Introduction: The Autonomous Vehicle Moment Has Arrived

Something seismic just happened in transportation, and honestly, most people missed it.

Waymo—the autonomous vehicle company born from Google's moonshot thinking—just secured $16 billion in a single funding round. That's not just money. That's a validation signal screaming through Silicon Valley that robotaxis aren't some distant sci-fi fantasy anymore. They're happening now, at scale, across multiple cities, generating real revenue from real passengers.

The funding round tells you something profound about where we are in 2025. When Dragoneer Investment Group, DST Global, and Sequoia Capital lead a

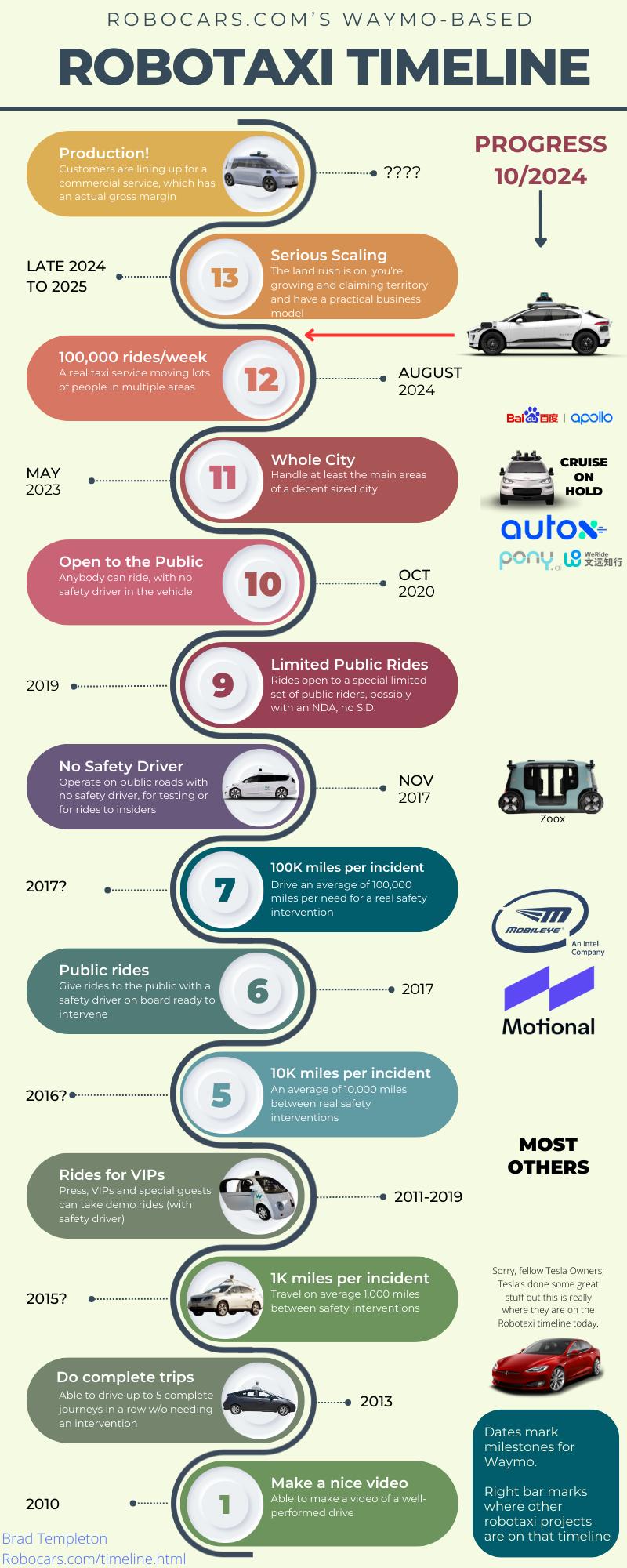

Let's be clear about what this means. Waymo currently operates robotaxi services across six major US metropolitan areas. In 2025 alone, the company more than tripled its annual ride volume to 15 million rides. That's not a pilot program. That's not a test. That's a commercial operation moving faster than almost anyone predicted.

The expansion plan is audacious. Waymo plans to launch robotaxi operations in over 20 additional cities during 2026—including international markets like London and Tokyo. That means stepping out of the relatively controlled US regulatory environment into completely different legal systems, infrastructure setups, and driving norms. It means scaling rapidly while navigating unprecedented complexity.

This funding round matters because it shows what institutional capital thinks about the future of transportation. It shows that the autonomous vehicle moment—the point where this technology transitions from research project to actual product—has definitely, unmistakably arrived. And it raises questions about what happens to cities, jobs, insurance, regulation, and the entire structure of how we move around our world.

In this comprehensive guide, we'll break down what Waymo actually is, why this funding matters so much, what's driving the expansion, what could go wrong, and what it all means for the future of transportation. We're not interested in hype here. We're interested in what's actually happening and what comes next.

TL; DR

- 126 billion, representing major institutional confidence in autonomous vehicle commercialization

- 20+ city expansion planned for 2026, including Tokyo and London, marking the first large-scale international robotaxi rollout

- 15 million rides in 2025 demonstrates proven demand and operational viability, with current operations across six major US metros

- Multiple regulatory investigations underway for safety incidents, highlighting the ongoing challenges of scaling autonomous technology

- Reshaping transportation economics with potential to eliminate driving jobs while creating new roles in fleet management and maintenance

Waymo is projected to expand its services to over 26 cities by 2026, with annual rides potentially doubling to 30 million. Estimated data reflects growth trends.

Understanding Waymo: From Google's Moonshot to Trillion-Dollar Company Catalyst

Waymo's origin story matters because it explains why this company approaches autonomous driving differently than pretty much everyone else.

The company started in 2009 as Google's self-driving car project. Not as a startup hungry to prove something. Not as a traditional automaker experimenting with new tech. But as a 20% project inside Google—the kind where engineers get time to work on moonshot ideas that might not have immediate commercial applications.

That created a different DNA. When you're not forced to hit quarterly revenue targets, when you have access to unlimited computing resources and the best machine learning researchers in the world, when you can iterate for over a decade without worrying about survival, you approach problems differently. You solve them more deeply.

Waymo spent years testing in the Bay Area. Just driving. Collecting data. Millions upon millions of miles. Building simulation environments. Training neural networks. Testing edge cases. The company didn't rush to commercialization. It waited until the technology was actually ready.

In 2018, Waymo spun out as an independent Alphabet subsidiary. That meant it still had the resources of Google—but needed to show commercial viability. It started offering limited ride-hailing services through an app in Phoenix called Waymo One. No human safety drivers. Actual passengers. Actual revenue.

The first few years were slow. Careful. The company expanded to Phoenix suburbs. Still limited. Still controlled. But the data kept improving. Every drive taught the system something. The cars got safer. Edge cases became fewer. The company scaled to San Francisco in 2023 after finally getting regulatory approval to charge for robotaxi rides in California.

Then acceleration happened.

By late 2024 and into 2025, Waymo wasn't in startup mode anymore. It was in scaling mode. Los Angeles. Austin. Atlanta. Miami. Each city brought different traffic patterns, different weather, different regulatory environments. And Waymo handled it.

The company serves a critical psychological role in this moment. When you see a Waymo robotaxi on the street—and increasingly, you will—it's not abstract anymore. It's real. There's no human at the wheel. A stranger just got out and walked into their apartment building. The technology actually works at consumer scale. That perception shift matters more than people realize.

Waymo's competitive advantages aren't just technological. They include a decade of data from real-world driving, relationships with regulators across multiple jurisdictions, an operating supply chain, insurance arrangements, and institutional knowledge about what actually breaks when you try to scale autonomous vehicles.

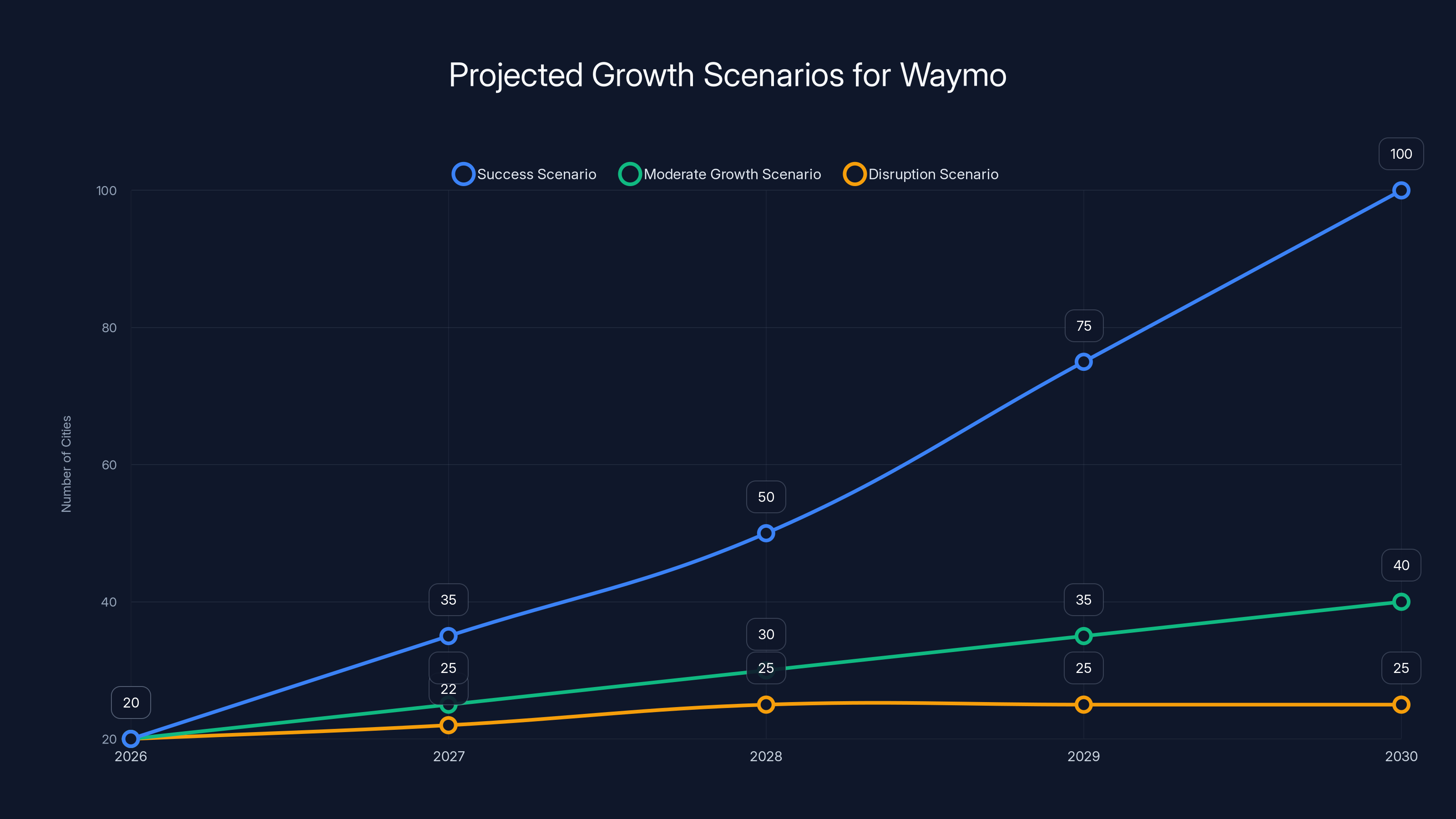

The chart illustrates three potential growth scenarios for Waymo's expansion into new cities by 2030. In the success scenario, Waymo reaches 100 cities, while moderate growth and disruption scenarios show significantly slower expansion. Estimated data.

The $16 Billion Moment: What This Funding Means

Let's talk about the money, because the specific structure of this funding round tells you a lot about where the autonomous vehicle market is heading.

$16 billion is a massive number. For context, it's more than the total annual R&D budget of most car companies. It's comparable to what some nations spend on infrastructure. It's enough to build out robotaxi operations in 20-50 cities depending on how you calculate the costs.

But the significance isn't just the size. It's who's writing the checks and what that signals.

Dragoneer Investment Group leads the round. Dragoneer is a growth equity firm managing around

DST Global joined as a lead investor. DST is famous for betting on technology companies at perfect moments in their growth curves—investing early in Spotify, Facebook, Twitter, Airbnb. When DST looks at Waymo and thinks this is a moment worth a multi-billion-dollar commitment, that's meaningful.

Sequoia Capital completing the lead trio matters because Sequoia doesn't just invest in companies—they invest in markets they believe will reshape industries. They see robotaxis as foundational to how cities work in the next decade.

But there's also the investor constellation. Andreessen Horowitz. Silver Lake (the massive technology infrastructure fund). Tiger Global. T. Rowe Price (managing $1.4 trillion in assets). Bessemer Venture Partners. These aren't venture investors. These are institutional capital managers that put billions into mature, scaled businesses.

The participation of Mubadala Capital matters too. Mubadala is the Abu Dhabi sovereign wealth fund. Its involvement signals that even foreign government money sees autonomous vehicles as a strategic technology to own a piece of. It's not just US tech money anymore.

Alphabet, Waymo's parent company, also participated and maintained its position as majority investor. This wasn't a situation where Google needed cash. This was Google saying, "We're so confident in this, we're adding even more capital." That's a credibility signal that carries weight.

The $126 billion valuation deserves attention too. That's roughly equivalent to the market cap of Ford. Or General Motors. Waymo doesn't own factories. It doesn't employ tens of thousands of manufacturing workers. But it's valued the same as companies that do, because investors believe the business model is so much more efficient.

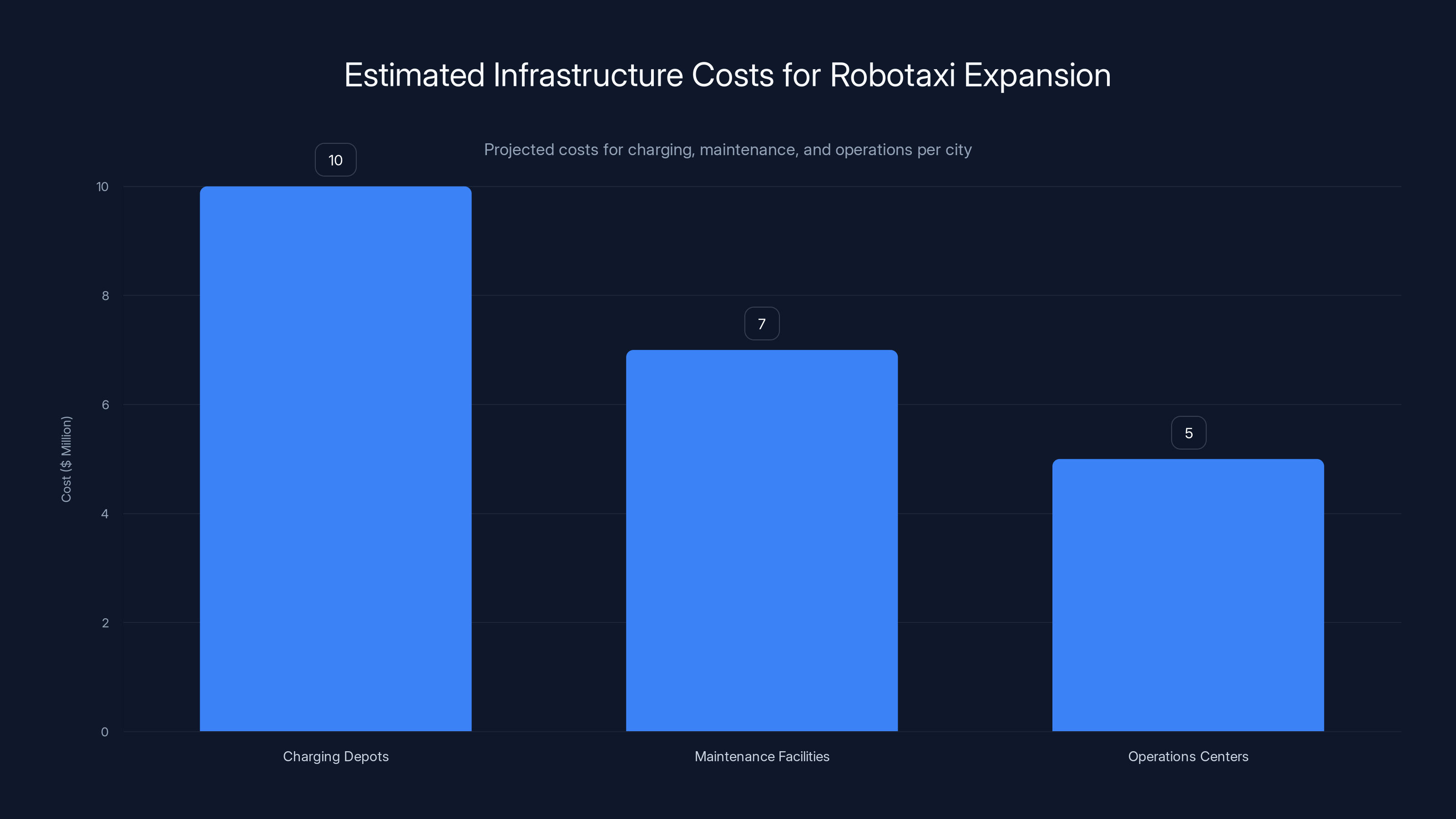

What does this money actually do? The obvious answer is fleet expansion. Building out operations in 20 additional cities costs money. You need the vehicles themselves (though Waymo uses Chrysler Pacificas and other manufacturer platforms). You need charging infrastructure. You need operations centers. You need customer support teams. You need insurance reserves. All of that adds up.

But the money also goes to less visible infrastructure. Building machine learning systems for new cities. Creating simulation environments that model London traffic or Tokyo street corners. Training customer service teams that can handle operations across different time zones and languages. Building relationships with local regulators. Creating partnerships with local operators (Waymo uses Uber as a partner in some markets).

The timeline matters here. Waymo says it plans to launch in 20+ additional cities in 2026. That's not next decade. That's next year. That timeline is aggressive. It suggests the company has already done much of the preparation work and is now just executing across multiple markets simultaneously.

Global Expansion: Taking Robotaxis to London and Tokyo

International expansion is where this gets genuinely complex. US cities are hard. London and Tokyo are harder by orders of magnitude.

London presents specific challenges. The city drives on the left side of the road. Waymo's existing systems were trained primarily on right-hand driving. That means retraining models, running extensive testing, and working with regulators who are skeptical of American tech companies making decisions about urban transportation.

The regulatory environment in the UK is more conservative than California's. California basically said, "Figure it out and tell us when you're confident." The UK regulatory approach is more: "Prove it works extensively before we approve it." Waymo will need to conduct thousands of miles of testing, potentially with human safety drivers, before launching public service. The company needs to navigate UK insurance frameworks, data protection laws (GDPR), and local opposition from taxi drivers who see robotaxis as an existential threat.

Tokyo adds different complexity. Japan has some of the world's most complex traffic patterns. Intersection logic differs from Western cities. Lane markings work differently. The regulatory environment is more cautious. Japanese regulators want extensive documentation of how the system makes decisions. There's also cultural hesitation about autonomous vehicles. Japanese drivers have high confidence in their own driving skills and less enthusiasm about sitting in a driverless vehicle.

Weather matters differently in both cities. London's rain and fog create challenges for computer vision systems trained primarily in sunny California. Tokyo's earthquakes and typhoons introduce infrastructure concerns that Arizona doesn't have.

The partnership model Waymo uses internationally differs from US operations. In some cases, Waymo doesn't directly operate the service—it partners with existing transportation companies. This makes sense. Local operators understand local regulations, have relationships with authorities, and understand customer preferences.

Waymo has indicated interest in additional cities like Singapore, Seoul, and potentially European hubs like Berlin. Each represents a different regulatory regime, driving pattern, and market dynamic. Singapore is highly regulated and tech-friendly. Seoul has established autonomous vehicle testing zones but protective regulations around local companies. Berlin operates within the EU regulatory framework and has strong labor union influence.

The international expansion serves multiple purposes beyond just revenue. It forces the technology to generalize. If Waymo can work in London and Tokyo, it can work anywhere. That makes the company more valuable long-term. It also creates a global presence that's harder to disrupt. If regulators in one country crack down, the company has revenue from many others.

Estimated distribution of the $16 billion funding round shows Dragoneer Investment Group as the largest contributor, highlighting their confidence in the autonomous vehicle market. Estimated data.

The Numbers: How Many Rides, How Much Revenue?

Waymo's operational metrics in 2025 are staggering compared to where autonomous vehicles were even five years ago.

15 million rides in 2025. Let's put that in perspective. That's more than the total number of Uber and Lyft rides combined in some cities. If you prorate it, Waymo is completing approximately 288,000 rides per week across six metropolitan areas. That's real commercial volume.

The company notes it surpassed 20 million lifetime rides total. Most of those came in the last year. The growth curve is exponential. That's not how you scale a service that has problems. You can't 3x revenue while shipping with serious bugs. The fact that Waymo achieved this growth suggests the core product—driverless operation—actually works reliably.

But here's what's important: Waymo isn't publishing detailed financial information. We don't know the revenue per ride. We don't know gross margins. We don't know burn rate. The company raises enormous amounts of capital, so presumably it's still spending more than it's making. But the trajectory matters more than today's profitability.

Using public rideshare data, we can estimate. Waymo charges approximately

The 400,000 rides per week metric across six metros is also revealing. That suggests saturation is beginning to hit in existing markets. In San Francisco, Waymo isn't the only robotaxi service anymore. Cruise (which has faced setbacks) operates there too. Demand is there, but it's not infinite. You can't grow 3x year-over-year forever in a single market. Geographic expansion becomes necessary.

Access to San Francisco International Airport was a milestone. Airport runs represent high-value trips (typically $30-50 each way) and high frequency. Corporate travelers, tourists, locals all use airports regularly. Having the capacity to move people to and from a major international airport validates that the technology can handle complex, high-stakes transportation decisions.

The expansion to Miami in 2025 was interesting strategically. Miami has tropical weather, distinct traffic patterns from California, and a demographics that's very different (older, more international, less tech-savvy). If Waymo can scale Miami successfully, it proves the system isn't just a California phenomenon.

Safety, Incidents, and the Regulatory Response

Here's where the article gets uncomfortable, because Waymo robotaxis have had problems.

The National Highway Traffic Safety Administration (NHTSA) and National Transportation Safety Board (NTSB) have opened multiple investigations into Waymo robotaxis. The specific issues include "illegal behavior" around school buses and at least one incident where a Waymo vehicle struck a child near a school.

The child injury incident is the most concerning. A Waymo robotaxi hit a child at approximately 6 mph. The child sustained minor injuries. That's still not something you want to happen. Any incident involving a child creates liability, regulatory attention, and public trust issues.

Robotraxs exhibiting dangerous behavior in school zones is a particular problem because schools represent the highest-stakes driving environment. Kids are unpredictable. They run between parked cars. They don't always look both ways. Parents dropping off children are distracted. If autonomous vehicles can't handle this complexity safely, there's a fundamental limitation in the technology.

Waymo's response has been characteristic of the company. They acknowledge issues. They issue software updates. They don't make excuses. But this points to something important: the last 5-10% of safe autonomous driving might be exponentially harder than the first 90%.

There are specific edge cases that are genuinely difficult:

Emergency vehicles: A fire truck with lights and sirens approaching. The system needs to recognize this, predict it will cross the intersection, yield appropriately, and not panic. Most humans handle this automatically. Training a vision system to do it reliably takes thousands of examples.

Construction zones: Road construction changes lane markings, removes standard markers, places temporary infrastructure. The system needs to navigate using different visual cues. Humans adapt immediately. Computer vision systems need retraining.

Weather events: Heavy rain floods the road surface. Snow obscures lane markings. Ice creates unpredictable vehicle physics. Systems trained in Arizona sun don't automatically handle this.

Behavioral prediction: A pedestrian looking at a phone might step into traffic. A cyclist riding against traffic might be more likely to make dangerous moves. The system needs to predict human behavior and act defensively. That's actually harder than being a good driver—you need to predict other people's mistakes.

The school zone incidents are happening because children are fundamentally harder to predict than adults. Waymo is encountering the edge case of edge cases.

What's critical here is that NHTSA has opened investigations, but hasn't shut down operations. That suggests the agency sees these as solvable problems, not fundamental flaws. The company has continued expanding even while under investigation. That wouldn't happen if regulators saw robotaxis as a threat to public safety that needed to be stopped.

But the incidents do matter for timeline. If Waymo's expansion plans require NHTSA to sign off on new markets, any finding that the company needs to address safety issues could delay expansion. If the NTSB investigation finds design flaws, regulatory approval in other states could slow.

Estimated costs show charging depots as the highest expense, followed by maintenance and operations centers. Estimated data based on infrastructure requirements for scaling robotaxi services.

The Economics: Why Robotaxi Could Reshape Transportation

The reason everyone's so excited about robotaxis—and why institutional capital is willing to commit $16 billion—comes down to unit economics.

A traditional Uber or Lyft ride requires a human driver. That driver needs to be compensated (currently, rideshare drivers in major cities make $15-25 per hour after vehicle costs). The driver needs benefits and insurance. The driver sometimes cancels, gets sick, or doesn't show up. The driver creates liability issues.

A robotaxi doesn't have a driver. That changes the math dramatically.

Let's model this:

Traditional rideshare economics:

- Driver cost: $20/hour (after insurance, vehicle wear, fuel)

- Average ride duration: 15 minutes (0.25 hours)

- Driver cost per ride: $5

- Rideshare company takes 25% commission

- On a 5

- Driver gets $15

- Net to company: $0 (company covers insurance, support, infrastructure)

Robotaxi economics:

- Vehicle maintenance: $0.50 per mile

- Electricity/fuel: $0.10 per mile

- Average ride length: 7 miles

- Maintenance + fuel per ride: $4.20

- Revenue per ride: $20

- Gross margin: $15.80 per ride (79%)

That margin difference is transformative. Traditional rideshare companies break even or lose money on individual rides, betting on scale and network effects. Robotaxis are profitable on a per-ride basis immediately.

When you scale to millions of rides, that margin difference creates billions in value. That's why the $126 billion valuation is defensible. If Waymo reaches profitability at scale, it could be one of the most profitable transportation companies ever created.

But there are still major cost categories:

Vehicle cost: Waymo uses modified Chrysler Pacificas. The vehicle itself costs maybe

Insurance: Self-driving vehicle insurance is unclear territory. Early robotaxis probably have premium insurance costs while the technology proves itself. As safety data accumulates, costs should decline. But this could be $1,000-5,000 per vehicle per year depending on coverage.

Operations: Human staff managing the fleet, customer service, cleaning vehicles, managing charging, addressing edge cases. This probably costs $2,000-5,000 per vehicle per year initially.

Software development and machine learning: This is expensive. Continuous improvement of the driving system, testing new features, handling new cities. Waymo probably spends $500+ million annually on this.

When you add these together, the cost per ride for a robotaxi is probably

But here's the catch: this only works if the technology is truly reliable. One major accident that kills someone could create insurance costs, regulatory restrictions, or public distrust that destroy the business model. That's why those school zone incidents matter more than they might seem to.

Employment and the Labor Question

Let's address the obvious concern directly: robotaxis eliminate jobs.

There are approximately 3.5 million professional drivers in the United States (truck drivers, Uber/Lyft drivers, taxi drivers, bus drivers). Robotaxis, if they achieve Waymo's stated goals, would make a significant portion of those jobs obsolete within 10-15 years.

That's not a small deal economically or socially. Professional driving is work that doesn't require a four-year degree. It pays reasonably (median wage around $45,000 annually). It's distributed across the country, not concentrated in tech hubs. Job displacement would be concentrated in communities that have fewer alternative opportunities.

Waymo isn't addressing this head-on. The company isn't proposing job retraining programs or transition support. The company isn't making arguments about how automation should be taxed to fund displaced workers. Waymo is a transportation company, not a labor policy organization. But the implications are real.

There's also a counter-narrative: robotaxis create jobs.

Fleet management. Vehicle maintenance. Sensor calibration. Machine learning training. Customer support for edge cases where the robotaxi needs human assistance. Cleaning and detailing. Charging infrastructure. These are all jobs that don't exist in the current rideshare model.

The net job count is unclear. It's possible that robotaxis create fewer jobs than they eliminate (unlikely but possible). It's possible they create more jobs, but in different locations and requiring different skills. It's possible that the transition period is painful but the long-term outcome is economically positive.

What's certain is that this transition will be politically contentious. Cities and states that depend on rideshare driver employment will resist. Taxi unions in cities like New York will fight hard against robotaxis. Labor unions more broadly might push for automation taxes or regulations that slow deployment.

Waymo's international expansion might avoid some of this pressure. In countries with different labor frameworks (like Japan), the conversation about job displacement might be different. In London, where taxi licenses are already controlled and taxi driver numbers are limited, regulatory barriers might be lower.

Waymo's revenue is projected to grow from

Competitive Landscape: Tesla's Different Bet, Traditional Automakers' Struggle

Waymo isn't the only company betting on autonomous vehicles, but it's the clear leader in the robotaxi space right now.

Tesla has taken a completely different approach. Rather than building purpose-built robotaxis, Tesla is adding autonomy to consumer vehicles. The company's "Full Self-Driving" system is available to Tesla owners today. It's not fully autonomous—it requires driver attention—but it's advancing toward true autonomy.

Tesla's advantage: they're already selling millions of cars with the sensors and computers needed. Every Tesla is a rolling data-collection platform. The company has billions of miles of real-world driving data. But Tesla also has limitations. Consumer vehicles aren't designed for 24/7 operation. The reliability standards are different. And building a robotaxi service requires managing fleet operations, insurance, and customer service infrastructure that Tesla hasn't built.

Cruise, backed by General Motors, was also pursuing robotaxi operations. Cruise ran into trouble with safety incidents and has scaled back operations. The company suspended operations in key cities and faces regulatory questions. Cruise's situation shows how quickly momentum can reverse if there are accidents or regulatory issues.

Traditional automakers—Ford, Toyota, Mercedes, BMW—are all investing heavily in autonomous driving. But they're playing a different game. They're building autonomous features for consumer vehicles, not robotaxi fleets. The economics are different. A consumer pays $10,000 for an autonomous driving package. A robotaxi has to generate that value over 5 years of operation. It's actually harder for automakers to shift their entire business model to robotaxis than to just add features to existing vehicles.

Chinese companies like Baidu and Pony.ai are also developing robotaxis, though they're focused on the Chinese market initially. If they succeed in China, they might eventually expand internationally.

Waymo's competitive advantages are significant but not insurmountable:

Data advantage: Waymo has more driving data than anyone else from its decade-long testing period. That's valuable but eventually decreases in importance as other companies accumulate their own datasets.

Regulatory relationships: Waymo has spent years building trust with regulators. That's hard to replicate quickly, but not impossible.

Operational experience: Waymo has actually scaled operations to multiple cities. That operational knowledge is valuable.

Technology quality: By most accounts, Waymo's driving system is more reliable than competitors'. But technology gaps can close quickly in software-driven systems.

The competitive landscape suggests that Waymo isn't winning by being the only player that can do this. It's winning by being further along than anyone else. That advantage persists only if the company keeps innovating and expanding faster than competitors.

Regulatory Questions: How Cities and Countries Will Handle Robotaxis

Regulation is the actual constraint on robotaxi growth, more than technology is.

California has been remarkably permissive. The state approved robotaxi operations relatively quickly and has allowed operations to expand without shutting Waymo down even when problems emerged. That permissiveness has been crucial to Waymo's success so far.

But not every jurisdiction will be California. New York City is actively resisting robotaxis. The taxi medallion system is fundamentally different—there are only about 13,600 licensed yellow taxis in NYC, each worth hundreds of thousands of dollars. Robotaxis would disrupt that system entirely. Expect intense political resistance.

Union cities might resist robotaxis as labor displacement. But union power varies by location. San Francisco is unionized but still allowed Waymo expansion. Chicago or Detroit might be more resistant.

Federal regulation will eventually matter. NHTSA could set national standards for autonomous vehicles. If NHTSA decides it needs to approve autonomous driving systems before they operate, that creates a bottleneck. If NHTSA is permissive, companies can move faster.

Liability is a huge question that regulation will need to address. If a robotaxi kills someone, who's liable? The vehicle manufacturer? The software company? The robotaxi operator? The answer will differ by jurisdiction and might require new legislation. Some places might explicitly shield manufacturers from liability (unlikely to happen). Others might require extensive insurance (likely).

Data privacy regulations will also matter. Autonomous vehicles collect enormous amounts of data—where people go, what routes they take, traffic patterns, road conditions. Europe's GDPR has strong privacy requirements. China requires data localization. These regulatory differences could fragment the market, requiring different systems for different regions.

Insurance regulation is another wildcard. If insurance companies refuse to insure robotaxis until they hit certain safety benchmarks, that could slow deployment. Conversely, if insurance rates for robotaxis are similar to human drivers even before extensive safety data exists, that accelerates deployment.

Internationally, regulation is even more fragmented. The UK might require human safety drivers during testing. Japan might require extensive local partnerships. Singapore might be highly permissive. India might demand technology transfer. This creates operational complexity that slows international expansion.

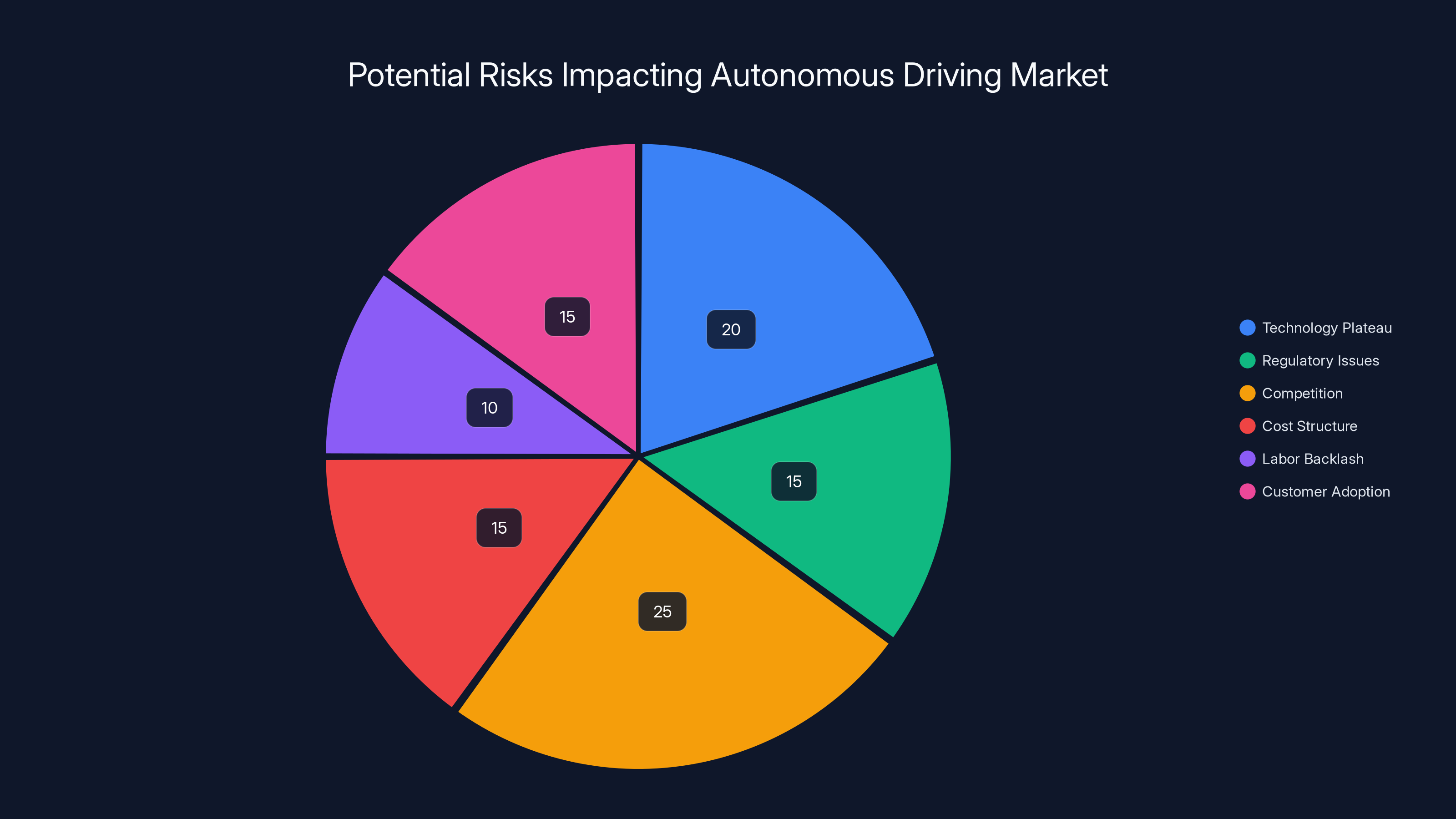

Estimated data suggests competition and technology plateau are the most significant risks, each potentially impacting 20-25% of the market viability.

Future Scenarios: Success, Moderate Growth, or Disruption

Waymo's expansion plan is aggressive. 20+ new cities in 2026. International presence in London and Tokyo. Continued growth in existing markets. But multiple scenarios are possible:

Scenario 1: Success as planned

Waymo executes the expansion, reaches 50+ cities by 2028, and becomes profitable on a per-ride basis around 2027. The company scales to 100+ million rides annually, generating

What needs to happen: No major accidents that result in deaths. Regulatory approval in major cities. International expansion succeeds despite complexity. Competition doesn't catch up.

Scenario 2: Moderate growth with competition

Waymo continues growing but at a slower pace. Tesla's autonomous features become good enough for robotaxi-like services. Cruise or other competitors recover and regain momentum. Geographic expansion hits regulatory resistance in some markets. By 2028, Waymo operates in 20-30 cities but growth has slowed. The company still becomes profitable but reaches it slower. Waymo maintains market leadership but market share shrinks from 90%+ to 50-60%.

What needs to happen: Technology advances more slowly. Regulatory hurdles prove more difficult. Competitor catch-up is faster. Market becomes more competitive.

Scenario 3: Disruption and regulatory restriction

A major accident involving robotaxi deaths triggers federal restrictions. Some states or cities ban autonomous vehicle operations pending new regulations. Insurance costs spike as insurers demand more safety data before covering robotaxis. Public sentiment turns against driverless vehicles. Waymo's expansion slows dramatically. The company reaches 20-25 cities but growth essentially stops. By 2030, the regulatory environment is uncertain and expansion plans are shelved. Waymo remains valuable but growth expectations collapse.

What needs to happen: Fatal accidents. Strong political resistance. Insurance companies demand better safety data. Public trust erodes.

Scenario 4: Exponential growth beyond expectations

Waymo solves the safety problems faster than expected. Cities embrace robotaxis. Federal regulation approves robotaxis at scale. By 2028, Waymo operates in 100+ cities. By 2030, robotaxis are in 1,000+ cities globally. The market opportunity proves so large that even with competition, Waymo grows rapidly. The company could potentially generate $10+ billion in annual revenue by 2030 if growth accelerates beyond current projections.

What needs to happen: Rapid safety improvements. Public enthusiasm. Regulatory approval at pace. Strong competitive advantage maintained.

Most likely: some combination of scenarios 1 and 2. Waymo probably does reach 40-50 cities by 2028 and becomes profitable. But growth probably hits some regulatory friction and competition. The company might end up with 30-40% of the robotaxi market rather than 90%+.

Insurance and Liability: The Overlooked Cost

There's one factor that doesn't get enough attention: insurance.

Right now, robotaxis operate under commercial insurance policies. These policies are expensive and probably underpriced relative to actual risk. Insurance companies don't have good historical data for autonomous vehicles, so they're either overcharging to create a safety margin or undercharging because they're not sure what to charge.

As robotaxis scale, this becomes more important. If a robotaxi fleet does 100 million rides annually with a 0.1% accident rate (better than human drivers), that's 100,000 accidents. Not all accidents are liability events—many are minor fender-benders. But some will involve injuries. Some will involve deaths. Each death could create $5-10 million in liability claims (legal settlements, medical costs, wrongful death awards).

If robotaxi accident rates are 50% of human driver rates (a reasonable expectation), and there are 100 million robotaxi rides annually, the insurance cost might be 10-20% of revenue. For Waymo, that could mean $300-500 million in annual insurance costs at scale.

That's manageable but significant. It also assumes insurance companies will price robotaxis the same as human drivers. They might demand a premium initially due to uncertainty.

There's also the question of who's liable when an accident happens. If a Waymo robotaxi is hit by a human driver, is Waymo liable? If a Waymo robotaxi hits a pedestrian who jaywalked, is Waymo liable? If a manufacturing defect in the vehicle causes an accident, is Chrysler liable? These legal questions are untested and could become very expensive if courts side against Waymo.

This is why the NHTSA investigations matter. If the investigations find that Waymo vehicles have systematic safety problems, insurance costs could spike. If regulators demand specific safety features or testing, that could increase vehicle costs.

Insurance is also a potential competitive advantage. If Waymo can demonstrate better safety records than competitors, insurance rates could become favorable relative to competitors. If competitors have accidents and Waymo doesn't, that creates a cost advantage that's hard for competitors to overcome.

Infrastructure Requirements: Charging, Maintenance, Operations

Scaling to 20+ cities doesn't just require the robotaxis themselves. It requires infrastructure.

Charging infrastructure is critical. If a robotaxi operates 16-20 hours daily, it needs to charge somewhere. The standard approach is depot charging—bringing vehicles back to a central location overnight for charging and maintenance. But as fleets grow, that becomes a bottleneck. Waymo might eventually need fast-charging infrastructure at multiple locations, or even opportunity charging (charging while waiting for passengers).

For 10,000 vehicles, you might need 5-10 depot locations per city. That's land, construction, electrical infrastructure. This is expensive—probably $1-5 million per depot depending on size and local costs.

Maintenance facilities need to handle sensor calibration, software updates, mechanical repairs, and accident repairs. Modern vehicles need professional service centers. That's another cost and complexity layer.

Operations centers need staff to monitor fleet health, respond to customer service issues, and manage edge cases where robotaxis need human assistance. For 10,000 vehicles operating 20 hours daily across multiple cities, you might need 500+ staff across operations, customer service, and technical support.

Customer support for a robotaxi service is different from Uber. With Uber, the driver handles edge cases and special requests. With robotaxis, edge cases need to be addressed either by the vehicle itself or by remote human operators. If 1% of trips require human intervention, that's potentially 150,000 trips monthly needing staff assistance.

Waymo is probably running most of this infrastructure already in existing markets. Scaling to new cities means replicating this infrastructure, which is hard but doable. This is probably where much of the $16 billion is going—building out the operational infrastructure to support 20+ city operations.

The Deeper Question: What Does This Mean for Cities?

If Waymo succeeds—if robotaxis become the dominant form of transportation in major cities—cities change fundamentally.

Parking demand drops dramatically. A human driver parks the car for 8 hours while at work. A robotaxi parks for maybe 15 minutes between rides. That's an 95% reduction in parking space needed per vehicle. In dense cities, this frees up enormous amounts of real estate currently used for parking.

Traffic patterns change. Robotaxis can coordinate with each other more effectively than human drivers. They can follow optimized routes instead of whatever route a human thinks is fastest. They can communicate with traffic systems. This could reduce congestion significantly, though early evidence is mixed.

Cars become less personal. Instead of owning a vehicle, people summon one when needed. That changes the relationship people have with vehicles. It changes what features matter (reliability and cleanliness matter more than aesthetic design). It changes the culture around cars.

Social divisions become more visible. If robotaxis are cheaper than human-driven rideshare, that's broadly good. But if robotaxis are more expensive initially, wealth becomes even more visible in transportation. The rich take robotaxis, the poor take human-driven rideshare or public transit. Or vice versa.

Public transit is disrupted. If robotaxis are very cheap and convenient, why take the bus? This could devastate funding for public transportation. Alternately, robotaxis could complement public transit (taking people to transit hubs) and reduce demand only for short trips.

Emissions change. If robotaxis are electric (Waymo is investigating this), emissions drop significantly. But if robotaxis are so cheap that people take more trips, total vehicle miles might increase even if per-trip emissions decline.

Jobs change. Taxi drivers disappear. Delivery drivers face pressure. But new jobs in robotaxi operations, maintenance, and support emerge.

These aren't just Waymo questions. These are questions about what cities become if autonomous vehicles work.

International Context: How Different Markets Will Respond

Waymo's London and Tokyo expansion matters precisely because these cities represent totally different contexts.

London factors: The UK has been cautious about autonomous vehicles. The government requires "operational design domain" approval—essentially saying the system must work safely in these specific conditions. Waymo will need extensive testing in London weather (rain, fog, sleet) before approval. The culture is also different—British drivers are skeptical of new technology. Labour unions have been vocal about job losses. But London also has regulatory frameworks in place and genuine openness to transportation innovation.

Tokyo factors: Japan has extensive robotics research and cultural comfort with robots in some contexts (factories, services). But cultural acceptance of autonomous vehicles specifically is lower. Japanese drivers trust their own driving skills highly. Safety expectations are extremely high. But the regulatory framework exists and regulators are pragmatic. Tokyo also has cleaner, more organized infrastructure than some other cities, which might make autonomous driving easier.

Why these cities matter: Succeeding in London and Tokyo proves the technology works outside California. That's psychologically important for investors, regulators, and the public. It also creates growth options for Asia and Europe rather than being purely a US phenomenon.

Waymo's partnerships with local operators suggest the company understands it can't just parachute in with American operations. There will be local partnerships, local hiring, local adaptation. That's different from Uber's playbook but potentially more sustainable.

Financial Viability: Path to Profitability

Waymo isn't profitable yet, but the path to profitability is becoming clearer.

Revenue side:

- Current: ~15 million rides at ~300 million annually

- 2026 target: ~50 million rides at 900 million

- 2027 target: ~150 million rides at 2.55 billion

- 2030 target: ~500 million rides at 7.5 billion

These are aggressive projections but not unreasonable if expansion succeeds.

Cost side: Variable costs per ride (maintenance, electricity, insurance): ~

At

This trajectory makes sense. The company is investing for growth now, expecting to reach profitability in 3-5 years. By traditional venture capital standards, that's reasonable.

But there's risk. If expansion slows, if costs don't decrease as expected, if insurance costs spike, if competition intensifies, profitability could be delayed by years. If major accidents occur, the entire model could be questioned.

The

Investor Thesis: Why Institutional Capital Is Betting Billions

Understanding why institutions like Dragoneer, DST, and Sequoia are investing billions requires understanding their investment thesis.

Market size: The transportation market is enormous. Globally, people spend roughly

Margin improvement: Robotaxis have fundamentally better margins than human-driven transportation. That's not an opinion—it's math. Better margins mean more profit at scale.

First-mover advantage: Waymo is years ahead of competitors in operational experience. That advantage compounds. The data Waymo collects in city A helps it launch in city B. The operational knowledge from scaling to 10 cities helps scaling to 20. This creates widening competitive advantages over time.

Optionality: Waymo's technology could be applied to trucking, delivery, or other domains beyond robotaxis. The company owns core technology that could be valuable across many applications.

Technology narrative: Investors believe autonomous vehicles are inevitable. The only question is who wins. Better to be early with Waymo than miss the entire trend.

Alphabet backing: Waymo has essentially unlimited capital from Alphabet. Waymo doesn't face financing constraints like other startups. For investors, that de-risks the investment significantly.

These factors combined make the investment thesis clear. Waymo might become one of the most valuable transportation companies ever. The company is already further along than anyone else. Investing now at

For institutions managing trillions in assets, a $16 billion bet on the future of transportation isn't even a big position. It's table stakes in the robotics revolution.

What Could Go Wrong: Risks and Limiting Factors

This narrative sounds promising, but multiple failure modes exist.

Technology plateau: What if the last 10% of autonomous driving safety is exponentially harder? What if Waymo's system works great for highways and simple city streets, but struggles with school zones, construction, and edge cases? That would limit the addressable market to maybe 30% of current transportation, making the business much smaller.

Regulatory lockdown: What if a high-profile robotaxi accident kills multiple people? What if NHTSA decides robotaxis need government pre-approval before deployment? What if liability frameworks are set such that robotaxi operators face crushing legal costs? Any of these would slow expansion dramatically.

Competition: What if Tesla's Full Self-Driving becomes good enough faster than expected? What if traditional automakers (Toyota, Mercedes, BMW) decide robotaxi services are strategically important and pursue them aggressively? What if Chinese companies launch high-quality robotaxis in their home markets and eventually internationalize? Waymo's lead could erode faster than expected.

Cost structure problems: What if vehicle costs don't decrease? What if insurance costs stay high? What if battery costs (for electric robotaxis) don't decline as projected? What if maintenance costs are higher than expected? None of these individually breaks the model, but combined they could reduce profitability significantly.

Labor backlash: What if taxi unions and driver advocates successfully lobby to restrict robotaxis? What if cities impose high licensing fees on robotaxi operations? What if mandates to hire humans reduce the labor cost advantage?

Customer adoption: What if the public simply doesn't want to ride in driverless vehicles? What if adoption rates are 10% of projections? This seems unlikely but early versions of Uber and Lyft also faced skepticism.

Geopolitical: What if international expansion faces tariffs, data restrictions, or hostile regulation? What if tensions between the US and China disrupt supply chains for robotaxi hardware?

These risks don't make the investment thesis wrong. They just mean there's uncertainty. Investing $16 billion in a company with multiple serious risks is a bet that the probability of success exceeds the probability of failure by enough to justify the capital.

The fact that multiple sophisticated institutions are making this bet simultaneously suggests they believe the odds are favorable. But that doesn't guarantee success.

FAQ

What exactly is Waymo and what do they do?

Waymo is an autonomous vehicle company owned by Alphabet (Google's parent company) that builds and operates driverless taxi services. The company started as Google's self-driving car project in 2009 and has spent over 15 years developing technology that allows vehicles to navigate without human drivers. Today, Waymo operates robotaxi services in six major US metropolitan areas including San Francisco, Los Angeles, Austin, Atlanta, and Miami, completing approximately 15 million rides annually. The company is expanding to 20+ additional cities globally in 2026, including London and Tokyo.

How does Waymo's autonomous driving technology actually work?

Waymo's system uses a combination of cameras, radar, and lidar (light-based ranging) sensors to create a 360-degree view of the vehicle's surroundings. Machine learning algorithms process this sensory data to detect pedestrians, vehicles, road markings, traffic signals, and obstacles. The system predicts how other road users will behave and makes real-time driving decisions accordingly. Waymo's vehicles have been tested on millions of miles of real roads, with the AI system continuously improving through accumulated driving experience. The company also uses sophisticated computer simulations to test the system in scenarios that are difficult to test on real roads, like rare weather events or emergency vehicle interactions.

Why is the $16 billion funding round so significant?

The funding round is significant because it represents major institutional investors betting that autonomous vehicle technology and robotaxi services are ready for large-scale commercialization. When growth equity firms like Dragoneer, plus established venture investors like Sequoia and DST Global, commit

How profitable is Waymo right now and when will it be fully profitable?

Waymo is not yet profitable as a company, though individual rides are likely generating positive contribution margins (revenue minus direct variable costs). The company is investing heavily in expansion, technology development, and operational infrastructure at the expense of near-term profitability. Based on public data and industry analysis, Waymo probably generates $300-400 million in annual revenue but spends significantly more on R&D, operations, and expansion. The company likely becomes modestly profitable around 2027-2028 as it scales operations across 30-40 cities, assuming expansion proceeds as planned. Full profitability with strong margins probably arrives in 2028-2030 if the company successfully reaches 50+ cities and achieves operational efficiency at scale.

What are the main safety concerns with Waymo robotaxis?

The primary safety concerns involve edge cases that human drivers handle intuitively but autonomous systems struggle with. Recent NHTSA and NTSB investigations focused on incidents in school zones, including one where a Waymo robotaxi struck a child at approximately 6 mph (resulting in minor injuries). Robotaxis have exhibited behavior patterns that regulators considered dangerous around school buses specifically. Other edge cases include handling emergency vehicles, navigating construction zones, operating in heavy rain or snow, and predicting erratic human behavior. Importantly, NHTSA investigations are ongoing but haven't resulted in bans on operations, suggesting regulators view these as solvable problems rather than fundamental technology failures. Waymo continues to address these issues through software updates and additional testing.

How many jobs will robotaxis eliminate and what are the economic implications?

Robotraxis could eventually eliminate approximately 3.5 million professional driving jobs in the United States (truck drivers, taxi drivers, Uber/Lyft drivers, bus drivers) if autonomous technology fully replaces human drivers across these categories. The timeline for this transition would likely be 10-20 years, allowing for gradual workforce adaptation. However, robotaxi operations create new job categories including fleet management, vehicle maintenance, sensor calibration, machine learning training, and customer support. The net job impact (jobs created minus jobs eliminated) remains unclear, but the transition period will likely be economically painful for workers in existing driving professions, particularly in communities where professional driving is a major employment category. Policy responses including job retraining programs, unemployment insurance adjustments, and potential automation taxes will likely be necessary to manage this transition.

What's the difference between Waymo's approach and Tesla's autonomy approach?

Waymo builds purpose-built robotaxis with specialized hardware and operates a service business similar to Uber, managing fleet operations, customer service, and insurance. Tesla adds autonomous features to consumer vehicles sold to individuals, betting that self-driving capability will eventually emerge from widespread adoption and data collection. Waymo's approach offers cleaner unit economics for fleet operations but requires building all operations infrastructure from scratch. Tesla's approach builds on existing vehicle distribution channels but makes it harder to optimize vehicles specifically for autonomous operation. Waymo's fleets currently have higher autonomy reliability than Tesla's consumer vehicles, but Tesla has advantages in data volume (millions of vehicles reporting telemetry) and capital efficiency (automakers subsidize development through vehicle sales).

Will robotaxi expansion face regulatory barriers in different countries?

Yes, regulatory barriers will vary significantly by country. California and Arizona have been permissive, approving operations relatively quickly. But cities like New York, with entrenched taxi medallion systems, are likely to resist heavily. Europe requires extensive regulatory approval processes and compliance with strict GDPR data privacy rules. Japan's regulatory system is methodical and demanding, requiring extensive local testing before approval. China maintains tight government control over autonomous vehicle deployment and typically requires technology transfer. Singapore and South Korea are relatively permissive. The UK requires formal approval of the "operational design domain" (specific conditions where the system operates safely). These differences will likely slow international expansion compared to optimistic timelines, with regulatory approval in new markets taking 12-24 months rather than the 6-9 months typical in California.

How will insurance and liability frameworks affect robotaxi operations?

Liability and insurance frameworks are still being established and will significantly impact robotaxi economics. Key questions include: Who is liable when an accident occurs—the robotaxi operator, vehicle manufacturer, or software developer? What insurance coverage levels are required? How will premium pricing work without historical accident data? Currently, robotaxis operate under commercial policies that are probably underpriced relative to actual risk due to lack of historical data. As robotaxi fleets scale and more accident data accumulates, insurance frameworks should become more standardized and potentially more expensive. Some jurisdictions may require manufacturers or operators to maintain specific insurance reserves. Insurance costs could represent 10-20% of revenue at scale, so favorable regulatory frameworks that don't impose excessive insurance requirements could provide significant competitive advantages.

What does Waymo's expansion timeline to 20+ cities in 2026 mean practically?

Waymo's plan to launch in 20+ additional cities in 2026 suggests the company has largely completed the foundational technical work and is primarily executing on operations scaling. This timeline requires opening operations centers, building charging and maintenance infrastructure, training local teams, and securing regulatory approvals across multiple jurisdictions simultaneously. The logistics are complex but Waymo has already done this successfully in six cities, so the company is replicating a known process rather than inventing a new approach. The timeline suggests Waymo expects to have 30-40 cities operating by end of 2026. If achieved, this would represent genuinely transformative scale—hundreds of thousands of daily robotaxi rides across diverse cities with different regulatory environments and traffic patterns, validating that the model works broadly rather than just in California-favorable conditions.

Conclusion: The Inflection Point Is Now

Waymo's $16 billion funding round isn't just a financing event. It's a signal that the autonomous vehicle inflection point has arrived.

For years, robotaxis lived in the future. "Autonomous vehicles are coming in 5-10 years" was a perennial prediction that kept receding. They were the tech equivalent of fusion power—always 30 years away. The difference now is that Waymo isn't promising a future. It's delivering one in the present.

Fifteen million rides in 2025 is real. Four hundred thousand rides weekly is real. Profitability on a per-ride basis is real. Scaling to multiple cities with different traffic patterns is real. These aren't projections or promises. They're facts.

The $16 billion funding from elite institutional investors reflects a decisive shift in how the world's smartest capital allocators think about autonomous vehicles. The debate isn't "will robotaxis work?" anymore. It's "how fast will they scale and who will win?" Those are completely different questions.

That said, nothing is guaranteed. Safety incidents could trigger regulatory restrictions. Competition could accelerate faster than expected. International expansion could face unexpected barriers. The path from where Waymo is now to where the company needs to be requires executing at scale in a completely new way. That's hard. Harder than developing the technology in the first place, arguably.

But the direction of travel is clear. In 5-10 years, robotaxis will be operational in dozens of major cities globally. They'll move millions of people daily. They'll reshape transportation economics, labor markets, and how cities work. Some people will have lost jobs. Other people will have created opportunities. The transportation industry will look fundamentally different.

Waymo is betting—and betting billions on—being the company that makes that future real. Based on the funding they just raised, institutional capital is betting with them. Whether that bet pays off remains to be seen. But it's no longer a question of whether autonomous vehicles will happen. It's a question of who will lead the transformation and how quickly it will move.

The Waymo funding round is the moment everyone will point to when they write the history of transportation's future. This is when robotaxis stopped being experimental and became inevitable.

Key Takeaways

- Waymo's $16 billion funding round validates that autonomous vehicle commercialization has reached an inflection point, with robotaxi operations already generating 15 million rides annually at scale

- $126 billion valuation puts Waymo among the world's most valuable transportation companies, reflecting investor confidence in robotaxi market opportunity and superior unit economics

- Expansion to 20+ cities including London and Tokyo in 2026 marks the first large-scale international robotaxi deployment, proving the model works beyond California's permissive regulatory environment

- Ongoing safety investigations and incidents in school zones reveal the last 10% of autonomous driving safety remains exponentially harder, with edge cases representing genuine technical challenges

- Unit economics show robotaxis with 60%+ gross margins compared to rideshare's 25%, creating profitability potential that justifies the massive valuation if scaling succeeds

Related Articles

- Waymo's $16 Billion Funding Round: The Future of Robotaxis [2025]

- Waymo's $16B Funding Round: The Future of Autonomous Mobility [2025]

- Waymo at SFO: How Robotaxis Are Reshaping Airport Transport [2025]

- Waymo Robotaxi Hits Child Near School: What Happened & Safety Implications [2025]

- Is Tesla Still a Car Company? The EV Giant's Pivot to AI and Robotics [2025]

- Waymo Robotaxi Strikes Child Near School: What We Know [2025]

![Waymo's $16B Funding: Inside the Robotaxi Revolution [2025]](https://tryrunable.com/blog/waymo-s-16b-funding-inside-the-robotaxi-revolution-2025/image-1-1770075478455.jpg)