The TikTok US Deal Explained: Who Owns It Now, What Changes [2025]

For over four years, TikTok's fate in the United States has been one of the most high-stakes tech dramas imaginable. It's involved multiple presidents, countless executive orders, national security debates, billionaire bidders, and enough legal battles to fill a law school curriculum. But in January 2025, after months of uncertainty and constant deadline extensions, the dust finally settled. TikTok officially completed a deal to divest its US operations to a consortium of American investors.

Here's what actually happened, who now controls one of the world's most powerful social media platforms, and what it means for the nearly 170 million American users who've built their lives around the app.

TL; DR

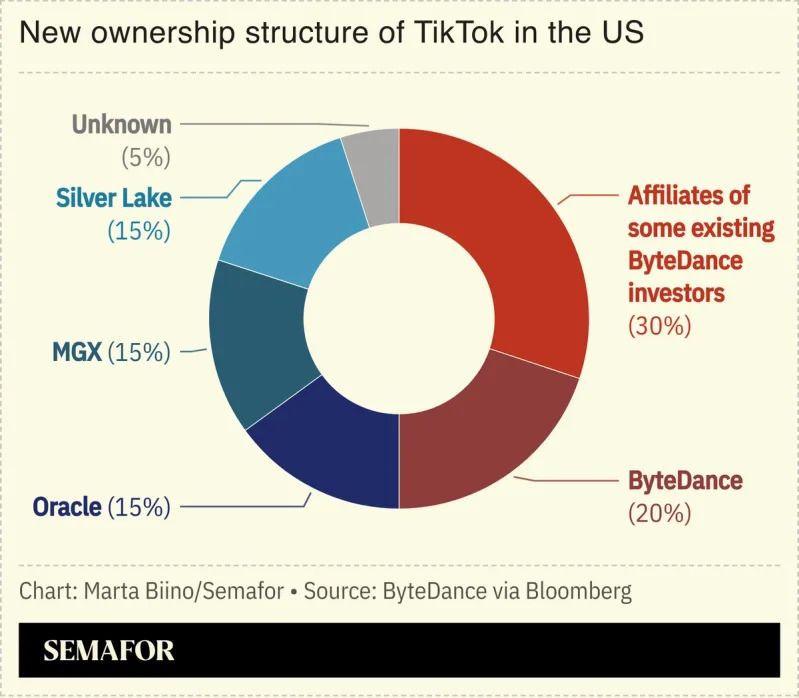

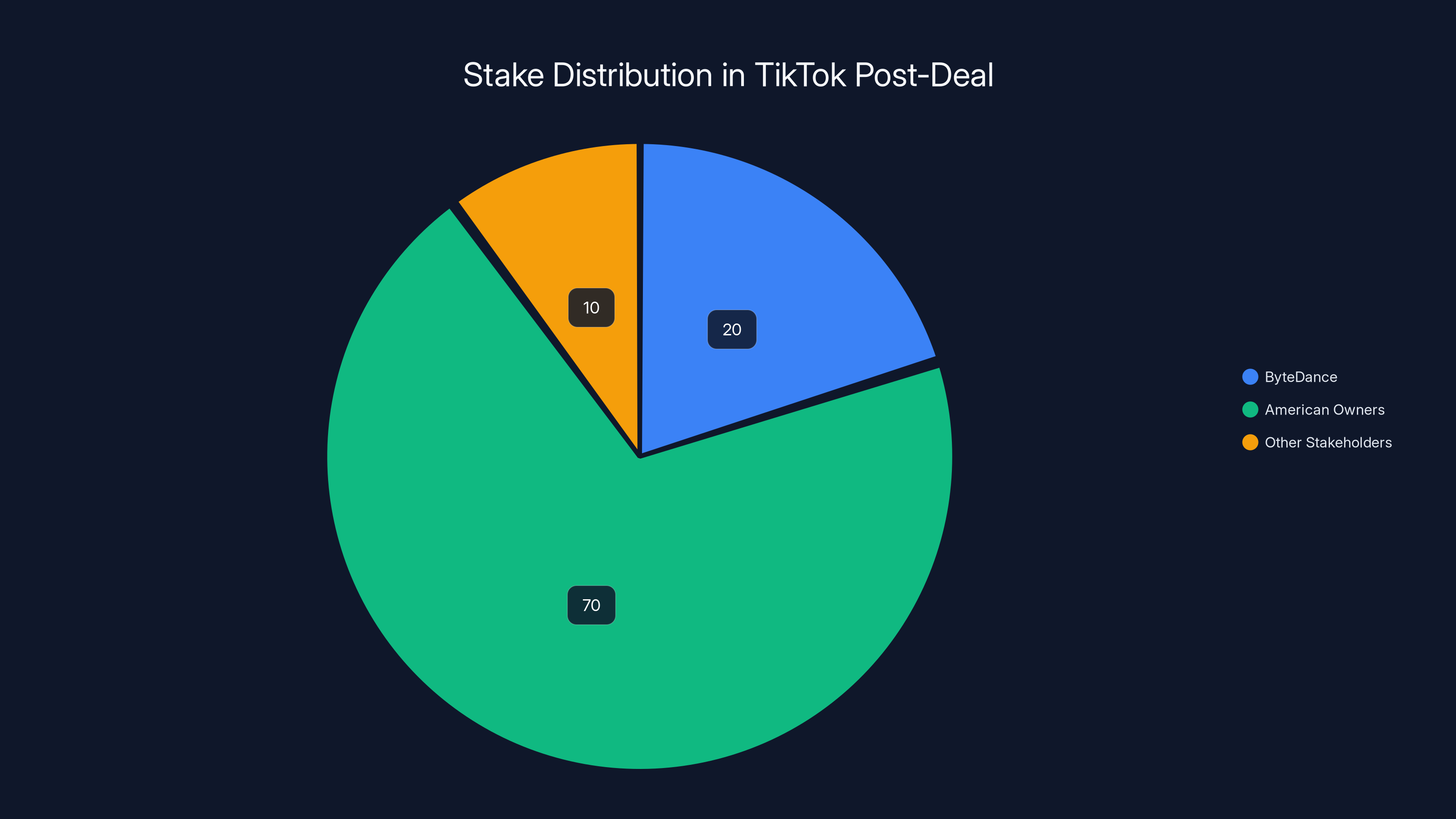

- The deal is done: Oracle, Silver Lake, and MGX now control 45% of TikTok US, with ByteDance retaining 20% as reported by ABC News.

- Valuation massive: TikTok's US operations valued at approximately **60+ billion speculation according to Yahoo Finance.

- Oracle's key role: The tech giant becomes the "trusted security partner" auditing data, algorithm, and compliance, as detailed in PBS NewsHour.

- Users stay connected: The app won't disappear, but a new separate platform may eventually replace it as noted by NPR.

- Deadline met: Deal officially closed January 22, 2026, ending years of legal uncertainty.

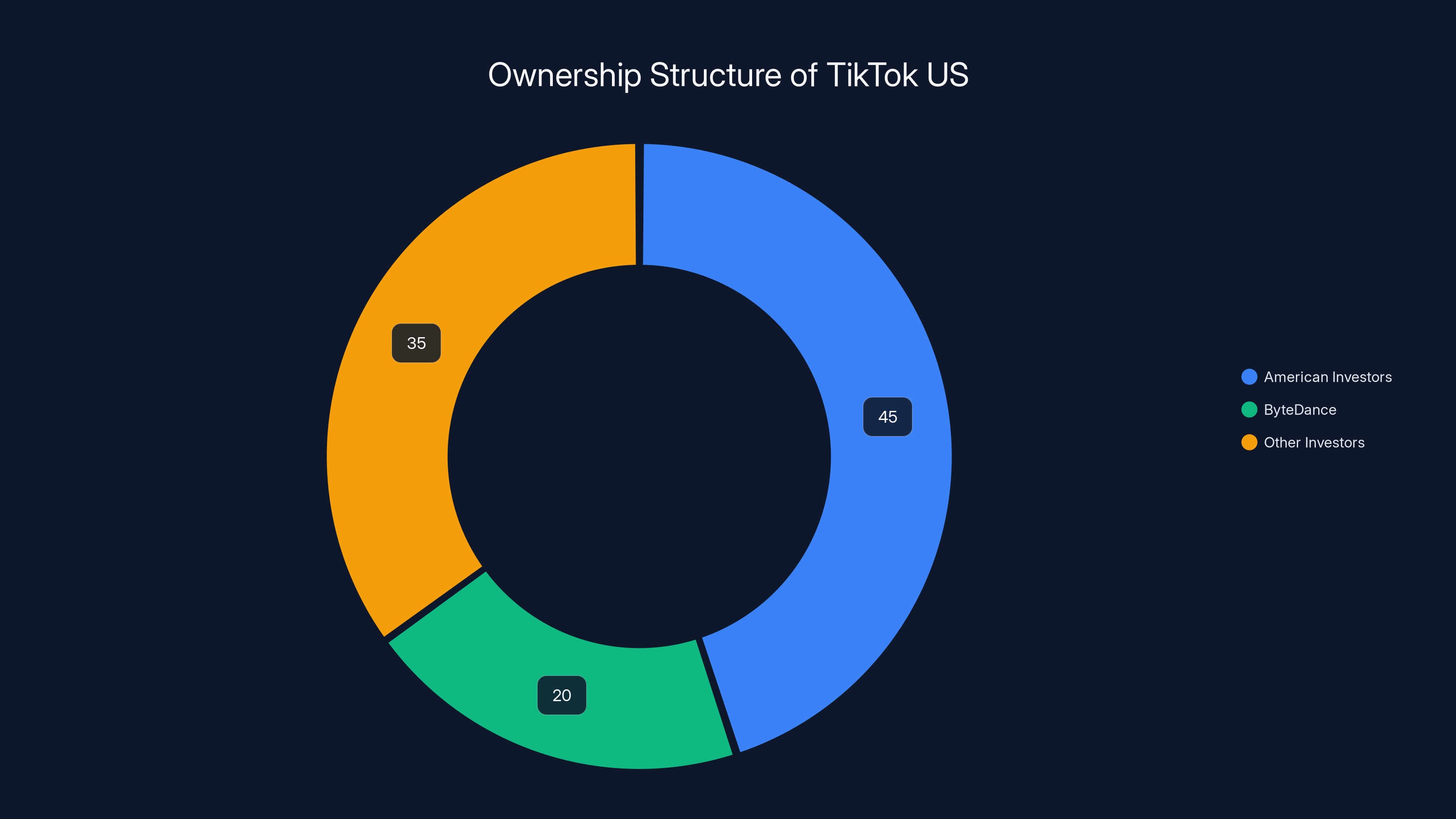

American investors hold a 45% controlling stake in TikTok's US operations, while ByteDance retains 20% and other investors hold 35%.

How TikTok Went From Dominance to Existential Crisis

If you've been living under a rock, here's the quick version: TikTok became the most downloaded app in the world, as highlighted by Gulf News. Teenagers were spending hours on it. Adults were discovering they had no idea what their kids were watching. And then, somewhere around 2020, Washington started asking uncomfortable questions.

The narrative around TikTok shifted from "fun entertainment app" to "potential national security threat." The concern was straightforward: TikTok's parent company ByteDance is based in China. Chinese law requires companies to cooperate with government surveillance requests. What if the US government's data on TikTok users was being funneled back to Beijing?

Was this concern overblown? Probably. Did it matter? Not really. When politicians start talking about "national security" and "foreign adversaries," it doesn't matter much if the threat is real or theoretical. The wheels are in motion.

In August 2020, then-President Donald Trump signed an executive order threatening to ban TikTok outright unless it divested its US operations to an American company, as reported by Reuters. This wasn't a policy debate. This was a government saying: sell or get out.

What followed was pure chaos. Microsoft wanted to buy it. Oracle made a bid. Walmart jumped in. The deadline got extended. Then extended again. And again. And again. TikTok's app was briefly shut down in January 2025, terrifying millions of users who thought it was gone for good. It came back within hours, but the message was clear: this threat was real.

Throughout this entire ordeal, TikTok's parent company ByteDance refused to sell outright. They fought the ban legally, arguing it violated free speech rights. They lobbied Congress. They even hired some of the biggest legal guns in the country. But they also knew the game was rigged. You can't win a national security argument against the US government. Eventually, they had to make a deal.

The Deal Structure: Who Owns What Now

When the dust settled, here's what the ownership structure actually looks like.

Oracle, Silver Lake, and MGX together control 45% of TikTok US. These three entities form a joint venture called "TikTok USDS Joint Venture LLC" that will handle all day-to-day operations in the United States, as explained by NBC News.

ByteDance keeps a 20% stake, which is important because it means the Chinese company hasn't completely lost its investment. The remaining 35% sits with unspecified parties, likely including other private investors and possibly some of the earlier bidders who didn't win outright but got a slice of the deal.

Let's break down what each major player brings to the table:

Oracle is the security partner. The company already runs TikTok's cloud infrastructure in the US, managing user data on American servers. Under the new deal, Oracle's role expands significantly. They'll audit the algorithm. They'll ensure ByteDance can't secretly access US user data. They'll monitor compliance with national security terms. Think of Oracle as the cop in the room, watching everything to make sure nobody cheats, as noted by CNBC.

Oracle CEO Safra Catz was involved in the original 2020 bid, so the company had experience with this file. They understand TikTok's infrastructure intimately. And they have the scale and credibility to convince Washington that they're actually in control.

Silver Lake is one of the world's largest private equity firms. They bring capital, operational expertise, and a track record of successfully managing tech acquisitions. When you're trying to convince investors and politicians that this deal is legitimate, you want Silver Lake's name on the paperwork.

MGX is an Abu Dhabi-based investment firm that signals international credibility. Their involvement says "this isn't just American investors doing this, it's a globally legitimate consortium."

The crucial detail everyone missed initially: this isn't a clean sale. ByteDance still has a stake. The deal isn't about completely removing Chinese influence. It's about adding enough American oversight that the government feels comfortable letting TikTok keep operating.

TikTok US's valuation at

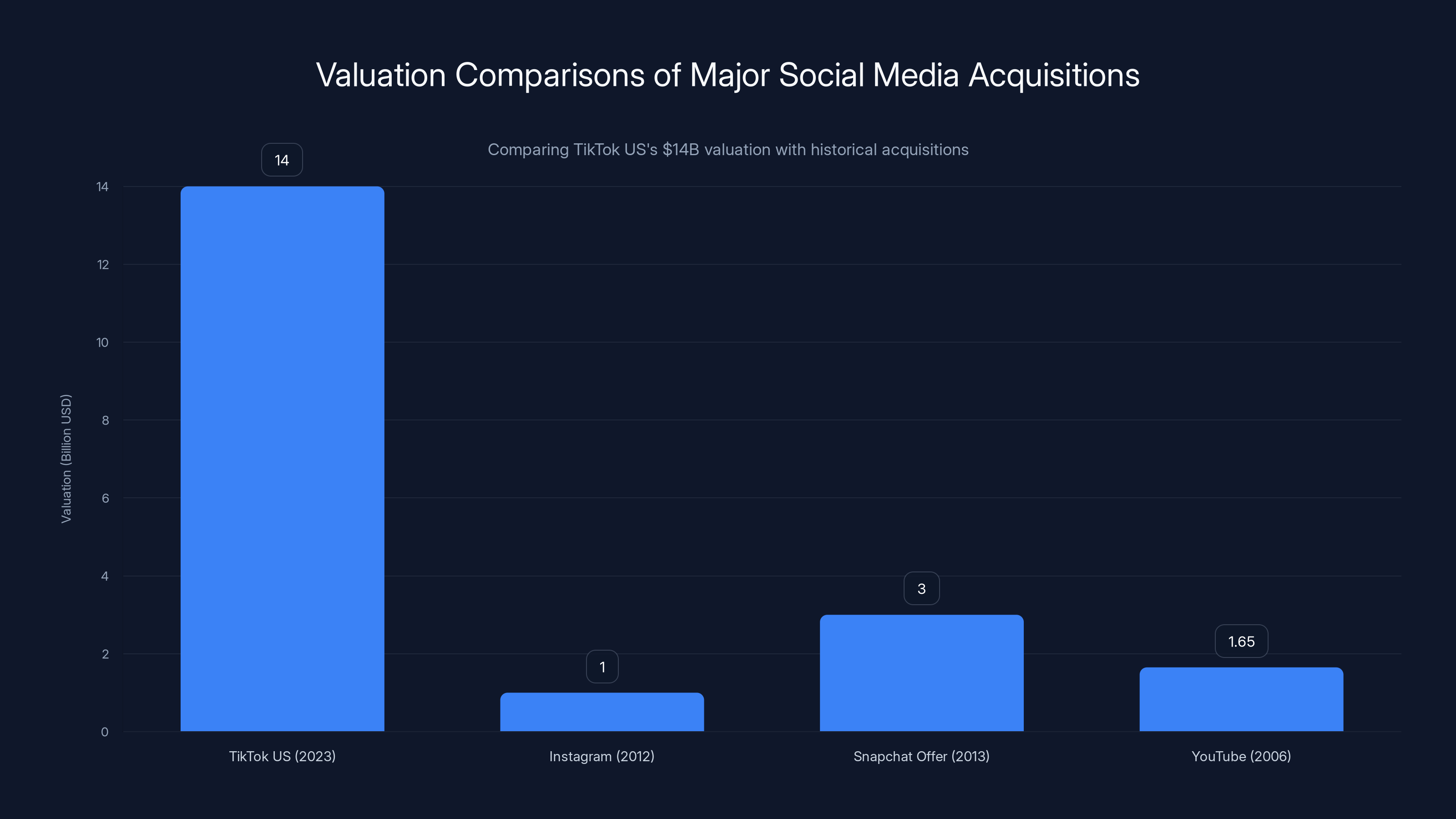

The Valuation: Why $14 Billion?

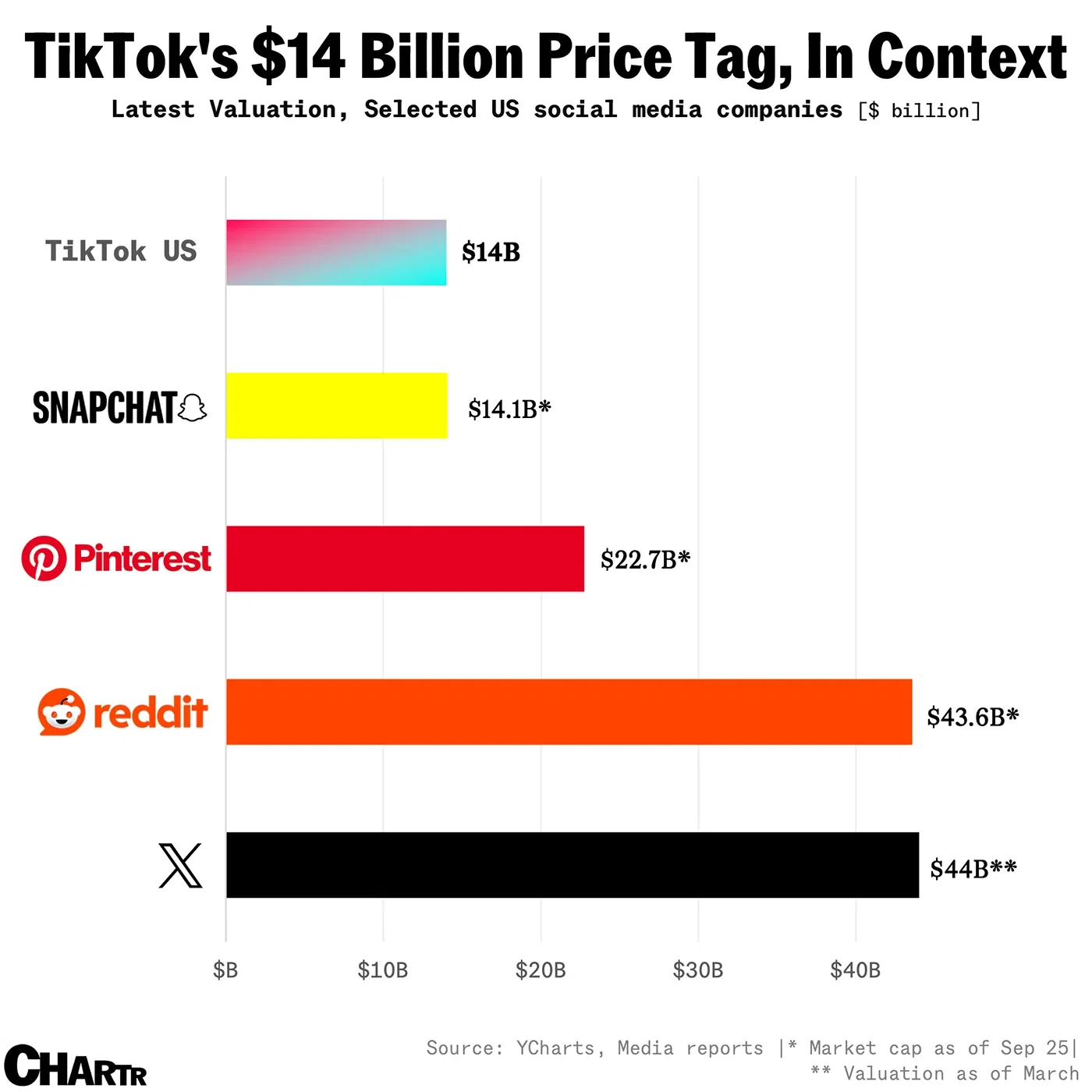

Here's a number that surprised everyone: TikTok's US operations are worth approximately $14 billion.

Wait, didn't people say

The $14 billion figure came from Yahoo Finance and was later confirmed by Vice President JD Vance. This is what the actual consortium paying actual money thinks the asset is worth.

Why is it "only" $14 billion? Several reasons:

First, it's a distressed sale. TikTok didn't have the luxury of running a normal auction process where 500 bidders compete and drive the price up. They had a government-imposed deadline and limited buyers. Distressed assets sell for less. That's just how it works.

Second, there's regulatory risk. Even after this deal, TikTok faces ongoing scrutiny. Congress could change its mind. A future president could impose new restrictions. The regulatory environment is unstable, which discounts the valuation.

Third, ByteDance is keeping a stake. If the full company was changing hands, the price might be higher. But since ByteDance retains 20%, they're essentially saying, "We think this is worth $14 billion as a whole," which implies the US portion is worth less on a standalone basis.

Fourth, the algorithm situation is complicated. Under the deal structure, TikTok US will likely license its algorithm from ByteDance. They're not buying the algorithm, just the right to use it. That's fundamentally different from buying TikTok as an independent company.

For context, **Instagram sold for

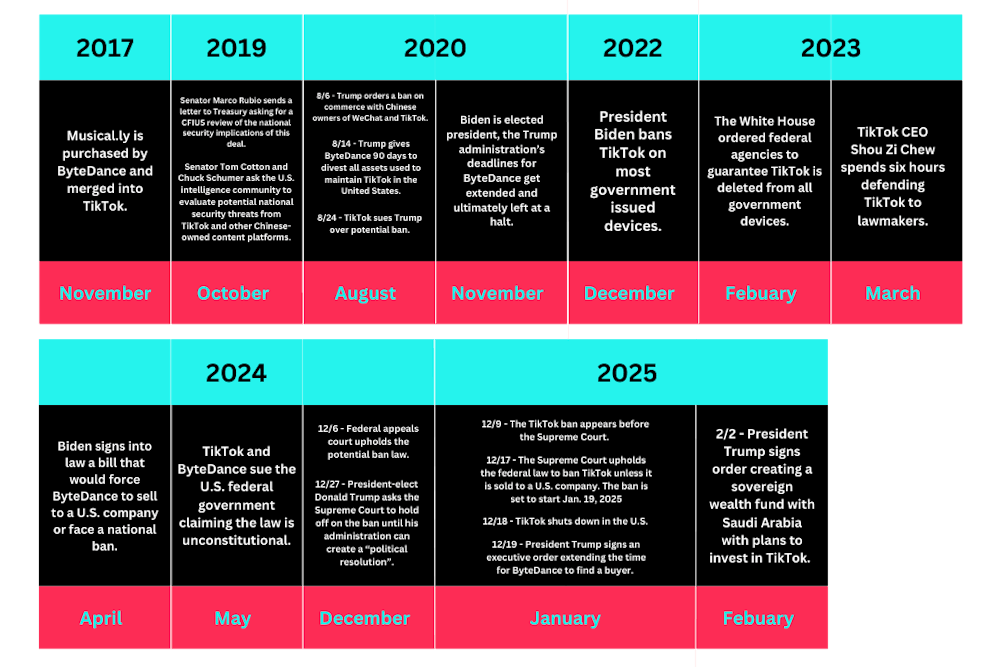

How We Got Here: The Four-Year Timeline That Led to Divestment

Understanding how TikTok ended up in this situation requires understanding the entire four-year political and legal saga that preceded it. It wasn't inevitable. There were multiple points where things could have gone differently.

August 2020: Trump Issues the First Executive Order

President Donald Trump signed an executive order threatening to ban TikTok unless it divested US operations to an American company. The reasoning was national security: if ByteDance is subject to Chinese law, and Chinese law requires surveillance cooperation, then US user data could be at risk, as noted by Reuters.

Was this reasoning sound? National security experts disagreed. Some said it was reasonable caution. Others said it was xenophobia dressed up in tech language. Regardless, it set the precedent: either divest or get banned.

September 2020: The Auction Begins

Once the ban threat was real, potential buyers emerged. Microsoft was interested. Oracle made a bid. Walmart joined in as part of an Oracle consortium. The negotiations were supposed to be completed by a September 15 deadline, then November 12, then December 4. None of these deadlines were met.

The problem: Chinese regulations prevented ByteDance from simply selling TikTok's algorithm to an American buyer. You can't export certain technologies from China. ByteDance had built something genuinely innovative in how TikTok's recommendation engine works. China's government didn't want to let that walk out the door.

2021: Legal Challenges and Delays

Biden took office in January 2021. Trump's executive order was technically still in effect, but the new administration deprioritized enforcement. With less urgency from Washington, the deal process stalled. TikTok continued operating normally. The app even grew during this period.

TikTok also filed lawsuits challenging the constitutionality of the ban, arguing it violated free speech protections under the First Amendment. Courts kept blocking enforcement of the ban while these cases worked through the system. Legally, TikTok had leverage.

2023: Biden Signs the Bipartisan Bill

In 2023, Congress passed and Biden signed a bipartisan bill requiring ByteDance to divest TikTok's US operations or face a complete ban, as reported by American Progress. Unlike Trump's executive order, this was law. It had real weight. The new deadline: January 19, 2025.

This changed the calculation. TikTok couldn't just delay indefinitely. The deadline was a real cliff edge. On January 19, 2025, the app would either be divested or shut down nationwide.

January 2025: The Crisis and Resolution

In the days before the January 19 deadline, TikTok actually shut itself down on the US market. For about 12 hours, the app was inaccessible to most American users. It was a political move: shut down first to pressure the government, show the disruption, remind people what they're losing.

Then, Trump indicated he might grant an extension. Within hours, TikTok came back online. The message was: we cooperated when the president suggested he might help.

Trump did grant an extension, pushing the deadline to January 22, 2026. During that extension period, the deal framework I outlined above was finalized. By January 22, 2026, TikTok's divestment deal was complete.

That's how we got here: executive orders, legal battles, congressional action, midnight deadlines, an app shutdown, and finally, a negotiated settlement that satisfied nobody completely but kept TikTok alive.

The Technical Details: How Oracle Becomes the "Trusted Security Partner"

The deal's most important technical component is Oracle's role in auditing and securing TikTok's US operations. This is the part that actually addresses the original national security concern.

Here's how it actually works:

Oracle hosts TikTok's US data. American users' data (videos, watch history, preferences, direct messages) is stored on Oracle's servers in the United States. This is already happening, and it continues under the new deal. ByteDance doesn't have direct access to this data anymore.

Oracle manages the algorithm. TikTok's recommendation algorithm—the system that decides which videos you see—is the crown jewel of the entire platform. ByteDance created this algorithm. But under the new structure, ByteDance provides the base algorithm to TikTok US, and Oracle actually runs it and monitors it. This is the critical safeguard. The algorithm is still powerful and still proprietary, but it's running on American infrastructure with American oversight.

Oracle audits everything. The company will conduct regular audits to ensure ByteDance doesn't have backdoor access, that the algorithm isn't being manipulated to serve Chinese interests, and that US user data never gets sent to China. Oracle reports directly to a security committee that oversees the joint venture.

ByteDance can't influence US operations. Under the terms, ByteDance is contractually prohibited from having operational control, decision-making authority, or access to US user data. They're essentially a shareholder with financial interest but no hands-on involvement.

Does this actually work? That depends on what you think is possible. If you believe a determined foreign government can't secretly hack into systems or manipulate algorithms through advanced cyberattacks, then yes, this works. If you think national security is about eliminating all theoretical risks, then no, this doesn't work. It's a best-efforts approach.

For most people and most purposes, though, this structure provides meaningful assurance. You have a major US tech company (Oracle) with its own reputation at stake, doing independent audits and security reviews. That's a meaningful layer of oversight that didn't exist when ByteDance fully controlled TikTok.

Estimated data shows account migration and algorithm changes as the most critical concerns, with ratings of 9 out of 10. These aspects could significantly impact user experience and platform continuity.

Who Actually Wanted to Buy TikTok? The Competing Bids

Through this entire process, multiple groups competed for the opportunity to own or operate TikTok. It's worth understanding who tried and why they didn't win (or did).

The Oracle-Silver Lake-MGX Consortium (The Winner)

This was the group that ultimately prevailed. Oracle brought technical credibility and existing infrastructure. Silver Lake brought operational experience and private equity might. MGX brought international capital and investment sophistication. Together, they checked all the boxes: American, technically capable, financially strong, and politically palatable.

Why did they win? Largely because they had the right mix of credibility, capability, and timing. When Trump signaled he might grant extensions and was open to deal-making, this consortium was ready with a coherent structure.

The People's Bid (Frank McCourt's Group)

Frank McCourt, founder of Project Liberty, assembled a competing consortium to bid for TikTok. This group had some fascinating backers, including Reddit co-founder Alexis Ohanian, investor Kevin O'Leary, and even Tim Berners-Lee (inventor of the World Wide Web). Their pitch was fundamentally different: let's make TikTok a public benefit corporation or restructure it around user governance rather than purely commercial interests.

Why didn't they win? The bidding process wasn't transparent, so we don't know the exact reasons. But likely factors include: less financial firepower than Oracle-Silver Lake, less proven operational track record in running platforms at scale, and potentially less comfort from Washington about whether they could actually execute.

The American Investor Consortium (Jesse Tinsley's Group)

Another competing group was led by Jesse Tinsley, founder of Employer.com. This consortium included Roblox co-founder David Baszucki and venture capitalists focused on building an American alternative to TikTok.

Their pitch emphasized creating something new rather than just managing ByteDance's existing platform. But without the operational scale or established infrastructure of Oracle-Silver Lake, they couldn't compete effectively.

Microsoft (2020 Bid Only)

In 2020, Microsoft was seriously interested in acquiring TikTok. The software giant thought about integrating TikTok with its existing social platforms and leveraging Microsoft's cloud infrastructure and advertising network. But as the process dragged on and the regulatory scrutiny became more intense, Microsoft quietly withdrew. Managing a Chinese social platform under intense government oversight didn't align with their strategic priorities.

Various Other Bidders

Over the years, other companies and investors expressed interest, including private equity firms, venture capital groups, and even some celebrity investors. But none of them made it to the final stages of serious negotiation. The barrier to entry was too high: you need billions in capital, proven operational competence, political credibility, and technical sophistication all at once.

What Changes for Regular Users?

If you're a TikTok user with 500,000 followers, or someone who just scrolls for fun, or a small business using TikTok to reach customers, here's what actually matters to you.

The App Stays (For Now)

First, the good news: TikTok isn't disappearing. Despite all the speculation about the app being "banned" or "shut down," the deal ensures TikTok continues operating in the US. Your account is safe. Your videos are still there. You can keep using TikTok the way you always have.

But there's a catch in the reporting. Bloomberg and other outlets have suggested that when the deal is fully implemented, the existing TikTok app will eventually be discontinued and replaced with a new separate platform. The specifics of this transition remain murky. Will it be a completely new app? Will you need to migrate your account? Will the features be different? None of these questions have clear answers yet.

Algorithm Changes Are Possible

With Oracle providing security oversight, the algorithm could theoretically be modified or restricted in certain ways. For example, if national security advisors determined that certain features were problematic, they could require changes. This might affect:

- How the algorithm learns your preferences

- What types of content get recommended

- How personal data is processed

- Which countries' servers host your data

Will the algorithm definitely change? Probably not substantially. But there's more potential for change now than there was before, when ByteDance had completely unilateral control.

Data Security Improves

The good news is that your data is definitely more secure. With Oracle auditing and ensuring that US data stays on US servers, the theoretical risk of Chinese government access is substantially reduced. This isn't paranoia. It's a reasonable security concern that the deal actually addresses.

Ads Might Change

TikTok's business model is advertising. With new ownership and oversight, advertising policies might evolve. Certain types of ads might be restricted. Data used for ad targeting might be limited. For creators and brands, this could affect revenue potential.

Geopolitical Content Could Be Sensitive

With American oversight, content touching on sensitive geopolitical issues (China, Taiwan, Tibet, etc.) might receive additional scrutiny. Not necessarily censorship, but increased attention and potential enforcement. This is political dynamite that new American owners might want to avoid.

The Algorithm Question: License vs. Sell

One of the trickiest parts of this deal is the algorithm situation. It deserves its own deep dive.

TikTok's algorithm is genuinely impressive. It's the secret sauce that made TikTok so addictive and successful. If you spend 30 minutes on TikTok, you see video after video perfectly tailored to your interests. That's not luck. That's hundreds of engineers and years of refinement creating a recommendation engine that's arguably better than YouTube's or Netflix's.

When this deal was being negotiated, here's where it got complicated: Can you even sell an algorithm?

Internally, there were debates about whether the algorithm should be:

- Completely sold and transferred to the new American owners, with ByteDance relinquishing all rights

- Licensed from ByteDance to the American operators, with ByteDance retaining ownership but having no control

- Reverse-engineered and rebuilt by the new American owners from scratch

What they chose: Option 2. ByteDance licenses the algorithm to TikTok USDS Joint Venture LLC. This means:

- ByteDance keeps the intellectual property and gets ongoing royalty payments

- The American operators can use the algorithm and potentially modify it

- Oracle audits the algorithm to ensure no backdoors or problematic code

- ByteDance can't unilaterally change or restrict the algorithm

Why did they choose licensing over a complete sale? Partly because Chinese law makes exporting certain technologies difficult. Partly because ByteDance wanted to retain some asset value. And partly because licensing actually provides a cleaner legal structure for the security oversight.

The criticism of licensing is: What if ByteDance includes backdoors or malicious code in the algorithm that Oracle doesn't catch? That's theoretically possible but practically unlikely. Oracle isn't hiring amateurs. They're going to have world-class security engineers auditing this code. And ByteDance knows that if any backdoors are found, the entire deal collapses and they lose everything.

So yes, there's some theoretical risk. But there's also real incentive alignment to make sure the algorithm is clean.

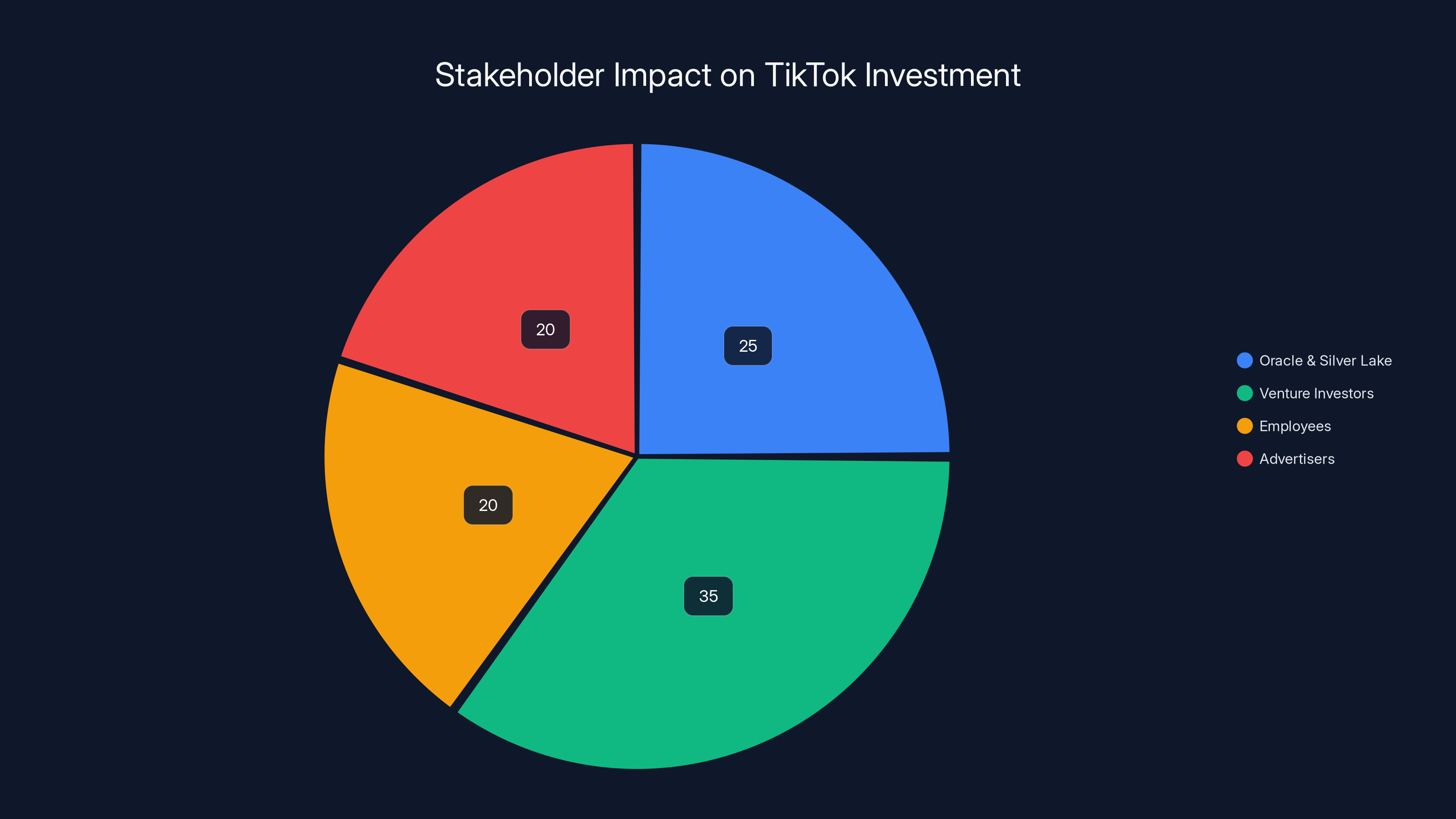

Estimated data shows venture investors face the highest impact due to divestment, while advertisers and employees experience moderate effects.

The Political Calculation: Why Trump Changed His Tune

Here's something fascinating about this deal: Trump was the original architect of the ban threat, back in 2020. He signed the executive orders pushing ByteDance to divest. He wanted TikTok gone or sold.

Then he came back for his second term in 2025 and... reversed course? Not exactly. What actually happened is more interesting.

Trump recognized that a complete TikTok ban would be incredibly unpopular. Millions of American teenagers and young adults would be furious. Small businesses and creators making money on TikTok would lose their primary platform. The political cost of a ban was too high.

But Trump also couldn't just drop the national security argument he'd been making for years. That would look weak. So he found a middle path: allow TikTok to continue operating, but with new American oversight and partial American ownership. This way, he can claim victory ("I made TikTok divest!") while avoiding the political pain of an outright ban.

For ByteDance, this is actually better than a complete ban, which was always the alternative. Keeping a 20% stake and ongoing licensing revenue is better than nothing.

For the new American owners, they get control of one of the most valuable and influential platforms in the world.

It's the kind of deal where everyone gets something, which is usually a sign of a compromise that actually works.

National Security: Real Threat or Political Theater?

Let's be honest about something: the national security argument around TikTok has always been complicated.

Is there a theoretical risk that ByteDance could be forced to cooperate with Chinese government surveillance? Yes. Chinese law theoretically allows this. But several caveats:

First, we don't have evidence this ever actually happened. In all the years TikTok has been operating in the US, there's no confirmed case of ByteDance providing US user data to Chinese authorities. That doesn't mean it didn't happen. It means we don't have evidence.

Second, other Chinese companies operate in America without the same restrictions. TikTok gets singled out for special scrutiny partly because it's so successful and visible, not purely because of technical security risks.

Third, American companies probably spy on you more than TikTok ever could. Facebook, Google, Amazon, Microsoft—these companies have vastly more data on American users and share it with government agencies through surveillance programs. Why is TikTok the national security threat but not these companies?

The honest answer is geopolitical competition. The US government wants to prevent China from building dominant platforms that could compete with American tech companies globally. The national security framing is real, but it's also convenient political language.

Does that make the deal bad? Not necessarily. Even if the national security threat is overstated, having American companies with American legal accountability running TikTok's US operations is arguably better than having a Chinese company in complete control. It's a reasonable policy even if the original reasoning was exaggerated.

The deal doesn't eliminate all risk (no deal can), but it meaningfully reduces the possibility of TikTok being used as a Chinese government surveillance tool. That's worth something.

What's Next: The Transition and Unknown Variables

The deal closed on January 22, 2026. But this isn't the end of the story. It's the beginning of a long transition.

Phase One: Integration and Auditing (Now)

Right now, the focus is on integrating the new ownership structure, establishing Oracle's auditing processes, and finalizing the joint venture's operational framework. This takes months. You'll notice this as a user: potential service interruptions, feature changes, backend improvements, etc.

Phase Two: Algorithm Transition (Months 3-12)

Over the next year, the algorithm will be gradually transferred to the new American system while maintaining the same user experience. This is technically complex. You're essentially rebuilding a critical system without the users noticing. It requires careful planning and testing.

Phase Three: New Platform Launch (12-24 Months)

Sometime in 2026 or 2027, the new TikTok US platform will launch separately from the ByteDance version. This is where things get murky. Will it be a completely new app? Will your account transfer automatically? Will there be downtime? We don't know yet.

Phase Four: Long-Term Governance (2027+)

After the transition, TikTok will be an American-owned platform with American regulatory oversight, competing in the US market alongside its parent company's potential TikTok-like products. That's never happened before.

There are many unknown variables that could disrupt this roadmap:

- Political changes: A new president could take a different stance on TikTok

- Operational problems: The technical transition could reveal unforeseen issues

- Market competition: New competitors could emerge that change the dynamics

- International escalation: China could retaliate in tech markets in unexpected ways

- Regulatory shifts: Congress could pass new laws affecting the deal

None of these are guaranteed, but they're all possible. The deal is done, but TikTok's future remains somewhat uncertain.

Estimated data shows ByteDance retains a 20% stake, while American owners hold 70%, and other stakeholders have 10%. This compromise allows ByteDance to maintain a significant interest while giving control to American entities.

The Broader Implications: What This Means for Tech and Politics

The TikTok deal is about much more than one app. It signals several important trends in how technology and politics intersect.

Geopolitical Tech Competition is Real

This deal represents the US government saying clearly: we don't want Chinese companies building dominant platforms in our market. This isn't just about TikTok. It's about competition with China for technological dominance. Expect more pressure on Chinese tech companies and more restrictions on Chinese investment in strategic tech sectors.

Governments Are Willing to Force Sales

For decades, tech companies operated with relative freedom from government intervention. The TikTok deal changes that. If you build a platform that governments see as strategically important or politically threatening, they can force you to sell. That's a precedent with major implications for future tech business models.

Data Localization is Becoming Standard

The requirement that TikTok's US data stay on US servers isn't unique to TikTok. This is becoming standard policy globally. Europe has similar requirements. So does India. And Australia is considering it. Expect more countries requiring that data about their citizens stays within their borders.

Regulatory Capture Can Work Both Ways

The irony here is that by forcing TikTok to divest, the US government has actually made it harder for Chinese competitors to emerge. The deal favors American companies like Oracle that can serve as trusted security partners. This is basically regulatory protection for American tech companies disguised as national security policy.

The Algorithm Is a Strategic Asset

The fact that so much negotiation focused on the algorithm shows how much power these AI-driven recommendation systems have. Companies, governments, and investors all recognize that the algorithm is the most valuable part of the platform. Expect future tech conflicts to increasingly focus on algorithmic control and ownership.

Could TikTok Actually Be Banned Instead?

Let's address the obvious question: Could this deal fall apart and TikTok get banned anyway?

Technically, yes. If Congress decides the deal doesn't actually protect national security, they could vote to ban TikTok. If the security concerns resurface with new evidence, that could trigger action. If political dynamics shift dramatically, bets are off.

But practically? It seems unlikely. Here's why:

The deal has bipartisan support. Both parties wanted this situation resolved. A complete ban would be reversed by the next president, creating instability. A deal that satisfies both parties is more politically durable.

TikTok's user base is enormous. Banning it would create immediate political pain. Congress knows this. Most lawmakers have constituents who use TikTok, or at least constituents who would be angry if it disappeared.

The deal actually addresses the security concerns. Whether you think the concerns are exaggerated or not, the deal does create meaningful American oversight and data localization. It's a legitimate response to the stated security problems.

Alternatives are worse. From the government's perspective, a working deal with oversight is better than a ban that doesn't stop foreign competition (someone else would build a TikTok clone) and creates economic damage.

So while "TikTok could be banned" is technically true, it's low-probability. More likely is that the deal holds, TikTok continues operating with American ownership and oversight, and everyone moves on to the next tech policy crisis.

What About International TikTok? Is This Just US?

Important clarification: this deal only applies to TikTok's operations in the United States. Globally, TikTok continues operating under ByteDance's control. This doesn't affect users in Europe, Asia, India, or anywhere else.

Other countries are watching, though. India already banned TikTok in 2020 over similar national security concerns. Europe is considering stricter regulations on foreign tech platforms. Australia is debating similar restrictions.

If the TikTok US deal is successful, expect other countries to demand similar arrangements. This could fragment TikTok into regional versions with different owners and operators. That's actually not great for the platform's global reach and consistency.

For ByteDance, having different regional versions with different operators is actually better than a complete global ban. They lose operational control but retain strategic influence through their platform and algorithm.

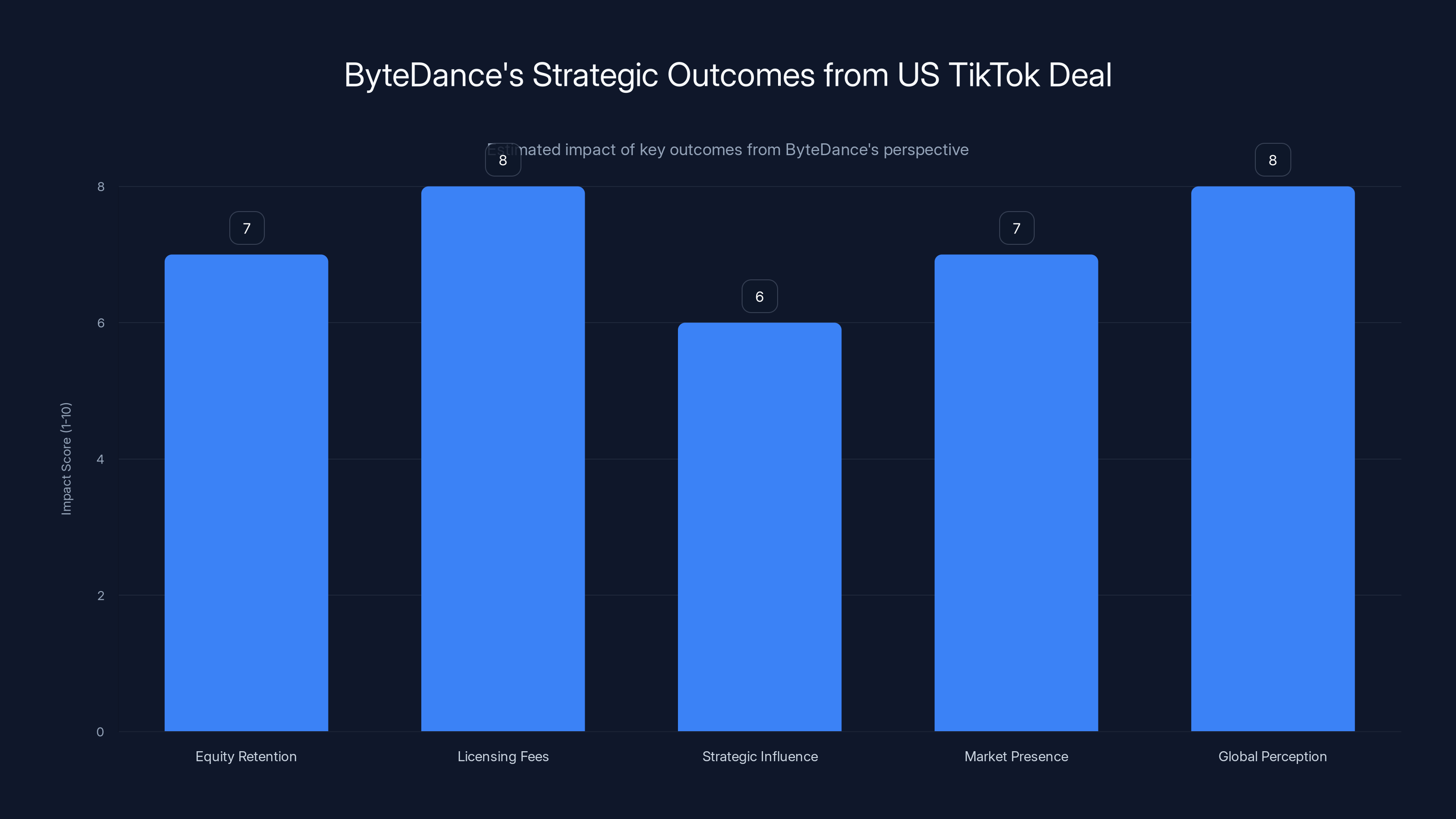

ByteDance retained significant strategic benefits despite reduced ownership, with high scores in licensing and global perception. Estimated data.

The Creator Economy Impact: What Happens to TikTok Creators?

If you make money on TikTok through the Creator Fund, brand partnerships, or selling products to your audience, what does this deal mean for you?

Revenue Sharing Shouldn't Change Immediately

TikTok's Creator Fund payments come from advertising revenue. Unless the new American ownership dramatically changes TikTok's advertising model, creator payments should remain relatively stable in the short term.

Monetization Policies Could Evolve

The new American owners might introduce different monetization options, different rates, different eligibility requirements. This could be good (more ways to earn) or bad (lower rates, stricter rules). Hard to predict without seeing their actual policies.

Content Moderation Might Shift

With American ownership, content moderation policies could change. What ByteDance allowed or didn't allow might differ from what the new owners allow. This could affect creators whose content skates close to gray areas.

Platform Stability Is Better

The one thing creators should feel good about: TikTok isn't going away. For years, creators had to worry that their entire income stream could disappear overnight if the government banned TikTok. That risk is substantially lower now. The platform has American ownership and investor backing, making it more stable long-term.

ByteDance's Perspective: Did They Get a Good Deal?

It's worth considering this from ByteDance's perspective. They started with a platform worth hundreds of billions (as part of their overall company value). They fought for years to keep TikTok independent. And they ended up with 20% ownership of a $14 billion US operation.

On the surface, that sounds like a terrible outcome. And it is compared to complete ownership.

But compared to the alternatives (complete divestment, forced sale at a lower price, or a complete ban that generates zero value), it's actually not terrible. ByteDance:

- Keeps 20% equity in a valuable asset

- Receives ongoing licensing fees for the algorithm

- Maintains strategic influence through algorithm evolution

- Avoids a total loss of their largest international market

- Preserves relationships with 170 million American users through a proxy

For a company facing a government that wanted to ban them entirely, this is a workable outcome. It's not a win. But it's better than complete defeat.

Interestingly, this might actually help ByteDance in global perception. Instead of being the "Chinese company that got banned," they're now "the company that successfully negotiated with the US government." That's useful for their brand and their future expansion efforts in other countries.

Comparisons to Other Forced Tech Divestitures

Is the TikTok deal unique, or is this part of a broader trend? Let's look at how other governments have handled similar situations.

China and Western Tech Companies

China has never forced American tech companies to divest. Google, Facebook, and Twitter have been banned or restricted by choice, not by government mandate. But Apple, Microsoft, and Amazon all operate in China under specific terms. So the relationship goes both ways in practice, just not through official divestiture requirements.

India and Homegrown Alternatives

When India banned TikTok in 2020, they didn't force a divestiture. They just banned it outright. This created space for Indian startups to build alternatives like Moj and Josh. The US took a different approach: force a change in ownership rather than complete removal.

Europe and Foreign Digital Services Tax

Europe hasn't forced divestitures of American tech companies, but they've imposed digital services taxes and threatened regulations on foreign platforms. They're exerting control through taxation and regulation rather than forced sales.

Australia's Foreign Investment Requirements

Australia has tightened foreign investment rules in tech sectors considered strategically important. Rather than forcing divestitures of existing platforms, they're preventing foreign companies from acquiring new properties. The TikTok situation created pressure to go further.

The TikTok divestiture is actually quite unique. It's the first time a major government has forced a completely foreign-owned platform to divest US operations. That makes this precedent-setting. Expect other countries to follow, at least with Chinese platforms.

The Unanswered Questions Still Lingering

Despite everything being finalized, several important questions remain unanswered:

1. What exactly will the new platform look like?

Reports suggest a new separate TikTok-like app will eventually launch for the US market. But will it have the same features? Will it look the same? Will the algorithm be as good? Nobody's saying yet.

2. How will account migration work?

If a new platform launches, how do you move your account, videos, and followers from the old TikTok to the new one? Will it be automatic? Will you need to manually switch? This is crucial but hasn't been detailed.

3. What's the long-term role of ByteDance?

With a 20% stake, ByteDance has ongoing financial interest. But how involved will they actually be in operations? Will they attend board meetings? Will they have a seat on the board? The governance structure is still unclear.

4. What happens if Oracle finds security issues?

What does Oracle do if they find a backdoor or unauthorized code in the algorithm? Can they remove it unilaterally? Do they need ByteDance's permission? The remediation process isn't clearly defined.

5. How much will this cost users?

Right now TikTok is free (supported by ads). With new American ownership focused on returns to investors, will that change? Could TikTok introduce a premium tier? Could ads increase? It's unknown.

6. Will the algorithm actually stay the same?

One of TikTok's superpowers is its algorithm. If the American owners modify it significantly for legal or operational reasons, will TikTok remain as engaging and addictive? That's an open question.

The Economic Impact: Broader Tech Industry Implications

This deal will likely affect the tech industry beyond just TikTok.

Valuation Compression for Foreign-Owned Tech Companies

If there's a risk that your company might be forced to divest in valuable markets, that reduces your valuation. Other Chinese tech companies are probably seeing a valuation discount right now. Investors are factoring in the risk of forced divestiture.

Increased M&A in Strategic Tech Sectors

American companies might accelerate acquisitions in social media, AI, and recommendation engine technology to consolidate control before international restrictions tighten. We could see a wave of consolidation.

Higher Standards for Security and Data Protection

Oracle's role in auditing TikTok will raise expectations for how other platforms handle security. Competitors like Meta and YouTube will face increased scrutiny about whether their data protection is equivalent to TikTok's new American oversight.

New Business Model: Security Partnerships

Oracle made money being the security partner. This creates a new business opportunity for companies that want to offer security auditing, algorithm oversight, and data protection services to platforms operating under regulatory scrutiny. Expect more companies building this capability.

Timeline: What Happens Next

Here's what we expect to happen in the coming months and years:

January 22, 2026 (Just Happened): Deal officially closes. Joint venture begins operations.

February - April 2026: Integration and systems setup. You might notice minor app performance issues or feature tweaks.

May - September 2026: Oracle ramps up security auditing. First security audit reports (unlikely to be public).

October 2026 - March 2027: Algorithm transition begins. More technical work on backend systems.

April - December 2027: New platform development reaches advanced stages. Announcement of new app details expected.

2028: New American TikTok platform launches. Users transition from old app to new app.

2028+: Long-term operations under American ownership with Oracle oversight.

This timeline is speculation based on typical M&A integration timelines, but the key phases are: integration, auditing, algorithm transition, new platform development, then eventual user migration. Each phase brings potential risks and opportunities.

For Investors and Stakeholders

If you're invested in TikTok through venture capital funds, private equity, or stock holdings in Oracle and Silver Lake, here's what matters:

Oracle and Silver Lake: Both companies now have equity stakes in a $14 billion asset. If the platform succeeds and grows, this investment could be valuable. If it struggles under the transition, it could underperform. The risk/reward is moderate. Both companies have diversified enough that TikTok isn't existential either way.

Venture Investors in ByteDance: You took a haircut. Your Chinese stake in a company worth $300+ billion is less valuable because the US operations (which probably represented 15-20% of total value) are now partly divested to foreigners. But you still have an asset that's worth billions.

Employees: Both TikTok and Oracle employees will be affected. Some roles might consolidate. Others might expand. The transition period creates both opportunities and uncertainty.

Advertisers: If you spent money on TikTok advertising, the deal shouldn't immediately change your ROI. But changes to targeting, privacy policies, or algorithm behavior could affect performance over time.

Conclusion: Living With Uncertainty

After four years of chaos, the TikTok deal represents a way out of an unsustainable situation. TikTok gets to keep operating. The US government gets American oversight and data localization. ByteDance keeps some financial interest. Nobody is completely happy, which means everyone probably got a reasonable deal.

But the transition is far from over. Integration will take years. The new American platform hasn't launched yet. Long-term governance remains to be fully established. And the geopolitical situation could change, affecting this deal's permanence.

What we know: TikTok isn't going away. American users will keep using it (probably with some modifications). Oracle will auditing it. And American companies now have partial control over a platform that reaches 170 million Americans weekly.

What we don't know: The exact details of the transition, the final form of the new platform, whether the deal will hold if politics shift, and how much the user experience might change.

For most users, the practical reality is: TikTok continues, with slightly more American oversight. That's probably fine. The app you love won't disappear tomorrow. But keep in mind that ownership and governance are in flux, and nothing is completely settled yet.

This deal is simultaneously a resolution and a beginning. It closes one chapter of the TikTok-US government drama while opening another.

FAQ

What exactly did TikTok have to divest in this deal?

TikTok didn't fully divest to a single buyer. Instead, ByteDance sold a controlling stake in TikTok's US operations to a consortium of American investors (Oracle, Silver Lake, and MGX) who together control 45% of the company. ByteDance retained 20%, with the remaining 35% held by other investors. This is a more complex arrangement than a traditional acquisition where one party fully buys another.

How much did the consortium pay for their stake in TikTok?

The exact purchase price hasn't been publicly disclosed, but the reported valuation of TikTok US is approximately

Will my TikTok account be deleted or transferred?

No. Your account and videos will remain active throughout and after this transition. However, reports suggest that eventually a new TikTok platform will launch in the US, and users may need to migrate to it. The company hasn't provided specific details about this migration process yet, so exactly how it will work remains unclear.

How does Oracle becoming the "security partner" actually protect my data?

Oracle's role is to audit TikTok's systems, ensure that US user data stays on American servers, monitor the algorithm for any backdoors or unauthorized access, and verify that ByteDance doesn't have unauthorized access to US user information. This doesn't guarantee perfect security (no system is 100% secure), but it provides meaningful oversight from a major US tech company with its own reputation at stake. The audits are ongoing and structural, not one-time events.

Is the national security risk from TikTok actually real or just political theater?

The risk is real but somewhat overstated. There's a genuine theoretical concern that a Chinese company could be forced to cooperate with government surveillance under Chinese law. However, there's no confirmed evidence this has actually happened with TikTok. Additionally, American tech companies probably collect and share more user data with governments than TikTok does. The national security framing is partly legitimate policy concern and partly geopolitical competition with China. The deal addresses the stated concerns even if the original threat was exaggerated.

What happens to ByteDance's algorithm ownership?

ByteDance maintains ownership of the algorithm but licenses it to TikTok US. This means the American operators can use and potentially modify it, but ByteDance retains the intellectual property and gets paid licensing fees. ByteDance cannot unilaterally change or revoke the algorithm under the deal terms, and Oracle audits it to ensure no backdoors are present. It's a licensing arrangement, not a complete sale of technology.

Could this deal be reversed or nullified by a future president or Congress?

Technically, yes. If a future administration determined the deal doesn't adequately protect national security, they could attempt to ban TikTok or force a complete divestiture. However, the deal has bipartisan support and addresses the stated security concerns, making it more politically durable than the original ban threat was. A reversal would require substantial new evidence of problems or a major political shift, which is possible but not probable.

Will TikTok remain free, or could they introduce paid tiers?

TikTok is likely to remain free with ad support in the near term. However, the new American owners might eventually introduce paid premium features or tiers (similar to YouTube Premium or other platforms). The basic app would probably remain free, but additional features could be behind a paywall. This is speculation based on typical tech business models, not announced policy.

How will this affect TikTok creators and their income?

Creator payments should remain relatively stable in the short term since they come from advertising revenue. However, the new American ownership might introduce different monetization options, different payout rates, or different eligibility requirements. One guaranteed benefit: with American investment backing, TikTok is now more likely to remain operating long-term, reducing the risk that creators' income stream disappears.

When will the new American TikTok platform actually launch?

There's no official launch date yet. Based on typical tech transition timelines, a new separate platform could launch in 2027 or 2028, but that's speculative. The company will need to develop it, migrate infrastructure, transfer the algorithm, and conduct security audits before launch. You'll likely receive advance notice when they're ready to migrate users.

Key Takeaways

- Oracle, Silver Lake, and MGX consortium controls 45% of TikTok US valued at $14 billion under new ownership structure

- ByteDance retains 20% stake and licenses algorithm to American operators while losing operational control

- Oracle becomes security partner auditing algorithm, data protection, and ensuring ByteDance cannot access US user information

- Deal closes January 22, 2026 after four-year political battle beginning with Trump's 2020 executive order

- User experience remains largely unchanged short-term, but new separate American TikTok platform expected to launch 2027-2028

- National security concerns about Chinese government surveillance are real but partly exaggerated by geopolitical competition

- Deal sets precedent for forced tech divestitures that may be replicated for other foreign platforms

- Creator economy and 170 million US users get stability with American ownership, though long-term policy changes possible

Related Articles

- New York's Social Media Warning Labels Law: What You Need to Know [2025]

- How Big Tech Surrendered to Trump's Trade War [2025]

- Best Cybersecurity Journalism 2025: Stories That Defined the Year

- How Global Trade Power Is Shifting: The Tariff War's Hidden Weapon [2025]

- [2025] The Rise of Super Apps: Crypto Payments & Encrypted Chat

- [2025] ElevenLabs' $6.6B Valuation: Beyond Voice AI

![The TikTok US Deal Explained: Who Owns It Now, What Changes [2025]](https://tryrunable.com/blog/the-tiktok-us-deal-explained-who-owns-it-now-what-changes-20/image-1-1767105618204.jpg)