Where AI Startups Win Against Open AI: VC Insights for 2025

There's a question hanging over every AI startup pitch right now: why does the world need you when Open AI exists?

It's not rhetorical. It's the first thing venture capitalists ask. And honestly? For a lot of companies, there's no good answer. But for the ones that have figured it out, the opportunities are enormous.

I sat down with some of the most experienced AI investors in the valley, and the pattern became clear. Open AI isn't going to kill every startup. In fact, the smartest money isn't trying to beat Open AI at their game. They're playing a completely different game.

The Reality of Competing in Open AI's Shadow

Let's be direct: Open AI has advantages that no startup can match. They have the best talent, billions in funding, relationships with every major tech company, and the most powerful models on the planet. Their latest releases set industry benchmarks that everyone else chases, as noted in Fortune's interview with OpenAI COO Brad Lightcap.

But here's what venture capitalists have discovered through years of investing in the AI space: dominance in raw model capability doesn't equal dominance across all use cases. It never has.

When Google dominated search, that didn't kill every other information platform. When Amazon dominated cloud infrastructure, it didn't eliminate the need for specialized tools. The pattern repeats: the strongest player in the foundation layer creates space for specialized players on top.

The math works like this: Open AI's incentives are aligned with maximizing usage and capturing broad market share. Their business depends on keeping Chat GPT as the default choice for as many people as possible. But that same incentive creates gaps. They can't optimize for everything. They can't go deep on every vertical. They can't focus obsessively on tiny slices of the market.

That's where startups live.

Vanessa Larco, partner at Premise and former partner at NEA, has been watching this dynamic for years. She's invested in consumer AI, enterprise AI, and everything between. Her take? "The winners in 2025 and beyond aren't the ones trying to build Chat GPT 2.0. They're the ones solving specific problems that the big players won't focus on," as discussed in Andreessen Horowitz's analysis of consumer AI.

This isn't about being anti-Open AI. It's about understanding incentive alignment. When you understand what Open AI is optimized for, you can see the gaps they're leaving wide open.

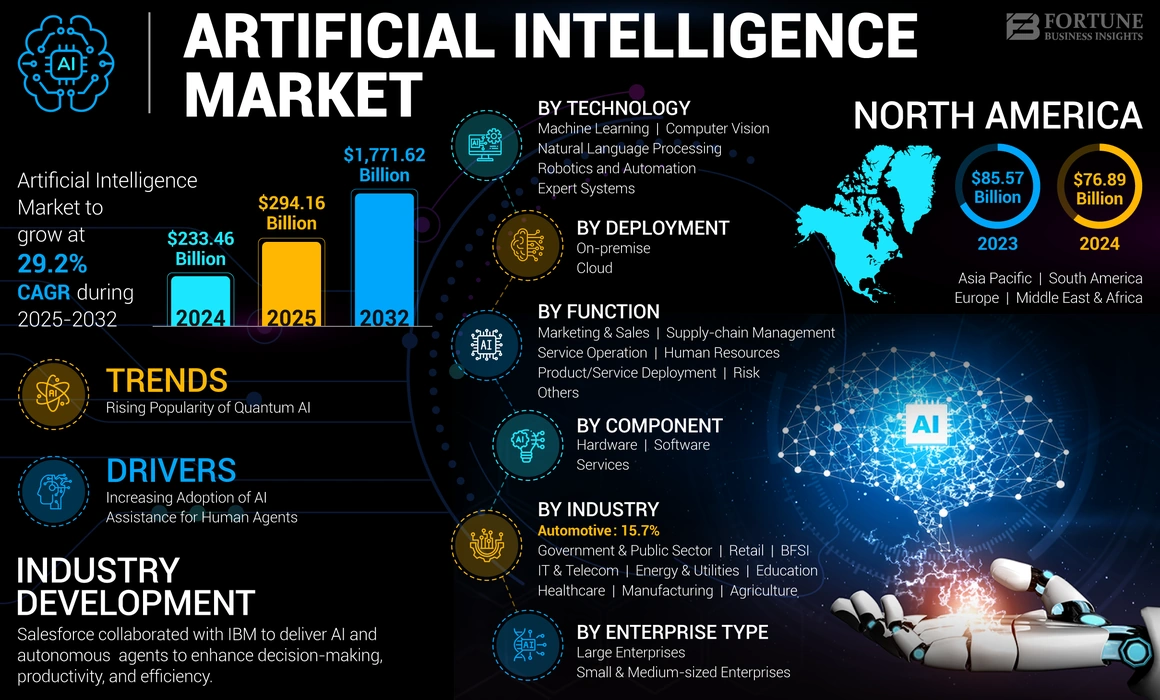

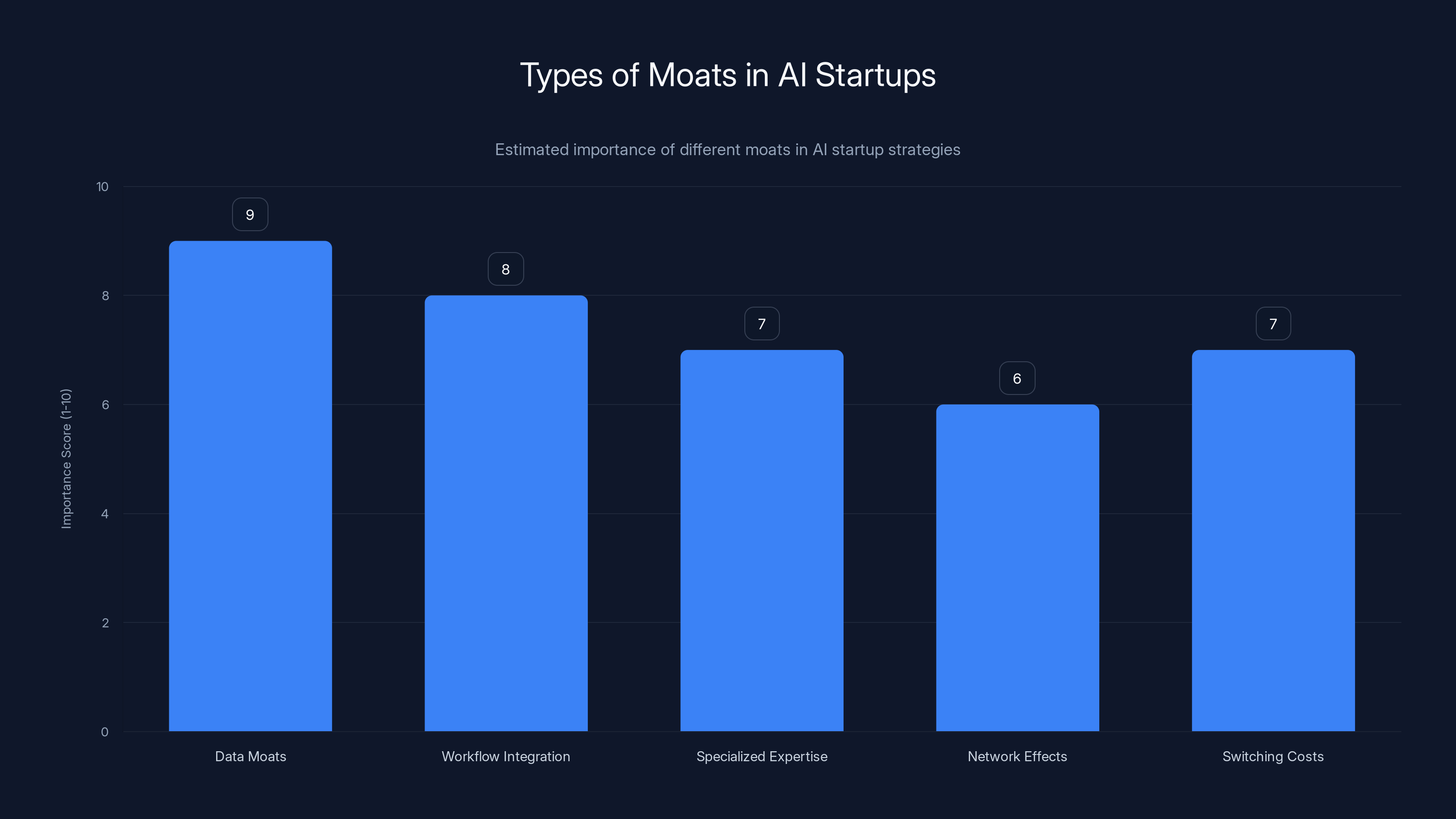

Data moats are considered the most important for AI startups, followed by workflow integration and specialized expertise. Estimated data based on industry trends.

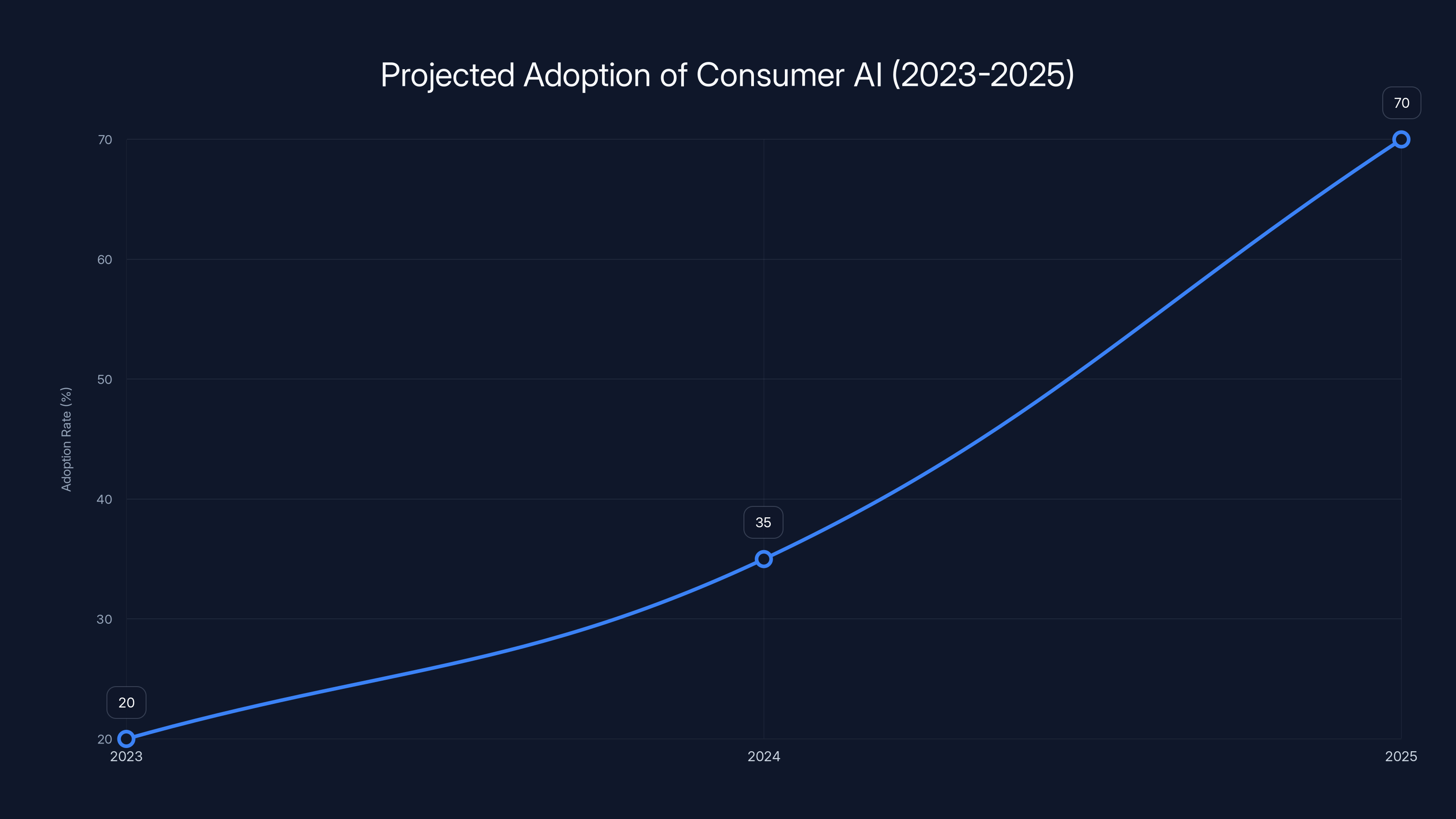

Consumer AI: Finally Getting Its Moment

Larco calls 2025 the year consumer AI actually takes off. And this matters because consumer AI has been the perennial false start in this cycle.

Everyone predicted consumer AI would explode in 2023. It didn't. Then 2024? Still waiting. Hundreds of millions went into consumer AI startups. Most of them are struggling. The adoption curves didn't match the hype. People weren't actually switching their daily habits for AI-powered apps.

But something shifted.

The issue wasn't that consumers didn't want AI. It was that early consumer AI products were just raw model interfaces dressed up as apps. Chat GPT in a mobile shell. Claude on the web. They felt like toys because they weren't integrated into actual life workflows. They required conscious switching. They required users to think "I should use this tool" rather than "this tool is just how I do things."

The breakthrough happens when AI becomes invisible. When it's woven into the fabric of existing services so seamlessly that users don't think about the AI part at all. It just works better.

This is what Larco calls the "concierge-like" AI experience. Imagine opening your health app and it doesn't just show you your symptoms. It's already researched them, found the most likely causes, checked your insurance coverage, found available appointments with doctors who specialize in those conditions, and suggested three options ranked by proximity and patient reviews. All without you asking.

That's the consumer AI that wins.

Where does Open AI fit in this picture? They can't do this. Not because they don't have the capability, but because they don't have the context. They don't know your health history. They don't have access to your insurance data. They don't have integration with your local doctor networks. They can build general-purpose AI. They can't build deeply contextual experiences, as highlighted in Fierce Healthcare's report on AI adoption.

So consumer AI startups that are winning in 2025 share a pattern: they start with a specific use case, integrate deeply into existing workflows, and use AI to augment rather than replace. Think of companies building AI features into health apps, financial tools, productivity software, and specialized services. They're not trying to become platforms. They're becoming indispensable components of platforms you already use.

The venture capital thesis is simple: there's hundreds of billions in consumer spending in verticals like health, finance, travel, and productivity. Even capturing a tiny percentage of those markets is enormous. And because these companies are integrated into existing workflows, switching costs are high and retention is strong.

Consumer AI adoption is expected to significantly increase by 2025, as AI becomes seamlessly integrated into daily workflows. Estimated data based on industry predictions.

Vertical AI: Going Deep Instead of Broad

While consumer AI plays the breadth game, vertical AI startups are winning by going so deep into one industry that they become irreplaceable.

This is the strategy: pick an industry. Get obsessed with understanding every complexity, regulation, workflow quirk, and pain point in that industry. Then build AI tools that are so specifically tuned to that industry that they work infinitely better than general-purpose tools.

The classic example is legal AI. General-purpose language models can read and summarize contracts. They're decent at it. But legal AI startups have built systems that understand legal terminology, precedent, jurisdiction-specific regulations, and the actual workflows lawyers use. They can do things with legal documents that a lawyer using Chat GPT directly would never trust, as discussed in Greylock's analysis of durable moats in AI.

VCs are seeing this pattern across every vertical. Medical AI isn't just about answering health questions. It's about diagnostic support, imaging analysis, treatment planning, and regulatory compliance in healthcare. Insurance AI isn't just about claims processing. It's about actuarial analysis, fraud detection, and underwriting optimization. Manufacturing AI isn't about general optimization. It's about supply chain prediction, quality control, and equipment maintenance.

The competitive moat here is profound. Once you've built AI systems that truly understand an industry, you've accumulated domain knowledge that's incredibly hard to replicate. You know the edge cases. You know what regulators care about. You know the workflows. You know what good looks like in that specific context.

Open AI's general-purpose models can't match that without essentially building the same vertical expertise. And by the time they consider doing it, the vertical startup has already captured the market, trained on industry-specific data, and built deep relationships with customers.

The numbers investors look at: how much is the industry spending on this problem today? How much more would they spend if it was solved perfectly? What's the TAM? For medical AI, it's in the hundreds of billions. For legal AI, similar. Insurance, manufacturing, finance, real estate: all TAMs measured in the hundreds of billions or more.

You don't need to capture a huge percentage of a vertical market to build a massive company. You just need to be so good at that one thing that switching feels impossible.

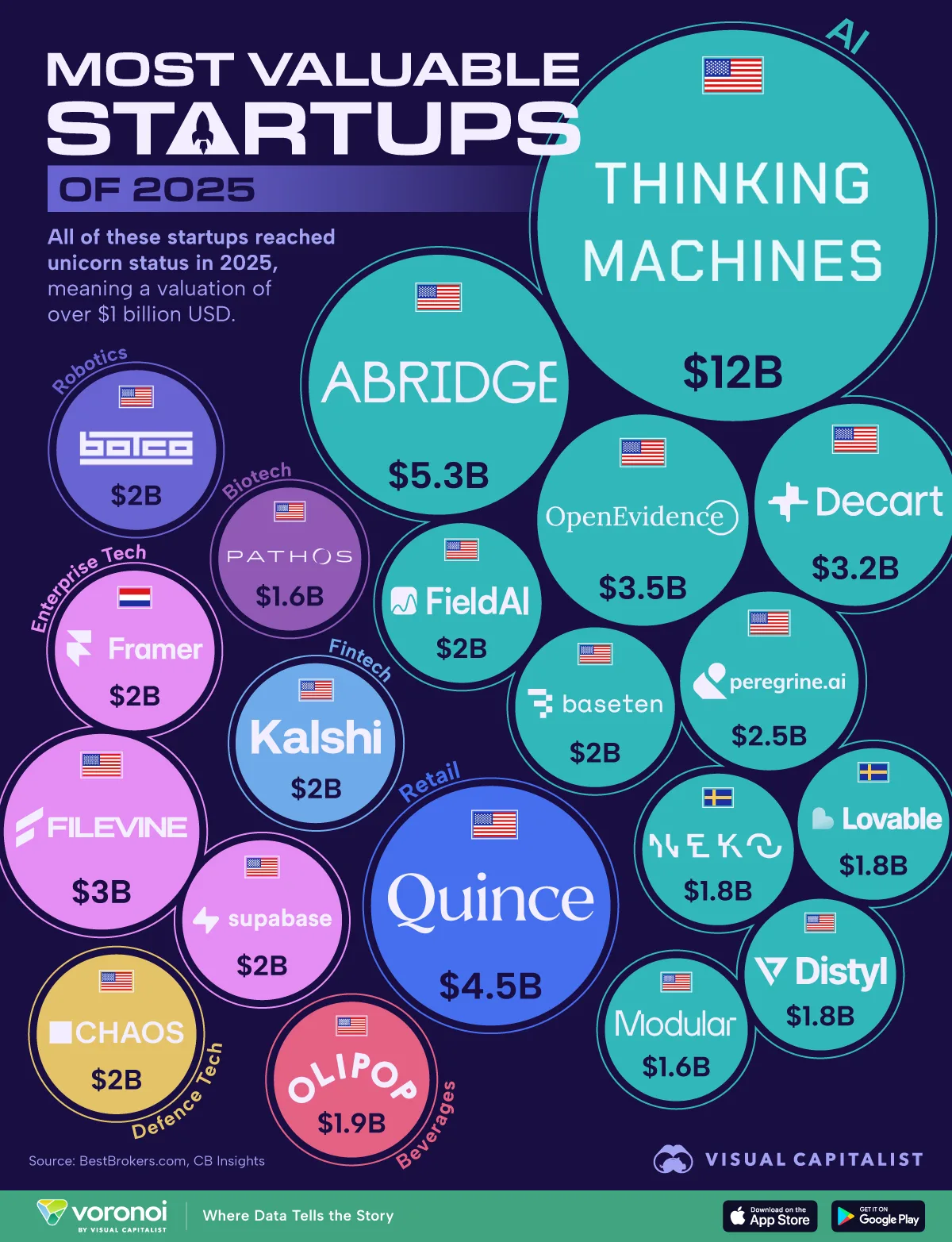

Enterprise AI Agents: The Biggest Prize

If you listen to what venture capitalists are most excited about, they're talking about enterprise AI agents. And they're not talking about chatbots.

An AI agent is software that can operate independently, make decisions, take actions, and learn from outcomes. Unlike a chatbot that just answers questions, an agent can be given a goal and will figure out the steps to achieve it. "Close this deal by end of quarter" or "Find the most cost-effective supplier for this material" or "Optimize this production line for throughput." The agent works toward that goal, sometimes over days or weeks, using whatever tools and data it needs.

This is fundamentally different from what Open AI or Google or Microsoft can build as a product feature. Enterprise agents need to integrate with your specific business processes, your data, your tools, your workflows. They need to understand your company's context in ways that a general-purpose AI can never achieve without enormous customization.

So enterprise AI startups are building agent platforms and agent services. Give them access to your data, your tools, and your workflows, and they'll deploy agents that handle specific business processes. One agent might manage customer support. Another might handle procurement. Another might optimize pricing. Another might manage inventory.

Vanessa Larco has been tracking this closely. The pattern she's seeing: "Companies are willing to spend real money on agents that solve specific business problems. We're not talking about chatbots that save a little time. We're talking about agents that handle millions in purchasing decisions or generate millions in new revenue," as noted in TechCrunch's podcast on AI investment.

This is where the real capital is flowing. Not into building better general-purpose models, but into companies that can deploy those models in specific business contexts to solve problems that have massive financial impact.

The barrier to entry is interesting. You need AI capability (you can license models), but you also need domain expertise, sales sophistication, and the ability to integrate deeply with enterprise systems. Not every startup can do this. The ones who can are seeing enormous traction.

ROI calculation for enterprises is straightforward: if an AI agent can save a procurement team 20 percent of their time, and that team handles a billion in annual purchases, that's $200 million in time savings. A system that captures even a tiny fraction of that ROI is worth hundreds of millions to the customer.

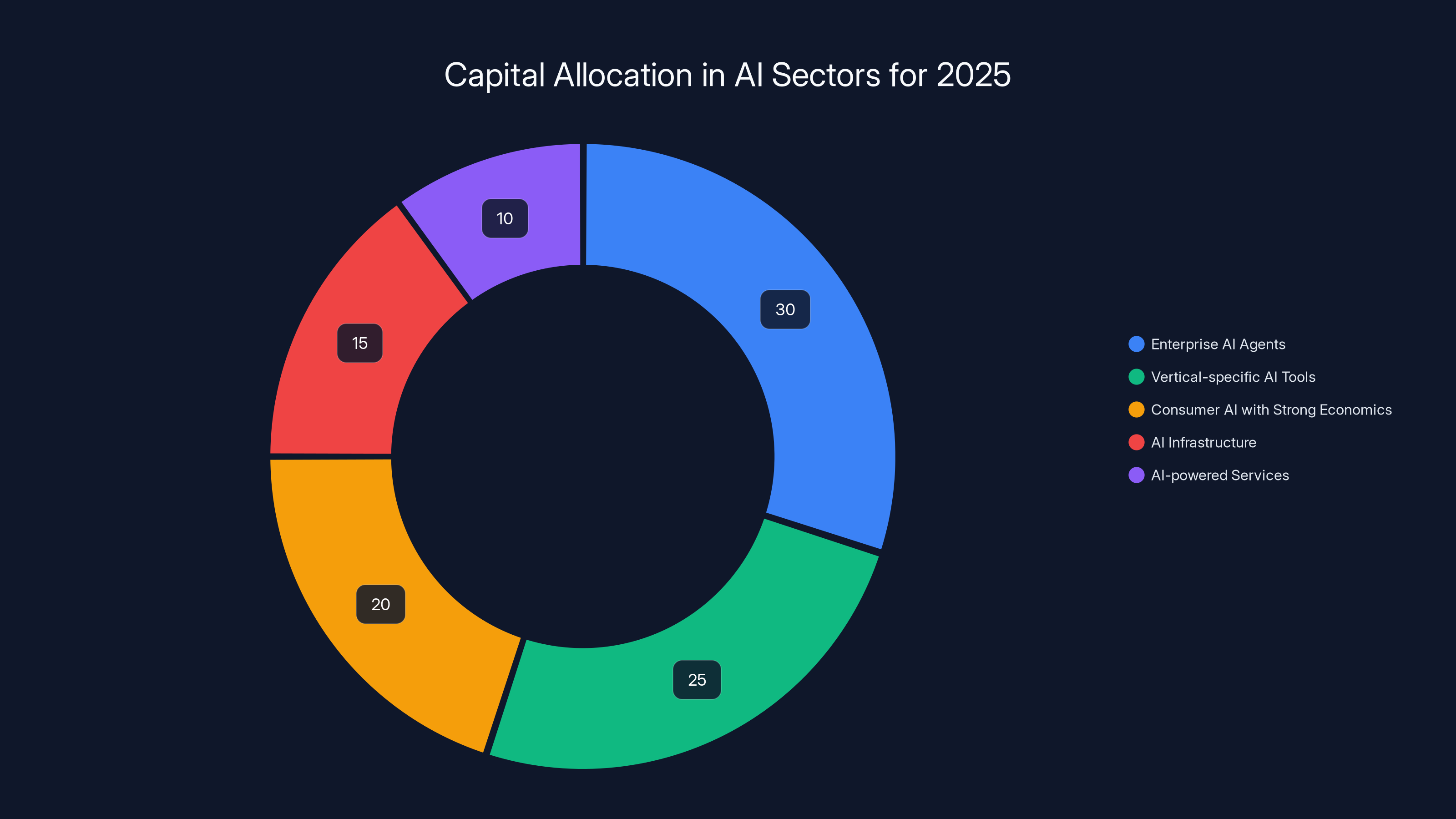

In 2025, enterprise AI agents are projected to receive the largest share of venture capital, followed by vertical-specific AI tools. Estimated data reflects a more disciplined market focus on business viability.

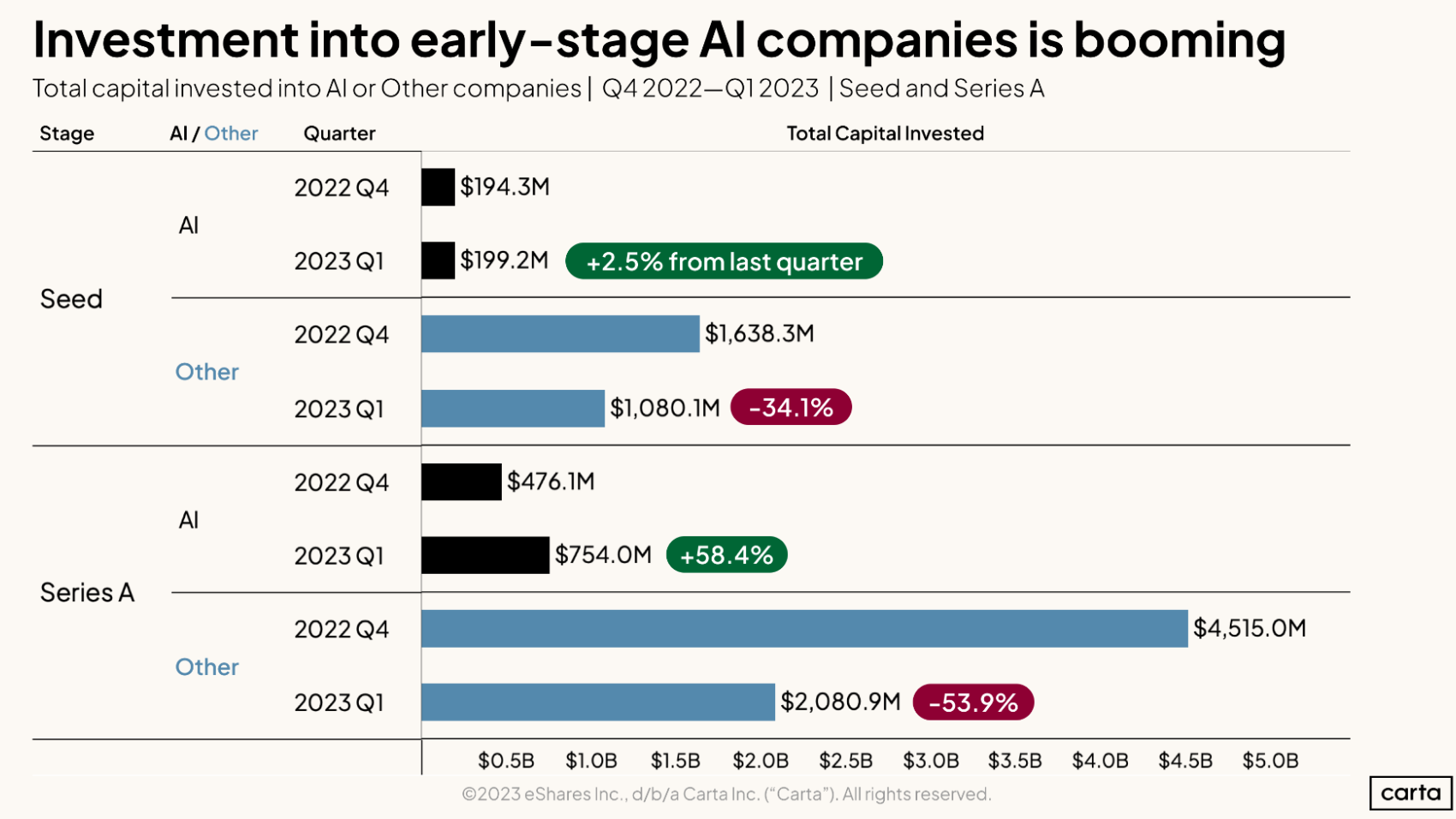

Building Moats in a World of Open Models

One of the biggest shifts in AI investment strategy is recognizing that model capability is becoming a commodity.

Three years ago, you needed proprietary model capability to compete. The only way to win was to build or train better models. Now? Open source models are phenomenal. Mistral, Llama, Deepseek: these are high-quality, commercial-ready models that anyone can use, as highlighted in TechCrunch's discussion on consumer AI startups.

This fundamentally changes the competitive dynamics. If the underlying model isn't proprietary, your moat can't be the model itself. It has to be something else.

Venture capitalists are looking for five types of moats in AI startups now:

First, data moats. If you have unique access to data that makes your AI better in specific ways, that's defensible. A health AI startup that has trained on millions of proprietary patient records has an advantage that's hard to replicate. A financial AI startup that has incorporated years of proprietary market data is building something unique.

Second, workflow integration moats. If your AI is so deeply integrated into how customers work that switching is prohibitively difficult, you're protected. This is why the consumer AI startups building into existing apps are onto something. Ripping out their AI means ripping out part of the workflow.

Third, specialized expertise moats. If your team has deep domain knowledge in a specific vertical, that's a moat. You understand regulatory requirements, industry workflows, and customer needs in ways that generalists can't match. This takes years to build and is very hard to hire your way into.

Fourth, network effect moats. If your product gets better as more people use it, that's powerful. Marketplaces of AI agents, platforms where people share and discover AI tools, or collaboration features that create lock-in: these can build real network effects.

Fifth, switching cost moats. If integrating your product is expensive or time-consuming, customers get locked in. Enterprise software wins on this constantly. The same applies to AI products.

The biggest mistake early AI startups make is thinking their moat is the AI itself. By the time you ship, better models are free. Your moat has to be something about the way you apply AI, not about the AI itself.

Larco has passed on dozens of companies that had good AI but no real moat. She's funded companies that had good AI plus a clear, defensible reason why they'd win in their specific market. That distinction is massive.

The Disruption of Legacy Consumer Products

Here's the uncomfortable question that keeps coming up in VC meetings: what happens to Web MD, Trip Advisor, Yelp, and the entire category of legacy consumer information products?

These are the platforms that have built massive usage and revenue by aggregating information and helping people make decisions. Web MD helps you understand your symptoms. Trip Advisor helps you find hotels and restaurants. Yelp does similar for local search. These companies are worth billions because they've captured attention and monetized it.

But what happens when AI can do what they do, better?

Imagine asking Chat GPT about a symptom. Instead of getting a list of generic information from Web MD, you get a personalized analysis of what it might be based on your health profile, your age, your recent activities, your symptoms, and the probability distribution across actual conditions. You get doctor recommendations, medication information, home treatment options, and when you should actually get professional help.

Web MD gets completely circumvented.

Or imagine using an AI travel assistant. You tell it about your trip, your preferences, your budget, your travel style. Instead of browsing Trip Advisor, you get a fully planned itinerary with hotels picked specifically for you, restaurants chosen based on your taste, attractions ranked by fit for your interests, and reservations made automatically.

Trip Advisor is the middleman in a process that doesn't need a middleman anymore.

Venture capitalists are deeply invested in thinking through this transition. Some believe these legacy products will be absorbed into AI assistants. Others think they'll evolve. Some believe they'll stay relevant because they've built real moats in user trust and data.

The reality is probably more nuanced. For pure information aggregation, legacy products are at risk. For community-driven content (Yelp's user reviews, Trip Advisor's traveler photos and reviews), there's defensibility. For vertical integration (companies that start as aggregators and move into booking, transaction, or fulfillment), the transition is easier.

But the disruption thesis is real. And it's creating opportunities for new companies that are built to win in an AI-first world.

Enterprise AI agents are primarily focused on procurement and customer support, with significant attention also given to pricing and inventory management. (Estimated data)

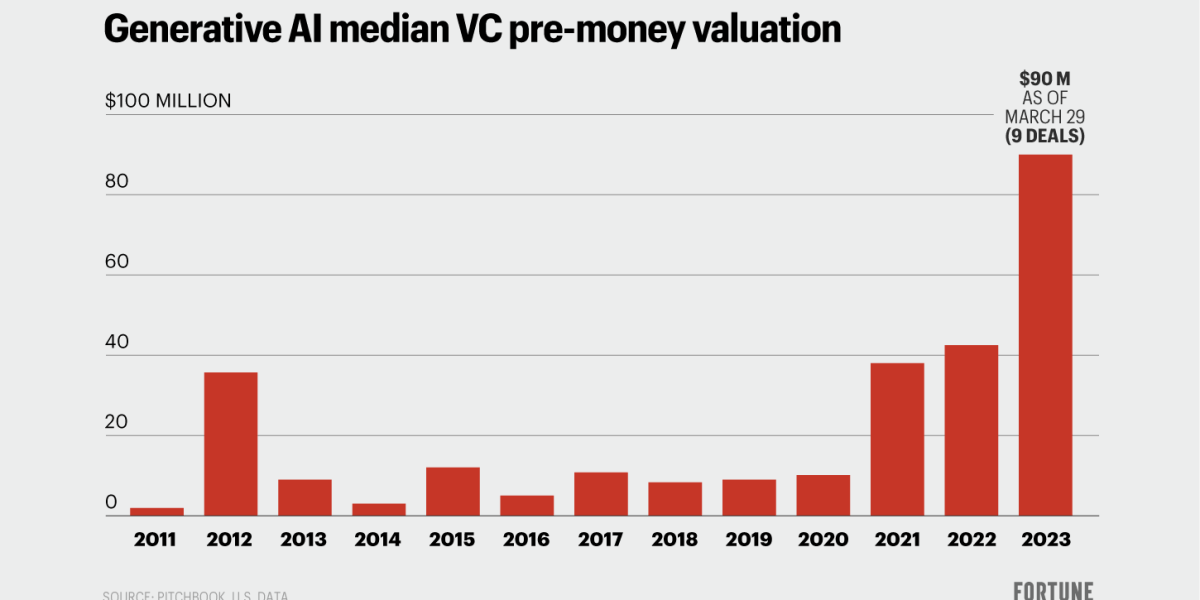

Where Capital is Actually Flowing in 2025

Talk to VCs about their deal flow and you see clear patterns about where they're writing checks.

Enterprise AI agents are getting the largest checks. Companies that can take an LLM and turn it into a business process manager are raising at high valuations with strong traction. Investors see clear ROI metrics, scalable go-to-market strategies, and defensible positions in specific verticals.

Vertical-specific AI tools are hot. If you're building AI for lawyers, accountants, contractors, doctors, or manufacturers, you can raise capital because you have a clear customer, clear value proposition, and clear willingness to pay.

Consumer AI with strong unit economics is finally getting funded again. The difference from 2023 and 2024 is that investors now demand proof of engagement, retention, and clear paths to monetization. Raw growth isn't enough. But the right consumer AI with strong fundamentals can raise easily.

AI infrastructure for businesses is still attracting capital, though the competition is intense. Vector databases, model serving platforms, fine-tuning platforms, and other infrastructure pieces are getting funded if they solve specific problems better than existing solutions.

AI-powered services where AI handles the delivery are getting traction. Think AI-powered customer support services, content creation services, design services, or coding services. If you can use AI to deliver services faster and cheaper while maintaining quality, you have a business.

What's NOT getting funded: pure model companies (unless you have something genuinely novel), applications that are just thin wrappers around Chat GPT, and companies without clear unit economics or path to profitability.

The venture capital market has moved from "can you build AI" to "can you build an AI business that makes money." It's a more mature market. Better capital allocation. Less hype, more discipline.

The Founder Profile That VCs Actually Fund

When you ask venture capitalists what they're looking for in AI founders, the bar has moved significantly.

Three years ago, you could raise capital on AI experience and a good technical team. Now? Investors want to see more.

First, they look at domain expertise. Have you spent years in the space you're trying to disrupt? Do you understand customer workflows, pain points, and willingness to pay? VCs have gotten burned by teams that understand AI but don't understand the industry they're disrupting. Domain expertise is a huge factor now.

Second, they evaluate founder history. Have you built something before? Have you shipped products? Have you acquired users? What did you learn? VCs are much more interested in repeat founders and people who have successfully navigated the hard parts of building companies.

Third, they scrutinize the founding team's balance. Do you have technical depth, business acumen, and industry connections? Teams with imbalanced skills struggle. A team of three Ph Ds struggles with sales and go-to-market. A team of three business people without technical depth can't build the product. VCs look for complementary skills.

Fourth, they assess founder conviction. Do you actually believe in your thesis? Can you articulate why this specific problem matters and why you're the right team to solve it? Founders with weak convictions who are just following trends raise less capital and struggle to stay focused through hardship.

Fifth, they evaluate willingness to commit to specific markets. The most successful AI startups go deep on one problem or one vertical. Founders who are trying to build broad platforms without specific focus struggle. VCs want founders committed to winning in a specific market.

Larco's observation: "The best founders I fund have deep knowledge of a problem space, they've thought about it for years, and they're building to solve a specific problem in a better way. They're not building because AI is hot. They're building because they saw a gap and became obsessed with filling it," as discussed in HR Grapevine's article on tech sector hiring.

That distinction shapes everything. Capital flows to founders with genuine insight and commitment, not just AI skill.

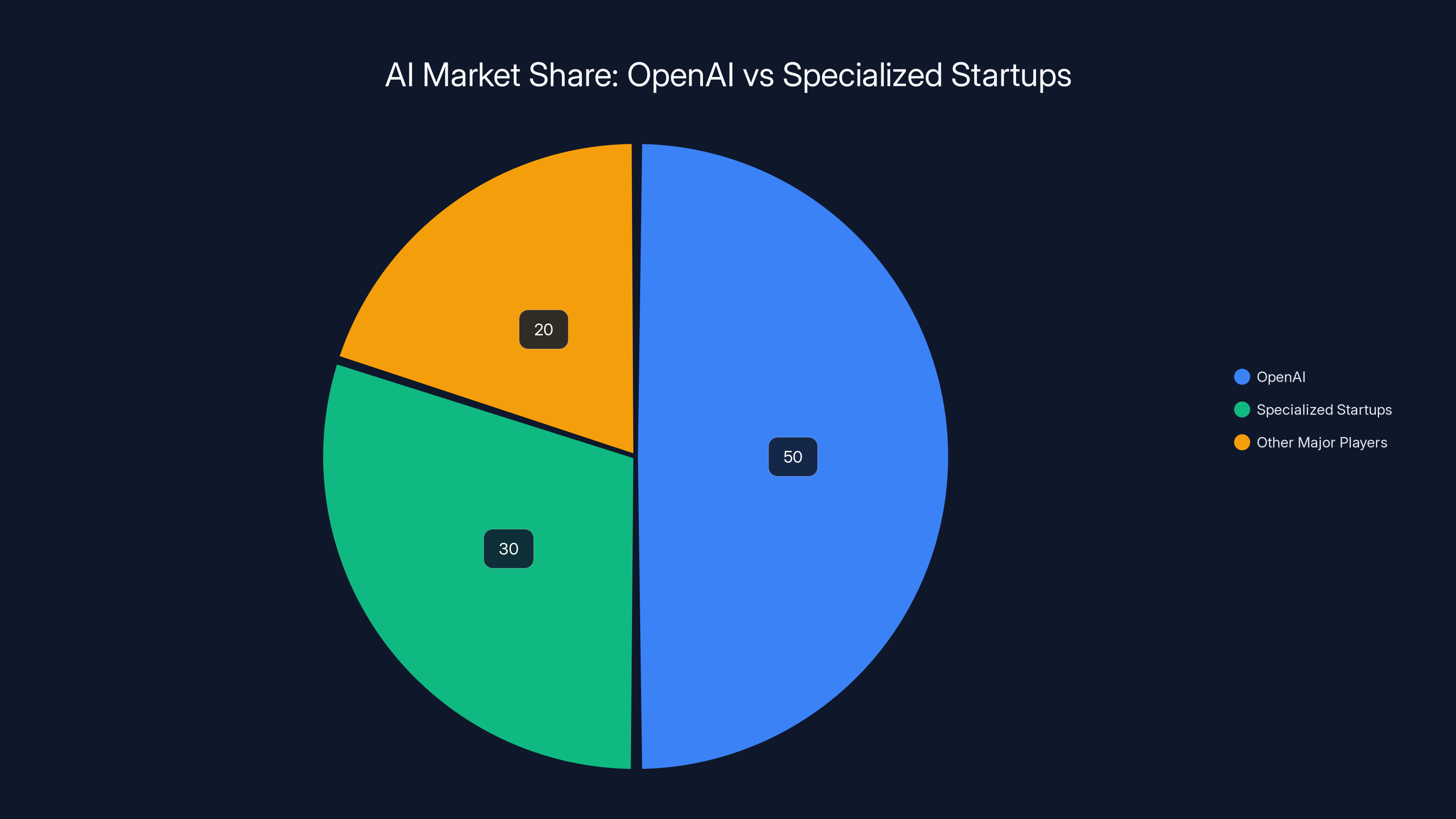

Estimated data suggests OpenAI holds a significant market share, but specialized startups capture a substantial portion by focusing on niche markets.

The Competitive Dynamics of AI Startups Against Each Other

Here's something that doesn't get talked about enough: the real competition for most AI startups isn't Open AI. It's other AI startups.

There are thousands of companies building AI-powered tools in every vertical. The startup ecosystem is intensely competitive. Getting funded, getting customers, and staying profitable all require outperforming other startups in your space.

Open AI is like the weather. It affects the environment, but it's not your direct competitor. Your direct competitors are the three other startups trying to build AI-powered legal tools, or the five companies building AI for accounting, or the dozen teams working on AI-powered customer support.

Venture capitalists look at this dynamic constantly. They ask: if we fund you, what's going to keep you from getting out-competed by two other well-funded startups in your space?

This is where the moats become critical. If you're the first to market with integrated AI legal tools, and you build a data moat from trained documents, you're protected. If you're the twentieth legal AI startup with a better model, you're in trouble.

The startup competition is shaping capital allocation. VCs are less likely to fund teams entering crowded spaces without clear differentiation. They're more likely to fund teams going deep on niche, defensible problems where network effects or data or expertise creates real protection.

Practical implications: if you're building an AI startup, don't compete on general capability. Compete on specific problem solving, domain expertise, customer integration, and defensible advantages. Don't try to beat Open AI at their game or out-engineer the other 50 startups in your space. Find something that's specifically valuable that they're not doing, and become the best in the world at that specific thing.

Regulatory and Competitive Pressures Shaping the Landscape

The AI regulatory environment is shifting, and it's creating both opportunities and challenges for startups.

In Europe, AI regulation is increasing. In the US, it's evolving but not yet heavily regulated. In Asia, it varies dramatically by country. For startups, this means: where you can operate matters. Regulatory compliance becomes a competitive advantage if you've built it in from the start.

Some startups are benefiting from increased regulation because regulation creates barriers to entry. A legal AI startup that's built with compliance baked in has an advantage over a competitor that has to add compliance later. A healthcare AI startup that's worked with regulators has an advantage over one that hasn't.

There's also the question of how big tech companies will compete with startups. Microsoft is aggressive in AI-powered enterprise software. Google is integrating AI throughout their products. Meta is building consumer AI experiences. Apple is building on-device AI.

For startups, this creates weird dynamics. You're competing with companies that have infinite resources and can integrate AI throughout their products. But you're also potentially partnering with them or being acquired by them.

The smart startups are thinking about this explicitly. Are you building something complementary to big tech? Or something that threatens their core business? If you're complementary, you might partner or get acquired. If you're threatening, you need stronger moats.

Larco's take: "The companies that do well in this environment are the ones that are so good at their specific problem that big tech doesn't bother competing. They're good enough to complement big tech's products or be acquired at a high price. The companies that struggle are the ones trying to build broad AI platforms because they look too threatening and are too hard to differentiate," as highlighted in Africa Center's spotlight on critical minerals.

Key Takeaways

- OpenAI's dominance in raw capability doesn't eliminate opportunities for specialized AI startups solving specific problems

- Consumer AI is finally taking off in 2025 because of seamless integration into existing workflows, not standalone apps

- Vertical AI startups building deep domain expertise in specific industries (legal, healthcare, finance) create defensible competitive moats

- Enterprise AI agents managing business processes represent the largest capital opportunity with clear ROI metrics

- Competitive moats for AI startups come from data access, workflow integration, specialized expertise, network effects, and switching costs, not from AI capability itself

- VCs are now scrutinizing founder domain expertise, team balance, and clear business unit economics instead of just raw AI capability

Related Articles

- Articul8 Series B: Intel Spinoff's $70M Funding & Enterprise AI Strategy

- CES 2026: Everything Revealed From Nvidia to Razer's AI Tools

- Why Navan's IPO Flopped While AI Companies Soar: The B2B SaaS Reckoning [2025]

- Building Engaged Communities: Strategies from TechCrunch Disrupt [2025]

- European Deep Tech Spinouts: How 76 University Companies Became Unicorns [2025]

- Meta Acquires Manus: The $2 Billion AI Agent Deal Explained [2025]

FAQ

What is Where AI Startups Win Against OpenAI: VC Insights 2025?

There's a question hanging over every AI startup pitch right now: why does the world need you when Open AI exists

What does the reality of competing in open ai's shadow mean?

It's the first thing venture capitalists ask

Why is Where AI Startups Win Against OpenAI: VC Insights 2025 important in 2025?

For a lot of companies, there's no good answer

How can I get started with Where AI Startups Win Against OpenAI: VC Insights 2025?

But for the ones that have figured it out, the opportunities are enormous

What are the key benefits of Where AI Startups Win Against OpenAI: VC Insights 2025?

I sat down with some of the most experienced AI investors in the valley, and the pattern became clear

What challenges should I expect?

Open AI isn't going to kill every startup