AI Freight Revolution: How Logistics Markets Crashed

Here's the thing about financial markets: they move fastest when uncertainty is highest.

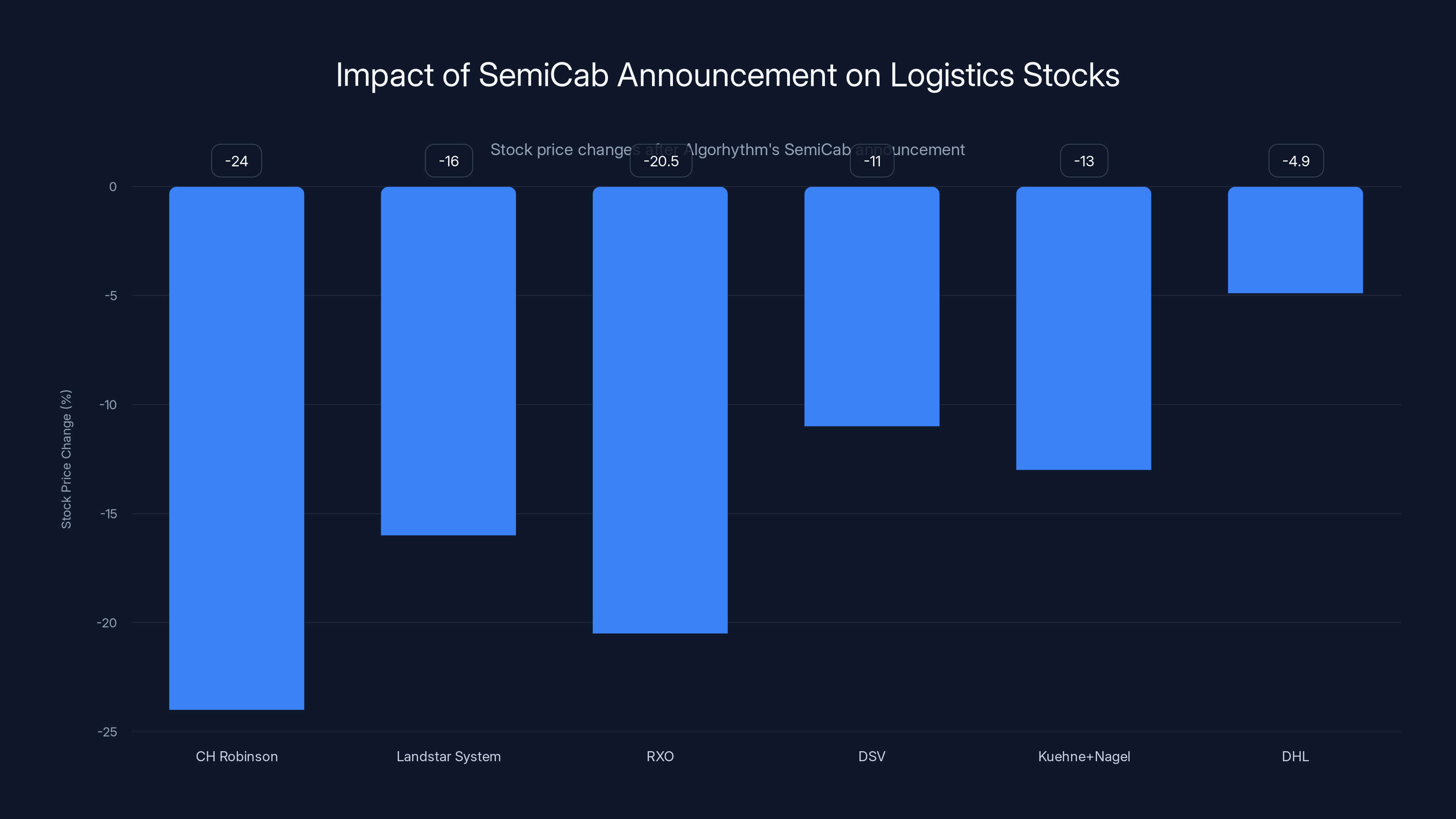

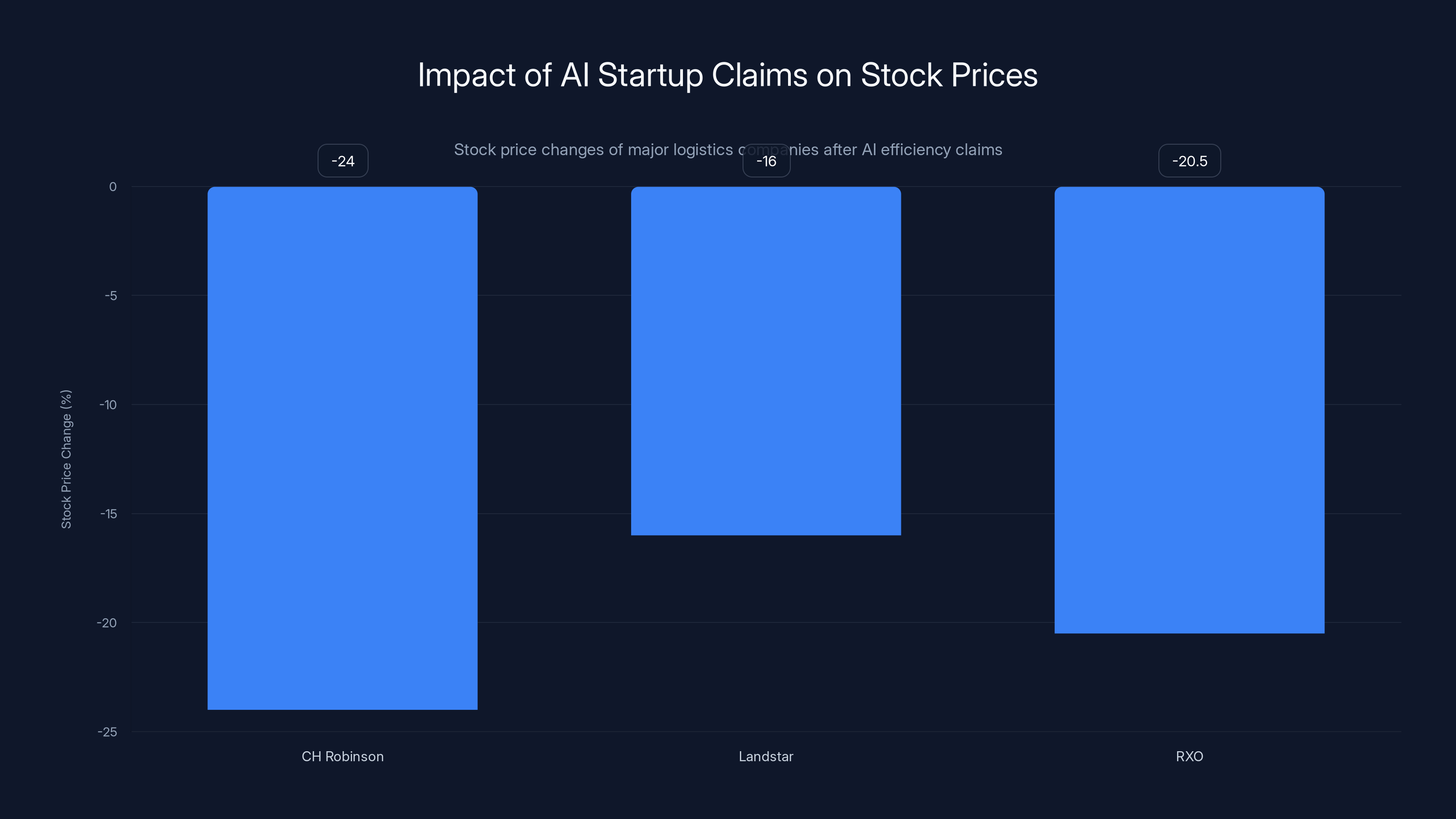

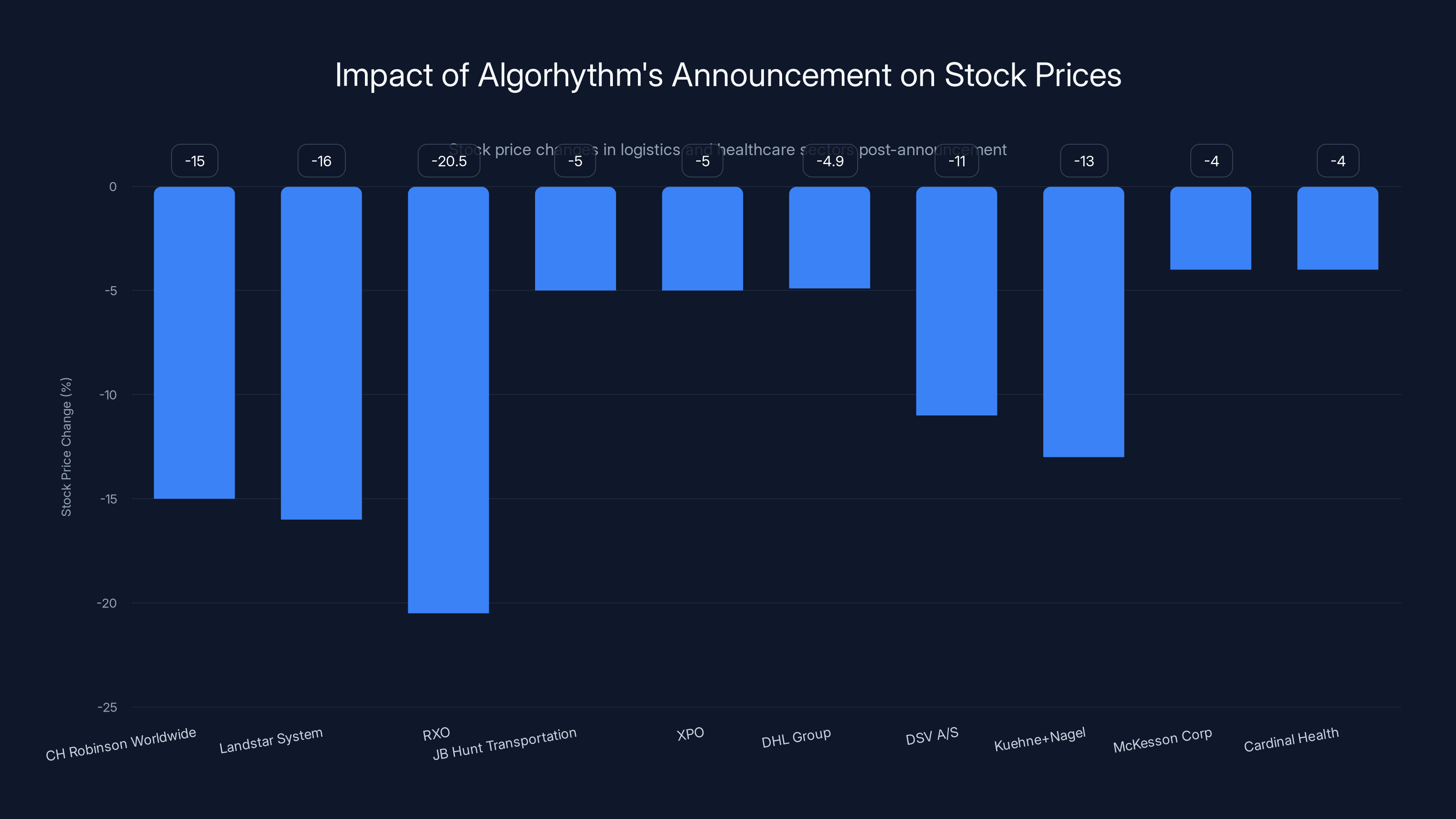

On a single trading day in early 2025, major logistics companies lost billions in market value. CH Robinson Worldwide dropped 24% at one point. Landstar System fell 16%. RXO lost over 20%. The Russell 3000 Trucking Index crashed 6.6%. Even European logistics giants like DSV and Kuehne+Nagel took major hits, with losses approaching 13%.

What triggered this? A company most people had never heard of: Algorhythm Holdings.

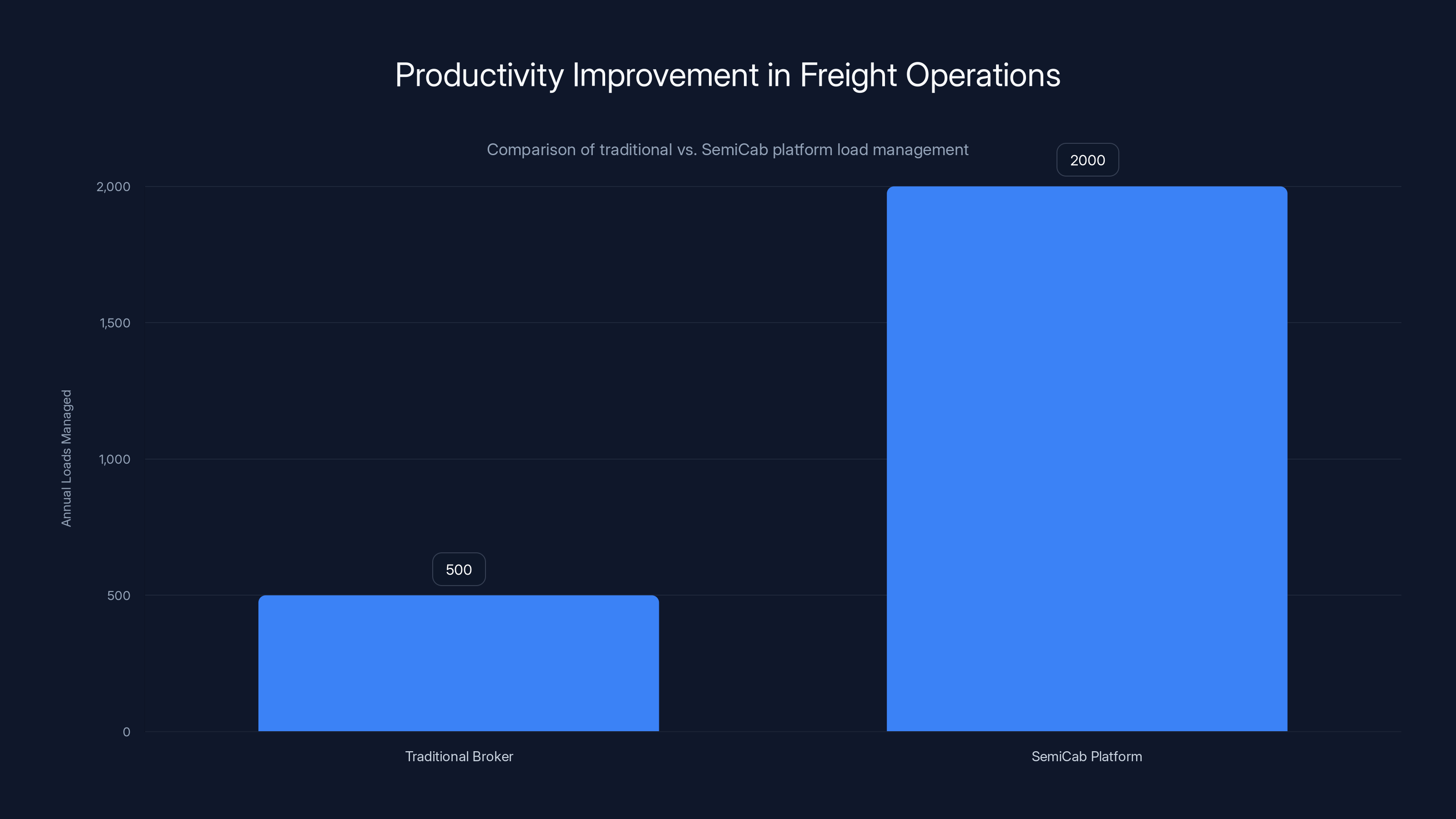

The narrative was simple but terrifying to traditional logistics operators. Algorhythm claimed its Semi Cab platform could help freight brokers manage 2,000 loads annually instead of the industry standard 500 loads per year. That's a 4x productivity improvement without hiring additional staff. For an industry already anxious about AI disruption, the message was clear: automation was coming for logistics jobs, and it was coming fast.

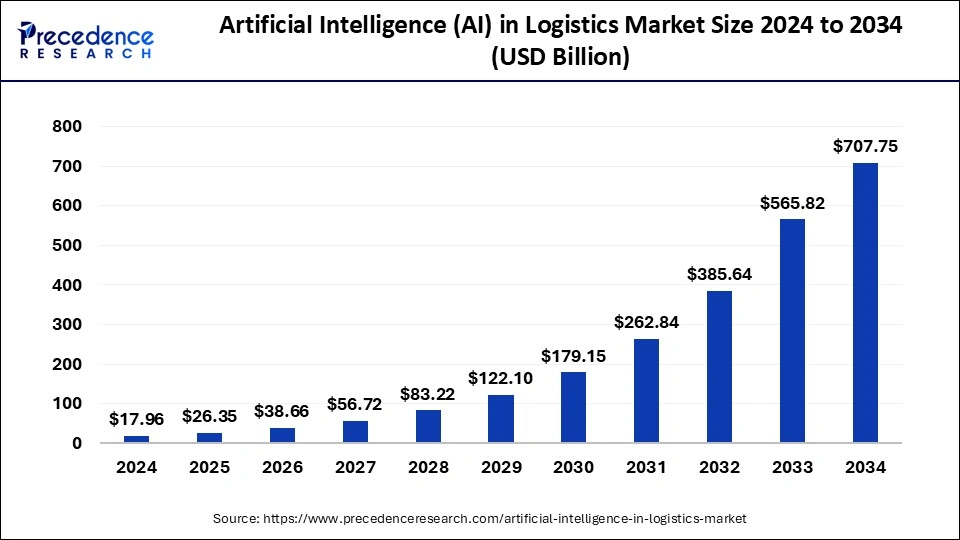

But here's what makes this story interesting. It's not really about whether Semi Cab actually delivers on its promises. It's about what happens when markets panic before asking critical questions. It's about the gap between hype and reality in AI. And it's about how one announcement can reshape how investors think about entire industries.

Let's break down what actually happened, why it matters, and what the AI freight revolution really means for logistics companies, workers, and the broader economy.

TL; DR

- Market Shock: A tiny AI startup's efficiency claims triggered a $10+ billion market sell-off across major logistics companies in a single trading day

- The Claims: Algorhythm claimed 300-400% volume scaling without additional staff, translating to 4x productivity gains versus industry benchmarks

- Stock Casualties: CH Robinson dropped 24%, Landstar fell 16%, RXO lost 20.5%, with losses spreading to healthcare and distribution companies

- Panic vs. Reality: The market reacted to potential AI disruption without waiting for proof of actual performance or adoption

- Bigger Picture: The incident reveals how fragile traditional logistics businesses are to automation threats and how fast institutional panic can spread

The SemiCab platform claims a 4x improvement in load management, increasing from 500 to 2000 loads annually, which could significantly boost logistics efficiency and profitability.

The Company That Started With Karaoke

Algorhythm Holdings wasn't always an AI freight company. That's actually important context.

Years ago, this company made karaoke machines. They owned a product line called Singing Machine, which you might recognize if you've been to a dive bar or owned consumer electronics in the 2000s. The business model was straightforward: sell karaoke hardware, make money on unit sales.

Then the market shifted. Karaoke moved to phones and apps. YouTube and streaming killed the dedicated hardware market. The company faced a choice: slowly decline or pivot aggressively.

They chose pivot. Algorhythm sold off the Singing Machine unit to Stingray for $4.5 million and redeployed those resources into AI freight software. That's actually a smart move for a struggling company. Find a growing market. Leverage whatever technology, talent, or capital you have left. Move fast.

What's less clear is whether they had the expertise. The jump from consumer karaoke hardware to logistics AI software is... substantial. Different markets. Different customers. Different technical requirements. Different risk profiles.

Yet here they were, entering one of the most complex and capital-intensive industries in the world with claims that would reshape it.

The Pivot That Changed Everything

Selling the karaoke business freed up resources, but capital wasn't the real constraint. The constraint was credibility. A karaoke hardware company saying "trust us with your freight operations" is like a smartphone maker saying "trust us with your financial infrastructure." Possible? Yes. Believable? Harder.

But timing matters. AI was becoming the narrative that explained everything. Anything could be disrupted. Any market could be automated. Any company could be the next unicorn. Algorhythm had the right message at the right moment, aimed at an industry known for resisting innovation.

Logistics hadn't been dramatically transformed by technology the way other industries had. Manufacturing had automation. Retail had e-commerce. Finance had digital banking. But logistics still relied on experienced human freight brokers making phone calls, building relationships, and coordinating shipments through accumulated knowledge.

That made it look vulnerable. And that's exactly what Algorhythm claimed to address.

The Claims That Shook Markets

Let's talk about what Algorhythm actually claimed. This matters because the specifics reveal what spooked the market.

The core claim: Their Semi Cab platform enables freight operators to "manage more than 2,000 loads annually, compared to the traditional industry benchmark of approximately 500 loads per year per freight broker."

That's the 4x improvement everyone quoted.

What they said about it: Gary Atkinson, Algorhythm's CEO, explained the value proposition clearly. "Historically, logistics has been constrained by human bandwidth. Every increase in volume requires more planners, more dispatchers, and more manual intervention. Our Semi Cab platform breaks that dependency by embedding intelligence directly into the freight operating system."

Translate that to financial terms: If one person can now do the work of four people, you need 75% fewer staff for the same throughput. Or you keep your current staff and multiply revenue by 4. Either way, margins skyrocket.

For logistics companies operating on thin margins (often 5-8% net profit), a 4x productivity improvement would be transformational. It would be worth hundreds of millions to major carriers. That's why the market reacted so violently.

Why The Numbers Were Scary

The logistics industry is fundamentally limited by human throughput. A freight broker is a middleman. They take loads from shippers, find trucks with capacity, negotiate pricing, handle paperwork, resolve issues, and coordinate delivery. It's knowledge work. It requires judgment. It's hard to scale without adding people.

If AI could actually do 75% of that work, entire business models collapse. You don't need as many humans. You don't need as many offices. You don't need as many layers of management. The companies that built their competitive advantage on having the best brokers suddenly face a threat where algorithmic matching outperforms human judgment.

That's fundamentally disruptive to the industry structure. And the market understood the threat immediately.

The 300-400% Volume Scaling Claim

Wait, I said 4x productivity improvement but the headline says 300-400% volume scaling. Are those the same thing?

Sort of, but not exactly. Here's the distinction:

4x productivity: One person does 4x the work. Same workload per person, just multiplied.

300-400% volume scaling: You add 3-4x more volume without proportional cost increases. That could mean better utilization, smarter routing, less idle time, or just pressing harder on the same infrastructure.

The numbers might not be directly comparable because they're measuring different things. One is about workforce output. The other is about business volume. But market participants heard both claims and extrapolated the worst-case scenario for their businesses.

CH Robinson experienced the largest drop at 24% during the announcement, highlighting significant market concern over AI's impact on logistics.

The Market Reaction: Panic in Slow Motion

Algorhythm's market cap was tiny. Around $6 million before the announcement. You could literally buy the entire company with a decent venture funding round. It wasn't a threat based on size.

Yet the announcement pushed Algorhythm's stock up nearly 30%. And it triggered an immediate sell-off across the entire logistics sector.

Here's the stocks that crashed:

- CH Robinson Worldwide: Down 24% at worst, closed down 15%

- Landstar System: Down 16%

- RXO: Down 20.5%

- JB Hunt Transportation Services: Down approximately 5%

- XPO: Down approximately 5%

- DHL Group: Down 4.9%

- DSV A/S: Down 11%

- Kuehne+Nagel International AG: Down 13%

The Russell 3000 Trucking Index dropped 6.6%.

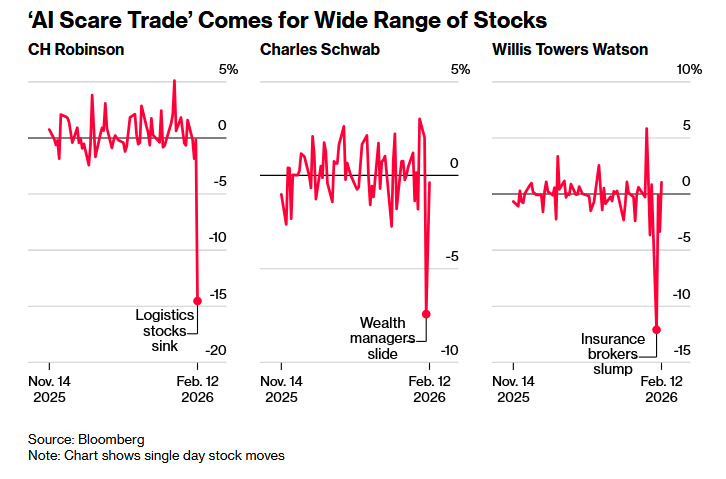

Why Did Healthcare and Distribution Also Fall?

Here's what's fascinating: the selling pressure didn't stay contained to freight. Drug distribution companies got hit too.

McKesson Corp: Down approximately 4% Cardinal Health: Down approximately 4%

Why? Because the same logic applies. If AI can automate distribution work in freight, it can automate distribution work in pharmaceuticals. If humans aren't needed to match supply with demand in trucking, they're not needed to match medicine shipments with pharmacies.

Once the market frame became "AI disruption spreading," the selling accelerated. It wasn't about specific companies anymore. It was about the sector vulnerability to automation itself.

The Wall Street Journal Observation

The Wall Street Journal described the reaction as "one of the most extreme examples yet of the sell-now, ask-later ethos sweeping financial markets in the artificial-intelligence era."

That's the key insight. The market didn't wait to see whether Semi Cab actually worked. It didn't demand proof. It didn't scrutinize the claims. Investors simply saw a narrative (AI automation threat) and reacted before anyone had verified whether the threat was real.

This is rational behavior in a specific context. If you believe the AI disruption story is true, better to sell before everyone else does. You don't want to be the last person holding logistics stocks when the market finally realizes they're obsolete.

But it reveals something about how fragile confidence in traditional businesses actually is. One claim from a tiny startup was enough to convince institutional investors that billion-dollar logistics companies might be worth 15% less.

What Actually Drives Freight Brokerage Value

To understand why the market reacted so sharply, we need to understand what actually determines profitability in freight logistics.

It's not magic. It's a combination of factors:

Relationship strength: Brokers with good relationships to both shippers and carriers get better rates and first access to premium loads. Those relationships took years to build. AI can't instantly replace that.

Market information: Knowing where freight is, where trucks are empty, what rates are sustainable, what's about to happen in the market. Experienced brokers have developed intuition. AI might eventually beat that intuition, but it's not instant.

Negotiation skill: Getting shippers to pay more and carriers to accept less requires judgment and communication. Software can't negotiate in the human sense.

Problem solving: When shipments get delayed, routes change, or customers get angry, brokers fix it. They make judgment calls. They know how to communicate and maintain relationships under stress.

Operational efficiency: Automating paperwork, route optimization, and administrative work. This is where AI can provide immediate value.

Where AI Actually Delivers

Algorhythm's real opportunity isn't replacing brokers entirely. It's automating the operational drudgery so brokers can focus on the valuable parts.

Specific use cases where AI freight software genuinely helps:

- Load matching: Using data to suggest optimal pairings of shippers and carriers faster than humans can manually find them

- Rate optimization: Analyzing historical data to recommend pricing that maximizes profit

- Route planning: Using real-time data to suggest efficient routes that save time and fuel

- Paperwork automation: Filling out shipping documents, manifests, and compliance paperwork automatically

- Capacity forecasting: Predicting when trucks will be available or when demand will surge

- Exception handling: Alerting humans to unusual situations that need intervention rather than requiring humans to scan for problems

These are real, valuable improvements. They would make brokers more productive. But they're not magic. They're good software solving specific problems.

The Gap Between Promised and Actual

Here's where the story gets complicated. Algorhythm's claims are ambitious. The execution is a different question.

Promises are easy. Execution is hard.

Let's think through what needs to be true for a 4x productivity improvement:

1. The software has to work reliably. It can't crash. It can't give bad recommendations. It has to be better than the human alternative. That's a high bar.

2. Integration has to be painless. Major logistics companies have legacy systems. Getting Semi Cab to work with their existing infrastructure, databases, and workflows isn't trivial. Integration projects routinely run over schedule and budget.

3. Adoption has to happen. Brokers who've built their careers on human judgment might resist. They might not trust the AI recommendations. They might see the software as a threat to their job (it might be). Getting humans to actually use the system is the hardest part.

4. Customer experience has to improve. Shippers and carriers need to see better service, not just cost cuts. If the AI-optimized system makes service worse, customers will go to competitors.

5. Edge cases need handling. Routine loads are easy to automate. Unusual situations, complex logistics problems, and custom requirements need human judgment. The AI needs to know when to escalate to humans.

Historical Context: Previous Logistics Technology Promises

Logistics has been promised disruption many times before.

Tons of startups have claimed to revolutionize freight matching. Most are forgotten. A few survive as incrementally useful tools. Almost none achieve the "10x productivity" improvements they promise.

Autonomous trucking is still a decade away (and has been for a decade). Blockchain was supposed to revolutionize supply chain visibility. It mostly hasn't. Drone delivery was supposed to change everything. It didn't.

That's not to say technology can't improve logistics. It absolutely can and does. But the gap between "significant improvement" (real) and "transformational disruption" (often overstated) is where most failures happen.

Algorhythm needs to prove it's in the first camp, not the second. The market assumed it was in the second. That's the mismatch that created the opportunity for a sell-off.

Major logistics companies experienced significant stock price drops, with CH Robinson down 24%, following claims of AI-driven productivity gains. Estimated data.

Industry Vulnerability: Why Logistics Was So Exposed

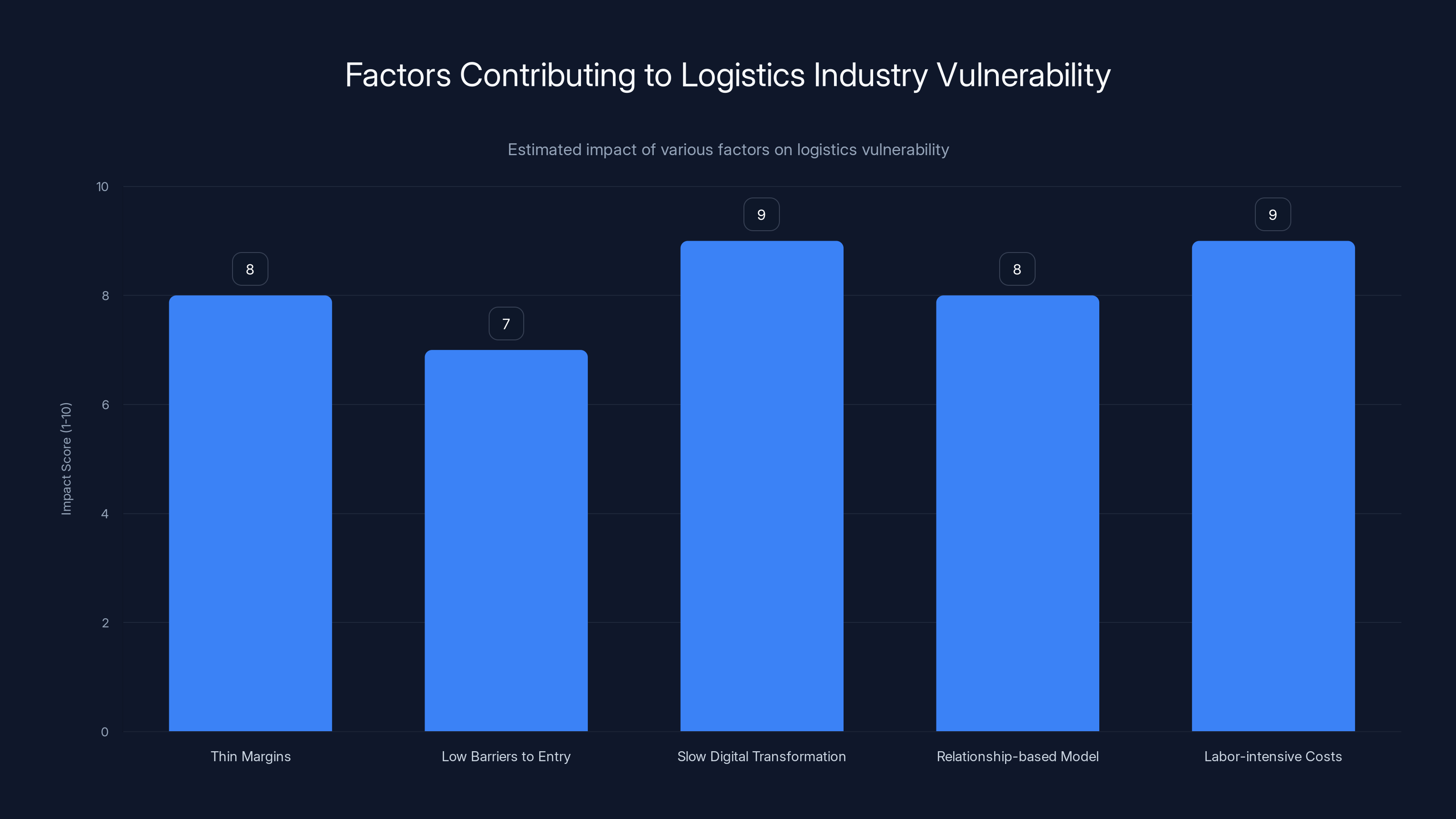

Logistics is surprisingly vulnerable to disruption narratives. Here's why:

Thin margins: Most logistics companies operate on 5-8% net profit. That's not much room for error. A competitor that can reduce costs even 10% has a huge advantage.

Low barriers to entry: You don't need advanced technology to be a freight broker. You need relationships and reliability. AI software could potentially level that playing field, making it easier for startups to compete.

Slow digital transformation: Logistics is behind other industries in digitization. Manufacturing has robotics. Retail has automation. Finance has algorithmic trading. Logistics still relies on people and experience. That makes it look like low-hanging fruit for AI.

Relationship-based business model: When you run a business on relationships rather than technology, new technology that automates relationships looks existential. A company built on having smart people making good decisions faces genuine disruption from software that makes better decisions.

Labor-intensive cost structure: If half your costs are people, then anything that reduces people required is huge. That makes automation especially threatening.

The Real Competitive Advantage Being Threatened

What makes CH Robinson or Landstar System valuable isn't their physical assets. It's their reputation, their relationships, their data, and their process efficiency. Those are all things that AI could theoretically replicate or exceed.

But here's the nuance: even if AI gets better at matching loads to trucks, it doesn't automatically get CH Robinson's customers. A shipper who's worked with a broker for years has switching costs. They trust the broker. They know they'll handle problems. Switching to an AI system risks service quality degradation.

So the vulnerability is real but not absolute. The market was pricing in maximum disruption risk (complete customer loss) when the actual risk is probably moderate (gradual customer migration over years, plus pressure on margins from new competitors).

That gap between maximum and actual risk is where investment opportunities usually hide. But in the moment of panic, investors don't distinguish carefully between maximum and actual. They're selling first and thinking later.

What Algorhythm's Claims Actually Require

Let's be concrete about what needs to happen for Algorhythm to deliver on its promises.

They're claiming freight brokers using Semi Cab can manage 2,000 loads annually instead of the 500 industry standard. That's 4x. Here's what that implies:

The Math Behind 4x Productivity

Scenario: A current broker managing 500 loads per year

If the average load takes 4 hours of human effort (initial inquiry, negotiation, matching, paperwork, follow-up), that's 40 hours per week of work on 10 loads.

With 4x productivity:

Doing 39 loads in the same 40 hours per week means each load takes approximately 1 hour instead of 4 hours. That's a 75% time reduction per load.

For this to work, the software needs to handle 75% of the work currently done manually. Specifically:

- Automated load matching (instead of manual search)

- Automated rate calculation (instead of manual negotiation)

- Automated paperwork (instead of manual data entry)

- Predictive customer preference (instead of relationship-based guessing)

The Skeptical Reading

Honestly? That's achievable. Modern software can do all of those things reasonably well. But there are catches:

Quality degradation risk: If the AI recommendations are 95% as good as human judgment, you've maybe saved 30% time, not 75%. Humans catch nuances the software misses.

Integration complexity: Getting the software to talk to existing systems, databases, and workflows usually adds 30-50% overhead to implementation timeline.

Change management overhead: Training brokers to use new software, handling resistance, fixing broken processes during transition. This typically takes 3-6 months of productivity loss.

Customer service issues: If automating the process means worse communication or errors, customers will notice. Some will leave, offsetting the efficiency gains.

Specialized load handling: Complex loads, unusual requirements, international shipments, and premium services probably still need human attention. Those might be 20-30% of volume but require 50% of effort.

So realistic outcomes might be:

- Optimistic: 2x-3x productivity improvement after full implementation

- Realistic: 1.5x-2x productivity improvement including integration costs

- Conservative: 1-1.5x improvement accounting for change management and customer issues

None of those are bad. A 50% productivity improvement would be valuable. But it's not 4x. That's the gap between headline claims and actual results.

The CEO's Surprise (And Why It Matters)

Gary Atkinson, Algorhythm's CEO, said something revealing after the market reaction: "Never in my wildest dreams would I ever have imagined a day like today. It's almost like David versus Goliath."

That comment suggests he didn't expect the market to care this much about a tiny company. Which tells you something important: Algorhythm probably didn't design the announcement to trigger a market-wide sell-off. The market did that to itself.

The company made a claim about their software's capabilities. That claim made economic sense. Smart brokers would use the software to improve productivity. That would put pressure on competitors.

But investors extrapolated from "smart brokers will use this" to "all brokers will immediately switch" to "entire logistics companies will become obsolete" in about 30 minutes. That cascade of assumptions is what created the sell-off.

The market did to itself what Algorhythm didn't have to do. And the CEO was probably shocked by how fast that happened.

The logistics industry is highly vulnerable due to slow digital transformation and labor-intensive cost structures, both scoring 9 out of 10 in impact. Estimated data.

Broader Context: AI Disruption Anxiety Is Real

The logistics sell-off didn't happen in a vacuum. It happened in a context where AI disruption anxiety is already high.

Large language models can write code, draft emails, analyze documents, and solve technical problems. Companies are experimenting with replacing customer service representatives with chatbots. Robots are increasingly common in warehouses. Autonomous vehicle development continues advancing.

For workers across many industries, the fear is legitimate. AI will displace some jobs. It will change how others are done. It will create new opportunities but not necessarily for the same people.

For investors in traditional businesses built on human labor, the fear is also legitimate. Entire business models could become less profitable if labor costs drop dramatically.

So when a company claims a 4x productivity improvement with AI, it hits a nerve. Investors hear that and think: "This could be the big disruption I've been worried about. Better get out before others do."

Cisco CEO's Warning

Cisco's CEO famously said about AI: "You shouldn't worry as much about AI taking your job as you should worry about someone who's very good using AI taking your job."

That frames the anxiety perfectly. The fear isn't that AI will fully replace humans. The fear is that AI-augmented humans will be so much more productive that regular humans won't be competitive anymore.

A broker with Semi Cab managing 2,000 loads per year is the "someone who's very good using AI." They'll out-compete brokers without the software. That's the real threat.

Whether Algorhythm actually delivers that threat is a different question. But from an investor's perspective, the threat is plausible. And when threats are plausible in a sector, sell buttons get hit.

Comparable Disruptions: Historical Parallels

Has something like this happened before? Yes, multiple times.

Photography disruption (2000s): Digital cameras made film photography obsolete. Companies like Kodak had to either adapt or die. Kodak had the technology but couldn't pivot. The market reacted by moving capital away from traditional camera companies. Those that didn't adapt became worthless.

E-commerce disruption (1990s-2000s): Online shopping threatened retail stores. The market panicked about retail completely dying. Some retailers (Amazon) adapted brilliantly. Others (Blockbuster, Borders) didn't. The market crushed those that didn't adapt.

Autonomous vehicle hype (2010s-2020s): The threat of self-driving trucks was supposed to eliminate truck driver jobs. That threat was way overstated relative to actual timeline. But companies like Tesla and Waymo captured massive investment on that thesis anyway. Meanwhile, traditional auto manufacturers got pressure because the market thought they were about to be disrupted.

In each case, the market moved based on the plausibility of disruption, not proof of disruption.

The pattern: New technology emerges. Early claims about its potential are made. Markets panic and reallocate capital from old to new. Some old companies adapt and survive. Some don't. Most new companies fail. A few succeed.

Algorhythm might be one of the few that succeeds. Or it might be one of the many that doesn't. But the market's reaction was predictable given historical patterns.

What Logistics Companies Should Actually Do

For large logistics companies staring at this situation, the appropriate response isn't panic. It's strategic action.

Option 1: Build in-house

Develop your own AI tools to automate the same functions Algorhythm is automating. Advantage: you control the technology. Disadvantage: software development is hard and slow. You'd need to hire talent and spend years building. By then, competitors using Algorhythm might get ahead.

Option 2: Partner or acquire

Form partnerships with AI companies or acquire startups developing freight software. This is faster than building from scratch. You inherit their team and technology. Disadvantage: acquisition integration is messy. You might overpay. The technology might not fit your needs perfectly.

Option 3: Invest and wait

Leave your core business mostly unchanged but invest in tech startups developing freight software. This hedges your bets. If the disruption is real, you own pieces of the disruptors. If it's hype, you haven't bet your entire company. Disadvantage: you might get left behind by competitors who are bolder.

Option 4: Focus on differentiation

If load matching and rate optimization get commoditized by software, shift focus to service, reliability, and customer relationships. The software can make suggestions, but humans make final decisions. That human touch becomes more valuable as software becomes common. Disadvantage: harder to compete on cost. You need to charge premiums for service quality.

Most successful logistics companies will probably do some combination of 2, 3, and 4. Build or acquire some technology. Invest in emerging competitors. Invest heavily in service differentiation. Don't try to compete purely on automation or cost.

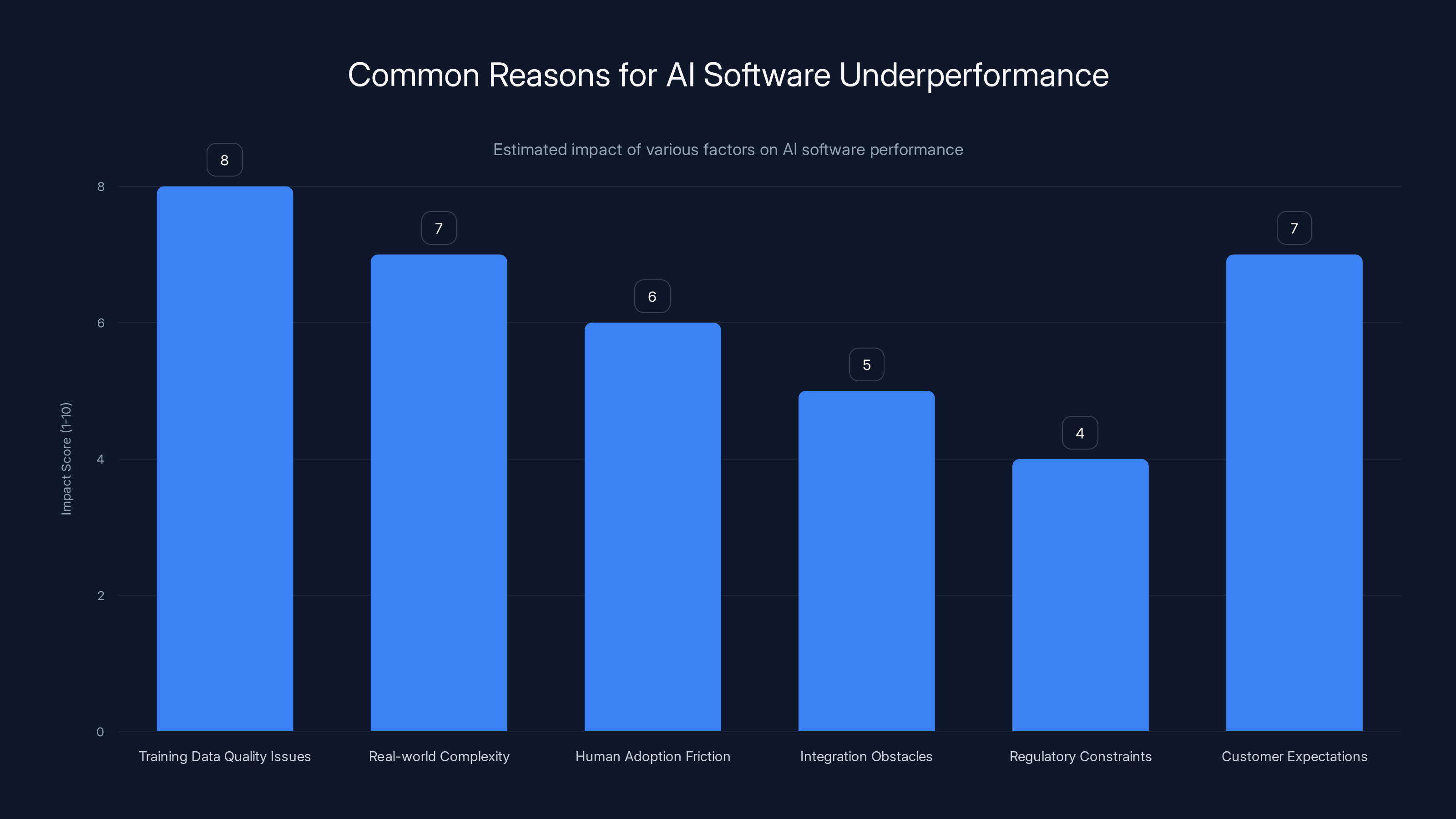

Training data quality issues and customer expectations are estimated to have the highest impact on AI software underperformance. Estimated data.

The Hype-Reality Gap in AI Software

Here's something important about AI software claims: they're almost always optimistic.

Why? Because entrepreneurs are incentivized to oversell. They need capital to build the product. They need customers to try it. They need pressure on competitors to drive adoption. Overselling the potential is a feature of the system, not a bug.

This doesn't make founders dishonest. It makes them hopeful. They genuinely believe their technology will eventually deliver on the bold claims. They just haven't spent enough time thinking about all the ways it might not.

Common reasons AI software underperforms initial claims:

1. Training data quality issues: The AI learned from historical data that might be outdated, biased, or incomplete. When applied to new data, it performs worse than expected.

2. Real-world complexity: The development environment (test data, controlled conditions) looks nothing like production. Unexpected edge cases keep appearing.

3. Human adoption friction: Employees don't trust the AI recommendations. They ignore them or work around them. The software becomes a shelf-ware that nobody uses.

4. Integration obstacles: The software doesn't integrate cleanly with existing systems. Companies spend months on custom integration work to get it running.

5. Regulatory constraints: What works technically might violate regulations or customer requirements.

6. Customer expectations: Users expect near-perfect performance. 95% accuracy sounds great until the 5% error rate costs customers money.

Algorhythm probably encounters several of these. That doesn't mean Semi Cab is worthless. It means the 4x productivity promise is probably optimistic.

Market Lessons: What This Reveals About Investor Behavior

The Algorhythm sell-off reveals something important about how markets work. Specifically, it reveals the power of narrative over analysis.

Investors didn't spend time modeling Algorhythm's actual customer acquisition timeline, integration costs, or realistic productivity improvements. They heard "AI disruption is coming" and sold reflexively.

That's not irrational. In a market where the disruption narrative becomes dominant, you want to be out before others are. It's a coordination problem. The incentive structure says: be the first to sell.

But for long-term investors who don't need to sell, the sell-off creates opportunities. Logistics companies didn't suddenly become bad businesses. Their fundamentals didn't change. They got cheaper because sentiment changed.

Historically, the best opportunities come after irrational panic. When the market overshoots downward, disciplined investors buy. When sentiment eventually normalizes, they make money.

That doesn't mean logistics companies will definitely recover. It means the 15% one-day drop is probably overcorrection. The actual impact of AI disruption is probably spread over years, not realized immediately.

Sentiment Cycles

Markets cycle through predictable sentiment patterns:

- Skepticism: New technology is over-hyped. Nobody important uses it yet.

- Awareness: Real companies start adopting. Narrative shifts to "this might be real."

- Panic: Market realizes disruption could be existential. Sells affected sectors.

- Capitulation: Everyone who was going to sell has sold. Bottom forms.

- Recovery: Realizing the disruption is real but more gradual than feared. Sentiment normalizes.

- Mania: Belief that the new technology will solve everything. Valuations go crazy.

- Correction: Reality fails to live up to hype. Bubble pops.

Algorhythm's announcement triggered the market to move from stage 2 to stage 3 in hours. That's what happened on the day of the sell-off.

Over time, the market will move to stages 4-5 as actual data about Semi Cab's real impact emerges. Some logistics companies will adapt successfully (stage 6). Investment capital will spread across winners and losers. Eventually, a new equilibrium forms.

The Talent Implications: Jobs in Logistics AI Era

Setting aside market mechanics for a moment: what does this actually mean for people working in logistics?

If AI software becomes genuinely better at freight matching, rate optimization, and logistics planning, the demand for experienced human judgment in those specific areas will decline. That's true.

But that's not the same as saying freight logistics jobs disappear. Here's what probably actually happens:

Jobs that change:

- Routine freight broker work: Shifts from "find matching loads" to "review AI recommendations and make exceptions." Fewer people needed, but existing people become more efficient.

- Dispatcher roles: Shift from "coordinate shipments manually" to "monitor AI-coordinated shipments for problems." Different skill set required.

- Administrative support: Much of this gets automated. Some positions disappear.

Jobs that become more valuable:

- AI software training: Teaching the system about company-specific requirements and customer preferences.

- Exception handling: Dealing with unusual shipments and complex problems that the AI can't solve.

- Customer relationship management: As matching becomes commoditized, the value shifts to service quality and relationships.

- Quality assurance: Monitoring AI recommendations to catch errors or bias.

New jobs created:

- Building and maintaining freight AI systems

- Analyzing freight data

- Managing AI-logistics hybrid workflows

- Training workers on new systems

The net result is probably: fewer total freight logistics jobs in 5-10 years, but not zero. The jobs shift from "routine matching" to "exception handling and relationship management." The skill set shifts from "experience and intuition" to "experience, intuition, AND ability to work with software."

For workers, that's disruptive. It requires retraining. It's not inevitable job loss, but it's definitely job disruption.

For the market reaction though, the fear of job displacement was probably the key factor that triggered selling. Investors saw AI freight software and thought: "Lots of freight jobs will disappear. Logistics companies will become less valuable. Sell."

That's probably too extreme. But it's not totally unfounded either.

Algorhythm's announcement caused significant stock price declines, particularly in the logistics sector, with CH Robinson Worldwide experiencing the largest drop of 15%. Estimated data.

Algorhythm's Credibility Challenge

Here's the tough spot Algorhythm is in now: they made bold claims, the market panicked, and now they have to actually deliver.

They probably underestimated how seriously the market would take their claims. Now they face enormous pressure to prove Semi Cab actually delivers on the 4x productivity promise.

If they can't deliver, the company becomes a cautionary tale about AI overhype. If they can deliver, they've genuinely built something transformative.

What they need to do:

1. Release actual customer data: Not vague claims, but real results. Specific customers. Specific metrics. Third-party verification if possible.

2. Be transparent about limitations: Show what Semi Cab is good at and what it's not good at. That builds credibility.

3. Move fast on integration: Get the software working with existing systems quickly. Every month of integration delays is a month competitors can catch up.

4. Focus on customer success: Help early adopters succeed. Turn them into references. Let them evangelize the product. Word-of-mouth beats marketing.

5. Manage expectations: Underpromise and overdeliver. This is the opposite of what they just did.

They also need to handle the David vs. Goliath narrative carefully. The CEO's comment about being surprised by the market reaction could become a strength if they handle it right. "We just wanted to help brokers. We didn't expect to trigger a market panic" reads as humble and authentic.

Or it could become a weakness if the market feels manipulated. "They made big claims, boosted their stock, now they're acting surprised" reads as inauthentic.

The next 6-12 months will determine which narrative wins.

Comparative Technology Disruptions

Let's zoom out and look at other disruption cases to contextualize this.

Stripe in payments: Stripe claims to make payments easier for developers. True claim. Did it destroy Visa and Mastercard? No. Did it disrupt payment processing? Yes. Did it make some companies (especially small payment processors) less valuable? Yes.

Canva in design: Canva claims to make design accessible to non-designers. True claim. Did it destroy design agencies? No. Did it disrupt lower-end design work? Yes. Did it displace some junior designer jobs? Probably.

Shopify in e-commerce: Shopify claims to make e-commerce easier for small merchants. True claim. Did it destroy retail? No. Did it accelerate e-commerce growth? Yes. Did it make brick-and-mortar less attractive? Yes.

Slack in communication: Slack claims to make team communication better. True claim. Did it destroy email providers? No. Did it make some enterprise software less useful? Yes. Did it change how companies communicate? Absolutely.

The pattern: Successful disruptive technologies usually don't destroy incumbents entirely. They change competitive dynamics. They raise the bar for survival. They accelerate capital reallocation. But they don't usually result in complete industry extinction.

Logistics will probably follow this pattern too. AI freight software will improve efficiency, pressure margins, require adaptation. But it won't kill major logistics companies. It will kill the poorly adapted ones and make the well-adapted ones more valuable.

That should have been the rational market reaction. But market reactions aren't always rational in the short term. They're rational over longer periods.

What Investors Missed in the Analysis

When the logistics sell-off happened, sophisticated investors should have been asking these questions:

1. What's the actual TAM (Total Addressable Market) for Semi Cab? How many freight brokers are there globally? How much would they pay for 2x-3x productivity improvement (being realistic, not trusting the 4x claim)? What's Algorhythm's realistic market share in year 5?

2. What's the competitive response timeline? How long until major logistics companies build or acquire equivalent technology? 6 months? 2 years? If it's short, Algorhythm's advantage evaporates fast.

3. What's the integration barrier? How hard is it actually to implement Semi Cab into existing logistics workflows? If it's hard, adoption will be slower than promised.

4. What's the switching cost for customers? Do logistics companies have incentive to switch to Semi Cab, or will they build in-house? If in-house is cheaper, Semi Cab loses competitive advantage.

5. What's happening to the logistics business model? Maybe freight brokerage margins compress from 8% to 5%, but volume still grows. The industry becomes less profitable per transaction but doesn't disappear. Market cap might decline 20%, not 100%.

Those analyses would have suggested a 10-20% sell-off as reasonable, maybe a 30% sell-off in a panic scenario. But not a 24% immediate drop on a single day with no customer data.

The market skipped the analysis and went straight to fear. That's when opportunities form.

The Broader AI Disruption Narrative

Algorhythm's announcement didn't happen in isolation. It happened in a moment when:

- AI anxiety was already high

- Companies were announcing major AI capabilities constantly

- The 2024-2025 period was characterized by "AI solves everything" narratives

- Investors were nervous about which traditional businesses AI would disrupt next

- The stock market was already volatile on various fronts

Into that context, Algorhythm's claims hit with maximum impact. If the same claims had been made in 2020 before Chat GPT, the reaction would have been different. Before the AI boom, the claims would seem speculative and unproven.

But in early 2025, amid the AI disruption moment, the claims seemed plausible and urgent. That timing amplified the market reaction.

This is an important lesson about how markets work. The same news, released at different times, gets different reactions. It's not just about the news. It's about the moment and what investors are already worried about.

Where Algorhythm Succeeds or Fails

Algorhythm's actual success hinges on specific variables:

Variables where success is likely:

- Building useful software that solves real problems (freight matching, rate calculation, route optimization)

- Attracting initial customers willing to beta test the platform

- Improving the product based on customer feedback

- Growing revenue from its early customer base

Variables where they're vulnerable:

- Proving the 4x productivity claim is real (probably can't, might settle for 2x)

- Defending against fast competitive response from incumbents

- Integrating cleanly with existing logistics infrastructure

- Expanding beyond early adopters to mainstream customers

- Maintaining software quality as the customer base grows

Most likely outcome: Algorhythm becomes a successful software company serving a niche in freight logistics. It helps brokers become more productive. It creates genuine value. But it's not the "existential threat to logistics" the market briefly believed.

Company value: Probably in the

What This Means for Other Industries

If Algorhythm-type claims can trigger panic selling across entire sectors, what other industries are vulnerable?

Manufacturing and industrial: AI for predictive maintenance, quality control, and production optimization could disrupt manufacturers. But implementation is slow.

Healthcare: AI for radiology, pathology, and diagnosis could disrupt physician services. But regulatory barriers are high.

Legal services: AI for contract review, legal research, and due diligence could disrupt law firms. But client relationships are sticky.

Accounting: AI for bookkeeping, tax prep, and audit could disrupt accounting firms. But audit and advisory services aren't easily automated.

Customer service: AI chatbots are already disrupting customer service. This is the one area where disruption is actually happening.

The pattern: Industries with high labor costs, routine cognitive work, and low switching costs are most vulnerable to AI disruption narratives. Industries with high switching costs, complex relationships, or regulatory barriers are less vulnerable.

Logistics hit several of those vulnerability factors. That's why the reaction was so sharp. But other industries will face similar narratives as AI capabilities improve.

The Recovery Timeline

When will logistics stocks recover from this sell-off? A few scenarios:

Scenario 1: Semi Cab fails (25% probability) Algorhythm can't deliver on promises. Customer adoption is low. Competitive responses from incumbents are fast and effective. Algorhythm becomes a failed startup. Logistics stocks slowly recover as market realizes the threat was overstated. Timeline: 6-12 months.

Scenario 2: Semi Cab succeeds but adoption is slow (50% probability) The software works well, but it takes years for adoption to spread. Logistics companies have time to respond. Margins compress gradually, not catastrophically. Logistics stocks recover partially but don't return to pre-announcement levels. Timeline: 12-24 months for partial recovery.

Scenario 3: Semi Cab succeeds and adoption is fast (15% probability) The software is genuinely transformative. Logistics companies that don't adapt fail. Companies that do adapt become winners. Market consolidates around AI-powered operators. Disruption is real. Logistics stocks that can't adapt stay depressed. Timeline: 2-5 years of volatility.

Scenario 4: Broader market factors override Algorhythm (10% probability) Economic recession, interest rate changes, or other macro factors dominate. Logistics stocks decline on fundamentals, not Algorhythm fear. Timeline: Varies.

Historically, most disruption panics follow Scenario 2. The technology is real but impact is slower than feared. Incumbent companies adapt and survive. Capital reallocation happens gradually over years, not overnight.

If you believed that pattern, the sell-off was opportunity. Logistics companies at 15-20% discounts were probably good buys if you had 3-5 year time horizon.

Key Takeaways: What We Should Remember

The Algorhythm story is more than just a stock market sell-off. It's a case study in how markets respond to AI disruption narratives.

What happened: A tiny AI startup claimed a 4x productivity improvement in freight logistics. The market panicked and sold billions in logistics stocks.

Why it happened: Logistics is a labor-intensive industry with thin margins. AI automation threatens the business model. Investors sold reflexively without analyzing whether the threat was real or timeline was realistic.

What we should remember:

- Markets overreact to disruption narratives, especially in vulnerable industries

- The gap between maximum risk and actual risk creates opportunities

- Disruption is usually slower than disruption narratives suggest

- Incumbent companies often adapt better than markets expect

- Being first with a disruption claim doesn't guarantee winning the market

- Panic selling is a sign of opportunity for disciplined investors

Algorhythm might genuinely change logistics. Or it might be a failed startup. Most likely, it's somewhere in between: a useful tool that improves productivity without fundamentally destroying the industry.

But the market didn't wait for that clarity. It sold first and will ask questions later. That's how markets work. And that's how opportunities form.

FAQ

What is Algorhythm Holdings and what does Semi Cab do?

Algorhythm Holdings is a company that pivoted from manufacturing karaoke machines to building AI software for freight logistics. Their Semi Cab platform claims to help freight brokers manage freight loads more efficiently using artificial intelligence, reducing the time needed per load from approximately 4 hours to 1 hour of human effort.

Why did logistics stocks fall when Algorhythm announced Semi Cab?

Investors panicked that AI software could automate freight brokerage work, threatening the profitability of traditional logistics companies. If brokers using Semi Cab could handle 4x more volume without additional staff, then logistics companies either needed to invest in similar technology or face losing market share and profitability. The market reacted by selling logistics stocks immediately rather than waiting for proof that Semi Cab actually works.

What specific productivity improvements did Algorhythm claim?

Algorhythm claimed that brokers using Semi Cab could manage more than 2,000 loads annually compared to the industry standard of approximately 500 loads per year, representing a 4x productivity improvement. They also claimed their platform could enable 300-400% volume scaling without adding proportional staff, effectively decoupling workforce size from business volume.

Which companies' stocks fell the most after the announcement?

CH Robinson Worldwide fell approximately 24% at its worst (closed down 15%), Landstar System fell 16%, RXO fell 20.5%, DSV fell 11%, Kuehne+Nagel fell 13%, and DHL fell 4.9%. Even healthcare distribution companies like McKesson and Cardinal Health were affected, falling roughly 4% as investors feared similar automation threats across multiple industries.

Is the 4x productivity claim realistic for AI freight software?

The 4x claim is probably optimistic. More realistic gains would be 1.5x-2x when accounting for integration complexity, human change management, edge case handling, and customer service requirements. AI software can genuinely improve matching and paperwork automation, but complete elimination of human judgment in freight logistics is unlikely. The 75% time savings per load would require the software to handle nearly all routine decision-making perfectly.

Has anything like this market panic happened before in response to new technology?

Yes. Photography stocks crashed when digital cameras emerged. Retail stocks fell when e-commerce threatened traditional stores. Auto stocks experienced pressure when autonomous vehicle announcements suggested massive job displacement. In most cases, the technology was real but impact was slower than feared. Incumbent companies adapted and survived, though often with compressed margins and reduced workforce needs. Algorhythm's announcement likely follows this historical pattern of disruption fear leading to overcorrection in stock markets.

What should investors actually be worried about with AI freight disruption?

The real concern isn't complete industry collapse but gradual margin compression and competitive consolidation. Logistics companies that successfully adopt AI tools will become more competitive. Those that don't will lose market share gradually. This suggests selective winners and losers rather than universal industry decline. Investors should focus on which logistics companies are best positioned to adopt and integrate AI tools, rather than assuming all logistics companies face extinction.

What's the timeline for AI actually disrupting freight logistics?

Major disruption would likely take 3-5 years minimum, not months. Software integration takes time. Customer adoption takes time. Competitive response from major companies takes time. Regulatory adaptation (if needed) takes time. The market reacted as if disruption would happen immediately, which is historically inconsistent with how complex technology implementations actually work in enterprise environments.

Could Semi Cab actually become a major market disruption?

Possibly, but probably not to the degree the market feared. Algorhythm could build a successful, valuable software company that improves freight logistics efficiency meaningfully. That's maybe a

What happened to Algorhythm's stock price after the initial surge?

Algorhythm's stock rose nearly 30% on the announcement day due to excitement about their claims, despite the company's tiny $6 million market value. However, the company faces significant execution risk. They need to prove the claims are real, achieve customer adoption, defend against competitive response, and build a sustainable business. If they fail on any of these, the stock could collapse just as quickly as it rose.

When you're trying to build AI automation tools that boost team productivity and document generation, platforms like Runable show how AI can genuinely accelerate routine work. At $9/month, it's an affordable way to explore whether AI-powered document creation, presentation generation, and report automation actually delivers productivity gains in your workflow.

The Algorhythm story is ultimately about the gap between bold claims and proven delivery. That gap exists in every emerging AI category. The best approach is testing small before believing the 4x claims. Try the software. Measure actual improvements. Then decide whether the disruption narrative matches reality.

Related Articles

- Robotaxis Meet Gig Economy: How Waymo Uses DoorDash to Close Doors [2025]

- Why Waymo Pays DoorDash Drivers to Close Car Doors [2025]

- Uber's New CFO Strategy: Why Autonomous Vehicles Matter [2025]

- Waymo's $16B Funding: Inside the Robotaxi Revolution [2025]

- Waymo's $16 Billion Funding Round: The Future of Robotaxis [2025]

- Waymo's $16B Funding Round: The Future of Autonomous Mobility [2025]

![AI Freight Revolution: How Logistics Markets Crashed [2025]](https://tryrunable.com/blog/ai-freight-revolution-how-logistics-markets-crashed-2025/image-1-1771279655033.jpg)