Anthropic's $14B ARR: The Fastest-Scaling SaaS Company in History

Last month, Anthropic closed a $30 billion Series G funding round, making it the second-largest private tech raise ever. But the fundraising number is almost beside the point. What should keep every software CEO awake at night is the revenue number they disclosed alongside it.

$14 billion in annualized revenue.

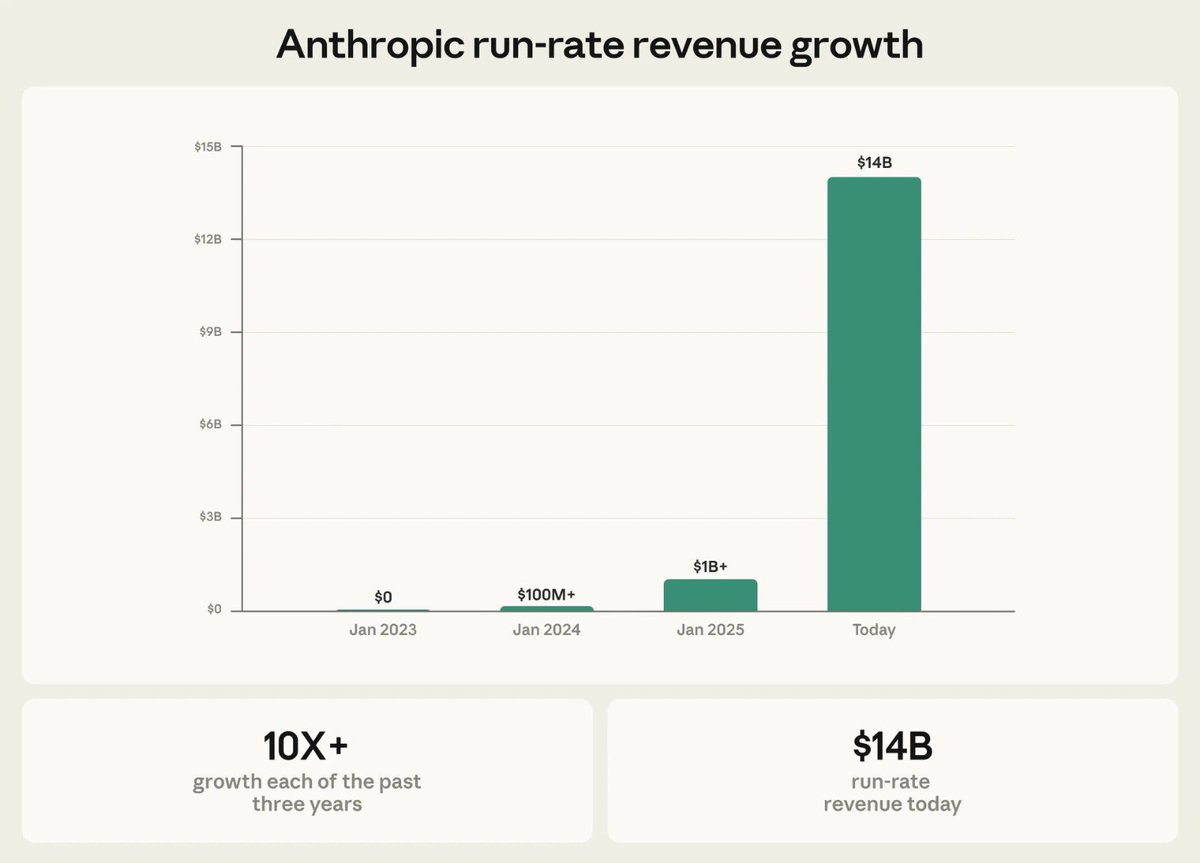

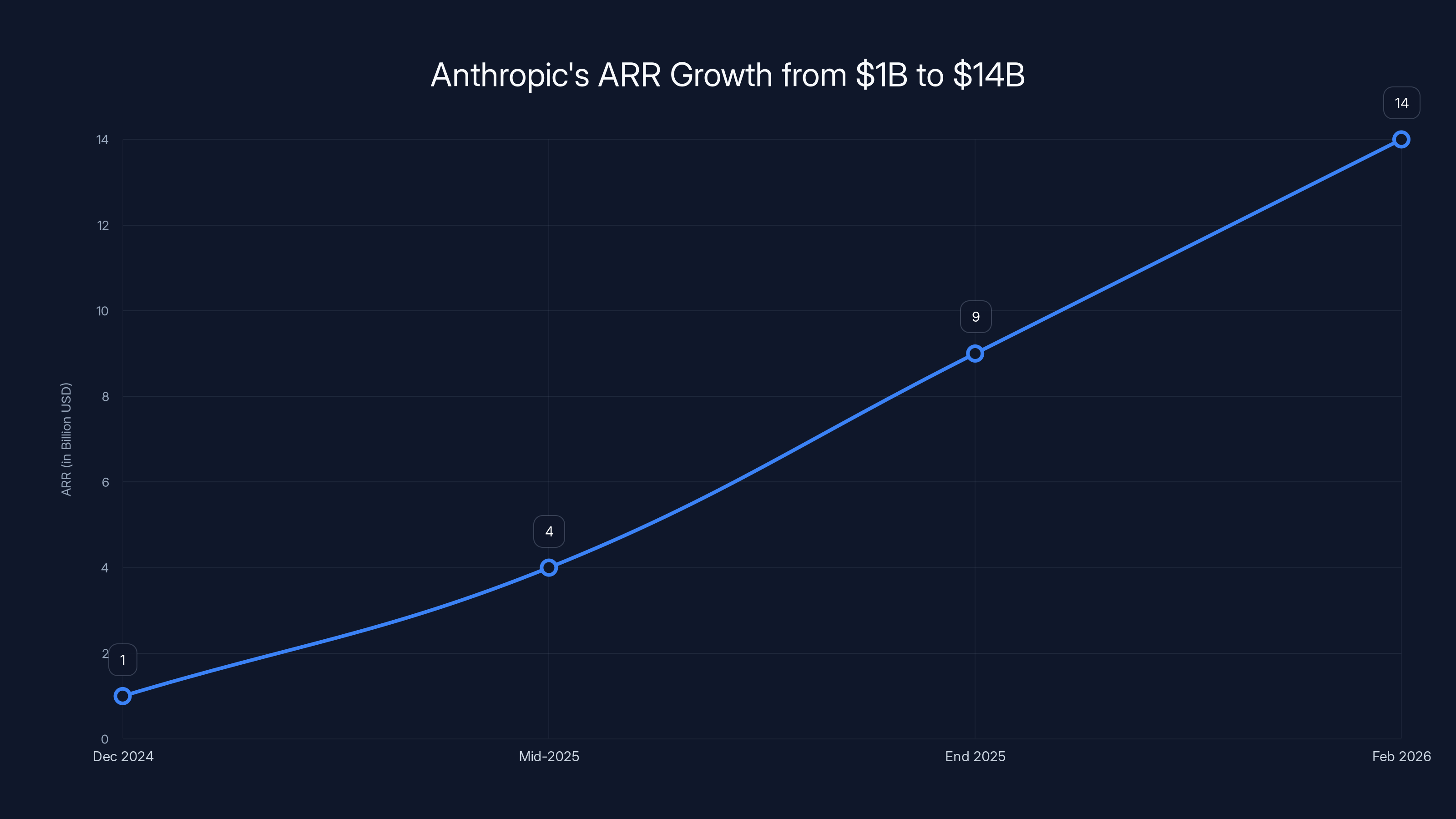

Think about that for a second. This company earned its first dollar in revenue less than three years ago. From December 2024 to February 2026, it scaled from

TL; DR

- **1B (December 2024) to $14B (February 2026), the fastest SaaS scaling in history

- 10x annual growth for three straight years: No software company has maintained this growth rate, ever—not Slack, not Zoom, not Snowflake

- Claude Code alone: $2.5B ARR: A nine-month-old product generating revenue faster than most Fortune 500 companies' entire divisions

- 80% enterprise revenue: Eight Fortune 10 companies are customers; enterprise customers grew 7x year-over-year

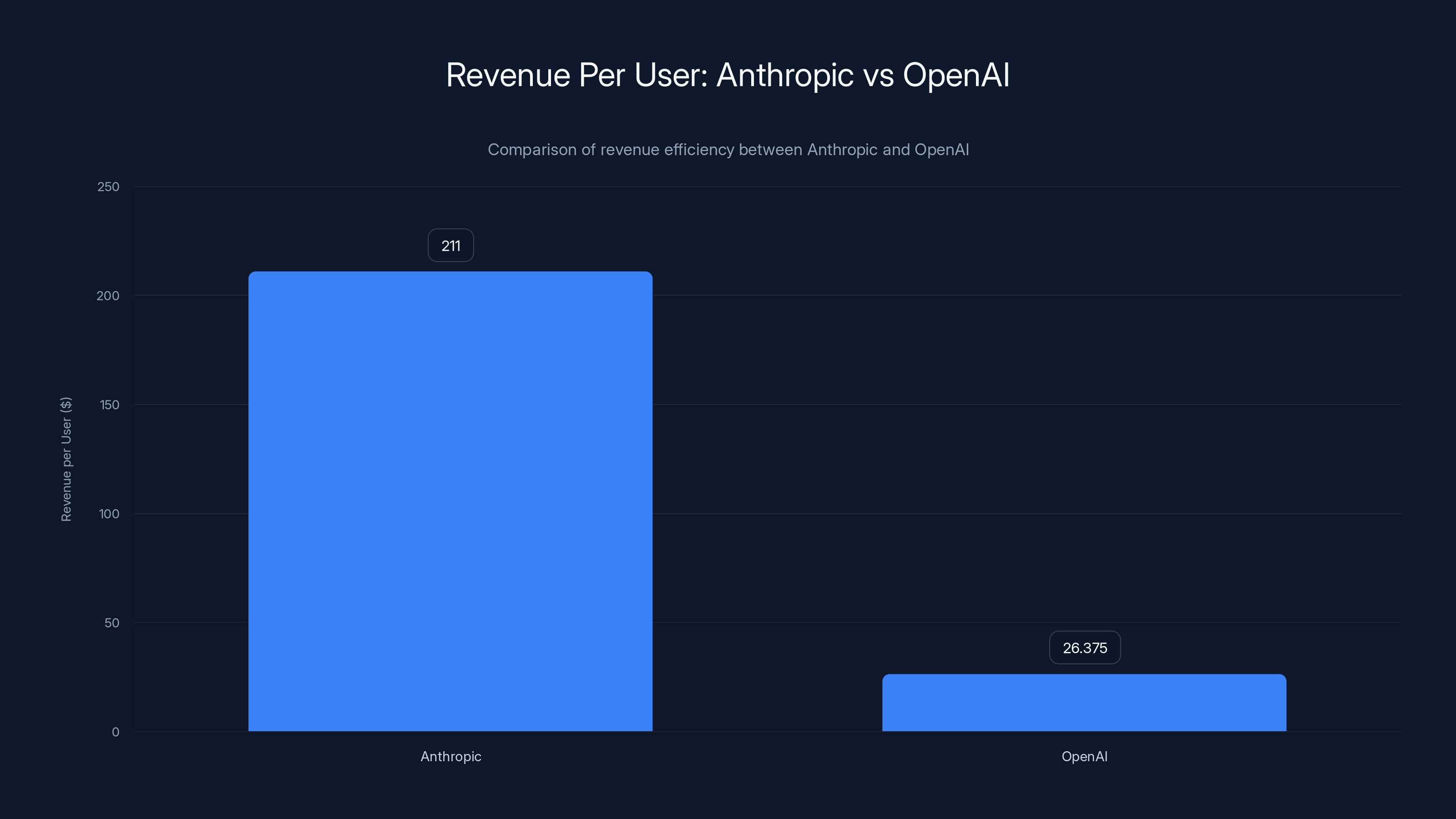

- $211 per user monetization: Anthropic extracts 8x more revenue per user than OpenAI, proving enterprise focus works

Anthropic generates approximately

Why This Matters: Context for the Uninitiated

If you've only casually followed AI news, you might think this is just another funding announcement. You'd be wrong. This is a watershed moment for SaaS, enterprise software, and what's possible when a product genuinely solves a real problem at scale.

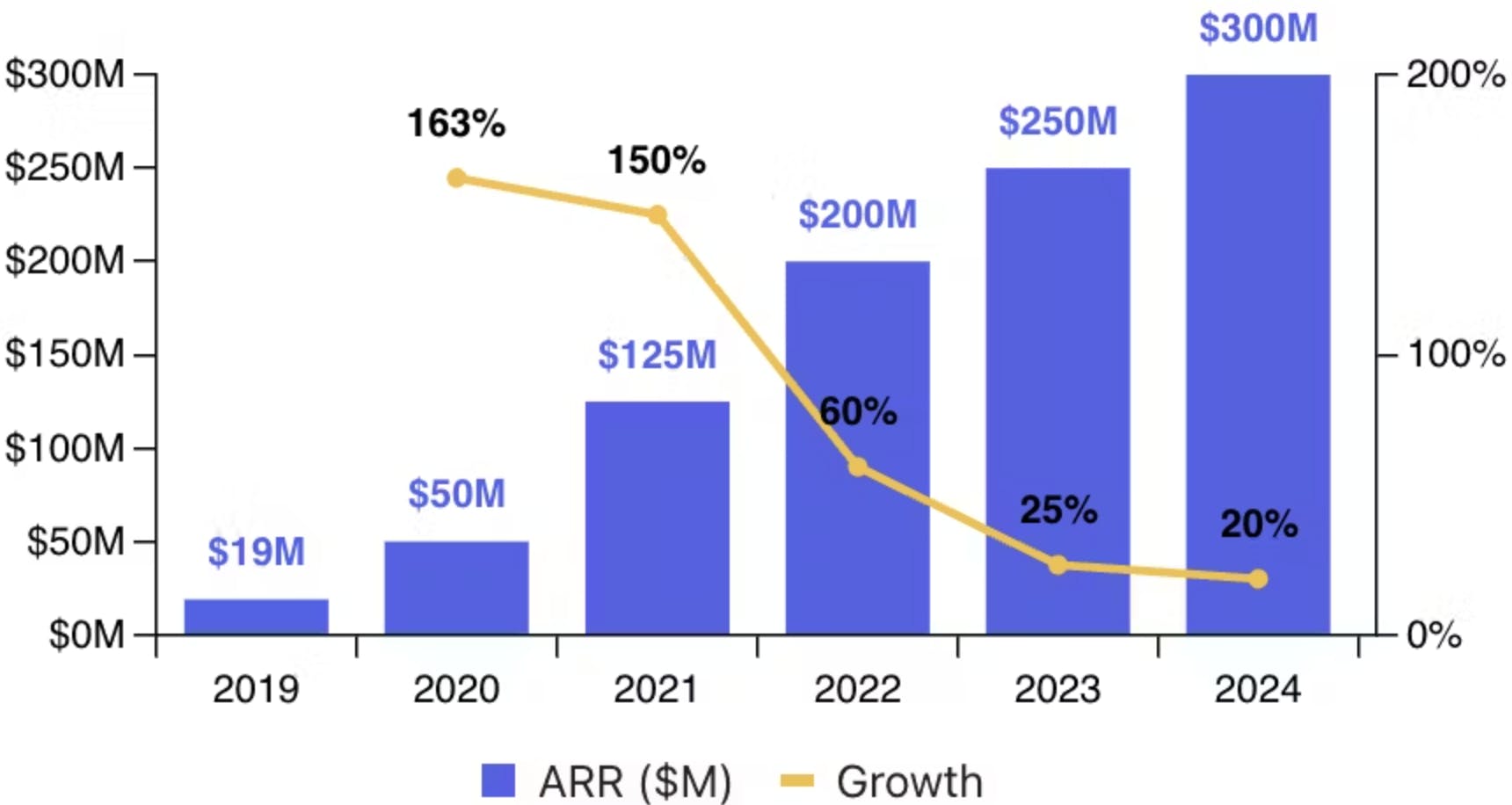

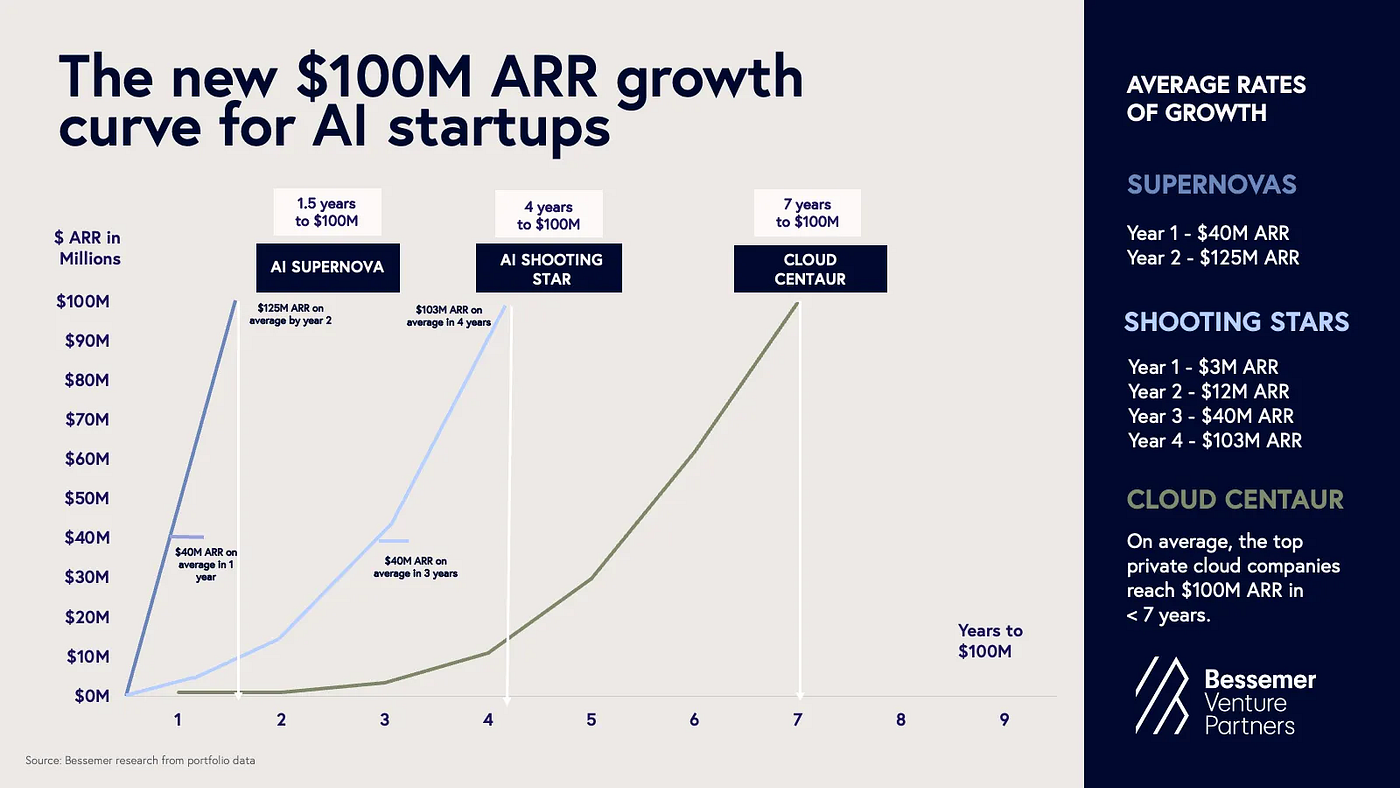

For context, here's what B2B software growth typically looks like. Cloudflare, one of the fastest-growing enterprise software companies of the 2010s, took roughly five years to reach

Anthropic got to $1 billion ARR in less than three years from founding. Then accelerated from there.

As Meritech noted publicly, they've analyzed the IPO filings of over 200 public software companies. This growth rate has never happened before. Not once. And yet Anthropic is accelerating, not decelerating.

What's happening here isn't luck. It's not a market bubble lifting all boats. It's a company that built something enterprises genuinely need, priced it right, and distributed it in a way that creates massive revenue velocity.

Let's break down what Anthropic actually did.

The 14B Sprint: What the Timeline Actually Reveals

Anthropic's growth trajectory reads like a fever chart. Here's the actual timeline:

December 2024:

What's fascinating here is that the growth isn't slowing. We'd expect a deceleration curve, right? Instead, we see acceleration. January 2026 alone saw significant growth metrics. This suggests the market for Anthropic's products is still in early innings.

To understand why this matters, you need to understand what "ARR" means in an API-driven business. Anthropic doesn't sell licenses. It sells consumption. When a customer uses Claude to generate text, analyze documents, or run code, Anthropic charges per token (roughly equivalent to per-word pricing for text).

This model has interesting properties. Revenue is tied directly to customer value creation. When enterprises use Claude more, they pay more. There's no artificial contract limit. There's no "seat" you buy that sits unused. Usage scales revenue.

This is why Anthropic's ARR growth is so staggering. They're not just adding customers. They're adding customers who use Claude intensively, at scale, across their entire organizations.

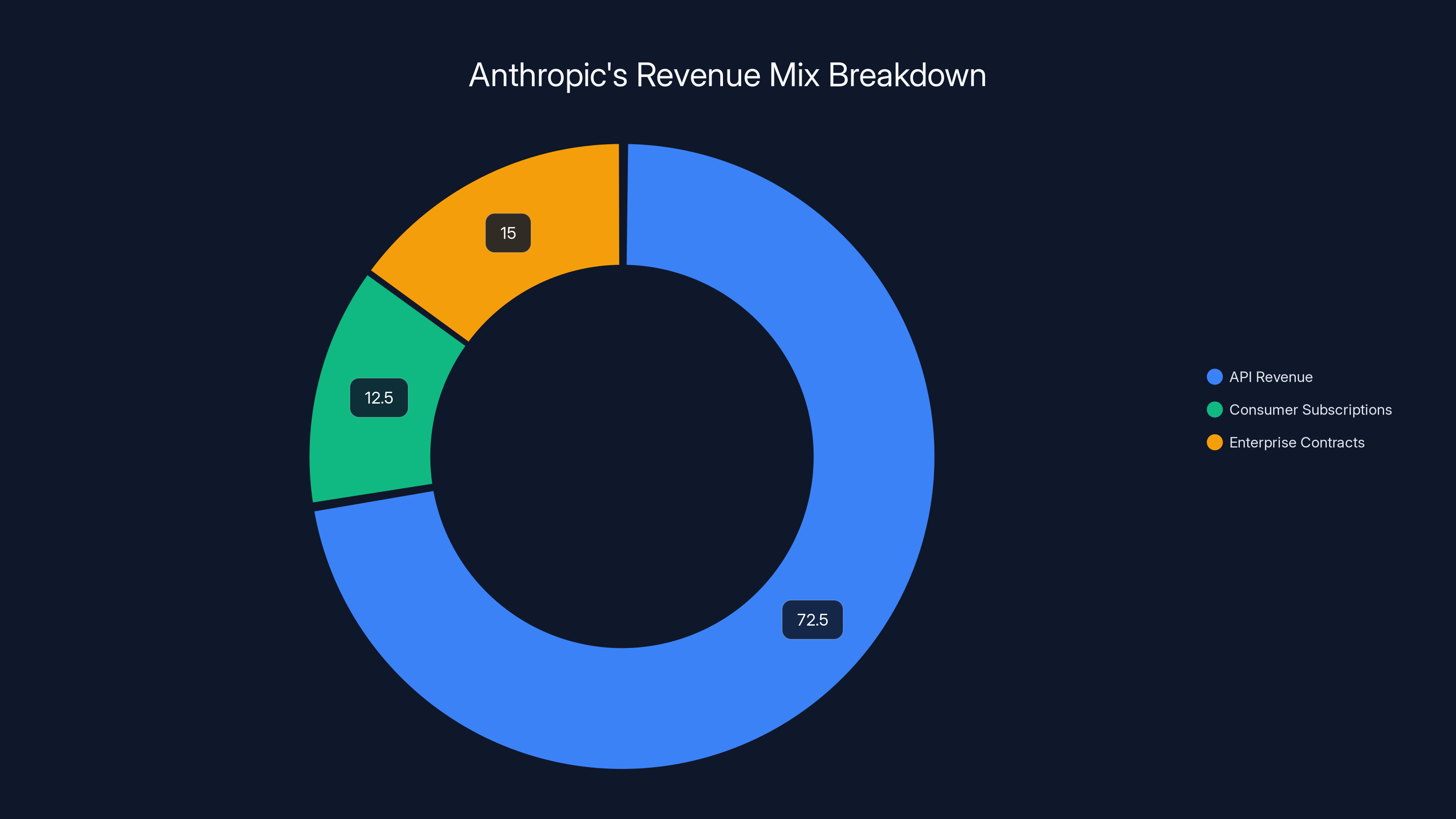

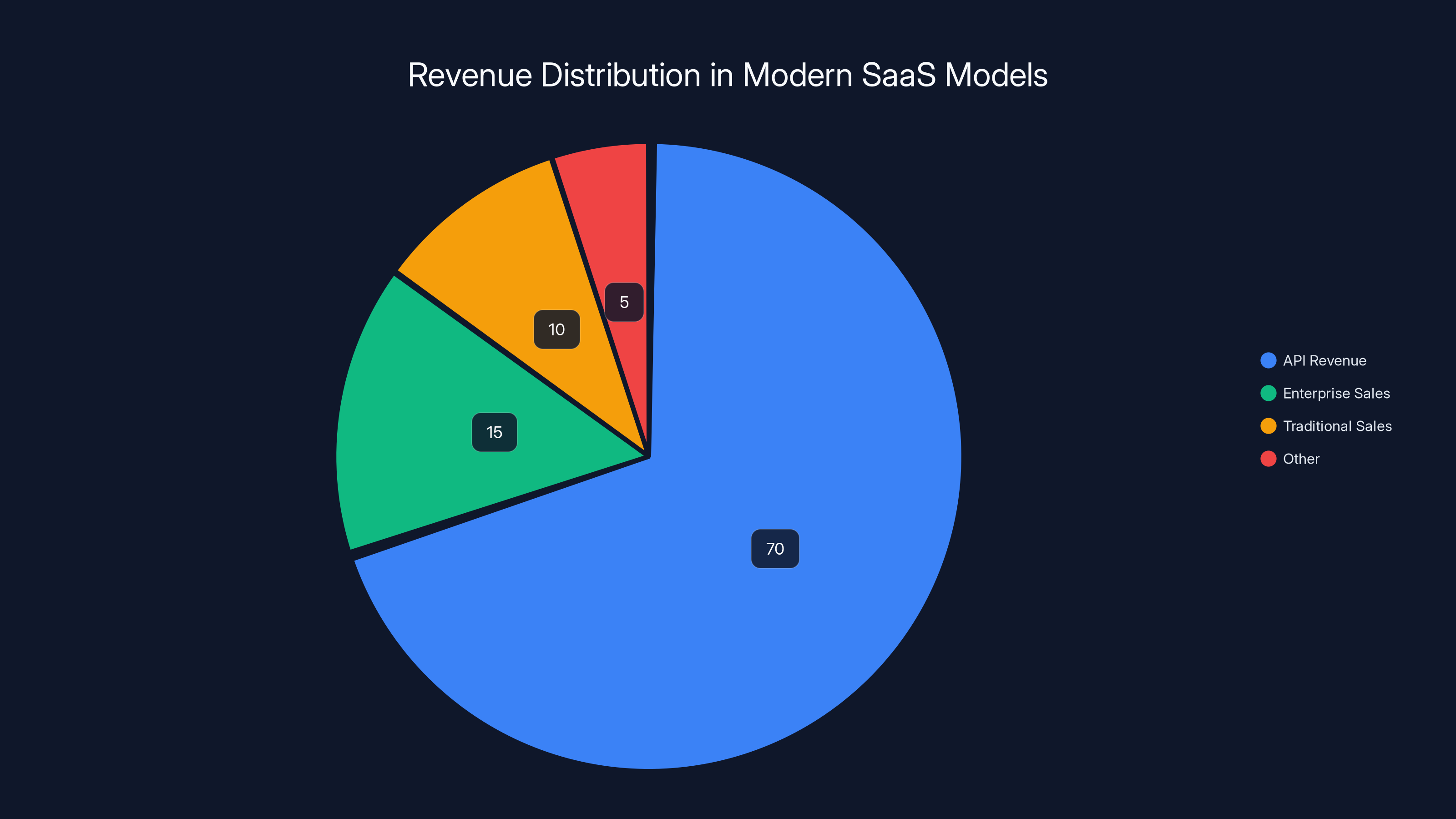

API Revenue dominates Anthropic's revenue mix at approximately 72.5%, followed by Enterprise Contracts and Consumer Subscriptions, each contributing around 12.5-15%. Estimated data.

Claude Code: $2.5B ARR in Nine Months

If the overall growth number feels abstract, Claude Code makes it concrete.

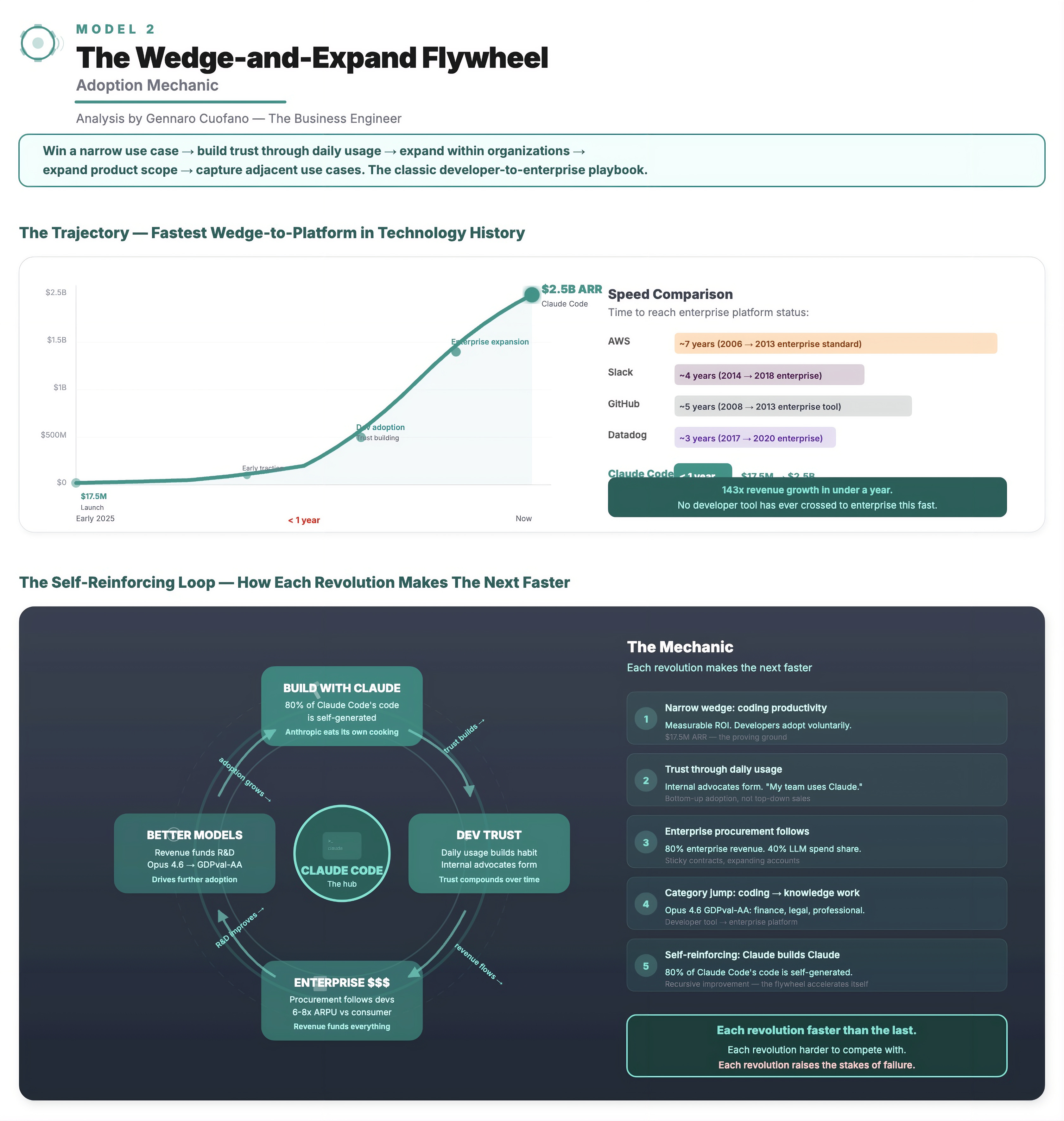

Claude Code launched to the public in May 2025. By February 2026, it was doing $2.5 billion in annualized revenue. In nine months. That's a company doing IPO-scale revenue from a single product that didn't exist a year ago.

For perspective, HashiCorp had roughly

What's Claude Code? It's an AI agent that writes, debugs, and ships code. You describe what you want, Claude Code builds it, tests it, deploys it. According to recent reports, 4% of all GitHub public commits are already authored by Claude Code. Anthropic is projecting 20%+ by year-end 2026.

Let me parse that for a moment. If projections hold, one AI system will be responsible for one out of every five code commits on the world's largest code repository. In 2026.

Business subscriptions to Claude Code quadrupled between January and February 2026 alone. Enterprise users now represent more than half of Claude Code revenue, meaning most of that $2.5 billion is coming from paying organizations, not individual developers.

This tells you something crucial about where enterprise value is concentrating. Code generation isn't a feature. It's becoming infrastructure. And Anthropic is positioning itself as the provider of that infrastructure.

The revenue trajectory also reveals something about Anthropic's customer acquisition strategy. They didn't need a massive sales team to build this. Claude Code drove bottoms-up adoption through sheer utility, then flipped into top-down enterprise contracts at scale.

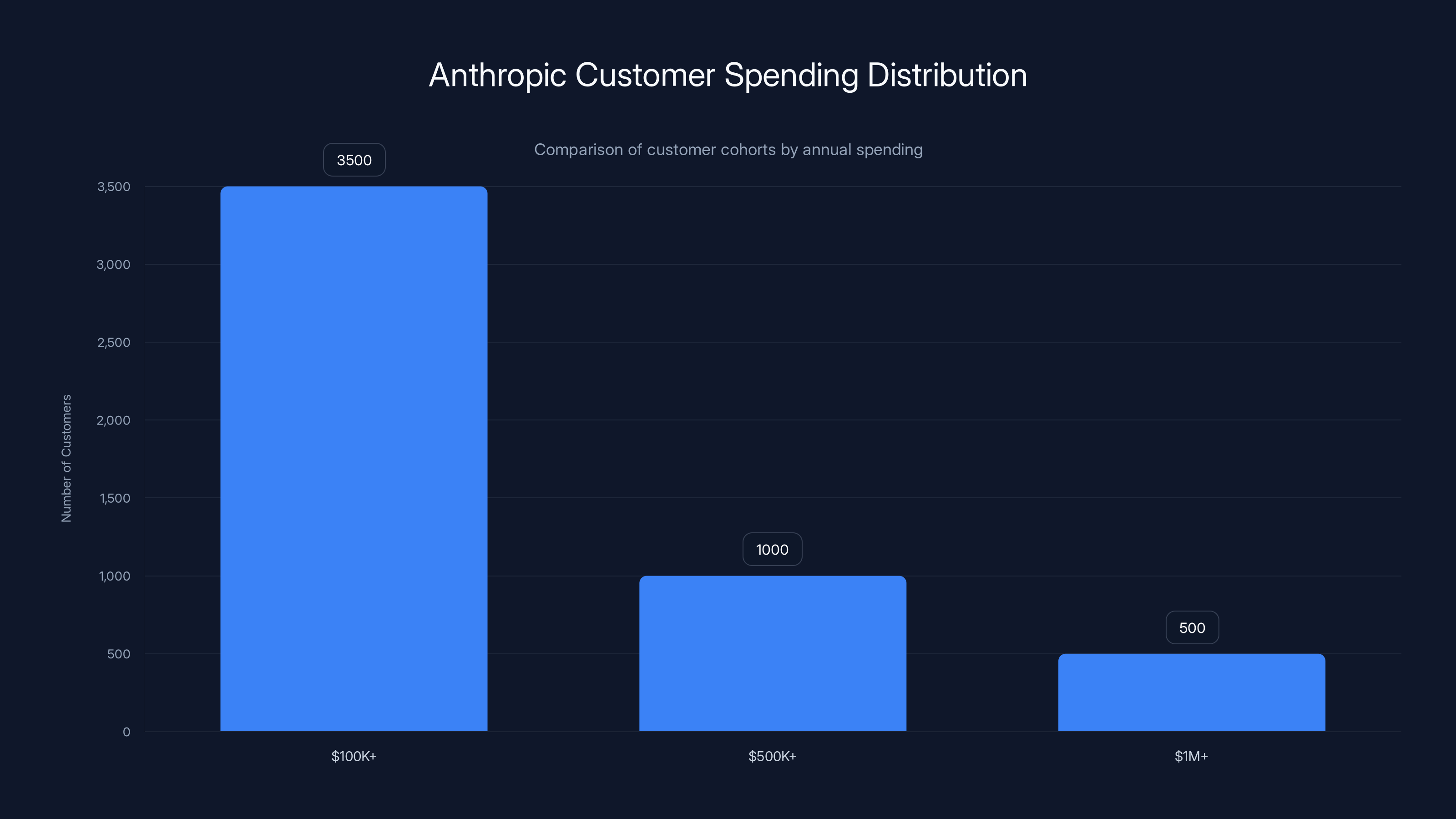

The Enterprise Metrics: 500+ $1M+ Customers in Two Years

Here's what Anthropic disclosed about its customer base, and these numbers are staggering:

7x growth in

That last point deserves emphasis. This isn't a zero-sum market where enterprises choose Claude OR OpenAI. They're buying both. Enterprises want optionality. They don't want to depend on a single AI vendor. So they're subscribing to multiple models, using them for different purposes, and building for multi-model resilience.

This is actually extremely bullish for Anthropic. It means the market is expanding, not consolidating. Enterprises see genuine competitive differentiation in Claude versus GPT-4, and they're willing to pay for both.

The

Stripe is perhaps the best comparison point. Stripe took several years to build a $1M ARR customer base. Anthropic did it in months. And Stripe is arguably the most successful SaaS company built in the last decade.

The Fortune 10 customer count is similarly significant. When you're one of the ten largest companies in the world and you're building AI into your core infrastructure, you're not picking Claude as a side project. You're building enterprise agreements, integrating into your core systems, and making multi-year commitments.

This is where enterprise software gets truly interesting. These aren't trials. These are real revenue, with SLAs, support requirements, and actual usage at scale.

Revenue Mix Breakdown: How Anthropic Actually Makes Money

Anthropic monetizes across three primary channels, and understanding the mix explains the monetization efficiency:

API Revenue (70-75% of total): This is the engine. Pay-per-token consumption from enterprises and developers. Every Claude API call generates revenue. Every customer integration creates ongoing, usage-based income. This is infinitely scalable with no marginal cost per unit above infrastructure.

Consumer Subscriptions (10-15%): Claude Pro at

Enterprise Contracts & Reserved Capacity (10-15%): Fixed-rate deals where enterprises pay a set fee for guaranteed model capacity, priority access, and SLAs. This is the highest-margin layer. Once built, support scales. Revenue predictability increases.

This mix is almost perfectly designed for SaaS bliss. API revenue creates linearity and scalability. Consumer subscriptions create distribution and viral motion. Enterprise contracts create predictability and margin.

Here's where it gets really interesting. Anthropic monetizes at roughly

How? Three reasons:

1. Enterprise focus: OpenAI has built a massive consumer base. Anthropic has built an enterprise base. Enterprises spend more than consumers, it's not close.

2. Higher usage per customer: Enterprise customers use Claude more intensively. A Fortune 500 company building AI features into their products creates vastly more tokens per unit time than an individual ChatGPT user.

3. Pricing power: Enterprise customers face different willingness-to-pay calculations. For a company like JPMorgan or Microsoft, paying millions for Claude to power internal tools drives millions in productivity gains. The math works at higher price points.

This monetization story is crucial because it explains why Anthropic's growth looks different from prior software companies. They're not chasing volume. They're chasing value. Fewer customers, higher revenue per customer, better margins, higher growth velocity.

Anthropic has rapidly grown its customer base, with 500 customers spending over $1M annually, showcasing significant enterprise adoption.

The API-First Go-to-Market: Why Anthropic Scaled So Fast

Most B2B software companies follow a predictable sales playbook. Build product, hire sales team, have sales team knock on doors, close deals over 3-6 month sales cycles.

Anthropic skipped several steps.

By distributing Claude primarily through an API, Anthropic created a product that could be adopted programmatically. Developers could sign up, get an API key, and start building immediately. No sales call required. No procurement cycle. No committee meetings.

This is the "consumption-based pricing" playbook that's worked phenomenally well for infrastructure companies like AWS, Google Cloud, and Azure. You pay for what you use. If you use more, you pay more. Simple.

But here's the trick: Anthropic didn't stop at bottoms-up. Once developers started building Claude into their applications, the value became visible to enterprise customers. Enterprises then demanded integration into their infrastructure. That's when Anthropic's enterprise team stepped in with contracts, reserved capacity, and SLAs.

Bottoms-up creates the wedge. Top-down expands the footprint. Consumption pricing scales the revenue. It's the perfect combination for explosive growth.

Compare this to Salesforce's playbook, which dominated enterprise software for decades. Salesforce relied on heavy sales teams, long sales cycles, and large upfront contracts. It works, but it scales slower and requires massive sales infrastructure.

Anthropic scales on product value and developer momentum, not sales machinery. This is why their growth is so different.

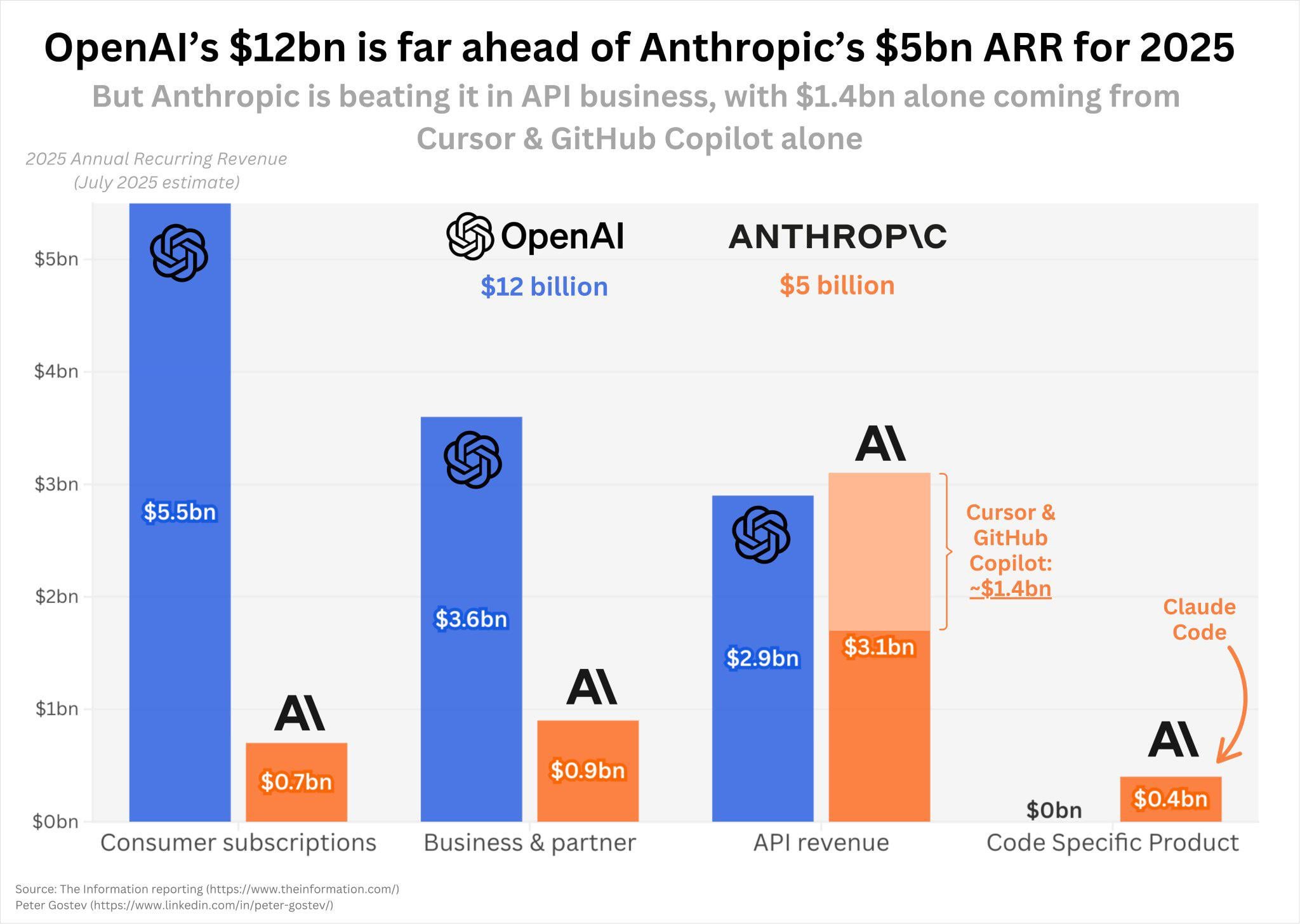

Competitive Response: OpenAI vs. Anthropic

The elephant in the room is OpenAI. How does Anthropic's growth compare?

OpenAI is larger in absolute terms. ChatGPT has over 200 million monthly active users. OpenAI's organizational dominance is real. But here's the thing: OpenAI hasn't disclosed ARR figures publicly. So we're doing some inference.

Based on available data, OpenAI's valuation jumped from

Here's the strategic divergence:

OpenAI's bet: Consumer dominance, brand strength, ChatGPT as the default AI product, enterprise upsell from there.

Anthropic's bet: Enterprise dominance from day one, developer distribution through API, consumer subscriptions as secondary.

Both are working. But in B2B software, enterprise focus typically wins long-term. Enterprises have higher lifetime value, lower churn, and more predictable revenue. Consumers are volatile.

Anthropic made the right bet structurally. Execute well, and they could end up the bigger revenue business despite OpenAI's larger user base.

Claude Code's Dominance: The Developer Infrastructure Play

Let's dig deeper into Claude Code because it deserves serious analysis.

Code generation has been tried before. GitHub Copilot, powered by OpenAI's Codex, launched in 2021. It's good. It's widely used. It's integrated into most developers' workflows.

Yet Claude Code—which launched nine months ago—is already capturing 4% of GitHub commits globally. That's extraordinary velocity.

Why? Several reasons:

Superior reasoning: Claude Code doesn't just complete lines of code. It understands context, suggests refactors, identifies bugs, and explains trade-offs. It reasons about code in ways prior systems didn't.

Agentic capability: Claude Code doesn't just generate. It plans, executes, verifies, and iterates. You can tell it "build me a web app" and it creates project structure, writes components, sets up tooling, and tests everything.

Enterprise distribution: From day one, Anthropic went hard at enterprise adoption. Companies saw value and paid. Copilot required enterprise contracts. Claude Code offered consumption-based pricing with no overhead.

Velocity perception: When developers see a tool getting better every month, they adopt it faster. Claude Code had clear, visible improvements between launch and February 2026. That momentum matters.

The GitHub commit metric is worth emphasizing. If projections hold and Claude Code hits 20% of commits by year-end, you're talking about developer infrastructure dominance. Every major codebase would have Claude-generated code. That's platform-level influence.

This also has downstream effects. When Claude Code writes code that trains on GitHub, that code feeds back into training data. The competitive moat gets wider.

Anthropic's model shows a shift towards API-driven revenue (70%), reducing reliance on traditional sales teams. Estimated data.

What This Means for the Broader SaaS Industry

Anthropic is not just growing fast. It's rewriting what "fast" means for enterprise software.

Traditional SaaS wisdom said: build slowly, reach product-market fit, then scale sales and marketing. Anthropic did it backwards. They built a world-class product, released it with minimal sales infrastructure, let it distribute through developer adoption, then layered on enterprise sales.

The implications are massive:

Sales organizations need to shrink in importance: If a product can distribute through APIs and developer adoption, you don't need a massive sales team. You need incredible product and a small enterprise team to land large deals. This is bad news for traditional enterprise sales orgs.

Consumption pricing becomes dominant: Enterprise buyers increasingly prefer usage-based pricing because it aligns incentives. They pay for value created. Anthropic's mix of 70-75% API revenue demonstrates this shift.

Infrastructure becomes the new application: Tools that become infrastructure get embedded into core workflows. Copilot is infrastructure now. Claude Code is becoming infrastructure. Infrastructure has pricing power and moat.

Model differentiation matters more than scale: Anthropic is proving you don't need 200 million users to build a billion-dollar business. You need better technology and enterprise focus. Claude's capabilities justify its premium pricing.

Software CEOs watching this are probably uncomfortable. It means the playbook they've been running since 2015 might not work anymore. It means product excellence matters more than sales machinery. It means enterprise focus beats consumer volume.

It also means the next decade of SaaS winners will look more like Anthropic than Salesforce.

The Valuation Question: Is $380B Justified?

Anthropic's Series G valued the company at $380 billion post-money. That's a massive number. Is it justified?

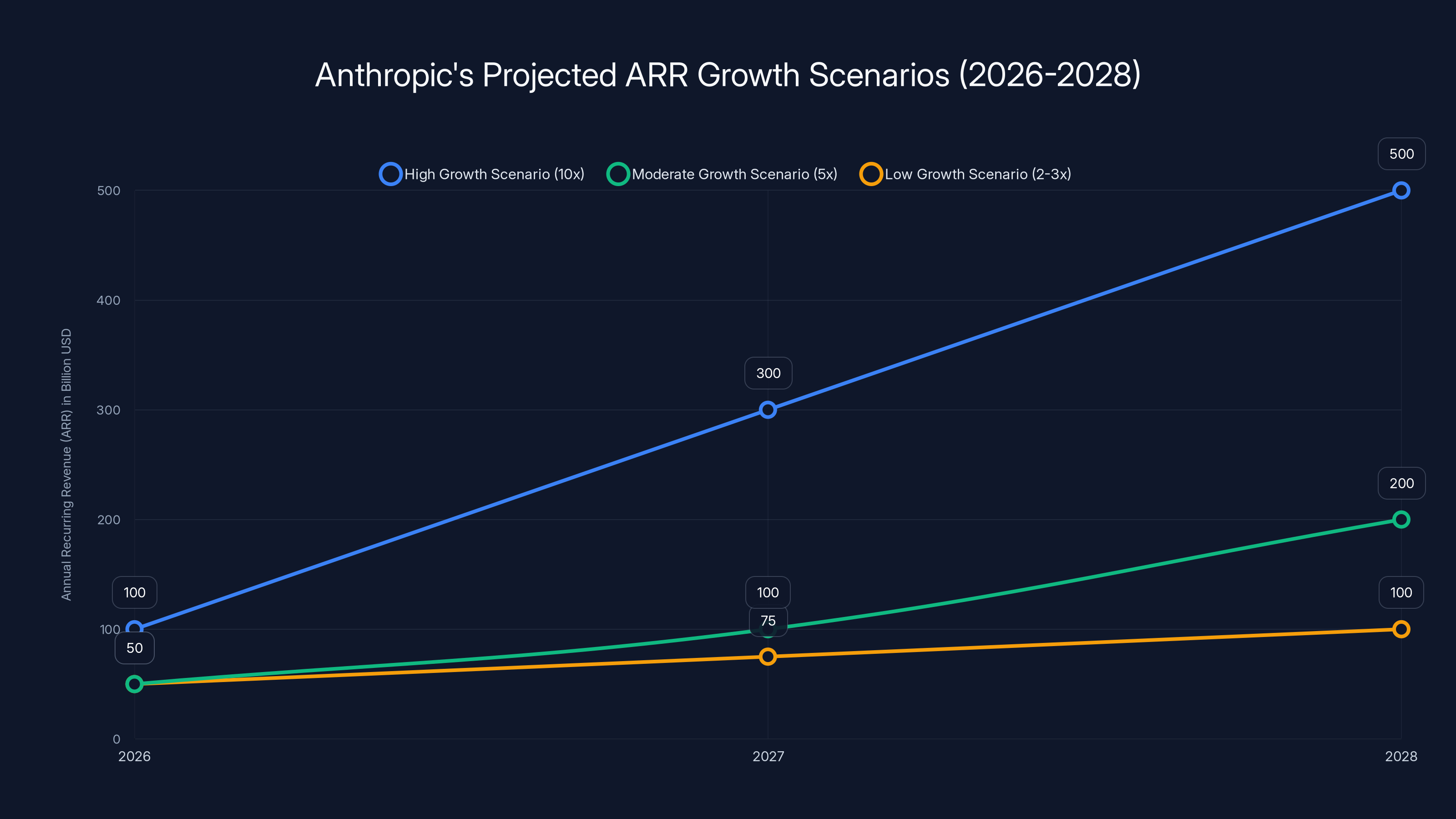

Let's do some math. If Anthropic is doing $14 billion ARR and growing 10x annually, here's the revenue projection:

2026E:

For context, Microsoft's enterprise business does roughly

But there's risk. AI model competition is intense. Meta's Llama is improving rapidly and is open-source, which could disrupt pricing. Google's Gemini is integrated into Android, Google Workspace, and Search. That's distribution that Anthropic can't match.

The valuation is bullish on Anthropic maintaining its competitive moat and continuing growth at 5-10x annually. If growth moderates to 2-3x, the valuation looks expensive. If Anthropic maintains its trajectory, it's a bargain.

Most likely outcome? Somewhere in between. Anthropic will continue growing faster than traditional software but slower than the past two years. Valuation in the $200-300 billion range at IPO seems reasonable.

Implications for AI Infrastructure and Model Providers

Anthropic has essentially proved that there's a massive market for frontier AI models. Not just consumer chatbots. Not just enterprise AI features. But AI as core infrastructure that enterprises spend billions on.

This opens massive opportunities for:

Vertical AI providers: Companies building industry-specific AI solutions (legal, financial, healthcare, manufacturing) can use Anthropic's models as their foundation and build $1-10 billion businesses on top.

AI development platforms: Tools that make it easier to build with Claude (prompt management, fine-tuning, evaluation) become valuable infrastructure. LangChain, Helicone, and similar platforms benefit significantly from Anthropic's traction.

Enterprise AI deployments: Consulting firms and systems integrators will build massive practices around deploying Claude into enterprise infrastructure. This is a multi-hundred billion opportunity.

Competitive model providers: Together AI, Mistral, and others proving that you can build sustainable businesses on open-source or differentiated models.

The AI market isn't zero-sum. Anthropic's success proves the market is expanding, not consolidating. Enterprises are buying multiple models, multiple platforms, and multiple services. This creates abundance for the entire ecosystem.

Projected ARR growth scenarios for Anthropic suggest varying outcomes based on growth rates. A high growth rate could see ARR reaching

Building for Similar Growth: What Can SaaS Founders Learn?

If you're building a B2B software company, what can you learn from Anthropic's trajectory?

Focus on true differentiation, not incremental improvement: Anthropic's Claude didn't just improve on prior models. It introduced new capabilities (long context, agentic reasoning, constitutional AI) that created new use cases. Incremental improvements don't drive 10x growth. Fundamental breakthroughs do.

Default to distribution through API first: API-first distribution scales infinitely. Building with a sales team limits your growth rate from day one. Build product, distribute via API, then layer on sales for enterprise deals.

Price for enterprise value, not consumer willingness-to-pay: Anthropic could have priced Claude at $10/month for consumers. Instead, they focused on enterprise value and priced accordingly. This attracted the right customer base.

Invest in enterprise contracts after bottoms-up momentum: Don't start with an enterprise sales team. Start with product. Once developers are using your API, then hire enterprise sales to expand accounts.

Measure engagement through usage, not users: Anthropic doesn't brag about user counts. They brag about revenue, customer growth, and model usage. This is the right metric for B2B SaaS.

Build for multi-year competitive advantage: Claude Code's dominance isn't secure forever. Anthropic is investing heavily in model improvements, longer context windows, and agentic capabilities. Competitive moat is built by continuous innovation.

Communicate growth and momentum: Anthropic disclosed aggressive growth metrics. This attracts talent, customers, and investment. Transparency about growth creates flywheel effects.

The Path to Sustainable Scale: What Anthropic Needs to Prove

Here's the hard truth: explosive growth is easy. Sustainable growth is hard.

Anthropic has proven that it can scale to $14 billion ARR. Now it needs to prove three things:

1. Sustainable margins: AI model inference is capital-intensive. Anthropic needs to prove it can maintain gross margins above 70-80% at scale. If margin compression happens, the business becomes less valuable. So far, the mix (75% API, 25% subscriptions and contracts) suggests margins are healthy, but this needs ongoing validation.

2. Competitive defensibility: OpenAI, Google, Meta, and others are investing billions in model development. Anthropic needs to stay ahead. The company's recent funding suggests investors believe in their ability to do this, but model competition is accelerating.

3. Customer retention and expansion: Anthropic has grown fast with new logos. Now it needs to prove that customers stay, expand, and become sticky. If churn is high, growth numbers mask retention problems. No public data on churn exists yet, but this is critical to monitor.

4. Profitability pathway: Growth at any cost is the startup playbook. At $14 billion ARR, investors want to see a path to profitability. Anthropic likely needs to show positive unit economics within 12-24 months to justify the valuation.

5. Organizational scaling: Anthropic is hiring rapidly to support growth. Maintaining culture, execution velocity, and quality as headcount increases is notoriously hard. Some companies lose magic when they scale past 500-1000 people. Others don't. Anthropic will need to prove it's in the latter category.

If Anthropic nails all five of these, it becomes one of the most valuable software companies ever built. If it stumbles on any one, valuation could reset significantly.

What's Next: The 2026-2027 Inflection

Here's what to watch over the next 18 months:

Claude Code's trajectory: Will it hit the projected 20% of GitHub commits by year-end 2026? If yes, it's become truly foundational infrastructure. If not, growth is moderating.

Enterprise seat expansion: As more Fortune 500 companies become customers, watch for seat expansion (more users per company). This is a leading indicator of value realization.

Competitive model releases: How does Claude perform against Google's next generation models? Against OpenAI's GPT-5? Model leadership is everything in this market.

International expansion: Anthropic's growth to date is heavily US-focused. European, Asian, and emerging market expansion could unlock another 2-3x in TAM.

Profitability metrics: Watch for any disclosure of operating leverage. Anthropic doesn't need to be profitable to stay valuable, but path to profitability matters.

Series H fundraising or IPO signal: At $380 billion valuation, an IPO within 18-24 months is possible. IPO signals confidence. Continued late-stage fundraising suggests they want runway.

The next 18 months will determine whether Anthropic becomes one of the most valuable software companies ever, or whether growth moderates and valuation resets.

Anthropic's ARR skyrocketed from

Implications for Developers and Technologists

If you're an engineer or technologist, Anthropic's rise has several implications:

Your job description is changing: AI capabilities are moving into core infrastructure. Understanding how to architect with AI models, manage costs, and optimize prompts is becoming a baseline skill.

Career optionality is expanding: Companies desperate to deploy AI are hiring AI engineers, prompt engineers, and LLM infrastructure specialists at 2-3x traditional salaries. If you have relevant skills, you have significant leverage.

Competitive pressure is real: If Claude Code reaches 20% of commits, that's competition for junior developers. The tools, languages, and skills that matter are shifting. Staying current is more important than ever.

Platform investment matters: Choosing which AI platform to build on (Claude, ChatGPT, others) is a strategic decision. Anthropic's traction suggests betting on Claude is reasonably safe, but no guarantee.

Open-source alternatives exist: Llama is open-source and improving. You can self-host. For some use cases, open models are good enough. For frontier capabilities, proprietary models still lead.

The practical implication: if you're building with AI models, diversify. Use Claude for reasoning tasks. Use GPT-4 for multimodal. Use Llama for cost-sensitive deployments. Building on multiple models protects you from vendor lock-in.

Enterprise IT Leaders: Risk and Opportunity

If you're an enterprise IT leader or chief architect, Anthropic's rise presents both risk and opportunity:

Opportunity: Claude's capabilities unlock entire categories of automation. Legal document review, financial analysis, code generation, and customer service can be radically improved with frontier AI models. The companies that deploy these capabilities first gain competitive advantage.

Risk: Regulatory uncertainty around AI remains. Data privacy concerns are real, especially for financial or healthcare data. Deploying Claude requires governance frameworks, data handling protocols, and compliance validation.

Cost management: Consumption-based pricing is great until it's not. A badly written prompt or a runaway integration can generate massive bills. Cost controls and monitoring are essential.

Vendor lock-in: Building extensively on Claude means lock-in to Anthropic's model evolution, pricing, and availability. Mitigation strategies (multi-model architecture, fallback systems) are wise.

Team skills: Your team needs prompt engineering, model evaluation, and cost optimization skills. These are new and scarce. Investing in training is essential.

The practical implication: treat AI infrastructure like you treated cloud infrastructure a decade ago. It's foundational. Treat it strategically, invest in talent, and build governance from day one.

The Broader AI Race and What It Means

Anthropic's growth is part of a larger story: the AI infrastructure market is becoming the most valuable market in computing.

Compare the valuations:

Traditional software: Salesforce is

AI infrastructure: Anthropic is

This tells you where capital, talent, and optionality are concentrating. If you're a technologist making career decisions, you want to be in the AI infrastructure space. The upside is enormous.

Long-term, the market will mature. Multiple competitors will emerge. Pricing will commoditize. But for the next 3-5 years, frontier AI model providers have significant pricing power and growth opportunity.

Anthropic is currently winning that race by revenue growth, but OpenAI is more famous and has broader distribution. Google Gemini has distribution through every Google product. Meta's open-source Llama has cost advantages. This is a long race.

But measured by growth and enterprise revenue, Anthropic is currently winning. That's worth noting.

Critical Gaps and What We Don't Know

Anthropic has disclosed impressive metrics, but several critical gaps exist:

Profitability: We don't know gross margins, operating margins, or path to profitability. This is crucial for long-term valuation.

Customer concentration: Is Anthropic's revenue concentrated among a few Fortune 10 customers, or well-distributed? High concentration is risky.

Churn rates: How many customers are staying and expanding versus leaving? High churn masks growth problems.

Competitive model performance: How does Claude compare to GPT-5, Gemini 2.0, or next-gen Llama on specific benchmarks? Perception matters, but performance is ultimate.

International revenue: Is 80% of revenue coming from North America? If so, international expansion is a growth vector, but also a dependency.

Content moderation and safety costs: As usage scales, moderation costs scale. What are Anthropic's safety infrastructure costs? This isn't disclosed.

Talent retention and cost: Anthropic is paying top dollar for AI talent. As the company scales, can it maintain cost discipline in R&D?

These gaps don't invalidate the growth story. They just highlight that the narrative is incomplete. Investors, customers, and technologists should be monitoring these metrics carefully.

Conclusion: The New Baseline for SaaS Growth

Anthropic just did something that's never been done before in B2B software. It scaled from zero to

This is not normal. This is not a blip. This is a new baseline for what's possible when you build something genuinely valuable, distribute it smartly, and price it for enterprise impact.

For software CEOs, the implications are unsettling. The playbook that worked for the last 20 years might not work for the next 20. For developers and technologists, the implications are exciting. The AI infrastructure market is opening up opportunities that didn't exist a year ago.

For enterprises, the implications are strategic. AI is no longer a nice-to-have feature. It's core infrastructure. Companies that don't build or integrate AI capabilities will fall behind. Companies that do will unlock competitive advantages that could be worth billions.

Anthropic is proof of concept. What happens next depends on execution, competition, and whether the market sustains its appetite for frontier AI capabilities.

If Anthropic executes, maintains model leadership, and continues scaling at 5-10x annually, it could become one of the three most valuable software companies in history within five years.

If model competition intensifies or growth moderates, valuation resets become possible.

Either way, Anthropic has rewritten the rules for what fast growth looks like in software. Every founder, investor, and executive should be studying how they did it.

FAQ

What is Anthropic and why is it growing so fast?

Anthropic is an AI company founded in 2021 that builds frontier AI models, most notably Claude. It's growing so fast because Claude solves real enterprise problems (code generation, document analysis, reasoning) better than alternatives, and Anthropic monetizes through consumption-based API pricing that aligns incentives with customer value. The combination of superior technology and smart pricing creates explosive revenue growth.

How does Anthropic make money compared to OpenAI?

Anthropic monetizes primarily through pay-per-token API consumption (70-75% of revenue), with secondary revenue from consumer subscriptions (Claude Pro, Claude Max) and enterprise contracts. This creates $211 in revenue per monthly user, roughly 8x higher than OpenAI's monetization. OpenAI has more users but less revenue per user, suggesting Anthropic's enterprise focus is more efficient. Both models work; they're just focused on different segments.

What is Claude Code and why is it significant?

Claude Code is an AI agent that writes, debugs, tests, and deploys code based on natural language descriptions. It reached $2.5 billion ARR in nine months, making it one of the fastest-growing products ever. It's significant because it demonstrates that AI has moved from productivity feature to core infrastructure, with 4% of GitHub commits already authored by Claude Code and projections of 20%+ by year-end 2026.

Is Anthropic's $380 billion valuation justified?

It depends on future execution. If Anthropic maintains 10x annual growth and reaches

What are the risks to Anthropic's growth trajectory?

Major risks include: (1) competitive model releases from OpenAI, Google, or Meta that overtake Claude, (2) margin compression from infrastructure costs if token pricing declines, (3) customer concentration if revenue is heavily skewed toward a few Fortune 10 customers, (4) international expansion challenges if revenue is primarily US-focused, (5) talent retention costs as the company scales, and (6) regulatory uncertainty around AI safety and data privacy.

Should enterprises adopt Claude or stick with OpenAI?

Enterprise should adopt both. The market is not zero-sum; enterprises are buying multiple models and building for resilience. Claude excels at reasoning, long-context understanding, and code generation. OpenAI's models excel at multimodal tasks and have broader distribution. Strategic enterprises use both, monitor performance on relevant benchmarks, and avoid vendor lock-in. For cost-sensitive workloads, Meta's Llama is viable as well.

What does Anthropic's growth mean for the broader AI market?

It proves that frontier AI models command premium pricing from enterprises, that consumption-based monetization works at scale, and that model differentiation (not just scale) drives value. It also suggests the market for AI infrastructure is much larger than initially assumed, capable of supporting multiple billion-dollar providers. For the broader tech industry, it signals that AI is becoming foundational infrastructure, not a feature, and companies that don't invest in AI capabilities risk competitive disadvantage.

How can I or my team get involved with Anthropic's ecosystem?

Several entry points exist: (1) develop with Claude API for your products, (2) build prompt engineering and model evaluation skills, (3) consider working at Anthropic if you have relevant expertise in ML, infrastructure, or enterprise software, (4) partner if you're a systems integrator or consulting firm helping enterprises deploy Claude at scale, and (5) invest if you're a venture investor or corporate investor seeking exposure to frontier AI companies.

Key Takeaways

- Anthropic reached $14 billion ARR in 14 months, the fastest growth in B2B SaaS history with 10x growth for three consecutive years

- Claude Code generated $2.5 billion in annualized revenue nine months after launch, demonstrating AI-as-infrastructure demand

- Enterprise monetization at $211 per monthly user is 8x higher than OpenAI's, proving focused enterprise strategy outperforms volume-based consumer models

- 500+ customers now spend over $1 million annually, with eight Fortune 10 companies as customers, signaling enterprise stickiness

- API-first distribution combined with enterprise upsells created a hybrid go-to-market that bypassed traditional sales infrastructure constraints

- Token-based consumption pricing aligns incentives and creates predictable, scalable revenue without artificial seat limits

Related Articles

- How Spotify's Top Developers Stopped Coding: The AI Revolution [2025]

- Cohere's $240M ARR Milestone: The IPO Race Heating Up [2025]

- Lenovo Warns PC Shipments Face Pressure From RAM Shortages [2025]

- Why OpenAI Retired GPT-4o: What It Means for Users [2025]

- ChatGPT-4o Shutdown: Why Users Are Grieving the Model Switch to GPT-5 [2025]

- The 10x ARR Club: Which SaaS Companies Still Trade at Premium Valuations [2025]

![Anthropic's $14B ARR: The Fastest-Scaling SaaS Ever [2025]](https://tryrunable.com/blog/anthropic-s-14b-arr-the-fastest-scaling-saas-ever-2025/image-1-1771162758671.png)