Tik Tok's Historic Restructuring Deal: Everything You Need to Know About the $5 Billion Joint Venture

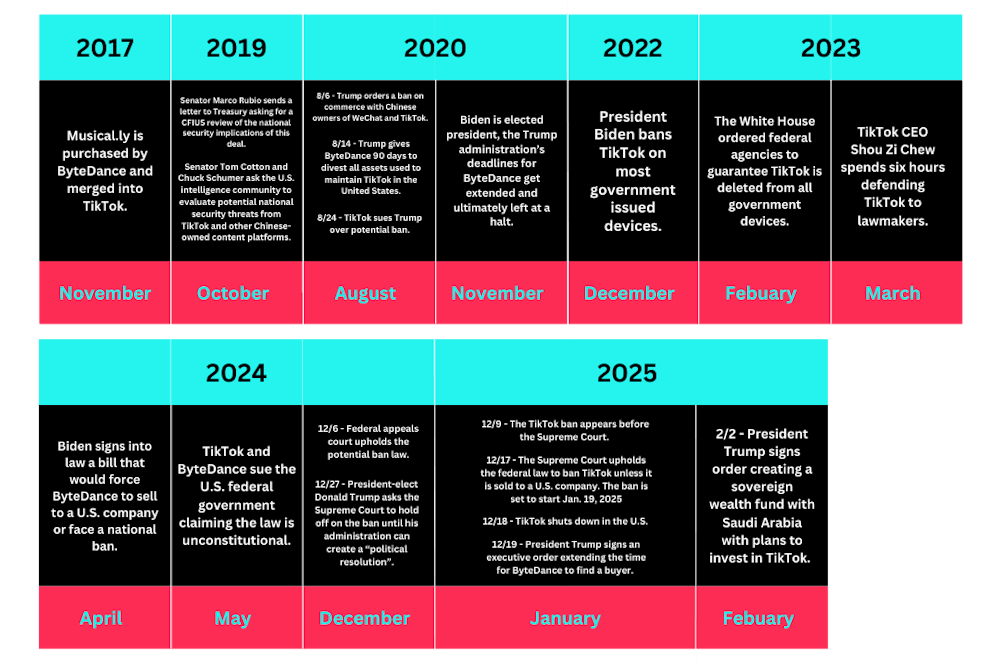

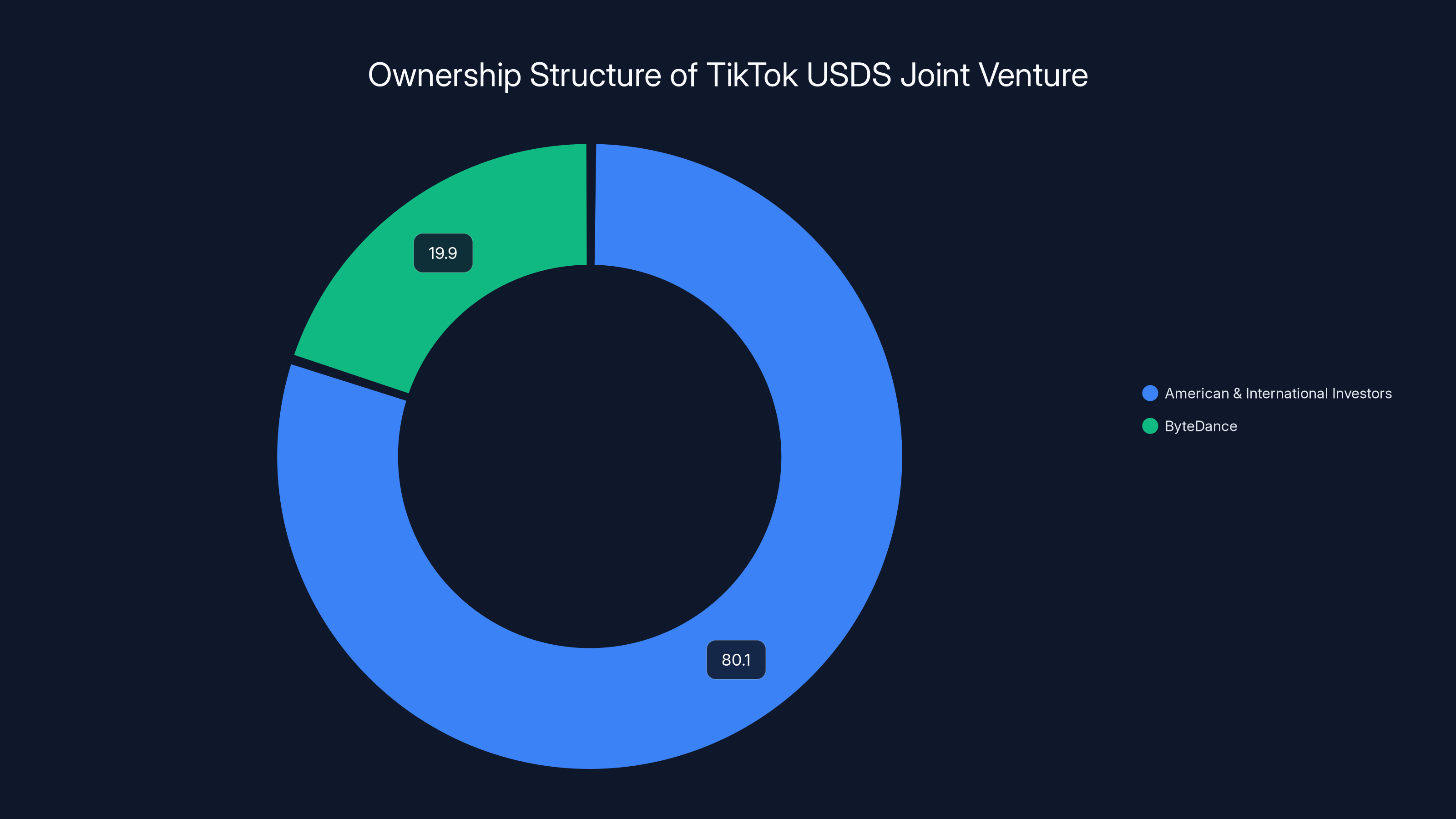

After more than a year of legal battles, executive uncertainty, and dramatic app store removals, Tik Tok's status in the United States has finally been resolved. The platform isn't being banned. It isn't being sold to a single American company. Instead, it's been restructured into something genuinely novel in tech history: a majority-American-owned joint venture that keeps Byte Dance's involvement at exactly 19.9 percent.

Let's be clear about what just happened. On January 20, 2025, after gaining approval from both US regulators and Chinese authorities, Tik Tok USDS Joint Venture LLC officially took control of the platform's American operations. This wasn't some back-room compromise or regulatory loophole. The structure was specifically designed to satisfy the Foreign Ownership of Residential Real Property and the Restriction on Certain Transactions Involving Byte Dance Limited Act signed by President Biden in 2024.

But here's the thing: most people don't actually understand what this restructuring means operationally, financially, or strategically. The headlines focused on whether Tik Tok would survive. Nobody explained what happens next, how the platform actually works under this new structure, or what it means for the 170 million American users who open the app every month.

I've spent the last few weeks digging into the details. The ownership structure, the governance model, the data security requirements, the algorithm changes, the technical infrastructure shifts. What I found is surprisingly complex and genuinely interesting. The deal isn't just about keeping Tik Tok online. It's about fundamentally reshaping how the app operates, who controls its decisions, and where its data lives.

This article walks through everything: the ownership breakdown, the management structure, the security requirements that just became law, the commercial implications for creators and advertisers, and what this means for the future of Tik Tok's ability to compete with Instagram and YouTube in the US market.

Ready? Let's dive in.

TL; DR

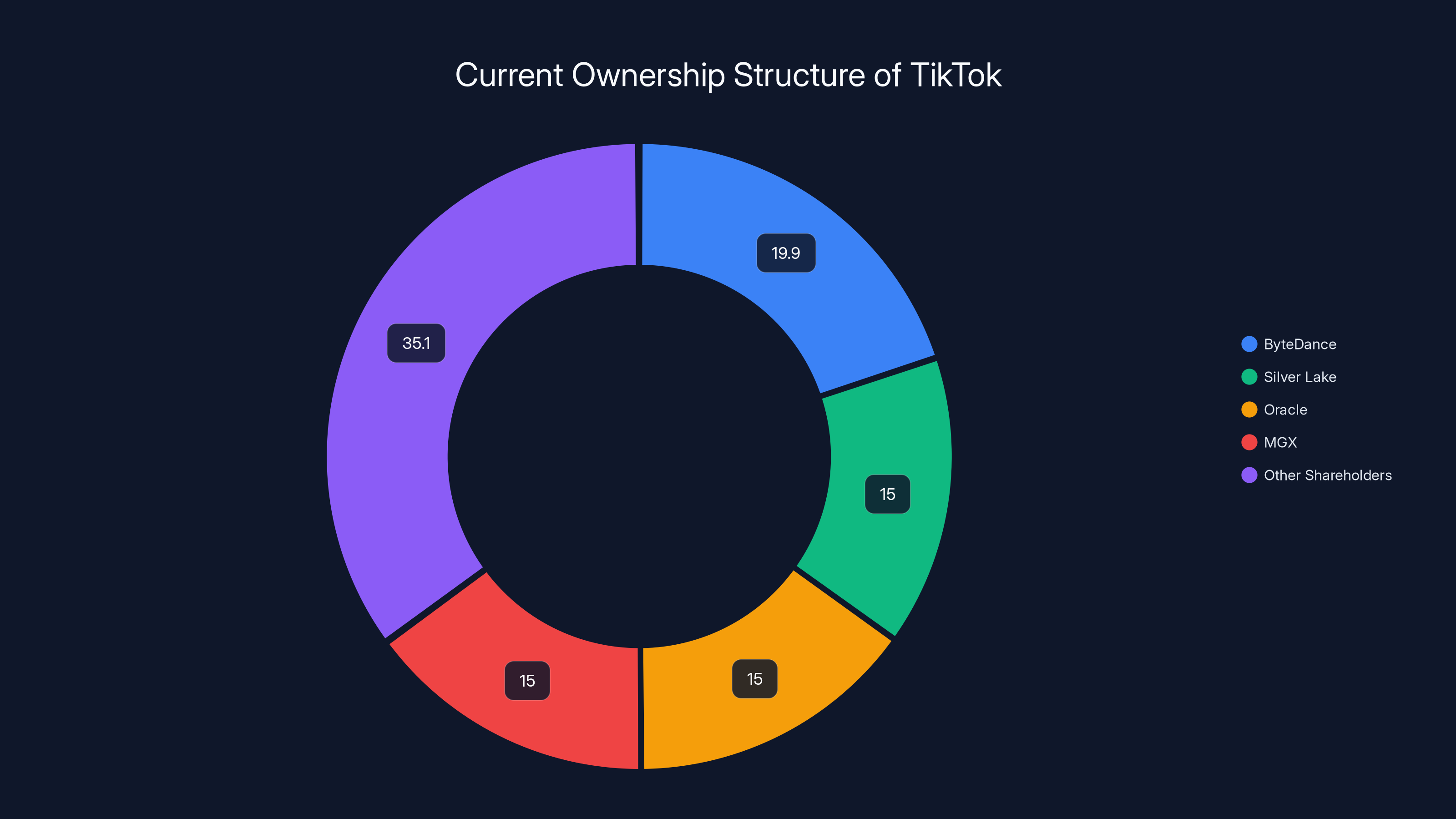

- The Deal is Official: Tik Tok is now 80.1% owned by American and international investors, with Byte Dance capped at 19.9% ownership

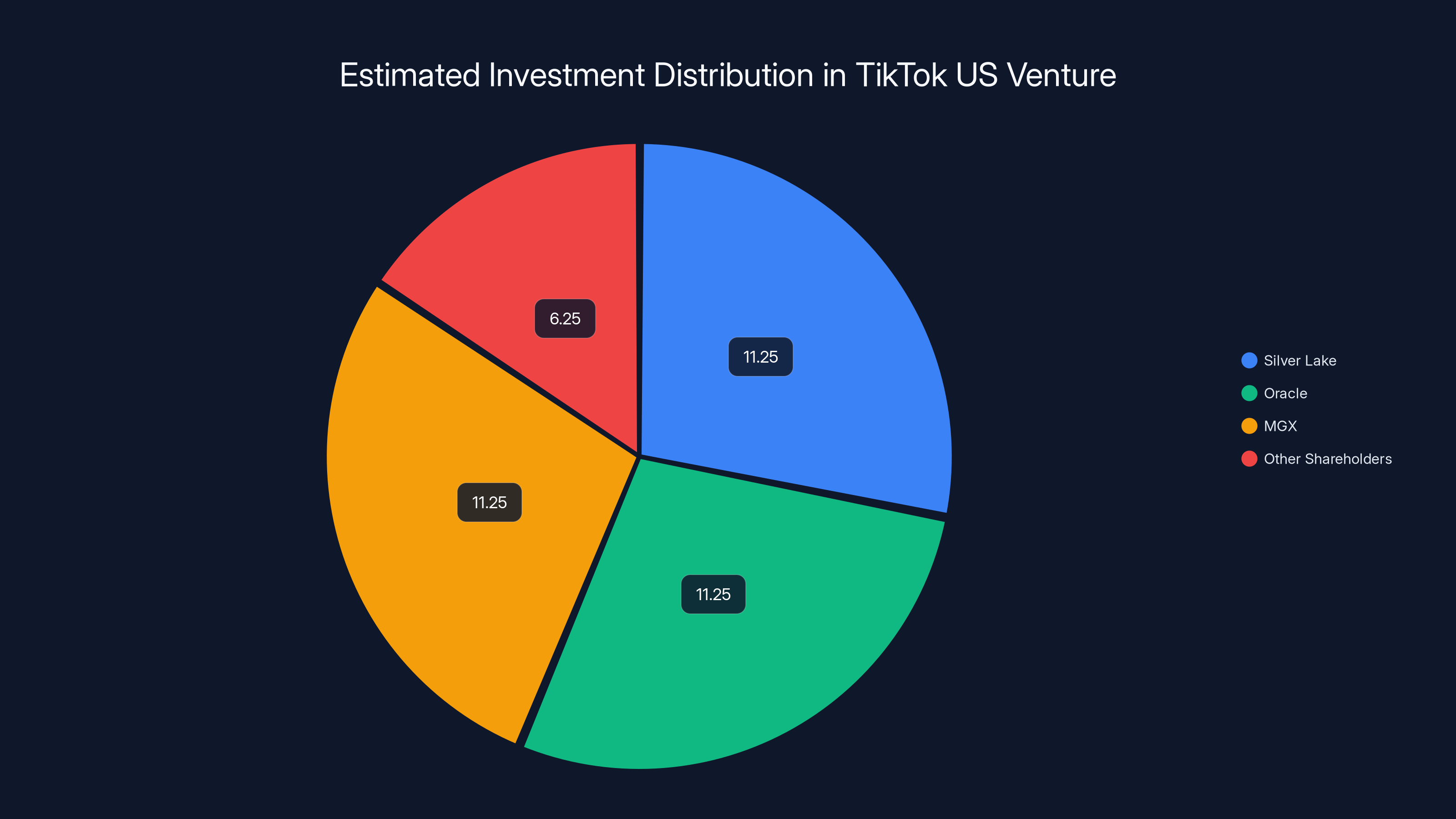

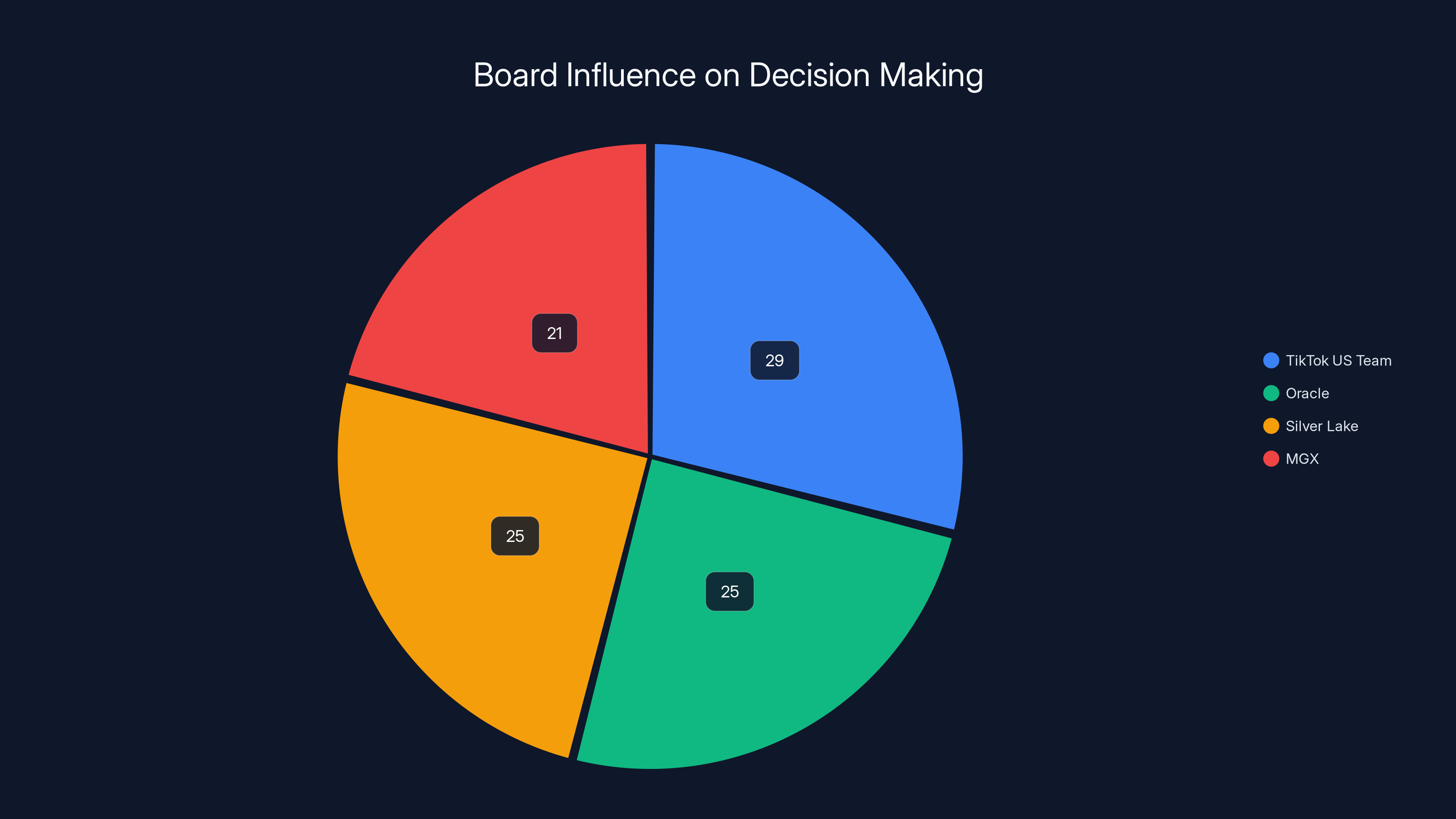

- Managing Investors: Silver Lake, Oracle, and Abu Dhabi's MGX each hold 15% stakes and control the platform's strategic direction

- New Leadership: Former operations head Adam Presser is now CEO, with oversight of data protection and content moderation across all Byte Dance US apps

- Data Sovereignty Required: All 170 million US monthly active users' data now lives in Oracle's secure US cloud environment, not Chinese servers

- Algorithm Independence: The recommendation algorithm must be retrained on US-only data, separating it from the global Tik Tok system

- Bottom Line: Tik Tok survives, but it's now fundamentally different operationally and may never be as globally connected as it was before

Estimated data suggests Silver Lake, Oracle, and MGX each invested

The Ownership Structure: Who Actually Controls Tik Tok Now?

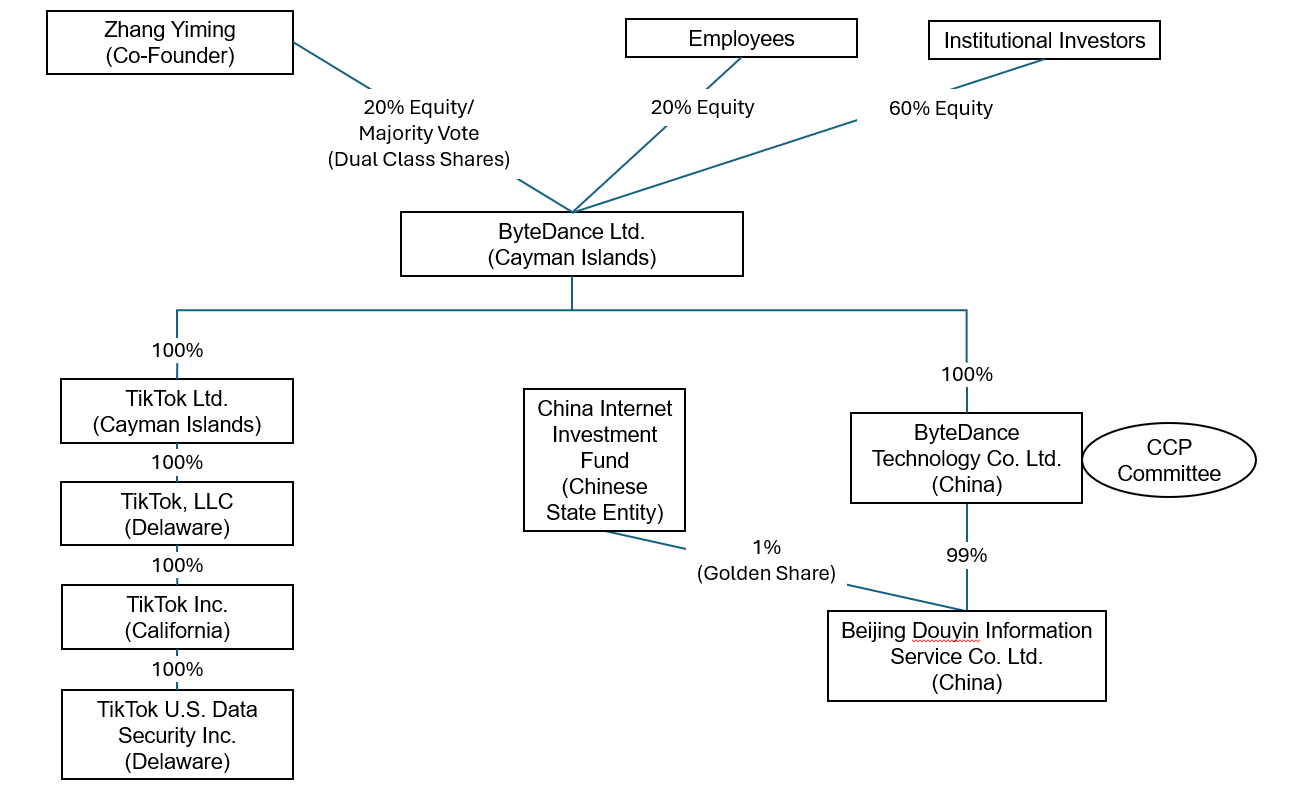

Let's start with something that might surprise you. Byte Dance didn't lose control of Tik Tok entirely. The Chinese company still owns 19.9 percent of the joint venture. But here's the crucial part: that's the maximum they're allowed to own under US law. They can't increase it. They can't vote beyond their stake. They can't even be represented on the board directly.

Instead, three investment firms now hold 15 percent each and effectively control the platform:

Silver Lake, the technology investment powerhouse with a history of managing major tech infrastructure deals. Oracle, which isn't just an investor but also the company hosting all US user data in its cloud infrastructure (a significant responsibility we'll discuss more later). And MGX, an Abu Dhabi sovereign wealth fund that's been increasingly active in American tech investments.

These three "managing investors" don't have equal power because they hold equal stakes. They have power because they're structured as the joint venture's primary decision-makers. Every major strategic choice at Tik Tok USDS (US Domestic Subsidiary) goes through them.

Beyond these three managing investors, there's a constellation of smaller shareholders:

Michael Dell's Family Office holds stakes through his investment vehicle. Susquehanna International Group, one of the largest proprietary trading firms in the world. General Atlantic, a growth equity firm. Dragoneer Investment Group, which focuses on technology. Yuri Milner's foundation through Virgo LI. And several other smaller investors representing various American and international capital sources.

The total adds up to exactly 80.1 percent American and international ownership, leaving Byte Dance at 19.9 percent—just under the legal threshold. This isn't coincidental. This is precisely calculated.

What's important to understand is that the old Tik Tok structure essentially had Byte Dance making unilateral decisions about what goes on the platform. Content moderation, algorithm changes, feature rollouts, advertising policy—all coming from Beijing or from US-based executives who ultimately reported to Byte Dance executives in China.

Now, every significant decision requires approval from the managing investors. Want to change how the algorithm ranks content? That needs Oracle, Silver Lake, and MGX agreement (or a board vote involving them). Want to modify content policies? Same structure. Want to enter into major commercial partnerships? Same governance.

This creates what's called a "governance flywheel"—no single entity can unilaterally control Tik Tok's direction anymore. But it also creates friction. Decisions that might have taken weeks now could take months. This matters more than you'd think for a platform competing with YouTube and Instagram in real-time.

The Seven-Person Board: Who's Making Decisions at Tik Tok?

The true power structure at Tik Tok reveals itself in its board composition. The joint venture operates with a seven-member board, and understanding who sits on it explains who actually controls the platform.

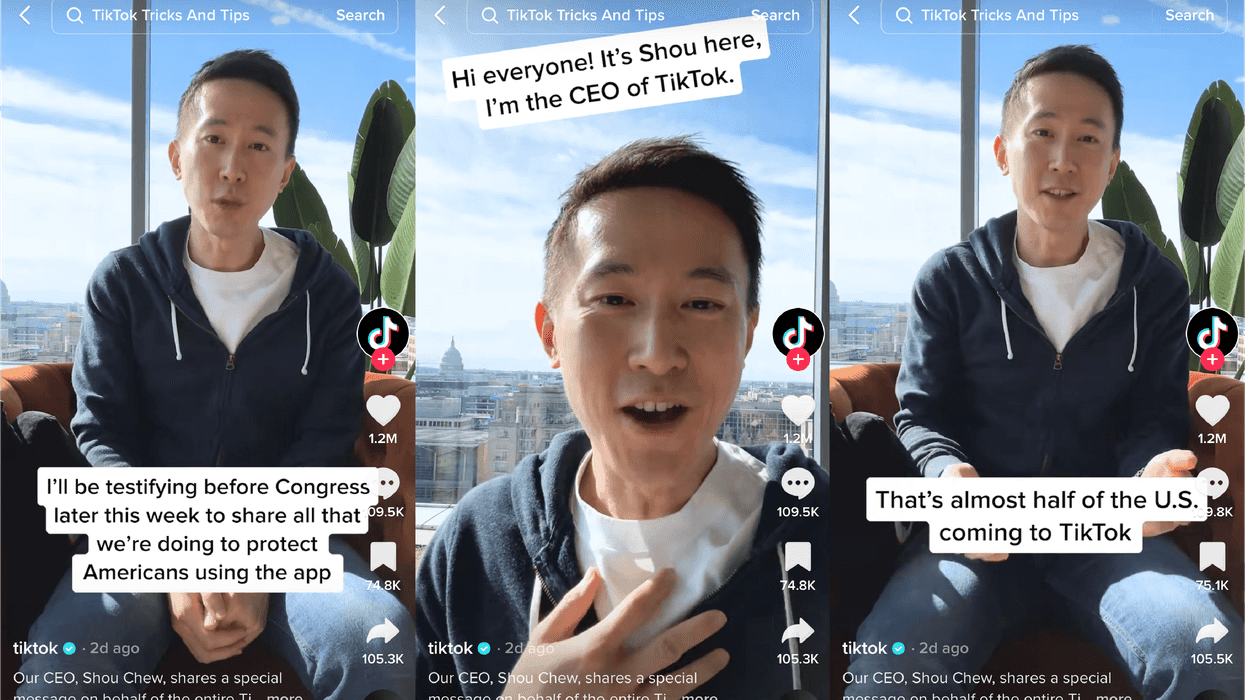

Tik Tok US CEO Shou Zi Chew occupies a board seat, though his power is fundamentally constrained compared to traditional CEO authority. Chew has been with Tik Tok since 2021 and served as the public face of the company during congressional hearings and regulatory battles. His presence on the board is partly practical (he needs to understand what the board's doing) and partly political (it signals to users and creators that Tik Tok still has continuity).

Adam Presser, Tik Tok's former head of operations and trust and safety, is now the joint venture's CEO—a critical distinction. Presser doesn't run Tik Tok the app. He runs Tik Tok USDS, the legal entity that owns Tik Tok in America. He's responsible for data protection, algorithm security, content moderation, and compliance with the new regulatory structure. He essentially has operational authority that supersedes Chew on matters of US compliance.

Beyond these two, the board seats are split among representatives from the three managing investors. Silver Lake gets representation. Oracle gets representation. MGX gets representation. These board members aren't employees. They're executives and principals from their respective investment firms who understand technology, infrastructure, and the specific requirements of this deal.

The board structure might seem bureaucratic, but it's actually quite elegant from a legal standpoint. It ensures that no single entity (including Byte Dance) can make unilateral decisions. It also creates a checks-and-balances system where the managing investors can push back against any move that violates the terms of the deal or threatens their investment.

The TikTok USDS Joint Venture is primarily owned by American and international investors (80.1%), with ByteDance retaining a 19.9% stake.

The Data Sovereignty Requirement: Where Does Your Information Actually Live?

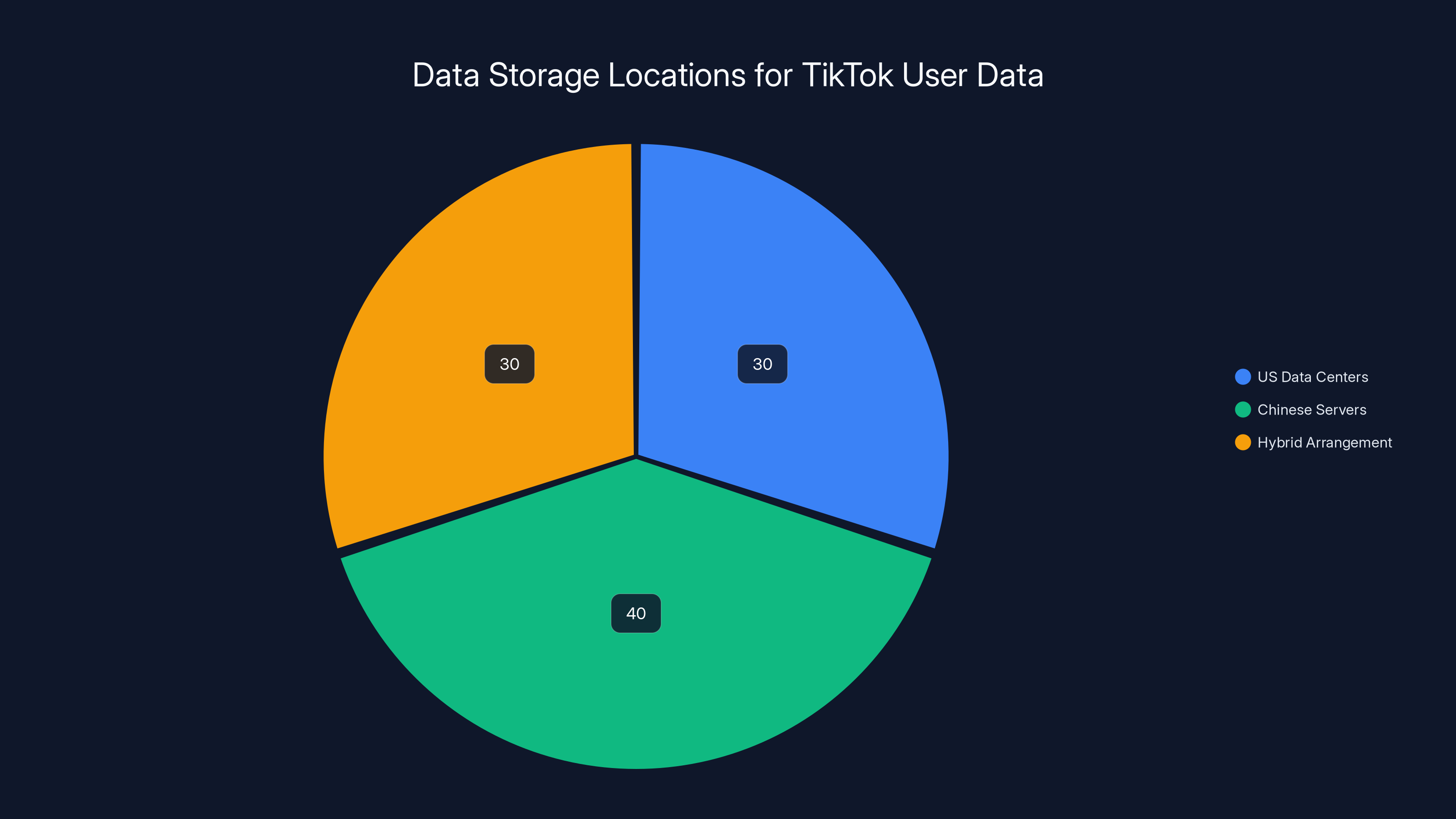

Here's where things get genuinely technical, and it's also where the deal has the most immediate impact on how Tik Tok operates. Every piece of data generated by the 170 million American Tik Tok users now has to be physically stored and processed in the United States, specifically in Oracle's secure cloud infrastructure.

This isn't just a mild preference. This is a hard technical requirement baked into the deal's terms. User data—your watch history, your likes, your comments, your direct messages, your location information if you've enabled it—lives in US data centers. Not in Chinese servers. Not in some hybrid arrangement. Completely in the US.

Why does this matter? Because before January 2025, Tik Tok operated as a truly global system. User data could flow between US servers and Byte Dance infrastructure in China. The algorithm could be trained on global user behavior and then deployed to US users. The content moderation systems could operate centrally from Chinese offices with US oversight teams reporting in.

Now, that's structurally impossible. The architecture has been fundamentally reorganized. US user data stays behind what's essentially a technical and legal firewall.

Oracle isn't just hosting the data. Oracle is also responsible for validating it. The deal includes ongoing source code reviews, software assurance protocols, and what's called "continuous validation." Essentially, Oracle's security team has to regularly confirm that no hidden backdoors or unauthorized data flows are occurring. This creates what's called a "trusted security partner" relationship, a legal status that gives Oracle significant authority over Tik Tok's US technical infrastructure.

But here's the complication that most people aren't discussing: separating US data from the rest of Tik Tok's global systems is technically challenging and operationally expensive. When a Byte Dance engineer in China would previously update a backend system that affects users worldwide, that now can't happen for US users. When Tik Tok wants to roll out a new feature globally, the US version has to be handled separately because it operates on segregated infrastructure.

This creates what infrastructure engineers call "operational overhead." The same feature now needs to be deployed twice. Updates need to be tested twice. Bugs might exist in the US version but not the global version, and vice versa. The platform becomes more complex, more expensive to maintain, and potentially slower to innovate.

The financial impact? Industry estimates suggest that data sovereignty requirements of this magnitude could increase Tik Tok's annual US operational costs by $200-400 million annually. That's not theoretical. That's real money that could otherwise go to creator payouts, product development, or server speed improvements.

Algorithm Independence: How Tik Tok's Recommendation System Gets Separated

If data sovereignty is about physical location, algorithm independence is about decision-making authority. And it's arguably more important to understanding how Tik Tok actually works.

Before the deal, Tik Tok's recommendation algorithm was essentially global. The system that decided which videos you saw was trained on behavior patterns from users worldwide. Byte Dance engineers in Beijing made changes to it. The algorithm learned from what billions of people did across all Tik Tok's markets. Then that same algorithm, occasionally tweaked for local preferences, showed videos to American users.

Now, that changes fundamentally. The deal requires that Tik Tok maintain a separate, US-specific version of the recommendation algorithm that is:

- Trained exclusively on US user behavior data (not global data)

- Retrained and updated on a regular basis within the US data infrastructure

- Secured within Oracle's US cloud environment

- Audited by third-party security experts to ensure no unauthorized changes

- Separate from Byte Dance's global algorithm development

What this means in practice is that the algorithm showing you videos on Tik Tok in the United States is fundamentally different from the algorithm Byte Dance deploys to users in India, Indonesia, Brazil, or anywhere else.

This has massive implications. The global Tik Tok system benefits from network effects—what works in one market can be quickly tested and deployed globally. The US algorithm now can't tap into that. If Byte Dance discovers some brilliant way to increase engagement in their core markets, they can't automatically apply it to American users.

Conversely, if Tik Tok's US team discovers something that works brilliantly for American content creators, they can't directly share that improvement with the global system without formal approval processes.

But here's something that's not widely understood: the US algorithm might actually become better at serving American users. Because it's trained exclusively on American behavior, it learns from what Americans actually watch, what content Americans create, what hashtags Americans use. A global algorithm optimized for all markets simultaneously is inherently a compromise. A US-specific algorithm doesn't have to compromise.

The question is: will Tik Tok's US team have the resources and autonomy to develop and improve this algorithm independently? Or will they basically copy the global version and tweak it minimally? That decision hasn't been publicly answered, and it has profound implications for whether Tik Tok remains competitive with YouTube's recommendation engine and Instagram's Reels algorithm.

Content Moderation and Trust & Safety: Who Decides What Stays Online?

Let's talk about something that affects every single person who uses Tik Tok: what content is allowed on the platform. Before the deal, content moderation decisions ultimately traced back to Byte Dance. Yes, Tik Tok had US-based trust and safety teams, but they operated under policies set in Beijing. If the Chinese government wanted something removed, Chinese government pressure could flow through to US policy decisions.

The new structure changes this. The joint venture has exclusive decision-making authority over content moderation and trust and safety policies for US users. Byte Dance can't override these decisions. The managing investors can't unilaterally impose policies without going through proper governance.

Who actually runs this? Adam Presser, as we discussed, holds the CEO title for the joint venture and has operational authority here. But the policies themselves are set by a trust and safety committee that includes:

- Representatives from the managing investors

- US-based trust and safety executives (some new hires, some existing Tik Tok staff)

- External advisors on platform moderation (the deal specifies that external expertise is required)

- Oversight from the board on major policy decisions

In practice, this means Tik Tok's moderation policies in the US can now diverge from global Tik Tok policies. The platform might allow something in France that gets removed in the US, or vice versa. This actually creates more responsibility for Tik Tok's US teams because they can't hide behind "global policy" excuses.

But there's a deeper implication here. Tik Tok's global content moderation, influenced by Chinese government preferences, sometimes erred on the side of heavy censorship around sensitive political topics, historical events China views controversially, or content critical of the Chinese government. The US system isn't required to follow those same rules (and couldn't legally, given free speech protections).

What this means: Tik Tok's US version could theoretically host content that would never survive moderation on Tik Tok's version in countries like India or Brazil where Byte Dance's direct influence remains stronger. This creates a fascinating situation where Tik Tok could become more politically open in the US than it is in other major markets.

The flip side? Responsibility. The joint venture can now be held directly accountable for content moderation decisions. If Tik Tok fails to remove terrorist content, removes political speech that shouldn't be removed, or enables harassment, the US-based board and management team face direct consequences.

ByteDance retains 19.9% ownership in TikTok, while Silver Lake, Oracle, and MGX each hold 15%. The remaining 35.1% is distributed among other shareholders, indicating a diverse ownership structure.

The Governance Board: Seven People, Near-Infinite Responsibility

Let's zoom back out and understand the actual mechanics of how decisions get made. The seven-person board meets, what, weekly? Monthly? We don't actually know. The deal doesn't specify meeting cadences.

But we do know the basic structure. Shou Zi Chew, Adam Presser, and four representatives from the managing investors/key shareholders. That's seven people making decisions that affect 170 million Americans' daily information diet.

The board has explicit authority over:

- Product decisions affecting US users: Major feature rollouts, algorithm changes, interface redesigns

- Data security and compliance: Confirming that US data stays in the US, that Oracle's infrastructure meets requirements

- Content policy and moderation: Setting rules for what's allowed on the platform

- Financial and commercial decisions: Advertising policies, e-commerce features, creator payment structures

- Governance itself: How the joint venture operates, how decisions get made, how conflicts get resolved

Where it gets interesting is the veto power. Does any single board member have veto authority? The deal doesn't specify. Presumably, significant decisions require some form of consensus or supermajority (like 5 out of 7 votes). But if Oracle, Silver Lake, and MGX all agree, they control 75% of the board if they vote as a bloc.

This creates an interesting dynamic. Tik Tok's US team (represented by Chew and Presser) can propose initiatives, but if the investors say no, they can't proceed. This is different from how traditional tech companies operate, where the CEO has significantly more unilateral authority.

But there's also investor diversity built in. Silver Lake, Oracle, and MGX have different motivations. Oracle cares about maintaining its role as trusted infrastructure provider and protecting its reputation. Silver Lake cares about maximizing the investment's return. MGX, as a sovereign wealth fund, cares about geopolitical positioning and long-term value. They don't always agree.

When investors disagree, the mechanism for resolution is unclear. The deal documentation doesn't publicly specify what happens if Oracle and Silver Lake vote one way and MGX votes another. In practice, probably some form of discussion, compromise, or escalation to higher-level investors. But this ambiguity is significant. It means certain decisions might get bottlenecked by governance disputes.

The E-Commerce and Commercial Opportunity: Where Tik Tok Actually Makes Money

Here's something that doesn't get discussed enough: Tik Tok is phenomenally good at selling things. The platform's visual design, its viral mechanisms, and its user engagement drive commerce in ways YouTube and Instagram still haven't matched.

In China, Douyin (the Chinese version of Tik Tok) is essentially a shopping platform with video content attached. Creators sell products directly through livestreams. Shoppable links are embedded throughout the app. The platform takes a cut of every transaction.

In the US, Tik Tok Shop exists but remains relatively underdeveloped compared to Douyin. Why? Partly because Tik Tok has been fighting for survival. Partly because the regulatory environment is different. Partly because American e-commerce has different infrastructure than China's.

But the new joint venture structure specifically identifies e-commerce as a priority. The deal mentions that Tik Tok's US entities will manage "e-commerce, advertising, and marketing" as part of maintaining a "global Tik Tok experience."

What this means: the managing investors are explicitly betting that Tik Tok's US shop can be a significant revenue driver. If Tik Tok can convince American creators to livestream product sales, if it can embed shopping features throughout the feed the way Douyin does, the financial upside is enormous.

Currently, Tik Tok makes money primarily through advertising. Advertisers pay to put ads in the feed. But take-rates on ads aren't as high as direct commerce. If Tik Tok could shift even 20% of user monetization toward e-commerce, revenue could double.

The joint venture structure actually helps here. American investors (Silver Lake, various family offices) understand US e-commerce dynamics better than Byte Dance's Beijing headquarters. They can push for strategies that work specifically in the American market. They can accelerate Tik Tok Shop development without waiting for global alignment on strategy.

But there's also friction. Tik Tok Shop means creators making money off Tik Tok, which creates a different legal liability structure than simple content creation. It means inventory management, logistics, customer service, payment processing. It means Tik Tok becomes not just a social platform but a marketplace, with all the regulatory complexity that entails.

Creator Economy Implications: What Changes for People Making Money on Tik Tok?

Let's get practical. There are probably millions of people whose primary income comes from creating content on Tik Tok. They make money through:

The Creator Fund: Tik Tok's direct payment program for creators with enough followers

Brand partnerships: Companies paying creators to make sponsored content

Tik Tok Live gifts: Viewers sending tips during livestreams

Tik Tok Shop: Selling products directly through the platform

All of these payment mechanisms now go through the joint venture. The question is: do terms change?

The deal documentation doesn't specify new creator payment percentages or rates. So theoretically, creators' compensation structures could stay the same. But the managing investors are clearly looking at the creator economy as strategic. Why? Because creators are the supply side of the platform's content. Better creator compensation means more and better content, which means more user engagement, which means higher ad rates and more e-commerce opportunity.

Here's what I think is likely to happen: Tik Tok will gradually increase creator payouts to compete with YouTube and Instagram. Not because of regulatory requirement, but because the managing investors understand that's a lever to drive platform growth. YouTube has invested billions in creator payouts specifically to keep creators from moving to Tik Tok. Now Tik Tok can reciprocate.

The challenge: where does the money come from? If creator payouts increase by 30%, Tik Tok needs revenue to grow by at least that much to maintain profitability. That means aggressive expansion of advertising and e-commerce. That means potentially more ads in the feed, more aggressive shopping features, more paywall content.

Creators benefit from higher payouts but experience a platform that's increasingly commercial. Users face a more cluttered feed. It's a classic tech platform trade-off.

Before January 2025, TikTok user data was distributed across US, Chinese, and hybrid servers. Post-January 2025, all US user data is stored exclusively in US data centers. Estimated data.

International Implications: Can Tik Tok Share Data or Features with Global Versions?

One of the deal's most interesting aspects involves something called "interoperability." Tik Tok USDS is allowed to maintain "global Tik Tok experience" through interoperability with its international operations.

What does that mean? Essentially, US creators can have their content discovered globally, and global creators can reach US audiences. But the way that happens is now explicitly regulated.

The deal specifies that Tik Tok Global's US entities will manage "global product interoperability and certain commercial activities, including e-commerce, advertising, and marketing." This is legalistic language for: Tik Tok's US team can make certain decisions that affect the global platform, but only in specific domains (commerce, advertising), not core infrastructure.

Why does this matter? Because before the deal, Byte Dance essentially made all strategic decisions that affected what version of Tik Tok users experienced globally. Now, the US team has partial veto power over certain decisions.

But there's a tension here. If Tik Tok's US team wants to implement an algorithm change that increases engagement in America but decreases it in other markets, what happens? The deal doesn't specify. Byte Dance's global team might say "no, this hurts our core markets." Tik Tok's US team might say "we need local optimization." The board would have to mediate.

In practice, this probably means that certain US-specific initiatives get blocked because they conflict with global strategy. The joint venture structure creates decision-making friction. That's intentional (it prevents unilateral power), but it also slows innovation.

Here's an example: suppose Tik Tok's US team discovers that showing more local content (from creators in your state/region) dramatically increases engagement. They want to implement this. But Byte Dance's data suggests that global algorithmic diversity (showing content from everywhere) drives engagement more effectively at scale. These two approaches conflict. How does the board resolve this?

The deal doesn't say. This is a governance gap that will play out in real time as Tik Tok's US team and the managing investors figure out how to actually operate this structure.

The Financial Investment: Who Put Money In, and How Much?

The deal announcement didn't include specific numbers on how much money each party invested. But we can make reasonable estimates based on market information and deal structures.

The three managing investors—Silver Lake, Oracle, and MGX—each hold 15% of the joint venture. For a platform with Tik Tok's user base and engagement metrics, a 15% stake is enormous. Industry comparisons (like Instagram's valuation before Meta acquisition, or YouTube's implied value before Google acquisition) suggest Tik Tok's US operation alone could be valued at $50-100 billion.

If the valuation is

The other shareholders (Michael Dell's office, General Atlantic, etc.) likely invested billions more. The total capital raised probably exceeds $40 billion.

Why so much capital for a restructuring? Because the joint venture needs to:

- Invest in data infrastructure: Moving US data to Oracle's systems and ensuring compliance requires significant capital

- Fund content and creator programs: Competing with YouTube and Instagram requires paying creators and producing premium content

- Invest in product development: Building a US-specific algorithm and features requires engineering resources

- Cover regulatory and legal costs: Complying with all the new rules is expensive

- Build redundancy and security: Operating independently requires backup systems, security audits, 24/7 operations

The managing investors are essentially betting that Tik Tok's US business, with full autonomy and capital investment, can become a $100+ billion asset within 3-5 years. That bet makes sense given the platform's user base and engagement metrics.

Data Security and Third-Party Audits: Who Watches the Watchmen?

All of the data protection and cybersecurity requirements we've discussed mean nothing if there's no enforcement mechanism. The deal includes what's called "third-party certification" for compliance.

Essentially, independent cybersecurity auditors (not chosen by Tik Tok, not chosen by the managing investors, but chosen through a formal process) regularly audit Tik Tok's compliance with:

- NIST Cybersecurity Framework: The national standard for government-grade security

- NIST 800-53 controls: Specific technical controls for protecting sensitive data

- ISO 27001: International standard for information security management

- CISA requirements: Cybersecurity and Infrastructure Security Agency standards

These aren't suggestions. These are mandatory compliance requirements, with regular third-party verification. If Tik Tok fails an audit, the consequences cascade. The board is notified. The regulatory authorities are notified. Tik Tok potentially loses operational authority over its US systems.

Who are these auditors? The deal doesn't specify by name (for security reasons—if everyone knew who was auditing Tik Tok, they'd know which vulnerabilities to look for). But they're likely major cybersecurity firms like Deloitte, Pw C, or specialized firms like Crowd Strike.

The frequency of audits? Also not publicly specified, but probably at least quarterly. Possibly monthly for critical systems. This means Tik Tok's security posture is under constant external scrutiny.

Why is this significant? Because no other US social media platform operates under this level of security oversight. Facebook, Instagram, YouTube, Twitter—they have internal security teams and external audits, but not formal third-party certification requirements baked into their licensing terms.

Tik Tok's security is now at a level typically reserved for government systems or critical infrastructure. That's a massive operational burden, but it also means that if Tik Tok's systems get breached, it's objectively worse than if competitors get breached. The standard is higher.

Estimated data shows that Oracle, Silver Lake, and MGX could control 75% of board decisions if they vote as a bloc, highlighting their significant influence over TikTok US operations.

The Cap Cut and Lemon 8 Angle: Why Tik Tok's Other Apps Matter

The official deal announcement mentions that the data protection and algorithm security requirements apply to Tik Tok, the video editor Cap Cut, Lemon 8, and "a portfolio" of other apps and services.

Cap Cut, for those who don't follow mobile apps obsessively, is the most popular video editing app in the world. Billions of people use it. Lemon 8 is Byte Dance's answer to Instagram—a photo-sharing app that competes with Instagram and Snapchat.

Why are these included in the restructuring? Because they're all owned by Byte Dance and pose similar national security concerns. If Tik Tok's algorithms and data need to be segregated from China, so do Cap Cut and Lemon 8.

But here's the complication: Cap Cut and Lemon 8 are fundamentally different from Tik Tok. Cap Cut is a creation tool, not a social platform. Its primary function is editing videos, not hosting them. Applying Tik Tok's data sovereignty and algorithm requirements to Cap Cut creates some weird technical requirements.

Do all of Cap Cut's editing renders need to live on Oracle's US cloud? That's computationally expensive and slow. Does Cap Cut need a separate US-trained algorithm for suggesting effects? That seems overengineered for an editing tool.

Lemon 8 is closer to Tik Tok—it's a social platform with content, algorithms, and user data. So the requirements make more sense there.

What this reveals is that the restructuring isn't perfectly tailored to each app. It's a blanket structure applied to Byte Dance's entire US portfolio. Some requirements fit better than others. Some create technical overhead that might not be justified.

Likely outcome: over time, the joint venture will probably push for more nuanced requirements for different apps. Cap Cut doesn't need the same level of algorithm separation as Tik Tok. Lemon 8 needs strong data protection but maybe not identical governance. The deal's initial language is broad intentionally—it can be refined as the joint venture figures out what actually needs to be where.

Competitive Implications: Tik Tok vs. YouTube, Instagram, and Emerging Competitors

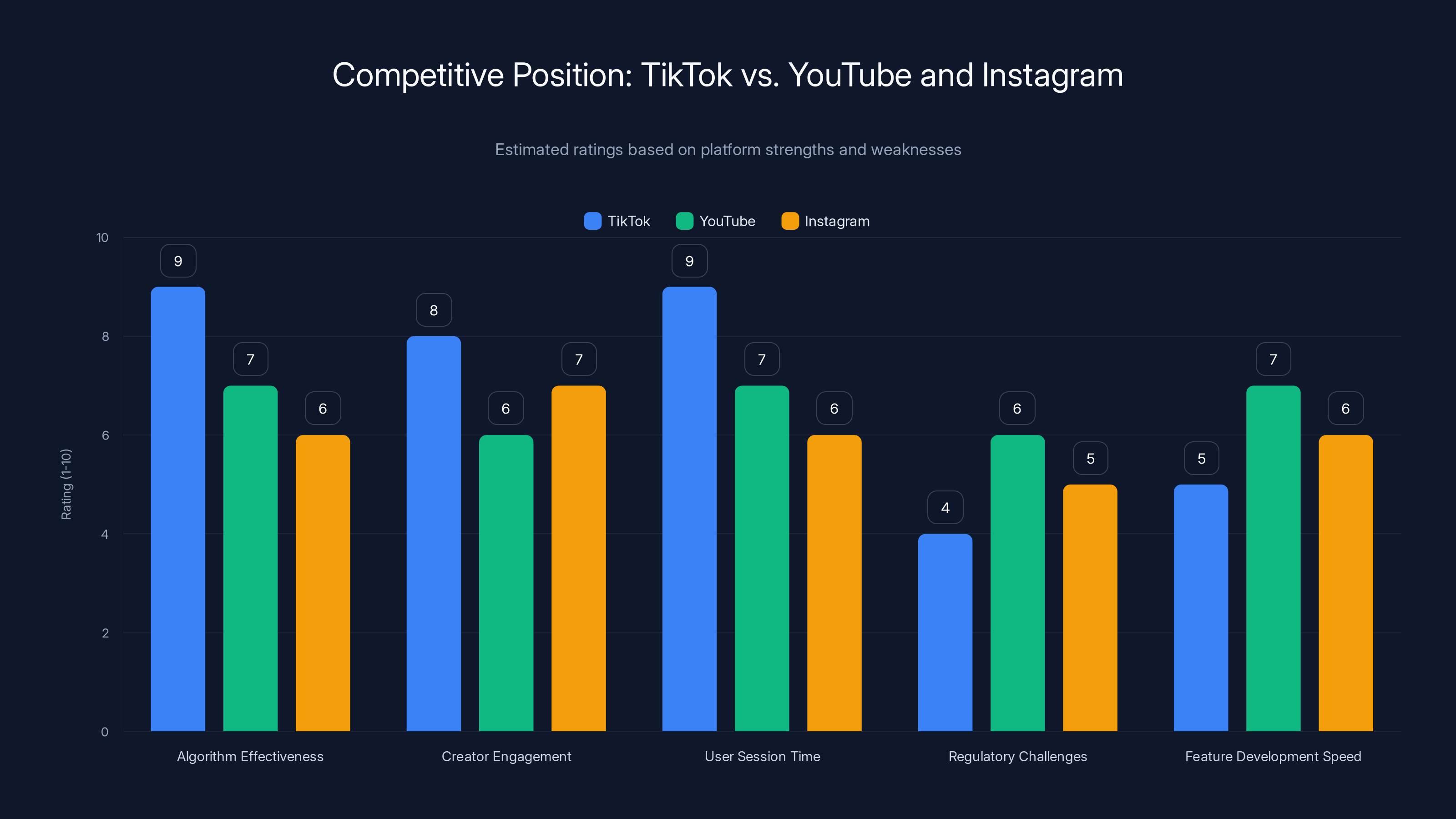

Let's talk about what this restructuring means for Tik Tok's competitive position. Before January 2025, Tik Tok had some advantages and some disadvantages versus competitors.

Advantages: Its algorithm is phenomenally good at predicting what users want to watch. The platform has achieved viral mechanics that YouTube and Instagram still haven't matched. Creator engagement is higher than competitors. User session times are longer.

Disadvantages: Global content moderation by a Chinese company creates regulatory friction. International operations are fragmented. Different countries have different rules for different apps.

The restructuring changes both the advantages and disadvantages.

New advantages: Tik Tok now has American investors who understand US markets deeply. The platform can move faster on US-specific features because it's not locked to global decision-making timelines. Creator payouts could increase if the managing investors invest heavily in creator acquisition.

New disadvantages: Algorithm development is now segregated. The US algorithm doesn't benefit from global data anymore. Feature development is slower because of board governance requirements. Operations are more expensive because of data sovereignty requirements.

Net-net, Tik Tok probably becomes slightly less competitive in the short term (6-12 months) but potentially more competitive long-term. Why? Because in the short term, governance friction slows decision-making. But long-term, the platform gets capital, operational autonomy, and managers who understand American users specifically.

YouTube's response is probably to lean harder into Shorts, which competes with Tik Tok's vertical video format. Instagram's response is probably to invest heavily in Reels recommendations. These platforms will accelerate investment to prevent Tik Tok from consolidating its position.

What about emerging competitors? Platforms like Reddit, Threads, and Bluesky are all experimenting with content algorithms and community features. None of them have Tik Tok's engagement, but they're investing in recommendation systems that could eventually compete.

The restructuring doesn't fundamentally change this competitive landscape. It just makes it murkier. We won't know for 12-18 months whether the joint venture structure helps or hinders Tik Tok's ability to compete.

The Regulatory Future: What Could Still Go Wrong?

The deal is done. Tik Tok is operating. The joint venture is in place. But it's not like the regulatory threats have evaporated.

First, Congress could pass new legislation specifically targeting Tik Tok or the joint venture structure. Incoming administrations could take different positions on national security concerns. If there's a significant incident involving Tik Tok (a massive data breach, for example), political pressure could build quickly.

Second, the Chinese government could create obstacles. If Byte Dance's 19.9% stake becomes controversial in China, the government could pressure Byte Dance to divest or restrict Tik Tok's access to Chinese data or infrastructure. This is less likely but not impossible.

Third, the board itself could fail. If the managing investors can't agree on strategic direction, decision-making gets paralyzed. If Oracle and Silver Lake have fundamentally different visions for Tik Tok's US future, they could deadlock on major issues.

Fourth, the auditing process could identify compliance failures. If third-party cybersecurity auditors find vulnerabilities that the joint venture can't fix quickly, the platform could face operational restrictions or heightened oversight.

None of these are probabilities necessarily. But they're non-zero risks that could reshape Tik Tok's US future again.

TikTok excels in algorithm effectiveness and user engagement but faces regulatory challenges. Estimated data.

The Creator and Advertiser Response: Early Signals

In the first few weeks after the deal closed, what have we seen from creators and advertisers?

Creators seem cautiously optimistic. Many content creators were worried that Tik Tok would simply be shut down, which would have destroyed their livelihoods. With the platform operational under a new structure, they're breathing easier. Some creators are waiting to see if creator payouts increase under the new management.

Advertisers are also cautiously optimistic. Brands that were hesitant to invest heavily in Tik Tok advertising (worried about regulatory instability) are now more willing to commit. The joint venture structure, with American managing investors, reduces the "Chinese government could shut this down" risk from advertiser perspective.

What we haven't seen is explosive growth or dramatic changes to creator compensation. The platform is operating mostly as before, just with new ownership and governance structures.

This makes sense. The first priority of the managing investors is to stabilize the platform and ensure regulatory compliance. Aggressive expansion and creator payout increases probably come in year two or three, not month one.

What Changes You'll Actually Notice as a User

Let's get specific about what you, as a Tik Tok user, will actually experience as a result of this restructuring.

In the next 3 months: Probably nothing obvious. The platform operates mostly as before. Videos load at similar speeds. Content recommendations seem similar. You might occasionally notice loading delays as Tik Tok integrates new backend systems, but nothing dramatic.

In 3-6 months: Potential algorithm changes as Tik Tok's US team fine-tunes the US-specific recommendation system. Your FYP (For You Page) might feel slightly different as the algorithm trains on purely US-based data without global influence. Some creators will experience different performance.

In 6-12 months: Potentially increased ads in the feed as Tik Tok monetizes more aggressively under its new ownership. More shoppable content if Tik Tok Shop expansion accelerates. New features developed specifically for US users (rather than global features deployed universally).

In 12+ months: Potentially increased creator payouts if the managing investors invest heavily in creator acquisition and retention. More video editing features if Cap Cut integration deepens. More e-commerce functionality.

But none of this is guaranteed. It depends on whether the board cohesion holds, whether the managing investors' strategy succeeds, and whether regulatory challenges emerge.

The Precedent This Sets: What Does This Mean for Other Foreign Platforms?

While Tik Tok is getting all the attention, the joint venture structure has implications beyond just Tik Tok.

Chinese companies that own or operate platforms in the US now have a template for how to structure ownership if they face similar national security concerns. Byte Dance used this with Tik Tok. Other Chinese tech companies could potentially use similar structures for their US operations.

But there's also a precedent in the opposite direction. If a US company faced similar regulatory concerns in China, they'd need to accept minority ownership and US investor control. This is essentially the same pattern that Tesla accepted when it expanded in China—local ownership requirements and oversight.

The Tik Tok restructuring could become a model for international tech business. Foreign platforms operating in the US? Accept American investor majority ownership and oversight. US platforms operating in China? Accept Chinese investor majority ownership and oversight. The structure balances national interests with commercial opportunity.

Other platforms watching this closely: Alibaba's e-commerce operations in the US (limited but growing). Baidu's AI initiatives. Any Chinese tech company with US ambitions.

For American tech companies, this is also significant. If you want to operate in China, you need to accept state oversight and local partnership requirements. Now there's a reciprocal model where Chinese companies operating in America need to accept US investor control. It's a kind of tech nationalism, but it's systematized rather than ad-hoc.

The Long-Term Vision: Where Is Tik Tok Headed?

If you believe the managing investors' stated strategy (and they've been consistent about this), Tik Tok's five-year trajectory looks like this:

Year 1-2: Stabilization Focus on regulatory compliance, security audits, infrastructure segregation. The goal is to prove that the joint venture can operate autonomously while meeting all security requirements. Growth is secondary. Stability is primary.

Year 2-3: Optimization Once the core systems are stable and audited, focus shifts to optimization. How can Tik Tok serve US users better than the global platform was serving them? Are there algorithm improvements? Are there US-specific features that drive engagement? Can Cap Cut and Lemon 8 integrate better with Tik Tok's core platform?

Year 3-5: Growth Once the platform is optimized, growth becomes the priority. Aggressive creator payout increases to pull content creators away from YouTube and Instagram. Expansion of e-commerce and shopping features. Potentially acquisition of other platforms or features to create a super-app similar to what Douyin is in China.

The managing investors' endgame? Create a US-based social media and e-commerce mega-platform that rivals Facebook's empire in scope but with better algorithms and more creator-friendly economics. That's a multi-billion dollar opportunity if executed well.

Is this plan realistic? Partially. The technical and regulatory pieces are feasible. The market competition is fierce—YouTube and Instagram aren't sitting still. But if Tik Tok can retain its user engagement advantages (170 million US users is a massive install base) and invest capital strategically, it's a plausible trajectory.

The biggest uncertainty: Will the board remain cohesive? If Silver Lake, Oracle, and MGX have fundamentally different visions for Tik Tok's future, the joint venture could stall. But investor incentives are aligned—they all profit if Tik Tok succeeds, and they all lose if it fails. That alignment probably holds for at least 3-5 years.

FAQ

What exactly is the Tik Tok USDS Joint Venture?

The Tik Tok USDS Joint Venture LLC is the legal entity that now owns and operates Tik Tok in the United States. It's owned 80.1% by American and international investors (with Silver Lake, Oracle, and MGX each holding 15%, plus several other investors) and 19.9% by Byte Dance. The joint venture is governed by a seven-member board and operates independently from Tik Tok's global operations.

Why did Byte Dance accept this deal instead of fighting it in court?

Byte Dance had several options: divest Tik Tok entirely (losing a platform worth potentially $50+ billion), fight the law in court (facing an uncertain legal battle), or accept a restructuring where it retains partial ownership while ceding operational control. The joint venture was likely the least bad option. Byte Dance retains a financial stake, Tik Tok remains operational, and the company avoids forced divestiture.

How much did the restructuring cost, and who paid for it?

The deal's total capital wasn't publicly disclosed, but industry estimates suggest the managing investors and other shareholders collectively invested $40+ billion to fund the restructuring, infrastructure migration, and ongoing operations. Oracle contributed capital plus infrastructure services worth potentially billions more.

What changes for Tik Tok users immediately?

For most users, very little changes immediately. The platform functions the same way. Content loads the same. Your FYP works similarly. The changes are behind-the-scenes: data is now stored in US data centers, the algorithm is trained on US-only data, content moderation is under US-based control. These don't affect user experience immediately but will shape platform evolution over months and years.

Will Tik Tok be cheaper or more expensive for creators in terms of payout rates?

That's not yet determined by the deal structure. The managing investors haven't announced new creator payment rates. However, industry analysts expect that the joint venture will likely increase creator compensation over time to compete with YouTube and attract more content creators, but this isn't guaranteed and depends on the board's strategy.

Can Tik Tok still share content and features with the global Byte Dance ecosystem?

Tik Tok can share content and features with global Tik Tok through what's called "interoperability," but this is now regulated and limited. The US team can't unilaterally make decisions that affect the global platform. Decisions about e-commerce, advertising, and marketing go through the joint venture. Structural changes to the core platform require coordination with global operations.

What happens if the three managing investors disagree on a major decision?

The deal doesn't publicly specify a conflict resolution mechanism. In practice, if Oracle, Silver Lake, and MGX disagree on a critical issue, it probably escalates to senior executives from each firm, and they negotiate a resolution. If consensus can't be reached, the board can take a vote (requiring at least some threshold majority). Significant deadlock could theoretically freeze platform decisions, though this is unlikely given aligned financial incentives.

Is Tik Tok's data actually secure now, and how can I verify this?

Tik Tok's security is now audited by third-party cybersecurity experts on a regular basis (probably quarterly or monthly for critical systems). The platform must comply with NIST standards, ISO 27001, and CISA requirements. These audit results aren't publicly available for security reasons, but you can be reasonably confident that Tik Tok's security is at least as strong as any US government agency's security (since they use the same standards).

Could the US government still ban Tik Tok even though this deal is done?

Theoretically yes, but practically unlikely. The joint venture structure addresses the primary national security concerns (data storage, algorithm independence, American oversight). Congress could pass new legislation, but it would need to overcome the fact that Tik Tok now has major American investors (including Oracle, a hugely influential US tech company) with significant financial stakes in keeping the platform operational.

How long will it take for users to notice differences in how Tik Tok operates?

Small differences could be noticeable within 3-6 months as the US-specific algorithm trains on more data and the board makes first strategic decisions. Significant differences (in creator payouts, e-commerce integration, feature availability) probably take 12+ months to implement. The first year is focused on stability and compliance, not aggressive changes.

What if one of the managing investors wants to exit their stake?

That's governed by shareholder agreements that aren't public. But generally, investors can probably sell their stake to other approved buyers (likely other investors from the existing consortium) after some holding period. The deal probably includes restrictions preventing Byte Dance from acquiring additional stakes or preventing the stake from being sold to parties the board deems security risks.

The Bottom Line

After more than a year of uncertainty, regulatory battles, and existential threats, Tik Tok has survived by transforming itself into something structurally unique in American tech. It's not fully American-owned. It's not controlled by Byte Dance. It's a hybrid that's never really been attempted at this scale before.

Is it perfect? No. The governance structure creates friction. The data segregation increases costs. The algorithm independence might slow innovation. But it's a workable compromise that addresses legitimate national security concerns while preserving a platform that 170 million Americans use daily.

The real test comes over the next 2-3 years. Can the board remain cohesive and make good strategic decisions? Can Tik Tok's US team optimize the platform for American users specifically? Can the joint venture balance growth with compliance? These questions don't have obvious answers yet.

What we do know: Tik Tok isn't going anywhere. The platform has institutional support from Oracle, Silver Lake, and MGX. It has capital. It has users. It has a path forward.

For creators worried about their livelihoods, this is probably good news. For users concerned about data privacy, the security oversight is reassuring. For competitors like YouTube and Instagram, the restructuring probably slows Tik Tok's growth, which buys time to catch up.

The Tik Tok deal being "finally done" doesn't mean the story is over. It means a new chapter is beginning. And unlike the previous chapters, this one actually has a coherent narrative direction.

We'll find out in the next couple of years whether the managing investors made a good bet. But for now, Tik Tok's American future is secure. And that stability, after the chaos of the previous year, is genuinely valuable for everyone involved.

Key Takeaways

- TikTok USDS Joint Venture is now 80.1% owned by American and international investors, with ByteDance capped at 19.9% ownership

- Three managing investors (Silver Lake, Oracle, MGX) each hold 15% stakes and control strategic platform decisions through a seven-member board

- All 170 million US users' data is now segregated in Oracle's US cloud infrastructure, separated from ByteDance systems

- TikTok's recommendation algorithm is retrained exclusively on US user data, no longer influenced by global ByteDance systems

- The restructuring creates operational overhead and governance friction that could slow innovation but provides regulatory certainty and capital investment

Related Articles

- Epic and Google's $800M Secret Deal: What It Means for Android [2025]

- Substack's TV App Launch: Why Creators Are Pushing Back [2025]

- Epic vs Google Settlement: What Android's Future Holds [2025]

- Substack's TV App Launch: Why Creators Are Torn [2025]

- Meta's Child Safety Case: Evidence Battle & Legal Strategy [2025]

- Wikipedia's AI Detection Guide Powers New Humanizer Tool for Claude [2025]

![TikTok's US Future Settled: What the $5B Joint Venture Deal Really Means [2025]](https://tryrunable.com/blog/tiktok-s-us-future-settled-what-the-5b-joint-venture-deal-re/image-1-1769134062875.jpg)