Lenovo Warns PC Shipments Face Pressure From RAM Shortages Despite Strong Revenue Growth [2025]

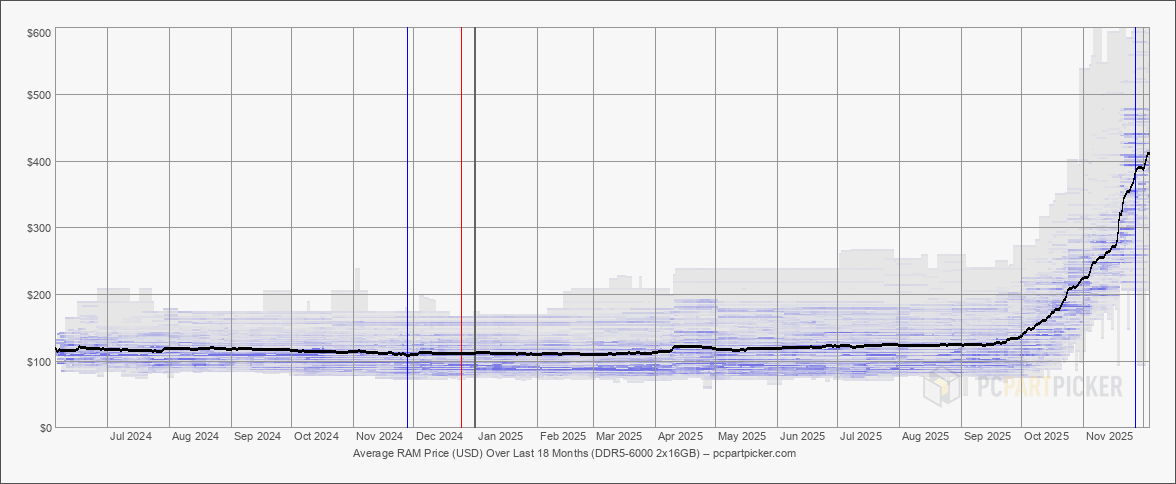

The world's largest PC manufacturer just dropped a reality check that nobody in the industry wants to hear. Even with record revenue, booming AI server demand, and strong profit margins, Lenovo is bracing for a rough ride on PC shipments. The culprit? A memory chip shortage that's become impossible to ignore.

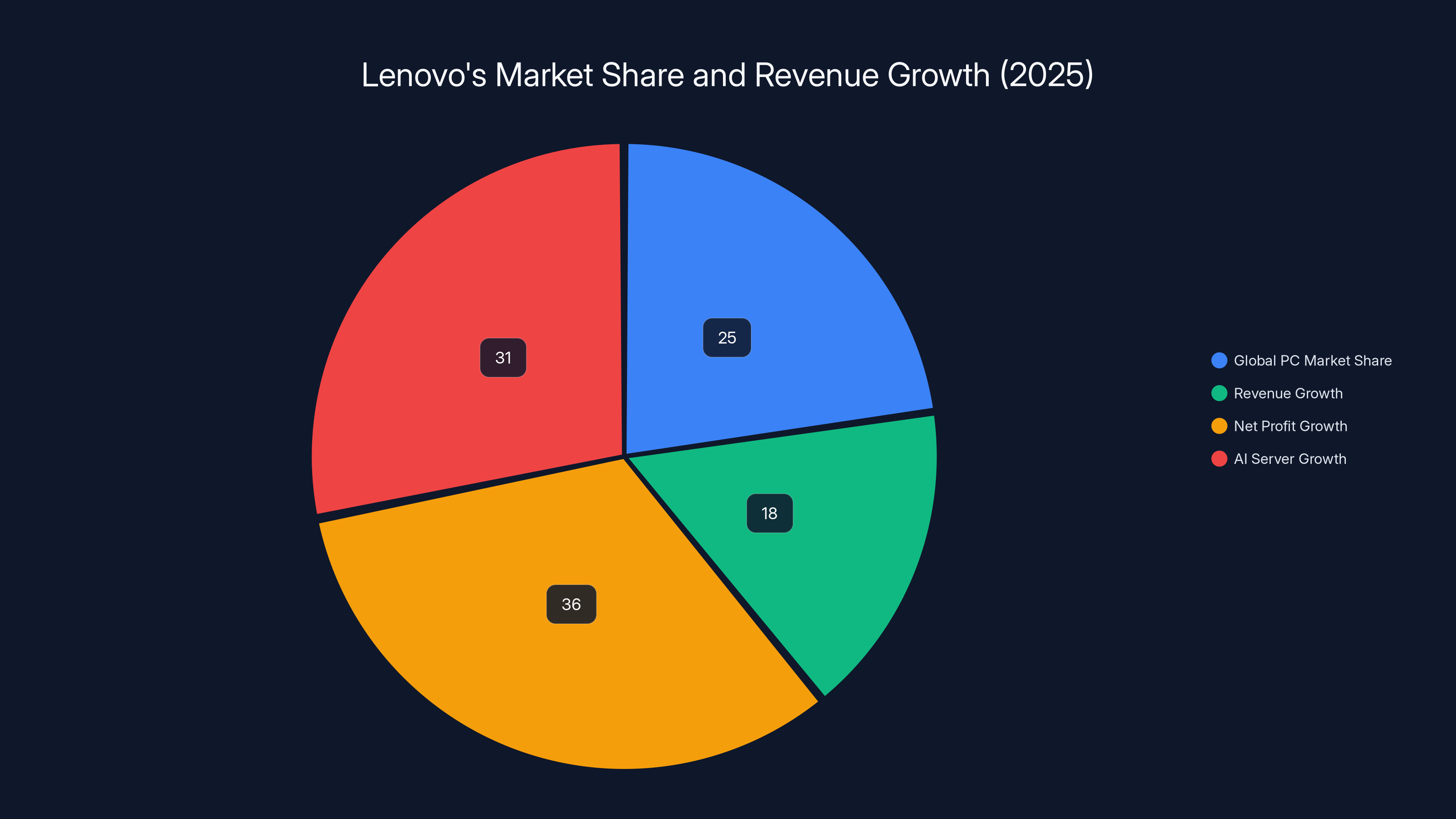

Here's what makes this announcement particularly significant. Lenovo isn't some struggling hardware maker complaining about supply issues. This is the company that controls roughly 25% of the global PC market. If Lenovo is worried, everyone should be paying attention.

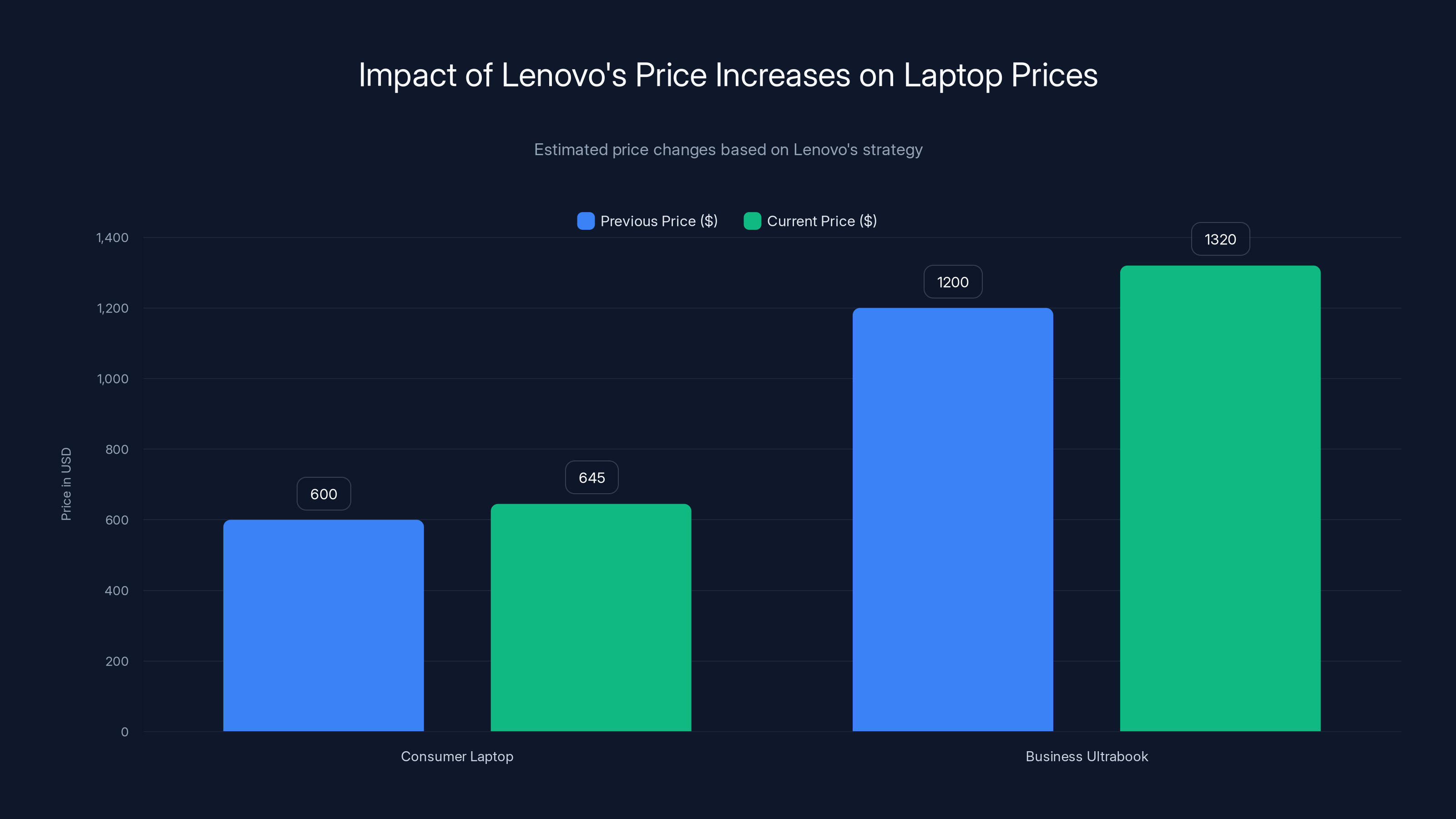

During its latest earnings call, CEO Yang Yuanqing was blunt about the situation. The company expects PC unit sales to face real pressure from memory scarcity, but has raised prices to offset rising RAM costs and maintain profitability. Think about that for a second. Even the world's most dominant PC maker is raising prices to protect margins. That tells you everything you need to know about how tight the memory market has become.

What's fascinating is the contradiction buried in Lenovo's numbers. The company's third-quarter revenue hit

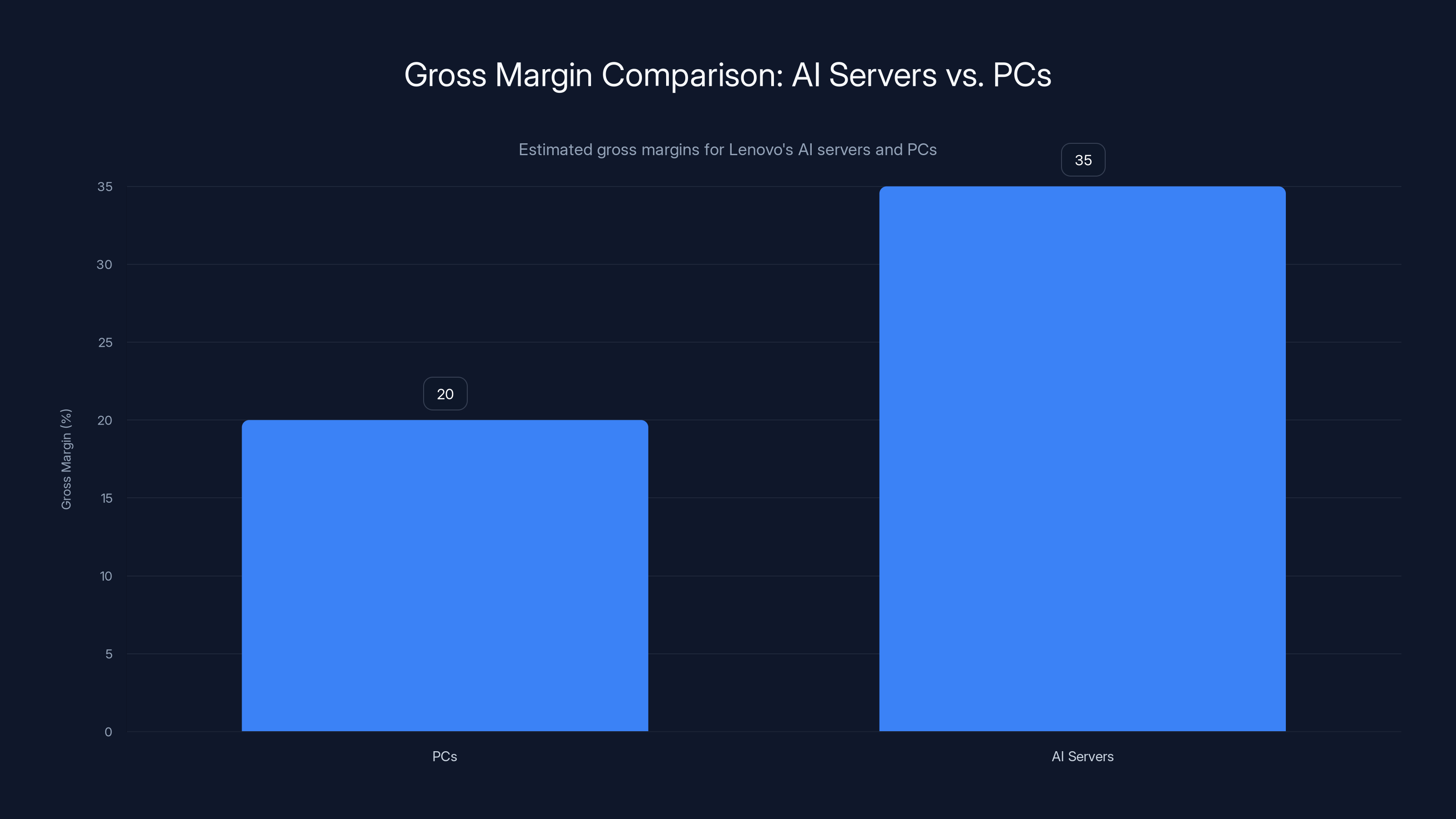

The memory shortage story gets more complicated when you zoom out. Lenovo's AI server business is absolutely crushing it, posting high double-digit growth fueled by Nvidia's GB200 NVL72 deployments. The company's digital infrastructure group grew 31% in the quarter. So Lenovo is simultaneously experiencing the best AI infrastructure boom in company history while watching its core PC business get squeezed by the same component constraints that are feeding AI demand.

This creates a strategic dilemma that hardware makers haven't really faced before. Every RAM chip, every memory module becomes a choice. Do you allocate it to AI servers where margins are potentially higher, or to PCs where you have massive installed base expectations and brand reputation at stake? Lenovo's answer seems to be: price the PCs higher and focus on capturing growth wherever margins are best.

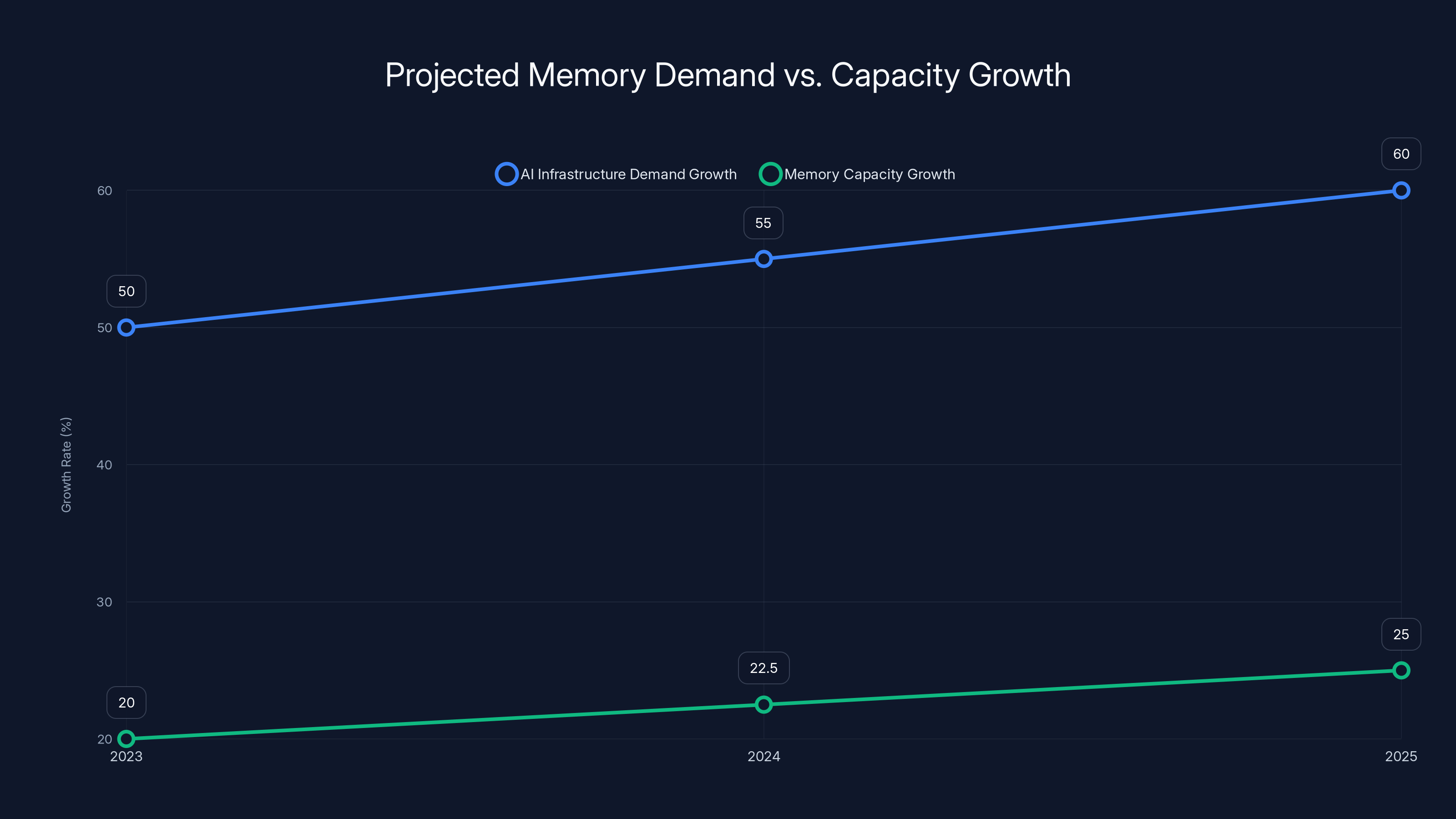

But here's what most articles about this shortage miss. This isn't a temporary blip that'll resolve in a few quarters. Industry observers are pointing to structural shifts in semiconductor allocation. AI infrastructure demand is fundamentally reshaping how memory production gets divvied up across the industry. And that reallocation is likely to persist for years, not months.

The Memory Shortage Reality: Why RAM Availability Is Tightening Across the Industry

Memory scarcity isn't happening by accident. It's the result of deliberate choices made by chip manufacturers, geopolitical factors, and an industry-wide pivot toward artificial intelligence systems.

Let's start with the straightforward economics. RAM production requires specialized facilities, specific manufacturing processes, and enormous capital investment. You can't just spin up a new memory fab overnight. Building a new facility costs billions and takes years to complete. This means current supply constraints are largely baked into the next 18 to 24 months, regardless of demand.

The allocation problem is where things get interesting. Memory manufacturers like SK Hynix, Samsung, and Micron aren't producing less memory overall. They're producing the same amount, but different customers are getting priority access. AI data center operators are getting preferential allocation. Why? Because they're ordering in massive volumes and paying premium prices for fast delivery and guaranteed supply.

When a cloud infrastructure company like Amazon or Microsoft orders 100,000 units of high-bandwidth memory for their AI clusters, that demand gets filled first. When a traditional PC maker like Lenovo orders the same amount of standard DDR5 RAM, they're competing with other PC makers for what's left. This creates a queuing effect where standard consumer and business PC shipments get delayed while specialty AI memory flows freely.

Geopolitical factors add another layer. The semiconductor industry is heavily concentrated in Taiwan, South Korea, and China. Any disruption in these regions creates global ripple effects. Trade restrictions and supply chain nationalism mean manufacturers are hesitant to overcommit to long-term supply agreements, preferring instead to play it safe and allocate supplies conservatively.

There's also a technology upgrade cycle at play. Newer AI workloads demand higher-bandwidth memory, lower-latency operations, and specific configurations that don't exist in consumer PC memory. This creates a segmented market where you have premium AI memory commanding 40% higher prices than standard consumer DRAM. From a manufacturer's perspective, that's where they want to invest production capacity.

Lenovo's stockpiling activity, which the company has confirmed through supply chain intelligence, suggests they see the shortage persisting well into 2025. Manufacturers don't build emergency reserves unless they believe supply will remain tight. The fact that multiple hardware makers are quietly hoarding memory speaks volumes about their internal forecasts.

Lenovo's price increases range from 5% to 12%, with consumer laptops now costing

How the Shortage Impacts Different PC Market Segments

The memory shortage doesn't affect all PC segments equally. There's a clear pecking order based on profit margins and production volume.

Enterprise and business PCs are getting hit hardest. These are the machines that corporations buy in bulk for their workforce. Enterprise buyers expect specific configurations, guaranteed delivery dates, and volume discounts. Memory shortages mean longer lead times, which disrupts corporate refresh cycles. A company planning to upgrade 10,000 desktops might find only 7,000 available in the timeframe they need, forcing them to stagger purchases or accept longer waits.

Consumer PCs are experiencing a different problem. Manufacturers are intentionally moving away from high-memory configurations. Instead of standard 16GB or 32GB builds, you're seeing more 8GB and 12GB configurations hitting the market. These use less memory but also provide worse performance, particularly for content creators and gamers who actually need the headroom. Consumers pay less but get worse value.

Gaming and creator PCs are in a weird middle ground. Enthusiast demand for high-memory, high-performance systems remains strong. Manufacturers know gaming and creator machines carry higher margins. So they're prioritizing these segments over basic office PCs. But even here, users are seeing price increases of 15% to 25% compared to the same configurations two years ago.

Mobile and thin-and-light laptops are getting squeezed the hardest. These machines use specialized, lower-capacity memory modules that are less profitable to manufacture than desktop RAM. Laptop makers are consolidating production around fewer models, meaning customers have less choice and less ability to find deals.

The commercial and industrial segment, which includes purpose-built machines for specific applications, is paradoxically doing okay. These systems typically ship with pre-configured memory built into proprietary designs. Once a machine is locked into production, the memory supply chain is more stable. But volumes are lower, so less public attention gets paid to these markets.

Lenovo's core business is business and consumer PCs, which means it's getting squeezed on both sides. The company has already indicated it's shifting marketing focus toward its more profitable segments, which means we should expect to see fewer ultra-budget laptops and more mid-range to premium machines.

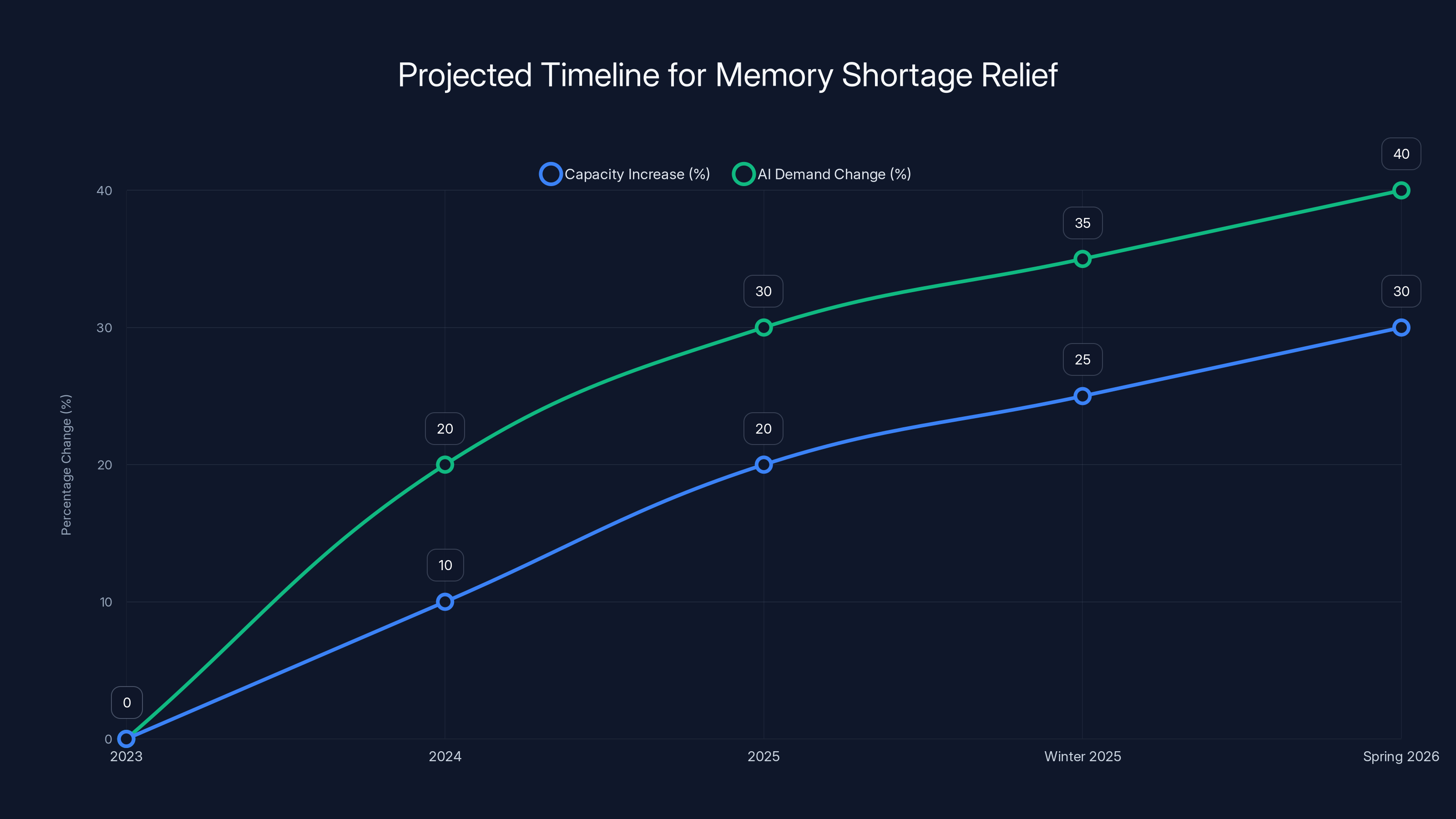

AI infrastructure demand is projected to grow over 50% annually, outpacing memory capacity growth of 20-25% through 2025. Estimated data.

Lenovo's Financial Response: Price Increases and Portfolio Strategy Shifts

Lenovo's strategy for dealing with the shortage is textbook manufacturer playbook, but executed with precision.

First, aggressive pricing. CEO Yang Yuanqing stated explicitly that the company has raised prices to offset rising memory costs. We're not talking about small adjustments. Typical increases are in the 5% to 12% range depending on configuration and market segment. A

Second, portfolio consolidation. Rather than offering 47 different laptop SKUs (stock keeping units), manufacturers like Lenovo are streamlining down to 25 to 35 core configurations. This reduces complexity, improves production efficiency, and lets them focus memory allocation on their most profitable machines. It also subtly pushes customers toward higher-margin options.

Third, segmentation strategy. Lenovo is making clear distinctions between what gets premium treatment and what gets commodity treatment. Lenovo's gaming line (Legion), premium ultrabooks (Think Pad X-series), and creator machines (Yoga) are getting priority memory allocation and faster shipping. Budget lines and chromebooks are facing longer lead times and less frequent updates.

Fourth, supply chain localization. Lenovo is increasingly working with regional memory suppliers and second-tier chipmakers to diversify its supply sources. This doesn't solve the shortage, but it provides redundancy and reduces dependence on primary suppliers who are prioritizing AI workloads.

The adjusted net profit figure is particularly telling. Lenovo's adjusted net profit jumped 36% despite unit sales pressure. That's the classic sign of successful price realization. Fewer units sold, but higher profit per unit. This is a sustainable strategy in the short term, but dangerous long-term if it prices customers toward competitors or second-tier products.

Lenovo's gross margin expansion, driven by pricing power and operating leverage, is the company's way of offsetting unit volume pressure. This works until either supplies normalize or customers rebel. The company is betting supplies normalize before customer sentiment shifts toward alternative brands.

The AI Infrastructure Paradox: Why Shortages Benefit Lenovo's Server Business

Here's the counterintuitive part of Lenovo's situation. While PC shipments face pressure, the company's AI server business is booming.

Lenovo's digital infrastructure group posted 31% revenue growth in the last quarter. More importantly, the AI server business specifically showed high double-digit growth driven by Nvidia-based deployments. The company recently introduced new enterprise servers for inference workloads in collaboration with AMD. This is Lenovo's fastest-growing segment by far.

Why the divergence? Several factors. First, AI infrastructure customers don't really care about price. A company deploying

Second, AI infrastructure has better gross margins. A typical PC might have 18% to 22% gross margin depending on configuration and volume. A high-end AI server can have 30% to 40% gross margin, particularly for custom or quasi-custom designs. So allocating scarce memory to AI servers is financially superior to allocating it to PCs.

Third, the AI server market is still supply-constrained, meaning customers are bidding up prices. If Lenovo has 100 units of high-bandwidth memory available, and it can either build 5 AI servers or 25 PCs, the servers generate significantly more revenue and profit per memory module. The economics are overwhelmingly in favor of AI infrastructure allocation.

Nvidia's GB200 NVL72 design, which Lenovo has built systems around, requires specific memory configurations that aren't as broadly used in consumer or enterprise PCs. This creates a natural separation between PC supply chains and AI infrastructure supply chains. Lenovo's access to Nvidia's memory doesn't cut into PC allocations because they're sourced differently.

However, this creates a subtle danger. If Lenovo over-indexes on AI infrastructure and under-invests in core PC business, it risks losing market share to competitors who stay focused on mainstream PC demand. The company is clearly trying to thread this needle by maintaining PC competitiveness through price increases while maximizing AI infrastructure growth. It's a high-wire act.

Lenovo's recent introduction of new inference-focused servers with AMD partnerships signals they're preparing for the next phase of AI infrastructure demand. Training (where Nvidia dominates) requires massive memory and compute. Inference (the deployment phase where models run queries and generate outputs) is where the actual revenue gets generated, and it's a much larger market opportunity. Lenovo is positioning to capture share in that segment before it gets completely commoditized.

AI servers have a significantly higher gross margin (35%) compared to PCs (20%), making them a more profitable segment for Lenovo. Estimated data.

Competitive Dynamics: How Dell, HP, and Other PC Makers Are Responding

Lenovo isn't alone in facing this shortage, but it's in a better position than some competitors.

Dell is in a trickier spot. Dell's PC business is smaller than Lenovo's as a percentage of total revenue, but the company is heavily invested in enterprise and premium segments where price elasticity is lower (meaning price increases stick better). Dell has also been raising prices, but the company lacks Lenovo's scale in AI infrastructure. This means Dell is more dependent on PC sales maintaining volume while dealing with margin pressure from component costs.

HP is perhaps most exposed. HP's PC business is roughly equivalent to Lenovo's, but the company has less diversified revenue. HP doesn't have a comparable AI infrastructure business to offset PC volume pressure. This forces HP to either raise prices (losing share) or accept lower margins (hurting profitability). Early signals suggest HP is trying selective price increases while exiting lower-margin segments entirely.

Apple's situation is entirely different due to its vertical integration. Apple designs its own chips, controls memory allocation internally, and builds entire systems as unified products. When memory gets tight, Apple simply raises prices on all products. The company's ecosystem lock-in means customers accept these increases rather than switch. This gives Apple a structural advantage in shortage environments.

Chinese manufacturers like Lenovo's competitors in the home market face different pressures. Domestic players often have better relationships with local memory suppliers (YMTC, Chang Xin) who are starting to produce competitive memory products. This creates a regional advantage where Chinese-based manufacturers can source memory more reliably for domestic sales while global manufacturers face allocation shortages.

The competitive dynamic is consolidating the market. Smaller manufacturers who can't absorb price increases or manage supply chains are exiting. This should ultimately benefit Lenovo because scale matters. A company with 25% market share can negotiate better with memory suppliers than one with 5% share.

Supply Chain Intelligence: What Lenovo's Stockpiling Reveals About Industry Forecasts

Lenovo has publicly confirmed it's stockpiling memory, which is the supply chain equivalent of loading up sandbags before a flood.

When manufacturers stockpile, they're signaling confidence in their shortage forecast. Building inventory costs money in working capital, storage, and handling. No rational executive does this unless they believe the shortage will persist long enough to justify those costs. Lenovo's stockpiling suggests internal forecasts see memory constraints lasting through 2025 and into 2026.

The types of memory Lenovo is stockpiling tell us something important. The company isn't stockpiling cutting-edge, high-bandwidth memory that commands premium pricing. Instead, Lenovo is focusing on standard DDR5 configurations used in mainstream business and consumer PCs. This suggests the company sees the risk as availability of commodity components, not access to specialty memory.

This has implications for consumers and businesses. If Lenovo gets memory and competes primarily on price, prices stay contained. If Lenovo gets memory and raises prices to maximize profit, pricing stays elevated. The company's quarterly earnings should reveal which strategy it's pursuing.

Other manufacturers are doing the same thing. Industry reports suggest the entire PC manufacturing ecosystem has increased memory inventory by 25% to 40% in the last two quarters. This large-scale stockpiling has created upward pressure on memory prices because the buying is so concentrated.

There's a timing risk here. If manufacturers overestimated shortage duration and memory supplies normalize faster than expected, these stockpiles become expensive deadweight inventory. Manufacturers have to liquidate excess stock at discounts, which suppresses pricing and cannibalizes near-term profitability. Early 2026 could see aggressive discounting if supplies normalize.

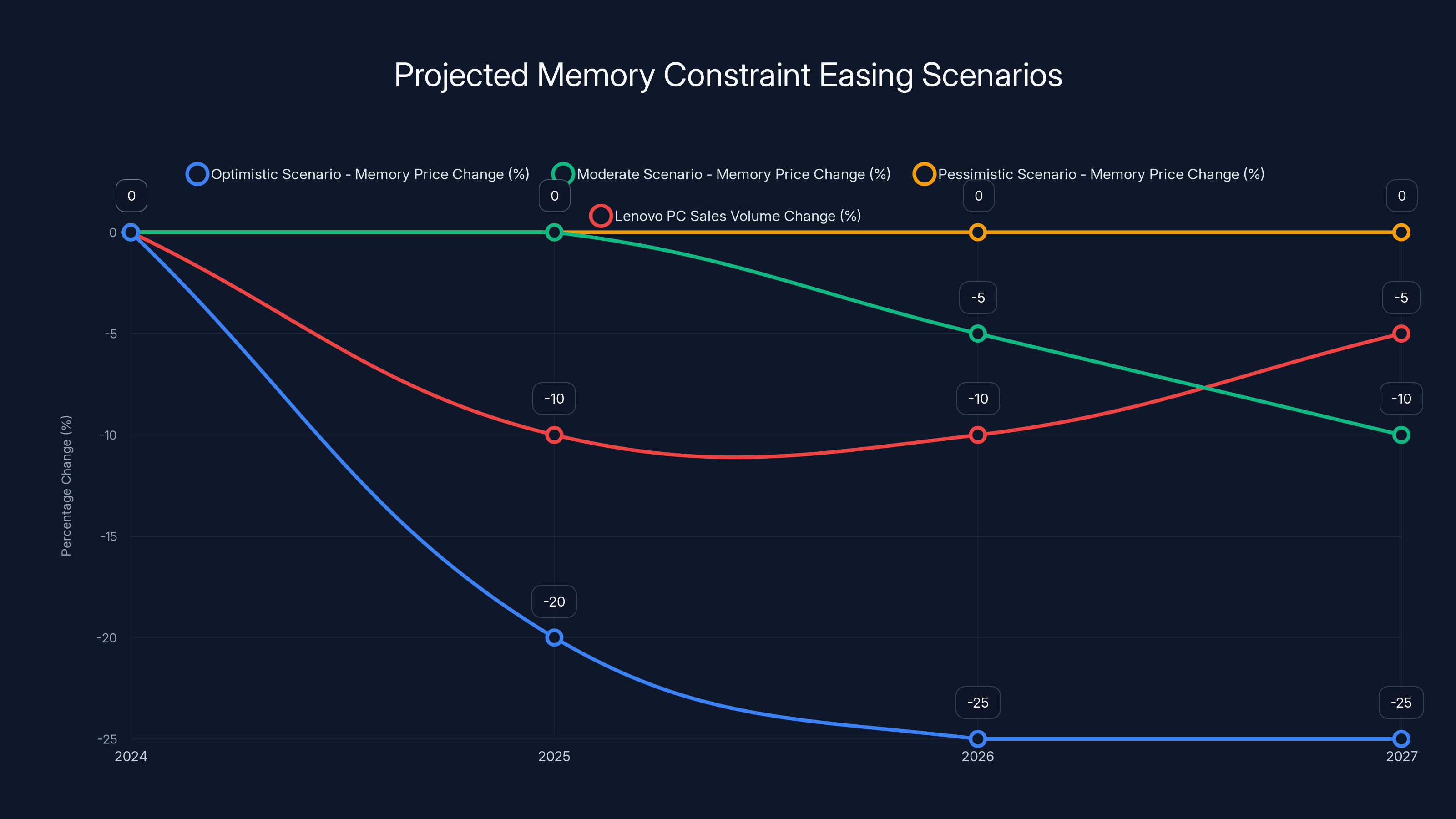

Estimated data shows that in the optimistic scenario, memory prices could decrease by up to 25% by 2025. Lenovo anticipates a moderate scenario with a 10% decline in PC sales volume by 2026. Estimated data.

Market Projections: When Will Memory Constraints Actually Ease?

Every manufacturer, analyst, and supply chain expert is making a bet about when this shortage ends.

The optimistic scenario sees memory constraints easing in mid-2025. This assumes AI infrastructure demand moderates slightly, production capacity increases come online, and customers stop panic-buying. In this scenario, memory prices fall 15% to 25% by late 2025, and manufacturers have to discount PCs to clear excess inventory. Lenovo would face pressure on both price realization and volumes.

The moderate scenario sees constraints persisting through 2025 with gradual easing in 2026. This is based on production capacity additions taking 18 to 24 months from announcement to actual manufacturing. Memory suppliers announced roughly 15% to 20% capacity additions through 2025, which would only moderately ease constraints given AI infrastructure demand growth. In this scenario, memory pricing stays elevated, manufacturers maintain price increases, and unit volumes stay under pressure. Profitability per unit improves while total volumes contract.

The pessimistic scenario assumes structural constraints persist through 2026 and beyond. This assumes AI infrastructure demand continues growing at 100%+ annual rates, consuming all production increases. In this scenario, memory becomes a permanent constraint, and manufacturers permanently shift portfolios toward higher-margin products and segments. This would fundamentally reshape the PC market toward premium products and away from mass-market budget machines.

Lenovo's guidance suggests the company is planning for the moderate scenario. The company expects PC unit sales to face pressure, implying volume declines of 5% to 15%. But the company expects to maintain profitability, implying pricing power through at least mid-2026. This suggests Lenovo's internal forecast shows constraints persisting for at least 18 months.

Industry capacity data supports this forecast. Current announced capacity additions total roughly 3 to 4 exabytes per year through 2026. AI infrastructure demand is growing at 50% to 60% annually. Simple math shows demand growth will consume all new capacity for at least two years. Only after 2027 should supply genuinely exceed demand for non-AI applications.

Industry-Wide Price Increases: The Broader Implications for Hardware Budgets

Lenovo's price increases are just the beginning. Across the hardware industry, price pressure is building.

Dell has already signaled price increases are coming. HP is implementing selective price hikes. Even specialty manufacturers like System 76 and Framework are dealing with component cost inflation. The cumulative effect is that enterprise and consumer hardware budgets are facing real pricing pressure heading into 2025.

For enterprise IT organizations, this creates a budget challenge. Corporate hardware refresh cycles are often planned 12 to 18 months in advance based on stable pricing assumptions. Suddenly those budgets are 10% to 15% short. This forces painful choices: reduce quantities, extend replacement cycles, or find additional budget.

Many enterprises are choosing to extend replacement cycles. Instead of refreshing business desktops every 4 to 5 years, companies are stretching to 5 to 6 years. This reduces immediate hardware spend but creates technical debt and potentially reduces productivity as employees work with older machines.

Smaller organizations are getting squeezed the most. Large enterprises can negotiate volume discounts that partially offset price increases. Small companies buying 50 to 100 machines pay full freight. This is creating an incentive structure where large, established companies do better in shortage environments than small, growing companies.

There's also a domino effect. When memory prices increase, motherboard manufacturers increase prices because memory costs are part of their bill of materials. When motherboard prices increase, system integrators increase prices. When system integrators increase prices, resellers increase prices. By the time the price increase reaches end customers, it's often 15% to 20% instead of 5% to 10%.

This pricing environment favors premium products. A

Estimated data suggests that memory capacity will gradually increase by 30% by Spring 2026, while AI demand is expected to rise by 40%. This timeline indicates potential relief from shortages by early 2026, assuming no major disruptions.

The AI Factor: How AI Infrastructure Demand Is Reshaping Hardware Allocation

Underlying the entire PC shortage is AI infrastructure demand that's reshaping how the entire hardware industry operates.

Cloud infrastructure companies like Amazon, Microsoft, Google, and Meta are ordering servers in volumes that would've been unthinkable five years ago. A single large cloud provider might order 50,000 to 100,000 AI servers in a single quarter. Each of those servers contains 10 to 20 times more memory than a typical PC. The arithmetic is staggering.

When you have a customer willing to buy 50,000 units of a product at premium pricing, you optimize your entire supply chain around that customer. You allocate your best suppliers, reserve production capacity, and make long-term commitments. Everyone else gets whatever's left.

This is a structural shift in the semiconductor industry. For decades, consumer and enterprise PC makers were the largest customers, so they got allocation priority. Now, cloud infrastructure is the largest customer segment, and that's reshaping entire supply chains.

Lenovo's decision to heavily invest in AI servers is explicitly a response to this market shift. The company sees AI infrastructure as the growth opportunity and is allocating engineering, manufacturing, and supply chain resources accordingly. PC manufacturing becomes the cash cow funding AI infrastructure growth.

Samsung, SK Hynix, and Micron are making the same bet. They're expanding memory production capacity, but specifically for AI applications. High-bandwidth memory for AI training, specialized memory for inference workloads, and ultra-low-latency memory for real-time AI applications get the investment focus. Standard consumer DRAM gets less focus.

This creates a multi-year dynamic where PC shortages are almost baked in structurally. As AI adoption accelerates through 2025 and 2026, memory allocation toward AI becomes even more concentrated. PC demand remains strong (people still need computers), but supply gets progressively constrained.

The question is whether this is temporary or permanent. If AI infrastructure demand eventually moderates and follows a normal product adoption curve, memory constraints ease after 2026. If AI infrastructure becomes the permanently dominant use case (which seems likely), then PC shortages and price increases could persist indefinitely relative to pre-AI normal.

Corporate Strategy: Lenovo's Long-Term Positioning Amid Supply Constraints

Lenovo's moves reveal a company strategically preparing for a very different hardware market than the one that existed five years ago.

First, geographic diversification. Lenovo is explicitly expanding manufacturing footprint in Southeast Asia, India, and eventually potentially Mexico to reduce dependence on single-source manufacturing. This helps hedge against regional supply disruptions and geopolitical risks. It also improves supply chain resilience when memory comes from multiple regions.

Second, product segmentation. Rather than competing on lowest price in commodity segments, Lenovo is consciously exiting the ultra-low-cost market. The company is focusing on consumer and business segments where it can command higher margins. Budget chromebooks and ultra-cheap laptops are getting discontinued. Higher-price-point machines get investment.

Third, services and software expansion. Lenovo is increasingly bundling software services, cloud integration, and managed services with hardware. This shifts revenue and margin from transactional hardware sales to recurring software and services revenue. This is a hedge against a future where hardware commoditizes further.

Fourth, vertical integration considerations. Lenovo has been exploring partnerships with memory suppliers, considering co-investments in manufacturing capacity, and building relationships with second-tier chipmakers. The company's not acquiring memory manufacturing (too capital intensive and different core competency), but it's getting closer to memory suppliers than it has been historically.

Fifth, ecosystem lock-in. Lenovo's Think Pad and Legion brands are increasingly becoming lifestyle brands with supporting ecosystems. Accessories, software, services, and cloud integration create stickiness that makes customers less price-sensitive. This provides pricing power during shortage environments.

These strategic moves suggest Lenovo is planning for a future where hardware supply is structurally tight and memory allocation remains AI-dominated for years. The company is positioning itself to thrive in that environment rather than hoping supplies normalize.

Lenovo controls 25% of the global PC market and has seen significant growth in revenue (18%), net profit (36%), and AI server business (31%) despite memory shortages. Estimated data.

The Consumer Impact: What Higher PC Prices Mean for End Users

When hardware manufacturers raise prices, the impact flows to every consumer and business that buys a computer.

For consumers upgrading personal machines, the impact is a straightforward math problem. A laptop that cost

For content creators and professionals, the situation is more nuanced. These users actually benefit from higher-end machine configurations, so they're somewhat insulated from price increases that hit budget segments hardest. A videographer buying a

For businesses, the impact depends on scale and negotiating power. Large enterprises can often negotiate volume discounts that partially offset manufacturer price increases. Small and medium businesses get stuck paying full retail prices and absorbing the costs fully.

One subtle but important impact is configuration changes. Rather than buying exactly the configuration they want, many customers are forced to compromise. Someone who wanted 32GB of RAM might drop to 16GB. Someone who wanted an SSD upgrade might stick with base storage. These compromises degrade user experience and reduce productivity for knowledge workers.

There's also a psychological impact. When prices are rising (especially significantly), consumer behavior changes. People become more cautious about purchases, do more research, and are more likely to buy from brands they know and trust. This typically benefits large established brands like Lenovo at the expense of smaller competitors and emerging brands.

For used PC markets, shortage and price dynamics create unusual arbitrage opportunities. Last-generation machines that were superseded by new releases now look more price-competitive. Refurbished enterprise machines become more attractive as businesses upgrade. This creates a bifurcated market where premium new machines carry big prices while used and refurbished machines offer better value.

When Will the Shortage Actually End? Timeline Analysis and Expectations

This is the question everyone's asking, and the honest answer is nobody knows precisely.

Memory manufacturers have announced production capacity increases totaling roughly 20% to 25% through 2025. But these announcements often get delayed. Facilities under construction sometimes face delays. Equipment shipments get held up. Production ramp-up takes longer than planned. The executed capacity increase is often 30% to 50% less than announced.

Demand is harder to forecast. AI infrastructure growth could moderate if there's a perception that the market is over-saturated. Or it could accelerate if new use cases emerge that weren't anticipated. Some analysts predict AI demand moderates 30% to 40% in 2025. Others think it accelerates 50%+. That's a huge spread with massively different implications.

Most industry experts are converging on a timeline where constraints ease gradually through 2025, with meaningful relief arriving in early 2026. Not relaxation. Relief. Even in optimistic scenarios, memory won't return to 2021 pricing or availability. The industry has fundamentally resized itself around AI being the dominant use case.

However, regional variations are important. Memory supplies could normalize faster in Asia-Pacific and Europe than in North America simply based on local supply patterns. This could lead to regional price divergence where PCs are cheaper in some markets than others due to supply imbalances.

Winter 2025 and spring 2026 are the inflection point. If capacity additions execute on schedule and AI demand moderates as expected, that's when we'll start seeing genuine inventory and pricing relief. If either of those conditions fails to materialize, shortages persist.

From Lenovo's perspective, the company needs supplies to remain tight through at least mid-2026 for its current strategy (higher prices, lower volumes, maintained profitability) to work. If supplies normalize faster, the company will have to discount to clear inventory that was built assuming ongoing constraints. This creates an interesting dynamic where Lenovo actually benefits from shortages persisting longer.

Forward Planning: What Businesses Should Do Now

If you're managing technology budgets, hardware procurement, or making strategic tech decisions, the shortage environment demands specific actions.

First, accept that prices won't return to pre-2024 levels. Even when supplies normalize, memory will be more expensive than it was because capacity utilization is higher. Plan budgets based on 5% to 10% higher hardware costs than historical baselines.

Second, implement strategic procurement timing. Negotiate annual hardware agreements with vendors now, before prices increase further. Spread purchases across quarters rather than making lump-sum purchases that hit higher prices. Take advantage of quarterly price fluctuations.

Third, optimize configurations aggressively. Rather than accepting default configurations from manufacturers, customize machines ruthlessly. Do you really need 32GB of RAM, or does 16GB handle your workload fine? Can you use external storage instead of expanding internal SSD? Small configuration optimizations compound into real savings.

Fourth, evaluate refurbished and previous-generation options. Organizations that buy the absolute latest models pay premium prices for marginally better performance. Mid-tier and previous-generation machines often have better value. Enterprise refurbished machines from companies like Dell or Lenovo come with solid warranties and often cost 20% to 30% less than new.

Fifth, extend replacement cycles strategically. Some machines should be replaced (performance has degraded, reliability suffers), while others should be kept (they're doing fine). Extend strategically rather than blanket decisions to extend all machines or replace all machines.

Sixth, build redundancy in your hardware supply chain. Don't depend entirely on one vendor or one configuration. Spread orders across multiple suppliers and build inventory buffers for critical machines. This costs more in the short term but protects against disruption.

Seventh, invest in software and services to extend machine life. Software optimization, additional RAM (if cost-effective), and better security tools can extend machine productivity. The cost of software optimization is often less than hardware replacement.

Looking Beyond 2025: The New Hardware Normal

Whatever happens with memory supply in the next two years, the fundamental dynamics driving this shortage aren't going away.

AI infrastructure demand is structural, not cyclical. As long as companies are building AI applications, training models, and deploying inference systems, memory demand for those applications will be enormous. The marginal GB of memory allocated to AI infrastructure is worth more than the marginal GB allocated to consumer PCs. This economic reality won't change.

This suggests a future where PC supply is perennially constrained relative to demand levels, and prices remain elevated relative to pre-AI baselines. The shortage might ease, but it won't vanish.

Manufacturers will adapt. We'll likely see standardization around fewer PC configurations, more aggressive segmentation (premium vs. commodity), and continued shift toward higher-margin products. The era of massive product choice at ultra-low prices is probably ending.

Software and services become more important as hardware differentiation decreases. If everyone's paying similar prices for similar specs, software quality and service quality become differentiators. Lenovo's investment in ecosystem and services reflects this understanding.

Regional differences may become permanent. Companies with better relationships with memory suppliers in their region will have structural cost advantages. This could accelerate geographic consolidation in manufacturing.

Vertical integration pressure increases. Companies that control their own supply chains (Apple, Microsoft in a limited sense) have advantages over companies dependent on spot market purchases (most traditional PC makers). We might see more acquisitions of specialty manufacturers or closer partnerships with suppliers.

The most important implication is that hardware buyers need to adapt their thinking. The assumption that hardware prices and supplies follow predictable patterns is broken. The new normal is volatility, constrained supply, and higher prices as the baseline rather than exception.

Conclusion: Navigating the New Hardware Reality

Lenovo's warning about PC shipments facing pressure is a watershed moment for the entire hardware industry. It signals that even the most dominant manufacturer can't insulate itself from structural supply constraints. When the global PC market leader is raising prices and expecting volume declines, smaller players are facing existential challenges.

The underlying story is simple but consequential: AI infrastructure has become more valuable and more consuming of component supply than consumer and business PC manufacturing. This reallocation is structural, driven by market economics, and likely to persist for years. Manufacturers are adapting by raising prices, reducing product diversity, and shifting toward higher-margin segments. The days of cheap, abundant computer choices are ending.

For consumers, this means accepting higher hardware prices and fewer options. For businesses, it means strategic procurement, extended refresh cycles, and acceptance that hardware budgets are permanently higher. For manufacturers like Lenovo, it means thriving in a market where supply is the bottleneck and pricing power flows to those who control allocation.

The shortage won't last forever. Capacity additions will eventually catch up to demand, supply will loosen, and at some point in 2026 or 2027, we'll have enough memory for both AI infrastructure and consumer PCs. But by then, the market will have fundamentally reshaped around new cost baselines, new competitive dynamics, and new strategic positioning. The hardware industry that emerges from this shortage period will look different from the one that entered it.

The best strategy right now is accepting the new reality, planning budgets accordingly, and making purchasing decisions based on 2025 economics rather than hoping for 2022 pricing. That's the hard truth embedded in Lenovo's earnings announcement.

TL; DR

- Memory Shortage is Real: Lenovo, the world's largest PC maker, is raising prices and expecting PC unit sales pressure due to RAM scarcity, even while reporting strong overall revenue growth.

- AI Infrastructure is Consuming Supply: Artificial intelligence data centers are consuming the majority of new memory production, leaving consumer and business PC manufacturers competing for declining allocation.

- Prices Are Here to Stay: Even when memory constraints ease, prices won't return to pre-2024 levels. Manufacturers are building strategy around permanently higher hardware costs and prioritized AI applications.

- Strategic Shifts Are Underway: Lenovo is consolidating product lines, exiting budget segments, and investing heavily in AI infrastructure where margins are higher and demand is stronger.

- Timeline for Relief: Meaningful easing of constraints is expected in early 2026, but the market will have fundamentally shifted by then with new competitive dynamics and cost structures.

FAQ

Why is memory becoming scarce if manufacturers are producing at full capacity?

Memory manufacturers are operating at capacity, but production allocation has shifted toward AI infrastructure applications due to superior margins and larger customer orders. Cloud providers like Amazon and Microsoft order memory in 50,000+ unit quantities for AI servers, while PC makers compete for remaining allocation. Capacity additions announced by suppliers total only 20-25% growth through 2025, which doesn't keep pace with 50%+ annual AI infrastructure demand growth.

How does Lenovo's AI server growth offset PC shipment pressure?

AI servers command higher prices (30-40% gross margins vs. 18-22% for PCs), require less-commoditized components, and come from customers with zero price sensitivity. For every unit of high-bandwidth memory, Lenovo can build either 5 AI servers (high margin) or 25 PCs (low margin). The financial incentive strongly favors AI infrastructure allocation, which is why Lenovo's digital infrastructure group posted 31% revenue growth despite PC volume pressure.

When will PC prices actually drop back to previous levels?

Likely never, at least not to pre-2024 baselines. Memory will remain more expensive due to permanently higher AI infrastructure demand consuming production capacity. Relief will arrive gradually starting in early 2026 as capacity additions come online, but even optimistic scenarios show 5-10% higher hardware costs than historical averages becoming the new normal.

Should businesses wait for prices to drop before upgrading their PC fleet?

No. Waiting is likely a mistake because supplies will remain tight through mid-2025, and prices will drop slowly even after constraints ease. Strategic approach is better: negotiate annual agreements with vendors now to lock in pricing, spread purchases across quarters, extend replacement cycles on machines that are still functional, and aggressively optimize configurations to minimize unnecessary costs rather than delaying purchases.

How is this shortage affecting competitors like Dell, HP, and Apple differently?

Dell and HP lack Lenovo's AI infrastructure business to offset PC volume pressure, forcing them to raise prices while defending volume. Apple's vertical integration lets it control memory allocation internally and simply raise prices across entire product lines without losing customers due to ecosystem lock-in. Chinese manufacturers often have better relationships with domestic memory suppliers, giving them regional advantages in Asian markets.

Will memory shortages permanently change the PC market structure?

Yes. The market is consolidating toward fewer, higher-price-point products as manufacturers exit low-margin segments. Budget chromebooks and ultra-cheap laptops are disappearing. Premium and business segments are prioritized. Services and software become more important as hardware differentiation decreases. Regional variations will emerge based on supply chain positioning. The outcome is a more stratified market with higher minimum prices and less product diversity than existed before 2024.

Last updated: January 2025

Key Takeaways

- Lenovo, world's largest PC maker, warns PC shipments face pressure from RAM shortages despite strong revenue growth

- Memory allocation is shifting dramatically toward AI infrastructure, leaving commodity PC manufacturing competing for declining supply

- Prices won't return to pre-2024 levels even when constraints ease, as AI infrastructure demand remains structurally elevated

- Lenovo's AI infrastructure business is booming with 31% growth, directly competing for same memory resources as PC manufacturing

- Relief from memory constraints expected in early 2026, but market structure will have permanently shifted toward higher prices and fewer options

Related Articles

- EU Data Centers & AI Readiness: The Infrastructure Crisis [2025]

- Steam Deck OLED Out of Stock: The RAM Crisis Explained [2025]

- Why OpenAI Retired GPT-4o: What It Means for Users [2025]

- ChatGPT-4o Shutdown: Why Users Are Grieving the Model Switch to GPT-5 [2025]

- The xAI Mass Exodus: What Musk's Departures Really Mean [2025]

- Dynabook Tecra A65-M Review: Full Analysis [2025]

![Lenovo Warns PC Shipments Face Pressure From RAM Shortages [2025]](https://tryrunable.com/blog/lenovo-warns-pc-shipments-face-pressure-from-ram-shortages-2/image-1-1771158966548.jpg)