Introduction: When a $1.38 Billion Acquisition Turns Into Mass Job Cuts

It was supposed to be exciting news. In September 2024, Bending Spoons, an Italian software company with a growing portfolio of acquisitions, announced it was buying Vimeo for $1.38 billion. The acquisition seemed like a natural fit, bringing together a platform with millions of content creators and a company experienced in scaling and optimizing software products.

But here's what happened next: just months after the deal closed, Vimeo began laying off a "large portion" of its workforce globally. One former employee described it as impacting "almost everyone" at the company. Another engineer said the entire video team was eliminated. For a platform that positioned itself as a creator-first service, the sudden departure of so many staff members raised immediate questions about the platform's future, the security of hosted content, and what this acquisition would really mean for millions of creators who depend on Vimeo.

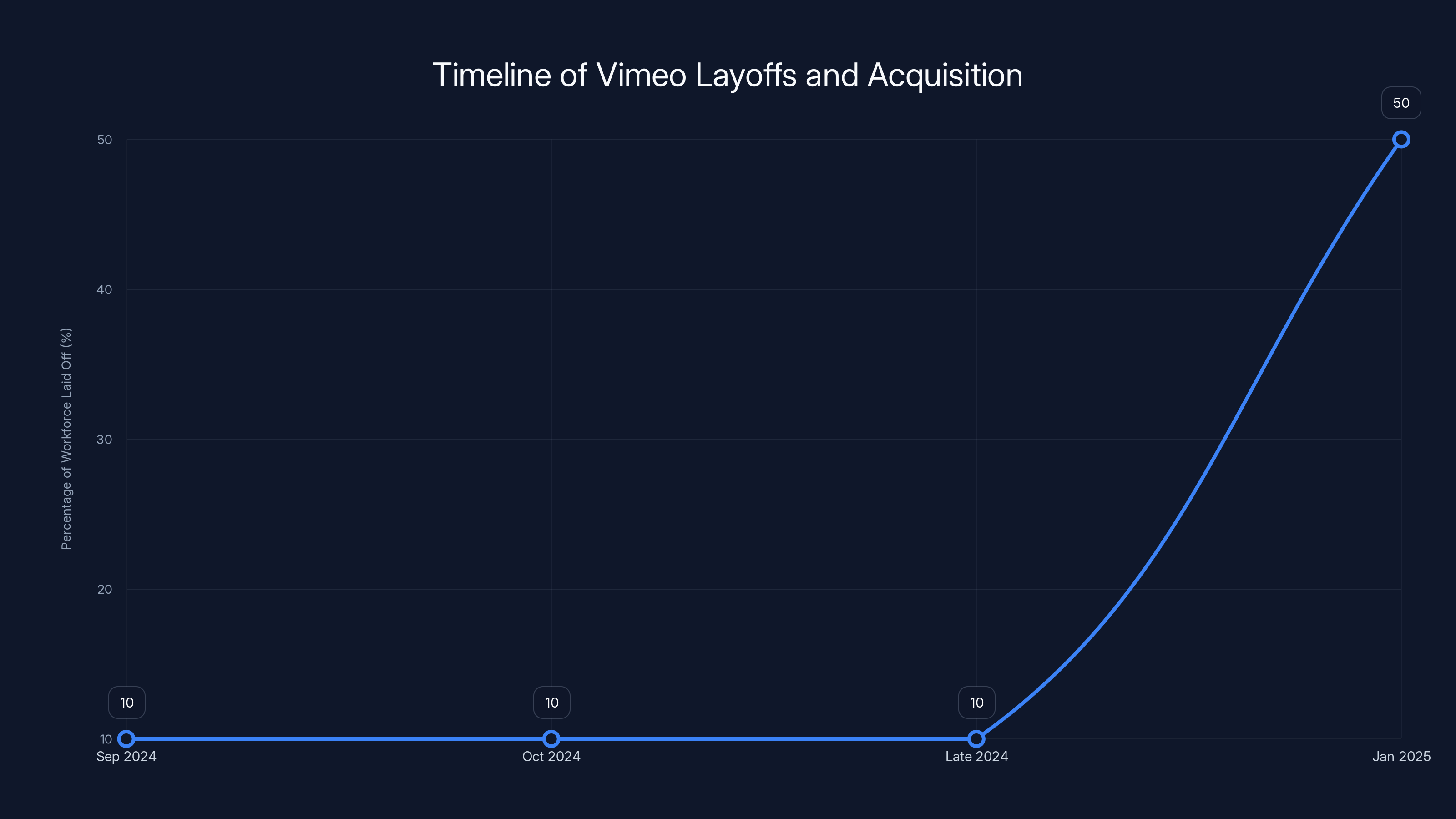

This wasn't the first round of cuts either. Vimeo had already laid off 10% of its workforce just one week before Bending Spoons announced the acquisition. So in the span of six months, the company shed potentially 15-20% of its entire staff or more, with few clear explanations about why or what would change.

The situation is particularly concerning because Vimeo hosts millions of videos, including professional productions like the comedy series created by Dropout. When a platform's technical team shrinks this dramatically, content creators worry about uptime, customer support, feature development, and whether their investments in the platform will be protected long-term.

This article breaks down everything that happened, why Bending Spoons made these cuts, what it means for creators and the industry, and what history tells us about how this acquisition might play out. We'll look at Bending Spoons' track record with other acquisitions, analyze the implications for content creators, and examine what comes next for the video platform.

TL; DR

- The Acquisition: Bending Spoons purchased Vimeo for $1.38 billion in late 2024, adding it to a growing portfolio of software companies

- The Layoffs: Months after closing the deal, Vimeo laid off "a large portion" of its global workforce, with some employees saying "almost everyone" was affected

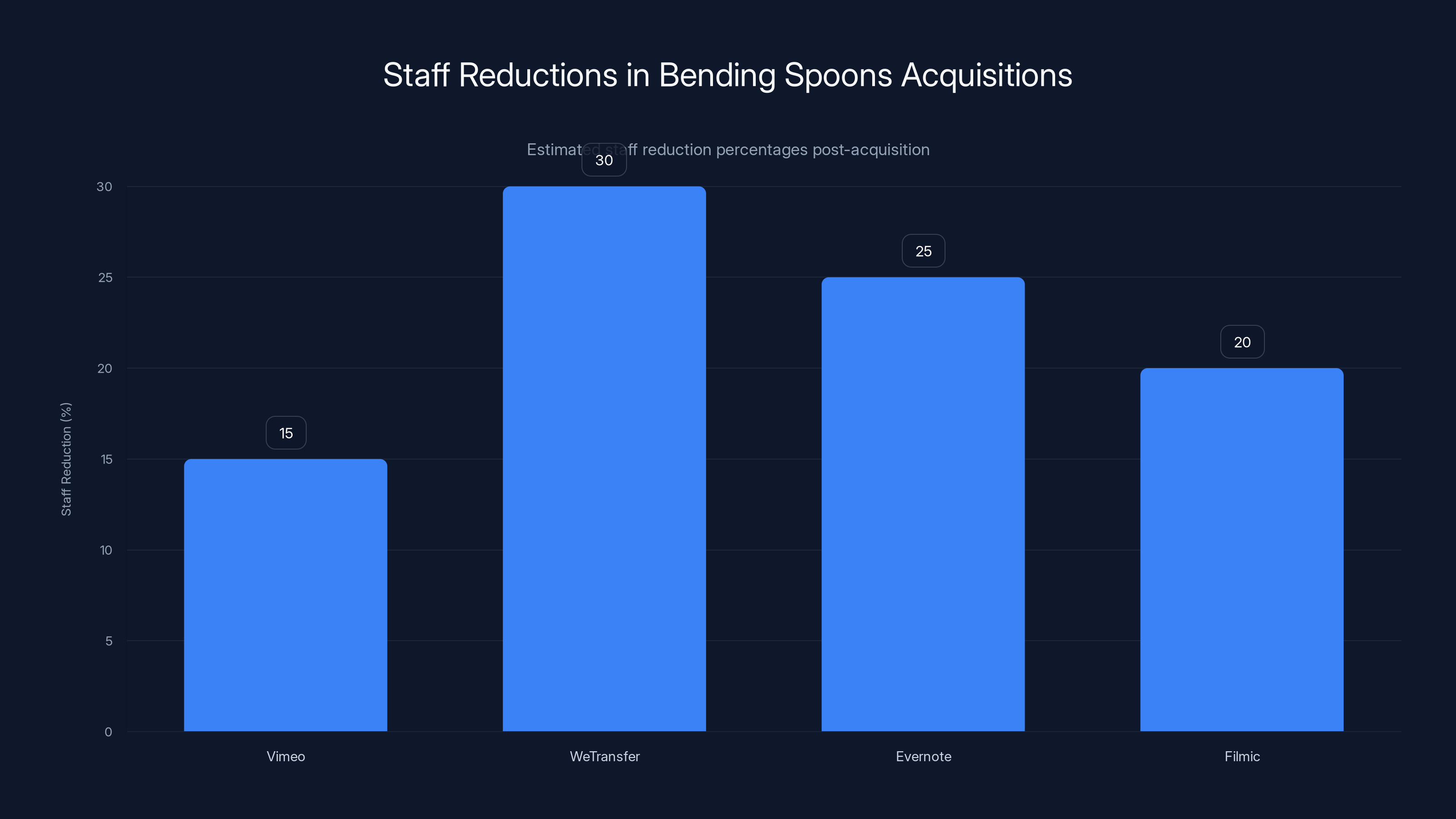

- Pattern of Behavior: This follows Bending Spoons' established pattern of acquiring companies and cutting staff significantly at We Transfer, Evernote, and Filmic

- Creator Concerns: Millions of video creators who depend on Vimeo now worry about platform stability, feature updates, and long-term viability

- What's Next: The layoffs signal Bending Spoons plans to streamline operations and cut costs, which typically means less investment in new features and more focus on monetization

Bending Spoons consistently reduces staff by 15-30% in its acquisitions to cut costs and increase profit margins. (Estimated data)

Understanding the Bending Spoons Business Model: Buy, Optimize, Cut, Profit

To understand why Vimeo's layoffs happened, you need to understand what Bending Spoons actually does. The company isn't a venture capital firm trying to grow startups into unicorns. It's something different: an "acquirer" that buys mature software companies and dramatically reduces their cost structure.

Bending Spoons was founded in 2013 as a mobile app development studio. For years, they built and published games and productivity apps on iOS and Android. But around 2018-2019, the company shifted strategy. Instead of building their own products from scratch, they started buying profitable software products that were already established but underperforming.

The playbook is straightforward. Identify a mature software product with an existing user base, paying customers, and recurring revenue. Acquire it for a reasonable multiple (typically 5-8x annual revenue). Then immediately cut costs by reducing the workforce, consolidating operations, and stripping away "non-essential" features and services. The goal is to improve profitability and cash flow, even if it means sacrificing growth or user experience.

This strategy has worked remarkably well for Bending Spoons financially. The company is profitable, doesn't need external funding, and generates significant cash flow from its portfolio companies. But it's disastrous for employees and often terrible for users.

The company's approach reflects a fundamental philosophical difference from most Silicon Valley acquirers. Rather than acquiring companies as a path to growth (like Facebook acquiring Instagram), Bending Spoons acquires them as a path to profitability and cash extraction. There's nothing inherently illegal or unethical about this strategy, but it does mean that employees and users should expect significant changes when Bending Spoons takes over.

The Vimeo Acquisition: How We Got Here

Vimeo's path to being acquired by Bending Spoons is important context. The company was founded in 2004 by Zack Klein, Jake Lodwick, and others as a "Flickr for video". For years, it was the preferred platform for serious videographers, filmmakers, and creative professionals who wanted a higher-quality alternative to YouTube.

Unlike YouTube, Vimeo never became obsessed with advertising and engagement metrics. The platform focused on video quality, creator control, and a premium experience. It attracted artists, documentarians, and creative studios. The culture was decidedly creative and maker-oriented, not growth-hacking-oriented.

Vimeo went public on the NASDAQ in May 2021, raising capital for growth initiatives. Public company status meant quarterly earnings pressure, analyst expectations, and a need to demonstrate growth and profitability improvements.

By 2024, Vimeo had been struggling. The company's core premium subscription business faced intense competition from YouTube, TikTok, and other platforms. The market hadn't seen sustainable growth. Profitability remained elusive. The stock price had declined significantly from its IPO peak. For Vimeo's board and investors, the Bending Spoons offer at $1.38 billion—a reasonable price relative to revenue—was attractive. It allowed shareholders to exit at a decent valuation.

But for employees and the platform itself, the transition raised immediate concerns. Bending Spoons' track record suggested significant restructuring was coming.

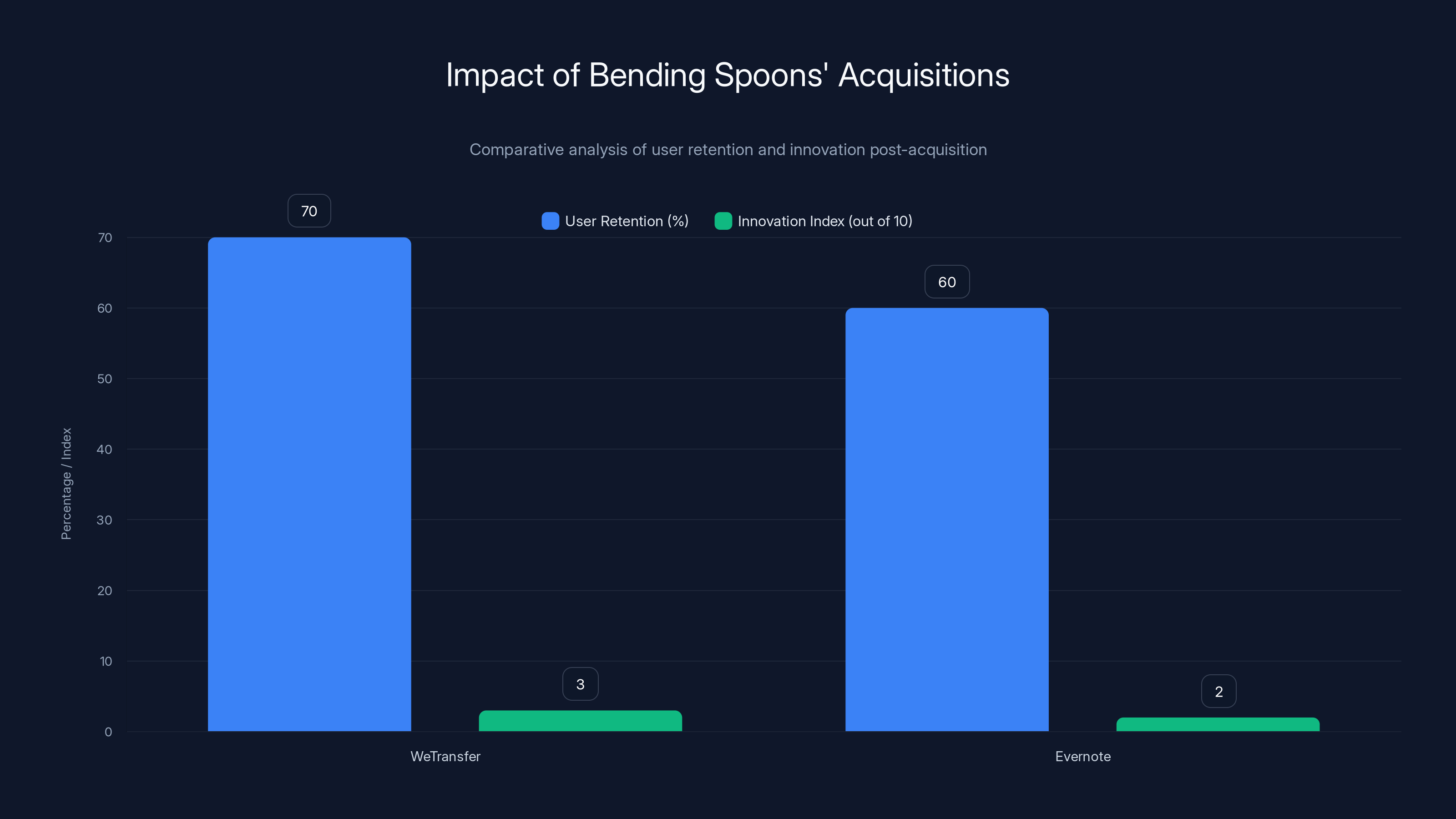

Post-acquisition, both WeTransfer and Evernote saw a decline in user retention and innovation, with WeTransfer retaining 70% of its users and scoring 3/10 on innovation, while Evernote retained 60% and scored 2/10. Estimated data.

Timeline: How Quickly the Cuts Actually Came

Let's trace the actual timeline of what happened, because the speed matters.

September 2024: Vimeo lays off 10% of its workforce. The company issues a standard press release about "optimizing our cost structure" and claims the layoffs will "help us focus on our core strengths and value drivers."

One week later, Bending Spoons announces the acquisition for $1.38 billion. For one week, nobody knew the company was about to be sold. So 10% of people lost their jobs, and then the company was acquired. That's bad luck for those employees.

Late 2024 / Early 2025: The acquisition closes. Bending Spoons takes control of the platform.

January 2025 (estimated): The second wave of layoffs begins. This time it's significantly larger. According to LinkedIn posts from former employees, this round impacts "almost everyone," "a large portion of the company," and "a gigantic amount of the company." One video engineer specifically says the "entire video team" was laid off.

CTech, an Israeli tech outlet, reports that Vimeo is laying off "most" of its employees in Israel. Given Vimeo's engineering presence in Israel, this suggests technical talent was hit particularly hard.

The pattern is clear: Bending Spoons waited for the acquisition to fully close, then immediately began cutting costs at scale.

What Made This Different: The Tech Team Problem

What's particularly notable about Vimeo's layoffs is that they seemed to target technical staff heavily. One former engineer said the "entire video team" was eliminated. Another mentioned layoffs across engineering broadly.

This is significant because it suggests Bending Spoons' cost-cutting wasn't just about removing redundant management or consolidating operations. They actively eliminated the team responsible for maintaining and improving the core video technology that makes Vimeo function.

For a video platform, the technical team is critical for:

- Encoding and transcoding video files to different formats and quality levels

- Maintaining infrastructure and servers that store and deliver billions of gigabytes of video

- Implementing security and content protection to prevent unauthorized access or piracy

- Monitoring platform health and responding to outages or performance degradation

- Building new features that creators and paying customers expect

- Optimizing performance to keep the platform fast and reliable

If you've eliminated the entire video team or most of it, how do you do any of these things? The practical answer is: you don't, or you do it at minimal levels with whoever remains.

This creates a real risk for Vimeo's millions of content creators. If videos start failing to encode, if playback becomes unreliable, if the platform experiences outages, who's fixing it? This is the concern that drove many creators to voice worry about their content being hosted on Vimeo.

Bending Spoons' Acquisition History: A Pattern Emerges

Vimeo isn't Bending Spoons' first acquisition. To understand what might happen next, let's look at the company's track record with other platforms it has bought.

We Transfer: File Sharing Gone Quiet

Bending Spoons acquired We Transfer, a popular file-sharing platform, in 2021 for approximately $570 million. We Transfer had 50 million monthly active users and was a beloved tool for creative professionals and everyday users alike. The platform was profitable and growing.

Immediately after the acquisition, Bending Spoons laid off 30% of We Transfer's staff. The company consolidated operations, merged teams, and shifted focus to monetization rather than growth. Today, We Transfer still exists, but it's noticeably different. Feature development has slowed. The product feels like it's being maintained rather than improved. No major new capabilities have been added in recent years. It's a profitable business, but it's not growing or innovating.

Creators who once used We Transfer as a preferred tool have largely shifted to alternatives like Dropbox, Box, or simple cloud storage options.

Evernote: From Promise to Preservation Mode

Evernote was once a dominant note-taking platform. At its peak, it had 200+ million users. But the company struggled with competition from newer, more focused tools like Notion and Obsidian. Bending Spoons acquired Evernote in 2023.

The company immediately began laying off staff and consolidating operations. Multiple sources reported that Evernote's development slowed. The company stopped working on some announced features. Product updates became less frequent. Today, Evernote still has millions of users, but the product is in survival mode, not growth mode. It's generating cash for Bending Spoons, but users have noticed the stagnation.

Filmic: The Professional Video Encoding Tool

Filmic, a popular app for professional video recording on mobile devices, was acquired by Bending Spoons in 2023. Shortly after, the company laid off a significant portion of the team. Feature development has slowed considerably. Professional videographers who relied on Filmic for advanced encoding options have been disappointed by the lack of innovation since the acquisition.

The Pattern

Across all three acquisitions, the pattern is consistent:

- Immediate layoffs (20-40% of staff)

- Slowed development of new features

- Shift to monetization over growth

- Long-term stagnation rather than improvement

- User experience deteriorates as technical debt accumulates and staff capacity decreases

Based on this history, creators using Vimeo should expect something similar. The platform will likely remain stable enough to function, but improvements will slow dramatically. New features will be rare. Customer support will probably become less responsive. The platform will focus on extracting maximum revenue from existing users rather than acquiring new ones.

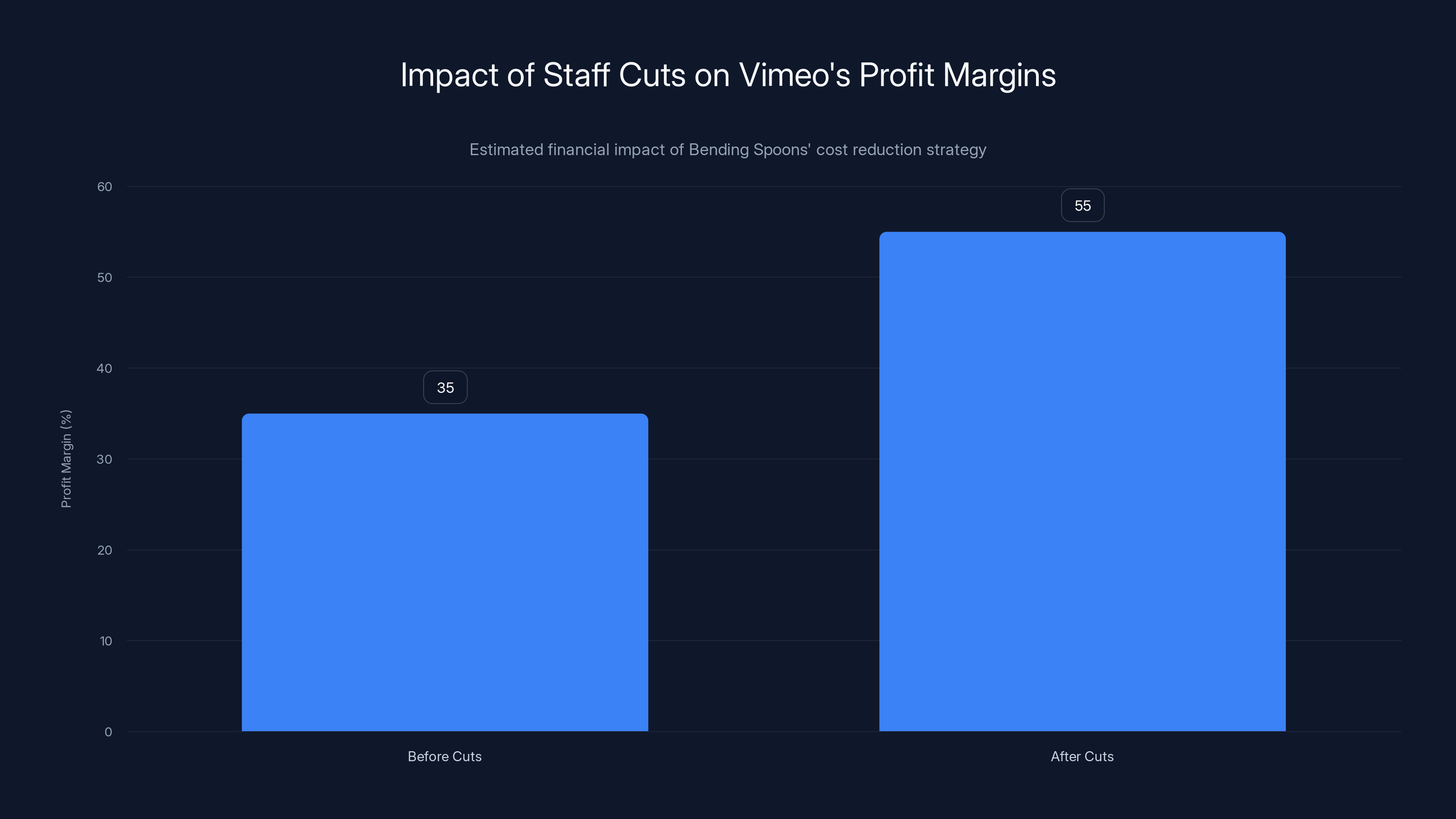

Estimated data: By reducing staff by 15-20%, Bending Spoons can increase Vimeo's profit margins from approximately 35% to 55%, enhancing cash flow without focusing on growth.

The Immediate Impact: What Creators Are Experiencing

The layoffs immediately triggered concerns among Vimeo's creator community. Dropout, the comedy platform that produces shows for Wired and other publishers, saw significant uncertainty about whether their content would remain safe and accessible.

Creators raised several specific concerns:

Reliability and Uptime: With a smaller technical team, would the platform be able to handle edge cases, unusual workloads, or unexpected traffic spikes?

Feature Development: Would Vimeo continue adding features that creators depend on, like better analytics, improved moderation tools, or new customization options?

Content Ownership: If the platform became unstable or too small to maintain, would creators be able to reliably download and export their content?

Customer Support: Would creators be able to get help when something breaks or when they have questions?

Long-term Viability: Is Vimeo's future as an independent platform secure, or would it eventually be shut down or merged into a different product?

These aren't theoretical concerns. They're the actual worries creators expressed online after learning about the layoffs. And they're not unreasonable—they're based on reasonable inferences from Bending Spoons' track record.

Why Bending Spoons Made These Cuts: The Economics

It might seem puzzling why Bending Spoons would immediately cut staff at a major platform. Wouldn't that damage the product? Shouldn't they invest in growth?

Not from Bending Spoons' perspective. Here's how the economics work:

Purchase Multiple: Bending Spoons likely paid 6-8x Vimeo's annual revenue (around

Operational Costs: Vimeo's operating costs were likely consuming 60-70% of revenue, meaning profit margins were only 30-40%. For a public company with growth expectations, that's disappointing. But Bending Spoons doesn't need growth.

Cost Reduction Target: By laying off 15-20% of staff, Bending Spoons can immediately reduce operating costs by $50-70 million annually. Suddenly, profit margins jump from 30% to 50% or higher.

Payback Timeline: The acquisition cost

From Bending Spoons' perspective, this makes perfect sense. They're not buying Vimeo to build the best video platform in the world. They're buying it to generate cash flow. Every dollar spent on R&D, customer support, or features is a dollar that reduces their cash generation.

Meanwhile, Vimeo has a significant installed base of users, many of whom pay for premium features and are unlikely to leave immediately even if the product gets worse. So there's very little downside to cutting costs dramatically.

This is the fundamental misalignment between what Bending Spoons wants from Vimeo and what creators want from Vimeo.

Creator Concerns: The Dropout Effect

One of the most concerning implications of Vimeo's layoffs is the impact on established content creators who depend on the platform for distribution and monetization.

Dropout, a digital entertainment company, produces original comedy content that's distributed through various platforms including Vimeo. Dropout's shows have millions of views and represent significant creative investment and revenue streams for the company.

When Vimeo's technical team gets cut, Dropout faces new risks:

Availability: What if Vimeo experiences an extended outage? Millions of viewers trying to watch Dropout content wouldn't be able to access it. There's no SLA (Service Level Agreement) or compensation for this—it just happens.

Encoding Quality: Dropout's audience expects high-quality video. If Vimeo's video encoding team is eliminated, would quality maintenance become a lower priority?

Support: If Dropout encounters a technical issue with their content, how quickly and effectively can Vimeo respond with a smaller team?

Feature Requests: If Dropout needs a specific feature for their distribution strategy, how long would it take to get built?

Long-term Viability: As a professional content distributor, Dropout needs confidence that their platform partner will be around and stable for years. Bending Spoons' track record suggests this confidence should be diminished.

These concerns aren't unique to Dropout. Any professional creator or media company using Vimeo faces the same questions. The layoffs signal a fundamental shift in what Vimeo is as a platform.

Bending Spoons typically reduces workforce by 30% post-acquisition while increasing profitability by 30% (Estimated data).

Alternatives and What Creators Are Considering

After the Vimeo layoffs, many creators started evaluating alternatives. What other platforms can replace Vimeo for professional video hosting and distribution?

YouTube

YouTube is the obvious alternative. It has the largest audience, the most robust infrastructure, and unlimited storage for free accounts (or essentially unlimited for monetized channels).

But YouTube comes with tradeoffs. The platform's algorithm is designed to maximize engagement, not quality. Content creators have less control over how their work is presented. Ads are more aggressive. The audience is more general. For professional and artistic creators, YouTube's direction often feels misaligned with their values.

Mux

Mux is a modern video infrastructure platform designed for developers and media companies. It provides APIs and tools for embedding video in websites and applications. Mux focuses on performance, reliability, and developer experience.

The downside is that Mux is primarily an infrastructure play, not a content distribution platform. You need to build your own UI and user experience on top of Mux's APIs. It's powerful but requires technical expertise.

Wistia

Wistia is a video hosting platform designed specifically for businesses. It offers responsive video players, detailed analytics, and integrations with marketing and sales tools. Wistia is professional-grade and maintains a smaller, more controlled community.

The downside is cost. Wistia is more expensive than Vimeo's premium tiers. It's designed for businesses with real budgets, not individual creators.

Self-Hosting

Some creators are exploring self-hosting video using open-source platforms like Peer Tube or OVideos. This gives complete control but requires technical expertise and infrastructure costs.

The reality is that no perfect Vimeo replacement exists. Each alternative has tradeoffs. YouTube is most accessible but least creator-friendly. Mux is technically best but hardest to implement. Wistia is professional but expensive. Self-hosting is most independent but most technically complex.

Many creators are adopting a hybrid approach, hosting content across multiple platforms to reduce dependency on any single service.

What About Platform Stability and Technical Risk?

A significant concern after large layoffs at a technical platform is whether the platform can remain stable and reliable without sufficient technical staff.

Video infrastructure is genuinely complex. Vimeo operates massive global infrastructure that:

- Stores petabytes of video content

- Encodes thousands of videos daily in multiple formats

- Serves billions of plays globally with low latency

- Maintains redundancy and failover systems

- Protects against DDoS attacks and security threats

- Handles unexpected traffic spikes

- Maintains compliance with copyright and privacy laws

- Provides customer support for millions of users

This infrastructure didn't get built by accident. It required years of investment by talented engineers. Maintaining it requires ongoing investment, monitoring, and improvement.

When you cut staff significantly, several things tend to happen:

Deferred Maintenance: Issues that aren't immediately critical don't get fixed. Technical debt accumulates.

Reduced Monitoring: Less staff means fewer eyes on systems. Problems don't get caught and fixed as quickly.

Slower Incident Response: When something breaks, there are fewer people available to fix it, and response times increase.

No Proactive Improvement: With a skeleton crew just keeping things running, there's no capacity for proactive improvements or optimization.

Knowledge Loss: When experienced engineers leave, institutional knowledge leaves with them. New problems become harder to solve.

This doesn't necessarily mean Vimeo will experience major outages tomorrow. The platform was built by talented people and likely has good operational foundations. But it does mean that reliability and performance will likely decline over time.

The Long-Term Outlook: What Happens to Vimeo Under Bending Spoons

Based on the pattern with We Transfer, Evernote, and Filmic, here's what we can reasonably predict for Vimeo's future under Bending Spoons:

Years 1-2: The platform remains stable and functional. Bending Spoons extracts maximum profit. Feature development slows noticeably. Staff and customer retention becomes a challenge as the culture shifts from creator-focused to profit-focused.

Years 2-5: Growth stagnates. Newer competitors potentially capture market share. User dissatisfaction increases due to lack of innovation and slower customer support. The product enters "maintenance mode" rather than growth mode.

Years 5+: Vimeo becomes a stable but declining platform. It remains profitable for Bending Spoons because the installed base is large enough to generate cash, but it's no longer a leader in any market segment. New creators avoid it, choosing alternatives instead. Existing creators gradually migrate their content to other platforms.

The most likely end state, based on Bending Spoons' history, is that Vimeo becomes a profitable but stagnant platform serving a declining user base over the next 5-10 years.

There's a small possibility that Bending Spoons sells Vimeo to another buyer at some point if the cash flows plateau. But that would likely be to another acquirer-focused company, not to a growth-focused competitor.

The timeline shows a 10% layoff in September 2024, followed by a significant increase to 50% in January 2025 after the acquisition was finalized. Estimated data.

Industry Implications: What This Means for Platform Risk

Vimeo's situation raises broader questions about platform risk for content creators and businesses. If you invest time and effort building an audience on a platform, how do you protect yourself against the platform being acquired and degraded?

The uncomfortable answer is: you can't fully protect yourself. You can diversify across multiple platforms, but you can't guarantee that any platform will remain stable and well-invested.

This is why many successful creators maintain their own websites and email lists—these are the only platforms they truly control. Video platforms are convenient distribution channels, but they're fundamentally dependent on a third party's continued investment.

The Vimeo layoffs are a reminder that platform stability isn't guaranteed. Even profitable, well-established platforms can be acquired and dramatically changed within months. Creators and businesses should design their content strategy with this assumption in mind.

Lessons for Investors and Employees

The Vimeo situation offers lessons for different groups:

For Employees: Be cautious of acquisitions by acquirer-focused companies like Bending Spoons. These acquisitions historically result in significant job cuts within months. If you work at a company being acquired by this type of buyer, start updating your resume immediately. Consider using any severance period to transition to a new role rather than waiting to be laid off.

For Investors: Bending Spoons' model generates strong financial returns but comes with reputational risk. The company consistently acquires platforms with strong user bases and valuable communities, then degrades them for short-term profit extraction. This creates goodwill risk and, eventually, regulatory scrutiny as policymakers become aware of the pattern.

For Companies Considering Acquisition: If your company is being acquired by an acquirer-focused buyer, negotiate heavily for management autonomy and separation from other portfolio companies. Push for efficiency targets but resist pressure for staff cuts that would harm core product functionality. These negotiations are difficult but not impossible.

The Broader Context: Tech Industry Consolidation

Vimeo's layoffs are part of a larger pattern in the tech industry. Over the past 2-3 years, we've seen:

- Meta laying off 21% of its workforce

- Amazon laying off 18,000 employees

- Twitter (now X) cutting 50% of staff

- OpenAI experiencing significant executive departures

- Hundreds of smaller companies conducting "optimization" layoffs

This pattern reflects several underlying realities:

Unrealistic Hiring: Many tech companies hired too aggressively during the 2020-2021 boom, expecting growth to continue indefinitely.

Profit Pressure: Public companies and VC-backed companies need to demonstrate improving unit economics. Cutting staff is the fastest way to show profit growth.

Acquisition Consolidation: Acquirer-focused companies like Bending Spoons are actively buying companies and immediately cutting staff.

Macro Conditions: Higher interest rates made venture capital more expensive and made growth-at-all-costs strategies less viable.

Vimeo is just one example in a much larger consolidation and cost-cutting wave.

Vimeo's stock price declined significantly from its IPO peak in May 2021 to its acquisition by Bending Spoons in 2024. Estimated data reflects typical market trends.

What Creators Should Do Now: Practical Steps

If you're a creator using Vimeo, here are concrete steps to protect yourself:

1. Audit Your Content: Make a list of all videos hosted on Vimeo. Identify which ones are critical to your business or brand.

2. Backup Critical Content: Download copies of your most important videos. Vimeo makes this easy with bulk export tools, but only while the platform is functional.

3. Evaluate Alternatives: Spend time on YouTube, Wistia, Mux, and other platforms. Understand their strengths, costs, and workflows.

4. Diversify Distribution: Instead of relying entirely on one platform, consider hosting videos on your own website or multiple platforms.

5. Monitor Changes: Follow Vimeo's product roadmap and communication. If major changes happen or if performance degrades, you'll have early warning to migrate.

6. Plan for Transition: If you decide to migrate off Vimeo, build a 6-month transition plan. Don't do it all at once. Gradually move new content to the new platform while keeping old content accessible on Vimeo.

7. Maintain Community: If you have viewers who are used to accessing your content on Vimeo, communicate proactively if and when you migrate. Make it easy for them to find your new home.

The Broader Narrative: What Happened to Vimeo's Mission

Vimeo was founded on a mission to be different from YouTube. While YouTube optimized for engagement and watched time, Vimeo optimized for creative quality and creator control. While YouTube's algorithm pushed sensational content, Vimeo trusted creators to find their audiences.

That mission attracted millions of creators who valued the platform precisely because it was creator-first, not algorithm-first. The platform became trusted for serious creative work.

Bending Spoons' acquisition and subsequent layoffs fundamentally change what Vimeo is. The company is no longer optimizing for creator value. It's optimizing for profit extraction. The layoffs are the visible symptom of this shift.

This is a loss for the creative community. It's a loss for creators who believed in Vimeo's mission. And it's a sign that even established platforms with strong values can be transformed quickly by acquisition and cost-cutting.

Regulatory and Antitrust Considerations

As acquirer-focused companies like Bending Spoons become more active and more aggressive, they're starting to attract regulatory attention. Acquiring established platforms and immediately degrading them raises questions about:

Consumer Protection: Should regulators intervene when acquisitions appear designed to extract value rather than improve products?

Merger Review: Should antitrust agencies scrutinize acquisitions by roll-up companies more carefully?

Data Protection: What happens to user data when platforms are acquired and degraded? Are privacy protections maintained?

Content Security: For user-generated content platforms, does the acquirer have obligations to maintain content security and availability?

These questions don't have clear answers yet, but they're increasingly important as acquisition patterns become more visible.

How to Think About Platform Risk Going Forward

The Vimeo layoffs are a concrete example of "platform risk"—the risk that a platform you depend on will be acquired, degraded, or shut down. This risk is real and increasing.

Here's how to think about it:

Every platform is potentially at risk: No platform is too big or too important to be acquired and changed. Think about Twitter, Instagram (acquired by Facebook), YouTube (acquired by Google), and countless others.

Profitability is not protection: Even profitable platforms like Vimeo and Evernote are vulnerable. Profitability makes them attractive acquisition targets.

Community is not protection: Even platforms with passionate user communities can be acquired and degraded. Users don't have a vote in acquisition decisions.

Trust is fragile: Platforms build trust over years but can lose it in months if acquired and mismanaged. Vimeo's creators trusted the company for 20 years. That trust is now at risk.

Ownership matters: Platforms owned by profit-focused acquirers are fundamentally different from platforms owned by founders or growth-focused companies. This changes incentives.

The practical implication: reduce your dependence on any single platform. Diversify. Maintain your own channels. Own your relationship with your audience directly rather than through a platform intermediary.

Conclusion: The Future of Vimeo and Lessons Learned

Vimeo's layoffs after Bending Spoons' acquisition represent a pivotal moment for the platform, its creators, and the broader tech industry. The acquisition signaled the end of Vimeo as an independent company optimizing for creator value. The layoffs confirmed that Bending Spoons' priority is profit extraction, not platform improvement.

Based on the company's track record with We Transfer, Evernote, and Filmic, we can predict that Vimeo will become a stable but stagnating platform over the next 5-10 years. Feature development will slow. Customer support will decline. User dissatisfaction will increase. The platform will generate healthy cash flows for Bending Spoons, but it won't be an innovative or leader in its market.

For creators currently on Vimeo, this means the time to develop a backup plan is now, not later. Whether that's diversifying to other platforms, self-hosting, or maintaining multiple distribution channels, it's wise to reduce your dependency on Vimeo as your primary platform.

For the broader industry, Vimeo's situation is a reminder that platform risk is real. Creators and businesses should design their strategies assuming that any platform they use could change ownership and direction quickly. The safest approach is to own your audience relationship directly through email, websites, and other owned channels while using platforms as distribution amplifiers rather than core dependencies.

The unfortunate reality is that Bending Spoons' model works financially. The company generates strong returns by acquiring platforms and cutting costs. As long as this model is profitable, expect to see more acquisitions and more layoffs. The question for policymakers and industry observers is whether this pattern serves users and creators, or whether it's primarily value extraction at their expense.

For now, Vimeo will remain functional and profitable. But the days of Vimeo as an innovative, creator-first platform are likely over.

FAQ

What exactly happened to Vimeo after the Bending Spoons acquisition?

After acquiring Vimeo for $1.38 billion in 2024, Bending Spoons implemented massive layoffs impacting "a large portion" of the company's global workforce just months after the acquisition closed. Former employees reported that the layoffs affected "almost everyone," including the entire video engineering team. This followed a 10% workforce reduction that Vimeo had implemented just one week before the acquisition was announced, making it roughly 15-20% or more total staff reduction in six months.

Why did Bending Spoons immediately lay off so many Vimeo employees?

Bending Spoons' business model is based on acquiring profitable software companies and dramatically reducing their cost structure to improve profit margins and cash generation. When Vimeo was acquired, the company likely had operating expenses consuming 60-70% of revenue. By laying off 15-20% of staff, Bending Spoons could immediately reduce annual operating costs by $50-70 million and increase profit margins from 30% to 50% or higher. The acquisition pays for itself in 15-20 years through improved cash flow, making the immediate cuts financially sensible from Bending Spoons' perspective.

What's Bending Spoons' track record with other acquisitions?

Bending Spoons has a clear pattern with its acquisitions. After buying We Transfer in 2021, the company immediately laid off 30% of staff. Evernote, acquired in 2023, experienced significant layoffs and now operates in maintenance mode with slowed feature development. Filmic, also acquired in 2023, saw dramatic staff reductions and virtually no feature updates since. In all cases, the platforms remain functional but enter long-term stagnation rather than growth or improvement.

What should Vimeo creators do about their content?

Content creators using Vimeo should take several precautions now. Audit all your Vimeo content and identify what's critical. Download backup copies of important videos while the export tools work smoothly. Explore alternative platforms like YouTube, Wistia, or Mux. Consider diversifying by hosting new content on multiple platforms rather than relying entirely on Vimeo. A gradual transition over 6-12 months is better than an emergency migration.

Will Vimeo shut down or stop working?

It's unlikely that Vimeo will completely shut down or become non-functional. The platform is profitable and has millions of paying users and terabytes of stored content. However, based on Bending Spoons' track record, Vimeo will likely experience declining feature development, slower customer support, and gradual stagnation over 5-10 years. Performance and reliability may decline over time, but the platform should remain operational from a technical standpoint.

How is Vimeo's situation different from what happened at Twitter after Elon Musk's acquisition?

Both acquisitions involved massive immediate layoffs, but the underlying motivations differ. Elon Musk laid off 50% of Twitter's staff to change the company's direction and reduce costs. Bending Spoons lays off staff to increase profitability and cash generation. Twitter's cuts were ideologically motivated. Vimeo's cuts are financially motivated. The practical outcome for users is similar in both cases: reduced product quality, slower feature development, and degraded user experience.

What are the best alternatives to Vimeo for professional video creators?

The best alternatives depend on your specific needs. YouTube offers unlimited storage and the largest audience but less creator control. Wistia provides professional-grade features and analytics but at higher cost. Mux offers powerful infrastructure and APIs but requires technical implementation. Self-hosting via Peer Tube provides complete control but requires technical expertise. Many creators use a hybrid approach, distributing across multiple platforms to reduce dependency risk.

Will Bending Spoons eventually sell Vimeo to another company?

It's possible but not immediate. Bending Spoons' typical acquisition strategy involves holding platforms for extended periods to extract cash flow. A sale would likely only happen if Vimeo's profitability plateaued or declined. If a sale occurs, it would most likely be to another acquirer-focused company rather than to a growth-focused competitor, which would mean continued stagnation rather than improvement.

How can the industry prevent this pattern from repeating?

Regulatory intervention could address Bending Spoons' pattern, but it's unclear what specific regulations would be most effective. Options include stricter merger review for acquisitions by roll-up companies, mandatory commitments to maintain feature development and support, user protection standards, and antitrust scrutiny of companies that acquire and degrade established platforms. However, implementing these regulations would require clear legislative action or regulatory guidance that doesn't currently exist.

Building on platforms controlled by others means accepting the risk that those platforms could change owners and directions. The Vimeo situation is a concrete, real-world reminder that this risk is not theoretical. Creators and businesses should design their content strategies accordingly.

Need to automate your workflow or generate reports without diving into code? Try Runable, an AI-powered platform that handles presentations, documents, and reports at $9/month. It's a useful tool for teams managing multiple content distributions and staying organized during platform transitions.

Key Takeaways

- Bending Spoons acquired Vimeo for $1.38 billion and immediately implemented massive layoffs affecting a large portion of the global workforce within months of closing the deal.

- Bending Spoons' business model is designed to acquire profitable companies and dramatically cut costs to improve profit margins, which explains the rapid staff reductions at Vimeo and other acquisitions.

- Based on Bending Spoons' track record with WeTransfer, Evernote, and Filmic, Vimeo will likely enter a period of maintenance mode with slowed feature development and declining user satisfaction over 5-10 years.

- Content creators depending on Vimeo should immediately backup critical content and develop a diversification strategy using multiple platforms to reduce dependency risk.

- The Vimeo situation demonstrates that platform risk is real and that even established, profitable platforms can be acquired and significantly degraded within months.

Related Articles

- Bluesky's New Features Drive 49% Install Surge Amid X Crisis [2025]

- Kioxia Memory Shortage 2026: Why SSD Prices Stay High [2025]

- YouTube's SRV3 Captions Disabled: What Creators Need to Know [2025]

- Meta Quest Layoffs and VR's Future: Why Palmer Luckey's Optimism Might Be Misplaced [2025]

- Elon Musk's $134B OpenAI Lawsuit: What's Really at Stake [2025]

- Apple's Self-Driving Car Confirmed by Airbnb: What It Means for AI [2025]

![Vimeo Layoffs After Bending Spoons Acquisition: What Happened [2025]](https://tryrunable.com/blog/vimeo-layoffs-after-bending-spoons-acquisition-what-happened/image-1-1769121525405.jpg)