Introduction: The Battle Over Open AI's Soul and a Fortune

Imagine building something from scratch. You invest your money, recruit the best people you know, make key introductions, and offer strategic advice. Then the founders pivot, restructure, and eventually transform the nonprofit into something worth half a trillion dollars without giving you a meaningful piece. That's essentially what Elon Musk is arguing happened with Open AI.

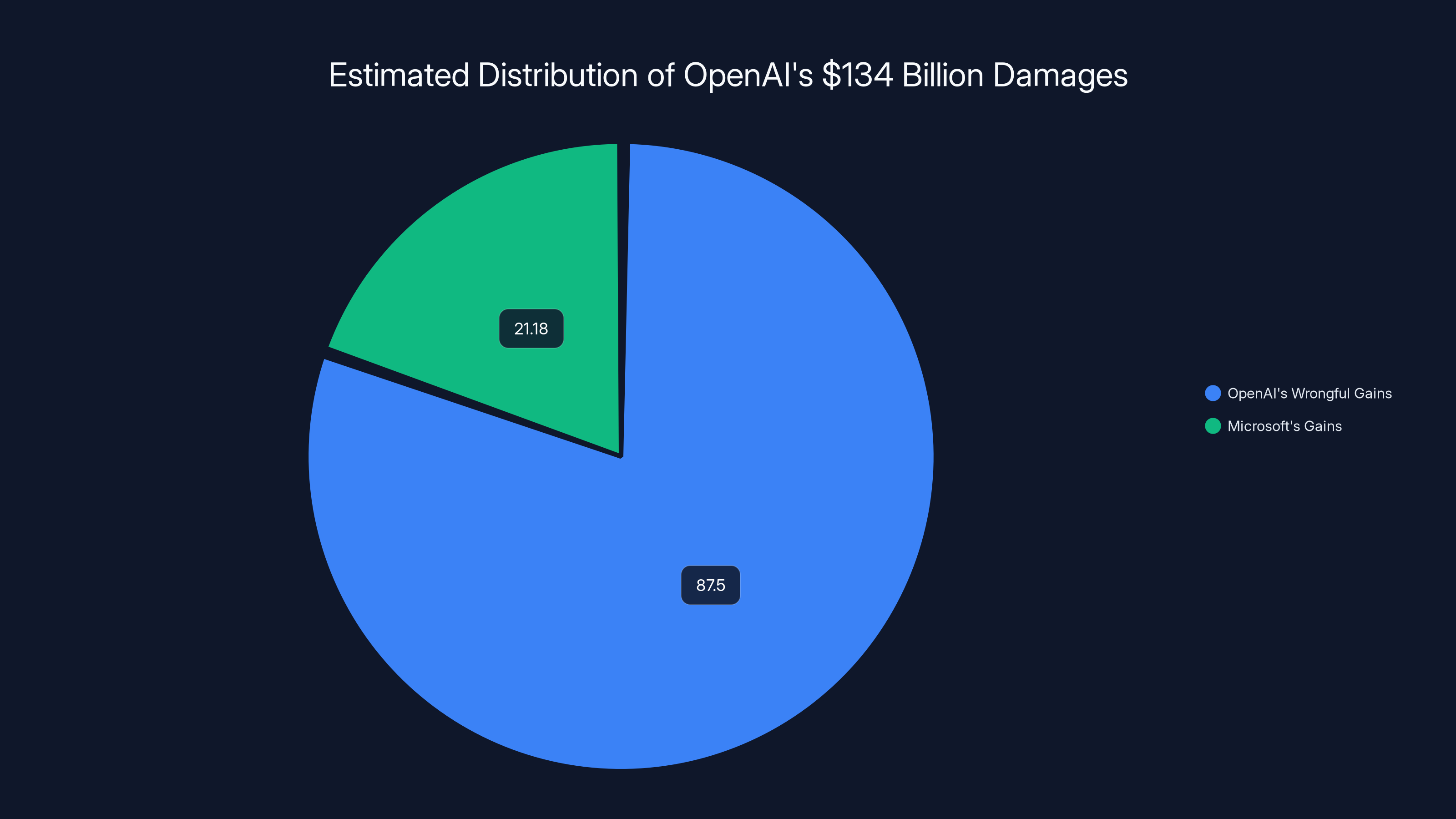

In March 2024, Musk filed a lawsuit against Open AI and later added Microsoft as a defendant. The claim was straightforward but bombshell: Open AI had abandoned its nonprofit mission and become a for-profit enterprise, violating its founding principles. But the lawsuit isn't just about principles. According to financial expert testimony filed in early 2025, Musk is entitled to somewhere between

Let that sink in. We're talking about one of the largest damages claims in Silicon Valley history, potentially larger than the entire market capitalization of most Fortune 500 companies. This case touches on fundamental questions about how startups should be structured, what founders owe their early investors, and whether a company's mission can simply be abandoned when the money gets bigger.

The

Musk's role in Open AI's founding wasn't marginal. He contributed approximately

This case matters far beyond just Musk versus Open AI. It raises questions that will reshape how Silicon Valley structures AI companies, how nonprofits can transform into for-profit enterprises, and what obligations founders have to early backers. The outcome could impact how future AI companies are funded and governed. Let's dig into what actually happened, what the lawsuit claims, and why this matters.

TL; DR

- The Payout Claim: Musk is seeking $79-134 billion in damages, claiming Open AI wrongfully earned gains by abandoning its nonprofit status

- His Contributions: Musk provided $38 million (60% of seed funding), recruited key talent, and offered strategic guidance during Open AI's founding

- The Core Claim: Open AI transformed from nonprofit to for-profit enterprise in violation of its founding charter, enriching itself and Microsoft

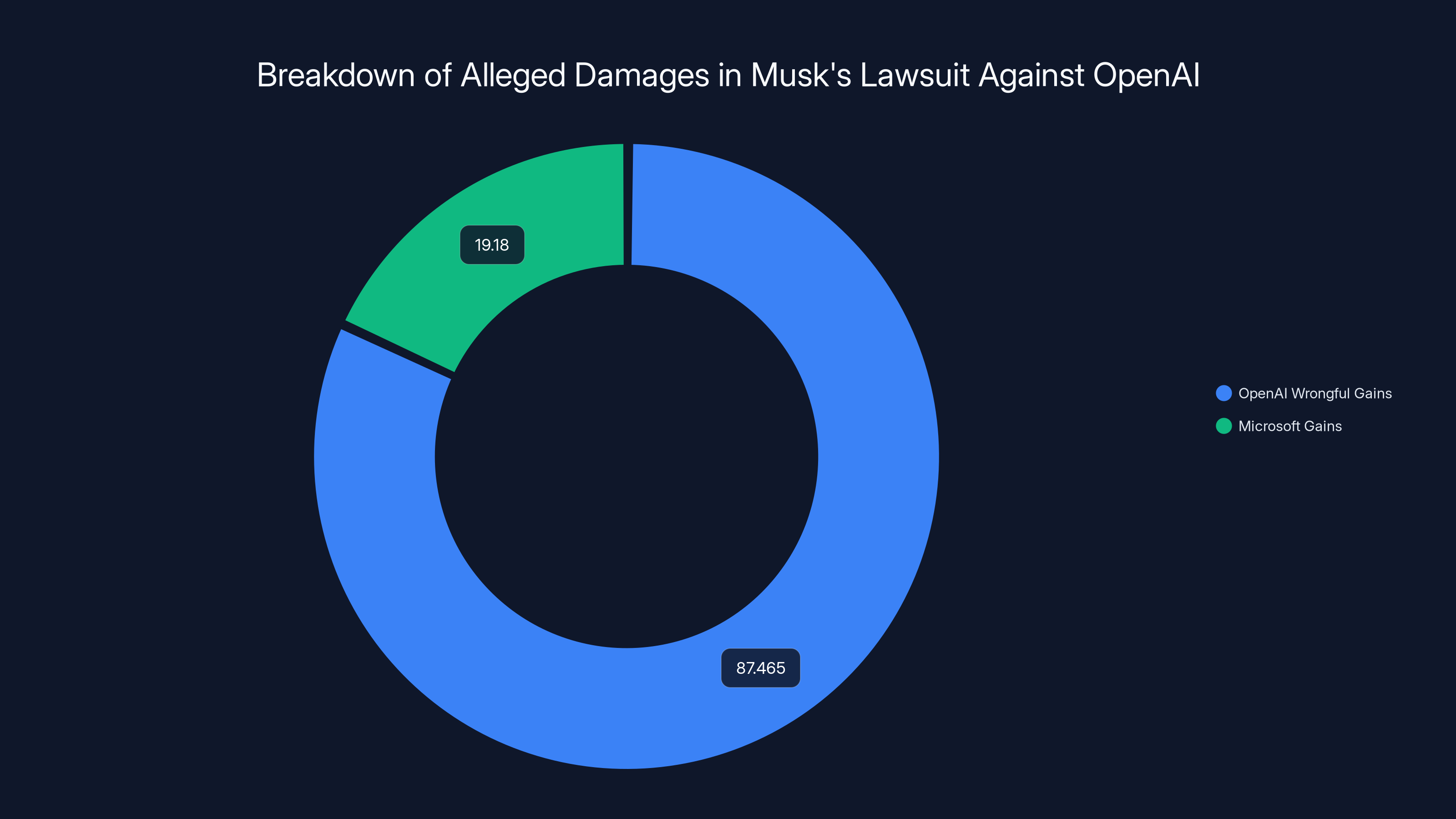

- Financial Breakdown: Alleged wrongful gains total 13.3-25.06 billion for Microsoft

- Bottom Line: This lawsuit could reshape how AI startups structure ownership and governance for years to come

OpenAI's restructuring is estimated to have resulted in

The Origins of Open AI: When Everything Was Nonprofit

Open AI wasn't born as a Silicon Valley gold rush startup. It started as something different, almost radical for tech: a nonprofit artificial intelligence research organization.

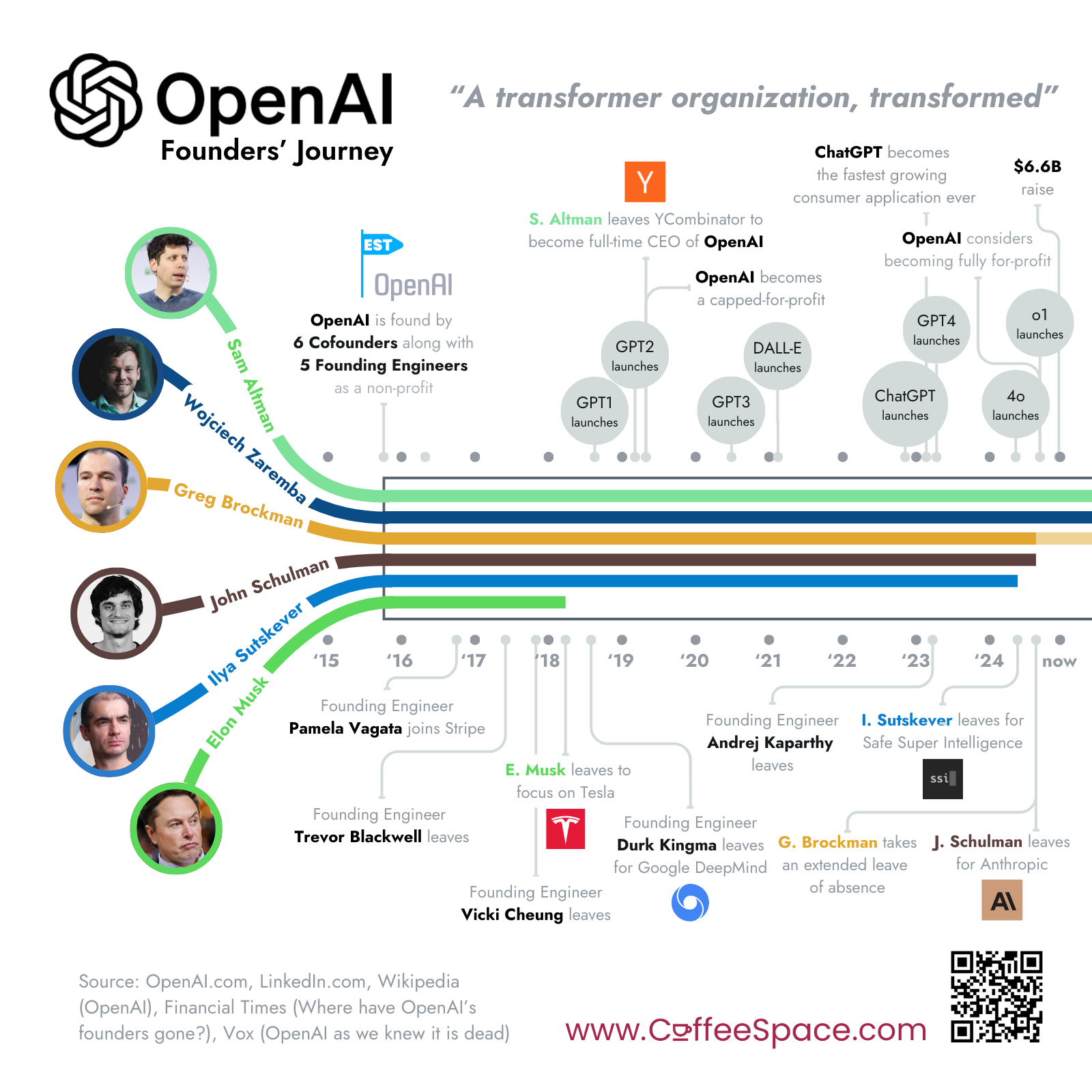

The founding in December 2015 brought together several prominent figures in AI and entrepreneurship. The nonprofit structure was intentional. The founders wanted to ensure that cutting-edge AI research would be developed with humanity's interests in mind, not just shareholder profits. They worried that leaving AI development entirely to corporations would create misaligned incentives where commercial gains trumped safety and societal benefit.

Elon Musk was a co-founder and chairman. He brought more than just money to the table. Musk had already proven his ability to recruit world-class engineers at Tesla and Space X. He had connections across Silicon Valley, Wall Street, and the tech industry globally. When Open AI needed top talent, Musk could pick up the phone and call researchers who might not have otherwise considered leaving prestigious academia or established tech companies.

The $38 million that Musk invested covered critical early expenses: computational resources, salaries for the first research teams, and infrastructure. For context, that was serious money in 2015-2016. It wasn't venture capital coming from a fund that had raised billions. It came from Musk's personal wealth and represented actual financial commitment.

The nonprofit structure created certain constraints and freedoms simultaneously. As a nonprofit, Open AI couldn't raise venture capital in the traditional sense. It had to operate through grants, donations, and partnership agreements. This limited its ability to scale rapidly compared to for-profit competitors. But it also meant the organization could claim alignment with societal good rather than profit maximization.

Musk's involvement was substantial during these early years. He helped hire talent. The company's first researchers and executives came partly through Musk's network. He advised on strategic direction, offering perspective from his experience building companies that attempted ambitious technical goals. He made introductions that led to partnerships and collaborations that helped the organization grow.

But here's the critical detail that Musk's lawsuit emphasizes: as a nonprofit investor, Musk didn't receive equity in the traditional sense. Nonprofits don't have stock. Instead, his claim is based on the theory that if Open AI had remained a nonprofit and later distributed its assets, he would have been entitled to a proportional share based on his contributions. The moment Open AI transformed into a for-profit structure, that theoretical claim became real money, and it benefited existing shareholders rather than early contributors.

The Transformation: How Open AI Became a For-Profit

Open AI's structure remained nonprofit for years. But as the AI company's capabilities grew and the competitive landscape shifted, the nonprofit model became increasingly constraining.

By the early 2020s, Open AI had achieved significant breakthroughs in language models. The scaling laws suggested that achieving artificial general intelligence required exponentially more computing power than anyone had previously thought. Acquiring and maintaining that computational infrastructure was extraordinarily expensive. A nonprofit couldn't raise the capital needed to stay competitive with Google, Meta, and other well-funded tech giants pivoting toward AI.

In 2023, Open AI introduced a new structure: a for-profit subsidiary that would operate under the nonprofit's guidance. This hybrid model allowed the company to raise venture capital while maintaining the nonprofit as a theoretical control mechanism. Microsoft invested billions into the for-profit subsidiary. Other investors poured in capital as well.

Then came the reorganization discussions that triggered Musk's injunction attempt. In 2024, Open AI announced plans to completely restructure away from the nonprofit model into a traditional for-profit public benefit corporation. The reasoning was straightforward: the nonprofit structure had become unworkable. The company needed capital it couldn't raise as a nonprofit, needed to offer equity incentives to compete for talent, and needed the flexibility to operate as a modern tech company.

But here's where Musk's lawsuit argument gets sharp: that reorganization happened without addressing what the original nonprofit's assets should become. Open AI had spent nearly a decade developing proprietary research, models, and infrastructure using funding that came from Musk and other early investors. When it transformed into a for-profit, those assets transferred to the new structure, and Musk received nothing.

From Musk's perspective, he wasn't just losing theoretical nonprofit claims. He was watching as the organization he helped found became one of the most valuable companies in the world, and watching his contributions be erased in the process.

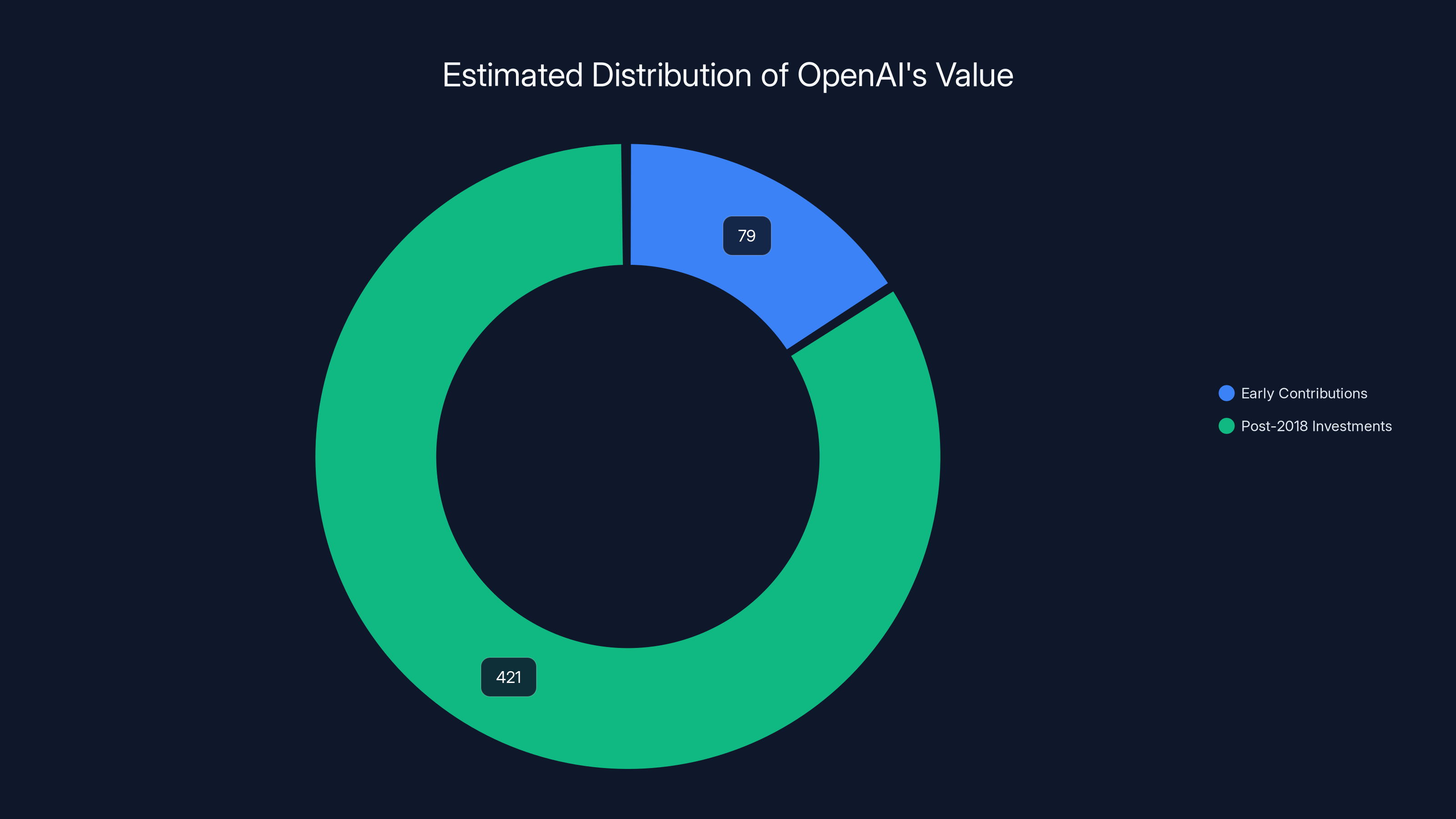

Estimated data suggests early contributions account for

Musk's Core Argument: The Nonprofit Betrayal

The legal claim Musk is pursuing rests on a specific argument: Open AI violated its founding charter by transforming from a nonprofit into a for-profit entity.

When Open AI was established as a nonprofit, the founding documents committed the organization to certain principles. It would prioritize AI safety and research over commercial gain. It would operate in the interest of humanity. It would maintain transparency about its research. These weren't casual mission statements written for marketing. They were foundational commitments that structured how the organization would function.

Musk's argument is that Open AI systematically violated these commitments. The company stopped publishing research papers as it once did. It became secretive about its models and capabilities. It prioritized commercial partnerships and revenue generation over open research. Most importantly, it created a for-profit subsidiary and began operating primarily through that entity while maintaining the nonprofit as a shell.

When Open AI shifted from nonprofit to for-profit structure, it essentially told its early contributors: your nonprofit shares in this organization are now worthless. The valuable assets and future revenue streams will exist in a for-profit entity where you have no claim. This wasn't a failure of execution or bad luck. It was a deliberate structural choice.

The legal theory here is grounded in something called "unjust enrichment." The argument goes like this: Open AI received contributions from Musk (money, talent recruitment, strategic advice) based on the nonprofit structure and mission. Using those contributions, the organization built something worth hundreds of billions. Then it restructured specifically to prevent early contributors from benefiting. That's enrichment that wouldn't have happened without the original contributions, and it's unjust because it directly violates the agreements that motivated the original contributions.

Musk's filing specifically points to statements made by Open AI's leadership over the years about the nonprofit mission. When they were fundraising from Musk and others, they emphasized commitment to beneficial AI development. When they needed to restructure to become profitable, suddenly that mission became negotiable. The lawsuit argues this represents a bait-and-switch: secure funding based on nonprofit mission, then abandon the mission once secured.

The Financial Expert's Calculation: 134 Billion

C. Paul Wazzan, the financial economist serving as Musk's expert witness, had to calculate something unusually complex: what is Musk's rightful share of Open AI's value if the nonprofit structure had been maintained?

This calculation requires several steps, each containing estimates and assumptions. First, establish Open AI's current valuation: $500 billion (or the highest recent valuation used in funding rounds). Next, determine what portion of that value was created due to early funding and guidance versus later efforts. This is where things get speculative.

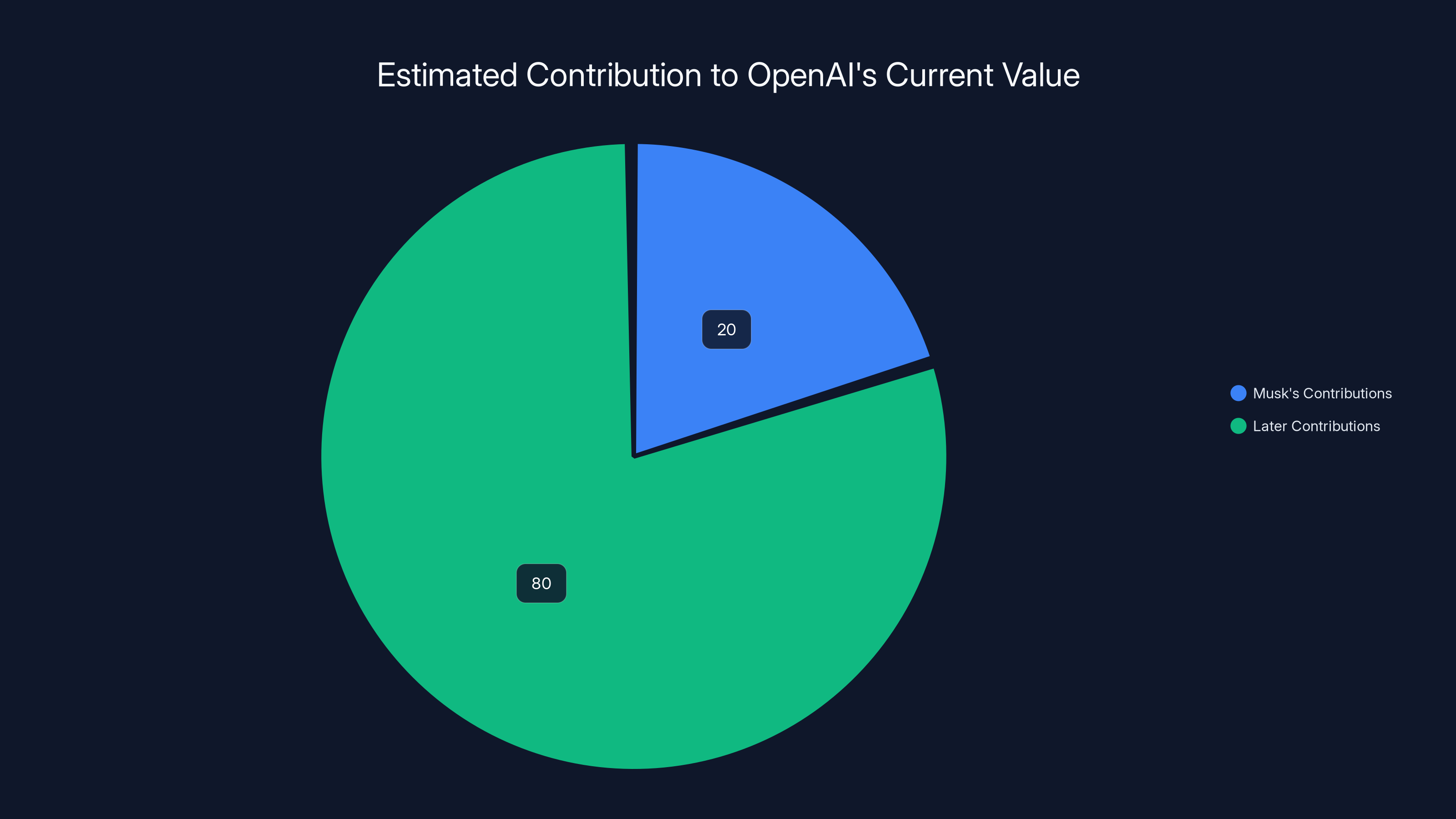

Wazzan's calculation methodology apparently follows this logic: if the nonprofit had remained a nonprofit and eventually liquidated or distributed its assets, early contributors would receive distributions proportional to their contributions. Musk contributed $38 million of the nonprofit's seed funding, representing roughly 60% of that early capital. He also contributed recruiting and strategic guidance, though quantifying that is more difficult.

The calculation produces a range rather than a single number because different assumptions yield different results. On the lower end,

The breakdown between Open AI and Microsoft matters legally. Wazzan calculated Open AI's wrongful gains at $65.5-109.43 billion. Why does Microsoft face liability? Because Microsoft invested tens of billions into Open AI's for-profit subsidiary and received exclusive partnership benefits that wouldn't have existed if Open AI had remained a nonprofit. Microsoft benefited from the wrongful transformation. It gained exclusive commercial rights, priority access to technology, and integration opportunities. So the lawsuit names Microsoft as jointly liable for the gains it received from those partnerships.

Microsoft's calculated share of wrongful gains comes to $13.3-25.06 billion. This represents the value Microsoft gained from having exclusive access to Open AI's technology and capabilities, which it wouldn't have had under the original nonprofit structure.

These numbers are enormous, which is precisely why the case has attracted such attention. For context, $134 billion is larger than the entire market capitalization of companies like Costco, Nike, or Intel. It's more than Apple's annual revenue. The scale reflects just how valuable Open AI has become and how early Musk's contributions were.

Microsoft's Unexpected Position: Why a Tech Giant Is Defending Open AI

Microsoft's role in this lawsuit is interesting because the company wasn't the initial defendant. Musk filed against Open AI first. Microsoft got added later as Musk's lawyers recognized that Microsoft's massive investments in Open AI created financial liability if the lawsuit succeeded.

Microsoft's situation is genuinely complicated. The company isn't defending Open AI's mission or arguing the nonprofit transformation was good. Instead, Microsoft's defense rests on different grounds: it didn't know it was doing anything wrong, it acted in good faith as an investor, and it shouldn't be held liable for Open AI's corporate structure decisions.

From Microsoft's perspective, the company conducted proper due diligence. Open AI's board approved the for-profit transformation. Legal counsel reviewed it. The restructuring was transparent. Microsoft invested billions based on standard venture capital practices. Why should Microsoft face $13-25 billion in liability for decisions that Open AI made regarding its own structure?

However, the lawsuit's argument cuts differently. The claim isn't that Microsoft did anything illegal independently. The claim is that Microsoft benefited from the wrongful transformation. By investing in the for-profit subsidiary and securing exclusive partnership rights, Microsoft received value that it wouldn't have received if Open AI had remained a nonprofit. Microsoft becomes liable not because it caused the transformation but because it reaped the financial rewards from it.

This creates an interesting incentive structure. If the lawsuit succeeds, it would make any company thinking about investing in a corporate structure questioned for these reasons nervous. Investors in competitors could face liability if a company they invested in is later found to have transformed its structure in violation of founding commitments.

Microsoft's position has also shifted over time. The company initially claimed it had limited understanding of Open AI's structural issues, but documents during discovery may reveal just how much Microsoft's leadership understood about the nonprofit-to-for-profit transition. If Microsoft knowingly benefited from a transformation it understood violated founding principles, the liability calculus changes entirely.

Estimated data shows Musk's early contributions account for 20% of OpenAI's current value, while later work contributes 80%. This highlights the ongoing debate over the significance of early vs. later contributions.

The Competitive Context: Why Open AI Couldn't Remain a Nonprofit

Understanding why Open AI felt compelled to restructure requires stepping back and looking at the AI competitive landscape in 2023-2024.

Google controls the largest AI talent pool through Deep Mind, acquired years ago. Meta has substantial AI research capabilities. Microsoft is investing tens of billions into AI through partnerships and internal development. These are companies with enormous capital bases that can spend whatever is necessary to win in AI.

Open AI, even as a nonprofit subsidiary, couldn't compete with that capital and flexibility. The nonprofit structure prevented it from raising venture capital directly, from offering stock incentives to top talent, from moving as quickly as pure profit-maximizing competitors. The scaling laws in AI mean that better models require proportionally more computing power, which requires proportionally more money.

When Open AI developed GPT-4 and saw clear signals that the approach was working, the board faced a stark choice: remain a nonprofit and gradually lose the competitive race as well-funded competitors outspent it, or restructure to compete on equal financial footing. In that context, the restructuring wasn't just a business decision. It was survival.

But here's the problem: survival doesn't eliminate the original commitments. The nonprofit founding charter still existed. Early contributors like Musk still had theoretical claims based on the nonprofit structure. The company was essentially saying: we know we promised nonprofit mission-alignment and early contributor benefits, but we need to abandon both to survive. Is that acceptable?

This creates a genuine dilemma in startup governance. Should founders and early investors be locked into a structure that prevents adaptation, even if the original structure becomes unworkable? Or does allowing transformation mean early commitments mean nothing? Different jurisdictions and courts might resolve this differently.

The Founding Documents: What Do the Papers Actually Say?

The lawsuit hinges on interpreting what Open AI's founding documents actually committed the organization to doing.

Open AI was incorporated as a Delaware nonprofit corporation. Delaware law governs how nonprofits can transform their structure and what obligations they have to contributors and stakeholders. The founding documents, board resolutions, and subsequent amendments create the legal foundation for the dispute.

Musk's filing argues that the founding documents explicitly committed Open AI to remaining a nonprofit focused on AI research and safety. The organization couldn't simply unilaterally decide to become a for-profit without violating those commitments. Early contributors invested based on those commitments.

Open AI's counter-argument (though not formally stated yet in available filings) would likely rest on the flexibility afforded to nonprofits under Delaware law. Nonprofits can restructure, merge, or transform if the board believes it's in the organization's interest and follows proper procedures. There's nothing necessarily illegal about the transformation if it was properly approved.

The technical question becomes: did Open AI follow proper procedures? Did it notify early contributors? Did it offer them compensation or alternative structures? Did it comply with its own bylaws and Delaware nonprofit law? Courts will examine these procedural questions carefully.

There's also a question of what happened to Open AI's nonprofit assets during the restructuring. Nonprofits have assets, even without shareholders. They have accumulated research, intellectual property, goodwill, and financial reserves. When transforming to for-profit, there must be a mechanism for handling those assets. If they simply transferred to the for-profit subsidiary without compensation to the nonprofit or its contributors, that could strengthen Musk's argument.

What Musk Actually Contributed: Beyond Just Money

The lawsuit isn't just about the $38 million. Quantifying Musk's other contributions is actually important to the damages calculation.

Recruiting and retaining top AI talent is extraordinarily difficult. Open AI needed researchers with world-class expertise in machine learning, systems engineering, and AI safety. Musk's reputation and network opened doors. Researchers who might not have left academia or larger companies for an unproven nonprofit suddenly considered it when Elon Musk told them about it personally.

Who were some of these key hires? The lawsuit filing doesn't name names in the public documents, but Open AI's early research team included specialists recruited from academia and industry. Many had multiple job offers. Musk's endorsement and connection mattered in recruitment.

Musk also made introductions that led to partnerships and funding. When a nonprofit is trying to establish partnerships with major companies or secure grants from foundations, having someone like Musk attached to the organization carries weight. His involvement suggested the company was serious and capable.

Strategic guidance is harder to quantify but potentially valuable. As founder of Tesla and Space X, Musk had experience building companies that attempted ambitious technical goals under constraints. He could advise on how to maintain research excellence while scaling operations, how to think about safety and mission alignment, how to recruit and retain talented people under pressure.

The lawsuit filing apparently claims that Musk provided "recruiting of key employees, introductions with business contacts and startup advice" beyond the $38 million. Quantifying these contributions requires expert testimony, which is why Wazzan's analysis includes estimates of their value.

If Musk had been a traditional venture investor receiving equity, these contributions would be naturally reflected in his equity percentage. The lack of formal equity doesn't mean the contributions lacked value. It means the nonprofit structure prevented standard equity arrangements. The lawsuit argues Musk should receive compensation equivalent to the value those contributions generated.

The lawsuit claims OpenAI earned between

The Timeline: When Did the Disagreement Start?

Understanding when Musk's and Open AI's interests diverged helps explain why the lawsuit filed when it did.

Musk was involved in founding Open AI and served as chairman initially. By 2018, he had stepped back from day-to-day involvement, though he remained publicly associated with the organization. His attention was increasingly consumed by Tesla and Space X. He didn't need to be as involved anymore. Open AI had a capable team and was making progress.

But his stake in the organization remained nominal. As a nonprofit founder, Musk didn't have equity. He didn't receive board seats in later years. He was essentially an early contributor who moved on.

When did tension emerge? That's less clear from public documents, but the timeline suggests it centered around Open AI's partnership with Microsoft and the subsequent restructuring announcements.

In January 2023, Microsoft announced a multi-year, multi-billion dollar partnership with Open AI. The structure involved Microsoft investing in Open AI's for-profit subsidiary while licensing technology for Azure and other products. This was the beginning of Open AI being clearly structured as a for-profit, even if the nonprofit still technically existed.

By late 2024, Open AI announced plans to fully restructure away from the nonprofit into a public benefit corporation. This announcement apparently triggered Musk's legal action. He tried to get an injunction preventing the restructuring until the legal issues could be resolved. The court denied the injunction, and the restructuring proceeded.

Then in March 2024, Musk filed the formal lawsuit claiming that Open AI had abandoned its nonprofit mission. Later, he added Microsoft as a co-defendant. And by early 2025, the financial expert's testimony established the $79-134 billion damage claim.

This timeline matters because it shows Musk waited years before acting. He didn't file immediately when the Microsoft partnership was announced. The delay could be used to argue that Musk is simply opportunistically suing after Open AI became valuable, rather than acting based on genuine harm. Open AI's defense might emphasize the delay.

The Broader Implications: What This Means for AI Governance

While the Musk-Open AI lawsuit is specific to those parties, it has implications for how AI companies should be structured and governed going forward.

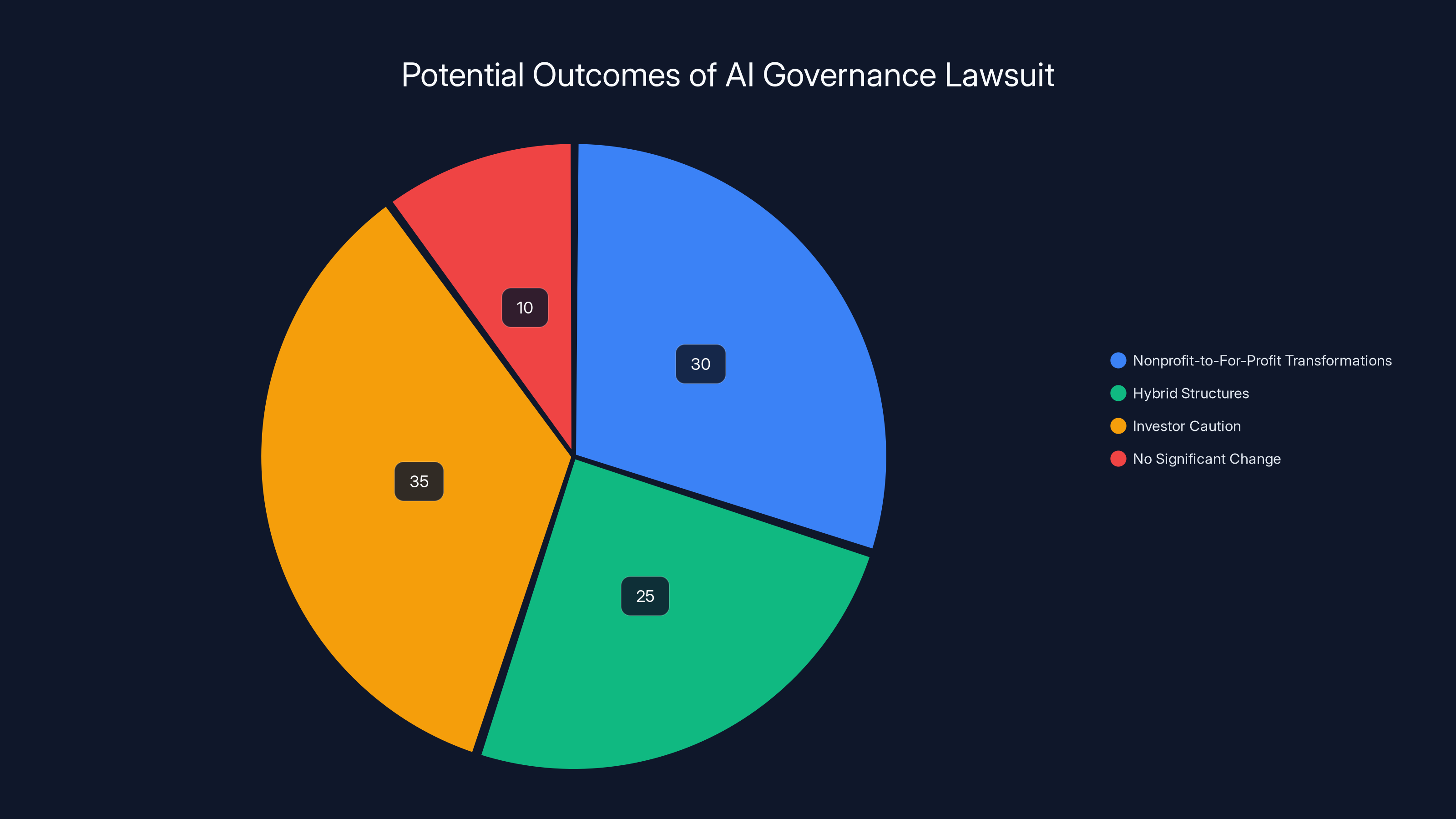

First, it raises questions about nonprofit-to-for-profit transformations. If startups plan to eventually restructure away from nonprofit status, how should they handle early contributions and contributors? What process ensures fairness? If companies must compensate early contributors at current valuations, that's enormously expensive. If they don't, they face litigation. There's no perfect answer, but the lawsuit might force companies to think more carefully about the issue upfront.

Second, it highlights the tension between mission-alignment and capital-raising. Many AI companies and other tech startups use nonprofit or mission-aligned structures to establish credibility and attract certain types of funding and talent. But those structures become constraining as the company grows. The Musk lawsuit shows the cost of that constraint. Future AI startups might be more careful about how they structure themselves from the beginning, perhaps using alternative approaches that allow capital-raising while maintaining mission-alignment.

Third, it creates uncertainty for investors in AI companies. If Microsoft faces potential liability for investing in a company that restructured, that could make other investors more cautious about AI investments unless they're absolutely certain the legal structure is sound. Conversely, if Musk loses the lawsuit, it would signal that companies can restructure largely as they choose, which might encourage similar transformations.

Fourth, it raises governance questions for AI research organizations. If an organization starts as a nonprofit focused on AI safety and research, what happens when commercial opportunity emerges? Can the organization pivot toward commercialization? How much must it maintain the original mission? Different organizations might resolve this differently, but the Musk case provides a template for how disputes might arise and be resolved.

Open AI's Response: What We Know

Open AI hasn't detailed its complete legal response in public filings, but the company's public statements provide some clues about its defense strategy.

First, Open AI has emphasized that the restructuring was transparent and properly approved. The board, including independent directors, approved the transformation. Proper notice was given. The process followed Delaware law. From this perspective, Open AI did everything correctly.

Second, Open AI has emphasized necessity. The nonprofit structure was working, but at a certain scale and competitive environment, it became constraining. Open AI needed capital it couldn't raise as a nonprofit. It needed to offer equity incentives to compete for talent. It needed the flexibility to move quickly in a competitive market. These weren't frivolous reasons for restructuring. They were legitimate business and organizational reasons.

Third, Open AI might argue that Musk's contributions, while valuable, were made voluntarily and with understanding that they were nonprofit contributions. Musk understood the nonprofit structure. He didn't invest conditional on maintaining that structure in perpetuity. Early investors and founders in nonprofits understand that the organization might change. That doesn't entitle them to compensation if it does.

Fourth, Open AI could emphasize that Musk moved on from the company years ago. He didn't continue contributing after the early years. He didn't attempt to maintain governance control. He essentially abandoned his relationship with the company and then sued it once it became valuable. The lawsuit looks more like opportunism than legitimate grievance.

But Open AI also faces challenging questions. If the founding documents committed to nonprofit status, what does changing that mean legally? If early contributors received nonprofit consideration (like board involvement or advisory roles), what compensation do they deserve if the structure changes? How much of Open AI's current value is attributable to its nonprofit era versus its for-profit era?

OpenAI is alleged to have gained between

The Legal Landscape: What Does Delaware Law Actually Say?

The lawsuit will be decided under Delaware law, which governs nonprofits created in that state. Delaware's approach to nonprofit governance and transformation provides the legal framework for the case.

Delaware nonprofit law allows corporations to restructure, merge, or transform if properly approved by the board and members (if any). The process must follow the bylaws and Delaware statutory requirements. If a transformation or restructuring is being challenged, courts examine whether proper procedures were followed and whether the organization breached fiduciary duties to stakeholders.

The key fiduciary duty concept here is that nonprofit directors must act in the organization's interest and in compliance with founding documents. If a restructuring violates founding documents, it might breach that duty. If it violates commitments made to contributors or stakeholders, that's also relevant.

Delaware courts have addressed nonprofit transformations in other cases, though usually at much smaller scales. The general principle is that nonprofits can change, but changes must be transparent, properly approved, and made in the organization's interest. They can't be used to unfairly enrich certain parties at others' expense.

Musk's lawsuit will argue that the transformation violated founding documents and fiduciary duties. Open AI will argue that it followed proper procedures and acted in the organization's interest. The court will need to review the founding documents, board minutes, and procedural steps to determine which argument prevails.

There's also the question of remedy. If Musk wins, what does he get? Direct compensation from Open AI? A share of the for-profit company? A percentage of future profits? The remedy depends on how the court interprets what the nonprofit owed him and what form of compensation is appropriate.

Xai and the Competitive Angle: Musk's AI Stakes

Musk's position on AI and Open AI has shifted as his own AI company, x AI, has become more prominent.

Musk founded x AI in 2023, positioning it as an alternative to Open AI's approach to AI development. Where Open AI has focused on large language models like GPT, x AI has emphasized developing AI that pursues truth and understands the physical world. In some ways, x AI is Musk's attempt to build the AI company he probably wished Open AI had remained.

The timing of Musk's lawsuit against Open AI, while x AI is competing in the same space, raises an interesting dynamic. Is this purely a contractual and financial dispute? Or is there also a competitive angle? If Open AI is damaged by litigation or forced to pay billions in damages, that benefits x AI's competitive position. If Microsoft is saddled with liability, that affects Microsoft's AI investment strategy, potentially benefiting competitors.

Musk would argue that the two are separate: he's pursuing justice regarding his contributions to Open AI, and coincidentally, he also started x AI. But skeptics would note that the timing is convenient. The lawsuit against Open AI comes as x AI is trying to establish itself as a serious AI company.

This competitive angle is relevant to how courts might view the case. Is Musk genuinely wronged? Or is he using the legal system to disadvantage a competitor? The evidence and testimony will need to address this. Courts generally try to decide cases on the merits, but the competitive context is worth noting.

Interestingly, Musk has also sued Open AI and Apple over App Store monopoly practices, claiming that Apple prevents x AI from competing fairly. This suggests multiple simultaneous legal battles, all of which improve x AI's competitive position if they succeed or even just distract competitors with litigation costs.

The Historical Precedent: Have Similar Disputes Happened Before?

Has there ever been a similar dispute between a nonprofit founder and a nonprofit that transformed to for-profit? The answer is rarely at this scale.

Wikipedia had governance tensions when its founder wanted to create for-profit ventures, but Wikipedia remained nonprofit while Wikimedia Foundation oversaw it. The Humane Society had disputes over governance between founders and later leadership, but didn't involve a transformation. Some university-backed startups have spun into for-profit structures, creating questions about attribution and contribution.

But a $100+ billion lawsuit over a nonprofit-to-for-profit transformation? That's essentially unprecedented. The scale of modern AI valuations makes this case unique. Open AI is worth more than most countries' GDP. The stakes are correspondingly enormous.

Historically, when AI researchers or founders have had disputes with organizations they founded, they've either remained as leadership (like Yann Le Cun at Meta's AI research group), separated amicably (like Andrew Ng leaving Stanford to found Coursera), or had smaller disputes resolved privately. The Musk-Open AI dispute is playing out publicly and at the scale of some of the biggest lawsuits in tech history.

There's also limited precedent for determining how to value contributions to a nonprofit when it transforms. If a founder contributed

Estimated data suggests the lawsuit could lead to increased investor caution (35%) and a rise in hybrid structures (25%) in AI companies.

What Success Would Look Like: Possible Outcomes

What does Musk win if he succeeds in this lawsuit? What does Open AI or Microsoft face?

Scenario 1: Full Victory for Musk

If courts rule that Open AI violated its nonprofit charter by restructuring into a for-profit without compensating early contributors, Musk could receive direct compensation. The

If Musk wins at that level, it would send shockwaves through Silicon Valley. It would signal that nonprofit founders and early contributors have legal recourse if a company restructures away from nonprofit status. Every subsequent nonprofit-to-for-profit transformation would face scrutiny and potential litigation.

Scenario 2: Partial Victory

Courts might find that Open AI did violate its nonprofit commitments but that the damages are less than claimed. Perhaps $10-20 billion. Or perhaps the court finds that Open AI violated its charter but allows a narrower remedy, like giving Musk a specific percentage of the for-profit company rather than a cash payment.

This scenario allows the court to acknowledge that something inappropriate happened without imposing penalties so large that they threaten Open AI's viability.

Scenario 3: Victory for Open AI

Courts might rule that while Open AI's restructuring created tensions with its nonprofit mission, it followed proper legal procedures, didn't breach fiduciary duties, and is therefore permissible under Delaware law. Nonprofits have the right to restructure if the board approves and procedures are followed. Musk, as an early contributor, had no enforceable rights in the nonprofit beyond the general nonprofit mission, which didn't create enforceable individual claims.

If this outcome occurs, it would signal that companies can restructure away from nonprofit status as long as they follow proper procedures, regardless of what early contributors think. It would reduce future litigation risk for companies considering similar transformations.

Scenario 4: Settlement

Most large cases settle before trial. Open AI and Microsoft might agree to pay Musk some amount—perhaps $5-15 billion—to avoid the uncertainty of litigation and the reputational damage of a public trial. This would allow all parties to declare some form of victory and move on.

A settlement also prevents establishing legal precedent, which means it wouldn't affect how future nonprofit-to-for-profit transformations are handled. It would be specific to Musk and Open AI.

The Broader AI Governance Question: Should Nonprofits Stay Nonprofits?

This lawsuit raises a fundamental question about how AI should be developed and governed: should the organizations creating advanced AI be nonprofit, for-profit, or hybrid?

The Case for Nonprofits

Nonprofits theoretically prioritize societal benefit over profit maximization. They're less likely to cut corners on safety or security to increase margins. They can publish research and contribute to the scientific community. They're less likely to create dependencies where profit motives conflict with public good.

The Case Against Nonprofits

Nonprofits struggle to raise capital, compete for talent, and move quickly. In AI, where computational resources and talent are enormous bottlenecks, nonprofits are at a disadvantage. A nonprofit might not have the resources to implement proper safety measures or to conduct extensive testing before deployment. The commercial incentive to stay ahead of competitors might actually drive better product quality.

The Hybrid Approach

Open AI and others have tried hybrid structures with a nonprofit parent and for-profit subsidiary. This allows raising capital while maintaining nonprofit governance. But as the Musk lawsuit shows, hybrids create their own complications. How much does the nonprofit actually control? What happens when the for-profit subsidiary's interests diverge from the nonprofit's stated mission?

The Alternative: Benefit Corporations

Some companies structure themselves as benefit corporations or public benefit corporations, which are for-profit but legally required to consider stakeholder interests and social good alongside shareholder returns. This might be Open AI's ultimate destination after the restructuring.

None of these approaches is perfect. Nonprofits struggle with capital. For-profits might cut corners on safety. Hybrids get complicated. Benefit corporations still prioritize shareholder returns while considering other factors.

The Musk lawsuit essentially forces a reckoning with this question. If Open AI couldn't remain a nonprofit while competing in AI, what does that mean for nonprofit AI research generally? Does it mean future AI research must be done by for-profit companies? Or does it mean nonprofits need better support and capital to remain viable?

The Microsoft Factor: A Big Tech Giant in the Middle

Microsoft's involvement in this lawsuit is interesting because the company wasn't part of Open AI's founding but is being held liable for its restructuring.

Microsoft invested tens of billions into Open AI's for-profit subsidiary, securing exclusive partnership rights, priority access to new models, and integration opportunities. These are enormously valuable. If the for-profit subsidiary wouldn't have existed without the restructuring that the lawsuit claims was wrongful, then Microsoft's benefits directly stem from that wrongful action.

Microsoft's position is that it invested in good faith, following proper due diligence. The company didn't cause Open AI to restructure. It simply chose to invest in the resulting for-profit entity. Why should Microsoft face liability for Open AI's decisions?

But the lawsuit's argument is that Microsoft knowingly benefited from the transformation and should therefore bear some responsibility for making Musk whole. If Open AI transforms improperly and Microsoft is the primary beneficiary of that transformation, Microsoft shares the liability.

This could have broader implications for tech investments. If a company invests in another company that's found to have engaged in wrongful conduct, can the investor be held liable for the wrongdoing? Microsoft might argue no. The lawsuit argues yes, at least when the benefits are direct.

Microsoft is also notable because it's been Open AI's closest partner and most vocal public defender. The company benefits from Open AI's success and has integrated Open AI's models into Copilot, Azure, and other products. Having Microsoft named as a defendant potentially damages the partnership, even if the partnership continues publicly.

The Role of Expert Witnesses: How We Got to $134 Billion

C. Paul Wazzan's testimony as a financial expert is crucial to the damage calculations. Understanding his methodology helps explain the enormous numbers.

Financial experts in litigation use various methodologies to calculate damages: comparable company analysis, discounted cash flow analysis, market multiples, and others. When valuing contributions to a company, experts consider factors like: current company valuation, contribution timing, contribution significance, and the portion of value attributable to each contribution.

Wazzan apparently calculated that Musk's contributions (the $38 million plus talent recruitment and strategic advice) were responsible for a significant portion of Open AI's current success. Early contributions often have disproportionate importance in startups. The first funding and early hiring set the trajectory. Later investments and efforts build on that foundation.

However, Wazzan's calculation is contestable. Open AI's current success also depends enormously on later work. The team that built GPT-3 and GPT-4 did work after Musk had largely stepped back. The infrastructure investments by Microsoft matter. The discoveries and insights of later researchers matter.

Open AI will certainly bring its own financial expert to contest these numbers. That expert might argue that only a small portion of Open AI's current value is attributable to Musk's early contributions. Perhaps 5-10% rather than the 15-25% that Wazzan's $79-134 billion calculation implies.

The battle of the experts will likely determine the outcome more than any specific legal issue. Judges and juries rely heavily on expert testimony when evaluating financial damages. The more convincing expert wins. Open AI's expert testimony is likely to be particularly detailed, since the company's defense depends on minimizing the value of Musk's contributions relative to later work.

The Discovery Process: What Will We Learn?

As the lawsuit proceeds, discovery will compel Open AI and Microsoft to produce documents and communications that might clarify the disputed issues.

What did Open AI's board discuss regarding the restructuring? What did leadership understand about Musk's potential claims? Were there discussions about compensating early contributors? What did Microsoft know about Open AI's nonprofit commitments? Did Microsoft make decisions assuming the nonprofit structure or accounting for the restructuring?

These documents, if produced, could heavily influence the case outcome. If board minutes show that the board consciously decided to restructure despite knowing it violated Musk's claims, that strengthens Musk's case. If minutes show good-faith efforts to address Musk's interests, that strengthens Open AI's defense.

Depositions of key executives will also be revealing. Musk will be deposed. Open AI's CEO Sam Altman will be deposed. Microsoft's leadership will be deposed. These depositions will explore what each party knew, when they knew it, and how they made decisions.

The discovery process typically takes many months or years in large cases. By the time a trial occurs, massive amounts of information will have been exchanged and analyzed. That information will shape what the ultimate resolution is.

One question worth watching: will Open AI produce documents showing it considered Musk's potential claims during the restructuring, and if so, what did they decide about addressing them? That's the kind of document that could be case-defining.

The Public Perception Challenge: Silicon Valley's Complicated Relationship with Musk

This lawsuit exists in a complicated context of public perception around Musk, Open AI, AI safety, and corporate governance.

Musk has been a controversial figure in tech. His acquisition of Twitter, his statements about AI, and his general public persona have made him simultaneously celebrated and criticized. Some view him as an essential visionary. Others view him as reckless and self-serving.

Open AI has also faced perception challenges. The organization started with nonprofit ideals but became increasingly commercial. Sam Altman, Open AI's CEO, moved from nonprofit thinking to venture capital-style growth focus. The company's dealings with employees have generated criticism. Some AI safety researchers have questioned whether Open AI prioritizes safety adequately.

Microsoft has been trying to rehabilitate its image from the aggressive 1990s-2000s era through partnership emphasis and commitment to responsible AI. The Microsoft-Open AI partnership is part of that effort. Having Microsoft named in a lawsuit threatens that positioning.

Public perception of this lawsuit might depend partly on narrative. Is this Musk opportunistically suing a company he founded because it became valuable? Or is this a legitimate grievance where early contributors were wronged by a nonprofit's transformation? Different people will see it differently based on their views of Musk, Open AI, and corporate responsibility.

The lawsuit's outcome might also be influenced by public perception. While judges are supposed to decide cases on the merits, public pressure and perception can influence case trajectory, settlement negotiations, and willingness to appeal or prosecute aggressively.

Timeline and Next Steps: When Will This Be Resolved?

Predicting legal timelines is uncertain, but major lawsuits like this typically follow a pattern: motions, discovery, settlement negotiations, and potentially trial.

Early 2025 is when the financial expert's damages calculation was filed. This means the case is somewhere in the middle stages. Motions to dismiss have likely been filed and ruled on. Discovery is probably active or about to accelerate.

If no settlement occurs, the case will likely proceed to trial sometime in 2025 or 2026. The trial could last weeks or months, depending on how many experts testify and how complex the evidence is. After trial, judgment could take months for the judge to write and issue.

If either party appeals, the case extends further. Appeals in financial cases can take years. This lawsuit could realistically span 3-5 years from filing to final resolution.

A settlement is possible at any point. As trial approaches and both parties face the reality of extended litigation costs and public exposure, settlements become more likely. The settlement could happen before the case even gets to trial.

What's the timeline for resolution?

- 2025: Likely includes ongoing discovery, expert reports, and settlement negotiations

- 2025-2026: Potential trial

- 2026+: Appeals or implementation of judgment/settlement

If a settlement occurs, it could happen much faster, potentially within months. But the default path suggests 2-3 years before resolution.

FAQ

What exactly is Elon Musk claiming Open AI did wrong?

Musk is claiming that Open AI violated its founding charter by transforming from a nonprofit organization into a for-profit entity, thereby abandoning its original mission. The lawsuit argues that when Open AI was established as a nonprofit, it made commitments to prioritize AI research and safety over commercial gain. By restructuring into a for-profit company to raise capital and compete with major tech firms, Open AI breached those commitments, and Musk, as an early contributor with $38 million in seed funding and other non-financial contributions, deserves compensation for the wrongful gains that resulted from this transformation.

How did the $134 billion figure get calculated?

The

Why did Open AI need to transform from nonprofit to for-profit?

Open AI faced significant constraints as a nonprofit. The organization couldn't raise venture capital directly, limiting its ability to fund the massive computational resources required for AI development. The nonprofit structure also prevented offering equity incentives to compete for top talent against well-funded competitors like Google and Meta. As the scaling laws of AI showed that better models required exponentially more computing power and therefore more capital, Open AI's board concluded that the nonprofit structure was preventing the company from competing effectively. The restructuring allowed Open AI to raise tens of billions in funding from investors like Microsoft and to offer stock incentives to employees, enabling competitive growth. However, the lawsuit claims that regardless of business necessity, the restructuring violated the company's founding commitments.

What is Musk's actual relationship with Open AI now?

Musk is not involved in Open AI's day-to-day operations or governance. He was a co-founder and chairman in the early days but stepped back years ago as his attention shifted to Tesla and Space X. He no longer holds a board seat or formal role. His engagement is primarily through this lawsuit and through his public criticism of Open AI's direction. Additionally, Musk founded x AI, a competing AI company, though he would argue the two matters are separate. The lawsuit represents Musk's attempt to recover financial value from his early contributions to Open AI rather than a bid to regain control of the organization.

Could Musk actually win and receive $134 billion?

It's possible but uncertain. The outcome depends on how courts interpret Open AI's founding documents, Delaware nonprofit law, and the significance of Musk's contributions. A full

Does Microsoft have responsibility for Open AI's restructuring?

Microsoft didn't cause Open AI to restructure, but the lawsuit argues Microsoft benefited from the wrongful restructuring and should therefore share liability. Microsoft's investments in Open AI's for-profit subsidiary wouldn't have been possible if Open AI remained a nonprofit. The exclusive partnership rights and access to technology that Microsoft gained directly stem from the for-profit structure that the lawsuit claims violated founding commitments. Microsoft's defense is likely to emphasize that the company invested in good faith, following proper due diligence, and shouldn't be held liable for Open AI's corporate decisions. However, if courts find that Microsoft knowingly benefited from a wrongful transformation, the company could face significant liability.

What happens if Musk wins? How would compensation work?

If Musk wins, the form of compensation could vary. The court could order direct cash payment from Open AI and/or Microsoft (either as a specific amount or a percentage of damages), could award Musk equity in Open AI's for-profit company (giving him ongoing ownership), or could order some combination of immediate payment and future distributions. A settlement might involve a negotiated amount that's less than the full claim but more than nothing. Different remedies have different implications for all parties. A cash judgment requires actual payment. An equity award gives Musk ongoing stakes in the company's future performance. A settlement allows both sides to control the outcome and avoid appellate risks.

Could this lawsuit affect how AI companies are governed in the future?

Absolutely. If Musk wins or even if the case generates significant legal precedent, it could make future AI startups and other companies far more cautious about nonprofit-to-for-profit transformations. Companies might structure themselves differently from the start, avoiding the nonprofit model entirely or using hybrid structures more carefully. The lawsuit could also influence how companies document their founding commitments and handle transitions. Investors might become more cautious about investing in companies that have shifted their structure. Researchers and founders might demand clearer agreements about their rights and compensation upfront, rather than relying on nonprofit status. The broader impact would be reshaping how AI and other tech organizations think about governance and investor relations.

How long until this lawsuit is resolved?

Major litigation like this typically takes years. We're currently in early 2025, and the financial expert's damages calculation has just been filed. Realistically, the case will likely go through discovery (gathering documents and depositions), expert reports, settlement negotiations, and potentially trial before a resolution. If the case goes to trial, that could happen in 2025-2026. If either party appeals, the process extends further. A settlement could occur much faster, potentially within months, if both parties decide the costs and risks of litigation outweigh continuing to fight. Full resolution could take anywhere from 1-5 years depending on how the parties proceed and whether appellate courts become involved.

Conclusion: A Defining Moment for AI Governance and Tech Accountability

The lawsuit between Elon Musk and Open AI, with Microsoft as a co-defendant, is far more than a financial dispute between prominent figures. It's a reckoning with fundamental questions about how AI research should be organized, how early contributors are treated when companies transform, and what obligations tech companies have to their founding missions.

Musk contributed

Open AI would argue that the restructuring was necessary for competitiveness, properly approved, and that early nonprofit contributors understood the nonprofit structure was always changeable. The company followed Delaware law and proper procedures. Microsoft would argue it invested in good faith and shouldn't be liable for Open AI's decisions.

The financial expert's calculation of $79-134 billion in damages highlights just how enormous the stakes are. If Musk wins anything close to that amount, it would be one of the largest judgments in tech history. If he loses, it signals that nonprofit-to-for-profit transformations can occur regardless of early commitments, as long as procedures are followed.

This lawsuit will likely influence:

How future AI companies structure themselves. Companies will be more cautious about nonprofit status if transformation creates liability. Hybrid structures might become more common, or companies might start as for-profit entities from the beginning.

How investors approach AI investments. If companies can be held liable for wrongful transformations, investors will demand clearer documentation of founding structures and transformation procedures.

How courts interpret nonprofit commitments. The ruling will establish precedent for whether founding documents create enforceable rights to early contributors or whether they're merely aspirational statements that don't create liability.

The relationship between profit motive and AI safety. If Open AI's transformation is vindicated, it suggests that moving toward commercial structures is acceptable when necessary for competitiveness. If Musk wins, it suggests that nonprofit commitments to safety and research should be maintained even if it creates competitive disadvantage.

The timeline is uncertain, but the case will likely produce significant documents and testimony that clarify the disputed history. Settlement remains possible at any point, potentially allowing all parties to avoid the full costs and uncertainties of litigation.

Regardless of the outcome, this lawsuit represents a shift toward greater accountability in how tech companies handle transformations and treat early contributors. Companies can't make commitments to nonprofit structure and early contributor interests without accepting legal risk if they later abandon those commitments.

For now, the case remains unresolved, with both sides presenting evidence and expert testimony about what Open AI owes Musk and whether Microsoft shares responsibility. The court's eventual determination will reverberate through Silicon Valley and influence how AI companies are founded and governed for years to come.

The fundamental tension the lawsuit highlights isn't going away: nonprofits struggling with capital constraints, for-profit companies pursuing profit over mission, and early contributors feeling that their contributions are uncompensated when organizations transform. How courts and companies resolve this tension will shape the future of AI governance.

Key Takeaways

- Musk contributed $38 million (60% of seed funding) plus talent recruitment and strategic advice to OpenAI's founding as a nonprofit

- Financial expert calculated Musk is owed $79-134 billion due to alleged wrongful gains from OpenAI and Microsoft's transformation of the nonprofit into a for-profit structure

- OpenAI's restructuring was necessary for competitiveness but violated founding nonprofit commitments according to the lawsuit

- Microsoft faces co-defendant liability because it directly benefited from the for-profit partnership that allegedly resulted from wrongful transformation

- This case could reshape how AI companies structure themselves and how early contributors are protected in future startup transformations

Related Articles

- OpenAI vs. Elon Musk: Silicon Valley's Biggest Legal Battle Headed to Trial [2025]

- California AG vs xAI: Grok's Deepfake Crisis & Legal Fallout [2025]

- ClickHouse Hits $15B Valuation: How an Open-Source Database is Challenging Snowflake and Databricks [2025]

- Grok's Deepfake Crisis: The Ashley St. Clair Lawsuit and AI Accountability [2025]

- Grok's Unsafe Image Generation Problem Persists Despite Restrictions [2025]

- Higgsfield's $1.3B Valuation: Inside the AI Video Revolution [2025]

![Elon Musk's $134B OpenAI Lawsuit: What's Really at Stake [2025]](https://tryrunable.com/blog/elon-musk-s-134b-openai-lawsuit-what-s-really-at-stake-2025/image-1-1768671424666.jpg)