Uber's New CFO Strategy: Why Autonomous Vehicles Matter in the Age of Autonomous Mobility

Back in 2009, most people thought autonomous vehicles were pure science fiction. Uber didn't exist yet. Today? Uber is betting billions that self-driving cars will fundamentally reshape its entire business model. The appointment of a new CFO who's deeply embedded in AV strategy isn't just a personnel shuffle. It's a declaration of war on the traditional ride-hailing industry.

Here's what's actually happening: Uber just promoted Balaji Krishnamurthy from VP of strategic finance and investor relations to Chief Financial Officer, replacing Prashanth Mahendra-Rajah who spent three years in the role. On the surface, this looks like a standard succession plan. But the timing, the person's background, and Uber's aggressive AV timeline suggest something far more strategic.

Krishnamurthy has spent over six years at Uber, most of that time managing investor relations and strategic finance. He sits on the board of Waabi, an autonomous vehicle company. He regularly posts about Uber's AV initiatives. During the company's Q4 earnings call, he laid out exactly where Uber's capital is flowing: AV software partnerships, equity investments in AV makers, offtake agreements, and infrastructure development.

The message is unmistakable. Uber isn't just dabbling in autonomous vehicles anymore. It's reorganizing its entire financial strategy around them.

TL; DR

- Balaji Krishnamurthy replaces Prashanth Mahendra-Rajah as Uber's CFO, signaling a major pivot toward autonomous vehicle investments

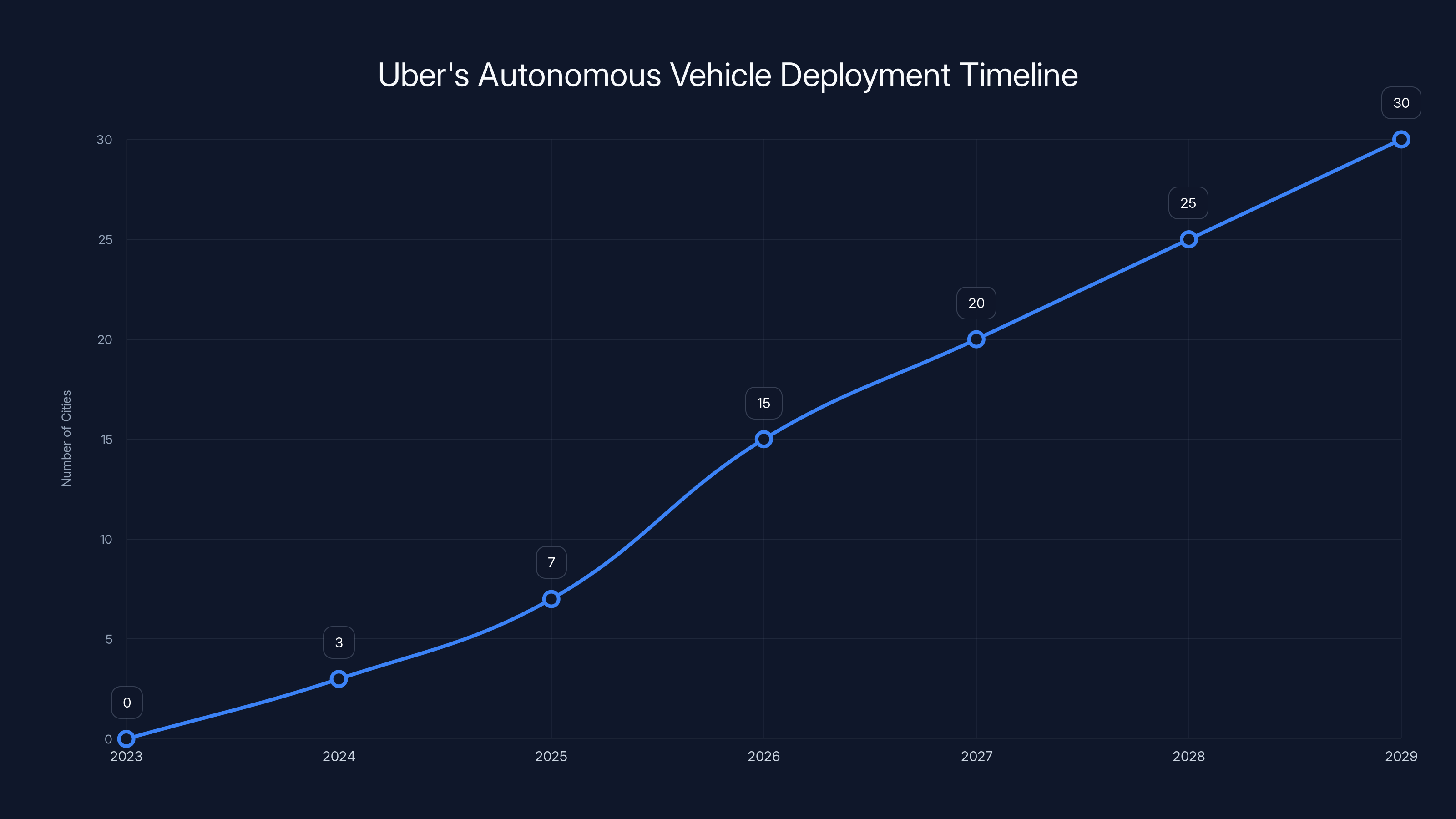

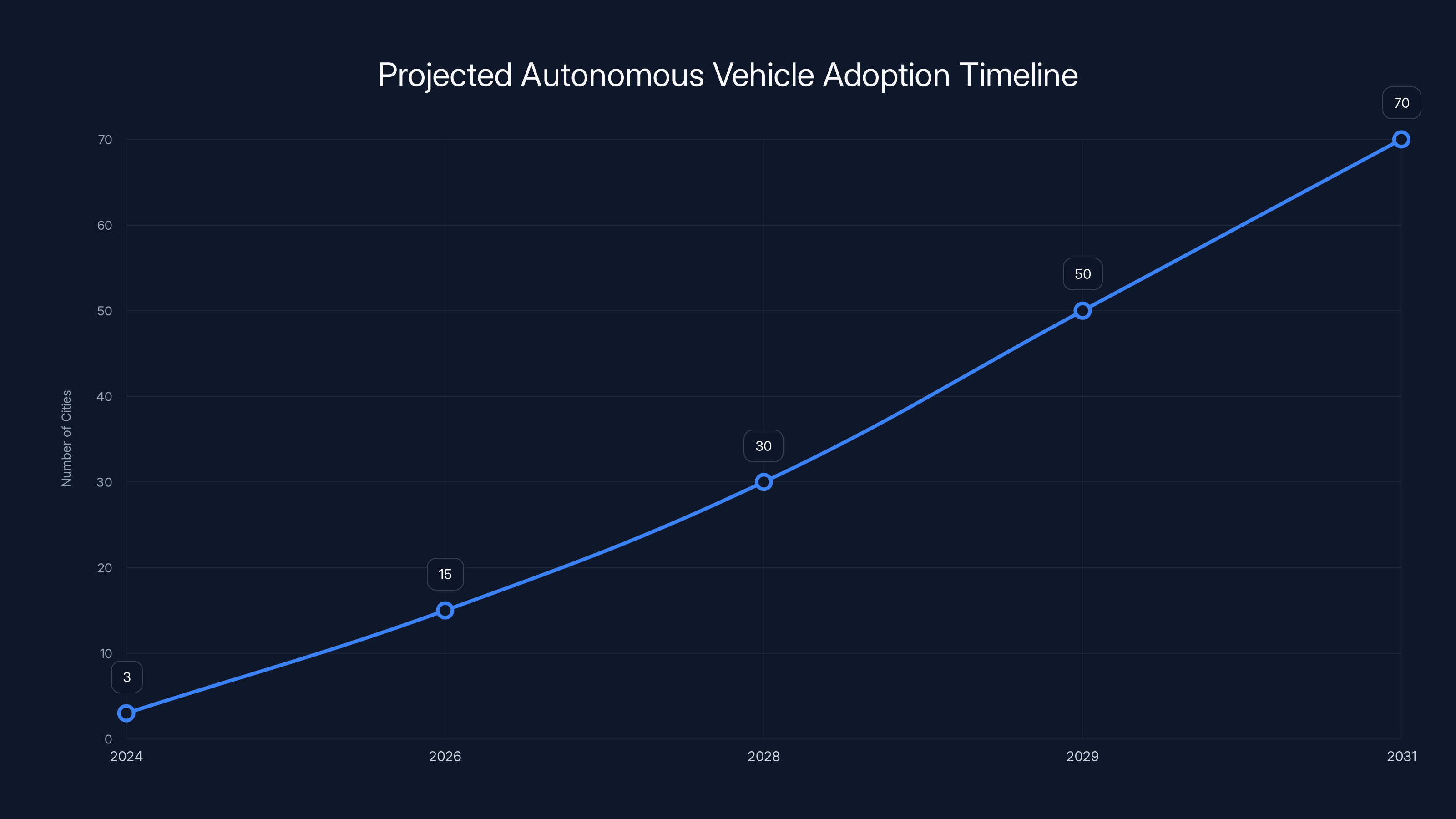

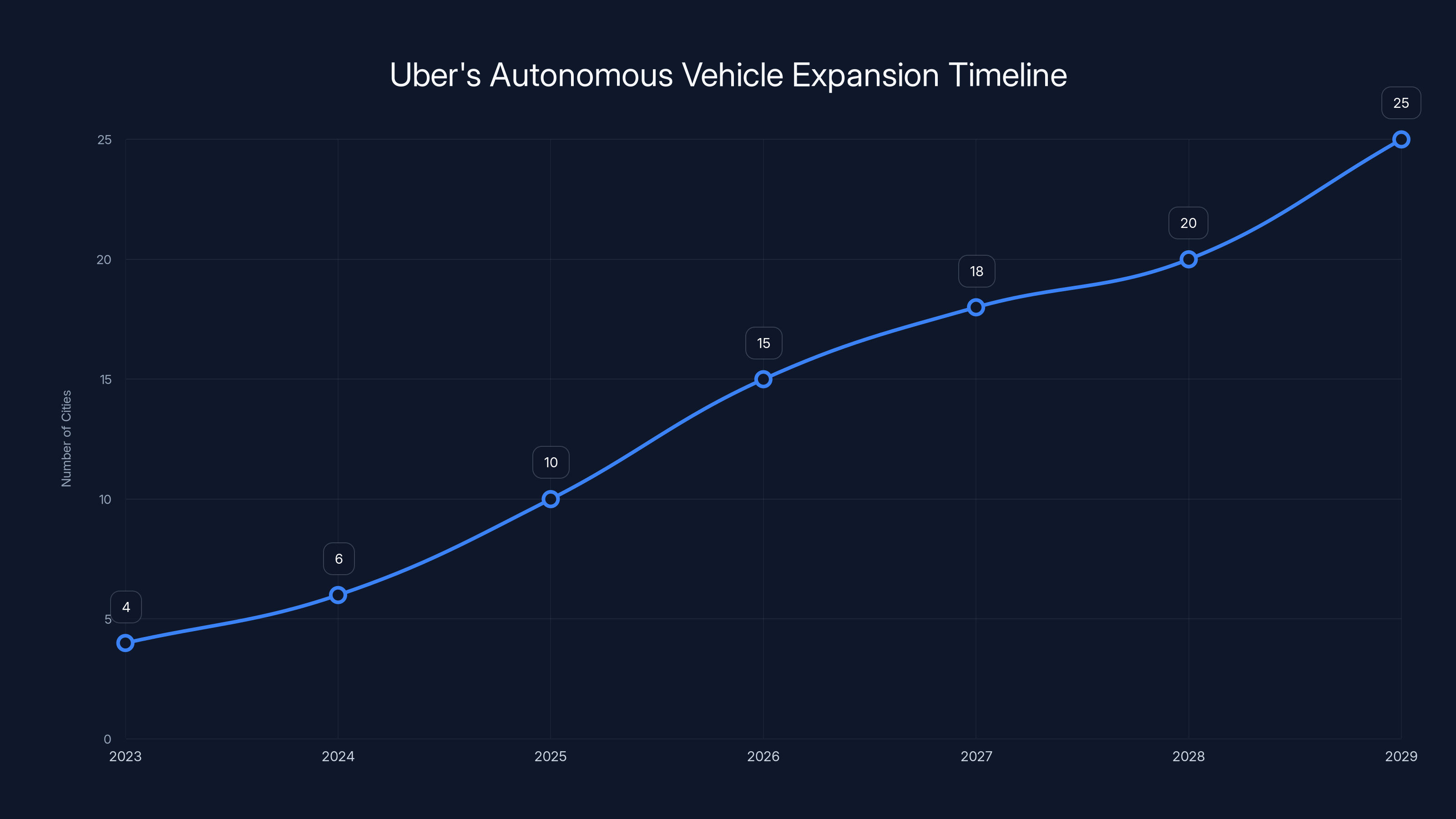

- Uber expects 15 AV cities by end of 2026, with plans to become the world's largest AV trip facilitator by 2029

- Capital allocation is shifting dramatically toward AV software partners, autonomous makers, and infrastructure—not traditional driver subsidies

- This changes everything about Uber's cost structure, potentially improving margins by eliminating driver payments in mature markets

- The broader implication: CFO appointments reveal corporate strategy better than any press release ever could

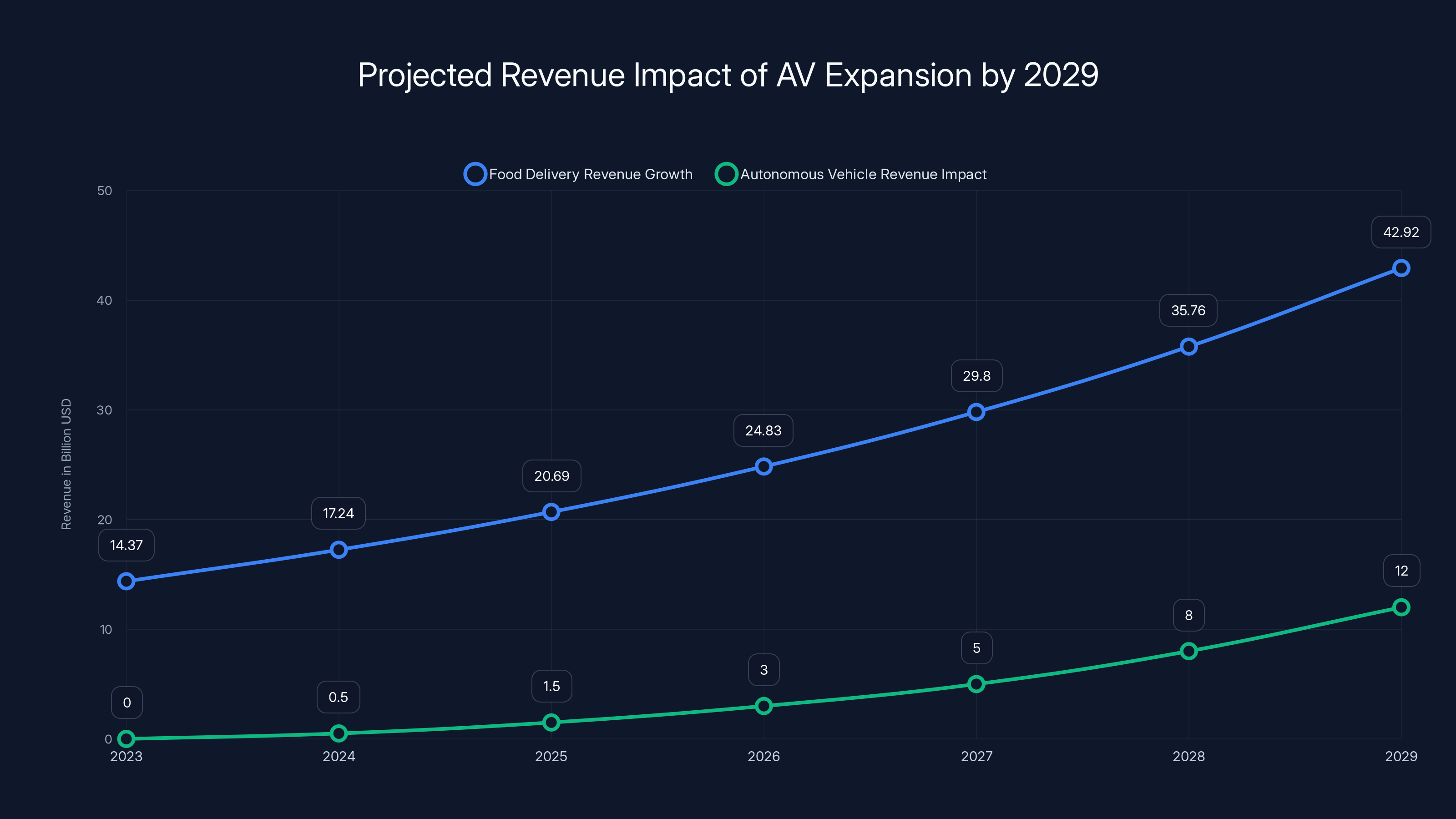

Estimated data shows Uber's food delivery continues to grow at 20% annually, while AV captures 10% of trip volume by 2029, significantly boosting revenue.

Why CFO Appointments Actually Matter More Than You Think

Most business press treats executive appointments like sports trades: "Team X acquires Player Y." Boring. But here's what actually matters. The finance chief controls capital allocation. Full stop.

Krishnamurthy isn't just signing off on expense reports. He's deciding which bets get funded and which get starved. In a company like Uber, that's literally world-changing power. When your CFO is someone deeply embedded in AV strategy, you're watching a company's true priorities emerge.

Think about what a CFO does. They answer the hardest question any company faces: "Where should we put money to maximize long-term value?" At Uber, that answer has fundamentally shifted. For the past decade, the CFO job was about managing driver costs, battling regulators, and proving the unit economics of ride-hailing work at scale.

Now? The CFO role is about funding a transition from driver-dependent logistics to autonomous systems. That's a different job entirely. It requires different expertise, different networks, and different conviction about the future.

Krishnamurthy brings something previous finance chiefs didn't: direct board-level experience with autonomous vehicle companies. That's not coincidental. That's Uber's board saying, "We need someone who deeply understands this category, not just someone who can read a spreadsheet."

Uber's Autonomous Vehicle Timeline: The 2026-2029 Roadmap Explained

Let's break down what Uber actually committed to. On the Q4 earnings call, CEO Dara Khosrowshahi laid out specific targets. These aren't aspirational. They're financial guidance, which means the company is putting resources behind them.

By the end of 2026: Uber expects to facilitate AV trips in as many as 15 cities globally. That's roughly even split between U.S. and international markets. So figure around 7-8 U.S. cities and 7-8 international.

Why is this aggressive? Because currently, autonomous ride-hailing is happening in maybe 3-4 cities at meaningful scale. Phoenix, San Francisco, a few others. Jumping to 15 in 12-18 months means Uber's either contracting existing AV operators into its platform or deploying its own fleet. Probably both.

By 2029: Uber intends to be the largest facilitator of AV trips in the world. This is the really important part. "Facilitator" is the key word. Uber doesn't necessarily need to own the cars. It just needs to be the platform where autonomous trips happen.

Let me put this in perspective. Uber's entire business model is about being the intermediary. Drivers are Uber's competitors, not partners. They're a necessary evil because humans still need to be behind the wheel. Autonomous vehicles eliminate that problem. Suddenly, Uber isn't splitting revenue with drivers. It's taking a commission from fleet operators instead.

The economics of that shift are staggering. Driver costs represent maybe 40-60% of trip revenue in mature markets. Remove the driver, and the margin profile changes completely. That's why Khosrowshahi called AV opportunities "multi-trillion dollar."

Uber plans to expand autonomous vehicle trips to 15 cities by 2026, aiming to be the largest facilitator by 2029. Estimated data based on company goals.

The Financial Strategy Behind Capital Allocation

Here's where Krishnamurthy's background becomes crucial. During the earnings call, he specifically outlined three categories of AV investment:

First: AV Software Partners

Uber doesn't want to build autonomous vehicle software from scratch. That's expensive and requires robotics talent that Uber historically hasn't had. Instead, it's betting on companies like Waabi (the company where Krishnamurthy sits on the board), which focus purely on the AI and autonomous decision-making layer.

Investing in software partners is capital-efficient. Uber funds the technology without building it. Better yet, if the partner succeeds with other customers, Uber benefits from that network effect. If it fails, Uber's loss is contained to the investment.

Second: AV Makers via Equity or Offtake Agreements

Uber is negotiating equity stakes in autonomous vehicle manufacturers or committing to "offtake agreements," which means Uber promises to purchase a certain number of autonomous vehicles at certain prices. This is how traditional manufacturers ensure demand.

Think of this like a pre-order system, but with Uber getting equity upside if the autonomous vehicle maker goes public or gets acquired. Uber wants skin in the game. It's not just a customer anymore. It's a stakeholder.

Third: AV Infrastructure Partners

Autonomous vehicles need infrastructure: charging stations, maintenance facilities, data centers for real-time map updates, connectivity networks. Uber is committing capital to build that ecosystem too.

This is the unsexy part that most people miss. Autonomous vehicles aren't just about the cars. They're about the ecosystem that supports them. Uber is funding that entire stack.

What This Means for Driver Economics and the Future of Ride-Hailing

Let's talk about the uncomfortable truth. Uber's move toward autonomous vehicles is fundamentally about eliminating drivers as a cost center.

I'm not saying Uber wants to hurt drivers. I'm saying that Uber's competitive advantage has always been about efficiently connecting supply (drivers) with demand (riders). But drivers are unreliable, expensive, and increasingly regulated. If Uber can eliminate that variable, it wins.

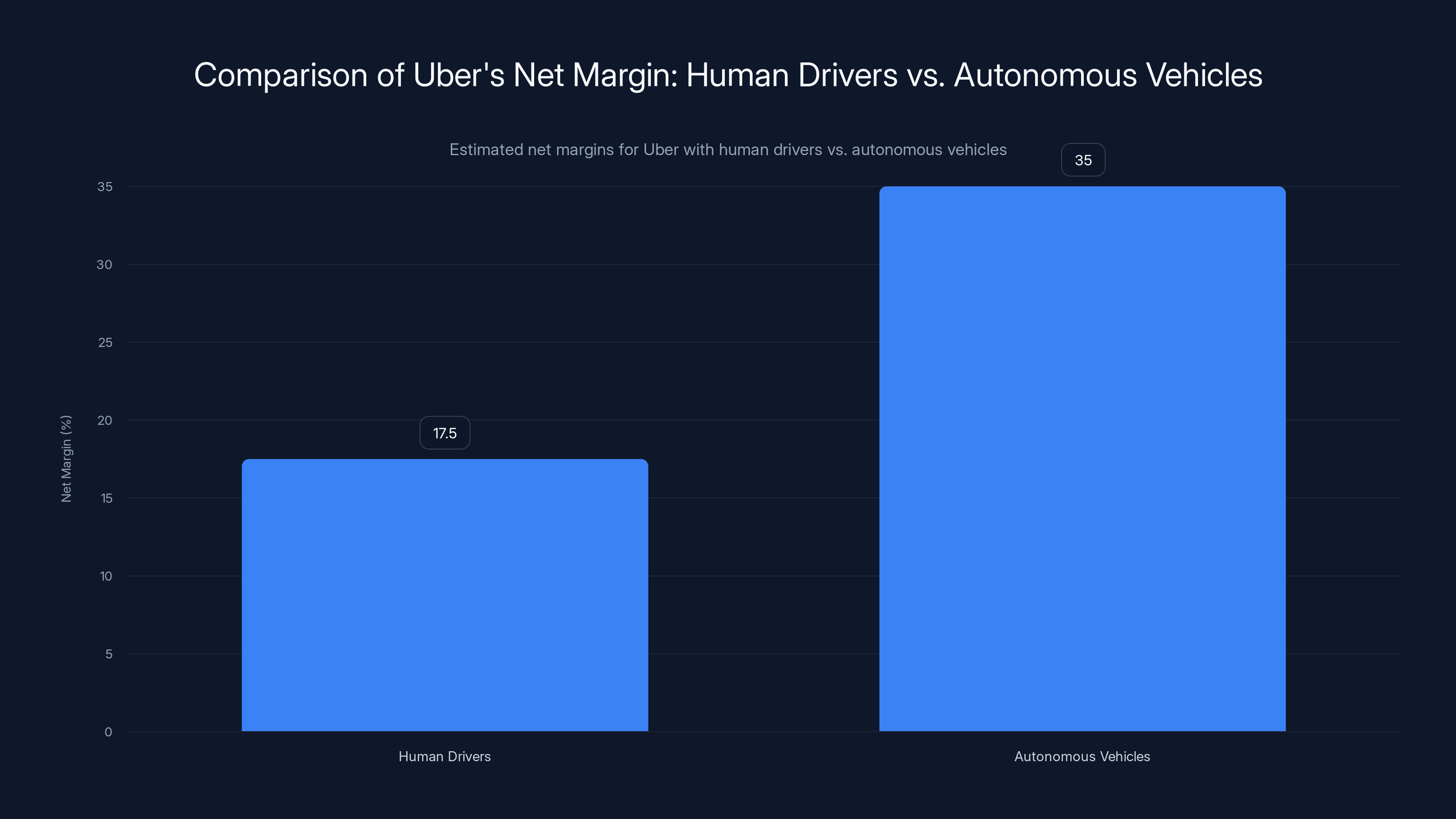

Consider the current economics. Uber takes roughly 25-30% of fare revenue. Drivers take the rest. Add in driver benefits, insurance, regulatory compliance, and Uber's actual net from ride-hailing is surprisingly thin in many markets. Probably 15-20% after all costs.

Now imagine autonomous vehicles. Uber negotiates a per-trip payment with fleet operators. Let's say it's 40% of fare revenue for autonomous trips. That's a premium over the driver cut, but it's sustainable because fleet operators have lower failure rates and more predictable economics than individual drivers.

Uber's net margin? Could jump to 30-40% on autonomous trips. That's why Khosrowshahi calls this a "multi-trillion dollar opportunity." It's not just bigger trips. It's fundamentally better unit economics.

For drivers, this is existential. Uber's public messaging is "AV will create new jobs," and that's probably partially true. But in mature markets where drivers already saturate supply, autonomous vehicles mean layoffs. Thousands of them.

How the Q4 Financial Performance Actually Supports AV Expansion

Uber's Q4 revenue hit $14.37 billion, up 20% year-over-year. That's solid growth. But the real story is where that growth came from and what it means for AV funding.

Food delivery drove the growth more than ride-hailing. That's important because it means Uber's core ride business is maturing. Growth rates in ride-hailing are slowing. Margins are tightening. The traditional business is hitting saturation in developed markets.

This is textbook innovation strategy. A company maximizes profitability in its mature business, then uses that cash to fund the next frontier. Uber's doing exactly that. Food delivery is the cash cow. Autonomous vehicles are the next business model entirely.

Here's the math: If Uber can maintain 20% growth in Delivery while capturing even 10% share of autonomous trip volume by 2029, the revenue impact could be enormous. And if AV trips have the margin profile I described earlier, profit impact is even bigger.

That's why Krishnamurthy's appointment matters so much. He's the person who needs to sequence these investments correctly. Fund AV aggressively enough to win the race, but not so aggressively that it destabilizes the current business.

Uber's net margin could potentially double from 17.5% with human drivers to 35% with autonomous vehicles, highlighting a significant economic shift. (Estimated data)

The Waabi Board Seat: Why This Matters More Than You Think

Balaji Krishnamurthy sits on the board of Waabi, an autonomous vehicle software company. This isn't just a resume line. This is a window into Uber's AV strategy.

Waabi's technology focuses on the "decision-making layer" of autonomous vehicles. It's not building the lidar or the hardware. It's building the AI that interprets sensor data and decides what the car should do.

Why does Uber want its CFO embedded in this company? A few reasons.

First, it gives Uber early visibility into autonomous vehicle progress. When you're sitting on a board, you see actual technical challenges, not marketing materials. You understand timelines and feasibility better than any pitch deck can convey.

Second, it signals commitment. Competitors see that Uber's CFO is actively involved in AV development, not just funding it. That's a credibility signal to investors, partners, and internal teams.

Third, it creates optionality. If Waabi becomes a unicorn, Uber's equity stake becomes valuable. If Waabi gets acquired by a competitor, Uber's board seat gave it visibility into that exit. If Waabi struggles, Uber's board position lets it renegotiate terms before things get dire.

This is sophisticated capital allocation. Uber isn't just writing checks. It's securing influence.

International AV Expansion: Why the Global Split Matters

Uber's targeting roughly equal U.S. and international cities for AV deployment. That's not evenly distributed development. That's strategic chess.

Why international? Because regulations in some countries are way ahead of the U.S. on autonomous vehicles. Singapore, Dubai, parts of Europe have been testing AV ride-hailing for years. The regulatory pathway is clearer. The government is eager for companies to solve transportation problems.

Developing markets also have severe driver shortages. In many Southeast Asian cities, getting enough drivers to meet demand is genuinely hard. Autonomous vehicles solve that problem immediately.

Plus, international markets often have less entrenched competition. Uber can deploy AVs there without facing the same driver backlash and regulatory hurdles it faces in California or New York.

The U.S. strategy is slower, more deliberate. Phoenix, San Francisco, maybe Las Vegas and Miami. Cities where autonomous vehicle testing has already happened. Where regulators are already comfortable with the technology. Where Uber can scale methodically.

By 2029, Uber wants to be the largest AV trip facilitator globally. That doesn't mean it owns the cars or operates in every market. It means Uber is the platform. It means riders open the Uber app and get an autonomous trip in 15 cities, with a clear roadmap to global dominance.

The Investor Relations Angle: Why Krishnamurthy's Background Matters

Krishnamurthy spent most of his six years at Uber managing investor relations. That's the department that tells the Wall Street story. That's the person who explains why Uber's strategy makes sense.

Why would Uber promote the investor relations guy to CFO? Because Uber needs someone who can tell Wall Street a coherent story about the autonomous vehicle transition.

Here's the risk: Investors worry about Uber's driver dependency. They worry about regulatory risk. They worry about whether ride-hailing margins ever improve. A CFO who's been explaining Uber's strategy to investors understands investor psychology. He knows what concerns keep analysts up at night.

Krishnamurthy can say things like, "AV reduces regulatory risk because you're not employing drivers," or "AV improves margins by 1500 basis points in mature markets." These aren't just financial facts. They're narrative tools. They're how you convince investors that the company's worth more in the future than it is today.

That's actually crucial for a company in Uber's position. Uber's stock price reflects investor expectations about profitability. The AV transition only works if investors believe in it. Krishnamurthy's job is to make them believe.

Estimated data suggests Uber could expand AV operations to 70 cities by 2031, even if regulatory challenges delay the 2029 target.

Capital Allocation Trade-Offs: What Gets Funded vs. What Gets Cut

Every dollar Uber invests in autonomous vehicles is a dollar it's not spending elsewhere. That's the hard part about being CFO. You have to choose.

Uber's Eats business is profitable and growing. But can it grow as fast with less capital? Probably. Uber's international expansion is ongoing. But can growth slow in favor of AV? Yes.

Uber's core ride-hailing business probably faces budget constraints to fund AV. Drivers might see fewer incentives. Customer acquisition costs might increase as Uber pulls some marketing budget. These seem like small cuts, but they add up.

Krishnamurthy has to balance present profitability with future opportunity. That's the eternal CFO problem. Do you milk the current business, or do you bet on the future? Most CFOs choose some balance. But everything about this appointment suggests Krishnamurthy is tilted heavily toward the future.

Autonomous Vehicle Market Timing: Is 2029 Realistic?

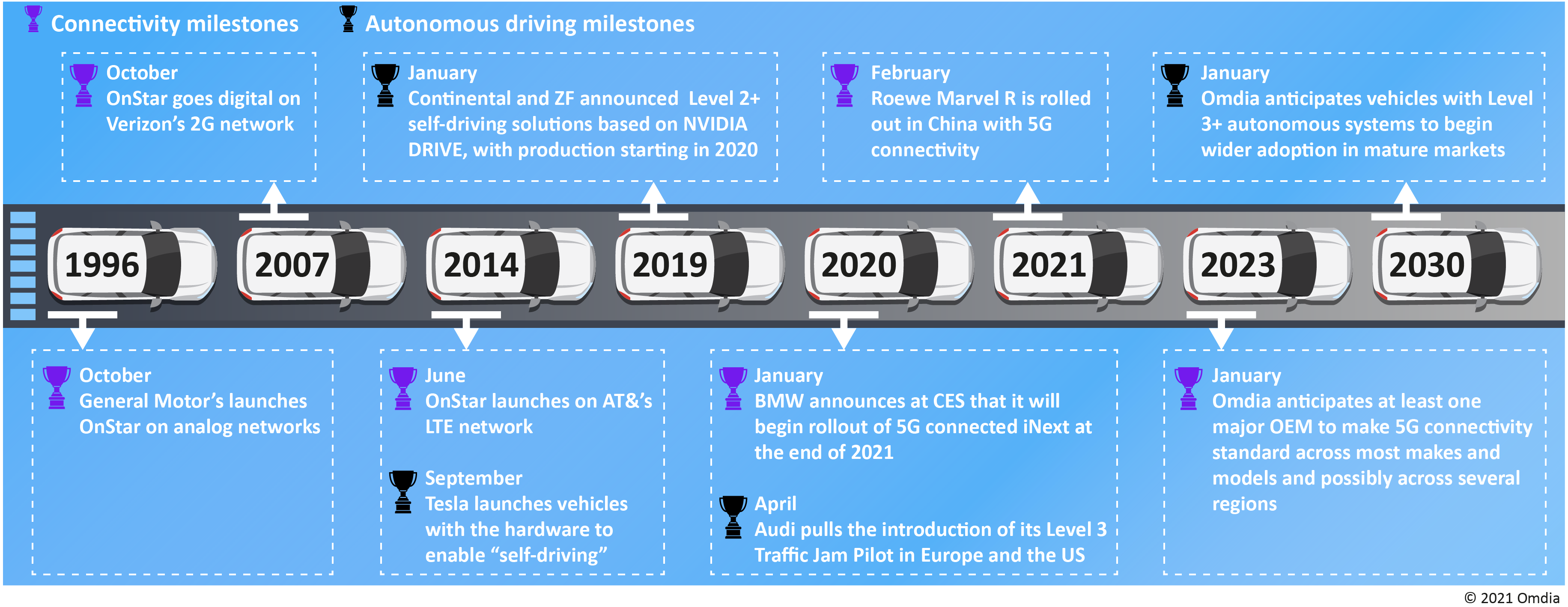

Uber says it will be the world's largest AV facilitator by 2029. That's five years away. Is that realistic?

Technically, yes. Autonomous vehicle technology has reached a level where it's viable in controlled environments. Phoenix's Waymo fleet has been operating successfully for years. Companies like Cruise (before its pause) were moving toward commercialization rapidly.

Capital-wise, yes. Uber has cash flow and access to capital markets. Funding AV growth is feasible if the company prioritizes it.

Regulatory-wise? That's the question mark. The U.S. regulatory environment around autonomous vehicles is fragmented. Each state has different rules. Some cities require local permits. The federal government hasn't established a comprehensive framework.

Uber's 2029 timeline assumes this regulatory environment improves. That's probably reasonable. By 2029, we'll have several more years of data on AV safety, and regulatory pathways will likely clarify.

International regulators are probably ahead of the U.S., so Uber might hit the 15-city target (15 by 2026 end, remember) more easily in international markets. U.S. expansion could lag.

But here's the thing: Even if Uber misses the 2029 target by two years and hits it in 2031, the strategy still works. The CFO's job is to fund the long-term bet, even if the timeline slips.

The Driver Backlash Scenario: How Uber Plans to Manage It

Let's talk about the political problem. Uber disrupted taxis. Drivers loved Uber. Now Uber's going to disrupt its own drivers. That's going to hurt.

Some drivers will lose income. Others will transition to fleet operations or different gig work. But there will be a transition period where income opportunity shrinks and driver sentiment turns negative.

Krishnamurthy's role includes managing this perception. Uber will likely announce retraining programs, transition payments, or opportunities for drivers to become fleet operators. These are real costs that eat into the AV margin improvement I described earlier.

But here's Uber's angle: It's either autonomous vehicles or complete commoditization of ride-hailing. If Uber doesn't go autonomous, competitors will. And when competitors do, Uber loses its margins anyway, but without the upside.

So the CFO's job becomes: "Manage the driver transition in a way that's humane AND preserves shareholder value." That's Krishnamurthy's real challenge.

Uber plans to expand its autonomous vehicle trips from 4 cities in 2023 to 25 cities by 2029, highlighting significant growth in its AV operations. (Estimated data)

How Other Transportation Companies Are Responding

Uber's not alone in the autonomous vehicle race. Lyft's pursuing AV partnerships but with less capital. Tesla's betting on its own autonomous fleet. Traditional automakers like Ford and Volkswagen are investing billions.

But here's where Uber has an advantage: A marketplace. Uber doesn't need to own fleets. It just needs to be the platform where autonomous fleets operate. That's a much cheaper scaling strategy than traditional automakers can deploy.

Competitors are watching Krishnamurthy's appointment closely. It signals confidence, ambition, and capital commitment. It also signals that Uber's serious about the timeline. Not "maybe autonomous vehicles in the 2030s," but "we're building this now, and we're reorganizing the company around it."

That kind of signal can scare competitors, intimidate regulators, and excite investors. Which is probably exactly what Uber wants.

The Broader Industry Implications: Mobility's Next Decade

Uber's AV pivot has implications far beyond Uber. It affects taxi companies, public transit, insurance companies, infrastructure providers, and battery manufacturers.

Think about insurance. Today, ride-hailing insurance is a particular risk category. When autonomous vehicles scale, liability models change. There's less human error, more software liability. Insurance companies need to rethink their entire pricing structure.

Public transit agencies are watching too. If Uber can provide on-demand autonomous trips at scale, traditional bus and train routes might be underutilized. City planning changes. Urban sprawl patterns change.

Battery manufacturers and charging infrastructure companies are directly affected. Autonomous fleets will be electric fleets (simpler, cheaper to operate). That means massive new demand for batteries and charging infrastructure.

Krishnamurthy's appointment isn't just about Uber. It's about the entire transportation ecosystem reorganizing around autonomy. And Uber, by moving aggressively, is forcing everyone else to catch up.

What Happens If the AV Transition Fails

Let's do the downside scenario. What if autonomous vehicles don't work on Uber's timeline? What if 2026 targets miss by years? What if regulatory hurdles become insurmountable?

Then Krishnamurthy's appointment becomes a bad bet. Uber will have underfunded its core ride-hailing business while overinvesting in AV, and competitors will eat its lunch.

But Uber's clearly betting this won't happen. The appointment signals conviction. If Uber's board wasn't convinced, they wouldn't promote someone so clearly identified with AV strategy.

There's also optionality here. If autonomous vehicles become less promising, Krishnamurthy can reallocate capital. He's a finance guy, not a technical evangelist. His job is to optimize returns, whether that's AV or something else.

But the direction is clear. Uber believes autonomous vehicles are inevitable, profitable, and achievable within the next few years. And the CFO appointment is Uber putting its money where its mouth is.

The Succession Pipeline Question

One thing we haven't discussed: What does Prashanth Mahendra-Rajah do next?

Mahendra-Rajah spent three years as Uber's CFO. That's a respectable tenure. He probably moves to another company—maybe another tech company, maybe a private equity role, maybe back to his previous career.

But his departure also says something. Mahendra-Rajah was probably more focused on optimizing the current business, not building the future one. He did his job well (Uber's financial performance improved during his tenure). But Uber needed someone with different priorities.

That's actually a healthy thing. Companies need succession planning. They need to move people when strategic needs change. Mahendra-Rajah's transition probably opens opportunities for other talented finance people at Uber.

And Krishnamurthy's promotion creates a blueprint for future CFOs: Show deep knowledge of the company's strategic direction, build relationships with key partners, and be ready to lead when the moment comes. It's not just about crunching numbers.

Key Metrics to Watch Post-Appointment

If you want to understand whether Krishnamurthy's appointment is actually working, watch these metrics:

1. Capital allocation breakdown: What percentage of Uber's capital goes to AV vs. existing businesses? This will be disclosed in quarterly earnings. Expect the AV percentage to grow significantly.

2. AV partnership announcements: How many fleet operators, software companies, and infrastructure partners is Uber signing up? Each partnership validates the strategy.

3. Timeline achievement: Does Uber actually get to 15 cities by end of 2026? This is the ultimate credibility test.

4. Profitability trends: If AV investments are working, Uber's overall profitability should improve despite near-term AV costs. This is crucial.

5. Investor sentiment: Does Wall Street believe the AV story? Stock price often reflects investor conviction better than any press release.

6. Competitive response: How are other companies reacting? Are they accelerating their own AV programs in response to Uber's moves?

Watch these metrics, and you'll understand whether the CFO appointment was strategic genius or a risky bet that backfired.

FAQ

Who is Balaji Krishnamurthy and why was he appointed Uber's CFO?

Balaji Krishnamurthy was Uber's VP of strategic finance and investor relations before his promotion to Chief Financial Officer. He's been at Uber for over six years and sits on the board of Waabi, an autonomous vehicle company. His appointment signals that Uber is prioritizing autonomous vehicle strategy at the highest financial level of the organization.

What are Uber's specific autonomous vehicle timelines?

Uber committed to facilitating autonomous vehicle trips in 15 cities by the end of 2026, split roughly evenly between U.S. and international locations. By 2029, Uber intends to be the world's largest facilitator of autonomous vehicle trips. These aren't aspirational goals—they're financial guidance that the company is committing capital to achieve.

How will autonomous vehicles change Uber's profit margins?

Autonomous vehicles could improve Uber's profit margins from current levels of approximately 15-20% to 30-40% or higher on autonomous trips. This is because fleet operator payments are likely more efficient than driver revenue splits, and autonomous vehicles eliminate many of the regulatory and labor costs associated with human drivers.

Why does Uber's CFO appointment indicate a shift in capital allocation?

The appointment of someone deeply embedded in autonomous vehicle strategy to the CFO position indicates that capital allocation decisions will increasingly favor AV investments over traditional ride-hailing growth. Krishnamurthy's background suggests Uber will pursue aggressive funding of AV software partners, equity stakes in autonomous vehicle manufacturers, and infrastructure development.

What does Krishnamurthy's board seat at Waabi mean for Uber's AV strategy?

Krishnamurthy's position on Waabi's board gives Uber early visibility into autonomous vehicle technology progress, signals deep commitment to the company's partners, and creates optionality if Waabi succeeds or is acquired. It's a sophisticated way to gain influence over critical technology without owning it outright.

How will the autonomous vehicle transition affect Uber drivers?

The AV transition could significantly reduce driver income opportunities in mature markets where Uber operates, potentially leading to layoffs in some regions. However, Uber will likely announce transition programs, retraining initiatives, or opportunities for drivers to become fleet operators to manage the political and social impacts of this shift.

Why is the international expansion part of Uber's AV strategy important?

Uber is targeting roughly equal numbers of U.S. and international cities for AV deployment because some international markets have clearer regulatory pathways for autonomous vehicles, face severe driver shortages, and have less entrenched competition. This allows Uber to scale autonomous fleets faster internationally while navigating slower U.S. regulatory environments.

What happens to Uber's investor relations strategy with Krishnamurthy as CFO?

Krishnamurthy's background in investor relations means he can effectively communicate the autonomous vehicle transition story to Wall Street in a way that maintains investor confidence. His ability to frame AV investments as long-term value creation is crucial for maintaining stock price support during the transition period.

How confident should investors be in Uber's 2029 autonomous vehicle goals?

The timeline is realistic from a technical and capital standpoint, but regulatory risk remains the biggest uncertainty. International markets will likely reach the 15-city target faster than U.S. markets due to clearer regulatory pathways. If the timeline slips by 1-2 years, the strategy still works, as the CFO's job is to fund the long-term bet rather than hit exact dates.

What competitive implications does this CFO appointment have for the broader transportation industry?

The appointment signals to competitors, regulators, and investors that Uber is moving aggressively into autonomous vehicles with full capital commitment. This puts pressure on companies like Lyft, Tesla, and traditional automakers to accelerate their own autonomous vehicle programs. It also affects insurance, public transit, battery manufacturers, and charging infrastructure providers who must adapt to an increasingly autonomous transportation landscape.

Uber's promotion of Balaji Krishnamurthy to CFO isn't just a change in personnel. It's a declaration that the company's future is autonomous. The appointment confirms what investors have suspected: Uber's willing to transform its entire business model around self-driving technology. Whether that gamble pays off depends on execution, regulation, and whether the technology lives up to the hype. But one thing's certain: The next five years will determine whether Uber becomes the dominant player in autonomous mobility or whether competitors leapfrog during the transition.

For investors, this is crucial context. Uber's stock price isn't just about current profitability. It's about belief in the autonomous vehicle future. Krishnamurthy's appointment asks investors to believe that belief is justified. Time will tell.

Key Takeaways

- Balaji Krishnamurthy's appointment as Uber CFO signals a strategic pivot toward autonomous vehicles as core business

- Uber targets 15 autonomous vehicle cities by end of 2026 and global AV dominance by 2029—specific financial commitments

- Capital allocation is shifting from driver subsidies to AV software partnerships, fleet operator investments, and infrastructure

- Autonomous vehicles could improve Uber's profit margins from 15-20% to 30-40%+ by eliminating driver costs

- CFO appointments reveal corporate strategy more clearly than any investor presentation ever could

Related Articles

- Waymo's $16B Funding Round: The Future of Autonomous Mobility [2025]

- Waymo's $16B Funding: Inside the Robotaxi Revolution [2025]

- Waymo's $16 Billion Funding Round: The Future of Robotaxis [2025]

- How Hackers Exploit AI Vision in Self-Driving Cars and Drones [2025]

- Is Tesla Still a Car Company? The EV Giant's Pivot to AI and Robotics [2025]

- Waymo at SFO: How Robotaxis Are Reshaping Airport Transport [2025]

![Uber's New CFO Strategy: Why Autonomous Vehicles Matter [2025]](https://tryrunable.com/blog/uber-s-new-cfo-strategy-why-autonomous-vehicles-matter-2025/image-1-1770215771606.jpg)