The AI Data Center Energy Crisis That Nobody Saw Coming

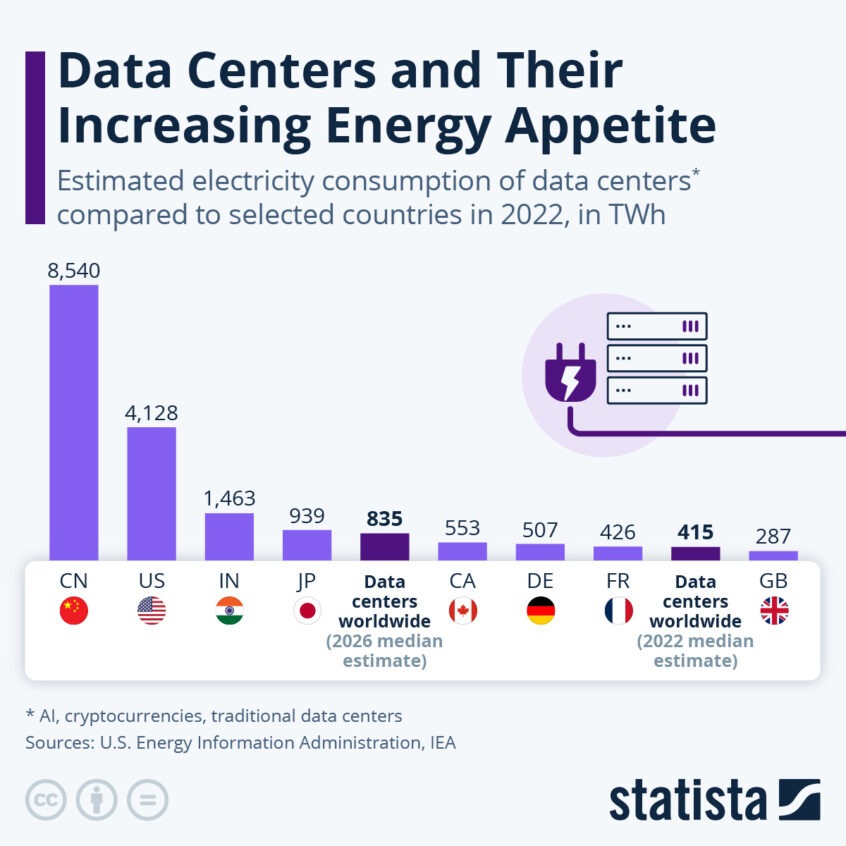

Here's something that caught a lot of people off guard: building an AI data center isn't just about throwing GPUs into a warehouse anymore. It's fundamentally an energy problem. And right now, that energy problem is so acute that companies are rethinking how they source, store, and manage power at a scale most people never imagined.

Redwood Materials got that memo early. A year ago, the battery recycling startup didn't have an energy storage business. Today, it's the fastest-growing unit in the company. This isn't a side hustle or a "we're hedging our bets" diversification play. This is a core business that's expanding at a pace that's forcing the company to quadruple its research facility space, move into new markets, and attract marquee investors like Google and Nvidia to the round.

What's happening here tells us something profound about where infrastructure is heading. The AI boom isn't just about compute power anymore. It's about reliable, sustainable electricity. And that shift is creating an entirely new category of business opportunities.

Redwood Materials' story is the canary in the coal mine. Well, except it's the opposite of a coal mine. It's about how energy storage—real, deployable, grid-integrated energy storage—has become the bottleneck nobody was expecting.

The company's San Francisco R&D facility expanded into a 55,000-square-foot space with nearly 100 engineers in just one facility. That's on top of 1,200 total employees spread across Nevada campuses. These aren't recruiting projections or aspirational headcount goals. These are people building hardware, integrating software, and testing power electronics systems right now. The facility opened in April 2025. By early 2026, it had already become a critical hub.

This matters because it signals where capital is flowing, where smart engineers are clustering, and what problems the industry actually considers solvable and urgent. When Nvidia and Google write checks into an energy storage business, they're not doing it because they believe in recycled batteries in the abstract. They're doing it because they can't build data centers without solving the power problem.

Let's break down what's actually happening, why it matters, and what it tells us about the next decade of infrastructure.

Why AI Data Centers Created an Energy Storage Shortage

Data centers have existed for 30 years. They've consumed a lot of electricity, sure, but the demand was predictable. You could plan capacity around it. You could negotiate long-term power purchase agreements with utilities. The grid could adapt.

Then AI happened. And suddenly, the playbook broke.

The difference is dramatic and specific. Traditional data centers operate with relatively stable, predictable power consumption. You know roughly how much electricity your servers need, and that doesn't change much month to month. Utilities can forecast, plan upgrades, and manage supply accordingly.

AI data centers are different. The raw compute density is higher. The power requirements per rack are immense. A single cutting-edge GPU can draw 400+ watts continuously. When you have thousands of them running simultaneously, doing matrix math for large language models and image generation, you're looking at power requirements that strain the grid in unprecedented ways.

Here's the real problem though: grid connection timelines. This is where Redwood's VP of business development, Claire Mc Connell, identified the core bottleneck. Companies building new data centers are being told that grid connection will take five to seven years. Not five to seven months. Years.

But the AI race doesn't wait for grid upgrades. Companies like OpenAI, Anthropic, and countless chip companies need compute capacity now. The competitive pressure is real. If you're not training models, you're falling behind. If you can't train models because you lack power, you've already lost.

That's where energy storage systems become critical. Instead of waiting for the grid, data center operators can deploy battery systems that provide immediate power, bridge the gap until grid connection, and offer backup during peak demand periods.

The math is compelling. A 12 megawatt system with 63 megawatt-hour capacity (like the one Redwood deployed with Crusoe Energy) can power a modular data center immediately while still serving grid stabilization functions. That's not theoretical future capacity. That's operational power today.

Mc Connell mentioned that pipeline conversations include hyperscalers seeking hundreds of megawatt-hours of capacity. Some conversations involve gigawatt-hour scale systems. To put that in perspective, a gigawatt-hour is 1,000 times larger than what Redwood deployed for Crusoe. That level of scale changes everything about infrastructure economics.

The shortage of available power isn't temporary gridlock. It's structural. The grid upgrade timelines are measured in years because utilities need regulatory approval, financing, environmental reviews, and construction time. You can't compress those processes just because Nvidia released a new chip generation.

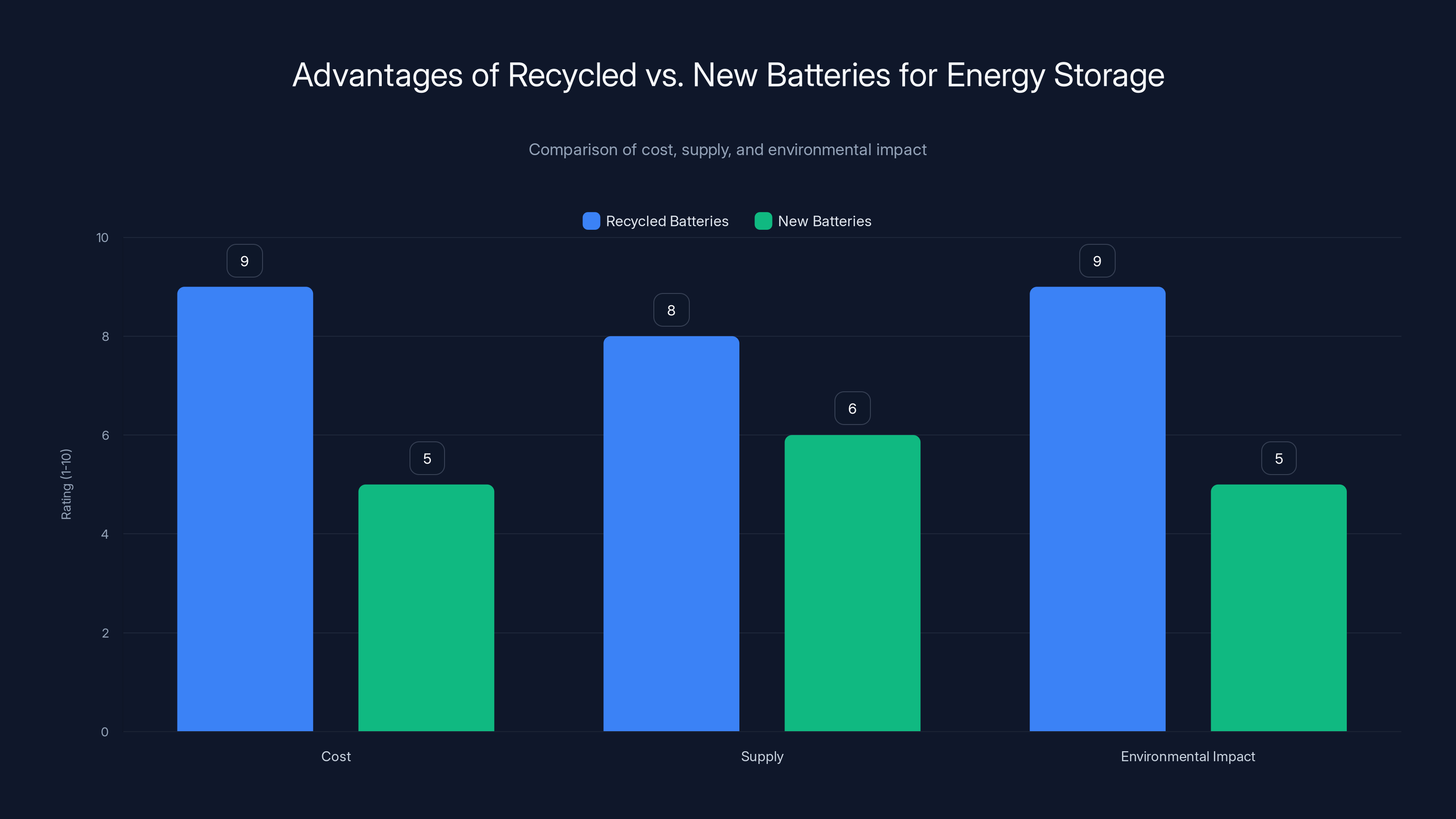

Recycled batteries score higher in cost-efficiency, supply predictability, and environmental benefits compared to new batteries. Estimated data based on qualitative advantages.

The Birth of Redwood Energy: How Battery Recycling Became Energy Storage

Redwood Materials was founded in 2017 by JB Straubel, the former CTO of Tesla. The original mission was beautifully simple: create a circular economy for batteries. Instead of throwing away used EV batteries after they degrade too much for vehicle use, recycle them, extract the valuable materials (nickel, cobalt, lithium), process them into new cathodes, and sell those back to battery manufacturers.

This was never about charity or environmental virtue signaling. It was about economics. Battery materials are expensive. Extracting them from ore is energy-intensive and environmentally destructive. If you could get those same materials from recycled batteries at lower cost and higher yield, you had a business.

For years, Redwood focused on this core mission. They built facilities, processed scrap from battery production and consumer electronics, and sold cathode material to customers like Panasonic. It was working. The business was growing. Battery recycling looked like a long-term, high-margin opportunity.

But then Straubel noticed something interesting. You don't process batteries instantly. You collect them, store them, sort them, process them. In that pipeline, you have thousands upon thousands of batteries that have degraded too much for vehicle use but haven't made it to the recycling line yet. These batteries still hold significant charge and can still cycle.

What if instead of waiting to recycle them, you used that stored energy?

Redwood Energy was born from that insight. The unit launched in the summer of 2025, leveraging the thousands of EV batteries accumulated through the company's recycling operations. Instead of extracting materials, you were extracting electricity.

The first deployment was with Crusoe Energy, an interesting choice because Straubel had invested in Crusoe back in 2021. Crusoe operates modular data centers and is known for its large-scale facility in Abilene, Texas, which served as the initial site for the Stargate project (the massive OpenAI infrastructure investment). Crusoe understood data center power requirements deeply.

The system deployed was substantial: 12 megawatts of power capacity with 63 megawatt-hours of energy storage. For reference, that's enough to power roughly 9,000 homes for one hour, or power a modest data center for several hours under peak demand.

The deployment model is elegant. Redwood sources used EV batteries that have been traded in, typically after 8-10 years of vehicle service. These batteries have lost capacity but can still cycle thousands of times. Rather than letting that capacity sit idle waiting for processing, it gets deployed immediately as grid-balancing and backup power for data centers.

What makes this model work economically is that the batteries have already paid for themselves. The battery pack cost was absorbed when the vehicle was manufactured and sold. By the time it reaches Redwood, it's essentially free material with residual value. That changes the unit economics completely compared to building new battery packs from scratch.

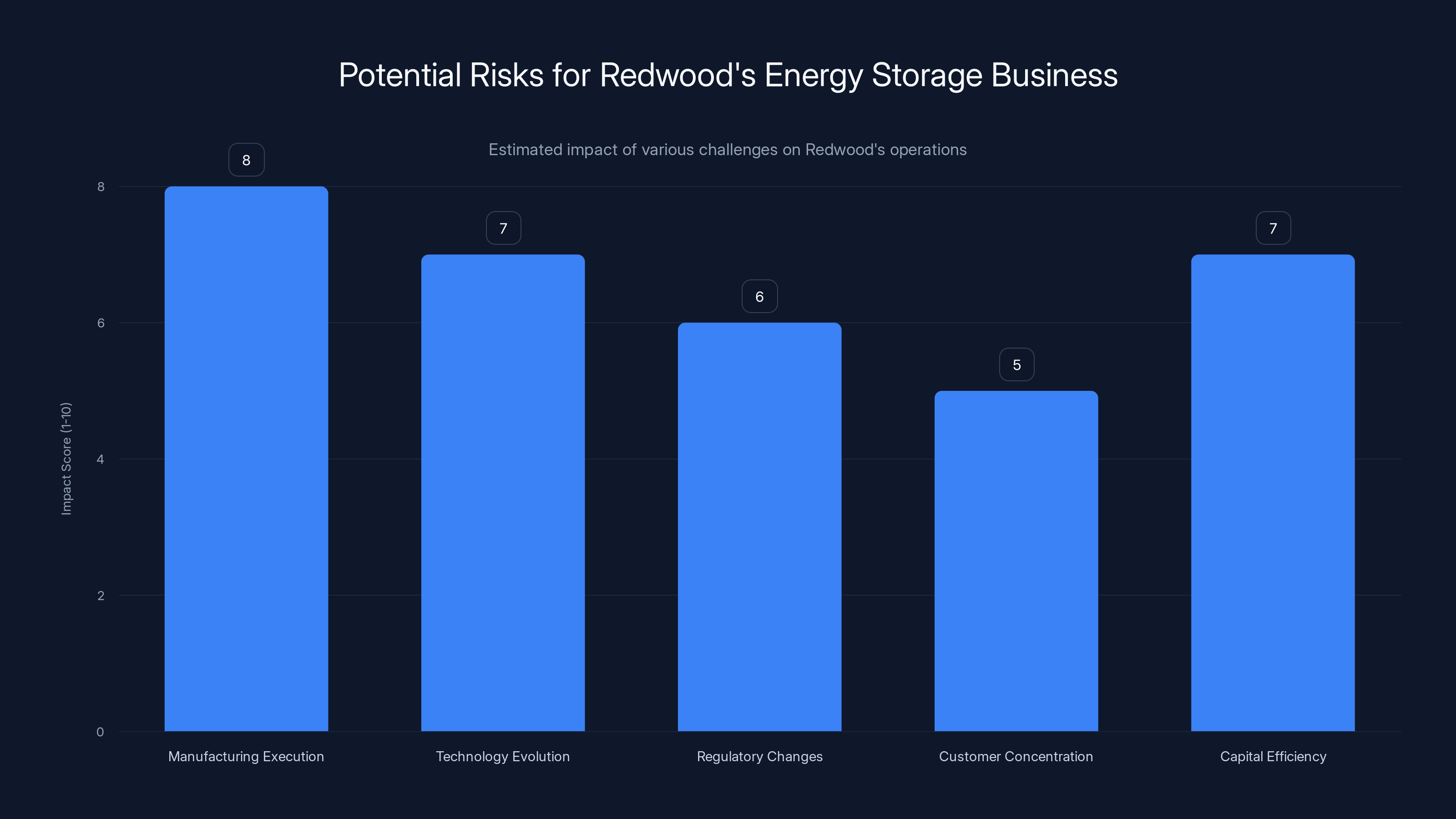

Estimated data: Manufacturing execution and technology evolution present the highest risks to Redwood's energy storage business, with scores of 8 and 7 respectively.

Understanding the $425 Million Series E: What Investors Actually Valued

In early 2026, Redwood raised $425 million in Series E funding. That's not a trivial amount. To put it in perspective, that's roughly what an entire Series C or D round would be for most venture-backed companies. This was strategic capital from serious players.

The round included Google as a new investor and Nvidia as an existing investor participating in the round. This wasn't diversification capital. This was infrastructure capital from companies that understand what they need to operate globally at scale.

Why would Google and Nvidia care about this round specifically? Because energy storage is a constraint on their roadmaps.

Google operates data centers across the world and is aggressively scaling AI infrastructure to compete with competitors. Grid access is increasingly difficult in many regions. Energy costs are rising. Reliability requirements are increasing. Energy storage systems that can bridge the gap between peak demand and available grid capacity directly solve a problem Google needs solved.

Nvidia doesn't operate data centers itself, but its entire business depends on customers being able to build and deploy data centers. If power is the bottleneck preventing GPU deployments, then power infrastructure becomes Nvidia's problem too. By investing in Redwood's energy storage business, Nvidia is removing a constraint on GPU adoption.

The capital itself will be deployed to scale manufacturing and deployment. Redwood needs to build more battery management systems, integrate more power electronics, and deploy systems at larger scales. Moving from the Crusoe deployment (12 MW, 63 MWh) to the pipeline conversations (hundreds of MWh, potentially gigawatt-hour scale) requires different infrastructure.

The San Francisco facility expansion is part of that. But so is manufacturing capacity. Redwood will need to produce more integrated systems, more power conversion equipment, more software that manages thousands of batteries operating in concert.

The Technical Challenge: Integrating Old Batteries into Modern Power Systems

Here's what most people don't understand about energy storage systems: taking a pile of used batteries and turning it into reliable, grid-integrated power is genuinely hard engineering.

Used EV batteries aren't uniform. They come from different manufacturers, different chemistries, different ages, and different states of health. A battery pack that spent five years in Phoenix has different characteristics than one from Minnesota. One that was charged aggressively has different cycle capabilities than one that was managed conservatively.

When you're building a grid-interactive system, you need predictability. The grid doesn't tolerate surprises. If you commit to providing 12 megawatts of power, you need to actually provide 12 megawatts. You can't have 5 megawatts randomly drop out because some batteries are behaving oddly.

That's where the engineering challenge lives. Redwood's San Francisco facility isn't just doing integration work. It's doing research to understand how heterogeneous used battery packs behave as a system, how to manage thousands of batteries with different characteristics, and how to maintain reliability while maximizing the utilization of imperfect components.

This requires sophisticated battery management systems. You need real-time monitoring of each battery module, predictive algorithms that forecast available capacity, active balancing systems that distribute load intelligently, and thermal management to keep everything operating safely.

The power electronics layer is equally complex. Converting the DC power from battery packs into AC power suitable for grid injection requires sophisticated inverters, controls, and safety systems. These systems need to respond to grid signals instantly, provide voltage support, handle phase balancing, and disconnect safely if something goes wrong.

Then there's the software layer. A deployed energy storage system isn't just a pile of batteries connected to the grid. It's an active participant in grid operations. Modern grids are increasingly dynamic, with distributed generation from solar and wind, electric vehicle charging that creates sudden demand spikes, and renewable variability that requires storage systems to respond intelligently.

Redwood's systems need to communicate with grid operators, respond to price signals, and make real-time decisions about when to charge and discharge. Mc Connell mentioned that the San Francisco facility integrates "hardware, software, and power electronics for energy storage systems." That triple integration is where the complexity lives and where competitive advantage emerges.

Systems that can respond faster, predict demand more accurately, and operate more reliably than competitors will get deployed first and at premium pricing. That's what Redwood's engineering team is solving.

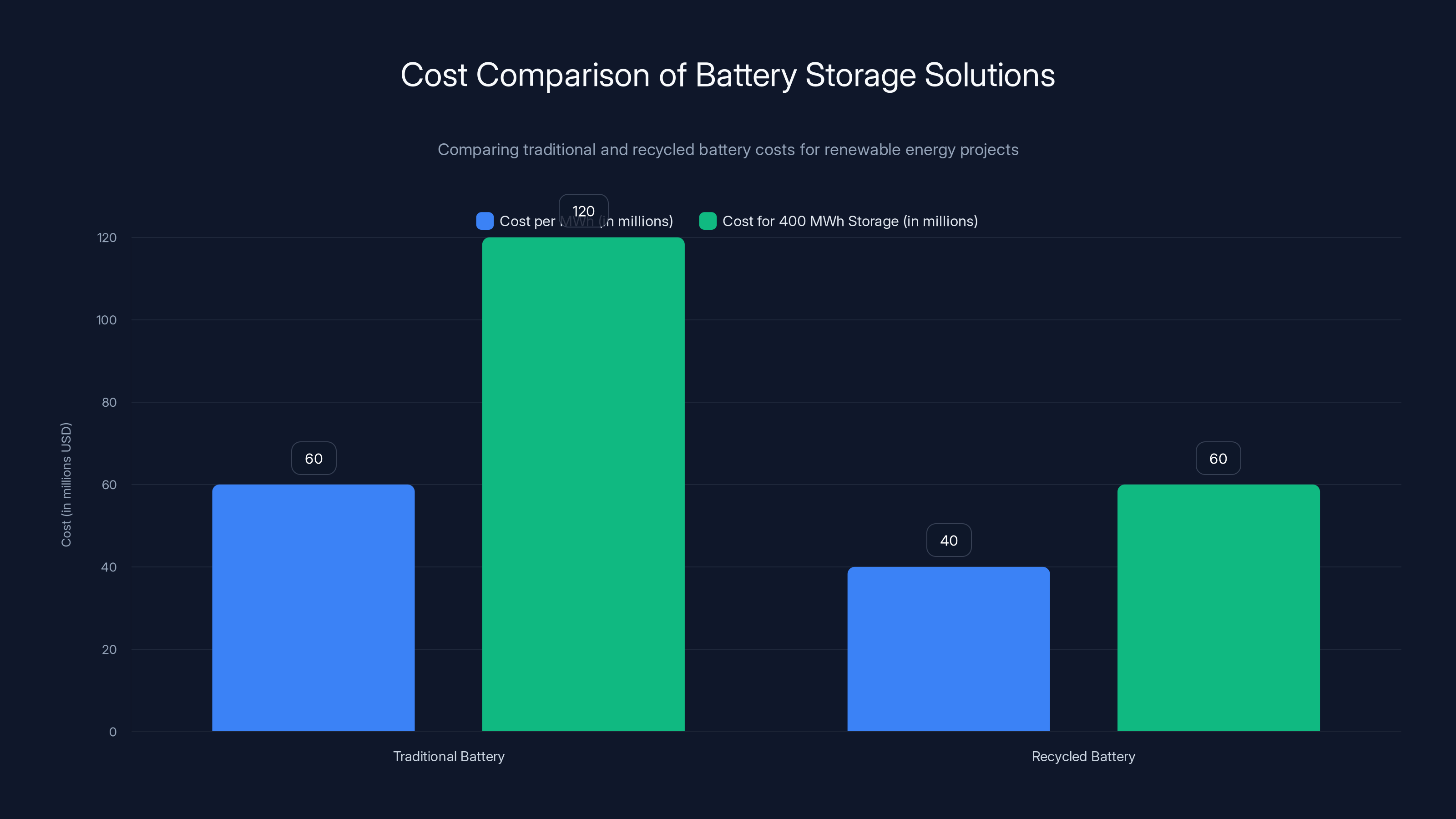

Recycled battery solutions can reduce storage costs significantly, from

The Data Center Power Economics: Why Energy Storage Beats Waiting for Grid Upgrades

Let's do some actual math on why energy storage makes economic sense for data center operators.

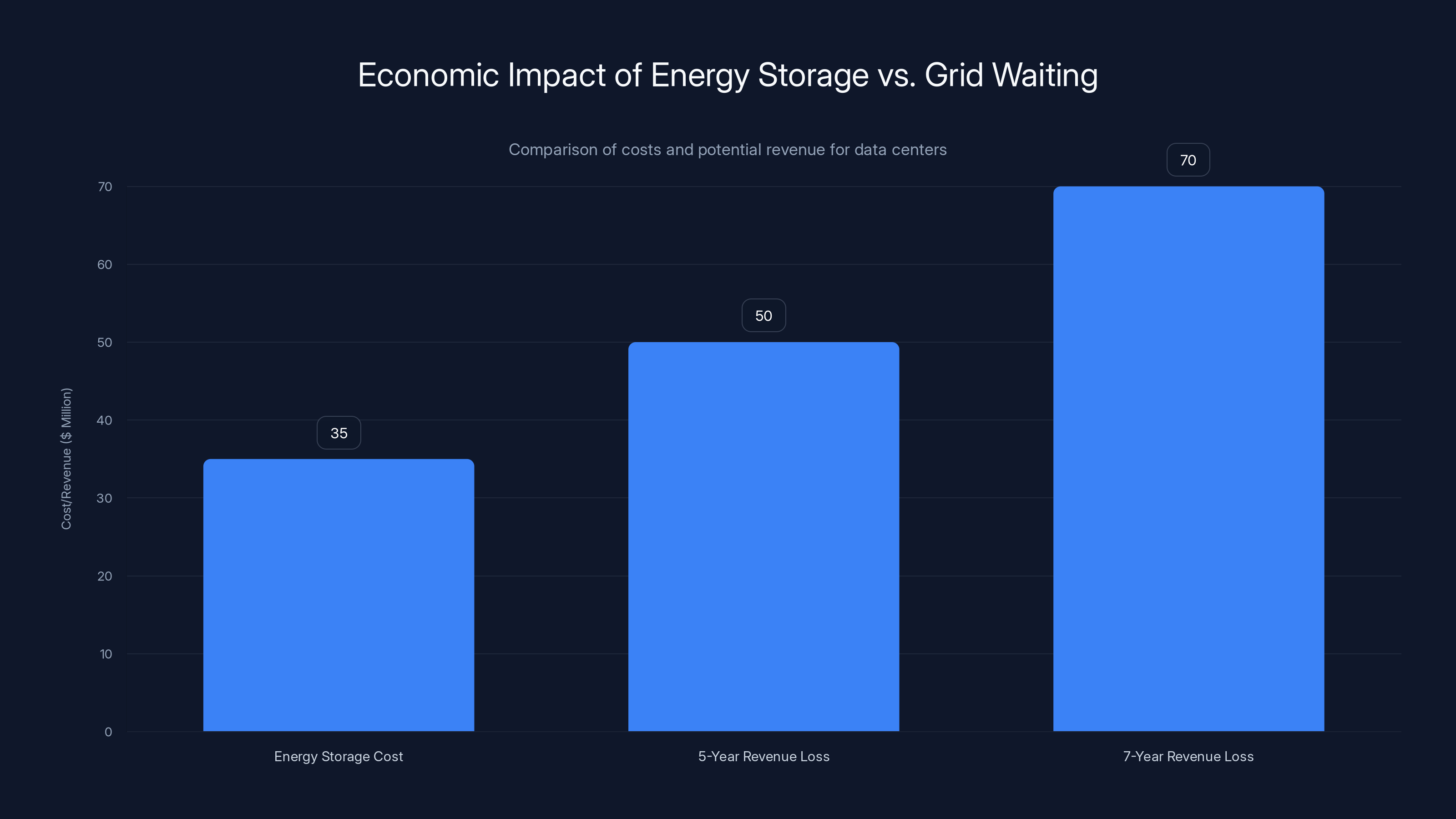

Assume you're an operator planning a new data center that will eventually draw 50 megawatts of continuous power. Grid connection takes 5-7 years. During that time, you can't operate. You lose competitive time, you can't serve customers, and you miss revenue.

Alternatively, you deploy a 50 MW energy storage system with sufficient duration to cover daily peaking. Let's use a reasonable figure of 4 hours of storage (200 MWh). This is roughly what a modern LCOS (levelized cost of storage) analysis suggests: $150-200 per MWh for battery storage deployed at scale.

At

For a hyperscaler training AI models, the value of immediate compute availability is measured in billions. A 50 MW data center running GPU clusters could generate $50-100+ million annually in model training revenue, API access revenue, or internal value. Waiting 5-7 years means losing that entire window.

There's also a strategic element. If Competitor A deploys energy storage and gets operational immediately, while Competitor B waits for grid connection, Competitor A has 5-7 years to develop better models, improve products, and gain market share. From that perspective, $35 million seems almost trivial.

This is why Mc Connell's mention of pipeline conversations including "hundreds of megawatt-hours" and "multiple gigawatt-hours" is so significant. Those aren't niche use cases. Those are mainstream hyperscaler deployments becoming standard practice.

Redwood's cost structure gives them an advantage. Because they're using already-depreciated EV batteries, their input material costs are lower than companies building systems from scratch. That advantage compounds as they scale. They can deploy larger systems at lower per-megawatt-hour costs than competitors, making more projects economically viable.

Renewable Energy Integration: The Broader Use Case Beyond Data Centers

While AI data centers are clearly driving Redwood Energy's near-term growth, Mc Connell was deliberate in mentioning other applications. Renewable energy projects—particularly solar and wind farms—represent enormous untapped potential.

The challenge with renewable energy isn't generation. Solar and wind can generate electricity cheaply at scale. The challenge is when that generation happens versus when demand occurs. Solar generates during the day; demand peaks in evening. Wind generates inconsistently; demand needs consistency. That mismatch is why renewables haven't completely displaced fossil fuels despite massive cost improvements.

Energy storage solves that mismatch. Battery systems that can absorb excess solar generation during the day and discharge during peak evening hours increase the value of the solar installation dramatically. The same applies to wind farms: storing excess generation from windy periods and providing power during calm periods.

But here's the issue: large-scale battery storage has been expensive. Traditional lithium-ion battery systems cost

Redwood's used battery approach could be a game-changer for renewable projects that currently struggle to justify storage economics. A wind farm generating 100 MW that wants to add 400 MWh of storage (4 hours of duration) needs

That's not a minor difference. That's the difference between projects being greenlit or rejected in development review. That's the difference between "great idea that doesn't work economically" and "great idea that makes financial sense."

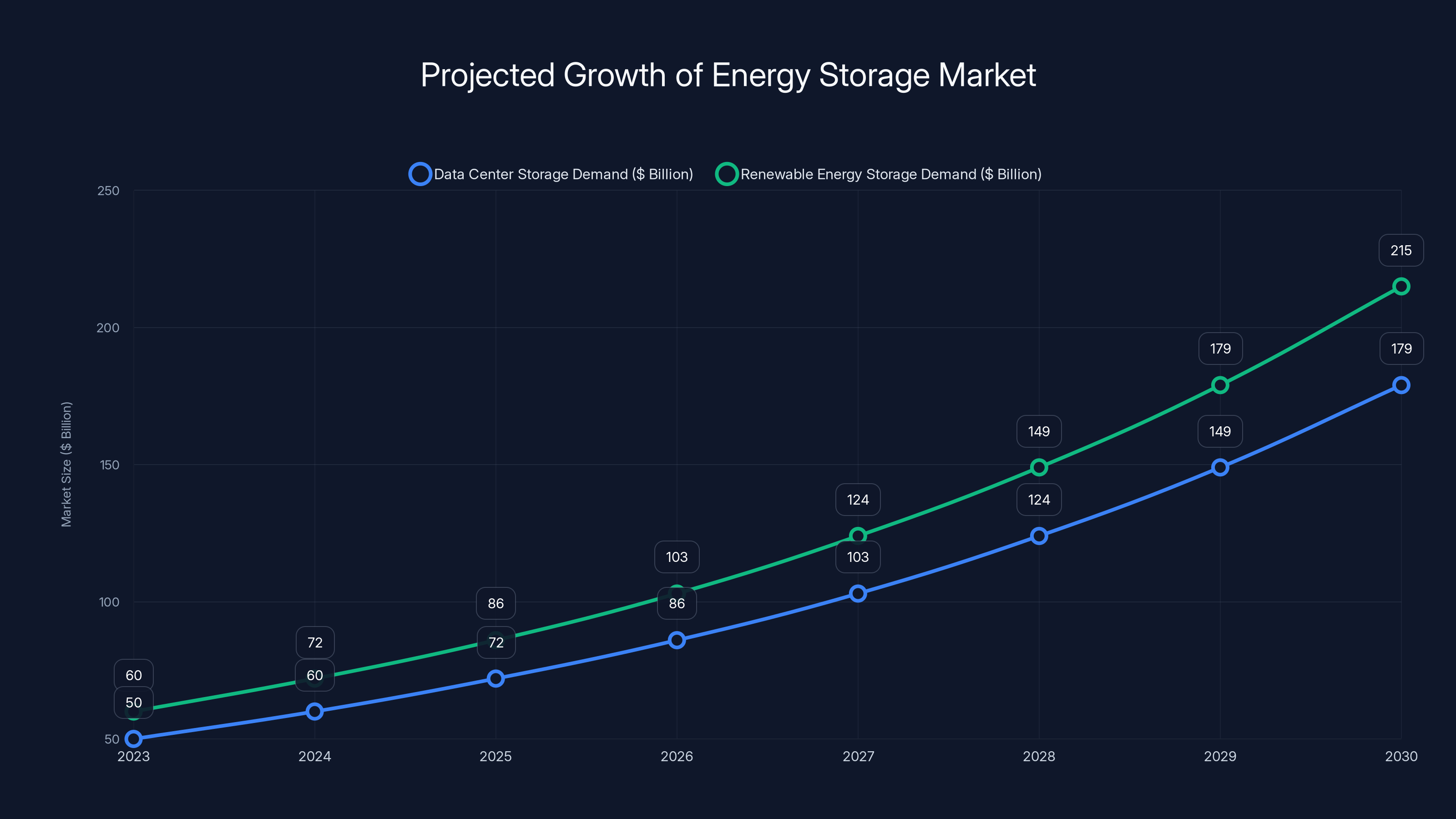

The renewable energy market is enormous. Global renewable energy capacity additions are approaching 500 gigawatts annually. Even a fraction of that capacity needing storage represents a multi-hundred-billion-dollar market over the next decade.

The energy storage market is projected to grow significantly, driven by data center and renewable energy demands, with potential market sizes reaching hundreds of billions annually. Estimated data.

The Battery Recycling Connection: Why Vertical Integration Matters

Redwood's origin as a battery recycling company isn't incidental to its energy storage strategy. It's foundational. The vertical integration between recycling and storage creates advantages that pure-play energy storage companies can't match.

First, there's the supply chain advantage. Redwood has thousands of used EV batteries flowing through its operations constantly. That's stable, predictable supply of the core material. A pure energy storage company building new battery packs is dependent on lithium, nickel, and cobalt supply—materials subject to price volatility, geopolitical risk, and supply chain constraints.

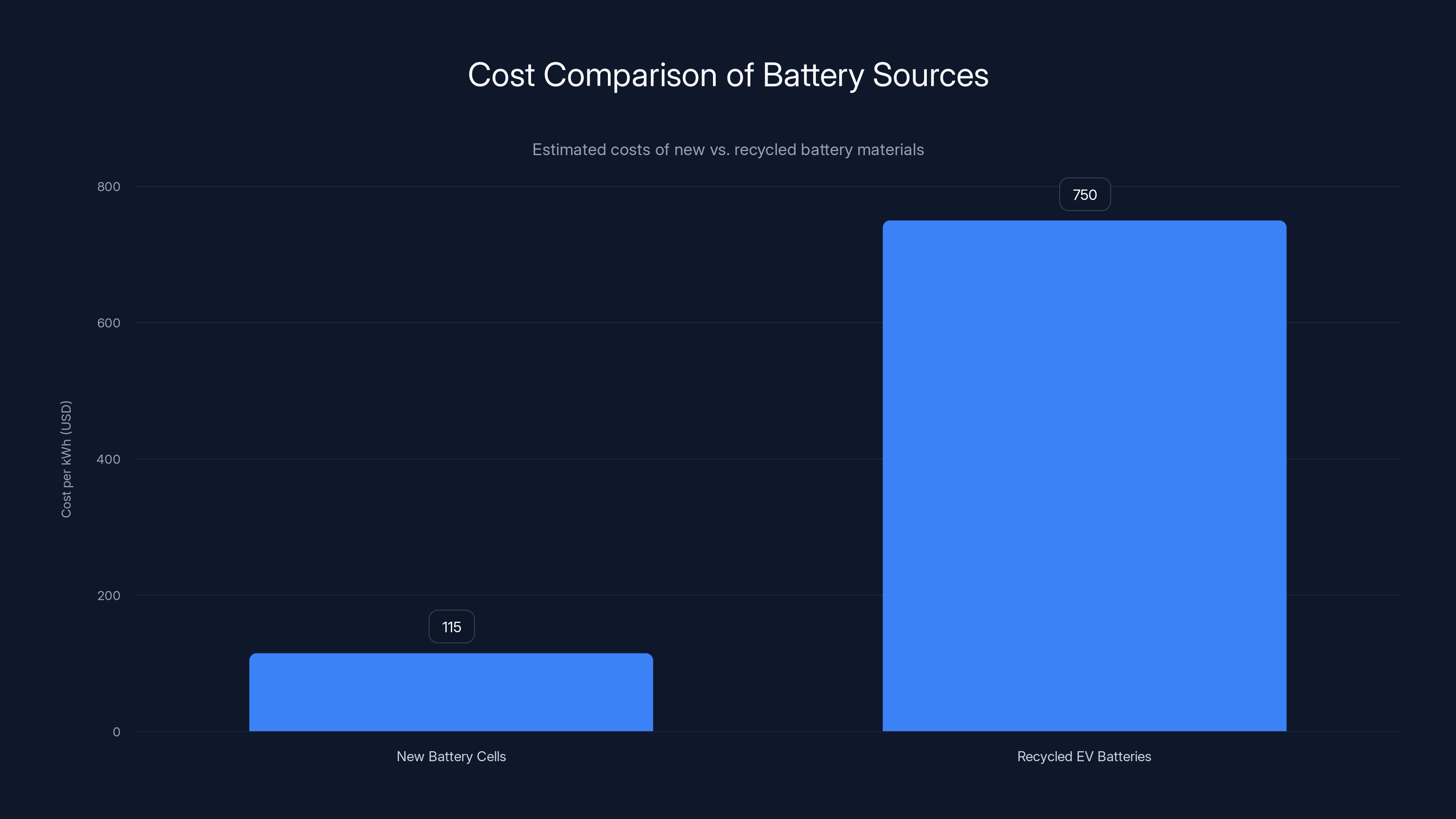

Second, there's the cost advantage. New battery cells cost $80-150 per kWh. Used EV batteries that Redwood acquires are essentially free (the original buyer paid for them, and Redwood captures the residual value). Even applying a 40-50% haircut for degradation and reconditioning, that's dramatically cheaper than new cells.

Third, there's the circularity advantage. Traditional battery manufacturing is energy-intensive and environmentally damaging. Redwood's model extracts second-life value from existing material, reducing the need for virgin extraction. That's increasingly important as regulations push toward circular economy requirements.

Fourth, there's the technological advantage. Understanding battery behavior deeply—how different cells age, what causes degradation, how to predict remaining useful life—is Redwood's core competency from its recycling business. That expertise directly applies to managing heterogeneous used batteries in energy storage systems.

This is why the company's expansion into energy storage wasn't a desperate pivot. It was a logical extension of existing capabilities into an adjacent market with massive demand. Redwood was already operating the supply chain, had the expertise, understood the material, and had relationships with potential customers (automakers, charge networks, etc.).

Redwood didn't need to build an energy storage business from scratch. It needed to redirect the material pipeline and apply domain expertise to a new application. That's a much faster path to market leadership than competitors building from zero.

Manufacturing Scaling: From Pilot to Production

Redwood Energy launched in June 2025. By early 2026, less than a year later, it was the fastest-growing unit in the company. That acceleration required manufacturing capability to scale rapidly.

The San Francisco facility expansion isn't just R&D. It's also where systems are integrated and tested before deployment. That's manufacturing work disguised as engineering. As Redwood moves from single deployments (Crusoe's 12 MW system) to multiple simultaneous deployments (the pipeline conversations), manufacturing throughput becomes the limiting factor.

Scaling energy storage manufacturing involves several challenges. First, the battery packing and conditioning work. Taking used batteries and preparing them for system integration requires systematic processes that can handle thousands of units simultaneously while maintaining quality. Redwood needs automated testing, binning (grouping similar batteries together), and reconditioning equipment.

Second, the power electronics manufacturing. The inverters and controls that convert battery DC power to grid AC power are sophisticated electronics requiring precision assembly and testing. As volume increases, Redwood needs to move from custom builds to modular, scalable production.

Third, the system integration. Actually connecting thousands of batteries, power electronics, controls, and software into a functioning system is complex assembly work. Redwood needs factories that can handle this at scale.

The $425 million funding round is largely going toward this manufacturing scaling. Redwood will probably build or expand manufacturing facilities beyond the San Francisco R&D site. The capital will support equipment purchases, supply chain development, and hiring manufacturing engineers and operators.

That's why the funding amount is significant. It's not inflated to make the valuation sound impressive. It's the actual capital required to move from lab-scale (Crusoe deployment) to production-scale (multiple simultaneous hyperscaler deployments).

Recycled EV batteries offer a significant cost advantage, with acquisition and processing costs estimated at

Competitive Landscape: Who Else Is Playing Energy Storage?

Redwood isn't alone in seeing the opportunity. The energy storage market is attracting players across the spectrum.

Traditional battery manufacturers like Tesla with its Megapack products and LG are building grid-scale battery systems. The advantage: integrated manufacturing, known quality, scale. The disadvantage: high costs and long delivery times due to supply chain constraints.

Pure-play energy storage companies like EOS Energy (which builds iron-air batteries) and Vault Energy are building novel battery chemistry. The advantage: potentially better energy density or cost. The disadvantage: unproven at scale, regulatory uncertainty, and long development timelines.

Utility companies like Duke Energy and southern California Edison are exploring battery storage deployments. The advantage: capital, real estate, grid integration expertise. The disadvantage: slow decision-making, legacy cost structures, less technical innovation.

What makes Redwood different is the combination of supply chain (used batteries), cost advantage (no virgin material costs), and vertical integration (from recycling to storage). Competitors can beat them on one dimension. It's harder to beat them on all three simultaneously.

Grid Integration and Regulatory Requirements

Energy storage systems don't exist in a vacuum. They integrate with power grids that are heavily regulated, with requirements that vary by region.

In the United States, energy storage systems participating in wholesale power markets need to navigate FERC (Federal Energy Regulatory Commission) rules about market participation, interconnection procedures, and operational requirements. Different regions have different independent system operators (ISOs) with different rules. PJM's rules differ from CAISO's, which differ from ERCOT's.

Then there are state-level regulations about renewable energy integration, storage incentives, and interconnection timelines. Some states (California, New York) have aggressive storage deployment targets. Others are just getting started.

International deployments add more complexity. European grids operate differently from US grids. Asian markets have different regulatory frameworks. Redwood's energy storage systems need to be flexible enough to operate across different regulatory environments while complying with local requirements.

This is where technical expertise compounds into competitive advantage. Redwood's engineers need to understand not just how to build storage systems, but how those systems interact with different grid architectures, frequency characteristics, and regulatory frameworks.

Deploying a 200 MWh energy storage system costs

Supply Chain Resilience: The Strategic Advantage of Used Batteries

Global supply chains for battery materials are increasingly strained. Lithium prices surged 10x between 2020 and 2022 before moderating. Cobalt supplies are concentrated in Congo with geopolitical risk. Nickel supplies are affected by Indonesia's export restrictions and processing limitations.

For companies building new battery packs, this is a constant headache. Prices are volatile. Availability is uncertain. Long-term contracts lock you into potentially unfavorable terms.

For Redwood, the supply chain is different. Used EV batteries are a predictable flow. As EV adoption continues growing, more batteries reach end-of-vehicle-life. Redwood has first-mover advantage in building relationships with recyclers, auto dealers, and fleet operators who source these batteries.

That supply chain resilience is undervalued strategically. In an environment where battery material supply is constrained, being able to operate at scale using recycled material is a massive competitive advantage. It insulates you from price spikes and supply disruptions that could halt competitors' operations.

This also creates a strategic moat. As Redwood scales energy storage deployments, it builds relationships with hyperscalers, grid operators, and renewable energy companies. Those customers have alternatives (Tesla Megapack, LG battery systems, etc.), but switching costs increase over time. Redwood becomes embedded in their infrastructure planning.

Meanwhile, competitors building systems from new batteries face increasing pressure from material supply constraints. The margin advantage swings further toward Redwood.

Market Size and Growth Projections: The Numbers Behind the Growth

Redwood Energy's rapid growth is grounded in enormous market demand. Let's look at the numbers.

Data center energy storage needs are being driven by AI infrastructure deployment. Major cloud companies (AWS, Google Cloud, Microsoft Azure) are building data centers at unprecedented scales. Industry analysts estimate $500 billion+ in annual infrastructure spending across major cloud providers. Energy storage is a critical component of that.

If just 10% of new data center capacity requires energy storage (a conservative estimate given grid constraints), that's

Renewable energy storage adds another dimension. Global renewable energy additions are approaching 500 GW annually. If 20% of that capacity includes co-deployed storage (another conservative estimate), that's 100 GW of storage deployed annually. At typical system costs of

Combined, the addressable market for energy storage systems is measured in hundreds of billions of dollars annually, with growth rates of 20-30% per year. Redwood is entering at a moment when the market is expanding rapidly and fragmentation is high.

For Redwood to capture even 5-10% of this market, it needs to scale manufacturing by orders of magnitude from current levels. The

That's not unrealistic. The market is that large. The demand is that urgent. The supply constraints are real. Redwood has competitive advantages. It's a credible path to a multi-billion-dollar business.

Deployment Timeline and Real-World Implementation

Redwood Energy's first real deployment was with Crusoe Energy in mid-2025. The 12 MW / 63 MWh system became operational and has been providing power to Crusoe's modular data center. This isn't vaporware or a prototype. It's a real system powering real workloads.

The Crusoe deployment is the reference installation for future deals. When Redwood talks to hyperscalers about deploying gigawatt-hour-scale systems, they can point to the Crusoe system as proof that the concept works. That's valuable for selling large deals.

But Crusoe deployment timelines are instructive. The project took roughly 12-18 months from concept to full operation. Sourcing used batteries, conditioning them, integrating power electronics, testing safety systems, obtaining interconnection approval—all of that takes time.

As Redwood scales to multiple simultaneous deployments, that timeline becomes critical. Hyperscalers aren't patient. They want systems operational yesterday. The company needs to reduce deployment timelines from 12-18 months to 6-9 months, or less. That requires standardized designs, pre-integrated components, and optimized installation procedures.

Mc Connell's comments about pipeline deals "in the hundreds of megawatt-hours" and "multiple gigawatt-hours" suggest deployment timelines within the next 12-24 months. That's aggressive. Redwood needs manufacturing capacity, supply chain, and installation expertise ramped up significantly.

The San Francisco facility expansion and $425 million funding round support that timeline. But execution risk remains. Moving from single deployments to simultaneous multi-gigawatt-hour deployments is manufacturing scaling on a grand scale.

The Strategic Significance of Google and Nvidia as Investors

When Google and Nvidia commit capital to a specific business unit, it signals strategic importance beyond financial return. These aren't passive investors hoping for equity appreciation. They're signaling that they need this business to succeed because it enables their own strategies.

Google's investment makes sense strategically. Google is aggressively building AI infrastructure to compete with Microsoft (which has invested heavily in OpenAI and controls significant compute capacity). Building data centers to train and serve large language models requires unprecedented power capacity. Grid constraints are becoming a real bottleneck to Google's AI roadmap. Energy storage systems that allow data center deployment without waiting for grid upgrades directly enable Google's infrastructure plans.

Nvidia's investment is slightly different but equally strategic. Nvidia's business depends on customers being able to build and deploy data centers using Nvidia GPUs. If power is the limiting factor, Nvidia's GPU sales are limited too. By investing in Redwood's energy storage business, Nvidia is removing a constraint on its own growth. The strategic payoff is potentially larger than the financial return.

Both investments also signal that grid-connected energy storage for data centers has moved from "interesting future possibility" to "critical near-term infrastructure." That signals changes how venture and corporate investment flows. Storage companies that looked speculative two years ago now look essential.

Challenges Ahead: What Could Go Wrong

Redwood's energy storage business has obvious tailwinds. Market demand is strong. Competitive advantages are real. Capital is available. But significant challenges remain.

First, manufacturing execution risk. Moving from prototype to production at scale is where many hardware companies stumble. Redwood needs to maintain quality while scaling volume, manage cost increases from supply chain pressures, and hire and retain manufacturing talent. Any misstep compounds across thousands of units.

Second, technology evolution risk. The energy storage market is moving rapidly. New battery chemistries (iron-air, solid-state, sodium-ion) could dramatically change unit economics within 3-5 years. If Redwood commits to recycled lithium-ion batteries and a fundamentally superior alternative emerges, the business model becomes obsolete. Managing technology risk while scaling current production is genuinely difficult.

Third, regulatory risk. Energy storage systems are heavily regulated. Rule changes at FERC, state PUCs, or international markets could alter market economics. Interconnection timelines, market participation rules, or incentive changes could affect demand.

Fourth, customer concentration risk. Early deals (like Crusoe) involve relatively small number of customers. If Redwood becomes dependent on hyperscalers that are also its investors (Google, Nvidia), conflicts of interest and pricing pressure become real issues.

Fifth, capital efficiency risk. The $425 million funding round enables growth, but it's not unlimited. If manufacturing costs exceed projections or deployment timelines stretch, Redwood could run into funding constraints before reaching profitability.

None of these are reasons to doubt Redwood's strategy. They're just reality checks on what execution actually requires.

Future Outlook: What Happens Next in Energy Storage

The energy storage market is at an inflection point. Grid constraints, renewable energy deployment targets, AI infrastructure needs, and electric vehicle charging demands all converge to create massive growth opportunities.

Redwood is positioned to capture significant share of that market. The company has supply chain advantages, cost advantages, technical expertise, and early market traction. The investment from Google and Nvidia validates the strategic importance of what Redwood is building.

But Redwood is also part of a broader transformation in energy infrastructure. The grid isn't built for a world where AI data centers consume terawatts of power, where electric vehicles charge by the millions, and where renewable generation is variable. Energy storage is part of how that world works.

The infrastructure being built today will define energy economics for decades. Redwood's choices about system architecture, battery management, and operational philosophy will influence how energy storage evolves. That's why Google and Nvidia care enough to invest. The outcome matters beyond just Redwood's financial success.

Over the next 5-10 years, expect energy storage to become as ubiquitous and critical as transmission infrastructure is today. Companies that can deploy storage systems reliably at scale will be essential to how the entire infrastructure ecosystem operates. Redwood is betting on being one of those companies. The early evidence suggests it's a credible bet.

FAQ

What is battery recycling and how does it relate to energy storage?

Battery recycling extracts valuable materials like lithium, nickel, and cobalt from used batteries that have reached end-of-life. Redwood Materials pioneered a circular model where recycled materials are processed into new battery cathodes. The connection to energy storage is that used EV batteries still contain significant energy capacity even after degradation from vehicle use, and this residual capacity can be deployed for stationary energy storage applications before final material recycling occurs.

How does Redwood's energy storage system work with AI data centers?

Redwood's energy storage systems provide immediate power to data centers while they wait for grid connections, which can take 5-7 years. The systems use recycled EV batteries that retain 70-80% of original capacity to store energy, which is then converted to usable AC power through power electronics and fed to data center infrastructure. This allows AI data center operators to begin operations immediately rather than waiting for grid upgrade timelines, enabling them to stay competitive in the AI race where deployment speed is critical.

What are the advantages of using recycled batteries for energy storage over new batteries?

Recycled batteries offer three major advantages: significantly lower cost since the original manufacturing expense was already absorbed by vehicle owners, predictable supply through Redwood's existing recycling operations, and environmental benefits from extending material life cycles. Additionally, Redwood's expertise in understanding battery degradation and behavior—developed through its recycling business—directly applies to managing heterogeneous used batteries in storage systems more effectively than competitors can.

Why did Google and Nvidia invest in Redwood Energy specifically?

Google needs reliable power infrastructure to build AI data centers globally without waiting for grid upgrades to keep pace with its infrastructure expansion plans. Nvidia depends on customers being able to build data centers using its GPUs, and power availability is increasingly the limiting factor. By investing in Redwood Energy, both companies are removing critical infrastructure bottlenecks that constrain their own growth and market opportunities.

What is the market size for energy storage systems?

The addressable market is enormous. AI data center infrastructure alone represents

What challenges does Redwood Energy face as it scales?

Key challenges include manufacturing execution at dramatically larger scales, managing technology evolution as new battery chemistries emerge, navigating complex and changing regulatory requirements across different grids and regions, reducing deployment timelines from 12-18 months to under 9 months, maintaining cost advantages as supply chains evolve, and avoiding customer concentration risk where early deals depend on a small number of hyperscaler customers. Successful execution across all these dimensions simultaneously is difficult and represents genuine scaling risk.

How do energy storage systems integrate with existing power grids?

Energy storage systems connect to power grids through sophisticated controls that manage frequency, voltage, and power flow in real-time. They respond to grid operator signals to charge during periods of excess generation or low demand, and discharge during peak demand periods. This requires compliance with complex FERC regulations, regional ISO (Independent System Operator) requirements, and state-level rules. Different regulatory jurisdictions have different rules about market participation, interconnection procedures, and operational requirements that systems must navigate.

What makes Redwood Materials different from other energy storage companies?

Redwood's vertical integration from battery recycling to energy storage deployment creates competitive advantages competitors can't easily replicate: a predictable supply chain of used batteries, dramatically lower input material costs, deep expertise in battery behavior and degradation from recycling operations, and established relationships across the battery ecosystem. This combination of supply chain, cost, and technical advantages makes it difficult for pure-play energy storage companies to compete on equal terms.

How long does it take to deploy a Redwood energy storage system at a data center?

Based on the Crusoe Energy deployment (Redwood's first major system), the timeline is roughly 12-18 months from project initiation to full operation. This includes battery sourcing and conditioning, power electronics integration, safety testing, control system development, and interconnection approval processes. As Redwood scales operations, the goal is to reduce this to 6-9 months through standardized designs and optimized processes, though this remains a major execution challenge.

What happens to energy storage systems after batteries degrade further?

Redwood Energy systems eventually reach a point where battery degradation makes them uneconomical to operate for storage (typically after 10-15 years of stationary use). At that point, batteries return to Redwood Materials' recycling operations where valuable materials are extracted and processed into new cathodes or sold to other battery manufacturers. This creates a true circular economy where material value is extracted at every stage of the battery lifecycle, not just at the end.

TL; DR

- AI data centers face a 5-7 year grid connection bottleneck that's driving urgent demand for energy storage systems to enable immediate operations

- Redwood Energy, launched in mid-2025, is the fastest-growing business unit at Redwood Materials with first deployment (12 MW / 63 MWh with Crusoe) already operational

- Google and Nvidia invested $425 million in Series E specifically to scale energy storage operations, signaling strategic importance beyond typical venture investment

- Supply chain advantages compound competitively: recycled EV batteries cost 50-60% less than new batteries while providing identical grid storage functionality

- Market opportunity is massive: AI data center storage alone is 60-160 billion, both growing 20-30% per year

- Challenges remain significant: manufacturing scaling, technology evolution, regulatory complexity, and deployment timeline compression all require flawless execution

- Strategic outcome matters beyond Redwood: how energy storage infrastructure is built today will define global energy economics for decades as AI infrastructure and renewable energy deployment accelerate

- Bottom line: Redwood's vertical integration from recycling to storage, combined with market tailwinds and strategic backing, positions the company to capture substantial market share in a multi-hundred-billion-dollar emerging market

What Redwood Materials' Energy Storage Growth Means for the Broader AI Infrastructure Ecosystem

The story of Redwood Energy isn't just a story about one company executing well on an opportunity. It's a story about infrastructure constraints forcing innovation. AI infrastructure is expanding faster than the grid can support it. Energy storage bridges that gap. Companies that solve that bridging effectively will be foundational to the entire AI infrastructure ecosystem for the next decade.

Redwood is one of the early leaders. The growth trajectory suggests they might be more than that.

Key Takeaways

- AI data center energy storage is the fastest-growing business segment, driven by 5-7 year grid connection timelines that make immediate power deployment essential

- Redwood Materials' vertical integration from battery recycling to energy storage deployment creates 50-60% cost advantages over new battery systems while ensuring stable supply

- Google and Nvidia's strategic investment signals that grid-connected energy storage has moved from speculative to critical infrastructure status for their own growth

- The energy storage market combines AI data center demand (60-160 billion annually), totaling hundreds of billions over the decade

- Deployment timelines and manufacturing scaling remain the highest execution risk as Redwood moves from single deployments to simultaneous gigawatt-hour scale operations

Related Articles

- Heron Power's $140M Bet on Grid-Altering Solid-State Transformers [2025]

- SoftBank's $33B Gas Power Plant: AI Data Centers and Energy Strategy [2025]

- Mirai's On-Device AI Inference Engine: The Future of Edge Computing [2025]

- Rapidata's Real-Time RLHF: Transforming AI Model Development [2025]

- Nvidia and Meta's AI Chip Deal: What It Means for the Future [2025]

- MSI Vector 16 HX AI Laptop: Local AI Computing Beast [2025]

![AI Data Centers & Energy Storage: The Redwood Materials Revolution [2025]](https://tryrunable.com/blog/ai-data-centers-energy-storage-the-redwood-materials-revolut/image-1-1771537224094.jpg)