Emergent Raises $70M Series B: Inside the AI Vibe-Coding Boom [2025]

Less than four months after closing a Series A, Emergent just pulled off what's become increasingly common in AI startup land: raising massive capital at dizzying speeds. The Indian startup announced a

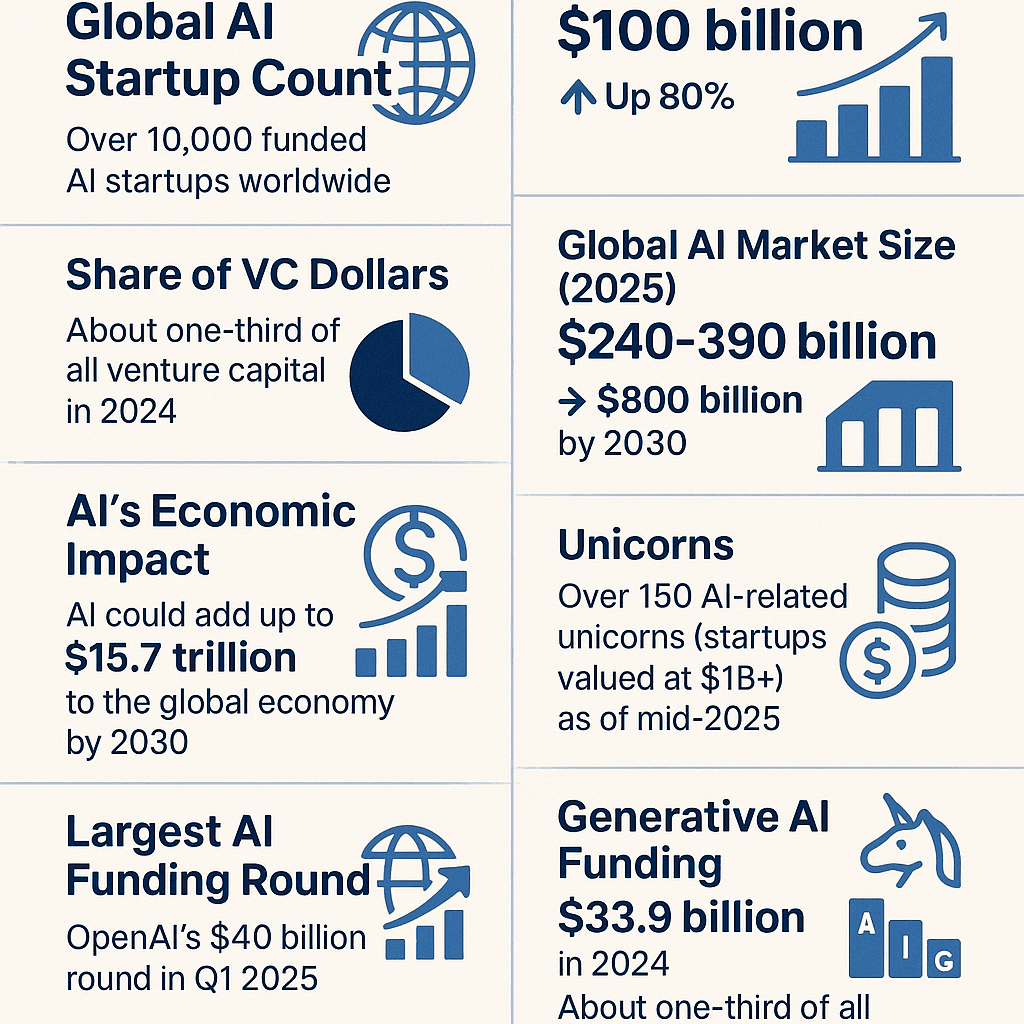

If those numbers seem absurd, that's because they kind of are. But they also tell you everything you need to know about where venture capital is flowing right now and why AI-powered code generation is becoming the most hyped vertical since mobile apps.

This article digs into what Emergent actually does, why investors are betting billions on vibe-coding platforms, and what this funding round reveals about the future of software development.

TL; DR

- 300M valuation from Soft Bank Vision Fund 2 and Khosla Ventures

- $50M ARR in 7 months with 5+ million users across 190+ countries

- Competing with Lovable, Cursor, and Replit in the AI code generation space

- 70 of 75 employees based in Bengaluru, with aggressive hiring planned

- Targets $100M ARR by April 2026, signaling explosive growth expectations

- Mobile app-building feature gaining strong traction, expanding beyond web apps

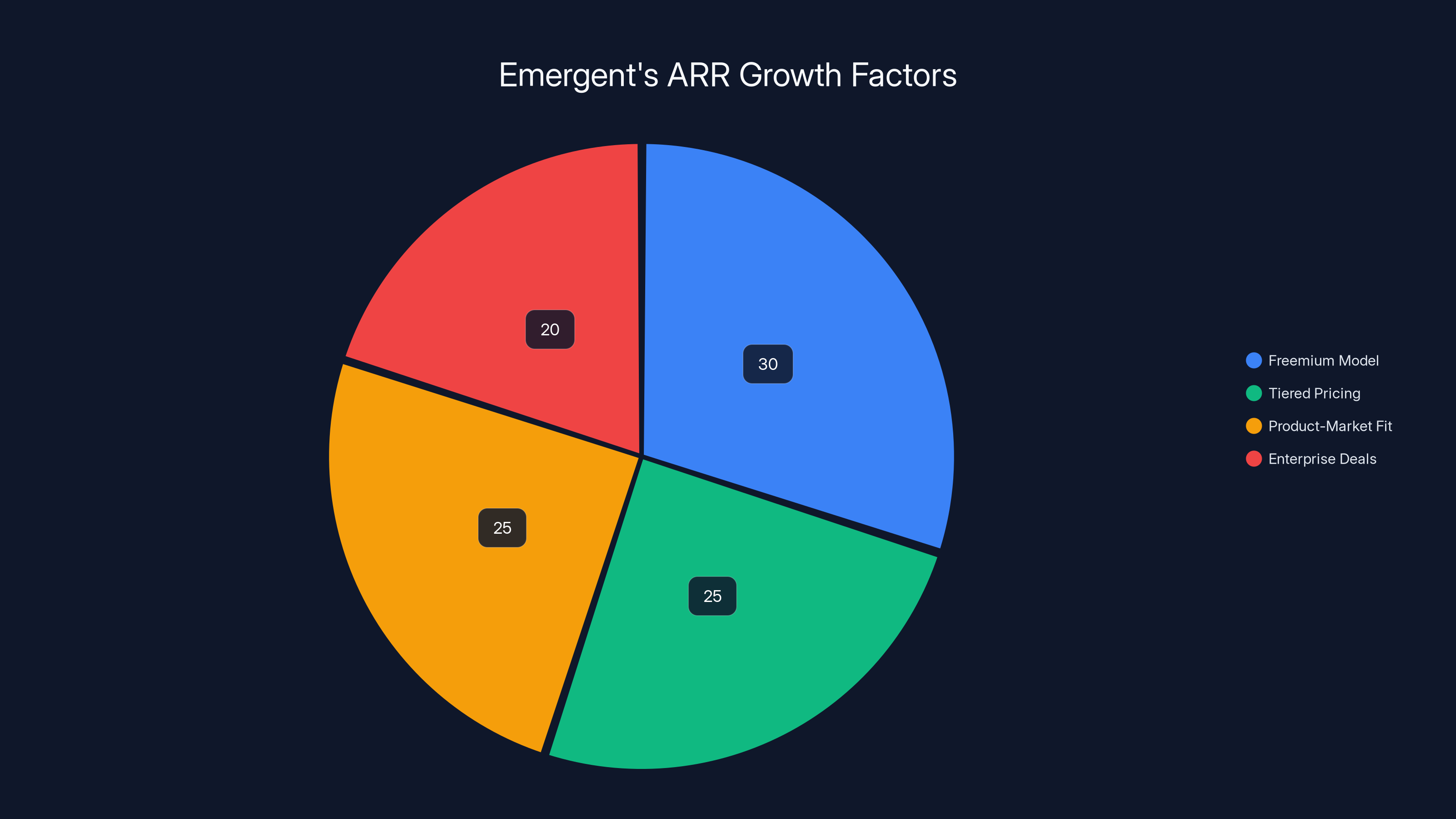

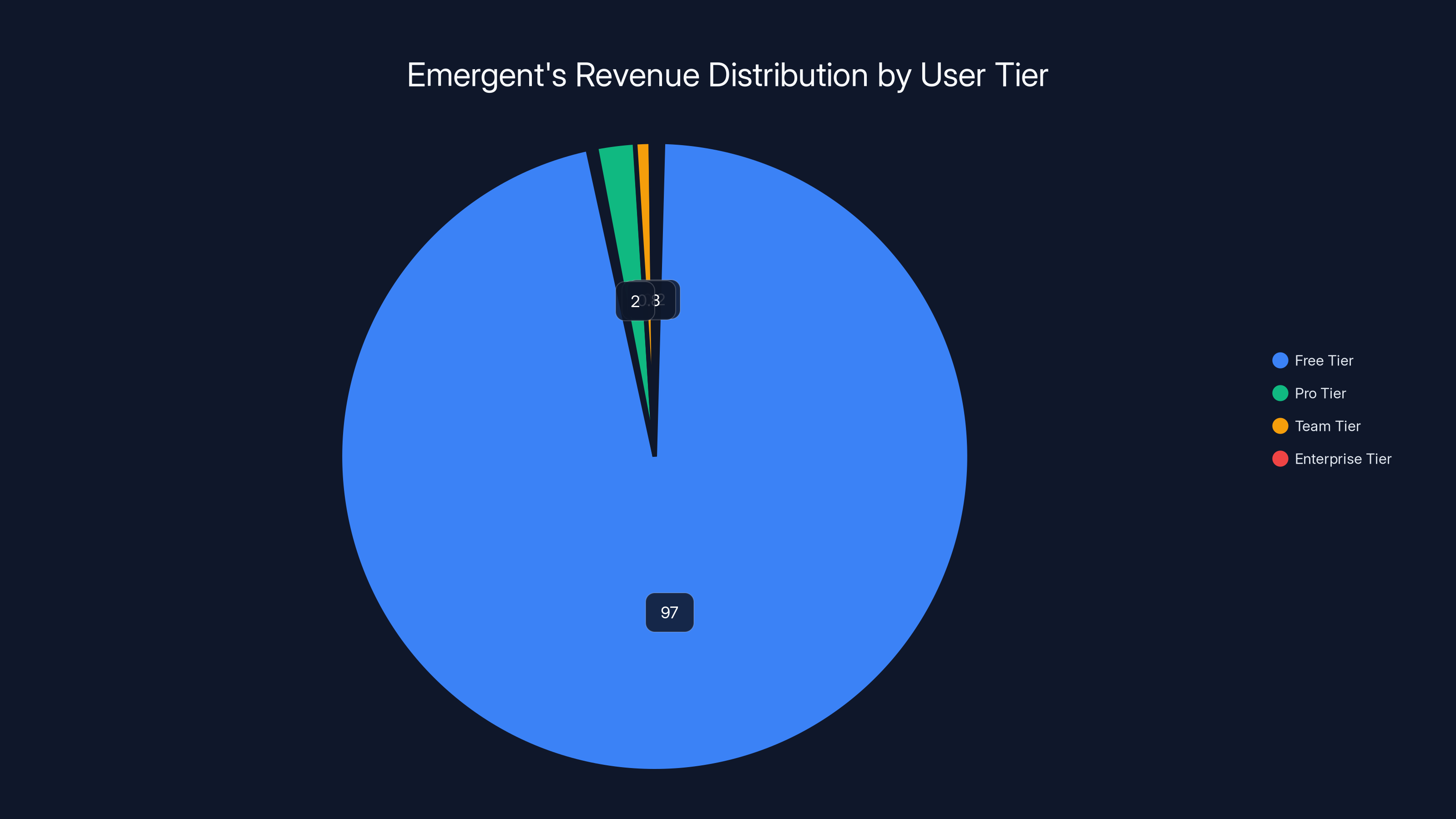

Emergent's rapid ARR growth is driven by a freemium model, tiered pricing, strong product-market fit, and enterprise deals. Estimated data.

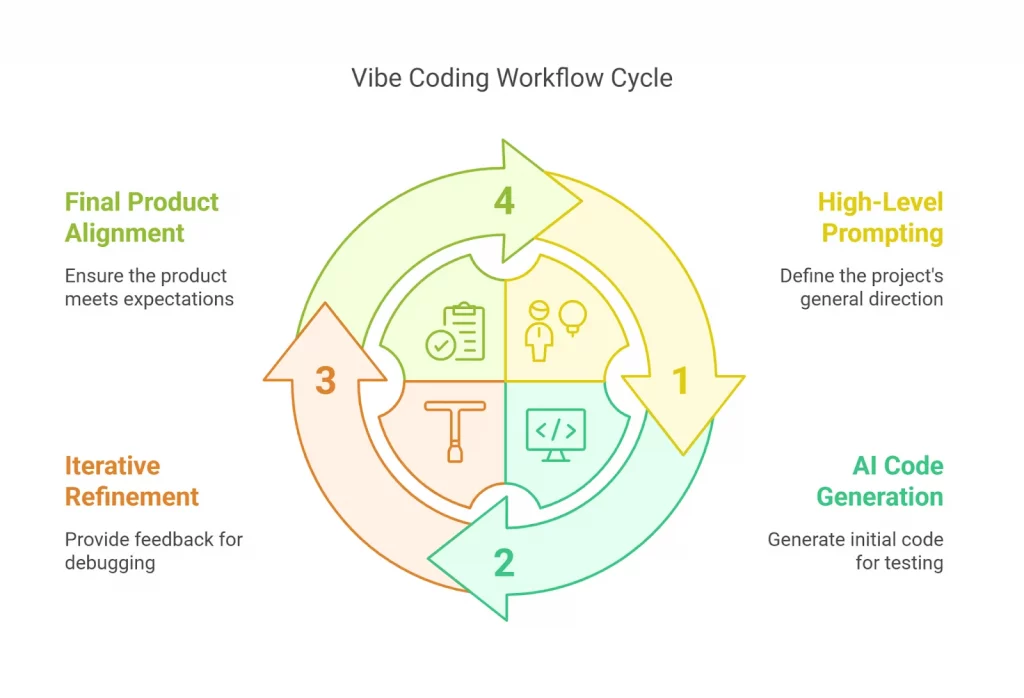

What Is Vibe-Coding, Really?

Let's be honest: "vibe-coding" sounds like Silicon Valley nonsense. And maybe it is. But it's also a pretty accurate description of what these platforms actually do.

Vibe-coding is the practice of describing what you want to build (your "vibe") and letting AI agents handle the actual coding. Instead of writing functions, debugging syntax, or wrestling with frameworks, you tell the AI what outcome you need. The platform generates full-stack code, tests it, and deploys it.

The genius here is that you don't need to know Java Script, Python, or React. You need to know what problem you're solving. That's a fundamentally different skill set than traditional software development.

Think of it this way: traditional coding is like being a novelist. You need to understand grammar, vocabulary, and structure to communicate your ideas. Vibe-coding is more like being a storyteller. You tell the story, and someone else writes the novel.

What makes Emergent different from just using Claude directly is the entire system wrapped around the AI. Emergent handles deployment, testing, iteration, version control, and multi-user collaboration. It's the infrastructure that makes vibe-coding practical at scale.

The platform lets entrepreneurs and small teams do something that previously required hiring a full engineering team. A founder in Mumbai or Des Moines can spin up a web app, a mobile app, and a backend service in hours instead of weeks.

That's not hype. That's the actual value proposition.

The $50M ARR Milestone: How Real Is It?

Here's where things get interesting (and where you should raise an eyebrow).

Emergent claims $50 million in ARR. That's an enormous number for a company that's been operating for seven months. For context, Stripe took years to hit similar revenue levels, and that was after building trust with enterprise customers.

So how is Emergent there? And more importantly, is that number real?

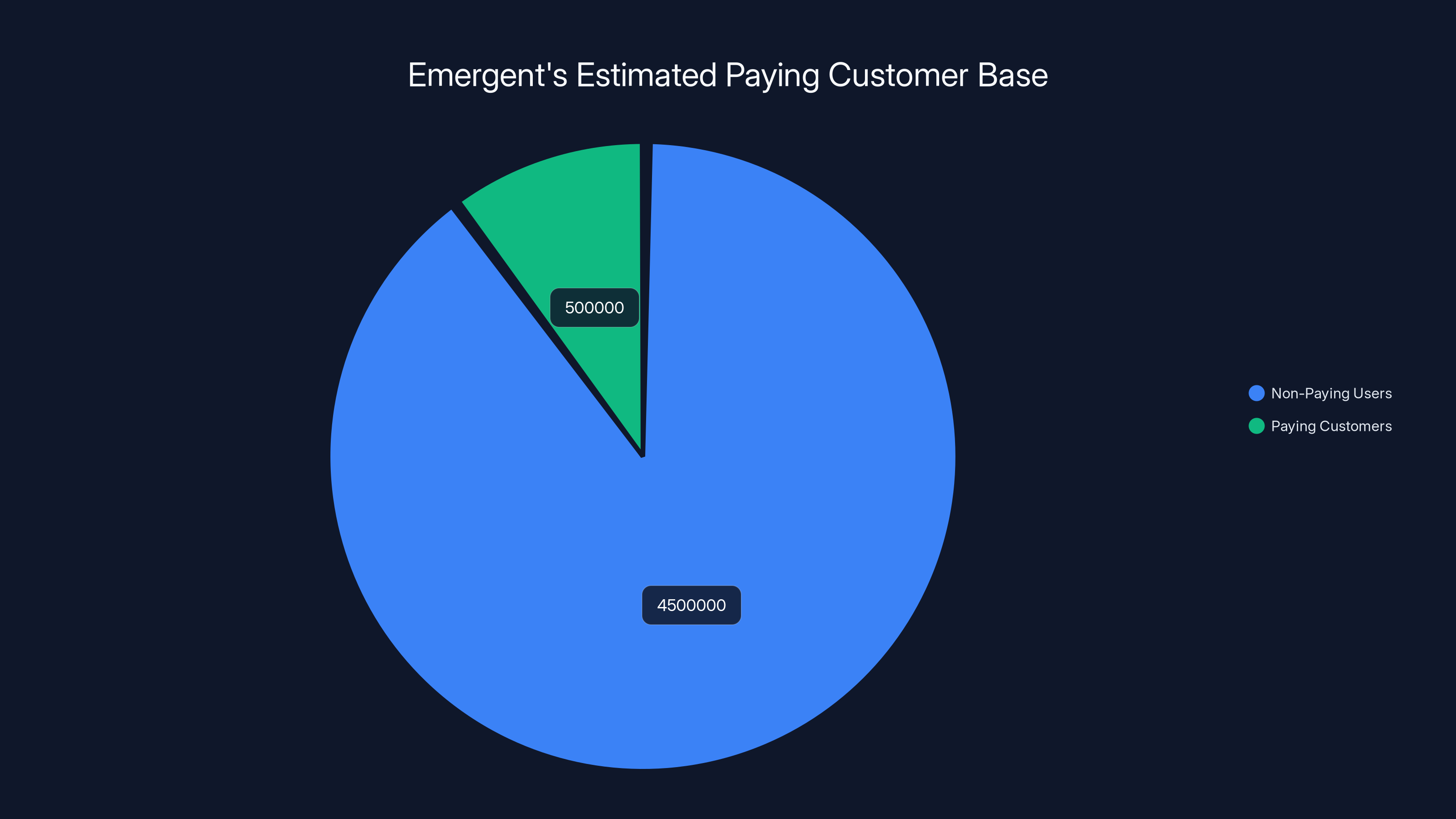

The most likely explanation is a mix of early pricing tiers, bulk enterprise deals, and possibly some aggressive assumptions about customer lifetime value. When you're selling to small businesses globally at

But here's the catch: there's a massive difference between "users" and "paying customers." Emergent likely has a freemium model where most of those 5 million are non-paying or on trial. The actual paying customer base is probably smaller, but even at a 5-10% conversion rate, that's 250,000 to 500,000 paying customers globally, which would justify $50M ARR at reasonable pricing.

The bigger question is sustainability. Can Emergent maintain this trajectory? Enterprise customers are notoriously sticky, but SMBs churn fast. If Emergent is relying on millions of small businesses paying $50-100/month, keeping those customers engaged is a constant battle.

That said, the fact that investors like Soft Bank and Khosla believe the numbers enough to write a $70M check at this valuation suggests the underlying metrics are solid.

Estimated data shows that Emergent's paying customers likely represent 5-10% of their total user base, supporting their $50M ARR claim.

Emergent's Positioning Against Competitors

Emergent isn't operating in a vacuum. The vibe-coding space has exploded, and they're competing directly with several well-funded players.

Lovable (formerly GPT Engineer) lets you describe a web app and it generates it using Claude's API. It's incredibly simple and has gained massive traction with the developer community. Lovable's advantage is simplicity and speed, but it's web-only.

Cursor takes a different angle. It's an AI-powered code editor, similar to Git Hub Copilot but more specialized. Cursor is for developers who still want to code but want AI assistance. The market for this is huge because it captures both developers and non-developers.

Replit is the elder statesman here. Started as a browser-based IDE, Replit pivoted hard into AI and now generates code, deploys apps, and handles hosting. They've raised enormous capital and have millions of users. Their advantage is the complete ecosystem.

Emergent's positioning is somewhere between Replit and Lovable. They want to be the end-to-end platform: design, build, test, deploy, monitor. The recently launched mobile app-building feature is crucial here because mobile is where the real money is. Most small businesses want apps, not web apps.

That's Emergent's wedge.

Soft Bank's Return to India: What It Means

This is the first major deal for Soft Bank Vision Fund in India since they backed Elastic Run nearly four years ago. That's a significant signal.

Soft Bank writes massive checks ($100M+) into global opportunities. That they're returning to India with an AI startup tells you a few things.

First, they've clearly been impressed by the talent and execution coming out of Indian tech teams. Emergent's 70-person team, almost entirely based in Bengaluru, represents exactly the kind of global-quality talent pool Soft Bank is banking on.

Second, they believe the vibe-coding market is big enough to justify

Third, they're signaling to other VCs that India-based AI startups are investable at global valuations. This creates a cascade effect where other founders get more confident, more talent migrates back to India, and the ecosystem gets stronger.

For Emergent specifically, Soft Bank's involvement is a mega-credibility boost. Enterprise customers pay attention to who's backing a company. A Vision Fund stamp of approval opens doors in banking, fintech, enterprise software, and other conservative industries where AI adoption is still cautious.

The Cap Table: Who's Betting on Emergent?

Beyond Soft Bank and Khosla, the Series B round includes some heavyweight investors.

Prosus, the Naspers subsidiary, is investing more aggressively in AI startups globally. They're not typically lead investors in early-stage rounds, so their participation suggests confidence in Emergent's metrics and roadmap.

Lightspeed Venture Partners is known for backing successful marketplaces and developer tools. They've got Figma, Stripe, and Slack in their portfolio, so they understand scaling developer tools to enterprise.

Together, an AI infrastructure company, is also participating. This is interesting because it suggests potential backend partnerships. Together could be providing compute infrastructure for Emergent's model inference, creating a symbiotic relationship.

Y Combinator likely participated through their secondary market fund. YC-backed companies often attract other YC investors because there's a network effect.

The cap table is strategically assembled. It's not just about money. It's about distribution, credibility, and technical partnerships.

Estimated data suggests that the majority of Emergent's users are on the Free tier, with a small percentage converting to Pro, Team, and Enterprise tiers. This distribution highlights the importance of converting free users to paid plans for revenue growth.

Revenue Model: How Emergent Makes Money

This is where the math matters. To hit $50M ARR in seven months, Emergent likely operates on a freemium Saa S model with tiered pricing.

Typical pricing structure probably looks something like:

- Free tier: Limited builds per month, basic features, for trying the product

- Pro tier: $50-100/month for individual developers and small teams

- Team tier: $200-500/month for 5-10 person teams

- Enterprise tier: Custom pricing for companies doing significant volume

With 5 million users and assuming a 3-5% conversion to paid, that's 150,000 to 250,000 paying users. If the average revenue per user is

But here's what matters for growth: what's the retention rate? If they're losing 5% of customers monthly, they need 50,000+ new paying customers monthly to stay flat. That's a lot of customer acquisition.

The fact that they're targeting $100M ARR by April 2026 (6 months away from the announcement) suggests either:

- Massive price increases across all tiers

- Enterprise deals starting to close

- Product expansion into high-margin segments (like the new mobile app builder)

- Aggressive marketing spend driving new customer acquisition

Most likely, it's a combination of all four.

The Mobile App Momentum: Expanding Beyond Web

Emergent's newly launched mobile app-building service is getting strong adoption. This is crucial.

Why? Because web apps are competitive and commoditized. Every vibe-coding platform can generate React apps. But mobile app development is still painful. You need Swift, Kotlin, React Native, or Flutter expertise. The barriers are higher.

By extending into mobile (iOS and Android), Emergent is addressing a bigger market. Small businesses don't just need web apps. They need mobile apps because that's where their customers are.

Think about a local restaurant, a fitness studio, or a plumbing service. They want apps on the App Store and Google Play. Emergent now lets them do that without hiring mobile engineers.

The adoption is strong because the pain point is real and underserved. Most vibe-coding platforms are web-first. Emergent recognized this gap and filled it fast.

This also explains part of the $100M ARR target. Mobile apps have different pricing economics. Hosting costs are lower, but support and maintenance are more complex. Enterprise customers will pay premiums for mobile app generation.

Geographic Strategy: US, Europe, and India

Emergent's founder Mukund Jha specifically called out the US, Europe, and India as top geographies. This tells us where the money is.

US market is obvious: billions in SMBs, high willingness to pay for productivity tools, and the largest concentration of venture capital globally. If you win the US, you've got proof points for global expansion.

Europe is interesting. European SMBs are conservative but well-capitalized. They also have higher labor costs than the US, which makes outsourcing to vibe-coding platforms even more attractive. A German plumbing company might pay premium prices for a tool that saves them hiring engineers at €80K+ per year.

India is home base. There's a massive population of entrepreneurs and small business owners with limited access to expensive engineering teams. Emergent can offer a freemium model here, build a large user base, and convert a small percentage to paid. The land grab effect is powerful.

However, India's lower purchasing power means lower lifetime value per customer. To compensate, Emergent needs volume. That's why they've built such a large user base there (and globally).

The geographic play also connects to the Bengaluru headquarters decision. By being in India, Emergent has timezone advantages for both US and European customers, plus easy access to global tech talent willing to relocate for startup opportunity.

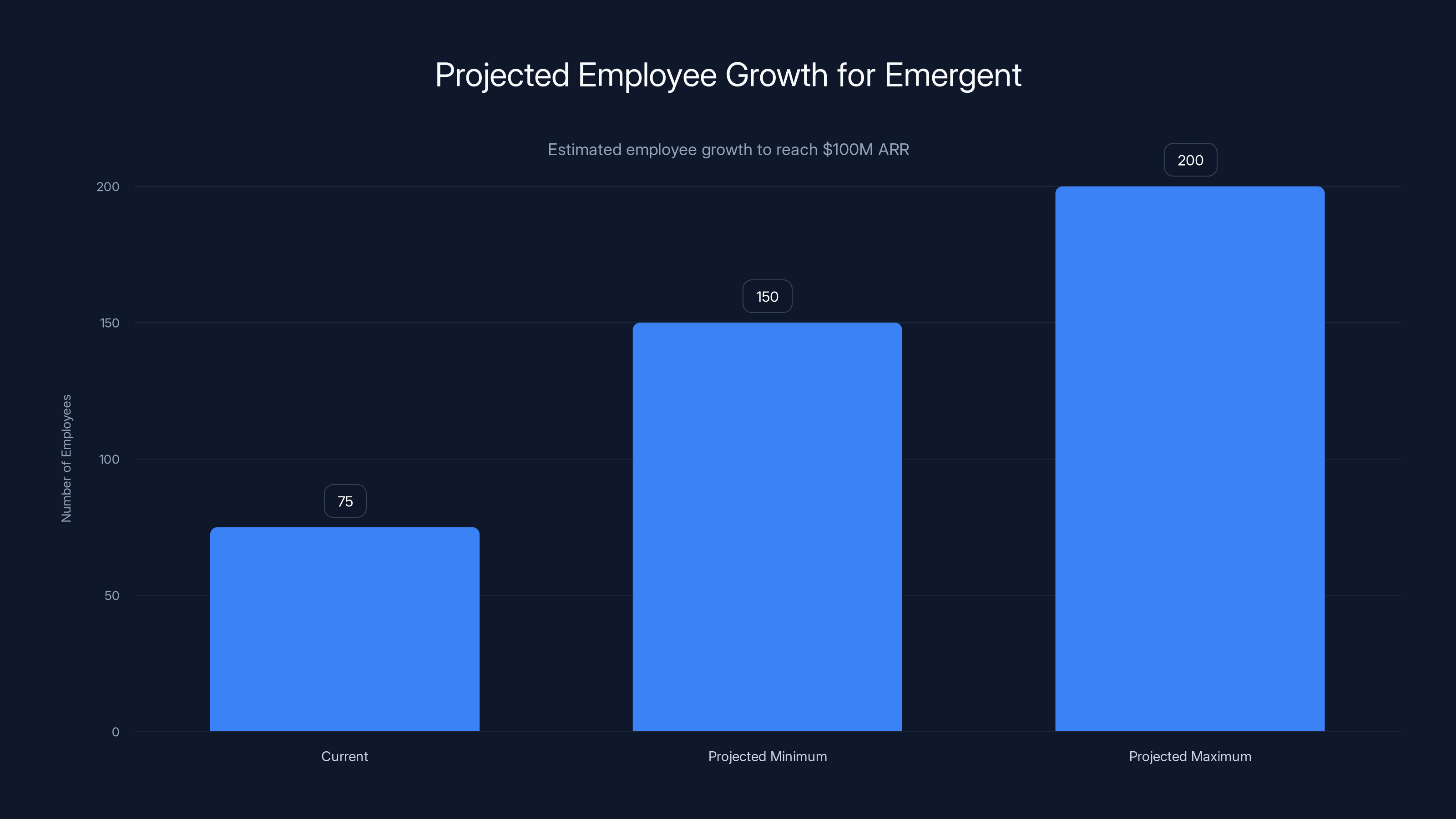

Emergent is currently at 75 employees but may need to grow to 150-200 employees to support a $100M ARR target. Estimated data based on typical startup scaling.

The Hiring Blitz: What It Means for Product

Emergent has 75 people and is hiring aggressively. At this stage, that usually means two things:

-

Product engineering scale: Building out the platform faster. Mobile is probably the focus, but also platform reliability, integrations, and performance improvements.

-

Sales and success: Enterprise deals require sales teams. Emergent likely needs to build GTM (go-to-market) infrastructure to sell to bigger customers.

For a startup targeting $100M ARR, the typical employee count would be 150-200 people. Emergent is still small relative to revenue, which suggests:

- Either the team is extraordinarily efficient

- Or they're outsourcing non-core functions

- Or the ARR numbers have some aggressive assumptions baked in

My guess? A combination of all three. Lean teams + outsourced customer support + aggressive pricing = faster to $100M ARR.

But hiring aggressively also signals confidence. If these metrics were shaky, they wouldn't burn money on headcount. The fact that they're hiring across multiple countries and functions suggests management believes the revenue numbers and growth trajectory.

The Competitive Landscape: Will Consolidation Happen?

The vibe-coding space is heating up, and eventually, consolidation will happen. That's how venture-backed software companies work.

Bigger players like Microsoft, Google, and Git Hub are all building AI-powered development tools. They have distribution, capital, and existing relationships with enterprises.

The question is: Will independents like Emergent, Lovable, and Cursor remain standalone, or will they get acquired?

Historically, the developer tool space consolidates around platforms. Git Hub owns a huge portion of software development workflow. Jet Brains dominates IDEs. Eventually, Slack and Atlassian consolidated around workflows.

I'd expect similar dynamics here. The winners will be:

- Companies that integrate deeply into existing workflows (Cursor, because it's an IDE)

- Platforms that offer comprehensive solutions end-to-end (Replit, and potentially Emergent)

- Specialization winners that solve very specific problems better than anyone else

Emergent's mobile app expansion is a smart strategic move precisely because it makes them harder to acquire or compete against. They're building moat through breadth.

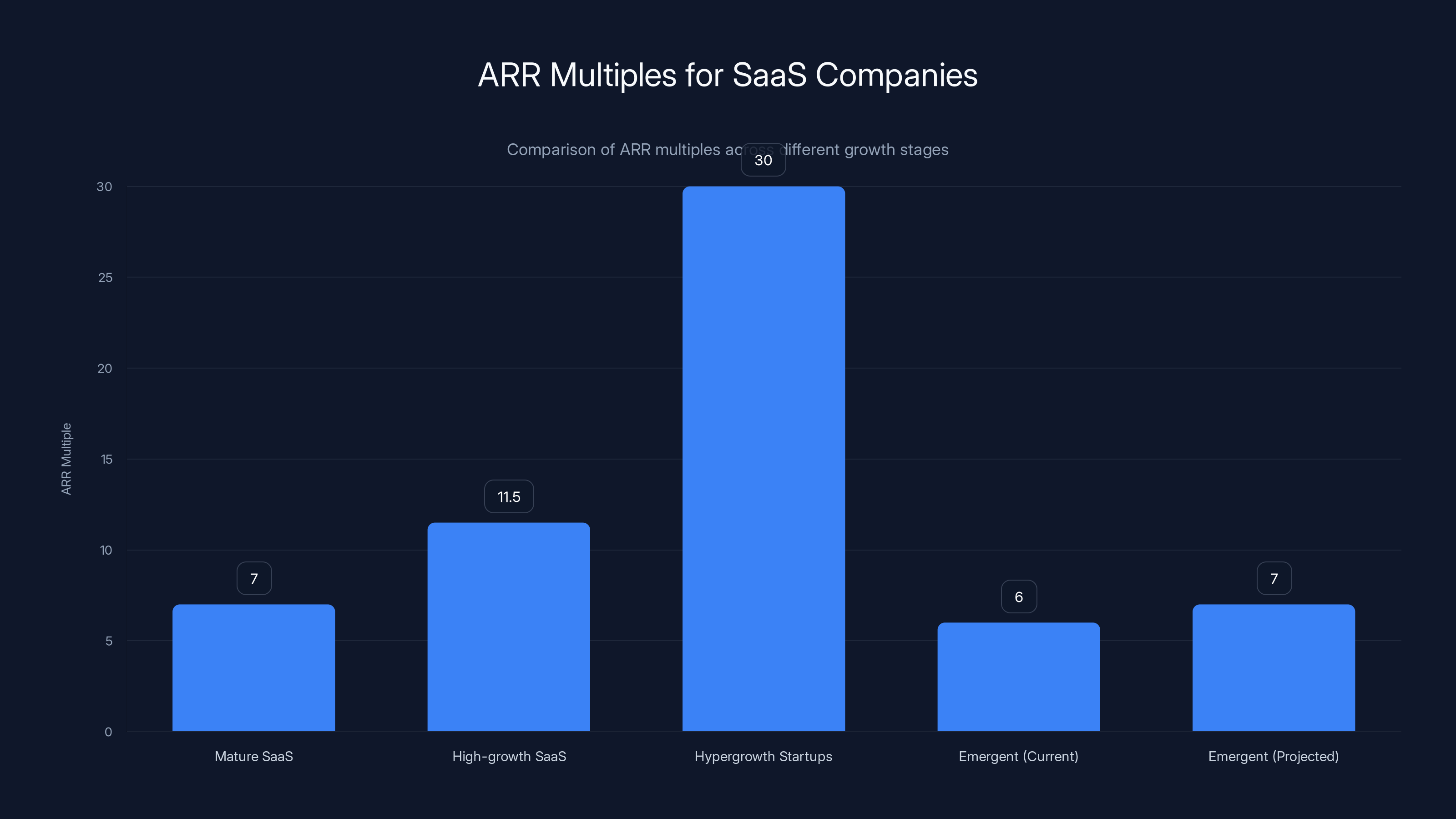

Valuation Analysis: Is $300M Fair?

Let's do the math. Emergent is valued at

On $50M ARR, that's a 6x ARR multiple. For context:

- Mature Saa S companies trade at 6-8x ARR

- High-growth Saa S (50%+ Yo Y) trades at 8-15x ARR

- Hypergrowth startups (100%+ Yo Y) can command 20-40x ARR at IPO

So

This suggests the current valuation is actually pretty reasonable. It's not frothy. It's not cheap, but it's fair for a fast-growing AI infrastructure play with real traction.

The key assumption is hitting that $100M ARR target. If they do, investors win huge. If they don't and growth slows to 30-40% annually, the valuation looks expensive.

That's why both Soft Bank and Khosla are probably confident. They've seen the unit economics, the retention data, and the enterprise pipeline.

Emergent's current 6x ARR multiple is conservative compared to high-growth and hypergrowth SaaS companies. If they achieve $100M ARR, their valuation could align with a 7x multiple, making it fair for their growth trajectory. Estimated data for projected values.

What This Means for AI Development Tools Broadly

Emergent's funding round is part of a much larger trend: the AI development tool category is real and enormous.

We're seeing capital concentrate here because the underlying shifts are fundamental:

- Code is becoming a commodity: With AI generating functional code on demand, the barrier to entry for building software is collapsing

- Speed wins: In markets like SMBs and startups, time-to-market is critical. Vibe-coding delivers that

- Skill requirements are changing: You don't need to be a developer to build software anymore. You need to understand the business problem

This changes everything about how software gets built globally.

Developed markets (US, Europe) will see freelancers and small agencies upgrade their productivity with these tools. Emerging markets (India, Southeast Asia, Latin America) will see entirely new businesses built by non-technical entrepreneurs using these platforms.

The winner-take-most dynamics in Saa S will apply here too. The best platform will capture the most users, most data, best model quality, and strongest network effects.

Emergent has a shot at being that winner, especially globally. Their India base, international user base, and mobile-first approach give them advantages that US-only competitors don't have.

The Path to $100M ARR: What Has to Happen

Here's what I think needs to happen for Emergent to hit $100M ARR by April 2026:

1. Retention stays above 90% monthly: If churn goes above 10%, they'll need to acquire even more customers to grow. This is the make-or-break metric.

2. Enterprise deals start closing: The real margin is in enterprise. They need customers paying $50K-500K+ annually. At least 20-30% of ARR should come from enterprises by April.

3. Mobile differentiation pays off: The mobile app builder needs to become 30-40% of new customer acquisition. Otherwise, they're just another web app generator.

4. International expansion accelerates: They can't rely solely on the US. They need significant traction in Europe, India, and Southeast Asia by April.

5. Unit economics remain strong: Acquisition cost can't explode. They need to stay below 12-18 months payback period on customer acquisition costs.

All of these are achievable but require flawless execution. Miss on any one, and the trajectory slows significantly.

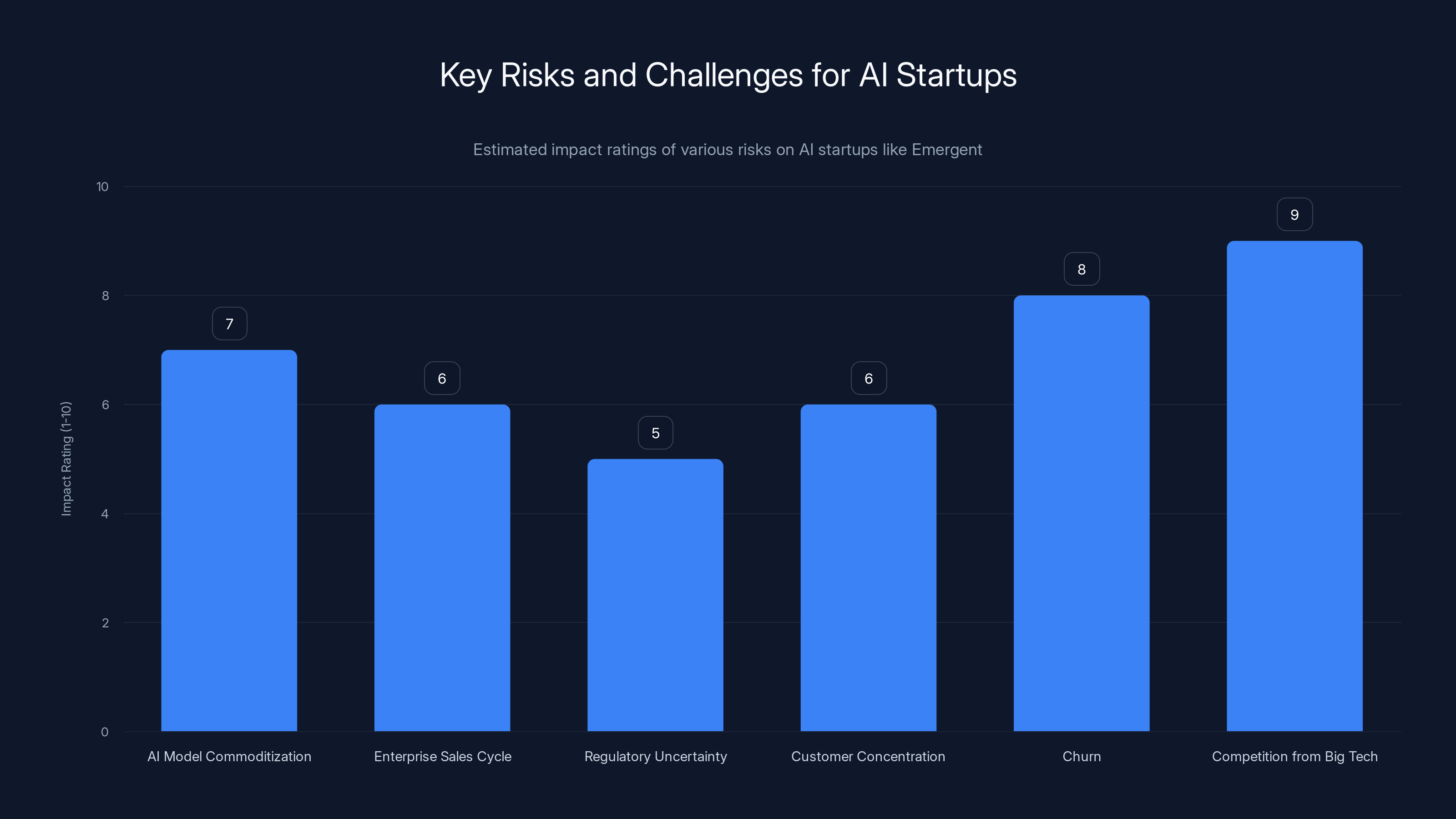

Risks and Challenges Ahead

Not everything is rosy. Here are the real risks:

AI Model Improvements Are Commoditizing: As Claude, GPT-4, and other models improve, anyone can build these tools. Emergent's moat isn't the AI, it's the product and the users. But big tech can outspend anyone on product.

Enterprise Sales Cycle: Enterprise deals are slow. They might not close fast enough to hit the $100M target. This could push the timeline to late 2026 or 2027.

Regulatory Uncertainty: AI in software development could face regulatory scrutiny. Governments might require licensing, auditing, or compliance frameworks that add complexity and cost.

Customer Concentration Risk: If a few enterprise deals go dark, it could crater growth. We don't know the customer concentration metrics.

Churn: If churn is higher than expected, they'll need to acquire even more customers to stay on pace. This could strain CAC (customer acquisition cost).

Competition from Big Tech: Microsoft, Google, and others are all building AI development tools. They could out-market and out-distribute Emergent.

These aren't dealbreakers, but they're real. Smart investors account for them, which is probably why Khosla and Soft Bank are building in optionality through board seats and follow-on funding capability.

Competition from big tech and high churn rates are estimated to have the highest impact on AI startups like Emergent. Estimated data.

How Emergent Compares to Runable and Other AI Automation Platforms

While Emergent focuses specifically on application development, platforms like Runable are addressing the broader AI automation and content generation market for developers and teams.

Runable enables AI-powered automation for creating presentations, documents, reports, images, and videos at $9/month. While Emergent specializes in full-stack app development, Runable offers a complementary suite for developers who need to automate content generation and workflow tasks.

For teams building applications and needing supporting collateral—pitch decks, technical documentation, reports, or marketing materials—combining Emergent for app development with Runable's AI agents for content creation creates a powerful development toolkit.

The distinction is important: Emergent is for engineering teams building products, while Runable is for automating the business operations around product development.

The Broader Implications: What This Funding Round Tells Us

Emergent's Series B isn't just a funding announcement. It's a signal about where the venture capital ecosystem believes the puck is headed.

When Soft Bank (a megafund managing $100B+) and Khosla (one of the most prescient VC firms) agree on something, it's usually worth paying attention.

They're saying: AI-powered development tools are real, valuable, and defensible businesses. They're saying: India-based teams can build global platforms. They're saying: The productivity gains are significant enough that enterprises and SMBs will pay for this.

Those are big bets. And they're probably right.

But they're also saying something else: The easy path to profitability in AI startups is narrowing. You can't just wrap a chatbot around an API and raise $100M anymore. You need real metrics, real users, and real revenue.

Emergent has those things. That's why the check was written.

What's Next for Emergent and the Vibe-Coding Space

If Emergent hits $100M ARR by April 2026, expect to see:

IPO filing or acquisition discussions in late 2026 or 2027. At $100M+ ARR, they'd be an attractive acquisition target for Microsoft, Google, or Git Hub. They could also go public directly or through a SPAC.

Deeper enterprise focus: They'll likely shift marketing and sales toward enterprise accounts, similar to how Figma and Slack evolved from SMB tools to enterprise platforms.

International expansion: Bengaluru won't be the only office. They'll likely open in London, San Francisco, and Tokyo to serve their key markets more directly.

Platform consolidation: The app development space will consolidate around a few winners. Emergent, Lovable, and Cursor will define the top tier. Others will struggle or get acquired.

Big Tech Integration: Expect Microsoft to integrate AI code generation more deeply into Visual Studio. Expect Google to do the same with Cloud development tools. Expect Git Hub Copilot to evolve into something more Emergent-like.

The competitive dynamics will intensify, but the market is big enough for multiple winners. The global spend on software development is hundreds of billions annually. Capturing 1% of that is a multi-billion dollar business.

For Founders and Developers: What You Should Understand

If you're building a startup or working in a team, what does Emergent's momentum mean for you?

First: Your engineering hiring model is about to change. You won't be able to hire your way to scale anymore. You'll need to think about how AI augments your team's productivity.

Second: Speed matters more than ever. If you can build product 2-3x faster using these tools, your time-to-market advantage is massive.

Third: The tools are getting insanely good, insanely fast. Six months ago, AI code generation was a novelty. Now it's table stakes. By 2026, it'll be expected.

Fourth: Geographic advantage is shifting. The best engineers used to be in Silicon Valley or New York. Now they're wherever internet exists. Emergent's Bengaluru base proves this.

If you're not thinking about how AI changes your development workflow, you're already behind.

FAQ

What exactly is vibe-coding and how does it differ from traditional software development?

Vibe-coding is a development approach where you describe what you want to build in natural language, and AI agents automatically generate, test, and deploy production-ready code. Unlike traditional development where you write code manually (requiring programming knowledge), vibe-coding focuses on the problem and desired outcome, with AI handling implementation details. The fundamental difference is skill requirements: traditional development requires understanding programming languages and frameworks, while vibe-coding requires understanding business problems and user needs.

How did Emergent reach $50 million ARR in just seven months?

Emergent's rapid ARR growth stems from a combination of factors: a freemium pricing model attracting millions of users globally, tiered pricing (

Why is Soft Bank's involvement significant for Emergent?

Soft Bank's involvement signals multiple important things to the market: first, Indian tech talent building globally competitive platforms is investable at premium valuations; second, AI-powered development tools are attracting megafund-level capital; third, Emergent's metrics have been validated by one of the world's most sophisticated venture investors. Soft Bank's $70M check also opens doors with enterprise customers who view Vision Fund backing as a credibility indicator. Additionally, it marks Soft Bank's return to India after nearly four years, suggesting renewed confidence in the country's startup ecosystem.

What are the main competitors to Emergent in the vibe-coding space?

Emergent's primary competitors include Lovable (web app generation from natural language), Cursor (AI-assisted code editor for developers), and Replit (comprehensive development platform with AI code generation, deployment, and hosting). Each has different positioning: Lovable excels at simplicity, Cursor at developer-focused assistance, and Replit at end-to-end platform capabilities. Emergent differentiates through mobile app development, targeting entrepreneurs who need both web and mobile solutions without technical expertise.

Is the $300 million valuation reasonable for Emergent's current stage?

On

What's the difference between Emergent and platforms like Runable for development teams?

Runable and Emergent serve complementary purposes in the development workflow. Emergent specializes in full-stack application development, generating functional code for web and mobile apps. Runable, available at $9/month, focuses on AI-powered automation for presentations, documents, reports, images, and videos. A development team might use Emergent to build their product and Runable to automate their business operations, marketing materials, and documentation.

What are the biggest risks to Emergent's growth trajectory?

Key risks include: competition from big tech companies like Microsoft and Google who have massive distribution and capital; customer churn rates if they exceed 10% monthly; slowdown in enterprise sales cycles if they don't close deals fast enough; regulatory uncertainty around AI in software development; customer concentration if a few large deals represent significant revenue; and commoditization of AI code generation as all models improve. The biggest risk is likely execution—hitting the aggressive $100M ARR target by April 2026 requires flawless operations and market execution.

How will Emergent likely monetize its platform long-term?

Emergent's monetization strategy will likely evolve as it matures. Currently, freemium Saa S pricing captures small users. As the platform scales, they'll likely shift focus toward enterprise accounts willing to pay premium prices for: white-label solutions, dedicated support, advanced security features, compliance certifications, and integration into existing enterprise workflows. The long-term opportunity is similar to how Figma or Slack evolved from SMB tools to enterprise platforms, where 70-80% of revenue comes from enterprise customers.

What does Emergent's success mean for the future of software development?

Emergent's rapid scaling validates a fundamental shift in how software gets built: the barriers to entry are collapsing, non-technical entrepreneurs can now build functional applications, and development speed is compressing from months to weeks. This has implications for every business that employs engineers, every geographic market seeking to build tech capacity, and every developer learning how to work alongside AI. The companies that win will be those that view AI not as a threat but as a tool to amplify human creativity and problem-solving.

Is it realistic for Emergent to reach $100 million ARR by April 2026?

Reaching

The Future Is Here

Emergent's $70M Series B isn't really about Emergent. It's about what Emergent represents: a fundamental shift in how software gets built.

For decades, we've assumed that building software requires specialized knowledge and hiring expensive experts. Emergent (and the vibe-coding category) is proving that assumption wrong.

If they execute on their roadmap and hit their targets, we're going to see a massive wave of new businesses built by non-technical entrepreneurs, existing businesses moving faster because their teams are augmented with AI, and the global software development capacity effectively doubling or tripling.

That's not hype. That's math. And that's why Soft Bank and Khosla just wrote $70M checks.

Key Takeaways

- Emergent raised 300M valuation from SoftBank Vision Fund 2 and Khosla Ventures, achieving unicorn-scale metrics in 7 months

- The startup claims 100M ARR by April 2026, representing extraordinary growth in AI coding platforms

- Vibe-coding represents a fundamental shift in software development: non-technical entrepreneurs can now build full-stack applications by describing desired outcomes in natural language

- SoftBank's return to India-based investments signals confidence in Indian tech talent building globally competitive AI platforms at premium valuations

- Mobile app development feature differentiates Emergent from web-only competitors like Lovable and Cursor, expanding market addressability

Related Articles

- Linus Torvalds' AI Coding Confession: Why Pragmatism Beats Hype [2025]

- Higgsfield's $1.3B Valuation: Inside the AI Video Revolution [2025]

- 55 US AI Startups That Raised $100M+ in 2025: Complete Analysis

- Startup Battlefield 200 2026: Complete Guide for Founders [2025]

- AI Coding Agents and Developer Burnout: 10 Lessons [2025]

- AI Bubble Myth: Understanding 3 Distinct Layers & Timelines

![Emergent Raises $70M Series B: Inside the AI Vibe-Coding Boom [2025]](https://tryrunable.com/blog/emergent-raises-70m-series-b-inside-the-ai-vibe-coding-boom-/image-1-1768917992004.png)