How a Single Bet Could Reshape Global AI Infrastructure

India just made a move that matters more than most people realize.

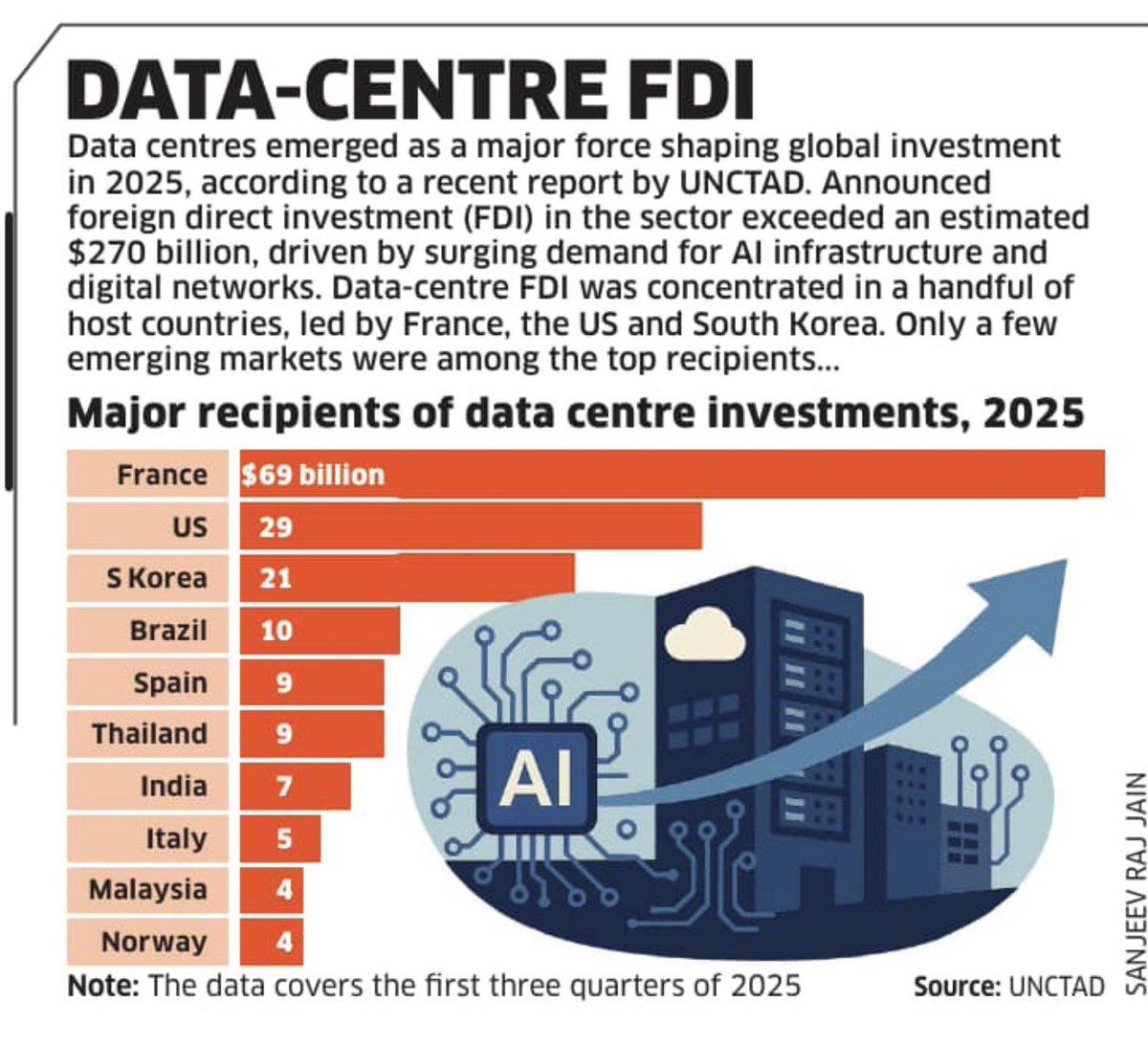

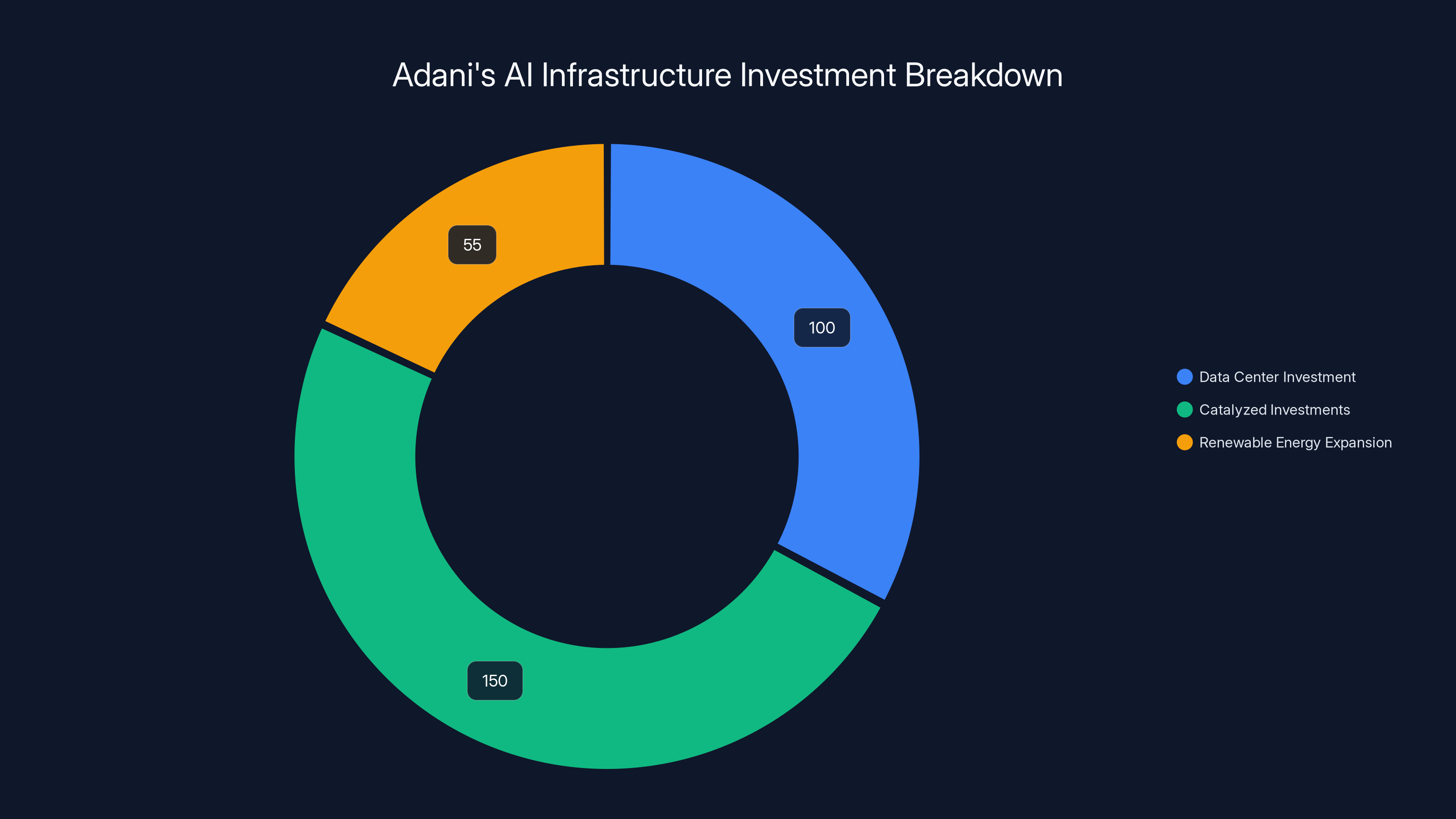

In early 2025, the Adani Group announced a $100 billion commitment to build AI-specialized data centers across India over the next decade. That's not just big spending—it's a strategic repositioning. And it came during India's AI Impact Summit, when executives from OpenAI, Nvidia, Anthropic, Microsoft, and Google were literally in the room.

Here's what's actually happening beneath the headlines: the global AI infrastructure race is decentralizing. For years, the U.S. dominated computing capacity. Now, energy costs, regulatory friction, and geopolitical tension are pushing companies to diversify. India, with its massive renewable energy portfolio and growing tech ecosystem, suddenly looks like a destination, not just a market.

Adani's bet reflects something deeper. India has been a software outsourcing hub for decades. But software doesn't move the geopolitical needle anymore. Infrastructure does. Data centers do. The ability to train and run massive AI models locally—that's power.

The Adani announcement includes 5 gigawatts of planned capacity, partnerships with Google, Microsoft, and Flipkart, and a commitment to supply renewable power through the company's 30-gigawatt Khavda renewable energy project. It's not hyperbole to say this could shift where AI innovation happens next.

Let's unpack why this matters, what's actually feasible, and what it means for the global tech landscape.

TL; DR

- $100B investment: Adani pledges funding through 2035 for AI-specialized data centers across India with up to 5 gigawatts of capacity

- **150 billion in related investments, creating a $250 billion AI infrastructure ecosystem

- Renewable power model: All data centers will run on carbon-neutral power from Adani's existing 30-gigawatt renewable portfolio (with 10GW already operational)

- Strategic partnerships: Google, Microsoft, and Flipkart are directly involved in the development of new facilities in Visakhapatnam, Noida, Hyderabad, and Pune

- Geopolitical timing: Announcement coincides with India's AI Impact Summit, positioning India as a serious player in global AI infrastructure rather than just a software market

Adani's cost of

The Infrastructure Crisis Nobody Talks About

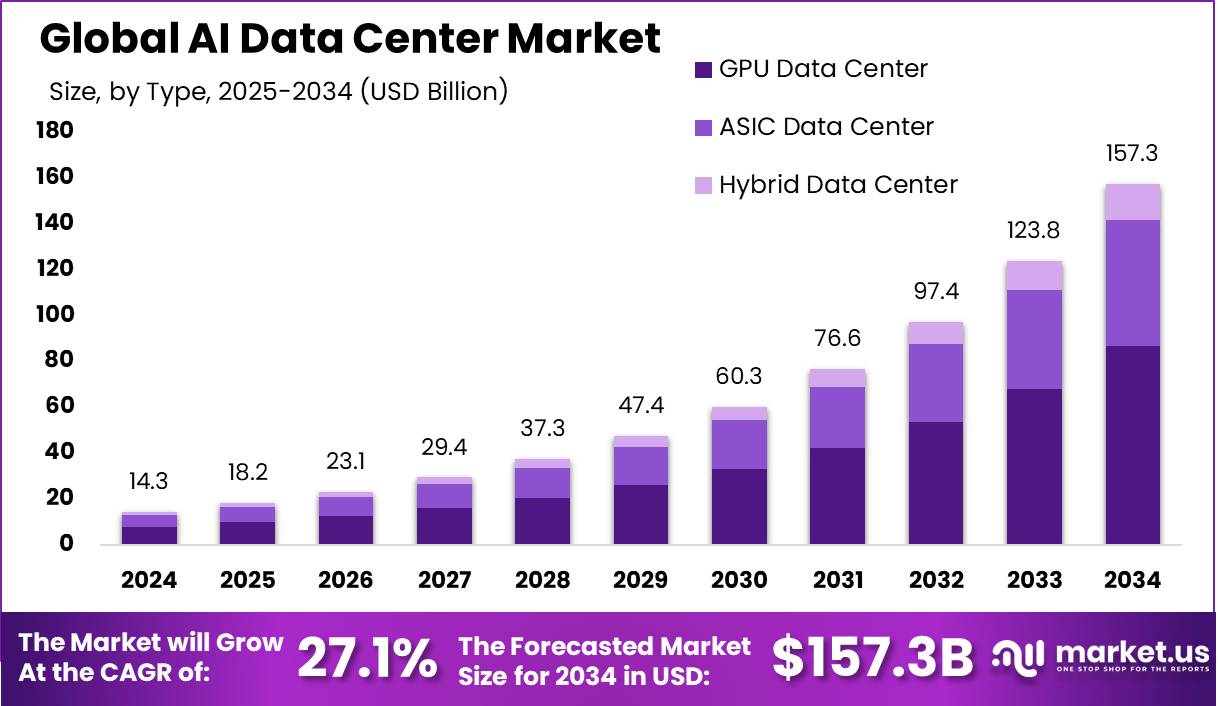

Here's something most articles miss: data center capacity is becoming a hard constraint on AI development.

Training large language models requires absurd amounts of compute. We're talking about thousands of GPUs running simultaneously for weeks. Running inference at scale—handling millions of queries per day—demands even more capacity. And most of that capacity currently lives in a few U.S. cities and European hubs.

That creates bottlenecks. Companies wait months for GPU allocation. Startups can't access enough capacity to train competitive models. And geopolitically, it's a vulnerability. If one country controls the infrastructure, it controls access to the technology.

Adani's play targets exactly this constraint. More capacity. More distributed. More renewable. That's not just good for Adani shareholders—it's strategically significant.

The current global data center situation looks roughly like this: major tech companies own the bulk of capacity, but they're demand-constrained. Cloud providers are maxed out. You can rent compute, but you're competing with everyone else. Academic researchers struggle to get allocation. Startups can't scale. Adani isn't trying to compete with AWS or Azure. They're trying to provide capacity that companies can actually access.

India has some genuine advantages here. First, labor costs. Indian engineers are world-class and significantly cheaper than Western counterparts. Second, regulatory environment. India's government actively wants to build AI infrastructure. There's no regulatory friction like you see in Europe. Third, renewable energy. Adani's existing portfolio is huge, and expanding it is cheaper than building new renewable capacity in the U.S. or Europe.

Fourth, there's the geographic arbitrage. India's time zone is genuinely useful. You can run workloads while U.S. teams sleep, then hand off results. That's not revolutionary, but it matters operationally.

The real constraint is one thing: can they actually pull it off?

Why This Isn't Just Corporate Hype

Adani isn't some startup making promises. They have a track record of executing massive infrastructure projects. They run ports, airports, power generation, and—importantly—they already run data centers.

Adani ConneX, a joint venture with EdgeConneX (a U.S. data center operator), has already deployed roughly 2 gigawatts of capacity across India. That's real infrastructure running real workloads. It's not theoretical. The company has experience building these facilities, running them efficiently, and managing customer relationships.

The new $100 billion commitment adds 5 gigawatts on top of that existing base. That's significant expansion, but it's building on demonstrated capability.

There are questions, of course. Adani didn't disclose exactly how much is already committed capital versus future allocation. They didn't specify the timeline clearly. But the fact that Google and Microsoft are partners suggests the commitment is real. Those companies don't attach their brands to fantasy infrastructure plans. They do due diligence. They have engineers who verify feasibility.

Flipkart's involvement is particularly interesting. It's an Indian e-commerce giant, owned by Walmart. Including them signals that this infrastructure is intended to serve India-based customers, not just international ones. There's a domestic AI ecosystem being built, not just export-oriented infrastructure.

The renewable energy piece deserves its own credibility analysis. Khavda is one of the world's largest renewable energy projects. Adani has already invested billions. They have 10 gigawatts operational, with plans to expand. Dedicating this power to data centers makes economic sense for them. It solves the utilization problem—running a power plant at high utilization is profitable.

So why is this credible? Because the incentives align. Adani gets revenue from hosting. They reduce power plant risk by diversifying customers. They get government support because this looks good for India's AI positioning. It all makes sense economically, not just politically.

The Competitive Landscape Is Shifting

Where does this leave established data center providers?

Companies like Equinix, Digital Realty, and CoreWeave have been the default option for compute-heavy workloads. They own massive capacity globally. But here's the tension: they're also expensive. And they're not purpose-built for AI workloads.

Adani is building specifically for AI. That matters. AI workloads have different cooling requirements than traditional enterprise infrastructure. GPU density is higher. Power consumption is different. Network requirements are weird. A facility optimized for AI from day one runs more efficiently than retrofitted data centers.

Moreover, Adani can price aggressively. They own the power source. They own the land. They own the construction. Their cost structure is just lower than competitors who need to buy power at market rates.

This doesn't mean Equinix dies. But it means the market fragments. You have the established players serving legacy customers and premium use cases. And you have new entrants like Adani serving the frontier—the latest AI workloads, the companies that need scale quickly, the researchers building the next generation.

There's also the geopolitical angle. Western data center companies might face scrutiny if they expand too aggressively in Asia. There's not that concern with Adani—they're Indian, serving India-based customers alongside international partners.

The timing is important too. This announcement came as countries worldwide are trying to attract AI infrastructure investment. Ireland competed heavily for data centers. Singapore is doing the same. So is Japan. India is joining that competition late but with genuine advantages. And Adani just credibly signaled: we're serious.

Regulatory and land acquisition pose the highest risk at a level of 9, highlighting the complexity of navigating different state regulations and acquiring land.

What 5 Gigawatts Actually Means

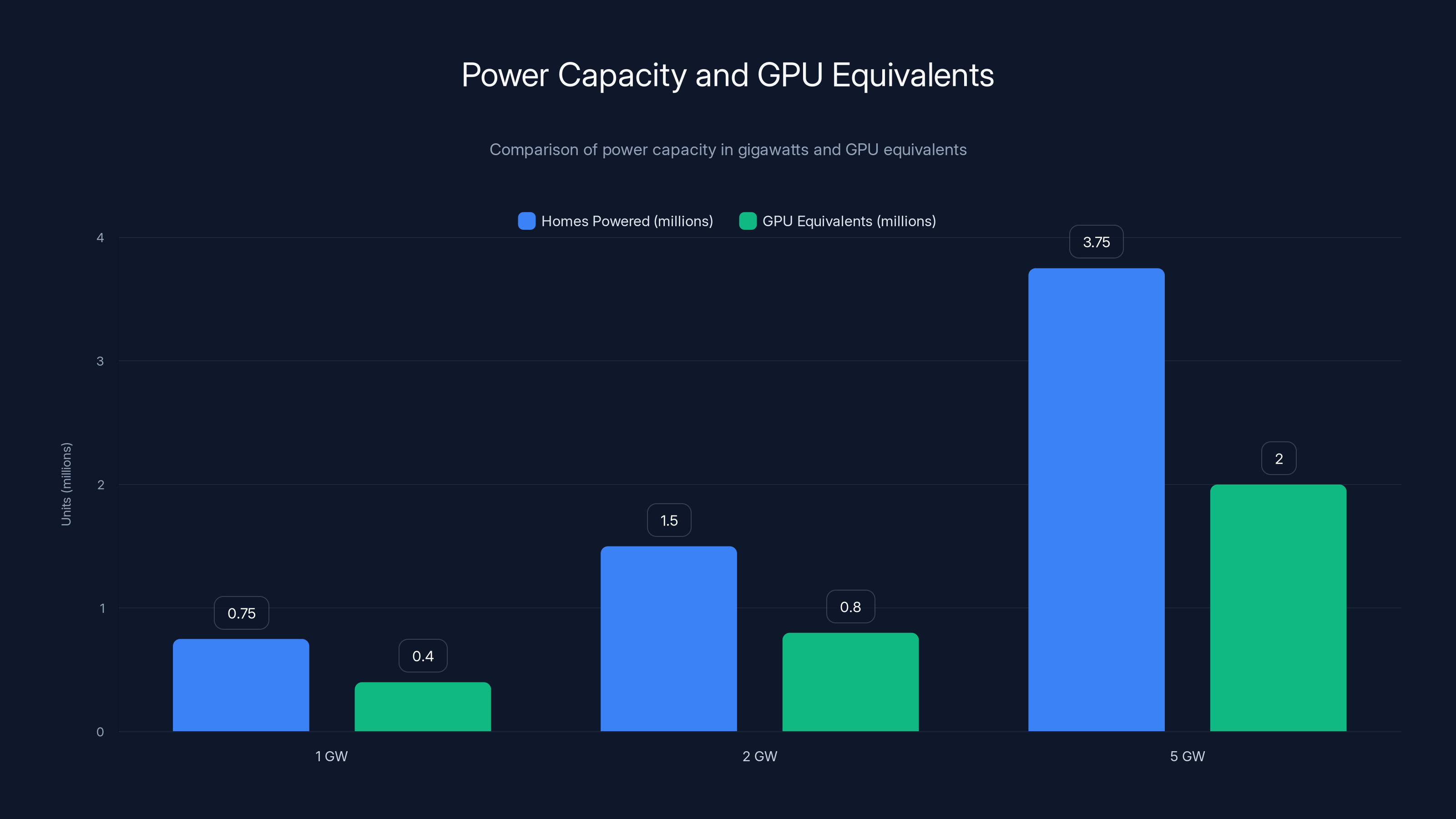

Numbers sound big until you understand them. Let's make 5 gigawatts concrete.

One gigawatt powers roughly 750,000 homes. Five gigawatts powers about 3.75 million homes. But data center power consumption is intense and concentrated. You're not spreading power across a city. You're concentrating it in a few massive facilities.

For AI workloads specifically, a megawatt of power supports roughly 300-500 high-end GPUs, depending on the model and utilization. That's not universal—it varies by architecture. But it's a reasonable approximation.

So 5 gigawatts equals 5,000 megawatts. At 400 GPUs per megawatt average, that's roughly 2 million GPU equivalents. That's capacity to train dozens of frontier AI models simultaneously. Or run inference for billions of queries per day.

For context, the largest AI training runs today use tens of thousands of GPUs. With 2 million GPU capacity, you could run 100 large-scale training projects in parallel. That's legitimately transformative for AI research and development globally.

Adani's existing 2 gigawatts already provides 800,000 GPU equivalents. The new commitment triples that.

One more comparison: all of AWS data center capacity globally is measured in similar terms, though the exact number is proprietary. But it's in the multi-gigawatt range. Adani is building capacity equivalent to a major chunk of AWS infrastructure dedicated specifically to AI. That's serious.

The phased rollout matters too. They're not trying to build everything at once. Facilities in Visakhapatnam, Noida, Hyderabad, and Pune will come online over time. That reduces risk. It allows them to iterate on design. It spreads capital deployment.

The Renewable Energy Angle Changes Everything

Most data center discussions miss the energy component. But it's critical.

Data centers are power-hungry. A 100-megawatt facility running 24/7 consumes about 876,000 megawatt-hours per year. At commercial rates of

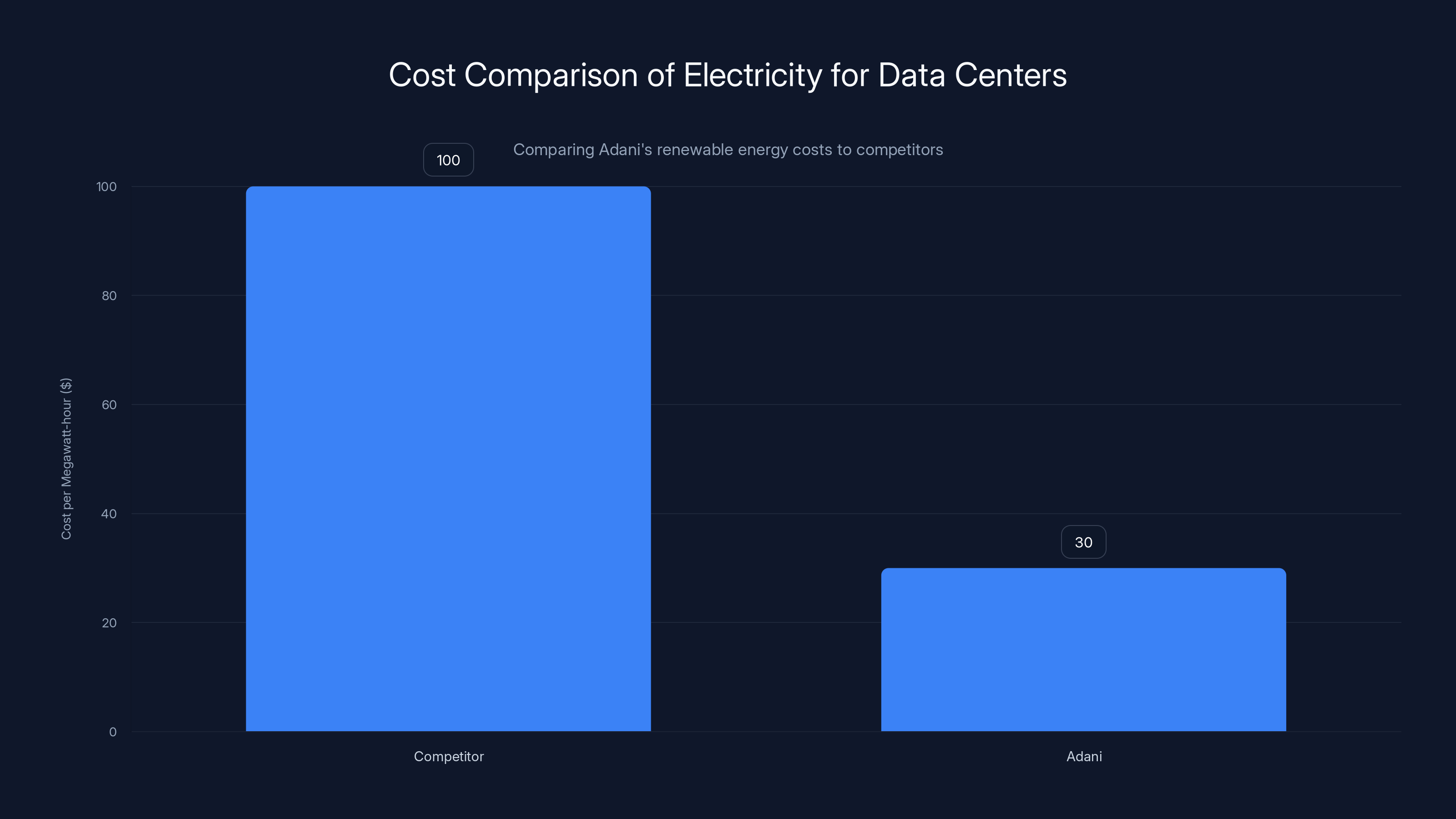

Adani owns the generation. They're not buying power at market rates. They're producing it. That cost advantage is enormous.

Moreover, renewable power is cheaper than it used to be. Solar and wind production costs have dropped 90% over the past decade. Khavda specifically produces power at some of the lowest costs globally—estimated under $30 per megawatt-hour. That gives Adani a crushing advantage in pricing.

Here's the math: if a competitor pays

But there's a secondary benefit. Renewable power is becoming a requirement, not a nice-to-have. Microsoft, Google, and Amazon have all committed to carbon neutrality. They can't put workloads on fossil fuel data centers long-term. Adani's renewable-powered capacity is literally the only option for companies that need to hit sustainability targets.

That's not a side benefit. That's a core value proposition.

There's also the energy storage angle. Adani mentioned plans to invest $55 billion in expanding renewable generation and battery energy storage. That's crucial. Renewable power is intermittent. You get solar during the day, wind when it's windy. Without storage, you can't run 24/7 data centers on renewables.

Battery technology has improved dramatically. Tesla's mega-factories produce batteries cheaper every year. Adani can install multi-gigawatt-hour battery banks to smooth out intermittency. That lets them offer reliable, always-on power from renewable sources. Western competitors can't match that cost structure.

The $150 Billion Ecosystem Multiplier

Adani's projection:

That might sound like corporate wishful thinking. But actually, it's probably realistic.

Here's why. Infrastructure investments create secondary investments. If Adani builds data centers, companies move employees to India to manage them. Those employees need housing, offices, restaurants. Real estate booms. Other companies build supply chain operations nearby. Electronics manufacturers expand. Fiber-optic cable companies run new infrastructure.

It's the same pattern you've seen in every major infrastructure boom. Build a highway, and surrounding areas develop. Build an airport, and a cluster forms nearby. Build data centers, and you create ecosystem opportunities.

Google already has research labs in India. Microsoft does too. They'll expand. Startups will launch to support the infrastructure—cooling system optimization, power management software, maintenance services. Consulting firms will open offices. This compounds.

Moreover, India has 1.4 billion people. A lot of them are learning to code. A lot of them want to work in AI. Having world-class infrastructure in India means those engineers can stay local, work on cutting-edge problems, and contribute to the global AI industry without moving to San Francisco. That's a genuine multiplier effect.

Educational institutions will expand AI programs. Universities will partner with companies building data centers. Students will train specifically for those roles. Over a decade, you create an entire ecosystem.

Is

Strategic Partnerships: The Real Signal

Google and Microsoft involvement isn't window dressing. It signals something important.

These companies have global infrastructure already. They don't need more data center space out of desperation. They're partners because they believe in this specific capacity for specific reasons.

Google's AI division is ravenous for compute. They train massive models. Having dedicated capacity in India lets them distribute workloads globally, reducing latency and cost. It also gives them local infrastructure to serve Indian customers and markets. That's strategically valuable.

Microsoft has similar incentives, plus the added layer that they're integrated with Azure and would offer cloud services through this infrastructure. They need capacity to compete with AWS. India is a growth market for cloud services. This checks multiple boxes.

Flipkart is the third major partner. That's about Indian customer access. Building recommendation systems for billions of e-commerce customers requires massive compute. Having local infrastructure keeps data local, improves latency, and reduces international data transfer costs. It's economically sensible.

None of these companies stake their reputation on fantasies. If they're partners, the infrastructure is real and feasible. That's due diligence.

The fact that this happens during India's AI Impact Summit is also significant. This isn't an accident. Adani announced this at the right moment, to the right audience, when the world was watching India position itself as an AI powerhouse. That's excellent timing and execution.

Adani Group's

Can They Actually Execute This?

Here's the honest assessment: execution risk is real.

Adani is experienced at large infrastructure projects, but this is scale beyond their usual. Building 5 gigawatts of specialized AI data center capacity globally is more complex than building a new port.

There are multiple risks:

Supply chain complexity: You need transformers, power electronics, cooling systems, servers, networking equipment. Global supply chains for all of this are strained. Adani mentioned co-investing in domestic manufacturing of critical components. That's smart but adds execution complexity.

Engineering talent: Building world-class data centers requires specialized expertise. Adani can hire this, but competition for talent is fierce. They'll need to recruit from the U.S., Europe, and other markets, while also developing Indian expertise.

Regulatory and land acquisition: Different states have different rules. Getting permits across multiple Indian states for massive industrial facilities takes years. Acquiring contiguous land for sprawling facilities is non-trivial. Visakhapatnam, Noida, Hyderabad, and Pune each have their own challenges.

Financing: $100 billion is enormous. They're phasing it over a decade, which helps, but it still requires consistent capital access. Interest rates, currency fluctuations, and geopolitical events create uncertainty.

Workload recruitment: Building capacity is one thing. Getting customers to actually use it is another. Google and Microsoft partnership helps, but they have their own priorities. Adani needs to recruit diverse customers. That takes sales effort.

Adani has answered some of these implicitly. The renewables investment proves they're serious about power. The existing 2 gigawatts proves they can execute. The partnerships prove they have credibility.

But skepticism is warranted. Not all infrastructure promises come to fruition on schedule and on budget. Some facilities will be delayed. Some segments might cost more than projected.

The baseline expectation should be: core facilities get built on time, with maybe 20% variance. Some stretch goals don't materialize. They hit roughly 80% of the target instead of 100%. That's still transformative.

The Geopolitical Dimension Can't Be Ignored

This isn't just business. It's geopolitics.

The U.S. currently dominates global AI infrastructure. That's a source of power. Companies worldwide depend on U.S. cloud providers. That creates political leverage.

India diversifying infrastructure changes that calculation. It's not about India replacing the U.S.—that won't happen in a decade. But it's about creating options. If a company needs compute and can choose between AWS in Virginia or Adani in Visakhapatnam, they have leverage. They can negotiate better terms. They can keep data local if they prefer. They have alternatives.

China understands this deeply. They've invested heavily in domestic infrastructure specifically to reduce dependence on Western providers. Europe is trying the same thing with their own initiatives. India joining that game changes the global structure.

The U.S. isn't happy about this. But U.S. policymakers are also pragmatic. If India builds neutral, open infrastructure that Western companies can use, that's actually acceptable. It's not a threat the way a Chinese-only infrastructure would be.

Adani's framing—partnering with Google and Microsoft, emphasizing openness, positioning as a global player—is deliberately designed to be non-threatening. This isn't about India controlling AI. It's about India providing capacity and building an indigenous ecosystem simultaneously.

That's a much stronger position than either pure nationalism or pure foreign dependence. It's pragmatic, economically sensible, and geopolitically smart.

India's Broader AI Ambitions

Adani's investment sits within India's broader AI strategy.

India has 1.4 billion people and rapidly growing digital adoption. That creates massive AI opportunities. Recommendations for 500 million e-commerce users. Credit scoring for hundreds of millions of unbanked people. Health AI for rural clinics. Agricultural optimization for tens of millions of farmers. The use cases are enormous.

But infrastructure is the bottleneck. You can't build sophisticated AI applications without access to compute. Indian startups have been handicapped because they can't access GPU capacity locally. They have to pay premium prices for cloud compute or relocate.

Adani's infrastructure removes that constraint. Indian entrepreneurs can suddenly train models locally at competitive prices. They can build and iterate faster. They can compete globally rather than just locally.

That unlocks innovation. Look at what happened in mobile. India became a major mobile software market not because Indians invented mobile, but because the infrastructure became available and the ecosystem built around it. The same dynamic applies to AI.

There's also a workforce angle. India produces millions of engineering graduates annually. Most of the world-class ones leave for the U.S. But if there are frontier AI infrastructure jobs in India, some percentage stay. Some percentage comes back. That's a long-term competitive advantage.

Government support matters too. India's government has been explicitly pushing AI infrastructure investment. They understand that controlling infrastructure is more valuable long-term than controlling any specific company. Policies are friendly, regulatory friction is low, and incentives are aligned.

This isn't guaranteed to work perfectly. There are cultural, organizational, and economic challenges. But the government isn't hostile. That matters.

The Renewable Energy Bet Is Underrated

We touched on this earlier, but it deserves deeper treatment.

Adani is betting that the future of data centers is renewable-powered. That's not a marginal position. It's central to their strategy.

Corporate commitments to carbon neutrality are real. Microsoft pledged to be carbon-negative by 2030. Google pledged 24/7 carbon-free electricity by 2030. Amazon pledged net-zero carbon by 2040. These aren't optional. They're hard targets with board oversight.

That means these companies literally cannot put workloads on fossil fuel data centers long-term. They need renewable-powered capacity. And they need a lot of it.

Adani is one of the few companies with the scale to provide that. They can generate power cheaper than almost anyone. They can guarantee 24/7 renewable power through batteries and hydro. They can scale to multigigawatt capacity.

That's a structural advantage. It's not temporary. As emissions constraints get tighter globally, renewable infrastructure becomes more valuable, not less.

There's a flip side: renewable energy is getting cheaper. That erodes margins. But Adani's already invested in generation. For them, the incremental cost of expansion is lower than building new facilities from scratch.

They're also positioned to benefit from battery technology improvements. Each generation of battery gets cheaper, more efficient, more durable. Adani can retrofit and upgrade as technology improves. That extends competitive advantage.

The renewable strategy is also politically smart. No government is against renewable energy. There's no constituency opposing solar and wind. But there is opposition to fossil fuel power plants. By anchoring to renewables, Adani makes it harder to politically attack the project.

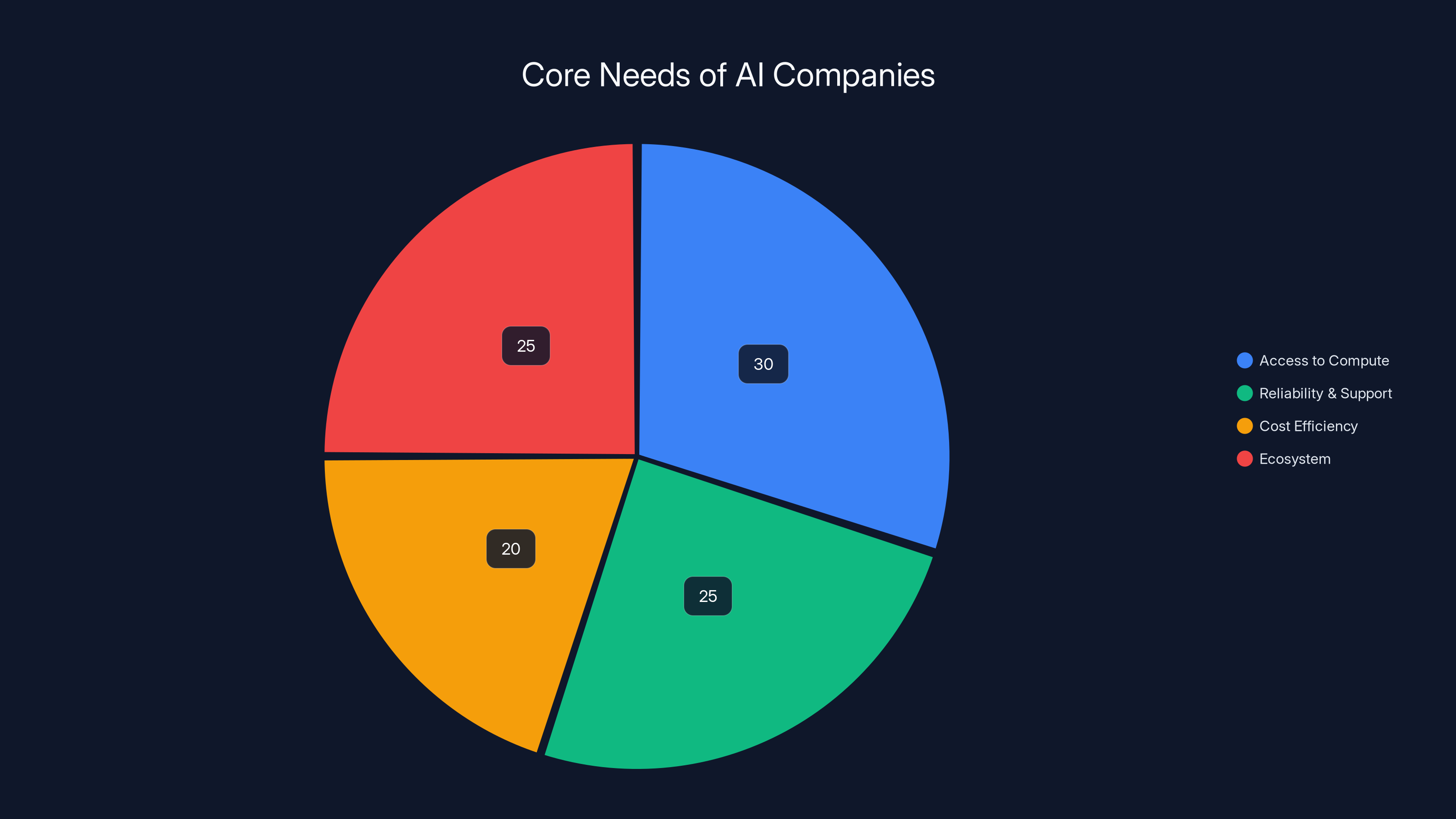

Access to compute and ecosystem are equally critical for AI companies, each accounting for 25-30% of their core needs. Estimated data.

Execution Timeline and Realistic Expectations

Adani committed through 2035. That's important. They're not promising everything by 2027. They're planning a decade-long rollout.

That's actually realistic. You can't build 5 gigawatts overnight. You need to:

- Acquire land (1-2 years per site, multiple sites in parallel)

- Develop sites with power and networking (2-3 years per site)

- Build first facilities with test workloads (1-2 years)

- Iterate on design based on learning (ongoing)

- Recruit customers and workloads (18-24 months)

- Scale to full capacity (years 3-5 of operation)

Ten years is actually aggressive. If they hit 60-70% of the target on schedule, that's a major success.

We should expect:

- Year 1-2: Announcements, land acquisition, design finalization. No new capacity online.

- Year 2-3: First facilities come online in Visakhapatnam and Noida. They're not at full capacity. Customer acquisition begins.

- Year 3-5: Capacity ramps. Hyderabad and Pune sites start. They probably have 1-2 gigawatts operational.

- Year 5-7: Expansion accelerates. Maybe 3-4 gigawatts operational.

- Year 7-10: Final buildout. They approach or exceed 5 gigawatts.

Timeline slips are normal. Cost overruns happen. But the trajectory is clear.

What matters is whether they achieve 3-4 gigawatts in the next 5-7 years. That alone transforms the global infrastructure landscape. The difference between 2 gigawatts and 5 gigawatts is significant, but 2-4 gigawatts is already transformative.

Why This Matters for Global Tech Competition

The concentration of infrastructure is a feature of tech today, but it's increasingly unstable.

For decades, the U.S. has dominated computing capacity, networking infrastructure, and technical talent. That concentration made sense when technology was centralized and capital was concentrated.

But the internet is global now. Data moves everywhere. Talent is distributed. Capital is global. And geopolitics is fraught. No single country wants to depend entirely on another for critical infrastructure.

India's move is part of a global diversification. Europe is building its own infrastructure. Japan is investing. Singapore is competing. Middle Eastern countries are building capacity. It's fragmentation from a single-hub model.

That fragmentation is important for innovation and competition. It's harder for any single entity to control the ecosystem. It opens opportunities for regional players. It forces everyone to innovate faster because there's always a competitive alternative.

Adani's bet accelerates that process. A credible alternative to U.S. data center dominance changes incentives for everyone.

Questions That Remain Unanswered

Adani's announcement leaves some questions hanging.

Speed to operation: How quickly will actual workloads run? The commitment runs through 2035, but when do the first substantial facilities go live with real customer workloads? Two years? Three years?

Pricing structure: What will they actually charge? Will they undercut AWS and Azure? Match pricing? Target specific segments? The business model affects everything.

Talent and hiring: How many people will they hire? Can they recruit and retain world-class engineering talent in India? This is solvable but non-trivial.

Technology choices: Which hardware will they standardize on? Nvidia GPUs? AMD alternatives? Custom chips? Architecture decisions ripple through everything.

International capacity: They mention domestic Indian facilities. Will they expand internationally? The ambition seems global, but initial facilities are India-only.

Regulatory clarity: How do Indian regulations affect data sovereignty, immigration for talent, and tax structure? These matter operationally.

Adani has probably worked through all of these internally. But they haven't revealed the answers publicly. That's fine—you don't share everything before execution. But it means there are unknowns.

Smart investors and analysts will be watching closely over the next 18-24 months for announcements that reduce uncertainty.

What This Teaches Us About Future Infrastructure

Adani's bet reflects fundamental truths about infrastructure in the AI era.

First, infrastructure is a competitive advantage, not a commodity. Having access to compute at scale changes what you can build. Companies without it are disadvantaged. This will matter more over time, not less.

Second, renewable energy and compute are converging. Future competitive advantage combines both. Adani understands this. So do Microsoft and Google. Others are learning.

Third, geography matters again. For decades, the internet seemed to eliminate geographic constraints. But infrastructure is physical. Location affects cost, latency, regulatory environment, talent access, and energy. These factor into competition.

Fourth, vertical integration has advantages. Adani owns generation, transmission, distribution, and now compute. That integrated model reduces costs and increases control. We'll probably see more of this pattern.

Fifth, scale creates real competitive moats. Small players can't compete with Adani's infrastructure cost structure. That favors large, capital-rich companies. It also favors winners who gain early advantage and scale fast.

These are structural forces, not temporary trends. Understanding them matters for everyone building in tech, not just infrastructure specialists.

5 gigawatts can power 3.75 million homes or support 2 million GPUs, enabling significant AI capabilities. Estimated data for GPU equivalents.

The Path Forward for Indian Tech

This is potentially a turning point for India's role in global tech.

For 25 years, India's contribution has been software services—outsourcing, IT consulting, development shops building for Western companies. That was valuable but limited. India wasn't building the platforms, controlling the infrastructure, or owning the strategic assets.

Adani's bet changes that calculus. By controlling infrastructure, India gets a seat at the table for decisions about how AI develops globally. When Google wants to train a massive model, they can do it locally. When startups need compute, they can find it at competitive prices without leaving India.

That access to infrastructure is the first step toward building indigenous innovation. It's not automatic. You need funding, talent, and vision. But without infrastructure, it's impossible.

India has funding emerging through VCs and tech entrepreneurs. It has talent—both diaspora returning and new generation engineers. It has government support. The one missing piece has been infrastructure at scale. Adani is filling that gap.

The next 5-10 years will reveal whether this translates into frontier AI innovation from India, or whether it's just infrastructure without breakthrough research. My guess is somewhere in between. You'll see Indian companies build world-class AI products serving global markets. You might not see India produce the next transformative AI architecture, but you'll see sophisticated applications, important companies, and real talent emerging.

That's still transformative compared to the last 25 years.

Comparative Infrastructure Moves by Other Countries

India isn't alone in recognizing infrastructure importance.

China has been building data center capacity for years, specifically to reduce dependence on Western providers. They have massive domestic capacity now, though much of it is protected from Western access. That gives them autonomy but limits ecosystem benefits.

Europe is trying to build infrastructure independence through initiatives like GAIA-X and European cloud platforms. But they're constrained by smaller capital bases and higher regulatory complexity. Progress is slower.

Middle Eastern countries are investing heavily—Saudi Arabia, UAE, and others recognizing that infrastructure investment today pays off long-term. But they're largely building for specific sectors or regional markets, not global scale.

Adani's bet combines elements of each approach: capital scale like China's, but with openness to partnerships like Europe's, and with regional focus like Middle Eastern investments. It's a hybrid that might actually work better than any individual approach.

The competition between approaches is good. Diverse infrastructure ecosystems are more resilient than monocultures. They create options for companies and countries. They distribute power more broadly.

Adani is betting that this diversification is inevitable and profitable. They might be right.

What Customers Actually Need

Let's think about this from a customer perspective.

A frontier AI company or research lab has three core needs:

- Access to compute: They need GPUs and TPUs in quantities large enough to train competitive models.

- Reliability and support: They need infrastructure that runs reliably with technical support when things break.

- Cost efficiency: They need pricing that allows them to operate profitably or sustainably on research budgets.

Adani addresses all three. Compute at scale through 5 gigawatts. Reliability through proven operational track record. Cost efficiency through renewable power and low-cost capital structure.

But there's a fourth need that's often overlooked: ecosystem. Companies want to build in environments with talent, other companies, supporting services, and collaborative opportunities. That's why Silicon Valley remains dominant despite higher costs.

Adani is trying to build ecosystem. Visakhapatnam, Noida, Hyderabad, and Pune aren't Silicon Valley. But they're becoming centers of tech activity. Proximity to infrastructure attracts talent and companies.

Over five years, you could plausibly see an ecosystem form around these hubs. That makes them more valuable than just compute capacity. They become destinations.

Customers weighing options will consider: do I run on AWS in Virginia, Azure in Europe, or Adani in India? For some workloads, India wins on cost. For others, existing integrations matter more. For others, data locality is decisive.

Getting 20-30% of workloads that would otherwise go to U.S. providers would be a massive success for Adani. That's probably the realistic target, not 100% market share.

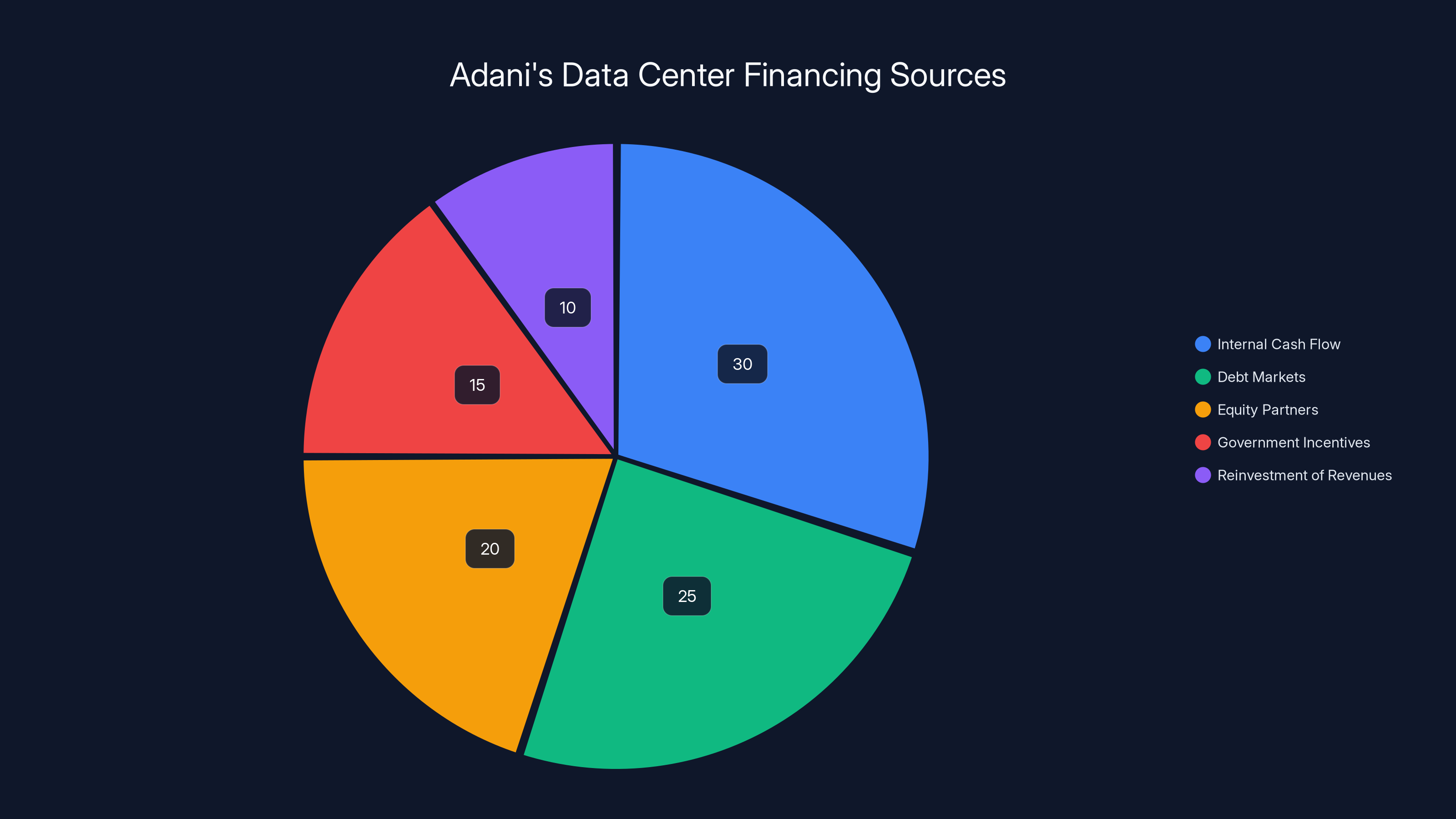

The Financing Question

How is Adani financing this?

They stated

Probably breakdown:

- Internal cash flow: Adani's existing businesses generate cash. Some goes to data centers.

- Debt markets: They can issue bonds. Infrastructure investment is attractive to debt markets.

- Equity partners: Google, Microsoft, and Flipkart probably contribute capital. They have incentive to fund capacity they'll use.

- Government incentives: Indian government might offer tax benefits or subsidies for strategic infrastructure. That's not guaranteed but possible.

- Reinvestment of revenues: As data centers generate cash, some gets reinvested.

The financing is probably the least concerning part. Adani has proven they can access capital markets. Infrastructure investment is attractive to investors. The question is execution, not financing.

There might be delays due to financing constraints, but not project abandonment due to inability to raise capital.

Estimated data shows that Adani's data center financing is diversified, with significant contributions from internal cash flow and debt markets.

How AI Companies Will Benefit

Let's trace through actual benefits for AI companies.

Openness: If you're an Indian AI startup without access to GPUs, Adani's infrastructure solves that immediately. You can train models locally at cost-competitive prices.

Speed: No more waiting months for cloud allocation. You can provision capacity as needed.

Cost: Lower prices because power costs less and there's no middleman markup like cloud providers charge.

Data locality: For companies handling sensitive Indian data, local infrastructure keeps data in India. That's regulatory benefit and risk reduction.

Customization: Direct relationships with infrastructure providers allow customization that cloud providers won't offer.

These are real benefits. They're not negligible. For certain companies, they're decisive.

The risk is infrastructure quality and support. If Adani's facilities are poorly run, customer support is weak, or technical issues are common, that erases the advantages. But Adani's existing track record suggests they take operations seriously.

Challenges That Are Underrated

Some challenges don't get enough attention.

Attrition and competition for talent: Building world-class data centers requires specialized engineers. India doesn't have a large existing pool. Adani will need to train people or recruit from overseas. Both are expensive and slow.

Customer support at scale: Running 5 gigawatts means supporting thousands of customers with diverse needs. Building that support organization is harder than building the infrastructure itself.

Continuous technology refresh: GPU and chip technology evolve rapidly. What's optimal today is obsolete in three years. Refreshing hardware across 5 gigawatts regularly is expensive.

Regulatory complexity: Different Indian states have different rules. Multiple countries might eventually have facilities. Managing regulatory across all of it is complex.

Geopolitical shifts: Things change. What's politically favorable today might not be tomorrow. Regulatory clampdown, capital controls, export restrictions—these are real risks.

None of these are showstoppers, but they're friction points that slow execution and increase costs.

What Success Actually Looks Like

Let's define success clearly.

In 3 years: First facilities operational. 500 megawatts to 1 gigawatt total new capacity online. Twenty to fifty major customers. Positive unit economics but not yet profitable at scale.

In 5 years: Three to four gigawatts total new capacity. Five hundred to one thousand customers. Approaching or at profitability. Ecosystem starting to form around hubs.

In 10 years: Four to five gigawatts operational. Thousands of customers. Profitable, competitive with established players. Demonstrable ecosystem of supporting companies and talent pools.

If Adani hits that trajectory, it's transformative. Global infrastructure landscape has changed. India has a seat at the table. The AI ecosystem is more distributed.

If they fall short significantly—say only 2-3 gigawatts by 2035, or if customer acquisition stalls—it's still meaningful but less transformative. It's still a win, but a smaller one.

The real failure scenario is complete project abandonment or inability to attract customers. That seems unlikely given partner commitments, but it's theoretically possible.

Regional Implications for Asian Tech

This also changes competitive dynamics in Asia.

Singapore and Japan have been building data center hubs. They're expensive but reliable. With Adani providing lower-cost alternative, companies might diversify across regions. Singapore stays premium for ultra-low-latency applications. Adani captures cost-sensitive workloads. Japan remains for specific use cases.

That's actually healthy competition. It forces everyone to optimize and innovate.

China's infrastructure is separate—not really accessible to Western companies due to regulatory and geopolitical constraints. So they're not direct competition. But India providing open infrastructure for global companies changes the calculus compared to a Chinese-only alternative.

Southeast Asia more broadly might see spillover benefits. If India becomes a major AI hub, talent and companies will locate there. Some will expand to Thailand, Vietnam, Philippines. That creates regional development.

Timeline Visualization

Here's how the next decade roughly breaks down:

2025: Announcements, partnerships, planning. No new capacity online yet. 2026-2027: Land acquisition, site development, permits. First construction begins. 2028-2029: First facilities come online. Test workloads begin. Customer acquisition ramps. Probably 300-500 megawatts operational. 2030-2031: Expansion accelerates. Multiple sites operational. Ecosystem starting to form. 1-1.5 gigawatts operational. 2032-2033: Scale ramps. Ecosystem becoming real. Companies relocating. 2-3 gigawatts operational. 2034-2035: Final buildout. Approaching full 5 gigawatts. Established player in global infrastructure.

This is optimistic. Delays and setbacks are likely. Real timeline might be: half a gigawatt by 2028, two gigawatts by 2032, three to four by 2035.

Even that slower timeline is transformative.

Looking Beyond Infrastructure: What This Unlocks

Infrastructure is means, not end.

The real value of Adani's commitment is what it enables. With affordable, local infrastructure:

- Indian startups can compete globally in AI without relocating or paying Western cloud prices.

- Researchers can train models at the scale required for cutting-edge work.

- Educational institutions can teach AI with real resources, not simulations.

- Enterprises can optimize operations with local AI without sending data overseas.

- Talent can stay in India and work on frontier problems instead of exporting themselves.

These are second and third-order effects. They happen over years. But they compound.

Ten years from now, there might be multiple billion-dollar AI companies founded in India and trained on Adani infrastructure. There might be breakthroughs in AI research coming from Indian institutions. There might be a globally competitive AI talent pool that wasn't cultivated in the U.S.

That's the real bet. Not just running data centers, but catalyzing an ecosystem.

The Bigger Picture: Infrastructure as Strategy

Let's zoom out.

For most of the internet era, infrastructure was commoditized. You built software, distributed over public internet. Location didn't matter much. Cost was roughly equal everywhere.

That's changing. AI infrastructure is expensive. It's concentrated. It matters where you build. Who you partner with matters. What power source you use matters.

Companies and countries that understand this are positioning accordingly. Adani does. India does. That puts them ahead of competitors who still think infrastructure is commodity.

Five years ago, this announcement would have been dismissed. "Adani building data centers? Who cares? AWS already dominates."

Today, it's credible and important. That's because infrastructure matters more now. That's a structural shift.

We're probably early in recognizing how important infrastructure becomes as AI develops. This might be the first major shift. But it won't be the last.

Countries and companies that build critical infrastructure—whether data centers, renewable energy, semiconductors, or foundational AI models—will shape the next era. Adani's bet positions India to be one of those shapers.

Conclusion: India's Infrastructure Moment

Adani's $100 billion commitment isn't just a corporate announcement. It's a moment.

For the first time, a non-U.S., non-European company is making a credible, capital-backed commitment to build frontier AI infrastructure at scale. With partnerships from the world's leading AI companies. With a clear path to profitability. With renewable energy underlying the whole thing.

This matters because infrastructure shapes what's possible. It determines who can build, what they can build, and what it costs.

For the next decade, we're going to watch whether Adani can execute. Whether they hit 5 gigawatts. Whether the ecosystem forms. Whether Indian AI companies emerge from this foundation.

I wouldn't bet that execution is perfect. But I would bet that the trajectory is real. Somewhere between year five and year ten, infrastructure that was previously concentrated is going to be distributed. India will have capacity at scale. Companies will have alternatives. The game changes.

That's worth watching.

The details matter—pricing, support, technology choices, timeline. But the direction is clear. India is becoming an AI infrastructure power, not by accident, but by deliberate, capital-backed strategy.

Adani's commitment is the signal that this is real.

FAQ

What is Adani's data center commitment?

Adani Group pledged to invest

How will Adani power these data centers?

All facilities will run on renewable energy through Adani's 30-gigawatt Khavda renewable energy project, which already has 10 gigawatts operational. The company plans to invest an additional $55 billion to expand renewable generation and battery energy storage, enabling 24/7 carbon-neutral power delivery for the data centers.

What major partners is Adani working with on this infrastructure?

Adani has partnerships with Google, Microsoft, and Flipkart. These companies are directly involved in developing new AI data center facilities in Visakhapatnam, Noida, Hyderabad, and Pune. The partnership with Flipkart specifically focuses on e-commerce infrastructure supporting billions of customer transactions.

Why is India's renewable energy advantage significant for AI infrastructure?

Renewable power from Adani's Khavda project costs significantly less than conventional commercial electricity rates, often under

How much capacity does 5 gigawatts actually represent for AI workloads?

Five gigawatts of power supports approximately 2 million GPU equivalents, assuming standard conversion rates of 300-500 high-end GPUs per megawatt. This capacity is sufficient to train dozens of frontier AI models simultaneously or handle billions of inference queries daily, making it comparable to a major cloud provider's global AI capacity.

What is the realistic timeline for this infrastructure to come online?

Realistically, initial facilities will begin operations in 2028-2029 with 300-500 megawatts of capacity. By 2032-2033, expect 2-3 gigawatts operational. The full 5-gigawatt target by 2035 is optimistic and subject to execution delays, but even reaching 3-4 gigawatts would be transformative for global AI infrastructure distribution.

Why does Adani's announcement matter for global AI competition?

This represents the first credible, capital-backed commitment from a non-U.S., non-European company to build frontier AI infrastructure at scale. It signals that infrastructure for AI development is becoming distributed globally rather than concentrated in the U.S., which changes competitive dynamics and creates new options for companies and researchers.

What industries or companies would benefit most from this infrastructure?

Indian startups training AI models, multinational companies seeking local infrastructure for data sovereignty, enterprises optimizing operations with AI, and research institutions conducting large-scale AI research would all benefit from lower costs and local infrastructure access. Additionally, companies serving billion-user markets in India would gain latency and regulatory advantages.

What are the main execution risks for this project?

Major risks include supply chain complexity for critical components, acquiring engineering talent in a competitive global market, navigating regulatory requirements across Indian states, financing challenges if capital markets shift, and recruiting diverse customer workloads. However, Adani's existing 2-gigawatt capacity and company track record reduce but don't eliminate these risks.

How does Adani's infrastructure commitment compare to other countries' initiatives?

China has massive domestic capacity but it's largely inaccessible to Western companies. Europe is building through initiatives like GAIA-X but progresses slower due to regulatory complexity. Middle Eastern countries invest heavily for regional focus. Adani's approach combines Chinese-scale capital with openness to global partnerships, making it potentially more effective at creating a globally distributed infrastructure ecosystem.

Use Case: Automate infrastructure reports and documentation for data center operations and capacity planning.

Try Runable For Free

Key Takeaways

- Adani's $100B commitment through 2035 targets 5 gigawatts of AI-specialized data center capacity across India with partnerships from Google, Microsoft, and Flipkart

- Renewable energy advantage: Adani's power costs 80-120 commercial rates, creating 70% cost reduction on largest operational expense

- Ecosystem multiplier: 150B from partners, creating $250B total AI infrastructure ecosystem by 2035

- Geopolitical significance: First major credible commitment from non-U.S./European company to build frontier AI infrastructure at scale, distributing infrastructure away from U.S. concentration

- Realistic timeline: 500MW-1GW online by 2028-2029, 2-3GW by 2032, targeting full 5GW by 2035 despite likely execution delays and challenges

- 5 gigawatts supports approximately 2 million GPU equivalents, enabling dozens of frontier AI model training runs simultaneously or billions of daily inference queries

Related Articles

- India AI Impact Summit 2025: Key News, Investments, and Industry Shifts [2025]

- OpenClaw Founder Joins OpenAI: The Future of Multi-Agent AI [2025]

- OpenAI Hires OpenClaw Developer Peter Steinberger: The Future of Personal AI Agents [2025]

- Blackstone's $1.2B Bet on Neysa: India's AI Infrastructure Revolution [2025]

- India's 100M ChatGPT Users: What It Means for AI Adoption [2025]

- Anthropic's $14B ARR: The Fastest-Scaling SaaS Ever [2025]

![Adani's $100B AI Data Center Bet: India's Infrastructure Play [2025]](https://tryrunable.com/blog/adani-s-100b-ai-data-center-bet-india-s-infrastructure-play-/image-1-1771335607742.jpg)