Saudi Arabia's The Line Transforms into AI Data Centers [2025]

When Saudi Arabia announced the Neom project back in 2017, everyone lost their minds. A gleaming linear city stretching 170 kilometers across the desert. Nine million people living in ultra-dense urban conditions with autonomous vehicles, renewable energy, and futuristic infrastructure. It was the kind of megaproject that made you believe anything was possible.

Except it wasn't.

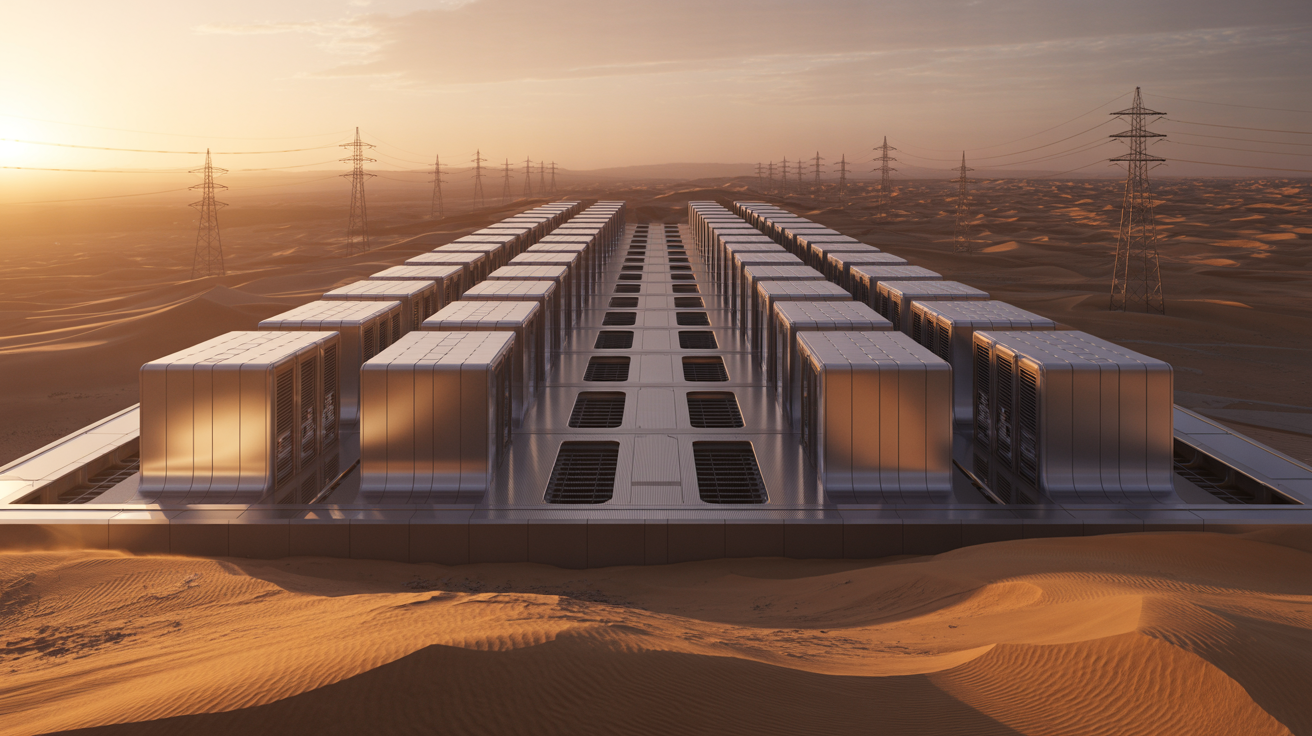

Now, reports suggest the kingdom's pivoting hard. The residential dream? Shelved. The 170km footprint? Shrinking dramatically. Instead, Saudi Arabia's apparently reconsidering The Line as a sprawling AI data center complex, not a city for millions of humans.

Here's the thing: this isn't a failure. It's actually a calculated pivot that might make more sense than the original vision. Let me explain why, and what it means for the global AI infrastructure boom that's reshaping how companies train and deploy artificial intelligence.

TL; DR

- The Line originally promised to house 9 million residents across 170km of desert, but reports now indicate a dramatic downsizing toward industrial and AI-focused use

- Climate challenges and rising costs have made the residential model financially unsustainable, pushing planners toward data center infrastructure instead

- Saudi Arabia's investing billions in GPU capacity for state-backed AI facilities, making a data center pivot strategically aligned with national AI ambitions

- Coastal seawater cooling at the Red Sea offers unique advantages for energy-intensive AI infrastructure in a hot desert climate

- The shift reflects broader industry trends where megaprojects are becoming more pragmatic, pivoting from speculative development to hard infrastructure that generates immediate ROI

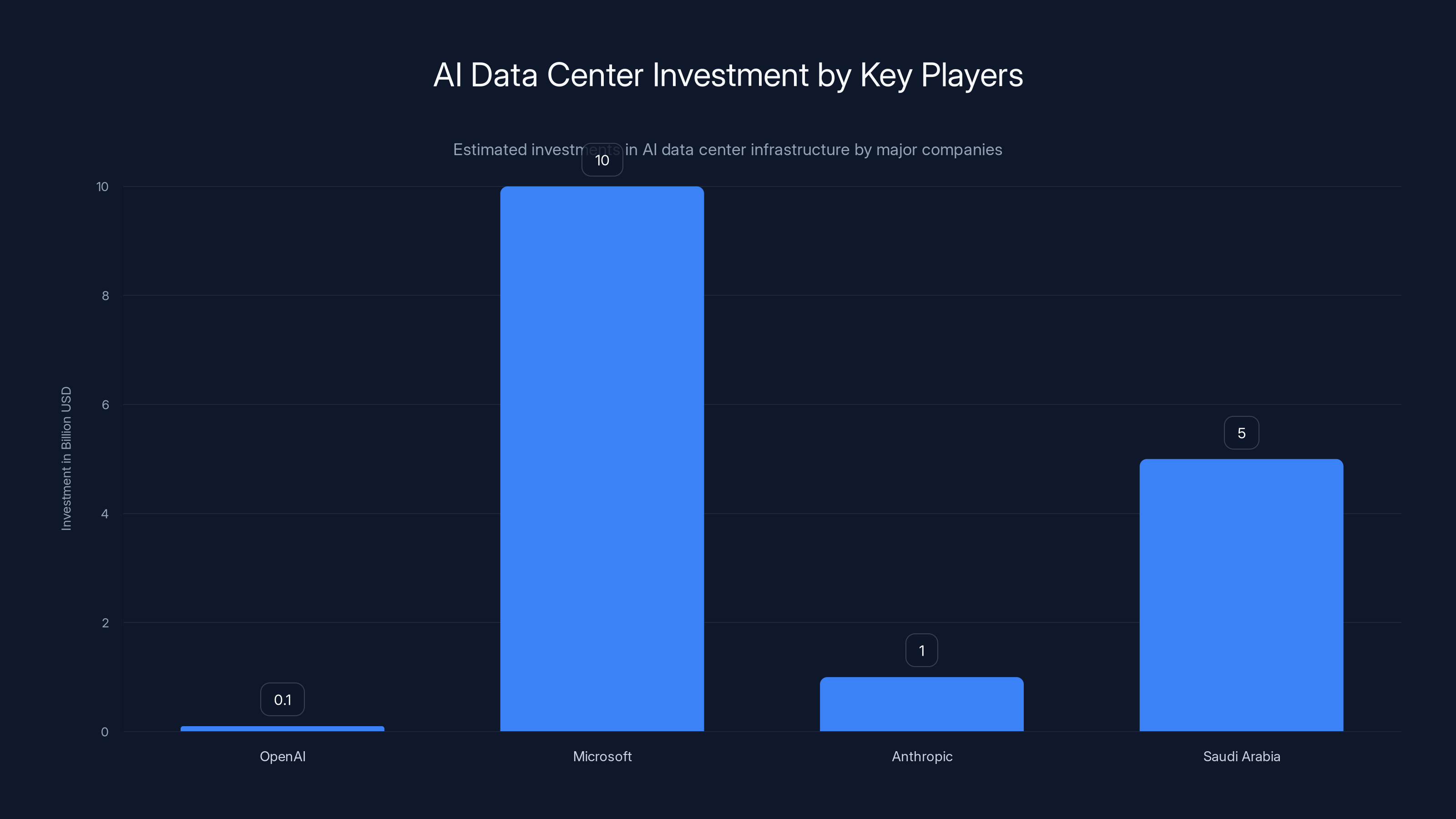

Estimated data shows significant investments in AI data centers, with Microsoft leading at

The Original Vision: Ambition Meets Reality

When The Line was first unveiled, the headlines wrote themselves. A futuristic linear city. Mirrored towers reflecting the desert. Vertical farms. Autonomous transit. Renewable energy. The kind of sci-fi infrastructure that made cities like Dubai look positional and outdated.

The numbers were staggering. One hundred seventy kilometers long. Just two kilometers wide. Nine million residents living in extreme density with supposedly zero emissions. No cars on streets, only automated pods moving through underground tunnels. Agriculture happening in stacked layers within buildings.

It was audacious. Maybe too audacious.

The problem wasn't the vision. The problem was execution cost, timeline realism, and something nobody talks about: climate physics don't bend for ambition. Building a megacity for millions in the Saudi desert isn't just logistically complex. It's an engineering challenge that gets exponentially harder when you do the math on water, cooling, and sustained electricity supply.

King Salman bin Abdulaziz and Crown Prince Mohammed bin Salman didn't kill The Line because it was bad optics. They killed it because Saudi Arabia's facing real fiscal pressure. Lower oil revenues mean tighter budgets. The 2034 World Cup hosting rights come with massive infrastructure commitments. The World Expo trade fair in Riyadh requires funding. And frankly, a $500 billion residential megacity started looking less strategically important when the kingdom could pivot to something that generates immediate economic returns and aligns with global tech trends.

That something is artificial intelligence infrastructure.

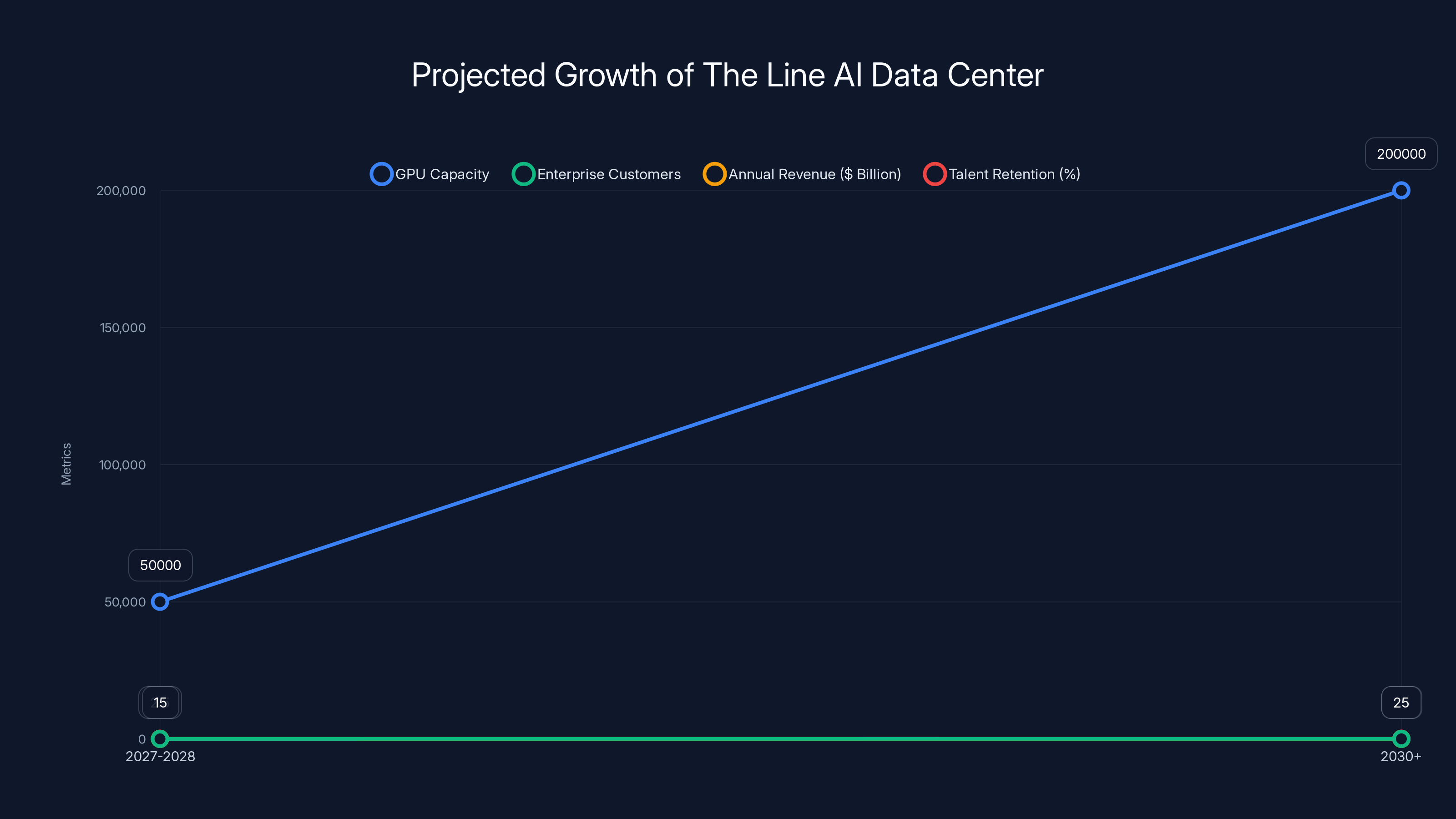

The Line is projected to significantly increase its GPU capacity and revenue by 2030+, aiming to become a top AI infrastructure provider. Estimated data.

Why AI Data Centers Make Strategic Sense

Let's be direct: The Line as a data center makes way more business sense than The Line as a residential city. Here's why.

First, the macro context. AI is consuming infrastructure like nothing we've seen before. Training large language models requires massive computational power. Open AI's GPT-4 training reportedly cost somewhere north of $100 million in compute alone. Anthropic's Claude models need similar scale. Even open-source models like Llama require serious GPU clusters to train efficiently.

That demand isn't going down. It's accelerating.

The global AI data center market is exploding. Microsoft's investing tens of billions into data center infrastructure to support Azure AI services. Anthropic's raising capital specifically for compute infrastructure. Nvidia can't manufacture GPUs fast enough to meet demand. There's a real shortage of available compute capacity, and whoever can provision it efficiently will have serious market advantage.

Saudi Arabia, sitting on sovereign wealth and strategic ambition, suddenly has an opportunity. Instead of building a city for nine million people—which honestly nobody asked for and most experts questioned—they can build a world-class AI infrastructure complex that serves regional and global demand.

Second, the geopolitical angle. The Financial Times reported that Saudi Arabia has been aggressively acquiring advanced GPUs for state-backed AI facilities. Thousands of chips. High-end GPUs from Nvidia and competing manufacturers. The kingdom's building out AI capacity because they understand something crucial: whoever controls AI infrastructure controls AI capability.

It's not unlike how the US position dominates cloud computing because AWS, Google Cloud, and Azure got there first. Saudi Arabia's investing to establish regional dominance in AI infrastructure, positioning themselves as a hub for training models, serving Middle Eastern markets, and generating geopolitical soft power through technological capability.

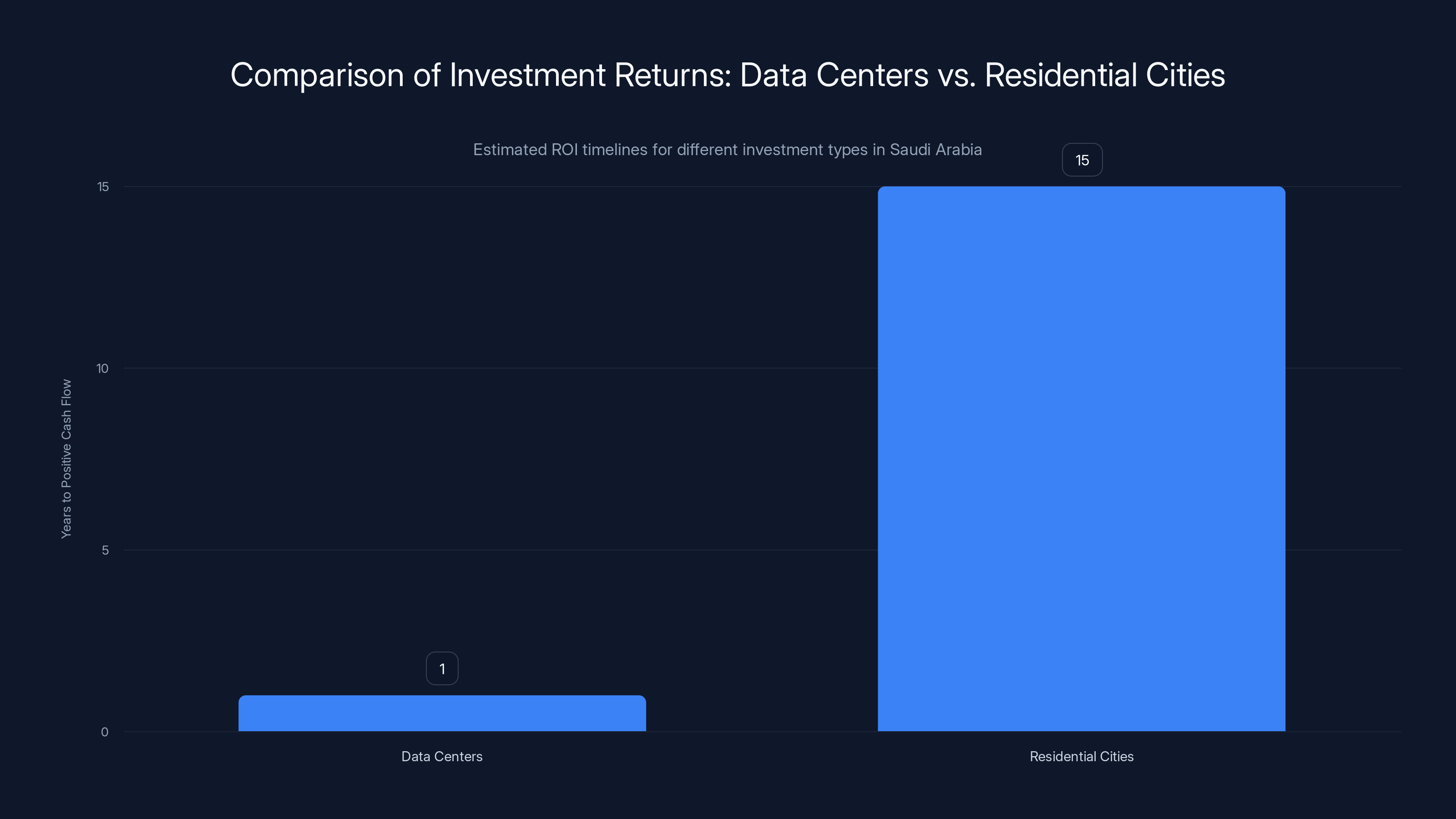

Third, the timeline and ROI calculation changes dramatically. A residential city takes 15-25 years to build and generate real return. A data center can be operational in 2-3 years and generating revenue immediately. Your first facilities start running AI workloads, capturing hosting fees, and proving the model before the infrastructure is even fully constructed.

That's a fundamentally different financial profile.

The Climate Problem: Why Desert Data Centers Are Actually Clever

Here's what most people don't realize about running data centers in the Saudi desert: it's genuinely a challenge, but it's not unsolvable. In fact, it's strategically smart if you solve it right.

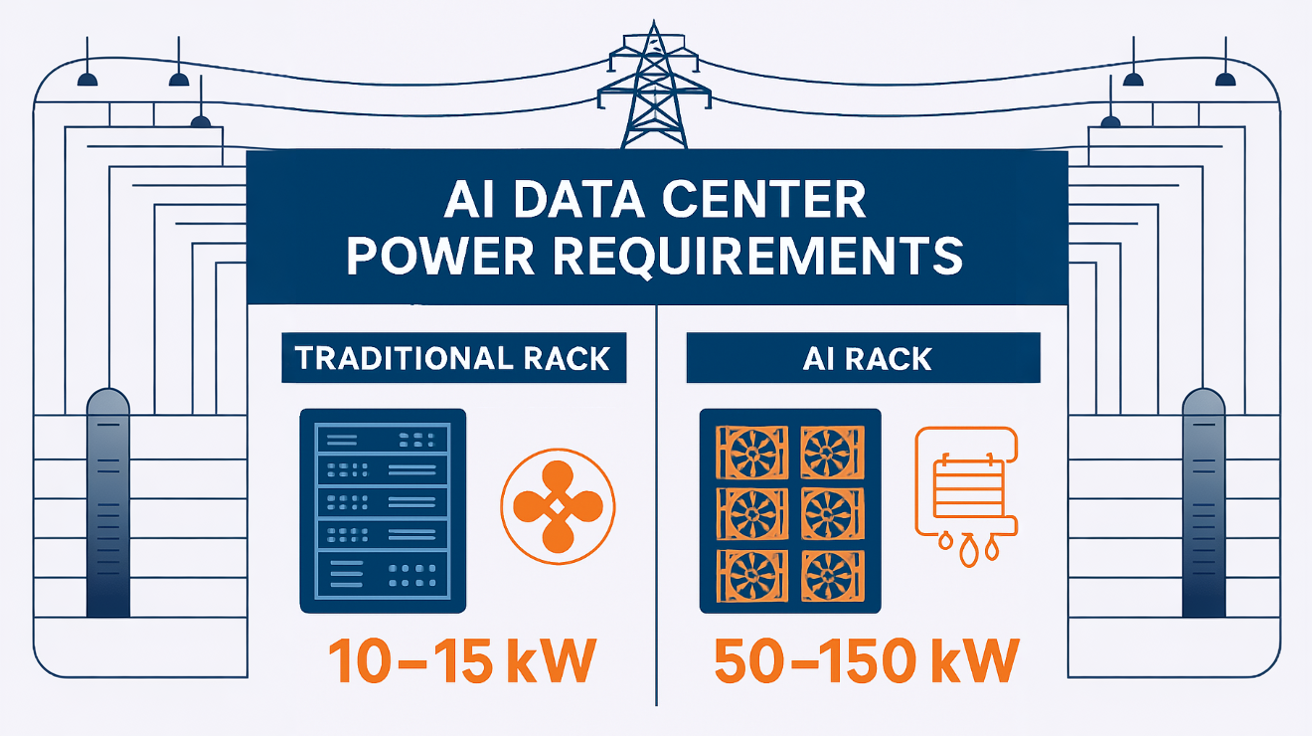

Data centers generate extraordinary amounts of heat. A single GPU runs hot. Cluster thousands together, and you're dissipating megawatts of thermal energy. That heat has to go somewhere, or your equipment throttles, fails, or burns out. Traditional data centers in cooler climates use air cooling and evaporative systems. Cost is moderate, efficiency is decent.

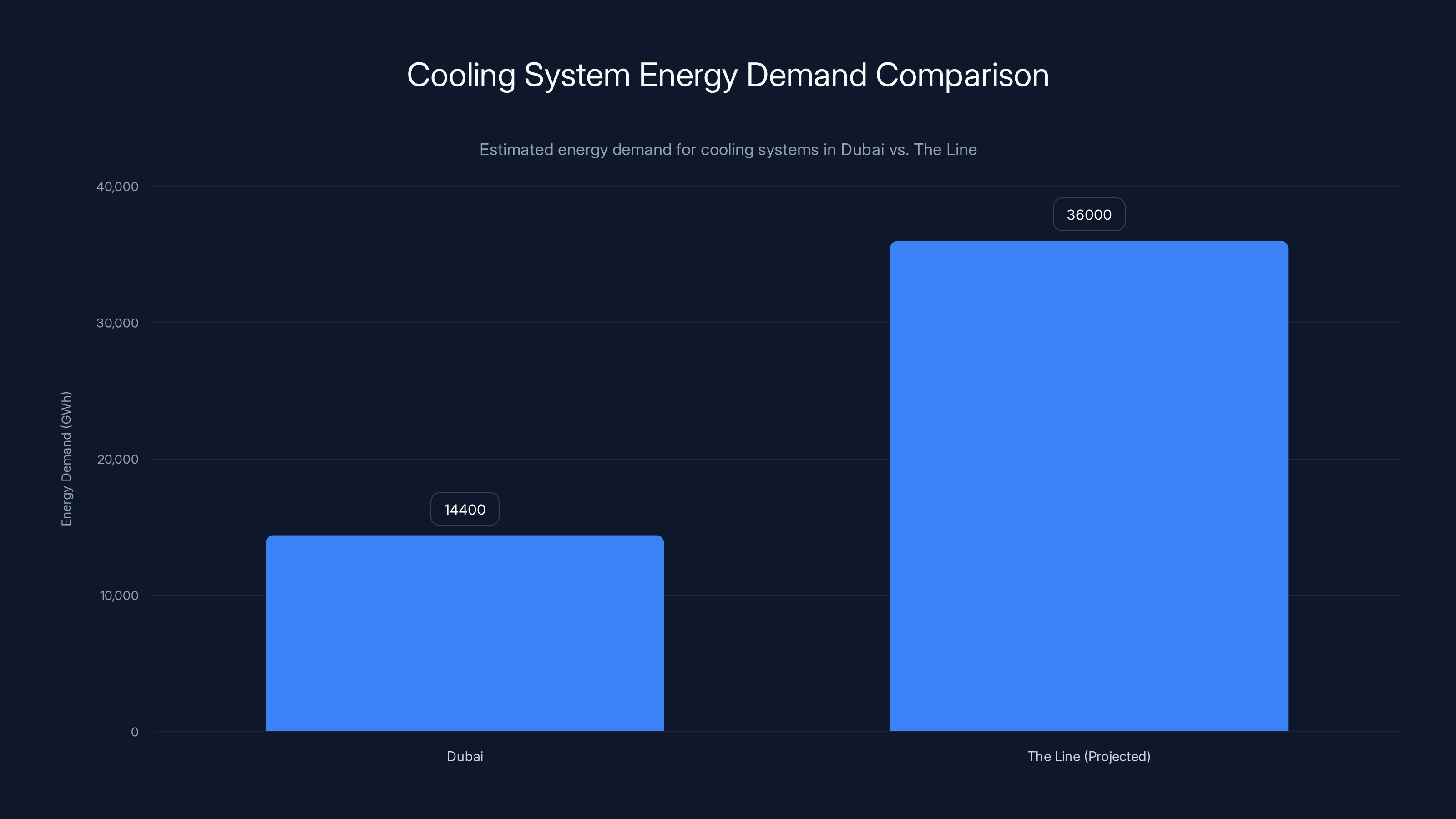

In Saudi Arabia, with sustained temperatures hitting 50°C (122°F) in summer, air cooling becomes economically ruinous. Your cooling costs spiral. Your equipment reliability suffers. Your efficiency metrics tank.

But here's where The Line's coastal location on the Red Sea becomes an actual competitive advantage, not just a design feature.

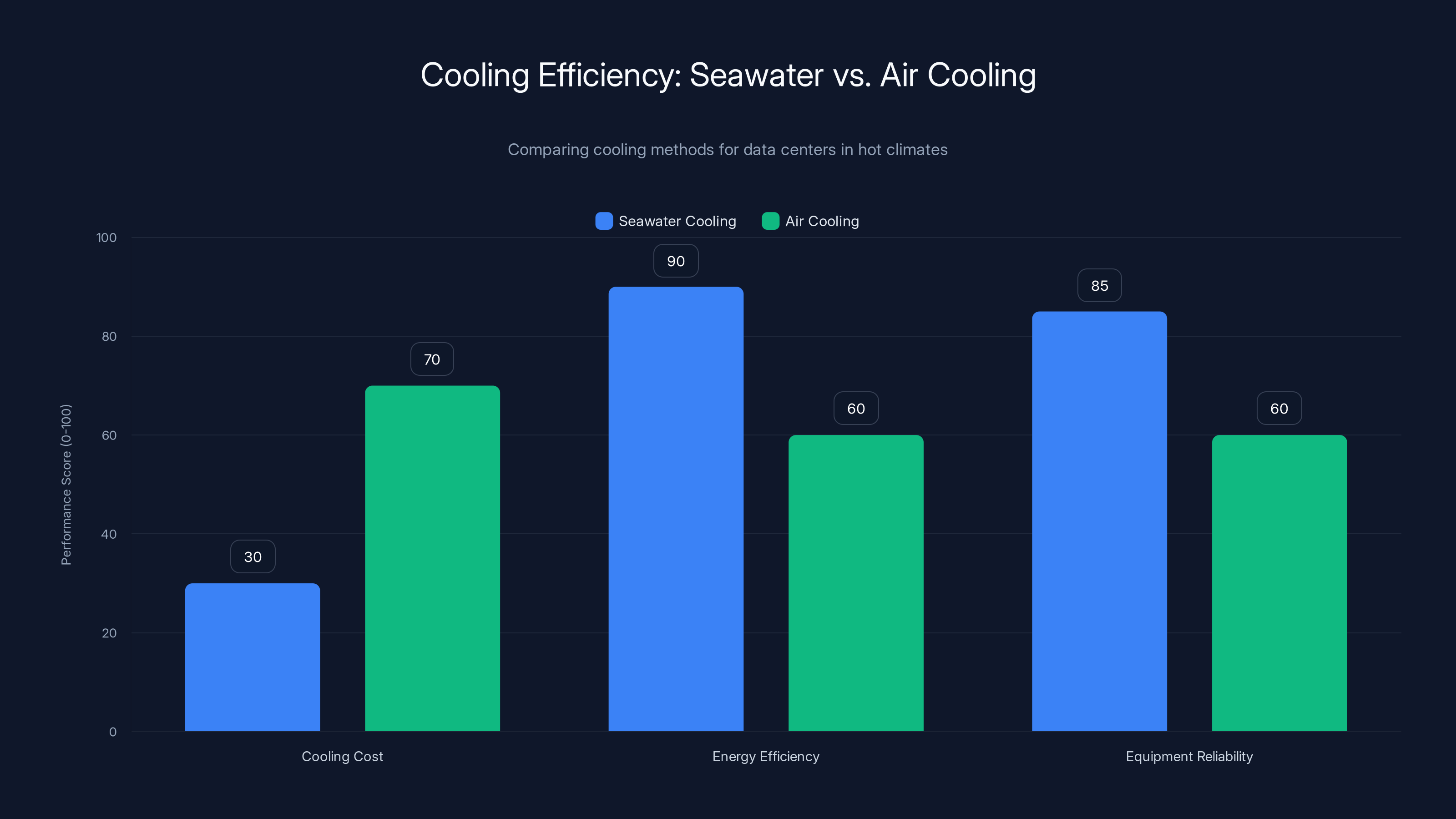

Seawater cooling is a game-changer for data centers in hot climates. You pump cool seawater through heat exchangers, extract the thermal energy from your equipment, and discharge the warmed water back into the sea. The thermodynamic advantage is enormous. Seawater at depth stays around 20-25°C year-round, even in tropical regions. Your cooling costs drop dramatically. Your energy efficiency metrics improve. Your equipment reliability increases.

This isn't theoretical. Facebook's run seawater-cooled data centers in Sweden and other coastal regions. Microsoft's experimenting with underwater data centers. The technology is proven.

Saudi Arabia's coastal access to the Red Sea means they can deploy seawater cooling at The Line facility, giving them energy efficiency that air-cooled competitors can't match, even in cooler climates. That's a legitimate structural advantage for hosting AI workloads that would otherwise be prohibitively expensive to cool.

Now, there's a catch. Seawater cooling introduces corrosion challenges. You need materials science sophistication to handle saltwater heat exchangers without catastrophic rust and degradation. But that's an engineering problem with engineering solutions, not a blocker.

Add renewable energy—Saudi Arabia's been investing in solar and wind capacity—and suddenly your AI data center complex has a compelling efficiency story: low cooling costs, cheap renewable electricity, low carbon footprint, high computational density. That's marketing narrative and operational reality working together.

Dubai's cooling systems consume about 14,400 GWh annually for 3.6 million people. The Line, with 9 million residents, would require an estimated 36,000 GWh, highlighting the immense infrastructure challenge. (Estimated data)

The Fiscal Reality: When Ambition Meets Liquidity Constraints

Let's talk about the real reason The Line pivoted. It's not that the idea was bad. It's that Saudi Arabia ran the numbers and realized they couldn't afford it.

Oil-dependent economies are vulnerable to price swings. When oil prices decline, revenue drops sharply. Saudi Arabia's been spending aggressively—the Saudi Vision 2030 initiative committed hundreds of billions to infrastructure, tourism, sports, and technology. The World Cup hosting in 2034. The World Expo in Riyadh. Neom itself. These aren't small investments.

Lower oil revenues mean tighter budgets. You have to make hard choices about capital allocation. Do you spend $500 billion on a futuristic residential city that's years away from generating any revenue? Or do you deploy that capital toward infrastructure that generates immediate ROI and supports your AI dominance strategy?

From a finance perspective, the decision is obvious. Data centers generate revenue from day one. Residential cities are capital sinks for 15+ years before producing positive cash flow.

Additionally, the original Line concept had execution risks that became increasingly apparent. Building and operating advanced infrastructure in the desert at that scale requires solving problems that haven't been solved at that scale. Water management. Waste handling. Transportation logistics. Maintenance and service delivery. Risk accumulates when you scale wildly in unfamiliar territory.

A data center is a known architecture. Equinix, Digital Realty, and other operators have decades of experience building and running them. Saudi Arabia can hire operators, deploy proven designs, and execute against a known playbook instead of inventing entirely new systems for housing millions of people in the desert.

This doesn't mean The Line is abandoned entirely. Reports suggest a phased approach where some smaller-scale residential components might still happen, but the centerpiece shifts to industrial and AI infrastructure. That's actually a reasonable middle ground: you preserve some of the original vision while pivoting the core to something that makes financial sense.

Precedent: How Other Megaprojects Are Pivoting

The Line's pivot isn't unique. Other massive infrastructure projects have undergone similar recalibrations, and there's a pattern worth understanding.

Consider the global crypto mining boom and subsequent bust. When Bitcoin and Ethereum prices were soaring, companies invested billions in mining farms. Then the market crashed, and suddenly you had massive data centers with excess capacity. What did they do? Pivot to AI infrastructure.

Reports from CNBC and other outlets documented how Bitcoin miners like Core Industrial Technologies and others shifted GPU capacity from crypto mining to AI model training. Same infrastructure, different workload, dramatically higher margins.

This suggests something important: infrastructure projects don't have to be locked into a single use case. They can evolve as markets shift and new opportunities emerge. The Line pivoting from residential to industrial to AI data center is consistent with how modern infrastructure operates.

You also see this in commercial real estate. Entire office towers are being converted to data centers because office demand collapsed post-pandemic while data center demand exploded. Architects and developers realized: the structural bones of a building can serve different purposes. Pivot the business model, and suddenly you're capturing market opportunity instead of sitting with stranded assets.

Another comparison: Tesla's Gigafactory strategy. Elon Musk originally envisioned massive vertical-integrated battery manufacturing complexes supporting EV production. The execution has been messier and smaller-scale than originally planned, but the company kept adapting rather than abandoning the concept. That flexibility let Tesla capture value as circumstances changed.

Saudi Arabia's applying similar logic to The Line. The original concept was ambitious and speculative. Market realities and fiscal constraints forced adaptation. Instead of doubling down on an increasingly unrealistic vision, decision-makers pivoted to something that's simultaneously more achievable and more strategically aligned with where technology investment is actually flowing.

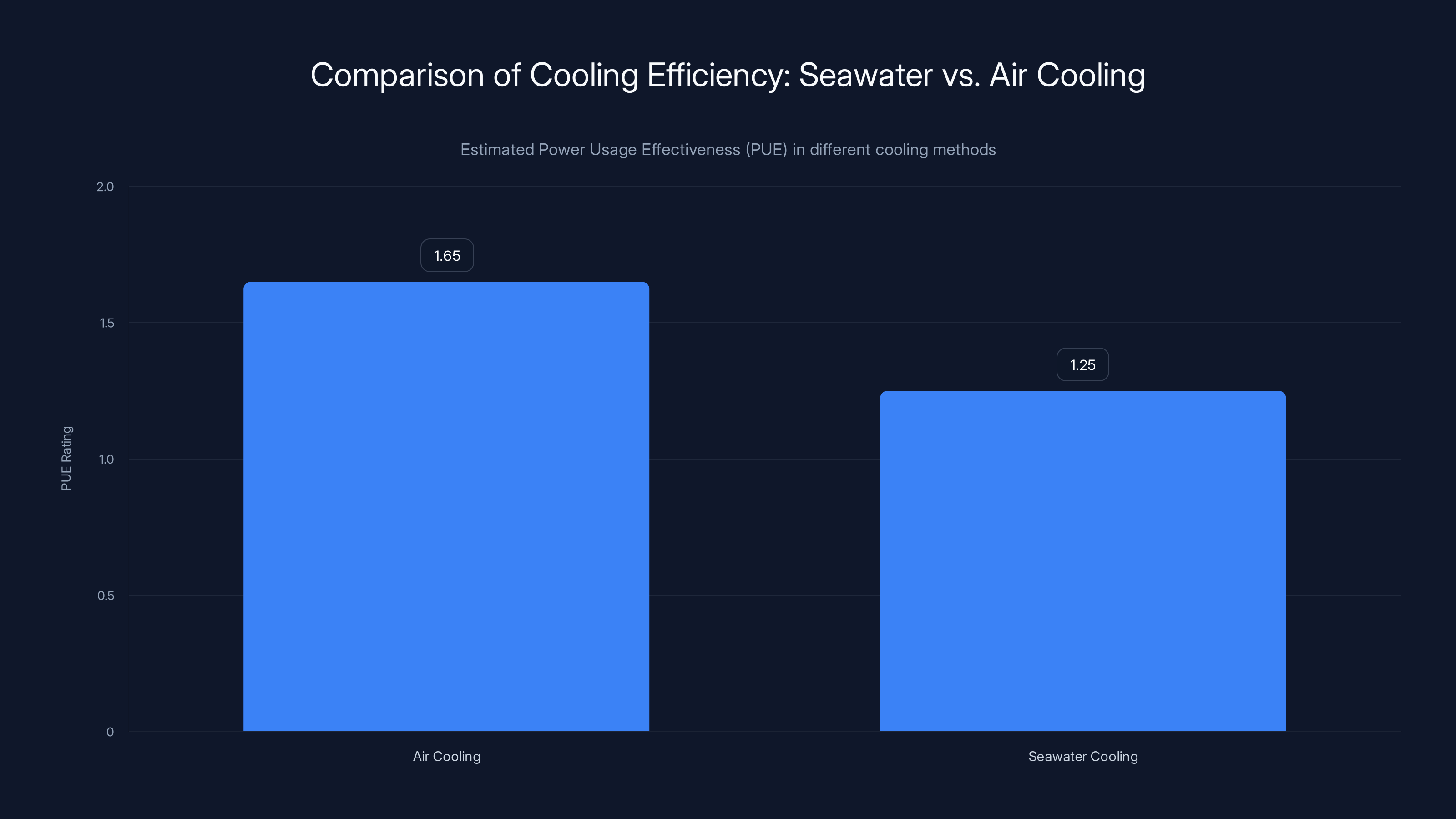

Seawater cooling offers a significant efficiency advantage with a lower PUE rating of 1.25 compared to air cooling's 1.65, translating to substantial energy cost savings. Estimated data.

The AI Infrastructure Boom: Context for Why This Timing Matters

The timing of The Line's pivot is crucial. This is happening exactly when global AI infrastructure is becoming the most competitive and valuable space in technology. Understanding the dynamics helps explain why Saudi Arabia's moving fast.

Historically, infrastructure advantage flowed from real estate and transportation. Whoever controlled rail networks, ports, highways, and property had power. In the 20th century, infrastructure meant physical assets generating slow, steady returns over decades.

AI infrastructure is different. It's competitive advantage that compounds quickly. Open AI needed computational access to train GPT-4 and GPT-4o. Anthropic needs serious compute to remain competitive with Claude. Google Deep Mind needs extraordinary compute for training. Microsoft built massive partnerships with Open AI specifically to access compute infrastructure and training capacity.

Whoever controls the compute resources controls which models get trained, at what scale, and how quickly. That's meaningful leverage.

Currently, compute capacity is concentrated in the US and increasingly China. AWS, Google Cloud, and Azure have enormous infrastructure. Dedicated GPU suppliers like Lambda and Paperspace run at near-full utilization. If you want compute capacity right now, you're buying from US-controlled infrastructure or waiting months for allocation.

Saudi Arabia entering the market as a regional and potentially global compute provider changes that dynamic. The kingdom could offer:

- Spare capacity when US providers are bottlenecked

- Lower costs through renewable energy advantages

- Regional edge for Middle Eastern and Asian customers

- Geopolitical autonomy in AI capability

None of these are trivial. A few percentage points in cost advantage compounds into billions over years. Regional latency advantage matters for real-time inference. Having non-US infrastructure for sensitive applications is strategically valuable for governments and enterprises avoiding geopolitical entanglement.

There's also a supply chain angle. Nvidia can't manufacture enough H100 and H200 GPUs to satisfy global demand. Backorders run months. By establishing compute infrastructure in Saudi Arabia with existing GPU capacity, the kingdom can serve demand that would otherwise go unsatisfied. That's not altruism—it's capturing market opportunity where demand exceeds supply.

Technical Architecture: What A Scaled AI Data Center Complex Looks Like

When Saudi Arabia pivots The Line to an AI data center complex, what's actually getting built? Let's talk specifics.

A modern AI data center designed for large-model training has a very different architecture than a traditional colocation facility hosting websites and applications.

You need:

GPU clusters organized for distributed training: GPUs like Nvidia's H100s or next-generation chips run in coordinated clusters where training jobs are parallelized across hundreds or thousands of devices. This requires ultra-low-latency networking—Infini Band or equivalent high-speed interconnects—connecting GPUs with microsecond latencies. Standard datacenter networks won't cut it.

Massive power delivery: A single H100 consumes ~700 watts under full load. A cluster of 10,000 GPUs is consuming 7 megawatts just for compute, plus cooling and auxiliary systems. The total power draw could hit 20-30+ megawatts for a mid-scale facility. You need dedicated substations, redundant power paths, UPS systems, and potentially on-site generation for backup. The power architecture is fundamentally different from traditional data centers.

Thermal management at scale: This is where seawater cooling becomes essential. The heat load from 10,000 GPUs running hard is staggering. You're extracting tens of megawatts of thermal energy continuously. Seawater cooling systems with enormous heat exchangers, custom piping, corrosion-resistant materials, and sophisticated control systems become mandatory infrastructure. Traditional air cooling becomes economically untenable.

Storage and I/O architecture: Training large models requires massive dataset loading. You're moving terabytes of training data continuously. That requires high-bandwidth storage networks, likely NVMe arrays or high-performance storage systems, connected via fast networks. Traditional spinning disk storage is too slow.

Orchestration and software stack: Managing thousands of GPUs running coordinated training jobs requires sophisticated software: Kubernetes for container orchestration, custom job schedulers, monitoring and observability systems tracking thousands of devices simultaneously, fault tolerance and recovery mechanisms. The software complexity is non-trivial.

Security and isolation: If you're running training jobs for different customers or research organizations, you need hardware and software isolation ensuring one customer's training job can't leak data to another. That means secure enclaves, encrypted communication, dedicated network paths, and rigorous access controls.

The architecture is complex, but it's also increasingly standardized. Companies like Core Weave, Lambda, and others have built competing infrastructure providers serving exactly this market. Saudi Arabia can hire experts who've run this playbook, deploy proven architectural patterns, and avoid re-inventing complex systems.

The advantage of using The Line's coastal location and available space is that you can build this infrastructure at massive scale without physical constraints. Traditional data center sites are limited by real estate availability, zoning, and local power capacity. The Line site offers effectively unlimited space and can be connected to power plants and seawater cooling infrastructure built specifically for the facility.

Data centers offer immediate revenue generation, while residential cities may take over 15 years to become profitable. Estimated data based on typical industry timelines.

Electricity and Power: The Foundational Challenge

Here's a truth about data centers that doesn't get enough attention: power is the limiting factor, not floor space. You can have acres of empty land, but if you can't reliably deliver 50+ megawatts of electricity, your data center stays empty.

Saudi Arabia has advantages here, but also challenges.

Advantages:

-

Renewable energy potential: The kingdom's been investing heavily in solar and wind. ACWA Power and other developers have been building utility-scale solar farms. Saudi Arabia could theoretically power a data center complex with cheap renewable electricity. Solar is reaching $15-25 per megawatt-hour in favorable locations, roughly half traditional fossil fuel generation costs.

-

Existing power infrastructure: Saudi Arabia runs massive power generation for domestic consumption and oil production. There's existing expertise in grid management, power distribution, and infrastructure expansion.

-

Hydrocarbons for backup: When renewable generation drops (cloudy days, low wind), Saudi Arabia can always spin up oil-fired or natural gas generation. You have fuel security most countries envy.

Challenges:

-

Delivering power to a desert location: The Line site is remote. Getting 50+ megawatts of continuous power to a desert facility requires new transmission infrastructure. That's capital-intensive and takes years to permit and build.

-

Peak load coordination: Data center power demand is relatively flat and predictable. But if you're running training on thousands of GPUs simultaneously, you have enormous power draws that need to be met instantly. That requires either dedicated power plants nearby or very sophisticated power management.

-

Reliability requirements: AI training jobs running for weeks can't tolerate extended outages. You need multiple independent power paths, redundancy at every level, and backup generation. That infrastructure is expensive and complex.

The practical reality is that a serious AI data center complex in The Line would likely require dedicated power infrastructure—either a solar + battery farm, or new transmission lines to existing generation facilities, or both. That's not a dealbreaker, but it's a significant capex item that's easy to underestimate in initial planning.

Competition and Risk: Why Success Isn't Guaranteed

Let's be honest: Saudi Arabia's entering a competitive market with existing players already established. Success isn't automatic.

Global AI infrastructure is becoming increasingly competitive. Hyperscaler competition is fierce. AWS, Google Cloud, and Azure have enormous resources, existing customer relationships, and proven execution. New entrants like Crusoe Energy and Core Weave are raising billions and scaling fast.

For The Line data center complex to succeed, Saudi Arabia needs to solve several hard problems:

Talent acquisition: You need engineers and operations experts who've run GPU clusters at scale. Those people are concentrated in tech hubs like San Francisco, Seattle, and increasingly cloud regions. Recruiting and relocating them to the Saudi desert requires offering compelling packages and solving visa/relocation challenges. It's doable, but not trivial.

Customer acquisition: Companies training large models want proven reliability, low latency to their existing infrastructure, and established support relationships. Getting customers to trust a new provider in a new region requires building reputation and demonstrating reliability. That takes time.

Cost leadership: If The Line's data center is 10% cheaper than AWS or Google Cloud, it becomes attractive. If it's the same cost or more expensive, it has no compelling value proposition. Achieving genuine cost advantage requires flawless execution on power, cooling, and operations efficiency.

Regulatory clarity: Saudi Arabia's regulatory environment for data centers is improving, but it's not as established as US or European frameworks. Data sovereignty, data privacy, and residency requirements vary. That uncertainty discourages some customers.

Geopolitical risk perception: Some organizations avoid infrastructure in certain countries for geopolitical reasons. The US government has restrictions on certain technologies being trained in non-allied countries. That limits potential customers.

These are real barriers. They don't make success impossible, but they make it harder than the glossy announcements suggest.

Additionally, there's the track record question. Saudi Arabia has a mixed history with megaprojects. Some succeed. Others face delays, cost overruns, and execution challenges. That history makes investors and customers cautious. The kingdom needs to execute flawlessly on The Line data center to build credibility for future infrastructure projects.

Seawater cooling significantly reduces costs and improves efficiency and reliability compared to air cooling, especially in hot climates like the Saudi desert. Estimated data.

Timeline and Phased Development

If The Line's becoming a data center complex, what's the realistic timeline?

Based on comparable projects and industry norms, a phased approach makes sense:

Phase 1 (2025-2026): Core infrastructure development

- Finalize architectural design and engineering

- Secure regulatory approvals and environmental clearances

- Begin site preparation and power infrastructure development

- Order GPUs and networking equipment (this has long lead times)

- Recruit core operations team

Phase 2 (2026-2027): Initial facility deployment

- Complete first modular data center building (maybe 5,000-10,000 GPUs capacity)

- Deploy seawater cooling infrastructure

- Connect to power infrastructure

- Begin initial customer workloads and testing

- Ramp up recruitment for operations and engineering

Phase 3 (2027-2029): Expansion and scale

- Deploy additional modular facilities

- Expand to 50,000+ GPU capacity across multiple buildings

- Establish established customer base and reputation

- Expand cooling and power infrastructure

- Possibly introduce smaller-scale residential or mixed-use components

Phase 4 (2029+): Optimization and growth

- Achieve full utilization and revenue ramp

- Expand beyond initial site if demand justifies

- Deploy next-generation GPU generations

- Become a credible global AI infrastructure provider

This timeline is optimistic. Reality usually introduces delays. Regulatory approvals take longer than expected. Technical challenges emerge. Supply chains disrupt. Customer acquisition is slower. Realistic timeline probably pushes Phase 4 outcomes to 2030-2032.

But even a delayed timeline is better than the original Line residential vision, which probably wouldn't have delivered value before 2040 at the earliest.

Regional AI Ambitions and Geopolitical Positioning

Understanding why Saudi Arabia's doing this requires understanding its broader AI strategy. This isn't just a business play. It's geopolitical positioning.

The kingdom has stated explicit ambitions to become a global AI leader. Neom's strategic plans include AI research facilities, and the Saudi government has been making substantial investments in AI development and deployment.

Why? Because AI is increasingly seen as critical infrastructure for national power. Countries without domestic AI capability find themselves dependent on others—primarily the US—for access to advanced models and capabilities. That dependency creates strategic vulnerability.

By investing in AI infrastructure, Saudi Arabia is:

-

Building technological self-sufficiency: The kingdom wants capability to train its own models, deploy AI systems domestically, and avoid dependence on foreign platforms.

-

Establishing regional leadership: With The Line as a hub, Saudi Arabia becomes the AI infrastructure provider for the Middle East, North Africa, and potentially Asia. That's geopolitical soft power.

-

Creating economic value: AI infrastructure generates revenue and attracts talent and investment. It's a legitimate economic development strategy.

-

Hedging US dominance: By building non-US infrastructure and proving viability, Saudi Arabia creates alternatives for organizations uncomfortable with US data dependency.

This aligns with broader Vision 2030 strategy, which aims to diversify the Saudi economy away from oil and toward technology, tourism, and high-value services. AI infrastructure is genuinely strategic for that diversification.

Comparing The Line to Other Megaproject Pivots

The Line isn't the only massive infrastructure project that pivoted when original plans proved untenable. There's actually a pattern worth examining.

Smart Cities Everywhere started as a vision where cities would be digitally connected, AI-managed, and autonomous-vehicle ready. Most of these visions dramatically scaled back when actual implementation costs and technological limitations became clear. Singapore's Smart Nation program, Barcelona's smart city initiative, and others all evolved from the original futuristic visions to more pragmatic, phased implementations focused on concrete problems (traffic management, utility efficiency) rather than entire city reinvention.

Lessons from these projects:

- Specificity beats vision: Projects work better when they solve specific problems than when they chase futuristic visions.

- Phased implementation allows learning: You can't build the entire future in one shot. Phased rollout lets you learn and adapt.

- Pragmatism beats ambition: The projects that succeeded focused on near-term ROI and practical value, not philosophical transformation.

The Line's pivot embodies these lessons. Instead of transforming an entire region, Saudi Arabia's focusing on a specific infrastructure problem (compute capacity) that's in acute shortage and has clear ROI.

What Success Actually Looks Like

If The Line succeeds as an AI data center complex, what does victory look like? Not in futuristic vision terms, but in concrete metrics.

By 2027-2028:

- 50,000+ GPU operational capacity serving live customer workloads

- Demonstrated 20-30% cost advantage versus US cloud providers in key metrics

- 10-20 enterprise customers including regional tech companies, research organizations, and potentially international players

- Profitability path identified with clear unit economics for compute services

- Talent retention above 80% (keeping skilled engineers is harder than hiring them)

By 2030+:

- 200,000+ GPU capacity making The Line a top-5 AI infrastructure provider globally

- $5-10 billion annual revenue from compute services

- Regional reputation as a trusted compute provider used by major AI companies

- Sustained energy efficiency metrics (PUE below 1.3) proving the seawater cooling advantage

- Become a model for other megaprojects pivoting toward pragmatic infrastructure

These metrics aren't guaranteed. They require flawless execution, talent, and market conditions cooperating. But they're achievable if Saudi Arabia executes correctly.

The Broader Lesson: When Ambition Meets Physics and Economics

The Line's pivot teaches something important about how massive infrastructure gets built in the 21st century. Ambition matters, but it bows to physics and economics eventually.

The original vision of a 170km linear city for nine million people was audacious. But it was based on assumptions that didn't survive scrutiny: that cooling a megacity in the Saudi desert would work at scale, that building housing for millions was more valuable than building infrastructure for global AI demand, that a 15-25 year capital burn was acceptable when geopolitical and economic conditions were shifting.

Realizing those assumptions were wrong and pivoting isn't failure. It's sound decision-making. Companies and governments that can recognize bad assumptions and change direction survive. Those that double down on failed bets fail.

Saudi Arabia's demonstrating adaptive capacity. The kingdom identified a better use case for the infrastructure investment (AI data centers), positioned it strategically (regional AI leadership, energy efficiency, sovereignty), and tailored it to current market dynamics (acute compute shortage, high demand, clear ROI).

That's pragmatism. And pragmatism often outperforms vision.

The Future: What Comes Next

If The Line becomes a serious AI data center hub, what cascades from that success?

Talent concentration: Success with Phase 1 and 2 could attract AI talent and research to Riyadh. Not as a residential megacity, but as a genuine tech hub with serious infrastructure and economic opportunity.

Regional AI ecosystem: Companies wanting access to compute capacity could locate in Saudi Arabia or the broader Middle East, creating a cluster effect similar to how cloud providers created tech hubs in their regions.

Competition for Azure and AWS: Even a 15-20% cost advantage in specific use cases could draw significant workload. That competitive pressure could accelerate cost competition across the AI infrastructure market, lowering costs globally.

Model for other nations: If Saudi Arabia succeeds, expect other countries and regions to replicate the model. Invest in compute infrastructure, attract customer workload, build regional dominance. Morocco, Egypt, and other countries could follow similar strategies, fragmenting US dominance in AI infrastructure.

New geopolitical dynamics: AI becomes more decentralized. No single country controls compute capacity. That creates genuine alternatives and reduces US leverage in AI policy globally.

None of this is predestined. Saudi Arabia still needs to execute. But the potential is there, and it's worth watching.

FAQ

What exactly is The Line, and why was it originally designed as a residential city?

The Line was Saudi Arabia's ambitious megaproject announced as part of its Neom initiative, envisioning a 170-kilometer linear city designed to house 9 million residents. The original concept emphasized ultra-dense urban development with automated transportation, renewable energy, vertical agriculture, and futuristic infrastructure all contained within a 2-kilometer-wide footprint. The vision was meant to showcase Saudi Arabia's technological capabilities and economic diversification beyond oil.

Why is Saudi Arabia pivoting from residential to AI data centers?

Saudi Arabia is pivoting to AI data centers because residential development proved financially and logistically unsustainable. The kingdom faces fiscal pressure from lower oil revenues, competing megaproject commitments (World Cup 2034, World Expo), and increasingly clear climatic and engineering challenges with sustaining a city for millions in the desert. Meanwhile, global AI infrastructure is in acute shortage, with compute capacity bottlenecks creating immediate demand and high margins. A data center complex generates revenue within 2-3 years, whereas a residential city requires 15-25 years to produce positive returns.

How does seawater cooling make The Line's data center location more viable than traditional air-cooled facilities?

Seawater cooling leverages the Red Sea's consistent cool water temperatures (roughly 20-25°C year-round at depth) to efficiently extract heat from AI infrastructure. This approach reduces cooling energy consumption dramatically compared to air cooling in a 50°C desert climate, improving Power Usage Effectiveness (PUE) metrics from typical 1.5-1.8 down to 1.2-1.3. That efficiency advantage translates to millions in annual energy cost savings, making The Line's coastal location a structural competitive advantage rather than a liability.

How much GPU capacity would The Line's AI data center complex realistically have when fully deployed?

Based on comparable facilities and phased development models, a fully deployed Line complex could eventually reach 100,000-200,000+ GPU capacity across multiple modular facilities by 2030-2032. Early phases (2026-2027) would likely start with 5,000-10,000 GPU capacity, scaling to 50,000+ by 2028-2029. The exact scale depends on power infrastructure availability, cooling capacity, regulatory approvals, and customer demand.

What global AI companies or research organizations might use The Line's data center services?

Likely customers include regional technology companies seeking compute access without relying on US cloud providers, research institutions needing affordable training infrastructure, AI companies like Anthropic or Deep Seek needing additional capacity when US providers are bottlenecked, and international enterprises developing models for Middle Eastern and Asian markets. Geopolitical considerations will influence customer composition—some Western tech companies may hesitate, while others prioritizing cost savings or diversity of infrastructure providers would be attracted.

What are the main risks that could derail The Line's AI data center project?

Major risks include execution delays (common with Saudi megaprojects), talent acquisition and retention challenges (specialized engineers prefer established tech hubs), power infrastructure delays (getting 50+ megawatts of reliable electricity to a remote desert location takes time and capital), geopolitical restrictions on technology transfer, competition from established cloud providers improving their cost competitiveness, and regulatory uncertainties around data sovereignty and privacy. Success requires Saudi Arabia to demonstrate reliable execution and attract enterprise customers willing to trust a new infrastructure provider.

How does The Line's pivot reflect broader trends in how megaprojects are being reconceived globally?

The Line exemplifies a broader trend where governments and investors are replacing speculative megaprojects with pragmatic infrastructure focused on near-term ROI and solving identified market gaps. Rather than building future-facing cities or speculative developments, successful modern megaprojects (like data centers, renewable energy facilities, or semiconductor plants) address acute current shortages and have clear revenue models. The shift reflects lessons learned from delayed megaprojects with uncertain returns, pushing decision-makers toward measurable value creation over speculative visions.

What is the estimated timeline for bringing The Line's AI data center to operational capacity?

Realistic timeline suggests Phase 1 core infrastructure development through 2026, initial facility deployment and first customer workloads by 2027, expansion to significant capacity (50,000+ GPUs) by 2028-2029, and mature operation with global visibility by 2030+. This assumes smooth execution without major delays, regulatory challenges, or supply chain disruptions. Historical megaproject timelines typically experience 15-30% delays, suggesting actual deployment might extend 12-18 months beyond these estimates.

The Bottom Line

Saudi Arabia's Line isn't failing. It's transforming into something potentially more valuable and more achievable: an AI data center complex positioned at the intersection of global compute shortage, energy efficiency innovation, and geopolitical diversification.

The original vision was audacious but increasingly unrealistic. The pivot is pragmatic and strategically sound. The kingdom recognized that building a residential city for nine million people in the Saudi desert was a 25-year capital soak with uncertain returns. Building compute infrastructure for global AI demand? That's 2-3 years to profitability and genuine strategic value.

Will it succeed? That depends entirely on execution. Saudi Arabia needs to deliver on talent, infrastructure, and customer acquisition. Those aren't trivial. But they're achievable, and the vision is focused enough that success is plausible.

What's happening at The Line matters beyond Saudi Arabia. It signals how governments and massive capital are adapting to the reality that AI infrastructure—not residential megacities or speculative development—is where genuine economic value lives right now. Other countries will notice. Other megaprojects will adapt. And the AI infrastructure market will become increasingly competitive and geographically distributed.

That's not just good business strategy. It's the future of how major infrastructure gets built in an AI-first world.

Key Takeaways

- The Line's pivot from 170km residential megacity to AI data center represents pragmatic adaptation rather than project failure

- Saudi Arabia faces fiscal pressure from lower oil revenues and competing megaproject commitments, making residential development unsustainable financially

- Global AI compute capacity faces acute shortage with demand exceeding supply; The Line addresses this market gap with immediate revenue potential

- Seawater cooling leverages Red Sea's consistent temperatures to achieve 20-30% better energy efficiency than air-cooled competitors in hot climates

- Success requires 2-3 year timeline to profitability versus 15-25 years for residential city, fundamentally changing project economics and ROI profiles

Related Articles

- Microsoft's $7.6B OpenAI Windfall: Inside the AI Partnership [2025]

- AI Data Centers Drive Historic Gas Power Surge [2025]

- Amazon's 16,000 Job Cuts: AWS Impact and Restructuring Strategy [2025]

- The Smart Glasses Revolution: Why Tech Giants Are All In [2025]

- Tesla's $2B xAI Investment: What It Means for AI and Robotics [2025]

- AI Data Centers and Power Grids: The Winter Storm Crisis [2025]

![Saudi Arabia's The Line Transforms into AI Data Centers [2025]](https://tryrunable.com/blog/saudi-arabia-s-the-line-transforms-into-ai-data-centers-2025/image-1-1769735233352.jpg)