Introduction: The AI Panic That Might Be All Noise

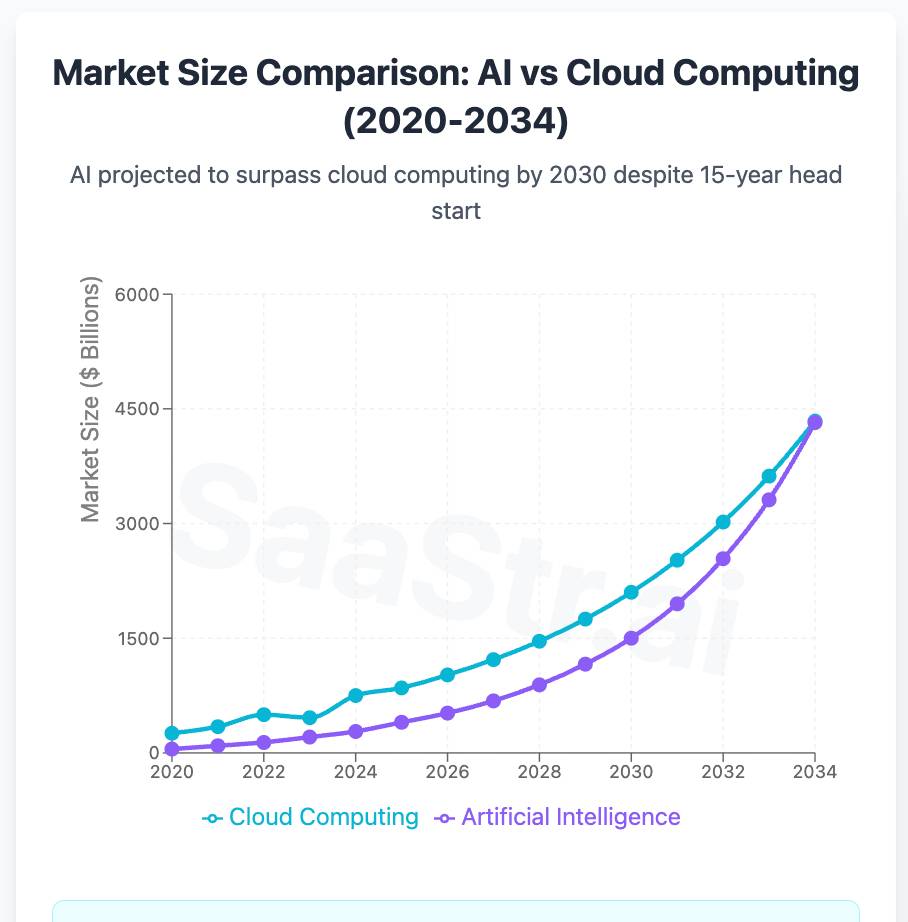

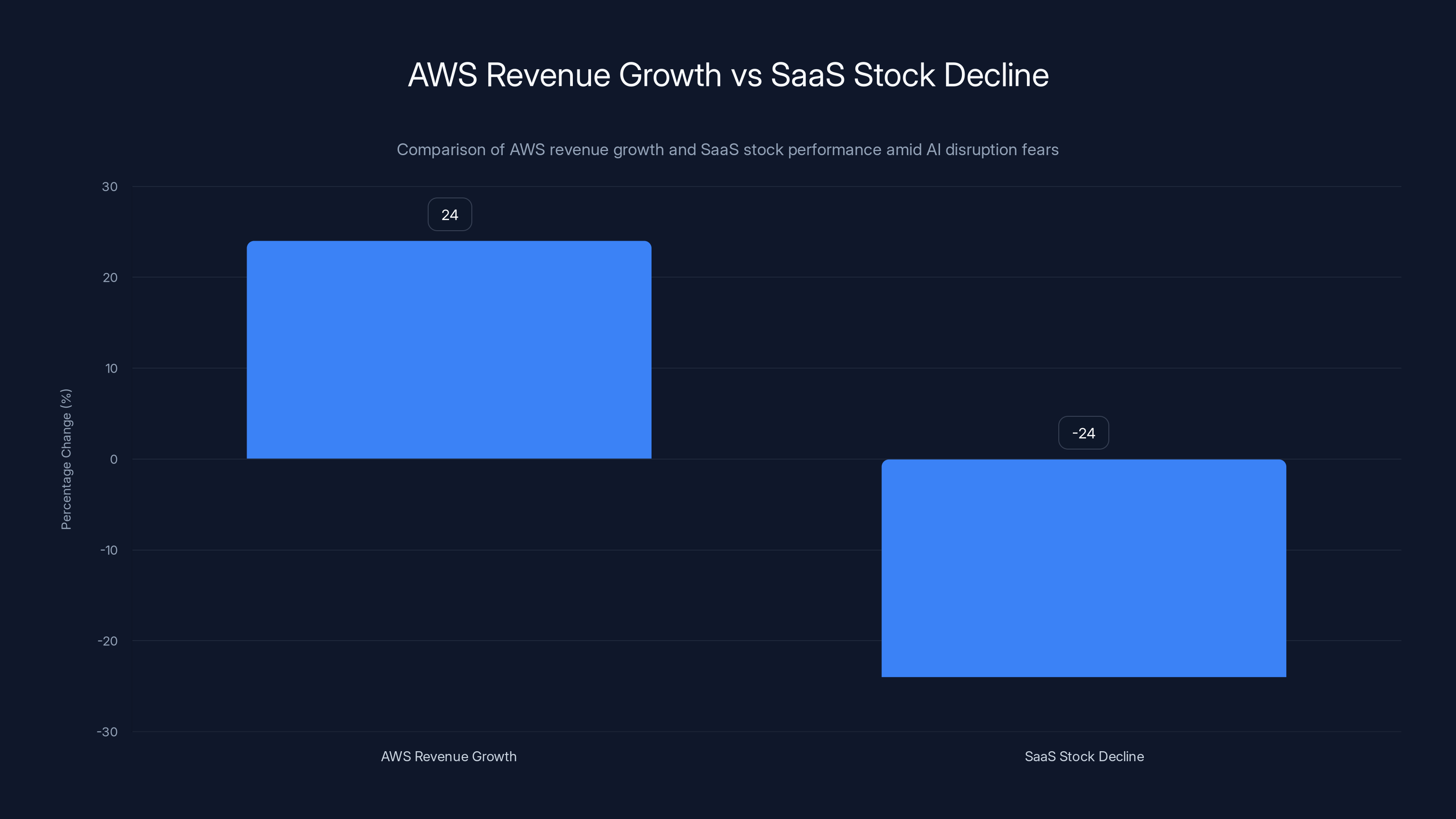

It's a strange moment in tech. In early 2025, investors watched a 24% plunge across software stocks while simultaneously seeing cloud infrastructure providers like AWS report record revenue and expanding margins. The contradiction is stark, almost surreal. One sector is drowning while another is thriving, yet they're supposedly facing the same disruption threat.

AWS CEO Matt Garman stepped into this chaos recently and said something that's increasingly rare in Silicon Valley: "Look, my own opinion is that much of the fear is overblown." He wasn't dismissing AI's impact—he was calling out the market's panic as disproportionate to reality.

This matters because what happens on Wall Street doesn't stay on Wall Street. When software stocks crash 24% in a year, it affects hiring decisions, venture funding, startup survival, and ultimately, which technologies get built and deployed. If investors are panicking based on false assumptions, the entire ecosystem feels the ripple.

So what's actually happening? Is AI about to collapse the SaaS industry, or are we watching a textbook case of fear outpacing evidence? Let's dig into the data, the narrative, and what it means for companies betting on AI adoption.

The story isn't as simple as "AI will destroy software companies" or "AI hype is overblown." It's more nuanced. It's about which companies survive the transition, how fast they adapt, and whether infrastructure spending actually grows as much as skeptics fear.

Here's what we're covering: the market panic, the actual data showing what's happening, why infrastructure might be safer than apps, how SaaS companies are fighting back, and what this means for your own tech strategy.

TL; DR

- SaaS stocks crashed 24% in 2025 driven by fears that AI would compress margins and reduce demand for subscription software.

- AWS revenue grew 24% year-over-year to $35.6 billion with 35% operating margins, suggesting infrastructure spending isn't slowing.

- CEO Matt Garman argues the panic is disproportionate, predicting companies will need increasing cloud capacity regardless of how they integrate AI.

- The real risk isn't disruption—it's adaptation speed. SaaS companies that innovate will survive; those that stagnate will get replaced.

- Infrastructure wins the first wave of AI adoption, but application layer companies with strong product-market fit will recover once the fear subsides.

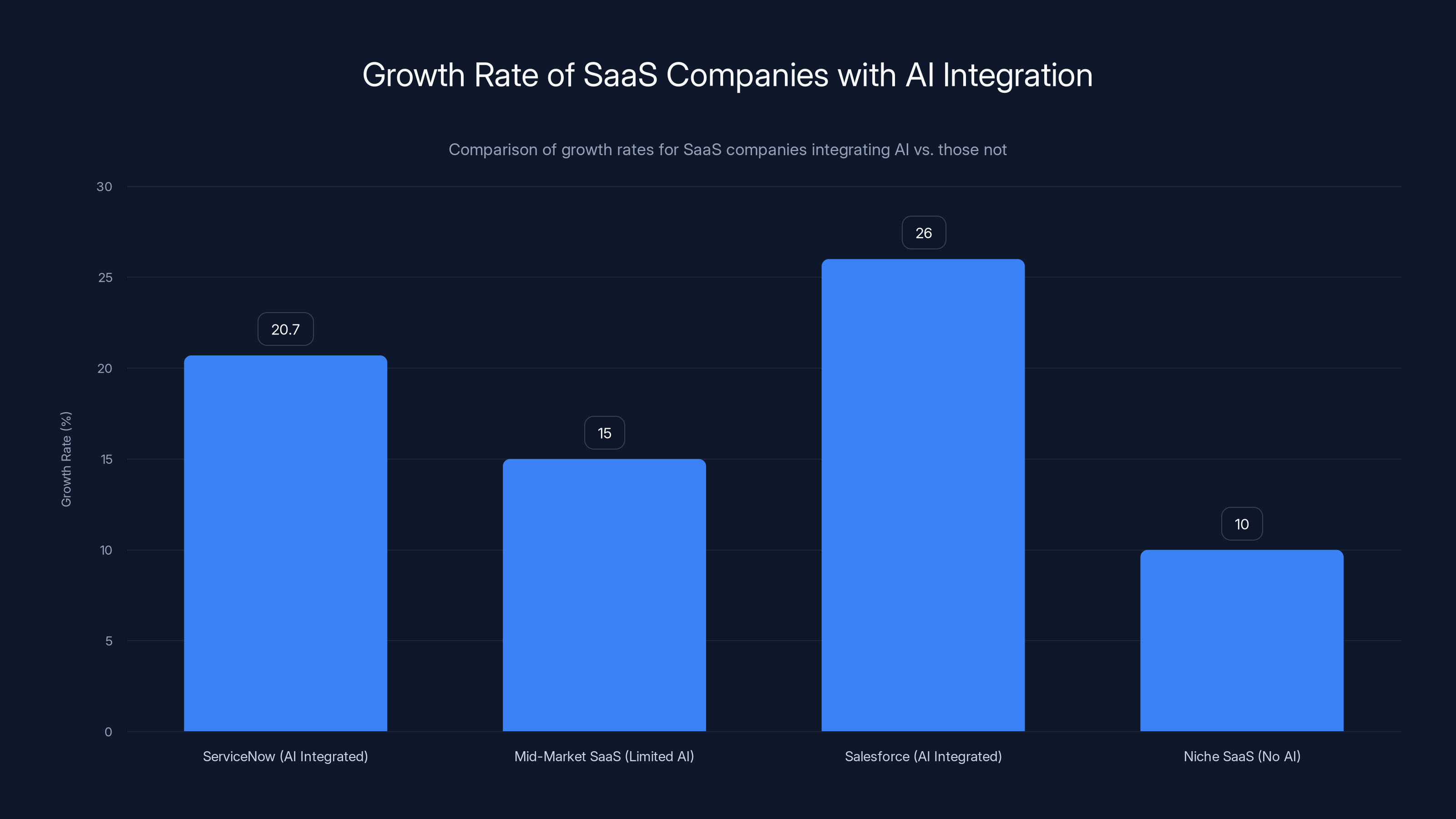

SaaS companies that integrate AI, like ServiceNow and Salesforce, show higher growth rates compared to those with limited or no AI integration. Estimated data for mid-market and niche SaaS companies.

The Market Panic: How AI Fears Triggered the Software Selloff

Wall Street doesn't deal in nuance. It deals in narratives. And in 2024-2025, the narrative shifted hard against software-as-a-service companies.

The panic started with a simple fear: if AI systems can automate work that humans currently pay for, why would companies keep paying for the software tools those humans used? If an AI agent can write code, manage projects, or handle customer support, does anyone still need GitHub Copilot, Asana, or Zendesk?

That fear crystallized when major AI labs released new models that appeared increasingly capable at tasks previously reserved for specialized software. OpenAI rolled out expanded capabilities. Anthropic published benchmarks showing improved reasoning. The market didn't ask "how long will this take to deploy?" It asked "what dies first?"

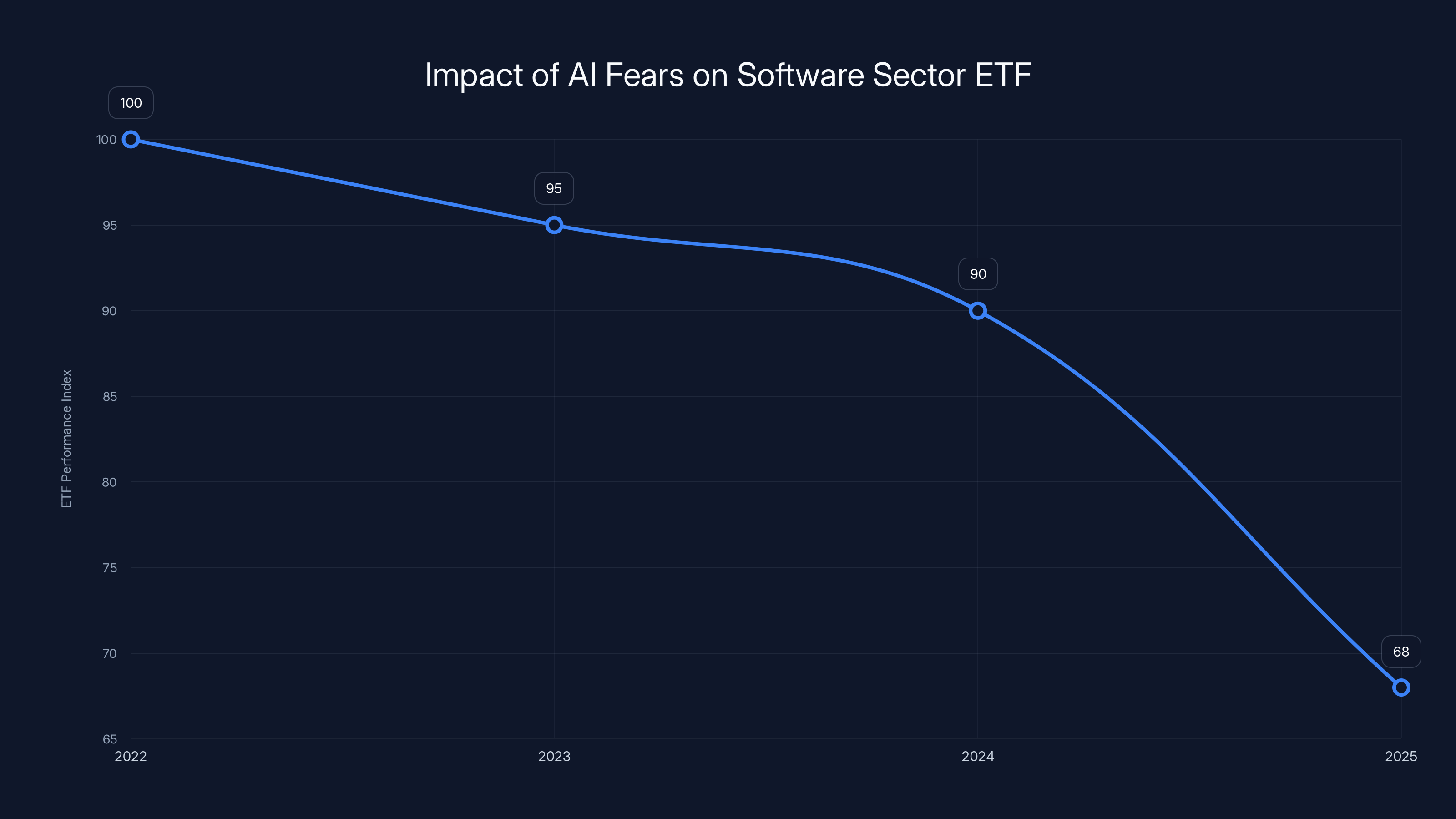

The iShares Expanded Tech-Software Sector ETF dropped approximately 24% in 2025, one of its worst years since 2022. That's not a small correction—that's a sector-wide repricing. Thousands of companies saw their valuations cut in half because of a hypothesis about disruption, not proof of disruption.

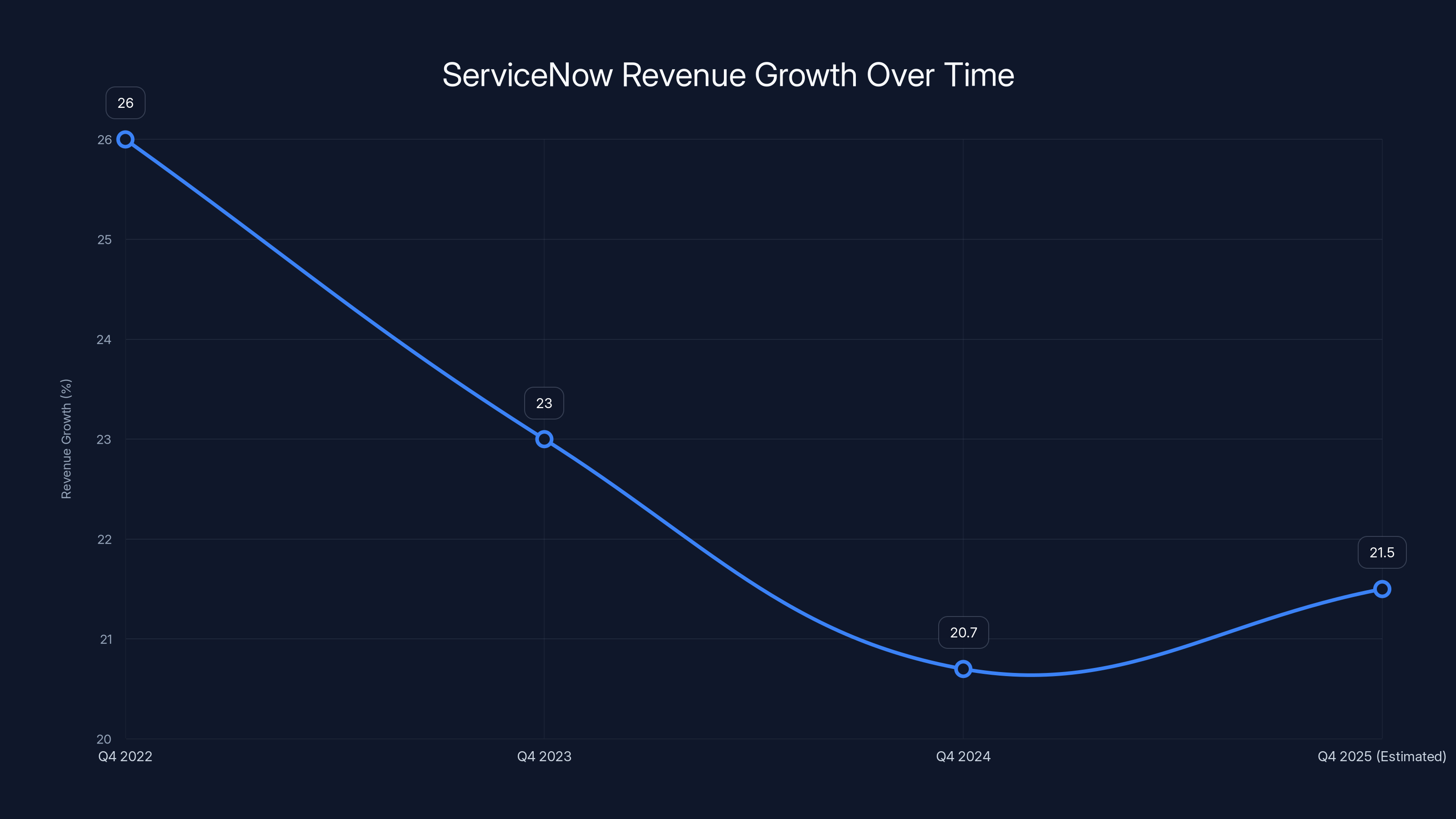

What made this sell-off different from previous tech crashes is that it wasn't tied to earnings disappointments yet. Companies like ServiceNow reported 20.7% revenue growth—which is still solid—but stock prices still fell because growth used to be 26%. The narrative had shifted from "how much are they growing" to "are they growing as fast as AI could theoretically displace them."

Analysts started using language like "SaaS apocalypse." Articles appeared questioning whether subscription software was a dying business model. The fear became self-reinforcing: if enough investors believe software is doomed, they'll sell, which drives down stock prices, which makes it harder for software companies to raise capital and invest in AI, which actually makes disruption more likely.

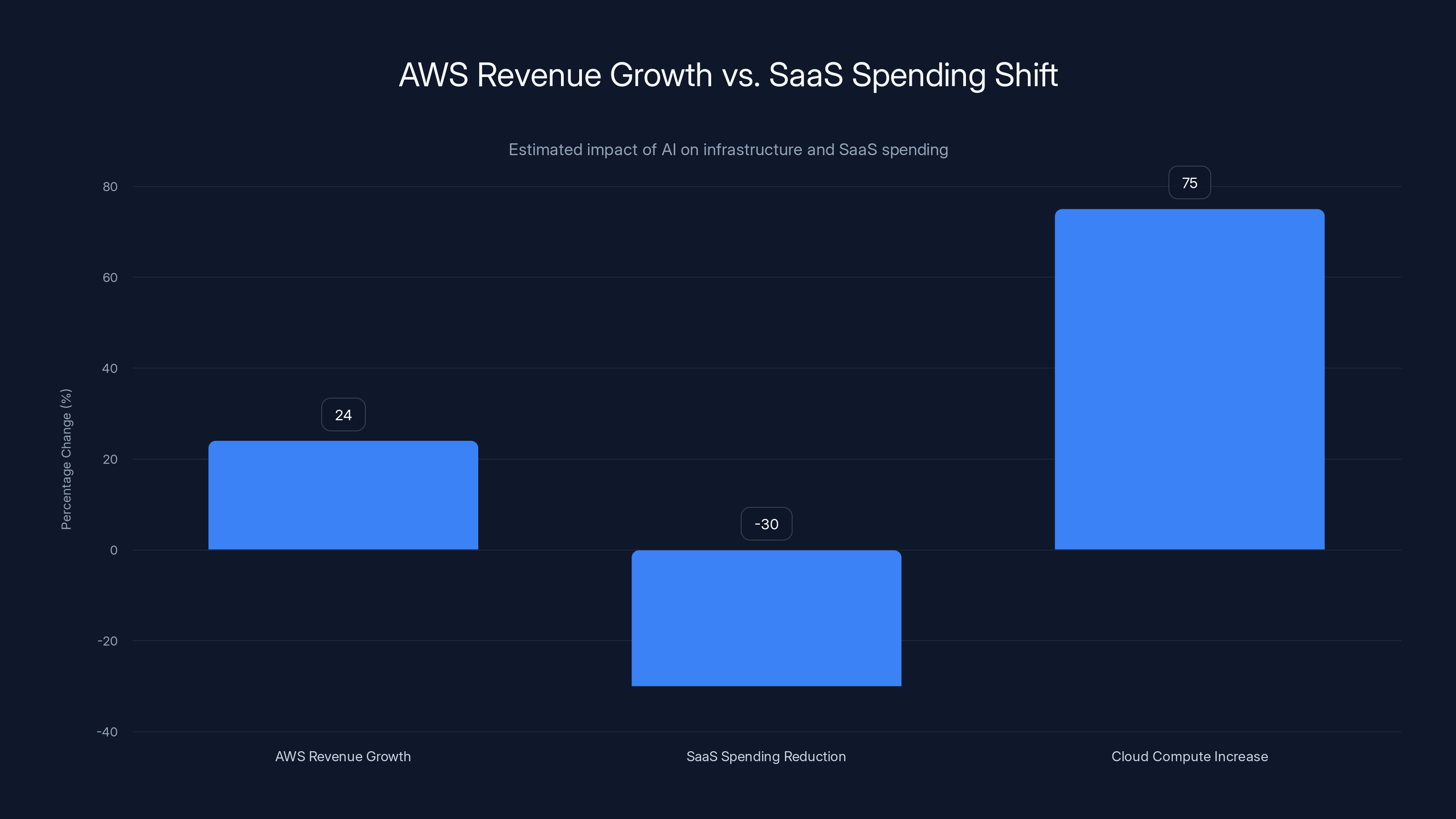

But here's where the narrative breaks down: AWS is part of the same tech sector. AWS saw 24% growth and expanding margins. If AI was destroying tech demand, shouldn't infrastructure be hurting too? Instead, cloud spending remained strong.

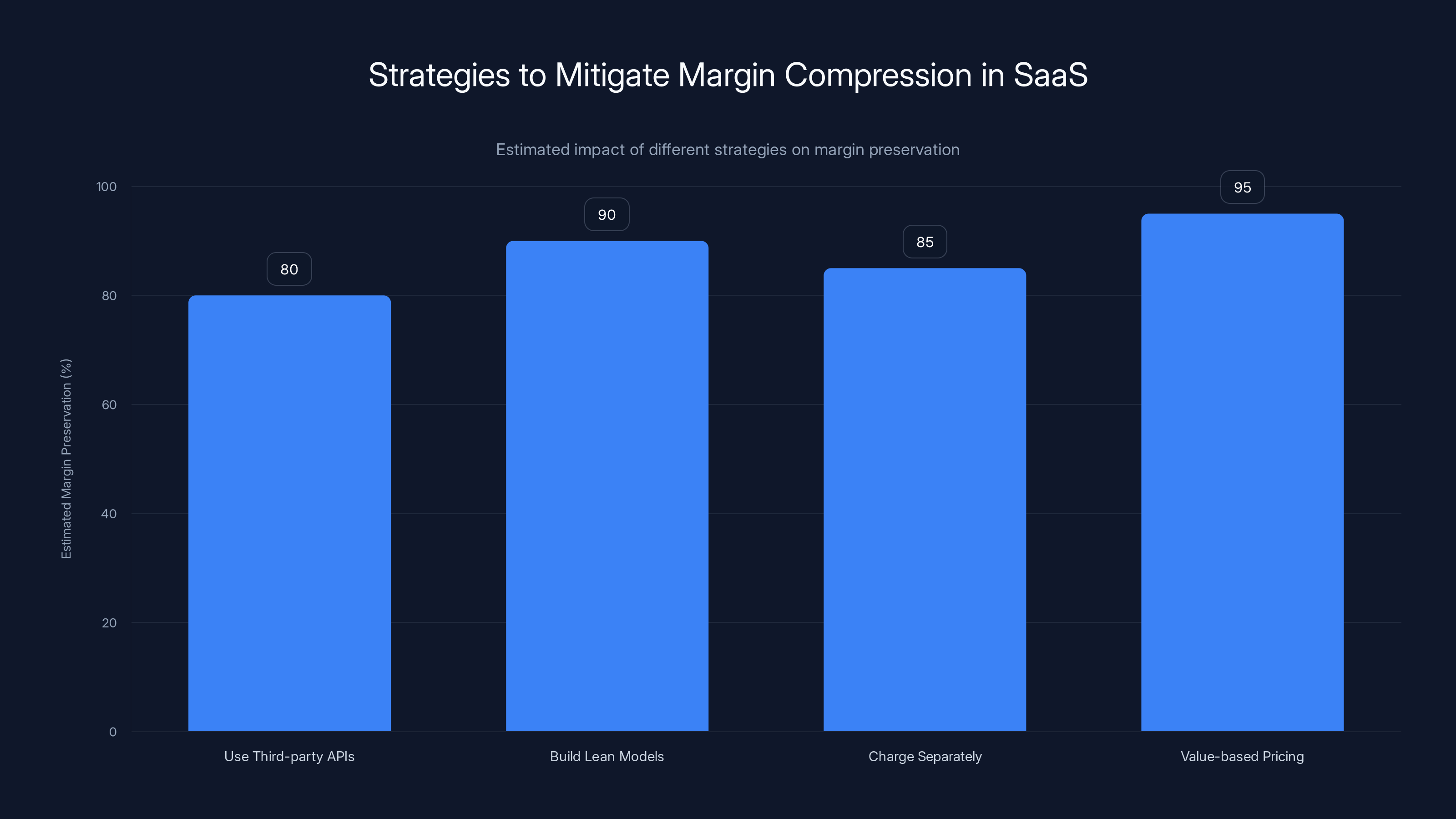

Estimated data suggests that strategies like value-based pricing and building lean models can significantly preserve margins, with potential preservation rates of up to 95%.

The Infrastructure Paradox: Why AWS Thrived While SaaS Panicked

Here's the thing that breaks the disruption narrative: infrastructure companies are supposed to be the biggest losers in an AI-driven world, because if software can do more with less, shouldn't companies need less computing power?

Instead, AWS just reported the strongest quarter in company history. AWS revenue hit $35.6 billion in Q4, up 24% year-over-year. Operating margins hit 35%, slightly higher than the previous quarter. This wasn't a close call—it was dominance.

Why? Because companies deploying AI actually need more computing power, not less. Training models requires massive GPU clusters. Running inference at scale requires distributed infrastructure. Fine-tuning models on proprietary data requires accessible compute. Even using third-party AI APIs means cloud providers are handling the underlying infrastructure.

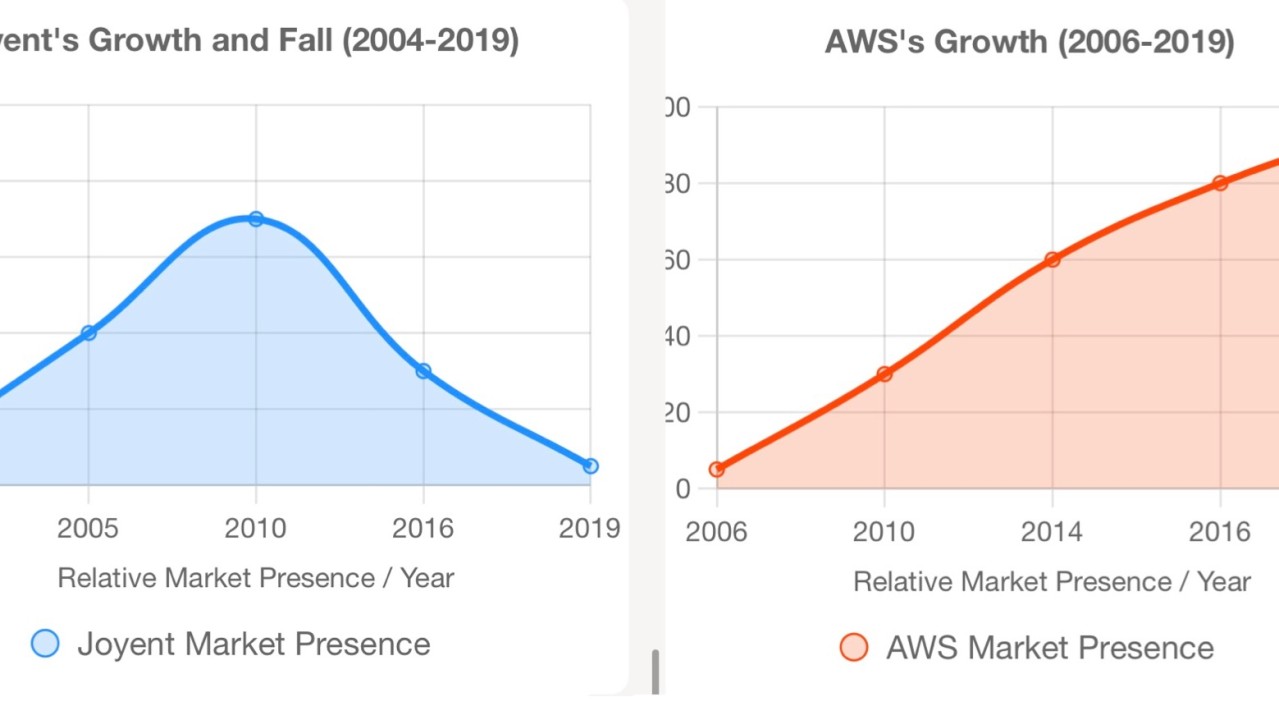

The paradox reveals something crucial about how disruption actually works: the first wave of disruption favors infrastructure and platforms, not niche applications. When electricity became cheap and abundant, it didn't destroy the companies making individual electrical devices—it created opportunities for them. The power companies made the most money first.

AWS CEO Matt Garman captured this in his recent comments: "Customers will require increasing amounts of computing power and infrastructure regardless of how they integrate AI into their operations." This isn't theory. It's backed by actual spending patterns.

Consider the math: if a company is automating 30% of tasks with AI, they might reduce their need for certain SaaS tools. But they're probably increasing their cloud compute spending by 50-100% to run the AI systems. The net effect isn't lower tech spending—it's reallocation of tech spending.

Garman went further: "In my view, companies may build their own systems, rely on SaaS providers, or combine both approaches, yet the underlying demand for cloud capacity is expected to expand."

This is the insight Wall Street missed. The question isn't "will companies need software?" It's "how will companies deploy AI?" The answer is: in multiple ways simultaneously. Some will use SaaS products with AI built in. Some will build custom AI systems on cloud infrastructure. Some will use APIs from AI companies like Anthropic or OpenAI. All of these paths require more cloud infrastructure.

The Innovation Imperative: SaaS Companies That Adapt Will Survive

So where does this leave traditional SaaS companies? Not dead. Not even necessarily disrupted. But definitely under pressure to evolve.

Garman made a pointed observation: "AI is a huge disruption—a disruptive force that's going to change how software is consumed and how it's built. SaaS and large players may have structural advantages, but they have to innovate. They can't stand still. If they stand still, they're absolutely going to be disrupted."

This isn't a prediction of collapse. It's a prediction of selection pressure. SaaS companies that quickly integrate AI into their products and maintain competitive pricing will survive. Companies that treat AI as optional or experimental will lose market share.

The evidence is mixed so far. ServiceNow's 20.7% growth is respectable, but it's down from 26% growth just two years prior. Deceleration suggests that AI features haven't yet driven significant customer acquisition or expansion. But this could be a timing issue—most companies deploy AI features in waves, and the market is still early.

There's also a selection effect at play: the companies panicking most are mid-market SaaS businesses with narrow use cases. A project management tool competes directly with an AI agent that can schedule, track progress, and generate reports. A content writing tool faces existential competition from large language models.

But companies like Salesforce, Slack, or Microsoft 365 that operate at the center of enterprise workflows and can integrate AI into everything they do—these companies have moats. They're not going anywhere.

The companies most at risk are those in niche categories where a focused AI system can replicate 80% of functionality for 20% of the price. That's a real threat. But it's not a threat to the entire SaaS industry. It's a threat to specific categories where the product provided limited differentiation to begin with.

Here's what separates winners from losers in the SaaS industry right now:

Winners have:

- Deep integrations with their customers' workflows (hard to replace)

- Network effects or high switching costs (lock-in, but earned through value)

- Data moats (proprietary datasets that improve their AI)

- Fast iteration and experimentation cultures (can ship AI features quickly)

- Strong sales and customer success organizations (can sell the AI value to customers)

Losers often have:

- Single-point-of-value propositions (easily replicated by AI)

- Shallow product integration (easy to replace)

- Weak or non-existent AI roadmaps

- Slow product development cycles

- Pricing strategies that assume feature complexity justifies cost

The harsh truth: if your SaaS product's main value is "it's easier than building it yourself," AI just made you obsolete. If your product's value is "it handles the hardest part of my job," you've got time to adapt and probably a moat.

ServiceNow's revenue growth has decelerated from 26% in 2022 to 20.7% in 2024, reflecting normal market maturation rather than AI disruption. Estimated data suggests slight stabilization by 2025.

Why Margin Compression Fears Are Overblown

Another major concern driving the SaaS panic: what if AI features are expensive to build and deploy, compressing margins?

That's a real risk for some companies. Training large language models is expensive. Deploying them at scale requires significant infrastructure. If SaaS companies want to offer premium AI features, they might need to invest heavily in compute, model training, and MLOps infrastructure.

But this risk is distributed, not concentrated. Companies have multiple paths:

Option 1: Use third-party APIs. Companies like Slack can use OpenAI's API for natural language features without owning the underlying model. The cost per user is manageable, and margins stay healthy. Margins compress slightly, but not catastrophically.

Option 2: Build lean models. Most SaaS use cases don't need GPT-4 level performance. Smaller, fine-tuned models can provide 95% of the value at 50% of the cost. Companies investing in efficient ML infrastructure will win here.

Option 3: Charge for AI features separately. Notion charges extra for AI. GitHub Copilot has its own subscription tier. Separating AI from the base product lets companies monetize AI capabilities without compressing existing margins.

Option 4: Improve customer outcomes so much that you can raise prices. If AI genuinely helps customers generate

AWS's 35% operating margins despite massive AI infrastructure spending suggest that infrastructure companies are finding ways to monetize AI demand profitably. If AWS can do it at scale, smaller SaaS companies focused on specific use cases can do it too.

The real margin risk isn't AI adoption. It's commoditization of your core product before you can transition to AI-powered value. That's a management execution problem, not an AI inevitability.

The Transition Risk: Companies That Can't Afford to Fall Behind

Here's where the panic actually has merit: there is a real risk for mid-market SaaS companies without deep pockets.

Adapting to AI requires investment: hiring ML engineers, building infrastructure, experimenting with new product experiences, retooling sales messaging. Companies with strong cash flow and healthy balance sheets can fund this transition. Companies burning cash or dependent on venture capital might not survive the transition period.

This creates a bifurcated market:

Large, cash-generative SaaS companies can invest heavily in AI R&D, maintain margins through value-based pricing, and use their installed base to fund experiments. They're not disrupted—they're the disruptors.

Well-funded venture-backed SaaS companies can spend heavily on AI features to chase growth, betting that they'll reach profitability later once AI drives adoption.

Bootstrapped or small venture-backed SaaS companies face real risk. If they can't afford to experiment with AI and compete on feature velocity, they'll lose to better-funded competitors.

This isn't new. This is how technology markets have always worked. The transition to cloud didn't destroy software—it destroyed software companies that couldn't afford to transition. The same will happen with AI.

But that's selection pressure, not apocalypse. The market is correcting and reallocating capital toward companies best positioned to win the AI era. That's painful if you're holding stock in a company that falls into the "at risk" category. But it's healthy for the overall tech ecosystem.

The iShares Expanded Tech-Software Sector ETF experienced a significant drop of approximately 24% in 2025 due to AI-related fears, marking one of its worst performances since 2022. Estimated data reflects the market's reaction to AI advancements.

Software Deceleration Isn't AI Disruption—It's Normal Market Maturation

Let's look at the actual revenue data rather than stock price reactions.

ServiceNow reported 20.7% revenue growth in Q4 2024, down from 26% growth just two years earlier. This is presented as evidence that AI hasn't helped, or is hurting. But this narrative ignores several important factors:

1. Law of Large Numbers. ServiceNow is a $70+ billion company with massive revenue base. Going from 26% to 20% growth is normal mathematical deceleration. A smaller competitor growing 26% isn't more impressive just because ServiceNow grows 20%—it's growing from a vastly smaller base.

2. Product Maturity. Many SaaS companies experienced hypergrowth in 2022-2023 because they were capturing unmet demand. That demand is largely captured. Now growth depends on true product innovation and market expansion, not just filling a void.

3. Economic Headwinds. Tech spending growth has slowed across the board due to macro factors, interest rates, and cautious enterprise IT budgets. This isn't AI-specific—it's cyclical.

4. AI Features Are New. Most SaaS companies just launched AI features in 2024-2025. It takes time for features to move from launch to monetization to revenue recognition. Expecting revenue acceleration in Q1 2025 from Q4 2024 launches is unrealistic.

What we should see over the next 12-24 months is:

- SaaS companies that ship quality AI features seeing acceleration or stabilization of growth

- SaaS companies that ignore AI seeing continued deceleration

- New entrants focused purely on AI use cases gaining market share in narrow niches

- Infrastructure spending remaining strong or growing

That would be the actual story. Stock market panics don't wait for evidence—they price in worst-case scenarios immediately.

How Companies Are Integrating AI: The Three Paths Forward

Garman mentioned that companies are taking different approaches to AI, and this is important for understanding why the "SaaS apocalypse" narrative doesn't hold up.

Path 1: Build Custom AI Systems on Cloud Infrastructure

Large enterprises with specific use cases are building proprietary AI systems tailored to their business. They're using AWS Bedrock, Google Vertex AI, or Azure OpenAI to run models. This approach maximizes customization but requires data science expertise.

This path increases cloud infrastructure spending because companies are building, training, and deploying their own systems. AWS wins here.

Path 2: Use SaaS Products That Integrate AI

Most companies lack the expertise to build AI systems. They want AI capabilities without the complexity. So they buy from SaaS companies that have already integrated AI, like Salesforce with Einstein, or Slack with AI features.

This path maintains SaaS company relevance because they become the delivery vehicle for AI. Revenue might not accelerate dramatically, but it stabilizes and grows as customers adopt AI features.

Path 3: Hybrid Approach

Large enterprises use both: SaaS products for standard use cases, custom AI systems for competitive differentiators. This is probably the most common approach.

All three paths involve increased cloud infrastructure spending. All three paths maintain some role for SaaS companies. Only SaaS companies that fail to integrate AI effectively lose share under this model.

AWS experienced a 24% revenue growth, while companies potentially reduced SaaS spending by 30% but increased cloud compute spending by an estimated 75% due to AI demands. Estimated data.

The Messaging Problem: Why Even Good News Triggers Panic

Here's a psychological insight that explains much of the panic: tech investors are primed to expect disruption. They've seen it before. They know that yesterday's winner becomes tomorrow's dinosaur.

So when they see AI getting better and better, they extrapolate: "If AI can do X now, it can do Y tomorrow, and Z next year. Eventually it replaces everything." This isn't irrational—it's pattern matching based on real historical examples.

But pattern matching can lead to wrong conclusions when conditions change. The error is assuming that just because disruption can happen, it will happen to your specific industry in the next 12 months.

Software companies make an easy target for this panic because:

- Software seems replaceable (if an AI can write code, why do we need developers?)

- Margin compression is visually scary (if costs go up 30%, profits drop 50%)

- The disruption narrative is compelling and gets press coverage

- It's emotionally satisfying (we're smart for seeing the danger!)

But the actual data—AWS revenue up 24%, AWS margins stable, enterprise cloud spending not declining—contradicts the panic narrative. Garman is right to call out the disconnect.

This doesn't mean there's no risk. There absolutely is. But it's risk of selection (some companies win, some lose) not risk of collapse (the entire category disappears).

What the Data Actually Shows: The Quiet Recovery

If you zoom out from the panic and look at what's actually happening:

Cloud spending is strong. AWS reported its strongest quarter ever. Google Cloud is growing faster and gaining share. Azure revenue is growing. This is the foundational layer—if it's strong, the rest of the ecosystem will recover.

Enterprise software spending is stable. Despite SaaS stock declines, enterprise software companies are still shipping features, signing customers, and generating revenue. Growth is decelerating, not collapsing.

AI adoption is accelerating. More companies are actually using AI tools now than six months ago. Usage patterns show AI features being adopted faster than previous software innovations.

The gap between expectation and reality is narrowing. Stock prices fell because expectations were unrealistic. As companies demonstrate actual AI-driven value, expectations will adjust. Stock prices will recover.

This is a narrative reset, not a market correction. The market is repricing based on more realistic assumptions about disruption timelines.

AWS experienced a 24% revenue growth, contrasting with a 24% decline in SaaS stocks, highlighting differing impacts of AI disruption fears on cloud infrastructure versus SaaS markets.

The Real Disruption: Speed and Integration

Here's what actually matters in the AI era: how quickly you can integrate AI into your product and how deeply it integrates into customer workflows.

Companies that can ship AI features in months, not years, will win. Companies that integrate AI so deeply that removing it would break core functionality will win. Companies that use AI to improve their core value proposition rather than add bolt-on features will win.

SaaS companies that are slow, unfocused, or trying to bolt AI onto outdated product architecture will lose.

This is the real selection happening right now. The market is correctly identifying which SaaS companies are positioned to win the AI era and which are dinosaurs in disguise.

But this selection pressure is healthy. It forces companies to innovate. It allocates capital to the winners. It creates opportunities for new entrants who can build AI-native products.

It's not an "apocalypse." It's capitalism working as designed.

Why Investors Are Overreacting: The Case for Moderation

Garman's core argument—that investors are overreacting—rests on a simple observation: the underlying drivers of cloud computing and software adoption haven't changed, even if the tools are evolving.

Companies still need to:

- Store and process data

- Collaborate across teams

- Automate repetitive work

- Analyze business metrics

- Manage customer relationships

- Track projects and timelines

AI enhances these capabilities. It doesn't eliminate them. So why would spending drop?

The narrative that makes sense: software spending shifts toward companies and tools that integrate AI effectively. Infrastructure spending increases to support AI workloads. Some narrow SaaS categories lose share to AI-native alternatives.

The narrative that doesn't make sense: software spending collapses because AI exists.

Investors pricing in scenario B when scenario A is more likely explains the 24% decline. Once evidence accumulates that scenario A is correct, the market will reprice.

This is why Garman's comments matter. They're a voice of evidence-based reasoning in a panic-driven narrative.

The Winner's Playbook: How to Navigate AI Transition

If you're building or investing in SaaS companies, here's what actually matters:

Strong Product-Market Fit: Your core product has to be genuinely valuable to customers, not just cheaper than alternatives. This is your moat.

Fast Iteration Culture: Companies that ship new features every week outcompete companies that ship quarterly. Speed is the advantage in rapid tech shifts.

AI Roadmap Clarity: You don't need to have perfect AI implementation today. You need to have a clear plan for how AI will enhance your core value proposition. Articulate this to customers and investors.

Data Strategy: Companies with proprietary data can train more effective models. If you have customer data, you have an advantage. If you don't, you'll be dependent on third-party models.

Pricing Strategy: Value-based pricing (charging based on customer outcomes) protects margins better than feature-based pricing in an AI era. Build toward value pricing.

Capital Efficiency: Companies that can prove ROI quickly and burn less capital will survive a harder funding environment. Invest efficiently in AI, not recklessly.

Customer Success: In transition periods, customers need support to adopt new features. Strong customer success teams keep customers through uncertainty.

Companies executing well on these fundamentals will be fine. Companies executing poorly will struggle. This is true regardless of AI.

Looking Forward: What Changes and What Doesn't

Over the next 24 months, we'll see three key trends:

Infrastructure Spending Accelerates: Cloud compute costs will remain high or rise as more companies deploy AI systems. AWS, Google Cloud, and Azure will capture significant value here.

SaaS Market Bifurcates: Top-tier SaaS companies with strong AI integration will maintain or grow market share. Mid-tier companies will consolidate. Narrow-category companies will lose to AI-native alternatives or be acquired.

New Entrants Gain Traction: Companies built from the ground up as AI-native—designed to use AI as core functionality, not added feature—will win in narrow categories. But they won't overtake existing incumbents with strong moats.

The panic we're seeing right now is the market pricing in worst-case scenarios. The recovery will come as evidence accumulates that best-case scenarios are unfolding instead.

Garman is right: the fear is overblown. But the fear isn't baseless—it's just mistimed and overamplified.

The Path From Fear to Confidence

Markets don't move based on perfect information. They move based on narratives and emotions. Right now the narrative is "AI disrupts software." Over the next 12-24 months, the narrative will shift to "AI enhances software." When that shift happens, SaaS valuations will recover.

The companies worth owning are those that:

- Have strong revenue and customer retention today

- Are shipping AI features customers actually use

- Have clear paths to AI-driven growth

- Can maintain or improve margins

The companies worth avoiding are those that:

- Have weak fundamentals masked by AI hype

- Are betting everything on AI disrupting competitors

- Have no real AI roadmap

- Will lose share to more innovative competitors

Garman's point is that the market is treating all SaaS companies as category two when in reality, most strong companies fit category one. That disconnect creates opportunity for investors willing to look at fundamentals rather than follow the panic.

Building on Cloud Infrastructure: Why Runable Represents the Application Layer

As enterprises work through this transition, they're discovering that building AI systems requires both infrastructure and the right tools to deploy them efficiently. This is where platforms like Runable fit into the AI ecosystem.

Runable represents a different category than traditional SaaS: instead of replacing core enterprise functionality, it extends cloud infrastructure by automating workflow generation. Companies can use Runable to create presentations, documents, reports, and custom applications on top of their cloud infrastructure.

This is exactly the kind of application-layer tool that survives the AI transition. By focusing on automation and removing toil from knowledge workers, Runable enables teams to deploy AI-powered workflows faster without building everything from scratch. At $9/month, it's accessible enough for teams exploring AI automation without major capital commitment.

The point: infrastructure providers like AWS handle the compute layer. Application providers like Runable handle the workflow layer. Both thrive in an AI-driven economy because both solve genuine pain points that aren't going away.

Use Case: Automating weekly status reports from raw data and generating presentation slides from code documentation with AI agents.

Try Runable For Free

Conclusion: The Market Will Self-Correct

Matt Garman's comments matter because they reflect a grounded perspective that contrasts sharply with the panic narrative dominating headlines.

He's not saying AI won't be disruptive. He's saying the disruption is being priced in with unrealistic severity. He's saying that companies building on cloud infrastructure (which includes most modern software) will actually benefit from AI adoption, not suffer from it.

The data supports him. AWS is thriving. Enterprise cloud spending is strong. SaaS companies with clear AI strategies are shipping features. Customers are adopting AI capabilities.

Yes, some SaaS categories will lose share to AI alternatives. Yes, some mid-market companies will struggle with transition costs. Yes, the market is correctly reallocating capital toward more innovative companies.

But that's not an "apocalypse." That's market selection. And market selection, while painful for some, is healthy for the overall ecosystem.

The 24% decline in software stocks isn't reflecting new fundamental risk. It's reflecting reallocation based on fear. Once evidence accumulates that the feared disruption is happening more slowly than expected, and that profitable SaaS companies are adapting effectively, the market will reprice.

Garman is betting that evidence and fundamentals will win out over panic and narratives. History suggests he's right.

Investors who can separate signal from noise, who can distinguish between real risk and panic-driven repricing, who are willing to buy quality companies when they're cheap—those investors will make exceptional returns over the next few years.

The question isn't whether software survives AI. The question is which software companies will be the winners in an AI-enhanced future. And there's far more nuance in that question than panic-driven stock markets currently price in.

FAQ

What does AWS CEO Matt Garman mean by saying AI fears are overblown?

Garman is arguing that Wall Street is overreacting to disruption narratives by assuming AI will immediately collapse software company valuations. He points to actual data—AWS revenue growth of 24% and stable margins—as evidence that cloud infrastructure and tech spending is not slowing. His view is that companies will still require substantial computing power regardless of how they integrate AI, making the feared disruption less severe than investors are pricing in.

Why did SaaS stocks decline 24% if software companies are still growing revenue?

The decline reflects a shift from absolute growth expectations to relative growth expectations. SaaS companies reporting 20% growth instead of 26% isn't a sign of collapse—it's normal market maturation. However, stock markets price in forward expectations. When investors worried that AI would compress margins or destroy demand, they repriced stocks to reflect worst-case scenarios, even though actual revenue and earnings data didn't support those fears yet.

Is software-as-a-service actually dying because of AI disruption?

No. What's actually happening is market selection. SaaS companies that quickly integrate AI capabilities will maintain or grow market share. Companies that ignore AI or move slowly will lose share. This is healthy creative destruction—it forces companies to innovate and allocates capital toward the winners. The SaaS category isn't dying; the SaaS category is evolving, and some companies will thrive while others struggle during transition.

Why is AWS thriving while SaaS companies are struggling if they're facing the same AI disruption?

AWS thrives specifically because companies deploying AI need more compute infrastructure. Training models, running inference, and managing AI workloads all require significant cloud resources. So AWS is actually the primary beneficiary of AI adoption, at least in the first wave. SaaS companies are also benefiting, but stock markets priced in disruption fears rather than waiting for evidence that SaaS companies would adapt effectively.

What separates SaaS companies that will survive the AI transition from those that will fail?

Winners have strong product-market fit, integrate AI deeply into core product functionality, maintain or improve margins through value-based pricing, ship features quickly, and have clear AI roadmaps. Losers tend to have weak product differentiation, slow product development, no clear AI strategy, and rely on feature complexity rather than core value. The difference isn't AI capability—it's execution quality and product strategy.

How long will it take for SaaS stocks to recover from the current panic-driven decline?

Historically, the gap between major technology disruption announcements and market repricing from panic to recovery is 18-24 months. We're currently 6-12 months into this cycle for AI disruption fears, which suggests recovery is likely in the next 12 months as evidence accumulates that strong SaaS companies are adapting effectively to the AI era.

Should companies stop using SaaS products because AI might make them obsolete?

No. SaaS products that integrate AI capabilities will likely become more valuable, not less, because they combine domain expertise with AI automation. For most companies, using SaaS products with AI features is more efficient than building custom AI systems from scratch. The risk is using SaaS products from companies that are slow to innovate, not using SaaS products in general.

What role does cloud infrastructure play in the AI era?

Cloud infrastructure is the foundation for AI adoption. Whether companies build custom AI systems, use third-party AI APIs, or deploy AI-enhanced SaaS products, they all require cloud computing resources. This is why AWS and other cloud providers are thriving—they're capturing value at the layer where all AI workloads must run. Infrastructure providers win first in any technological transition.

Final Thoughts on AI Disruption and Market Rationality

The tech industry's current moment reveals something important about how markets work and how narratives shape decisions. We're watching a genuine technological shift (AI capabilities improving rapidly) get interpreted through a catastrophic narrative (SaaS apocalypse) that doesn't match the actual data.

Garman's intervention isn't contrarian for the sake of being contrarian. It's pointing out that the data contradicts the narrative. When infrastructure providers are thriving, enterprise software companies are still shipping features and generating revenue, and customers are adopting AI capabilities across the board, the narrative of "software is dying" loses credibility.

What's actually happening is more interesting: the market is sorting companies into winners and losers based on their ability to integrate AI effectively. That sorting is painful for companies caught in the "loser" category and their shareholders. But it's healthy for the overall ecosystem. It forces innovation. It allocates capital toward the best companies. It creates opportunities for new entrants.

For anyone building, investing in, or depending on software companies, the key insight is simple: don't panic about the category. Panic about the company's execution and strategy. Strong companies will be fine. Weak companies will struggle. This has always been true, and it remains true in the AI era.

Garman is right. Much of the fear is overblown. The market will eventually recognize this.

Key Takeaways

- AWS CEO argues investor panic about AI disruption is disproportionate to actual market evidence.

- AWS revenue grew 24% year-over-year with 35% operating margins while SaaS stocks crashed 24%, revealing infrastructure paradox.

- SaaS companies aren't dying but undergoing market selection: innovators survive, laggards get disrupted.

- Cloud infrastructure spending accelerates in AI era because AI workloads require massive compute resources.

- The gap between worst-case investor expectations and actual market impact creates exceptional opportunities for disciplined investors.

- Companies pursuing custom AI systems, SaaS-integrated AI, or hybrid approaches all require increased cloud infrastructure.

- Software companies with strong moats, clear AI roadmaps, and efficient execution will recover valuations as panic subsides.

Related Articles

- Fractal Analytics IPO Signals India's AI Market Reality [2025]

- AI Freight Revolution: How Logistics Markets Crashed [2025]

- Anthropic's $14B ARR: The Fastest-Scaling SaaS Ever [2025]

- AI Gross Margins, R&D Spend, and Pricing Trends [2025]

- Google Gemini Hits 750M Users: How It Competes with ChatGPT [2025]

- Microsoft's AI Chip Stops Hardware Inflation: What's Coming [2025]

![AWS CEO Says AI Disruption Fears Are Overblown: Why SaaS Panic Is Misplaced [2025]](https://tryrunable.com/blog/aws-ceo-says-ai-disruption-fears-are-overblown-why-saas-pani/image-1-1771281268249.jpg)