Ariane 6 Rocket: Europe's Heavy-Lift Success and the Evolution of Global Space Launch

Introduction: A Watershed Moment for European Space Capability

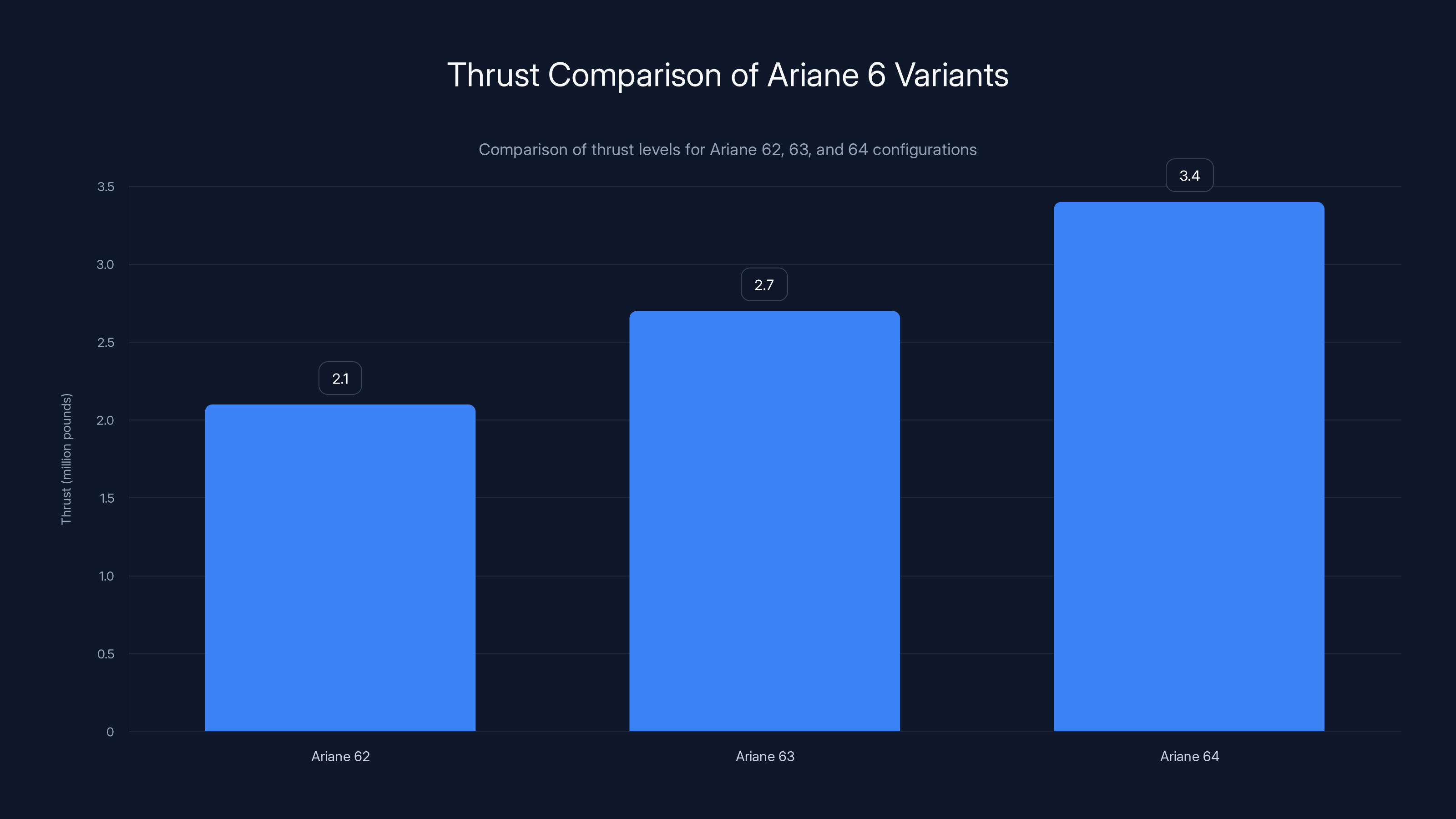

On a Thursday morning in February 2026, Europe's space ambitions reached a critical inflection point. The Ariane 6 rocket, lifting off from the Guiana Space Center on South America's northeastern coast, completed a mission that had taken nearly two decades to accomplish. For the first time, the rocket's most powerful configuration—the Ariane 64—ascended into the tropical sky, powered by a hydrogen-fueled main engine and four strap-on solid rocket boosters generating over 3.4 million pounds of thrust. This wasn't merely another satellite launch; it represented a fundamental repositioning of Europe in an increasingly competitive global space economy dominated by American innovation and SpaceX's reusable rocket technology.

The mission's payload consisted of 32 spacecraft destined for Amazon's Kuiper constellation, a satellite broadband network designed to challenge SpaceX's Starlink dominance. Amazon's selection of Europe's newest heavy-lift vehicle, rather than exclusive reliance on American providers, signaled both desperation and opportunity. Desperation because Amazon faced what it internally described as a "near-term shortage of launch capacity", forcing the company to pursue multiple launch providers across different continents. Opportunity because it validated Ariane 6 as a credible, operational alternative in a market where launch reliability and capacity command premium prices.

The broader context reveals an industry in flux. SpaceX's Falcon 9 rockets have launched over 9,000 Starlink satellites, creating a near-monopoly on commercial lift capabilities. Yet this dominance, combined with increasing geopolitical tensions and supply chain vulnerabilities, has prompted governments and corporations alike to diversify their launch portfolios. Amazon's strategy exemplifies this hedging approach: the company booked commitments across four separate launch providers, betting that no single vendor would achieve the capacity and reliability needed for constellation deployment at scale.

This article explores the significance of Ariane 6's achievement, the technical specifications that make the Ariane 64 configuration possible, the competitive dynamics reshaping the launch industry, and the implications for future space-based services. We'll examine how traditional European space programs adapted to compete with American commercial innovators, analyze the economics of satellite constellation deployment, and assess what this launch signals about the future of Europe's role in space commerce.

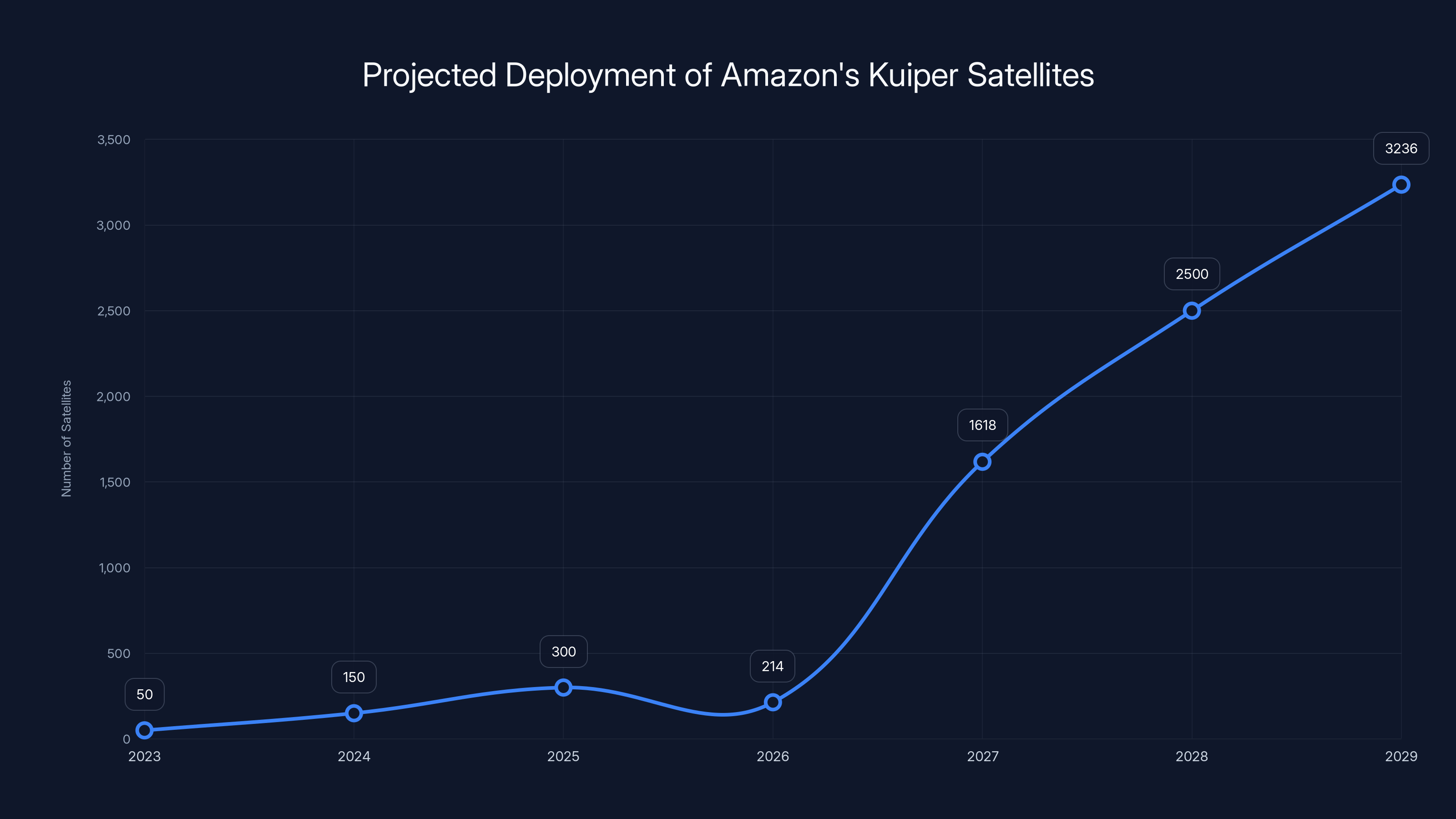

Amazon plans to deploy half of its Kuiper satellites by 2027 to achieve commercial viability, with full deployment by 2029. Estimated data based on strategic goals.

Technical Specifications: Understanding the Ariane 64 Architecture

The Four-Booster Configuration: Engineering Excellence Under Pressure

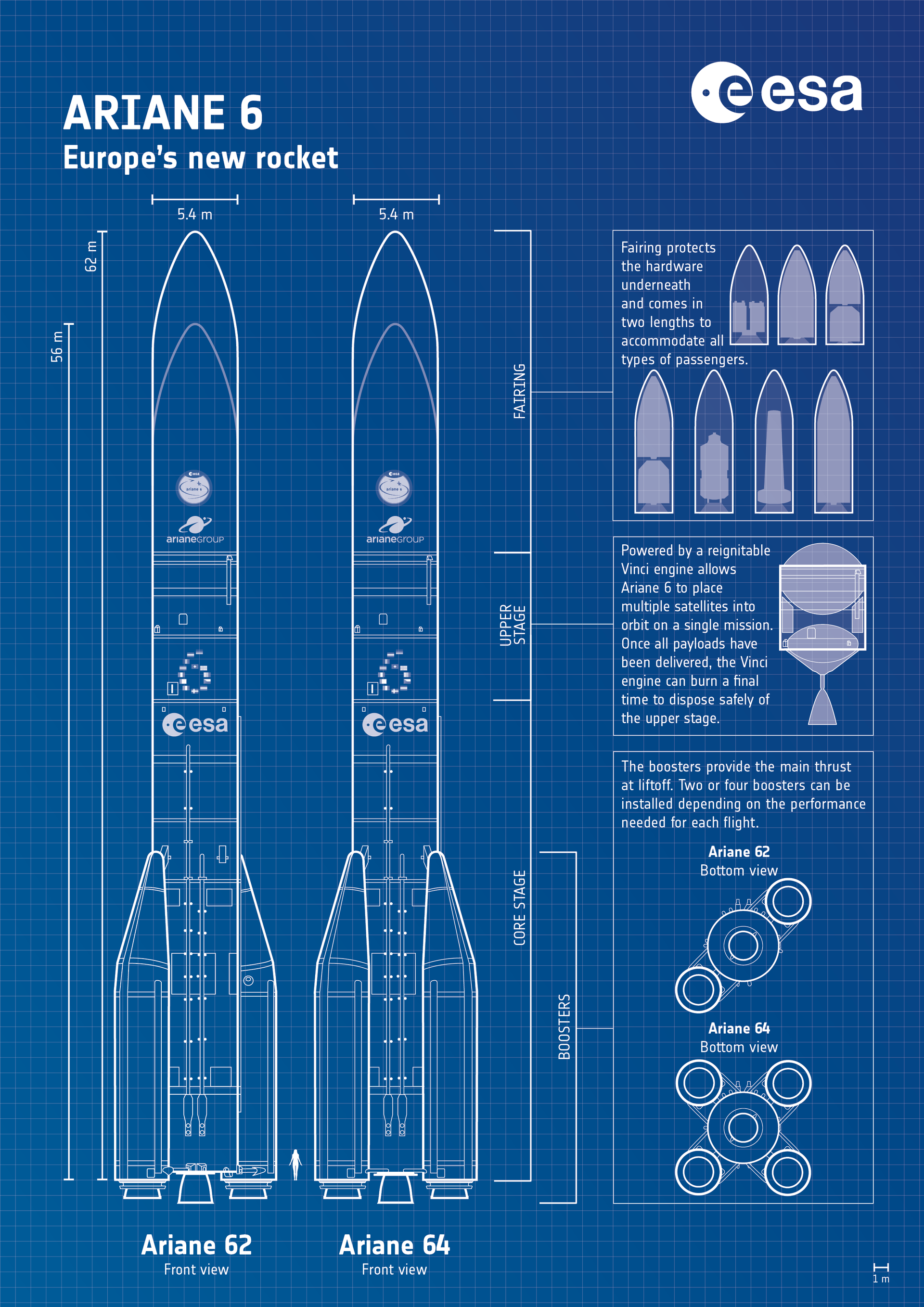

The Ariane 64 represents the full realization of the Ariane 6 program's initial design vision. Whereas earlier Ariane 6 launches utilized either two or four solid rocket boosters attached to the core stage, the four-booster variant (Ariane 64) had never before flown. This configuration demands extraordinary precision in aerodynamic design, structural engineering, and thermal management.

Each solid rocket booster (SRB) measures approximately 55 meters tall and contains specially formulated solid propellant that burns at extremely high temperatures. The four boosters work in perfect synchronization, delivering thrust vectoring control that allows the vehicle to steer during the initial ascent phase. Any asymmetry in burn rates or thrust levels would create vehicle oscillations that could stress structural components or compromise trajectory accuracy. Engineers designed the Ariane 64 with advanced sensor arrays continuously monitoring pressure, temperature, and vibration signatures to detect anomalies in real-time.

The hydrogen-fueled Vulcain 2.1 main engine driving the core stage operates at a chamber pressure of around 200 bar, with an expansion ratio designed to optimize performance during both low-atmosphere and high-altitude flight regimes. The engine's bell nozzle extends significantly below the vehicle's base, requiring clearance considerations at the launch pad. The combined thrust vector—3.4 million pounds from all five engines working together—creates acceleration profiles that expose vehicle structures to forces exceeding 4.5 Gs during the first minute of flight.

The extended payload shroud, modified specifically for Thursday's mission, accommodates the unusual geometry of stacking 32 satellite units. Traditional rocket fairings enclose payloads in a cylindrical envelope to minimize aerodynamic drag; the lengthened shroud added approximately 2 meters to the vehicle's total height, requiring modifications to launch pad interfaces and ground support equipment.

Payload Integration: The Challenge of 32 Satellites and 44,000 Pounds

The 44,000-pound payload represented approximately 95 percent of the Ariane 64's maximum lift capability to the required 289-kilometer altitude (the standard deployment altitude for Amazon's Kuiper constellation). Every kilogram mattered. The satellite stack required custom-designed deployment mechanisms, vibration isolation systems, and sequencing logic to release spacecraft safely without collision risk.

Amazon's Kuiper satellites weigh approximately 590 kilograms each, requiring a secondary payload adapter capable of holding all 32 units while maintaining structural integrity throughout launch acceleration, atmospheric flight, and the deployment sequence. The adapter incorporates multiple deployment platforms that release satellites in carefully calculated sequences, ensuring sufficient separation velocity to prevent re-contact.

Thermal management posed additional challenges. Deployed satellites in Low Earth Orbit experience extreme temperature variations: direct sunlight exposure creates temperatures exceeding 100 degrees Celsius, while shadow periods drop below -100 degrees Celsius. The payload fairing protects satellites during ascent from aerodynamic heating and dynamic pressure, but once released, satellites must function across their full operational temperature range.

The deployment sequence itself requires extraordinary precision. Upper stage attitude control systems must maintain precise orientation while spacecraft separation sensors confirm successful ejection. Any spacecraft failing to deploy correctly would become debris, threatening other constellation operators. European Space Agency officials confirmed that deployment telemetry data indicated all 32 satellites successfully separated at precisely calculated intervals.

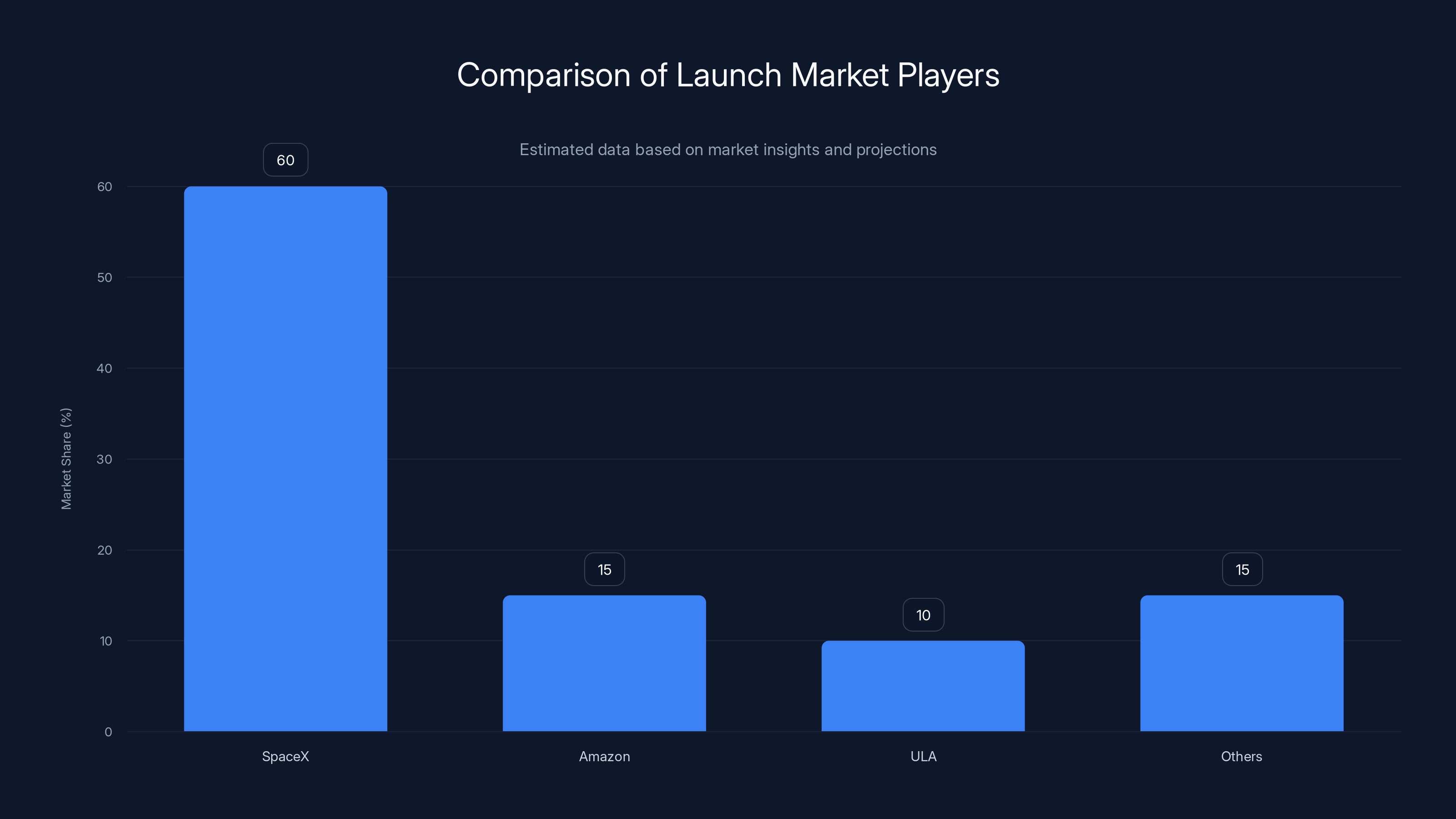

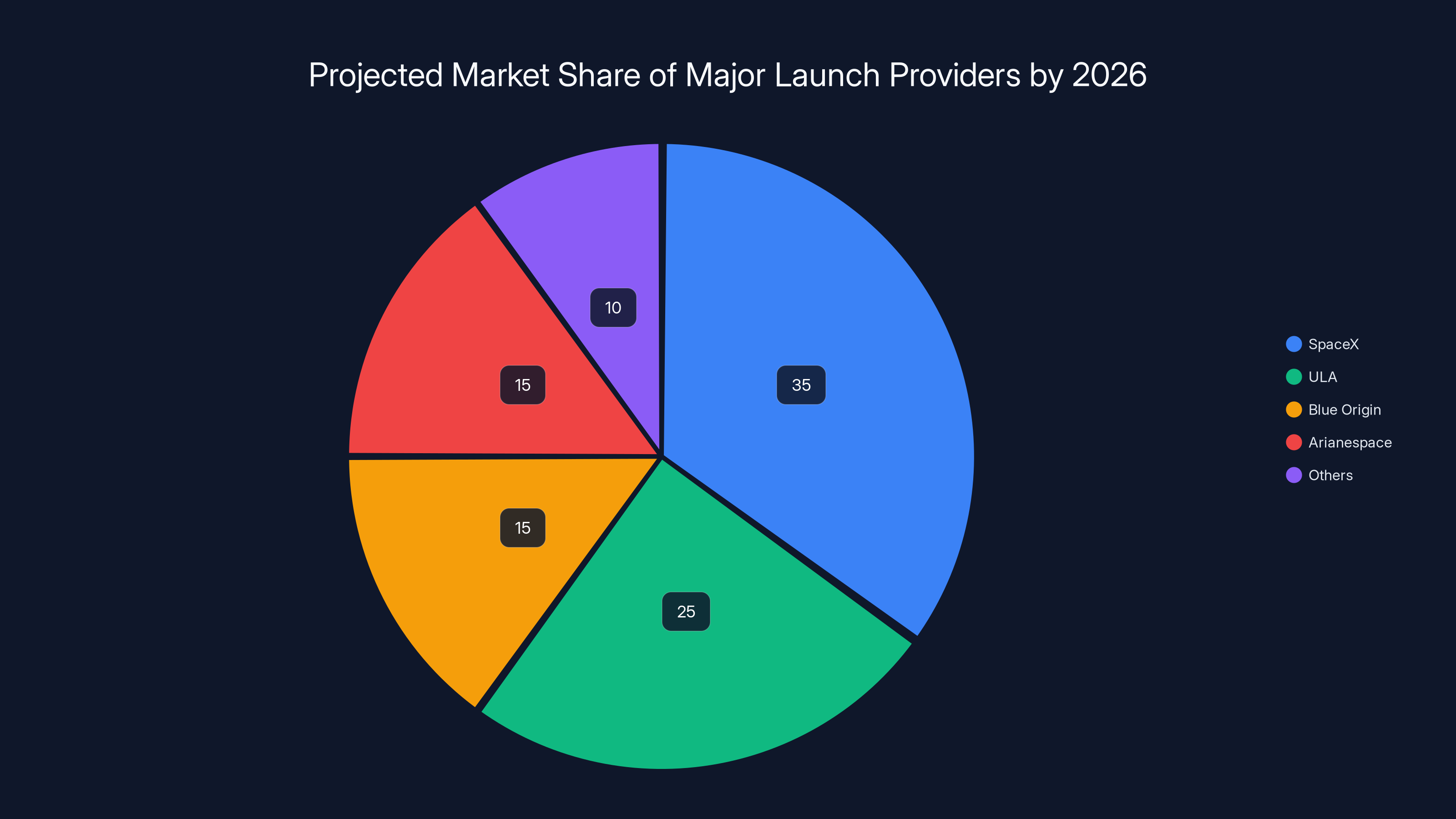

SpaceX leads the competitive launch market with an estimated 60% share, driven by its technological and operational advantages. Estimated data.

Amazon's Kuiper Constellation: Strategic Context for Launch Selection

The Kuiper Program: Why Amazon Competes in Space

Amazon's entry into satellite broadband reflects the company's long-term strategic assessment that terrestrial infrastructure will never achieve global coverage. The Kuiper constellation, initially called Project Kuiper during its secretive development phase, targets 3,236 satellites organized across three orbital shells at different altitudes. The constellation aims to deliver high-speed, low-latency broadband access to underserved regions where terrestrial buildout proves economically impractical.

The business case rests on several key assumptions: (1) satellite broadband prices will decline as constellation capacity increases, eventually competing with terrestrial broadband in underserved markets; (2) latency will decrease as satellite technology improves, making service viable for interactive applications; (3) geopolitical fragmentation will create opportunities where terrestrial operators face regulatory barriers. Amazon's early estimates suggested the Kuiper program requires deployment of roughly half the constellation by 2027 to achieve commercial viability, with full deployment by 2029.

As of the February 2026 launch, Amazon had deployed 214 production satellites across eight missions using different launch providers. This distributed approach differs fundamentally from SpaceX's Starlink strategy, which relies almost exclusively on Falcon 9 rockets. SpaceX's vertical integration approach—manufacturing rockets, manufacturing satellites, and operating the constellation—creates operational efficiency but creates a single point of failure. Amazon's diversified supplier strategy reduces dependency risk but complicates logistics and operational complexity.

Launch Capacity Constraints: The Shortage That Forced Strategic Diversification

In regulatory filings with the Federal Communications Commission, Amazon disclosed facing a "near-term shortage of launch capacity" that threatened the company's deployment timeline. This frankly-stated admission revealed the fundamental tension driving Amazon's multi-provider strategy. No single rocket company possessed the capacity to accommodate Amazon's launch cadence while simultaneously serving other customers and maintaining operational reserves.

Amazon had committed to 100+ missions across four launch providers: United Launch Alliance's Atlas V and Vulcan, Blue Origin's New Glenn, SpaceX's Falcon 9, and Arianespace's Ariane 6. This portfolio approach creates scheduling nightmares but provides flexibility. When ULA's Vulcan rocket experienced solid booster anomalies, Amazon could pivot constellation deployment to other providers. When SpaceX offered capacity at favorable pricing, Amazon seized the opportunity.

The capacity constraint reflected genuine industry limitations. SpaceX's Falcon 9 achieved approximately 60 launches by early 2026, representing the highest flight rate any operational rocket had achieved historically. Yet even this record cadence couldn't accommodate all commercial demand, government priorities, and military national security requirements. The situation created an artificial scarcity that drove launch prices upward and complicated constellation deployment planning.

Amazon responded pragmatically by purchasing 10 additional SpaceX launches in 2025, bringing the total Falcon 9 flights supporting Kuiper to 13 missions. This decision, made reluctantly according to internal communications, reflected recognition that competing with SpaceX on innovation wasn't possible, but Amazon could use its purchasing power to secure capacity. The financial implications were significant: SpaceX's standard commercial rate for dedicated Falcon 9 flights approached

The Competitive Launch Market: A New Era of Diversity and Specialization

SpaceX's Starlink Dominance: The Baseline Against Which Others Measure

SpaceX's dominance in satellite broadband rests on multiple technological and operational advantages. Falcon 9 reusability enables rapid launch cadence and declining unit costs. First stages return to Earth autonomously for relanding on drone ships, enabling reuse within weeks. By early 2026, SpaceX had reflown individual Falcon 9 boosters over 20 times, driving down marginal launch costs substantially below new-build equivalents.

Starlink operations at scale—9 million+ subscribers by early 2026—generate cash flows funding continued constellation expansion and technology improvements. The virtuous cycle of revenue funding reinvestment creates momentum competitors struggle to match. SpaceX's manufacturing capacity, optimized for Starlink production, allows rapid satellite manufacturing at costs approaching $150,000-200,000 per unit. When multiplied across thousands of satellites, the cumulative advantage compounds.

Yet dominance creates vulnerabilities. Single-sourcing launch capability creates operational risk. Regulatory changes affecting Starlink—including potential spectrum reallocations or interference restrictions—threaten revenue streams. Competitors view the market differently: if Starlink achieves profitability within its dominant position, secondary operators like Amazon can potentially achieve profitability in terrestrial segments where Starlink doesn't focus.

ULA's Vulcan Rocket: American Heritage Meets Uncertainty

United Launch Alliance's Vulcan rocket represents a generational transition for the venerable aerospace contractor. ULA combined Boeing and Lockheed Martin rocket divisions in 2006, creating a company with unmatched experience across military and commercial launch. The Atlas V rocket, which had launched 100+ times without failure, provided a proven platform that U.S. national security leadership trusted implicitly.

Vulcan was designed to replace both Atlas V and Delta IV, consolidating two launch lines into a single, more efficient vehicle. The rocket's core stage measures 3.8 meters in diameter, powered by twin BE-4 engines manufactured by Blue Origin. This dependence on Blue Origin for engines created strategic complexity: two companies with overlapping interests (both serving constellation operators) tightly coupling their operations.

By early 2026, Vulcan had completed four operational flights, reaching an enviable 100% success rate despite extended development timelines. However, a solid rocket booster anomaly on a military mission in early February—the second such issue in three flights—raised questions about booster reliability. The failures occurred in different flight regimes, suggesting potential design vulnerabilities rather than isolated manufacturing defects.

Amazon's $2 billion commitment to upgrade ULA's manufacturing infrastructure reflected confidence in the platform's ultimate success, but the booster anomalies complicated deployment planning. Amazon's first batch of Kuiper satellites designated for Vulcan flights remained in inventory, awaiting confidence in booster performance improvements. The delays rippled across Amazon's constellation timeline, forcing the company to seek alternatives.

Blue Origin's New Glenn: Bezos' Answer to Falcon 9

Blue Origin's heavy-lift New Glenn rocket, named after astronaut John Glenn, represents founder Jeff Bezos's direct challenge to SpaceX's dominance. New Glenn's design emphasizes reusability at an even more aggressive level than Falcon 9: the vehicle uses identical BE-4 engines powering the booster and upper stage, simplifying logistics and manufacturing. The first-stage booster stands approximately 95 meters tall, among the largest launch vehicles ever built.

By early 2026, New Glenn had completed only two test flights, with preparations underway for a third flight as soon as March or April. The slower pace reflected Blue Origin's more methodical, testing-intensive approach compared to SpaceX's rapid iteration philosophy. Each New Glenn flight carried fewer payloads than comparable Falcon 9 missions, allowing engineers to gather detailed performance data before increasing utilization.

Amazon and Blue Origin's shared ownership structure created complex relationships. Amazon Web Services' cloud infrastructure powered much of Blue Origin's data systems. Yet the companies operated independently, with Amazon Kuiper teams working separately from Blue Origin's launch operations. No Kuiper satellites had launched on New Glenn as of early 2026, though Amazon reserved significant capacity on planned flights.

New Glenn's reusability design paralleled Falcon 9's architecture but with design refinements intended to improve booster recovery reliability. The larger stage diameter and dual-engine configuration provided payload capacity exceeding Falcon 9 to the same orbits, offering Amazon flexibility for future mega-satellite deployments or multi-manifest configurations.

Arianespace's Ariane 6: European Renaissance or Generational Decline?

Arianespace's Ariane 6 represents the European Space Agency's most ambitious vehicle development program since the original Ariane 5, which dominated commercial launch for decades. The Ariane 5 retired in 2023 after 117 consecutive successful flights—a record unmatched by any launch vehicle in history. The achievement created extraordinary confidence in European engineering and launch reliability.

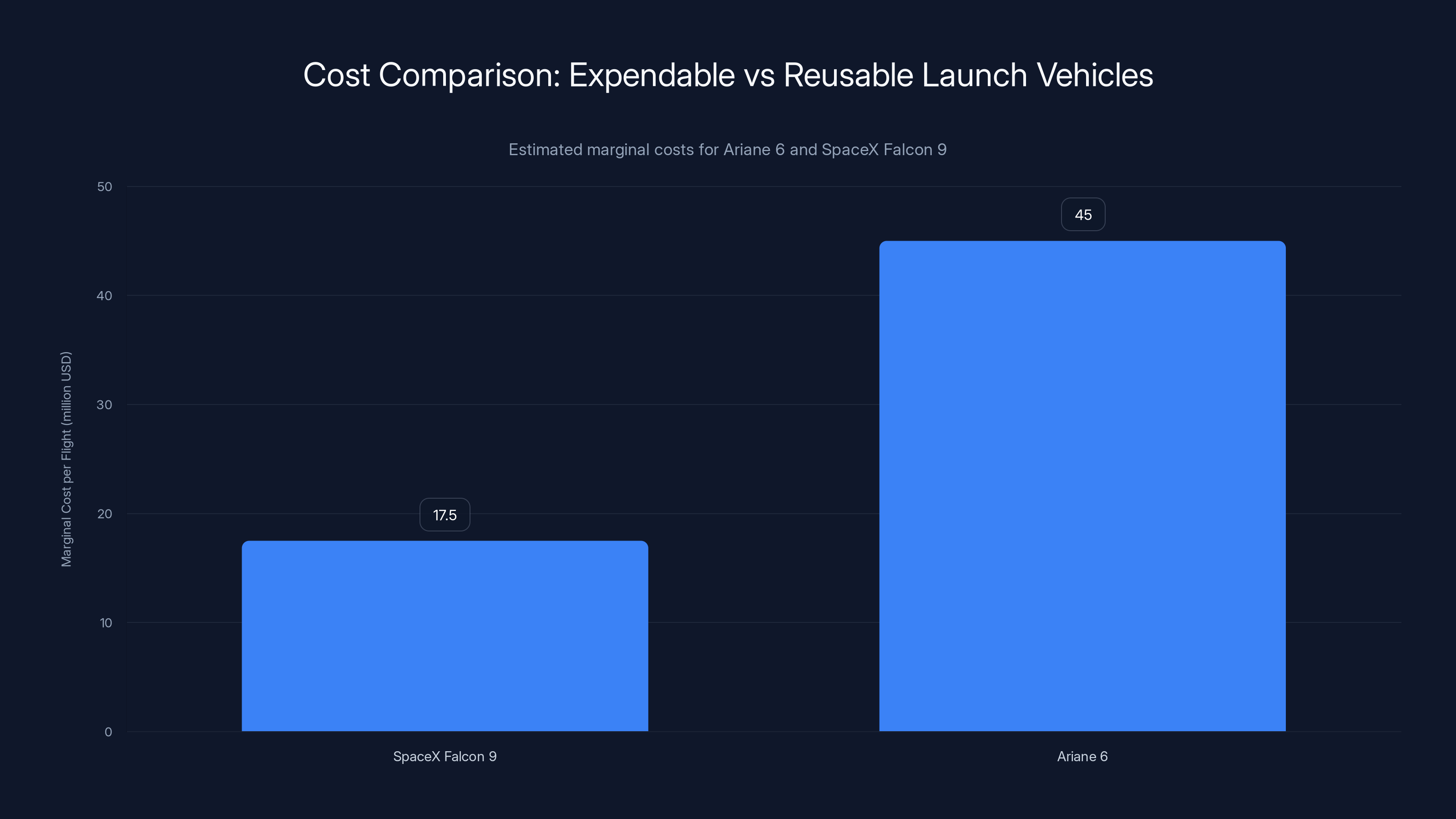

Ariane 6's design emphasized a different philosophy than Falcon 9: cryogenic fuels (liquid hydrogen and liquid oxygen), large composite structures, and expendable vehicle architecture. Unlike Falcon 9's reusable first stage, Ariane 6 was designed from inception as an expendable vehicle, with cost reduction achieved through manufacturing efficiency and production scaling rather than booster reuse.

The rocket achieved six successful flights by early 2026, accumulating approximately 140 metric tons of payload delivered to various orbits. The rapid flight rate—doubling every six months—suggested Arianespace had solved manufacturing and launch logistics challenges that plagued early development. Ground infrastructure improvements at the Guiana Space Center, including additional launch pads, supported higher cadence.

Ariane 6's primary market advantages centered on reliability perception (European brand recognition among government and institutional customers) and geographic diversity (launching from South America provided orbital inclination advantages for certain missions). However, Ariane 6 faced fundamental economic challenges: expendable vehicle architecture meant each flight required manufacturing replacement hardware, creating unit costs higher than Falcon 9's reusable approach on a per-flight basis.

Arianespace compensated through three strategies: (1) government subsidies supporting European space industrial base; (2) long-term contracts with institutional customers requiring launch insurance against SpaceX capacity unavailability; (3) competitive pricing on mega-constellation missions where first-stage reusability provided less advantage. Amazon's Kuiper contract, valued at roughly $500 million for 18 missions, represented a significant validation of Ariane 6's competitiveness.

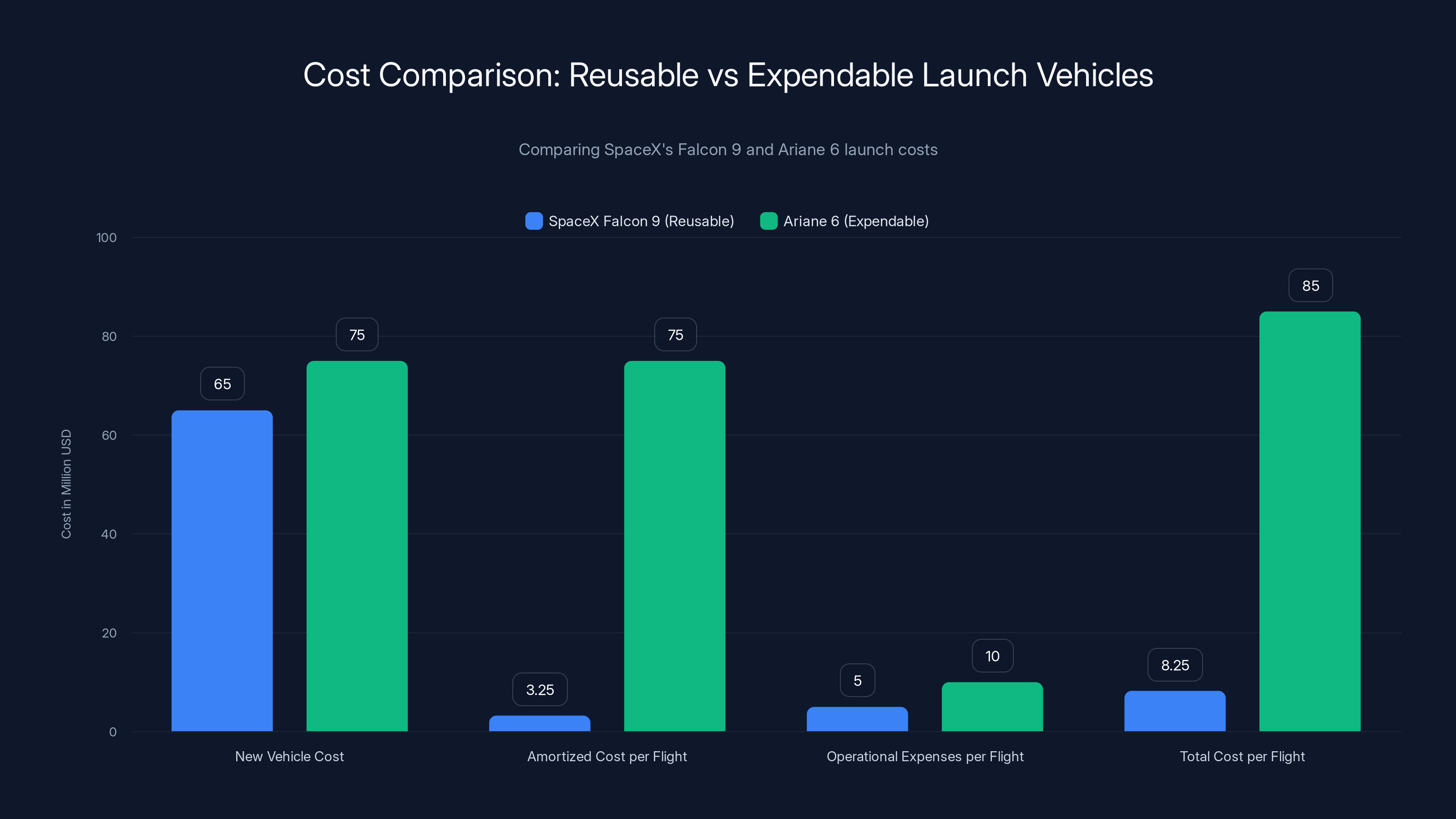

SpaceX's Falcon 9 reusability significantly reduces per-flight costs compared to Ariane 6's expendable design, highlighting the economic advantage of reusable technology. Estimated data for Ariane 6 based on available figures.

The Launch Economics: Understanding Cost Structures in the New Space Age

The Reusability Revolution: Economics of Booster Recovery

SpaceX's reusable Falcon 9 first stage transformed launch economics fundamentally. A new Falcon 9 first stage costs approximately $45-60 million to manufacture, yet the stage itself represents roughly 60-70 percent of the total new vehicle cost. When a booster flies once and is discarded, this substantial capital investment becomes a sunk cost amortized across a single mission.

Booster reusability inverts this calculation. SpaceX's boosters, by early 2026, were flying 20-25 times before retirement. This multiple-flight amortization reduces the effective booster cost per flight to $3-5 million, or roughly 5-10 percent of new manufacturing cost. The first-stage engine (Merlin), manufacturing quality maintenance, and refurbishment costs consume the remaining allocation.

The mathematical impact on total launch cost is substantial. A new Falcon 9 vehicle costs approximately

Ariane 6's expendable design creates different economics. Each Ariane 6 flight requires manufacturing a complete new vehicle, estimated to cost

Blue Origin and ULA are pursuing hybrid approaches: Blue Origin's New Glenn booster is designed for reuse but had not yet achieved booster recovery by early 2026. ULA's Vulcan uses a reusable first stage concept, but relies on third-party booster manufacturing and separation systems, complicating the logistics. Both companies are working toward Falcon 9-equivalent reusability within 2-3 years.

Constellation Deployment Economics: The Math Behind Mega-Satellite Operations

Satellite constellation deployment economics differ fundamentally from traditional point-to-point satellite missions. Traditional missions launched single or dual satellites, with launch costs amortized across modest capacity. Constellations reverse this calculation: thousands of satellites, deployed over multiple years, require launch cost minimization across large production runs.

Amazon's math: the Kuiper constellation requires approximately 3,200 satellites with average lifespan of seven years. This implies replacement cadence of roughly 460 satellites annually once the constellation reaches steady state. At $590 kilograms per satellite, each year's replenishment requires 271 metric tons of payload to orbit.

Using Falcon 9 economics as the baseline: a dedicated Falcon 9 flight carries approximately 22,800 kilograms to low-Earth orbit, meaning Amazon requires roughly 12 Falcon 9 flights annually for replacement satellites alone. At

Ariane 6, with maximum payload of approximately 20,000 kilograms, requires 14 flights annually for equivalent replenishment capacity, or

These economics drive Amazon's hedging strategy. By diversifying across multiple providers, Amazon gains several advantages: (1) negotiating leverage through competition; (2) insurance against single-provider capacity shortages; (3) geographic and geopolitical diversity reducing systemic risk. The cost premium of using higher-priced launches is recouped through availability assurance and risk mitigation.

Government Subsidies and Strategic Support: The Hidden Economics

Ariane 6's competitive viability depends substantially on government support invisible in published pricing. The European Space Agency invested approximately €2.4 billion in Ariane 6 development—a public investment in infrastructure. By comparison, SpaceX's Falcon 9 development was privately funded, though government contracts purchasing launch services contributed to early profitability.

This distinction reflects different national strategies. European governments view space infrastructure as strategic public goods warranting investment similar to transportation or communications infrastructure. The U.S. approach, increasingly, treats commercial space as private sector responsibility with government as customer purchasing services at competitive prices.

The subsidy implications are significant: if European taxpayers invested €2.4 billion to enable Ariane 6 operations, and Ariane 6 completes 50 commercial flights (a realistic five-year target), the implicit government support per flight approaches €50 million. This effectively subsidizes Arianespace's commercial pricing, enabling competition with SpaceX despite higher inherent vehicle costs.

Amazon's decision to use Ariane 6, therefore, partially reflects valuation of European government support. By purchasing Ariane 6 launch services, Amazon indirectly benefits from ESA's infrastructure investment. From an economic perspective, this is rational: Amazon competes in commercial markets by capturing value from subsidized infrastructure investments made by various national governments.

The Mission: February 2026 Launch Details and Flight Achievements

Liftoff and Ascent: The First Ariane 64 Experience

Thursday, February 2026, dawned clear at the Guiana Space Center, the European-managed launch facility located on the northeastern coast of South America. The geographic location provides significant launch advantages: the equatorial location and eastward-launching orientation enables launch vehicles to exploit Earth's rotational velocity (approximately 465 meters per second at the equator), effectively providing free acceleration toward orbital velocity.

Ariane 6 lifted off at 11:45 am EST (16:45 UTC), with launch readiness confirmed after extended weather monitoring and final systems checks. The first-stage ignition sequence began with the Vulcain 2.1 main engine achieving full thrust, followed milliseconds later by four solid rocket boosters simultaneously ignitioning. The ground shook from the combined acoustic signature—over 230 decibels at launch pad proximity—forcing spectators to cover ears despite protective equipment.

The vehicle began its initial pitch maneuver, tilting progressively toward the northeast, establishing the correct launch azimuth. The four solid rocket boosters burned for approximately 70 seconds, after which depletion charges severed the attachment bolts holding the boosters to the core stage. The separation happened violently, with explosive charges creating relative velocity between core and boosters sufficient to prevent recontact.

With the boosters jettisoned, the Vulcain 2.1 main engine continued its solo burn, accelerating the vehicle and payload toward orbital velocity. The upper stage fairing—the extended shroud protecting the 32 satellites—experienced maximum dynamic pressure (known as "max Q") at approximately 60 seconds of flight, with aerodynamic forces reaching their peak. The vehicle structure flexed under the combined thermal and acoustic environment, with strain gauges on monitoring systems confirming loads remained within design predictions.

Core stage separation occurred at approximately 2 minutes 40 seconds of flight, with the vehicle at an altitude of approximately 67 kilometers and velocity near 3.6 kilometers per second. The upper stage, powered by a single hydrogen-fueled HM-7B engine, continued accelerating the payload eastward.

Deployment Sequence: The Critical 32-Satellite Release

The upper stage coast phase—unpowered flight allowing the vehicle to coast toward the desired deployment point—lasted approximately 45 minutes. During this phase, the vehicle tracked across the Atlantic Ocean, passing over Africa at an altitude exceeding 200 kilometers. Ground tracking stations monitored trajectory using GPS constellation signals and Doppler analysis of radio transmissions.

Approaching the target deployment altitude of 289 kilometers, the upper stage initiated the deployment sequence. First, separation ordnance severed all mechanical attachments between the upper stage and payload adapter. Next, spring mechanisms imparted separation velocity (approximately 0.5 meters per second), creating initial distance.

The sequential deployment mechanism then activated, releasing satellite pairs at carefully calculated time intervals. The deployment sequence lasted approximately 12 minutes, with all 32 spacecraft released in a controlled manner preventing collision risk. Telemetry confirmed successful separation of all spacecraft: each satellite confirmed independent orientation control and power system activation.

The upper stage maintained orbit briefly after deployment, burning residual fuel to lower its altitude below the constellation altitude, effectively removing itself from the operational space. This "deorbit burn" is standard practice—leaving upper stages in constellation altitudes creates debris risk and contributes to space sustainability challenges.

Confirmation and Celebration: The Industry Validates Ariane 6

Mission success was announced approximately 90 minutes after launch, with all deployment telemetry confirming nominal performance. Arianespace declared the mission a complete success; the European Space Agency's director general, Josef Aschbacher, released a statement emphasizing the achievement: "With the powerful roar of four boosters at liftoff comes more than double the payload mass to orbit, setting Europe back on stage for launching all satellites to all orbits."

The language revealed underlying confidence: "back on stage" carried dual meaning—both celebrating the achievement and acknowledging a recovery from decades of declining commercial launch market share. Aschbacher announced immediate planning for Ariane 6 upgrades, including enhanced upper stage capabilities and potential reusability enhancements for future variants.

Arianespace's leadership noted the mission fulfilled a critical strategic objective: demonstrating the Ariane 64 capability to Amazon with perfection, validating the company's claims about payload capacity and reliability. David Cavaillolès, Arianespace's CEO, committed to a "series of 18 missions enabling the deployment of their constellation," establishing a clear multi-year schedule building customer confidence.

The geopolitical implications were significant. European space industry officials noted that the achievement maintained Europe's position as a major spacefaring power despite decades of SpaceX-driven market disruption. American observers recognized that despite SpaceX's technological dominance, competitors with sufficient capital and government support could maintain operational relevance through alternative approaches.

The Ariane 64 configuration generates the highest thrust at 3.4 million pounds, significantly more than the Ariane 62 and 63 variants. Estimated data based on typical configurations.

Industry Implications: How One Launch Reshapes Competitive Expectations

Validation of Alternative Launch Architectures

Ariane 6's success proved that expendable launch vehicles could achieve operational maturity and competitive pricing despite fundamental cost disadvantages versus reusable platforms. This validation matters because it preserves options for launch providers unable to develop reusable booster recovery systems.

The distinction between Ariane 6's expendable design and Falcon 9's reusable architecture represents different engineering philosophies with different economic implications. Expendable designs simplify vehicle structure, reduce structural margins, and eliminate complex booster recovery systems. These design choices reduce manufacturing complexity but increase per-flight costs.

Reusable designs require more robust structure, more sophisticated guidance systems, and sophisticated booster recovery procedures. These increase vehicle complexity and development cost, but amortize those costs across multiple flights.

Ariane 6's commercial viability despite these disadvantages signals that customers value supplier diversity, geographic launch options, and reduced dependence on any single provider. Amazon's commitment to purchasing 18 Ariane 6 flights, despite higher costs than Falcon 9, explicitly reflects these preferences.

The Fragmentation Benefit: How Satellite Operators Win Through Competition

Satellite constellation operators benefit directly from launch market fragmentation. Competition drives pricing pressure, improves service quality, and creates redundancy. Amazon's decision to use four different launch providers—ULA, SpaceX, Blue Origin, and Arianespace—exemplifies this hedging strategy.

From Amazon's perspective, paying price premiums to maintain supplier diversity is rational risk management. If Falcon 9 faced operational constraints (which occurred in 2024-2025 due to booster anomalies), Amazon would maintain deployment momentum using alternative providers. If Vulcan boosters continued experiencing failures, Amazon could pivot additional satellites to SpaceX or Ariane 6.

This dynamic favors multiple launch providers maintaining operational capability. The market can sustain four competitors (SpaceX, ULA, Blue Origin, Arianespace) if each captures sufficient customer volume to achieve production efficiency. The question is whether markets can sustain five, six, or more competitors—a threshold where excess capacity exists and pricing pressures become unsustainable.

Geopolitical Dimensions: Space as Strategic Infrastructure

The Ariane 6 launch carries geopolitical significance beyond commercial considerations. European governments view space infrastructure as strategic capabilities comparable to transportation, energy, or communications networks. Maintaining European launch capability ensures continental independence from American launch services.

The broader geopolitical context includes concerns about American export controls on space technology, potential sanctions affecting space commerce during international disputes, and strategic advantages gained from control over orbital infrastructure. European governments, therefore, view Ariane 6 investments as worthwhile despite inferior economic efficiency compared to SpaceX alternatives.

Amazon's decision to use Ariane 6 also reflects diplomatic considerations. By supporting European launch industry, Amazon maintains favorable relationships with European regulators overseeing satellite operations, spectrum allocation, and terrestrial infrastructure. This is rational corporate strategy: government relationships matter for regulatory approval of constellation operations.

China's developing launch capabilities, including the Long March rocket family, add additional geopolitical dimension. The space launch market increasingly reflects broader great-power competition between the United States, Europe, and China. Each region pursues independent launch capability for strategic autonomy.

Challenges Facing Ariane 6: Obstacles to Long-Term Success

The Reusability Challenge: Can Expendable Vehicles Compete Long-Term?

Ariane 6's fundamental challenge is economic: expendable vehicles face structural disadvantage versus reusable platforms in mature markets. SpaceX achieved booster reusability reducing effective first-stage costs by approximately 80-90 percent. This advantage compounds over time as competition drives unit pricing toward marginal costs.

In competitive markets, pricing pressures eventually force launch costs toward unit production costs. If SpaceX's marginal cost per Falcon 9 flight approaches

Arianespace faces strategic choices: (1) develop reusable capability, accepting substantial development cost and technical risk; (2) maintain expendable design, accepting declining market share as reusable competitors capture cost-sensitive customers; (3) specialize in market segments where reusability provides less advantage, such as medium-lift missions or unusual orbits.

The company appears pursuing a hybrid strategy: maintaining Ariane 6 as expendable baseline while developing reusability concepts for future variants. This preserves near-term revenue from operational flights while investing in long-term competitiveness.

Manufacturing Capacity: Scaling from 6 to 18+ Annual Launches

Ariane 6 completed only 6 flights by early 2026, requiring expansion to 18+ annual flights to fully support Amazon's Kuiper deployment schedule. This four-fold increase in flight rate demands proportional increases in manufacturing, testing, and launch infrastructure.

Arianespace announced facility upgrades adding manufacturing capacity and launch pad infrastructure at Guiana Space Center. However, scaling manufacturing from proven prototypes to high-rate production involves challenges: supply chain constraints, workforce training, quality control, and cash flow demands.

SpaceX's vertical integration—manufacturing engines, avionics, and structures in-house—provided advantages during scaling. Arianespace relies on multiple subcontractors across European industrial base, complicating coordination and supply chain management. Component delays propagate through the manufacturing schedule, constraining flight rate.

Technology Maturity: Upper Stage Improvements and Future Variants

Ariane 6's current upper stage achieved proven operational capability, but Aschbacher's statement about "upgrades already in progress" signals plans for enhanced variants. These could include improved upper stage restart capability, longer coast times enabling multiple deployment orbits, or expanded payload capacity.

Development of new variants requires investment and introduces technical risk. SpaceX's Falcon 9 remained relatively unchanged for over a decade, allowing manufacturing optimization and cost reduction. Ariane 6 variants, if developed, would split manufacturing attention and introduce development costs.

SpaceX Falcon 9's reusable model significantly reduces costs, offering a competitive edge over Ariane 6's expendable design. Estimated data.

Future Outlook: What Ariane 6 Achievement Means for Space Industry Evolution

The Multi-Provider Future: Expecting Sustained Competition

Ariane 6's success validates sustainability of multiple launch providers serving different customer segments and geographic regions. The market, by early 2026, supported SpaceX (high flight rate, reusable), ULA (U.S. military/government, heritage), Blue Origin (early-stage, development flights), and Arianespace (European, institutional support) with additional competitors emerging globally.

This fragmentation differs from mature commercial aviation, where consolidation produced a handful of airframe manufacturers. Space launch appears to be following a different trajectory: high barriers to entry (capital, technical expertise) prevent unlimited competition, but government support and large constellation opportunities enable multiple viable competitors.

The economic question is sustainability threshold: can four major launch providers maintain profitability and investment capability in competitive markets, or will eventual consolidation to two or three providers occur? The answer depends on market growth rates, reusability improvements, and sustained government demand.

Constellation Wars: How Launch Competition Shapes Orbital Real Estate

Satellite constellation deployment costs depend entirely on launch economics. SpaceX's cost advantages with Falcon 9 provide Starlink economic advantages over competing constellations. If Starlink achieves

However, alternative scenarios exist: if terrestrial broadband serves most profitable markets, leaving satellite operators competing in lower-margin segments, profitability depends on achieving extreme cost efficiencies. Multiple constellation operators might achieve viability by specializing in different market segments or geographic regions.

Amazon's Kuiper constellation specifically targets markets where terrestrial infrastructure is economically impractical or geopolitically restricted. This segmentation strategy allows Kuiper to compete without achieving Starlink's global coverage scale.

Launch Capacity and Orbital Debris: Sustainability Questions

If multiple mega-constellations deploy thousands of satellites each (Starlink 9,000+, Kuiper 3,200+, OneWeb 650+), orbital debris accumulation becomes a serious long-term concern. Each satellite eventually reaches end of life and deorbits, creating temporary debris. Failed satellites and upper stage hardware create uncontrolled debris.

The February 2026 Ariane 6 mission deliberately deorbited the upper stage after deployment, exemplifying responsible debris management. However, not all operators follow equivalent practices. Chinese anti-satellite tests in 2007 created extensive debris fields, demonstrating the long-term accumulation risk.

Orbital sustainability requires technical standards for deorbiting, debris tracking, and collision avoidance. These standards are emerging but not yet internationally binding. Future launch rates sustainable in Earth orbit depend on solving debris and sustainability challenges.

The Broader Context: Space Industry Transformation and Ariane 6's Role

From Government to Commercial: The Privatization of Space

Ariane 6 represents a transition point in space industry evolution: the shift from government-funded, government-operated space programs toward commercial operators managing infrastructure. The European Space Agency developed Ariane 6, but Arianespace operates it commercially, competing with private firms like SpaceX.

This privatization creates both opportunities and challenges. Commercial operators focus on cost efficiency and customer service, improving industry productivity. However, purely commercial operators struggle with unprofitable government missions (science, exploration) or low-margin services (debris removal, on-orbit servicing).

Future space industry will likely consist of hybrid ecosystem: SpaceX and other commercial operators serving high-volume commercial and government customers; specialized providers handling unique missions; government agencies (NASA, ESA) funding science missions and long-term capability development.

Technology Development Cycles: Why Reusability Took So Long

SpaceX's reusable Falcon 9 represents decades of aerospace engineering development. Booster recovery requires extraordinary guidance precision, landing systems, and structural design. These technologies didn't exist until SpaceX developed them, guided by clear profit motive and willingness to accept failures as learning experiences.

Traditional aerospace companies (Boeing, Lockheed Martin, European contractors) developed incrementally, with conservative approaches and extensive testing. SpaceX's rapid iteration methodology—building, flying, learning, improving—compressed development cycles by accepting higher near-term failure rates for faster long-term progress.

This methodological difference explains why SpaceX captured launch market dominance despite late entry. Earlier competitors (Arianespace, ULA) had greater experience and resources but operated under different development assumptions that yielded slower innovation.

Vertical Integration: SpaceX's Structural Advantage

SpaceX manufactures Falcon 9 engines, structures, avionics, and related components in-house, controlling quality and schedules. This vertical integration enables rapid iteration and cost optimization. Supply delays from subcontractors don't affect SpaceX's schedule; the company manages all components directly.

Arianespace, by contrast, depends on European subcontractors distributed across France, Germany, Italy, and other nations. This international industrial base reflects political choices—sharing space industry benefits across European nations—but creates coordinating challenges and reduced agility.

Future competitive advantage likely accrues to companies combining vertical integration (manufacturing control) with partnership ecosystems (customer support, specialized services). SpaceX has pursued this hybrid strategy; Arianespace is evolving similarly through strategic partnerships.

Estimated data suggests SpaceX will hold the largest market share by 2026 due to its high flight rate and reusability, while ULA and Arianespace maintain significant portions through government and institutional support.

Conclusion: Ariane 6's Achievement and the Future of Space Launch

The February 2026 launch of Ariane 6 in its Ariane 64 configuration delivered more than satellite deployment. The mission validated that European space industry, despite decades of disruption from American commercial innovators, remains capable of fielding world-class launch capability. Amazon's decision to trust 32 Kuiper satellites to this maiden flight of the four-booster variant demonstrated customer confidence in Arianespace's engineering and execution.

The broader significance extends beyond commercial success metrics. The Ariane 6 program represents sustained institutional commitment to maintaining European strategic autonomy in space access. Government investment in space infrastructure, often criticized as inefficient compared to private sector alternatives, proved essential for sustaining competitive launch capabilities. SpaceX's achievements would not have been possible without prior government funding for foundational technology and initial customer contracts.

The launch industry in 2026 appears to be settling into a sustainable multi-provider equilibrium. SpaceX maintains cost leadership through reusable technology, achieving unmatched flight rates. ULA serves government and national security missions with proven reliability. Blue Origin is emerging as a reusable competitor for the 2027-2030 timeframe. Arianespace provides geographic diversity and alternative sourcing for customers prioritizing supplier segmentation.

Amazon's strategy to spread Kuiper deployment across all four providers exemplifies rational hedging in a complex competitive environment. The company sacrifices some unit cost efficiency through higher-priced launches, gaining insurance against single-provider capacity shortages and geopolitical disruptions. This is sophisticated procurement strategy reflecting understanding that space infrastructure matters strategically, not just commercially.

Looking forward, several critical questions emerge: Will reusable booster recovery become universal across the launch industry within five years, or will some providers maintain competitive capability through alternative architectures? Can Ariane 6 achieve sustained flight rates supporting Amazon's constellation deployment, or will manufacturing constraints limit European launch capacity? What role will Chinese launch providers play in global space commerce, and how will geopolitical competition affect launch market structure?

The Ariane 6 achievement suggests answers to these questions won't be determined by any single company or nation. Instead, space launch is evolving toward a genuinely international industry where American, European, Chinese, and emerging commercial providers compete across distinct market segments while maintaining technical leadership in specialized domains. This fragmentation may reduce efficiency compared to theoretical optimal consolidation, but provides redundancy, reduces strategic dependencies, and sustains innovation through competition.

For satellite operators like Amazon, this competitive landscape creates unprecedented optionality. Where space launch was historically constrained by limited capacity and few providers, contemporary operators can choose among multiple launch services, negotiate from positions of strength, and maintain operational resilience through diversification. The February 2026 Ariane 6 launch with 32 Kuiper satellites demonstrated that this competitive dynamic is working as intended: multiple credible providers delivering critical infrastructure at manageable costs with genuine redundancy.

The question for the next decade is whether this multi-provider, competitive launch market can sustain both profitability and innovation while managing orbital debris challenges, maintaining quality standards, and adapting to emerging technologies. If it does, space-based services—broadband constellations, Earth observation, scientific research, and future missions—will achieve unprecedented accessibility. If it doesn't, consolidation or geopolitical fragmentation may follow. For now, Ariane 6's success demonstrates that multiple paths to space leadership remain viable in the contemporary era.

FAQ

What is the Ariane 6 rocket?

Ariane 6 is the European Space Agency's latest heavy-lift launch vehicle, designed to replace the Ariane 5 rocket that retired in 2023. The rocket features a hydrogen-fueled Vulcain 2.1 main engine and can be configured with either two or four solid rocket boosters, with the four-booster Ariane 64 variant achieving the highest payload capacity of over 20,000 kilograms to low-Earth orbit. The Ariane 6 program represents Europe's effort to maintain competitive launch capability in an industry increasingly dominated by reusable rocket technology pioneered by SpaceX.

How does the Ariane 64 configuration differ from earlier Ariane 6 variants?

The Ariane 64 variant uses four solid rocket boosters attached to the core stage, compared to earlier Ariane 62 and Ariane 63 configurations that used two or three boosters respectively. This four-booster arrangement generates over 3.4 million pounds of thrust and enables payload capacity exceeding 20,000 kilograms to low-Earth orbit altitudes. The February 2026 launch marked the first-ever flight of the Ariane 64 configuration, validating design predictions about thrust levels and structural performance under maximum acceleration loads.

What was Amazon's motivation for using Ariane 6 to launch Kuiper satellites?

Amazon selected Ariane 6 to diversify its launch provider portfolio for the Kuiper satellite broadband constellation. Amazon explicitly acknowledged facing a "near-term shortage of launch capacity" that threatened deployment timelines, prompting the company to secure commitments across four separate launch providers including SpaceX, United Launch Alliance, Blue Origin, and Arianespace. By distributing constellation deployment across multiple providers, Amazon gains insurance against individual provider capacity constraints while maintaining flexibility to respond to technical issues with any single system.

What are the advantages of reusable launch vehicles like SpaceX's Falcon 9 compared to expendable rockets like Ariane 6?

Reusable launch vehicles achieve dramatic cost reductions through booster recovery and reuse. SpaceX's Falcon 9 boosters fly repeatedly—some over 20 times—reducing the effective booster cost per flight by approximately 80-90 percent compared to new manufacturing. This translates to total launch costs approaching

How many satellites did the February 2026 Ariane 6 mission deploy?

The Ariane 64 mission successfully deployed 32 Amazon Kuiper satellites into low-Earth orbit at an altitude of 289 kilometers. The payload totaled approximately 44,000 pounds or roughly 20 metric tons, representing approximately 95 percent of the vehicle's maximum lift capability to the required orbital altitude. All 32 satellites deployed successfully with no anomalies, validating the extended payload shroud and deployment mechanism specifically designed for mega-constellation missions.

What does the Ariane 6 achievement mean for the future of European space industry?

Ariane 6's successful demonstration of full four-booster capability validates European space industry's ability to compete in contemporary commercial launch markets despite technological advantages held by SpaceX and emerging competitors like Blue Origin. The program demonstrates that government-supported space industrial capabilities, developed through sustained investment by the European Space Agency, can achieve operational maturity and commercial viability. The achievement preserves Europe's position as a major spacefaring region while maintaining strategic autonomy in access to space—a capability many governments view as essential infrastructure comparable to transportation or communications networks.

How does the launch capacity shortage affecting Amazon impact satellite broadband competition?

The launch capacity shortage creates multiple effects on satellite broadband competition. First, it limits deployment rates for all constellation operators, slowing the timeline for achieving profitable service coverage. Second, it forces constellation operators toward multi-provider strategies, increasing total deployment costs through higher pricing from less-preferred providers. Third, it advantages established operators like SpaceX with dedicated launch capability (Falcon 9) over newer entrants like Amazon that must negotiate with multiple suppliers. However, the shortage also validates the business case for alternative launch providers like Ariane 6, creating market opportunities for established space contractors.

What technical challenges did Ariane 6 overcome to achieve the four-booster Ariane 64 configuration?

The Ariane 64 configuration required solutions to multiple technical challenges: aerodynamic stability with four external boosters requiring sophisticated thrust vectoring control, structural design accommodating 3.4 million pounds of combined thrust, synchronization of four separate solid rocket booster burn profiles to prevent asymmetric loading, thermal management during booster separation transients, and design of the extended payload shroud to accommodate 32 satellites while maintaining structural integrity and aerodynamic efficiency. Engineers implemented advanced sensor arrays and guidance systems to manage these complexities, with all systems performing nominally during the February 2026 mission.

What are Amazon's remaining challenges in deploying the Kuiper constellation?

Amazon faces multiple challenges in completing Kuiper deployment. First, the near-term shortage of launch capacity continues constraining deployment rates; the company has booked over 100 missions but needs reliable, predictable access to adequate lift capability. Second, competing constellation operators (primarily SpaceX's Starlink) have already deployed over 9,000 satellites, establishing market presence and revenue streams before Kuiper achieves full deployment. Third, regulatory challenges including spectrum allocation, interference management, and orbital compliance require negotiation with multiple national authorities. Fourth, achieving profitability with Kuiper requires either subscriber adoption at scales matching or exceeding Starlink's 9 million+ user base or specialized market penetration (government, maritime, aviation) supporting premium pricing.

How do government subsidies affect launch provider competitiveness?

Government subsidies, whether explicit or implicit, fundamentally reshape launch provider competitiveness. The European Space Agency invested approximately €2.4 billion in Ariane 6 development—a public investment enabling Arianespace to offer competitive pricing despite higher inherent vehicle costs. This subsidization allows Ariane 6 to compete with SpaceX despite cost disadvantages from expendable architecture. SpaceX's Falcon 9, developed primarily with private capital but supported by early government contracts from NASA and other agencies, demonstrates how government can support innovation through customer purchases rather than direct development funding. China's government directly funds launch provider operations, effectively subsidizing Long March rocket operations. These varying subsidy models distort price-based competition but reflect different national strategic assessments about space infrastructure importance.

Key Takeaways

- Ariane 6's first Ariane 64 flight successfully deployed 32 Amazon Kuiper satellites, validating Europe's heavy-lift capability and four-booster configuration

- Amazon's multi-provider launch strategy reflects rational hedging against capacity shortages and single-provider dependencies in competitive space markets

- Reusable rocket economics (SpaceX Falcon 9) create permanent cost advantages over expendable vehicles (Ariane 6), yet government support and geographic diversity preserve alternative providers

- Launch capacity remains constrained despite multiple competing providers, forcing constellation operators toward higher costs and complex procurement strategies

- Space launch industry is settling into sustainable multi-provider equilibrium: SpaceX dominates through cost leadership, while European, American, and emerging competitors maintain specialized capabilities

- Ariane 6's success depends on scaling from 6 to 18+ annual flights, requiring manufacturing expansion and managing supply chains across distributed European industrial base

- Satellite constellation deployment economics require launch cost minimization across thousands of spacecraft; different operator choices between reusable (Starlink) and diverse providers (Kuiper) yield different competitive dynamics

- Government subsidies, strategic investments, and geopolitical considerations significantly influence launch provider viability despite commercial market pressures

Related Articles

- Why Elon Musk Pivoted from Mars to the Moon: The Strategic Shift [2025]

- Commercial Deep Space Program: Congress Shifts NASA Strategy [2025]

- Rocket Lab's Archimedes Engine Explosions: Why Blowing Up Is Part of the Plan [2025]

- SpaceX Super Heavy Booster Cryoproof Testing Explained [2025]

- NASA Astronauts Can Now Take Smartphones to Space [2025]

- Elon Musk's Orbital Data Centers: The Future of AI Computing [2025]