Introduction: Why a Century-Old Technology Just Got Disrupted

Imagine a piece of technology that's been sitting in electrical substations basically unchanged for over 100 years. It works fine. It's cheap. It does exactly what you need.

Now imagine someone figured out how to replace it with something smaller, smarter, and way more flexible.

That's what Heron Power is doing with solid-state transformers, and the market is responding fast.

Drawing parallels to how battery technology disrupted transportation, solid-state transformers are quietly revolutionizing how electricity moves across the grid. The technology doesn't sound exciting—transformers rarely do—but the implications are enormous. And the speed at which investors and customers are piling in suggests they understand something most people don't: grid infrastructure is about to become a bottleneck, and whoever solves it first wins big.

Heron Power's $140 million Series B fundraise, announced in February 2025, tells you everything you need to know about where this market is heading. The company didn't raise this money because it was desperate. Founder Drew Baglino, a Tesla veteran who spent nearly two decades building the company's powertrain and energy groups, raised it because customers were practically begging him to build faster. "If our customers are leaning in, we need to lean in as well," Baglino told the press. "We gotta go faster."

This isn't hype. This is customer demand outpacing supply.

We're going to break down what solid-state transformers actually are, why they matter now, where the money's going, what competitors are doing, and what this means for the broader energy infrastructure story. But first, let's understand the problem these devices solve.

TL; DR

- Heron Power raised $140 million in Series B funding to mass-produce solid-state transformers for data centers and the electrical grid

- Customers pre-ordered 40+ gigawatts of capacity, showing serious demand for the new technology

- Solid-state transformers replace century-old iron-core transformers with smaller, smarter, more efficient alternatives

- Data centers are the main driver, needing massive amounts of electricity delivered quickly and reliably as AI training scales

- Production ramping in 2027, with the company targeting 40 gigawatts annual capacity by 2029

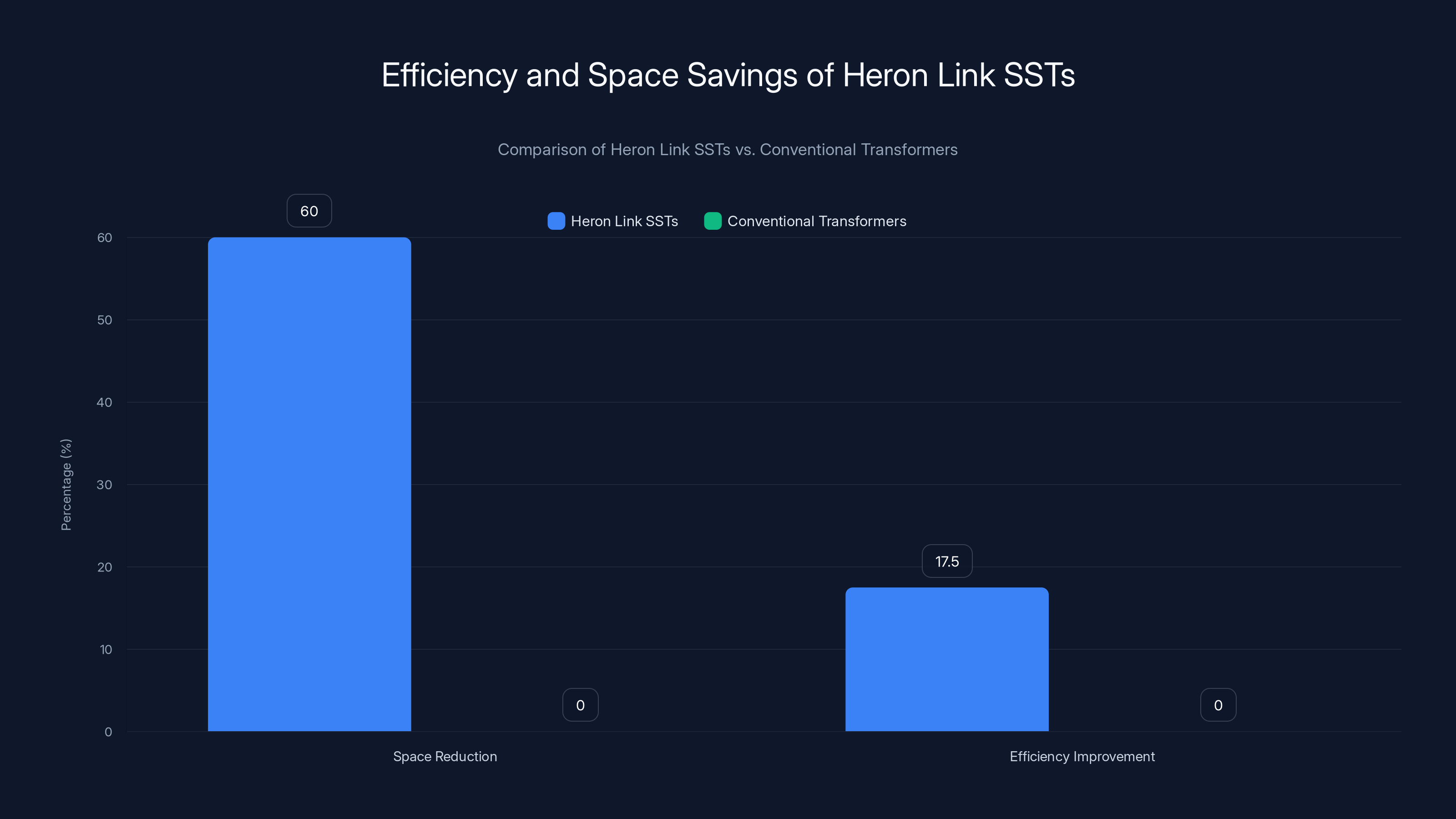

Heron Link solid-state transformers offer a 60% reduction in space and a 15-20% improvement in efficiency over conventional transformers. Estimated data.

What's Wrong With the Grid's Old Transformers?

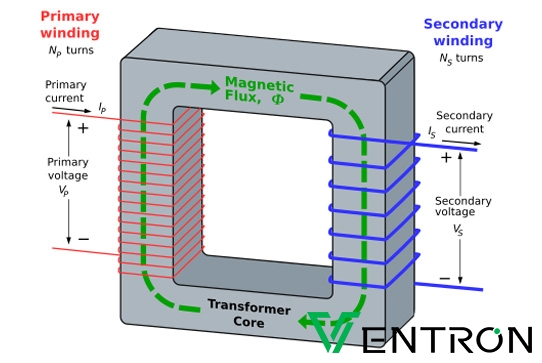

Let's start with basics. The electrical grid moves power from generation (power plants, solar farms, wind turbines) to consumption (your home, data centers, factories). But the voltage changes along the way.

Power plants generate electricity at different voltages depending on the type of generation. Long-distance transmission lines use extremely high voltages (hundreds of thousands of volts) because it reduces energy loss over distance. But you can't plug a light bulb into a 345,000-volt line. It would explode. So transformers step the voltage down at multiple points along the path, from transmission lines to distribution lines to your house.

For over a century, this job was done by iron-core transformers. They're elegantly simple: two copper coils wrapped around an iron core. Electricity flowing through the first coil creates a magnetic field in the iron. That magnetic field induces current in the second coil. The ratio of coils determines the voltage conversion. It works. It's cheap. It lasts 40-50 years. They're everywhere.

But here's the problem: iron-core transformers are passive devices. They can only do one thing: step voltage up or down. They're also physically massive. A large transmission transformer can weigh 300+ tons and take up significant space. And they generate heat, especially when power demand spikes.

For data centers, this matters a lot. Modern hyperscale data centers consume enormous amounts of power. Google's electricity consumption hit 39.5 terawatt-hours in 2023, roughly equivalent to a country's power demand. AWS is similar. The electrical infrastructure needed to feed these facilities is becoming a constraint. You can't build faster CPUs or more GPUs without reliable power delivery. And you can't scale power delivery efficiently with devices designed in the 1920s.

When you're designing a facility that needs hundreds of megawatts, every inefficiency multiplies. A passive transformer that generates heat means you need cooling systems to manage that heat. That cooling needs power. That creates more heat. It's an inefficiency spiral. And space constraints matter. You can't keep expanding substations forever.

Understanding Solid-State Transformers: How They're Different

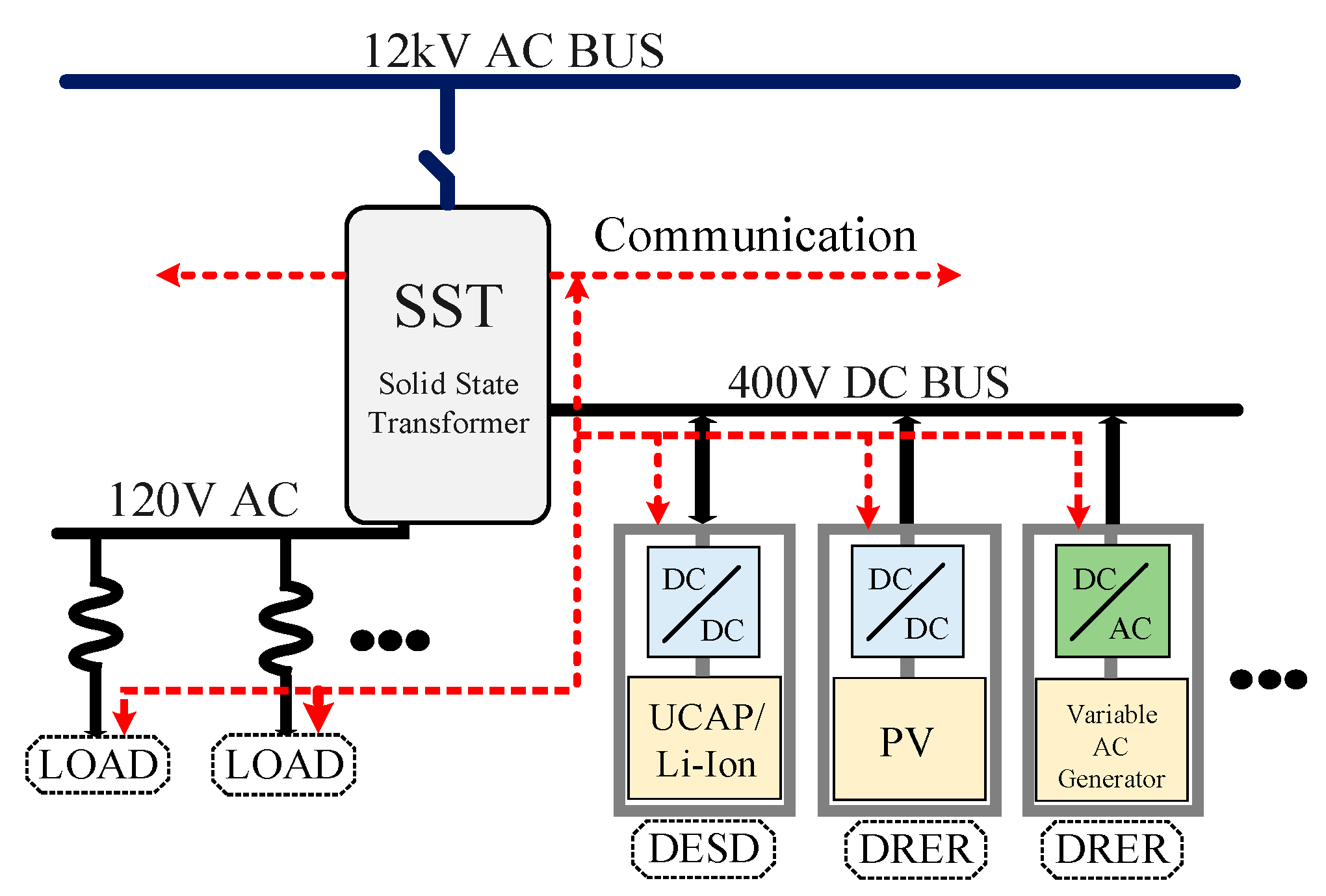

Solid-state transformers (SSTs) replace the passive iron-core design with semiconductors and power electronics. Instead of passive magnetic coupling, they use semiconductors to convert electricity electronically. Think of it like replacing a mechanical transmission with an electronic one.

Here's why this changes everything:

They're active devices. Instead of passively converting voltage, they can actively manage power flow. They can accept inputs from multiple sources (grid, solar, wind, batteries) and intelligently decide where power goes. Imagine a traffic controller vs. a simple road. The solid-state transformer is the traffic controller.

They're smaller. Because you're not lugging around hundreds of tons of copper and iron, they take up way less physical space. For data centers where real estate is expensive and every square foot matters, this is huge.

They're more efficient. By replacing multiple passive components with integrated power electronics, you eliminate conversion losses. And they generate far less heat, reducing cooling overhead.

They have faster fault tolerance. If an iron-core transformer fails, you're replacing the whole device. That can take days or weeks. Heron Power's design uses modular construction. If a power module fails, it swaps out in about 10 minutes while the device keeps operating at reduced capacity.

They can balance power intelligently. With power electronics, you can respond to grid conditions in real-time. You can prioritize certain loads, smooth out voltage fluctuations, and integrate variable renewable energy more effectively.

For Heron Power specifically, their product is branded Heron Link. It converts medium-voltage electricity to 800-volt DC power, which is exactly what Nvidia's reference rack designs specify. Each unit handles 5 megawatts continuously and contains tens of modular conversion units.

They've also built in lithium-ion batteries that can discharge quickly, providing 30 seconds of power to smooth the transition to backup systems. This is elegant: they're eliminating the need for expensive uninterruptible power supplies (UPS) entirely. One fewer component. One fewer failure point. Lower cost. Better reliability.

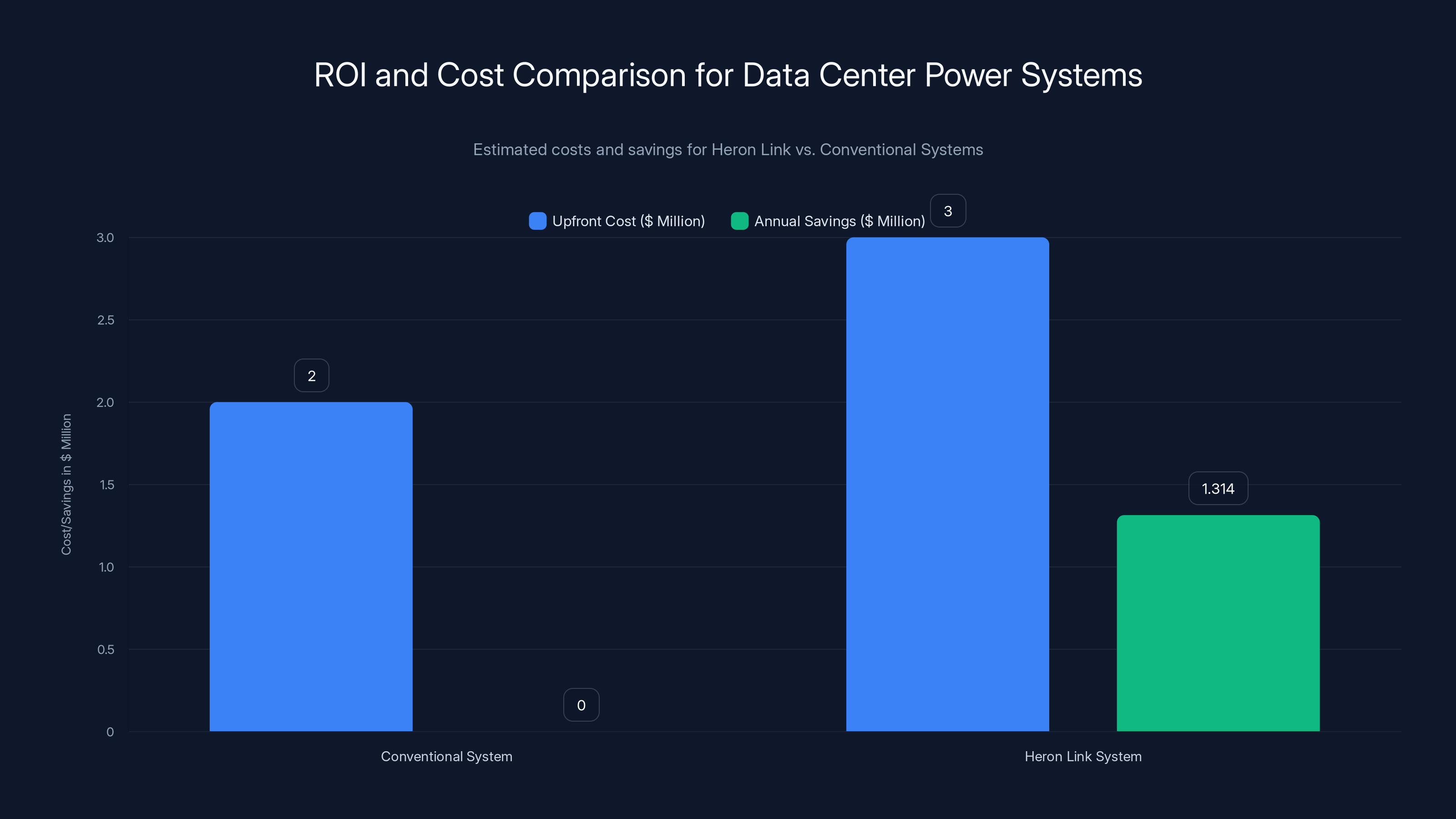

Heron Link systems, despite higher upfront costs, offer significant annual savings due to efficiency gains, leading to a payback period of less than a year. (Estimated data)

Why Data Centers Are Driving This Market

Let's talk about why this is happening now, not five years ago or five years from now.

The fundamental driver is artificial intelligence. Training large language models requires massive computational resources. Open AI's GPT-4 required millions of dollars in compute infrastructure. Each training run for a modern AI model can consume as much electricity as a small town for weeks. And we're doing this multiple times per year, across multiple companies, globally.

This has created an unprecedented demand spike for data center capacity. But you can't just build data centers everywhere. You need locations with cheap power and cooling. You need space. And crucially, you need reliable electricity infrastructure that can scale.

The problem: transformer production can't keep up. Iron-core transformer manufacturing was never designed for this kind of demand growth. Lead times have stretched to 12-18 months in some cases. Grid operators are scrambling to upgrade infrastructure. And new data center projects are literally waiting for transformer availability before they can break ground.

This is where Heron Power's $140 million raise becomes strategic. The company isn't raising this money speculatively. Customers have already committed. Baglino mentioned that customers expressed interest in buying more than 40 gigawatts of capacity. That's not casual interest. That's signed agreements or letters of intent.

For perspective: the entire United States peak electricity demand is about 800 gigawatts. 40 gigawatts is roughly 5% of total U.S. peak demand. For a single technology category, just for data center applications, that's enormous.

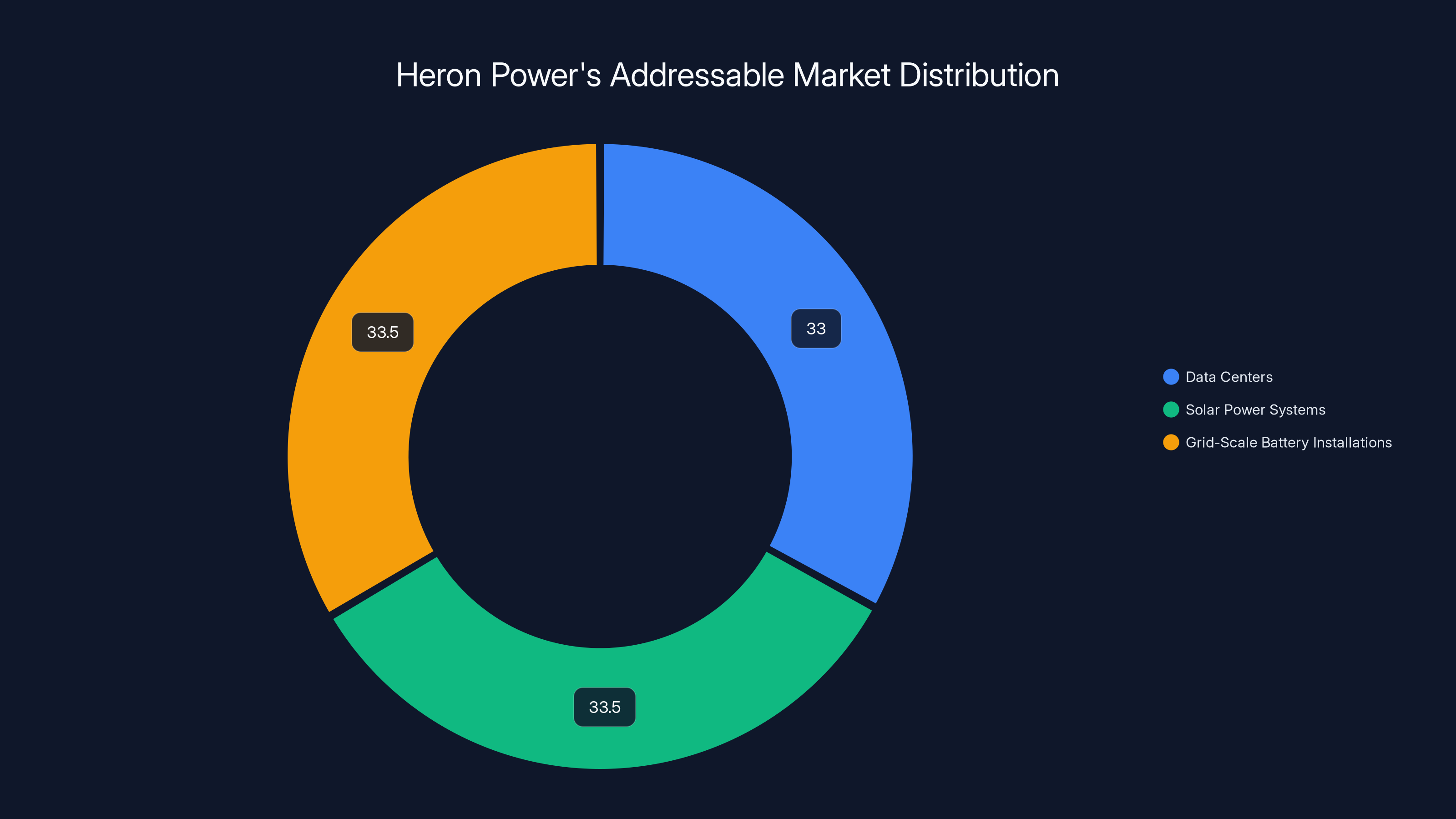

We should also note that data centers are only about 33% of Heron Power's addressable market currently. The remaining two-thirds are split between solar power systems and grid-scale battery installations. Both of those applications benefit from the same properties that make SSTs valuable for data centers: active power management, flexibility, compact size.

The Money: Serious Capital, Serious Expectations

Let's break down the funding round because it tells a story about investor confidence.

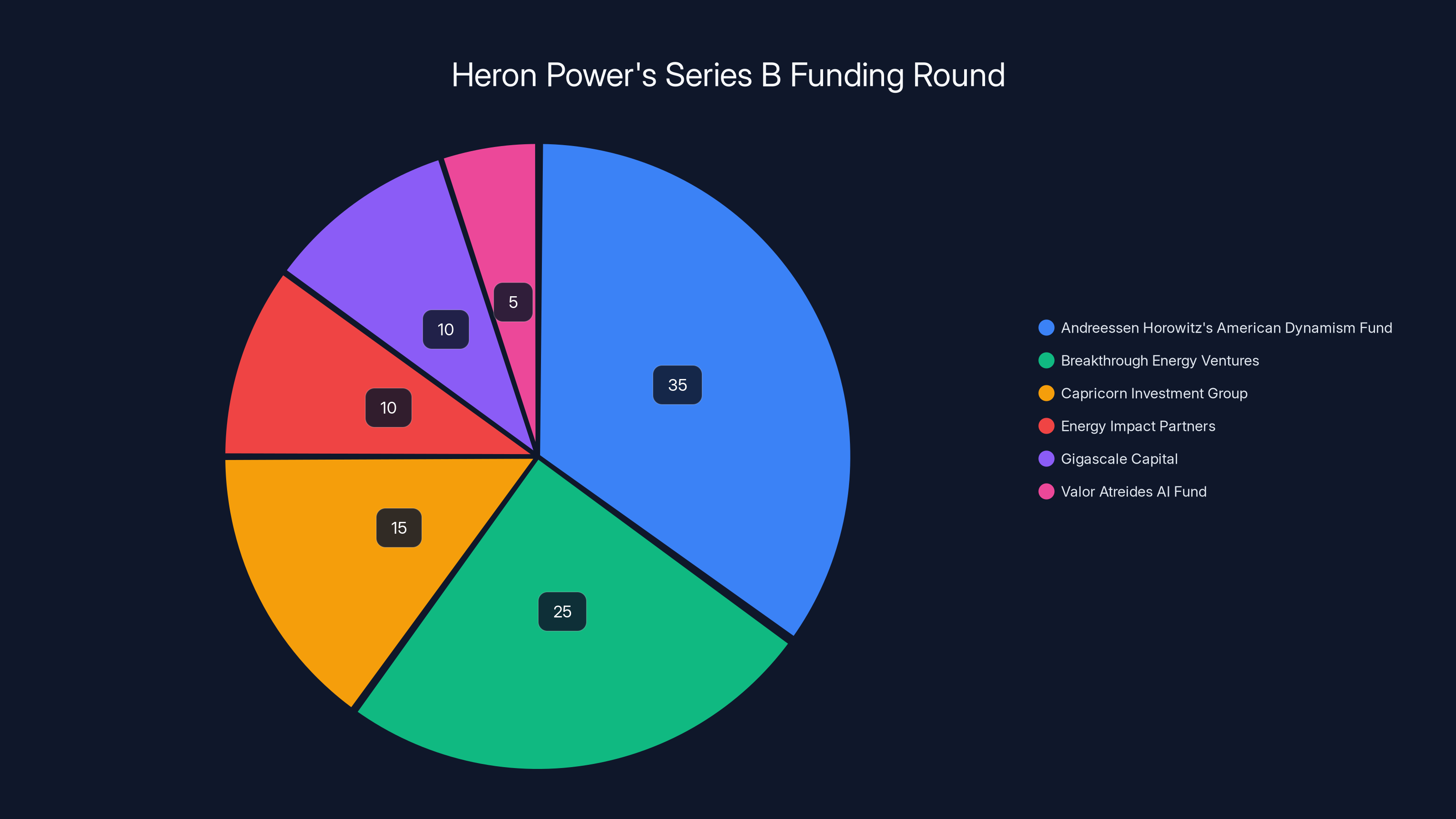

Heron Power's Series B was led by Andreessen Horowitz's American Dynamism Fund and Breakthrough Energy Ventures. These aren't random venture investors. American Dynamism is a16z's dedicated fund for critical infrastructure technologies. Breakthrough Energy is backed by Bill Gates and focuses specifically on decarbonization and clean energy infrastructure.

Additional participants included Capricorn Investment Group, Energy Impact Partners, Gigascale Capital, and Valor Atreides AI Fund. That's a pretty deep bench of energy-focused institutional capital.

The timing is also interesting. Heron Power raised a $38 million Series A in May 2024. By February 2025, just nine months later, they're back raising at a much larger scale. This speed tells you something important: this wasn't a planned Series B that was going to happen anyway. Customer demand forced it.

Baglino's quote is revealing: "We didn't need the money. Our customers are leaning in, we need to lean in as well." This is the opposite of what most startups say when they raise. Most say something like "The market opportunity is huge and we want to capture it." Heron said "We literally can't make product fast enough, so we need to build a factory."

The $140 million is specifically targeted at building a manufacturing facility. Heron Power plans to construct a factory capable of producing 40 gigawatts of Heron Link transformers annually. Let's contextualize that:

- 40 gigawatts per year represents about 10-15% of global transformer production outside China

- It's roughly equivalent to the peak power demand of the state of Texas

- For data centers specifically, it would satisfy pre-orders and still leave room for market growth

The company plans to begin pilot production in early 2027 and ramp full production over the following two years. That's a 24-month ramp timeline, which is aggressive but not unprecedented for high-demand industrial equipment.

Manufacturing at Scale: The Hardest Part

Here's where it gets interesting. Baglino spent nearly two decades at Tesla. If you know anything about Tesla's history, you know that manufacturing at scale is exponentially harder than designing a good product.

Tesla's history is basically: great product design (the original Roadster) meets manufacturing hell (Model S ramp) meets borderline miraculous execution (Model 3 production). Elon Musk famously said the hardest part of Tesla wasn't designing the car, it was building the machine that builds the car.

Heron Power is entering this territory now. Solid-state transformers are proven technology in lab settings. Companies have been developing them for over a decade. But moving from "it works in the lab" to "we produce 40 gigawatts per year at acceptable cost" is a different challenge entirely.

Manufacturing power semiconductors is capital intensive and requires precision. You need clean rooms. You need supply chains for high-purity silicon, rare earth elements for magnets, copper, and other materials. You need to hit cost targets while maintaining quality. You need to find workers with the right skills and train new ones.

Baglino probably has an advantage here given his background. But it's not a guarantee. Companies fail at scaling all the time, even with good products and experienced management.

However, the customer demand signal is real. When customers are pre-ordering 40 gigawatts of capacity before production starts, it's not speculative. These are likely binding agreements with penalties if the company doesn't deliver.

Data centers account for 33% of Heron Power's market, with solar power systems and grid-scale battery installations each comprising 33.5%. Estimated data.

Competitive Landscape: Heron Power Isn't Alone

Let's be clear: Heron Power isn't the only company working on solid-state transformers. This isn't a blue ocean opportunity where they're alone in the market.

Other players include Gengo, which has been working on SST technology for years and has partnerships with major utilities. There's Siemens, the massive German industrial conglomerate that's investing in power electronics. There's ABB, another industrial giant with significant resources. And there are numerous other startups and research groups working on variations of the technology.

What gives Heron Power an advantage:

Timing and focus. While incumbents like Siemens and ABB have solid-state transformer programs, they're not their main business. These are massive conglomerates with diverse portfolios. Heron is 100% focused on this one product category.

Customer relationships. Data center operators and hyperscalers are a different customer base than traditional utilities. They're accustomed to working with technology startups. They move faster. They're willing to adopt new technology if it solves their problems.

Recent founding. The company was founded after the technology matured and customer demand became obvious. They're not carrying legacy investments in iron-core transformer manufacturing. They don't have legacy customers to protect.

Founder credibility. Baglino's Tesla background matters. He's proven he can execute at scale. He's attracted top talent. He has investor relationships and credibility with energy infrastructure players.

The competitive advantage probably isn't permanent, though. If Heron succeeds at manufacturing scale, incumbents will respond. Siemens and ABB have massive manufacturing networks and customer relationships. They can copy successful designs. But by the time they do, Heron will likely have established market share and relationships that are hard to displace.

This is similar to how Tesla disrupted automakers. It wasn't that Tesla was uniquely smart at manufacturing. It was that they had focus, urgency, and customer relationships with a new market segment that incumbents underestimated.

The Technical Specifications: What Heron Link Actually Does

Let's get into the technical details of what Heron Power is actually building.

The core product is Heron Link, a solid-state transformer that converts medium-voltage electricity (typically 4-35 kilovolts) to 800-volt DC power. Why 800 volts? That's the voltage specified by Nvidia's reference designs for AI accelerator racks. In data center infrastructure, Nvidia essentially sets the standard that everyone else builds around.

Each Heron Link unit:

- Handles 5 megawatts continuously without needing to step down to lower loads

- Contains tens of modular conversion units for redundancy

- Features hot-swappable modules that can be replaced in about 10 minutes if they fail

- Includes integrated lithium-ion batteries that provide 30 seconds of bridge power

- Achieves higher efficiency than equivalent iron-core transformer solutions by 15-20% in typical data center applications

- Reduces footprint by approximately 60% compared to conventional transformer + UPS solutions

- Enables active power management from multiple sources (grid, solar, batteries, fuel cells)

The lithium-ion battery integration is clever engineering. Traditional data centers need uninterruptible power supplies (UPS) to bridge the gap between utility power loss and backup generator startup. Those are expensive, require space, and need maintenance. By integrating battery functionality directly into the transformer, Heron eliminates an entire component category.

Think about what that means economically. For a large data center, you might eliminate a $2-5 million UPS installation, the space it occupies, and the maintenance it requires. Over 20 years (the life of a data center), that's significant cost savings.

The modular architecture also matters from an operations perspective. Data center engineers hate single points of failure. A monolithic transformer is a single point of failure. If it fails, the entire facility loses power. With Heron Link's design, if one module fails, the device continues operating, just at reduced capacity (maybe 80% instead of 100%). That's much more operationally acceptable.

Why 40 Gigawatts Matters: Market Context

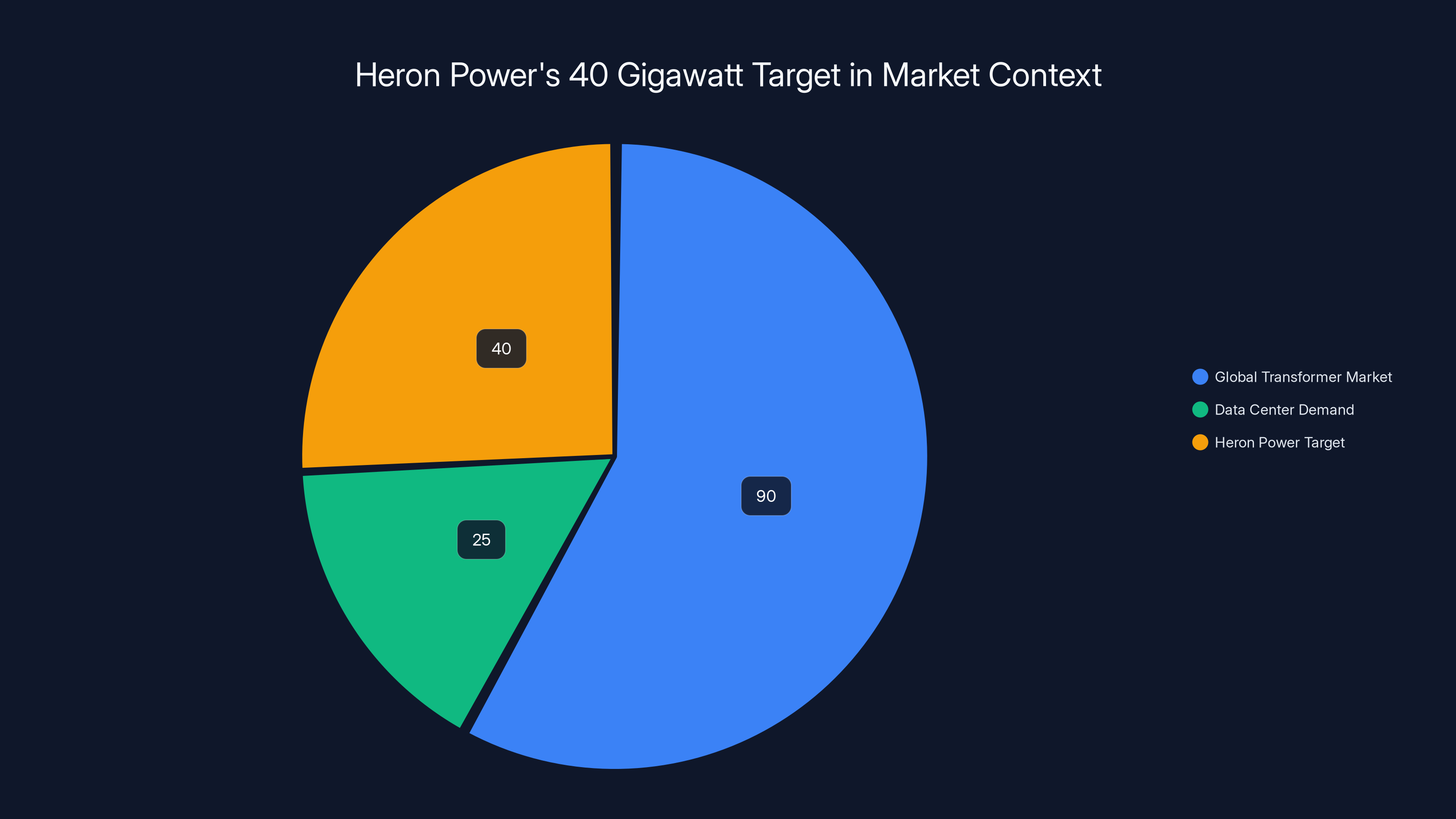

Heron Power is targeting 40 gigawatts of annual production capacity by 2029. Let's understand what that means in market context.

Global transformer market: The global power transformer market is roughly 80-100 gigawatts of installed capacity annually. That includes everything: grid transformers, distribution transformers, power transformers for industrial applications. So Heron's target of 40 gigawatts is a huge percentage of global output, at least for the specific category of solid-state transformers.

Data center demand: Current U.S. data center electricity consumption is roughly 200 terawatt-hours annually. That's about 25 gigawatts of continuous power demand. Projections suggest this could double by 2030 due to AI workloads. If Heron can capture even 20% of new data center infrastructure builds, that's 8+ gigawatts of their production going to one market segment.

Grid modernization: Utilities are replacing aged infrastructure. The American Society of Civil Engineers estimates that $2.6 trillion needs to be invested in U.S. infrastructure upgrades through 2029. A meaningful portion of that is electrical grid upgrades. As utilities modernize, they're increasingly considering solid-state solutions.

Solar and battery integration: The renewable energy transition is accelerating. Solar generation is intermittent and needs sophisticated power management. Battery systems need intelligent charging and discharging. These are use cases where solid-state transformers' active power management capabilities shine.

The 40-gigawatt target isn't arbitrary. It's probably based on customer pre-orders plus management estimates of addressable market growth over a 4-year period.

Andreessen Horowitz's American Dynamism Fund and Breakthrough Energy Ventures are the leading investors in Heron Power's Series B funding, highlighting strong confidence in the company's growth potential. Estimated data.

The Financial Case: Unit Economics and ROI

We don't have exact pricing information for Heron Link from the public announcements, but we can make some educated estimates based on market comparables.

A 5-megawatt iron-core transformer plus UPS system might cost a customer somewhere in the range of

A Heron Link unit probably costs more upfront—solid-state technology is more expensive to manufacture than iron-core transformers. But if you're bundling UPS functionality and achieving 15-20% better efficiency, the total cost of ownership might be comparable or better.

For a data center operator, here's the ROI calculation:

For a 10-megawatt data center operating 8,760 hours/year with 15% efficiency gains and $0.10/kWh electricity:

If a Heron Link system costs an extra $1 million upfront compared to conventional transformer + UPS, the payback period is less than a year. From that point forward, it's pure savings.

Add in operational simplicity (one fewer system to maintain), reduced space requirements (which could enable denser server configurations), and faster fault recovery, and the value proposition becomes compelling.

This is probably why customers are pre-ordering 40 gigawatts of capacity. They've done the math and the economics work.

Grid Infrastructure: The Broader Story

Heron Power's growth isn't happening in isolation. It's part of a broader transformation of electrical grid infrastructure.

For most of the 20th century, the electrical grid was relatively simple: power plants generated electricity, transmission lines carried it, distribution lines delivered it to consumers. It was one-way flow. Utilities managed supply to match demand. End of story.

But modern grids are becoming multidirectional and complex. Solar panels on rooftops, wind turbines, battery systems, and electric vehicles create generation and storage at the edge of the network. You can't optimize a grid like that with passive infrastructure. You need active management.

Solid-state transformers enable that active management. They can accept power from the grid OR from rooftop solar OR from a battery system, intelligently routing it based on real-time conditions. They can smooth out voltage fluctuations caused by sudden demand changes. They can respond to grid signals in milliseconds.

This is why utilities are interested in SST technology, even though traditional utilities move slowly. They understand that grid modernization is becoming necessary, not optional. Heron Power is riding that wave.

There's also a resilience angle. As extreme weather events become more common, grid reliability becomes more critical. Distributed generation with intelligent power management is more resilient than centralized generation. Solid-state transformers are a key enabling technology for that transition.

Manufacturing Timeline: 2027 Pilot to Full Ramp

Heron Power's plan is to move from development to manufacturing in roughly two years. Here's the timeline:

2025: Design manufacturing processes, secure supply chains, and begin facility construction Early 2027: Pilot production starts, volumes ramping from hundreds to thousands of units 2028-2029: Full production ramp, targeting 40 gigawatts annual capacity

This is aggressive. For comparison, when Tesla ramped Model 3 production, the company went from making a few hundred cars monthly to several thousand. It took longer than planned and caused significant operational challenges. Heron Power is undertaking a similar ramp, just with transformers instead of cars.

The advantage Heron has is that customer demand is proven and committed. When customers have pre-ordered product and are waiting for supply, the incentive to execute is enormous. Delays mean lost revenue.

The risk is that manufacturing challenges could delay the timeline. Power semiconductor manufacturing is precision work. Quality failures could be costly. Supply chain disruptions could impact timelines. Scaling from hundreds of units to millions of units annually is harder than it sounds.

But given Baglino's track record and the amount of capital committed, odds are decent they can execute on an aggressive timeline.

Heron Power's 40 gigawatt target represents a significant portion of the global transformer market, with potential major contributions to data center demand and grid modernization. Estimated data.

Investors Placing Bets: What They See

The investor composition tells you something important about what this market looks like from inside the decision-making process.

Andreessen Horowitz's American Dynamism Fund is specifically focused on American infrastructure. They're not looking for 10x returns on SaaS. They're looking for technologies that strengthen American competitiveness and infrastructure resilience. Investing in critical power infrastructure fits their mandate perfectly.

Breakthrough Energy Ventures is specifically focused on climate and clean energy. They understand that transitioning to renewable energy requires grid infrastructure upgrades. Solid-state transformers that enable distributed renewable generation and integrate with battery storage are directly relevant to their thesis.

Energy Impact Partners is a fund focused on the energy sector. They bring domain expertise and likely have customer introductions from their existing portfolio.

Gigascale Capital focuses on semiconductor and electronics manufacturing. They understand the complexity of scaling power electronics production.

The investor syndicate isn't random. These are funds that understand energy infrastructure, understand the challenges of scaling manufacturing, and have conviction about the addressable market.

When a16z puts money into critical infrastructure, it usually signals that they believe the market dynamics are strong and the team can execute. They have a high bar for risk and detailed conviction on addressable market sizing.

Challenges and Risks: What Could Go Wrong

Let's be honest about the risks. Heron Power's success isn't guaranteed.

Manufacturing execution risk: Power electronics manufacturing is hard. If quality issues emerge at scale, it could damage the company's reputation and delay revenue. Tesla had to burn through billions to get manufacturing right. Heron has less financial cushion.

Supply chain constraints: Solid-state transformers require specialized materials and components. If supply becomes constrained (semiconductors, rare earth elements, copper), it could limit production ramps.

Competitive response: Incumbent transformer manufacturers will respond once they see the market opportunity. Siemens and ABB have vastly more resources. They could copy successful designs and undercut Heron on price using their existing distribution networks.

Technology standardization: Heron Link is targeting Nvidia's 800V reference design. But what if the industry adopts a different voltage standard? Or what if the market stays fragmented with different voltage levels? That would reduce addressable market.

Regulatory uncertainty: Grid interconnection standards and safety regulations could evolve in ways that disadvantage new technologies. Regulatory approval processes could move slower than expected.

Customer concentration: If Heron's customers are predominantly hyperscalers (AWS, Google, Meta, Microsoft), then revenue is concentrated among a few large buyers. If even one major customer delays builds or reduces spending, it impacts revenue significantly.

Capital requirements: Building a 40-gigawatt facility will probably require more than $140 million by the time it's operational. Future financing rounds could be necessary, and they might happen at less favorable terms.

None of these risks are unusual for a scaling manufacturing company. But they're real.

Similar Disruptions: Historical Parallels

We've seen this pattern before. A technology that's been around for decades gets disrupted by a new approach that's 15-20% better on key metrics, and suddenly entire industries transform.

LED lighting disrupted incandescent and fluorescent lighting. LEDs were more efficient, lasted longer, and took less space. The established lighting industry (Philips, Sylvania, GE) didn't disappear, but they had to radically reorganize around LED manufacturing.

Lithium-ion batteries disrupted lead-acid batteries for many applications. They were lighter, denser, and more reliable. Lead-acid is still around for starter batteries, but everywhere else, lithium-ion dominates.

Solid-state batteries might be in the early stages of disrupting lithium-ion, offering even better energy density and safety.

In each case, the incumbent technology was good enough for decades. But once a meaningfully better alternative emerged, the transition happened faster than most people expected. Industries reorganized around the new technology.

Solid-state transformers follow that pattern. They're not 5% better. They're 15-20% more efficient, orders of magnitude smaller, and fundamentally smarter. Once production scales to meet demand, iron-core transformers will transition into legacy status quickly.

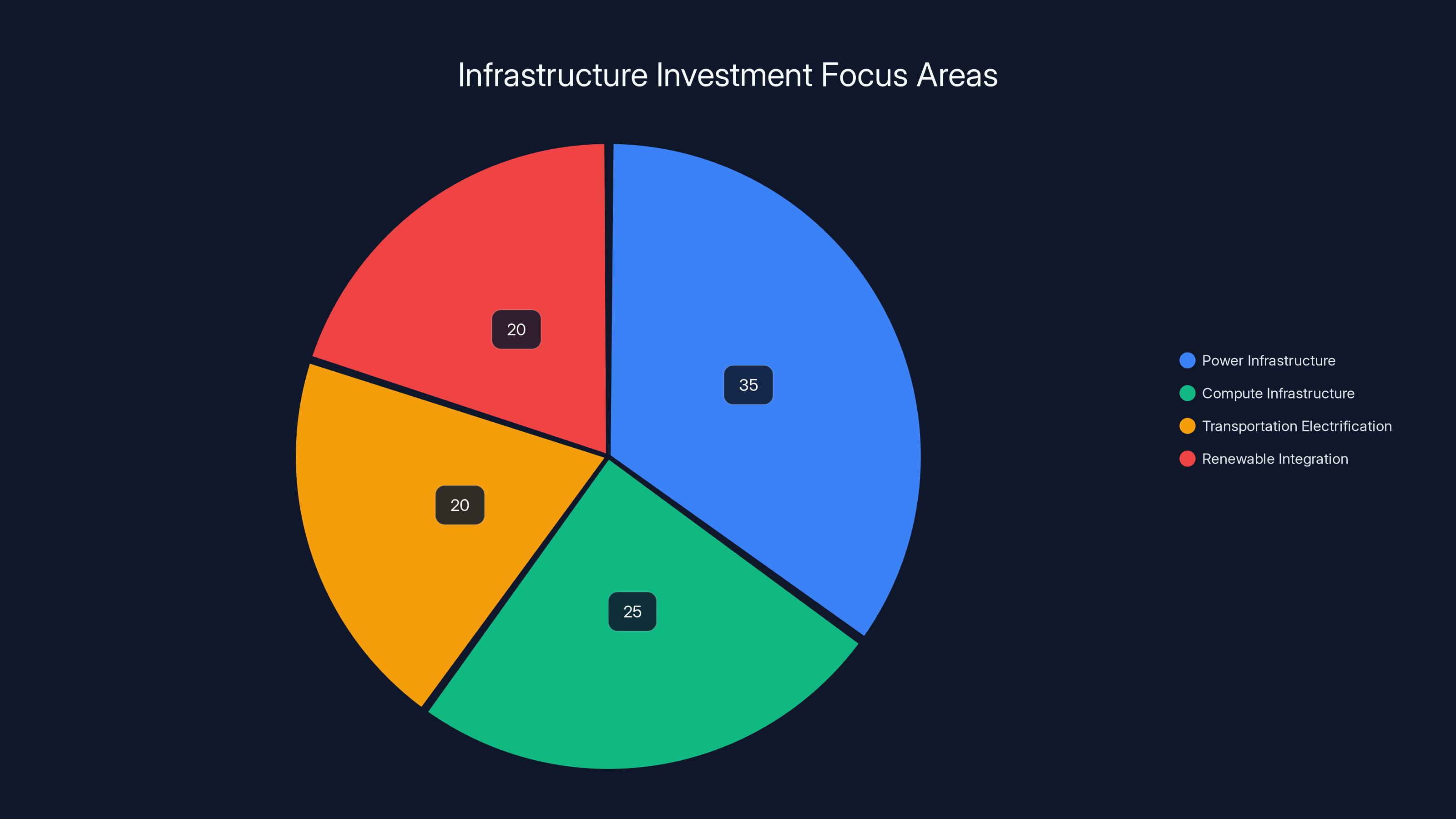

Estimated data shows a balanced investment focus across power, compute, transportation, and renewable integration, highlighting infrastructure's role in enabling AI and energy advancements.

The Broader Energy Infrastructure Opportunity

Heron Power is specifically focused on transformers, but there's a larger ecosystem opportunity.

The transition to renewable energy, electrification of transportation, and growth of data centers are all driving huge changes in electrical infrastructure. We need:

- Better power electronics to manage variable renewable generation

- Smart grid technologies to route power efficiently

- Grid-scale battery storage to buffer renewable intermittency

- Fault-tolerant infrastructure that works when individual components fail

- Real-time monitoring and control systems

Solid-state transformers are one piece of this puzzle. Companies like Form Energy (long-duration battery storage), Longo (grid batteries), and Way Power Technologies are attacking other pieces.

The winner in this ecosystem won't be the company with the single best technology. It will be the companies that can integrate with the broader infrastructure ecosystem and create systems that work together.

Heron Power is probably aware of this. Their customer relationships with hyperscalers and utilities give them insight into what complementary technologies matter.

Impact on Data Center Growth

Let's tie this back to where we started: data centers and AI.

AI training and inference are compute-intensive. The infrastructure to support AI is power-intensive. Data centers use 15-20% of global electricity in some developed countries. That's going to increase as AI workloads grow.

But you can't build data centers faster than you can build electrical infrastructure. Transformer availability has become a bottleneck. Some data center projects are delayed 6-12 months waiting for power equipment.

If Heron Power can solve that bottleneck by delivering 40 gigawatts of capacity annually, they're not just selling transformers. They're enabling faster data center growth, which enables faster AI model training, which impacts how quickly AI capabilities advance.

This is infrastructure-level impact. It's not flashy, but it matters.

The companies building frontier AI models care deeply about infrastructure bottlenecks. If Heron can remove the transformer bottleneck, they become strategically important to the AI ecosystem.

We might see Heron Power become a strategic partner to hyperscalers in ways that go beyond simple vendor relationships. This is how Nvidia became foundational to AI: they solved a critical bottleneck that mattered for the entire ecosystem.

Future of Grid Infrastructure: 5-Year Outlook

Assuming Heron Power executes successfully, what does the grid look like in 5 years?

More distributed generation: As costs of solar and batteries fall, more distributed generation happens at the edge. Solid-state transformers make that economically viable.

More intelligent power management: Grids become more actively managed rather than passively operated. Real-time optimization of power flows replaces periodic human planning.

More resilient infrastructure: Redundancy and distributed generation make grids more resilient to failures. This is increasingly important as extreme weather impacts grid reliability.

Faster electrification: Industries that were hard to electrify (heavy industry, heavy transportation) become more viable as grid infrastructure becomes smarter and more flexible.

New business models: As power becomes more commoditized and grid services become more sophisticated, new business models emerge around grid services, demand response, and virtual power plants.

Heron Power is one player in this transformation. But they're a strategically important player because they're solving a bottleneck that was holding back progress.

Lessons for Founders and Investors

If you're paying attention to Heron Power's progress, here are some lessons worth noting:

Customer demand matters more than capital. Heron raised a large Series B because customers were already committed to buying product. They didn't raise capital and then try to find customers. They found customers, discovered they couldn't meet demand, and raised capital to scale. This is the healthiest scenario.

Infrastructure businesses can move fast. We often think of infrastructure as slow-moving and bureaucratic. But if the customer pain is real (transformer shortages), and the solution is meaningfully better, adoption can be surprisingly fast.

Founder credibility matters. Baglino's Tesla background accelerated everything: recruiting talent, building customer relationships, attracting investors, getting manufacturing partnerships. Starting a capital-intensive manufacturing business with an unknown founder would be much harder.

Timing and focus. Heron exists at exactly the moment when data center demand is peaking, transformer bottlenecks are real, and the technology is mature. A decade earlier and the tech wasn't ready. A decade later and incumbents would have solved it.

Find investors aligned with your business. Heron didn't raise from classic VC investors who want 10x returns in 7 years. They raised from infrastructure-focused investors who understand long-term value creation in essential infrastructure. That alignment matters.

Competitive Moats and Long-Term Sustainability

Assuming Heron executes successfully, what prevents someone else from disrupting them in 5-10 years?

Manufacturing capacity: By 2029, if Heron has built and optimized a 40-gigawatt facility, they'll have institutional knowledge that a competitor can't easily replicate. Building a second 40-gigawatt facility will be easier and faster for them than building the first one.

Customer relationships: The hyperscalers and utilities that are committing to Heron now will have locked into their products. Switching costs are real. Changing transformer specifications in a new facility is difficult. Once you've standardized on Heron Link, you'll likely keep standardizing on it.

Supply chain control: By 2029, Heron will have secure relationships with critical component suppliers. A new competitor would have to compete for the same supply, which could be constrained.

Intellectual property: Heron is probably filing patents on manufacturing techniques, circuit topologies, and system designs. These won't create a permanent moat, but they create friction that slows competitors.

Economies of scale: Every additional unit Heron manufactures drives costs down and quality up. A smaller competitor will have higher unit costs and lower volumes. That's a real advantage.

None of these moats are permanent. But they're sufficient to create a 5-10 year window where Heron can dominate the solid-state transformer market if they execute well.

Investment Thesis: Why This Matters

From an investment perspective, Heron Power represents something increasingly important: solving infrastructure bottlenecks that limit broader economic growth.

For decades, infrastructure was viewed as boring and non-scalable. VC investors focused on software because software scales infinitely with minimal marginal costs. But physical infrastructure doesn't scale that way. It requires capital, manufacturing expertise, and long-term focus.

But infrastructure problems create huge opportunities. When supply is constrained (like transformers), whoever solves that constraint wins a massive market. The margins are healthy, the customers are committed, and the barriers to entry are high.

Heron Power is riding a wave of infrastructure opportunity. If they execute, returns could be exceptional not just for financial reasons, but because they're enabling broader economic growth.

This is the kind of company that could become a multi-billion dollar infrastructure company in 10-15 years. Investors who see that opportunity and commit capital early could achieve 10-50x returns while also solving a real problem.

FAQ

What exactly is a solid-state transformer and how does it differ from traditional transformers?

A solid-state transformer (SST) uses semiconductors and power electronics to convert electricity, replacing the passive iron-core design that's been used for over a century. Traditional transformers rely on copper coils and iron cores to magnetically couple two circuits and step voltage up or down. Solid-state transformers actively manage power using semiconductors, making them smaller, more efficient, and capable of intelligent power management. They can accept inputs from multiple sources (grid, solar, batteries) and respond to grid conditions in real-time, whereas traditional transformers are passive one-way conversion devices.

Why are data centers specifically driving demand for Heron Power's solid-state transformers?

AI training and inference require massive computational resources, and each data center needs hundreds of megawatts of reliable electricity. Conventional transformer + UPS solutions take up significant space, generate heat, and require cooling infrastructure. Heron Link eliminates multiple components by bundling transformer and UPS functionality, reducing footprint by 60%, improving efficiency by 15-20%, and providing intelligent power management. Additionally, hyperscalers are currently constrained by transformer availability—lead times have stretched to 12-18 months—making Heron Link's promised production scale attractive.

What is Heron Power's manufacturing plan and timeline?

Heron Power plans to build a factory capable of producing 40 gigawatts of Heron Link transformers annually. Pilot production is scheduled to begin in early 2027, with full production ramps planned over the following two years. This 40 gigawatts represents roughly 10-15% of annual global transformer production outside China and is approximately equivalent to Texas's peak power demand. The company's timeline is aggressive but motivated by strong customer pre-orders.

How does the $140 million Series B funding compare to previous rounds, and what does it signal?

Heron Power raised

Who is investing in Heron Power and why?

The Series B was led by Andreessen Horowitz's American Dynamism Fund and Breakthrough Energy Ventures, with participation from Capricorn Investment Group, Energy Impact Partners, Gigascale Capital, and Valor Atreides AI Fund. This investor mix reflects the strategic importance of the opportunity: American Dynamism focuses on critical infrastructure, Breakthrough Energy specializes in clean energy transitions, Energy Impact Partners brings sector expertise, and Gigascale Capital understands power electronics scaling. The investor composition suggests strong conviction about both the market opportunity and management's execution capabilities.

What are the economic advantages of solid-state transformers for data center operators?

For a 10-megawatt data center, solid-state transformers could generate

What are the main risks to Heron Power's success?

Key risks include manufacturing execution at scale (power electronics are precision manufacturing), supply chain constraints for critical components, competitive responses from incumbents like Siemens and ABB, potential changes in industry voltage standards, regulatory uncertainties around grid interconnection, and customer concentration among hyperscalers. Additionally, the company will likely need more capital before reaching 40-gigawatt production capacity, and future financing rounds might occur at less favorable terms. Historical precedent from Tesla's manufacturing struggles shows that scaling new production facilities is significantly harder than expected.

How does Heron Power's technology enable renewable energy integration?

Solid-state transformers use power electronics rather than passive magnetic coupling, enabling active, real-time power management. This allows them to intelligently accept and route electricity from multiple sources including grid power, solar generation, wind turbines, and battery systems. They can smooth voltage fluctuations caused by variable renewable generation, respond to grid signals in milliseconds, and optimize power flows based on real-time conditions. This capability makes them critical infrastructure for grids with high renewable penetration and is why utilities alongside hyperscalers are driving demand.

What is the broader infrastructure opportunity beyond transformers?

Solid-state transformers are one component of a larger grid modernization ecosystem that includes long-duration battery storage, smart grid technologies, fault-tolerant distributed generation, and real-time monitoring systems. Companies like Form Energy and Longo are addressing complementary pieces of this puzzle. The broader opportunity involves upgrading global electrical infrastructure to support electrification of transportation, integration of renewable energy, and growth of power-intensive industries like data centers and advanced manufacturing.

Where is Drew Baglino coming from and why does his background matter?

Baglino spent nearly two decades at Tesla, where he led the powertrain and energy groups. He has proven experience scaling power electronics and energy infrastructure manufacturing at gigawatt scale. His credibility accelerates recruiting of top talent, builds relationships with customers and suppliers, and gives investors confidence in execution capabilities. In capital-intensive manufacturing startups, founder credibility is often the differentiator between success and failure.

Conclusion: Infrastructure as the Next Frontier

Heron Power's $140 million fundraise is being reported as a tech story. But it's actually an infrastructure story. And that matters because infrastructure is becoming the new frontier for substantial returns and meaningful impact.

For decades, venture capital focused on software because software scales infinitely. But we're hitting real physical limits that software can't solve. You can't train larger AI models without more compute. You can't build more data centers without more power infrastructure. You can't electrify transportation without stronger grids. You can't decarbonize without integrating renewable energy.

All of those require infrastructure breakthroughs. And infrastructure breakthroughs don't come from pure software innovation. They require deep technical expertise, manufacturing capability, capital, and customer relationships.

Heron Power has all of those things. Drew Baglino has the manufacturing expertise from Tesla. The company has customer relationships with hyperscalers who are committed to buying 40+ gigawatts of product. They have capital from investors who understand infrastructure and its strategic importance.

If they execute, they'll have created a multi-billion dollar company while solving a real bottleneck that's currently limiting data center growth, AI advancement, and grid modernization.

For founders, this is a lesson: the biggest opportunities might not be in the flashiest domains. Sometimes they're in the unglamorous infrastructure problems that enable everything else.

For investors, this is a signal: infrastructure, particularly infrastructure that enables AI and renewable energy, is increasingly important. Bet on founders with relevant expertise who understand their customers' pain deeply.

For the energy industry, this is a wake-up call: disruption can come faster than you expect. Iron-core transformers have dominated for over 100 years. Within a decade, solid-state transformers could displace them in most new installations. The transition won't be universal, but it will be substantial.

Solid-state transformers aren't the first or last time we'll see century-old infrastructure disrupted by new technology. But they're a clear signal that the age of infrastructure as a growth engine is beginning.

Companies that can solve real infrastructure constraints and execute at scale will create massive value. Heron Power is betting they can be one of those companies. The next 24-36 months will tell us if they're right.

Key Takeaways

- Heron Power raised $140M in Series B to build a 40-gigawatt annual production factory for solid-state transformers, driven by customer pre-orders rather than speculative capital needs

- Solid-state transformers are 15-20% more efficient, 60% smaller, and intelligently manage power from multiple sources compared to century-old iron-core transformer designs

- Data center operators have urgent demand for transformer capacity due to AI workload growth, with conventional transformer lead times stretched to 12-18 months creating a market bottleneck

- Drew Baglino's Tesla manufacturing experience and the investor syndicate (a16z American Dynamism, Breakthrough Energy) suggest serious execution capability and market opportunity conviction

- Infrastructure technology disruption is becoming a major venture capital theme, with solid-state transformers exemplifying how foundational systems can be reimagined to solve modern constraints

Related Articles

- DG Matrix Raises $60M: Solid-State Transformers Transform Data Center Power [2025]

- Mesh Optical Technologies $50M Series A: AI Data Center Interconnect Revolution [2025]

- AI Memory Crisis: Why DRAM is the New GPU Bottleneck [2025]

- SurrealDB 3.0: One Database to Replace Your Entire RAG Stack [2025]

- Adani's $100B AI Data Center Bet: India's Infrastructure Play [2025]

- India AI Impact Summit 2025: Key News, Investments, and Industry Shifts [2025]

![Heron Power's $140M Bet on Grid-Altering Solid-State Transformers [2025]](https://tryrunable.com/blog/heron-power-s-140m-bet-on-grid-altering-solid-state-transfor/image-1-1771419989970.jpg)