Introduction: The Unlikely AI Alliance That's Changing Europe

Imagine the scene: OpenAI executives walk into a room. Microsoft reps are already seated. Google engineers file in. Then Anthropic. Then Meta. Then Mistral. For years, these companies have been throwing jabs at each other in the AI arms race, competing for talent, compute resources, and market dominance. Yet here they are, in Paris, agreeing to collaborate on something unprecedented.

This isn't some elaborate peace treaty. It's something more pragmatic and perhaps more powerful: F/ai, a startup accelerator that marks the first time these major AI labs are working together on a single initiative. The program, run by Station F (Europe's largest startup incubator based in Paris), launched in January 2025 and is designed to help European founders build AI applications on top of the foundation models created by these tech giants.

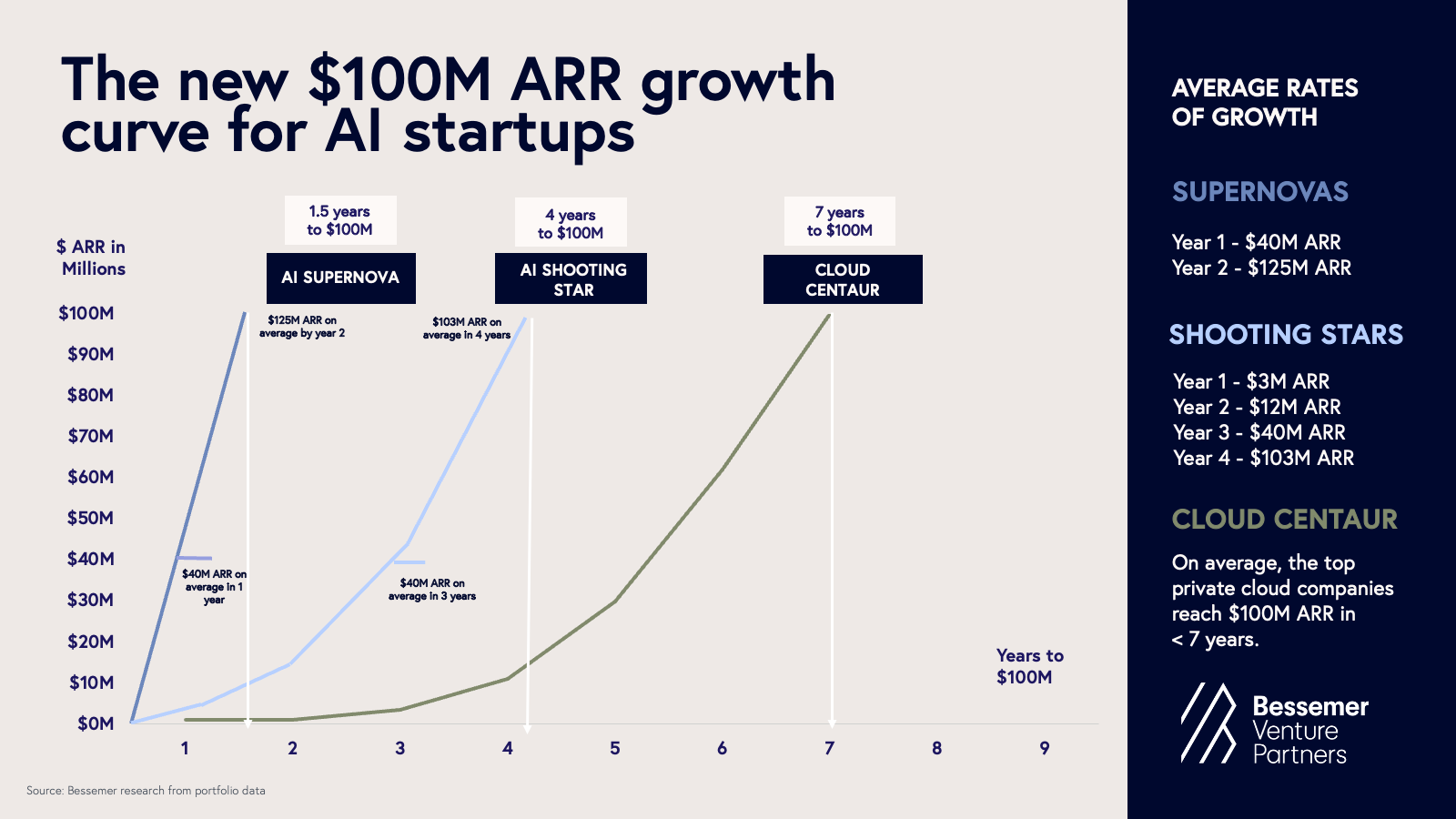

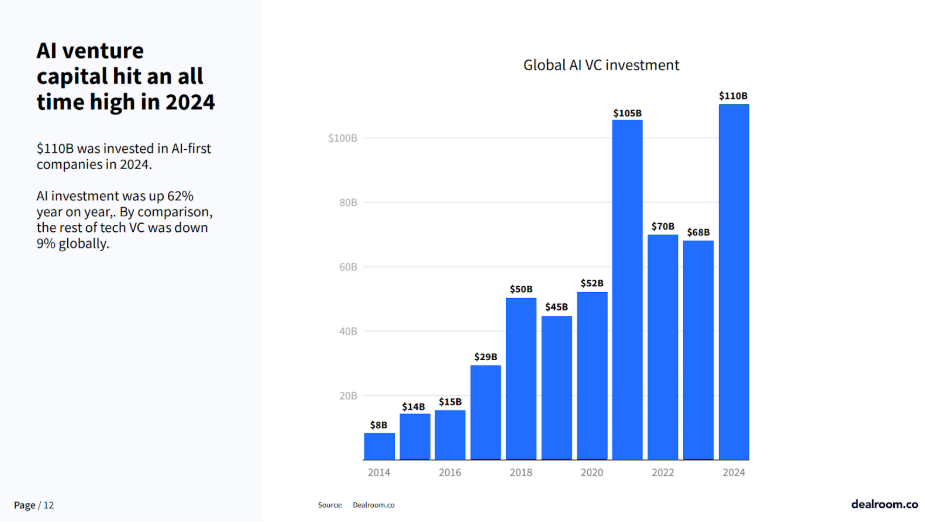

What's remarkable isn't just that rivals are cooperating. It's that they're doing it strategically. Each company sees the same problem: European AI startups are stuck in a painful gap. They're not getting to profitability fast enough. They're not scaling globally. They're losing to American and Chinese competitors who move faster, have easier access to capital, and don't face the infrastructure constraints that plague European founders.

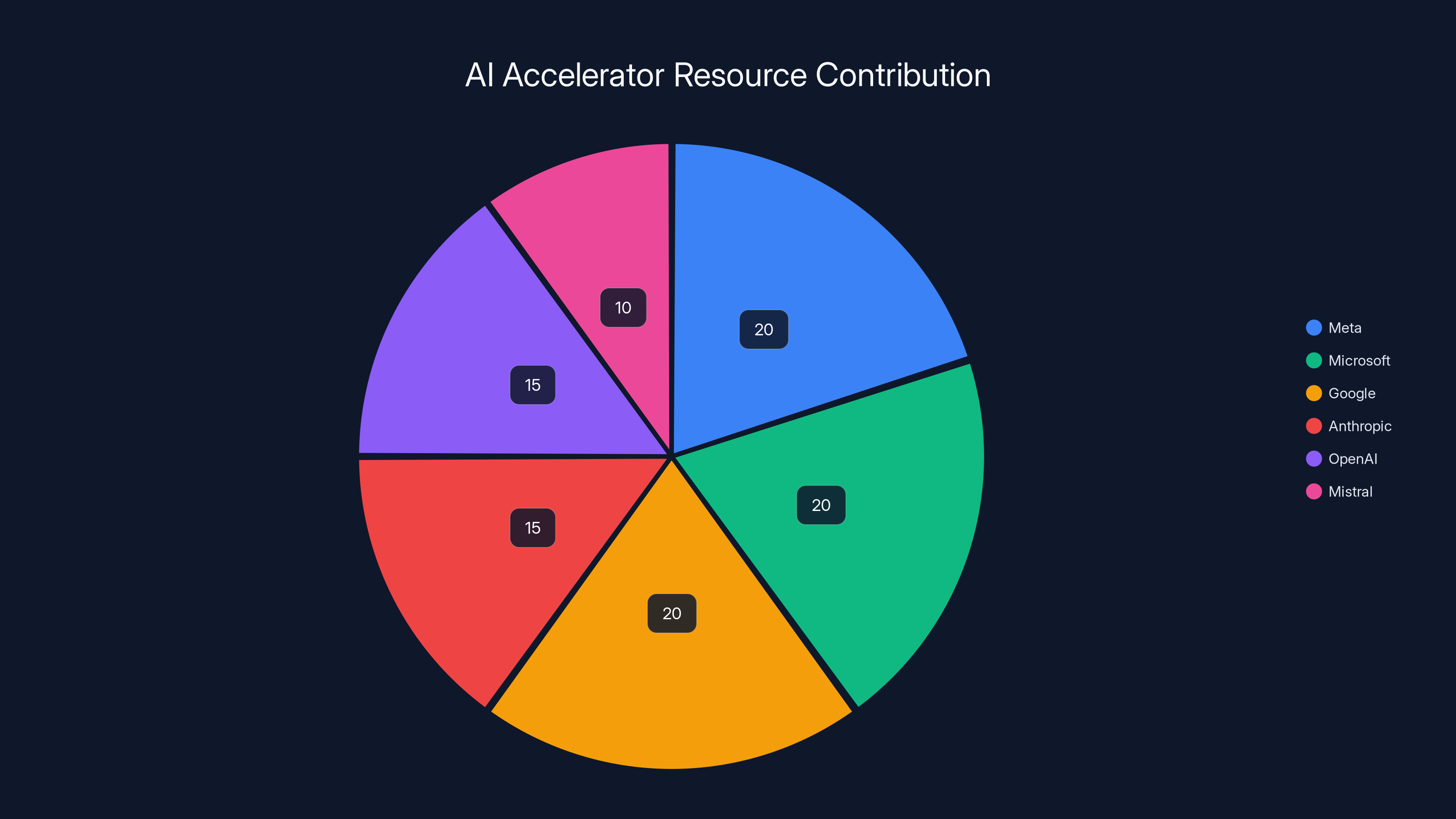

The accelerator takes 20 startups per cohort and runs twice yearly. Instead of direct funding, participants receive over $1 million in credits for API access, compute resources, and services from Meta, Microsoft, Google, Anthropic, OpenAI, Mistral, AWS, AMD, Qualcomm, and OVH Cloud. It's a three-month intensive program designed around one core principle: rapid commercialization.

But this partnership reveals something deeper about how AI competition actually works in 2025. Yes, these companies are rivals. But they're also builders of an ecosystem. And ecosystems need healthy, diverse participants. An accelerator that helps European startups succeed isn't a charity move. It's strategic infrastructure investment. It locks in developers early, builds dependency on their models, establishes market presence in a region where AI regulation is tightening, and creates a pipeline of potential acquisition targets or partners.

This article digs into what F/ai really is, why competitors would team up on it, how it works, who's actually running it, what startups are building on these platforms, and what this signals about the future of AI development in Europe and beyond.

TL; DR

- Major AI labs collaborating: OpenAI, Google, Anthropic, Meta, Microsoft, and Mistral are all partnering on F/ai, marking the first time these rivals have jointly supported a single accelerator

- **1 million in API credits, compute access, and services from participating companies

- Focus on European founders: The program specifically targets European AI startups that are building applications on foundation models but struggling to reach profitability and scale

- Rapid commercialization model: The three-month program emphasizes getting startups to revenue quickly, addressing investor concerns that European AI companies move too slowly

- Strategic investment: The partnerships reveal how AI labs lock in developer ecosystems early, establish market dominance, and create regulatory goodwill in Europe

The F/ai Accelerator Program runs twice a year, starting with its first cohort in January 2025. Each cohort consists of approximately 20 startups, creating a consistent pipeline of new companies every six months. (Estimated data)

What Is F/ai, Exactly?

F/ai is a startup accelerator program, but calling it that might undersell what's actually happening. It's a coordinated infrastructure play disguised as a mentorship program.

Here's the basic structure: Station F, the Paris-based incubator founded in 2017, runs the program. Each cohort accepts 20 startups for a three-month intensive program that runs twice per year. The first cohort started January 13, 2025. Startups get access to Station F's physical space in Paris, mentorship from specialists, introductions to investors and customers, and (critically) over $1 million in credits they can use across participating company services.

Think of it like Y Combinator, but instead of a single company (like OpenAI) providing the compute and API access, you've got a consortium. That changes everything about how the program works.

Station F itself is worth understanding. The facility is housed in a converted rail freight depot in Paris, spanning 34,000 square meters. It's become the largest startup incubator in Europe, hosting over 1,000 companies at any given time. For founders, Station F offers community, mentorship infrastructure, and visibility to European investors and media.

What made Station F particularly attractive as the hub for F/ai is exactly this: it's not controlled by any single AI lab. It's neutral ground. Anthropic might compete with OpenAI, but they can both work with an independent incubator. Station F has also been deliberately building relationships with European AI companies, VCs, and policymakers for years. They understand the local ecosystem in a way that, say, a San Francisco accelerator would not.

The credits system is crucial. Rather than write checks, the AI companies provide credits. This does several things simultaneously. First, it solves the legal and competitive issue of rival companies co-investing. If OpenAI wrote a check to a startup, that startup might use OpenAI's GPT models but also build on Anthropic's Claude. Neither company wants to directly fund competitors. Credits sidestep this. Second, it incentivizes startups to use the services. Startups get over $1 million in value, but they have to actually use the platforms to access it. That means building on these models, learning their APIs, and becoming locked in to some degree.

Roxanne Varza, director of Station F, framed the program's mission as clear: "We're focusing on rapid commercialization. Investors are starting to feel like, 'European companies are nice, but they're not hitting the $1 million revenue mark fast enough.'" That quote gets to the heart of what F/ai is actually trying to solve.

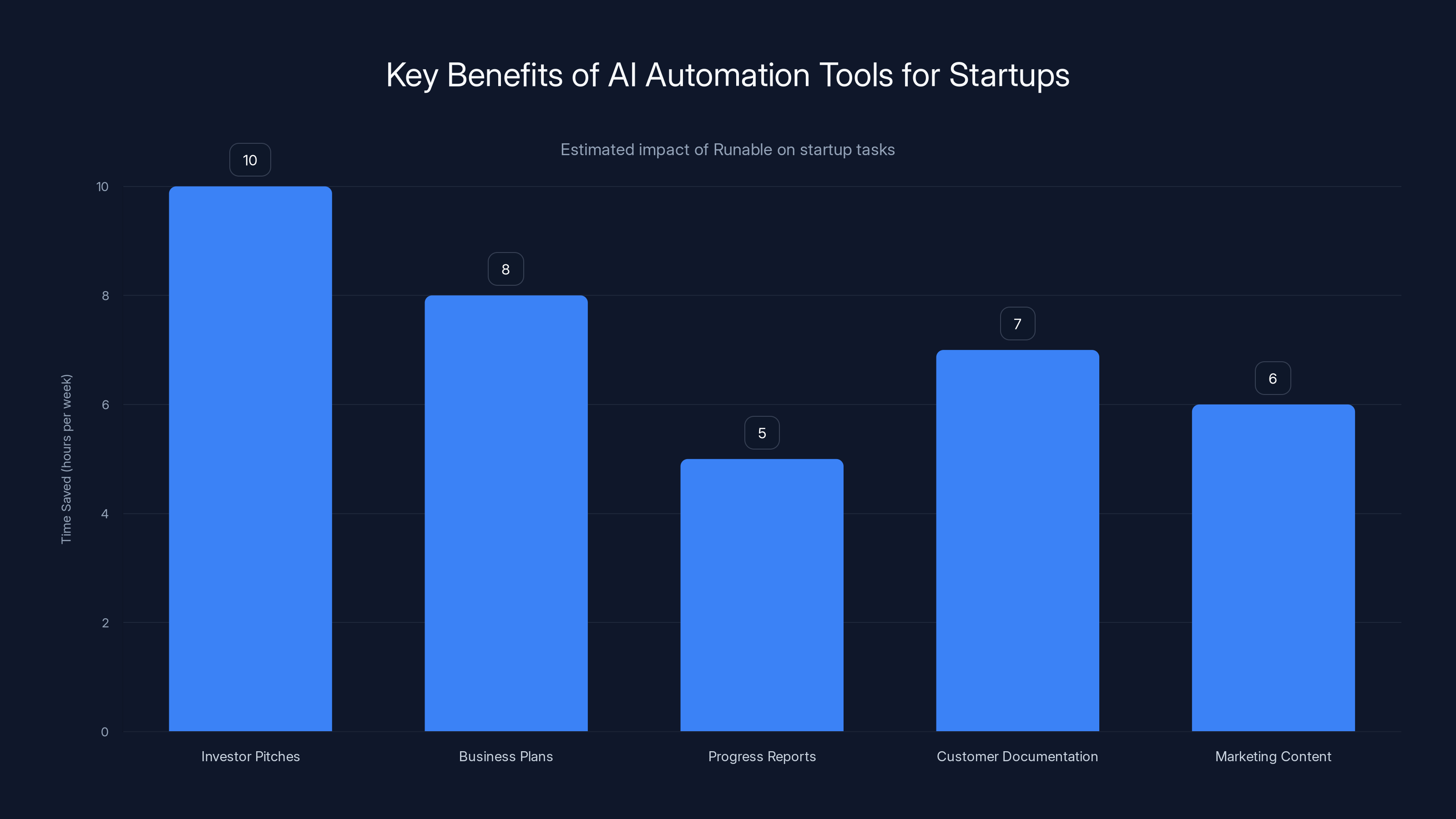

Estimated data shows that AI automation tools like Runable can save startups significant time across various tasks, with the most time saved in creating investor pitches.

Why Competitors Are Suddenly Playing Nice

The question everyone asks when they hear about F/ai is simple: why would OpenAI and Anthropic, bitter rivals, work together? The answer has three parts: market expansion, developer lock-in, and strategic positioning in Europe.

Market Expansion and Developer Ecosystem

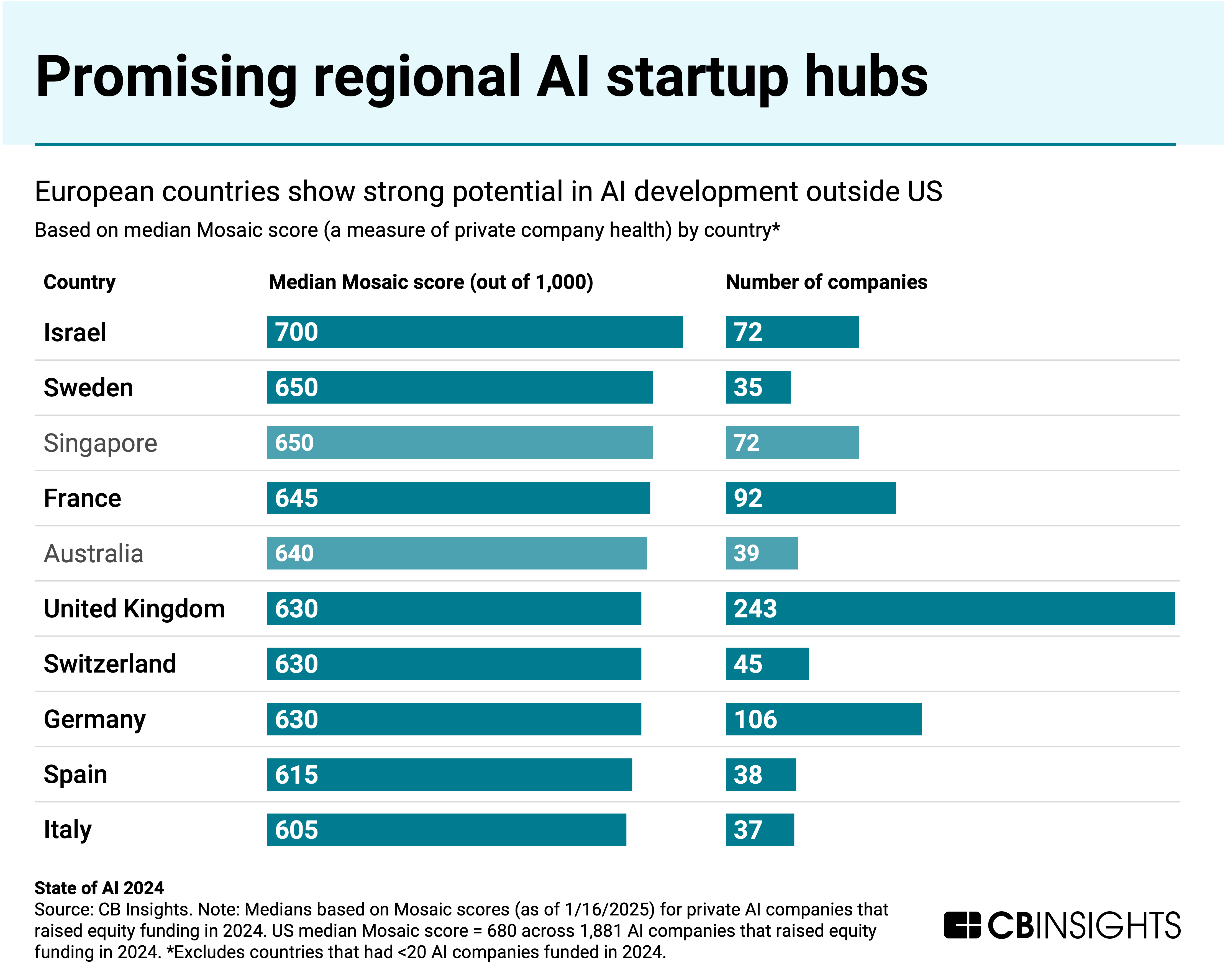

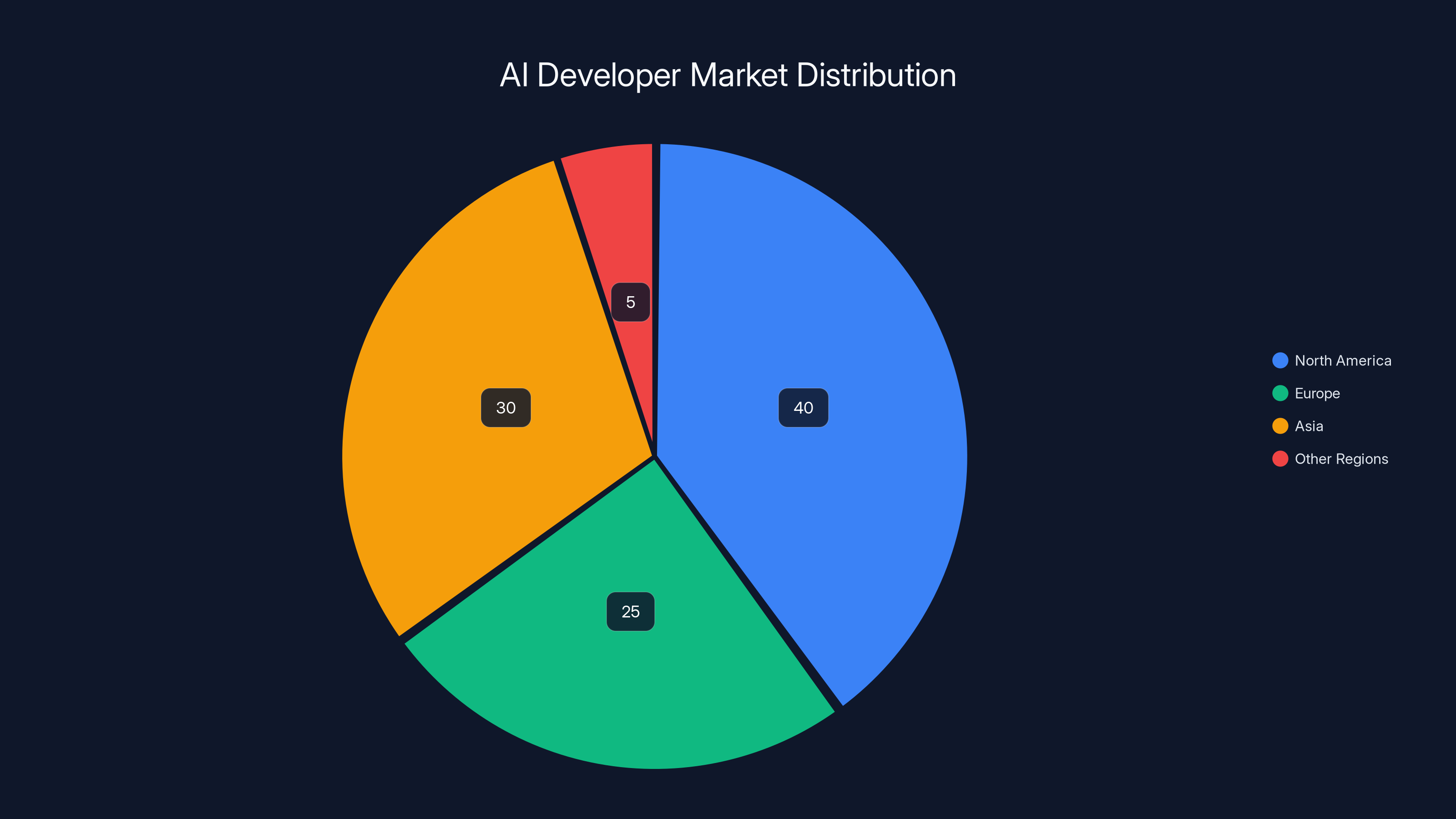

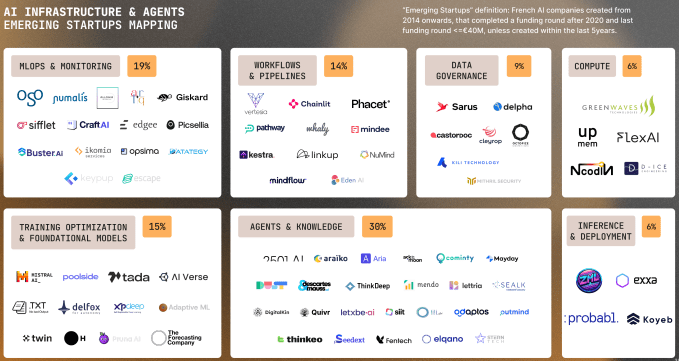

There's a finite pool of AI developers in the world. American developers are already fairly saturated with AI tool choices. European developers are a largely untapped market with strong technical talent, growing AI interest, and significantly less attention from the big AI labs. This is low-hanging fruit.

When Anthropic or OpenAI support a European startup accelerator, they're not just helping startups. They're cultivating an entire generation of developers who'll build on their platforms. These developers will try Claude or GPT models during the program, learn the quirks of the APIs, and establish patterns of working with the platforms. Three months of intensive development time creates real attachment.

A startup that starts building on Claude in January is unlikely to switch to GPT-4 three months later, even if GPT-4 technically performs better on a benchmark. They've got an entire product built. Their team understands Claude's specific behaviors, error modes, and strengths. The switching cost is high.

Europe has been underserved by American tech companies for years. The continent has strong talent, capital, and growing regulatory influence. Yet most European founders still have to go to San Francisco or build relationships with Valley investors to get attention. F/ai changes the equation. A European founder can build a world-class AI startup without leaving Europe.

Developer Lock-In Theory

This is where it gets strategic. Anthropic, OpenAI, and other foundation model companies operate in a winner-take-most market for developer mindshare. Whoever gets the developer in the door first often wins their lifetime loyalty.

Marta Vinaixa, a partner at VC firm Ryde Ventures, explained this dynamic clearly during interviews about the program. When a developer starts building on a foundation model, they're not just learning an API. They're learning the model's specific quirks, its failure modes, what it's good at, and what it's bad at. Over time, the developer builds workarounds, develops intuitions, and structures their entire product around that model's behavior.

Imagine a startup using Claude for classification tasks. Their team learns that Claude handles ambiguous edge cases differently than GPT-4 would. They optimize their prompts for Claude's behavior. They build confidence in Claude's outputs. Now, switching to another model doesn't just mean swapping an API endpoint. It means retraining, retesting, potentially redesigning workflows. The longer a company stays on a model, the more difficult switching becomes.

Vinaixa noted: "Once you start with a foundation, at least for the same project, you're not going to change to another. The sooner that you start, the more that you accumulate, the more difficult it becomes."

By getting startups onto their platforms during the critical early stage, before product-market fit is even achieved, the AI labs are essentially creating long-term customers. The startup might hit challenges with the model later, might find competitors with better models, but switching is costly. This is classic vendor lock-in, but achieved through early engagement rather than predatory contracts.

Regulatory and Political Positioning

Here's something many people miss: AI regulation is happening fastest in Europe. The EU's AI Act is the most comprehensive AI regulation on the planet. The UK, France, Germany, and other European countries are all developing their own AI strategies and regulatory frameworks.

When OpenAI, Google, and Anthropic support a European AI accelerator, they're not just building market share. They're building political goodwill. They're showing European policymakers that they're committed to fostering local AI innovation. They're positioning themselves as partners in European AI development, not just American corporations extracting data and value.

This is particularly important as Europe moves toward potentially mandatory safety testing, algorithmic auditing, and other regulations. A company that's been investing in local startups and demonstrating commitment to European founders has more credibility when sitting down at regulatory tables.

The History of AI Accelerators and Why This Is Different

Startup accelerators aren't new. Y Combinator launched in 2005 and proved the model works. Since then, hundreds of accelerators have launched globally. But AI accelerators are relatively recent, and most have been single-company affairs.

OpenAI itself benefited from accelerator support early. The company was partially funded and supported by Y Combinator's research division (YCR) in 2015, before becoming a standalone organization. Later, OpenAI built its own startup support programs, including partnerships with various investors and platforms.

Most foundation model companies have run their own startup programs. Anthropic has worked with startups building on Claude. Google has long operated accelerators and incubators. But these are typically single-company initiatives. A startup might get support from one platform.

What makes F/ai genuinely different is the consortium approach. Multiple competing foundation model companies are all participating simultaneously. This creates a genuinely neutral environment where startups can build on multiple models, compare performance, and make informed technology choices. It also prevents any single AI lab from monopolizing the accelerator.

Historically, when a single company runs an accelerator, there's an inherent bias toward their own technology. A startup in Google's accelerator is more likely to use Google's models. This isn't evil; it's just how incentives work. When multiple companies run an accelerator together, each one has to prove their technology is worth using on its own merits.

For context, consider how American tech accelerators evolved. Y Combinator started as a pure accelerator, taking equity in startups but not creating dependency on a single tech platform. This neutrality became a feature, not a bug. Companies wanted to work with YC because YC didn't lock them in to a particular technology.

F/ai is attempting something similar but in the AI space. It's an accelerator that doesn't have a built-in bias toward OpenAI or Anthropic or Google. Startups can use all three, compare them, and choose based on technical merit. This approach may actually be more successful long-term than single-company accelerators because it doesn't create the appearance of conflicts of interest.

That said, the lock-in dynamics mentioned earlier still apply. Even if F/ai is neutral, once a startup starts building deeply on a particular model, switching costs increase regardless.

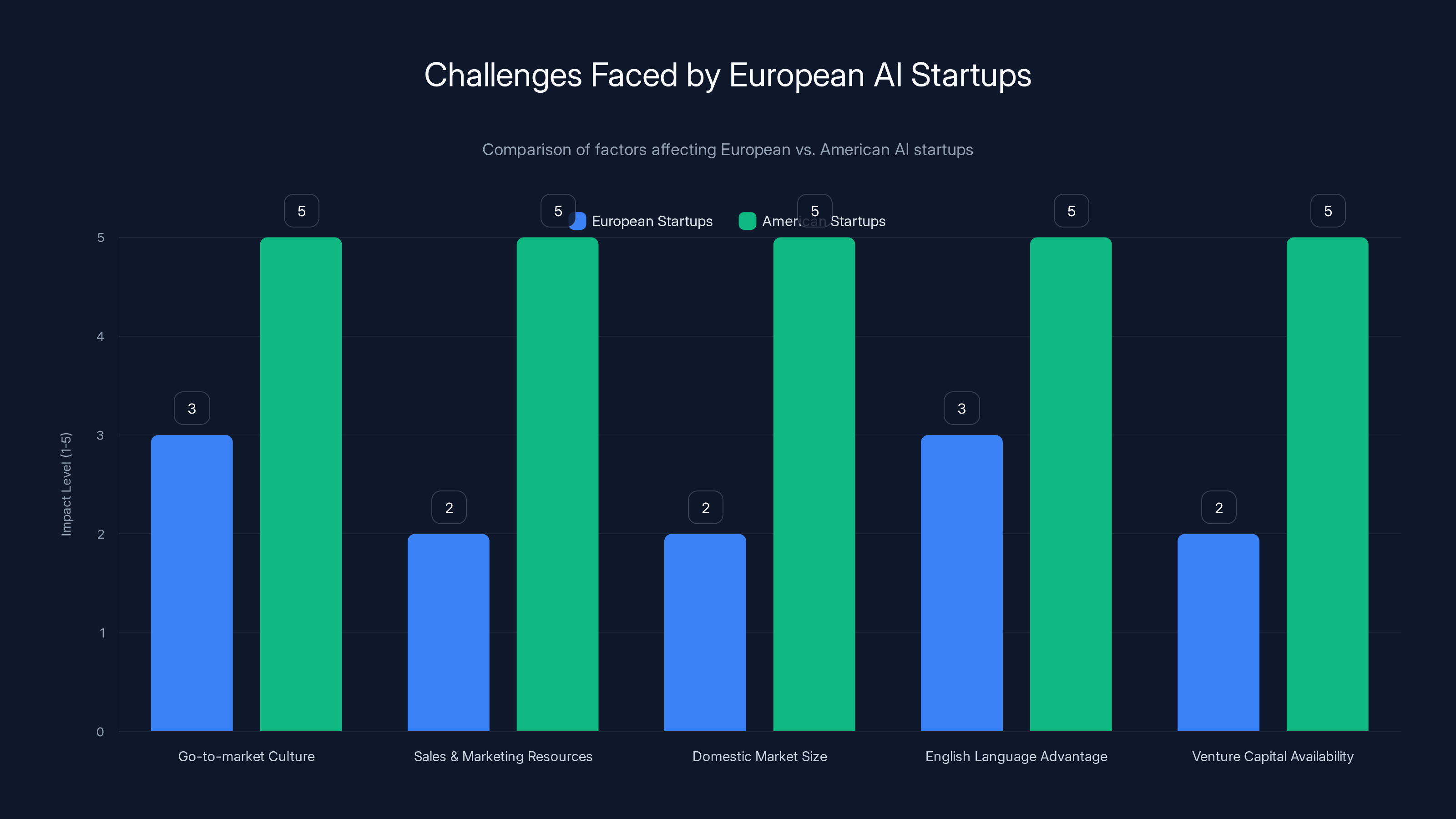

American AI startups outperform European ones due to stronger go-to-market culture, better sales and marketing resources, larger domestic market, English language advantage, and more venture capital. Estimated data.

Station F: The Incubator at the Heart of F/ai

Understanding F/ai requires understanding Station F, the Paris-based incubator that runs the program. Station F is essentially the largest startup incubator in the world by physical space and probably by number of resident companies.

Founded in 2017, Station F occupies a historic former train depot in Paris. The 34,000-square-meter facility houses over 1,000 companies at any given time, ranging from pre-seed startups to scale-ups raising Series B funding. The facility includes office space, meeting rooms, a cafeteria, event spaces, and community areas designed specifically for startup collaboration.

Station F's advantage in running F/ai comes down to several factors. First, it's geographically located in Paris, which is positioned as a major European tech hub and capital. Second, Station F has built relationships across European VC networks, media, and tech communities over seven years of operation. Third, Station F is not controlled by any single tech company, making it genuinely neutral ground for competing AI labs.

Roxanne Varza, the director mentioned in F/ai announcements, has been central to Station F's growth. Varza's background includes experience with startup ecosystems, international networks, and a clear vision for European tech development. Her emphasis on "rapid commercialization" reflects a deep understanding of what's actually holding back European AI startups.

The facility itself matters psychologically. When startups move to Station F for the F/ai program, they're not just getting API credits and mentorship. They're moving to Paris for three months. They're embedded in a community of 1,000+ other founders. They're attending talks and workshops. They're building relationships with other teams. This community aspect creates momentum and accountability that remote accelerators simply can't match.

Station F has also been deliberately building relationships with European policymakers and investors who are increasingly interested in AI. The facility has become a destination for European tech journalists, EU officials interested in tech policy, and international investors looking for European AI deals. Being based there gives F/ai startups visibility they wouldn't otherwise have.

The Participating Companies and Their Strategic Interests

Let's break down why each major participant is involved in F/ai and what they get out of it.

OpenAI

OpenAI is the market leader in foundation models, with GPT-4 and the upcoming GPT-5 being the most widely used large language models globally. OpenAI's strategic interest in F/ai is developer penetration. Every startup that builds on GPT models during the program becomes a potential long-term customer. OpenAI also benefits from positioning itself as a European partner, which matters as EU AI regulation develops.

OpenAI's API is accessible globally, but having a structured program specifically for European founders creates a focused go-to-market channel. Plus, OpenAI doesn't have the scale of operations in Europe that it does in America. An accelerator partnership lets OpenAI reach European founders without building out its own European infrastructure.

Anthropic

Anthropic is newer than OpenAI but has been aggressive about positioning Claude as the AI model that's better at reasoning, safer, and more reliable than competitors. For Anthropic, F/ai is a critical way to establish developer mindshare in Europe before OpenAI dominates completely.

Anthropic is smaller and has less brand recognition outside of AI developer circles compared to OpenAI. An accelerator program provides a structured way to get Claude in front of early-stage founders when they're making technology choices. Anthropic has been particularly careful about building relationships with academic institutions and researcher networks; an accelerator continues this pattern.

Google and Microsoft

Google and Microsoft approach F/ai differently. Both have existing cloud infrastructure, existing developer relationships, and existing AI platforms. For these companies, an accelerator is less about market entry and more about ensuring they're not left out of the next wave of startup innovation.

Google's Gemini models and Microsoft's partnership with OpenAI (through their Azure OpenAI Service) are already available globally. But having a seat at the table in European accelerators ensures they're visible to founders making critical early technology choices. Plus, it keeps them honest. If Google or Microsoft weren't part of F/ai, they might be seen as not committed to European development.

Meta

Meta is newer to the foundation model space compared to OpenAI or Anthropic, having only recently released Llama 2 and Llama 3. For Meta, F/ai is crucial for building out the ecosystem around Llama. Meta wants developers to see Llama as a viable open-source alternative to OpenAI's models. An accelerator program where startups can build on Llama provides social proof that the model is production-ready.

Meta also has strong European operations and relationships, particularly in France (where F/ai is based). This makes sense for Meta as a home-region play.

Mistral

Mistral is a French-based foundation model company founded in 2023 by former Meta and Nvidia researchers. For Mistral, F/ai is essentially a home-field advantage. Being a French company participating in a Paris-based accelerator is natural. Mistral also has strong relationships with European policymakers and investors. Participating in F/ai increases Mistral's visibility as a European AI champion.

Mistral's models have gained traction particularly in Europe, and F/ai provides a structured way to build out the developer ecosystem around Mistral models.

Cloud and Infrastructure Partners

AWS, AMD, Qualcomm, and OVH Cloud are the infrastructure layer. They're providing compute resources, cloud services, and hardware. For AWS, it's straightforward: startups trained on AWS infrastructure will likely stick with AWS as they scale. For AMD and Qualcomm, it's about ensuring their chips and hardware are considered when startups build infrastructure plans. For OVH Cloud, a French company, it's about positioning as a European alternative to US cloud providers.

Estimated distribution of $1 million credits shows balanced support from major AI companies, fostering a collaborative ecosystem for European startups.

How the Accelerator Program Actually Works

Let's walk through the practical structure of F/ai, because understanding the mechanics reveals how intentional the program's design is.

Cohort Selection and Timing

F/ai runs twice per year, with cohorts of approximately 20 startups each. The first cohort launched January 13, 2025. Startups in the first cohort were largely recommended by venture capital firms involved in the program, including Sequoia Capital, General Catalyst, and Lightspeed Venture Partners.

This VC involvement isn't accidental. When top-tier VCs recommend startups for the program, they're signaling that these are founders worth watching. It also means the startups already have early capital or investor relationships, which is helpful. The program isn't designed for pre-idea founders; it's designed for founders who've already started building and have some validation.

The three-month duration is strategic. It's long enough to make real progress on a product, get initial users, and see what works technically with AI models. But it's short enough that it doesn't require founders to move to Paris permanently. Many founders will move to Paris for the three months, but others might do some hybrid arrangement. Three months is also proven as an effective accelerator length from Y Combinator's experience.

Running twice per year means cohorts graduate every six months. This creates a steady pipeline of demo day startups, media coverage, and investor opportunities. Investors know exactly when to expect new batches of companies to evaluate.

The Curriculum: Rapid Commercialization

This is the core innovation of F/ai. Rather than a traditional accelerator curriculum focused on product development, F/ai's curriculum is explicitly designed around "rapid commercialization." This means getting startups to revenue as quickly as possible.

Most accelerators help founders build product. F/ai helps founders build products that generate revenue. This is a subtle but crucial distinction.

The curriculum likely includes:

- Go-to-market strategy workshops: Founders learn how to position their product, identify customers, and run sales processes

- Fundraising preparation: Even though startups don't directly raise capital in the program, they're being prepared to raise after the program ends

- Metrics and milestones: Founders learn which metrics actually matter for AI startups and how to measure progress

- Pricing strategies: This is critical for AI startups. Should they charge per API call? Subscription? One-time license? The program helps founders figure this out

- Customer development: Founders learn how to validate that customers actually want what they're building and are willing to pay for it

Specialists from the partner companies (OpenAI, Anthropic, Google, etc.) lead some of these sessions. When an OpenAI engineer talks about building production AI systems, founders are learning from someone who's actually built production systems at scale.

The Credits: $1M+ in Free Services

The headline stat is that each startup gets "more than

Here's roughly how the credits might break down:

API Credits: If a startup is using Claude API for their product, they might get

Compute Credits: If a startup needs to train a model or run large inference operations, they might get AWS, Google Cloud, or other infrastructure credits. These typically come from cloud providers at discounted rates.

Model Access: Startups get access to the latest versions of foundation models, sometimes before public release. This is valuable for testing.

Premium Features: Some of the partner companies offer premium features or priority support. Startups might get enterprise-level support bundled into their credits.

The credits are structured so that startups can't just hoard them. Most cloud and API credits expire after a certain period (typically 12 months). So a startup has incentive to actually use the services and build their product during and after the program.

This credit structure also solves a major problem: startups need to make technical decisions about which models, platforms, and cloud providers to use. The credits let them try different options without capital constraints. A startup can build a prototype on GPT-4, test performance on Claude, and compare infrastructure costs across AWS and Google Cloud. The credit structure lets them do empirical comparison instead of guessing.

Mentorship and Network Access

The other major value of F/ai is access to mentorship and networks. Station F itself provides mentorship infrastructure. The VC firms involved in the program (Sequoia, General Catalyst, etc.) likely have mentors embedded in the program. The participating AI labs send engineers, product managers, and executives to mentor startups.

This mentorship is particularly valuable for technical founders building AI products. When Claude-building Anthropic engineer can review your prompt engineering strategy or your fine-tuning approach, that's access to expert knowledge that typically costs thousands per hour if you hired a consultant.

Network access matters equally. Startups meet other founders in their cohort, creating both collaboration opportunities and friendly competition. They meet investors. They meet potential customers and partners. Station F itself hosts events, workshops, and networking sessions. The program is designed to create serendipity, those unexpected meetings that sometimes turn into partnerships or deals.

Demo Day and Beyond

Like traditional accelerators, F/ai culminates in a demo day where startups pitch their products to investors, media, and potential customers. The timing (every six months) and location (Paris, a major European hub) means demo day gets media coverage and attracts investors looking for European deals.

After the program ends, startups maintain access to Station F's community and facilities. Most accelerators provide some post-program benefits. F/ai likely does similarly. Startups can continue using the space, attending community events, and leveraging relationships built during the program.

The Startups Building in F/ai: What Are They Actually Building?

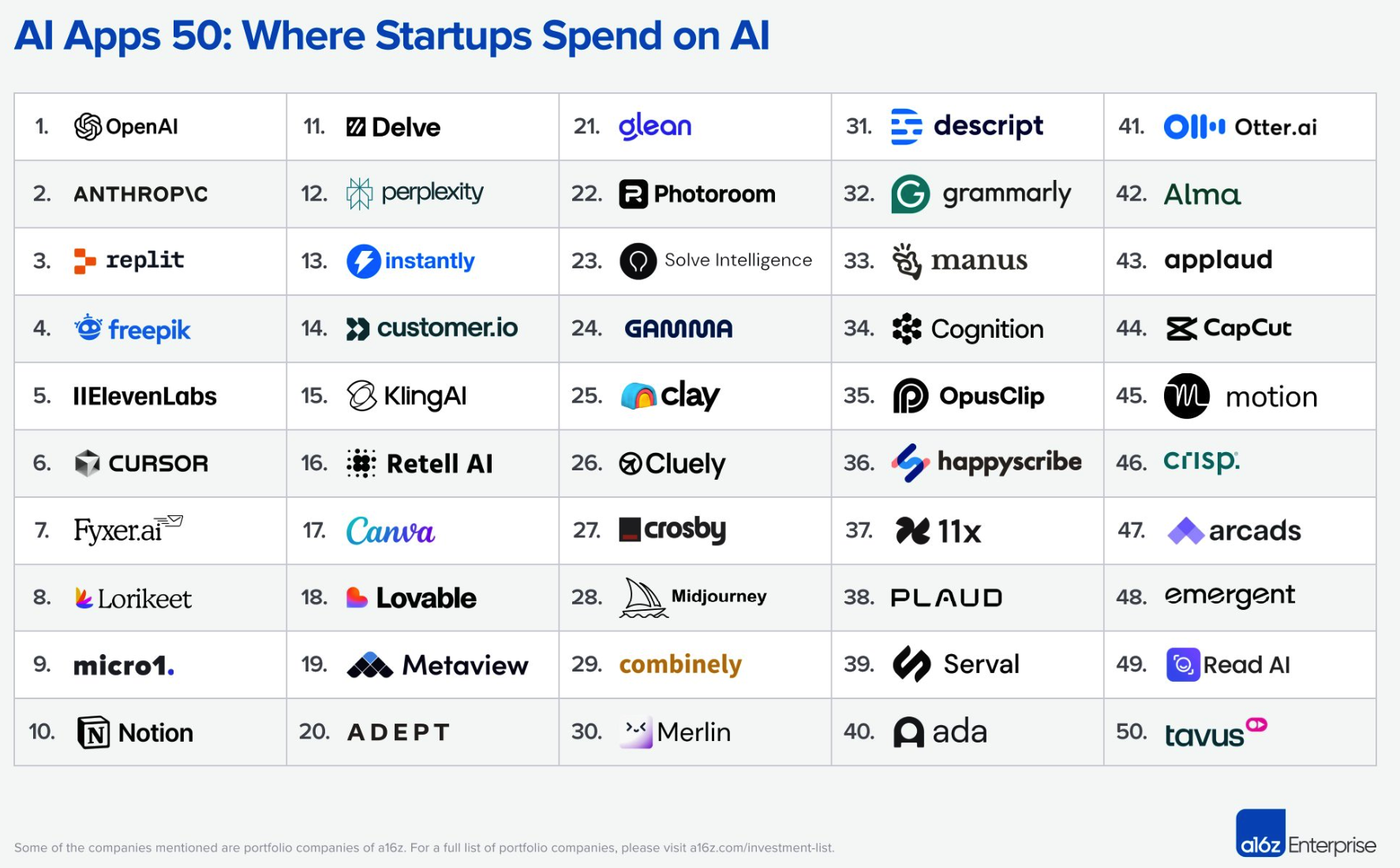

The F/ai program focuses on startups building AI applications on top of foundation models. This is important because it means startups aren't trying to build their own large language models (which would be prohibitively expensive and probably impossible for small teams). Instead, they're building applications that use foundation models as a core component.

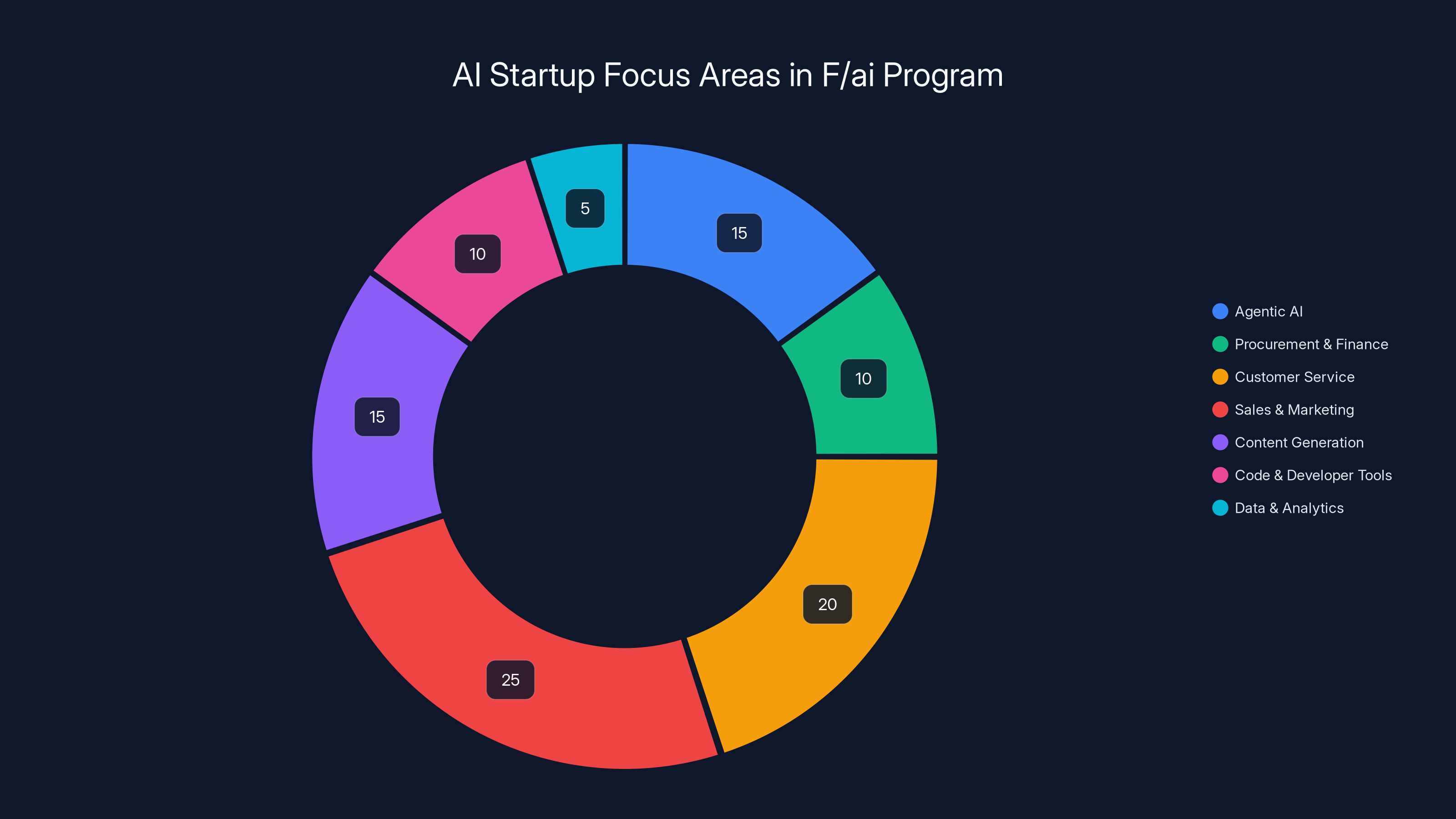

The press announcements mention that startups in F/ai are building in areas including:

- Agentic AI: Systems where AI models are given tools and autonomy to solve problems step-by-step, perhaps with human oversight

- Procurement and finance: Specific verticals where AI can automate workflows, extract insights from documents, and handle complex business logic

But the full diversity of startups is likely broader. Based on trends in AI startups generally, F/ai probably includes companies building in categories like:

Customer Service and Support: AI systems that handle customer inquiries, resolve common issues, and escalate to humans when needed. Companies like this have genuine path to revenue because they replace expensive human customer service reps.

Sales and Marketing Automation: Tools that help sales teams find prospects, craft personalized outreach, or analyze customer conversations. Hundreds of startups are building in this space.

Content Generation and Marketing: AI-powered tools that help companies create marketing copy, blog posts, social media content, or ad copy. This is a huge space because every company needs marketing content.

Code and Developer Tools: AI-powered IDEs, code review tools, documentation generators. The developer tools space is hot because developers have high budgets and are early adopters of AI.

Data and Analytics: AI systems that extract insights from data, identify patterns, or create reports. This works for companies that have data but lack analytical resources.

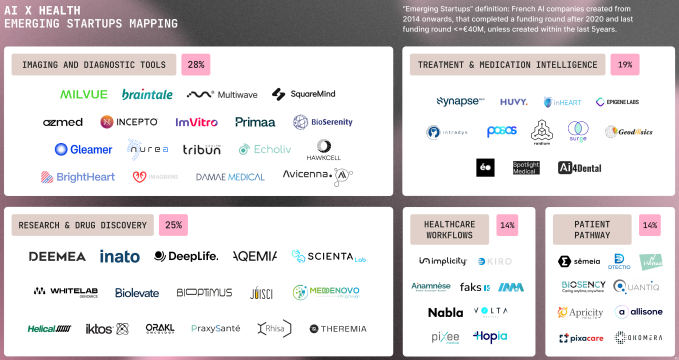

Healthcare and Science: AI applications in medical imaging, drug discovery, or scientific research. Healthcare applications can command high prices due to regulatory requirements and life-or-death stakes.

Finance and Legal: AI systems that analyze contracts, identify legal risks, help with financial planning, or detect fraud.

What all these have in common is that they're not selling a foundation model. They're selling a solved problem. A startup selling customer service automation isn't selling GPT-4. It's selling the solution to "we're drowning in customer support tickets." GPT-4 is just part of how they solve that problem.

This is crucial because it changes the revenue dynamics. A startup that's built a customer service product on top of Claude doesn't have to charge customers enough to cover Claude's API costs plus profit. Instead, they charge based on value provided. If the AI system saves a customer $100,000 per year in customer service costs, they can charge a percentage of that savings and both parties win.

Estimated data shows that Europe represents a significant untapped market for AI developers, with 25% of the global pool, compared to 40% in North America.

Why European AI Startups Are Struggling (And What F/ai Is Trying to Fix)

To understand why F/ai exists, you need to understand the actual problem it's trying to solve. European AI startups are genuinely struggling compared to their American and Chinese counterparts.

The Speed Problem

Roxanne Varza's quote is telling: "Investors are starting to feel like, 'European companies are nice, but they're not hitting the $1 million revenue mark fast enough.'"

This is the key metric. American startups are reaching $1 million in annual recurring revenue (ARR) faster than European startups. Why?

Several factors contribute:

Go-to-market culture: American startup culture is intensely focused on growth, revenue, and rapid scaling. European startup culture is more cautious, more focused on profitability and sustainability. These different cultural approaches mean American founders optimize for revenue growth while European founders optimize for different metrics.

Sales and marketing resources: American startups have easier access to growth capital specifically allocated to sales and marketing. European VCs are often more conservative about funding expensive sales and marketing operations. This means American startups can spend more aggressively to acquire customers.

Domestic market size: The US is a single market of 330 million people with aligned language, regulations, and preferences. Europe has 450+ million people spread across 27 different countries with different languages, regulations, and preferences. Selling to the European market requires navigating complexity that selling to the US market doesn't.

English language advantage: Most AI tools, APIs, and documentation are in English and designed with American use cases in mind. American startups have home-field advantage. European startups often have to navigate language translation, localization, and cultural adaptation.

Less venture capital: The VC market is less mature in Europe. There's less total capital available for early-stage startups compared to the US. This means lower valuations, less funding per startup, and more difficulty raising capital at all.

The Founder and Talent Problem

Top AI talent congregates in a few places: the San Francisco Bay Area, New York, and Beijing. Europe has talent, but it's more dispersed. The top AI researchers tend to work in academia (where they have intellectual freedom) or at American tech companies (where they have the best tools and resources).

Founding an AI startup requires not just AI talent but also commercial talent: people who can sell, build business strategy, and make hard product decisions. This combination is rarer in Europe than in the US.

The Infrastructure Problem

Building AI applications at scale requires access to significant compute resources, which are expensive. American startups have easier access to venture capital to fund compute costs. European startups struggle to justify the expense.

There's also the matter of regulation. The EU's AI Act imposes requirements around model documentation, algorithmic auditing, and transparency that American startups don't face. This adds complexity and cost to European AI startups that their US competitors don't have to deal with.

The Ecosystem Problem

American AI startups have access to an ecosystem of experienced founders, investors, engineers, and mentors who've built AI companies before. European founders are building in a less mature ecosystem. There are fewer examples of "this is how you build an AI startup," fewer relationships to tap into, and fewer proven playbooks.

F/ai is directly trying to solve this by:

- Providing infrastructure: The credits and compute resources remove capital as a barrier

- Building community: Bringing 20 startups together creates peer learning

- Creating mentorship: Engineers from OpenAI, Anthropic, etc. can teach founders how to actually build production AI systems

- Providing go-to-market guidance: The curriculum is specifically about rapid commercialization

- Building reputation: Participating in F/ai signals to investors that these startups are worth watching

The European AI Strategy Context

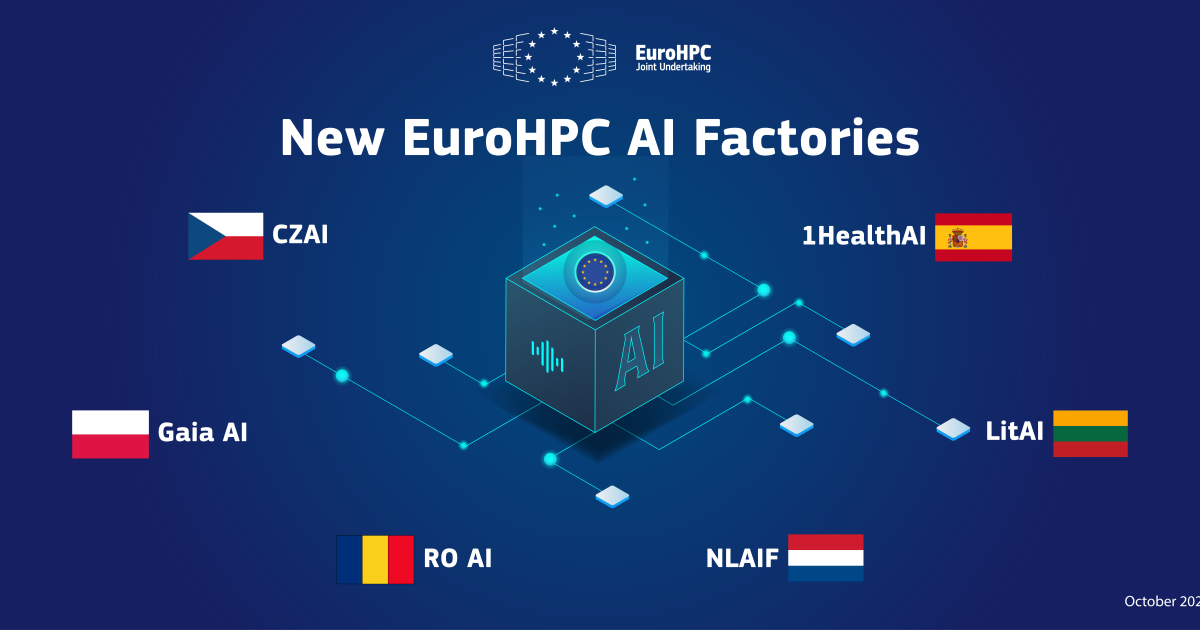

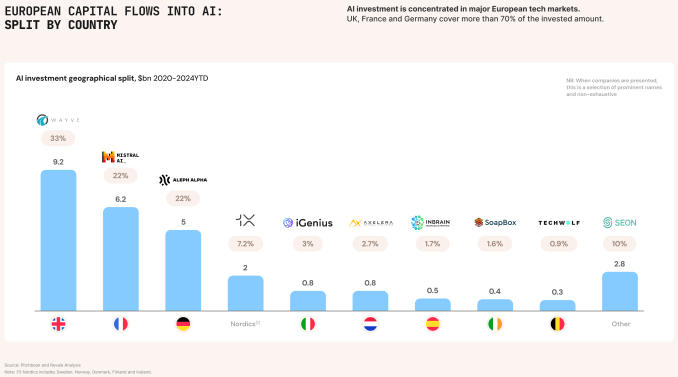

Understanding F/ai requires understanding the broader European AI strategy. Both the UK and EU governments are aware they're lagging behind the US and China in AI development. They're concerned about strategic dependency on American and Chinese tech companies. Both governments are investing heavily to support homegrown AI development.

EU AI Regulation and Strategy

The EU passed the AI Act, which is the most comprehensive AI regulation in the world. The Act categorizes AI applications by risk level and imposes different requirements for each category. This creates both opportunities and challenges for European startups.

Opportunities: The regulation creates a level playing field where European startups and global tech companies all have to follow the same rules. There's also a possibility that European regulation becomes a global standard, giving European companies home-field advantage.

Challenges: The regulation adds compliance costs. European startups have to navigate the Act's requirements while American startups can build for the US market (which has less regulation) and worry about EU compliance later.

Beyond regulation, the EU is investing in AI infrastructure. The AI Chips Act allocated billions toward developing European AI chip capability. The European Commission is funding AI research and development through Horizon Europe. There's a clear strategic commitment to building European AI capacity.

French Tech Strategy

France specifically has positioned itself as a tech hub with programs like France 2030, which allocates 30 billion euros toward emerging technologies including AI. Paris has become a magnet for tech talent and startups, particularly through efforts to build a thriving startup ecosystem.

Station F itself is partly a result of French government support for tech entrepreneurship. Locating F/ai in Paris is strategic because it signals French commitment to AI development and makes Paris more attractive to European founders.

The Strategic Dependency Question

Here's the subtext nobody says out loud but everyone understands: Europe is strategically dependent on American technology companies for AI. There's no European equivalent to OpenAI. Anthropic is building in San Francisco. The most advanced foundation models are American or Chinese.

F/ai is partly European governments saying to American tech companies: "Help us build our own ecosystem. Invest in European startups. Show us you care about European development." And American tech companies agreeing because it's good PR, good business, and helps them lock in developer ecosystems.

This isn't nefarious. It's how international tech development works. American companies built dominance by investing globally in startups and ecosystems. European companies are now trying to do the same, and F/ai is one tool in that effort.

Estimated data suggests that sales & marketing automation and customer service are leading focus areas for AI startups in the F/ai program, reflecting broader industry trends.

Comparison: How F/ai Stacks Up Against Other AI Accelerators

To understand what makes F/ai unique, let's compare it to other AI startup support programs.

Y Combinator

Y Combinator is the gold standard of accelerators. It operates globally, takes 500+ startups per year across multiple cohorts, and charges no equity from startups (instead, early investors on the Y Combinator note receive equity). YC provides $500K in funding per startup, office space, mentorship, and access to a network of 1,000+ experienced founders and investors.

How F/ai compares:

- Funding model: YC provides cash ($500K). F/ai provides credits (no cash). Credits are less flexible but still extremely valuable for AI startups.

- Scale: YC operates massive cohorts (100+). F/ai operates smaller cohorts (20). Smaller cohorts mean more personalized attention but fewer total startups supported.

- Geography: YC is headquartered in San Francisco but operates globally. F/ai is specifically focused on Europe.

- Mentorship: Both provide mentorship, but F/ai's is specifically tailored to AI. YC's mentors include successful startup founders across all verticals.

- Demo day: Both culminate in demo days that attract investor attention. YC's demo day is more prestigious globally.

Verdict: Y Combinator is broader and more prestigious globally. F/ai is more specialized for AI and more specific to Europe.

OpenAI's Startup Fund

OpenAI runs its own startup fund, which provides capital and credits for startups building on GPT models. It's not an accelerator in the traditional sense; it's more of an investment program.

How F/ai compares:

- Single vs. multi-platform: OpenAI's program focuses on GPT. F/ai is multi-platform (startups can use any of the participating models).

- Capital: OpenAI's program can include venture capital investment. F/ai doesn't include direct funding.

- Cohort structure: OpenAI's program is ongoing. F/ai has defined cohorts.

- Geography: OpenAI's program is global. F/ai is Europe-specific.

Verdict: OpenAI's program is more capital-focused. F/ai is more community-focused.

Anthropic's Claude Fund and Partnerships

Anthropic has been building partnerships with AI startups but doesn't run a traditional accelerator. Instead, Anthropic provides API credits and technical support to early-stage companies building on Claude.

How F/ai compares:

- Structure: Anthropic's approach is ad-hoc partnerships. F/ai is a formal, cohort-based accelerator.

- Community: Anthropic's approach doesn't create community among startups. F/ai puts 20 startups together for three months, creating peer learning.

- Mentorship: Anthropic provides technical mentorship. F/ai provides business mentorship focused on commercialization.

- Geography: Anthropic's partnerships are global. F/ai is Europe-specific.

Verdict: F/ai is more structured and community-focused than Anthropic's ad-hoc partnerships.

Mistral's Ecosystem Programs

Mistral, as a French company, is involved in F/ai but also runs its own ecosystem programs. Mistral's approach is more focused on open-source development and community building around Llama-style models.

How F/ai compares:

- Open vs. closed: Mistral emphasizes open-source. F/ai includes proprietary models (GPT, Claude) alongside open-source options.

- Community vs. capital: Mistral focuses on community. F/ai is more capital and resources focused.

- Geography: Both are European-focused, but Mistral might emphasize French dominance more.

Verdict: F/ai is more capital-intensive and multi-platform compared to Mistral's approach.

European Government Programs

Both the EU and national governments run startup support programs. These vary widely but often include:

- Grants (not equity-diluting)

- Tax incentives

- Regulatory sandboxes

- Technical support

- Access to public research

How F/ai compares:

- Source of resources: Government programs are funded by taxes. F/ai is funded by private companies.

- Speed: Government programs move slowly. F/ai should move faster.

- Business focus: Government programs often focus on broader economic impact. F/ai focuses on commercial viability.

- Scale of support: Government programs might support hundreds of startups annually. F/ai supports 40 per year (two cohorts).

Verdict: F/ai is more nimble and business-focused than government programs, but government programs provide capital that F/ai doesn't.

The Challenges F/ai Will Face

Despite its promising structure, F/ai will face real challenges.

Managing Competing Interests Among Partners

When rivals cooperate, friction is inevitable. OpenAI might want to position GPT as the default model for most use cases. Anthropic might want startups to use Claude for high-stakes reasoning applications. Google might want to protect relationships with strategic customers.

If the program starts to feel like a competition where partners are trying to lock startups into their platforms, the neutrality breaks down. The best accelerators feel genuinely aligned with the startups' success, not the partners' strategic interests.

Managing this requires real diplomacy from Station F. The accelerator needs to position itself as truly serving founders, not serving the interests of any particular partner. This is doable but requires constant attention.

European Market Size and Venture Capital

Even with an excellent accelerator, European startups face structural challenges. The European venture capital market is less developed than the American market. There's less total capital available for startups. This limits how big European AI startups can grow.

F/ai can help startups reach product-market fit faster, but if venture capital for scaling isn't available in Europe, successful startups will move to the US to raise Series A and beyond. This has historically happened to successful European tech startups.

F/ai doesn't solve this fundamental issue, though it might help by increasing the visibility of successful European AI startups to global investors.

Regulation and Compliance Complexity

The EU AI Act and other regulations add complexity that American startups don't face. A startup built in F/ai will need to think about compliance early. The program's curriculum probably includes regulation content, but navigating the specifics of AI Act compliance while building a product is genuinely difficult.

Some startups will find that the compliance burden makes their business model unviable in Europe. These startups might choose to operate only in the US, which undermines the goal of building strong European AI startups.

Brain Drain and Acquisition Risk

Historically, successful European tech startups have been acquired by American companies. Facebook bought Instagram. Google bought DeepMind. Microsoft bought Activision Blizzard (American, but the dynamic applies). Successful F/ai startups might be acquisition targets for OpenAI, Google, Anthropic, or other tech giants.

This isn't necessarily bad. Founders get exits, employees get opportunities at large tech companies. But it means that building European AI capability is challenging when successful European startups end up inside American companies.

Founder and Talent Constraints

A strong accelerator can't create AI talent where it doesn't exist. Europe has strong technical talent, but the concentration of AI expertise is less than the US. F/ai can help founders build better products, but it can't create additional talented AI engineers if they don't exist.

There's also the matter of founder quality. Y Combinator succeeds partly because it attracts world-class founders. F/ai is newer and less prestigious globally. It might attract strong European founders, but whether it attracts the same caliber of founders as Y Combinator or top-tier American accelerators is an open question.

How AI Automation Tools Can Support Startups Like F/ai

Building a startup is incredibly time-consuming. Founders spend enormous amounts of time on tasks that could be automated: creating pitches, writing business plans, preparing financial models, responding to emails, organizing information, and creating reports for investors.

This is where tools like Runable become valuable for founders. Runable is an AI-powered platform that helps teams automate document generation, create presentations, generate reports, and handle workflow automation. For F/ai startups, Runable could streamline several critical workflows:

Creating investor pitches and presentations: Instead of spending hours designing pitch decks, founders can use Runable's AI to generate professional presentation slides from their business plan or talking points. This saves time and ensures consistency.

Generating business plans and financial models: Runable can help founders create comprehensive business plans, financial projections, and strategy documents based on their business model and market research.

Automating progress reports: Startups in accelerators often need to report progress to mentors, investors, and program directors. Runable can generate these reports automatically from startup metrics and achievements.

Creating customer-facing documentation: As startups build products, they need documentation, help content, and user guides. Runable can auto-generate these from product descriptions and technical specs.

Building image and video content: Startups need marketing materials. Runable's capabilities include image generation, video creation, and visual content production.

At $9/month, Runable is affordable enough for pre-revenue startups, yet powerful enough to handle serious automation workflows. For F/ai startups in particular, leveraging AI-powered automation tools to handle documentation and content creation means founders can focus their limited time on product development and customer acquisition.

Use Case: Startup founders can generate pitch decks, business plans, and investor reports automatically, freeing up time to focus on product development and customer acquisition.

Try Runable For Free

The Future of International AI Accelerators

F/ai is likely to be the first in a series of international AI accelerators. If it succeeds, we'll probably see similar programs in other regions.

Potential for Expansion

Once F/ai establishes itself in Paris, similar programs could launch in other European cities. London, Berlin, and Amsterdam are all strong tech hubs. If F/ai graduates successful startups that achieve significant exits or IPOs, other cities will want their own versions.

We might also see regional accelerators for Asia, focused on serving Southeast Asian and South Asian startups, or Middle Eastern accelerators serving startups in that region.

Implications for AI Development

If F/ai succeeds at producing European AI startups that scale globally, it changes how AI development happens internationally. Instead of being concentrated in the Bay Area and Beijing, AI development becomes more distributed. This could lead to more diverse perspectives on AI development, different approaches to AI safety, and more competition between different AI companies.

It could also lead to more fragmentation, where different regions develop their own AI stacks and ecosystems that don't interoperate smoothly. There are advantages and disadvantages to both scenarios.

The Role of Open Source

The presence of Mistral and Meta (with Llama) in F/ai signals importance of open-source foundation models. Llama is open-source, and Mistral's models are more accessible than proprietary models. If F/ai startups have the option to build on open-source models with lower API costs, the economics of AI startups change dramatically.

Startups building on open-source models like Llama can fine-tune the models for their specific use case, potentially getting better performance than using proprietary APIs. The downside is that fine-tuning requires more technical expertise and compute resources. The upside is that you own your model and don't have vendor lock-in.

Competition with US Accelerators

F/ai will compete with Y Combinator and other US accelerators for European founder talent. Y Combinator's advantage is prestige and network. F/ai's advantage is location (no need to move to California) and specialization (AI-focused). For European founders who don't want to relocate, F/ai might be more attractive than Y Combinator.

We might see increasing competition between US-based and Europe-based accelerators for the best founder talent globally. This competition drives improvements in accelerator quality and services, which benefits all founders.

Key Trends Emerging from F/ai

Beyond the specific accelerator, F/ai signals several important trends in AI development.

Trend 1: Rival AI Companies Are Increasingly Cooperating

The fact that OpenAI, Anthropic, and Google all agreed to participate in a single accelerator suggests that despite their public rivalry, they have enough aligned interests to cooperate. This is somewhat surprising but makes sense upon reflection: all these companies benefit from a growing ecosystem of AI developers and startups.

We should expect to see more cooperation between AI companies on infrastructure, standards, safety research, and ecosystem development, even while they compete on products.

Trend 2: Regional Specialization in AI Development

F/ai emphasizes that AI development is becoming geographically distributed. Europe is building its own AI capability. So is Asia. This is different from the early internet era when US dominance was nearly total. AI is the first technology where multiple regions have the capability and capital to compete at the frontier simultaneously.

This has implications for AI safety and alignment. Rather than a single model or approach to AI safety dominating globally, we'll see different approaches to AI safety, different values and priorities, and different regulatory frameworks. Whether this leads to better or worse outcomes is still unclear.

Trend 3: Founder-Friendly Acceleration Models

F/ai's credit-based model (rather than equity investment) suggests that accelerators are evolving toward models that are more friendly to founders. Rather than giving up equity to a large number of investors and advisors, founders in F/ai get resources without dilution. This is good for founder economics and might make accelerator participation more attractive.

We might see more accelerators adopting credit-based or resource-based models rather than equity-based models in the future.

Trend 4: Commercialization Focus

F/ai's explicit focus on "rapid commercialization" rather than product development or innovation reflects a maturation of the AI market. The early days when every AI startup was about research or pushing boundaries are over. Now it's about building profitable businesses.

Future accelerators will likely emphasize similar focuses: not just innovation, but revenue generation, unit economics, and scalability.

Conclusion: What F/ai Means for the Future of AI

F/ai is important not because it's revolutionary, but because it's emblematic of larger shifts happening in AI development. It represents the moment when AI moved from being a frontier technology controlled by a handful of companies to being an infrastructure layer that supports diverse applications and entrepreneurs.

The accelerator itself might succeed or fail. Some of the startups might become unicorns. Others might fizzle out. But the existence of F/ai signals several things:

First, AI labs recognize they need ecosystem partners. Building a foundation model is only the beginning. To capture value from that model, you need developers building on it, integrating it, and creating products that users actually use. This requires building an ecosystem. F/ai is a strategic investment in that ecosystem.

Second, Europe is a serious player in AI development. The days when AI was purely an American affair are over. Europe is building regulatory frameworks, infrastructure, and entrepreneurship programs. European startups are competitive. F/ai is one tool among many (regulation, government funding, venture capital) that Europe is using to build AI capability.

Third, cooperation between competitors is possible when interests align. OpenAI and Anthropic compete fiercely on models and products, yet they cooperate on accelerating ecosystem development. This suggests that the AI market isn't winner-take-all at every level. There's room for competition and cooperation to coexist.

Fourth, business models for AI are diversifying. Early AI was all about the models themselves. Now it's increasingly about applications built on those models. This changes how AI companies make money, how they structure partnerships, and how they compete.

For European founders, F/ai represents something concrete: an opportunity to build a world-class AI startup without leaving Europe, with access to world-class mentorship and resources, and with exposure to major tech companies and investors. For the AI industry broadly, F/ai represents the acceleration of AI's transition from frontier research to infrastructure to everyday applications.

The accelerator probably won't be the only factor determining whether European AI startups achieve the scale that American and Chinese startups have. Founder quality, market dynamics, regulation, and access to capital all matter equally. But F/ai is a significant positive signal and a concrete tool that removes some of the barriers that have historically held back European tech startups.

Twenty startups per cohort might not sound like much. Over five years, that's 200 startups. Most won't become unicorns. But a few will. And if even one becomes a defining European AI success story, F/ai will have justified its existence. More importantly, the fact that major AI labs saw enough strategic value in supporting European AI development to participate in F/ai suggests we should expect more initiatives like it.

The era of American dominance in AI infrastructure and platform companies might be ending. F/ai is one sign that the next era is geographically distributed, with multiple regions building AI capability, startups emerging globally, and competition happening across borders. Whether that leads to better AI outcomes, safer AI, or more diverse AI perspectives remains to be seen. But it's coming.

FAQ

What is F/ai and who runs it?

F/ai is a startup accelerator program based in Paris, run by Station F, Europe's largest startup incubator. The program is a partnership between major AI labs including OpenAI, Anthropic, Google, Meta, Microsoft, and Mistral, along with infrastructure partners like AWS, AMD, and Qualcomm. The program takes approximately 20 startups per cohort for a three-month intensive program, running twice per year.

How does F/ai differ from Y Combinator?

F/ai and Y Combinator are both startup accelerators but have significant differences. Y Combinator is headquartered in San Francisco, operates larger cohorts (100+ startups per batch), and provides direct funding ($500K per startup). F/ai is Europe-focused, takes smaller cohorts (20 startups), and provides credits rather than cash. Y Combinator is broader and more prestigious globally, while F/ai is specialized for AI startups and specific to Europe. Y Combinator mentors are successful founders across all industries; F/ai mentors include engineers from the major AI labs themselves, providing specialized AI expertise.

What do F/ai startups actually receive?

Startups in F/ai receive over $1 million in credits for API access, compute resources, and services from the participating companies. These aren't cash grants but rather credits that can be spent on foundation model APIs (like GPT-4 or Claude), cloud computing resources (AWS, Google Cloud, etc.), hardware, and priority support. Startups also get mentorship from specialists in AI development and business strategy, office space at Station F in Paris, and introductions to investors and potential customers. The program culminates in a demo day where startups pitch to investors and media.

Can non-European founders participate in F/ai?

F/ai is specifically designed for European founders building AI startups, though the exact eligibility requirements haven't been publicly detailed. The program's focus on European AI development and its location in Paris suggest preference for founders based in Europe or planning to base their startup in Europe. However, for specific eligibility questions, interested founders should contact Station F directly. The program is ultimately more geographically restricted than truly global accelerators like Y Combinator or Techstars.

How does developer lock-in work with F/ai?

When startups spend three months building intensively on a particular foundation model (like Claude or GPT-4), switching to a different model later becomes increasingly costly. Developers invest time in learning the model's specific behaviors, optimize their prompts for that model, build workarounds for its limitations, and structure their entire product around that model's capabilities. The longer a startup uses a model, the more entrenched the dependency becomes. This dynamic, explained by VC Marta Vinaixa, means that F/ai's credits effectively incentivize startups to build lock-in to the participating platforms. The AI labs get early developer relationships that are difficult to break later.

What are typical applications F/ai startups are building?

F/ai startups build AI applications across many verticals: customer service automation, sales and marketing tools, content generation platforms, developer tools, data analysis systems, healthcare and scientific applications, financial analysis platforms, and procurement automation. These aren't new foundation models but rather applications solving specific problems using foundation models as a component. A startup might use Claude to analyze customer support tickets, or GPT-4 to generate marketing copy, or Llama to build a specialized vertical tool. The category is so broad because foundation models are applicable to nearly every business process that involves language, reasoning, or data analysis.

Will F/ai make European AI startups competitive globally?

F/ai is a significant step but not a complete solution to European AI startup challenges. The accelerator removes infrastructure barriers (access to compute and APIs), provides business guidance, and creates community. But it doesn't directly solve structural challenges: European venture capital is less available than American venture capital, brain drain remains a risk (successful startups get acquired by larger companies), and regulatory complexity adds overhead. F/ai should improve the success rate of European AI startups and accelerate their time to revenue, but whether it makes European AI startups competitive with American and Chinese startups at the mega-scale level (raising Series C and beyond) depends on complementary support from European venture capital markets, regulation, and government policy.

Why would rival AI companies cooperate on an accelerator?

Despite public competition on models and products, OpenAI, Anthropic, Google, and other AI labs have aligned interests in building a healthy AI ecosystem. Each company benefits when developers learn their platform, build products on their models, and become locked into their ecosystem. An accelerator ensures a steady pipeline of founders making early technology choices. Additionally, participating in F/ai allows these companies to build political goodwill in Europe as AI regulation develops, position themselves as partners in European AI development, and secure early access to promising startups as potential acquisition targets. The cooperation is strategic, not altruistic, but it's genuine cooperation nonetheless.

How is F/ai funded if startups don't receive cash investments?

F/ai is funded through in-kind contributions from the participating companies. OpenAI, Anthropic, Google, Meta, Microsoft, and Mistral all contribute API credits, compute resources, and engineer time for mentorship. Cloud and hardware partners like AWS, AMD, and Qualcomm contribute computing resources and priority support. This means F/ai operates with minimal cash burn: Station F provides the facility and administrative staff, while the tech companies provide the product credits and expertise. This model is efficient for the AI labs because they're essentially allocating resources they already produce (API access, compute resources) rather than writing checks to an external entity.

What happens after F/ai? Can startups stay in Europe?

After the three-month program concludes, startups can stay in Europe if they choose. Station F provides post-program support, and successful startups might raise Series A funding from European VCs or global investors who attended demo day. However, historically, successful European tech startups have relocated to the US to raise larger funding rounds and scale globally. The risk is that even if F/ai graduates successful startups, they eventually move operations to the US or get acquired by American tech companies, limiting the long-term impact on European AI capability. Addressing this requires complementary support from European venture capital and policy frameworks that make staying in Europe economically viable for rapidly scaling startups.

Key Takeaways

- F/ai marks the first time major AI rivals (OpenAI, Anthropic, Google, Meta) have jointly partnered on a single accelerator, signaling that ecosystem cooperation is valuable even amid fierce competition

- European AI startups receive $1M+ in credits for API access and compute resources rather than direct funding, incentivizing them to build on the participating foundation models and creating developer lock-in

- The program addresses a real gap: European AI startups are reaching $1M revenue milestones slower than American counterparts, a barrier F/ai targets through its "rapid commercialization" curriculum

- Developer lock-in dynamics mean that startups beginning to build on Claude or GPT-4 early become increasingly dependent on those platforms as they optimize APIs and build workarounds over time

- F/ai signals Europe's commitment to building independent AI capability and competes with American accelerators like Y Combinator for founder talent by offering specialized AI expertise and avoiding forced relocation

Related Articles

- Thomas Dohmke's $60M Seed Round: The Future of AI Code Management [2025]

- OpenAI's ChatGPT Ads: What It Means for AI's Future [2025]

- Venture Capital Split Into Two Industries: SVB 2025 Report Analysis [2025]

- Tech Billionaires At Super Bowl LIX: Inside Silicon Valley's $50K Power Play [2025]

- Epstein's Silicon Valley Network: The EV Startup Connection [2025]

- xAI Founding Team Exodus: Why Half Are Leaving [2025]

![AI Rivals Unite: How F/ai Is Reshaping European Startups [2025]](https://tryrunable.com/blog/ai-rivals-unite-how-f-ai-is-reshaping-european-startups-2025/image-1-1770808135561.jpg)