Anthropic's $30 Billion Funding Round: How AI Fundamentally Rewrote the Rules of Enterprise Valuation

In early 2025, something shifted in how the world values artificial intelligence companies. Anthropic closed a

This isn't just another funding announcement. This is a seismic realignment of capital, narrative, and expectations that's reshaping venture capital, enterprise spending, and the entire B2B software landscape.

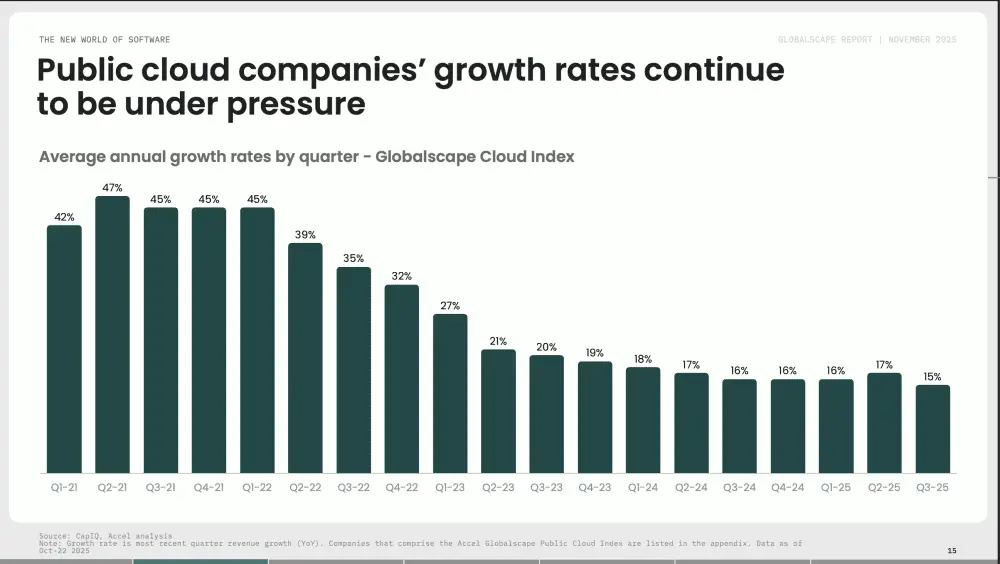

What we're witnessing is the creation of what insiders call the "B2B Software Gravity Well." Everything is being pulled into it. Companies growing 24% annually can't escape. Growth alone doesn't matter anymore. Profitability doesn't matter. A decade of product-market fit doesn't matter. The only thing that matters is AI.

If you're a founder, an investor, or a tech executive, you need to understand what's happening, why it's happening, and what it means for the next three to five years. This isn't speculation. This is happening right now, and the momentum is accelerating.

TL; DR

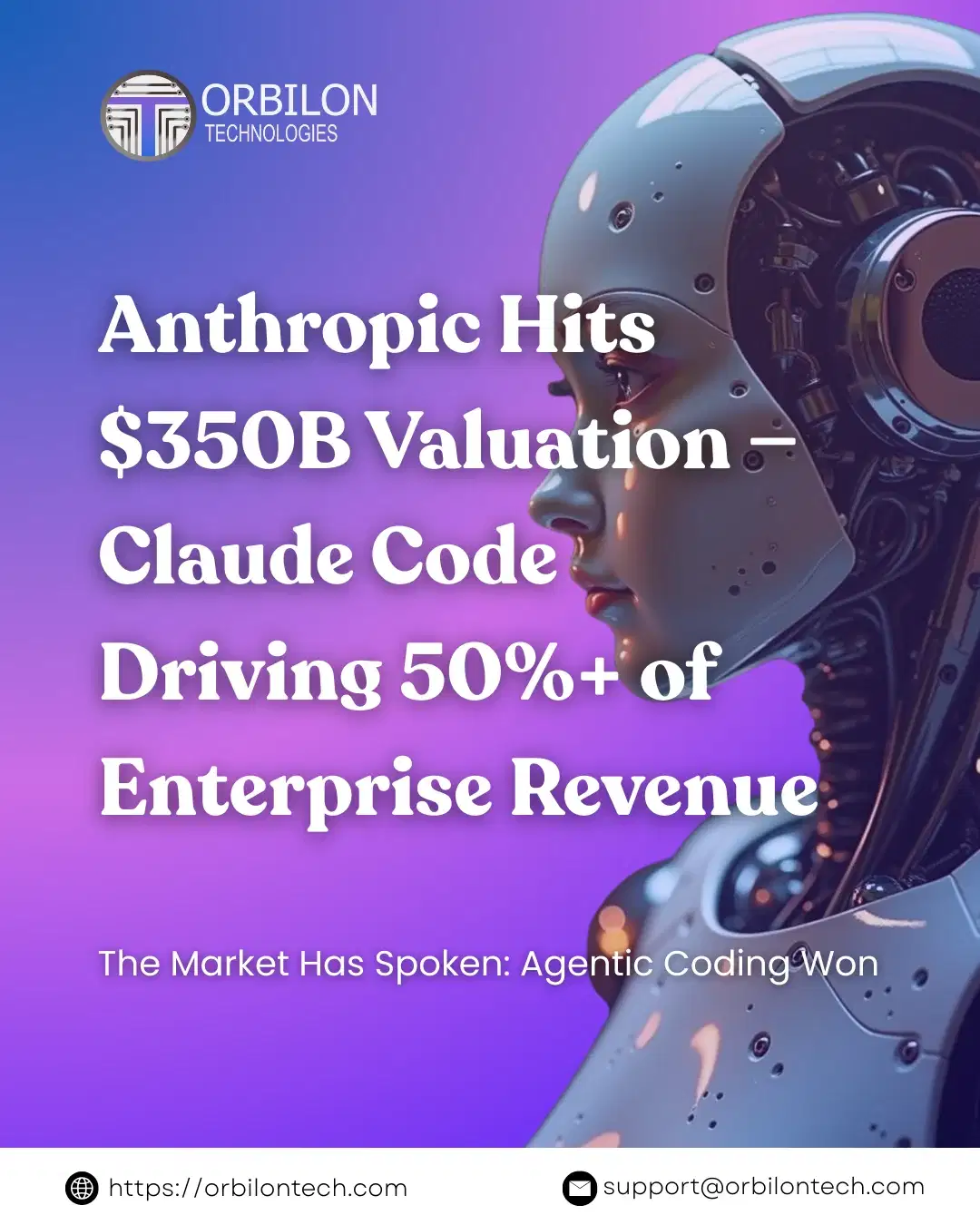

- Anthropic's 380B valuation represents unprecedented capital concentration in AI, driven by enterprise AI adoption that's moving faster than anyone predicted.

- The "B2B Software Gravity Well" describes how all capital and narrative momentum is being pulled toward AI companies, crushing traditional SaaS valuations regardless of growth rates or profitability.

- Corporate America has decided AI replaces labor, and venture capital is betting the ROI will materialize, even though actual productivity gains remain unproven at enterprise scale.

- Non-AI B2B software is being repriced downward with companies at $6B ARR growing 24% now trading at valuations similar to companies growing 5-10%, a historic reversal of SaaS multiples.

- The forcing function that breaks this dynamic will likely be enterprise ROI realization—if major companies spend $20-30B on AI and don't achieve promised labor savings, the momentum will reverse.

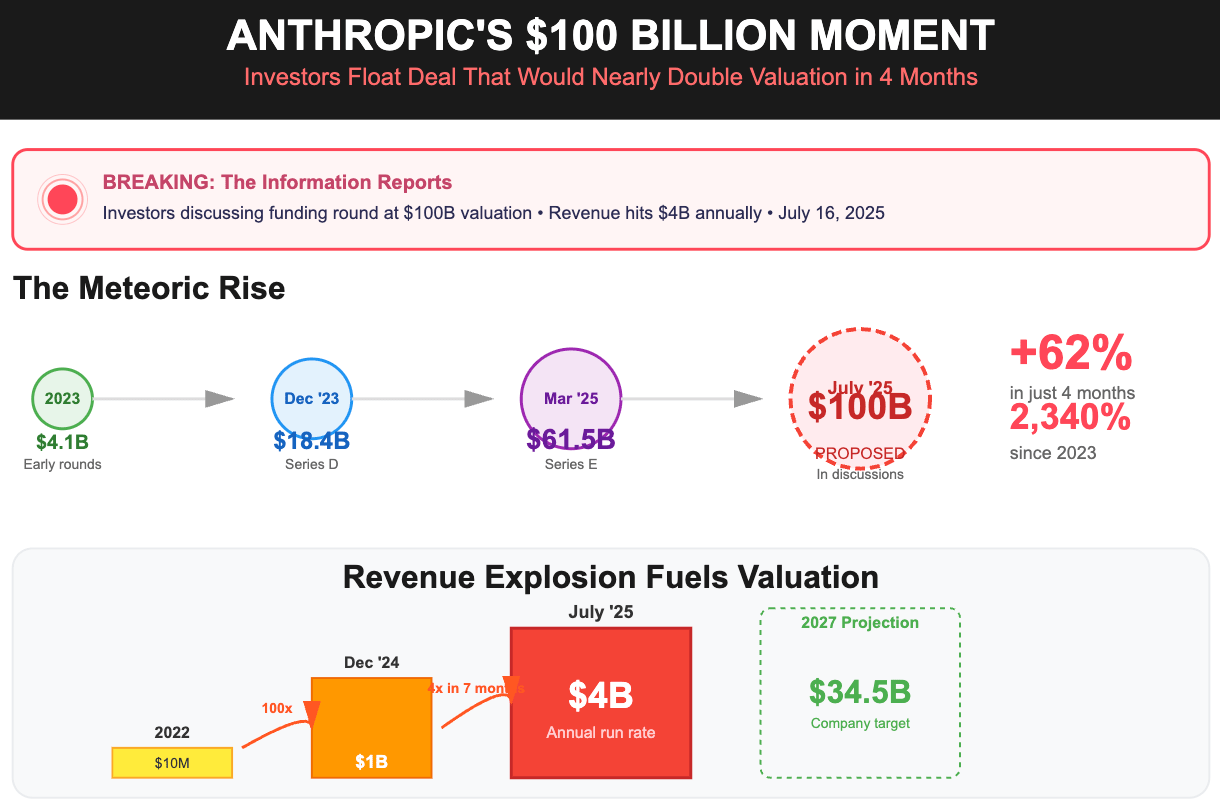

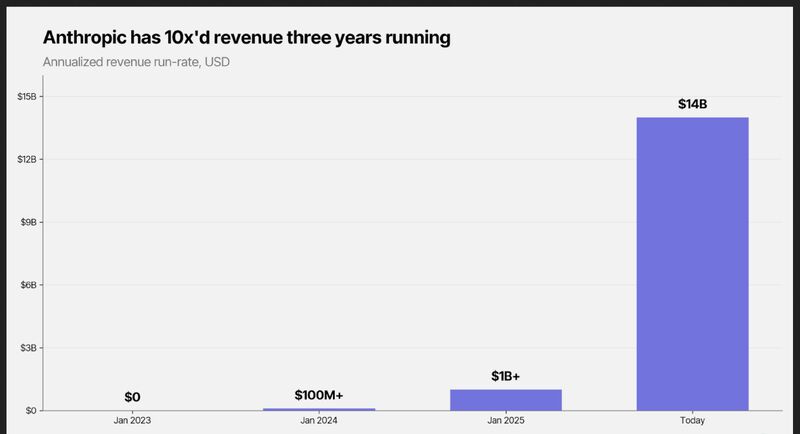

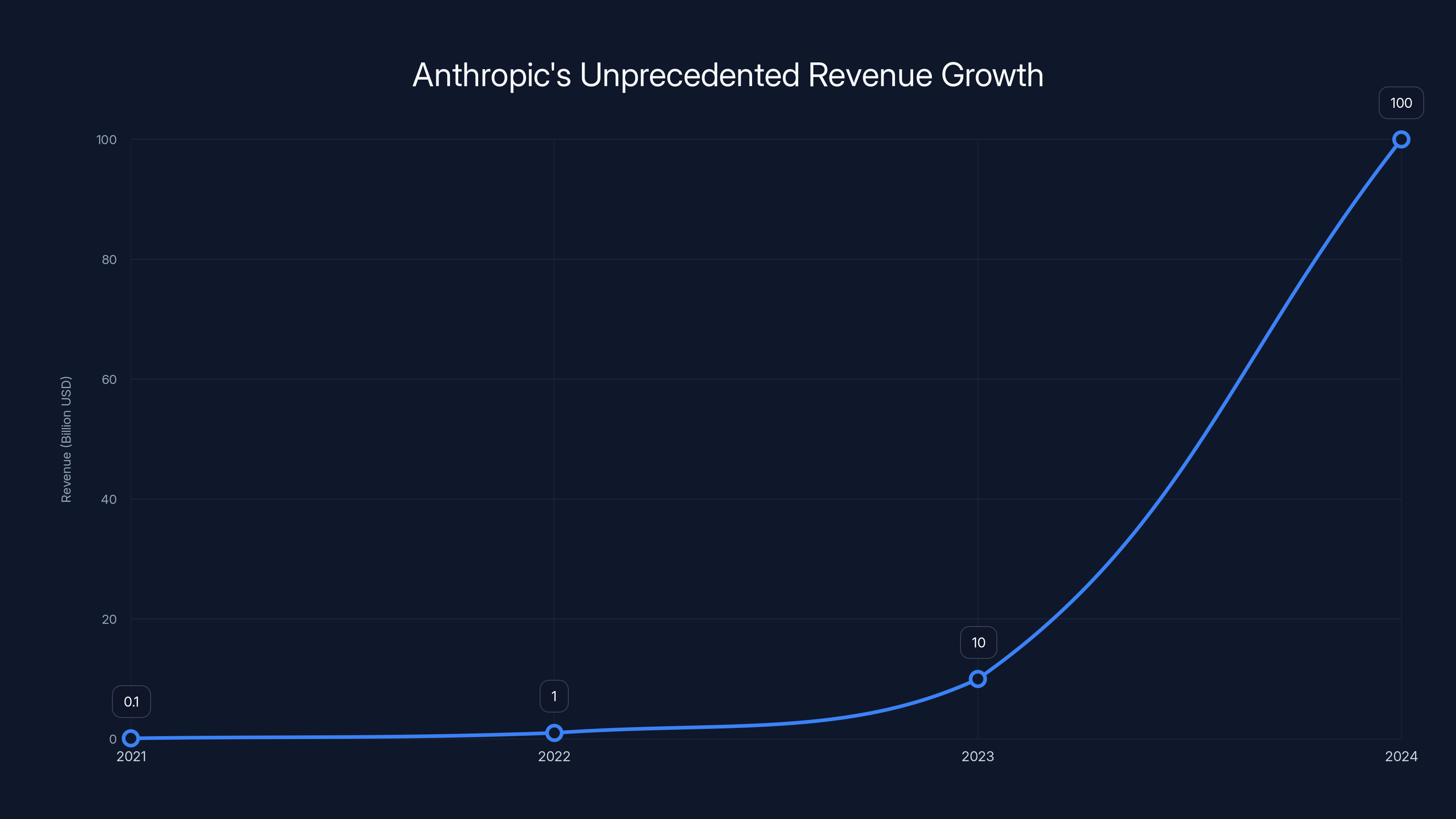

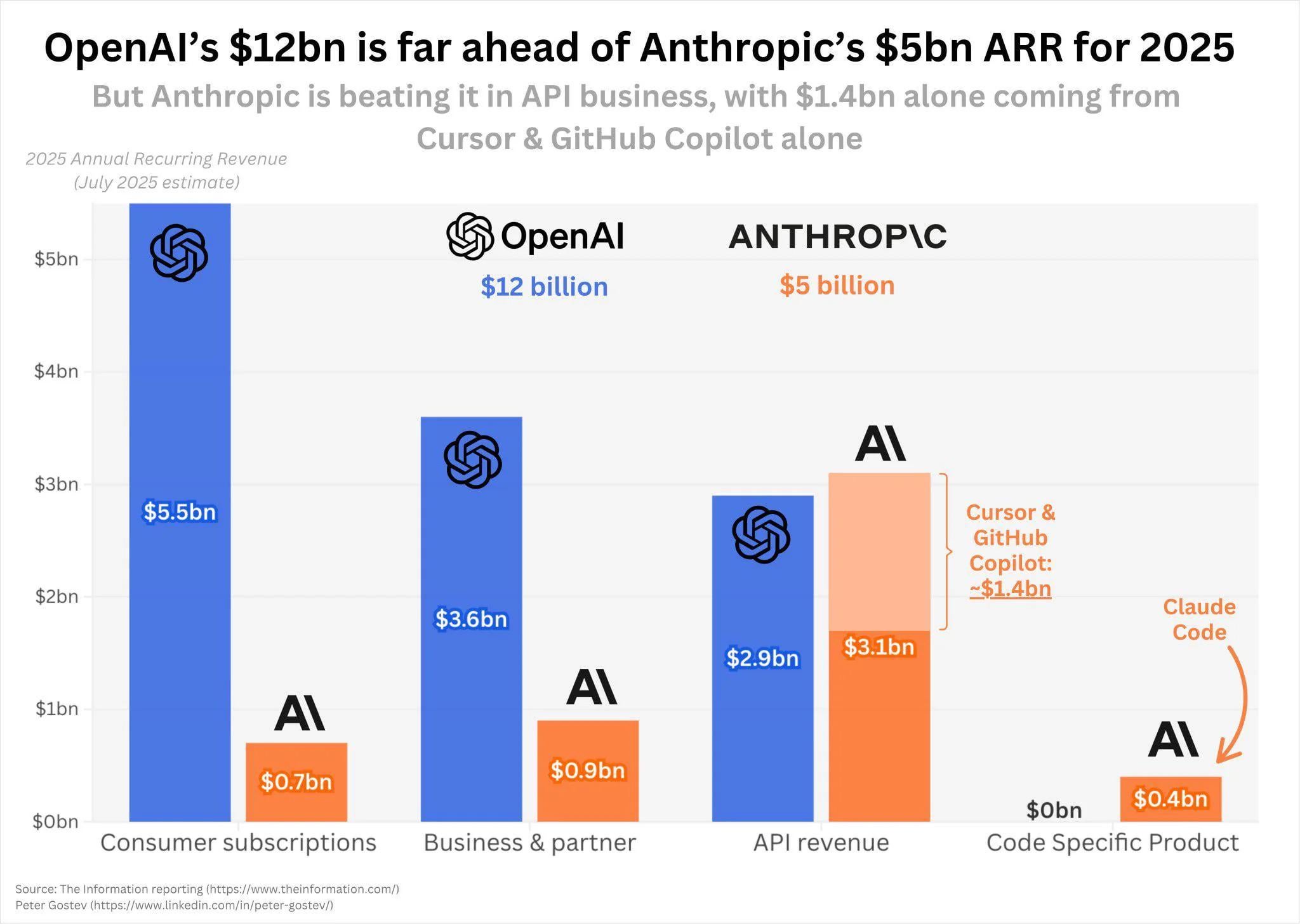

Anthropic has achieved an estimated 10x year-over-year revenue growth for three consecutive years, marking an unprecedented trajectory in the software industry. Estimated data.

Why Anthropic's $30 Billion Raise Broke the Venture Capital Playbook

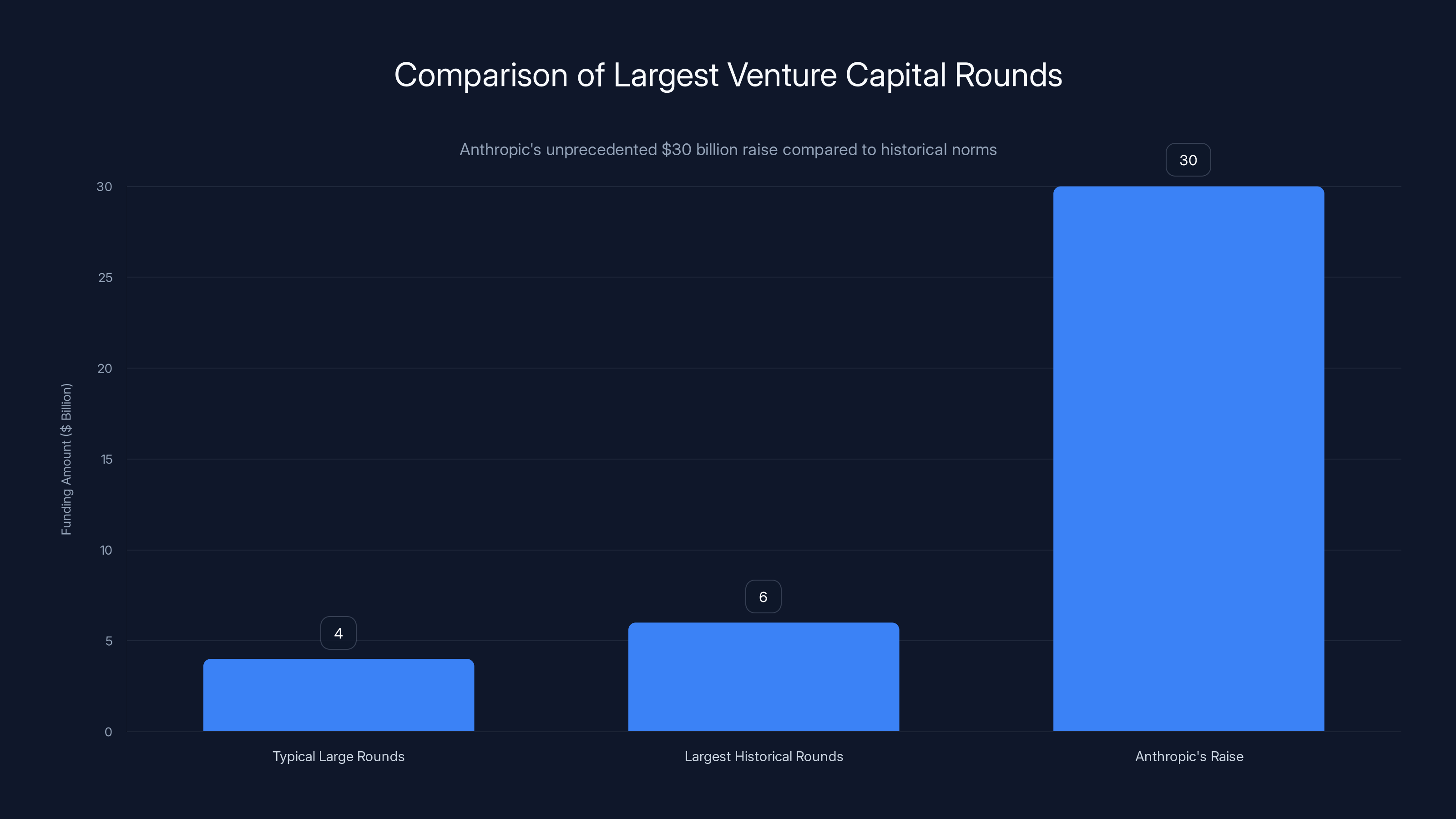

Let's be clear about something: a

Anthropic started with a $10 billion raise planned. The round tripled in size not because the company asked for more money, but because demand overwhelmed supply. Every major institutional investor on Earth wanted in. The calculus was simple: if you didn't have exposure to Anthropic, you had to explain to your limited partners why you missed the only venture investment that's actually worked in the last 18 months.

The previous two Anthropic rounds—a

But here's where the math gets weird. Anthropic is still losing money. Not slightly unprofitable—deeply unprofitable. The company burns enormous sums on compute infrastructure just to train its models and serve users. Dario Amodei, Anthropic's CEO, has publicly stated that if the company miscalculates spend on compute for a single year, it could go bankrupt. You're looking at a $380 billion company where the founder openly discusses insolvency risk, and investors are shrugging.

Compare this to early Microsoft or Google. Both companies were wildly profitable during their hypergrowth phases. Microsoft made money from day one. Google achieved profitability before going public. Anthropic is operating at the opposite end of the spectrum, spending tens of billions annually just to stay competitive.

Yet the market has decided to completely ignore this risk. Why? Because the narrative around AI has become so dominant that traditional financial metrics no longer apply. If you're a fund manager, the burden of proof has flipped entirely. You don't have to prove Anthropic will be profitable. You have to prove it won't be profitable to sit out the round.

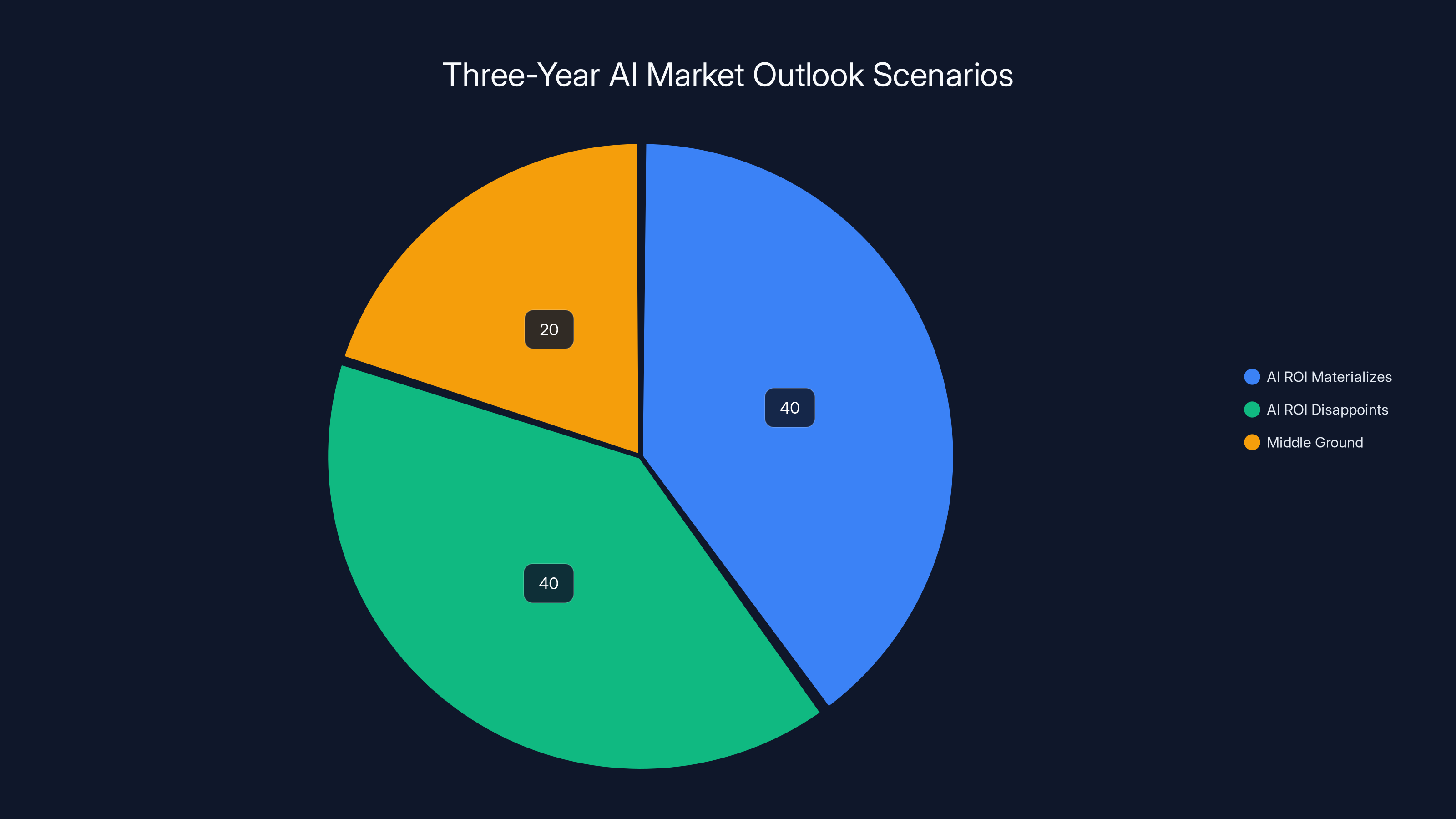

The AI market has a 40% chance each of either achieving significant ROI or disappointing expectations, with a 20% chance of a mixed outcome. Estimated data based on scenario analysis.

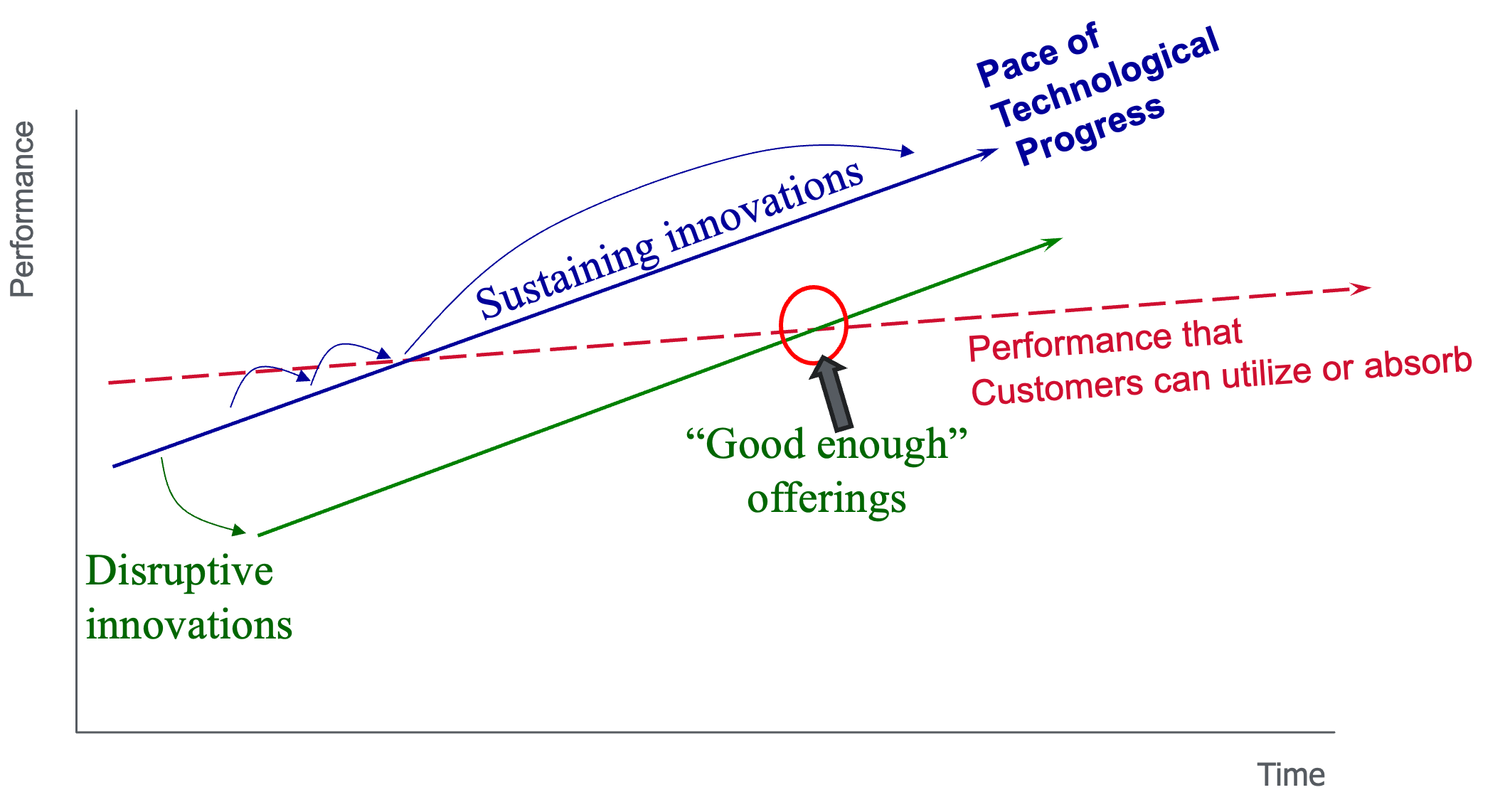

The B2B Software Gravity Well: How Traditional SaaS Got Left Behind

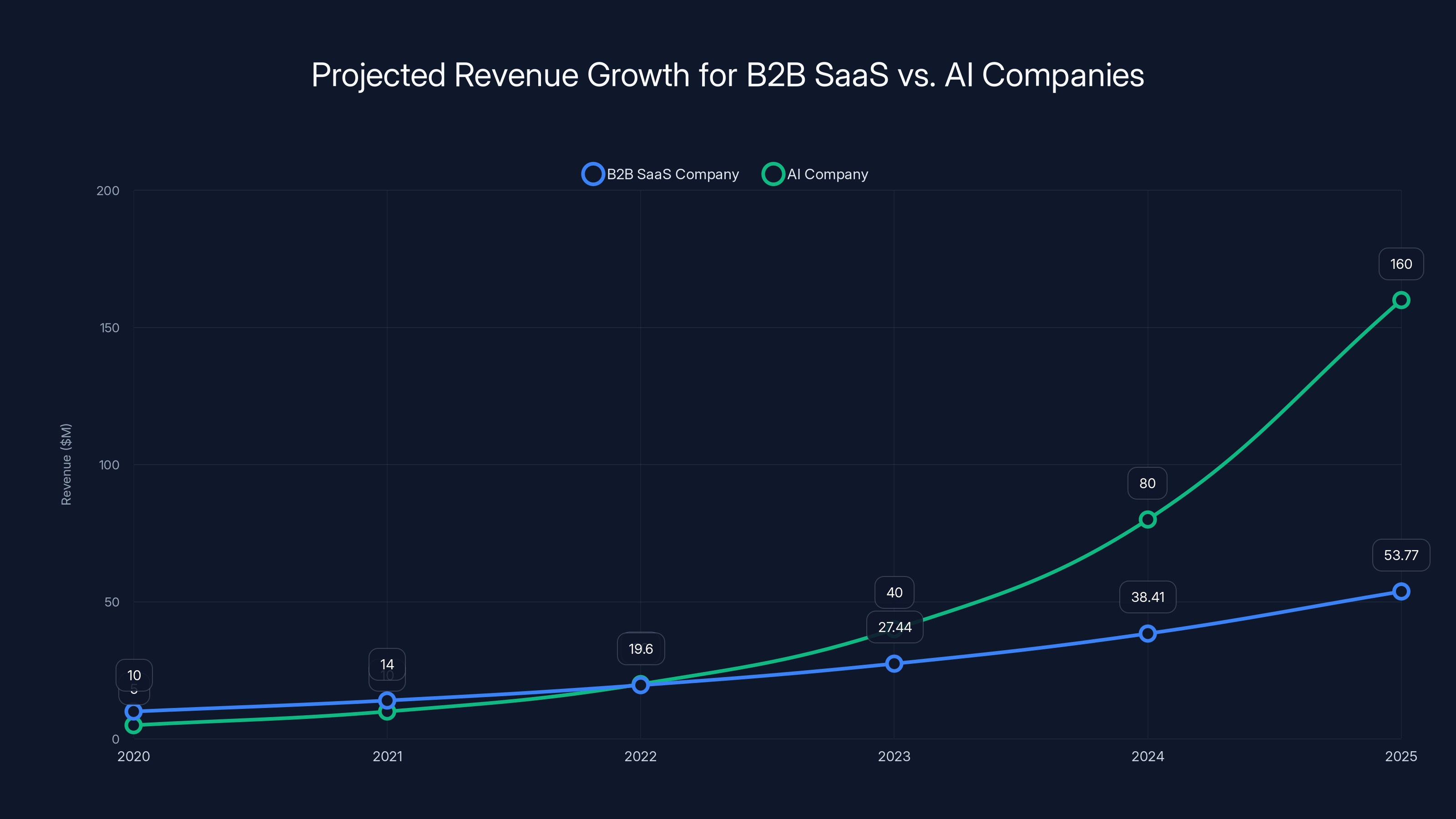

Here's a metaphor that perfectly captures what's happening to traditional B2B software right now: gravity. Imagine Jupiter suddenly appearing in the middle of the solar system. Everything gets pulled toward it. The planets don't collide with Jupiter, but they all shift their orbits. Some escape gravity entirely. Most don't.

In the B2B software world, Anthropic, OpenAI, and Databricks are Jupiter. Everything else is getting pulled inward.

Let's look at concrete examples. Atlassian is an $6 billion ARR company growing at 24% annually. By any traditional software metric—revenue scale, growth rate, profitability trajectory—Atlassian is thriving. A decade ago, a company at that scale growing that fast would be the most valuable software company on the market by multiples.

Today, Atlassian's market cap is under

The forcing function isn't "your growth rate isn't high enough." It's "your company doesn't have AI in its narrative."

What's particularly brutal about the gravity well is that it's not discriminating. Companies with legitimate AI products are benefiting. Companies that have nothing to do with AI are being punished simply for not being AI. The market has decided that 2025-2026 is a single-narrative market, and if you're not part of that narrative, you're worth less.

Jason Lemkin, the founder of SaaStr, shared portfolio data from his last fund that crystallizes this dynamic: two companies are massively benefiting from the current world. One is "a push"—getting help in some ways, hurt in others. Everything else in the fund is struggling because of AI. The pattern repeated in 2023 when the market got obsessed with something else, but this time the gravity is stronger.

Here's the honest question nobody wants to ask: what snaps this spell? What breaks the gravity well?

The answer is almost certainly enterprise ROI. Companies are about to spend somewhere between $20-30 billion on AI initiatives in the next 18-24 months. If that capital doesn't produce the labor savings executives are expecting—if they can't actually replace headcount, if the productivity gains don't materialize, if the ROI is 0.7x instead of 3x—then everything reverses.

But that forcing function is still 12-24 months away. Until then, momentum and narrative dominate valuation. And right now, the only narrative is "AI replaces everything."

Corporate America Has Already Decided: AI Is Replacing Labor

There's a critical misunderstanding about what's happening with enterprise AI adoption. Most observers think companies are cautiously experimenting with AI, carefully measuring ROI, and rolling out applications methodically.

That's not what's happening.

What's actually happening is that corporate America—specifically the C-suite of Fortune 500 companies—has made a decision. They've decided that AI will replace labor. They've decided it's doable. They've decided it's happening. Now they're asking: how do we implement it?

The ROI debate is secondary. It's almost academic. The decision was made before the ROI analysis was complete. Now it's just execution.

This is a radical shift from how technology adoption typically works. Usually, companies adopt technology because it solves a specific problem better than existing solutions. But AI adoption isn't following that pattern. It's following a different pattern: "This technology is transformative and everyone else is adopting it, so we have to adopt it or lose competitive advantage."

That's a narrative-driven adoption cycle, not a fundamentals-driven one. And narrative-driven cycles create their own momentum that has nothing to do with actual productivity gains.

What makes this different from previous tech bubbles is that the underlying technology is genuinely powerful. AI works. Claude actually understands code better than junior engineers. GPT-4 can actually handle customer service interactions that previously required humans. Anthropic's models actually pass professional-level exams.

So companies aren't being irrational when they decide AI is valuable. They're being rational about the trajectory, if not always about the timeline or ROI expectations.

The problem is the gap between "AI is powerful and will eventually replace some labor" and "AI will replace X% of labor by Y date and cost Z billion dollars." That second half is still largely guesswork. And by the time companies realize the guesswork was off, they've already committed capital and narrative.

Anthropic's $30 billion raise is five times larger than typical large venture rounds and significantly surpasses the largest historical rounds, highlighting its unique market position. Estimated data.

Why Wall Street Fell Out of Love with SaaS to Fall in Love with AI

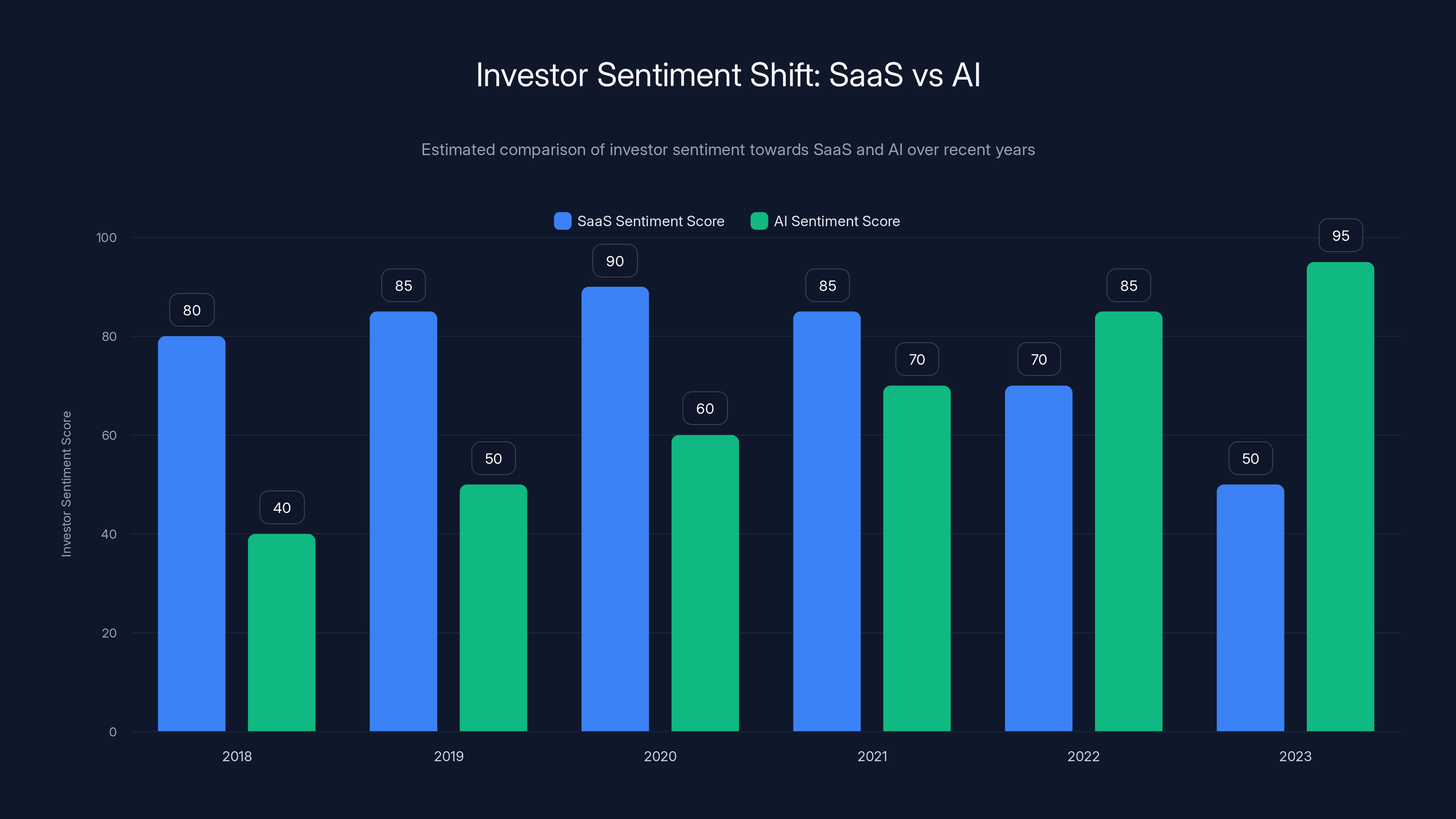

For roughly two decades, Wall Street treated B2B software as the safest high-growth asset class available. The metrics were predictable. The growth was sustainable. Profitable SaaS companies got premium multiples because the business model worked at every scale.

Then AI happened, and the investment thesis inverted.

Harry Stebbings, founder of the 20VC podcast, crystallized this shift in a single observation: "Wall Street fell in love with AI and had to fall out of love with SaaS to do it."

What he means is that investors face a choice. They can allocate capital to AI companies or traditional SaaS companies, but not equally. Capital is finite. If you're chasing the only narrative that's working, you have to abandon the old narrative.

The burden of proof completely flipped. Traditional SaaS companies used to get the presumption of success. Investors started with an assumption that if you were operating with good unit economics, strong retention, and predictable growth, you'd eventually be valuable. The default assumption was positive.

Now the default assumption is failure. A SaaS company has to prove it won't be disrupted by AI. A company has to prove its business model is defensible against autonomous agents and large language models. The presumption of success is gone.

Meanwhile, AI companies get the presumption of success. Anthropic doesn't have to prove it's profitable. OpenAI doesn't have to prove it's profitable. Databricks doesn't have to prove its unit economics. The assumption is that if they're growing this fast in AI, they'll figure out profitability later.

This is a completely inverted risk allocation. Traditional SaaS is lower risk, lower uncertainty, and more proven. AI companies are higher risk, higher uncertainty, and largely unproven at scale. Yet the market has decided to price traditional SaaS as risky and AI as safe.

This inversion will eventually equilibrate. Price clears all markets. Eventually, valuations will normalize, and companies will trade based on cash flow, growth, and competitive position rather than narrative. But we're not there yet. We're in a period where narrative dominates, and the narrative is "SaaS is dead, AI is everything."

The marker of when this starts to change? When enterprises actually have to report the ROI of their AI investments. When the first major company announces "We spent $2 billion on AI and it didn't deliver," the whole dynamic shifts.

Anthropic's Growth Trajectory: Numbers That Break Historical Precedent

Let's talk about the actual business performance that's justifying this valuation.

Anthropic has done something unprecedented: achieved 10x year-over-year revenue growth for three consecutive years at massive scale. This isn't a startup growing from

Rory O'Driscoll, a venture partner at Scale Ventures, went back and analyzed early growth at Microsoft, Google, and Compaq—companies that defined hypergrowth in their eras. None of them achieved 10x GAAP revenue year-over-year growth for three consecutive years at scale. It's literally never happened before.

Now, the caveat is important: Anthropic isn't profitable GAAP. The "GAAP" part is crucial because it means this is real revenue growth, not accounting tricks. But it's revenue growing faster than any company in history while the company burns money on infrastructure.

The math on this is worth understanding. If Anthropic is doing

But here's the insight that justifies some of the valuation: if Anthropic can scale inference (serving users) more efficiently than training (building new models), there's a path to profitability at $50B+ revenue scale. The leverage in the model is enormous if execution is perfect.

That's a big if. Compute costs might not decline as fast as Anthropic hopes. Competition might force pricing down. Enterprise adoption might hit a wall. But the mathematical possibility of 10x margins at massive scale is why investors are willing to overpay for growth today.

Anthropic has achieved an estimated 10x year-over-year revenue growth, reaching $100B ARR by 2024, an unprecedented feat in the tech industry. Estimated data.

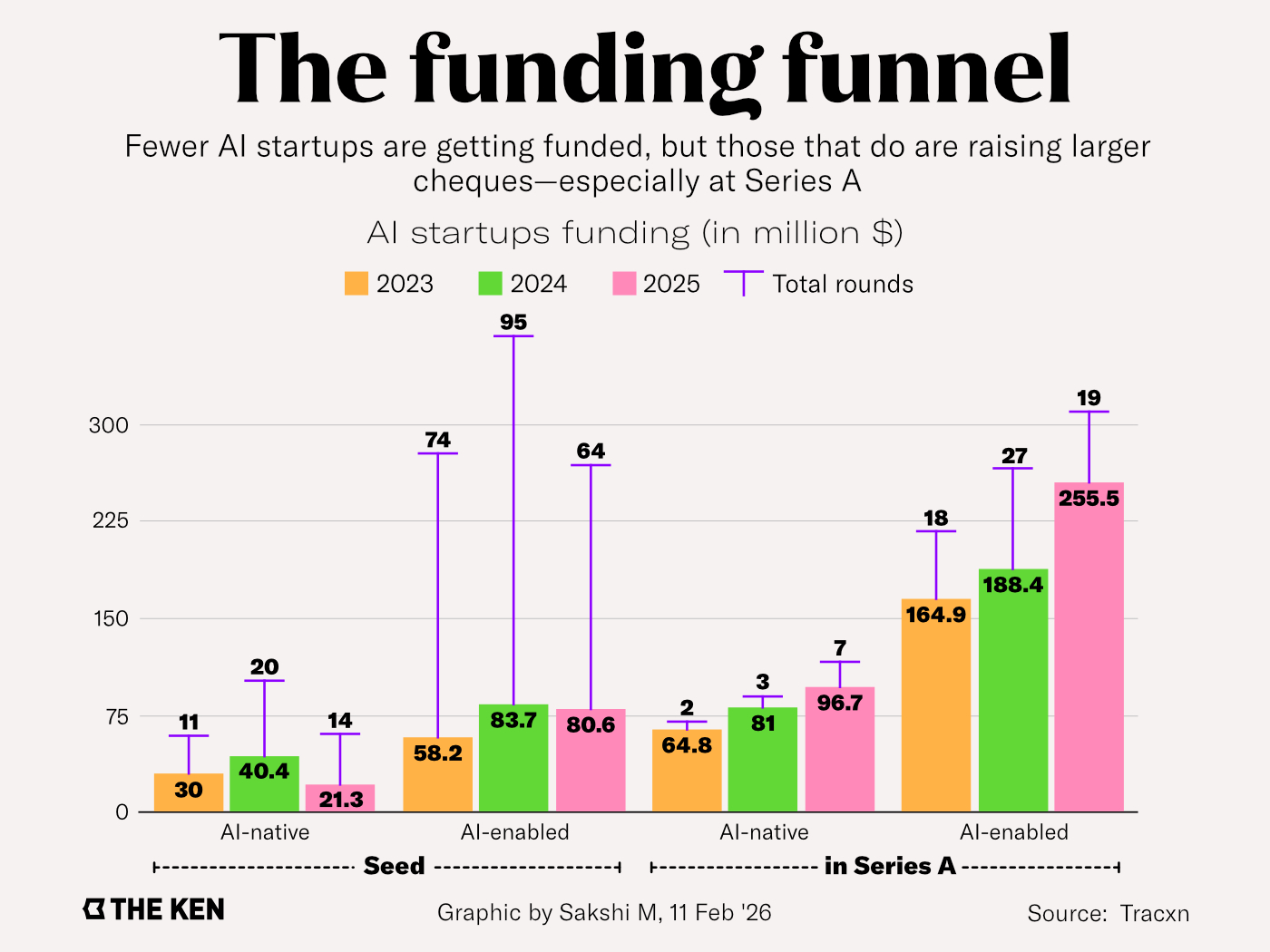

The Venture Capital Response: Participation Becomes Mandatory

When you look at who participated in Anthropic's $30 billion round, the list reads like a who's who of institutional capital. This isn't hype. This is every major multi-stage fund deciding they have no choice but to participate.

The logic is brutal but rational from an investor perspective. If you have a $10 billion fund and you miss Anthropic, you've just underperformed by potentially 2-3x because you gave up the only investment that's actually worked. Your best companies are getting 20% annual returns. Anthropic is getting 2-3x in under a year.

So you either participate or you explain to your LPs why you voluntarily gave up the best return opportunity available.

That pressure cascades through the entire venture ecosystem. Seed and Series A investors feel it because their companies are getting crushed. They ask themselves: should we be doing seed stage at all when we can get 10x returns on secondary sales of Anthropic equity? Should we be funding Series A in enterprise software when every Series A company is worth less in 2025 than it was in 2023?

This creates a weird dynamic where capital concentration increases precisely when it should be diversifying. In rational markets, capital flows to opportunities with the best risk-adjusted returns across multiple asset classes. But in momentum-driven markets, capital concentrates in the narrative that's working and abandons everything else.

We're in a momentum-driven market. Venture is flooded with dry powder looking for Anthropic-like opportunities and finding nothing. So it's just getting recycled into Anthropic and a handful of other AI picks.

The Gravity Well's Victims: Why Even Great Companies Are Getting Crushed

Nowhere is the gravity well more visible than in the market caps of legitimately great, profitable, growing B2B software companies.

Take Figma. The design collaboration platform is probably the best-in-class product in its category. It has incredible retention, strong network effects, and a defensible market position. In 2022-2023, Figma was one of the hottest companies in venture. It should be thriving.

Instead, Figma's valuation has been cut roughly in half since its peak, despite the company having grown and become more profitable. Why? Because it's not an AI company. Because the narrative around Figma doesn't include "generative design agents that replace designers." Because investors would rather own a 50% stake in an AI company that's probably not profitable than own a 1% stake in Figma that definitely is.

Similarly, companies like Intercom, Calendly, and Notion have all been repriced downward despite being stronger businesses than they were two years ago. They built better products. They acquired more users. They achieved better unit economics. And they're worth less because the narrative moved away from them.

This is what the gravity well does. It's not that these companies are bad. It's that they're the wrong narrative.

The cruelest part is that some of these companies are adding AI features. Figma launched an AI design generation tool. Notion is integrating AI assistants. But adding AI features doesn't change the narrative. These companies aren't "AI companies." They're "software companies that added AI." That's a completely different investment thesis.

The gravity well is going to reshape the venture capital market in ways we're just starting to see. You're going to have a handful of massive AI companies worth hundreds of billions. You're going to have a long tail of traditional SaaS companies trading at depressed multiples and struggling to raise capital. And you're going to have a huge gap in the middle where companies used to live.

Investor sentiment has shifted significantly from SaaS to AI over the past five years, with AI now perceived as the more attractive investment opportunity. (Estimated data)

Compute: The Real Constraint Beneath the AI Valuation

All of this AI growth—Anthropic's 10x trajectory, OpenAI's expansion, every major tech company launching large language models—is built on a foundation that nobody talks about: compute infrastructure.

Training large language models costs billions of dollars. OpenAI spent an estimated $5-6 billion training GPT-4. Anthropic is probably spending similar amounts per training run. Microsoft, Google, and Amazon are spending tens of billions building out the data centers and GPU capacity to train and serve these models.

This creates an interesting dynamic. Compute is the most capital-intensive part of AI, and it's getting more expensive, not cheaper. GPU prices have actually gone up in the last 18 months because demand is so high. Data center costs are rising. Power costs are rising.

Yet valuations are rising faster than compute costs. That suggests one of two things: either AI productivity is genuinely so high that it justifies the expense, or we're in a bubble where investors are assuming compute costs will eventually become negligible.

The truth is probably somewhere in the middle. AI probably is transformative enough to justify high spending on compute. But high spending on compute is also a constraint that could limit growth if demand exceeds supply or if Moore's Law stops delivering efficiency gains.

This is why Dario Amodei's comment about potential insolvency is actually concerning. If Anthropic miscalculates on compute needs, it could blow up the entire valuation. And unlike software companies that can cut compute spending relatively easily, Anthropic's business depends on being able to train new models regularly. You can't cut compute spending without cutting the competitive moat.

What Happens When Enterprises Actually Measure ROI

The big question hanging over all of this is: what happens when enterprises actually try to measure the ROI of their AI investments?

Right now, companies are making decisions about AI based on narrative and competitive pressure. "If we don't adopt AI, we'll lose to competitors." That's powerful enough to drive adoption. But once you've adopted AI, you have to measure whether it's actually working.

Initial results from early AI adopters are mixed. Some companies report productivity gains of 20-30% in certain roles. Others report gains closer to 5-10%. Some report no measurable gains at all. The variance is huge, and a lot of it depends on implementation, change management, and actual adoption by employees.

Here's the scenario that would break the gravity well: Fast forward to late 2026, early 2027. Companies have spent $20-30 billion on AI. C-suite executives are asking for the ROI analysis. The finance team reports back: we achieved 15% productivity gains in some roles, 0% in others, and actually declined productivity in some cases because employees are spending time learning the new tools. The net ROI is probably 0.8x on our investment.

In that scenario, the narrative snaps immediately. Companies that haven't spent on AI yet pull back. Companies that spent heavily look like they made bad decisions. The AI companies' growth rates slow down because enterprise adoption plateaus. Valuations reset across the board.

But that's a scenario that requires two things to happen: first, enterprises have to actually measure ROI (many won't), and second, they have to be honest about it with shareholders (many won't). So the forcing function might take longer than people think.

In the meantime, the gravity well keeps pulling. Capital keeps flowing to AI. Traditional SaaS keeps getting repriced downward. And the gap between "companies that might benefit from AI" and "companies that probably won't" keeps widening.

Estimated data shows AI companies potentially experiencing exponential growth compared to steady growth in B2B SaaS companies. The AI focus may lead to higher valuations despite profitability challenges.

The Founder Problem: Building a $100M Revenue Company in 2025

If you're a founder trying to build a B2B software company right now, you're operating in an incredibly strange market.

Your company is solving a real problem. You've achieved product-market fit. You've built a great team. You're growing 40-50% annually with good unit economics. In 2020, this would be the dream scenario. You'd be approaching a Series C, scaling sales, on a clear path to $100M ARR and beyond.

In 2025, investors are asking: "But is it AI?"

If the answer is no, you're swimming upstream. You can build a great company, but you're fighting valuation gravity. Investors would rather own 2% of an AI company that's worth nothing today but might be worth

This creates a problem: the incentive structure for founders is completely misaligned with fundamentals. The founder who builds the most profitable SaaS business gets worse economics than the founder who builds an unprofitable AI company with higher growth.

Some founders are pivoting toward AI even if it doesn't make sense for their products. Some are adding AI features just to change the narrative. Some are just raising less capital and accepting that they'll build slower. None of these are good options.

The sorting that's happening is going to reshape the venture ecosystem for a generation. The companies that can credibly call themselves "AI" will get capital and reach scale. Companies that can't will have to bootstrap, find niche markets, or be acquihired into larger companies.

This isn't sustainable long-term, but it might be the reality for the next 2-3 years until the gravity well breaks.

Capital Concentration and the Venture Sustainability Question

Traditionally, venture capital works because it allocates capital to opportunities with the best risk-adjusted returns. That requires discipline, comparison, and willingness to say no to hot deals.

What we're seeing instead is capital concentration driven by momentum and fear of missing out. Every fund is worried that if they don't have AI exposure, their returns will be terrible. So they all pile into AI. The capital that used to go to 50 different Series B rounds now goes to Anthropic. The seed stage ecosystem collapses because LPs want AI bets, not traditional software bets.

This dynamic is somewhat self-correcting. Once Anthropic, OpenAI, and Databricks are valued high enough that they're actually expensive, capital will eventually flow to less crowded opportunities. But that recalibration might take a few years.

In the meantime, the venture capital market is undergoing a strange transformation. There's not enough capital available for traditional software companies. Valuations are compressing. Seed rounds are harder to close. The median Series A is smaller and more expensive.

Some of this is healthy. The venture market probably was oversized relative to the supply of actually viable companies. Some of this is destructive. Real companies with real products are going unfunded because they're not AI.

How AI Companies Are Actually Different from Traditional SaaS

Underneath all the narrative, there actually are real differences between how AI companies operate and how traditional SaaS companies operate. Understanding these differences helps explain why the market is treating them so differently.

Network Effects and Scale: Traditional SaaS companies build network effects slowly. AI companies get them immediately from model improvements. When Anthropic trains a new version of Claude, every user gets smarter instantly. That's different from how traditional software improves, where upgrades are incremental.

Capital Intensity: Traditional SaaS is capital light once you've built the product. AI is capital intensive forever. You have to keep spending on compute to stay competitive. This changes the economics dramatically and means AI companies need more capital to stay alive.

Competitive Moat: Traditional SaaS moats come from switching costs, integration, and network effects built over time. AI moats come from model quality, training data, and compute resources. They're harder to defend long-term because model quality can shift quickly.

Pricing Power: Traditional SaaS companies have pricing power that grows with lock-in. AI companies have limited pricing power because they're competing on model capability, and if you fall behind, users will switch. This constrains margin expansion.

Path to Profitability: Traditional SaaS companies usually get more profitable over time as they scale infrastructure across more customers. AI companies might never get more profitable because the cost of staying competitive (keeping up with new models, new training data, new compute infrastructure) keeps pace with revenue growth.

These aren't differences in narrative. These are actual operational differences. And some of them suggest that AI companies might actually be riskier long-term bets than traditional SaaS, not less risky.

But the market has decided to price risk differently for AI companies than for SaaS companies. That's an arbitrary decision, and it will eventually get repriced.

The Three-Year Outlook: What Actually Changes

Let's zoom out to three years from now and ask: what will this market look like?

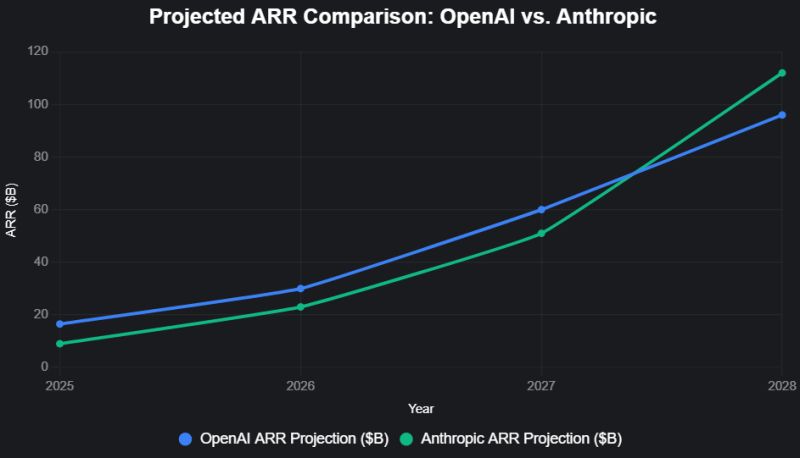

Scenario 1: AI ROI Materializes (40% probability) Companies actually achieve the labor savings and productivity gains they're expecting. Claude Code becomes the default for coding. AI customer service agents replace a meaningful percentage of support staff. The gravity well keeps accelerating. Anthropic, OpenAI, and similar companies hit $100B+ ARR. Traditional software companies get acquired or consolidate. Venture capital fully bifurcates into AI and non-AI.

Scenario 2: AI ROI Disappoints (40% probability) Companies realize after spending $20-30B that the ROI is 0.8-1.2x on investment. The productivity gains are real but modest. The narrative snaps. AI company growth rates slow to human levels (30-50% instead of 100%+). Valuations reset. Capital floods back into traditional software. The gravity well dissipates in 12-18 months.

Scenario 3: Middle Ground (20% probability) AI ROI is real but lumpy. Some companies achieve 3x ROI. Others achieve 0.5x. The market segregates. Best-in-class AI companies (Anthropic, OpenAI) continue scaling. Second-tier AI companies struggle. Meanwhile, B2B software that's genuinely valuable and defensible rebuilds valuation multiples on fundamentals. We get a more normalized market by 2027, but AI companies still command a premium.

The base case probably is some version of Scenario 3, where the truth is more complex than either pure enthusiasm or pure skepticism. But we won't know which scenario we're in until enterprises start reporting their AI ROI in late 2026.

Until then, the gravity well persists.

What This Means for Different Player Types

For Venture Capitalists: You're in a market where the safe play (AI exposure) is actually the risky play. You're also in a market where not playing is the riskiest play. This has led to herd behavior and capital concentration. If you're managing a fund and you don't have Anthropic exposure, you need a compelling narrative for why your returns will be good despite missing the obvious winner.

For Founders: If you're building AI-first, you have wind at your back in fundraising but also extreme competition and execution risk. If you're building traditional software, you have headwind in fundraising but also less competition for capital, lower expectations, and the possibility of building a genuinely profitable company while AI hype sorts itself out.

For Enterprise Buyers: You're being pressured to spend money on AI before you've proven the ROI. The prudent move is to do small pilots, measure carefully, and only scale what works. The risky move is to follow the herd and spend billions on the assumption that AI will eventually deliver.

For Employees: If you work at an AI company, you're potentially in on something genuinely transformative. If you work at a traditional software company, you're potentially in a company that's being repriced downward even if it's getting better. Career risk might be higher at traditional software right now, purely from a stock option perspective.

The Forcing Functions: What Actually Breaks the Spell

Gravity wells eventually break. They always do. The question is what causes the break.

Forcing Function 1: Enterprise ROI Reality (most likely) When companies report the actual ROI of AI spending, reality hits. This probably happens in Q4 2026 or Q1 2027 when annual planning cycles force honest conversations about what worked and what didn't.

Forcing Function 2: AI Model Plateau If Claude, GPT-5, or the next generation of models doesn't show meaningful improvement over current models, the narrative of "AI improves forever" breaks. Growth rates decelerate because the use cases don't expand.

Forcing Function 3: Compute Cost Inflation If the cost of compute doesn't decline or actually increases, AI company margins get squeezed. Profitability becomes impossible at any price point. Valuations reset because the path to earnings is closed.

Forcing Function 4: Regulatory Constraint If governments actually regulate AI substantially (not just talk about it), the capital requirements and compliance costs for AI companies rise dramatically. Smaller AI companies fail. The ecosystem consolidates around regulation-ready companies.

Forcing Function 5: Competitive Saturation If every large tech company launches a competitive AI product and gives it away for free (which they're basically already doing), there's no pricing power left for standalone AI companies. Growth becomes a shared problem.

Any one of these forcing functions will break the gravity well. We're probably 12-24 months away from at least one of them materializing.

The Bottom Line: Momentum Is a Terrible Valuation Framework

Here's what everyone in the venture capital and AI industry already knows but won't say publicly: valuations right now are being driven by momentum, not by fundamentals. Anthropic is worth $380 billion because every investor wants in, not because financial models justify that valuation.

Momentum-driven valuations work great if you can sell before the momentum breaks. If you can get into Anthropic early and exit when valuations are at peak euphoria, the returns are extraordinary. But for capital that has to stay invested, momentum-driven valuations are terrifying.

What's happening right now is that venture capital has collectively decided that momentum is the valuation framework. Narrative matters more than metrics. Growth trajectory matters more than profitability. The only narrative is AI. Everything else is undervalued.

This will eventually seem absurd. A company worth

In the meantime, if you're a founder, an investor, or a tech executive, you have to operate in this market as it is, not as it should be. The gravity well is real. The repricing of non-AI software is real. The concentration of capital in AI is real.

Navigate accordingly.

FAQ

What does Anthropic's $30 billion funding round actually represent?

Anthropic raising

Why is the "B2B Software Gravity Well" such a significant problem for traditional SaaS companies?

The gravity well describes how all capital flows, narrative, and valuation momentum are being concentrated in AI companies while traditional B2B software companies are being repriced downward regardless of their actual growth rates or profitability. A company like Atlassian growing 24% annually at $6 billion ARR would have been the most valuable software company a decade ago, but today it trades at a lower valuation multiple because it lacks an "AI narrative." This creates a structural disadvantage for non-AI software companies that has nothing to do with their fundamental business quality.

How is Anthropic's growth trajectory different from historical software company growth?

Anthropic has achieved approximately 10x year-over-year revenue growth for three consecutive years at scale, which is unprecedented in software history. Early Microsoft, Google, and Compaq never achieved this level of growth sustainably. The key difference is that Anthropic is doing this while unprofitable—burning $5-7 billion annually on compute infrastructure—whereas historical hypergrowth companies were typically profitable or near-profitable during their rapid expansion phases.

What is the main risk in Anthropic's business model that the $380 billion valuation doesn't seem to account for?

The primary risk is that Anthropic must maintain enormous spending on compute infrastructure (

When will the "B2B Software Gravity Well" likely break, and what triggers it?

The gravity well will most likely break when enterprises actually measure and report the ROI of their AI investments in late 2026 or early 2027. If companies that have spent $20-30 billion on AI initiatives report that they achieved less than 1.5x ROI or failed to achieve promised labor savings, the narrative around AI dominance will snap, capital will flow back to traditional software, and AI company valuations will reset significantly downward.

Should founders building non-AI B2B software companies be concerned about current market conditions?

Founders building traditional software should be concerned about fundraising difficulty and valuation expectations, but optimistic about long-term business prospects. The current market is creating artificial headwinds for non-AI software in terms of capital availability and multiples, but the underlying businesses may be more sustainable than AI companies. Prudent strategy involves building conservatively, raising smaller rounds, focusing on profitability rather than growth, and planning to benefit from a repricing once the gravity well breaks.

Conclusion: The Inevitable Reckoning

We're witnessing something historically unusual: a capital market where narrative has completely overwhelmed fundamentals in determining valuations. Anthropic's $380 billion valuation, the collapse of traditional SaaS multiples, the concentration of all venture capital into AI—none of this is sustainable indefinitely.

But it's sustainable enough to reshape careers, companies, and entire market segments over the next 2-3 years.

The venture capital market is in a phase where momentum dominates, narrative matters more than metrics, and the only acceptable thesis is that "AI replaces everything." This has created extraordinary opportunities for AI companies and extraordinary headwinds for everything else. Fund managers are forced to participate in AI because not participating means potential career risk. Founders of non-AI companies are being punished not for building bad businesses but for building businesses in the wrong narrative.

This dynamic will eventually break. When enterprises measure their AI ROI and find it disappointing. When AI model improvements plateau. When compute costs increase instead of decrease. When new regulation makes AI more expensive to operate. When competition drives pricing down to unsustainable levels. Something will break the spell.

Until then, the gravity well persists. Capital concentrates. Momentum dominates. And a market that should be allocating capital based on risk-adjusted returns is instead allocating capital based on narrative and fear of missing out.

If you're a founder, an investor, or an executive, the practical implication is simple: you have to operate in this market as it is, not as it should be. Navigate the gravity well. Plan for when it breaks. And remember that today's bubble can still create real value if you understand when to exit and when to hold.

Key Takeaways

- Anthropic's 380B valuation represents unprecedented AI capital concentration that's reshaping venture ecosystem.

- B2B Software Gravity Well describes structural repricing of traditional SaaS downward regardless of growth or profitability metrics.

- Enterprise AI spending will hit $20-30B in next 18 months, but actual ROI remains unmeasured and likely disappointing versus hype.

- Venture capital participation in AI funding became mandatory rather than optional due to return trajectories that doubled or tripled in under a year.

- The gravity well will break when enterprises report actual AI ROI in late 2026-early 2027, likely triggering dramatic valuation reset across AI and SaaS sectors.

Related Articles

- The AI Productivity Paradox: Why 89% of Firms See No Real Benefit [2025]

- OpenClaw AI Ban: Why Tech Giants Fear This Agentic Tool [2025]

- Thrive Capital's $10B Fund: What It Means for AI and Venture Capital [2026]

- AWS CEO Says AI Disruption Fears Are Overblown: Why SaaS Panic Is Misplaced [2025]

- Fractal Analytics IPO Signals India's AI Market Reality [2025]

- Anthropic's $14B ARR: The Fastest-Scaling SaaS Ever [2025]

![Anthropic's $30B Funding, B2B Software Gravity Well & AI Valuation [2025]](https://tryrunable.com/blog/anthropic-s-30b-funding-b2b-software-gravity-well-ai-valuati/image-1-1771537224088.jpg)