The Sudden Resignation That Shook the Antitrust World

It happened quietly on X, posted in the evening like a resignation letter no one expected to see coming. Gail Slater, the head of the US Department of Justice's antitrust division, announced she was stepping down from her role as Assistant Attorney General. The message was gracious, almost melancholic. "It is with great sadness and abiding hope that I leave my role," she wrote. But behind that measured tone lay something far messier: a power struggle at the highest levels of government that would reshape how America approaches corporate mergers, competitive markets, and the future of Big Tech regulation.

This wasn't just any resignation. Slater had been overseeing some of the most significant antitrust cases in recent memory, including the controversial Netflix-Warner Bros. Discovery merger that Trump personally said he would involve himself in. She was also steering the DOJ's lawsuit against Live Nation, the ticketing monopoly that's been strangling artists, fans, and promoters for years. But according to multiple reports, her skepticism of big mergers put her directly at odds with Attorney General Pam Bondi, who appears to favor a more business-friendly approach to antitrust enforcement.

The real story here isn't just about one person leaving a job. It's about what her departure signals for the future of antitrust enforcement in America. When the person tasked with protecting market competition from the inside is forced out, it raises serious questions about whether the Trump administration actually believes in competition anymore, or whether they're simply clearing the field for corporate consolidation.

Let's dig into what happened, why it matters, and what it means for Netflix, Warner Bros., and every other company waiting to see if their merger will get the green light.

Who Was Gail Slater?

Before she became the head of the antitrust division, Gail Slater was known in certain circles as a serious operator. She had worked as a Vice President at Fox Corporation, which immediately raises eyebrows—this is someone who understands how media companies work, how they consolidate power, and how they compete (or don't). She was also an adviser to JD Vance during his vice presidential campaign, giving her direct connections to the Trump administration's inner circle.

Being an insider at Fox doesn't automatically disqualify someone from running antitrust. But it does mean she understood the industry from a corporate perspective. What made her appointment significant was that Slater appeared to actually believe in using the antitrust laws to block deals when they harmed competition. This wasn't a rubber-stamp position to her. She took it seriously.

The antitrust division is supposed to be technically independent from politics, but let's be real: it never truly is. The AG sets the tone, the division follows. When Slater took the role under the Trump administration, there was some uncertainty about whether she'd be more business-friendly than the Biden antitrust team had been. Early signals suggested she might be.

But then something interesting happened. She started actually examining mergers. She didn't approve things just because corporate interests wanted them approved. She asked hard questions. She looked at competition impacts. And she apparently said "no" when she thought deals would hurt consumers or competitors.

That's where the friction with Bondi began.

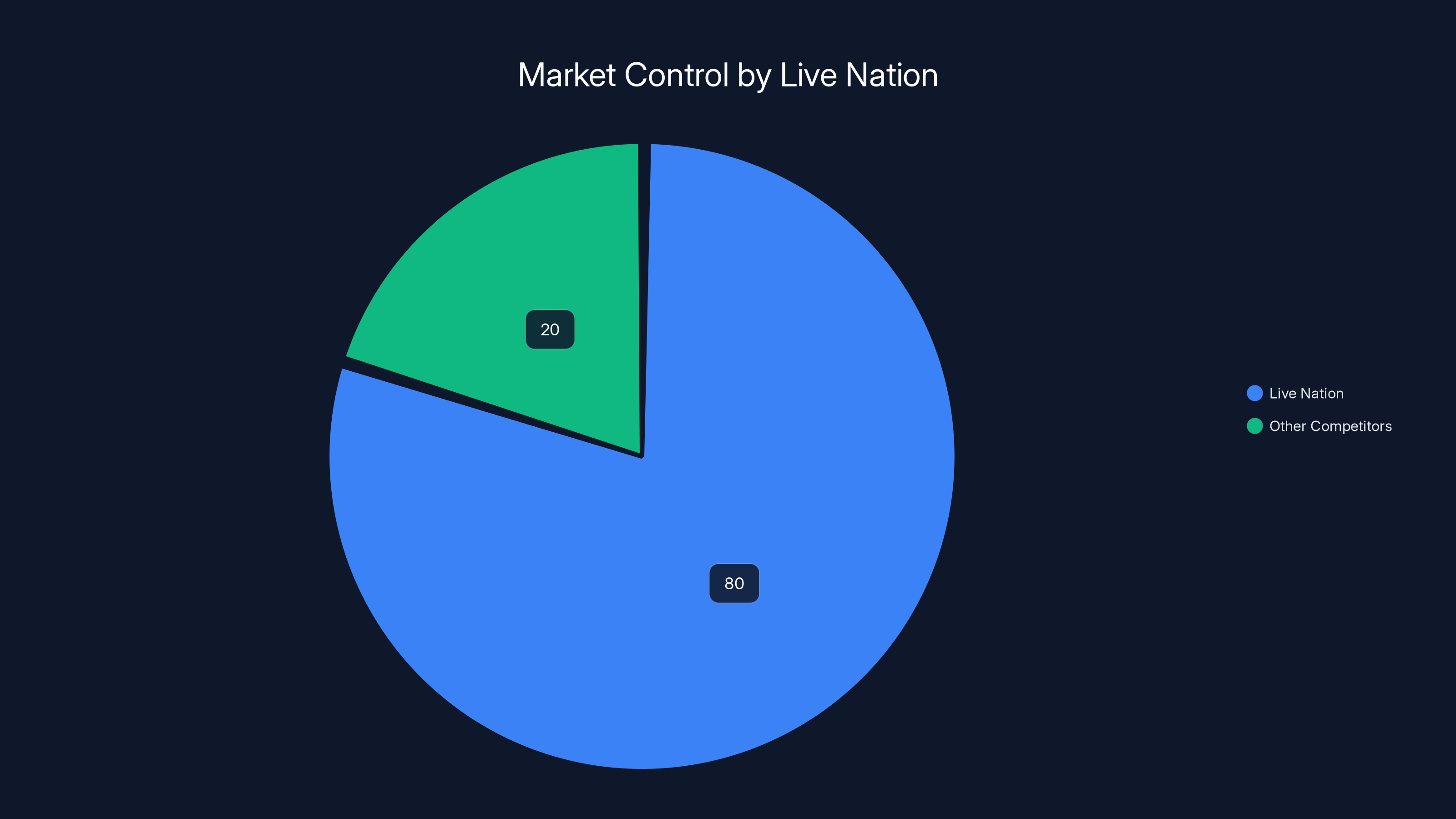

Live Nation controls an estimated 80% of the ticketing market, highlighting its dominant position and the antitrust concerns raised in the DOJ lawsuit. Estimated data.

The Hewlett-Packard and Juniper Networks Conflict

The real breaking point came over the Hewlett-Packard Enterprise merger with Juniper Networks. This deal would have combined two major companies in cloud computing and wireless networking infrastructure. Slater wanted to block it, believing it would create a duopoly that would reduce competition and ultimately harm customers.

Her concerns weren't theoretical. When you combine the dominant players in cloud networking and wireless infrastructure, you eliminate competitive pressure. Prices can rise. Innovation can slow. Customers lose negotiating power. These are the core concerns of antitrust law, and Slater took them seriously.

But here's where the national security angle came in. John Ratcliffe, the CIA Director, pushed back on blocking the merger. His argument: blocking it might force business to go to Chinese competitors instead, which poses national security risks. It's a classic move—wrap a corporate interest in a national security flag, and suddenly the conversation changes.

Slater apparently told Bondi that US intelligence hadn't actually raised concerns about blocking the merger. In other words, Ratcliffe's national security argument wasn't backed by the intelligence community more broadly. But Bondi sided with Ratcliffe anyway, and the deal was approved. This was the first major clash.

The message was clear: if Slater wanted to stay in her position, she needed to be more aligned with the administration's pro-merger stance. That alignment never really happened.

The Netflix-Warner Bros. Discovery Deal

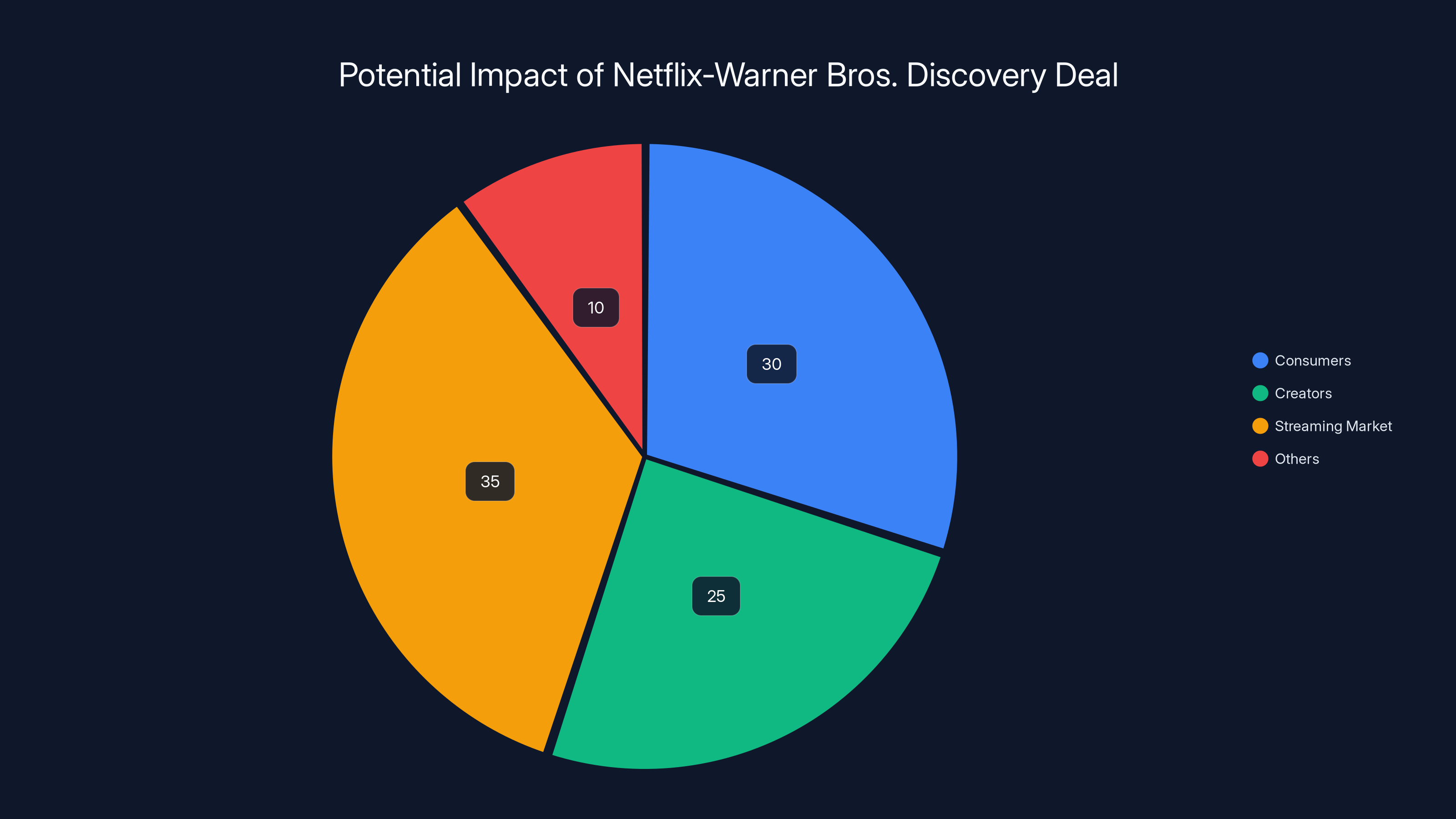

Enter the Netflix-Warner Bros. Discovery merger, one of the most significant entertainment consolidation deals in years. This is where things get really interesting, because the stakes are enormous. Netflix wants to absorb Warner Bros. Discovery's streaming assets, content library, and distribution platform. For consumers, this could mean fewer independent entertainment options. For creators, it could mean less negotiating power. For the streaming market, it could mean less competition.

Slater and Bondi were both overseeing this deal. But their perspectives were diverging sharply. In December, Trump had already signaled he'd be personally involved in the review—an extraordinary statement that suggested the CEO-turned-president intended to weigh in on the decision rather than letting the Justice Department make the call independently.

Meanwhile, Netflix and Paramount were both lobbying hard. Netflix wanted the deal approved. Paramount, which owns competing streaming services, launched a hostile takeover bid for Warner Bros., trying to spoil Netflix's plans. The lobbying was intense, public, and unapologetic.

Then in January, the Wall Street Journal reported something troubling: the DOJ was investigating whether Netflix had engaged in anticompetitive practices during the merger process itself. This suggested Slater's team was taking the competition concerns seriously. They weren't just rubber-stamping approval. They were actually investigating whether Netflix had tried to intimidate competitors or manipulate the process.

This is exactly what an antitrust division is supposed to do. But from the Trump administration's perspective, it was interference with business.

The Power Struggle: Bondi vs. Slater

The conflict between Bondi and Slater became increasingly bitter. Reports suggest Bondi repeatedly told the White House that Slater's views on antitrust were making the relationship untenable. Bondi wanted a more business-friendly approach. Slater wanted to actually use antitrust law.

These aren't just different philosophies. They're incompatible worldviews. Bondi, a former Florida Attorney General and Trump loyalist, sees antitrust enforcement as potentially damaging to the economy and business confidence. Slater, despite her Fox background, apparently actually believed that markets need competition to function well.

The tension escalated over weeks. Bondi made clear, through various signals, that Slater's continued presence in the role was becoming a problem. And Bondi herself was dealing with other controversies—notably the hearing where she "yelled, insulted and deflected" her way through questioning about why the DOJ was stonewalling on releasing files related to the Epstein case. She had her own political headaches and didn't need her own antitrust chief undermining her.

By late January, it became clear Slater wasn't going to win this fight. She could either resign on her own terms or be forced out. She chose to resign, posting her gracious letter to X and maintaining some dignity on the way out. But multiple sources confirmed she was forced out.

The whole affair took maybe three weeks from the moment it became clear she had to go.

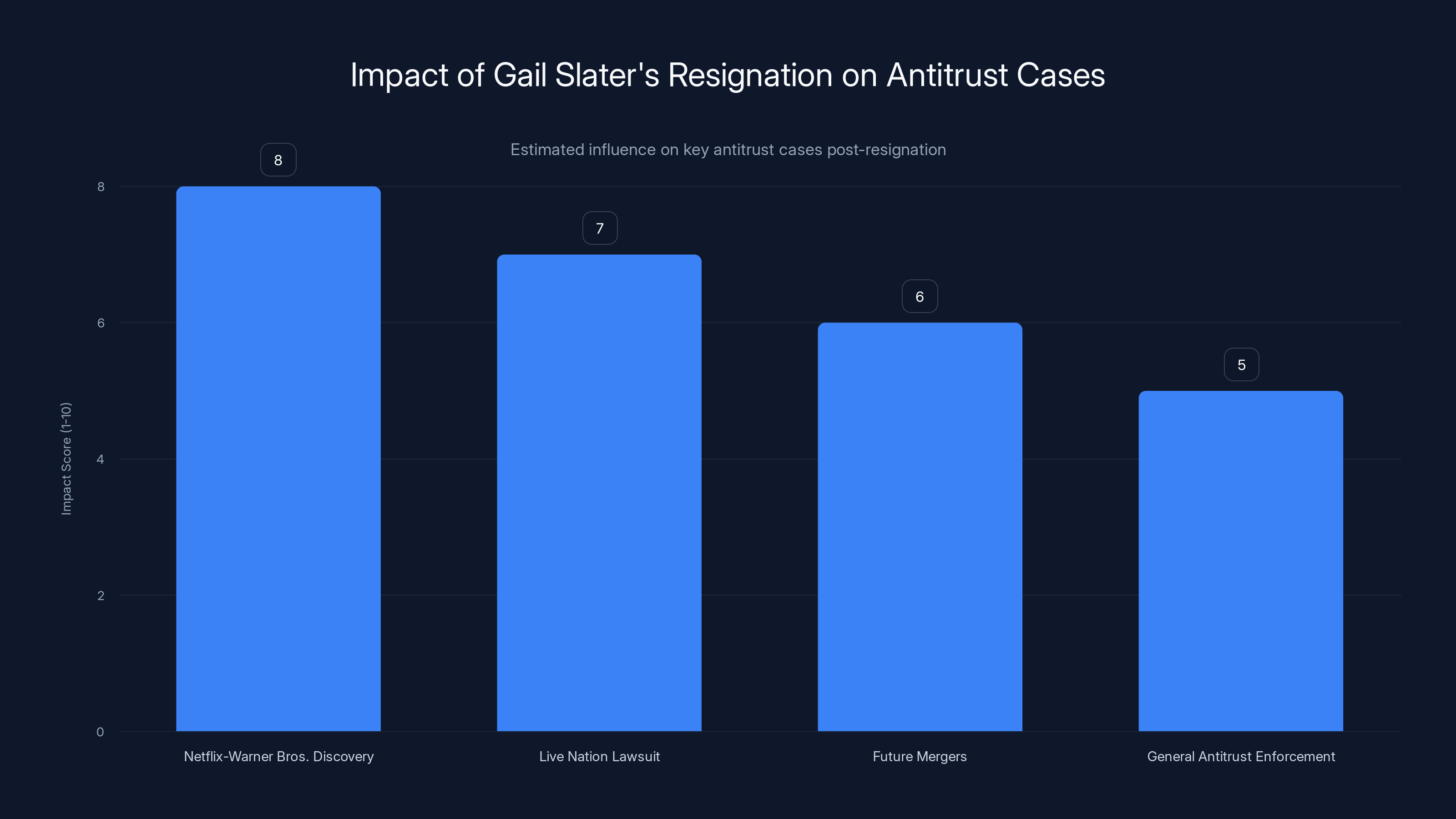

Estimated data suggests a significant impact on the Netflix-Warner Bros. Discovery merger and Live Nation lawsuit following Gail Slater's resignation, potentially altering the DOJ's stance on future mergers.

What Happens to the Netflix Deal Now?

This is the million-dollar question, or in Netflix's case, the multi-billion-dollar question. With Slater gone, who's overseeing the Netflix-Warner Bros. merger review? Presumably whoever Bondi appoints as the next Assistant Attorney General for Antitrust will be more aligned with Bondi's pro-business stance.

Does this mean the deal gets approved? Not necessarily, but it certainly changes the dynamics. The investigation into Netflix's conduct during the merger process could still go somewhere. But without Slater pushing for a rigorous review, there's less institutional pressure to block or heavily condition the deal.

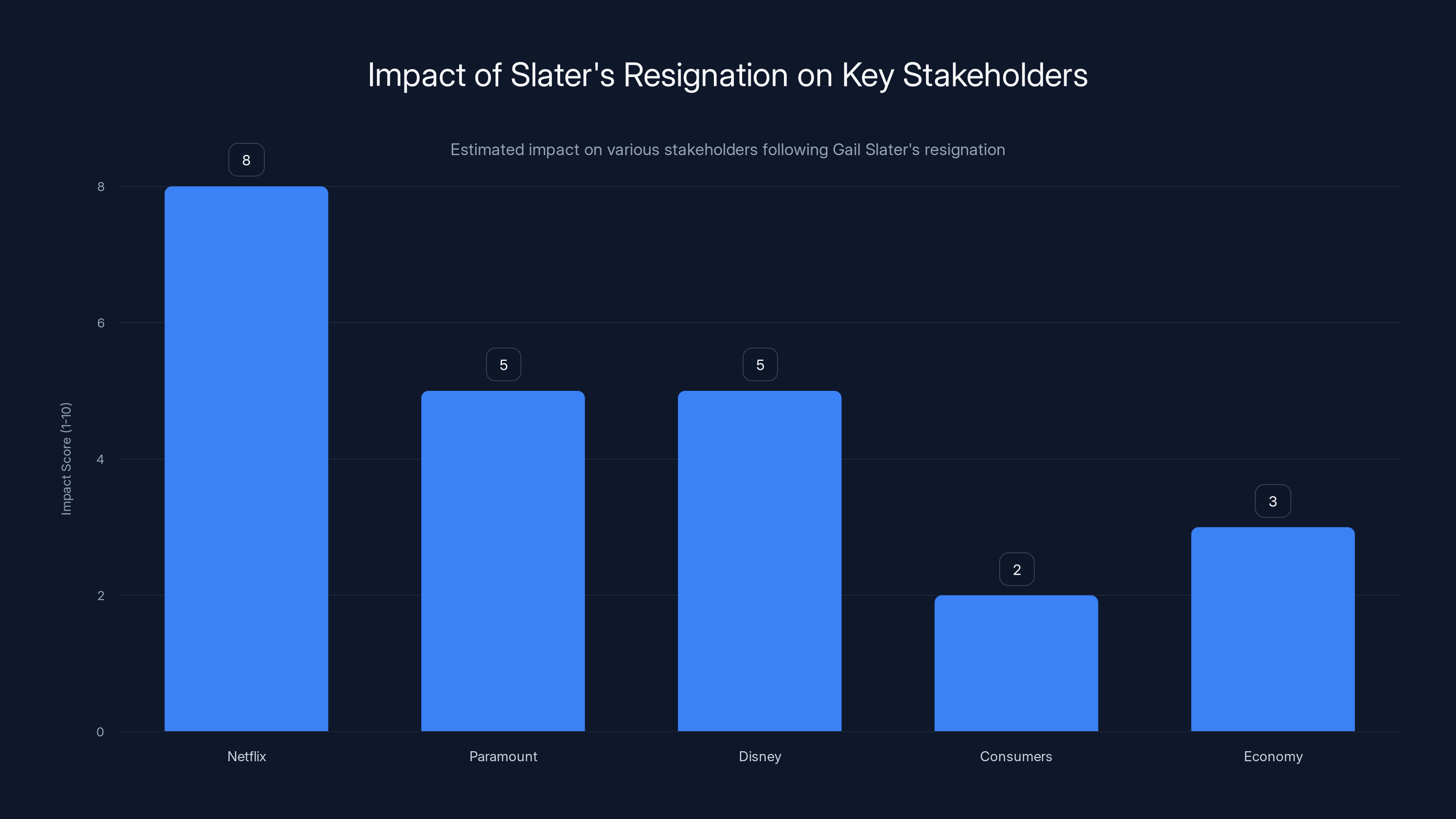

For Netflix investors, this is probably good news. For competitors like Paramount and Disney, it's worse. For consumers who value having multiple streaming options, it's concerning.

The Trump administration has shown little appetite for aggressive antitrust enforcement. Trump himself has been skeptical of antitrust cases against Big Tech. With Slater gone, that skepticism can now govern the antitrust division directly.

The Live Nation Monopoly Case

There's another major case in play here: the DOJ's lawsuit against Live Nation Entertainment, the ticketing monopoly that owns Ticketmaster. This case was filed during the Biden administration, and it's a legitimate antitrust lawsuit. Live Nation controls roughly 80% of ticket sales in the United States through its ownership of Ticketmaster. Artists, promoters, fans, and competitors have all been harmed by this monopoly.

With Slater at the helm, that case had an advocate within the DOJ who believed in it. Now, without her, the question is whether the case will continue with the same vigor. Bondi hasn't indicated she wants to drop it, but she also hasn't shown enthusiasm for aggressive monopoly enforcement.

Live Nation executives are probably watching this very carefully. If the next antitrust chief is less committed to the case, Live Nation could score a significant victory just by waiting out the process. Legal battles are expensive; if the other side loses institutional support, settlements that favor the defendant become more likely.

The Bigger Picture: What's the Trump Antitrust Policy?

Slater's resignation reveals something important about the Trump administration's actual approach to antitrust enforcement. They say they're pro-competition. They say they care about small business. But when push comes to shove, they don't want an antitrust division that actually uses the law to block or challenge big mergers.

Trump has long been skeptical of antitrust enforcement. During his first term, he was relatively quiet on antitrust issues, and the FTC under Ajit Pai took a light approach. Now, with a more aggressive Democratic-leaning antitrust movement having happened during the Biden years, the Trump administration seems to be course-correcting toward deference to corporate interests.

The question is whether this is sustainable policy or just political theater. Antitrust law exists for a reason: markets don't self-regulate, and unchecked consolidation harms innovation, consumer choice, and fair competition. By sidelining someone like Slater, the Trump administration is essentially betting that markets will work fine without aggressive enforcement.

History suggests that bet is wrong. Every major wave of consolidation without antitrust enforcement has eventually led to stagnation, higher prices, and innovation slowdowns. But that's a long-term concern, and administrations often care about short-term metrics.

How Political Leadership Shapes Antitrust Enforcement

One of the most important lessons from Slater's resignation is how much antitrust enforcement depends on leadership commitment. In theory, the antitrust division should make decisions based on law and economics, independent of politics. In practice, the Attorney General sets the tone.

When an AG is skeptical of antitrust enforcement, it permeates the whole division. Junior attorneys notice that controversial cases don't get resources. Aggressive legal theories don't get pursued. Decisions that favor business consolidation get celebrated, while decisions that block mergers get scrutinized.

Slater apparently tried to resist this dynamic, which is why she had to go. She was creating friction by actually wanting to use the law. For an administration that prefers smooth relationships with the business community, that friction is intolerable.

This has huge implications for how antitrust law actually functions. The law itself doesn't change. But enforcement becomes selective. Big deals that the administration likes move forward easily. Deals that threaten key constituencies face real scrutiny.

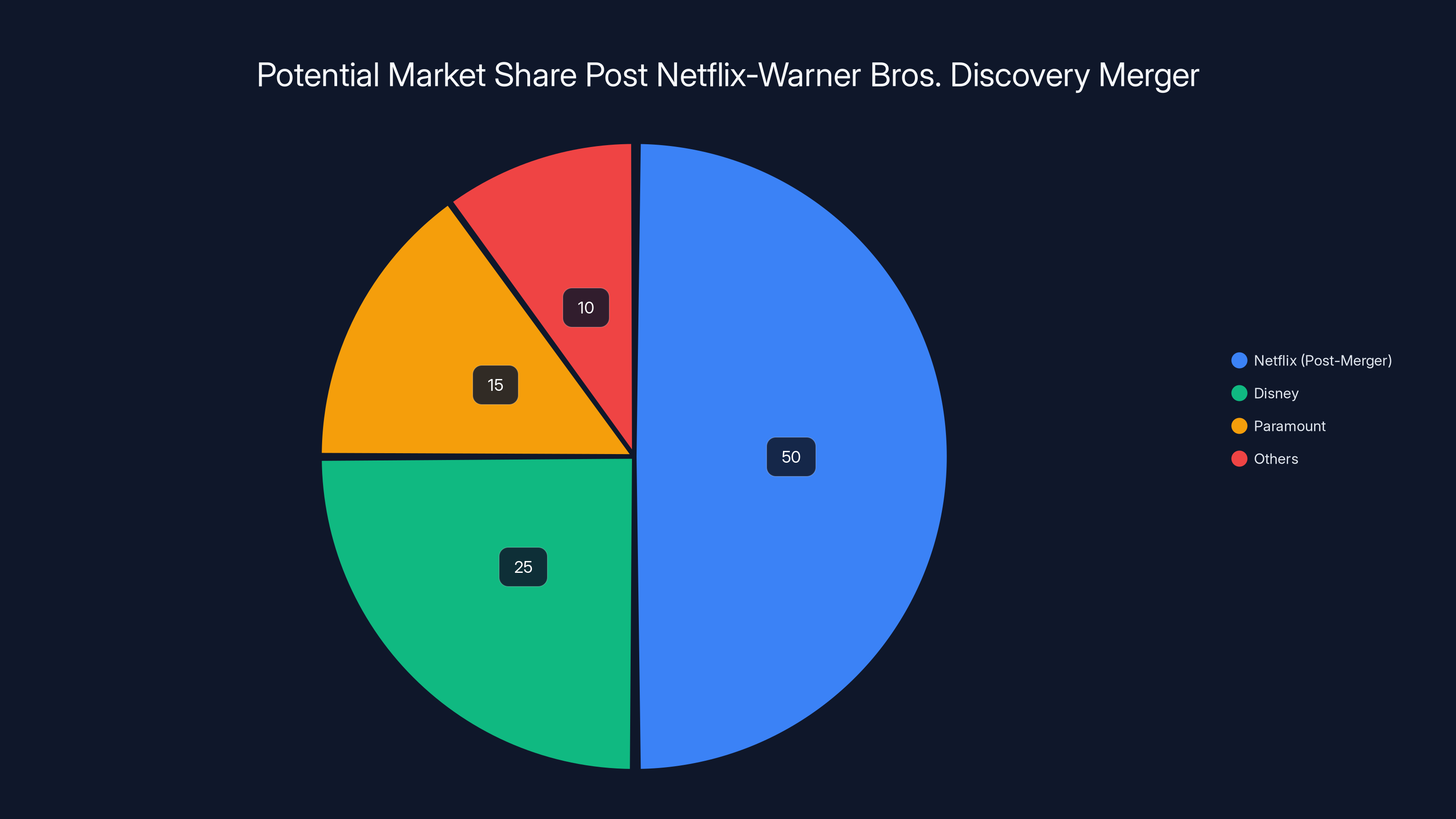

Estimated data shows Netflix could hold 50% market share post-merger, overshadowing Disney and Paramount. Estimated data.

The Media Industry's Consolidation Problem

Let's zoom out and think about what's happening in media specifically. Netflix acquiring Warner Bros. Discovery would combine two of the largest streaming services in the world. The consolidation in media has been happening for decades: cable, broadcast, streaming, all seeing massive mergers that reduced the number of independent voices.

When you have fewer entertainment companies, you have fewer content creators choosing what gets made and distributed. You have fewer people deciding what stories get told, what voices get amplified, what perspectives get considered mainstream. This isn't just an economic issue; it's a cultural and political issue.

Slater apparently understood this. She understood that letting Netflix absorb Warner Bros. meant fewer competitors, less choice, and less pressure to innovate. But that understanding wasn't valued in the current administration.

The media industry has been consolidating for so long that most people don't even notice it anymore. We think of Netflix, Disney, and Paramount as distinct competitors. But they're all massive corporations with interconnected interests. Another round of consolidation narrows the field further.

What Happened to Merger Skepticism?

There was a moment in American politics, mainly during the Biden years, when merger skepticism was ascendant. Lina Khan at the FTC was blocking deals and challenging consolidation. Progressive politicians were talking about antitrust enforcement. The consensus seemed to be shifting toward "maybe we shouldn't let every company just buy every other company."

Slater's appointment suggested some continuity with that skepticism. But it turned out her appointment was more about optics than substance. The Trump administration wanted to appear like they were taking antitrust seriously without actually empowering someone to do it.

Her resignation signals the end of that moment. We're back to the default position: consolidation is fine, mergers are good, business needs certainty and stability. The antitrust division is now, once again, primarily a place where deals go to get approved, not blocked.

The Personal Cost of Principle

It's worth noting what Slater sacrificed here. She had a prestigious position as Assistant Attorney General. She had connections to the Trump administration. She presumably had ambitions for her career. And she walked away because she disagreed with the direction of her boss.

Or rather, she was forced to walk away because she disagreed.

That's not common in government. Most people in her position compromise, find ways to work within the system, accept that their boss makes the final call. Slater apparently tried to do that, but the disagreements were too fundamental. She couldn't oversee the Netflix deal one way while Bondi wanted it handled another way.

So she's out. And there's probably some satisfaction in that—she didn't stick around to rubber-stamp deals she disagreed with. But there's also a cost. She lost her job. She lost influence. The agenda she believed in lost its most powerful advocate inside the DOJ.

This is what institutional power really means. Bondi had it. Slater didn't. And when they clashed, Bondi won.

What Comes Next for Antitrust Enforcement?

The real question now is who replaces Slater. Bondi will choose someone more aligned with her vision of a business-friendly antitrust division. That person will likely be someone with corporate experience, skeptical of aggressive merger enforcement, and comfortable with the idea that markets mostly self-regulate.

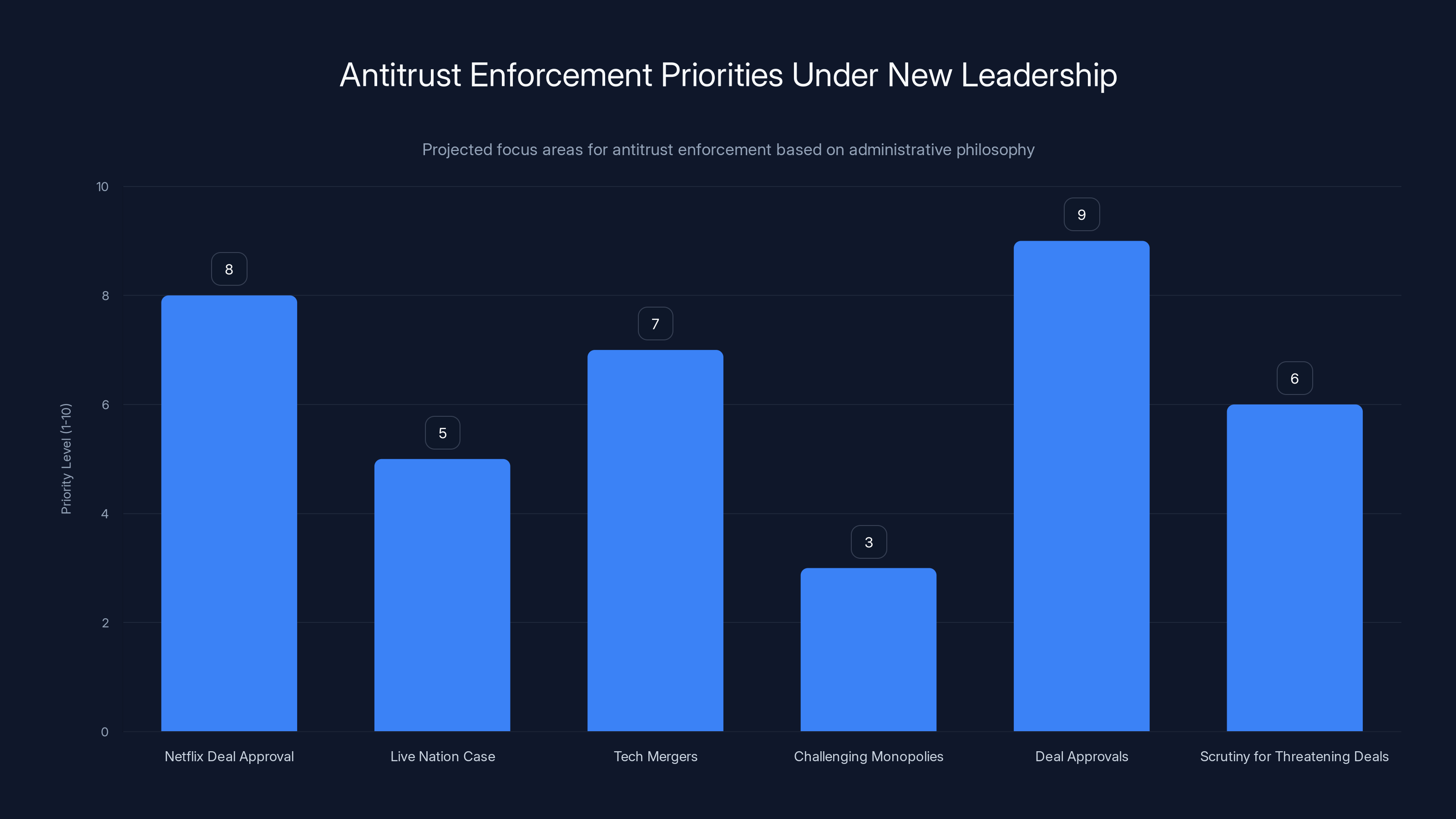

With that person in place, expect to see:

- Netflix deal approval with minimal conditions

- Continued skepticism toward the Live Nation case, possibly settlement discussions

- More permissive standards for tech mergers and consolidation

- Less resources for challenging existing monopolies

- Faster approvals for deals that the administration likes

- More scrutiny for deals that threaten administration allies

This isn't necessarily illegal or even unprecedented. Every administration shapes antitrust enforcement to reflect its philosophy. But it's a significant shift from the skepticism of the prior administration.

Slater's resignation is estimated to positively impact Netflix, while consumers and the economy may face negative consequences. Estimated data.

The Netflix-Warner Deal Timeline

The Netflix-Warner Bros. merger is still technically under review, but with Slater out, the timeline becomes harder to predict. The DOJ isn't supposed to have formal deadlines for merger reviews, but there's usually pressure to resolve them within a few months.

Expect the new antitrust chief to move more quickly on approvals. With Slater gone, the internal momentum shifts from "let's carefully examine this deal" to "let's process this deal." Netflix's lobbying efforts, which have been substantial, will become more effective in an environment with less internal resistance.

A deal approval could come within weeks of the new chief taking office. Netflix is probably already celebrating Slater's resignation.

Competitive Implications for Streaming

If Netflix absorbs Warner Bros. Discovery, the streaming landscape changes dramatically. Netflix gains:

- HBO's entire content library

- DC Comics films and shows

- Warner Bros. film library

- Discovery Channel content

- Additional distribution channels

- Increased negotiating power with suppliers

Meanwhile, Paramount and Disney become smaller competitors. Paramount especially, with its attempt to do its own hostile takeover, is in a precarious position. Disney has theme parks and other revenue. Paramount has less diversification.

For consumers, this means fewer independent options and more consolidated decision-making about what content gets made. It also means less competitive pressure on Netflix to improve pricing, features, and service quality.

This is what merger skepticism is supposed to prevent. But that skepticism left the building with Gail Slater.

The Broader Antitrust Enforcement Landscape

Slater's resignation is just one data point, but it's a crucial one. It signals how the Trump administration will approach antitrust enforcement broadly. The answer appears to be: with restraint and business deference.

This has implications beyond entertainment mergers. Other industries are watching. Pharmaceutical companies considering mergers. Tech companies planning acquisitions. Retail chains looking to consolidate. Every executive is reading this news and concluding that the environment for deals is suddenly much friendlier.

That's exactly what the administration intended. By removing Slater, they've signaled that aggressive antitrust enforcement is not a priority. That's good for business consolidation. It's probably not good for competition, innovation, or consumer choice. But those aren't metrics the Trump administration prioritizes.

Why This Matters Beyond Washington

You might think, "This is just Washington politics, why should I care?" But antitrust enforcement directly affects your life:

- Entertainment choices: Fewer companies making content means less diversity of options

- Prices: Consolidated industries tend to have higher prices because there's less competitive pressure

- Innovation: Monopolies don't need to innovate; they can just buy competitors

- Worker power: Consolidated industries have fewer employers, reducing worker bargaining power

- Creative expression: Fewer companies controlling media means narrower range of voices and perspectives

When antitrust enforcement gets weaker, these effects compound over time. It's not immediately obvious, but over years and decades, a consolidation wave reduces competition and consumer welfare.

Slater understood this. That's why she wanted to actually use antitrust law. And that's why she had to go.

The new leadership is expected to prioritize faster deal approvals and tech mergers, while allocating fewer resources to challenging existing monopolies. (Estimated data)

The Political Economy of Mergers

Here's a cynical but probably accurate take: big mergers often benefit executives and shareholders, but harm consumers and workers. Executives get bonuses for completed deals. Shareholders see stock price increases from consolidation. But consumers lose choice, and workers lose bargaining power.

An antitrust chief who's skeptical of mergers is essentially saying, "I'm going to prioritize consumer welfare over investor returns." That's a radical position by current standards, but it's what antitrust law is theoretically supposed to do.

The Trump administration clearly prefers the opposite. They're saying, "Let's make it easy for businesses to consolidate. Growth is good." Whether that's actually true depends on who benefits from that growth—and spoiler alert, it's not consumers.

Slater's resignation reflects this fundamental disagreement about what economic policy should optimize for: investor returns or consumer welfare. The Trump administration chose investor returns. Slater apparently cared more about consumer welfare.

Lessons for Future Antitrust Leadership

What can we learn from Slater's brief and troubled tenure? A few things:

- Political loyalty matters more than legal principle in government. Slater tried to follow the law. She was fired.

- Antitrust enforcement is always political, no matter how much officials claim otherwise. The AG sets the agenda.

- Business consolidation is the default state under Republican administrations and increasingly under Democratic ones too.

- Standing up to bad policy costs you your job. Slater paid a price for her skepticism.

- Consumer protection loses to business interests in the Trump administration. That's the actual policy choice being made.

Future antitrust chiefs will see Slater's resignation and understand: if you want to keep your job, don't actually challenge the administration's merger-friendly stance. Rubber-stamp deals. Don't ask hard questions. Certainly don't investigate corporate conduct during mergers.

What About the Specific Mergers?

Let's check back in on the deals Slater was overseeing:

Netflix-Warner Bros. Discovery: Almost certainly gets approved now. The investigation into Netflix's conduct will probably be dropped or resolved quietly. Netflix wins.

Live Nation-Ticketmaster case: Likely becomes less of a priority. The case might drag on, but with less institutional support, Live Nation has better odds of a favorable settlement.

Future tech mergers: Expect to see a significant increase in approvals. Companies will start announcing deals they've been sitting on, knowing the environment is now friendlier.

Slater's resignation is basically a green light for corporate consolidation across multiple industries.

The History of Antitrust in America

America has had aggressive antitrust enforcement before. Teddy Roosevelt broke up the railroads. The 1980s saw major cases against AT&T and IBM. The 2000s saw the Microsoft case (though ultimately settled weakly).

But for the last 20 years, antitrust enforcement has been relatively weak. Consolidation has proceeded apace. We've seen massive mergers in tech, pharmaceuticals, airlines, agriculture, retail, and media. Few have been blocked.

There was a moment when that might have changed. The Biden administration showed interest in aggressive enforcement. But that moment is apparently over. The Trump administration is signaling a return to the permissive approach.

Slater's resignation is a symbol of that return. She represented the possibility of stronger enforcement. Now that she's gone, that possibility is closed.

Estimated data suggests the deal could significantly impact the streaming market (35%) and consumers (30%), with creators also affected (25%).

The Role of Intelligence and Security Arguments

One interesting detail from the HP-Juniper deal is how national security arguments were used to override antitrust concerns. This is becoming more common. Companies argue that their merger is necessary for security reasons, and intelligence officials back them up.

It's a convenient argument because it's hard to publicly challenge. Who wants to be accused of weakening national security? But it can also be cover for decisions that actually just benefit corporations.

Slater apparently questioned whether the HP-Juniper national security argument was real. She was right to. But her skepticism lost to Ratcliffe's assertion, and the deal was approved.

This is a pattern worth watching. The more national security gets used as a justification for mergers, the less antitrust enforcement will actually constrain consolidation.

Implications for Tech Companies

Tech companies are probably the most interested in Slater's departure. The tech industry has seen unprecedented consolidation: Facebook buying Instagram and WhatsApp, Google buying dozens of companies, Amazon acquiring Whole Foods and other retailers. Most of these deals faced minimal antitrust scrutiny.

With Slater gone, that's unlikely to change. If anything, tech consolidation might accelerate. Companies will feel more confident announcing major acquisitions. The FTC, which has been somewhat combative with tech companies, might find itself with a DOJ that's less interested in complementary enforcement.

For startup founders and investors, this is probably good news in the short term (easier exits to big tech companies). For competition and innovation in tech, it's probably bad news long term.

The Streaming Wars Context

The Netflix-Warner deal happens in the context of the streaming wars, where Netflix emerged as the clear winner and most other streaming services are burning money or struggling. Paramount is particularly in trouble. HBO Max (Warner Bros.) has been a distant second.

A Netflix acquisition of Warner Bros. effectively ends the streaming wars by making Netflix even more dominant. That's convenient for Netflix but potentially problematic for the diversity of streaming options and content creation incentives.

Slater apparently understood this. With her gone, that understanding stops mattering inside the DOJ.

The Bondi Appointment Itself

Gail Slater's departure also raises questions about Pam Bondi's fitness for the Attorney General position. Bondi has been controversial throughout her tenure: from the Epstein files stonewalling to her legal challenges to the Affordable Care Act as Florida AG.

The fact that she immediately forced out her own antitrust chief because that chief wanted to actually enforce antitrust law suggests Bondi's vision of the AG's office is one where business deference comes first. That's a particular philosophy, but it's not necessarily aligned with protecting consumers or maintaining competitive markets.

Future AGs will be watching this precedent. Slater's fate might discourage future assistant AGs from actually using their authority independently. They'll know that challenging the AG's pro-business stance costs them their jobs.

International Implications

One thing worth noting: other countries are taking antitrust enforcement seriously. The European Union has been aggressive in going after tech monopolies. China's government is consolidating control over its tech sector. India is investigating antitrust issues.

The US moving in a more permissive direction means American companies get a competitive advantage in consolidation, at least in the short term. That might be intentional—maybe the Trump administration wants American companies to be bigger global players.

But it also means the US is outsourcing antitrust to other countries. EU regulators might end up being the primary constraint on American tech company power. That's unusual and probably not ideal from a US perspective, but it's the consequence of weaker domestic enforcement.

The Future of Merger Reviews

Going forward, expect merger reviews to become faster and less rigorous. The new antitrust chief will probably have a mandate to clear deals more quickly. Companies will get faster answers. But those answers will be "yes" more often.

This will particularly benefit large companies with M&A ambitions. Startups and smaller competitors won't be killed by regulatory uncertainty; deals will move fast. But the overall market structure will become more consolidated because the deals that would be blocked under skeptical review will now be approved.

For the Netflix deal specifically, expect an approval decision within 2-3 months of the new chief taking office. Bondi will probably want a clean win on this, so she'll push for a quick resolution.

Conclusion: What Slater's Resignation Means

Gail Slater's resignation from her role as head of the DOJ's antitrust division marks a significant turn in American competition policy. It signals that the Trump administration has no interest in aggressive merger enforcement. It signals that internal dissent within the administration gets punished. It signals that business interests trump competition concerns.

For Netflix, this is good news. For Paramount and Disney, it's complicated. For consumers who value streaming options and competitive pricing, it's bad news. For the broader economy and the health of competitive markets, it's concerning.

But it's also predictable. This is how administrations typically work. They fill key positions with people who share their philosophy. When someone doesn't share that philosophy, they get forced out.

Slater apparently thought the job was important enough to resist. She thought antitrust law mattered. She thought consolidation merited skepticism. Those principles cost her the position.

Now, someone more aligned with Bondi and the administration's business-friendly approach will take her place. Mergers will move forward. Markets will consolidate. And the next chapter in American consolidation will begin.

The Netflix-Warner Bros. deal will probably be approved. The Live Nation case will probably be deprioritized. Other companies with M&A ambitions will feel emboldened.

Slater tried to stand in the way. She lost. And with her departure, the era of skeptical antitrust enforcement in this administration has effectively ended before it really began.

FAQ

Who was Gail Slater and why was her resignation significant?

Gail Slater was the Assistant Attorney General for Antitrust at the US Department of Justice, overseeing the government's major antitrust cases including the Netflix-Warner Bros. merger review and the Live Nation monopoly lawsuit. Her resignation was significant because she was apparently forced out due to disagreements with Attorney General Pam Bondi over her skepticism of corporate mergers, signaling a shift toward more business-friendly antitrust enforcement.

What was the conflict between Slater and Bondi about?

Slater and Bondi clashed over merger policy. Slater wanted to block or heavily scrutinize deals like the Hewlett-Packard Enterprise-Juniper Networks merger due to competition concerns, while Bondi and other administration officials favored approving deals, sometimes citing national security arguments. Their longstanding feud became untenable, leading to Slater's forced resignation.

How does Slater's departure affect the Netflix-Warner Bros. merger review?

With Slater gone, the review now lacks its most vocal skeptic within the DOJ. The investigation into whether Netflix engaged in anticompetitive practices during the merger process may be dropped or resolved quietly. A new antitrust chief more aligned with Bondi's business-friendly stance will likely approve the deal with minimal conditions within weeks.

What is the Live Nation monopoly case and what happens now?

The Live Nation case is a DOJ lawsuit filed during the Biden administration claiming that Live Nation operates as a monopoly, controlling roughly 80% of ticketing through its Ticketmaster subsidiary and harming artists, fans, and competitors. With Slater's departure, the case likely becomes a lower priority, and Live Nation may negotiate a favorable settlement rather than facing aggressive prosecution.

What does this resignation reveal about the Trump administration's antitrust philosophy?

Slater's forced resignation reveals that the Trump administration prioritizes business consolidation and investor returns over consumer protection and market competition. Rather than using antitrust law to challenge mergers, the administration appears to favor a permissive approach where deals move through approvals quickly, provided they don't threaten key political allies.

How does antitrust enforcement typically vary between administrations?

Antitrust enforcement is inherently political, with each administration shaping policy toward its philosophy. Democratic administrations tend to be more skeptical of mergers and consolidation, while Republican administrations historically favor a lighter touch. The Trump administration is signaling a return to the permissive approach of the pre-2020 era, with Slater's departure being a clear symbol of that shift.

What are the broader implications for media consolidation and streaming services?

Slater's resignation likely accelerates consolidation in the streaming and media industries. Netflix's acquisition of Warner Bros. Discovery will probably proceed, reducing the number of independent streaming competitors. This follows decades of consolidation in media where the number of companies controlling entertainment has dramatically decreased, affecting content diversity and consumer choice.

How might Slater's resignation affect other pending mergers across different industries?

With Slater's departure signaling a friendlier environment for mergers, companies across tech, pharmaceuticals, retail, and other sectors will likely announce long-delayed acquisitions. The approval rate for mergers is expected to increase significantly, and the time required for reviews will likely shorten as the new antitrust chief operates under different priorities than Slater did.

Why did national security arguments matter in the HP-Juniper dispute?

Slater opposed the HP-Juniper merger on antitrust grounds, but CIA Director John Ratcliffe argued blocking it posed national security risks because the business might go to Chinese competitors instead. This national security argument overrode Slater's competition concerns and the deal was approved, illustrating how security justifications can be used to overcome antitrust skepticism, potentially providing cover for decisions that primarily benefit corporations.

What historical context is there for antitrust enforcement in America?

America has periods of aggressive antitrust enforcement and periods of permissiveness. Theodore Roosevelt aggressively broke up monopolies, the 1980s saw major cases against AT&T and IBM, and the 2000s included the Microsoft case. However, the past 20 years have been relatively permissive, with massive consolidation across tech, pharma, airlines, and other sectors. The Biden administration briefly suggested renewed enforcement, but Slater's resignation signals a return to the permissive era.

Key Takeaways

- Gail Slater was forced out as antitrust division chief due to conflict with AG Pam Bondi over merger skepticism

- Her departure removes the strongest internal advocate for blocking the Netflix-Warner Bros. merger

- The resignation signals the Trump administration prioritizes business consolidation over competition enforcement

- Companies with pending mergers now face a significantly friendlier regulatory environment

- Media consolidation will likely accelerate, reducing streaming options and creative diversity

Related Articles

- Live Nation's Monopoly Trial: Inside the DOJ's Internal Battle [2025]

- DOJ Antitrust Chief's Surprise Exit Weeks Before Live Nation Trial [2025]

- WBD-Netflix Merger Battle: What Ancora's Opposition Means [2025]

- Why Bezos Abandoned the Washington Post's Newsroom [2025]

- Netflix's Warner Bros. Acquisition: The $82.7B Megadeal Explained [2025]

- Netflix DOJ Antitrust Investigation: What It Means for Streaming [2025]

![Antitrust Chief Gail Slater Resigns Amid Netflix-Warner Merger Review [2025]](https://tryrunable.com/blog/antitrust-chief-gail-slater-resigns-amid-netflix-warner-merg/image-1-1770926993938.jpg)