Space X Acquires x AI: Creating the World's Most Valuable Private Company [2025]

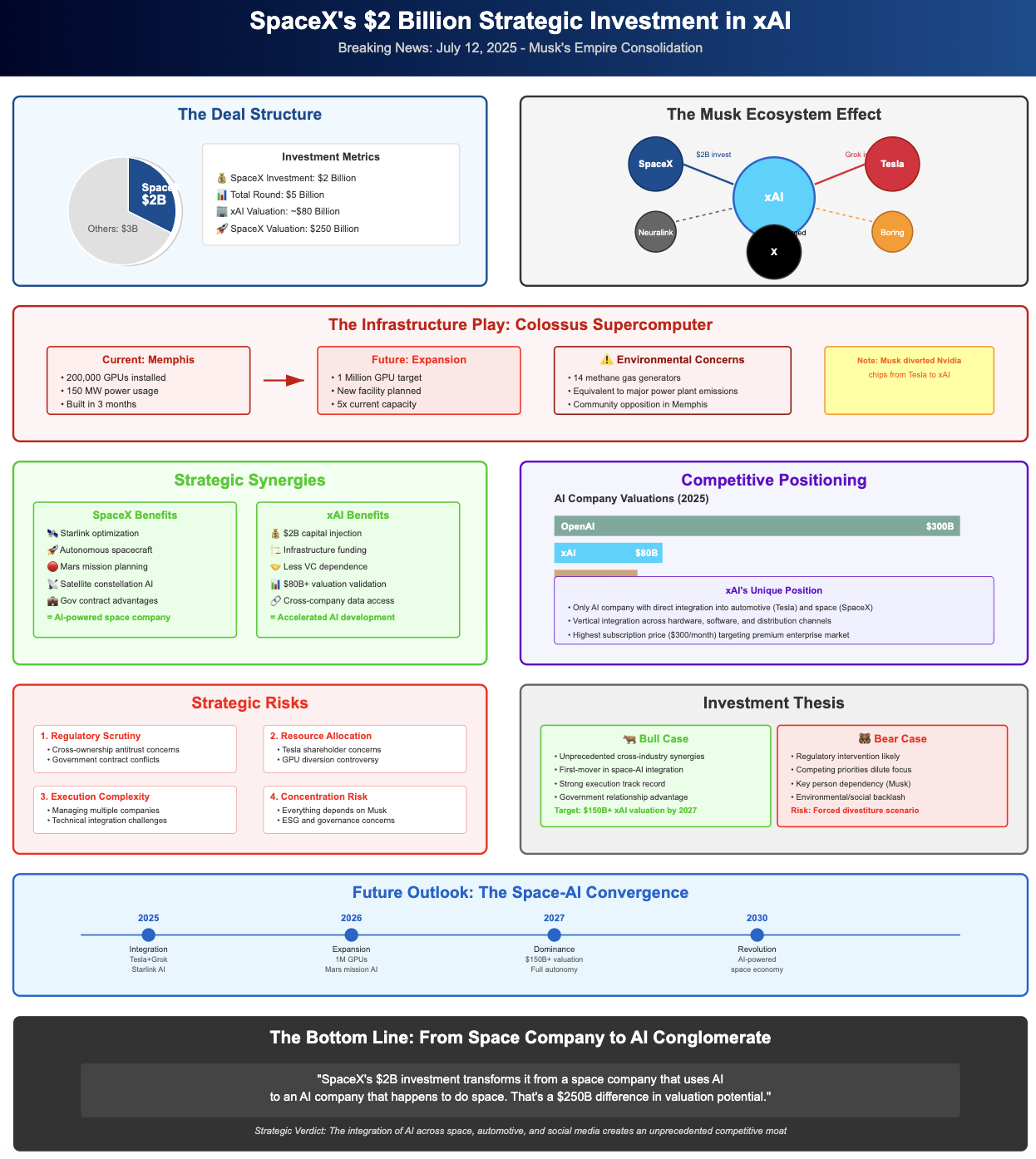

When Elon Musk announced that Space X was acquiring his AI startup x AI, the business world did a double take. This isn't just another tech acquisition. It's the merging of two companies valued at over $1 trillion combined, creating the most valuable private company on Earth.

But here's what's actually striking: this deal reveals how one person is consolidating unprecedented control over technologies that shape national security, artificial intelligence, and global communication infrastructure. Space X controls satellite networks. x AI controls cutting-edge large language models. And x AI already owns X, formerly Twitter, the world's most influential social media platform.

So what does this actually mean? Why does Musk care about merging these companies? And what happens to competition when one person controls the rockets, the AI, and the megaphone?

That's what we're breaking down in this comprehensive guide. Whether you're an investor trying to understand the deal's implications, a technologist concerned about concentration of power, or simply curious about where tech is heading, this article covers everything.

TL; DR

- The Deal: Space X is acquiring x AI in a move that values the combined entity at $1.25 trillion, making it the world's most valuable private company

- The Logic: Musk argues that space-based data centers are necessary to power future AI systems, requiring integration of satellite infrastructure with AI technology

- The Consolidation: This merger represents x AI's second major acquisition in months, following its $110 billion acquisition of X (formerly Twitter) last year

- The Valuation: Space X alone was valued at 20 billion at a $230 billion valuation in late 2024

- The Implication: One person now controls rockets, AI systems, social media infrastructure, neural interfaces, and tunneling technology—raising regulatory and competition concerns

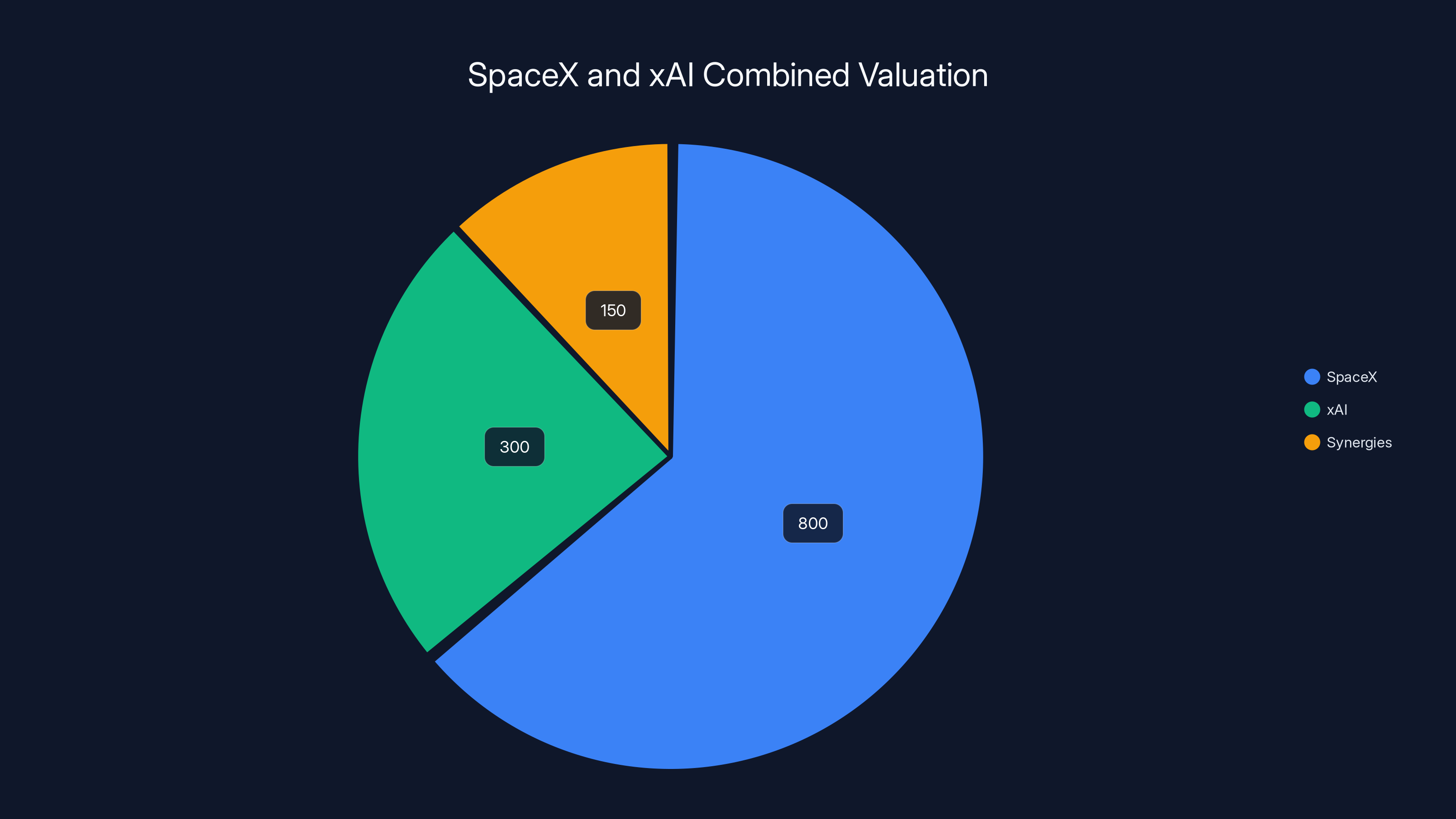

The $1.25 trillion valuation of the combined SpaceX and xAI is estimated to be primarily driven by SpaceX's existing value, with significant contributions from xAI and potential synergies. Estimated data.

The Acquisition: What Happened and Why It Matters

On a Monday in early 2025, Musk published a blog post announcing that Space X would acquire x AI. The announcement was characteristically bold. Rather than filing SEC paperwork and quietly negotiating terms, he explained the rationale in publicly accessible language: AI data centers consume so much electricity that Earth-based infrastructure can't support them long-term.

"In the long term, space-based AI is obviously the only way to scale," Musk wrote. The logic is that Space X's satellite infrastructure and launch capabilities could transport massive data center hardware to orbit, where solar power and thermal dissipation become easier problems to solve than on the ground.

The deal values the combined entity at $1.25 trillion, a figure that positions Space X above every other private company in the world. For context, that's higher than the market cap of most Fortune 500 companies. It surpasses the valuation of Apple when adjusted for pure enterprise value.

But valuations alone don't tell the story. What matters is what this consolidation represents: one person controlling multiple critical infrastructure layers simultaneously.

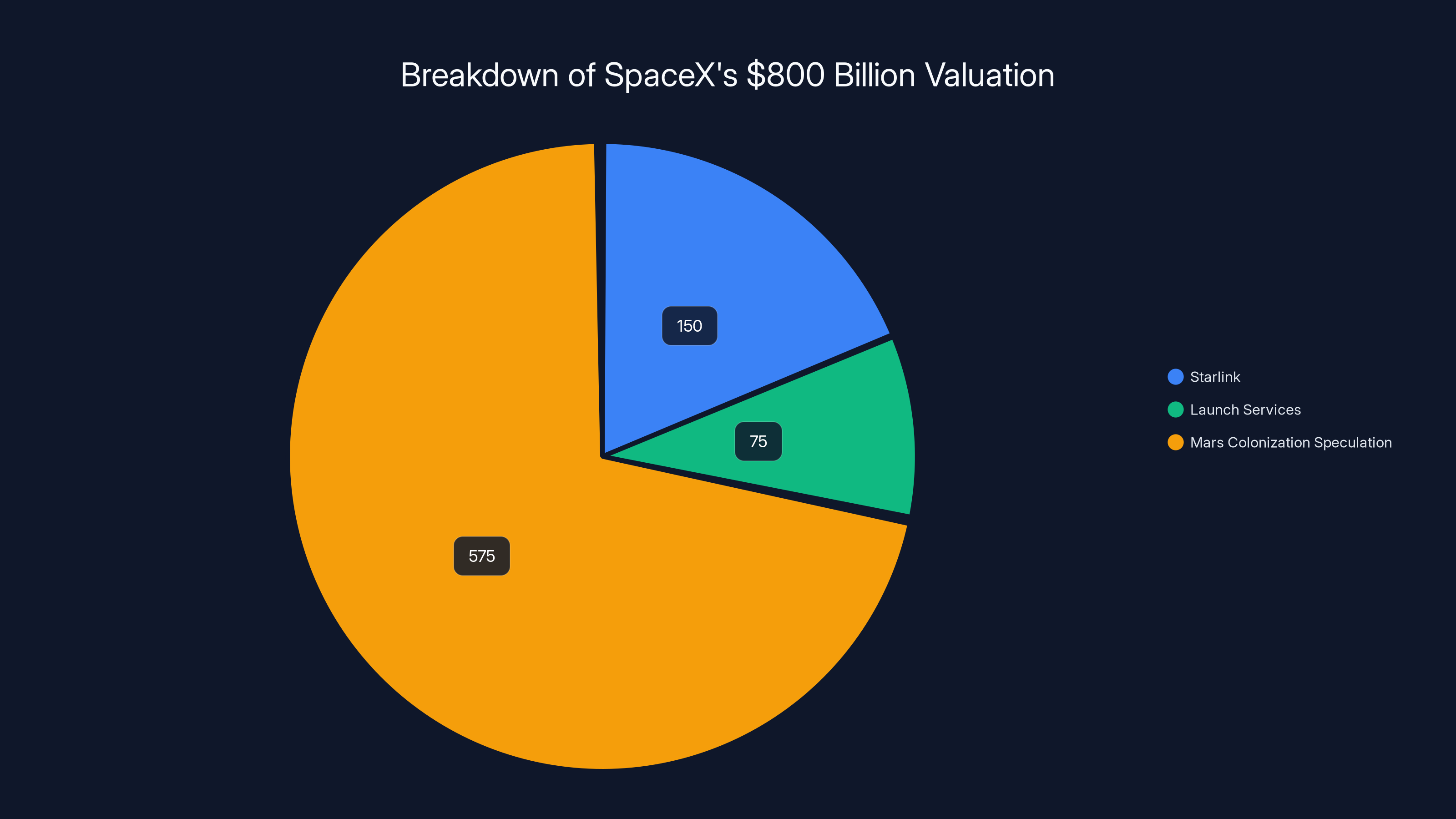

Starlink and Launch Services contribute significantly to SpaceX's valuation, but Mars colonization speculation forms the largest component. Estimated data.

Space X's Role: The Rocket Company Goes AI-First

Space X started in 2002 as a rocket company. Its mission was straightforward: reduce the cost of space access, enable human Mars colonization, and eventually establish a multi-planetary civilization.

Over two decades, Space X accomplished something remarkable. It developed the Falcon 9 rocket, the first orbital-class rocket capable of landing itself and being reused. It created the Starship fully reusable super-heavy lift vehicle. It deployed Starlink, a constellation of thousands of satellites providing global broadband internet.

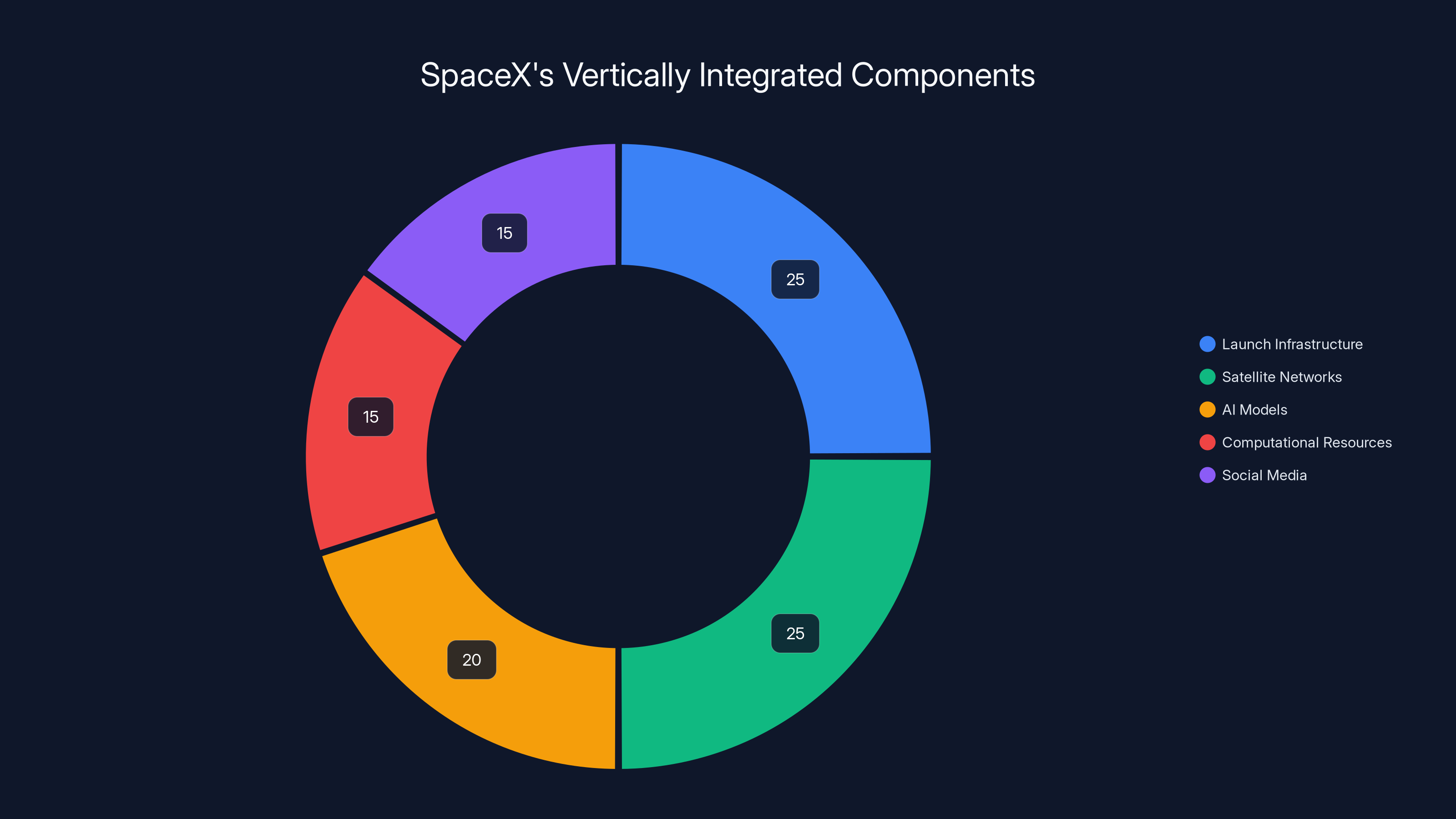

But in 2025, Space X isn't just a rocket company anymore. By integrating x AI, it becomes a vertically integrated entity controlling:

- Launch infrastructure to reach orbit

- Satellite networks for communication and power transmission

- AI models to operate those networks autonomously

- Computational resources to run advanced AI systems

- Social media as a distribution channel and data source

This vertical integration creates a closed loop. Space X can use x AI's AI models to optimize satellite operations. It can use Starlink data to train those models. It can promote x AI's consumer products through X. Each component strengthens the others.

Now here's where it gets interesting. Space X wasn't planning to stay private much longer. The company was preparing for an initial public offering (IPO) later in 2025, according to reporting from Bloomberg. An IPO would have exposed Space X to public markets, SEC scrutiny, and shareholder demands for quarterly profits.

But merging with x AI changed the calculus. The combined entity remains private, which means less regulatory oversight, no quarterly earnings pressure, and continued operational flexibility for Musk to pursue long-term bets that might not generate immediate returns.

x AI's Trajectory: From Startup to Infrastructure Company

x AI is less than two years old. Musk founded it in early 2023, positioning it as an alternative to Open AI, which had pivoted toward serving enterprise customers and building commercial products.

The company's core product is Grok, an AI assistant that was designed with a contrarian, sometimes irreverent personality. Unlike Chat GPT, which refuses certain queries and carefully balances political neutrality, Grok was built to be provocative and willing to engage with edgy topics.

But Grok wasn't just a chatbot. x AI assembled a team of world-class ML researchers—many poached from Google Deep Mind, Open AI, and Tesla. The company raised

But here's the critical part: last year, x AI acquired X (formerly Twitter) for over $110 billion. This gave x AI not just a consumer product, but a data source. X's platform generates billions of text interactions daily. That data feeds Grok, trains x AI's models, and provides real-time signals about what humans are interested in.

So by the time of the Space X-x AI merger, x AI had already transformed from a pure research company into a full-stack enterprise:

- AI Research: Building foundational models

- AI Products: Deploying Grok to consumers

- Data Infrastructure: Owning X's platform

- Distribution: Integrated into X for user acquisition

Now it was adding a fifth layer: Physical Infrastructure through Space X's rockets and satellites.

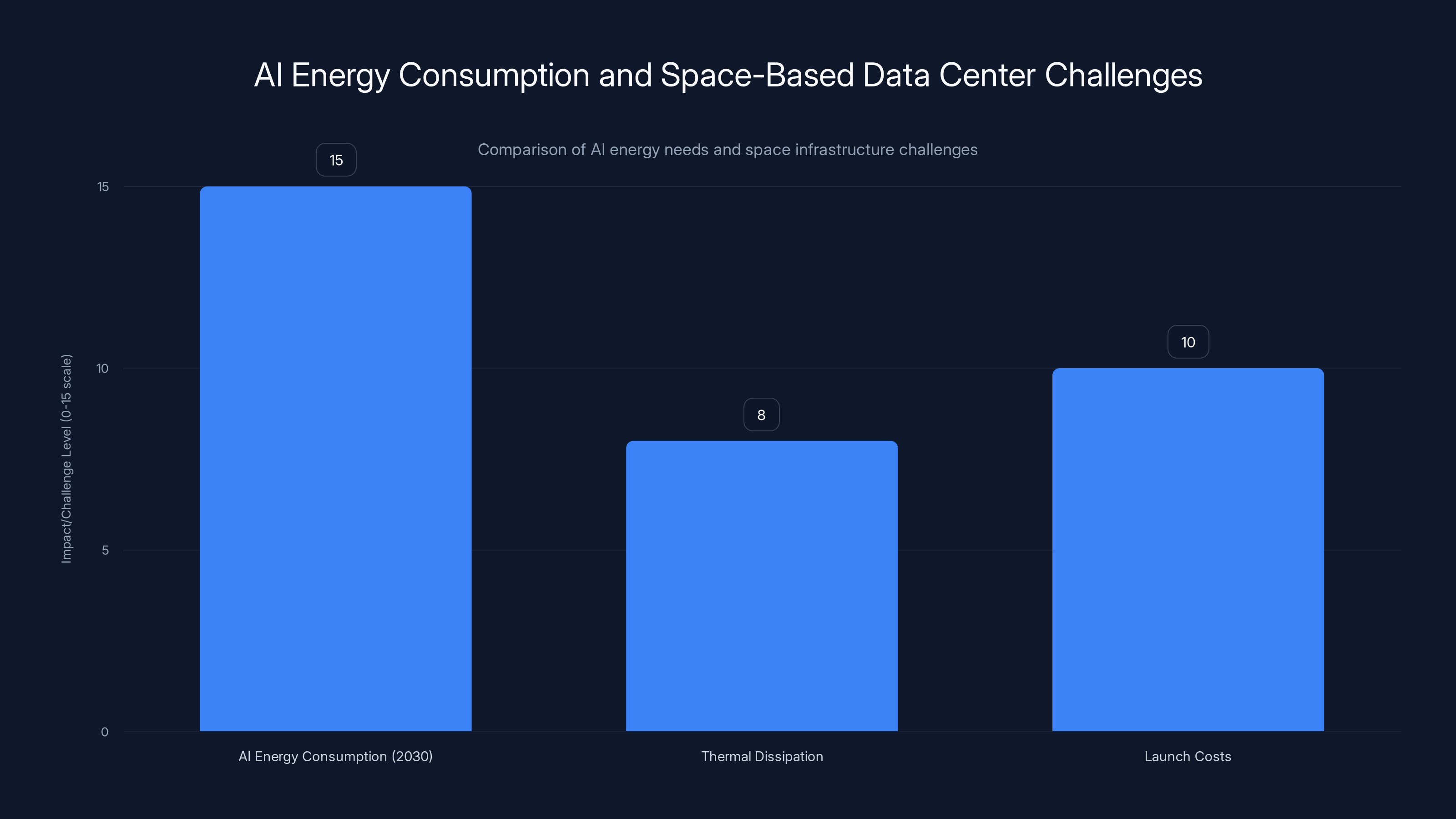

AI could consume 10-15% of global electricity by 2030. Space-based data centers face significant thermal and cost challenges. Estimated data.

The Space-Based AI Infrastructure Argument: Is It Real?

Musk's core claim is provocative: Earth-based data centers can't support the power requirements of future AI systems. The solution, he argues, is to move data centers to space.

Let's examine this claim. Modern large language models require enormous computational power. Open AI's GPT-4 reportedly required approximately 100 petaflops of computation during training. That's roughly equivalent to 100,000 trillion floating-point operations.

Each petaflop of computation requires significant electricity. A rule of thumb in the data center industry: 1 megawatt of compute power requires roughly 0.5 megawatts of cooling. So a truly massive AI training cluster might consume 5-10 megawatts of electricity continuously.

For context, that's equivalent to the power consumption of a small city. And if we're training multiple models simultaneously, the aggregate demand becomes staggering.

Musk's argument has some validity. The International Energy Agency estimates that AI could account for 10-15% of global electricity consumption by 2030 if deployment accelerates. That's a massive increase in demand.

But the space-based data center idea faces enormous practical challenges:

Challenge 1: Thermal Dissipation Computers generate heat. On Earth, we use liquid cooling systems and fans to dissipate that heat. In space, thermal management becomes harder because you can't use air cooling—there's no air. You'd need to radiate heat directly to space using radiators, which adds weight and complexity.

Challenge 2: Launch Costs

Even with reusable rockets, launching a multi-ton data center to orbit costs millions of dollars. Falcon 9 launch costs roughly

Challenge 3: Communication Latency Data center clients expect low-latency access. A data center in orbit is constantly moving. Communicating with it requires ground stations, relay satellites, or Starlink connectivity. That adds latency, which is problematic for real-time AI applications.

Challenge 4: Maintenance and Repair Unlike Earth-based data centers where technicians can physically access hardware, servicing equipment in orbit requires either robotic systems or astronaut missions. Both are extraordinarily expensive.

So why is Musk pushing this idea if the engineering challenges are so significant?

Probably for several strategic reasons:

-

Long-term positioning: By integrating x AI and Space X now, Musk positions himself to capture value if space-based computing becomes viable in the future.

-

Starlink synergy: Even if dedicated AI data centers don't launch to orbit, using Starlink to power distributed AI inference across global customers creates real value.

-

Regulatory positioning: Framing Space X as critical infrastructure for AI development gives Musk leverage in regulatory discussions.

-

Talent retention: Ambitious engineers and researchers are attracted to seemingly impossible challenges. The space-based AI vision helps recruit top talent.

The space-based data center idea might be real, partially real, or mostly aspirational. But the strategic logic of merging Space X and x AI is sound regardless.

Valuation Analysis: Is $1.25 Trillion Reasonable?

Let's talk about whether the $1.25 trillion combined valuation makes sense.

Space X's $800 billion valuation (from December 2024) is based on a few factors:

1. Starlink's Revenue Potential

Starlink is projected to generate

2. Launch Services Revenue

Space X launches commercial satellites for customers and government contracts. This business generates roughly

3. Future Mars Colonization Much of Space X's valuation reflects investor belief in eventual Mars colonization. That's speculative but represents enormous optionality. Investors pricing in a non-zero probability of settlement on Mars justify higher valuations.

4. Network Effects of Starlink + Launch Services Space X's ability to launch its own satellites and service its own constellation creates operational efficiencies competitors can't match. This moat justifies a valuation premium.

Combining these factors, $800 billion is aggressive but defensible if you believe in Starlink's growth trajectory and eventual profitability.

x AI's $230 billion valuation (before the Space X merger) is harder to justify by traditional metrics:

The Challenge: x AI isn't profitable. It's burning billions annually on compute infrastructure and model development. It has no established revenue stream comparable to Starlink.

The Justification: Investors are betting on x AI's technology and Musk's ability to monetize it through multiple channels:

- Grok subscriptions through X premium

- Enterprise AI licensing

- Integration with Tesla autonomous driving

- Licensing to corporations

But these revenue streams are hypothetical. x AI hasn't demonstrated profitability. Its valuation is based almost entirely on future potential.

The Real Value: The merger creates synergies that don't exist separately:

- Space X can use x AI's AI to optimize satellite operations, reducing costs

- x AI can use Space X's infrastructure to train and deploy models at scale

- X platform provides a feedback loop for Grok improvement

- The combined entity has optionality to enter markets neither could separately

These synergies might justify a combined valuation higher than the sum of the parts. But $1.25 trillion assumes aggressive growth and successful execution.

For comparison, consider other massive private company valuations:

| Company | Valuation | Primary Business | Year |

|---|---|---|---|

| Space X + x AI (combined) | $1.25 trillion | Rockets, AI, Satellites | 2025 |

| Stripe | $95 billion | Payment processing | 2023 |

| Databricks | $43 billion | Data analytics | 2024 |

| Figma | $20 billion | Design software | 2022 |

The gap is enormous. Space X + x AI is valued 13x higher than Stripe, the next-most-valuable private company.

So is the valuation justified? That depends on your faith in:

- Starlink's ability to capture the global satellite internet market

- x AI's ability to compete with Open AI and Anthropic in AI

- Space-based computing becoming economically viable

- Musk's ability to integrate these businesses successfully

If all four happen, $1.25 trillion looks cheap. If even one fails, the valuation looks optimistic.

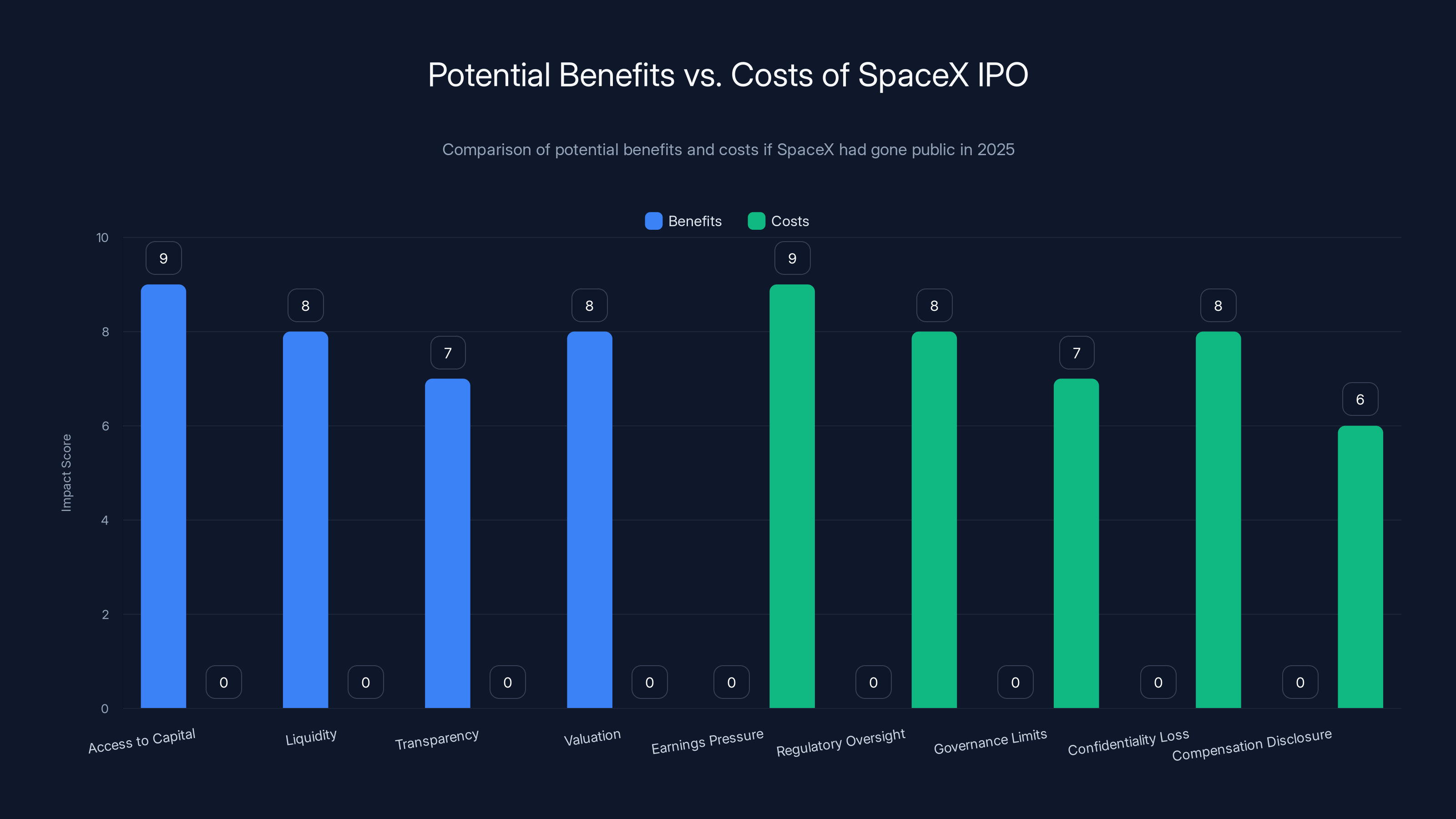

The chart highlights the potential benefits and costs of a SpaceX IPO. Access to capital and liquidity are major benefits, while regulatory oversight and earnings pressure are significant costs. (Estimated data)

The Consolidation Strategy: Connecting Musk's Businesses

This isn't Musk's first attempt at consolidating his various enterprises. Let's look at the pattern.

Tesla and Solar City (2016) Musk used Tesla shares to acquire Solar City, a renewable energy company run by his cousin Lyndon Rive. The rationale: Tesla needed to control energy production (solar panels) and storage (batteries) to create a complete clean-energy ecosystem.

The deal was controversial at the time. Tesla shareholders questioned whether Solar City was overvalued at $2.6 billion. But in hindsight, it made strategic sense. Tesla Energy now generates meaningful revenue and margin.

x AI and X (2024) x AI acquired X (formerly Twitter) for over $110 billion. This gave x AI a data source (billions of daily text interactions), a user base (hundreds of millions of accounts), and a distribution channel (the X platform itself).

This move was more controversial. Many observers questioned why an AI company needed to own a social media platform. But the strategic logic is clear: Grok benefits from access to real-time social media data. X provides that. Plus, x AI could integrate Grok directly into X features, providing direct user access.

Space X and x AI (2025) Now Musk is merging his rocket company with his AI company. The rationale is that future AI requires space-based infrastructure.

Looking at these three deals, a pattern emerges: Musk isn't trying to optimize each company individually. Instead, he's building an interconnected system where each company feeds the others.

┌─────────────────────────────────────────────────────────┐

│ The Musk Business Ecosystem │

├─────────────────────────────────────────────────────────┤

│ │

│ Space X (Rockets, Satellites) │

│ ↓ │

│ Starlink (Global Broadband) │

│ ↓ │

│ x AI (AI Models) │

│ ↓ │

│ X (Social Media, Data) │

│ ↓ │

│ Tesla (Vehicles, Energy) │

│ ↓ │

│ Neuralink (Brain-Computer Interface) │

│ ↓ │

│ The Boring Company (Tunnels) │

│ │

└─────────────────────────────────────────────────────────┘

Rockets launch satellites. Satellites provide connectivity. AI models optimize networks. X provides data and distribution. Tesla vehicles are potential Neuralink platforms. Neuralink interfaces could be in tunnels.

It's not a random collection of companies. It's an attempt to build a comprehensive system where each component strengthens the others.

But this approach creates concentration risk. If any critical component fails, the entire ecosystem suffers. It also raises regulatory questions about monopolistic practices.

National Security Implications: Who Controls Critical Infrastructure?

Here's where the Space X-x AI merger gets complicated. We're not just talking about a business deal. We're talking about control over critical infrastructure.

Satellite Infrastructure Starlink operates the world's largest satellite broadband constellation. That's no longer just a commercial business. It's critical infrastructure. Governments depend on it. During the Ukraine invasion, Ukrainian military forces used Starlink terminals for communications. That demonstrated how satellite internet is becoming essential for national security.

But Starlink is entirely controlled by one person. If Musk decides to deny service to a government or region, he has that power. This has already happened: Musk refused to allow Starlink to support certain military operations during the Ukraine conflict, citing concerns about escalation.

AI Infrastructure x AI's models are becoming increasingly important for both commercial and government applications. The U. S. Department of Defense is interested in AI for logistics, targeting, and strategic planning. But if x AI's models are controlled entirely by Musk, there's a concentration of power.

The U. S. government has started thinking seriously about this. The White House has been developing AI safety guidelines and considering regulations around critical AI systems. A company with significant market share in advanced AI models becomes subject to increased scrutiny.

Social Media Infrastructure X (Twitter) is arguably the most influential social media platform globally. It's where politicians, journalists, and billions of people exchange information. Controlling it gives Musk significant power over information distribution.

The merger of Space X, x AI, and X creates what some regulators might call a "chokepoint" for critical infrastructure:

- Communications (Starlink and X)

- Computation (x AI models)

- Launch capability (Space X)

One person controlling all three layers is unprecedented in modern times. Historical precedents include oil and railroad monopolies in the late 1800s. Those eventually led to antitrust action.

There's genuine ambiguity here. Musk's companies serve important functions. Starlink provides broadband to rural areas traditional telecom companies ignored. x AI's models advance AI capabilities. Space X has dramatically reduced launch costs.

But with great power comes regulatory risk. Expect the following developments:

- Congressional scrutiny: Senators will investigate the deal and question whether it's compatible with national security interests

- Regulatory review: The FCC and other agencies may review whether the merger presents antitrust concerns

- International pressure: Other governments (EU, China) will develop policies to ensure they don't become dependent on Musk-controlled infrastructure

- Investor pressure: Shareholders in Space X want to see returns. If regulatory pressure increases, it affects valuation

These aren't guarantees of action. But they're realistic possibilities.

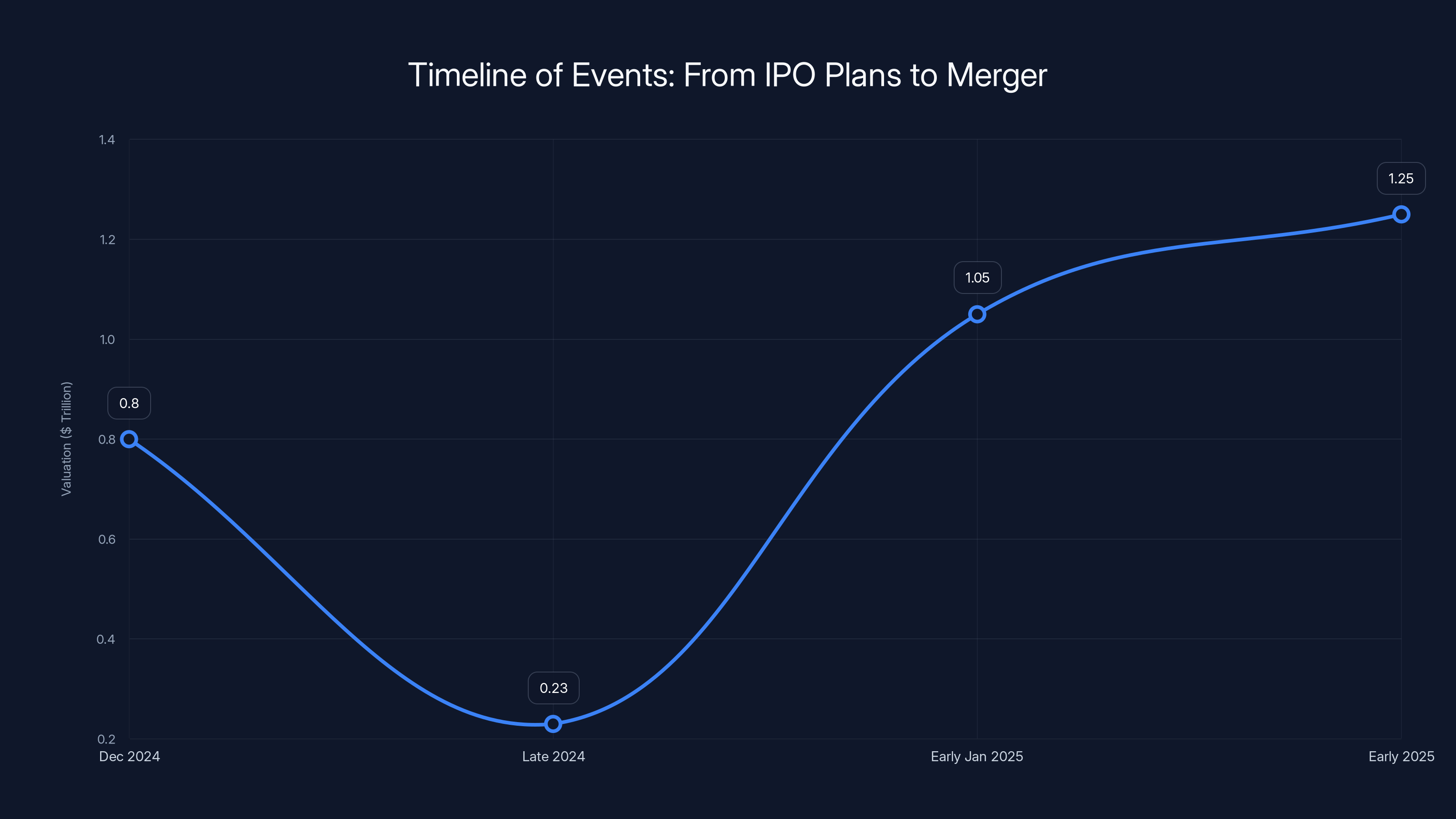

The timeline shows a significant increase in valuation from

Competitive Implications: The AI Arms Race

The Space X-x AI merger also affects competition in the AI industry. Let's break down why.

AI Compute Requirements Are Escalating

Training state-of-the-art AI models requires more compute power each year. Here's the trend:

- 2019: GPT-2 training required ~10,000 compute-hours

- 2020: GPT-3 training required ~3.6 million compute-hours

- 2023: GPT-4 training required ~100+ million compute-hours

- 2025+: Next-generation models will likely require 1+ billion compute-hours

Each order-of-magnitude increase in compute requirements makes training more expensive and harder to access. Only companies with massive capital and compute infrastructure can compete.

This is why Open AI partnered with Microsoft. Anthropic secured funding from Google Cloud and AWS. Google leverages its own infrastructure. Meta uses its data center network.

Now x AI has access to Space X's launch infrastructure and potential space-based computing. That's a unique advantage. No other AI startup has access to rockets and satellite networks.

The Data Moat

x AI has another advantage: it owns X, which generates billions of text interactions daily. That's training data. Open AI's models were trained on Common Crawl and other internet data sources. But x's training data is proprietary and continuously refreshed.

This data advantage compounds over time. Models trained on fresher, higher-quality data can be better. Better models attract more users. More users generate more data. The cycle repeats.

Potential Competitive Impacts

-

Pricing pressure: x AI could undercut competitors on price by using integrated infrastructure advantages. This could force price competition across the industry.

-

Innovation speed: x AI might move faster than competitors by leveraging Space X and X directly. No need to partner with external infrastructure providers.

-

Data access: The combination of Grok (AI) and X (data source) creates a feedback loop competitors can't easily replicate.

-

Geographic distribution: Space X's global satellite coverage could enable x AI to serve customers in regions other companies can't reach.

For competing AI companies, the Space X-x AI merger is concerning. It's like watching a competitor acquire both superior manufacturing (rockets) and distribution (satellites and social media) simultaneously.

Timeline: From IPO Plans to Merger

The sequence of events matters here. Let's trace the timeline to understand how we got to this moment.

December 2024: Space X tells employees it will conduct an insider share offering. The deal values Space X at $800 billion. Plans for a public IPO are discussed for later in 2025.

Late 2024: x AI raises

Early January 2025: Rumors circulate that Musk is considering merging x AI into Space X. Financial analysts question the logic. Why would a rocket company buy an AI company? Why abandon IPO plans?

Early 2025: Musk announces the merger via blog post. He explains the space-based AI data center rationale. The deal values the combined entity at $1.25 trillion.

Immediate aftermath: Regulatory agencies begin reviewing the transaction. Congressional members express concerns about Musk's consolidated power. International governments consider policy responses.

What's interesting is what changed between December (IPO planned) and January (merger announced). There are a few possibilities:

Possibility 1: Strategic Realization Musk realized that integrating x AI and Space X creates more value than operating them separately. The synergies justify consolidation. This is probably part of it.

Possibility 2: Regulatory Avoidance An IPO requires SEC scrutiny, public disclosures, and shareholder governance. A private merger avoids that. By staying private, Musk maintains operational flexibility and doesn't face quarterly earnings pressure.

Possibility 3: Control Consolidation Musk cares deeply about maintaining control of his companies. Public shares mean public shareholders have a say. Merging keeps everything under his umbrella.

Possibility 4: Capital Efficiency With Space X and x AI combined, the company might reduce duplicate overhead. Finance, HR, legal teams can consolidate. This could save hundreds of millions annually.

Probably all four factors played a role. The IPO versus merger decision isn't just financial. It's about control, strategy, and operational philosophy.

SpaceX's vertical integration by 2025 includes launch infrastructure, satellite networks, AI models, computational resources, and social media, with each component contributing significantly to its operations. Estimated data.

The IPO That Didn't Happen (Yet)

Early 2025 reporting suggested Space X was preparing for an IPO in the second or third quarter of 2025. An IPO would have created these dynamics:

Benefits of an IPO:

- Access to public capital markets (could raise $50-100 billion)

- Liquidity for existing shareholders (early Space X employees could finally sell shares)

- Operational transparency requirements might improve accountability

- Public market valuation could validate company worth

Costs of an IPO:

- Quarterly earnings pressure (Wall Street would demand consistent growth)

- Regulatory oversight increases significantly

- Shareholder governance limits Musk's operational freedom

- Confidentiality decreases (competitors learn more about strategy)

- Executive compensation becomes public

The merger avoids all the costs while sacrificing access to public capital. But with x AI investors providing funding and existing shareholders able to trade in secondary markets, capital access isn't as constrained.

Musk's choice to merge rather than IPO reveals his priorities: operational control > access to public capital.

For investors, this creates a challenge. If you wanted to buy Space X shares in a public offering, that option is gone (at least for now). Your options are:

- Wait for future IPO: Space X may eventually go public once merger integration is complete

- Secondary market: Buy shares from existing shareholders at negotiated prices (illiquid, expensive)

- Diversify to competitors: Invest in publicly traded alternatives like Lockheed Martin (space/defense) or Open AI (if it goes public)

The merger announcement essentially told the public market: "You're not getting a piece of this." That's a bold statement from a company that became the most valuable private entity on Earth.

Regulatory Landscape: What Could Stop This Deal?

Major deals of this scale face regulatory review. Here's what could happen:

Antitrust Review The Federal Trade Commission (FTC) and Department of Justice (DOJ) could challenge the merger under antitrust laws if they believe it reduces competition. The question: do Space X and x AI compete in any markets?

Direct competition is minimal. Space X makes rockets and satellites. x AI makes AI models. But indirect effects might trigger scrutiny:

- Market power in compute: Combined, Space X + x AI could dominate space-based computation

- Essential infrastructure control: Starlink is becoming essential for some applications. Controlling it plus AI could be problematic

- Data advantages: Owning both AI models and the X platform creates data advantages competitors can't match

Antitrust law historically focuses on consumer harm (higher prices, reduced innovation). If Space X + x AI create a more efficient combined entity that lowers prices, antitrust challenges become harder. But if they use combined power to exclude competitors or extract monopoly pricing, challenges become likely.

National Security Review The Committee on Foreign Investment in the United States (CFIUS) reviews deals with national security implications. While Musk is a U. S. citizen, his companies have received government contracts and have access to sensitive technology.

Specific concerns:

- Starlink provides military-grade satellite communication

- x AI might develop models with military applications

- Space X launches classified satellites for the Defense Department

Combining all three could trigger CFIUS review. But since Musk isn't a foreign party and the companies are U. S.-based, blocking the deal would be extremely difficult.

FCC Review The Federal Communications Commission regulates satellite communications. Since Starlink is a major satellite operator, FCC approval might be required. But again, FCC authority is narrow—they review technical and public interest factors, not antitrust issues directly.

Congressional Review No formal approval is required, but Congress could hold hearings or propose legislation restricting future deals by Musk's companies. This is more about signaling and creating regulatory pressure than blocking the specific merger.

International Regulation The EU might impose conditions on how Space X + x AI operate in European markets. China will likely develop countermeasures to reduce dependence on Starlink. India might require data localization from x AI. These create complexity but not direct deal-blocking power.

My assessment: The merger probably faces regulatory scrutiny and possibly congressional hearings, but actual blocking is unlikely because:

- Direct competition between Space X and x AI is minimal

- Both are U. S.-based companies

- Consumer harm isn't obvious

- National security implications are ambiguous (the companies are U. S.-controlled but the concentration of power is concerning)

However, the deal will likely face conditions or commitments from Musk regarding:

- Data sharing (ensuring competitors have access to certain datasets)

- Pricing (preventing monopolistic pricing for Starlink or x AI services)

- Operational separation (ensuring Space X and x AI don't give each other unfair advantages)

These wouldn't kill the deal. But they'd modify it.

Financial Integration: How It Actually Works

Now let's talk about how these companies will actually operate together.

Organizational Structure

Most likely structure:

- Holding Company: A new parent entity (possibly a trust or LLC under Musk's control) owns both Space X and x AI

- Operational Independence: Space X and x AI remain separate operating companies with distinct management teams

- Integration Points: Specific functions (finance, legal, some engineering) might consolidate

- CEO Structure: Musk likely remains ultimate decision-maker but delegates day-to-day operations

This is similar to how Berkshire Hathaway operates. It owns dozens of businesses but lets them operate somewhat independently while extracting synergies at the corporate level.

Financial Consolidation

The combined entity will have:

- Revenue: Estimated $5-8 billion annually (Space X from commercial launches + Starlink; x AI from potential Grok subscriptions)

- Costs: Estimated $8-12 billion annually (satellites, compute infrastructure, R&D)

- Path to profitability: Starlink revenue should eventually exceed operating costs. x AI remains unprofitable but could become profitable if Grok generates significant subscription revenue

Right now, the combined entity is probably unprofitable. Space X might break even on launch services, but Starlink is still ramping. x AI is burning billions on compute infrastructure.

But investors are betting on future profitability. If Starlink becomes profitable at scale and x AI monetizes successfully, the combined entity could become massively profitable.

Capital Allocation

With $1.25 trillion in implied valuation but no public equity, the combined entity will need to fund growth through:

- Operating cash flow (once Starlink becomes profitable)

- Debt (Space X and x AI could borrow at favorable rates given their valuations)

- Equity raises (future funding rounds with private investors)

Musk has shown he's willing to invest his personal wealth. He bought X with Twitter cash flow and personal funds. He could do the same here.

Strategic Endgame: What's the Long-Term Vision?

Looking at Musk's pattern of consolidation, a long-term vision emerges:

Step 1: Establish Platform Infrastructure

- Space X provides launch and satellite capability

- Starlink provides global connectivity

- x provides information distribution

- Tesla provides vehicles and energy

Step 2: Add Intelligence Layer

- x AI provides AI models that optimize all platforms

- Grok becomes the interface for human-AI interaction

- AI agents manage Starlink, Tesla, and other operations

Step 3: Integrate Human-Machine Interface

- Neuralink enables direct brain-computer interaction

- Combine with AI agents for seamless control

- Enable humans to "think" commands to machines

Step 4: Provide Physical Transportation

- Boring Company tunnels enable rapid ground transport

- Tesla vehicles operate autonomously

- Space X rockets enable space travel

The endgame appears to be a fully integrated ecosystem where:

- AI optimizes all systems

- Neuralink enables human control

- Physical transportation (ground, space) is seamless

- Information flows globally via Starlink and X

- Energy is provided by Tesla solar and batteries

This isn't just a business. It's an attempt to build a comprehensive technological civilization.

Is it realistic? Parts are definitely achievable. Others are highly speculative. But the vision guides investment and acquisition decisions.

Investor Implications: Who Benefits and Who Loses?

Let's break down how different parties are affected by this merger.

Shareholders in Space X and x AI

- Benefit: Valuation increases from potential synergies. The combined entity at 800B +1.03T separately

- Risk: Integration challenges. Merging two complex companies is difficult. Execution risk increases

Employees of Space X and x AI

- Benefit: Potential for career advancement across both companies. Combined company is larger

- Risk: Potential redundancy in some functions (finance, HR, legal). Job losses possible during integration

Competitors (Open AI, Anthropic, Stripe, AWS)

- Impact: Negative. A competitor just acquired powerful capabilities (Starlink infrastructure, X data, Space X resources)

- Response: Likely to accelerate their own strategic M&A or funding

Customers of Space X

- Impact: Neutral to slightly positive. Integration might improve service or reduce costs through efficiency gains

- Risk: If Starlink becomes fully integrated with x AI, customers might have less flexibility in choosing AI services

Customers of x AI

- Impact: Potentially negative. If Space X resources are prioritized for x AI internal use, external customer service could suffer

- Benefit: Access to Space X infrastructure could enable new services

Government Agencies

- Impact: Mixed. They benefit from improved technology but lose leverage. If Space X-x AI is the only provider for critical services, government has fewer options

Retail Investors

- Impact: Negative. A company they could have invested in (Space X IPO) is now private for the foreseeable future

- Alternative: Invest in Space X competitors like Rocket Lab (now public) or Axiom Space

Comparable Deals: Historical Precedent

Has anything like this happened before? Let's look at comparable mega-mergers:

AT&T's Vertical Integration (1980s-1990s) AT&T owned local phone service (Bell), long-distance (AT&T Long Lines), manufacturing (Western Electric), and research (Bell Labs). It was the closest parallel to Space X + x AI controlling multiple infrastructure layers.

The U. S. government eventually forced a breakup in 1984, creating separate regional "Baby Bells." The rationale: one company shouldn't control both local and long-distance service.

Microsoft's Vertical Integration (1990s-2000s) Microsoft owned the Windows operating system, Office suite, Internet Explorer, and other software. The Department of Justice sued, arguing that bundling services gave Microsoft unfair advantage.

The case dragged on for years. Eventually, Microsoft agreed to changes but wasn't broken up. The precedent: you can't be broken up just for being big, but antitrust law can restrict anti-competitive bundling practices.

Disney's Vertical Integration Disney owns content studios (Marvel, Pixar, Star Wars), distribution (Disney+), theme parks, and now streaming platforms. The FTC hasn't broken it up, but monitors whether Disney uses its distribution advantage unfairly.

The pattern: Mega-conglomerates are tolerated if they don't use market power anti-competitively. But they face regulatory scrutiny.

What About Artificial Intelligence for Automating Your Work?

While Musk and x AI are building massive AI infrastructure, practical tools already exist for automating your team's work today. Runable is an AI-powered platform designed to help teams automate presentations, documents, reports, and workflows at scale. For $9/month, you get AI agents that can generate slides from data, create professional documents, and automate routine reporting.

Unlike the speculative space-based data centers Musk envisions, Runable delivers practical value today. Teams use it to cut hours off weekly presentation and documentation work. It's not science fiction. It's operational efficiency you can implement immediately.

While Space X and x AI race toward advanced AI infrastructure, Runable focuses on the urgent problem: how do we make knowledge workers more productive right now?

Use Case: Automate your weekly client reports by having AI generate slides and documents from your data, saving your team 3-4 hours per week.

Try Runable For Free

Key Lessons: What This Deal Reveals About the Future

The Space X-x AI merger teaches us several things about the direction of technology:

1. Vertical Integration is Back For decades, business strategy emphasized focus and outsourcing. Do one thing really well and partner for everything else. Musk's strategy is opposite: control as many layers as possible. This works if you have execution excellence and deep capital.

2. AI Infrastructure is the New Frontier In the 20th century, companies competed on physical infrastructure (railroads, power grids, highways). In the 21st century, they'll compete on AI infrastructure (compute, data, models). The merger positions Musk to dominate this frontier.

3. Control > Capital in Private Companies Musk chose to merge and stay private rather than IPO for capital. This reveals that operational control matters more to him than access to public market funds. This has implications for future tech founders.

4. Regulatory Scrutiny is Inevitable Once companies get too powerful, regulation follows. The merger will face regulatory challenges. Future tech consolidation will face similar pressure.

5. One Person Shouldn't Control Everything The concentration of power in Musk's hands is genuinely concerning. Starlink provides critical communication. X influences global information flow. x AI develops advanced AI. Space X controls launch access. When one person controls all four, system-wide risk increases.

Conclusion: The Beginning of a New Era

The Space X-x AI merger isn't just a business transaction. It's a signal about where technology is heading and how power will be distributed in the future.

Musk has built a comprehensive ecosystem combining:

- Physical infrastructure (rockets, satellites)

- Software infrastructure (AI models)

- Information infrastructure (social media)

- Transportation (vehicles, tunnels)

- Human-machine interfaces (Neuralink)

No company in history has controlled this combination of capabilities. It creates unprecedented optionality. The combined entity can pursue opportunities no competitor can match.

But that power creates risk. Risk to competition. Risk to regulatory stability. Risk to national security if one person's preferences override public interest.

Investors have valued the combined entity at $1.25 trillion, making it the most valuable private company ever. Whether that valuation proves correct depends on execution. Musk and his teams need to:

- Successfully integrate two complex companies

- Convert synergies into actual operational benefits

- Navigate regulatory challenges

- Maintain operational excellence across eight different companies

- Eventually monetize vision (whether space-based data centers, Starlink profit, or x AI revenue)

Historically, mega-conglomerates struggle with integration. Some succeed (Berkshire, Microsoft). Others fail spectacularly (failed hotel chains, automotive diversifications). Musk's track record suggests he can pull it off. But it's genuinely difficult.

For the tech industry, the merger raises important questions:

- Should one person control critical infrastructure?

- Do we need stronger regulation of vertical integration?

- How do we ensure competition when one player has such advantages?

- What happens if Musk loses interest or makes catastrophic strategic mistakes?

These questions will dominate tech policy for years. The Space X-x AI merger is the event that crystallized the concern.

For investors, the merger presents an opportunity to think differently about infrastructure, integration, and long-term value creation. For employees, it creates both opportunities (larger company, more resources) and risks (integration challenges, potential redundancy). For competitors, it's a wake-up call that the landscape is shifting faster than expected.

The future of technology won't be decided by who has the most capital or the smartest researchers (though both help). It will be decided by who controls critical infrastructure and builds the most integrated systems. Musk just moved into the strongest position on that board.

FAQ

What does Space X acquiring x AI actually mean?

It means Space X is combining with x AI into a single company valued at $1.25 trillion. Rather than operating as separate entities, Space X and x AI will now share resources, infrastructure, and strategic direction. This allows Space X to integrate AI into its satellite operations and gives x AI access to Space X's rockets and infrastructure for potential future space-based data centers.

Why would a rocket company want to buy an AI company?

Musk's core argument is that advanced AI models in the future will require more electricity than Earth-based data centers can provide. His solution is to move data centers to space, where solar power and thermal dissipation are easier to manage. Additionally, x AI's AI models can optimize Space X's satellite operations, reduce costs, and improve service quality. The combination creates synergies neither company could achieve separately.

What about national security concerns with one person controlling so much?

There are legitimate concerns. Starlink controls a major portion of global satellite broadband, which governments depend on for communications. x AI develops advanced AI models with potential military applications. X (formerly Twitter) is a critical information platform. Combining these under one person's control creates risk that one individual could deny services to governments or populations, or prioritize personal interests over national security. This is why regulatory agencies are likely to scrutinize the deal and possibly impose conditions.

Is the $1.25 trillion valuation realistic?

The valuation is based on aggressive assumptions about future growth and synergies. Starlink is not yet profitable but could become a multi-billion-dollar business if it captures the global satellite internet market. x AI is developing competitive AI models that could generate significant revenue through subscriptions and licensing. The combined company has strategic advantages competitors can't easily match. Whether $1.25 trillion ultimately proves correct depends on successful execution of multiple complex initiatives. It's not unrealistic, but it's optimistic.

How does this affect competition in AI?

The merger strengthens x AI's competitive position relative to Open AI, Anthropic, and other AI companies. x AI now has access to Space X's infrastructure, Starlink's data, and resources from a company with proven execution ability. The combination of proprietary training data (from X) and unique infrastructure advantages (space-based computing potential) could give x AI advantages competitors can't match. This could accelerate x AI's development but also reduce incentives for healthy competition.

Will the merger face regulatory challenges?

Most likely yes. The FTC and DOJ will probably review the deal for antitrust concerns. CFIUS (the Committee on Foreign Investment in the United States) will assess national security implications. Congress may hold hearings. However, actually blocking the deal is difficult because Space X and x AI don't directly compete. The regulators are more likely to impose conditions (like data sharing or operational separation) rather than prevent the merger entirely. Expect a process that takes months and involves negotiation with multiple agencies.

What happens to Space X's planned IPO?

The IPO is essentially off the table for the foreseeable future. By merging with x AI and staying private, Space X's owner Musk avoids the quarterly earnings pressure, investor governance demands, and regulatory scrutiny that come with being public. This gives him more operational flexibility to pursue long-term bets. However, this means potential retail investors can't buy Space X shares. The option to invest in Space X through a public offering has been postponed indefinitely.

How does Runable fit into the AI infrastructure landscape?

While Musk and x AI are building massive AI infrastructure for the future, Runable focuses on practical AI automation that teams can use immediately. Rather than waiting for space-based data centers, Runable helps organizations automate presentations, documents, reports, and workflows using AI today. For teams looking to increase productivity without massive capital investment, Runable at $9/month delivers immediate operational value.

Could this deal be blocked?

Blocking the deal would be legally difficult. U. S. antitrust law generally doesn't prevent companies from merging just because they become more powerful, unless there's evidence of reduced competition or consumer harm. Space X and x AI don't directly compete, so the traditional antitrust case is weak. National security concerns are possible but wouldn't necessarily result in blocking—more likely conditions on operations. Congress could pass new legislation restricting future consolidation by Musk's companies, but that wouldn't retroactively block this deal. Bottom line: the merger will probably proceed, though possibly with conditions.

Key Takeaways

- SpaceX's 230 billion creates a $1.25 trillion merged entity, making it the most valuable private company in history

- Musk's vertical integration strategy consolidates control over satellites (Starlink), AI models (Grok), social media (X), and launch infrastructure (SpaceX rockets)

- The merger allows SpaceX to remain private and avoid IPO pressures while achieving integration synergies that separate companies couldn't realize

- Space-based data centers for AI face significant engineering challenges including thermal management, launch costs, and latency, making the vision highly speculative

- Regulatory agencies will likely scrutinize the deal for antitrust and national security concerns, but actual blocking is unlikely given minimal direct competition between SpaceX and xAI

- One person now controls critical infrastructure spanning communications (Starlink), social media (X), and advanced AI, raising concerns about concentration of power and potential regulatory action

Related Articles

- SpaceX Acquires xAI: Building a 1 Million Satellite AI Powerhouse [2025]

- SpaceX's 1 Million Satellite Data Centers: The Future of AI Computing [2025]

- SpaceX's Million-Satellite Network for AI: What This Means [2025]

- Microsoft's Maia 200 AI Chip Strategy: Why Nvidia Isn't Going Away [2025]

- NVIDIA's $100B OpenAI Investment: What the Deal Really Means [2025]

- SpaceX's Million Satellite Data Centers: The Future of Cloud Computing [2025]

![SpaceX Acquires xAI: Creating the World's Most Valuable Private Company [2025]](https://tryrunable.com/blog/spacex-acquires-xai-creating-the-world-s-most-valuable-priva/image-1-1770075439931.jpg)