Introduction: India's AI Moment Is Here

India just became the center of the global AI conversation. Seriously.

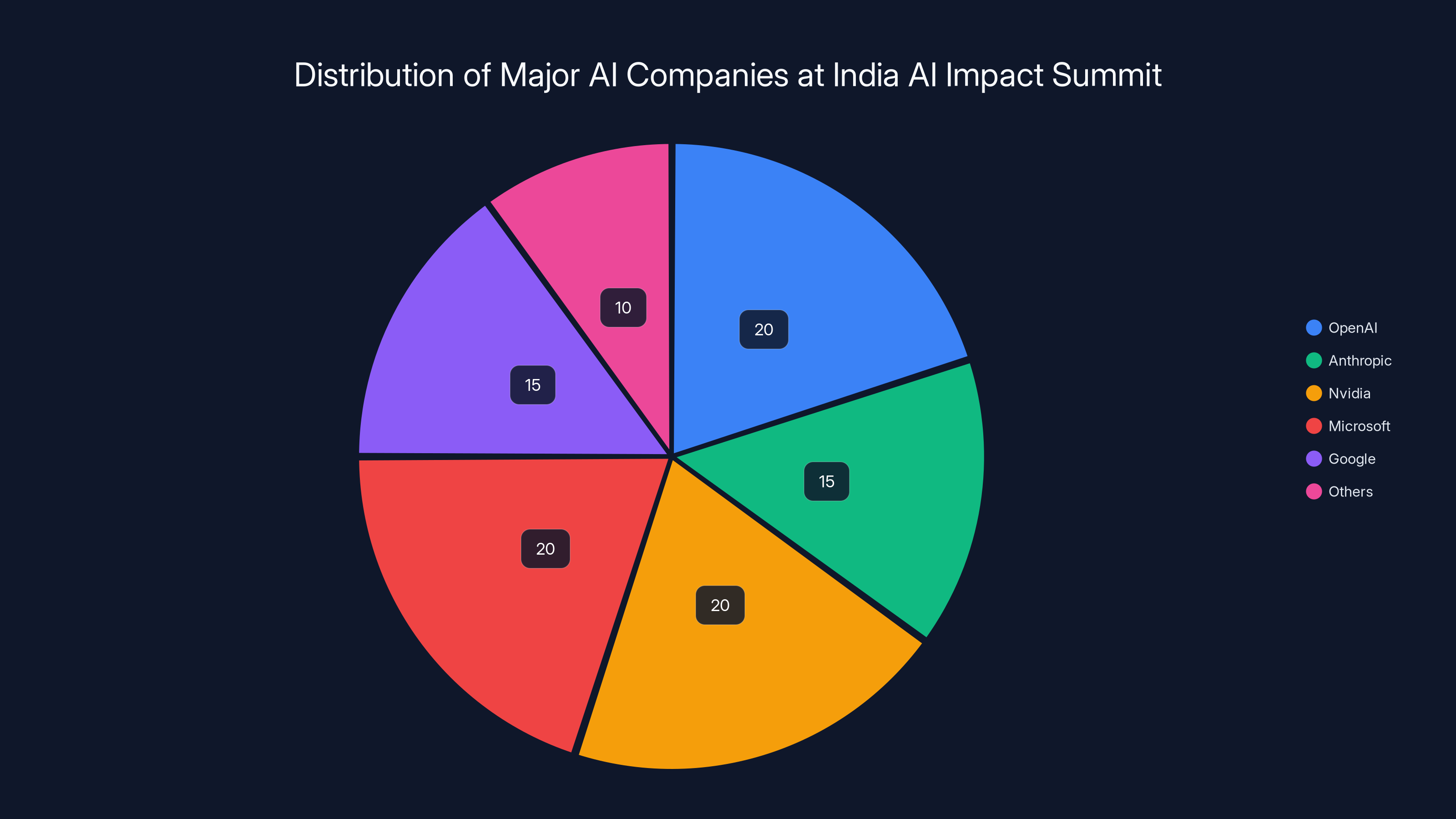

This week, the country is hosting a four-day AI Impact Summit that's drawing some of the most influential people in technology. We're talking about Sundar Pichai from Alphabet, Sam Altman from OpenAI, Dario Amodei from Anthropic, Demis Hassabis from Google DeepMind, and a long list of executives from Microsoft, Google, Nvidia, and Cloudflare. That's basically every major AI player showing up.

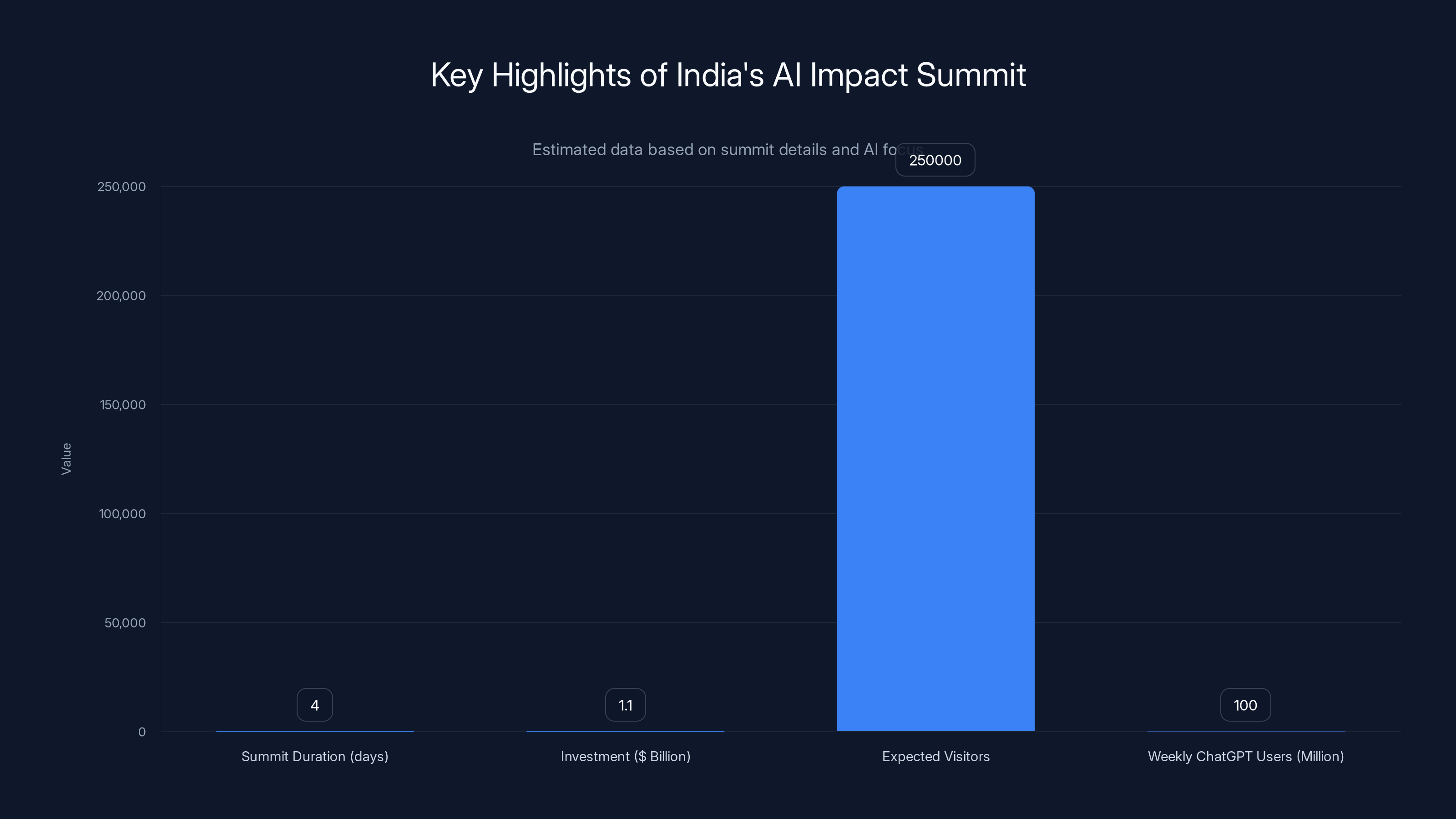

But here's what makes this moment different. This isn't just another tech conference. India is making a calculated, massive bet on becoming an AI superpower. The government has earmarked $1.1 billion for a state-backed venture capital fund focused on AI and advanced manufacturing startups. Prime Minister Narendra Modi is scheduled to speak alongside French President Emmanuel Macron. They're expecting 250,000 visitors.

What's happening in India right now is a blueprint for how emerging markets are competing in the AI race. And the numbers tell a story that Western tech companies can't ignore.

The summit is revealing something crucial about the global AI landscape. While everyone talks about AI regulation, data centers, and compute power in San Francisco and Brussels, the real growth story is happening in South Asia. India isn't just adopting AI tools—it's building the infrastructure, companies, and policies to compete globally.

Let's break down what's actually being announced, what it means for the AI industry, and why you should care about what's happening at this summit.

TL; DR

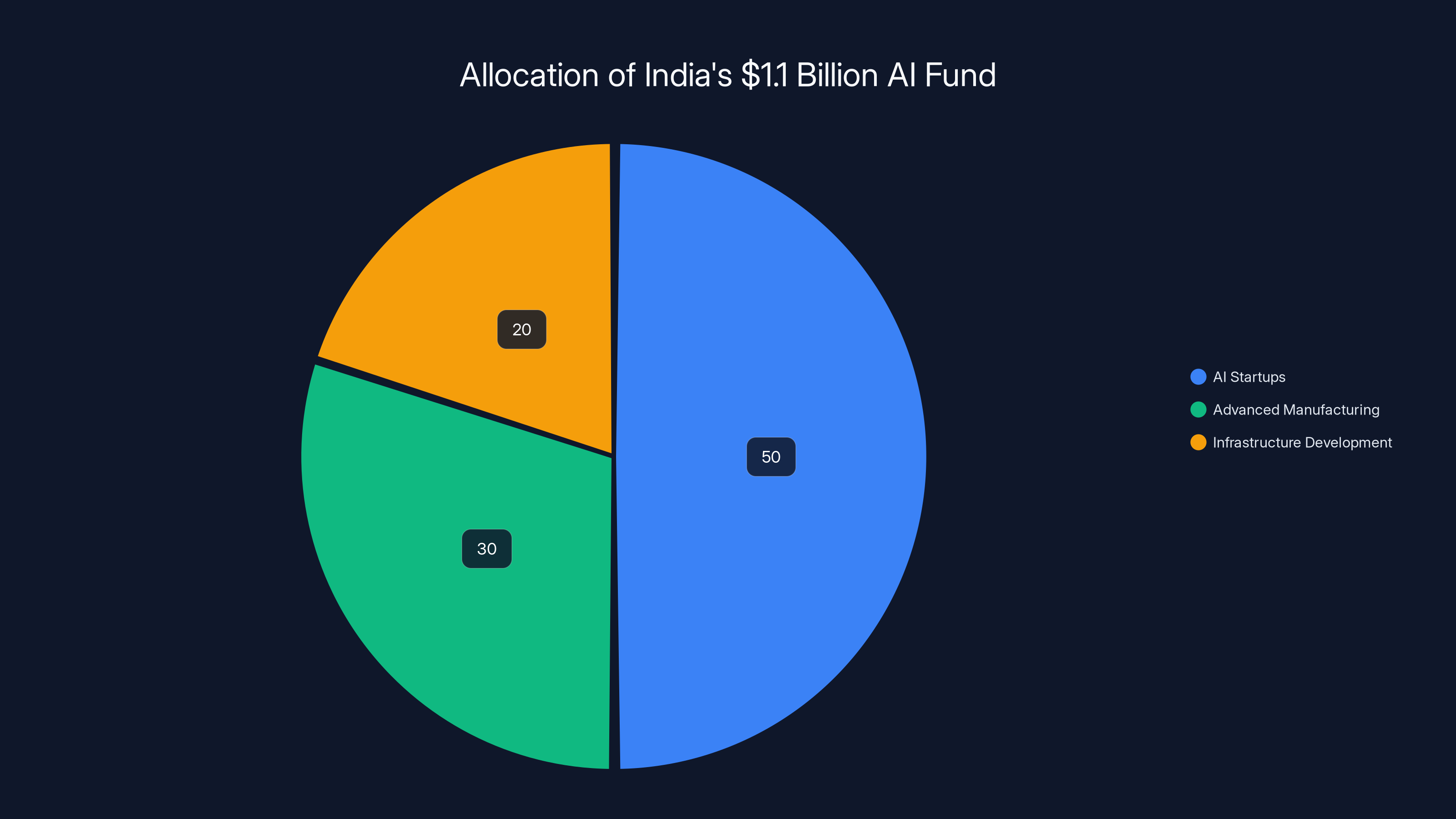

- $1.1B Government Fund: India launches state-backed VC fund for AI startups, signaling serious long-term commitment to building domestic AI companies

- 100M+ Chat GPT Users: India is Chat GPT's second-largest market and largest student user base, showing massive AI adoption already underway

- Major Private Investment: Blackstone takes majority stake in Indian AI startup Neysa for $600M equity round, plans to deploy 20,000+ GPUs

- Infrastructure Partnerships: AMD partners with TCS to build rack-scale AI infrastructure, accelerating local data center capabilities

- IT Services Shift: Indian IT companies pivoting away from job creation to profit focus amid AI disruption concerns

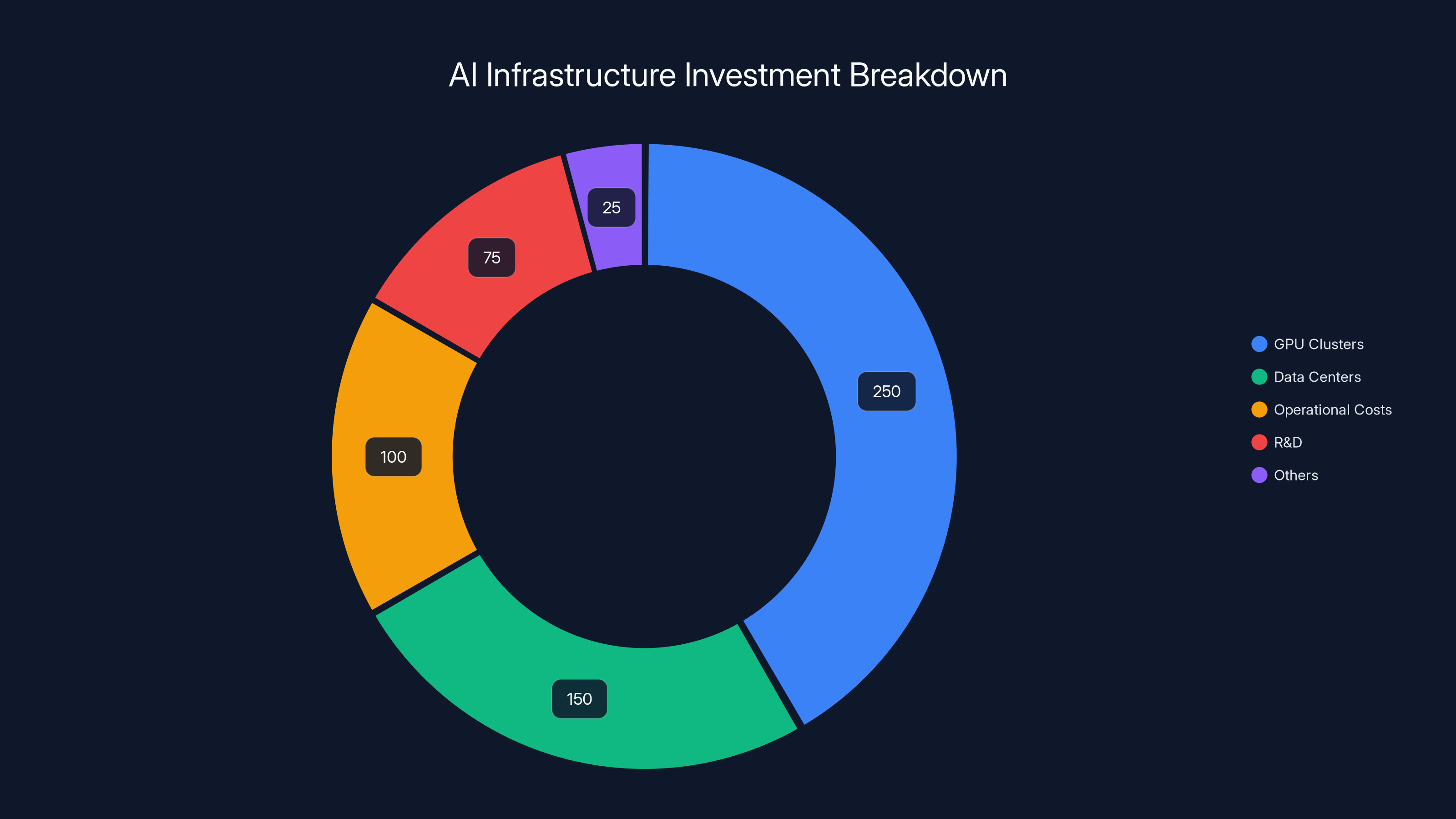

Estimated data shows GPU clusters receiving the largest share of Neysa's $600M investment, highlighting the focus on scalable compute capacity.

India's $1.1 Billion AI Bet: What Government Funding Really Means

Let's start with the headline that matters most: India is committing $1.1 billion to a state-backed venture capital fund. This isn't venture capital as Silicon Valley knows it. This is a government-backed institution specifically designed to invest in AI and advanced manufacturing startups across the country.

Here's why this announcement is bigger than it sounds on the surface.

Government-backed VC funds work differently than traditional venture capital. They're patient capital. They're not trying to flip companies in five years for 10x returns. They're building an ecosystem. When a government commits $1.1 billion to AI specifically, it's saying: "We're not betting on one or two companies. We're building an entire industry."

Look at what China did with semiconductor manufacturing in Shenzhen in the 1980s, or what South Korea did with semiconductors and memory chips in the 1990s. Government backing created the conditions for entire industries to flourish. India's doing the same thing with AI, just 30 years later.

The fund's structure matters too. By focusing on both AI and advanced manufacturing, India is hedging its bets. AI is critical, obviously. But advanced manufacturing—that's the physical infrastructure that supports everything else. It's the data centers, the chip packaging, the cooling systems. You can't build an AI industry on imports alone.

What's particularly smart about India's approach is the timing. Most countries are just starting to understand they need AI infrastructure. India is moving first among major emerging markets. By the time other countries realize what's happening, India will already have built companies, trained talent, and created regulatory frameworks.

The real impact won't hit for three to five years. That's when you'll see the first wave of Indian AI companies scaling internationally. And they'll have built on government backing that insulated them from the crazy burn rates and premature scaling that killed many Western AI startups.

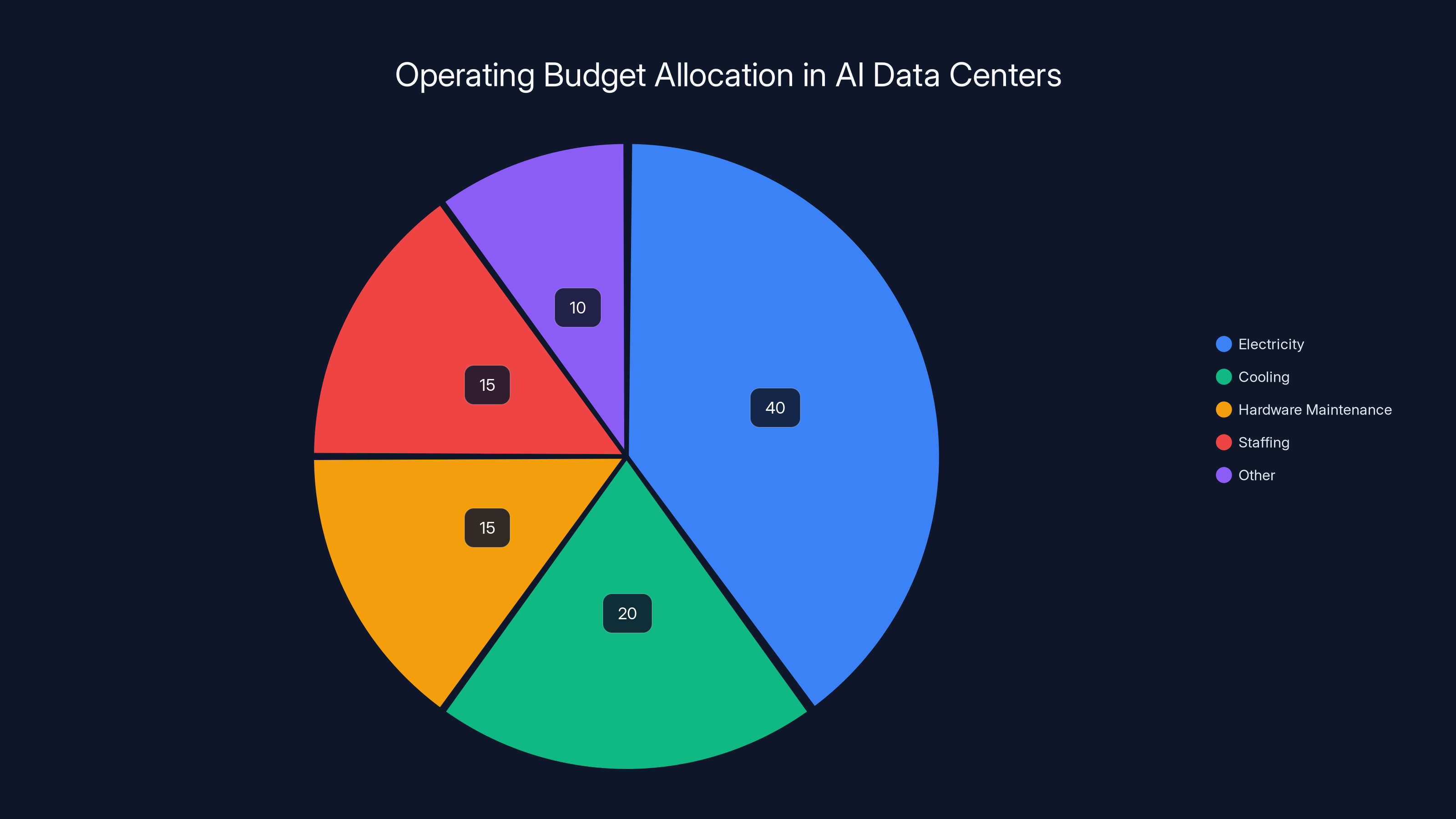

Electricity can account for 30-50% of a data center's operating budget. Reducing power consumption by 10% can significantly impact profitability. (Estimated data)

Chat GPT's Second-Largest Market: The Numbers Behind India's AI Adoption

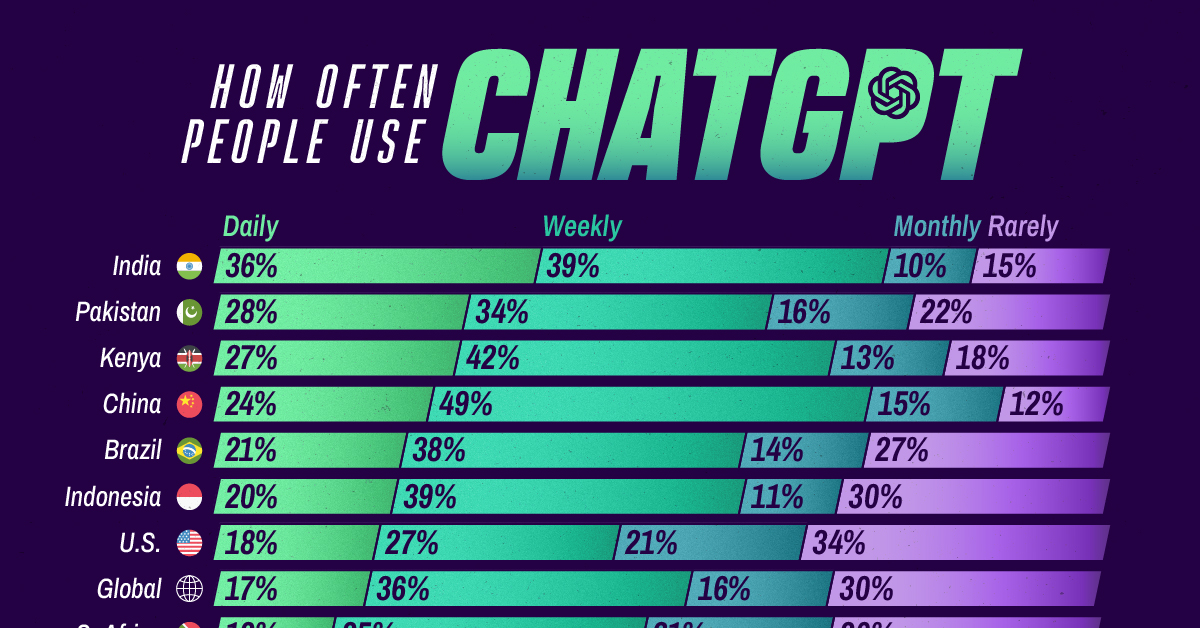

Sam Altman dropped a number at the summit that should make every AI executive in the world pay attention: 100 million weekly active Chat GPT users in India.

Let that sink in. That's second only to the United States. But here's the part that's even more revealing: Indians account for the largest student population using Chat GPT globally.

This isn't a passive user base. This is young people, in schools and colleges, fundamentally changing how they learn and work with AI. That's generational. These students will graduate expecting AI tools as part of their standard toolkit. They'll start companies, get jobs at major firms, and rebuild entire industries with AI as a baseline assumption.

Let's do some math here. India has a population of about 1.4 billion people. If 100 million are weekly active Chat GPT users, that's roughly 7% of the population. The United States has about 330 million people. If we assume similar or slightly higher adoption, that's maybe 150-200 million U.S. users.

The gap looks huge in penetration rates, but here's the thing: India's growth rate is much steeper. The U.S. market is already saturated. India's is just getting started. Add another year, maybe two years of growth at current trajectories, and India overtakes the U.S. in absolute numbers of Chat GPT users.

What does this mean for the broader AI economy? It means the market for AI is no longer just San Francisco, New York, and London. It's not even really Western anymore. India has 1.4 billion people entering the digital economy at scale. That's demand for AI tools that will dwarf current usage by an order of magnitude.

This also explains why every major AI company sent executives to this summit. OpenAI, Anthropic, Google, Microsoft—they're not there just to be nice. They're there because India represents their largest growth opportunity in the next five years. Getting into the market early, building relationships with government, and understanding local needs—that's the game.

For students in India using Chat GPT, this shift happens almost invisibly. They're just using a tool that works. They don't think about it as a historic moment. But it is. Their generation will have completely different skills and expectations than the previous one. They'll build different companies, solve different problems, and create different opportunities.

The Neysa Deal: What a $600M Investment Signals About AI Infrastructure Plays

Blackstone taking a majority stake in Indian AI startup Neysa for $600 million in an equity fundraise is huge. But the size of the check is almost less important than what it reveals about where capital is flowing in the AI market.

Neysa's focus is on building and operating AI infrastructure—specifically, managing GPU clusters for companies that need compute power but don't want to manage it themselves. Think of them as a services layer for AI infrastructure.

Blackstone, if you don't follow real estate and infrastructure investing, is one of the largest capital allocators in the world. They manage trillions of dollars. When they deploy $600 million into a company like Neysa, they're not making a venture capital bet. They're making a long-term infrastructure investment.

Here's what this means: Blackstone believes that AI infrastructure in India is a bet-the-company opportunity. They're not investing in the software company. They're investing in the pipes, the power, the buildings, and the people who run the infrastructure.

This is exactly how capital concentrated in the hands of mega-firms like Blackstone thinks about emerging markets. They look for bottlenecks. What's the scarcest resource that everyone needs but can't build themselves? In India's AI ecosystem, that resource is reliable, managed compute capacity at scale.

Neysa's plan to raise another $600 million in debt and deploy more than 20,000 GPUs tells you everything about scale expectations. Twenty thousand GPUs is serious infrastructure. That's not a pilot. That's a production-grade data center operation that can support thousands of companies and projects simultaneously.

For context, 20,000 NVIDIA A100 or H100 GPUs represents somewhere between

What makes this interesting is the debt structure. Raising $600 million in debt against AI infrastructure is notoriously difficult in most markets. Lenders worry about obsolescence, technical risk, and whether the company using the infrastructure will stay in business.

But Blackstone taking a majority stake changes everything. When Blackstone owns the company, lenders feel much more comfortable. Blackstone has a track record managing long-term infrastructure assets. They're not going to suddenly shut down the data centers in three years. That changes debt pricing and availability.

For India's AI economy, this deal is transformative. Having local, well-capitalized infrastructure providers means Indian AI companies don't have to rely on AWS, Google Cloud, or Azure for compute. They can build on top of Neysa. That creates independence and keeps more capital flowing within the country.

Estimated data shows a balanced presence of major AI companies at the India AI Impact Summit, highlighting diverse participation from global tech leaders.

Teachers' Venture Growth, TVS Capital, and the Investor Coalition Behind Indian AI

The Neysa fundraise brought together some of India's most sophisticated investors. Teachers' Venture Growth, TVS Capital, 360 ONE Asset, and Nexus Venture Partners all participated. This investor coalition matters more than you might think.

These aren't random money managers. Teachers' Venture Growth is tied to pension funds and long-term capital. TVS Capital has deep roots in Indian manufacturing and infrastructure. 360 ONE Asset is a wealth manager for ultra-high-net-worth individuals. Nexus Venture Partners is one of India's most successful venture firms.

What you're looking at here is a convergence of long-term capital, manufacturing expertise, and venture experience. That's a powerful combination. It means the deal isn't just about the money. It's about bringing strategic expertise and networks into Neysa that will help them scale.

When pension funds participate in AI infrastructure deals, it signals maturity. Pension funds are conservative. They don't invest in moonshots. They invest in infrastructure plays that will generate steady returns for the next two decades. If Teachers' Venture Growth is comfortable putting pension money into AI infrastructure in India, that's a strong signal about the sector's fundamentals.

The fact that traditional wealth managers like 360 ONE Asset are participating also suggests that India's ultra-high-net-worth individuals are convinced AI infrastructure is where growth is happening. These investors see capital flows globally. When they concentrate on Indian AI infrastructure, it means they think India's opportunity is bigger than opportunities elsewhere.

C2i's $15 Million Series A: The Unglamorous Infrastructure That Powers AI

While everyone was paying attention to Neysa's

Here's why: Data centers are power-hungry machines. A typical modern AI data center consumes anywhere from 10 to 30 megawatts of electricity. That's enough to power a small city. When you're building 20,000 GPUs, you're not just solving the GPU problem. You're solving the power problem, the cooling problem, and the energy management problem.

C2i's focus on power solutions means they're solving one of India's most critical constraints: reliable, efficient power distribution to data centers. India's electrical grid is improving rapidly, but there are still challenges with consistency and efficiency. Companies like C2i that build power management solutions are essentially removing a major bottleneck.

Peak XV, Yali Deeptech, and TDK Ventures funding C2i tells you something about where India's technology investors are placing their bets. They're not just betting on AI software companies. They're betting on the infrastructure and support systems that will make AI companies viable.

Think of C2i like this: If Neysa is building the pipes that deliver compute, C2i is building the power station that fuels those pipes. Both are essential. Both are unglamorous. But both determine whether the entire ecosystem works.

For India's AI infrastructure story, these deals matter because they show that entrepreneurs are solving real, specific problems that will unlock growth elsewhere. You can't build a world-class AI data center if you don't have companies solving power distribution, cooling, and energy management. India's now building those companies.

India's $1.1 billion fund is estimated to allocate 50% to AI startups, 30% to advanced manufacturing, and 20% to infrastructure development. Estimated data.

HCL CEO's Stark Warning: IT Services Companies Are Abandoning Job Creation

This one cut through all the celebration. HCL's CEO Vineet Nayyar said something that sounded almost heretical in the context of an Indian tech company: "Indian IT companies will focus on turning profits and not being job creators."

Let that statement hang for a moment. For decades, Indian IT services companies like HCL, Infosys, TCS, and Wipro have been engines of job creation. They've hired millions of people, trained them, and created a massive labor pool that kept India's unemployment low and provided middle-class opportunities to people across the country.

But AI is changing that calculus entirely.

When you can do the same work with AI assistance that previously required multiple humans, the business model breaks. You don't need as many people. The profit margins might actually be higher with fewer employees and more AI tooling. From a shareholder perspective, that's a win.

But from a societal perspective, that's a major shift. If India's largest software companies are explicitly saying they're pivoting away from job creation toward profitability, that's a statement about where AI is headed. It's not just a tool. It's a replacement.

The Indian IT stock market reacted poorly to these comments, which tells you how serious investors are taking them. When executives explicitly say job creation isn't a priority anymore, stocks dip because people recognize this is a structural shift, not a temporary slowdown.

But here's the nuance that often gets missed: This doesn't mean Indian IT services companies are disappearing. It means they're transforming. They'll likely be smaller by headcount but much more valuable. The people who work there will need to be more skilled, more specialized, and more AI-literate.

For India as a country, this creates pressure to retrain workers faster than probably ever been attempted at scale. If millions of people are working in IT services with job security, and that security suddenly evaporates, where do they go? They need retraining into new fields. The government and educational institutions have maybe three to five years to figure this out before the problem becomes acute.

Nayyar's comments are actually a gift of honesty in an industry that usually dances around these topics. He's saying out loud what everyone's thinking. And that clarity, while uncomfortable, is the first step toward actually solving the problem.

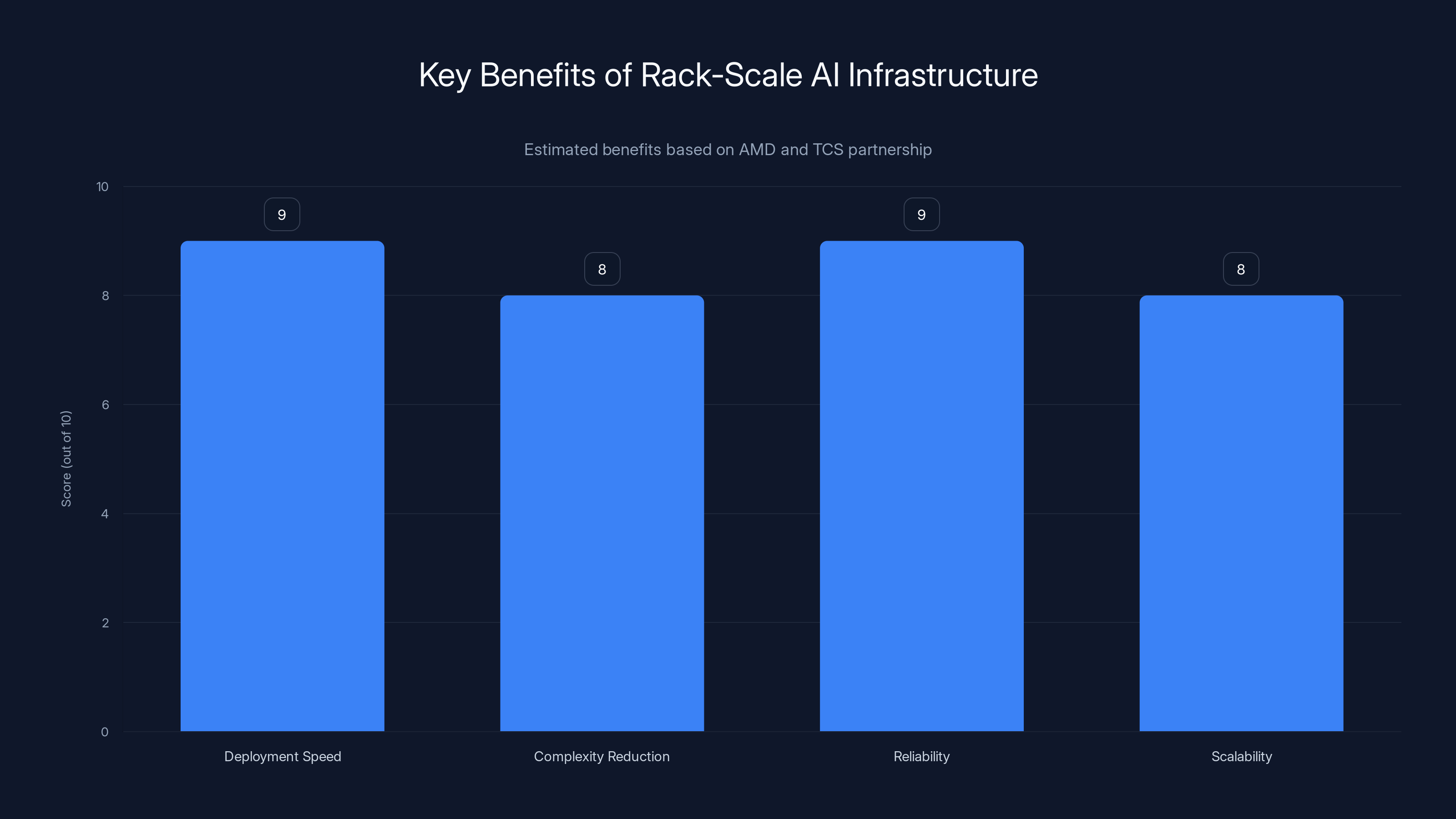

AMD and TCS Partner: Building Rack-Scale AI Infrastructure Together

AMD and Tata Consultancy Services partnering to build rack-scale AI infrastructure based on AMD's Helios platform represents a different kind of AI news than the funding announcements. This is about localized manufacturing and infrastructure capability.

Let's unpack what this means.

Rack-scale infrastructure refers to complete, integrated systems that can be deployed as a unit. Instead of building data centers server-by-server, you build them rack-by-rack. Each rack is a complete, tested system ready to deploy. This matters because it reduces complexity, speeds up deployment, and improves reliability.

AMD's Helios is specifically designed as a modular platform. It uses AMD's EPYC processors and accelerators in configurations that can be tailored to different workloads. TCS, with its massive IT services and infrastructure experience, can take those designs and deploy them at scale across Indian data centers.

What makes this partnership significant is the independence angle. Historically, India has relied on Western companies for critical technology and infrastructure. AMD and TCS working together creates a pathway to building more self-sufficient infrastructure in India. It's not that AMD is moving manufacturing to India overnight. It's that they're working with Indian companies to integrate systems and build local expertise.

For Helios specifically, this partnership means the platform gets tested and validated by TCS at massive scale. TCS moves billions of dollars through infrastructure every year. When they deploy Helios at scale, they'll surface real-world issues, optimization opportunities, and use cases that help AMD improve the product.

On the geopolitical front, this is also interesting. China has been investing heavily in making its semiconductor and infrastructure supply chains independent from U.S. companies. India's doing something similar, but with partnerships rather than isolation. AMD's helping India build capability while also selling AMD products. That's more collaborative than a purely nationalist approach, but it achieves some of the same goals.

The long-term play here is that India wants to reduce dependence on cloud providers like AWS, Google Cloud, and Azure for critical AI infrastructure. By building local capability and partnerships, Indian companies can deploy AI infrastructure without routing everything through Western cloud providers. That has implications for data sovereignty, latency, cost, and independence.

Rack-scale AI infrastructure offers significant benefits, including faster deployment, reduced complexity, improved reliability, and enhanced scalability. (Estimated data)

The Geopolitical Subtext: India's AI Independence Play

Everything happening at this summit sits within a larger geopolitical context. The U.S., Europe, and China are all racing to build AI capability and ensure they're not dependent on other countries for critical infrastructure.

India's making its own play. It's not trying to replicate what the U.S. or China have done. It's building something different—a ecosystem that leverages India's advantages: massive population, young demographics, English-speaking workforce, and democratic governance.

By funding infrastructure companies, partnering with global companies like AMD, and creating venture capital vehicles, India is ensuring that it won't be a consumer of AI. It'll be a builder.

This matters because the next wave of AI applications will be built for emerging markets. If you want to build AI for agriculture in Africa, fintech for Southeast Asia, or education for Latin America, you probably want to build that in a country that understands these markets. India, with its experience building technology for its own diverse, emerging-market population, has an advantage.

The government backing is particularly strategic. It creates patient capital for companies that might not hit venture capital returns for a decade. It allows long-term bets on infrastructure and capability-building rather than just software optimization.

Why This Summit Matters: The Broader Implications

The India AI Impact Summit isn't just a conference. It's a statement that India is a serious player in the global AI economy.

Ten years ago, India was seen as a place to outsource IT services. Five years ago, it was becoming known for startup activity and venture capital. Today, it's positioning itself as an AI infrastructure and capability hub.

That shift doesn't happen accidentally. It happens because of deliberate choices: government funding, private capital deployment, and entrepreneur focus. Everything being announced at this summit is part of that strategy.

The attendance of global leaders is also significant. When Sam Altman comes to India, he's not doing it because he has time. He's doing it because OpenAI sees India as critical to its future. Same with every other executive at the summit.

They see 100 million weekly active Chat GPT users. They see a government committed to AI. They see private capital flowing into AI companies. They see an education system starting to integrate AI into how students learn. And they're thinking: this is where growth is happening.

For Western AI companies, India is essential not just as a market but as a source of talent and innovation. For Indian companies, the moment is now. In five years, the infrastructure will be built, the companies will be established, and the competitive landscape will be set. The opportunity window is still open, but it won't stay open forever.

India's AI Impact Summit highlights include a $1.1 billion investment and 250,000 expected visitors, showcasing its strategic focus on AI. (Estimated data)

What Happens Next: The 18-Month Timeline to Watch

Over the next 18 months, here's what to watch:

Months 1-6: The state-backed AI fund starts deploying capital. First batch of funded companies will be announced. Neysa and other infrastructure companies will start building out their operations. TCS and AMD will announce specific deployment timelines and target data center locations.

Months 6-12: First Indian AI companies backed by the government fund will launch products or services. Neysa's GPU capacity will hit meaningful scale—probably 5,000-10,000 GPUs operational. Global companies will announce localized AI products built for the Indian market.

Months 12-18: The first real test will come when funded Indian AI companies try to scale beyond India. Will they succeed in global markets? Also, first layoffs at IT services companies will become visible as AI-driven productivity gains kick in. The talent transition challenge becomes real.

If India pulls this off—which isn't guaranteed—it becomes the first major emerging market to build an independent AI ecosystem while staying connected to global AI development. That's historically significant.

The Talent Question: Can India Retrain Fast Enough?

All these infrastructure investments and government funding don't matter if India doesn't have talent to build on them.

Here's the good news: India has millions of young people entering the workforce every year. The education system has proven it can scale training quickly. Companies like Google and Microsoft have massive training operations in India already.

Here's the challenge: Retraining millions of IT services workers into AI-focused roles is different from initial training. These are people with 10-15 years of experience, set in their ways, with families depending on their salary. Getting them to reskill in something as rapidly evolving as AI is hard.

The $1.1 billion government fund might actually need to fund retraining and education as much as it funds companies. If Indians working in IT services lose jobs without having alternative skills, you get social disruption and brain drain. Both are bad for India's AI ecosystem.

Smart policy would pair the $1.1 billion in venture capital with substantial education and retraining investment. Create pathways for IT services workers to transition into AI roles. That's not sexy venture capital, but it's how you actually build sustainable ecosystem change.

India vs. China vs. U.S.: The Three-Way AI Race

India's moves need to be understood in context of what the U.S. and China are doing.

The U.S. is trying to maintain dominance in AI research, foundational models, and software. Companies like OpenAI, Anthropic, and Google are building the core technology. The government is trying to maintain semiconductor supply chain security and export controls to limit China's access.

China is building its own AI ecosystem with homegrown companies like Baidu, Alibaba, and ByteDance. It's investing in semiconductor manufacturing and trying to reduce dependence on Western chips. It's also building AI applications tailored to its domestic market, from surveillance to e-commerce.

India is a different play. It's not trying to build foundational models or compete with OpenAI and Google. It's trying to build infrastructure and applications that serve its own massive population first, then scale globally. It's leveraging its advantages in software engineering, startup mentality, and population scale.

What happens if India succeeds? You get a world where AI isn't just American and Chinese. It's actually plural. That changes incentives for everyone. It means AI policy gets discussed globally instead of just in Washington and Beijing. It means AI applications get built for the global majority, not just wealthy markets.

Why Investors Are Betting on India's AI Ecosystem

Blackstone, Peak XV, Nexus Venture Partners, and the other investors flowing capital into Indian AI companies are betting on growth. But what growth exactly?

Market growth: India's AI market is probably less than 2-3% of global AI market value today. Within five years, it could be 8-10%. That's a 3-5x expansion.

Talent growth: Engineers trained in India are becoming increasingly competitive globally. As they get more experience with AI systems, that advantage compounds.

Infrastructure growth: Building data center capacity and infrastructure before it's fully needed is cheaper than building it during peak demand. Investors get land, power, and real estate at today's prices, then sell services at tomorrow's higher prices.

Policy growth: Government support creates certainty. When investors know the government is committed to AI, they take longer-term, larger bets.

For capital allocators like Blackstone, betting on Indian AI infrastructure is similar to betting on Indian data centers 15 years ago or telecom infrastructure 20 years ago. It's a secular growth trend powered by fundamental demand that won't go away.

The Regulatory Question: How Will India Handle AI Governance?

One thing that's notably absent from summit announcements is discussion of AI regulation and governance.

India's been silent on AI regulation compared to Europe's AI Act or the U.S.'s emerging regulations. That's probably strategic. By not regulating too early, India lets companies innovate faster than they would in Europe or under strict U.S. rules. That speeds up capability development.

But eventually, India will need to govern AI. How it chooses to do that will matter enormously. Will it follow Europe's precautionary approach and regulate strictly? Will it follow the U.S.'s lighter-touch approach? Will it create its own regulatory framework?

The answer will determine what kind of AI ecosystem emerges. Strict regulation creates certainty but limits experimentation. Light-touch regulation enables innovation but creates risk.

My prediction: India does a hybrid approach. It regulates the highest-risk areas (surveillance, military applications, critical infrastructure) strictly, while leaving most commercial AI relatively free. That balances enabling innovation with addressing public concern.

The Education Angle: Generational Shift in AI Literacy

Remember that statistic about Indians being the largest student population using Chat GPT? That's not an accident. It's a conscious or unconscious shift in how education is happening.

A high school student in Delhi today who uses Chat GPT for homework is learning differently than one from five years ago. They're learning that AI is a tool, not magic. They're learning to work with AI, not against it. They're learning to prompt, iterate, and think about what AI can and can't do.

That becomes the baseline. When these students graduate and enter the workforce, they won't have the adoption lag that older workers have. They'll assume AI is part of how you work.

For India's AI ecosystem, that's a huge advantage. You're building on a foundation of millions of young people who already think in AI-native ways.

Education is also where much of the government funding probably needs to go. Not just venture capital for companies, but scholarships, grants, and programs to get more Indians trained in AI fundamentals, data science, machine learning operations, and related fields.

Long-Term Vision: Where India's AI Ecosystem Is Heading

Look out five to ten years. If India executes on what's being announced at this summit, here's what the landscape probably looks like:

Domestic companies: 20-30 Indian AI companies that are profitable and scaling internationally. These aren't trying to beat OpenAI. They're solving specific problems in industries where India has advantages: agriculture, fintech, healthcare, education.

Infrastructure providers: 5-10 world-class Indian companies providing AI infrastructure, data center services, and computational resources. They're reliable, cost-competitive, and preferred by companies building for emerging markets.

Global talent hub: India becomes a primary destination for AI talent globally. Not because it's the cheapest, but because it has the best infrastructure, capital, and opportunities. Engineers choose to work in India on AI problems because that's where the action is.

Policy influence: India becomes a significant voice in global AI policy discussions. Not a rule-maker like the U.S. or EU, but an important perspective from the global majority.

That's ambitious. But everything being announced at this summit is in service of that vision.

FAQ

What is the India AI Impact Summit?

The India AI Impact Summit is a four-day conference being held in India this week that brings together executives from major AI labs, technology companies, government officials, and investors to discuss AI development, policy, and investment opportunities in India. The summit is expecting 250,000 visitors and includes attendance from leaders of OpenAI, Anthropic, Nvidia, Microsoft, Google, and other major technology firms.

Why is India hosting this AI summit?

India is hosting the summit to position itself as a major player in the global AI economy and to attract international investment in its AI ecosystem. The government wants to signal commitment to AI development, showcase investment opportunities, and build relationships with global technology leaders that will drive local innovation and economic growth.

How many Chat GPT users does India have?

According to OpenAI CEO Sam Altman speaking at the summit, India has more than 100 million weekly active Chat GPT users, making it the second-largest market after the United States. Additionally, Indians represent the largest student population using Chat GPT globally, indicating significant adoption of AI tools among younger users.

What is the $1.1 billion Indian AI fund?

The $1.1 billion fund is a state-backed venture capital fund created by India's government specifically to invest in artificial intelligence and advanced manufacturing startups across the country. The fund represents India's commitment to building a domestic AI ecosystem and supporting entrepreneurs developing AI solutions tailored to the Indian market and global opportunities.

What does the Blackstone and Neysa deal mean for AI infrastructure in India?

How are Indian IT services companies responding to AI disruption?

Indian IT services companies are shifting their focus from job creation to profitability, according to statements from executives at the summit. HCL's CEO stated that Indian IT companies will prioritize profits over hiring, reflecting concerns that AI automation will reduce demand for traditional IT services labor. This marks a significant shift in the industry's historical role as a major employer in India.

What is the significance of the AMD and TCS partnership?

The partnership between AMD and Tata Consultancy Services to develop rack-scale AI infrastructure based on AMD's Helios platform builds local AI infrastructure capability in India. This partnership reduces dependence on Western cloud providers and creates an opportunity for India to build sovereign, scalable AI infrastructure while also testing and validating AMD technology at massive scale through TCS's operations.

Why is India's AI market growing so rapidly?

India's AI market is growing rapidly due to several factors: a massive young population with digital access, high adoption of AI tools like Chat GPT among students, government commitment through policy and funding, abundant engineering talent, significant venture capital inflow, and a large domestic market that serves as a testing ground for AI applications before global scaling. Additionally, India's experience building technology for its diverse, emerging-market population gives it advantages in creating AI solutions for global emerging markets.

What are the risks to India's AI ecosystem development?

Potential risks include the challenge of retraining millions of IT services workers as automation displaces jobs, potential talent brain drain to Western AI hubs, regulatory uncertainty, geopolitical tensions affecting technology imports, dependence on Western companies for foundational models and chips, and the possibility that infrastructure investments don't generate sufficient local AI application development to justify the spending.

How does India's AI strategy differ from China's and the U.S.'s?

The U.S. focuses on foundational AI research and maintaining dominance in core models while controlling chip exports. China emphasizes self-sufficiency and building homegrown AI companies independent from Western technology. India's strategy is different: it's building infrastructure and applications tailored to its massive domestic market while partnering strategically with global companies. Rather than isolation (like China) or dominance (like the U.S.), India is pursuing interdependence and localization.

Conclusion: India's AI Moment Is Just Beginning

What's happening in India this week is significant, but it's only the beginning.

The government funding, the private capital, the partnerships, the 100 million Chat GPT users—these are all pieces of something much bigger. India is building an AI ecosystem that doesn't just consume AI. It builds it.

That shift matters globally because it means AI isn't American or Chinese or European. It's going to be plural. There will be Indian AI companies building for Indian problems that also solve problems for the rest of the world. That's how you actually democratize AI and ensure it serves human need rather than just shareholder value.

For people in India, the opportunity window is probably the next 18 to 24 months. If you're thinking about starting an AI company, this is the moment. Government capital is flowing. Private capital is flowing. Talent is available. Infrastructure is being built. In a few years, the best founders will have already built their companies and the competitive landscape will be set.

For global AI companies, India is where growth is. Not just in user numbers, but in building capability, finding talent, and understanding how AI applies to the parts of the world that are still digitizing. Companies that get into India early, build relationships with government, and genuinely try to understand the market will have advantages that persist for years.

For everyone else, just pay attention. What happens in India over the next few years will reshape how AI develops globally. A country that spent decades as a consumer of Western technology is becoming a builder. That's rare. That's significant. And it's just getting started.

The summit ends in a few days. The real work—actually building companies, deploying capital, training talent—starts now. And that's where the real story begins.

Key Takeaways

- India hosts landmark AI summit with $1.1B government venture fund for AI startups and advanced manufacturing

- ChatGPT has 100M+ weekly active Indian users with India accounting for largest student user population globally

- Blackstone invests $600M in Indian AI startup Neysa to deploy 20,000+ GPUs and build managed infrastructure

- AMD partners with TCS to build rack-scale AI infrastructure, reducing India's dependence on Western cloud providers

- Indian IT services companies pivoting from job creation to profitability as AI automation reduces workforce needs

- India's strategy differs from US (dominance) and China (self-sufficiency), focusing on partnerships and localization

Related Articles

- Blackstone's $1.2B Bet on Neysa: India's AI Infrastructure Revolution [2025]

- OpenClaw Founder Joins OpenAI: The Future of Multi-Agent AI [2025]

- OpenAI Hires OpenClaw Developer Peter Steinberger: The Future of Personal AI Agents [2025]

- AI Data Centers Hit Power Limits: How C2i is Solving the Energy Crisis [2025]

- India's 100M ChatGPT Users: What It Means for AI Adoption [2025]

- Anthropic's $14B ARR: The Fastest-Scaling SaaS Ever [2025]

![India AI Impact Summit 2025: Key News, Investments, and Industry Shifts [2025]](https://tryrunable.com/blog/india-ai-impact-summit-2025-key-news-investments-and-industr/image-1-1771242002466.jpg)