How Cohere Became the Stealth Winner in Enterprise AI

There's a moment in every startup's journey when the noise stops mattering. When the hype cycles and funding announcements fade into background static, and what's left is pure, measurable traction. For Cohere, that moment arrived in early 2026 with a number that's hard to ignore: $240 million in annual recurring revenue.

Let that sink in for a second. Not total revenue. Not projections. Not venture capital raised. Actual recurring revenue from actual customers paying real money month after month.

The Canadian AI startup founded in 2019 by Aidan Gomez, Ivan Zhang, and Nick Frosst has been working quietly while everyone else was watching the Open AI and Anthropic headline machine. While the world obsessed over Chat GPT's latest capabilities and Claude's reasoning improvements, Cohere was doing something arguably more valuable: convincing enterprises that its technology actually works for their specific problems.

Here's what makes this story interesting. Cohere didn't build a consumer chatbot. It didn't race to 100 million users. Instead, the startup targeted the market where AI adoption actually generates revenue: enterprises willing to pay serious money for models they can deploy, control, and integrate into existing workflows.

The $240 million ARR announcement came via an investor memo obtained by CNBC in February 2026. But the really stunning detail wasn't just the absolute number. It was the growth rate: more than 50% quarter-over-quarter throughout 2025. That kind of consistency suggests the hockey stick isn't luck anymore. It's a pattern.

Now Cohere is positioned for what's being called the "IPO race of 2026." Open AI is exploring public markets. Anthropic has been growing aggressively and exploring its own path to capital. Space X's Elon Musk is pushing x AI toward profitability and potential public markets. The competitive landscape has shifted dramatically since Cohere's last funding round, and suddenly the company's quiet execution looks less like a disadvantage and more like a strategic advantage.

In this article, we'll break down how Cohere got here, why its approach matters for the broader AI industry, what the IPO timeline might look like, and what this all means for the future of enterprise AI adoption. We'll also explore how Cohere compares to its competitors, why enterprises chose it over alternatives, and what the company needs to do to maintain momentum as it potentially moves toward public markets.

TL; DR

- Cohere surpassed $240 million ARR in 2025 with over 50% quarter-over-quarter growth, signaling strong enterprise AI adoption

- The company is positioned for a potential 2026 IPO, directly competing with Open AI, Anthropic, and x AI for public market attention

- Cohere's enterprise focus and cost-efficient models differentiate it from competitors obsessed with scaling laws and frontier capabilities

- The AI IPO race is accelerating, with at least four major AI companies potentially going public in the next 18 months

- Enterprise AI spending is the real driver of value, not consumer adoption or research breakthroughs, and Cohere understood this earlier than most

Cohere's

The Cohere Story: From AI Lab to Enterprise Powerhouse

The Founding: Canadian AI Researchers Build an Alternative

Cohere's origin story is worth understanding because it explains why the company chose the path it did. Aidan Gomez wasn't building Cohere to chase viral moments or breakthrough capabilities. He was building it because he saw a fundamental gap in the market.

Gomez, along with co-founders Ivan Zhang and Nick Frosst, left Google Brain in 2019 to start Cohere. This was before Chat GPT existed. Before most people knew what a transformer was. Before the entire world became obsessed with large language models.

They recognized something important: the organizations that would actually use AI language models at scale weren't looking for the most capable model. They were looking for models that were practical, deployable, and cost-effective. A financial services company doesn't need GPT-5 to classify customer support tickets. A manufacturing firm doesn't need a frontier model to analyze equipment logs.

Cohere's core product philosophy emerged from this insight. The company built what it called the "Command" family of models. These models were designed to be efficient enough to run on limited GPU resources, making them attractive for enterprises that didn't want to spend millions on computational infrastructure.

This was a fundamentally different bet than what Open AI was making with GPT-4, or what most other AI labs were pursuing. While others raced toward bigger, more capable models, Cohere optimized for deployment reality.

Early Backing from Unexpected Places

Cohere's early investor list tells a story about enterprise AI's real believers. The startup raised seed funding from investors like Index Ventures and Radical Ventures. But more importantly, it attracted backing from hardware companies that understood enterprise AI's actual needs.

Nvidia invested in Cohere. AMD invested in Cohere. Salesforce invested in Cohere. These weren't companies betting on AI as a concept. These were enterprises that understood the gap between research breakthroughs and actual deployment. They knew that models like Cohere's could run on their hardware, integrate with their platforms, and solve real customer problems.

This early backing gave Cohere something crucial: credibility with enterprises. When Nvidia backs your company, it's not just capital. It's a signal that your technology actually works in production environments. It's an endorsement from the company that manufactures the infrastructure where AI runs.

By 2022 and 2023, as the generative AI boom exploded, Cohere had already built relationships with enterprises. While Chat GPT was capturing headlines, Cohere was already in customer deployments, refining its models based on real-world usage patterns, and learning what enterprises actually needed from AI.

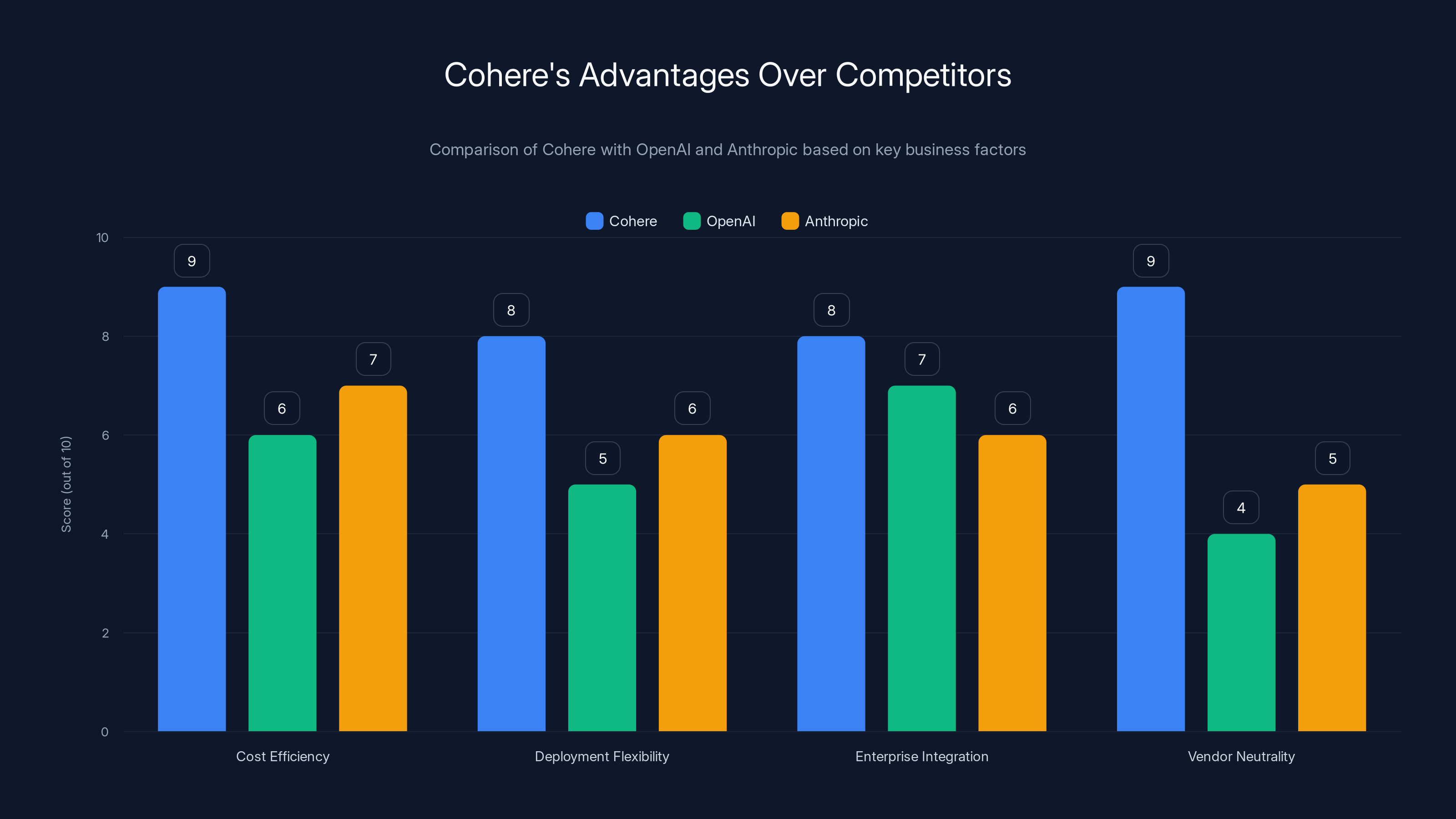

Cohere excels in cost efficiency and vendor neutrality, offering significant advantages over OpenAI and Anthropic in enterprise contexts. (Estimated data)

Understanding Enterprise AI: Why Cohere's Approach Won

The Enterprise AI Adoption Problem

Here's what most AI coverage misses: enterprise AI adoption and consumer AI adoption are almost entirely different problems.

Consumer AI is about virality, ease of use, and creating new behaviors. Chat GPT succeeded because it made AI accessible to anyone with a web browser. The distribution problem was solved through public access.

Enterprise AI is about integration, security, cost control, and measurable ROI. An enterprise doesn't care if an AI model can write poetry or pass the bar exam. It cares about whether the model can integrate with existing systems, run on available infrastructure, comply with data privacy regulations, and generate genuine business value.

Enterprise adoption is slower but stickier. When a financial services firm deploys an AI model for document analysis, that model isn't going to be swapped out for something else. It's embedded in workflows, integrated with databases, potentially running on specialized hardware. The switching costs are enormous.

Cohere understood this dynamic earlier than most. While Open AI and Anthropic were focused on pushing the boundaries of what AI could do, Cohere was focused on making sure its AI could actually be deployed and used by real organizations.

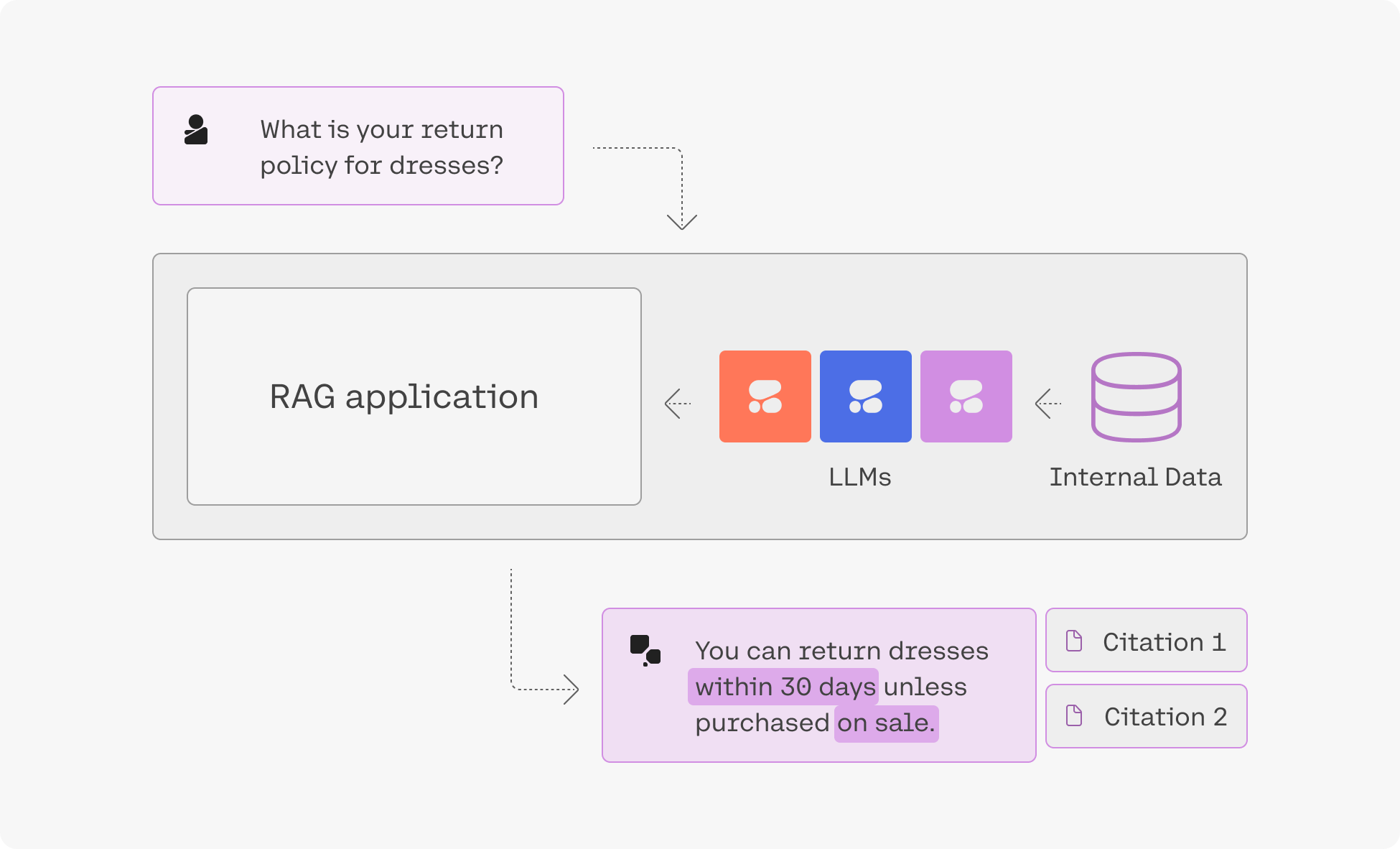

The Command Model Family: Engineering for Reality

Cohere's primary product is the Command family of language models. Unlike the typical "bigger is better" arms race in AI, Command was designed with constraints in mind.

Specifically, Cohere optimized for efficient inference. This means running the model on actual hardware, actually getting outputs, without requiring the most advanced GPUs or massive computational clusters.

Why does this matter? Let's do the math. A company running GPT-4 in production might need to provision powerful computing resources with costs that scale with usage. A company using Cohere's models could often run them on more modest hardware, potentially even on-premises, with much more predictable costs.

For enterprises dealing with sensitive data—financial institutions, healthcare providers, government agencies—this efficiency advantage isn't just cost savings. It's permission to use AI in use cases where they previously couldn't.

A healthcare provider might hesitate to send patient data to a cloud API. But if Cohere's model can run on-premises with similar performance characteristics, suddenly that same organization can deploy AI across its entire clinical documentation workflow.

North: The Enterprise AI Platform

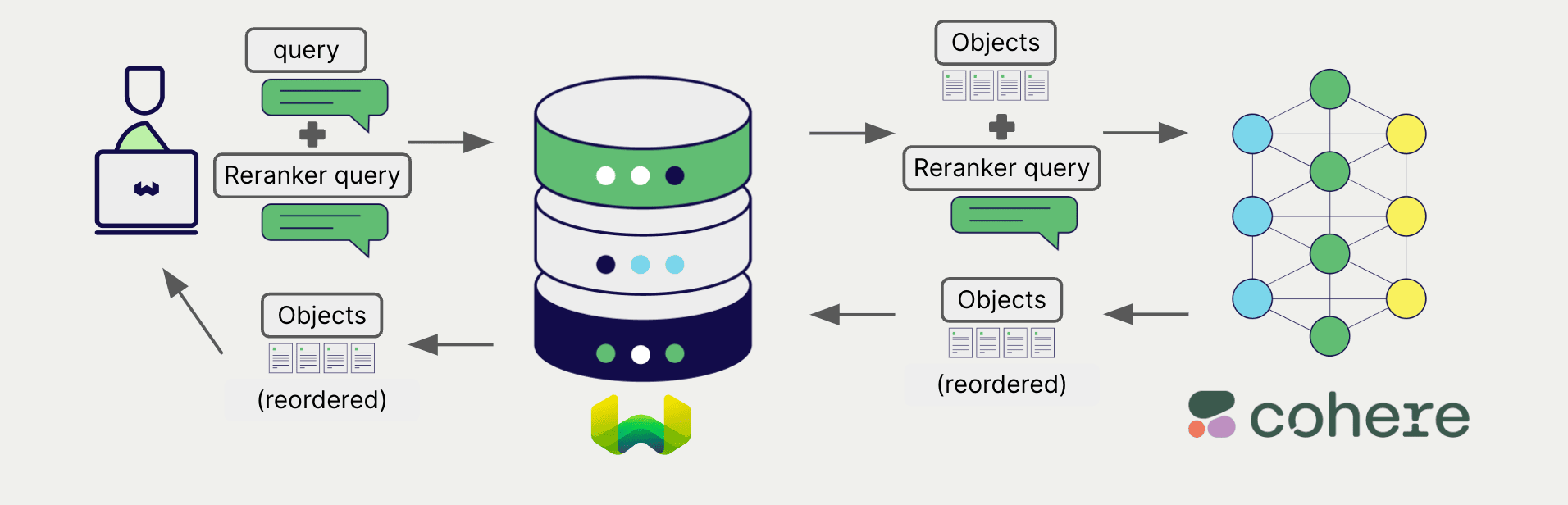

In summer 2025, Cohere launched a new product called North. This represented an evolution from just selling models to building an entire enterprise AI platform.

North is positioned as a workspace for building secure, custom AI agents and workflows. Instead of customers using raw APIs to Cohere's models, North provides a higher-level abstraction where enterprises can define their own AI agents, build custom workflows, and maintain security and control over their data.

This is a significant product shift because it signals that Cohere sees the future not as selling commodity models, but as providing enterprise platforms where those models are the engine. It's similar to how Salesforce doesn't just sell databases—it sells business software powered by databases.

North positions Cohere more directly against competitors like Anthropic and Open AI, but with a crucial difference: Cohere is building for enterprises to run custom AI on their own infrastructure, while others focus more on API-based consumption of frontier models.

The North launch in summer 2025 likely contributed directly to the acceleration in ARR growth throughout late 2025 and into 2026. Enterprises could move from consuming Cohere's APIs to building entire AI-powered business processes on the North platform.

The $240 Million ARR Achievement: What It Really Means

The Mathematics of Enterprise AI Revenue

Let's be specific about what $240 million ARR actually represents. This is recurring, contracted revenue. Not revenue run rate extrapolated from a great month. Not projected revenue based on sales pipeline. Actual money coming in every year from actual customers.

To understand the significance, consider that most AI startups measure success in funding raised or user counts. Cohere is measuring itself by actual paying customer revenue. There's a massive difference.

When a company hits

The more important metric, though, is the growth rate. Over 50% quarter-over-quarter growth throughout 2025 is extraordinary for a company of Cohere's scale. It's not typical startup growth. It's the kind of growth that venture capital firms use as a primary signal for IPO readiness.

Here's why that growth rate matters for an IPO timeline. Public market investors look for three things: market size, growth rate, and path to profitability. Cohere is demonstrating two of those clearly. With $240M ARR and 50%+ Qo Q growth, the company is showing that the enterprise AI market is real, large, and still accelerating. That's a compelling IPO narrative.

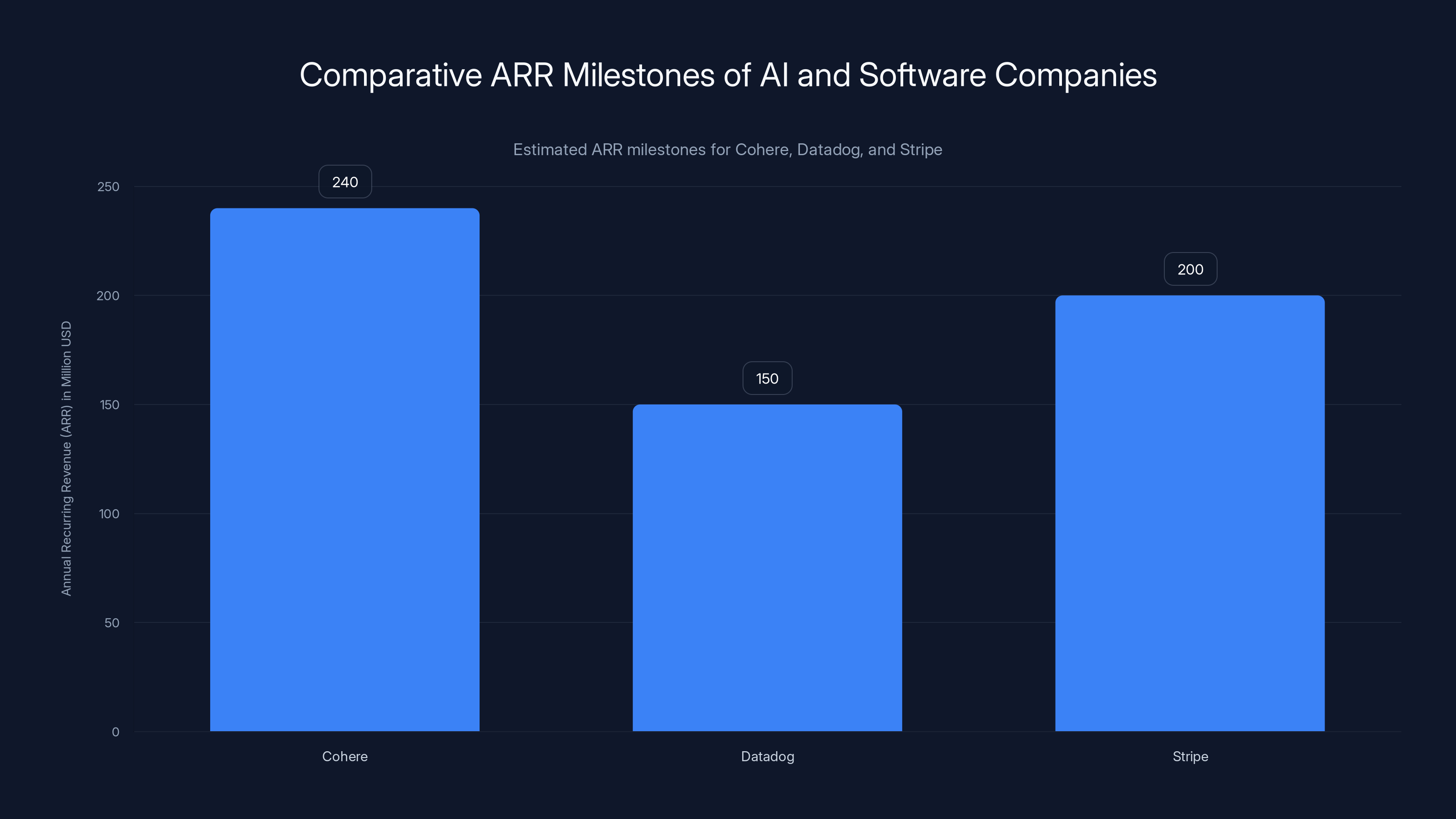

Benchmarking Against Comparable Companies

To understand the significance of Cohere's $240M ARR milestone, it helps to look at comparable software companies at similar revenue scales.

Datadog reached approximately

Cohere's $240M ARR is actually ahead of where many of these companies were at their IPO moments. The difference is that Cohere achieved this in a shorter timeframe, in a newer market category, with arguably more competition.

This suggests one of two things: either Cohere is growing faster than historical comparables, or the enterprise AI market is adopting AI solutions faster than previous software categories did. Probably it's both.

Profitability and Unit Economics

One detail the investor memo didn't include: profitability. Enterprise software companies typically operate at negative gross margins or low margins while scaling. The high-growth phase prioritizes top-line revenue growth over profitability.

For an AI company, this calculation is even more complex. The cost of inference (running the model) varies based on deployment architecture. A customer running Cohere models on their own infrastructure has different economics than a customer using Cohere's cloud API.

The fact that Cohere is growing at 50%+ Qo Q suggests the company has achieved sufficient product-market fit that revenue growth is outpacing cost growth. Whether the company is actually profitable or near-profitable isn't clear from public information, but the growth rate suggests the unit economics are favorable.

OpenAI leads the potential 2026 AI IPO race with an estimated valuation of

The IPO Race: Cohere in Context

The 2026 AI IPO Sprint

Cohere's potential IPO isn't happening in a vacuum. The AI industry has created what some analysts are calling the "IPO sprint of 2026," with at least four major AI companies potentially going public within 18 months.

Open AI, the most well-known AI lab, is apparently exploring public markets. The company has been profitable on a net income basis according to some reports, and revenue estimates suggest it's in the

Anthropic, led by Dario Amodei, has been growing aggressively and has been exploring options that could include going public. The company has strong institutional backing and reported to be generating significant revenue.

x AI, Elon Musk's AI company, is being built with the explicit goal of achieving profitability quickly. If Musk decides to take it public, it would draw enormous attention simply because of his name association.

Space X might also go public, though that's separate from x AI, and would be treated differently by public markets given it's an aerospace company rather than pure AI.

Into this crowded field comes Cohere. The company is neither the most famous (Open AI), nor the most well-funded (Anthropic has raised more), nor the most hyped (x AI gets more media attention). But Cohere is demonstrating something that many investors care more about: actual, measurable, sustainable revenue growth.

This is Cohere's competitive advantage in an IPO race. It's not about being the most impressive AI laboratory. It's about being the most compelling revenue story.

Timeline and Likelihood

Aidan Gomez said in October 2025 that Cohere might go public "soon." This is classic CEO language for "the board is discussing it, but we're not ready to commit to a timeline."

If

The timeline pressure probably looks like this: Cohere wants to go public soon enough that it's still riding the enterprise AI adoption wave, but late enough that it can demonstrate sustained, predictable growth. Timing windows in the public market are narrow. A mid-2026 or late-2026 IPO window seems plausible.

What could accelerate it: a major strategic customer win or acquisition. What could slow it: recession, shift in public market appetite for AI companies, or competitive pressure that impacts growth rate.

Valuation Scenarios

Estimating Cohere's valuation at IPO is speculative, but we can use comparable software companies as a baseline.

For Saa S companies, valuation multiples at IPO often range from 8-15x revenue, depending on growth rate, profitability, and market conditions.

Conservative scenario (8x revenue multiple):

Mid-range scenario (10x revenue multiple):

Bullish scenario (12x+ revenue multiple):

None of these valuations would make Cohere a mega-cap company, but they would represent significant value creation for early investors. Investors like Nvidia, AMD, and Salesforce would see substantial returns on their early-stage investments.

For context, Anthropic was last valued around

Why Enterprises Chose Cohere Over Competitors

Cost Efficiency: The Underrated Advantage

Here's a detail that most AI analysis glosses over: operational cost matters more to enterprises than it does to consumers.

A consumer doesn't care if Chat GPT costs 0.1 cents or 0.5 cents per query. The difference is imperceptible. But an enterprise running AI at scale, processing millions of documents or queries per month, absolutely cares about per-token costs.

Cohere optimized its models for efficiency early. This means lower operational costs for customers, which translates directly to higher margins for Cohere as it scales.

Consider a customer using Cohere's models for document classification. If the cost per document is 1 cent versus 5 cents, the difference between

By focusing on efficiency, Cohere didn't just build a better product. It fundamentally changed the unit economics of AI adoption, making it feasible for organizations that otherwise couldn't afford deployment at scale.

Data Privacy and Deployment Flexibility

Cohere's models can run on-premises or in customer-controlled cloud environments. This is not true of all AI providers. Open AI's models, for instance, are primarily accessed via cloud API, which means customer data goes to Open AI's infrastructure.

For regulated industries—financial services, healthcare, government—this creates a compliance nightmare. A bank can't send customer financial data to Open AI's servers. A healthcare provider can't transmit patient health records via third-party APIs.

Cohere's architecture solves this problem. By offering models that can run on customer infrastructure, Cohere opened entire market segments that were previously unavailable to AI adoption.

This flexibility wasn't a nice-to-have feature. It was the unlock that enabled trillions of dollars in enterprise AI spending that would otherwise have remained stuck in compliance limbo.

Integration with Enterprise Infrastructure

Cohere's backing from Nvidia and AMD wasn't just investor diversification. It ensured that Cohere's models worked well on the GPUs these companies produced. It ensured deep integration with enterprise infrastructure.

Salesforce's investment meant Cohere models could be integrated into Salesforce applications, Einstein AI platform, and the broader Salesforce ecosystem. This gave Cohere automatic access to Salesforce's enterprise customer base.

These partnerships created a network effect. Each partnership made Cohere more attractive to enterprises using that partner's infrastructure or products. By contrast, Open AI and Anthropic have had to negotiate integrations from a position of pure model capability.

Timing and Market Awareness

Cohere launched at exactly the right moment. Generative AI had captured the world's imagination with Chat GPT's launch in late 2022. But by 2023-2024, enterprises were moving past hype toward actual implementation. They were asking: "How do we actually use this technology in our business?"

Cohere had products, partnerships, and a clear narrative about enterprise AI deployment. While others were still raising hype capital, Cohere was already selling to customers.

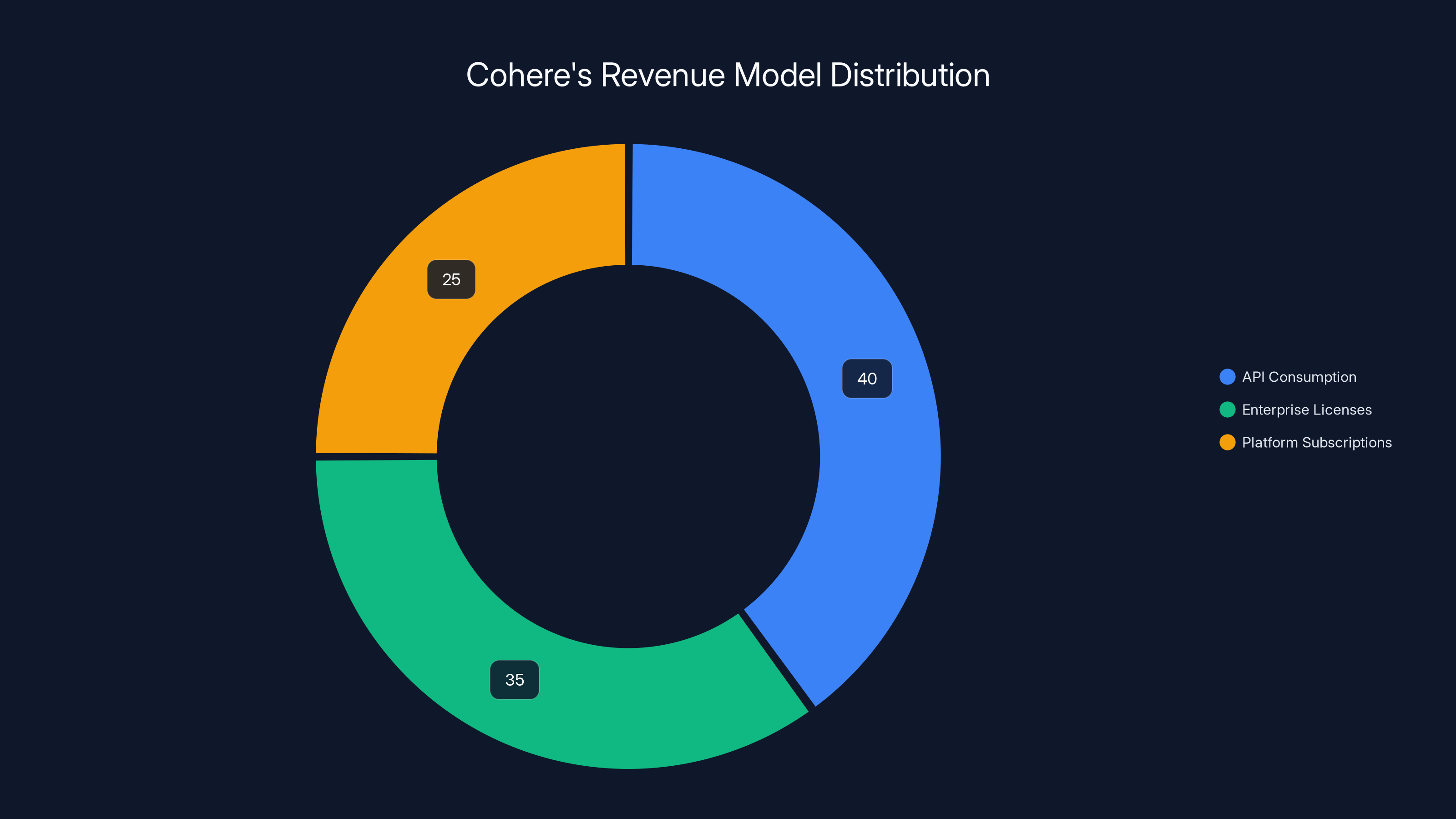

Estimated data shows Cohere's revenue is diversified across API consumption (40%), enterprise licenses (35%), and platform subscriptions (25%), reducing dependency on any single channel.

Competitive Dynamics: Cohere vs. The Giants

Open AI: Frontier Capabilities vs. Enterprise Practicality

Open AI dominates mindshare. Chat GPT is the most well-known AI application. GPT-4 is considered one of the most capable language models ever created.

But Open AI's approach emphasizes frontier capabilities. The company pushes toward bigger, more powerful models. The business model relies primarily on cloud API consumption and enterprise licensing of GPT-4 and upcoming models.

This approach has advantages and disadvantages. The advantage: Open AI models are genuinely more capable than Cohere's for certain complex reasoning and generation tasks. The disadvantage: they're harder to deploy, more expensive to run, and require handing data to Open AI's infrastructure.

For many enterprises, Open AI's capabilities exceed what they actually need. And the practical constraints (cost, deployment complexity, data privacy) matter more than having the most powerful model.

Anthropic: Safety-First Research vs. Market Execution

Anthropic has built Claude, which many researchers consider the most reliable and safe large language model available. The company emphasizes constitutional AI, detailed interpretability research, and thoughtful scaling.

Anthropic is also venture-backed and well-funded, giving it runway to pursue long-term research. The company has attracted top talent from Open AI and other labs.

But Anthropic, like Open AI, emphasizes frontier research and capabilities. The business model is similar: selling API access to Claude and enterprise licenses.

Anthropic is arguably more focused on enterprise than Open AI, but it's still primarily a capability-first company. It's saying: "Use our best model." It's not saying: "Here's the right tool for your specific problem."

Cohere's differentiation is subtly different. Cohere is saying: "Here's the model that works best for your actual use case, given your constraints." That's a more consultative, problem-solving approach.

x AI and Other Competitors

x AI is still relatively new and focuses on transparency and efficiency. But like Open AI and Anthropic, x AI emphasizes research and frontier capabilities.

Other competitors exist—Google with Gemini, Meta with Llama, Microsoft (via partnership with Open AI)—but most are not pure-play AI companies. They're leveraging AI to serve other business units.

Cohere's position is unique: a pure-play enterprise AI company that's proven it can grow revenue faster than more famous competitors.

The Enterprise AI Market: How Big Is It Really?

Market Size and Growth Projections

Quantifying the enterprise AI market is challenging because definitions vary. But several themes are clear.

Robert Half estimated that 51% of U. S. companies are currently using AI in their business operations as of 2024. That's over half the economy. The market is not emerging anymore. It's here.

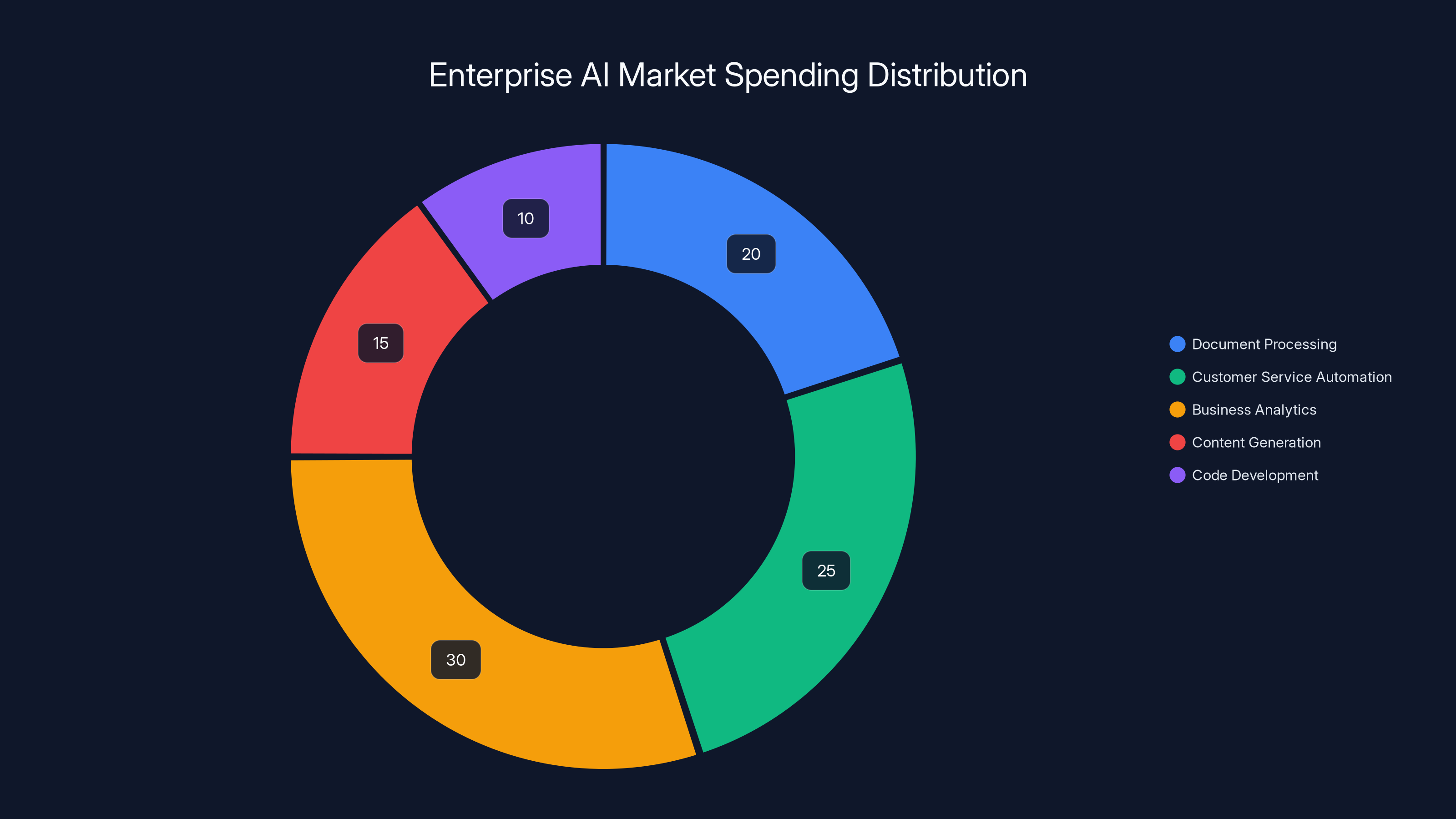

Where is this spending concentrated? Document processing, customer service automation, business analytics, content generation, and code development. These are the use cases driving revenue for companies like Cohere.

A 2025 survey by Mc Kinsey estimated that enterprise AI spending had reached approximately $50B+ globally, with annual growth rates of 25-30%. These aren't speculative projections. This is money being spent right now.

Within this market, Cohere's

Spending Patterns and Budget Movement

One underappreciated trend: enterprises are consciously shifting budget from other categories to AI. A company might reduce spending on traditional business intelligence software, reduce spending on customer support headcount, and redirect that budget toward AI tools.

This is important for Cohere because it means the company isn't fighting for entirely new budget. It's fighting for budget that's already allocated to technology and operations.

The businesses allocating budget fastest are in services, finance, and healthcare. These are exactly the segments where Cohere has strongest traction.

Competitive Dynamics Within Enterprise AI

A key insight: the enterprise AI market is not winner-take-all. Unlike consumer software where one company often dominates, enterprises standardize on multiple tools.

A typical large enterprise might use: Open AI for certain high-capability tasks, Anthropic for safety-sensitive applications, Cohere for cost-efficient deployment, Google for integration with their cloud infrastructure, and several smaller specialized vendors for specific use cases.

This means Cohere doesn't need to beat everyone. It needs to be one of the essential providers in the stack. Based on its growth rate, it's clearly achieved that position.

The enterprise AI market spending is concentrated in business analytics (30%) and customer service automation (25%), reflecting the high demand for efficiency and data-driven insights. (Estimated data)

The Path to Profitability: How Cohere Makes Money

Revenue Model Structure

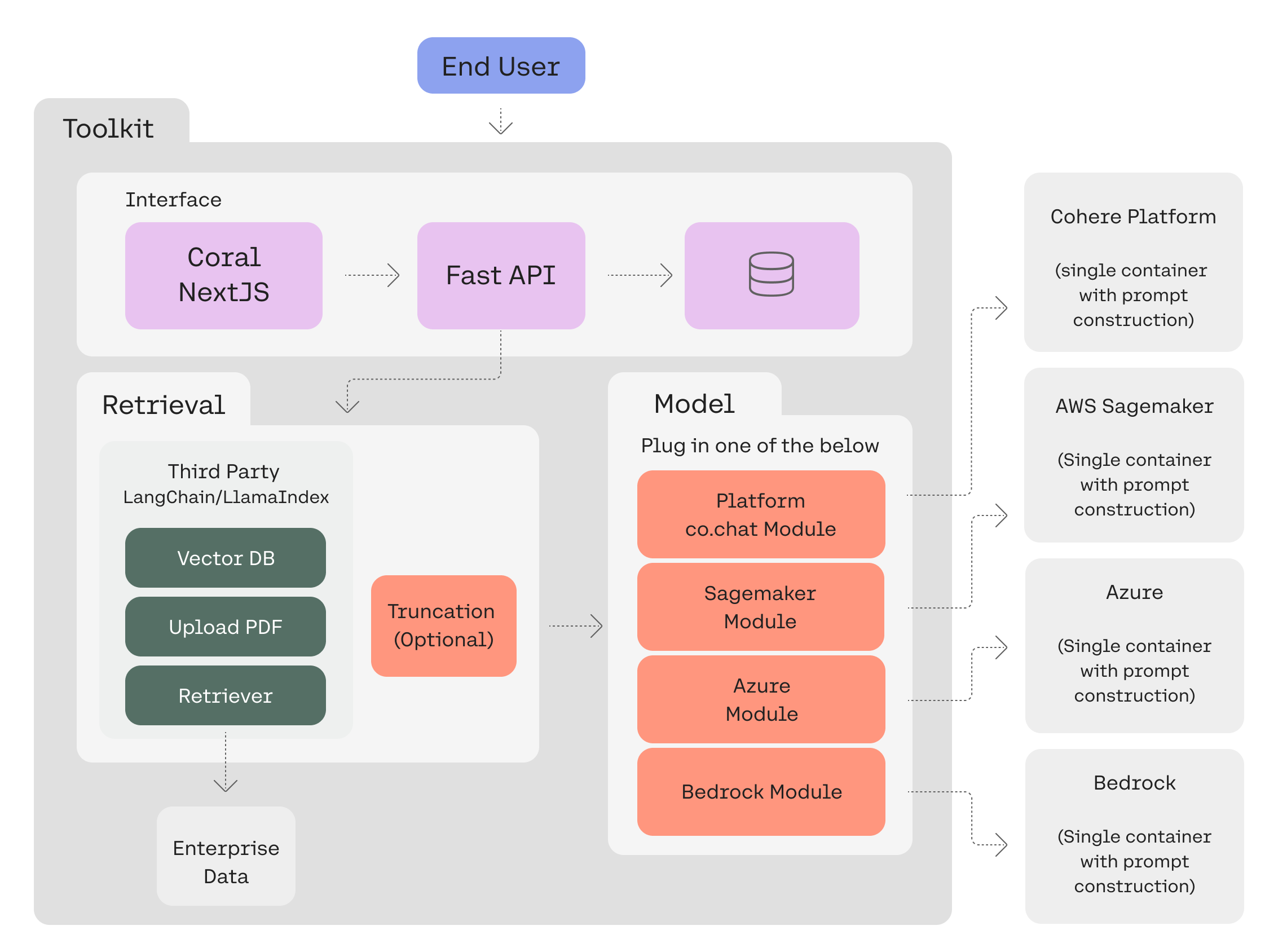

Cohere generates revenue through several channels: API consumption (per-token pricing), enterprise licenses, and increasingly, platform subscriptions via North.

The per-token model is straightforward: customers pay a certain amount per thousand tokens (roughly 4 characters of text). This pricing model aligns Cohere with competitors like Open AI, which also uses per-token pricing.

The enterprise license model involves larger contracts where customers pay a fixed annual fee for access to models, support, and potentially custom training or fine-tuning.

The North platform introduces subscription-based pricing where enterprises pay for the platform itself, separate from API usage.

This diversification of revenue models is important because it reduces dependency on any single pricing mechanism. If customers get more price-sensitive on per-token costs, revenue from licenses and platform subscriptions becomes more important.

Cost Structure and Margin Economics

For an AI company, primary costs are: infrastructure (GPU costs to run models), engineering (salaries for ML engineers and software engineers), and go-to-market (sales and marketing).

Cohere's focus on inference efficiency directly impacts profitability. By building models that require fewer computational resources, Cohere reduces per-unit cost of serving customers.

With $240M ARR and 50%+ growth, Cohere has likely achieved a scale where the economics are favorable. Infrastructure costs are probably dropping as a percentage of revenue. Engineering costs are spread across more customers.

The path to profitability likely requires moderate growth from here. With careful cost management, Cohere could hit profitability within one to two years of its current revenue level. This would be unusual for a growth-stage company, but not unheard of.

Investor Expectations for IPO

When a company goes public, public market investors don't require immediate profitability. But they do require a clear path to profitability. Cohere has that path.

The investor thesis likely goes like this: Cohere has achieved product-market fit and strong revenue growth. It has favorable unit economics. With scale, it can reach profitability while continuing to invest in product and market expansion. The company doesn't need to choose between growth and profitability; it can do both.

Challenges and Headwinds Facing Cohere

Competitive Intensity

Cohere is not facing an empty market. Every major tech company is investing in AI, and many have launched their own language model offerings.

Google's Gemini, Meta's Llama (available open-source), Microsoft's partnerships with Open AI, and countless smaller competitors create a crowded landscape.

Cohere's advantage is that it's ahead in the enterprise adoption game. But maintaining that advantage requires continuous innovation and customer expansion.

Open Source Competition

Meta released Llama as open-source in 2023, and the open-source ecosystem has accelerated. Companies can now use models like Llama, Mistral, or other open-source alternatives without paying Cohere.

This puts pressure on Cohere's business model. The company must provide more value than just the model: better performance, better deployment tools, better support, better integration.

Cohere's North platform is partly a response to this. By providing the platform layer, the company competes less on the model itself and more on the tooling and ecosystem around the model.

Talent and Research Competition

Cohere competes for talent with companies that have bigger budgets (Google, Open AI, Anthropic). Attracting and retaining top ML researchers is challenging when competitors can offer higher salaries or more prestigious positions.

Cohere's advantage is that it offers a different value proposition: the chance to build a commercially successful company rather than pure research credibility. But this appeals to a different type of researcher.

Regulatory and Compliance Risks

As AI becomes more regulated, compliance costs will increase. Cohere needs to navigate regulations in different jurisdictions, potentially different rules for different types of AI applications.

This could increase costs for all AI companies, but especially for those deploying in regulated industries. Cohere's early focus on regulated verticals (financial services, healthcare) gives it experience with compliance, but also exposes it to regulatory risk.

Cohere's revenue showed a consistent 50% quarter-over-quarter growth throughout 2025, reaching $135 million by Q4. Estimated data based on reported growth rate.

Investor Perspective: Why Cohere's IPO Makes Sense Now

The Public Market Appetite for AI

Public market investors are clearly interested in AI. Any company with "AI" in its pitch gets attention. But most public company analysts struggle to value AI companies because the metrics are often opaque.

Cohere offers something different: clear revenue, clear growth, clear path to profitability. These are metrics public market investors understand.

Compare this to a company trading on speculation about future capabilities or theoretical TAM (total addressable market). Cohere is trading on demonstrated market traction.

Return Potential for Early Investors

Cohere's early investors (Nvidia, AMD, Salesforce, various venture firms) would see substantial returns in an IPO.

If Cohere goes public at a

These return multiples are compelling reasons to push toward an IPO sooner rather than later.

Strategic Options Beyond IPO

Cohere also has options besides IPO. The company could: be acquired by a larger tech company, accept a strategic minority investment from a major tech player, or continue scaling as a private company.

But given the competitive intensity and need for capital to continue scaling, an IPO seems like the natural next step. It provides liquidity for employees and investors while giving Cohere capital to compete.

What This Means for the Broader AI Industry

The Shift From Hype to Execution

Cohere's $240M ARR milestone represents a shift in how the AI industry measures success. In 2022-2023, success meant raising large funding rounds and generating hype.

Now, success increasingly means revenue, customer retention, and sustainable growth. Cohere has achieved all three.

This shift matters because it puts pressure on other companies to demonstrate similar metrics. Open AI and Anthropic are presumably growing even faster, but they're not as transparent. x AI is new and unproven. Smaller competitors need to show traction or risk being outpaced.

The Enterprise AI Gold Rush

Cohere's success proves that enterprises will pay for AI solutions that solve real problems. The "gold rush" narrative—everyone getting AI because it's trending—is shifting to the "sustainable business" narrative—enterprises using AI because it generates clear ROI.

This is healthier for the industry long-term. Companies focus on profitability, sustainability, and customer value rather than just raising hype capital.

Impact on Venture Capital and AI Startups

Cohere's potential IPO will dramatically affect how venture capital flows in AI. Investors will see that building an enterprise software company with sustainable revenue is more valuable (and less risky) than chasing frontier research breakthroughs.

This should lead to more funding for AI startups focused on specific enterprise problems (vertical AI, industry-specific solutions) rather than horizontal foundation model companies.

The Technical Advantage: Why Cohere's Models Matter

Efficiency as a Feature

Cohere's models are optimized for something that most AI coverage ignores: actual deployment efficiency.

When researchers benchmark models, they typically measure capability on public test sets. When enterprises deploy models, they measure cost and speed on their actual data and hardware.

Cohere optimized for the latter. This means: lower latency (faster responses), lower cost (fewer computational resources), better reliability (fewer edge cases), and higher throughput (more queries processed per second).

These might seem like engineering optimizations rather than research breakthroughs, but they're actually more valuable for enterprise adoption.

The Command Model Family

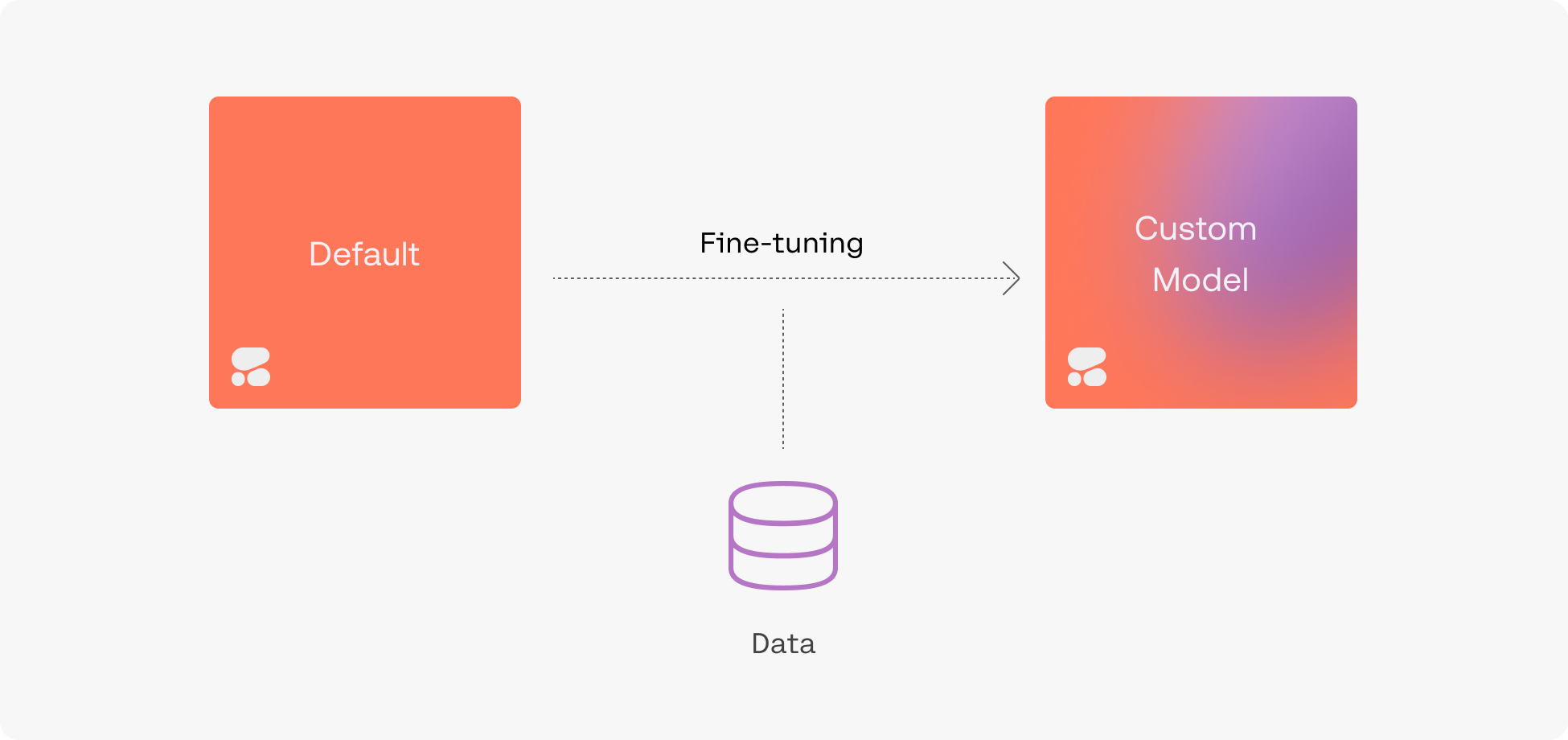

Cohere's primary models—Command, Command Light, and Command R—are designed for different deployment scenarios.

Command Light is optimized for speed and cost, suitable for high-volume, latency-sensitive applications. Command R balances capability and efficiency. Command represents a higher-capability option for complex reasoning tasks.

This segmentation allows Cohere to compete across different customer needs with a single product family, optimized for their specific constraints.

Fine-Tuning and Customization

Cohere offers fine-tuning capabilities where customers can adapt models to their specific domain or task.

This is crucial for enterprises because every industry has specialized language and concepts. A model fine-tuned on financial documents will understand financial terminology better than a generic model.

Fine-tuning also improves performance while reducing required model size, further improving economics.

Future Trajectory: What's Next for Cohere

Product Evolution and the North Platform

Cohere is clearly moving from a model company to a platform company. North represents this transition. Future development will likely focus on: agent orchestration (multiple AI agents working together), workflow automation, and enterprise integration.

The long-term vision seems to be: Cohere provides the foundation (models and infrastructure) and platform (North), and enterprises build their specific applications on top.

This is similar to how AWS went from providing compute (EC2) to providing platforms and application services.

Geographic Expansion

Cohere is Canadian, and most of its early customers are likely North American. Significant geographic expansion opportunity exists in Europe and Asia.

Europe has stricter data privacy regulations (GDPR), which makes Cohere's on-premises deployment option especially valuable. Asia has enormous enterprise populations in China, India, and Southeast Asia.

Expanding into these regions requires local partnerships, localized products, and regulatory navigation. But the TAM opportunity is enormous.

Vertical Specialization

Over time, Cohere might develop specialized models or platforms for specific industries: financial services, healthcare, legal, manufacturing.

Vertical specialization creates stronger defensibility than horizontal platforms because switching costs increase and competitive differentiation is harder to replicate.

Acquisitions and Strategic Moves

An IPO gives Cohere currency (stock) to make acquisitions. The company might acquire: complementary AI companies, vertical-specific software providers, or companies with specific technical capabilities.

Conversely, Cohere might become an acquisition target for larger companies. If Cohere stays private and its growth stalls, that changes the equation. But with strong growth, IPO is more likely than acquisition.

The IPO Process: What to Expect

Timeline and Preparation

If Cohere targets a mid-to-late 2026 IPO, the company is likely already in deep preparation. This includes: auditing financials, strengthening governance, preparing investor materials, and selecting underwriters.

The process from serious IPO consideration to public trading typically takes 6-12 months. So if Cohere is serious about 2026, the formal process probably began in late 2025 or early 2026.

Underwriter Selection

Cohere will select major investment banks to underwrite the IPO. The selection signals strategic direction. Underwriters have specialist teams covering different sectors.

For an AI company focused on enterprise software, underwriters like Goldman Sachs, Morgan Stanley, or J. P. Morgan would be typical. These banks have strong relationships with institutional investors interested in enterprise software.

Roadshow and Investor Education

After filing S-1 documents with the SEC, Cohere will conduct a "roadshow" where management meets with institutional investors to pitch the company.

Given that enterprise AI is still a relatively new category for most public investors, significant investor education will be required. Cohere needs to convince public investors that its business model is sustainable and defensible.

Price and Valuation

The IPO price will be determined through a "book-building" process where underwriters gauge investor demand at various price points.

Based on comparable companies and Cohere's growth metrics, a valuation in the

Public market investors often look at price-to-sales multiples. For a Saa S company with Cohere's growth rate, 8-15x revenue is typical. This suggests a similar valuation range.

Strategic Implications for Enterprise AI Buyers

Choosing Your AI Vendors

Cohere's IPO would signal that the company is a stable, credible vendor for long-term enterprise AI deployments.

For enterprises currently evaluating AI vendors, Cohere's path to IPO should increase confidence in the company's ability to support long-term customers. Companies like Google, Open AI, and Anthropic have their own sustainability questions (even if less pressing). But an IPO-bound Cohere demonstrates institutional staying power.

Lock-in and Switching Costs

Once Cohere is public, the incentive structure changes. The company will face pressure from public markets to grow and maintain profitability. This might lead to strategic decisions around pricing or product focus that favor the company's growth over customer flexibility.

Enterprises deploying Cohere at scale should consider this when making decisions about lock-in or custom deployments.

Vendor Diversification

Cohere's IPO will be part of a broader wave of AI vendor consolidation. The market will eventually have a few major vendors (Open AI, Anthropic, Google, potentially Cohere and x AI) and many smaller specialized vendors.

Enterprises should plan on multi-vendor strategies rather than betting everything on one AI company.

FAQ

What is Cohere?

Cohere is a Canadian AI startup founded in 2019 that builds large language models and enterprise AI platforms. The company specializes in creating AI models optimized for efficiency and enterprise deployment, focusing on practical business applications rather than frontier research capabilities. Cohere's primary products include the Command family of language models and the North platform for building custom AI agents and workflows.

How did Cohere reach $240 million ARR?

Cohere achieved $240 million in annual recurring revenue through a combination of: strong enterprise product-market fit, strategic partnerships with infrastructure companies like Nvidia and AMD, enterprise-friendly deployment options (on-premises, cloud-agnostic), and focus on efficiency-optimized models that reduce customer costs. The company added more than 50% quarter-over-quarter revenue growth throughout 2025, demonstrating accelerating market demand for its solutions.

Why is Cohere's growth significant compared to competitors?

Cohere's growth is significant because it represents sustainable, measurable revenue from enterprise customers rather than speculative valuations based on capabilities or research breakthroughs. While companies like Open AI and Anthropic may have higher capabilities or more funding, Cohere has demonstrated the ability to convert those capabilities into recurring revenue at scale. For public market investors, this revenue traction is more compelling than raw AI capabilities.

What are Cohere's advantages over Open AI and Anthropic?

Cohere's main advantages are: cost efficiency (lower per-token costs and lower infrastructure requirements), deployment flexibility (ability to run on-premises or customer infrastructure), enterprise integration (partnerships with major infrastructure companies), and vendor neutrality (not tied to any single cloud provider). Open AI and Anthropic have stronger research credentials and more capable frontier models, but Cohere is optimized for practical enterprise deployment.

When might Cohere go public?

Based on CEO Aidan Gomez's statement that an IPO might happen "soon," and given Cohere's current revenue scale and growth metrics, a 2026 IPO seems plausible. Enterprise software companies typically go public around

What could the IPO valuation be?

Based on comparable enterprise software companies and Cohere's growth rate, a reasonable IPO valuation range would be

How does Cohere's model compare technically to others?

Cohere's models are optimized for efficiency and practical deployment rather than absolute capability benchmarks. While GPT-4 and Claude are more capable on research benchmarks, Cohere's models are faster, cheaper, and easier to deploy. For many enterprise applications, Cohere's efficiency advantage and cost profile are more valuable than raw capability. This represents a different optimization trade-off rather than technical inferiority.

What are the risks to Cohere's growth trajectory?

Key risks include: intensifying competition from larger companies (Google, Microsoft), open-source alternatives (Llama, Mistral) that reduce paid model demand, regulatory challenges in deploying AI in regulated industries, talent retention amid competition from better-funded rivals, and public market volatility that could delay or complicate an IPO. Additionally, enterprise AI spending could slow if economic conditions deteriorate.

Why do enterprises prefer Cohere for certain use cases?

Enterprises prefer Cohere because the company directly addresses their real-world constraints: cost efficiency, data privacy (on-premises deployment), integration with existing infrastructure, and predictable scaling. Many enterprises don't need the absolute most capable AI model; they need models that work reliably, cost-effectively, and securely within their existing systems. Cohere was designed with these constraints in mind from the start.

What does Cohere's growth mean for the broader AI industry?

Cohere's growth and path to IPO signals that enterprise AI adoption is real, measurable, and generating significant revenue. This shifts the industry narrative from "AI hype" to "sustainable AI business." It validates that the primary value in AI is not in breakthrough research or consumer virality, but in solving specific business problems for enterprises willing to pay for solutions. This likely leads to more funding for vertical and specialized AI companies rather than horizontal foundation models.

Conclusion: Cohere's Quiet Dominance and What Comes Next

Cohere's path to $240 million ARR is a story about strategic clarity in a hype-filled industry. While the world watched Open AI's Chat GPT phenomenon and Anthropic's well-funded research efforts, Cohere quietly built an enterprise AI business that actually makes money.

This matters because it proves something that many in the AI industry doubted: enterprises will adopt AI at scale, and they'll pay real money for solutions that address their specific constraints.

The company's potential 2026 IPO won't be the flashiest AI IPO story. It won't command the attention that an Open AI or Anthropic public debut would generate. But for investors, customers, and partners, Cohere's IPO will validate something even more important than technological breakthrough: sustainable business model, genuine market demand, and defensible competitive position.

As we enter what some are calling the "IPO sprint of 2026," Cohere stands out precisely because it's not racing toward a technological ceiling. It's executing on a clear business strategy: build products enterprises need, optimize for their constraints, grow revenue sustainably, and use that traction to access public markets.

For enterprises still navigating AI adoption, Cohere's growth signals that the company is a safe, viable long-term vendor with institutional backing and clear path to profitability. For investors, Cohere's metrics demonstrate that there's enormous business value in optimizing AI for practical deployment rather than chasing frontier breakthroughs.

The next 12-18 months will determine whether Cohere's IPO actually materializes in 2026, whether the company maintains its growth momentum amid competition, and how public markets value enterprise AI companies. But one thing is already clear: Cohere has fundamentally changed the conversation about AI value from "what can AI do" to "what can AI do that makes business sense."

That shift matters far more than any single IPO announcement. And for Cohere, that shift is the real achievement.

Key Takeaways

- Cohere surpassed $240 million in annual recurring revenue in 2025 with over 50% quarter-over-quarter growth, demonstrating sustainable enterprise AI adoption.

- The company is positioned for a potential 2026 IPO, competing against OpenAI, Anthropic, and xAI in what's being called an 'AI IPO sprint'.

- Cohere's strategic differentiation lies in efficiency-optimized models and flexible deployment options rather than frontier research capabilities.

- Enterprise AI spending has reached 240M ARR captures less than 0.5% of this market, indicating massive growth potential.

- The company's path from research lab to profitable enterprise vendor validates that sustainable AI business models and practical deployment matter more than raw capability breakthroughs.

Related Articles

- Who Owns Your Company's AI Layer? Enterprise Architecture Strategy [2025]

- Atlassian Stock Down 70% Despite 23% Revenue Growth: Why Markets Miss the Real Story [2025]

- How to Operationalize Agentic AI in Enterprise Systems [2025]

- QuitGPT Movement: ChatGPT Boycott, Politics & AI Alternatives [2025]

- How Spotify's Top Developers Stopped Coding: The AI Revolution [2025]

- Building AI Culture in Enterprise: From Adoption to Scale [2025]

![Cohere's $240M ARR Milestone: The IPO Race Heating Up [2025]](https://tryrunable.com/blog/cohere-s-240m-arr-milestone-the-ipo-race-heating-up-2025/image-1-1770997297664.jpg)