Open Evidence Reaches $12 Billion Valuation: The AI Healthcare Platform That Investors Can't Ignore

In January 2026, medical information startup Open Evidence announced a

Thrive Capital and DST Global co-led this latest round, alongside a collection of blue-chip investors including Sequoia Capital, Nvidia, Kleiner Perkins, Blackstone, Bond, and Craft Ventures. What makes this even more interesting is that the company has also attracted strategic investors like Mayo Clinic, one of the world's most respected healthcare institutions.

To understand why this matters, you need to grasp what Open Evidence actually does and why investors are suddenly so convinced it's worth $12 billion. The company built what you might call the modern version of Web MD, except it's designed for doctors instead of worried hypochondriacs googling their symptoms at midnight. It's an AI-powered medical information platform that helps healthcare professionals make better clinical decisions by aggregating, synthesizing, and presenting medical evidence.

Here's the thing: the healthcare industry is drowning in data. Studies, research papers, clinical guidelines, patient records, lab results, and pharmaceutical information exist scattered across thousands of databases, journals, and proprietary systems. No single doctor can possibly keep up with the explosion of medical knowledge. That's where Open Evidence comes in. The platform uses artificial intelligence to collect, organize, and present relevant medical information in seconds, helping doctors make faster, more informed clinical decisions.

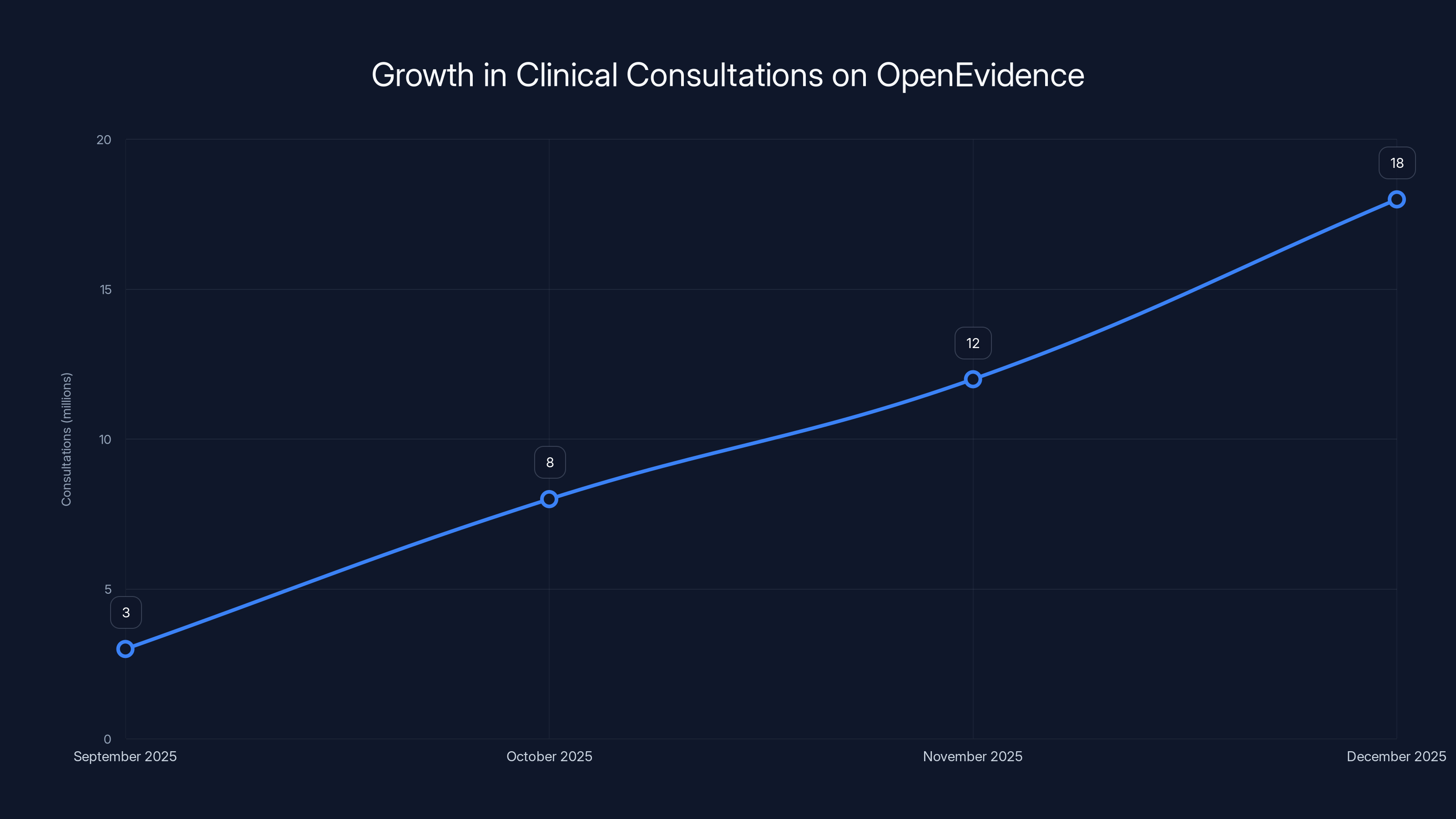

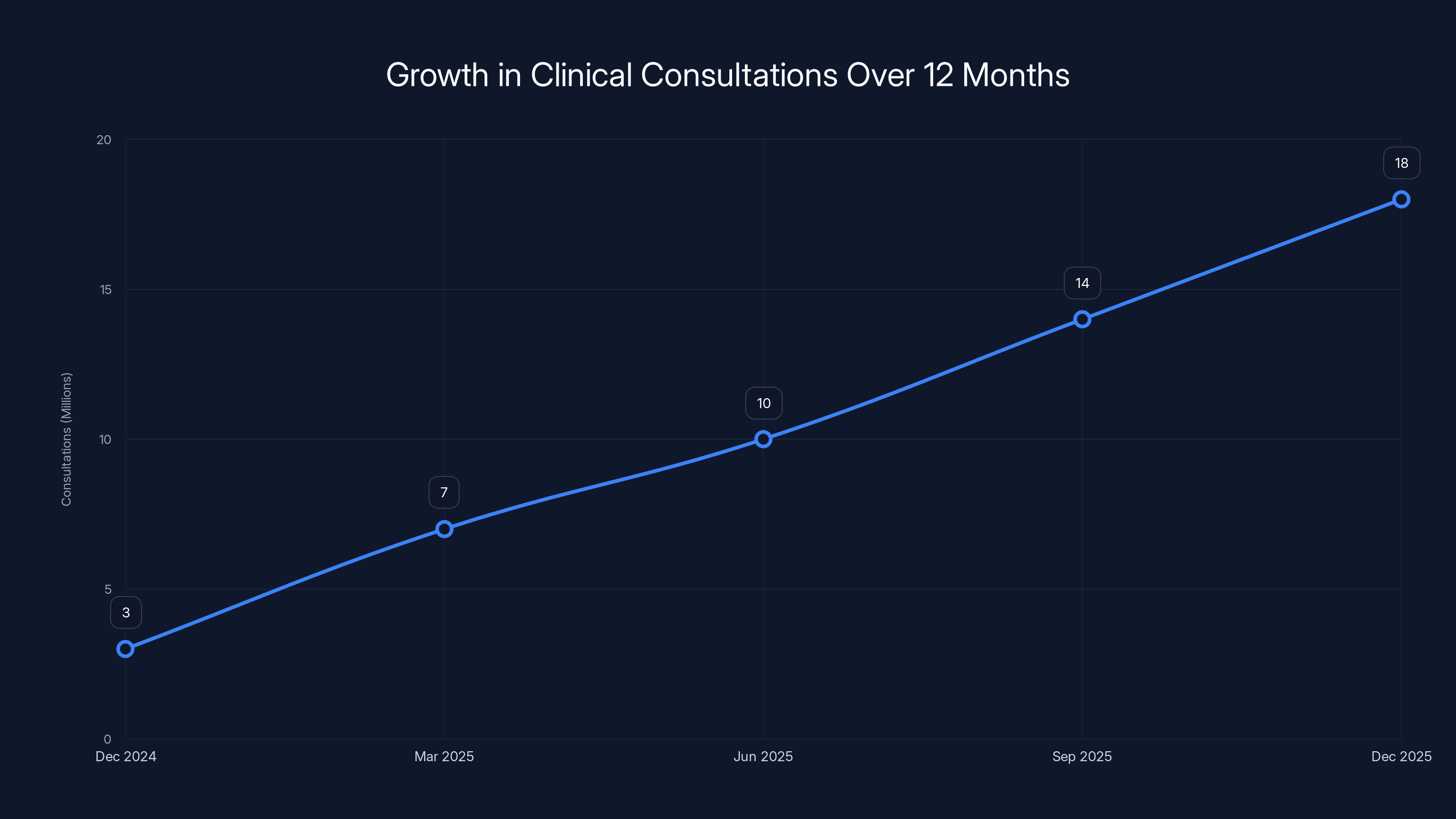

In December 2025 alone, the platform served 18 million clinical consultations from verified healthcare professionals across the United States. That's roughly six times higher than the 3 million monthly searches the platform was handling just a year prior. The company has also crossed the $100 million revenue threshold, a milestone that usually takes startups far longer to achieve, especially in healthcare where adoption is notoriously slow.

So why should you care about Open Evidence's fundraising? Because it signals something fundamental about the future of healthcare, the competitive landscape around AI, and where venture capital believes the real money will be made in the years ahead.

The Medical AI Gold Rush: Why Healthcare Is Different

Medical AI isn't like consumer AI. When you're building a chatbot for general audiences, your biggest competitors are other chatbot companies. When you're building AI for healthcare, your competitive landscape is far more complex and high-stakes.

Open AI and Anthropic have both launched healthcare-focused products recently. Open AI released a health information tool aimed at consumers. Anthropic launched Claude for Healthcare, which targets patients, payers, and healthcare providers. Yet despite this competition from some of the most well-funded AI companies on the planet, investors are still writing $250 million checks to Open Evidence. Why?

The answer lies in specificity. General-purpose AI models like GPT-4 or Claude can talk about almost anything, but they weren't trained specifically on medical data with healthcare-specific workflows in mind. They weren't optimized for the unique challenges doctors face: working quickly, accessing verified information, understanding drug interactions, reviewing the latest clinical guidelines, and making decisions that literally affect whether patients live or die.

Open Evidence, by contrast, is purpose-built. The platform was trained on medical literature, clinical guidelines, research papers, and evidence-based data. It understands the context of medical practice. It knows what doctors actually need when they're treating a patient. It integrates into existing workflows at hospitals and clinics rather than asking doctors to adopt yet another generic AI tool.

This specificity creates what investors call a "moat"—a competitive advantage that's hard for larger companies to replicate. Yes, Open AI could theoretically add medical-specific training to GPT-4. But Open Evidence has already done it. The company has relationships with hospitals. It has access to real clinical data. It understands healthcare compliance, privacy regulations, and the specific ways doctors work. Building that from scratch would take a large AI company years.

Moreover, the healthcare industry moves slowly. Hospitals are risk-averse. They're not going to rip out their existing systems and replace them with consumer AI tools. They want partners they can trust. Open Evidence, backed by Mayo Clinic and other healthcare institutions, looks like a trustworthy partner. Open AI, for all its capabilities, is still primarily known as a consumer technology company.

OpenEvidence saw a significant increase in monthly clinical consultations, growing from 3 million to 18 million over four months, contributing to its valuation doubling.

Understanding Open Evidence's Business Model

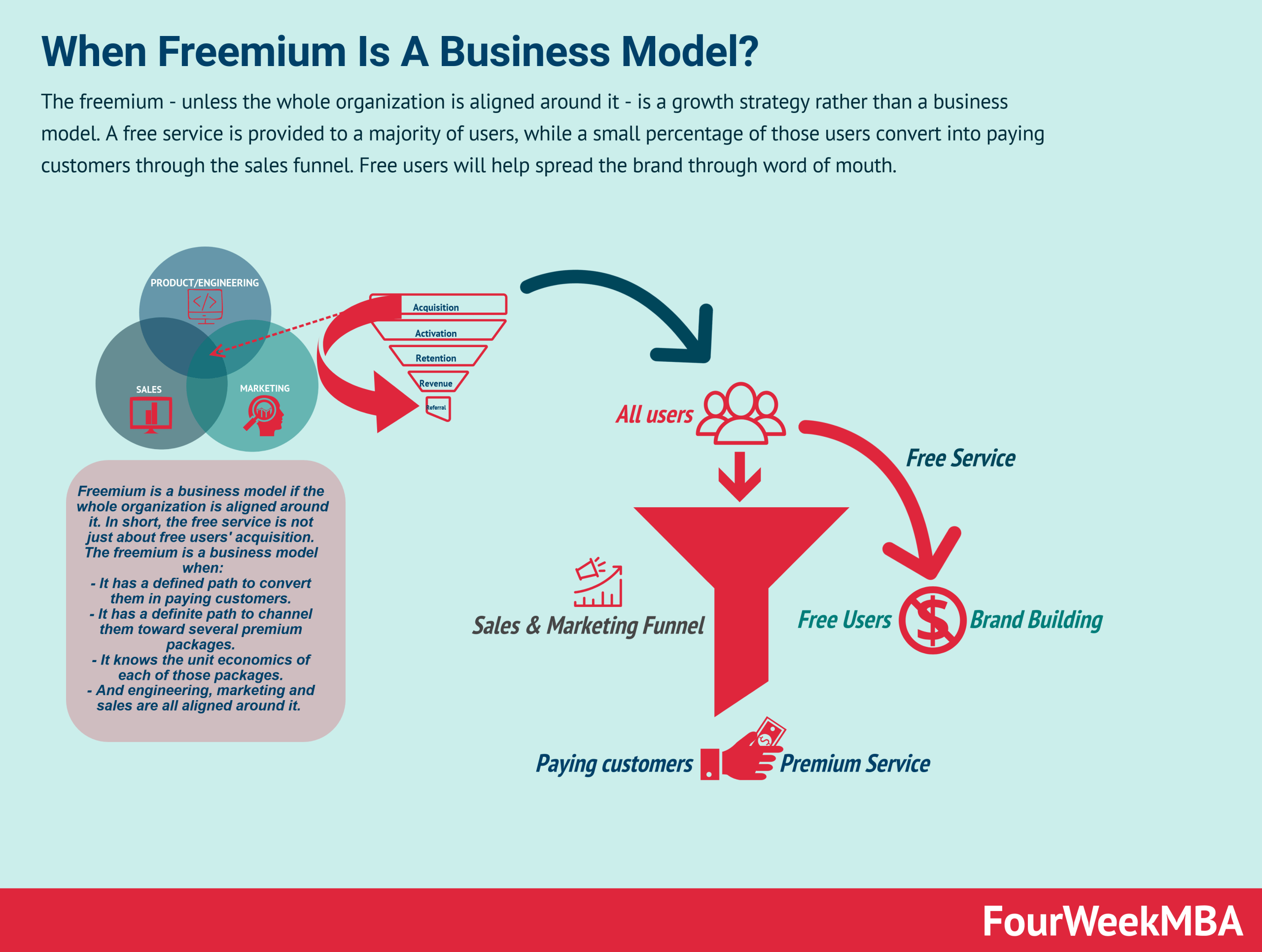

Open Evidence operates on a freemium model, which is crucial to understanding why the company can command a $12 billion valuation. The platform offers a free, ad-supported tier that serves healthcare professionals who don't want to pay for access. This free tier is incredibly popular—those 18 million clinical consultations in December? Most of those likely came from free users.

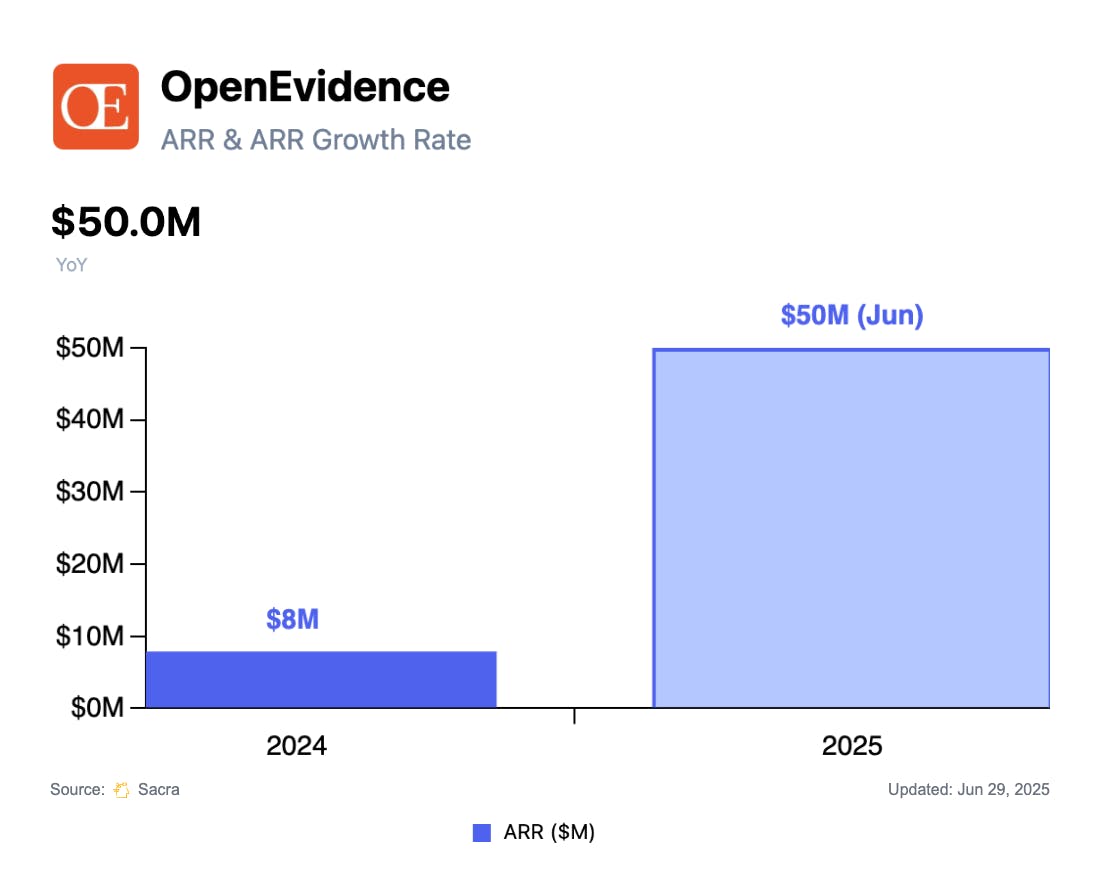

The business model here is classic: attract massive free user adoption to build network effects and demonstrate usage volume, then monetize through premium features, institutional subscriptions, and data insights. The company is already doing this successfully, having crossed $100 million in annual recurring revenue.

But here's where it gets interesting for investors. Healthcare institutions pay for guaranteed uptime, priority support, custom integrations, and enhanced analytics. As more doctors use Open Evidence on the free tier, the platform becomes more valuable to hospital systems, which want to ensure their staff has access to the best tool. Individual doctors are essentially lobbying internally for their hospital to buy an institutional license. It's a brilliant acquisition flywheel.

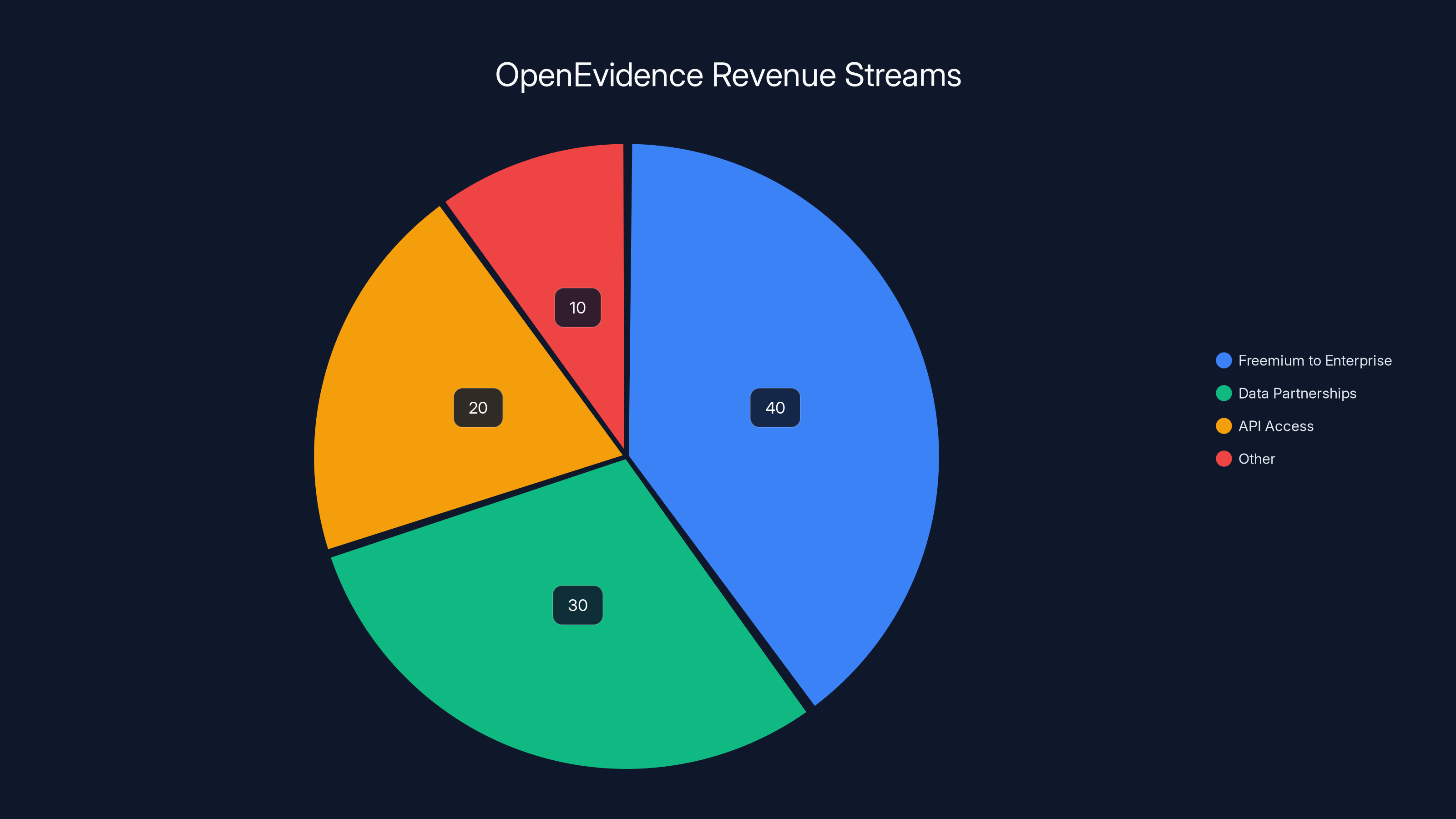

The data Open Evidence is collecting is also incredibly valuable. Every search, every lookup, every clinical consultation generates data about what healthcare professionals are looking for, what conditions they're treating, and what information they need. Anonymized and aggregated, this data helps identify new patterns in healthcare, potential drug interactions that haven't been formally documented, or emerging health trends. That data could be valuable to pharmaceutical companies, insurance companies, hospital networks, and public health agencies.

Future revenue streams could include white-label versions of the platform, API access for other healthcare software companies, partnerships with electronic health record systems like Epic and Cerner, and possibly licensing of the company's medical knowledge base to other healthcare technology providers.

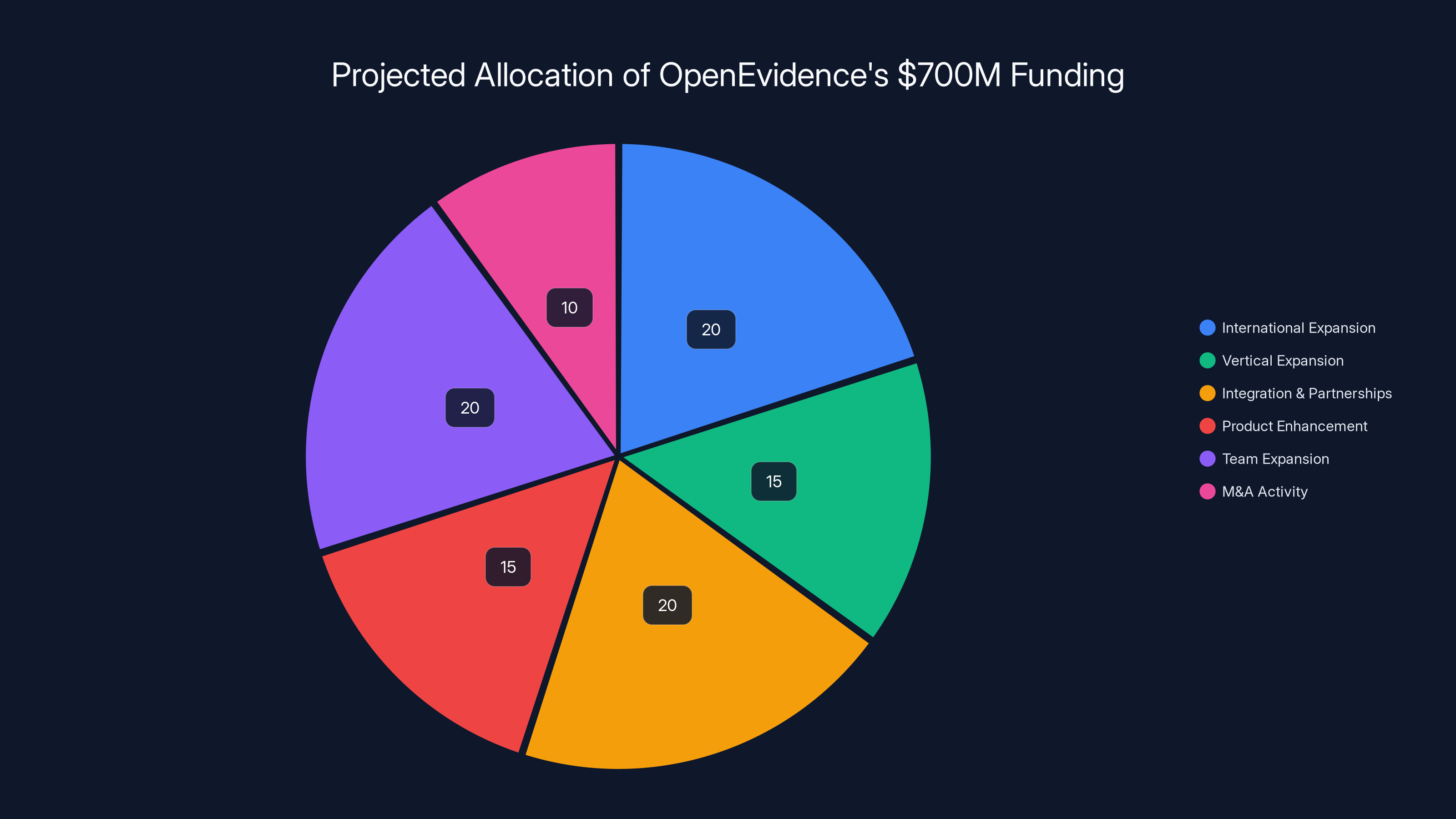

Estimated data: OpenEvidence is likely to allocate its $700M funding across various strategic initiatives, with significant portions dedicated to international and team expansions.

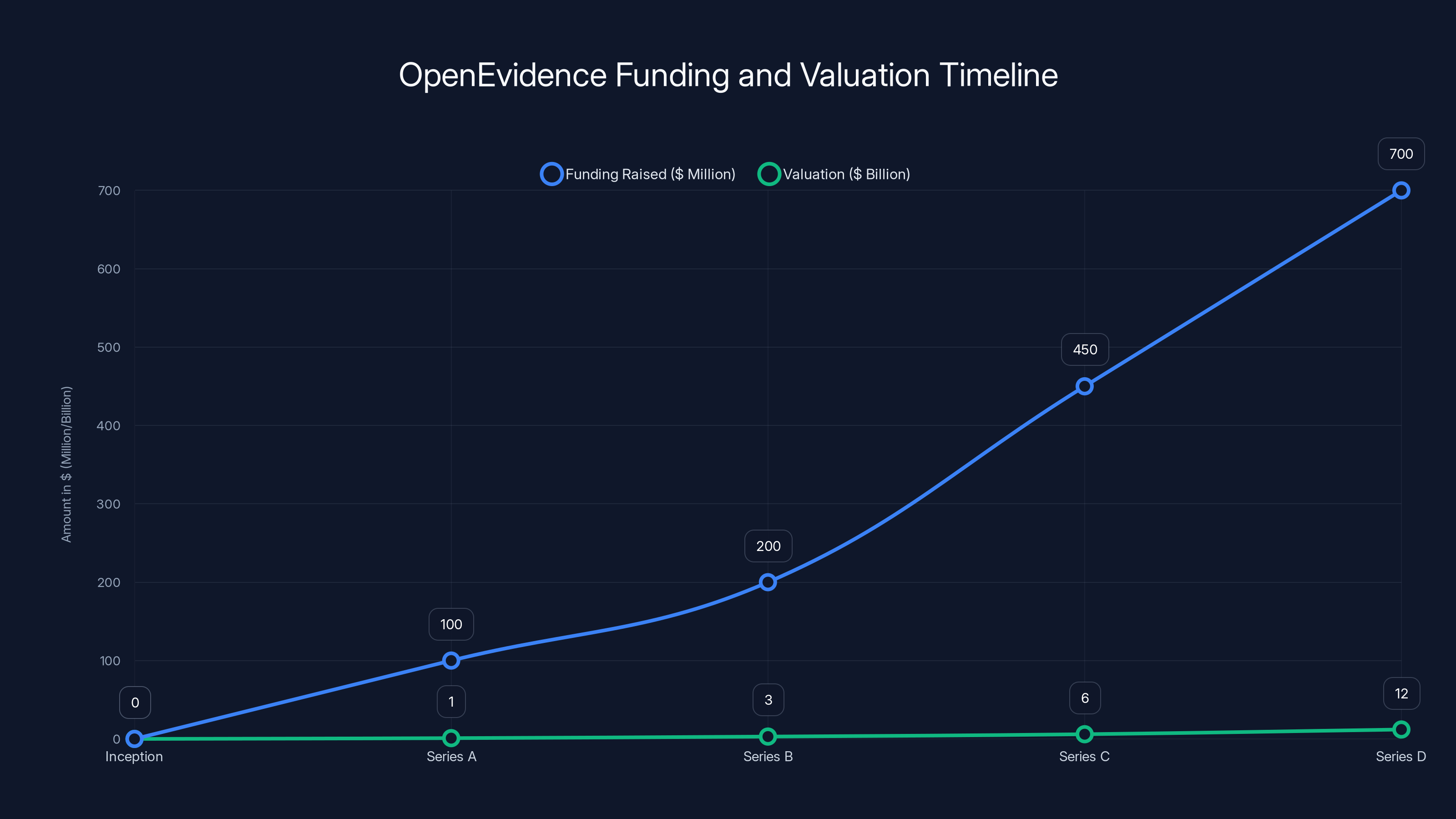

The Funding Timeline: How We Got Here

Understanding Open Evidence's trajectory requires looking at how quickly the company raised money and how much the valuation climbed with each round. This funding progression tells you something important about investor enthusiasm and market momentum.

The company had raised

The Series C round in October 2025 valued the company at

First, the user growth has been explosive. Doubling from 3 million monthly searches to 18 million clinical consultations in a single month is extraordinary growth. Second, the revenue milestone of $100 million demonstrates that this isn't just a user acquisition play—the company is actually making substantial money. Third, the competitive threat from Open AI and Anthropic has clarified the market opportunity. Instead of making investors nervous about competition, it's made them confident that healthcare AI is the next major frontier.

Thrive Capital and DST Global, the co-leads of this round, are both experienced investors in high-growth technology companies. Thrive has backed companies like Stripe, Figma, and Twitter. DST has invested in Facebook, Airbnb, Spotify, and Slack. These aren't investors who throw money at companies casually. Their participation signals confidence that Open Evidence can scale to become a dominant player in healthcare AI.

The Healthcare Market Opportunity: Why $12 Billion Isn't Crazy

It's easy to look at a $12 billion valuation and think it's inflated. But understanding the total addressable market for healthcare AI helps put that number in context.

The global healthcare software market alone is worth over $300 billion annually. Within that, the clinical decision support and medical information segments represent tens of billions in spending. Hospital systems spend billions on electronic health records, administrative software, imaging systems, and dozens of other technology solutions. If Open Evidence can capture even a small percentage of that market, the company could eventually be worth far more than its current valuation.

Consider also that healthcare is one of the last major industries where AI is still in early adoption. While AI is now pervasive in consumer technology, finance, and e-commerce, healthcare has been slower to adopt. This slowness has been driven by regulation, privacy concerns, and the risk-averse nature of the industry. But that also means there's a massive untapped opportunity. Once healthcare providers become comfortable with AI tools, adoption could accelerate dramatically.

Open Evidence is positioned to be a primary beneficiary of that acceleration. The company isn't just another AI tool—it's solving a specific, high-value problem that every hospital, clinic, and healthcare provider cares about: helping doctors make better decisions faster. If the platform can become standard in hospitals the way email is standard in offices, the valuation could be justified many times over.

The platform experienced a six-fold increase in clinical consultations over 12 months, highlighting its rapid adoption by healthcare professionals. Estimated data.

Competitive Dynamics: Open AI, Anthropic, and Others

Let's address the elephant in the room: if Open AI and Anthropic have launched healthcare products, why are investors still so bullish on Open Evidence?

First, it's important to understand the difference between what these companies are building. Open AI's health information product is aimed at consumers. Anthropic's Claude for Healthcare is positioned for patients, payers, and providers—a broader audience. Open Evidence is laser-focused on healthcare professionals making clinical decisions. The narrower focus actually gives Open Evidence advantages in terms of optimization and fit.

Second, Open AI and Anthropic are distributed across many markets and applications. Healthcare is one vertical for them among dozens. For Open Evidence, healthcare is the entire business. The company can optimize every feature, every integration, and every workflow specifically for what doctors need. It's the focused specialist versus the generalist.

Third, there's an incumbent factor. Healthcare is already dominated by other software companies. Electronic health record systems like Epic and Cerner control vast market share and have deep integrations throughout hospital systems. Smaller healthcare software companies like Teladoc, Athenahealth, and dozens of others are well-established. Open Evidence isn't trying to replace these systems—it's trying to integrate with them and be the layer that helps doctors access the information they need.

When Open AI launches a healthcare product, hospitals don't suddenly replace their entire infrastructure. They might add it as a tool. But Open Evidence, positioned as a clinical decision support system, fits more naturally into existing workflows.

That said, the competitive threat is real. If Open AI decided to focus seriously on healthcare, they could potentially build something competitive with unlimited resources. But the fact that investors aren't worried enough to stop backing Open Evidence suggests they believe the market is large enough for multiple players, or that Open Evidence has advantages that even Open AI's resources can't easily overcome.

The Role of Mayo Clinic and Strategic Investors

One detail that often gets overlooked in funding announcements is the presence of strategic investors like Mayo Clinic. Mayo isn't investing in Open Evidence for financial returns the way Thrive Capital or Sequoia are. Mayo is investing because the company aligns with the institution's mission to improve patient care.

When a world-renowned healthcare provider like Mayo Clinic invests in a healthcare AI company, it's essentially giving a seal of approval. It's saying that Mayo's clinical experts have evaluated the platform and believe it's worth the institution's capital and credibility. This is valuable in ways that go beyond the monetary contribution.

First, it gives Open Evidence credibility with other healthcare institutions. If Mayo trusts Open Evidence, other hospitals will be more likely to evaluate and adopt the platform. Second, it likely gives Open Evidence access to Mayo's clinical expertise and data (with appropriate privacy protections). This helps the company improve its product with guidance from some of the world's best doctors and researchers.

Third, it creates a partnership opportunity. Mayo Clinic operates several hospitals and health systems. Open Evidence could become deeply integrated into Mayo's operations, making it the standard tool for clinical decision support. If that happens, Mayo becomes a flagship customer that other hospital systems will want to match.

The presence of other strategic investors in the funding round reinforces this. Nvidia, which specializes in AI chips, is investing because Open Evidence's growth will drive demand for Nvidia's AI infrastructure. Kleiner Perkins and Sequoia are investing because they see Open Evidence as a potential dominant player in a major market.

Estimated data shows valuation risk and competitive threat as the highest challenges for OpenEvidence, with potential significant impacts on growth.

Growth Metrics: What the Numbers Tell Us

Let's break down the growth metrics that justify this valuation increase.

Clinical Consultations: The jump from 3 million searches per month a year ago to 18 million clinical consultations in December 2025 is a six-fold increase over 12 months. That's the kind of growth rate that venture capitalists dream about. Even more impressive, the company specifies "clinical consultations from verified healthcare professionals," which suggests that this number isn't inflated by bots or casual users. Real doctors are using the platform at increasing rates.

Revenue: Crossing the $100 million revenue threshold is significant. Many venture-backed Saa S companies struggle to reach this milestone. Open Evidence reached it while maintaining explosive user growth, which suggests the monetization flywheel is working.

Funding Velocity: The company raised $250 million in this round. For comparison, that's more than many Series A and Series B rounds combined. The fact that investors are willing to write such large checks suggests confidence in the company's trajectory and market opportunity.

Valuation Multiple: The company's Series D valuation of

The Healthcare AI Arms Race: Strategic Positioning

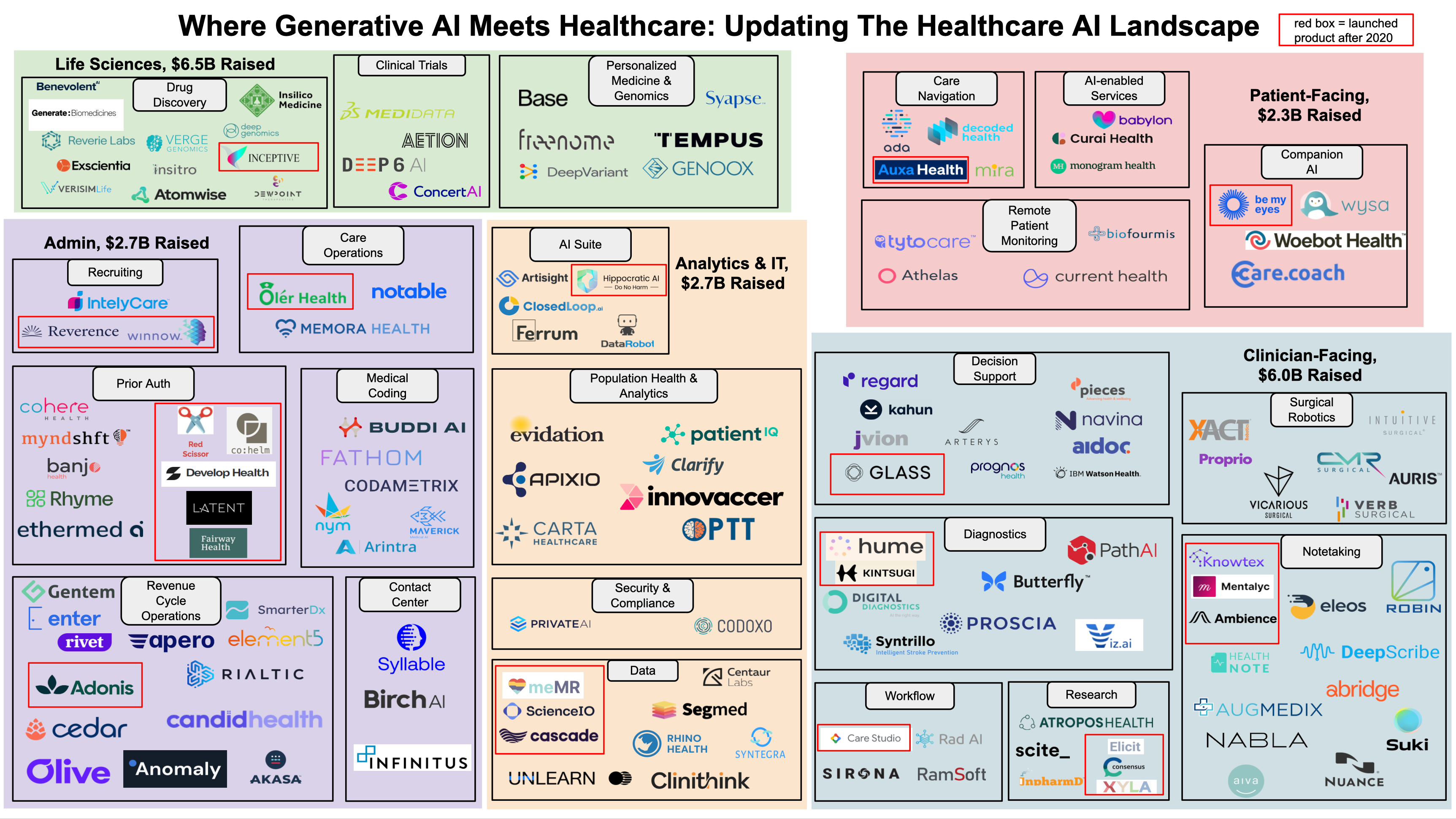

Open Evidence's $12 billion valuation should be understood in the context of a broader arms race in healthcare AI. Multiple companies and platforms are competing to become the standard AI tool for different segments of healthcare.

There's strong competition in diagnostic AI, where companies use machine learning to interpret medical imaging. There's competition in administrative AI, where companies help with billing, coding, and insurance approvals. There's competition in drug discovery AI, where startups are trying to accelerate pharmaceutical development. And now there's increasingly strong competition in clinical decision support AI—the segment Open Evidence dominates.

The company that becomes the standard clinical decision support platform for healthcare will have enormous network effects. If 80% of doctors in the United States are using a particular platform to look up information and make decisions, that platform becomes indispensable. Hospitals will feel pressure to subscribe. Healthcare systems will integrate it into their workflows. Insurance companies might offer it as a benefit to providers. The winner in this category could become a multi-hundred-billion-dollar company eventually.

Investors are betting that Open Evidence will be that winner. The company's early traction, funding support from healthcare institutions, and rapid growth suggest they might be right.

OpenEvidence's funding and valuation have shown significant growth, with a total of

Revenue Model and Monetization Strategy

Understanding how Open Evidence is actually making money helps explain the company's impressive metrics and investor enthusiasm.

The freemium model drives adoption. Free users—primarily individual doctors and healthcare professionals—experience the value of the platform with no financial commitment. This removes adoption friction. A doctor doesn't need to convince their hospital to buy a subscription before they can try the product.

Once doctors are regularly using Open Evidence, hospitals face a decision. They can allow their staff to use the free tier, or they can purchase institutional subscriptions. Premium tiers likely offer features like guaranteed uptime, advanced analytics about how their clinical staff are using the platform, integration with their existing EHR systems, and priority support.

The freemium-to-enterprise model is proven. Slack, Dropbox, and Figma all built billion-dollar companies on this principle. Users experience value on the free tier, and enterprises eventually pay for premium features and reliability.

Open Evidence might also monetize through data partnerships. Pharmaceutical companies pay billions for market research and insights into prescribing patterns. Healthcare institutions pay for benchmarking data showing how their prescribing or treatment patterns compare to peers. If Open Evidence can collect anonymized data about what clinical information doctors are accessing, it could sell insights to these parties.

API access could be another revenue stream. If Open Evidence's medical knowledge base and search capabilities can be accessed via API, other healthcare software companies might license access, integrating Open Evidence's information layer into their own products.

The Broader Implications: Healthcare's Digital Transformation

Open Evidence's $12 billion valuation isn't just significant for the company itself. It signals something larger about healthcare's digital transformation and the role AI will play in medicine going forward.

For decades, healthcare has lagged behind other industries in technology adoption. Hospitals still use electronic health record systems that sometimes feel like they belong in the early 2000s. Insurance and billing processes are so arcane and backward that they've become a genuine problem in the healthcare system. Diagnostic and treatment processes haven't fundamentally changed in many respects since before the internet.

But AI is starting to change that. The explosion of medical knowledge makes it increasingly clear that humans need tools to help navigate that information. Patients demand faster, more personalized care. Hospitals want to reduce costs and improve outcomes. Insurance companies want to prevent fraud and inappropriate care. All of these needs create opportunities for AI solutions.

Open Evidence is riding this wave. The company is positioned at the intersection of information access and clinical practice—one of the highest-value places to be in healthcare. As hospitals and doctors increasingly adopt AI tools, Open Evidence is already on the platform, building relationships and proving value.

Investors recognize this. The funding will help Open Evidence accelerate development, expand its clinical database, build out integrations with existing healthcare systems, and pursue international expansion. The company will likely hire dozens of additional engineers, clinical advisors, and business development professionals.

OpenEvidence's revenue is primarily driven by the freemium to enterprise model, with significant contributions from data partnerships and API access. (Estimated data)

Regulatory and Compliance Advantages

One factor that often gets understated in discussions about healthcare AI companies is the importance of regulatory and compliance expertise. Healthcare is one of the most heavily regulated industries in the world.

Open Evidence has to comply with HIPAA (Health Insurance Portability and Accountability Act), which governs the privacy and security of protected health information. The company must meet standards for data handling, encryption, audit logging, and user authentication. It must handle patient data appropriately even though it's ostensibly a tool for healthcare professionals.

Beyond HIPAA, healthcare AI tools increasingly face scrutiny from the FDA. If a tool provides recommendations about patient care or assists in diagnosis, the FDA might require validation and oversight. Open Evidence has presumably navigated these requirements already, which is a significant competitive advantage against newcomers.

Both Open AI and Anthropic have tremendous engineering resources, but they don't have deep expertise in healthcare compliance and regulation. Building that expertise takes time and requires hiring people with specific knowledge. Open Evidence already has it.

Moreover, the company's relationships with healthcare institutions like Mayo Clinic create implicit regulatory credibility. A tool endorsed by Mayo has gone through serious evaluation by clinical experts concerned about safety and efficacy.

The Investment Thesis: Why Thrive and DST Believe in Open Evidence

To understand whether a $12 billion valuation makes sense, it helps to think like an investor making this bet.

Thrive Capital and DST Global see several things when they look at Open Evidence. First, they see a company that has solved a real problem that doctors care about. The user growth metrics prove people want to use the product. Second, they see a market opportunity in healthcare that's vastly larger than what Open Evidence has currently captured. Of the millions of doctors in the United States, a fraction are using the platform. International expansion could multiply that opportunity.

Third, they see defensibility. Open Evidence has data advantages, healthcare relationships, regulatory expertise, and product-market fit. These create moats that protect against competition.

Fourth, they see network effects. As more doctors use Open Evidence, the platform gets better. More usage data helps improve the AI. More integrations make the platform more useful. The product becomes more valuable for hospital systems considering adoption. This creates a flywheel where growth begets more growth.

Fifth, they see multiple paths to value. Even if Open Evidence never becomes the dominant platform for all doctors, the company could still be worth billions by becoming essential in specific healthcare verticals (surgery, oncology, cardiology, etc.), specific geographies, or specific healthcare institutions.

Final, they see a founder and team they believe in. (The article doesn't detail the founders, but evidently, Thrive and DST felt confident in the team's ability to execute.) Venture investors bet on people as much as ideas.

Challenges and Risks: The Other Side of the Coin

While the Open Evidence story is compelling, it's important to acknowledge the risks and challenges that come with such a high valuation.

Healthcare Adoption is Slow: Despite the impressive growth metrics, healthcare adoption remains slower than in other industries. Hospitals are conservative. Changing workflows is difficult. Doctors are busy and resistant to learning new tools. Open Evidence needs to maintain momentum and continue proving value as it scales.

Competitive Threat is Real: Open AI and Anthropic have enormous resources and existing distribution through their consumer products. If they decide to focus on healthcare seriously, they could become formidable competitors. There's also a risk that healthcare incumbents like Epic or Cerner build their own AI-powered clinical decision support tools.

Regulatory Uncertainty: Healthcare regulation evolves. New requirements could increase compliance costs or create liability issues for the company. FDA oversight of healthcare AI is still being figured out, and requirements could become more stringent.

Data Privacy Concerns: As Open Evidence collects more data about doctors' clinical decisions and patient information, privacy concerns will likely grow. A significant data breach or privacy incident could damage the company's reputation and ability to operate.

Monetization Uncertainty: While the $100 million revenue milestone is impressive, it's not clear how much further monetization can scale. If hospitals don't convert to paid subscriptions at the rates investors expect, or if regulatory changes limit data monetization opportunities, revenue growth could slow.

Valuation Risk: At

Looking Ahead: What's Next for Open Evidence

With $700 million in total funding, Open Evidence is well-capitalized for the next phase of growth. Here's what we might expect the company to do with this capital.

International Expansion: The current metrics focus on the United States. European healthcare systems, particularly in countries with advanced healthcare infrastructure like Germany, France, and the UK, represent a significant opportunity. So do healthcare markets in Canada, Australia, and other developed nations.

Vertical and Specialty Expansion: Open Evidence could expand beyond general clinical decision support to specialize in particular medical areas. Separate tools optimized for oncology, cardiology, psychiatry, or other specialties could command premium pricing and deeper adoption in those areas.

Integration and Partnerships: The company will likely deepen integrations with existing healthcare software platforms. Partners with Epic, Cerner, and other EHR systems would expand reach and increase stickiness. White-label versions for health insurance companies and large hospital networks could also become significant revenue drivers.

Product Enhancement: Additional features powered by AI—drug interaction checking, personalized treatment recommendations based on individual patients, clinical trial matching, integration with patient records—could deepen the platform's value.

Team Expansion: With significant capital, Open Evidence will hire aggressively. The company will expand engineering teams to improve the platform, build out clinical advisory boards, hire business development professionals, and expand international operations.

Potential M&A Activity: With

The Bigger Picture: AI and Healthcare's Future

Open Evidence's $12 billion valuation sits within a much larger transformation of healthcare driven by AI.

Machine learning is improving diagnostic accuracy in radiology and pathology. Natural language processing is helping extract insights from unstructured clinical notes. Predictive models help identify patients at risk of certain conditions before they become critical. Generative AI is assisting in research, drug discovery, and medical education.

Open Evidence represents a specific slice of this transformation: using AI to help healthcare professionals access and apply medical evidence in real-time during clinical care. It's not the flashiest application of AI in healthcare—diagnostic AI with computer vision gets more headlines—but it might be more fundamentally important.

Clinical decision support doesn't require replacing doctors or taking away their agency. It's fundamentally about augmenting their decision-making with the best available evidence. That's an application of AI that doctors are actually excited about, not suspicious of. It's an application that improves patient outcomes without asking hospitals to upend their entire infrastructure.

As healthcare becomes increasingly data-intensive and medical knowledge continues to expand, tools like Open Evidence will become increasingly important. The company is essentially building the information infrastructure that modern medicine needs.

Conclusion: Valuation in Context

Open Evidence's journey from a startup to a $12 billion company in a remarkably short time might seem dramatic, but it reflects several fundamental realities: the explosion of medical knowledge that professionals can't manually track, the slowing adoption of AI in healthcare relative to other industries, and the massive market opportunity if a company can solve the right problem well.

The company has demonstrated that it's solving a problem doctors care about through explosive user growth. It's shown that it can monetize through reaching $100 million in revenue. It's secured support from world-class investors and healthcare institutions. It's built defensibility through regulatory expertise, data advantages, and relationships.

Does this guarantee success? Absolutely not. Healthcare is unpredictable. Competition could intensify. Adoption could slow. Regulatory changes could shift the landscape. But the $12 billion valuation, while high, reflects a realistic assessment of the market opportunity and Open Evidence's early execution.

In the years ahead, Open Evidence's success or failure could significantly influence how AI shapes the future of medicine. If the company succeeds, it could become one of the most important healthcare infrastructure companies of the era. If it fails, it will have provided valuable lessons about what works and what doesn't in healthcare AI.

For now, the investment community is betting on success. The capital is being deployed. The challenge for Open Evidence is to execute on the promise and deliver on the extraordinary expectations that come with a $12 billion valuation.

FAQ

What is Open Evidence and what does it do?

Open Evidence is an AI-powered medical information platform designed specifically for healthcare professionals including doctors, clinicians, and healthcare staff. The platform aggregates medical research, clinical guidelines, treatment protocols, and evidence-based information to help healthcare professionals make faster, more informed clinical decisions. Think of it as a modernized, AI-enhanced version of medical reference tools that combines vast medical databases with intelligent search and synthesis capabilities.

How does Open Evidence generate revenue?

Open Evidence operates on a freemium business model where individual healthcare professionals can access a free, ad-supported version of the platform. The company generates revenue through premium institutional subscriptions offered to hospitals, healthcare networks, and medical systems that want guaranteed uptime, priority support, advanced analytics, and custom integrations. The platform has reportedly surpassed $100 million in annual revenue, demonstrating successful monetization across both individual and institutional segments.

Why did Open Evidence's valuation double from 12 billion in just three months?

The rapid valuation increase reflects several factors: the platform nearly sextupled clinical consultations from 3 million monthly searches to 18 million consultations in December 2025, the company crossed the $100 million revenue milestone demonstrating strong monetization, and investor confidence in the massive healthcare AI market opportunity grew as Open AI and Anthropic launched competing health products. The funding also attracted prominent investors including Thrive Capital, DST Global, Mayo Clinic, and others who see Open Evidence as positioned to dominate clinical decision support.

How does Open Evidence compete with Open AI and Anthropic in healthcare?

While Open AI and Anthropic have launched healthcare products, Open Evidence maintains competitive advantages through vertical specialization (focused exclusively on clinical decision support versus these companies' broader applications), purpose-built healthcare infrastructure, existing relationships with major healthcare institutions, and deep expertise in healthcare compliance and regulations like HIPAA. Additionally, Open Evidence is optimized specifically for doctor workflows and existing healthcare systems rather than being a general-purpose AI tool adapted for healthcare.

What are the main growth drivers for Open Evidence?

Primary growth drivers include rapidly increasing clinical adoption from healthcare professionals, institutional subscriptions from hospitals wanting to ensure their staff has access to the platform, potential international expansion beyond the United States, vertical specialization in specific medical disciplines, deep integrations with electronic health record systems and other healthcare software, and potential data monetization through anonymized insights valuable to pharmaceutical and insurance companies.

Is the $12 billion valuation justified?

The valuation reflects several justifications: the global healthcare software market exceeds $300 billion annually, clinical decision support represents a specific high-value segment, the platform has achieved rapid user growth and significant revenue, healthcare AI adoption is still in early stages with massive untapped opportunities, and a dominant player in this category could eventually become worth far more than the current valuation. However, valuation risk remains significant given execution requirements, healthcare adoption unpredictability, and competitive threats.

Who are the major investors in Open Evidence?

Key investors in Open Evidence include Thrive Capital and DST Global (co-leads of the Series D round), Sequoia Capital, Nvidia, Kleiner Perkins, Blackstone, Bond, Craft Ventures, and strategic healthcare investor Mayo Clinic. The company has raised a total of $700 million across multiple funding rounds from a collection of blue-chip venture and strategic investors.

What challenges does Open Evidence face moving forward?

Significant challenges include healthcare's traditionally slow adoption of new technologies, intense competition from well-funded companies like Open AI and Anthropic, evolving regulatory requirements for healthcare AI, data privacy and security risks as the platform collects sensitive clinical information, and the need to maintain aggressive growth rates to justify the current valuation. Healthcare incumbents like Epic and Cerner could also build competing solutions.

Medical AI and Healthcare Technology Resources

For readers interested in learning more about the intersection of artificial intelligence and healthcare:

- Healthcare Software and EHR Systems: Understanding existing healthcare infrastructure helps contextualize why specialized platforms like Open Evidence create value beyond general-purpose AI tools

- Clinical Decision Support Systems: The specific category of healthcare technology that Open Evidence operates in, with decades of research on effectiveness and adoption

- Healthcare Data Privacy and Compliance: HIPAA, data security, and regulatory frameworks that constrain and shape healthcare AI development

- Medical Evidence and Clinical Guidelines: The foundational information that Open Evidence aggregates and synthesizes for healthcare professionals

- Healthcare AI Applications: Broader landscape including diagnostic AI, administrative AI, drug discovery AI, and personalized medicine

- Venture Capital in Healthcare: Understanding healthcare's unique position as a venture investment category with longer timelines and higher regulatory complexity than typical software

Key Takeaways

- OpenEvidence achieved a 6 billion in just three months, signaling explosive investor confidence in healthcare AI

- The platform served 18 million clinical consultations in December 2025, a six-fold increase from 3 million monthly searches a year prior, demonstrating rapid adoption among healthcare professionals

- OpenEvidence's vertical specialization and healthcare expertise create competitive advantages over general-purpose AI platforms from OpenAI and Anthropic in the clinical decision support segment

- The company has already surpassed $100 million in annual revenue, proving successful monetization through freemium adoption converting to enterprise institutional subscriptions

- Strategic investment from Mayo Clinic and other healthcare institutions provides regulatory credibility, data partnerships, and real-world validation that traditional venture investors alone cannot offer

- Healthcare represents a massive untapped opportunity for AI adoption, with the global healthcare software market exceeding $300 billion annually and clinical decision support representing a high-value subset

Related Articles

- AI Healthcare Revolution: Why Tech Giants Are Racing Into Medicine [2025]

- Serve Robotics Acquires Diligent: Why Healthcare Robots Are the Next Frontier [2025]

- Luminar's Collapse: Inside Austin Russell's Bankruptcy Battle [2025]

- Emergent Raises $70M Series B: Inside the AI Vibe-Coding Boom [2025]

- OpenAI's 2026 'Practical Adoption' Strategy: Closing the AI Gap [2025]

- 55 US AI Startups That Raised $100M+ in 2025: Complete Analysis

![OpenEvidence's $12B Valuation: Why AI Medical Data Matters [2026]](https://tryrunable.com/blog/openevidence-s-12b-valuation-why-ai-medical-data-matters-202/image-1-1769020685298.jpg)