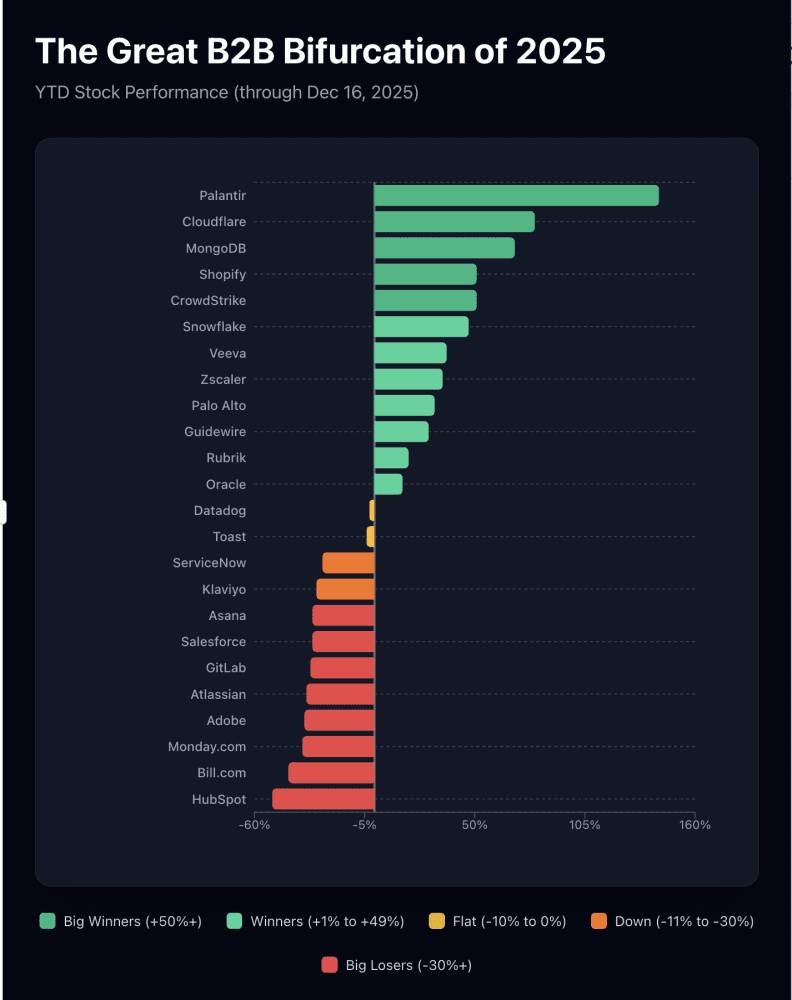

The Venture Capital Market Just Split Into Two Completely Different Industries

Last week, Silicon Valley Bank released their 2025 State of the Markets report, and honestly, it's the most data-rich snapshot of the startup ecosystem I've seen in years. We're talking 39 pages of raw numbers, trends, and structural shifts that tell you everything you need to know if you're building, funding, or advising a SaaS company in 2025.

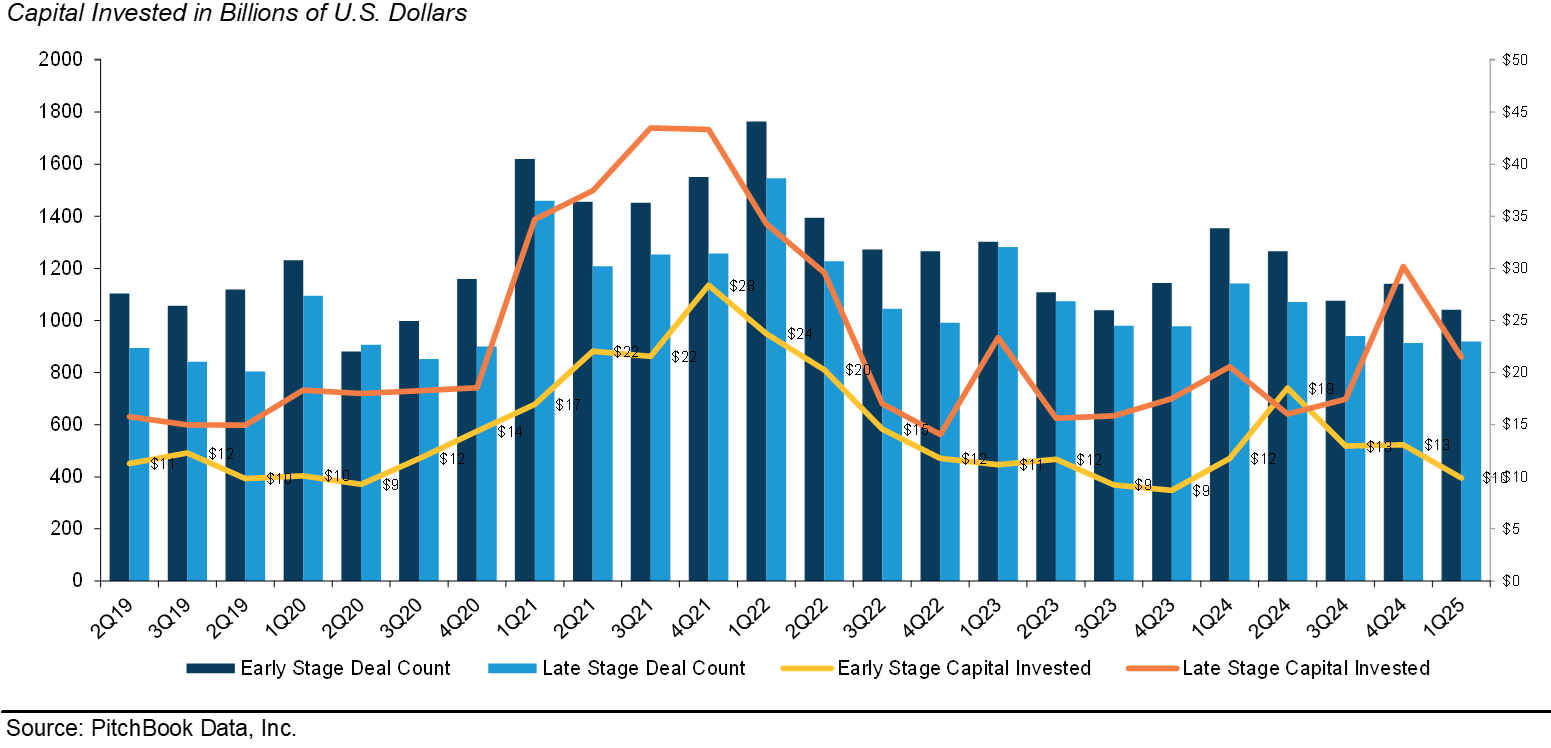

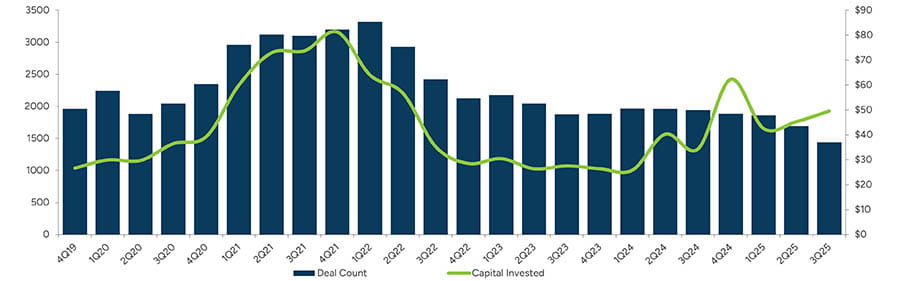

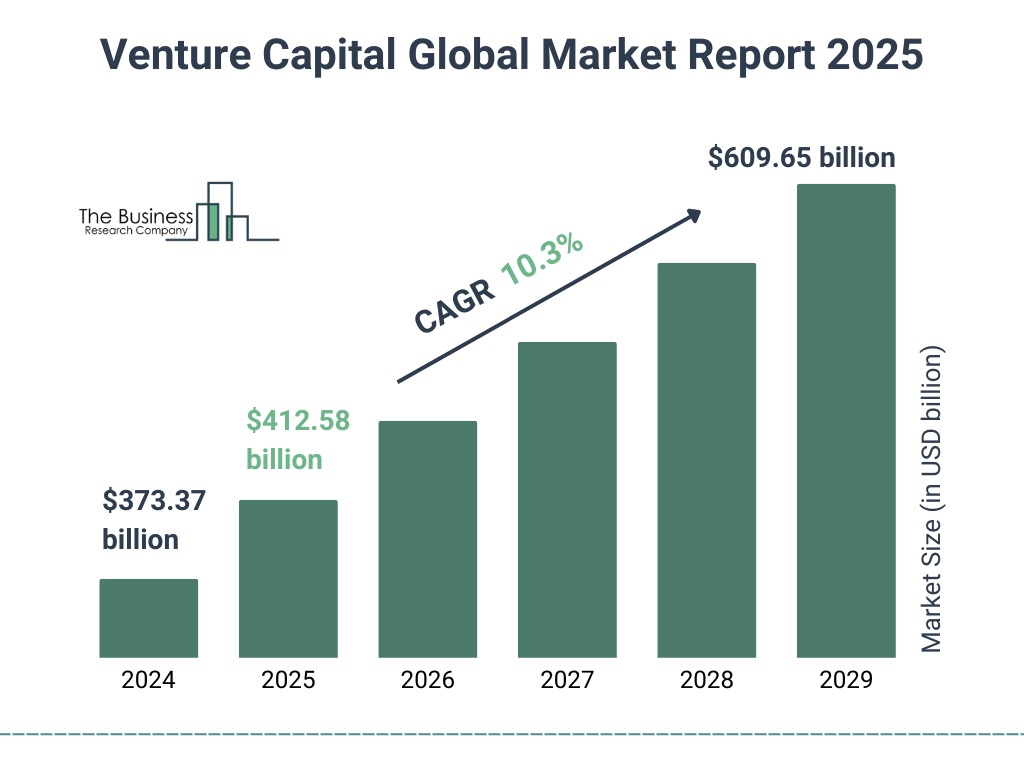

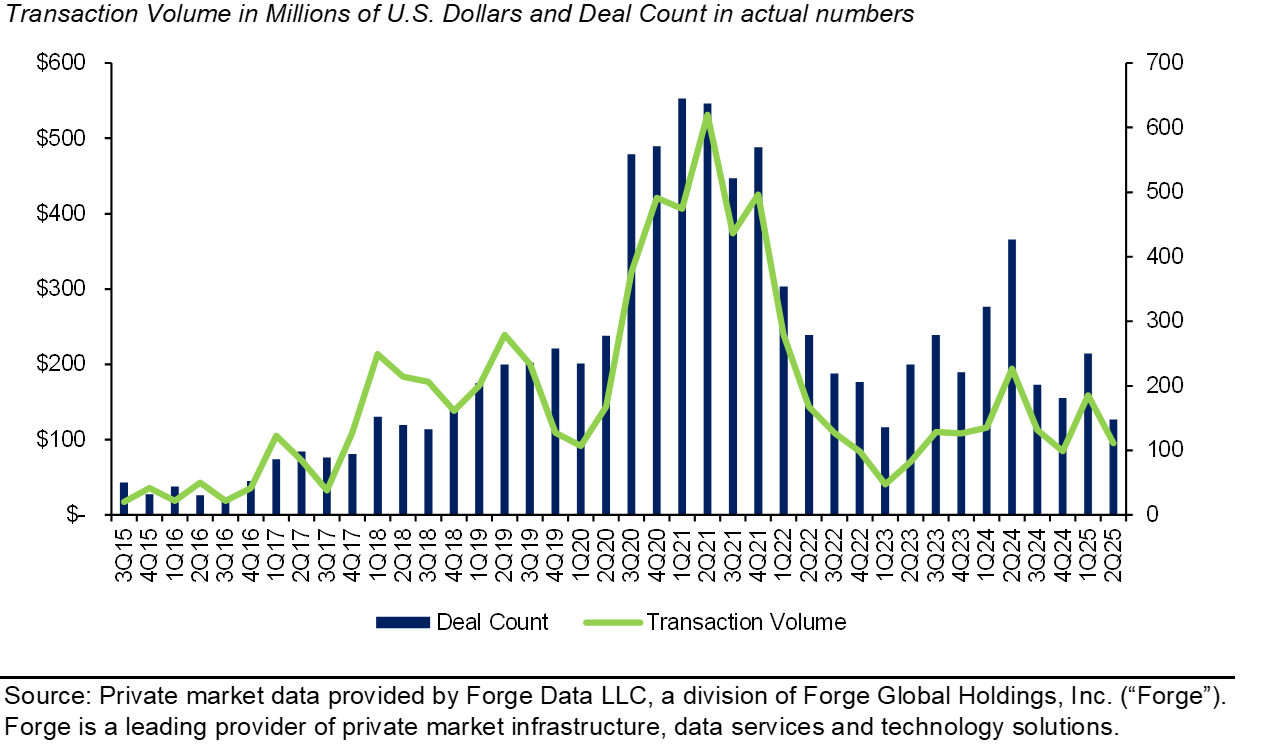

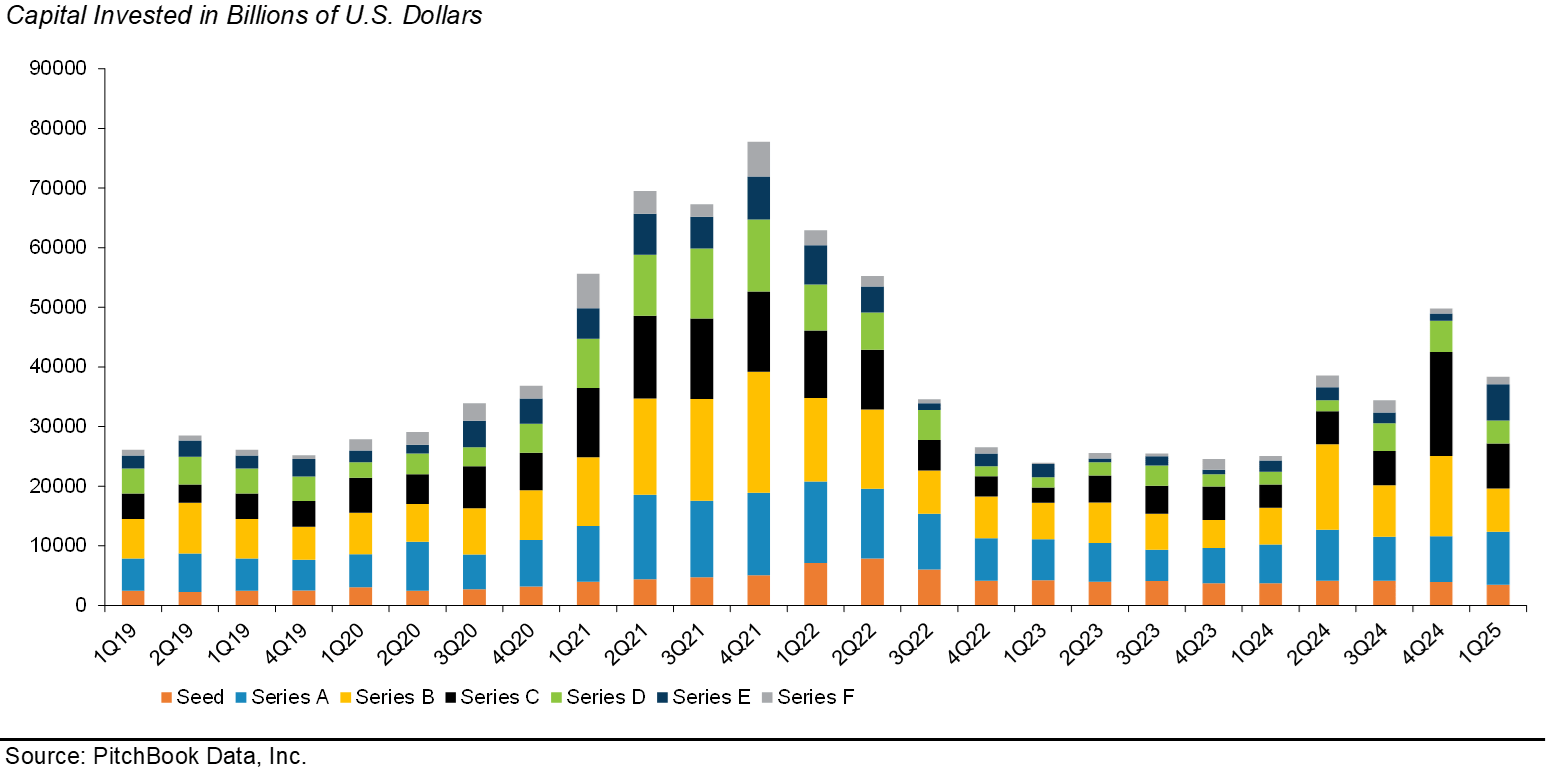

Here's the thing: the headline numbers look incredible. Nearly $340 billion flowed into US VC-backed companies last year—the second-highest amount ever recorded. Sounds amazing, right? But dig deeper, and you'll see something that fundamentally changes how founders should think about raising capital.

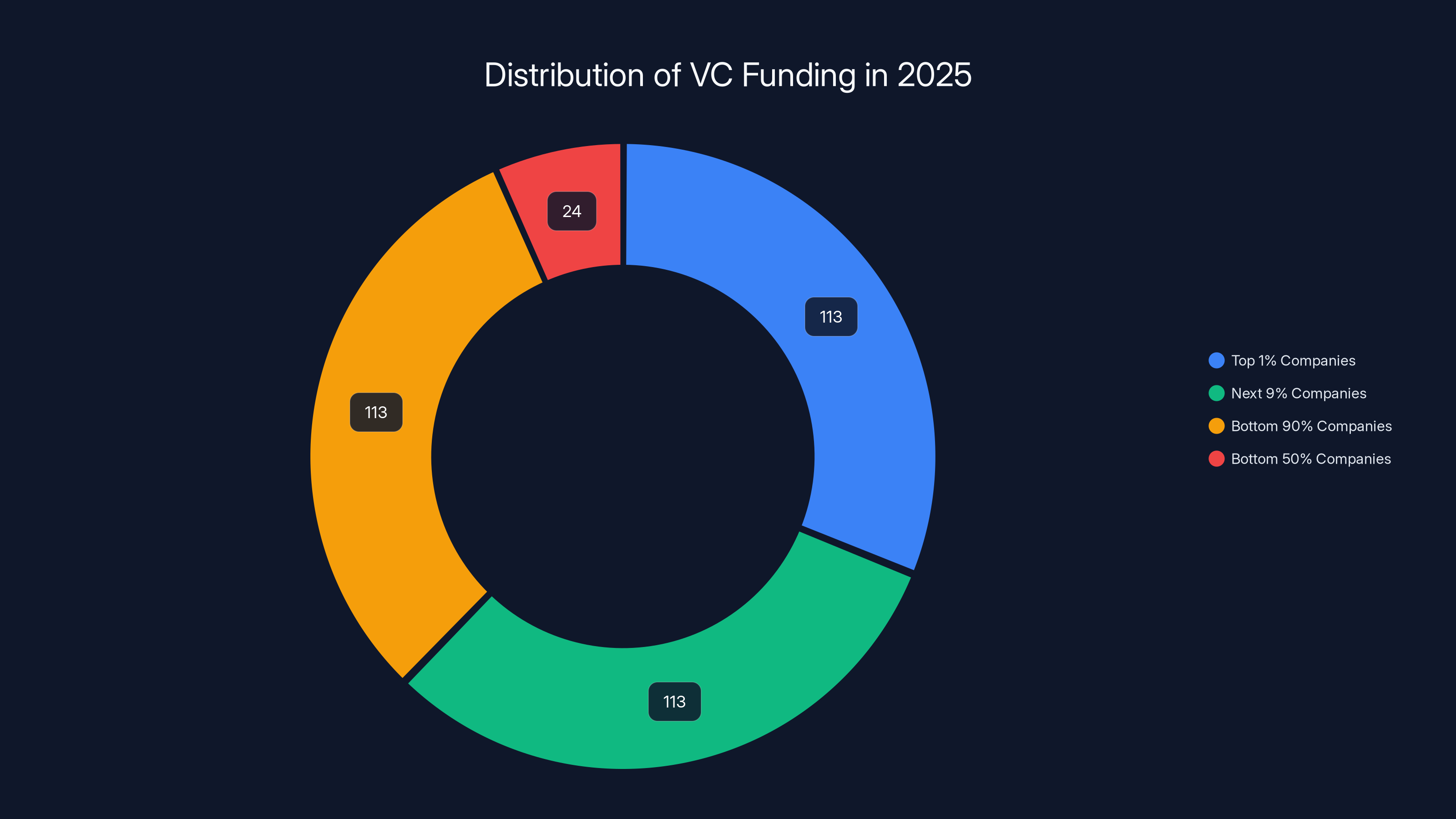

The top 1% of companies by valuation captured a full third of all that capital. The bottom 50% got just 7%. Meanwhile, the number of deals actually fell 15% year-over-year even as dollars invested jumped 53%.

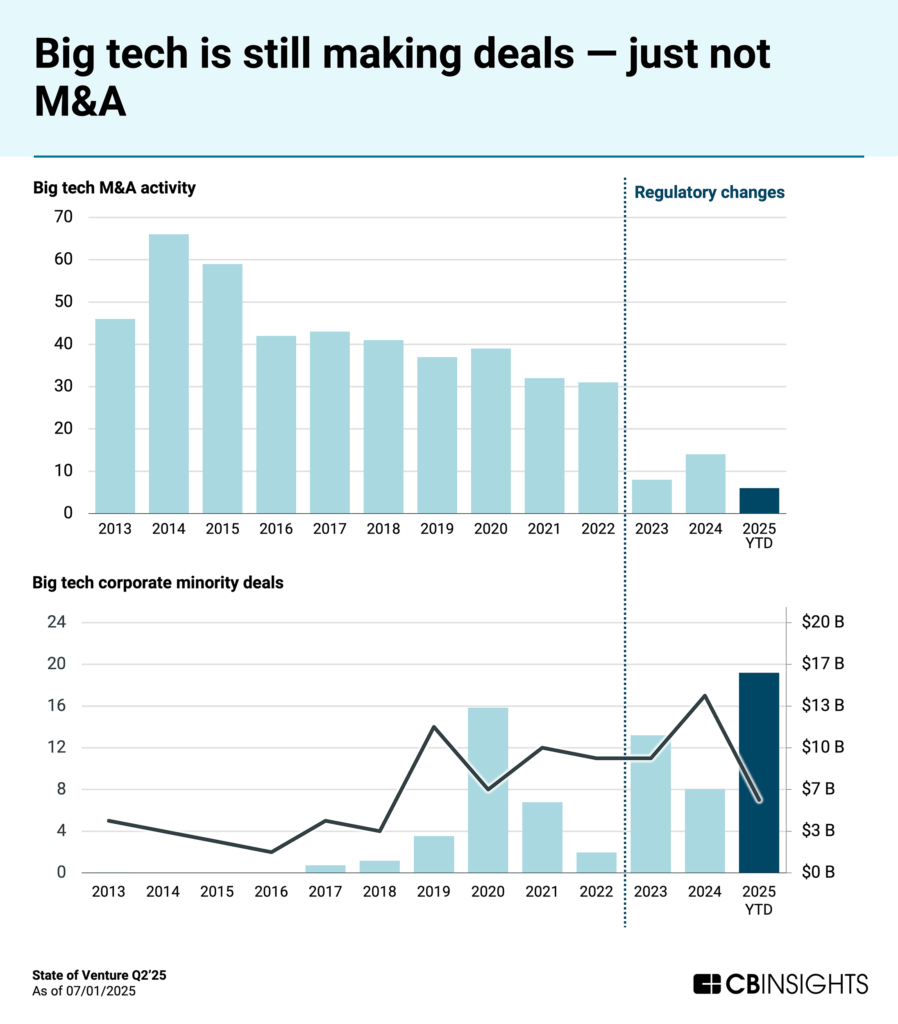

What you're witnessing isn't a healthy VC market. It's a market that has bifurcated into two entirely separate industries operating under the same label. At the top, there's late-stage private asset management—billion-dollar checks flowing into Series H and Series J rounds for OpenAI, Databricks, and a handful of other mega-unicorns. These funds generate returns primarily through management fees, not carried interest. At the bottom, there's still traditional early-stage venture, where founders are scrapping for $5M Series A rounds in a genuinely difficult fundraising environment.

If you're outside the AI mega-round club, those headline numbers about "record VC investment" have almost nothing to do with your reality. And understanding this split is critical to planning your fundraising strategy for 2025 and beyond.

Let me walk you through the 10 biggest takeaways from SVB's report and what they actually mean for your company.

TL; DR

- VC has split into two industries: Mega-rounds for AI companies capture 33% of all capital, while the bottom 50% get just 7%

- Higher bars, slower growth: Median Series A revenue is now $2.5M, but top-quartile growth rates have been cut in half since 2021

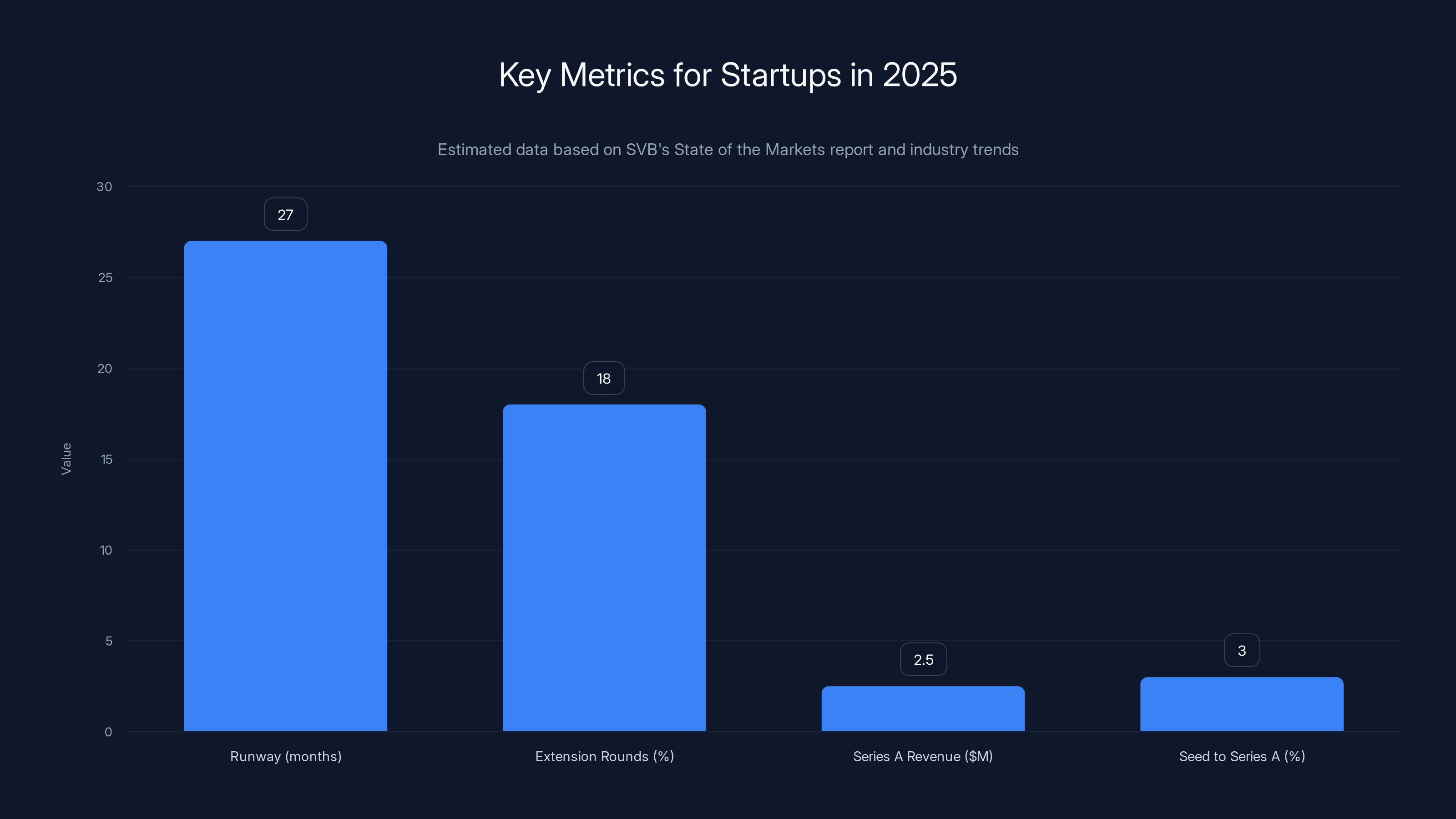

- Extension rounds are mainstream: Nearly 18% of Series A deals in 2025 involved founders who previously did a seed extension

- AI valuations showing bubble signs: The top five AI unicorns are worth $1.2 trillion, exceeding the entire dot-com IPO era by inflation

- Graduation rates have collapsed: Only 3% of seed companies reach Series A within 12 months, down dramatically from 2021

- Series B funding environment is brutal: The median company raising Series B has been burning cash faster than historical norms

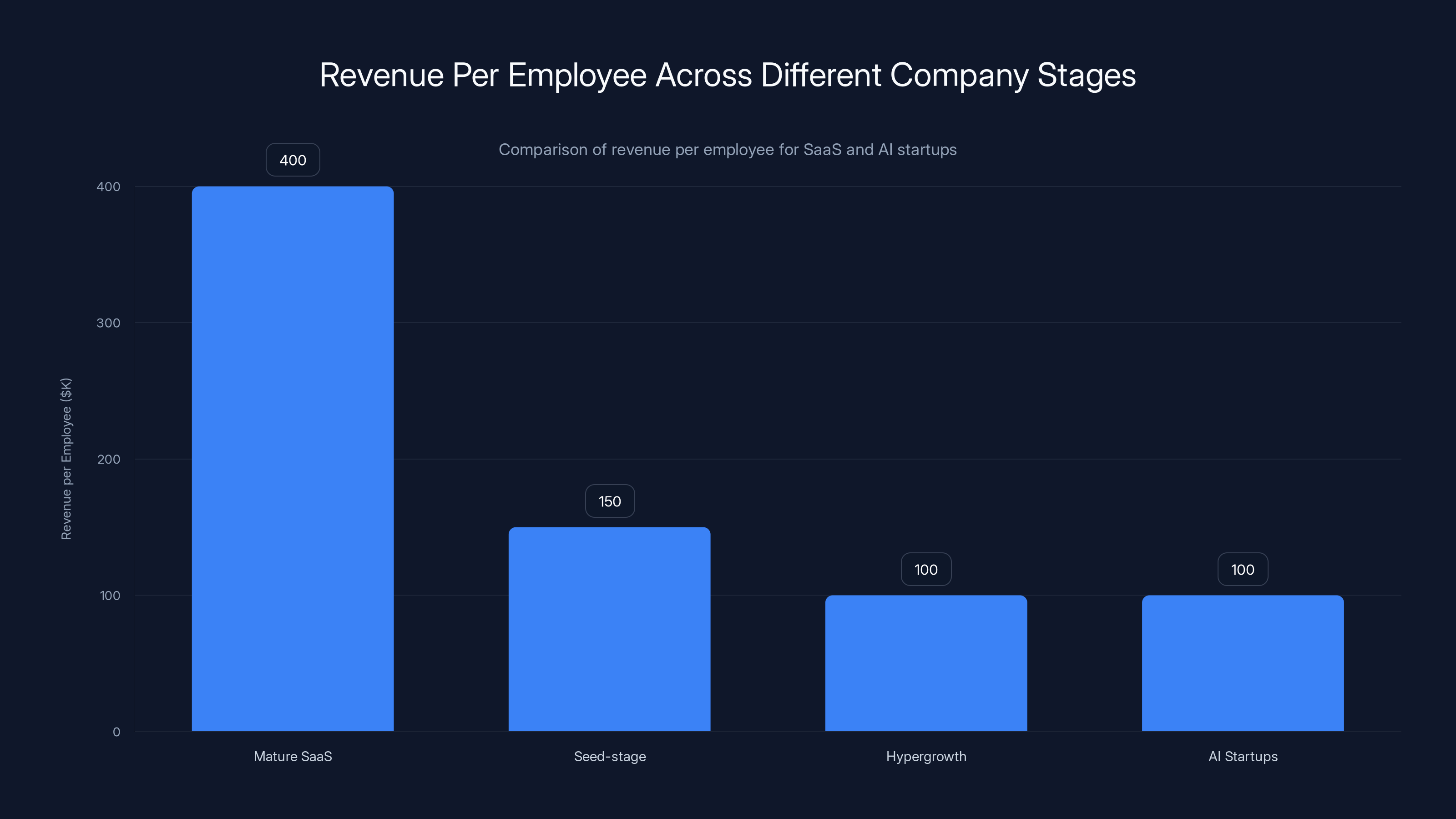

- Revenue per employee is declining: AI startups show concerning burn multiples and unit economics

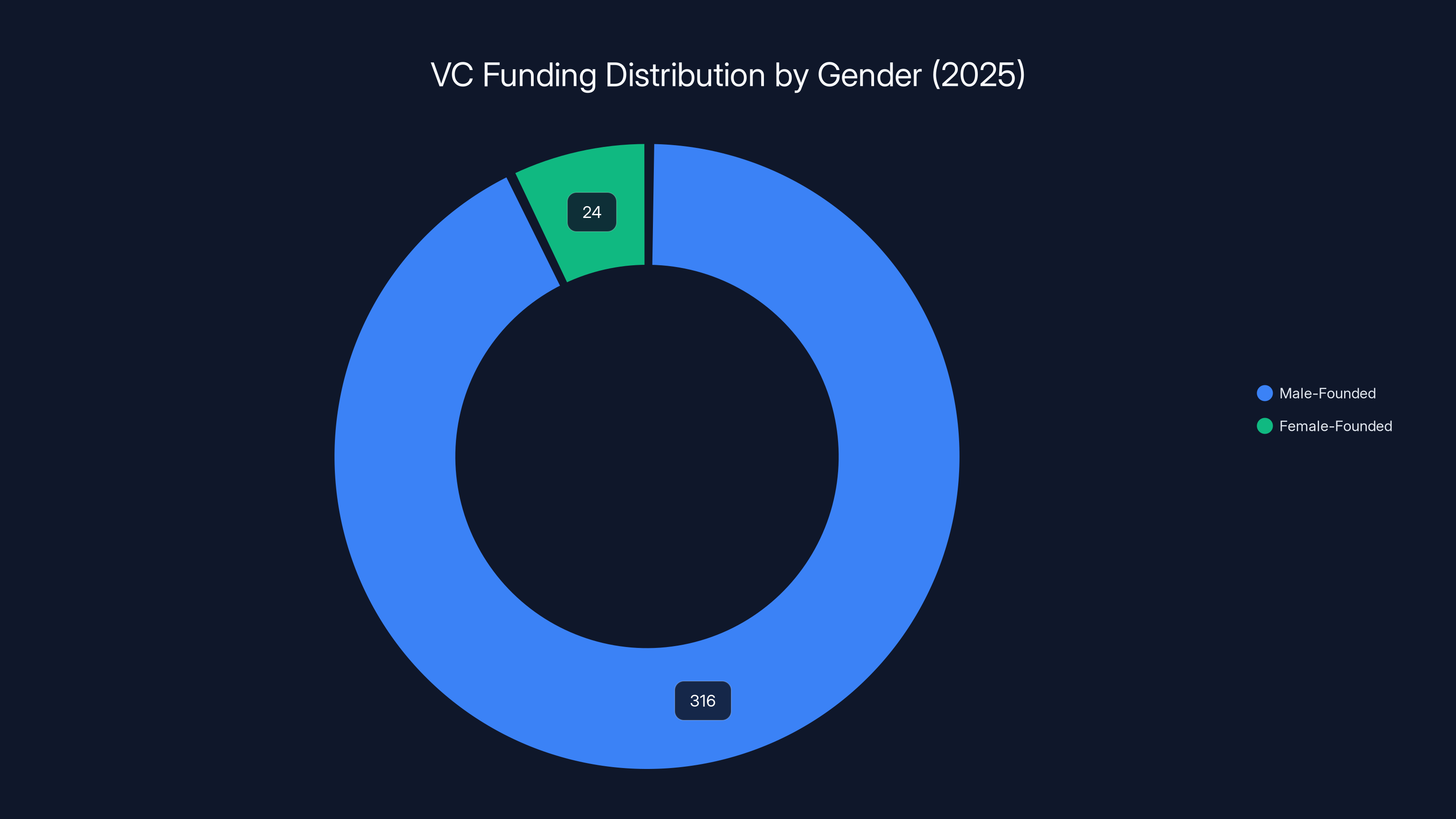

- Female founders getting less capital: Women founders saw only a 5% increase in dollars raised despite overall market growth

- Geographic concentration is extreme: Bay Area, New York, and Los Angeles capture 48% of all VC dollars

- Profitability has become attractive: More founders are talking about path-to-profitability instead of hypergrowth

In 2025, seed-stage companies should plan for 27 months of runway, with 18% using extension rounds. The median Series A revenue is $2.5M, and only 3% of seed companies reach Series A within 12 months. Estimated data.

#1: VC Has Officially Split Into Two Completely Separate Industries

This is the single most important structural shift in the entire report, and it affects everything downstream. The $340 billion headline obscures a brutal reality: the venture capital market is no longer one market. It's two markets that happen to use the same term.

Let me break down the numbers. In 2025, approximately

But here's where it gets worse. The bottom 50% of companies received only $24 billion total. That's 7% of the entire market. Meanwhile, deal volume fell 15% year-over-year. So fewer companies are raising capital, and those that do are fighting over scraps while mega-rounds absorb the lion's share.

What's happening is that mega-round investors have fundamentally different economics. A fund that's raising

Meanwhile, traditional early-stage venture is squeezed. A Series A fund needs portfolio returns to hit 10x or better. But if your portfolio companies are growing slower and taking longer to exit, hitting those targets becomes mathematically harder. So they raise larger cheques per company, write fewer deals, and focus on revenue benchmarks rather than user growth.

The Two Industries in Practice

Industry One: Late-Stage Private Asset Management

This operates at scale. Series H, I, J, K rounds. Companies are already profitable or very close. These are often government-backed or strategically important (AI, semiconductors, biotech). The returns come from management fees on $1-2 billion funds, plus occasional liquidity events. This is where you see Saudi Vision Fund, Abu Dhabi's ADIA, and other sovereign wealth players entering.

Industry Two: Early-Stage Venture

This is the traditional model. Seed to Series B. Companies are pre-revenue or early revenue. Investors need 3-5 year exits. Fund sizes are smaller ($200-500M), but management fees alone don't work. They need carried interest. And to get carried interest, they need returns. This is where founders raising Series A rounds are living right now, and the market is hard.

The key insight: if you're a founder outside the AI mega-round space, stop assuming the headline numbers apply to you. They don't. Plan for a 24-30 month fundraising cycle with higher revenue benchmarks and slower growth expectations.

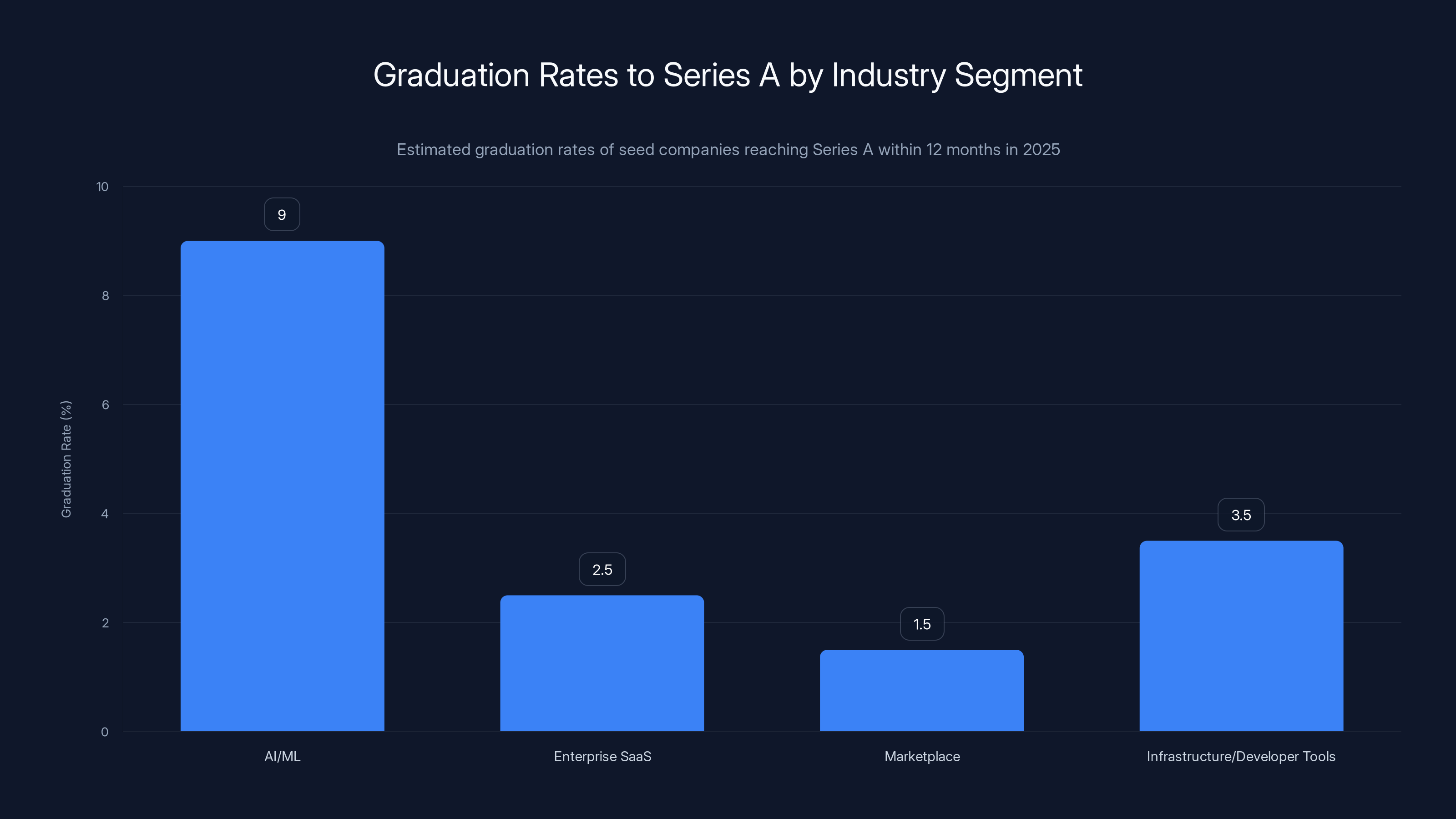

AI/ML companies have the highest graduation rate to Series A at around 9%, while Marketplace companies have the lowest at 1.5%. Estimated data.

#2: The Revenue Bar to Raise Your Next Round Is Higher Than Ever

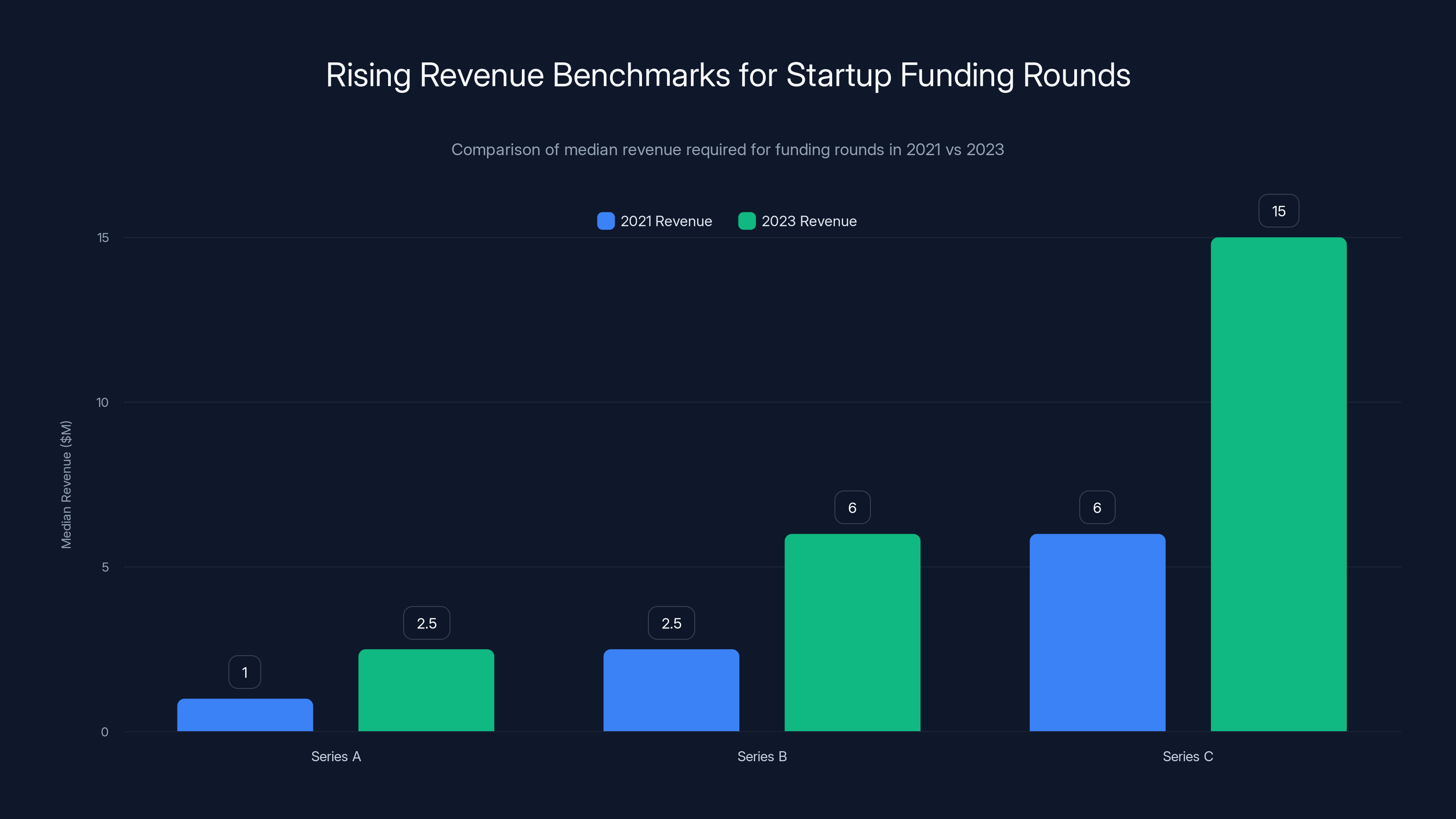

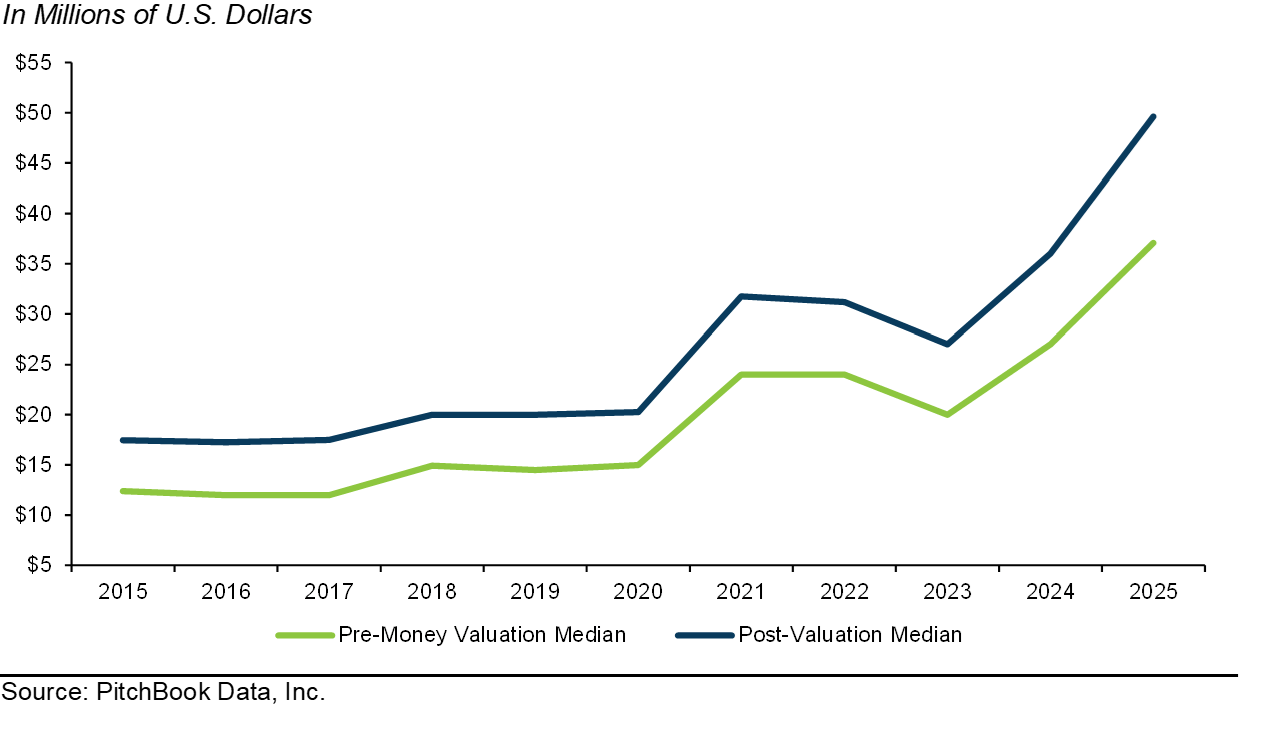

Here's the compounding challenge that's quietly crushing a lot of startups right now. SVB's proprietary data shows that median revenue at time of raise has increased substantially across every series compared to 2021. This isn't just inflation talking. This is founders needing to demonstrate more business fundamentals before accessing capital.

Let's look at the numbers:

- Median Series A: Now raising at around **1M in 2021)

- Median Series B: Now at **2-3M in 2021)

- Median Series C: Now at roughly **5-7M in 2021)

That alone would be a manageable shift. Founders would just need to prove more traction before raising. That's actually healthy.

The problem is compound: top-quartile revenue growth rates have been cut roughly in half since 2021 at every stage. This is devastating.

- Seed-stage top-quartile growth: Dropped from 960% to 320% year-over-year

- Series A top-quartile growth: Dropped from 480% to 165%

- Series B top-quartile growth: Dropped from 240% to 125%

So you need more revenue to raise your next round, but you're growing slower getting there. If you're a seed-stage company and you grew 320% in 12 months (which is exceptional by modern standards), you're now at

What This Means for Your Runway

The old playbook said: raise seed funding, give yourself 18 months of runway, and raise Series A. That timeline assumes you'll hit growth benchmarks and have a clear path to the next round.

That doesn't work anymore. You need to extend your runway to 24-30 months minimum. Here's why: if you're growing slower, you need more time to reach higher revenue benchmarks. If you run out of money before hitting those benchmarks, you're negotiating from a position of weakness (which often means a down round or shutting down).

This also means being brutally honest with yourself about whether you're tracking to the revenue benchmarks for your next round. Don't assume you'll hit them. Calculate them. If you're 12 months into a 30-month runway and you're 30% of the way to your Series A revenue target, you won't make it. Time to think about pivot, extension round, or profitability.

#3: Extension Rounds Have Become the New Normal (And That's Actually OK)

Three years ago, extension rounds were stigmatized. They meant your Series A fundraise flopped. They meant you'd failed. Investors didn't want to signal that they'd backed a failed round.

That's completely changed. Extension rounds are now mainstream, and SVB's data shows they're actually a smart strategic move in the current environment.

Here's the data: nearly 18% of all Series A deals completed in 2025 were raised by companies that had previously done a seed extension round. That's not a small number. That's one in five Series A companies using extension rounds as a stepping stone.

What changed? The math changed. When you're growing slower but facing higher benchmarks, an extension round becomes a rational bridge strategy. Instead of raising a full Series A at a discount (which dilutes everyone and signals weakness), you raise an extension from existing investors at a reasonable valuation, buy yourself 6-12 more months of runway, and come back to raise Series A from a stronger position.

SVB found that the median return per dollar invested from an extension round to the next series is only about

When Extension Rounds Make Sense

Extension rounds make sense when you're 60-70% of the way to your next-round benchmarks and you have strong investor relationships. Your existing seed investors understand your business. They know you're not a failed company—you're just growing slower than expected (because everyone is).

Don't frame an extension as a failure. Frame it as a tool. You're buying time to hit higher benchmarks without raising capital at a punitive valuation. That's smart capital strategy.

Extension rounds don't make sense if you're 30% of the way to benchmarks or if you don't have strong investor relationships. At that point, you're either pivoting (and should be honest about it), or you're raising at a discount (which means you need to go big with new investors, not ask for more from existing ones).

The Valuation Question

One thing founders always ask: what valuation should we use for an extension round? SVB's data doesn't give exact guidance, but the market convention is: use a valuation that's 10-20% higher than your seed round. Not 50-100% higher (which would be a primary round). Just enough to show progress without creating expectations that you've solved the core problem.

If you raised seed at a

AI startups show lower revenue per employee (

#4: AI Valuations Are Real—But the Bubble Signals Are Unmistakable

Let's talk about the elephant in the room: AI valuations. SVB makes a striking comparison that puts things in perspective.

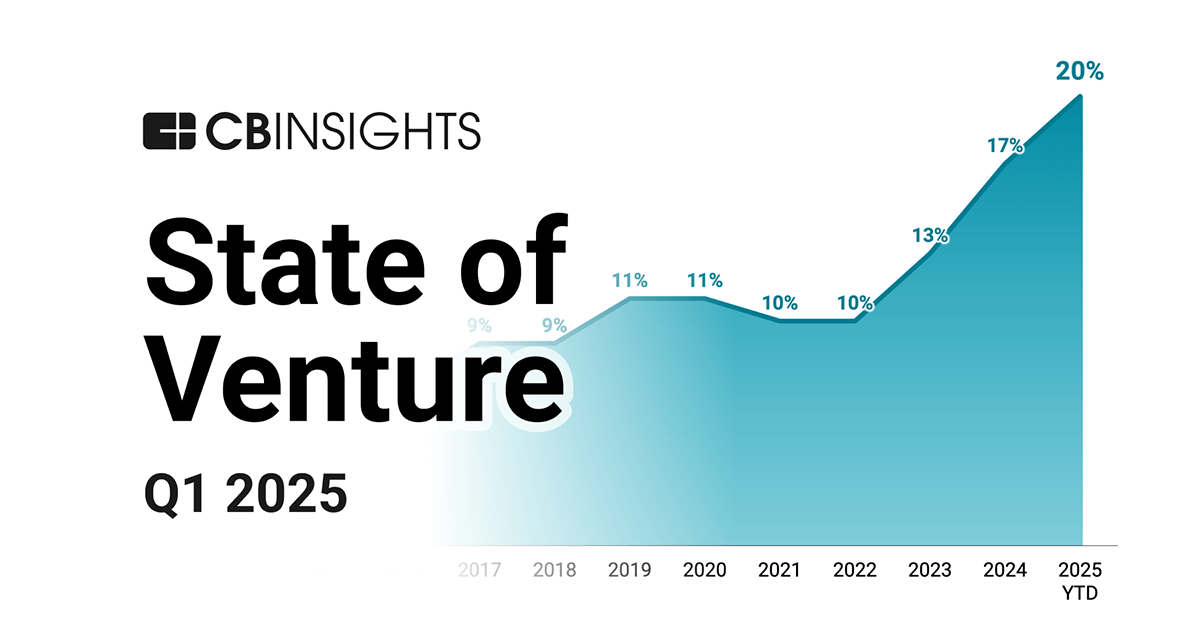

The top five AI unicorns (OpenAI, x AI, Anthropic, Databricks, and Scale AI) are collectively worth more than $1.2 trillion. Let that number sink in. That exceeds the total market value of every single IPO during the entire dot-com era, adjusted for inflation.

Total AI venture investment since 2022 has hit $560 billion. That roughly matches the entire dot-com era's VC deployment across the full decade. We've compressed what took ten years of the dot-com boom into four years of AI hype.

The valuations aren't baseless. OpenAI has legitimate enterprise adoption. Anthropic's Claude is being integrated into enterprise workflows. Databricks is becoming infrastructure. These companies are doing real business.

But SVB also notes clear signs of overexuberance in AI:

- Elevated burn multiples: Many AI startups are burning through capital at 2-3x the rate of non-AI startups at the same stage

- Low revenue per employee: Some AI companies have 50K-100K revenue per employee. That's an inverted unit economics problem

- Unrealistic path-to-profitability assumptions: Many business plans assume pricing power that hasn't materialized

- Winner-take-most dynamics emerging: The top 10 AI companies are capturing disproportionate share of enterprise adoption

What's Different From Dot-Com

It's important to note that the parallels to dot-com aren't perfectly symmetrical. Unlike dot-com companies, many of today's AI companies have:

- Actual revenue (not just user growth)

- Defensible moats (trained models, proprietary data)

- Clear business models (API pricing, seat-based licensing)

- Enterprise willingness to pay

But the economic warning signs are there. When a company can raise

The Real Risk

The real risk isn't that AI is overhyped. It's that capital is flowing to winner-take-most dynamics faster than ever before. OpenAI, Anthropic, and a handful of others will likely emerge as structurally important companies. But hundreds of other AI startups won't. And they're raising capital at valuations that assume they will.

For founders in AI, that means: focus obsessively on unit economics. Don't assume continued capital availability. Many AI startups will run out of money when Series C funding gets harder in 2026-2027.

#5: Graduation Rates Have Collapsed—Only 3% of Seed Companies Reach Series A in 12 Months

This is one of the most concerning numbers in the entire report. In 2021, roughly 10-12% of seed-funded companies reached Series A within 12 months. That's still a minority, but it represented a healthy number of fast-moving, VC-viable companies.

In 2025, that number has dropped to just 3%.

Think about what that means. If you raise a seed round, you have only a 3% chance of being VC-ready for Series A within a year. You're almost certainly going to need 18-24+ months between seed and Series A. That's a massive timeline shift.

Why? Because the higher revenue benchmarks for Series A mean founders need more time to build traction. You can't hit $2.5M in revenue in 12 months if you're starting from zero and growing at "only" 320% year-over-year (which is still exceptional). The math doesn't work.

What This Changes About Seed Strategy

The old venture playbook assumed a 12-month cycle from seed to Series A. That entire paradigm is broken. Founders should now assume a 18-24 month cycle, which means:

- Seed rounds need to be sized for 24+ months of runway, not 18

- You should raise more capital per round to account for longer timelines

- Be very conservative about hiring, since you have more time to reach milestones

- Focus on revenue metrics early, not just user growth, because investors will care about both

This also explains why extension rounds are now common. With a 24-month seed-to-Series A timeline, you often need to bridge the gap between your initial seed capital and your Series A. Extensions fill that gap naturally.

The Segmentation

SVB's data also shows that this collapse isn't uniform. Some segments graduate faster:

- AI/ML companies: ~8-10% graduate to Series A in 12 months (still significantly higher than others)

- Enterprise SaaS: ~2-3%

- Marketplace companies: ~1-2%

- Infrastructure/developer tools: ~3-4%

If you're building AI infrastructure or developer tools, you have slightly better odds. But even then, most companies need more than 12 months.

In 2025, the top 1% of companies captured

#6: Series B Funding Is Getting Brutal—High Cash Burn and Longer Runways

If seed and Series A are hard, Series B is getting genuinely brutal. SVB's data shows something alarming: the median Series B company today is burning cash faster than historical norms, while also raising at lower valuation multiples.

Let's break this down. The median Series B company raises roughly

The median Series B company is burning **

Historically, Series B companies could expect Series C funding 12-18 months later. But Series C rounds have gotten harder to access. The path to Series C requires hitting much higher revenue benchmarks (we covered this earlier). Many Series B companies are going to run out of money before they're Series C-ready.

The Series B Trap

This creates a structural problem: Series B companies are stuck in the middle. They're too mature for seed investors. They're too immature for late-stage venture. They're burning cash too fast to profitability. And they can't access Series C capital because they're not hitting the revenue benchmarks.

What's the escape route? A few options:

- Extend your Series B runway by cutting burn: This is the boring-but-effective solution. Cut headcount, focus on revenue over growth, and extend your runway to 18-24 months

- Raise a larger Series B: Instead of 35-40M. This buys you more time to hit Series C benchmarks

- Find strategic funding: Corporate venture capital, strategic investors, or debt financing can bridge the gap

- Pursue profitability: Many Series B companies in 2025 are saying goodbye to "growth at all costs" and focusing on path-to-profitability instead

SVB's data shows option 4 is increasingly popular. More founders are talking about profitability than at any point since 2015.

#7: Revenue Per Employee Is Declining—A Red Flag for Unit Economics

One metric that's particularly concerning in SVB's report is revenue per employee. This is a simple measure: take your annual revenue, divide by number of employees, and you get revenue per person.

For most mature SaaS companies, a healthy benchmark is **

But many AI startups are showing revenue per employee of only $50K-150K despite being 4-6 years old and well-funded. That suggests they're burning capital on headcount without matching revenue growth.

SVB attributes this to a few factors:

- Hiring ahead of revenue: AI startups raised capital so easily that they hired aggressively before proving unit economics

- Compute costs: AI companies have massive infrastructure costs that don't show up as "headcount" but still burn capital

- R&D intensity: Many AI startups are spending heavily on research without clear near-term revenue

- Low-margin business models: Some AI companies have APIs priced at commodity rates, making it hard to reach healthy margins

What This Means

Revenue per employee is a leading indicator of whether a company will be able to fund itself. If you're at $50K revenue per employee and you're at Series B/C stage, you have a math problem. You need to either:

- Cut headcount: Reduce your team to improve the ratio

- Increase pricing: Get customers to pay more per dollar of consumption

- Improve sales efficiency: Get your sales and marketing to convert more efficiently

- Target profitability: Accept slower growth in exchange for better unit economics

The companies that improve this metric in 2025-2026 will survive. The ones that don't will run into Series C or D funding challenges.

The median revenue required to raise Series A, B, and C funding has increased significantly from 2021 to 2023, indicating higher expectations for startups to demonstrate business fundamentals.

#8: Female Founders Got Left Behind—Funding Gap Widening

Here's a trend that's concerning for diversity in tech: female-founded companies saw only a 5% increase in total dollars raised in 2025, despite overall market growth of 53%.

In absolute terms, female founders accessed roughly

Why is this happening? SVB's research suggests a few factors:

- Geographic concentration: Female founders are more concentrated in geographies with less VC capital (not concentrated in Bay Area, NYC, Boston)

- Sector bias: Female founders skew toward healthcare, education, and B2C startups, while capital is flowing to AI and enterprise software

- Network effects: VC funding still follows networks, and senior VC partners are disproportionately male

- Unconscious bias in fundraising: Studies show female founders are asked different questions in pitches (risk questions vs. growth questions)

The data also shows that female-founded companies are raising smaller Series A rounds (median of

What's Actually Happening

The venture capital market isn't actively discriminating against female founders (though there's likely unconscious bias). It's that capital is flowing to AI/infrastructure, where representation is particularly skewed toward male founders. Female founders are concentrated in other sectors that are getting less capital.

For female founders building in competitive spaces (B2C, marketplace, consumer apps), the capital environment in 2025 is particularly harsh. You're competing for capital in a market where investors are chasing AI winners.

#9: Geographic Concentration Is Extreme—Bay Area, NYC, and LA Capture 48% of All Capital

VC capital has never been evenly distributed. But the concentration in 2025 is striking. Bay Area, New York, and Los Angeles combined captured approximately 48% of all VC capital. That's roughly

Breaking it down further:

- Bay Area (including Silicon Valley): ~$110-120 billion (32-35%)

- New York: ~$30-35 billion (9-10%)

- Los Angeles: ~$20-25 billion (6-8%)

- Everything else in the US: ~$170 billion

What's interesting is that "everything else in the US" is massive geographically, but diluted across 47 other states, dozens of cities, and hundreds of individual markets.

The Secondary Markets

Outside the top three metros, there are pockets of strong venture activity:

- Austin: ~$8-10 billion (concentrated in crypto, hardware, enterprise software)

- Boston: ~$6-8 billion (biotech, enterprise software)

- Seattle: ~$5-7 billion (cloud infrastructure, gaming)

- Denver: ~$2-3 billion (enterprise software)

- Miami: ~$1-2 billion (fintech, growth stage)

But these are still small relative to the Big Three. And many of these markets are dominated by a handful of mega-rounds. If you're a seed-stage company in Austin or Denver, you're still competing for capital in a market where mega-rounds absorb capital faster than traditional venture deals.

What This Means for Non-Bay Area Founders

If you're building outside the Big Three metros, you need to be realistic about your fundraising timeline and source. You might get a seed round locally (from regional angel networks or early-stage funds). But Series A and beyond, you'll likely need to pitch investors in Bay Area, NYC, or LA.

This creates a friction point: you're building a company in Denver, but you need to spend a week a month in San Francisco for investor meetings. That's expensive and disruptive.

Alternatively, some founders are finding success with:

- Remote-first pitch processes: Some VCs are now doing Series A funding entirely remotely

- Regional VCs: Funds like Techstars, 500 Startups, and others have distributed networks

- Strategic investors: Corporate venture capital and strategic investors are often less geographic-dependent

But the reality is that if you're fundraising and not in Bay Area, NYC, or LA, you're fighting upstream.

In 2025, female-founded companies received approximately

#10: Profitability Is Suddenly Attractive—Growth-at-All-Costs Is Dead

This is perhaps the most important psychological shift in the 2025 market: founders and investors are having serious conversations about profitability.

For the last decade, the venture mantra was simple: "Growth at all costs. Profitability is for mature companies." Burn cash, acquire customers, scale, and worry about unit economics later.

That narrative is shifting. SVB's data shows that in 2025, more Series B and Series C founders are talking about path-to-profitability (18 months, 24 months, etc.) than at any point since 2015.

Why the shift? A few factors:

- Higher cost of capital: When capital was free (2020-2021), profitability didn't matter. When capital costs more (higher interest rates, harder fundraising), profitability becomes existential

- Slower growth rates: If you can't grow fast anymore, the case for burning cash weakens. Better to be profitable and slow than unprofitable and slightly less slow

- Shorter runway expectations: With fewer deals happening, founders need to plan for longer periods without access to capital. That requires profitability

- Valuations have compressed: When you can raise Series B at lower valuations, the upside of hypergrowth diminishes

What "Profitable" Means Today

When founders say "path-to-profitability," they're not talking about traditional accounting profitability. They mean:

- Unit-level profitability: Each customer generates positive cash flow (revenue minus cost of goods and direct customer costs)

- Operating profitability: Revenue minus operating expenses is positive or near-zero

- Cash flow profitability: You're not burning cash month-to-month

Many founders are targeting 18-24 month paths to cash-flow profitability. That's aggressive but achievable if you're disciplined about burn rate.

The Competitive Advantage

Here's an interesting dynamic: if you can hit profitability or near-profitability while still in growth phase, you have an extreme competitive advantage. You're no longer dependent on the venture capital markets. If capital dries up (as it did in 2022-2023), you can keep operating. Competitors who are raising capital every 12 months will struggle.

SVB's data shows that companies that reached profitability or near-profitability before Series C have significantly better outcomes in down markets.

The Bigger Picture: What This All Means for Your Fundraising Strategy in 2025

Let's connect all these dots. What should you actually do with this information if you're a founder or early-stage investor in 2025?

If You're Raising Seed

Raise for 24 months of runway, not 18. You're going to need longer to hit Series A benchmarks. Build relationships with investors who can support you through an extension round if needed. Don't optimize for raising fast. Optimize for raising the right amount of capital to hit your next milestone.

Focus on revenue early. If you can hit even $50K-100K MRR before Series A, you're in the top quartile. Revenue is what matters now, not vanity metrics.

If You're Raising Series A

Understand the new benchmarks. You probably need $1.5-2.5M in revenue. If you're below that, you're negotiating from weakness. Consider an extension round to buy time.

Don't assume you'll raise Series B. Plan for a 24+ month horizon from Series A to Series B. Build a business that could theoretically reach profitability if capital becomes unavailable. That's your downside protection.

Focus on founder-market fit and team. In a slower market, investors care more about the team and the problem the company is solving. They care less about growth rates and more about the quality of revenue growth.

If You're Raising Series B

You're in the danger zone. You have the highest chance of running out of money without access to Series C. Plan for a 18-24 month runway, not 12. Cut burn if necessary. Focus obsessively on revenue per employee and path to profitability.

Consider alternative capital sources: debt financing (venture debt is cheaper than equity at this stage), strategic investors, or corporate partnerships. Don't assume you can raise Series C just because you raised Series B.

If You're Investing

Recognize the bifurcation. You're either investing in mega-rounds (which is a different business model) or you're investing in traditional venture (which requires higher revenue benchmarks and more conservative assumptions).

Be patient with timelines. The companies that will return 10x are the ones that are building sustainable businesses, not necessarily the ones with the highest growth rates. Don't chase momentum. Chase fundamentals.

What SVB's Data Tells Us About 2026 and Beyond

Looking beyond 2025, what does SVB's report suggest about the coming years?

Capital Will Remain Concentrated

The mega-round phenomenon is structural, not cyclical. As long as AI development requires massive capital (GPUs, compute, talent), mega-rounds will continue. This means the top 1% of companies will keep capturing 30%+ of capital.

Growth Rates Will Remain Compressed

Unless there's a major market shift (a new category emerges, regulations change), growth rates across SaaS will remain in the 100-300% range for seed-stage companies and 50-150% for Series A and beyond. Plan accordingly.

Series B and C Funding Will Get Harder

As more companies get stuck in the Series B/C gap, funding will become more selective. Only companies with clear paths to Series C (either through exceptional growth, large enterprise customers, or profitability) will raise easily.

Profitability Becomes a Differentiator

Companies that reach profitability or near-profitability will have major competitive advantages. They'll have less dilution, more strategic flexibility, and better downside protection.

Alternative Capital Becomes More Important

Equity capital will remain competitive. But we'll see more founder-friendly capital sources: venture debt, revenue-based financing, strategic partnerships, and even founder-friendly equity deals.

The Uncomfortable Truth About Venture Capital in 2025

Let me be direct about what SVB's report actually shows. The venture capital market in 2025 is not broken. It's optimizing. And that optimization is brutal for the majority of founders.

Capital is flowing where the returns are. The returns are in mega-rounds for AI companies. So capital is flowing there. Everyone else is fighting for the leftovers.

This is how markets work. It's not unfair. It's not conspiracy. It's just math. If top 1% of companies deliver 30%+ of returns, then investor capital follows them.

The uncomfortable implication: if you're not building an AI company and you're not in Bay Area/NYC/LA, and you don't have strong connections to mega-round investors, you should think very carefully about raising venture capital at all. Maybe the venture model isn't right for your company. Maybe you bootstrap. Maybe you take strategic investment. Maybe you take smaller checks from a broader network of angels.

The venture model still works. But it's increasingly specialized. It works for companies with massive market opportunities, exceptional teams, and rapid growth. If that's not you, don't try to force it.

Summary: 10 Concrete Takeaways for Your Company

-

Understand that VC has bifurcated. If you're not in the mega-round club, the headline numbers don't apply to you. Plan for a harder fundraising environment.

-

Higher revenue benchmarks = longer timelines. You need more revenue to raise Series A, which means you need more runway. 24-30 months, not 18.

-

Extension rounds are smart, not a failure. If you're 60-70% to Series A benchmarks and have investor relationships, an extension is a legitimate strategy.

-

Focus on revenue per employee early. This metric will become more important as Series B and C investors scrutinize unit economics.

-

Graduation rates have collapsed. Plan for a 20-24 month horizon from seed to Series A, not 12 months.

-

Series B is the danger zone. Higher burn, lower runway, and longer path to Series C. Plan for alternatives (debt, profitability, strategic capital).

-

Location matters. If you're outside Bay Area/NYC/LA, factor in extra time and cost for fundraising. Or find alternative capital.

-

AI hype is real, but fundamentals matter. Don't build an AI company just because capital is flowing there. Build something with good unit economics.

-

Profitability is back. Treating it as a backup plan is outdated. Treat it as your strategy. It's a competitive advantage in 2025.

-

Question whether venture is right for you. Not every startup should raise venture capital. If you're not going for a $1B+ outcome, consider bootstrapping or alternative capital.

FAQ

What is SVB's State of the Markets report?

SVB (Silicon Valley Bank) releases an annual State of the Markets report that analyzes venture capital trends, startup funding data, and broader economic conditions affecting the startup ecosystem. The 2025 report covers 39 pages of data on VC funding patterns, deal volume, valuations, and sector-specific trends.

Why is the split between mega-rounds and traditional venture significant?

The bifurcation matters because it fundamentally changes the fundraising environment for most founders. Mega-rounds (billion-dollar checks) are separate from traditional venture (Series A-C rounds). Understanding which category you're in determines your realistic fundraising timeline, capital requirements, and growth expectations.

How much runway should a seed-stage company plan for in 2025?

Seed-stage companies should plan for 24-30 months of runway, not the traditional 18 months. With higher Series A revenue benchmarks and slower growth rates, most companies take longer to reach their next funding milestone. More runway provides a buffer and reduces the pressure to raise capital at unfavorable terms.

Are extension rounds considered a failure?

No. Extension rounds have become mainstream in 2025, with approximately 18% of Series A companies using extension rounds as a stepping stone. They're a legitimate strategic tool that allows founders to buy time to hit higher Series A benchmarks without raising at a discount valuation.

What revenue should I have before raising Series A?

The median Series A company in 2025 has approximately

How long does it take to graduate from seed to Series A?

In 2025, only about 3% of seed companies reach Series A within 12 months. The median timeline is 18-24 months. This is significantly longer than 2021, when roughly 10-12% of seed companies graduated within 12 months. The longer timeline reflects higher revenue benchmarks and compressed growth rates across the market.

Should I focus on growth or profitability?

In 2025, the answer is: both, but optimize for profitability first. The days of "growth at all costs" are over. Investors now want to see unit economics that suggest the business could eventually reach profitability. Fast growth with terrible unit economics is less attractive than slower growth with sustainable economics.

Does location matter for fundraising?

Yes. The Bay Area, New York, and Los Angeles capture approximately 48% of all VC capital. If you're building outside these metros, expect longer fundraising timelines and more effort to build relationships with investors. Consider remote-first pitch processes or regional venture funds as alternatives.

What's happening with AI startup valuations?

AI startup valuations are reflective of real business potential, but there are clear bubble signals. Many AI companies have elevated burn rates, low revenue per employee, and optimistic profitability assumptions. The top five AI unicorns are worth $1.2 trillion combined, which exceeds the entire dot-com IPO era by inflation. Plan for potential correction in 2026-2027.

What alternative capital sources should I consider?

Beyond traditional venture equity, consider venture debt (which is cheaper than equity), revenue-based financing, strategic investors, corporate venture capital, and founder-friendly equity from angel networks. These alternatives can bridge gaps between rounds and reduce your dependence on traditional VC markets.

How do I know if my company is Series B-ready?

You're Series B-ready when you have approximately

What should I do if I can't hit Series A benchmarks?

If you're tracking to fall short of Series A revenue benchmarks, consider: raising an extension round from seed investors, cutting burn rate to extend runway, pursuing profitability and bootstrap growth, pivoting to a new market or product, or seeking alternative capital (debt, strategic investors). The key is making a decision early rather than waiting until you're out of cash.

The Bottom Line

SVB's 2025 State of the Markets report tells a story about structural change in venture capital. The easy capital of 2020-2021 is gone. The party's over. What we're seeing now is the new normal: a bifurcated market where mega-round AI companies dominate capital flow while traditional venture companies compete for scraps.

For most founders, this is harder than 2021-2023. But it's also more honest. You're building a business that investors believe in based on fundamentals, not hype. That's healthier long-term.

Understand the numbers. Know where your company sits in this market. Build accordingly. The next few years will reward founders who are realistic about the environment and strategic about capital.

The venture market hasn't died. It's just become much more selective. And if you're building something real, that's actually good news.

Key Takeaways

- Venture capital has bifurcated into mega-round late-stage PE and traditional early-stage VC, with the top 1% capturing 33% of $340B funding

- Series A revenue benchmarks have doubled to ~$2.5M while growth rates have been cut in half, extending seed-to-Series A timelines to 24-30 months

- Extension rounds are now mainstream (18% of Series A companies) and represent a legitimate strategic tool, not a sign of failure

- Series B companies face a critical 'danger zone' with limited runway and longer paths to Series C, requiring focus on unit economics and profitability

- Geographic concentration is extreme (48% of capital in Big 3 metros) and female founders are being left behind despite overall market growth

- AI startup valuations show clear bubble signals despite real business potential, with top five unicorns worth $1.2 trillion

- Profitability has become a competitive advantage and strategic priority, with founders treating it as primary goal rather than backup plan

- Graduation rates from seed to Series A within 12 months have collapsed from 10-12% to just 3%, forcing longer runway planning

Related Articles

- Epstein's Silicon Valley Network: The EV Startup Connection [2025]

- Resolve AI's $125M Series A: The SRE Automation Race Heats Up [2025]

- India's Deep Tech Startup Rules: What Changed and Why It Matters [2025]

- Tech Billionaires At Super Bowl LIX: Inside Silicon Valley's $50K Power Play [2025]

- The 'March for Billionaires' Against California's Wealth Tax [2025]

- How Elon Musk Is Rewriting Founder Power in 2025 [Strategy]

![Venture Capital Split Into Two Industries: SVB 2025 Report Analysis [2025]](https://tryrunable.com/blog/venture-capital-split-into-two-industries-svb-2025-report-an/image-1-1770565037029.jpg)