AMD's Strong Financial Results Despite PC Market Decline: What Investors Need to Know

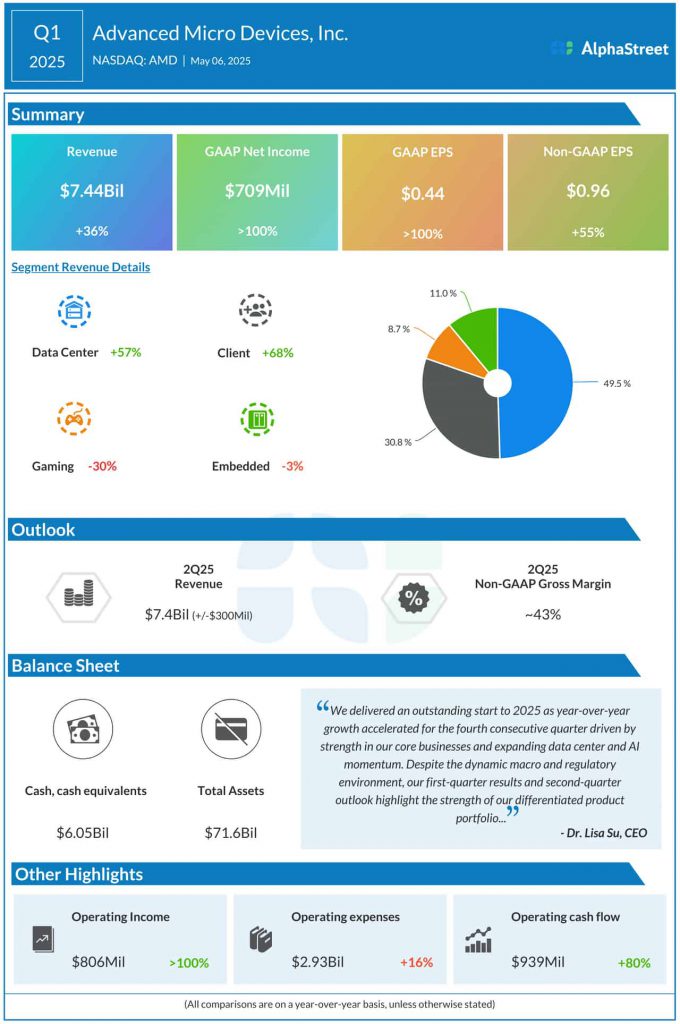

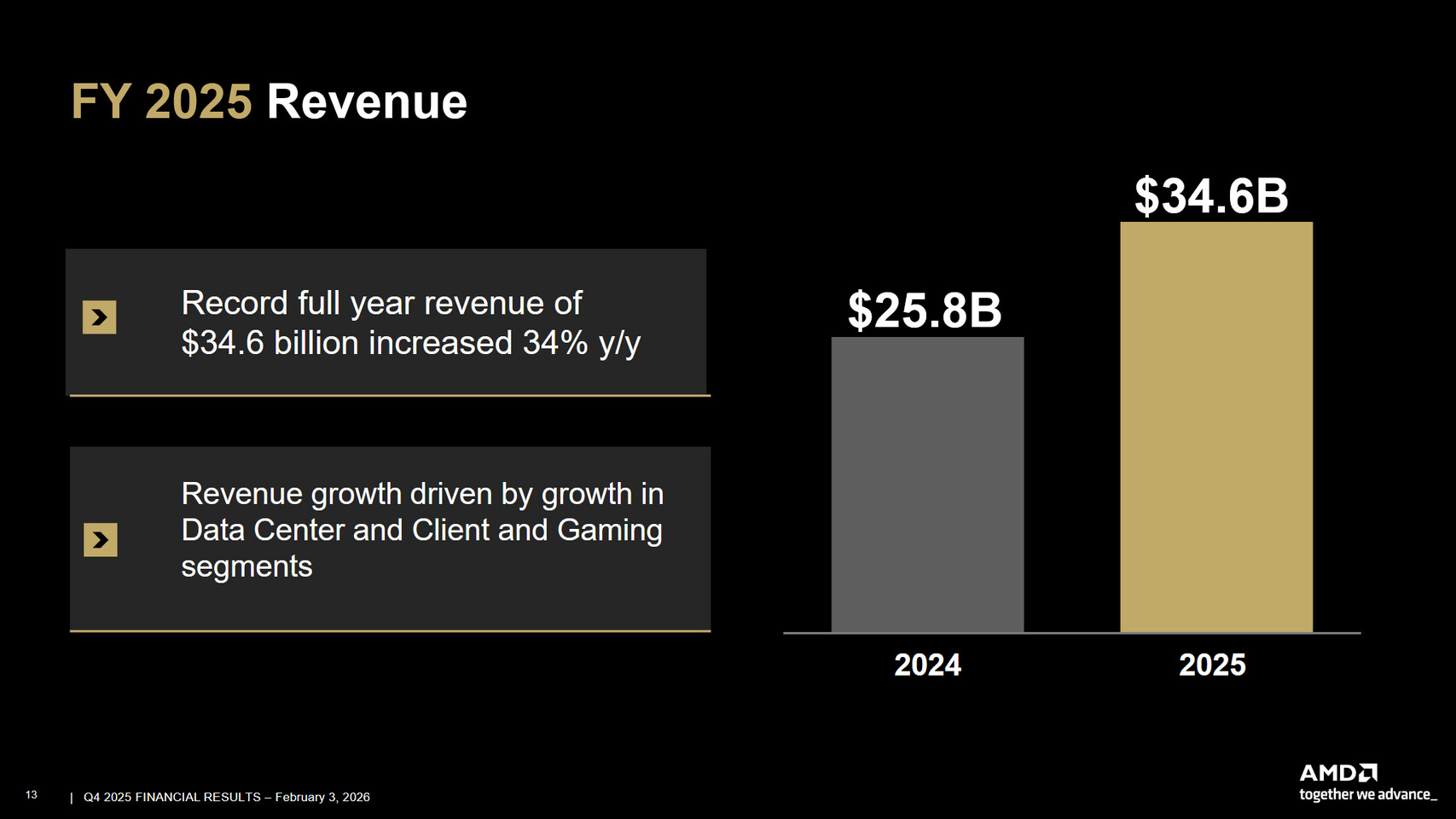

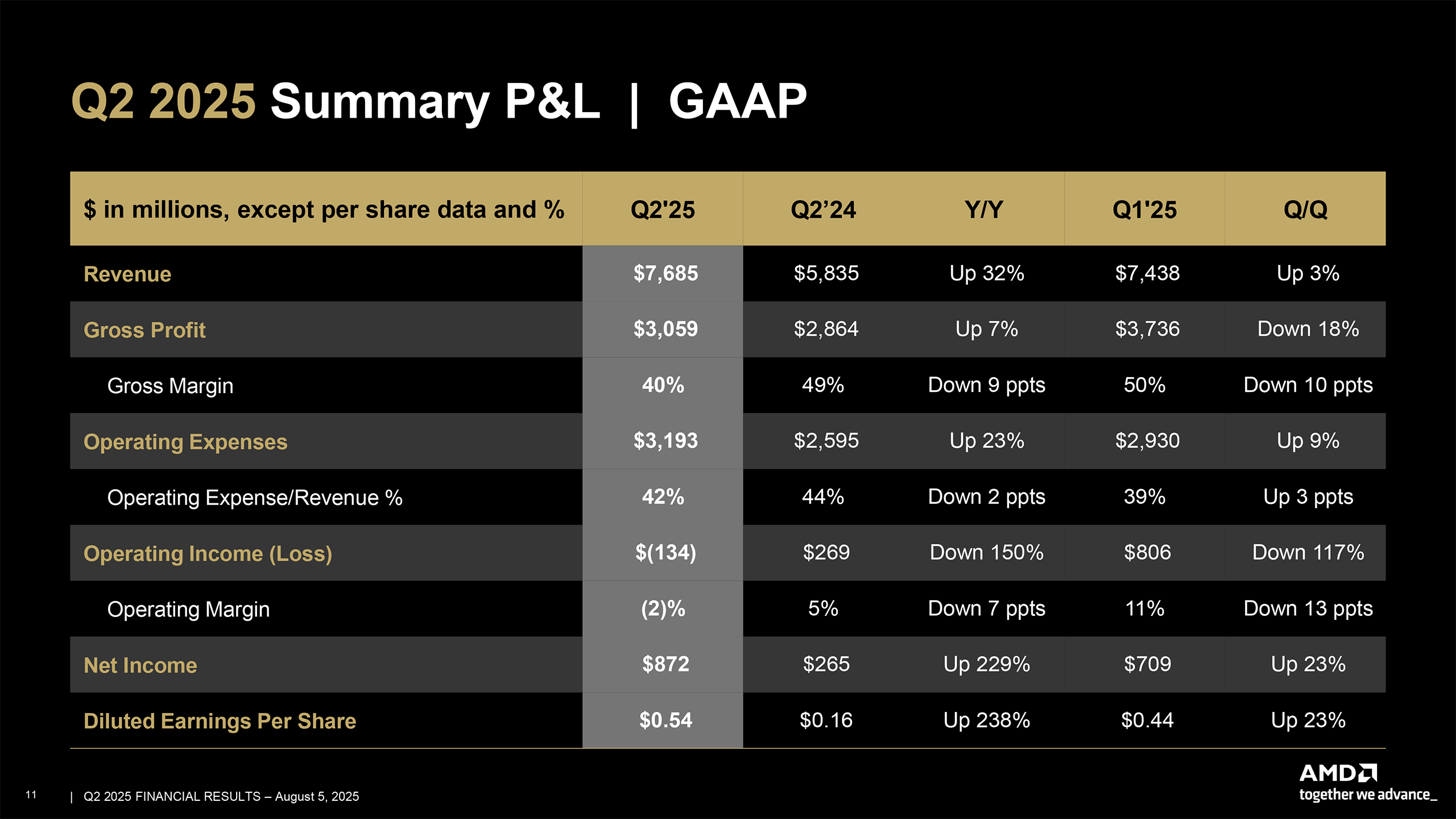

AMD just posted numbers that would make most tech companies pop champagne. We're talking

While AMD's data center business is absolutely crushing it, Dr. Lisa Su is quietly warning that the traditional PC market is shrinking. Fast. And that matters more than you might think, because the PC business has been AMD's bread and butter for decades.

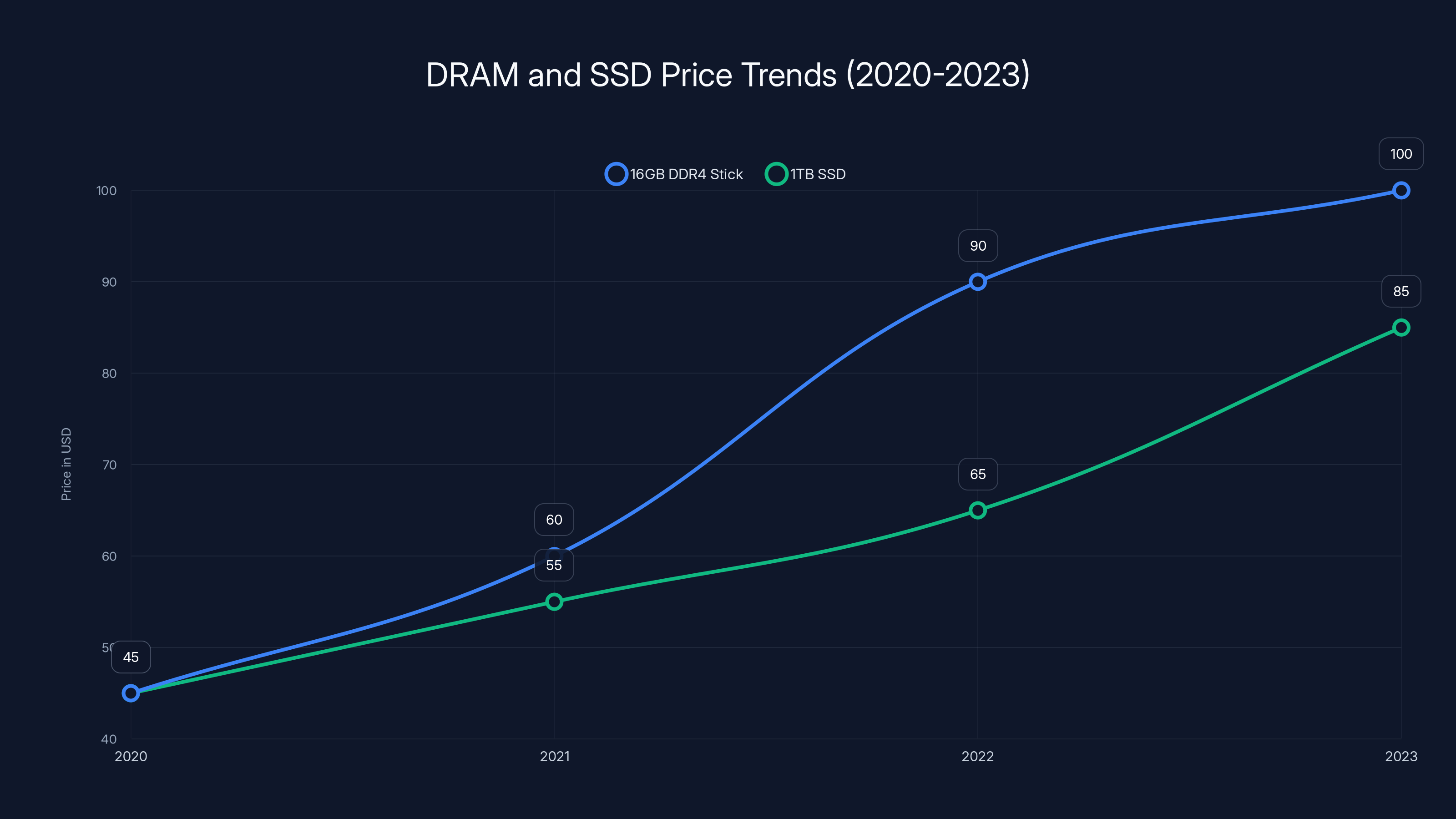

Here's what's actually happening: memory and SSD prices have skyrocketed, making new PC builds increasingly expensive. We're not talking about a modest price bump. Some RAM kits now cost four times more than they did at recent lows. That's the kind of pricing that makes people hold onto their computers longer, skip upgrades, and generally decide that whatever they've got is good enough for another year.

But AMD's CEO isn't panicking. Instead, she's pivoting. The company is deliberately shifting focus toward enterprise customers and premium market segments, basically abandoning the race to compete on volume in the consumer space. It's a strategic move that says a lot about where the entire chip industry is heading, and it has real implications for anyone building PCs, upgrading hardware, or investing in semiconductor companies.

In this article, we're going to dig into AMD's actual financial performance, understand what's driving the growth, and decode what the company's strategic shift means for the future of PC computing. Because these earnings aren't just numbers on a balance sheet—they're a roadmap for how the entire industry is evolving.

TL; DR

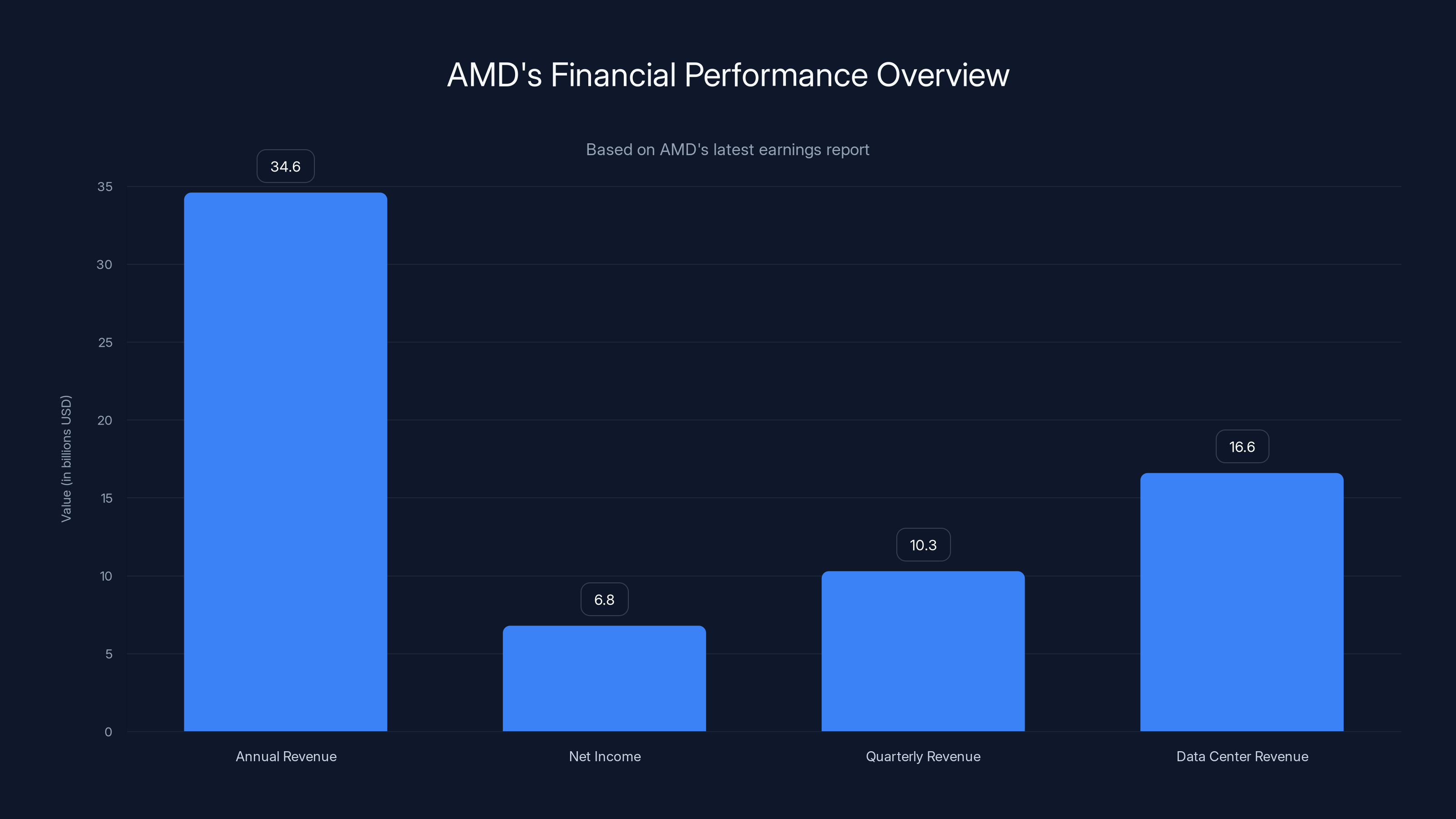

- AMD hit 6.8B in net income, proving semiconductor demand remains strong

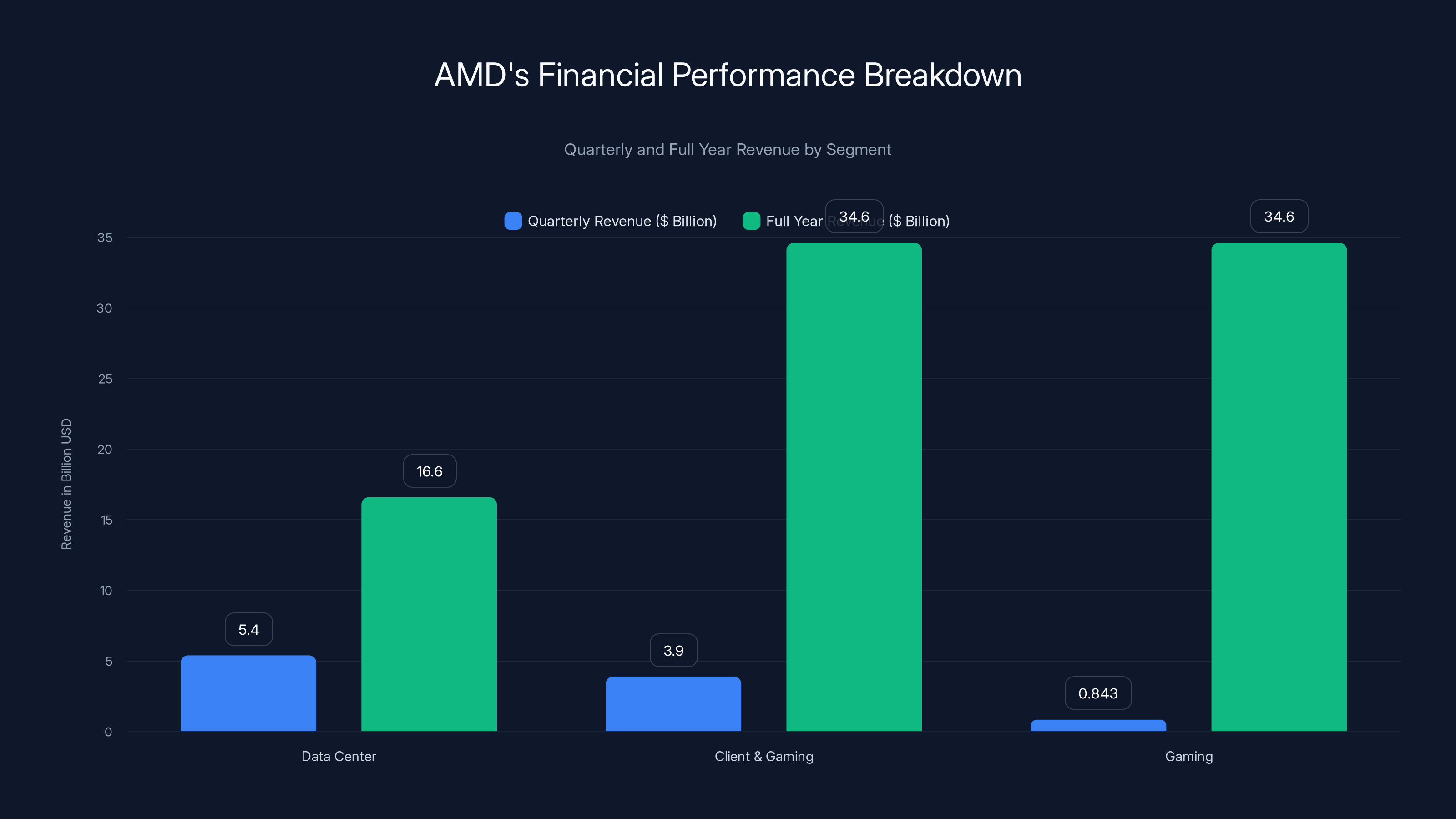

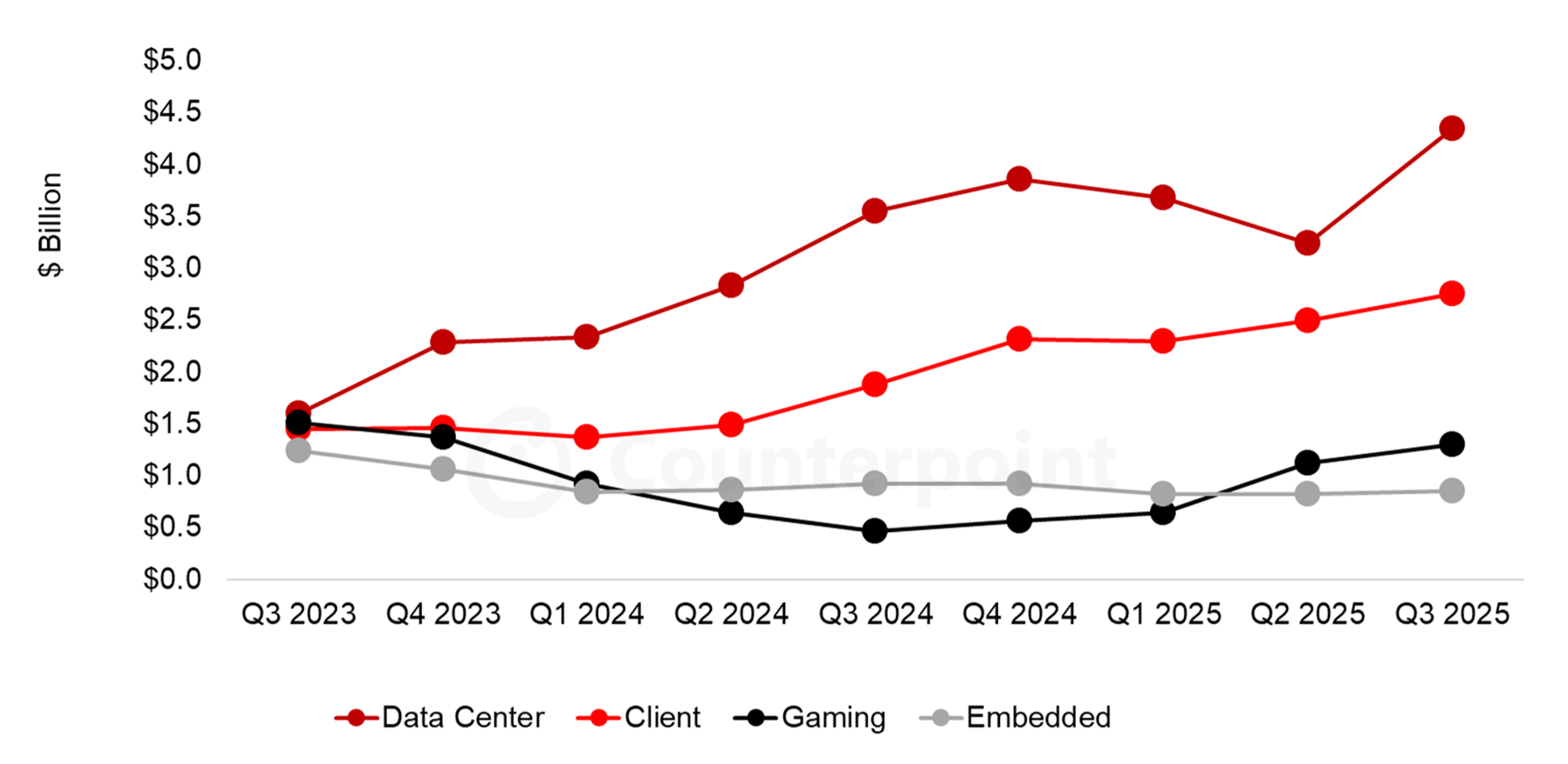

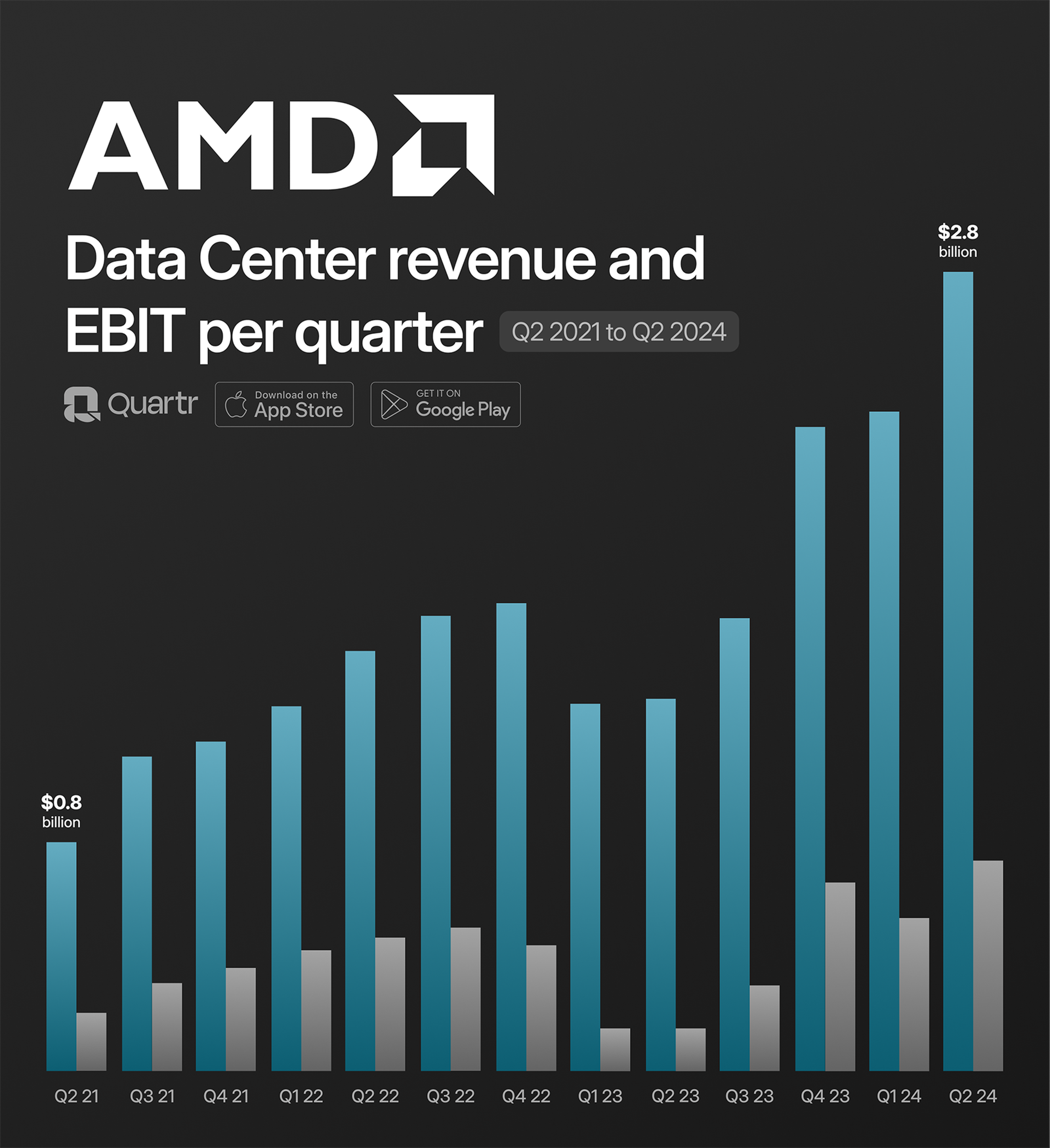

- Data center business is now the dominant revenue driver, generating $16.6B annually and growing 32% year-over-year, far outpacing traditional PC sales

- PC market is expected to shrink, but AMD plans to grow its PC business by targeting premium and enterprise segments where margins are higher

- Memory and SSD prices have quadrupled compared to recent lows, making consumer PC builds unaffordable and forcing market contraction

- AMD's strategy shift reflects industry reality: the era of mass-market PC growth is ending, and the money is moving toward data centers, AI, and premium enterprise solutions

AMD's gaming revenue grew 50% to

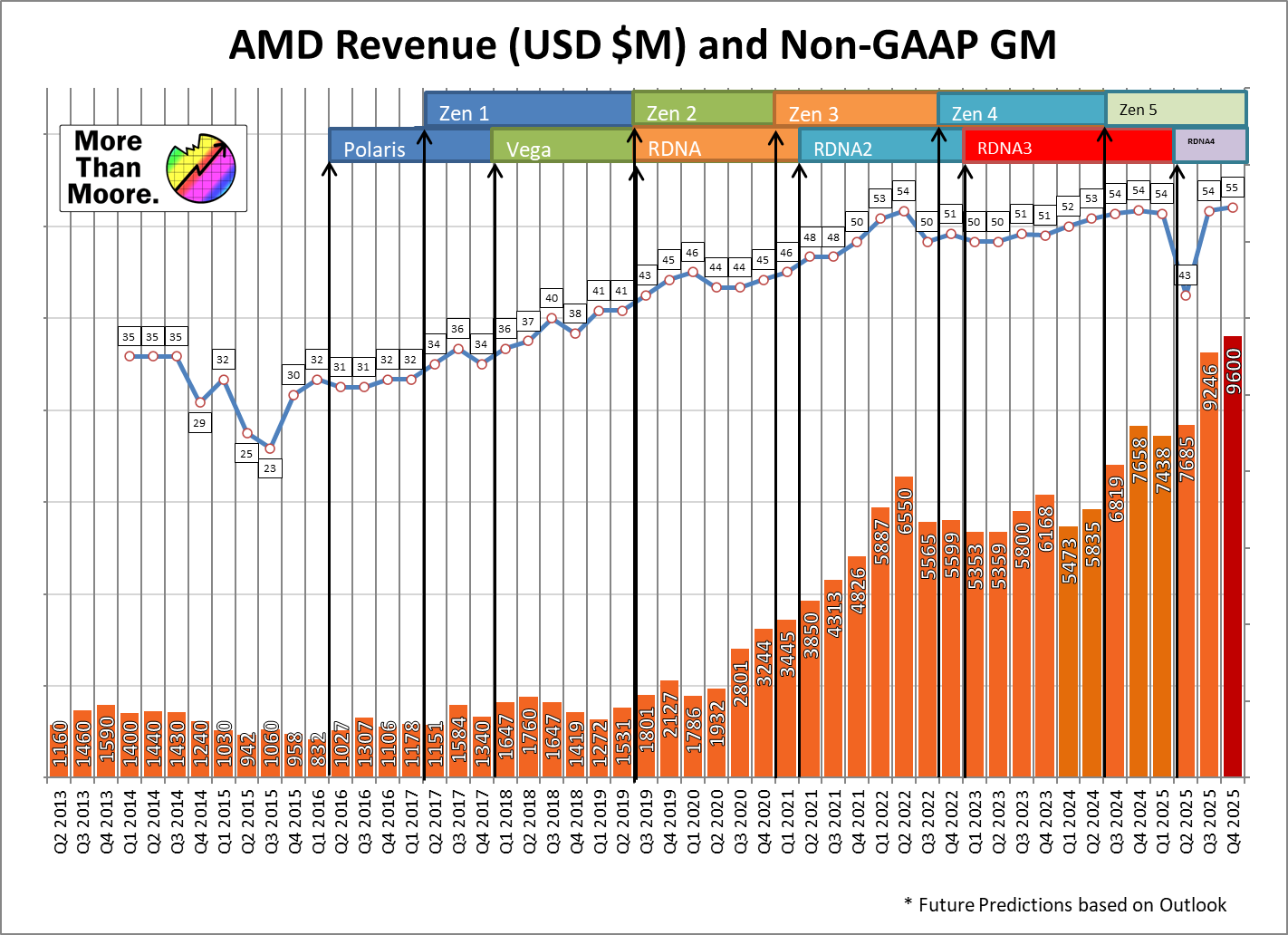

AMD's Record-Breaking Financial Performance Explained

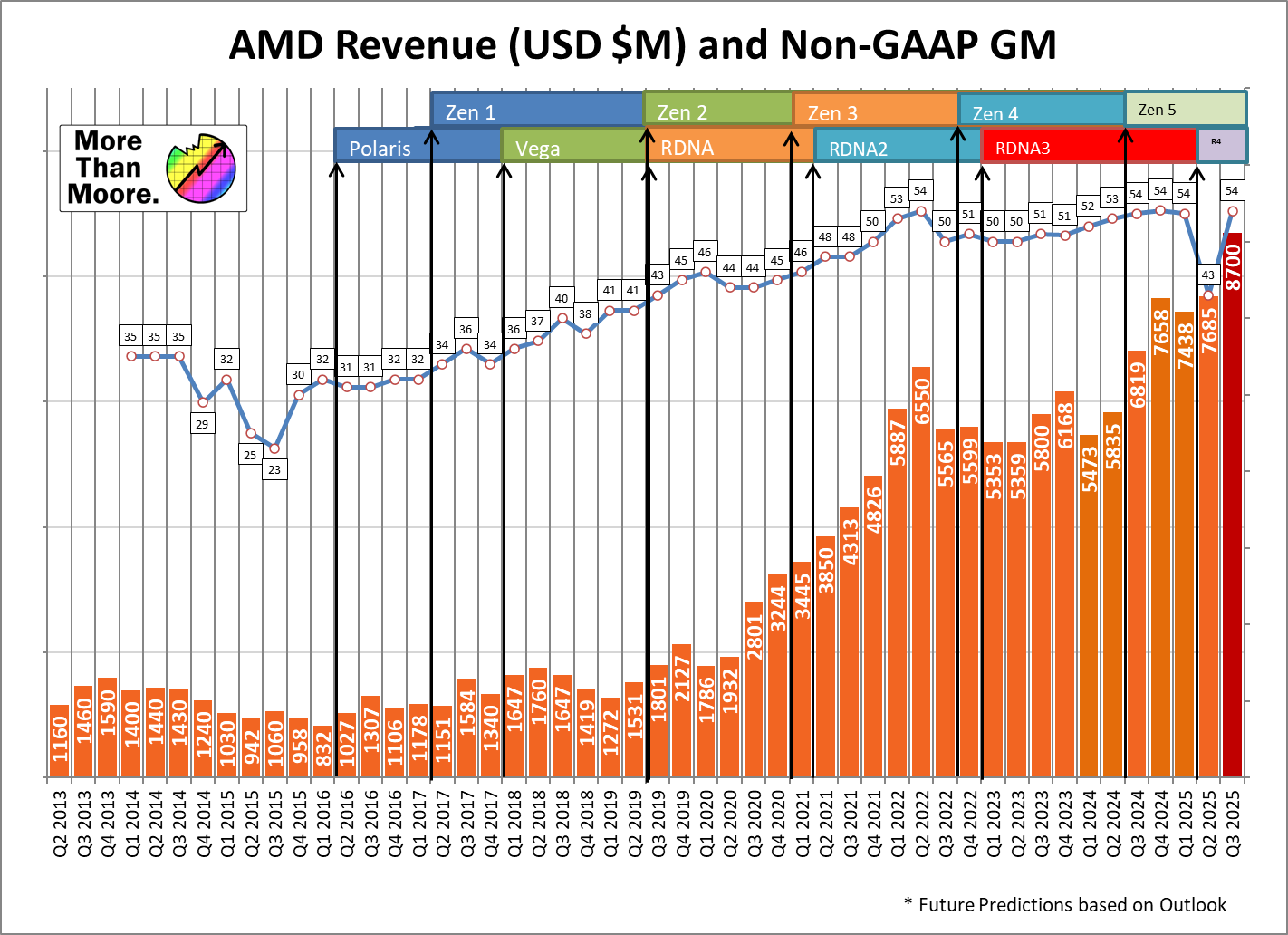

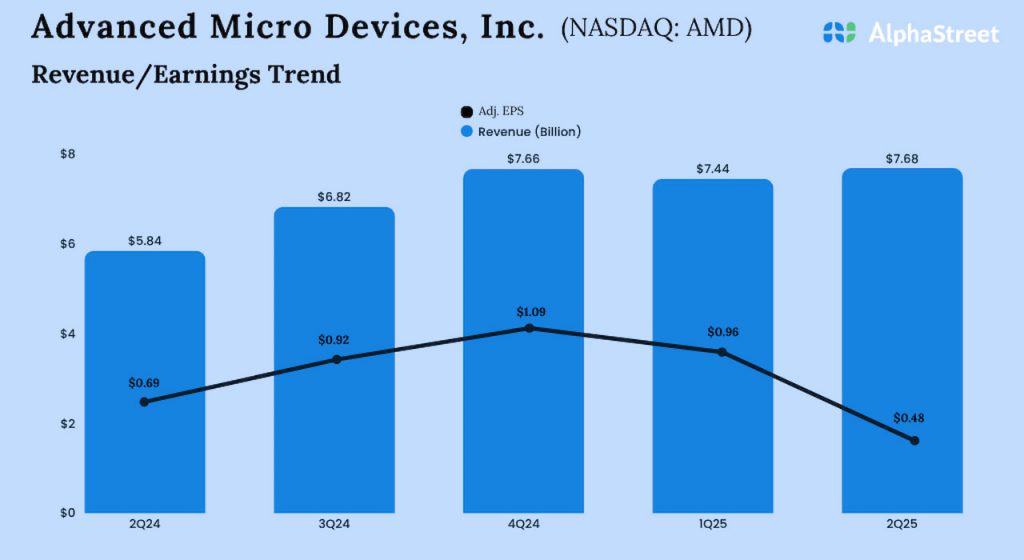

Let's start with the numbers, because they're impressive. AMD reported

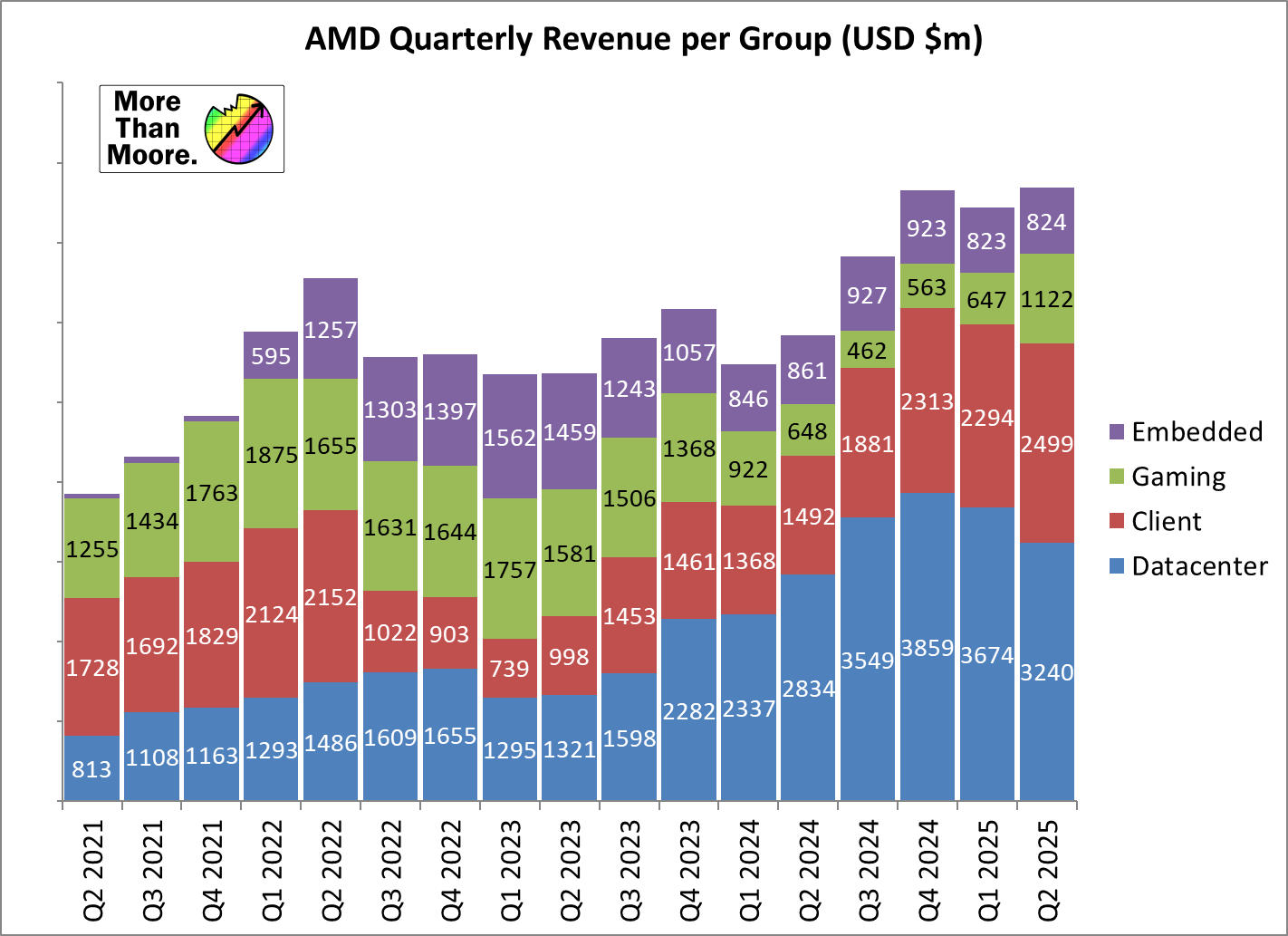

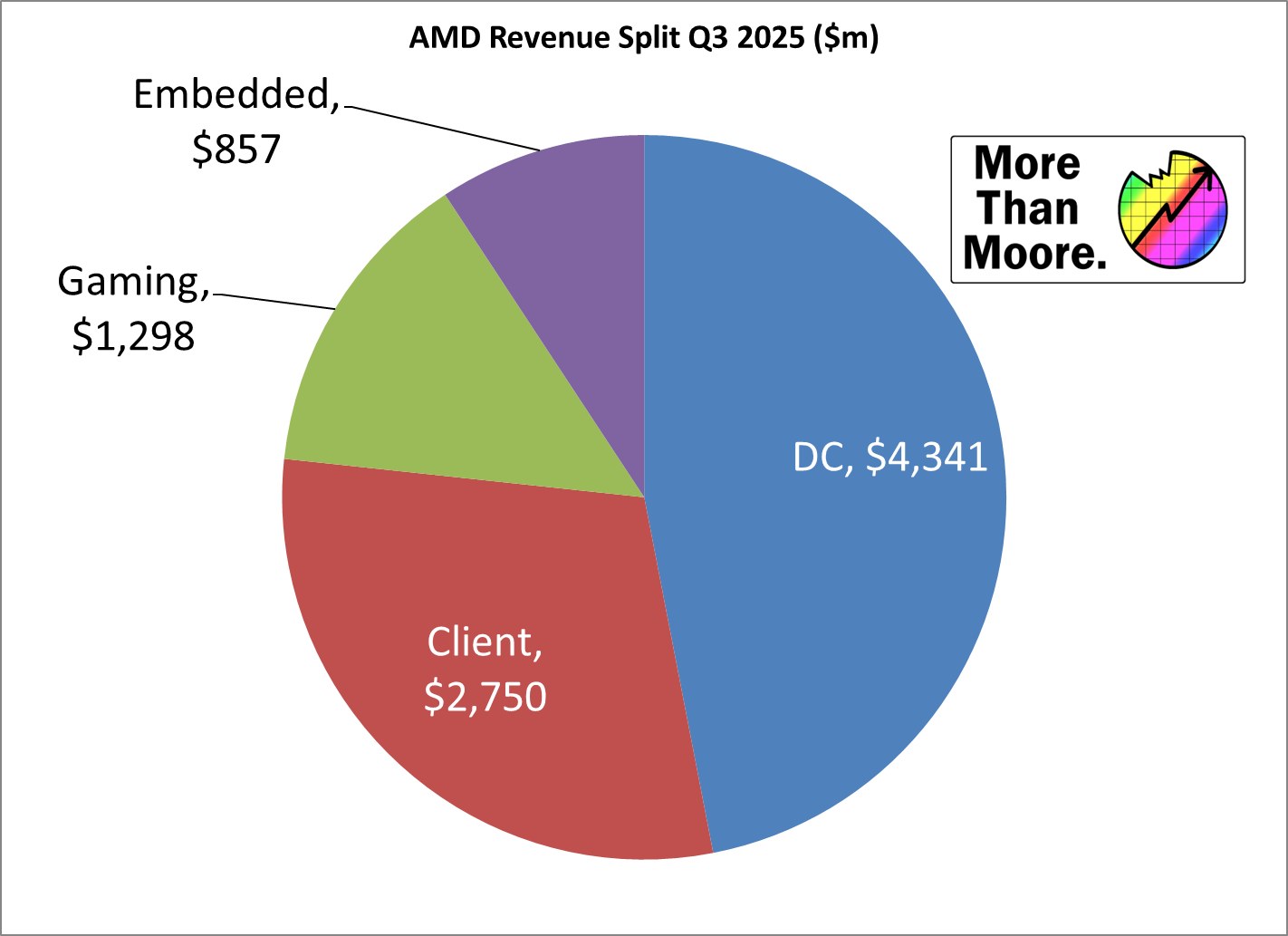

Breaking this down by segment tells a clearer story. The data center business generated

The client and gaming segment posted

Gross Margins Remain Healthy Despite Market Pressures

Here's where AMD's strategy becomes clearer. The company maintained a 54% gross margin in the most recent quarter. For the full year, that non-GAAP gross margin held steady at 52%. These are exceptional numbers for semiconductor manufacturing. When you're operating at 52-54% gross margin, you're not competing on volume. You're competing on value.

Compare this to what AMD would need to maintain if it were trying to win market share in the budget PC segment. Cheaper components, thinner margins, higher volume. AMD just decided that math doesn't work anymore, so it's walking away from that battle. Instead, the company is going after customers who'll pay premium prices for premium performance.

Net income came in at

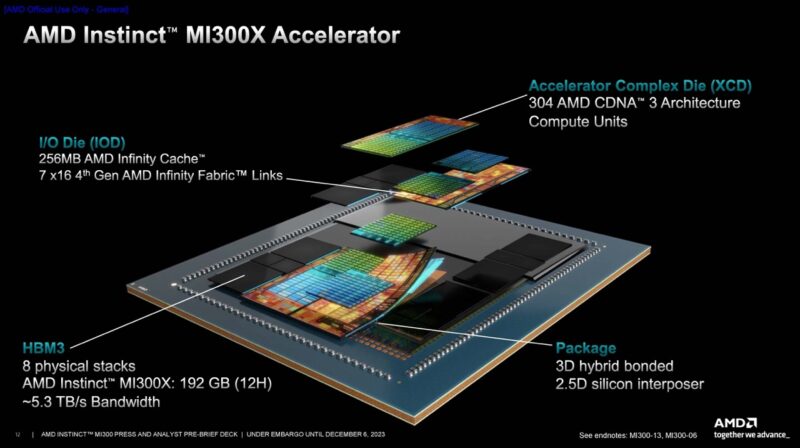

The Instinct MI308 Accelerator: Export Control Impact

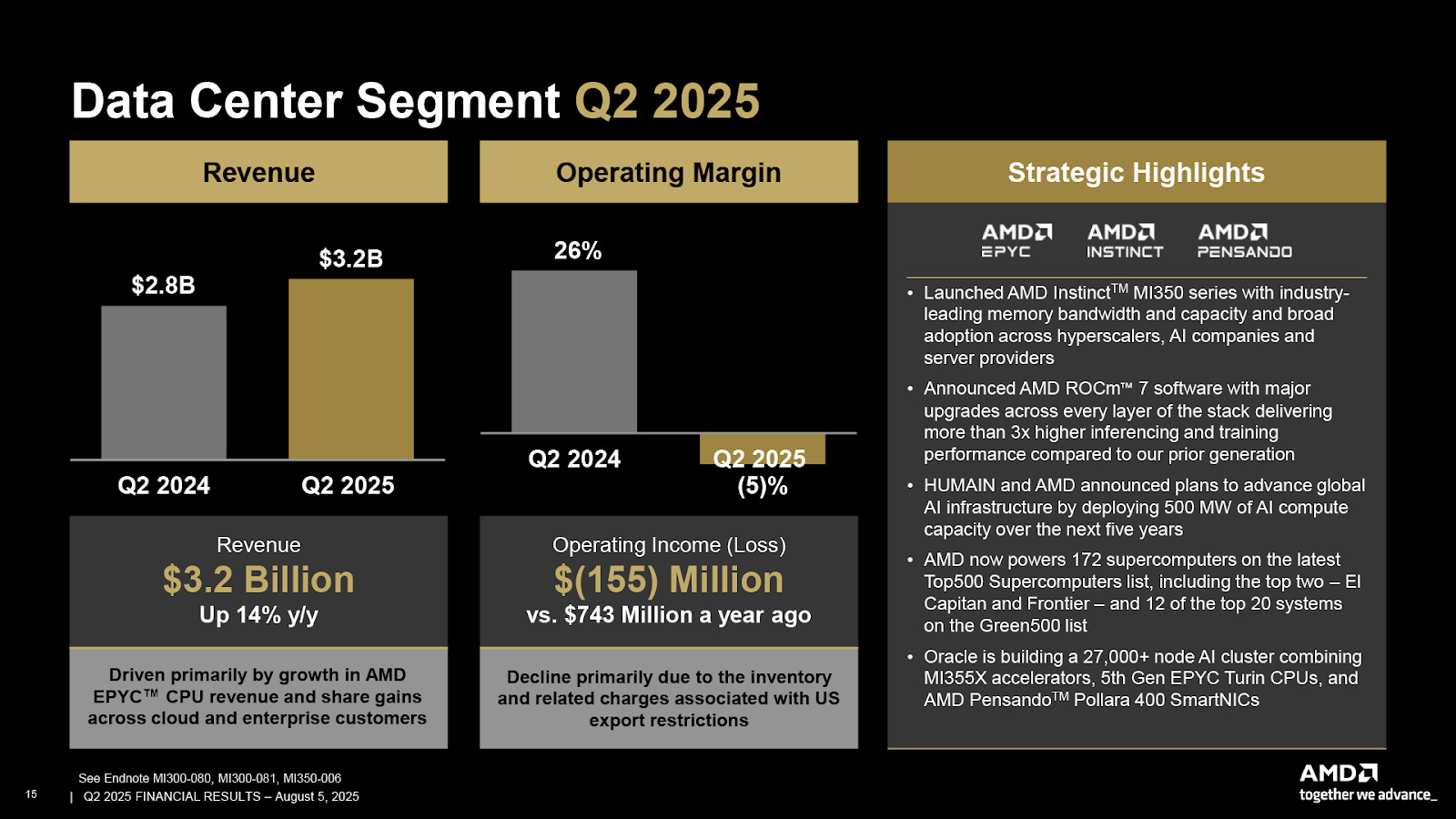

There's one interesting detail buried in the financial results that deserves more attention. AMD has

What does this mean? It means AMD has massive demand for AI accelerators, but geopolitical restrictions are limiting how much the company can actually sell to certain markets. If those export controls were lifted tomorrow, AMD's numbers would look even better. The company is basically leaving money on the table because the U. S. government says it has to.

This is crucial context. AMD's growth isn't limited by demand. It's limited by policy. If that policy changes, we could see another acceleration in revenue. If it tightens further, AMD's growth could stumble. That's a risk that doesn't show up clearly in the quarterly earnings, but it's worth monitoring.

AMD's data center segment led the growth with

Data Center: AMD's New Growth Engine

Five years ago, if you asked anyone at AMD about the future of the business, they'd probably talk about gaming, consumer PCs, and competing with Intel in the mainstream market. Today, the company barely mentions those things in earnings calls. Instead, the focus is relentlessly on data center.

Data center revenue hit

Why is data center growing so fast? Three reasons: cloud computing infrastructure, AI training workloads, and enterprise compute acceleration. Companies like Microsoft, Google, Meta, and Amazon are building out massive GPU clusters to power their AI models. AMD's EPYC server CPUs are powering the infrastructure that runs these systems. Every data center build-out is a massive purchase order that dwarfs anything in the consumer market.

EPYC CPUs Capturing Market Share

AMD's EPYC processors are increasingly becoming the default choice for data center workloads. The company has been taking market share from Intel in the server space for years now, and the momentum hasn't slowed. EPYC's architecture is efficient, scalable, and increasingly cost-effective compared to Intel's alternatives.

The real impact shows in volume. AMD is shipping more server processors than ever before. Each processor generates higher margins because enterprises will pay for performance. A 5% performance improvement in a data center setting might translate to thousands of dollars in annual operational savings, making higher CPU costs an easy tradeoff.

AI Accelerators Drive Premium Pricing

The data center segment also benefits from AI accelerator demand. AMD's Instinct GPUs are competing directly with Nvidia's products, though Nvidia still dominates the market. But AMD is gaining traction, particularly with customers trying to reduce their dependence on a single vendor.

AI accelerators command premium pricing because they're essential infrastructure for any company trying to deploy large language models or other machine learning systems. A single GPU cluster can cost millions of dollars. In that context, paying a bit more for diversified supply is a rounding error.

The PC Market Shrinkage: Why It's Happening and What It Means

Now here's the uncomfortable truth that AMD's earnings call tried to soften but ultimately couldn't hide: the PC market is shrinking. Dr. Lisa Su said the company expects the PC Total Addressable Market to decline. This isn't speculation. This is the CEO of a semiconductor company that's spent decades selling PC chips admitting that the PC market is getting smaller.

The official reason the company gives is memory and SSD prices. RAM and storage have become so expensive that new PC builds are no longer economically attractive for many customers. If you can buy a mid-range laptop or desktop with 8GB of RAM and 256GB of storage, and upgrading to 32GB and 1TB costs you an extra $400-600, a lot of people are just keeping their existing computers.

But there's a deeper trend here. Smartphones are increasingly powerful enough for everyday computing. Tablets run professional software. Cloud services mean you don't need local processing power. The universe of people who absolutely need a new PC every few years has gotten smaller. The universe of people who want a new PC because it's fun or slightly faster has gotten much smaller.

Memory Prices: The Hidden Supply Chain Crisis

Memory prices are particularly brutal right now. DRAM prices have climbed substantially from their pandemic lows. A basic DDR5 kit that cost

Why are memory prices up? Several factors. Demand from AI systems is consuming enormous amounts of memory. Geopolitical tensions have created supply uncertainty. Manufacturing capacity constraints mean producers can maintain higher prices without losing significant volume. And frankly, customers seem willing to pay it.

The consequence is that a budget PC build that would have cost

Market Consolidation at the Premium End

This is where AMD's strategy becomes clear. The company isn't trying to win the budget PC market. It's given up on volume. Instead, AMD is focusing on the premium segment where customers are willing to spend serious money for the best performance.

A gamer building a high-end system will spend

AMD's Ryzen CPUs dominate these premium segments. The company offers better core count per dollar than Intel in many configurations, better power efficiency than previous generations, and strong gaming performance. Customers at the premium end aren't price-sensitive. They want the best available performance.

AMD reported strong financial performance with

Client and Gaming: AMD's Play for Premium Segments

The client segment is AMD's traditional PC business, but the strategy has shifted dramatically. AMD reported $3.9 billion in client and gaming revenue for the quarter, up 37% year-over-year. But here's the critical part: this growth is happening while the overall market shrinks.

How is that possible? Market share gains. AMD is taking share from Intel in consumer CPUs. Ryzen processors consistently outperform Intel equivalents in benchmarks and real-world workloads. Intel's execution has been rocky, with manufacturing delays and architectural missteps. AMD is capitalizing on these mistakes.

Ryzen CPUs Dominating Market Share

Ryzen processors have become the default recommendation for enthusiasts, content creators, and professionals. If you're building a PC and you're reading tech forums or watching YouTube reviews, the vast majority of recommendations point toward Ryzen. This brand momentum is incredibly powerful because hardware purchasing decisions are often influenced by what others recommend.

Ryzen 7000 and Ryzen 9000 series processors offer exceptional core counts, strong single-threaded performance, and reasonable power consumption. A Ryzen 9 7950X3D is genuinely the best gaming CPU available. A Ryzen 9 9950X offers 16 cores of processing power at a price point where Intel is charging more for less.

This pricing and performance advantage is driving market share gains despite the overall market contracting. AMD is winning a bigger slice of a smaller pie. In absolute dollars, that might still look good, but there's a ceiling. Eventually, the market shrinks too much for volume gains to compensate.

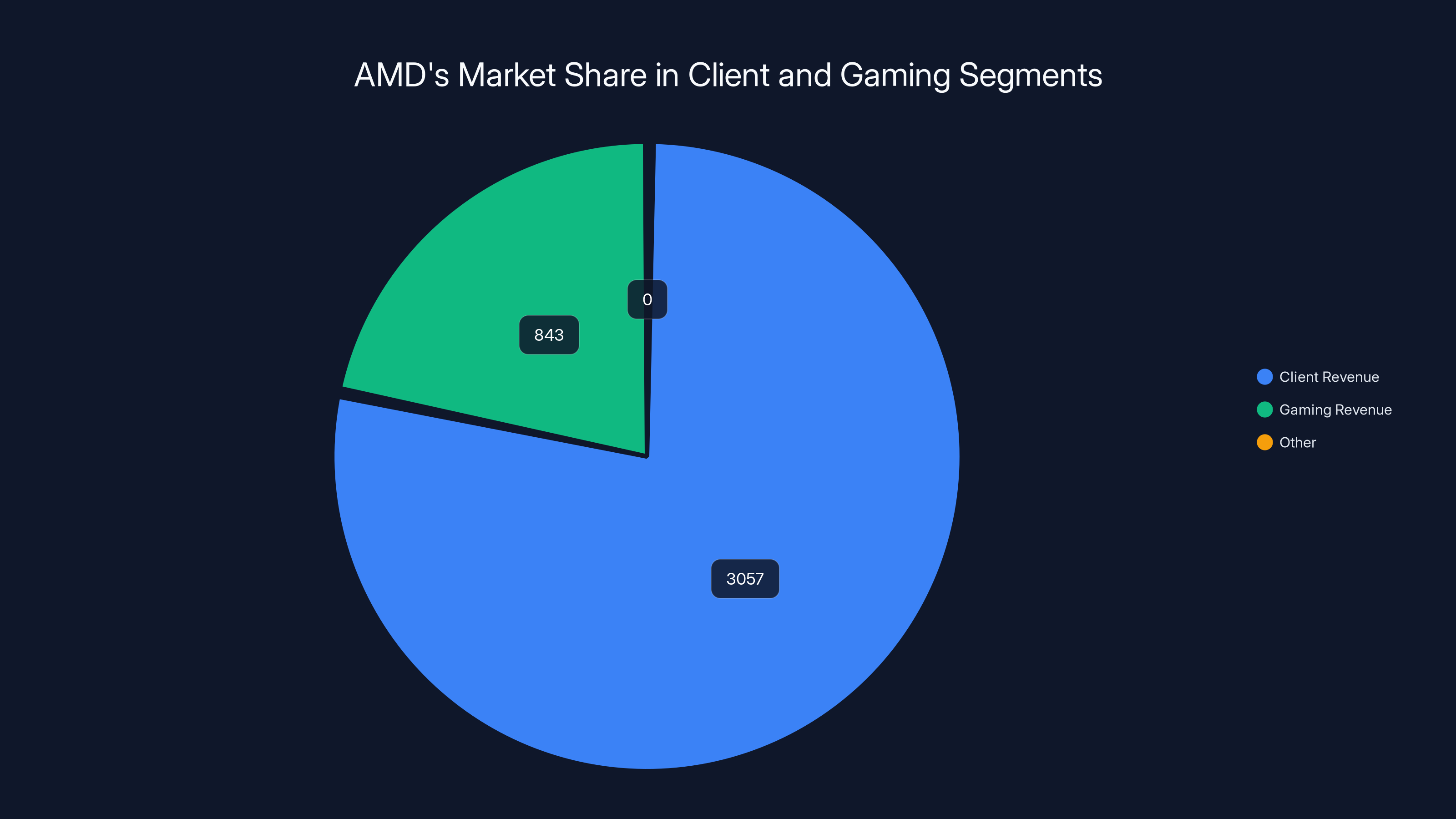

Gaming Revenue Growing Faster Than Overall Client Business

Gaming revenue specifically grew 50% to $843 million for the quarter. This is driven by two things: console chips and discrete GPUs. PlayStation 5 and Xbox Series X/S still sell millions of units per year. Those are AMD chips. The Steam Deck uses an AMD APU. Nintendo Switch uses custom AMD silicon.

These semi-custom products are incredibly valuable because they're long-term revenue streams. A game console has a seven to ten-year lifecycle. AMD gets paid for every unit sold. Unlike consumer CPUs where you might replace your chip every few years, a console is a one-time purchase from the manufacturer.

Radeon discrete GPUs are making a comeback in gaming because the gap between Nvidia and AMD has narrowed. Nvidia still dominates, but AMD's RDNA 3 architecture is competitive. Gamers looking for a 4070-class or 4080-class card now have real alternatives to Nvidia.

Enterprise and Premium Markets: AMD's Pivot

Dr. Lisa Su was crystal clear about where AMD is placing its bets. She said: "Our focus areas are enterprise and just continuing to grow at the premium, higher-end of the market." This isn't ambiguous. The company is explicitly deprioritizing mass-market consumer products.

Enterprise markets include everything from server CPUs to workstation processors to embedded systems sold to corporations. These are high-margin, long-contract business relationships. A company buys 10,000 servers with AMD processors, and that's a multi-year relationship. Each of those servers probably costs $5,000-10,000, and the CPU is a significant portion of that cost.

Premium consumer products include high-end gaming CPUs, professional workstation chips, and extreme enthusiast processors. These sell in lower volumes but at higher per-unit prices. A Ryzen 9 processor might cost

Workstation and Professional Markets

AMD's Threadripper line is specifically designed for professional workloads like video rendering, 3D simulation, scientific computing, and other CPU-intensive tasks. These processors cost significantly more than mainstream Ryzen chips, but professionals will pay because the work they do demands extreme performance.

A video editor rendering a 30-minute 4K documentary might spend 40 hours waiting on CPU performance. If a Threadripper processor with 32 cores saves them 10 hours of rendering time, they make that money back immediately. The CPU cost becomes trivial compared to the time value saved.

These professional markets are less cyclical than consumer markets. A company's workstation investment is an operational expense that doesn't stop during market downturns. If anything, downturns sometimes accelerate workstation upgrades as companies try to maintain productivity with smaller teams.

Enterprise Relationship Stickiness

Once you standardize on AMD processors for your data center or enterprise infrastructure, switching becomes expensive and disruptive. You've trained your staff on AMD systems. Your applications are optimized for AMD hardware. Your vendor relationships are built around AMD partnerships. The friction cost to switch is enormous.

This stickiness is why enterprise markets are so valuable. The total addressable market might be smaller than consumer markets, but the reliability is higher. AMD can count on predictable revenue from large enterprise customers because those customers face massive switching costs.

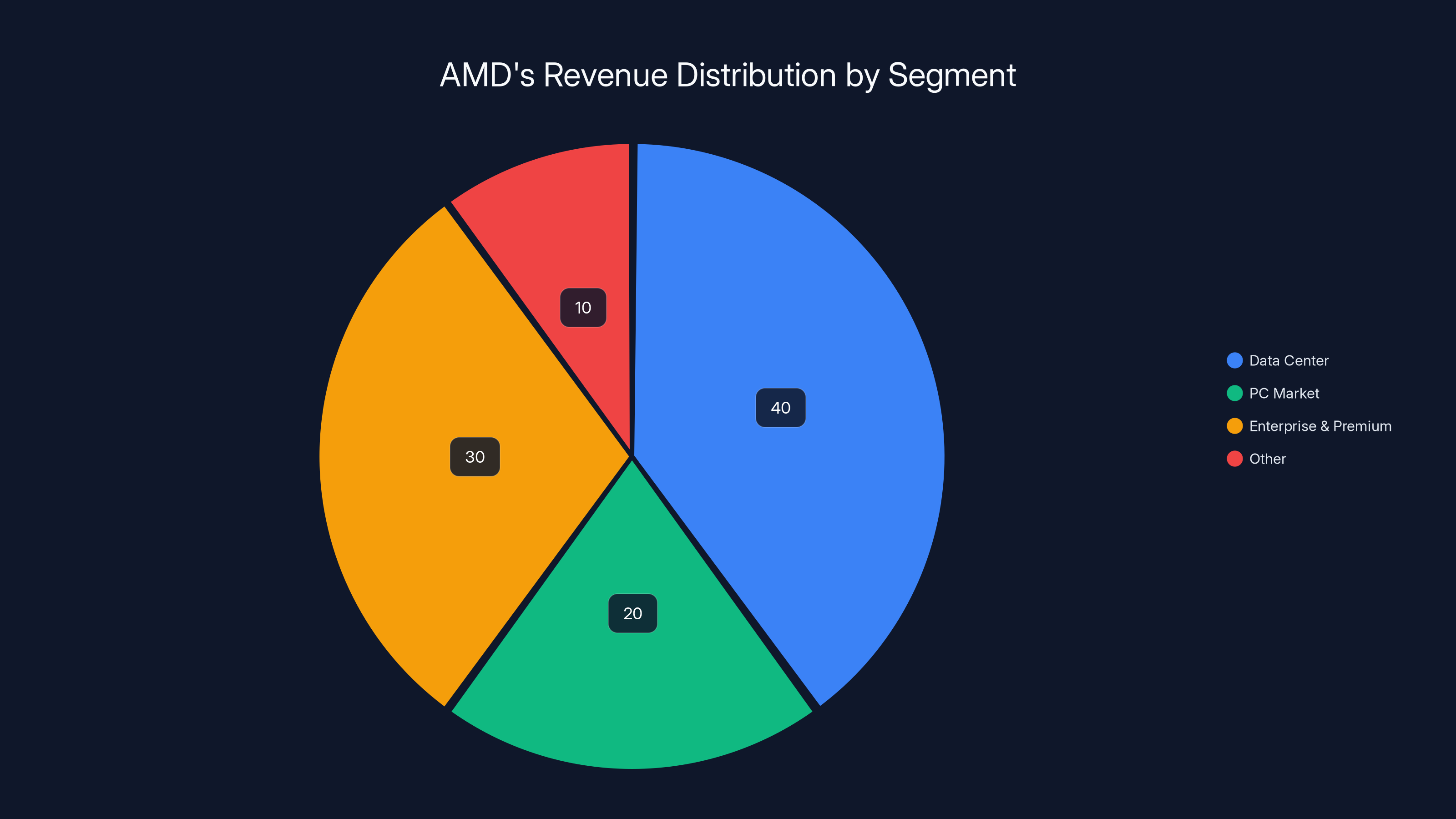

Data center is now AMD's largest revenue segment, surpassing gaming and consumer CPUs. Estimated data reflects recent growth trends.

Memory and SSD Pricing: The Hidden Supply Shock

Let's dig deeper into why memory prices have become such a problem for the PC market. This isn't a simple supply-and-demand story. Multiple factors have converged to create what amounts to a hidden supply chain crisis that most people haven't noticed because they're focused on smartphones and laptops instead of RAM prices.

DRAM Pricing Surge: Root Causes

DRAM (Dynamic Random Access Memory) prices have roughly doubled from pandemic lows. A 16GB DDR4 stick that cost

First, AI systems are memory-intensive. Training a large language model requires enormous amounts of DRAM. Data centers building out infrastructure for AI are placing massive orders for memory, consuming supply that would otherwise be available for consumer products.

Second, geopolitical tensions have made everyone nervous about supply security. If you're a major tech company and you think there might be trade restrictions or supply chain disruptions, you build inventory. This hoarding behavior artificially inflates demand, pushing prices up.

Third, DRAM manufacturing is highly concentrated. A handful of companies (Samsung, SK Hynix, Micron) produce most of the world's DRAM. If there are any disruptions in production, it affects the entire global supply. And these manufacturers have no incentive to expand capacity when they can just maintain tight supply and pocket higher margins.

NAND Flash Storage Prices

SSDs have experienced similar price increases, though the trajectory has been different. NAND flash prices dropped during crypto mining cycles when people were dumping GPUs and storage, flooding the market with cheap equipment. Prices have climbed back up as that supply dried up and demand recovered.

A 1TB SSD that cost

The Four-Times-Multiplier

When AMD says RAM kits "now cost four times more than recent lows," they're not exaggerating. During the crypto crash and pandemic era, you could buy DDR4 memory absurdly cheap. 16GB kits for

This pricing change has real consequences. A

Embedded Systems: The Overlooked Segment

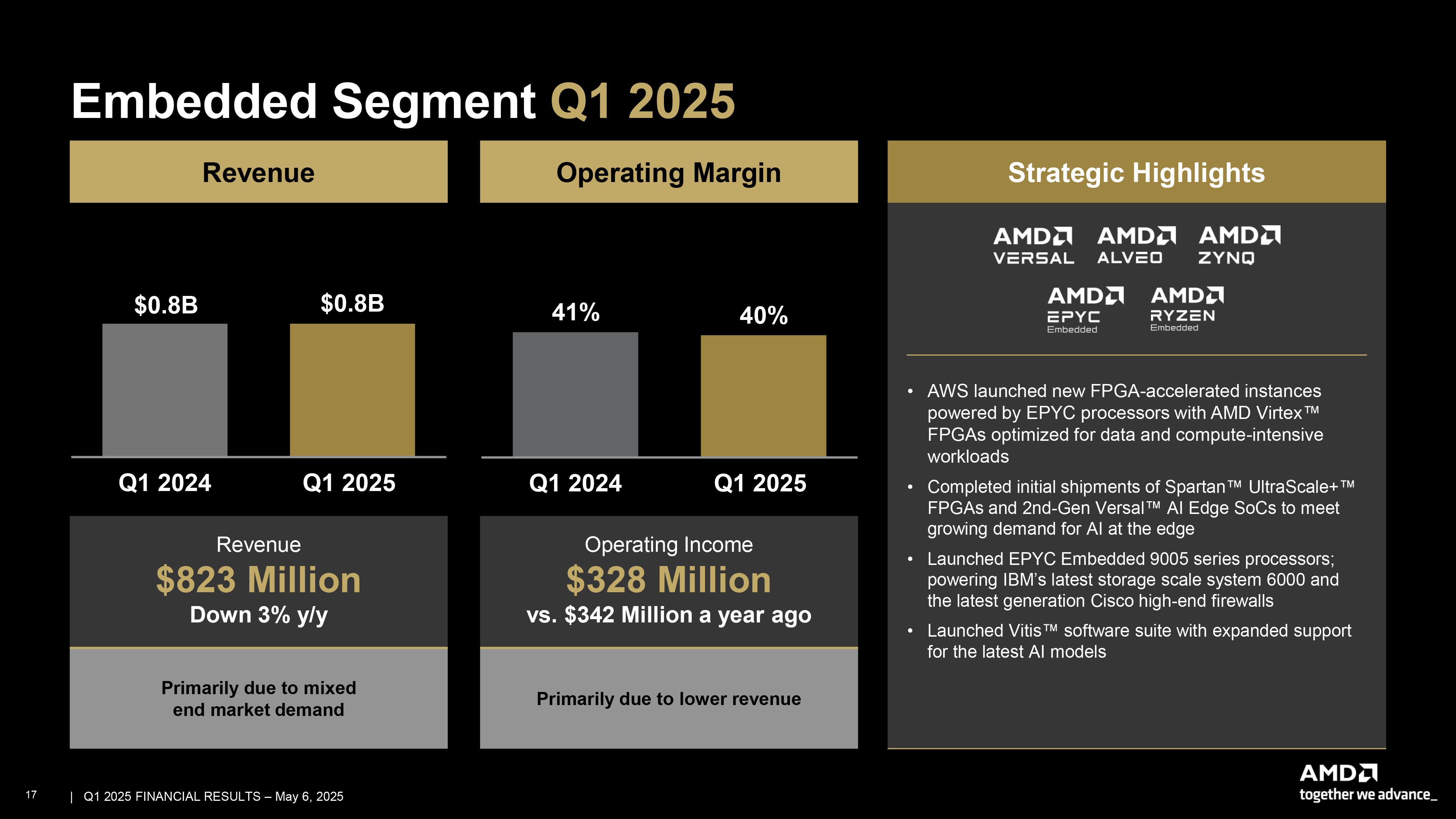

AMD's embedded business is the quiet corner of the company that doesn't get much attention. It generated

So embedded is basically flat. Not growing, not shrinking dramatically, just stable. This segment includes everything from automotive chips to industrial systems to specialized computing devices. It's less exciting than data center and gaming, but it's incredibly important because embedded systems have long product lifecycles and sticky relationships.

An automotive manufacturer that standardizes on AMD embedded processors might use that chip for seven to ten years across multiple vehicle generations. That's a guaranteed revenue stream. Industrial equipment manufacturers do similar things. Once you're in the design, you're there for the product lifecycle.

The slight decline year-over-year might reflect market saturation or reduced industrial activity, but it's not a crisis signal. Embedded is a reliable, stable business that doesn't command Wall Street headlines but generates consistent earnings.

DRAM prices have doubled since 2020 due to AI demand and geopolitical tensions, while SSD prices have risen due to market recovery post-crypto mining. Estimated data.

The Strategic Pivot: Why AMD Is Abandoning Consumer Volume

Understanding AMD's strategy requires looking at the fundamental economics of different market segments. In the consumer PC market, AMD faces intense price competition. Intel is also a capable competitor. Margin pressure is relentless.

But in data center, AMD has much more pricing power. Enterprise customers care about performance, reliability, and total cost of ownership. They don't price-shop the same way consumers do. If an AMD processor gives you a 10% performance improvement, many data centers will happily pay a 10% premium for that improvement.

The shift from consumer to enterprise is essentially a shift from volume and low margin to smaller volume and higher margin. The data center business generates substantially more profit per dollar of revenue than the consumer PC business.

Profitability Per Dollar of Revenue

Here's a useful metric: gross margin. AMD maintains 52-54% gross margins across the company. But different segments have different margins. Data center probably operates at 55%+ margins. Consumer might be closer to 45-50%. Embedded is probably in the middle.

When you run the math, even though consumer PC revenue might be substantial, the profit generated is less than you'd expect from the same revenue in data center. So the company is rationally shifting resources toward higher-margin business.

The Intel Opportunity

Intel has been stumbling. Execution problems, manufacturing delays, architectural missteps. AMD is capitalizing on these mistakes in both consumer and enterprise markets. Taking share from Intel is easier than growing the market. That's rational competitive strategy.

Once AMD has solidified market leadership in servers and high-end consumer products, Intel will have less leverage. Smaller market position means less R&D funding for future competitive products. AMD compounds this advantage by winning more enterprise contracts, which funds more R&D, which leads to more competitive products.

Export Controls and Geopolitical Constraints

There's a dimension to AMD's business that doesn't always get proper attention: export controls. The company has

What this means is that AMD manufactures AI accelerators with global appeal. The U. S. government has restrictions on selling advanced AI chips to China. AMD has to navigate these restrictions, which means some of its inventory can't be sold to the customers who want to buy it.

This is a constraint on AMD's growth. The company isn't selling fewer chips because demand is weak. It's selling fewer chips because the government won't let it. That distinction matters because it means the underlying demand is actually much stronger than reported revenue suggests.

What Changes If Export Restrictions Loosen?

If export controls were relaxed, AMD could suddenly report much higher revenue and earnings. The company wouldn't need to do anything differently operationally. It would just sell inventory that's currently sitting in warehouses.

Conversely, if export restrictions tighten, AMD's growth trajectory could stumble dramatically. The company would need to redirect that production to other markets or reduce manufacturing volume. Either scenario would impact shareholder returns.

AMD's strategic focus shift is evident with an estimated 40% of revenue now coming from data centers, while the PC market share is reduced to 20%. Estimated data.

Market Dynamics: Why PC Market Contraction Is Accelerating

The PC market isn't just slightly shrinking. It's experiencing structural decline. Let's break down why this is happening and why it's probably irreversible.

Smartphone Substitution

For a large percentage of users, a smartphone now does everything a PC did five years ago. You can browse the web, check email, work on documents, edit photos, watch videos, and run applications all from a phone. The phone is always with you. You don't need a separate device.

This substitution is permanent. A teenager today might never buy a personal computer in their entire life. They'll use school computers, eventually company computers, but they won't feel the need to own one. The TAM for PC sales has been permanently reduced by the smartphone revolution.

Tablet Productivity

Tablets like the iPad Pro have become sophisticated enough for real work. With a keyboard and trackpad, an iPad Pro is a genuinely productive device for many tasks. You get longer battery life than a traditional laptop, touch screen capabilities, and better portability.

This gives consumers another option to bypass traditional PC purchases. Why buy a Windows laptop when an iPad Pro handles most of what you need, costs less, and has better battery life?

Cloud Computing Shift

Cloud services mean you don't need a powerful local computer. Google Workspace, Microsoft 365, Adobe Creative Cloud, and similar services run in the browser. A cheap Chromebook or even an older laptop can run modern cloud applications perfectly fine.

This means the push to upgrade hardware every few years has weakened. Your three-year-old laptop can still run modern web-based applications effectively. That's a huge brake on the PC replacement cycle.

Work From Home Hardware Fatigue

During the pandemic, everyone needed to upgrade their PC to work from home. That created a huge wave of PC sales in 2020-2021. We're now years past that wave. Most of those systems are still fine. Until they need replacement, that's suppressing the market.

When replacement does happen, it'll be spread over years, not concentrated in a single boom. The market will never get back to pandemic spike levels.

Competitive Implications: What This Means for Intel

AMD's shift toward premium and enterprise markets is simultaneously a statement about Intel's weakness. If Intel were competitive in consumer markets, AMD would fight harder for that volume. The fact that AMD is willingly ceding market share in consumer segments tells you something important: Intel is competitive enough to fight, but not competitive enough to win.

Intel still owns substantial market share in consumer CPUs and data center. But AMD is gaining in both. Intel's newer products are competitive, but they haven't regained momentum. Meanwhile, AMD keeps improving and taking share.

For Intel, this is a long-term problem. As AMD gains market share and data center relationships, the company funds more R&D. Future products are better. The cycle repeats. Unless Intel can break this cycle with a major breakthrough, AMD's position will continue strengthening.

Intel's Manufacturing Challenges

Intel has been having trouble executing its manufacturing roadmap. The company owns its own fabs, which is expensive and risky. When you miss a technology node, you fall behind for years. AMD outsources manufacturing to TSMC, which has been executing flawlessly.

This gives AMD an advantage. AMD doesn't bear the risk and cost of fab ownership. AMD gets access to the latest manufacturing process. Intel has to develop new processes itself, which takes longer and costs more.

Future Outlook: What Comes Next for AMD

If AMD's earnings and guidance are accurate, here's what the next 2-3 years probably look like: data center growth continues at strong double-digit rates, enterprise segments grow steadily, premium consumer products maintain solid margins, and the overall PC market continues to shrink.

AMD will take market share in enterprise and gaming segments because the company has better products and Intel is struggling. The company will grow earnings despite overall market contraction because it's capturing share and shifting toward higher-margin businesses.

Memory prices will probably remain elevated longer than most people expect because demand from data centers and AI systems keeps consuming supply. Consumer PC builds will remain expensive, suppressing the market further.

AI Accelerator Opportunity

One area to watch is AI accelerators. AMD is competing with Nvidia in this space, but Nvidia still dominates. If AMD can gain even modest market share in AI GPU sales, it would represent a enormous opportunity. Every percentage point of market share gained is billions of dollars in annual revenue.

The company is investing heavily in this area. MI308, MI325X, and future generations of accelerators are getting better. If AMD can convince major cloud providers to diversify their GPU supply, it could reshape the company's growth trajectory.

Enterprise Software Stickiness

As AMD gains enterprise customers, the company can develop deeper relationships. Software optimization for AMD platforms creates customer lock-in. Partners build tools and services around AMD infrastructure. Switching costs increase. This is the path toward becoming an essential vendor rather than just another chip supplier.

Intel is fighting to prevent this from happening, but AMD has momentum. In five years, AMD could be the default server CPU choice for new deployments. That changes the entire competitive dynamic.

Investment Implications: What Matters for Shareholders

For investors, AMD's earnings tell a clear story: the company is executing well in high-growth segments and strategically exiting low-margin segments. The data center business is the crown jewel, growing 32% year-over-year with strong margins.

The PC business decline is a non-issue because AMD is taking share. The company will sell fewer PCs but maintain revenue and margins because it's winning in premium segments. Enterprise relationships are sticky and long-term.

The main risks are geopolitical. Export controls could tighten and suppress growth. Trade wars could disrupt supply chains. But absent external shocks, AMD's position is strengthening.

The Broader Semiconductor Industry Shift

AMD's strategy reflects a broader industry shift. Semiconductor companies are moving up the value chain. Raw compute is commoditizing. The real profits are in specialized applications: AI, data center infrastructure, gaming optimization, professional workstations.

Companies that can't compete in these segments are being pushed down into low-margin commodity businesses. The winners are companies like AMD that can offer differentiated products at premium prices to customers who value performance.

This consolidation of profit in premium segments is structural. It's not temporary. As technology advances, products become more commoditized in lower tiers while new differentiation emerges at the high end. AMD is positioned to capture this value.

Conclusion: AMD's Earnings Signal Industry Evolution

AMD's strong financial results aren't surprising if you understand the company's strategy. The company is deliberately shifting toward profitable, high-growth segments while letting commodity segments shrink. It's a rational strategic choice that's paying dividends.

The PC market is structurally declining, but that's not a problem for AMD because the company is growing share in the segment that matters: premium and enterprise. Data center is the growth engine, and that growth is accelerating.

Memory and SSD prices will probably remain elevated for years because demand from data center and AI systems is strong. This will continue suppressing the overall PC market, but it won't hurt AMD because the company isn't competing for volume anymore.

Intel's challenges create an opportunity for AMD to gain market share at critical inflection points. Enterprise customers are evaluating architectures and making multi-year commitments. AMD's products are competitive or superior. The company is winning more of these decisions.

For anyone building a PC or upgrading hardware, understand that the market you're buying into has structurally changed. Premium products are where development is happening. Budget options will feel increasingly outdated. That reflects AMD's strategy: the company would rather own the high end than compete on volume.

This earnings report is less about where AMD has been and more about where it's going. The company is transforming from a volume-focused semiconductor supplier to a premium, enterprise-focused company. The transition is working. Revenue is growing, margins are strong, and competitive position is improving. That's a story that justifies the company's valuation and supports optimistic long-term outlooks.

FAQ

What exactly did AMD report in its latest earnings?

AMD reported

Why is AMD's PC business growing when the overall market is shrinking?

AMD is gaining market share in consumer and premium PC segments. As the overall market contracts due to high memory prices and smartphone substitution, AMD's superior products and Intel's execution challenges mean AMD is capturing a bigger percentage of the remaining market. The company is growing through share gains, not market expansion.

How much do memory prices impact PC market demand?

Memory and SSD prices have roughly quadrupled from pandemic lows, making new PC builds significantly more expensive. A budget PC that cost

What's AMD's strategy for the PC market going forward?

AMD is deliberately shifting focus toward premium consumer segments and enterprise customers rather than competing for volume in the budget market. The company prioritizes high-margin products and relationships over raw sales numbers. This strategy trades lower volume for higher profitability and is explicitly stated by CEO Lisa Su as the company's primary focus.

How does AMD's data center growth compare to overall market growth?

AMD's data center business is growing at 32% annually, far exceeding broader semiconductor market growth. This accelerated growth is driven by cloud infrastructure expansion, AI workload demands, and AMD gaining market share from Intel. Data center is now the largest segment by revenue and the fastest-growing, representing the bulk of the company's future earnings potential.

What impact do export controls have on AMD's revenue?

AMD has substantial inventory of AI accelerators (MI308) that cannot be sold to restricted markets due to geopolitical export controls. The company reported $360-390 million in restricted revenue. If export restrictions were relaxed, AMD could report significantly higher revenue without operational changes. Conversely, tighter restrictions would suppress growth prospects materially.

Why is embedded systems revenue declining when data center is booming?

AMD's embedded segment (automotive, industrial systems) is relatively mature with long product lifecycles. The 3% year-over-year decline likely reflects reduced industrial activity and product maturation rather than competitive pressure. Embedded remains strategically important for long-term customer relationships, even though growth is slower than data center segments.

How does AMD's gross margin of 52% compare to competitors?

AMD's 52% gross margin is exceptionally strong for semiconductor manufacturing, indicating the company is competing on value and performance rather than price. This margin level supports the company's strategy of prioritizing premium and enterprise segments where customers have lower price sensitivity. Maintaining margins at this level while growing revenue is a sign of strong operational execution.

Key Takeaways for Decision-Makers

AMD's latest financial results represent a significant evolution in the company's market strategy. Rather than viewing PC market contraction as a threat, AMD is capitalizing on the opportunity to shift toward higher-margin enterprise and premium segments. The company's strong data center growth, expanding market share against Intel, and improving competitive position in AI accelerators suggest sustained earnings growth despite broader market headwinds. For consumers, this means new PC development will increasingly focus on premium features while budget options stagnate. For investors, AMD's margin improvement and segment shift signal a company executing a sophisticated strategy to maximize shareholder returns despite mature market conditions.

Related Articles

- Intel's GPU Strategy: Can It Challenge Nvidia's Market Dominance? [2025]

- ChromeOS Expiration Date: What Google's 2034 Plan Means [2026]

- Crunchyroll Price Hikes: Inside Sony's Anime Streaming Strategy [2025]

- Microsoft's Maia 200 AI Chip Strategy: Why Nvidia Isn't Going Away [2025]

- NVIDIA's $100B OpenAI Investment: What the Deal Really Means [2025]

- Saudi Arabia's The Line Transforms into AI Data Centers [2025]

![AMD's Strong Financial Results Despite PC Market Decline [2025]](https://tryrunable.com/blog/amd-s-strong-financial-results-despite-pc-market-decline-202/image-1-1770329319898.jpg)