest heavily. Overall, the funding concentration in frontier AI is reshaping the entire tech industry's capital allocation and competitive dynamics.

Key Takeaways

- Anthropic raised 380B valuation, more than doubling from Series F's $183B—signaling extraordinary growth in frontier AI funding

- The funding round was led by sovereign wealth funds and elite venture capital firms, indicating strategic international support for Anthropic's AI development

- Claude and GPT-4 are competitive on capability, but differentiate on specific dimensions—Claude excels at long-context analysis and safety, GPT-4 benefits from larger ecosystem and Microsoft integration

- Capital concentration in frontier AI (Anthropic 100B) is creating high barriers to entry for new competitors while accelerating enterprise AI adoption

- Enterprise adoption of Claude is genuine and accelerating across customer service automation, content analysis, and development workflows, providing real revenue growth foundation

- Valuation is defensible if AI becomes foundational infrastructure, but risks include regulatory uncertainty, commodity compression of margins, and competitive technology shifts

- Mega-rounds fund compute infrastructure, research acceleration, enterprise features, and talent expansion—not just operational burn

- For developers and enterprises, Anthropic's capitalization ensures long-term platform stability and continued product investment, making Claude a credible alternative to OpenAI

- Multiple AI providers are differentiating through specialization rather than competing solely on frontier capability—creating opportunities for niche AI solutions

- The funding race signals venture capital confidence that AI will become trillion-dollar infrastructure sector, but sustained profitability remains unproven

Related Articles

- Modal Labs $2.5B Valuation: AI Inference Future & Market Analysis

- Microsoft's $37.5B AI Bet: Why Only 3.3% Actually Pay for Copilot [2025]

- Hauler Hero $16M Series A: AI Waste Management Software Revolution 2025

- TechCrunch Startup Battlefield 200 [2026]: Complete Guide to Pitching Success

- How AI and Nvidia GB10 Hardware Could Eliminate Reporting Roles [2025]

- Orbital AI Data Centers: The $42B Problem & Economics