The Great Social Media Shift: How Threads Became a Mobile Powerhouse

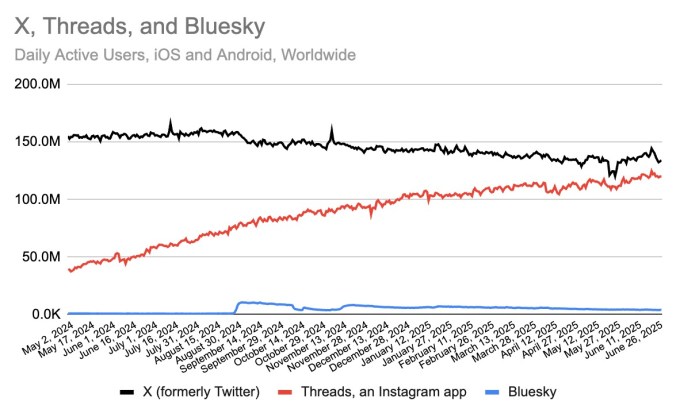

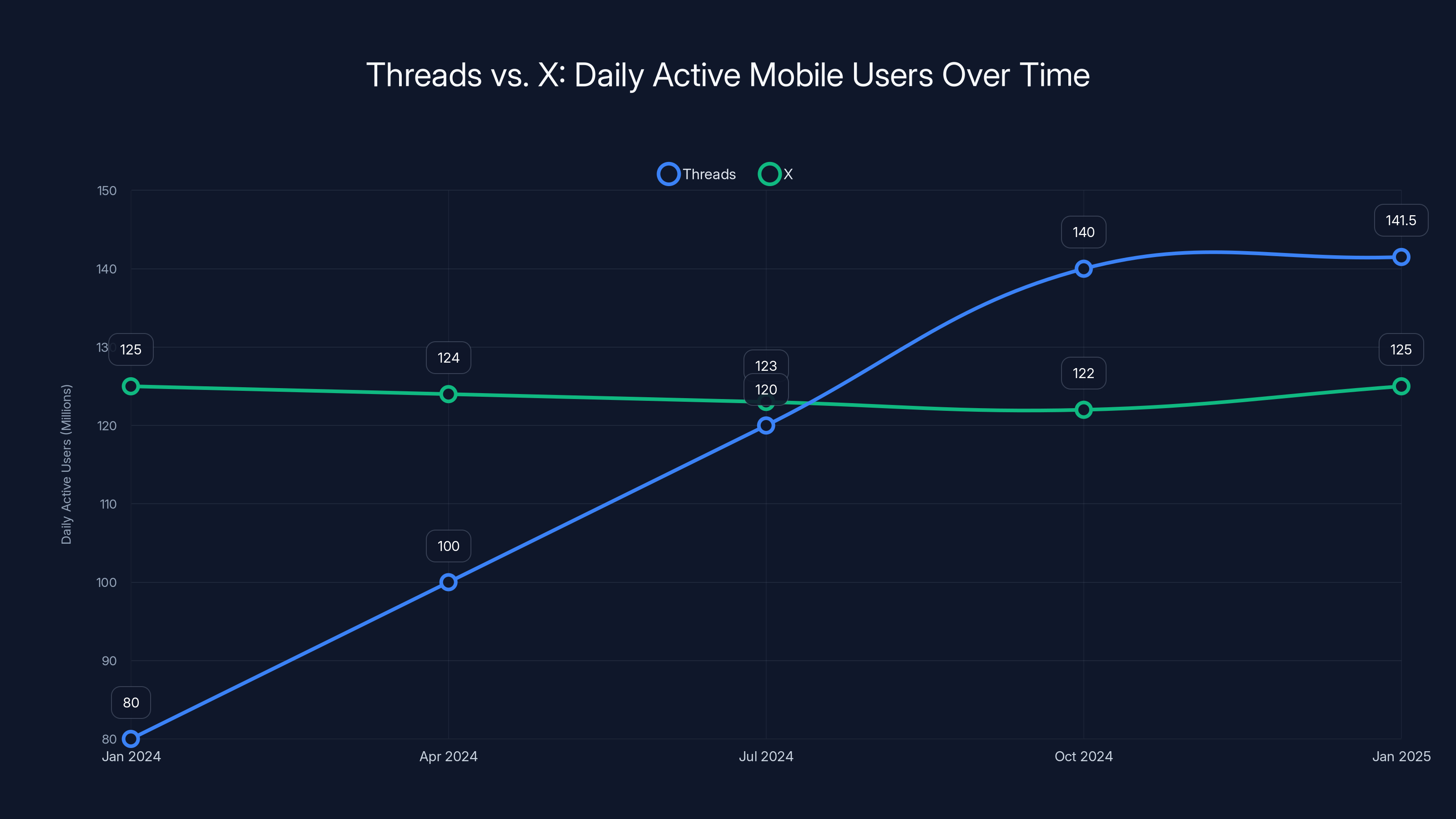

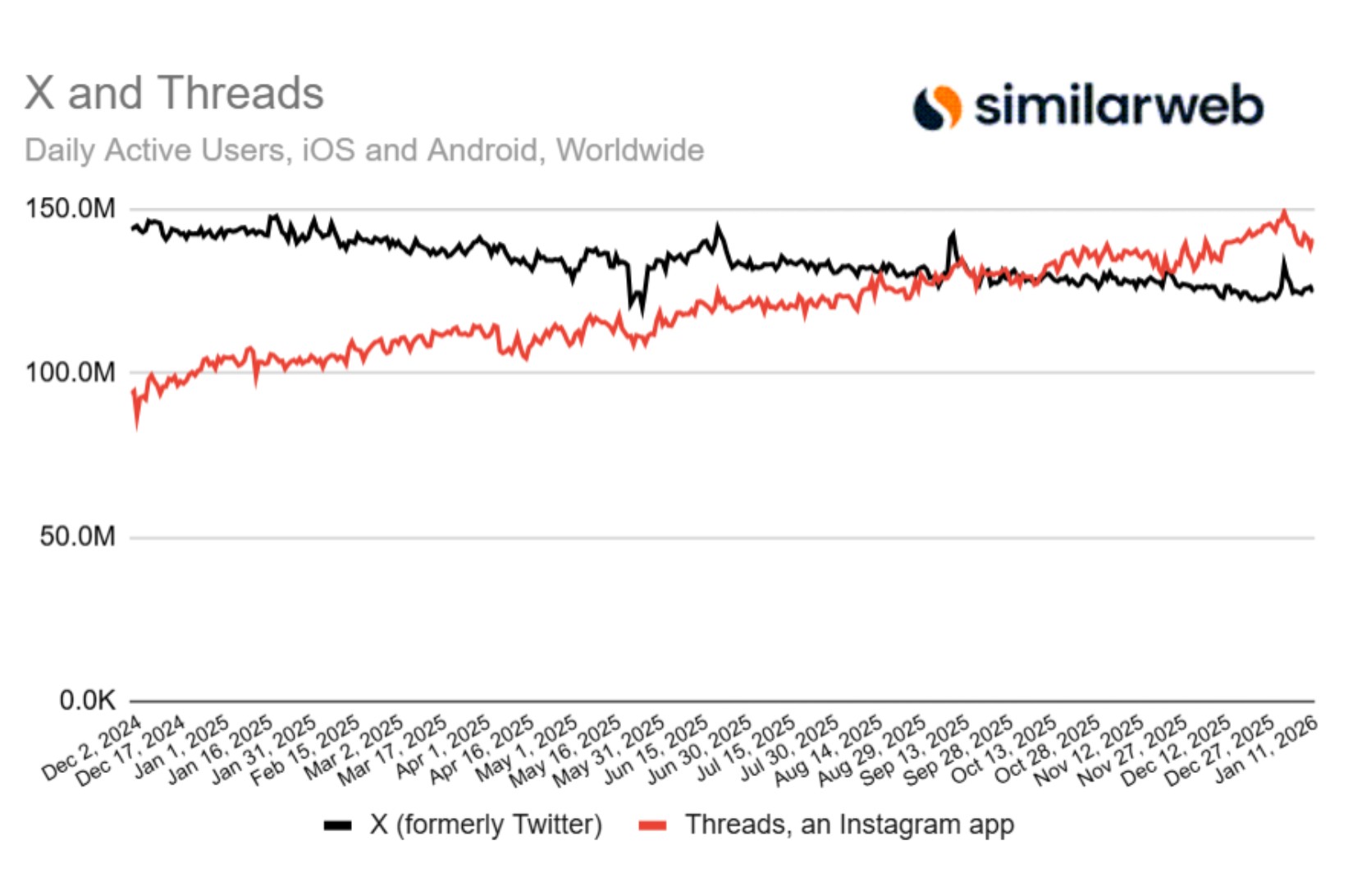

Last January, something quietly shifted in the social media landscape. No headlines screamed it from the rooftops. No celebratory posts flooded timelines. But the numbers told an unmistakable story: Threads, Meta's relatively young competitor to X, had quietly overtaken its rival in daily active mobile users.

This isn't just a minor statistic buried in an analyst report. It's a significant turning point that reveals something fundamental about how the internet is consuming social media in 2025. After launching almost three years prior, Threads achieved what many thought impossible: beating Elon Musk's X in the one metric that matters most to younger, mobile-first audiences.

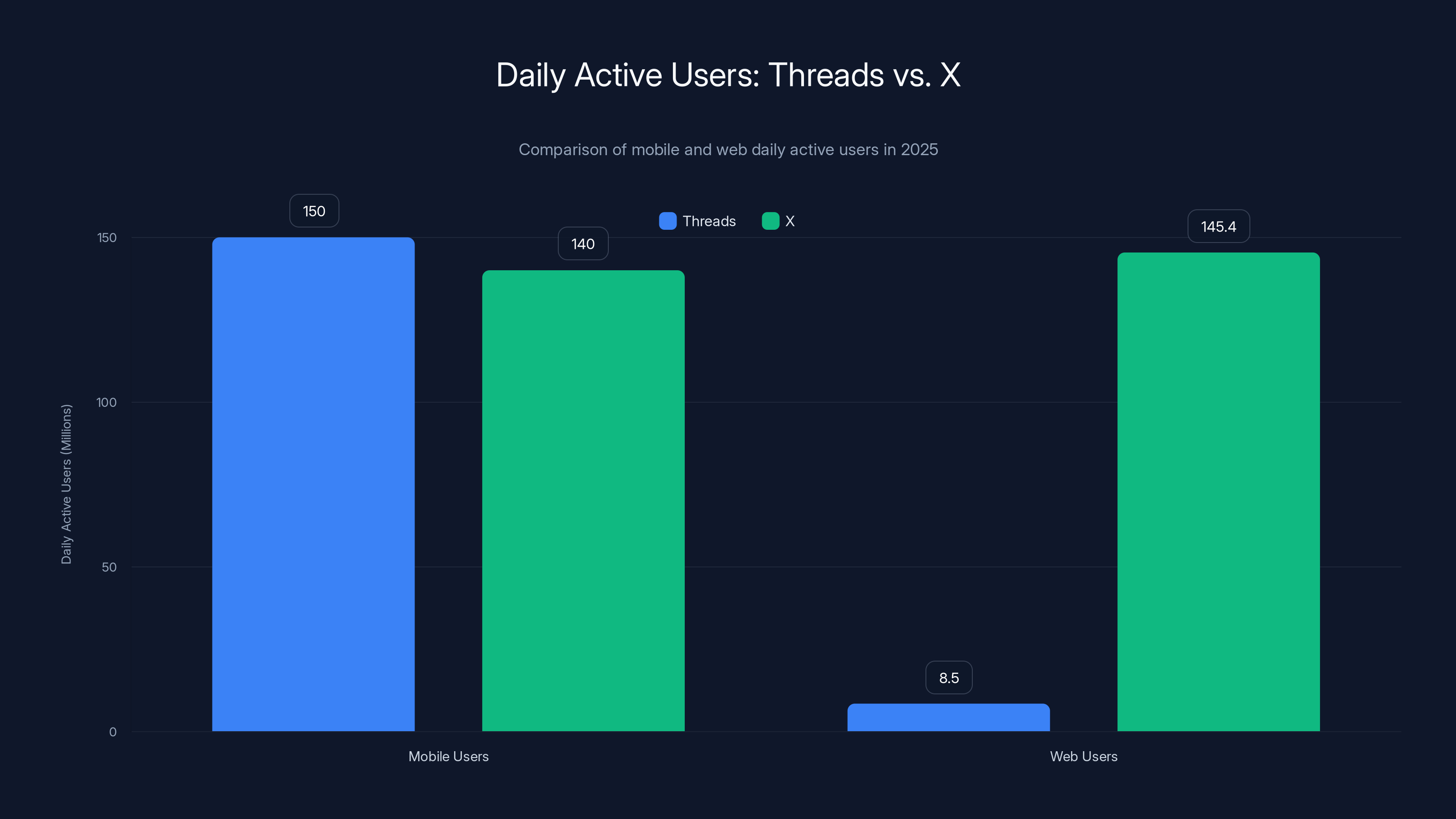

But here's where it gets interesting. Despite this victory, the story doesn't end there. While Threads celebrates its mobile dominance, X maintains an iron grip on web traffic that makes Threads look almost irrelevant on desktop. The gap is staggering. X pulls in 145.4 million daily web visitors compared to Threads' mere 8.5 million. That's a 17-to-1 ratio. It's the kind of disparity that tells you these platforms aren't actually competing for the same user base anymore.

So what does this mean for the future of social media? Which platform is actually winning? And what can this shift teach us about where digital communication is heading? These questions matter more than they seem. The mobile-first versus web-first divide isn't just about user counts. It's about engagement patterns, monetization potential, and which platforms will shape online discourse in the years ahead.

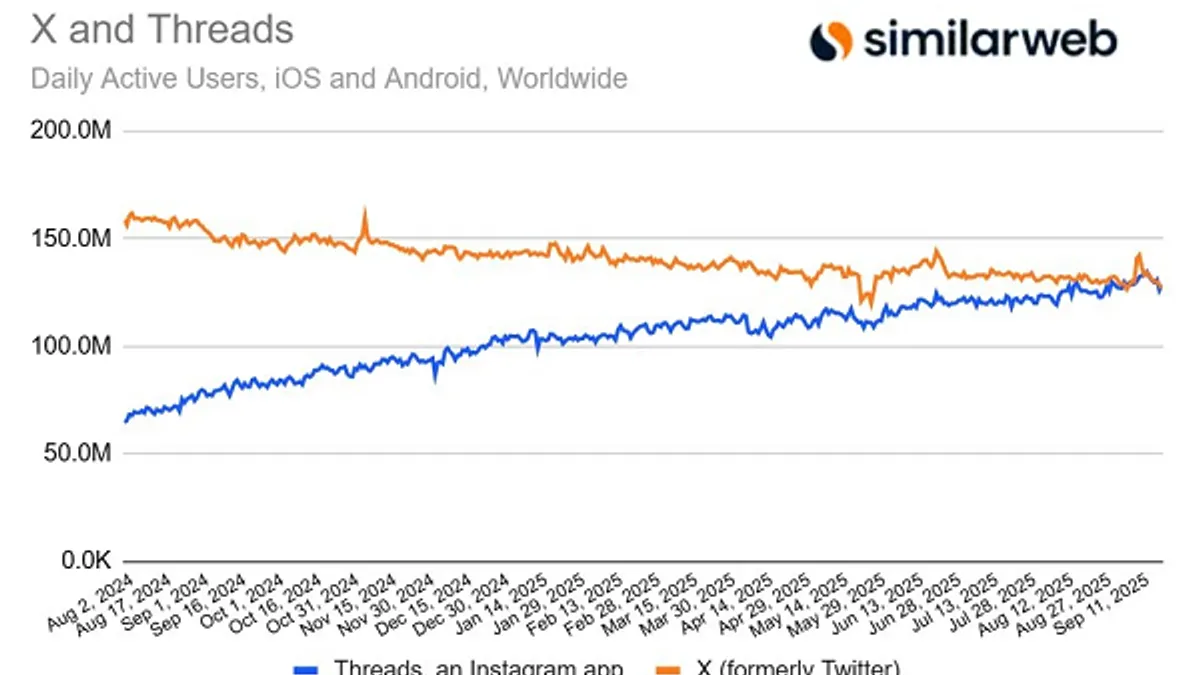

The data comes from Similarweb, tracked across multiple months and verified through various analytics sources. The milestone wasn't a sudden spike in December or January. Instead, Threads achieved this overtaking sometime between late October and early November of the previous year, representing consistent growth rather than a viral moment or controversy-driven surge.

This is the story of how a platform that many dismissed as "Instagram's Twitter clone" became essential infrastructure for hundreds of millions of people. It's also the story of how X, despite massive investment and constant headlines, may have fundamentally misread what its users actually wanted. Let's dig into what really happened.

Understanding the Mobile-First World: Why This Moment Matters

You've probably noticed something if you use social media: most of your scrolling happens on a phone. This isn't a quirk or preference. It's become the dominant way people interact with social platforms. In 2025, mobile traffic accounts for over 60% of all internet usage globally. For social media specifically, the number is even higher.

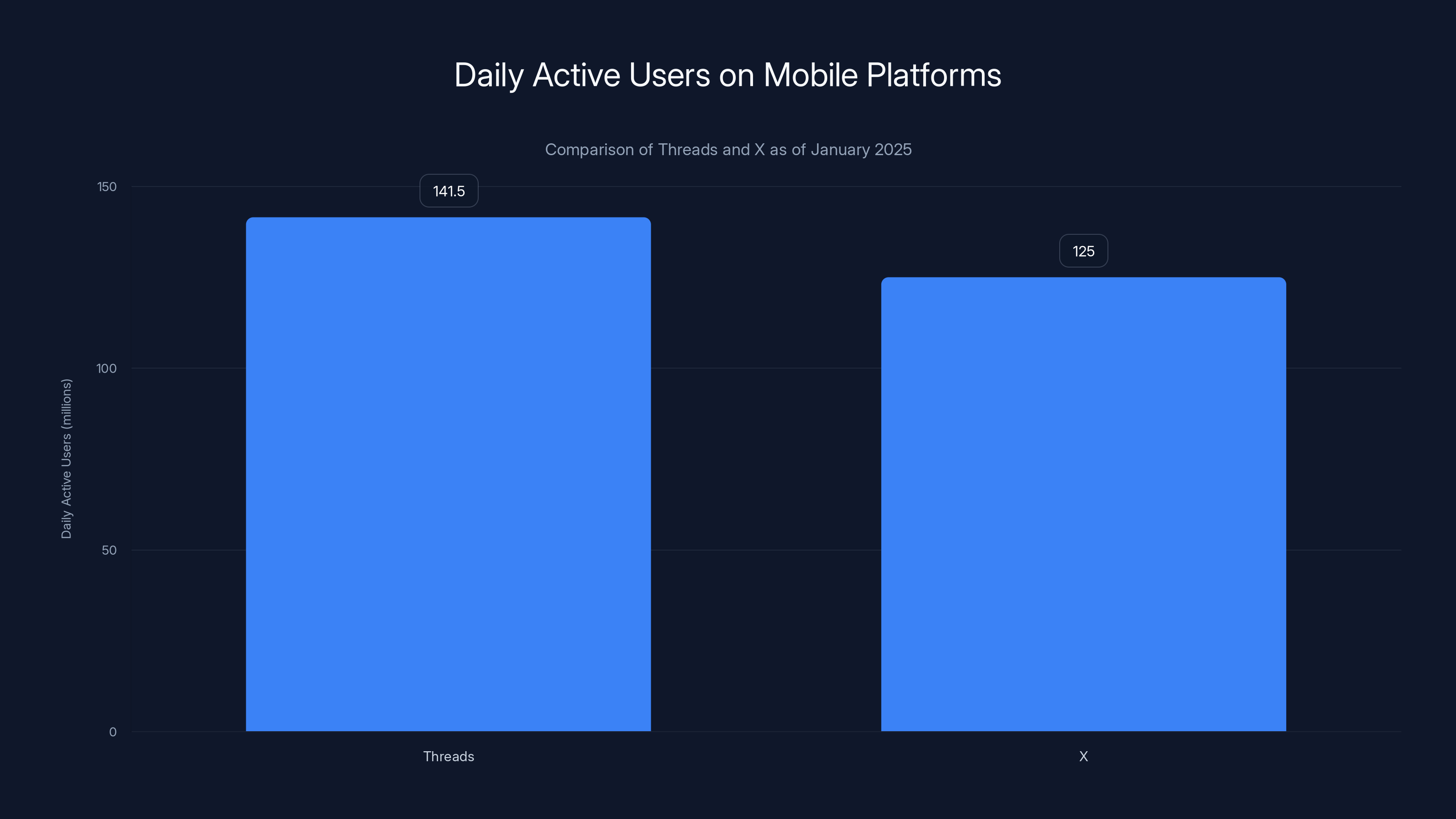

This reality completely reframes the Threads versus X conversation. When you look purely at daily active users on iOS and Android, Threads has won decisively. At 141.5 million daily mobile users versus X's 125 million, Threads holds a 16.5 million user advantage. That's the population of Australia worth of people choosing Threads on mobile every single day.

But why mobile matters so much goes deeper than just "more people use phones." Mobile usage patterns are fundamentally different from web usage. Mobile users are scrollers. They're in transit, waiting in lines, or sitting on couches. They want quick hits of content, not deep dives. They want feeds that work perfectly with one thumb. They want apps that don't drain battery life. Web users, by contrast, sit down deliberately. They're more likely to open multiple tabs, engage in longer conversations, and spend extended time on a single platform.

Threads understood this instinctively. The entire platform was built mobile-first. The interface is optimized for touch, not mouse cursors. The algorithms prioritize short-form content that works in vertical scrolling. Even the naming reflects this mobile-centric vision. Threads suggests conversation threads, the kind of quick back-and-forths that work perfectly on a pocket-sized screen.

X, meanwhile, was built during a different era. Twitter launched in 2006 when mobile was barely a consideration. The platform evolved to support mobile, certainly, but its core architecture reflects web-first thinking. Threading works differently. Quote posts create nested structures. Conversations bifurcate in ways that feel natural on a desktop but create confusion on a four-inch screen.

When Elon Musk took over X in October 2022, he made numerous changes aimed at driving engagement and monetization. Some worked. Others didn't. But none of them fundamentally rethought whether X was actually optimized for how billions of people actually use social media in 2025. That might be the core issue here.

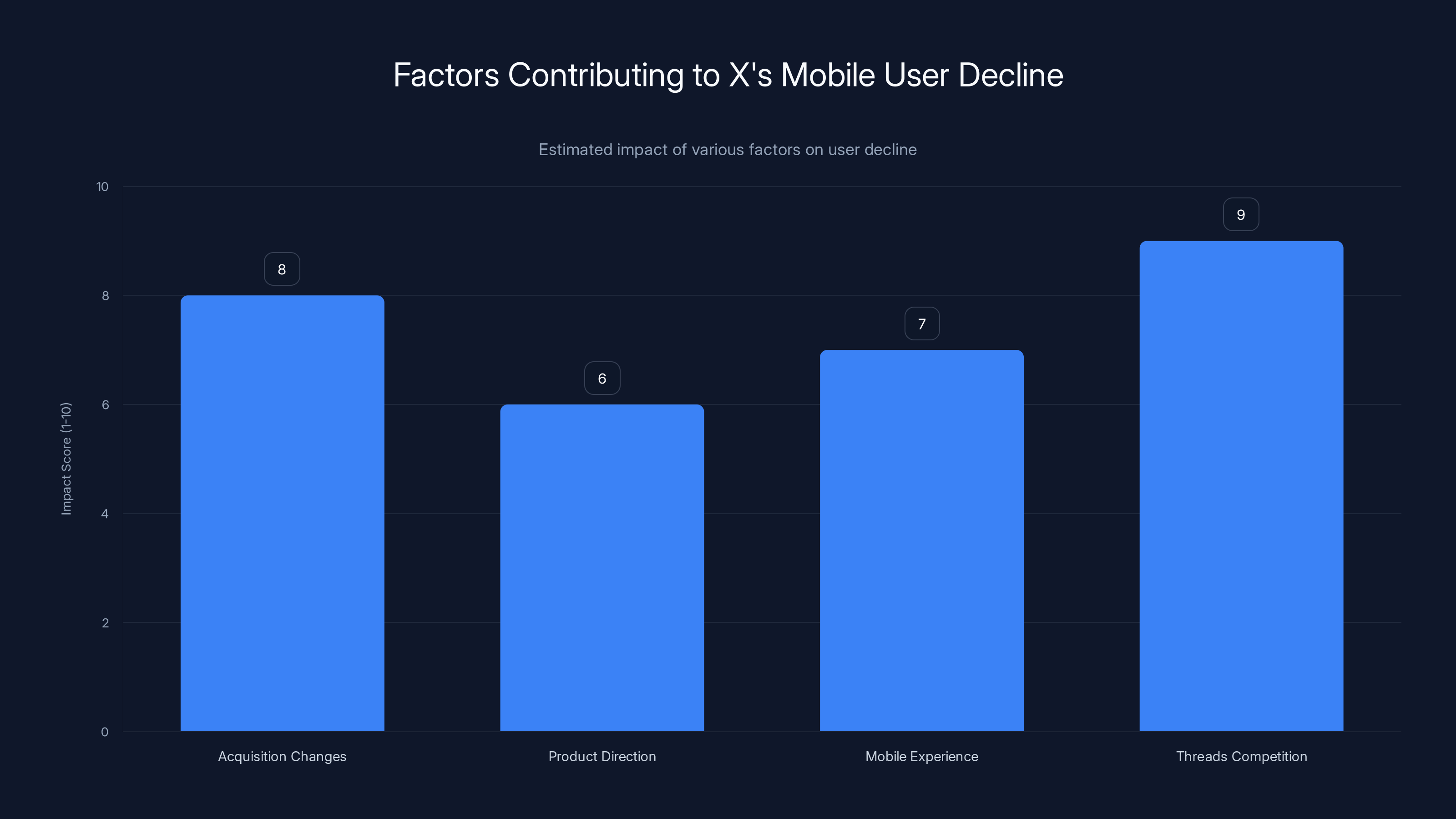

The decline in X's mobile users is attributed to multiple factors, with Threads offering a superior product experience being the most impactful. (Estimated data)

The Numbers Behind the Overtaking: What Similarweb Data Reveals

Let's talk specifics about what happened. Similarweb, a web analytics company that tracks billions of visits, provided the data that confirmed Threads' mobile user overtaking. As of January 7th, Threads registered 141.5 million daily active iOS and Android users globally. X, meanwhile, counted 125 million daily mobile users during the same period.

The overtaking itself wasn't explosive. Threads didn't suddenly surpass X in December 2024 or early January 2025. Instead, the crossover happened between late October and early November of 2024, representing the culmination of months of consistent growth. This gradual trajectory matters because it shows Threads' rise wasn't accident or controversy-driven. It was systematic.

Tracking backwards, you can see Threads' steady climb. Throughout 2024, the platform showed consistent user growth, particularly strong in mobile metrics. Meanwhile, X's mobile user numbers remained relatively flat or declined slightly. By October 2024, the lines on any graph would be converging. By November, they crossed.

One important caveat: these numbers reflect daily active users, not total registered users. X still has more total users overall, but many of those accounts are inactive, abandoned, or used infrequently. Daily active users are the true measure of a platform's health and relevance. An account you haven't opened in months doesn't contribute to engagement, ad revenue, or network effects.

Geographically, the story varies slightly. In the United States specifically, X still maintains mobile user advantage over Threads. Similarweb data shows X ahead domestically, though Threads is catching up rapidly. However, this US lead represents X's stronghold, and even it's eroding. X has approximately half as many daily active mobile users in the US in January 2025 as it did in January 2024. That's a 50% decline in a single year.

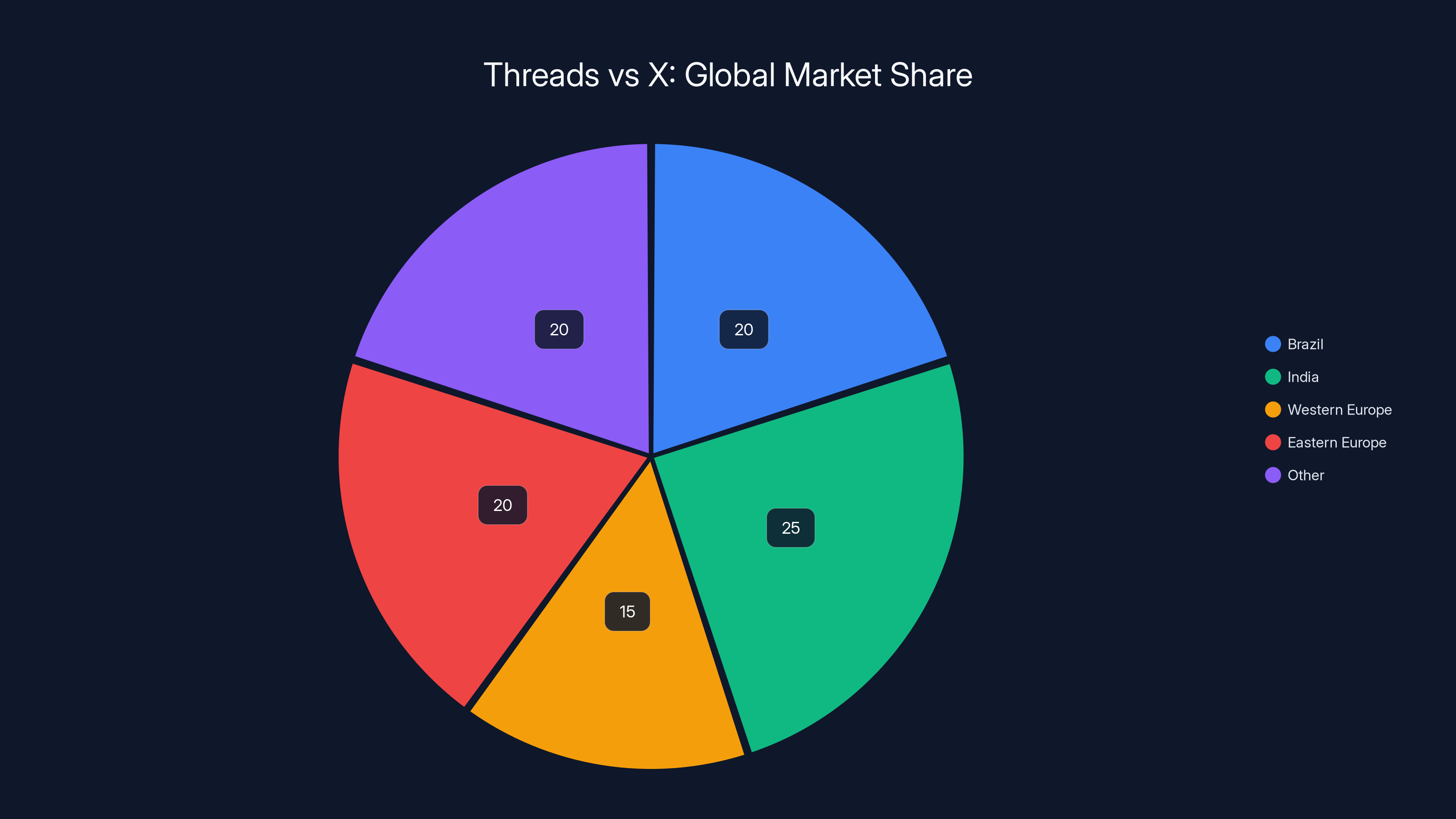

The global picture tells a different story. In many international markets, Threads' mobile dominance is even more pronounced. In Brazil, India, and several European countries, Threads has significantly more mobile users than X. This geographic split explains why X can still claim dominance in some metrics while Threads wins in others.

The Web Traffic Reality Check: Why X Still Dominates

Here's where the story takes a sharp turn. While Threads celebrates mobile supremacy, the web traffic numbers paint an entirely different picture. As of January 13th, 2025, X was attracting 145.4 million daily web visitors. Threads, meanwhile, pulled in just 8.5 million web visitors daily.

That's not even close. That's a 17-to-1 ratio. To put this in perspective, X's web traffic is roughly equal to the combined mobile user base of both platforms. In absolute numbers, X's web visitors exceed Threads' total daily active users across both mobile and web combined.

What explains this massive discrepancy? Several factors converge. First, X's existing desktop user base from the Twitter era represents a massive installed base of people who've built habits around the platform. For many professionals, journalists, and engaged users, X remains the destination for real-time news and conversation. The shift to mobile hasn't eliminated desktop entirely.

Second, X's monetization strategy has been heavily web-focused. When Elon Musk introduced new revenue-sharing models, verification requirements, and premium features, many of these flowed through the web interface first. Desktop users are more likely to click ads, fill out surveys, and engage with sponsored content. This creates a virtuous cycle where advertisers focus on web, driving more engagement there.

Third, and this is crucial, web users tend to be older, more professional, and more monetizable. They're not just scrolling mindlessly. They're reading news, conducting research, and making decisions. A web user represents different value than a mobile user, even if the mobile user base is larger.

Fourth, Threads still lacks certain features that desktop users expect. It launched as a mobile-first platform, which made sense for its intended audience but left desktop users feeling like they were using a stripped-down experience. When you visit Threads on web, it works, but it feels like an afterthought. X's web experience, by contrast, was purpose-built and remains the platform's primary interface for many power users.

Threads surpassed X in daily active mobile users with 141.5 million compared to X's 125 million, highlighting a shift in user engagement towards mobile-first platforms.

Meta's Strategy: How Threads Became the Mobile Alternative

Threads' existence came from a specific strategic vision at Meta. After failing to acquire TikTok and facing regulatory pressure over its monopolistic behavior, Meta needed a new source of growth. Instagram had plateaued. Facebook was aging. The company needed a fresh platform that could capture the emerging social media user base.

When Mark Zuckerberg announced Threads in June 2023, the vision was clear: build a Twitter alternative designed for the modern mobile internet. Not a Twitter clone running on legacy systems, but something purpose-built from the ground up for how people actually use social media in 2025.

This manifested in specific design choices. Threads kept things simple. The mobile interface is uncluttered. The algorithm surfaces relevant conversations without algorithmic bloat. The onboarding experience leverages Instagram's existing user base, meaning new users immediately have followers and connections waiting for them.

Meta invested heavily in infrastructure. The platform needed to handle the traffic spike from Instagram's billion-plus users. It needed to scale rapidly. It needed to be reliable from day one. Most startups don't have this luxury. Threads did because Meta has resources that few companies can match.

The company also understood what Threads needed to avoid: all the things that made existing social platforms annoying. No excessive monetization pressure in the early days. No aggressive dark patterns trying to addict users. No blatant ad invasion. Threads started with a lighter touch, letting the product and user experience speak for itself.

Meta's existing advertising infrastructure also positioned Threads for eventual monetization. Unlike entirely new platforms that need to build ad networks from scratch, Threads could eventually tap into Instagram and Facebook's enormous advertiser relationships. This created a path to profitability that pure competitors could never match.

The timing also helped. Threads launched right as Twitter was experiencing significant turmoil following Elon Musk's acquisition. The platform was hemorrhaging users, experiencing reliability issues, and alienating creators. The zeitgeist created a perfect opportunity for an alternative. Threads captured this moment.

The X Decline: Understanding the Structural Challenges

X's mobile user decline didn't happen in a vacuum. Multiple factors combined to drive the downward trajectory that resulted in losing the mobile crown to Threads.

First, there's the acquisition itself. When Elon Musk took over Twitter for $44 billion in October 2022, he immediately made dramatic changes. He cut roughly 50% of staff. He eliminated numerous policies around content moderation and verification. He introduced controversial features like rate limiting and paid verification. For many users, the changes felt chaotic and poorly thought through.

These changes had consequences. Journalists found their reach diminished. Creators saw engagement drop. Advertisers grew nervous about brand safety. Users who'd spent years building audiences began migrating to alternatives. Each departure made the network less valuable for remaining users, accelerating the decline.

Second, the product direction felt scattered. In one quarter, Musk would emphasize payments and commerce. In the next, he'd focus on long-form content or video. The platform seemed to lurch from one strategic direction to another without clear long-term vision. Users want consistency and predictability. X provided neither.

Third, there's the mobile experience itself. While X works on mobile, it doesn't shine there. The interface requires deliberate navigation. Threading creates cognitive load. Quote posts create nested discussions that are hard to follow on a small screen. Features built for desktop—like the sidebar, advanced search, and detailed analytics—don't translate well to mobile.

Fourth, Threads simply offered a better alternative. Once users tried it, many found it smoother, faster, and more enjoyable. This is the critical factor that often gets overlooked. X didn't lose users because Threads had better marketing or more money. X lost users because Threads provided a better product experience.

Demographics and User Composition: Who's Actually Switching?

The users migrating from X to Threads aren't random. Specific demographic patterns emerge when you look at the data.

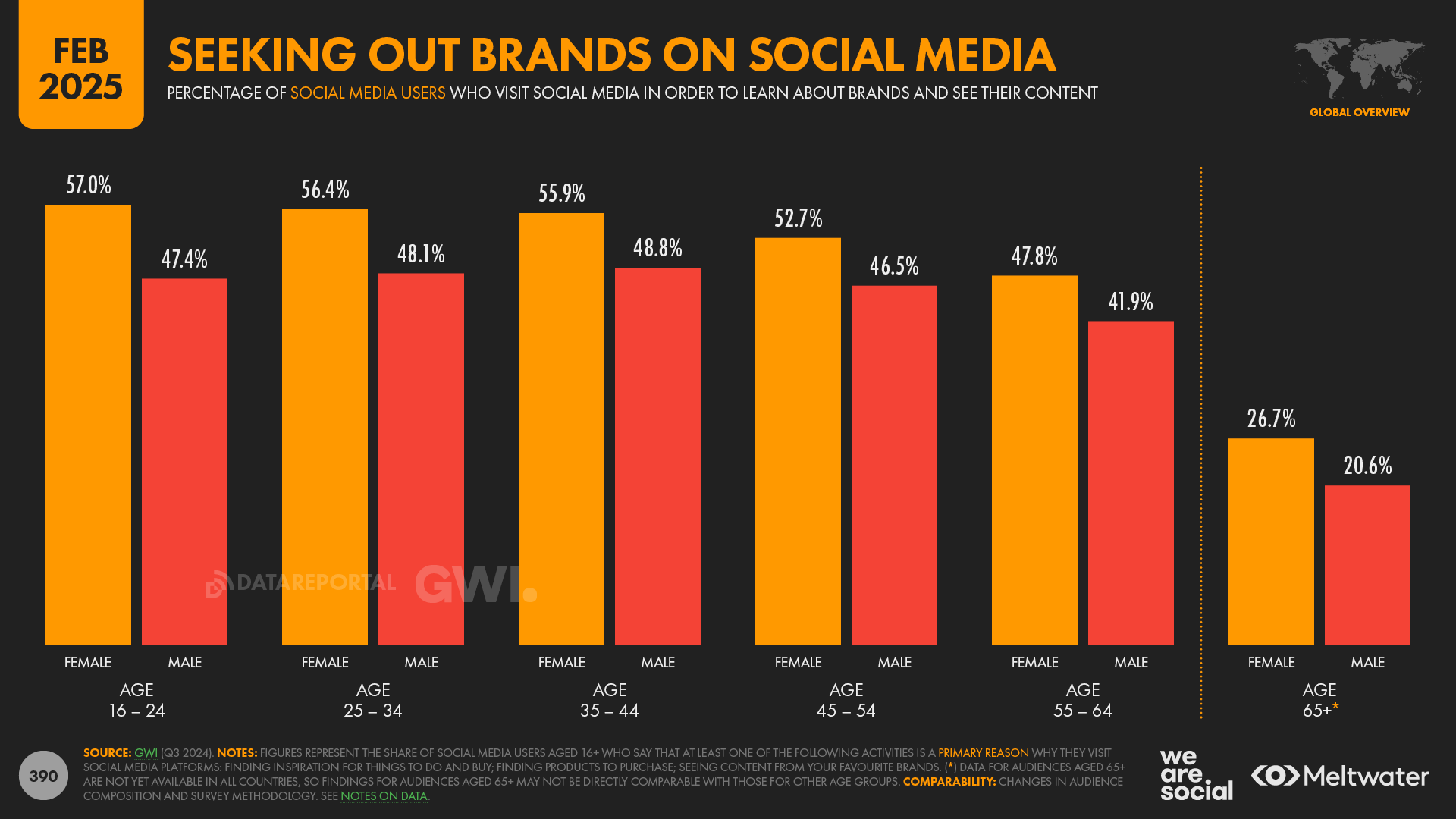

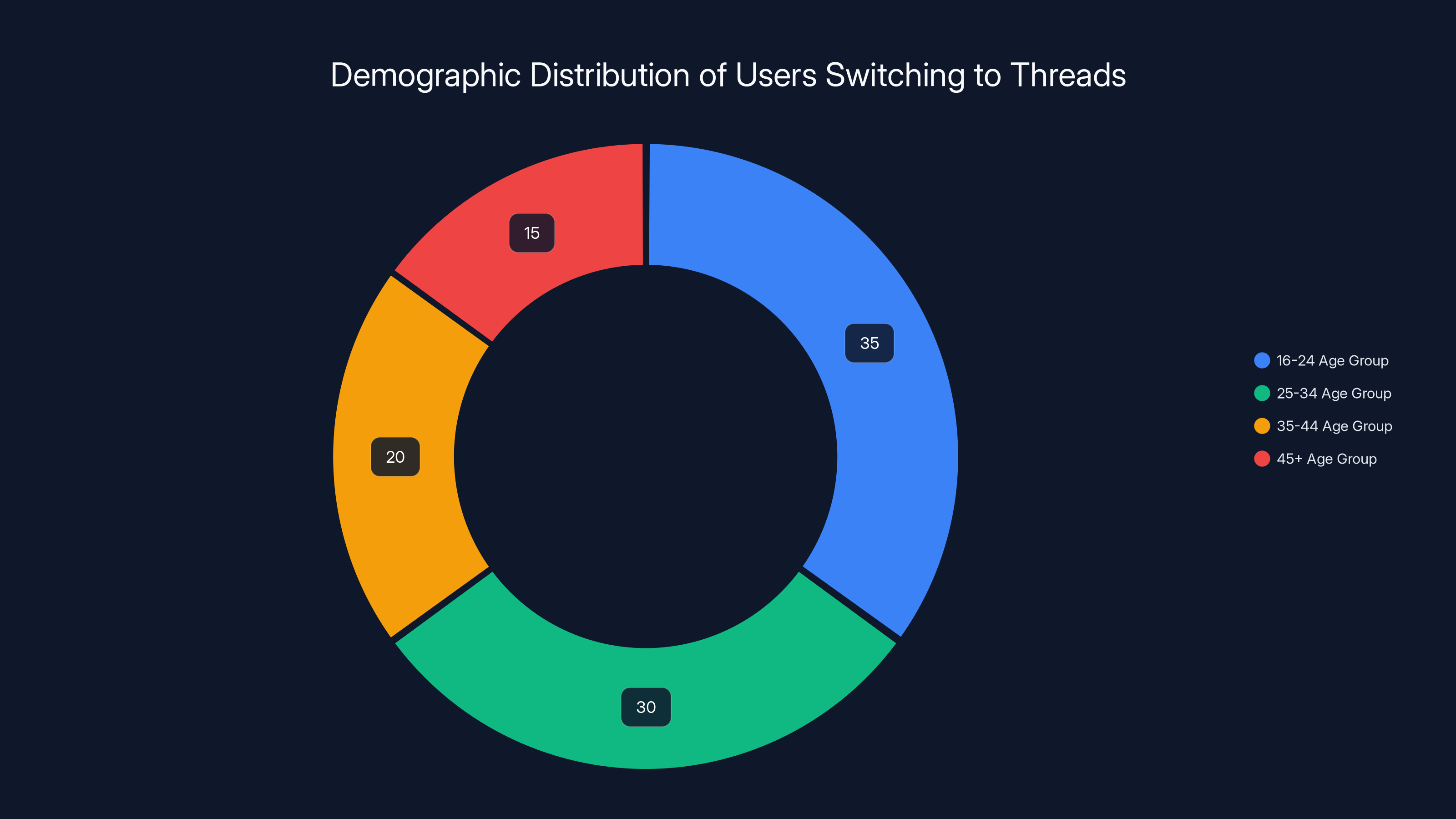

Threads has disproportionate appeal to younger users. While X remained popular with professionals and older demographics, Threads attracted the 16-34 age bracket more heavily. These are digital natives who grew up on mobile and view desktop as a legacy platform. For them, Threads felt natural immediately.

Geographically, Threads shows particular strength in markets where mobile-first internet adoption happened earliest. In India, Southeast Asia, and Latin America, where many users accessed the internet primarily through phones rather than computers, Threads gained traction quickly. X's relative strength in the US reflects the country's higher desktop usage rates among active social media users.

By profession, the shift is revealing. Journalists initially split between platforms. Some maintained X presence out of necessity for news distribution. Others migrated to Threads for a less toxic environment. Academics showed similar patterns. Creators of all types—video, visual content, long-form writing—found Threads' interface more conducive to sharing their work.

Content creators especially embraced Threads. The platform's algorithm doesn't punish external links as severely as X does. Creating content for Threads didn't feel like you were constantly fighting against the platform's incentives. You could share a blog post, link to your Substack, or promote your YouTube channel without feeling like you were gaming the algorithm.

By activity level, Threads captured many casual users who logged in once or twice daily, scrolled their feed, and logged out. X's interface caters more to power users who want granular control and advanced features. This seems counterintuitive—shouldn't power users drive growth? But mobile-first platforms don't work that way. Mobile users don't want complexity. They want elegance.

Threads' consistent growth in daily active mobile users led to overtaking X between October and November 2024. Estimated data shows a systematic rise for Threads, while X's numbers remained flat.

The Engagement Question: Depth vs. Breadth

One metric that matters beyond simple user counts is engagement. Do Threads users actually spend time on the platform and engage with content? Or are they largely passive scrollers?

This is where the analysis becomes more complex. Public data on average session length is limited, but available indicators suggest both platforms retain users, just in different ways. X users tend to have longer, more intentional sessions. They're reading threads, clicking links, and engaging in conversations. Threads users tend to have shorter, more frequent sessions. They're scrolling, liking, and sharing more casually.

From a platform perspective, both engagement models work. X's model suits monetization through premium subscriptions and advertiser relationships. X Premium subscribers are power users willing to pay for better features. Threads' model suits younger users and casual scrollers. Eventually, Meta will monetize these users through advertising once the user base stabilizes.

One factor affecting engagement is the quality of discourse. X became known for high-quality long-form conversations but also for toxicity and harassment. Threads launched with more moderation and fewer inflammatory conversations. Some users find this refreshing. Others miss the high-stakes discourse that made X compelling.

The nature of communities also differs. X's core communities—journalists, tech workers, financial professionals, political junkies—are smaller but incredibly engaged. They make X essential infrastructure for understanding news and current events. Threads' communities are broader but perhaps less deep. They're more lifestyle, entertainment, and casual interest focused.

International Dynamics: The Global Picture

When looking purely at domestic US metrics, X maintains more legitimacy. But globally, the story shifts significantly. Threads' dominance is particularly pronounced in international markets.

Brazil represents perhaps the most dramatic example. The country accounts for roughly 15-20% of Threads' daily active users, making it the largest single geographic market for the platform. Meanwhile, X's presence in Brazil is far smaller. This reflects several factors. Brazil's internet infrastructure is heavily mobile. The country has a large young population. And culturally, Brazilians embraced Threads enthusiastically.

India shows similar patterns. With over 1.4 billion people and a predominantly mobile-first internet, India became crucial for Threads' growth. X has presence in India, particularly among English-speaking elites, but Threads' broader appeal captures larger market share.

Europe presents a mixed picture. Western Europe shows more balanced competition between platforms, with some countries favoring Threads' mobile-friendliness and others maintaining loyalty to X. Eastern Europe and newer EU markets lean toward Threads more heavily.

This geographic split matters strategically. If Threads is dominant in high-growth international markets while X maintains strength in established Western markets, the long-term trajectory likely favors Threads. International users represent growth potential. Western users represent established value but less future expansion.

The Monetization Challenge: How Platforms Translate Users to Revenue

User counts mean nothing without monetization. A platform with 500 million daily active users that can't generate revenue is a charity project, not a business. Conversely, a platform with 100 million users that generates billions in revenue is far more successful.

X has made monetization central to its strategy. The platform relies on advertising for the vast majority of its revenue, with supplemental income from X Premium subscriptions. Since Elon Musk took over, he's pursued aggressive monetization tactics, including rate limiting free users and requiring X Premium for full functionality.

These tactics drive revenue per user up. They also drive engagement down. Users who feel they're being nickeled-and-dimed often reduce their usage. Advertisers who can't reach free users become less interested in the platform. It's a tightrope. You want revenue, but not so much that it destroys the product's core value proposition.

Threads, by contrast, hasn't focused on monetization yet. The platform operates much like Facebook did in its early years—build user base first, monetize later. This approach has advantages. It lets the product develop without short-term revenue pressure. Users stick around because they're not constantly being shown ads or blocked by paywalls.

But it also creates risk. Investors grow impatient. The parent company faces pressure to show returns. Eventually, Threads will need to monetize. When it does, users might react negatively. The transition from free platform to monetized one is notoriously difficult.

Meta can probably navigate this better than most companies. Instagram's transformation from pure social platform to ad-driven platform was handled relatively smoothly. Facebook's monetization, while controversial, generated the financial resources that made the company a colossus. Threads has the advantage of learning from these predecessors.

Estimated data shows that Threads appeals more to younger users, with 65% of its user base under 35. This highlights Threads' success in attracting digital natives.

Content Moderation: The Hidden Factor in User Preferences

One rarely-discussed factor in the X-to-Threads migration is content moderation philosophy. It matters more than you might think.

X has moved toward lighter moderation under Musk's leadership. The platform removed many policies around misinformation, harassment, and harmful content. The stated rationale is that users should decide what's acceptable speech through community notes and quote-posting. The actual result is more toxic interactions, more conspiracy theories, and a more hostile environment for many users.

Threads launched with more proactive moderation. Meta uses automated systems combined with human reviewers to remove clear violations—spam, harassment, explicit content, and misinformation. This creates a cleaner, less chaotic environment. It's not perfect, but it's noticeably different from X's hands-off approach.

For many users, this difference is decisive. They don't want to see constant harassment, conspiracy theories, and inflammatory content. They want to see interesting updates from people they follow. Threads provides this. X increasingly doesn't.

This moderation difference also affects advertiser comfort. Companies want their ads appearing next to high-quality content, not next to hateful tirades or false information. Threads' moderation approach is more advertiser-friendly. As Meta eventually monetizes Threads, this becomes a significant advantage over X.

Prediction Accuracy: The Data Pointed Here

In retrospect, the Threads overtaking wasn't surprising. Anyone paying attention to the metrics could see it coming.

By mid-2024, the trend was unmistakable. Threads' growth trajectory was consistent. X's decline was steady. The crossover was inevitable. Some observers predicted it would happen in late 2024. It did. Others thought it might take longer. It happened faster.

The surprise wasn't that it happened, but that so few people predicted it. The tech industry and media were skeptical of Threads from the beginning. Many thought it was just another Meta product that would fail to gain traction. Some believed X was too entrenched, too essential for too many users. The data suggested otherwise.

What's interesting is that X's total user base actually increased during this period in some metrics. X didn't lose users to inactivity; it lost them to Threads. It's a direct migration. When given a modern alternative that works better on mobile and feels less hostile, users chose Threads.

What This Means for the Future: Three Possible Scenarios

The Threads overtaking raises questions about social media's future. What happens next? Several scenarios seem plausible based on current trajectories.

Scenario One: Continued Threads Growth and X Decline. Threads continues gaining users while X slowly shrinks. Eventually, X becomes a niche platform for specific communities—journalists, financial professionals, diehard power users. It remains valuable but becomes less central to mainstream social media discourse. Meta becomes the dominant social media company with even greater market share. This scenario seems consistent with current trends.

Scenario Two: Market Stabilization and Dual Dominance. The migration slows as migration always does. Users who want to migrate have already done so. Remaining X users are those most committed to the platform. A new equilibrium emerges where both platforms maintain significant user bases but serve different purposes. X remains the professional network; Threads becomes the consumer network. This seems less likely given X's recent experience but remains possible.

Scenario Three: New Competitor Emergence. Threads' success attracts competitors. Other tech companies launch social media platforms. X adapts and improves. The market fragments further. No single dominant platform emerges. This would represent a return to pre-Twitter fragmentation. It seems unlikely given network effects, but it's not impossible.

Most likely is Scenario One. The trends are too clear, the advantages too pronounced, and the inertia too strong for significant reversal. Threads will probably eventually surpass X in all meaningful metrics except perhaps total registered users.

Threads surpassed X in mobile users with 150 million daily active users, while X dominates web usage with 145.4 million users. Estimated data for mobile users.

The Broader Implications: What This Tells Us About the Internet

The Threads vs. X dynamics reveal something fundamental about the internet's evolution in 2025. User preferences and platform design matter more than ownership or investment. Meta's resources helped, but they weren't decisive. Threads succeeded because it offered a better user experience.

This suggests the era of web 2.0 dominance by monolithic platforms is ending. Users now have choices and use them. When a platform becomes hostile or antiquated, users migrate. When a better alternative exists, users try it. Network effects still matter, but they're not absolute.

Second, mobile-first design will continue dominating. The internet has been mobile-first for years, but most platforms were still fundamentally built for desktop. Threads' success proves that platforms designed from the ground up for mobile outperform those trying to retrofit mobile into legacy systems.

Third, user experience and moderation philosophy matter as much as features. Threads doesn't have capabilities X lacks. It doesn't have superior algorithms. It has a better overall product feel and less toxic interactions. For most users, that's enough.

Fourth, the social media market isn't zero-sum. X's decline doesn't mean it's dying. It means it's specializing. The biggest opportunity isn't X replacing Threads or vice versa. It's both platforms serving distinct markets effectively.

Lessons for Platforms and Creators

What should creators and businesses take from the Threads overtaking? Several lessons emerge.

First, diversify your presence. Don't put all your eggs in one platform basket. The last decade has taught repeatedly that platform dominance isn't permanent. Threads' rise, TikTok's growth, Instagram's evolution—all came suddenly. Building presence across platforms hedges risk.

Second, optimize for mobile. Whatever platform you use or build, make sure the mobile experience is excellent. This is where users are. This is where growth happens. Desktop optimization is secondary.

Third, user experience beats features. Creators want platforms that make sharing and connecting easy. Algorithm changes that obscure your content or make distribution difficult drive creators away. Platforms that respect users' time and attention retain them.

Fourth, understand your audience demographics. X remains essential for journalists and financial professionals. Threads works better for general audiences. Choose platforms matching your target users.

The Competitive Landscape: Other Platforms' Response

Threads' rise and X's decline have reverberated across the social media landscape. Other platforms have watched carefully and adjusted strategies accordingly.

Bluesky, the Twitter alternative launched by former Twitter CEO Jack Dorsey, presented itself as a decentralized alternative to centralized platforms. The platform gained some traction, particularly among journalists and early adopters disillusioned with X. However, Bluesky's growth has been moderate and hasn't seriously challenged either Threads or X for overall market share.

Mastodon, the open-source, decentralized social network, saw brief interest spikes when users fled Twitter but hasn't maintained momentum. Its decentralized nature appeals to privacy advocates and tech enthusiasts but doesn't work for mass audiences.

Instagram has increasingly positioned itself as a TikTok alternative, focusing on Reels short-form video. This creates interesting synergy with Threads, as Instagram can drive users to Threads and vice versa. Meta's portfolio approach—where different platforms serve different needs—provides significant competitive advantage.

TikTok remains the growth engine in social media, attracting younger users and driving time spent. However, TikTok's geopolitical challenges in the US market create opportunity for other platforms. Threads has benefited somewhat from users looking for TikTok alternatives when political pressure against the Chinese-owned platform intensifies.

Larger tech companies are watching too. Apple has reportedly explored building a social network. Google maintains various social ambitions. Amazon has considered social platforms. The competitive landscape remains dynamic, though Meta's dominance through Instagram, Facebook, and now Threads seems nearly unassailable.

Threads shows significant dominance in Brazil and India, capturing large market shares due to mobile-first internet usage and cultural adoption. Estimated data.

Technical Infrastructure: The Unsexy Factor That Matters

One aspect of the Threads vs. X story that gets overlooked is technical infrastructure. Building a platform that can handle 141.5 million daily active mobile users is hard. Doing it reliably is even harder.

Threads had Meta's infrastructure advantage. Meta runs some of the largest data centers in the world. The company has decades of experience scaling social platforms to billions of users. When Threads needed to handle surge traffic, the infrastructure was ready. When reliability needed to improve, Meta's teams could focus on product rather than basic scaling.

X has had infrastructure challenges. Rate limiting in 2023 was partly about technical capacity. When traffic surged, the system couldn't handle it. This frustrates users and drives them to alternatives that work better. Technical reliability might not seem like a feature, but it's essential.

Threads' infrastructure advantage probably won't be talked about in five years. But it was crucial to the platform's success. When a user opens the app and it loads instantly, they don't think about the thousands of servers making that happen. But they notice when it doesn't work.

The Creator Economy Implications

Threads' rise has affected the creator economy in specific ways. Creators making a living through social media need to understand where their audiences are shifting.

For most creators, the answer is: both platforms matter, but in different ways. X remains important for reach and discoverability. Journalists, tech creators, and thought leaders still need X presence because that's where their professional peers and audiences congregate.

But Threads is increasingly where general audiences spend time. Entertainment creators, lifestyle creators, and community builders have found more success on Threads for building engaged followers.

Money-wise, X Premium's revenue-sharing program provides direct monetization for creators. Threads hasn't launched equivalent monetization yet. This is changing—Meta has indicated Threads will eventually have creator monetization—but as of now, most creator income still comes through X Premium, sponsorships, or leveraging social platforms for audience before monetizing elsewhere.

The optimal strategy for most creators: maintain X presence for professional credibility and discoverability, build Threads presence for engaged audience growth, and diversify across Substack, YouTube, or other platforms for direct monetization.

The Advertiser Perspective: Where Marketing Dollars Flow

Advertisers represent another crucial constituency. Where they spend money determines platform success more than user counts do.

X still attracts premium advertising because of its professional audience concentration. A luxury brand might prefer X's smaller but wealthier and older demographic to Threads' larger but younger audience. Financial services companies want access to X's finance and business professionals.

Threads attracts different advertiser categories. Retail, entertainment, fashion, and consumer goods companies want access to broader demographics. As Threads' youth skew becomes more pronounced, entertainment and consumer brands will invest more heavily.

Mediawise, advertising dollars follow users. As Threads grows, more advertising dollars naturally flow there. Meta has every incentive to make Threads' ad product superior to X's. The company's decades of advertising platform experience should make this possible.

Long-term, we should expect Threads to capture increasing advertising share. The platform's growth trajectory, younger demographic, and mobile focus all support this. X's niche professional audience provides value but limits total advertising market available.

Privacy and Data Concerns: The Asterisk Under Threads' Success

Threads' rise happened against important questions about privacy and data. Meta's history with user data is complex. The company has faced regulatory action, fines, and public criticism over privacy practices. Some users choosing Threads over X might be making a conscious choice. Others might not fully understand they're trading one large data collector for another.

X under Elon Musk has actually improved in some privacy respects. The company has been more transparent about data collection and taken a somewhat harder line on third-party access to user data. However, the perception remains that X is chaotic and unpredictable on privacy matters.

Threads operates under Meta's existing privacy framework, which is extensive. The company collects substantial data for targeted advertising. For users concerned about privacy, both platforms have drawbacks. The choice becomes which drawback you prefer.

This probably doesn't significantly affect user choices. Most users prioritize user experience and functionality over privacy concerns, even if they claim to care about privacy in surveys. Threads' success suggests privacy wasn't a deciding factor. Experience and moderation mattered more.

Regulatory Challenges: The Elephant in the Room

Both platforms face regulatory pressure, though in different forms. For Threads, the challenge is Meta's overall market dominance. Regulators in the EU, UK, and US have all investigated Meta's practices. The company faces potential breakup discussions and substantial fines.

Threads' growth could draw regulatory scrutiny around anti-competitive practices. If regulators decide Meta is using Instagram's installed base to unfairly advantage Threads, they might mandate changes or restrictions.

X faces different regulatory challenges. The platform's moderation approach and Elon Musk's political statements have drawn regulatory attention in multiple countries. Some nations have threatened to ban or restrict X entirely. These regulatory risks didn't directly cause user migration to Threads, but they contributed to the perception that X's future is uncertain.

The regulatory landscape will probably matter more in the next few years. If EU regulations force Meta to separate Threads from Instagram, Threads' growth could slow significantly. If X faces bans in major markets, the user migration could accelerate.

The Narrative Shift: How Media Coverage Influenced Perceptions

One often-overlooked factor in social media platform dynamics is media coverage and narrative. How journalists and tech commentators write about platforms influences user perceptions and adoption rates.

In 2023 and 2024, X received mostly negative coverage. Articles about Threads moving users away, about X's reliability problems, about the toxicity of post-Musk X dominated the discourse. This narrative didn't create the trends, but it reinforced them.

Threads, meanwhile, received mostly positive coverage about growth, user migration, and fresh alternatives. The narrative was hopeful and forward-looking.

This media effect probably accelerates whatever underlying trends exist. Users who hear repeatedly that "everyone's moving to Threads" are more likely to try Threads themselves. They see their favorite creators on Threads and follow them there. Small trends become self-fulfilling prophecies.

X's media narrative also matters for perception if not necessarily reality. Even if X generates more web traffic and more total engagement, the perception among casual users is that X is dying and Threads is the future. These perceptions affect user behavior.

Looking Forward: The Next Chapter

If Threads' mobile overtaking of X represents one chapter in social media's evolution, what comes next?

Most likely, we'll see Threads continue gaining share across all major metrics. X will stabilize as a specialized platform for professionals while remaining culturally significant. Both platforms will find sustainable equilibrium at different scale levels.

Threads will eventually need to monetize, which will test whether users stick around when ads become prominent. Meta probably navigates this successfully based on past experience, but it remains a key inflection point.

New platforms will probably emerge, particularly if regulatory pressure forces Meta to make structural changes. The most successful will probably continue the mobile-first, user-experience-focused approach that made Threads successful.

The broader internet discourse will gradually shift further toward mobile-native platforms. Desktop, while it won't disappear, will become increasingly specialized and professional.

What's clear is that the era of any single social platform dominating completely is ending. Instead, a more complex ecosystem with different platforms serving different purposes for different demographics will emerge. Threads and X represent this new normal where size and success are measured differently depending on your use case and audience.

Conclusion: The Significance of the Shift

The fact that Threads overtook X in daily active mobile users represents a genuine milestone in social media history. It signals the end of Twitter's universal dominance, the viability of Meta's decentralized approach across multiple platforms, and the acceleration of mobile-first internet culture.

But it's important to contextualize this victory properly. Threads surpassing X in mobile users doesn't mean X is finished or irrelevant. X maintains substantial web traffic, cultural significance, and professional utility that won't disappear overnight. Specialized platforms often succeed even as they lose broader market share.

What it does mean is that the social media landscape has fundamentally shifted. Users now have meaningful choices. When platforms become hostile or antiquated, users migrate. When better alternatives exist, users try them. This represents a maturation of the internet where product quality and user experience matter more than network effects and lock-in.

For Meta, Threads' success validates the strategy of building mobile-first alternatives to mature platforms. For X, the decline serves as warning that even established platforms can lose dominance if they neglect user experience and community health.

For the rest of us, the Threads overtaking means the social media landscape will remain competitive and dynamic. New platforms can still succeed. Established platforms can fail. Users have agency in determining which platforms thrive.

As we move further into 2025 and beyond, watch where the migration trends point next. They'll tell you where the internet is actually heading, regardless of what executives and venture capitalists claim.

FAQ

What does it mean that Threads overtook X in daily mobile users?

It means Threads reached 141.5 million daily active users on iOS and Android, exceeding X's 125 million daily mobile users, according to Similarweb data as of January 2025. This represents the culmination of months of consistent user migration from X to Threads, with the actual crossover occurring between late October and early November 2024. Daily active users represent the most important metric for measuring platform health and relevance, as they reflect actual engagement rather than total registered accounts.

Why do mobile users matter more than total registered users on social platforms?

Daily active users (DAU) directly indicate which platforms people actually use regularly, while total registered users include abandoned accounts and infrequent users that don't generate engagement or revenue. Mobile users specifically matter because over 60% of all social media usage happens on smartphones and tablets. A platform with 100 million active daily mobile users has more value and momentum than one with 500 million registered accounts where users rarely log in. Investor valuations, advertiser interest, and strategic importance all track more closely to DAU than total registrations.

How does X maintain web dominance while losing mobile dominance to Threads?

X attracts 145.4 million daily web visitors compared to Threads' 8.5 million daily web visitors, despite losing the mobile user race. This reflects different user demographics and usage patterns. X's web experience caters to professional users, journalists, and power users who deliberately sit down to engage with content. Threads, designed mobile-first, excels at casual scrolling but hasn't fully optimized for desktop. Additionally, X's desktop user base from the pre-Musk Twitter era built habits that persist. Monetization also favors X's web traffic since desktop users engage with advertising more effectively.

What factors caused users to migrate from X to Threads?

Multiple interconnected factors drove migration including product design (Threads optimized for mobile while X required adaptation), user experience (simpler interface, faster loading), content moderation (Threads' proactive approach versus X's lighter moderation), and organizational stability (X's constant change versus Threads' consistent development). X's reliability issues in 2023-2024 frustrated users, while Threads simply offered a modern alternative built for how people actually use social media. The migration wasn't because of any single factor but rather the accumulated weight of many small advantages favoring Threads.

Is X dying or just becoming a niche platform?

X isn't dying but is specializing into a niche platform focused on professionals, journalists, and power users who find value despite its challenges. The platform still generates substantial revenue, maintains cultural significance in news cycles, and retains core communities that depend on it. However, X is no longer a mass-market social platform but rather a specialized tool for specific communities. This represents a significant change from its Twitter era universal appeal but doesn't make X irrelevant. Specialized platforms can remain extremely valuable even as they lose broader market share.

When will Threads surpass X in web traffic, and does it matter?

Based on current trajectories, Threads will probably need several years to build web traffic comparable to X's current numbers. However, the timeline depends partly on when and how Meta monetizes Threads, which could accelerate or decelerate growth. Whether Threads needs web dominance matters less than whether it captures the daily active users and engagement necessary to sustain growth and monetization. Mobile dominance combined with growing web presence probably suffices for Threads' long-term success even if X maintains some web traffic advantage.

How will advertiser spending shift between the platforms?

Advertisers will increasingly shift budgets toward Threads as the platform grows and Meta makes its advertising products more sophisticated. However, X's professional audience and specialized communities will retain premium advertising value for certain categories like financial services, luxury goods, and B2B services. Expect a gradual reallocation where Threads captures growing share of consumer brands and entertainment advertising while X retains finance and professional services. This split reflects different advertiser needs and audience values.

Could X successfully compete with Threads if Elon Musk made different product decisions?

Possibly, though it would require fundamental architectural changes that would take years. X would need to rebuild its mobile interface from the ground up, dramatically improve reliability, and moderate content more proactively. The bigger challenge is that network effects favor newer platforms starting fresh. Users migrating to Threads gain immediate followers from Instagram, while X would need to rebuild that network. Hypothetically better product decisions might have slowed Threads' rise, but reversing the current trajectory would be extremely difficult regardless of decisions going forward.

What happens to the broader social media ecosystem as these dynamics play out?

The ecosystem will likely remain fragmented with different platforms serving different purposes for different demographics rather than any single dominant platform. Threads will probably become the primary consumer social network while X specializes in professional and news-focused communities. New competitors will emerge to fill gaps. Instagram maintains photo and video dominance. TikTok continues attracting younger users. This represents a healthier, more competitive market than the pre-Twitter-Musk era when single platforms could maintain near-total dominance.

Key Takeaways

- Threads achieved 141.5 million daily active mobile users, surpassing X's 125 million as of January 2025, after crossing over between October-November 2024

- X maintains dominant web traffic advantage with 145.4 million daily web visitors versus Threads' 8.5 million, showing platform specialization by device type

- Mobile-first architecture and improved user experience were decisive factors in user migration, more impactful than any single feature or controversy

- Different platform strengths emerging: Threads leads in consumer mobile engagement while X specializes in professional and news-focused communities

- Meta's portfolio advantages—including Instagram integration and proven infrastructure—provided crucial competitive advantages Threads competitors couldn't replicate

Related Articles

- Bluesky's New Features Drive 49% Install Surge Amid X Crisis [2025]

- Why Grok's Image Generation Problem Demands Immediate Action [2025]

- Grok AI Deepfakes: The UK's Battle Against Nonconsensual Images [2025]

- How Grok's Deepfake Crisis Exposed AI Safety's Critical Failure [2025]

- X Platform Outages: What Happened and Why It Matters [2025]

- Very Chinese Time: Why The Meme Went Viral [2025]

![Threads Overtakes X on Mobile: What This Means for Social Media [2025]](https://tryrunable.com/blog/threads-overtakes-x-on-mobile-what-this-means-for-social-med/image-1-1768824447808.jpg)