Introduction: The Fall From Grace

There's a scene that plays out across every SaaS boardroom right now. A CFO pulls up a spreadsheet with valuation multiples from 2020. Then 2021. Then today. The numbers don't make sense anymore.

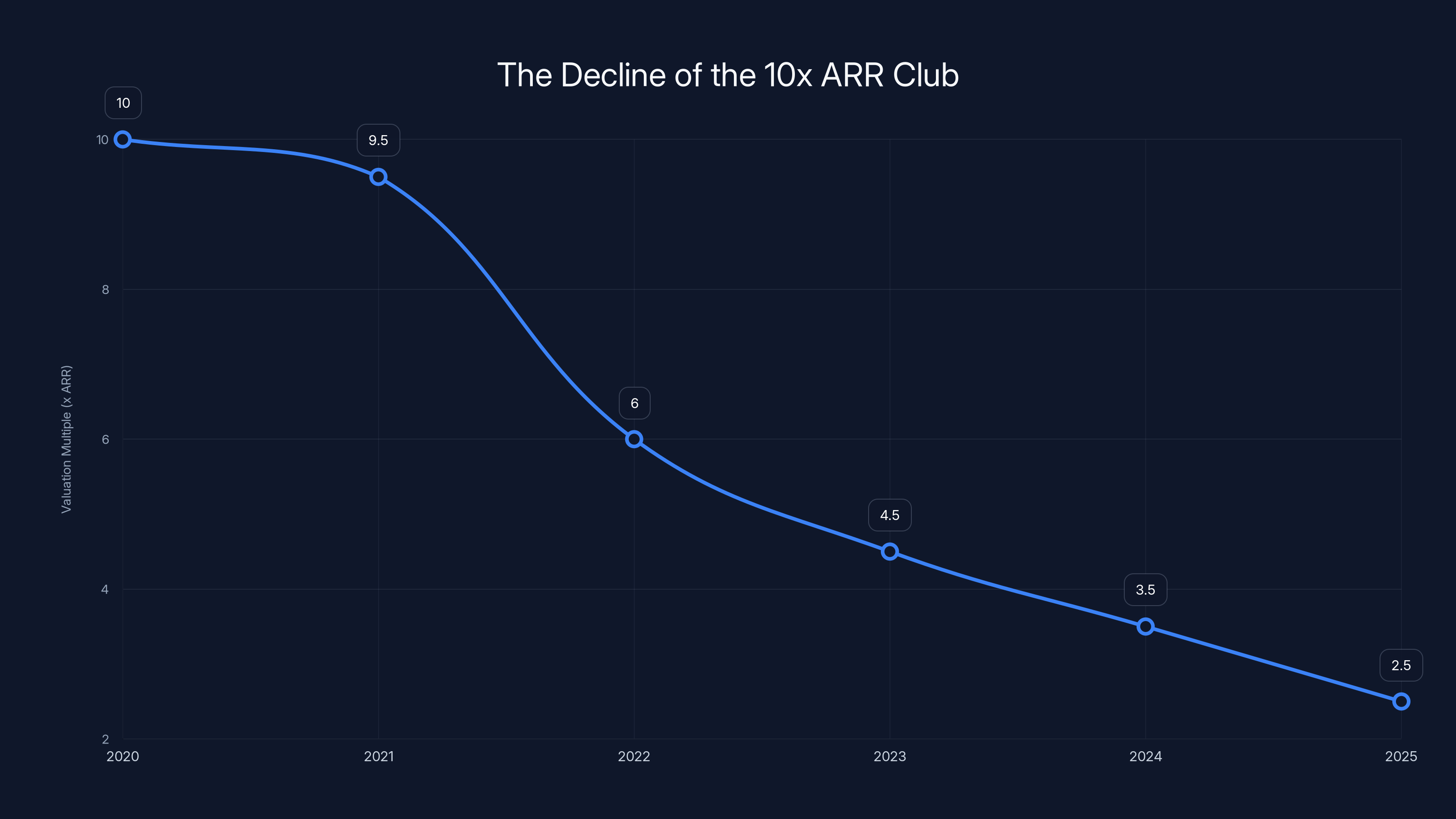

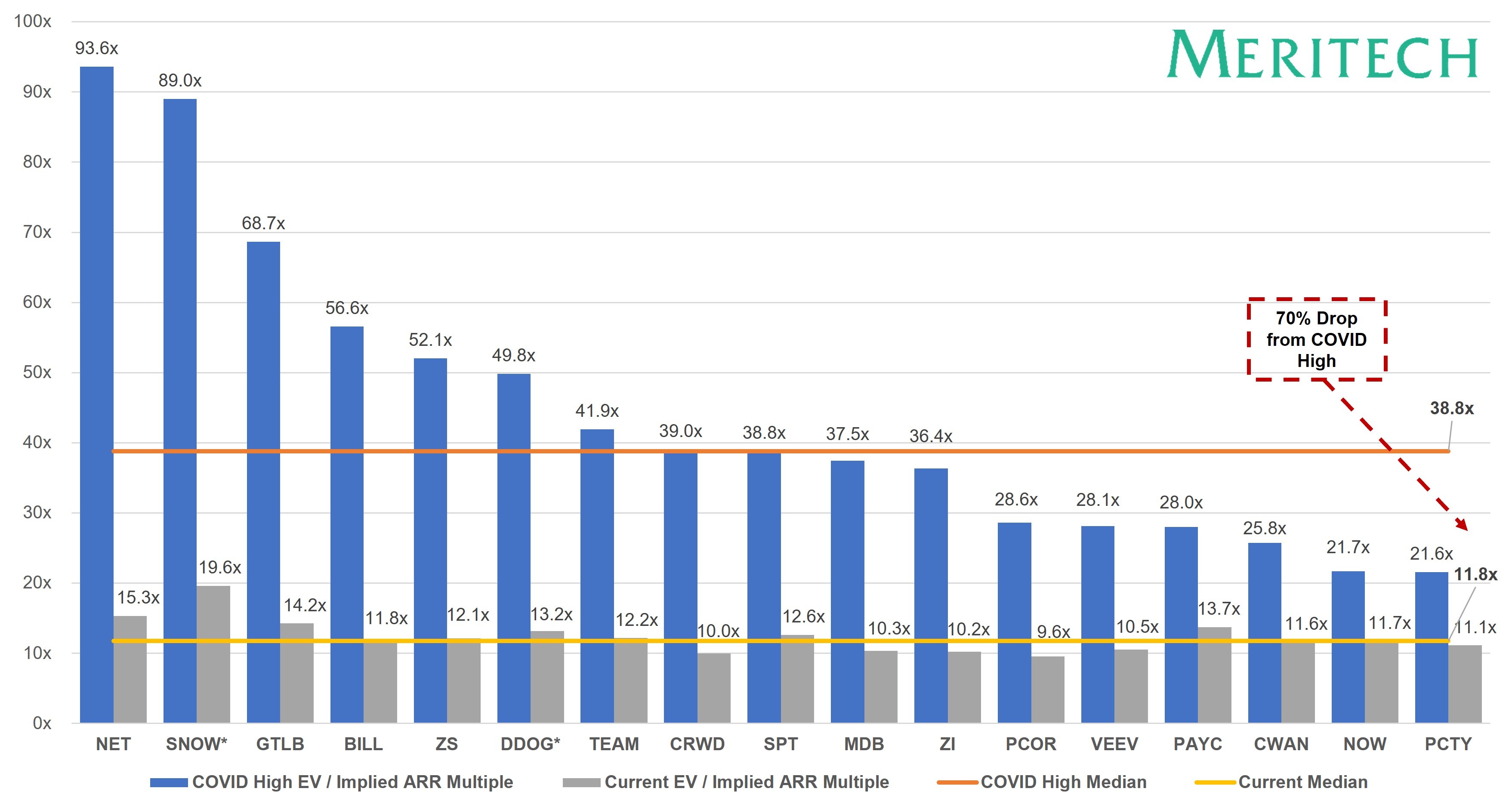

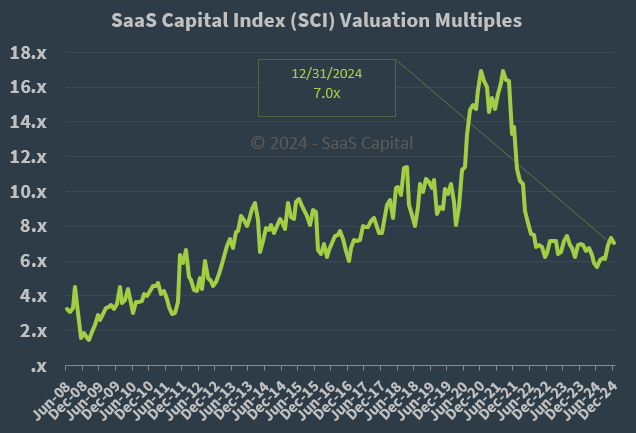

Back in Q4 2020, the SaaS world felt invincible. Sixty percent of public B2B companies traded at 10x revenue or higher. Some hit stratospheric heights: Asana at 89x, Service Titan at 48x, even Zoom at 82x. The median SaaS multiple was north of 18x. These weren't outliers. They were the norm. Every founder wanted in. Every investor wanted a piece. The 10x ARR Club wasn't exclusive. It was crowded.

Then everything inverted.

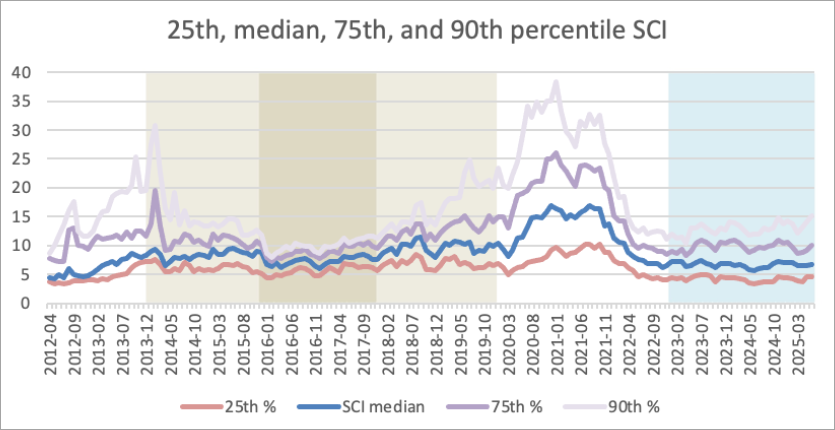

As of February 2026, we're living in what some are calling a "Software Armageddon." That phrase gets thrown around, but the data backs it up. The median public B2B company now trades at roughly 4x revenue. The average sits around 6.6x. That's not a correction. That's a complete repricing of what software companies are actually worth.

Salesforce, the largest pure-play B2B software company in the world, dropped 43% and now trades below 4x revenue. Monday.com tanked 20% in a single session despite beating earnings, simply because guidance came in

The question everyone's asking now is simple: who's left?

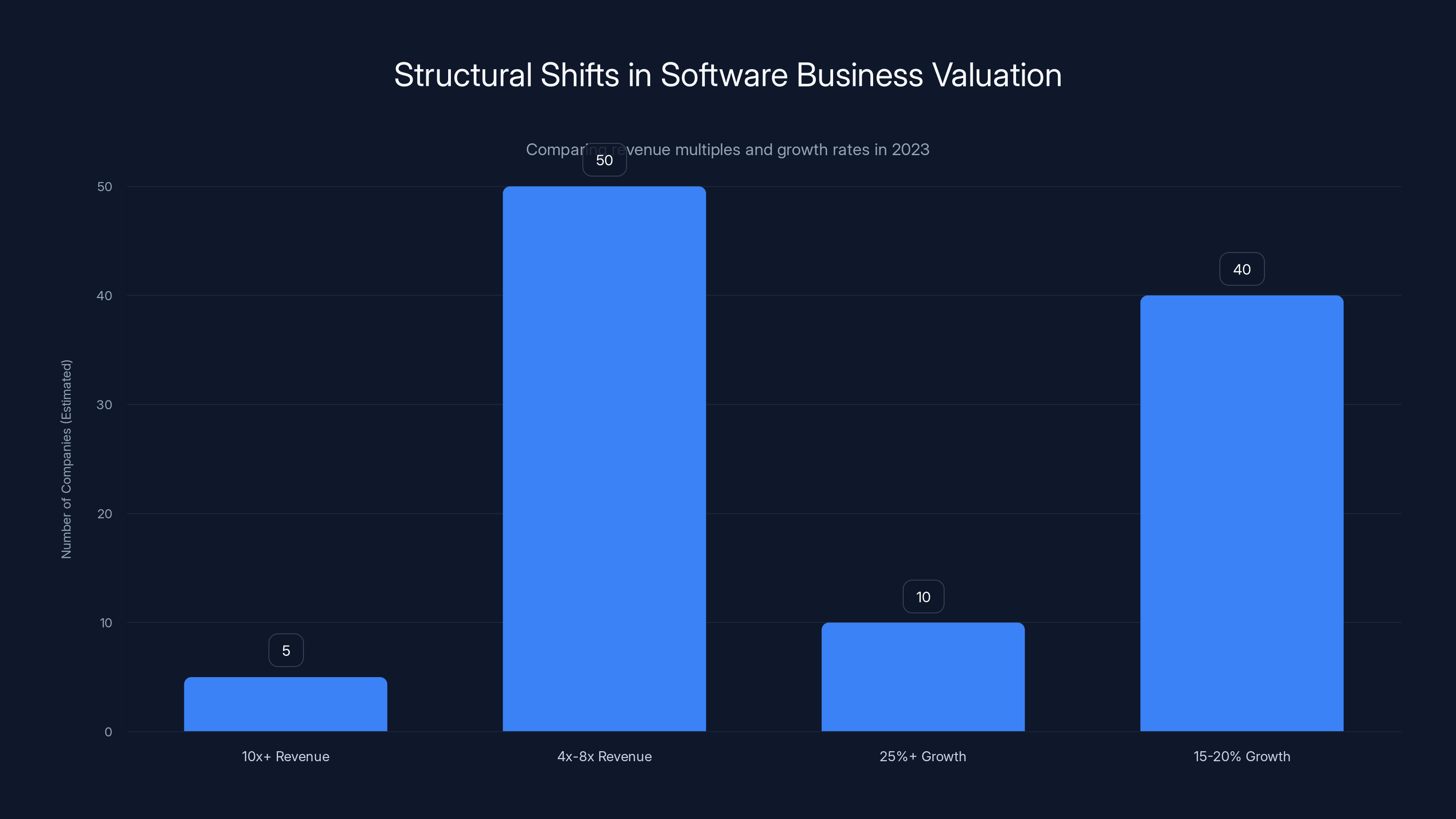

Turns out, barely anyone. But the companies still standing at 10x or higher? They're telling us something crucial about where enterprise software is actually headed. This isn't about nostalgia for 2020 multiples. It's about understanding which business models actually work when capital gets scarce and execution matters more than narrative.

Let's look at who's still in the club, and more importantly, why they're still here when everyone else got decimated.

TL; DR

- The 10x Club collapsed: From 60% of public B2B companies trading at 10x+ revenue in Q4 2020 to barely a handful today

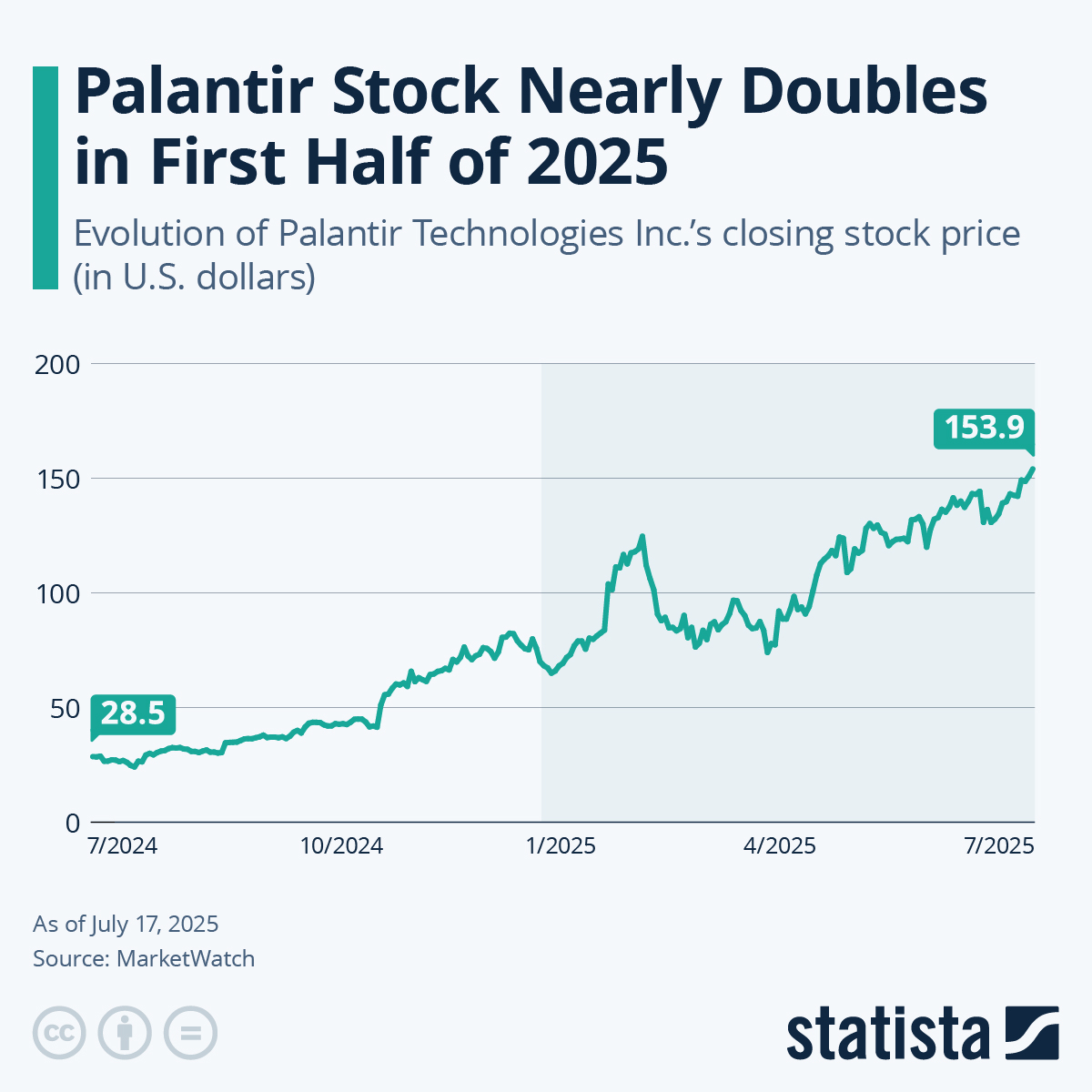

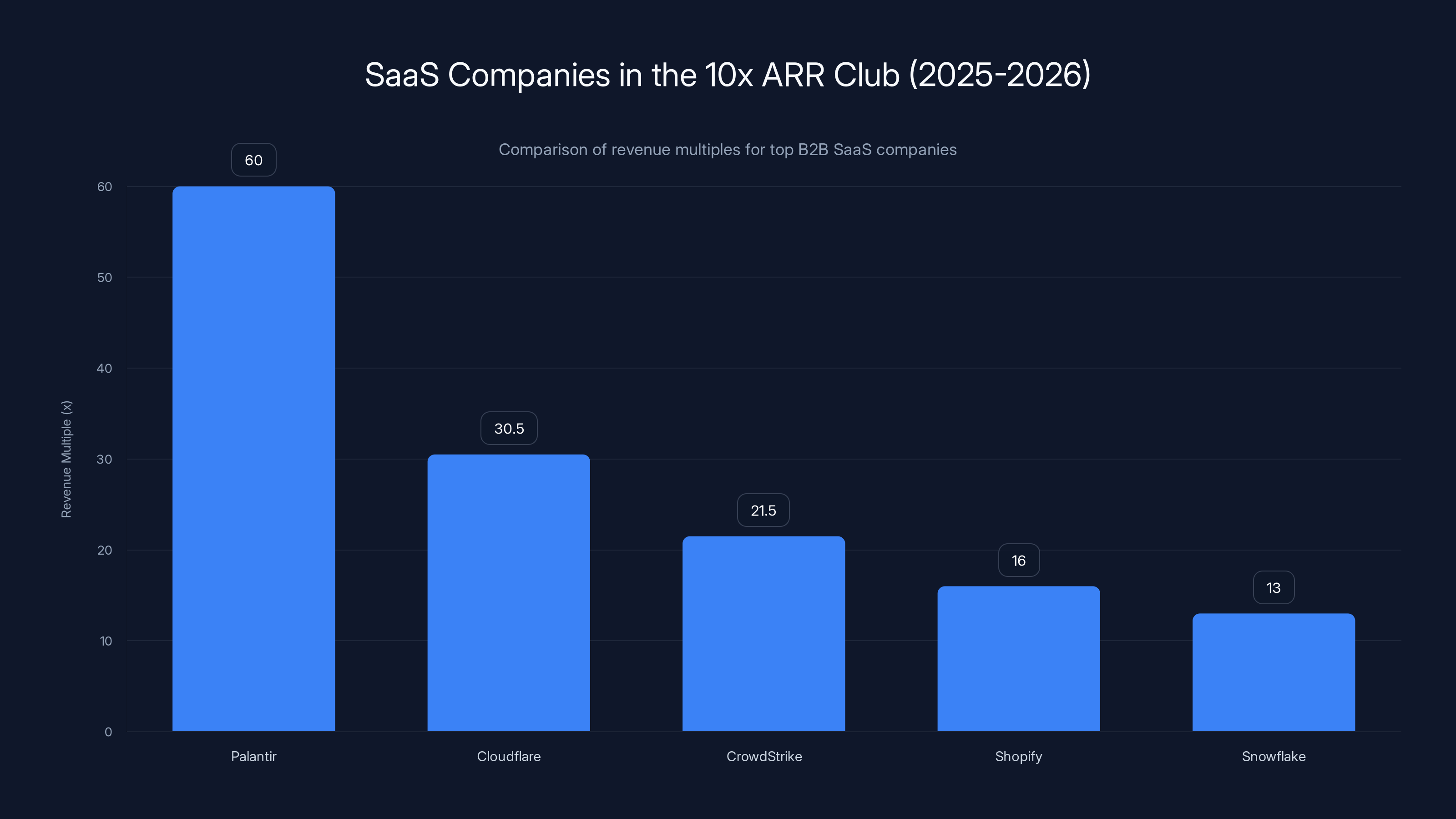

- Palantir is the only stratosphere resident: Trading at ~60x revenue, the only company accelerating growth from 30% to 70% at $4B+ scale

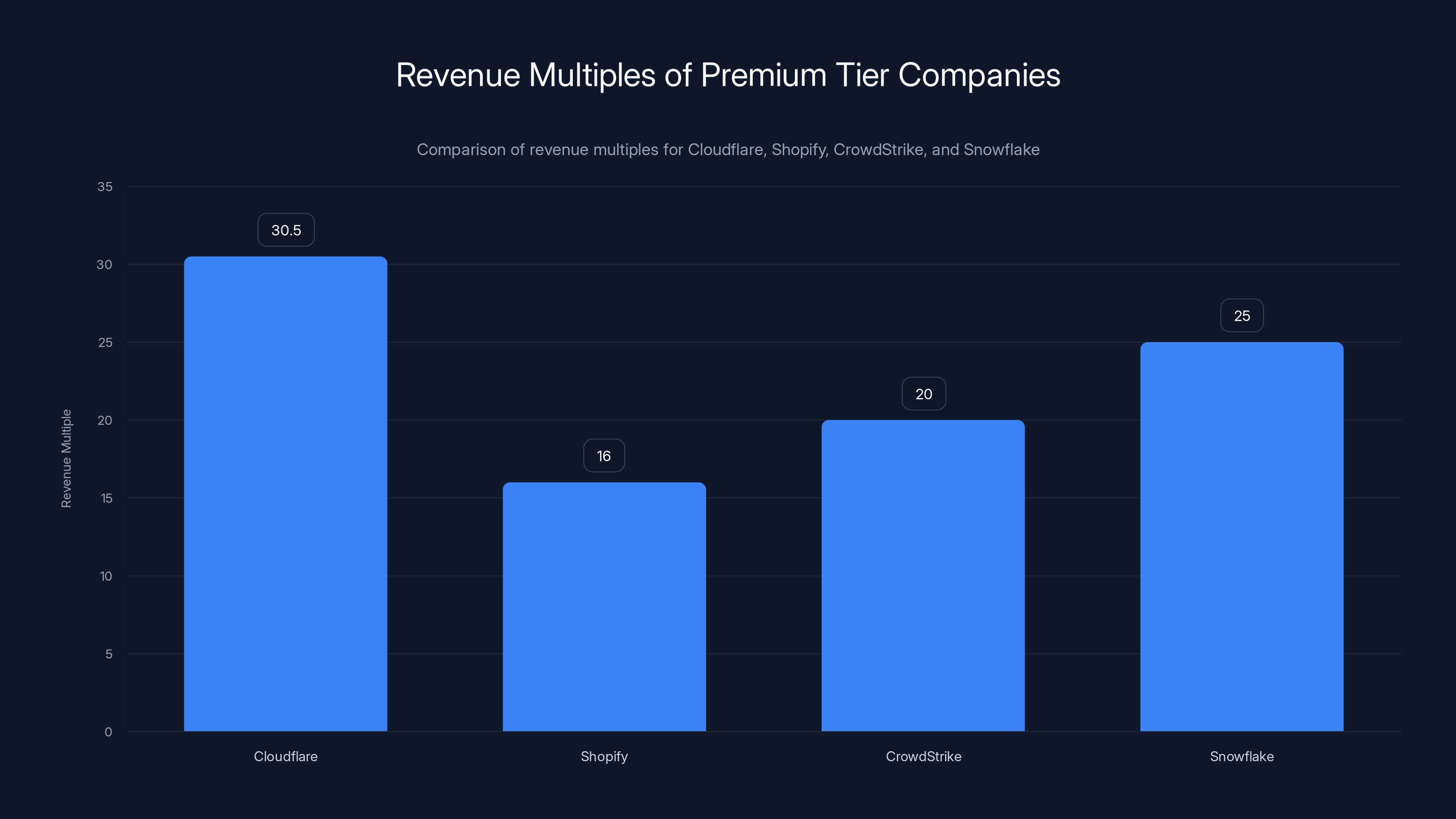

- Premium tier exists but tiny: Cloudflare, Shopify, CrowdStrike, and Snowflake cling to 10x-32x multiples due to structural moats

- Growth at scale is the differentiator: Companies still valued highly grew 25%+ while most peers decelerated to single digits

- AI disruption fears drove the repricing: Markets pricing in obsolescence risk for non-AI-native businesses

Cloudflare leads with a revenue multiple of approximately 30.5x, reflecting its strategic position in edge AI. Shopify, despite a market cap drop, maintains a 16x multiple due to its merchant moat. (Estimated data for CrowdStrike and Snowflake)

The Incredible Shrinking Club: How We Got Here

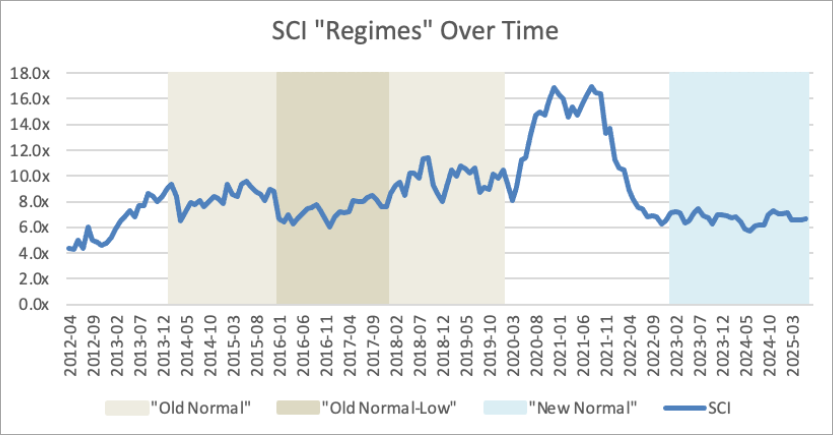

Understanding the collapse of the 10x ARR Club requires understanding what happened between late 2020 and today. This wasn't a smooth decline. It was three sharp cliffs.

The first cliff came in 2022 when interest rates started rising. For a decade, venture capital and public markets treated SaaS companies like bond proxies. Low interest rates meant investors needed growth at any price. Burn through cash? No problem. Lose money on every customer? Fine. The Fed will keep rates low forever. This created the most perverse incentive structure in business history: companies got rewarded for growth, regardless of profitability. Multiples reflected this insane capital environment.

Then the Fed actually hiked rates. Fast. The 10-year Treasury went from 1.5% to 4.5% in twelve months. Suddenly, that software company burning $100 million annually had to justify itself against a 4.5% risk-free bond. The multiples didn't just decline. They collapsed in what traders call a "de-rating."

The second cliff came in 2023 when founders and operators realized something terrifying: building a SaaS company was much harder than the 2020-2021 playbook suggested. You couldn't just hire 200 salespeople and watch revenue explode. Unit economics mattered. Churn mattered. Customer acquisition cost mattered. Companies that had raised $500 million on the premise of "move fast and break things" suddenly had to prove they could actually generate returns. Many couldn't. The companies still trading at premium multiples today are the ones that figured it out.

The third and most brutal cliff started in late 2024 and accelerated through 2025: AI disruption fears. This one's different. This one's real.

When ChatGPT hit 100 million users in two months, every SaaS CEO woke up at 3 AM asking the same question: what if our entire business becomes a feature in ChatGPT? What if the thing that made us valuable gets commoditized by a large language model? Businesses built on labor arbitrage. Businesses built on information asymmetry. Businesses built on automation they now thought was at risk of instant obsolescence.

The market started asking which SaaS companies were AI-native versus AI-threatened. Palantir, which had been boring enterprise software forever, suddenly became a hedge against AI disruption in government and defense. Cloudflare, which processes massive amounts of internet traffic and sits at the edge of the network, became essential infrastructure for AI inference. Cybersecurity companies like CrowdStrike became non-discretionary because ransomware attacks powered by AI would accelerate.

Companies that couldn't answer "how does AI make our business more defensible?" got priced for existential risk. That's why so many fell below 5x revenue.

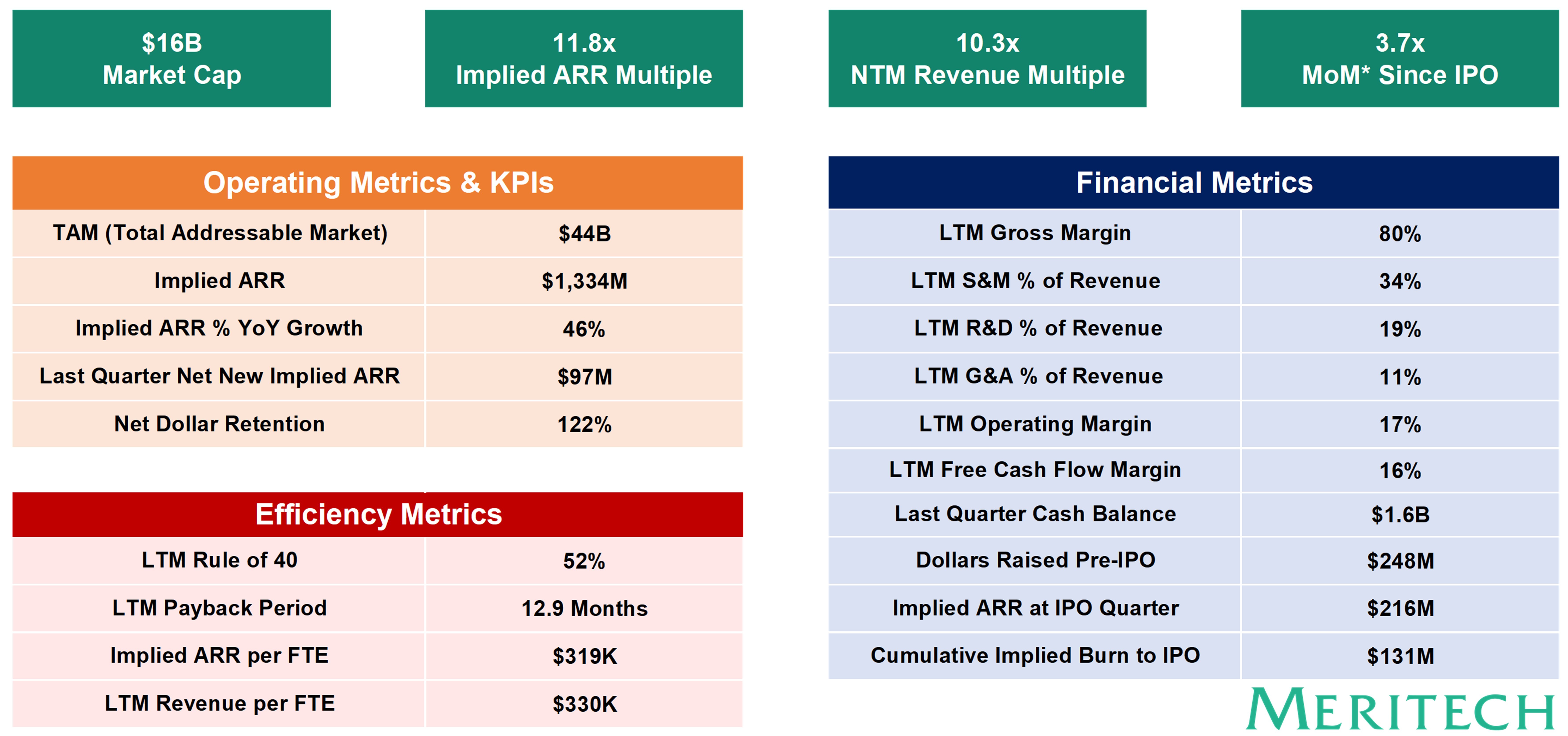

SaaS company valuations have sharply declined from 10x ARR in 2020 to an estimated 2.5x ARR by 2025 due to rising interest rates, operational challenges, and AI disruption fears. Estimated data.

Palantir: The Entire Club By Itself

Palantir is not in the 10x ARR Club. Palantir IS the 10x ARR Club.

At roughly

The reason is actually straightforward: Palantir just did something that's never been done before in the history of enterprise software. It accelerated.

Most SaaS companies follow the same arc. You grow 80%+ at

Palantir's path looked like this too. The company was founded in 2003, grew in stealth through government contracts, and by 2020 was already at a $2 billion+ revenue run-rate. When it went public in September 2020, expectations were low. It was old. It was government-focused. It had no cloud business. Most analysts thought it would grow 10-15% forever.

Then something shifted. The company started winning US commercial contracts. Massive ones. In 2024, Q4 growth was 30%. In 2025, Q1 was 39%. Q2 was 44%. Q3 was 53%. Q4 was 70%.

At $4.5 billion revenue, the company grew 70% year-over-year. And not from a small base. The US commercial revenue grew 137%. This was genuine category creation.

The market is betting that Palantir becomes the default AI operating system for every significant government and enterprise. The company isn't selling AI as a feature. It's selling AI as the core product. Gotham Platform processes classified government data. Apollo processes commercial enterprise data. Artificial Intelligence Platform (AIP) lets customers build AI applications on top of Palantir's data infrastructure.

What's remarkable is that even with the stock down 35% from recent highs, investors still value the company at 60x revenue. By historical standards, this is insane. But at 70% growth at $4B+ scale? It's actually justified. Possibly even cheap.

The Premium Tier: Cloudflare, Shopify, CrowdStrike, and Snowflake

Below Palantir lies an absolutely tiny club of companies still commanding 15x to 32x revenue multiples. There are only four, and they're remarkable for entirely different reasons.

Cloudflare: The Network Layer

Cloudflare trades at roughly 29-32x revenue. That's an enormous multiple in this environment. The company processes 20% of all internet traffic. That's not marketing hype. That's architectural reality. Cloudflare sits between every major company and the internet. They see everything.

When you're in that position, your business becomes incredibly defensible. Cloudflare processes more traffic than their three largest competitors combined. This creates a data moat. Every request that flows through Cloudflare's network makes their security and AI products smarter. They see patterns of attacks faster than anyone. They see application performance trends before anyone. They see exactly where on the internet things are breaking before anyone else.

The company is growing at 28%+, which is respectable at $2B+ revenue. But the real reason for the premium multiple is what they're positioned for: AI inference at the edge. Training AI models happens at massive data centers. But inference, the part where trained models actually answer questions, is starting to happen everywhere: at the edge, on devices, in cars.

Cloudflare's entire network is positioned to be the default infrastructure for edge AI. If every app developer needs to run AI models closer to users for latency, Cloudflare is the platform where that happens. The market is pricing in this structural advantage.

Shopify: The Merchant Moat

Shopify got absolutely hammered, dropping from

Why doesn't it go lower? Because Shopify has something almost no SaaS company has: genuine platform gravity.

Once a merchant sets up their Shopify store, they're not leaving. Switching costs are high. Integration costs are high. The merchants on the platform are generating revenue through it. They're not going to migrate to BigCommerce or WooCommerce for a slightly better admin interface.

More importantly, Shopify went from 26% growth to 31%+ growth while at $9+ billion revenue. That's insane. At that scale, accelerating is nearly impossible. Most companies are lucky to maintain growth. Shopify is accelerating.

The reason is their marketplace. They're monetizing their platform by taking a cut of all the transactions happening on it. They're monetizing by offering services to merchants: shipping, fulfillment, capital. The more merchants they have, the more services they can sell. It's a compounding machine.

Even in the downturn, merchants still need to sell things. That makes Shopify relatively recession-resistant compared to discretionary SaaS tools.

CrowdStrike: Non-Discretionary Security

CrowdStrike pulled back from

The reason is security. Once a company decides to deploy CrowdStrike's Falcon platform, the alternative is undefended against advanced threats. You can't downgrade security. You can't say "we'll just take our chances for a quarter." Security is non-discretionary.

CrowdStrike demonstrated this with Q3 FY26 earnings: revenue of

The industry consensus from CIOs is clear: cybersecurity budgets will grow 50% faster than overall software spending even in a downturn. When everything else gets cut, security is what you protect. CrowdStrike is the platform of choice for preventing endpoint breaches.

Add in the fact that ransomware attacks powered by AI are accelerating, and CrowdStrike becomes strategically essential, not just tactically useful.

Snowflake: The Data Warehouse Foundation

Snowflake trades at roughly 13x revenue, right at the 10x line. The stock has been hammered 30% in a month, but the company remains valuable because of a simple fact: you can't do AI without data.

Most companies have their data scattered across dozens of systems. Data lakes. Data warehouses. Spreadsheets. Whatever. Snowflake centralizes all of it into a single cloud data platform. They abstract away the infrastructure. They make it fast.

With product revenue growing 28%+ and remaining performance obligation up 37%, the company is building something durable. More importantly, Snowflake's Cortex AI platform lets customers build AI models on top of their data without leaving the Snowflake ecosystem. That keeps them sticky.

The question is whether Snowflake's multiple contracts further if the selloff continues. They're on the knife's edge of the 10x club.

Estimated data shows a potential growth trajectory for AI-native companies aiming for $500M ARR in 10 years with consistent 25%+ growth.

The Dangerous Zone: Datadog, MongoDB, Service Titan

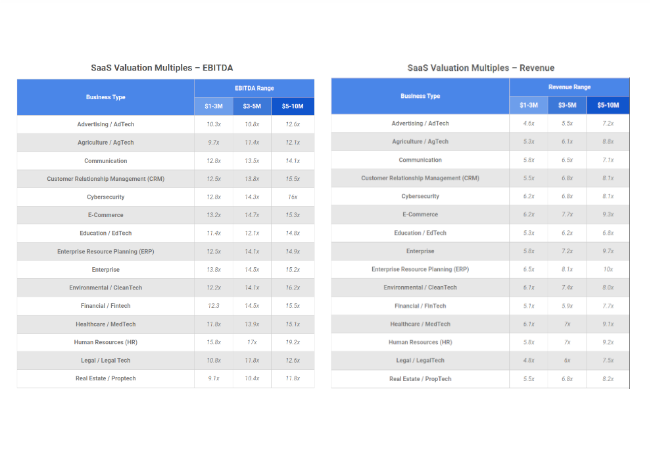

Below the premium tier lies a dangerous zone where companies trade between 8x and 12x revenue. They're not quite in the club. But they're not far below it. One bad quarter could push them down. One good quarter could pull them back up.

Datadog trades at roughly 12.5x EV/Revenue. The company is the observability standard: every company needs to know what's happening inside their software systems. Datadog gives them that visibility. But growth has decelerated to 27%, and the company is in a brutal competitive war with New Relic, Elastic, and open-source alternatives.

MongoDB trades at roughly 12x revenue. Document databases are essential infrastructure, but the company faces commoditization risk from cloud provider offerings. AWS DocumentDB is free if you're already on AWS. PostgreSQL with JSON support is free. Why pay MongoDB?

Service Titan trades at roughly 10x revenue. They were the darling of the last cycle, a vertical SaaS for home service businesses. But growth decelerated, and the market repriced them accordingly.

These companies are in limbo. They're still valuable. They're still growing. But they're not demonstrating the category dominance or growth acceleration necessary to justify a premium multiple.

The Forgotten Majority: 4x-8x Revenue

Most public B2B SaaS companies now trade in the 4x to 8x revenue range. This is where the mass of the market sits.

Companies like Okta, Zscaler, Dynatrace, HashiCorp, Elastic all fell into this range. They're not broken. Many are still profitable. Many are still growing at 15-25%. But the market decided they're not special.

A company at 6x revenue with 20% growth and positive operating margins has a perfectly reasonable business model. It generates returns. But it doesn't generate the kind of explosive returns that justified the 2020 multiples.

For founders and investors, this is the brutal reckoning. Your company could be great. It could be a $100 million ARR business generating real cash flow. It could be going public at a reasonable valuation. And it will still trade at 6x revenue because the market doesn't believe in SaaS as a growth story anymore. It believes in SaaS as a utility.

This creates a strange situation where a

Palantir leads the 10x ARR Club with a 60x revenue multiple, significantly higher than other top B2B SaaS companies like Cloudflare and CrowdStrike. Estimated data.

The Collapse Tier: 2x-4x Revenue

Below 4x revenue, you find the true walking wounded. Zoom trades below 2x revenue. Figma at 2.5x. Twilio at 2.8x. These were the darlings of the pandemic. Zoom was worth

Figma's collapse is particularly brutal. IPO'd at

These companies aren't failures. They're established businesses generating billions in revenue. But they've fallen from the sky to Earth. That transition is psychologically devastating for investors and employees who bought the 2020-2021 narrative.

The interesting question is whether any of these could return to the 10x club. Zoom might if they figure out how to integrate AI to create new use cases. Twilio might if they become essential infrastructure for AI agent communication. But that would require either growth acceleration or market sentiment shift. Neither seems likely in the near term.

Why Growth at Scale Is the Magic Threshold

The through-line of every company still in the 10x ARR Club is the same: they're growing faster than anyone expects at much larger scales than historically possible.

Palantir is growing 70% at $4.5B revenue. That's against the laws of physics for enterprise software.

Cloudflare is growing 28% at $2.1B revenue while processing 20% of all internet traffic.

Shopify is growing 31%+ at $9B+ revenue despite being a 20-year-old company in a mature category.

CrowdStrike is growing 22% with 73% net new ARR expansion at $4.9B ARR.

Snowflake is growing product revenue 28% at $1.5B+ scale.

Most SaaS companies decelerate predictably. They can't sustain high growth at scale. There's math that explains this: if your total addressable market is

Companies in the 10x club are breaking this pattern. The market is valuing them based on the assumption that they can keep breaking the pattern.

For Palantir, the thesis is that AI makes their value proposition unstoppable. For Cloudflare, it's that edge computing and AI inference make them essential. For Shopify, it's that marketplace dynamics create compounding. For CrowdStrike, it's that security is non-discretionary. For Snowflake, it's that AI requires centralized data.

These aren't price-to-earnings multiples. These aren't even traditional price-to-revenue multiples. These are bets that these companies will look 10x different in five years.

Palantir leads with a 60x revenue multiple, significantly higher than peers like Cloudflare and Shopify, which maintain 10x-32x due to structural advantages. Estimated data based on industry insights.

The Market Mechanics Behind the Repricing

Understanding why multiples collapsed requires understanding the mechanical forces at work.

First, there's the duration effect. SaaS revenues are recurring, so you can model them as a perpetuity. The value of a perpetuity is revenue divided by discount rate. When interest rates go from 1% to 4.5%, your discount rate nearly quintuples. That alone explains most of the multiple compression.

Second, there's the growth deceleration. Companies that were growing 50%+ in 2020-2021 are now growing 20%+. That's a real decline in the growth they're delivering. The multiple compression reflects that decline.

Third, there's the realization that SaaS isn't a perpetual growth story. It's a business that generates returns, then matures. The 2020-2021 market was pricing in perpetual acceleration. That was always wrong.

Fourth, there's the AI disruption fear. Every founder and investor is asking whether their business becomes a feature in ChatGPT or survives AI disruption. Companies can't prove they'll survive. So the market applies a haircut to all businesses that can't demonstrate AI defensibility.

What's remarkable is that Palantir, Cloudflare, Shopify, CrowdStrike, and Snowflake have largely addressed all four concerns. They have secular growth drivers. They're not collapsing in growth. They've demonstrated sustainable business models. And they've positioned themselves in the AI value chain.

Everyone else got the repricing.

AI as the New Valuation Moat

The most important shift isn't technical. It's psychological.

In 2020-2021, founders thought the moat was network effects, switching costs, or data. You built a business that was sticky and defensible. Great. That still matters.

But starting in 2024, the question changed. The new question is: is this business defensible against AI disruption? Is your data moat actually a data moat, or is it just the thing that trains the model that makes your business obsolete?

Palantir answered that question by saying: we are the AI platform. Cloudflare answered it by saying: we process the traffic. CrowdStrike answered it by saying: we prevent the attacks. Shopify answered it by saying: we process the transactions.

These aren't abstractions. These are positioning statements based on real architectural advantages.

Companies that can't answer the AI question got repriced. Is Okta defensible against AI-native identity platforms? No clear answer, so the stock went to 6x. Is Zscaler defensible when network security becomes AI-driven? Unclear, so it went to 7x. Is Elastic defensible when someone builds a better search engine with AI? Can't say for sure, so it went to 6x.

The 10x club companies have clear answers. That clarity is worth a premium.

Estimated data shows that only a few companies achieve 10x+ revenue multiples, while most cluster in the 4x-8x range. Similarly, fewer companies maintain 25%+ growth rates.

What's Actually Changed: The Structural Shift

This isn't a cyclical downturn that will reverse. This is a structural repricing that reflects real changes in how software businesses work.

First change: Growth no longer trumps profitability. In 2020-2021, you could burn cash and get valued like a growth company. Now you have to prove you can generate returns. This is healthy. It means capital will flow to sustainable businesses.

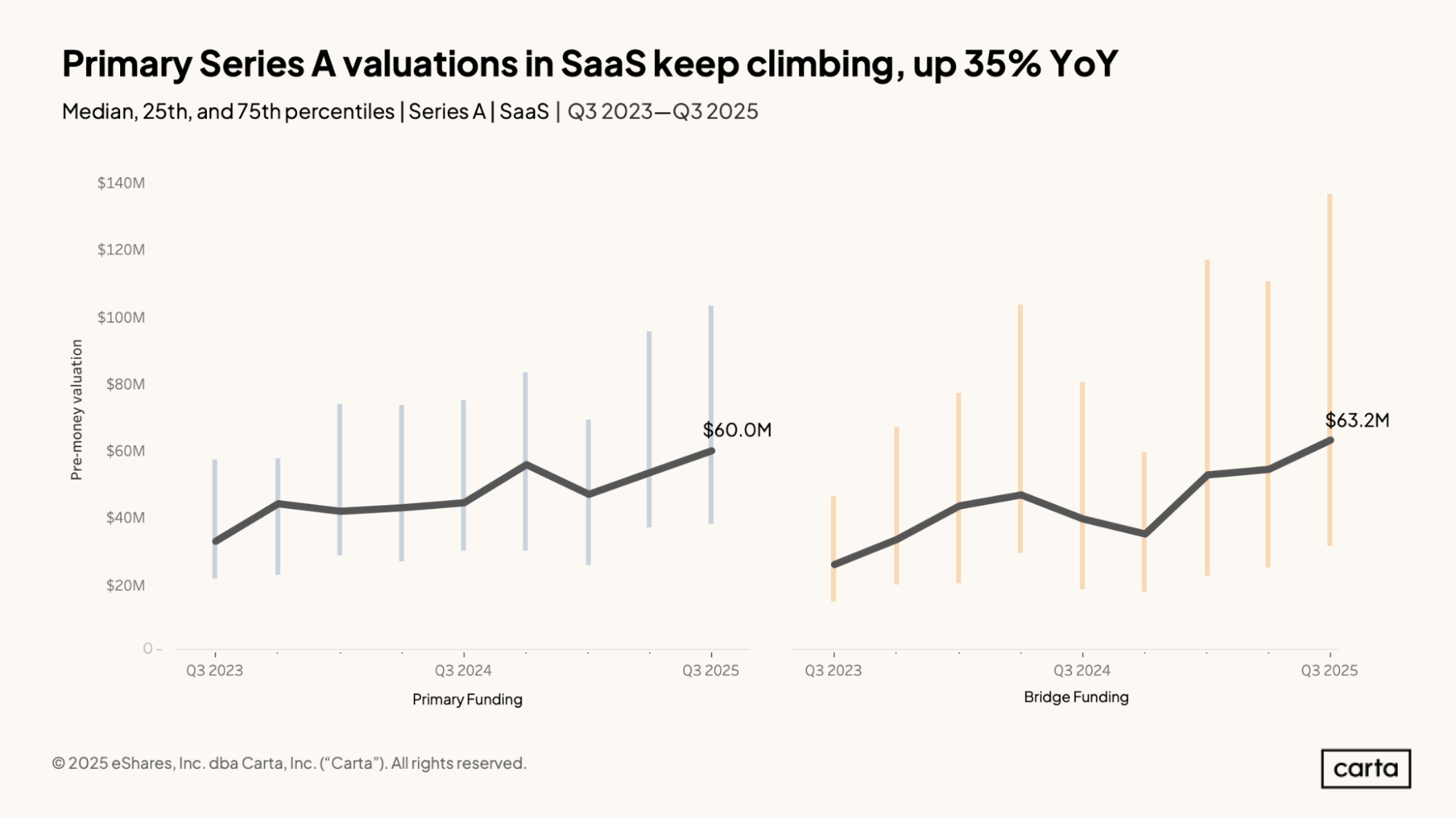

Second change: Scale is harder. The bar to grow 30%+ at

Third change: Competitive intensity increased. It's easier to build software now. It's easier to copy ideas. That means companies have to fight harder to maintain their positions. Only the companies with genuine moats can sustain premium valuations.

Fourth change: AI is reshaping the entire industry. This is still in the early innings. But companies that embrace AI as core to their offering are thriving. Companies that treat AI as a feature are struggling.

Fifth change: The IPO market is effectively closed below 50x revenue or so. If you can't get to $100M ARR growing 25%+, you probably won't go public. This means the bar to exit has increased dramatically. More companies will be acquired. Fewer will go public.

These structural shifts mean the 10x ARR Club will probably stay small. You might get five to seven companies at any given time trading at 10x+ revenue. Most software companies will cluster in the 4x-8x range. That's not a disaster. That's just the normalized economics of the business.

Investment Implications: What This Means for Different Stakeholders

For Founders

If you're building a SaaS company, you need to be realistic about the destination. The goal is probably not to go public at a

The 10x club is not achievable for most founders. It requires hitting specific conditions: massive TAM, defensible moat, growth at scale, and the right timing. Palantir didn't go public until 2020 because they didn't want to. They were patient. When they finally did, they were already at scale. That allowed them to be selective with customers and maintain growth velocity.

For most founders, the goal should be to build a $100M ARR business with 20-30% growth and strong unit economics. That's a successful outcome. That's a real business.

For Investors

The shift from 10x to 4x multiples is actually healthy for long-term returns. You're buying cheaper. A business generating $100M ARR at 20% growth with positive margins at 4x revenue is a much better buy than the same business at 8x revenue.

The challenge is that the venture capital industry was built on buying cheap and selling at 10x+ multiples. If everything sells at 4-6x, the venture returns compress. This will shrink the venture capital industry. There will be far less money chasing founders.

For late-stage investors and growth capital, this is actually an opportunity. You can buy real, profitable SaaS businesses at reasonable multiples and generate decent returns without betting on AI disruption or infinite growth.

For Employees

Equity is worth less. That's the brutal truth. A

But there's a silver lining: profitable SaaS companies generate real cash flow. Some of that might flow back to employees through bonuses and dividends. You're trading equity upside for stability and cash.

The Window for Future 10x Club Members

If you were founding a company today, could you make it into the 10x club in 10 years?

The requirements would be:

- Find an AI-native thesis that creates genuine category advantages

- Nail product-market fit with something that's non-discretionary

- Grow to $500M ARR minimum while maintaining 25%+ growth

- Build a defensible moat that strengthens with AI rather than weakening

- Go public at the right time when there's narrative alignment

Palantir is betting that's possible for an AI operating system company. Anthropic is trying to do it in the model layer. Figma was trying to do it in creative tools, but markets repriced them.

The next 10x club members probably haven't been founded yet. They'll be built on new category creation enabled by AI. They'll be the companies that figure out how to do things that were previously impossible.

That's the opportunity that's hidden inside the collapse. The repricing isn't permanent. It's a reset. When the next genuinely differentiated company emerges, markets will re-rate software valuations. But it'll require real innovation, not just another SaaS CRM or analytics platform.

The Best Is Yet To Come

The headline of this analysis is that the 10x ARR Club collapsed. That's true.

But the subheading matters: the companies that remain are better than ever. Palantir is actually growing faster than anyone expected. Cloudflare is more essential than ever. CrowdStrike is more critical than ever. Shopify is dominating its category more completely than ever.

The companies that got repriced aren't necessarily worse. The market's expectations were just too high.

What's actually happening is a recalibration. We're moving from a world where any company with $100M ARR and 30% growth could trade at 10x revenue, to a world where you need something special to trade at 10x revenue.

That something special might be:

- Accelerating growth at massive scale (Palantir)

- Becoming essential infrastructure (Cloudflare, CrowdStrike)

- Sustainable platform advantages (Shopify)

- Foundational category dominance (Snowflake)

These are higher bars than 2020. But they're also more sustainable.

The best outcome for SaaS is that it becomes a normal business. Not a speculation play. Not a growth-at-all-costs industry. Just good, profitable, defensible software businesses that generate real returns for investors and employees.

The 10x ARR Club will probably always exist. It will always be small. But the companies in it will be genuinely exceptional. And that's better than a world where anyone with venture capital and a growth narrative can claim a premium.

FAQ

What is the 10x ARR Club?

The 10x ARR Club refers to publicly traded B2B SaaS companies trading at 10x or higher revenue multiples. In Q4 2020, 60% of public B2B companies qualified. This was driven by low interest rates, unlimited venture capital, and market belief in perpetual software growth. Today, fewer than five companies qualify, representing a fundamental repricing of software valuations.

Why did SaaS multiples collapse from 10x+ to 4x-6x?

Three factors drove the repricing: First, interest rates rose from 1% to 4.5%, which mathematically reduces the valuation of recurring revenue streams. Second, growth decelerated as companies matured and competition intensified. Third, AI disruption fears made investors uncertain whether legacy SaaS businesses would survive transformation. The market applied a significant haircut to any business that couldn't clearly articulate AI defensibility.

Which companies are still in the 10x ARR Club in 2025-2026?

Palantir stands alone at 60x+ revenue. A small premium tier exists: Cloudflare at 29-32x revenue, CrowdStrike at 20-23x revenue, Shopify at 16x revenue, and Snowflake at 13x revenue. That's essentially the entire club. Most other public B2B SaaS companies trade in the 4x-8x revenue range, a 50-80% compression from 2020 levels.

Is trading at 10x revenue justified for any SaaS company?

Yes, but only for companies demonstrating exceptional execution: growing 25%+ at

What does the 10x club collapse mean for SaaS investing and returns?

Multiple compression reduces venture capital returns if you're buying at lower multiples with slower growth. However, it also means lower acquisition costs for profitable SaaS businesses. For long-term investors, buying quality software at 4x revenue with 20% growth and positive unit economics can generate solid returns. The venture capital industry will likely shrink as expected returns decline without 10x+ multiple expansion.

Could new SaaS companies reach the 10x club in the next 5-10 years?

Possibly, but the bar is much higher. New entrants would need to create entirely new categories enabled by AI, achieve product-market fit in non-discretionary offerings, scale to $500M+ ARR while maintaining 25%+ growth, and build moats that strengthen rather than weaken with AI. Companies like Palantir and potential AI-native platforms founded today could achieve 10x valuations, but it requires genuine innovation rather than incremental SaaS improvements.

Conclusion: The End of an Era, The Beginning of Something Real

The 10x ARR Club didn't just contract. It collapsed. What was once a crowded gathering of 60% of all public B2B companies is now an exclusive club of fewer than five exceptional businesses.

That collapse feels devastating if you believed the 2020-2021 narrative. It feels like SaaS is broken. Like software investing is dead. Like the growth era is over.

But here's what's actually true: the growth era is over. Good. It was built on broken assumptions. The idea that you could burn cash infinitely and still generate returns? That was always wrong. The idea that any software company could scale to $10B valuation with venture capital and persistence? That was never true for most industries.

What's happening now is a recalibration to what actually works. SaaS companies that solve real problems for enterprise customers and do it profitably will generate great returns. Just not 10x multiple expansion returns. They'll generate 15-20% annual returns from growing revenue and improving margins. That's a real, sustainable business.

The companies that remain in the 10x club are exceptional precisely because they're doing things that are genuinely hard: Palantir is accelerating growth at massive scale. Cloudflare is building the new internet infrastructure layer. CrowdStrike is defending against an evolving threat landscape. Shopify is creating platform dynamics. Snowflake is becoming the data foundation for AI.

These aren't just good companies. They're companies doing things that haven't been done before in enterprise software. That's why they still command premium valuations.

For founders and investors, the lesson is simple: build for defensibility, not just growth. Build for sustainability, not just acceleration. Build for real customer value, not venture capital narrative.

Do that, and maybe you'll make it into the next generation of the 10x club. Or maybe you'll build a $100M ARR business that trades at 6x revenue, generates real cash flow, and provides a stable exit. That's a better outcome than it sounds.

The software industry is maturing. That's not bad. That's growth. Real growth. The kind that lasts.

Key Takeaways

- The 10x ARR Club contracted from 60% of public B2B companies in Q4 2020 to fewer than 5 companies by Q1 2026, driven by interest rate increases, growth deceleration, and AI disruption fears

- Palantir stands alone at 60x+ revenue multiple by accelerating from 30% to 70% growth at $4.5B scale, defying historical enterprise software maturation laws

- Premium tier includes Cloudflare (30x), CrowdStrike (22x), Shopify (16x), and Snowflake (13x), each with defensible moats in AI-critical infrastructure

- Growth rate acceleration at scale is the primary differentiator between premium-valued and median SaaS companies, with 25%+ growth at $1B+ revenue commanding premiums

- Structural market shifts toward profitability, increased competition, and AI defensibility requirements mean the 10x club will remain small, with median SaaS companies clustered at 4x-8x revenue multiples

Related Articles

- Atlassian Stock Down 70% Despite 23% Revenue Growth: Why Markets Miss the Real Story [2025]

- AI-Led Growth: The Third Era of B2B SaaS [2025]

- Cohere's $240M ARR Milestone: The IPO Race Heating Up [2025]

- How Spotify's Top Developers Stopped Coding: The AI Revolution [2025]

- Who Owns Your Company's AI Layer? Enterprise Architecture Strategy [2025]

- How AI Transforms Startup Economics: Enterprise Agents & Cost Reduction [2025]

![The 10x ARR Club: Which SaaS Companies Still Trade at Premium Valuations [2025]](https://tryrunable.com/blog/the-10x-arr-club-which-saas-companies-still-trade-at-premium/image-1-1771083384382.jpg)