Atlassian Stock Down 70% Despite 23% Revenue Growth: Why Markets Miss the Real Story [2025]

Introduction: The Disconnect Between Reality and Perception

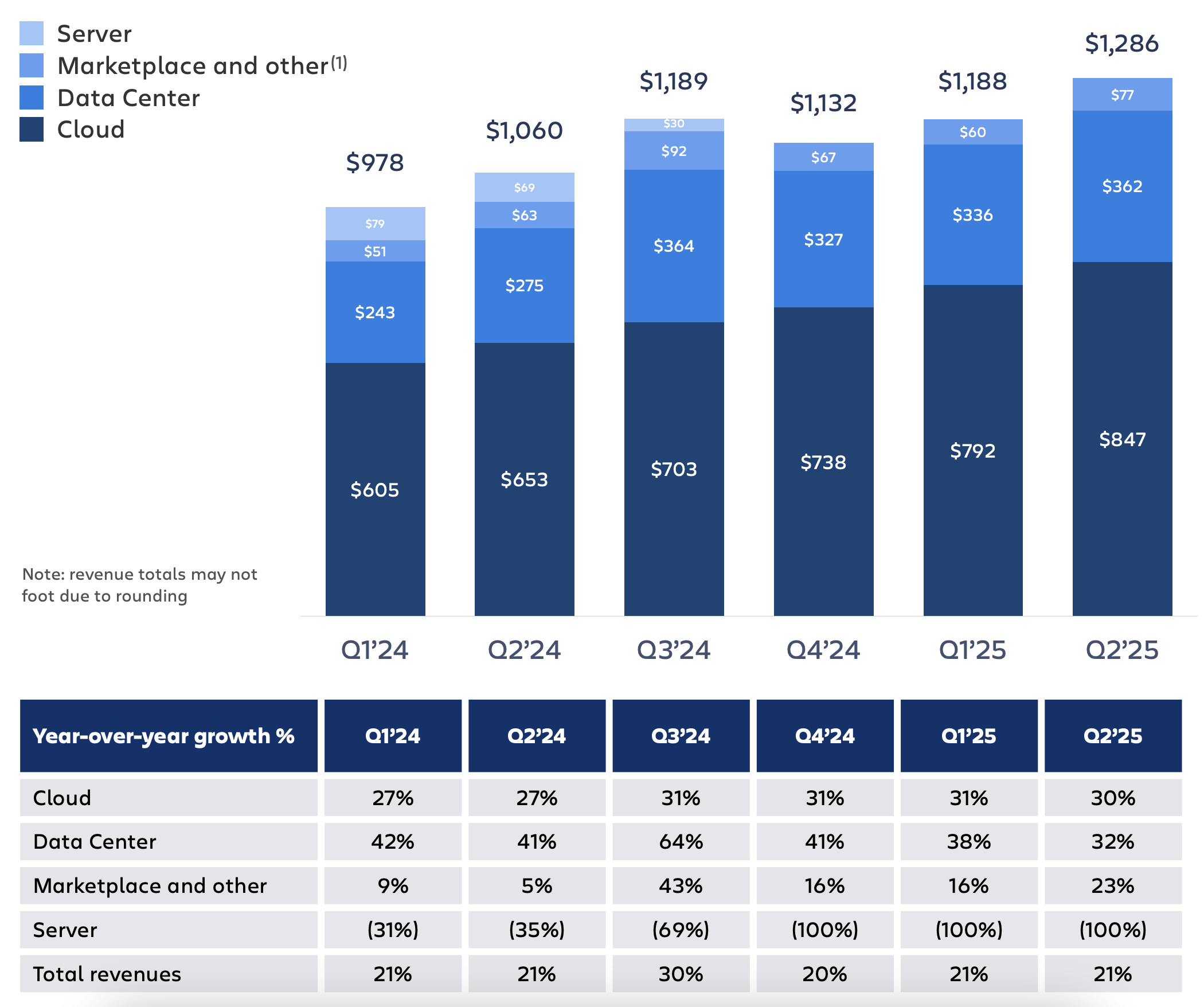

Here's something that doesn't make sense on the surface. Atlassian just reported Q2 FY26 results that would make most enterprise software companies pop champagne. They're sitting at

And yet the stock is trading around

This is one of the most fascinating disconnects in the market right now. Not because Atlassian is some struggling company hanging on by a thread, but because the fundamentals tell a completely different story than the headlines. The numbers reveal a company that's actually accelerating in the right ways, building deeper customer relationships, and moving upmarket at scale. None of that is priced in.

What's really happening here isn't about AI disruption or a collapsing software market. It's about how the market misreads the signals of mature, enterprise-focused SaaS businesses operating at scale. It's about the difference between revenue growth and expansion velocity. It's about understanding what Remaining Performance Obligations (RPO) actually tell you about customer commitment. And it's about recognizing that sometimes the best buying opportunities appear when everyone else is panicking about the wrong thing.

Let's dig into the five most important numbers from this quarter, what they actually mean, and why the market got the story completely backwards.

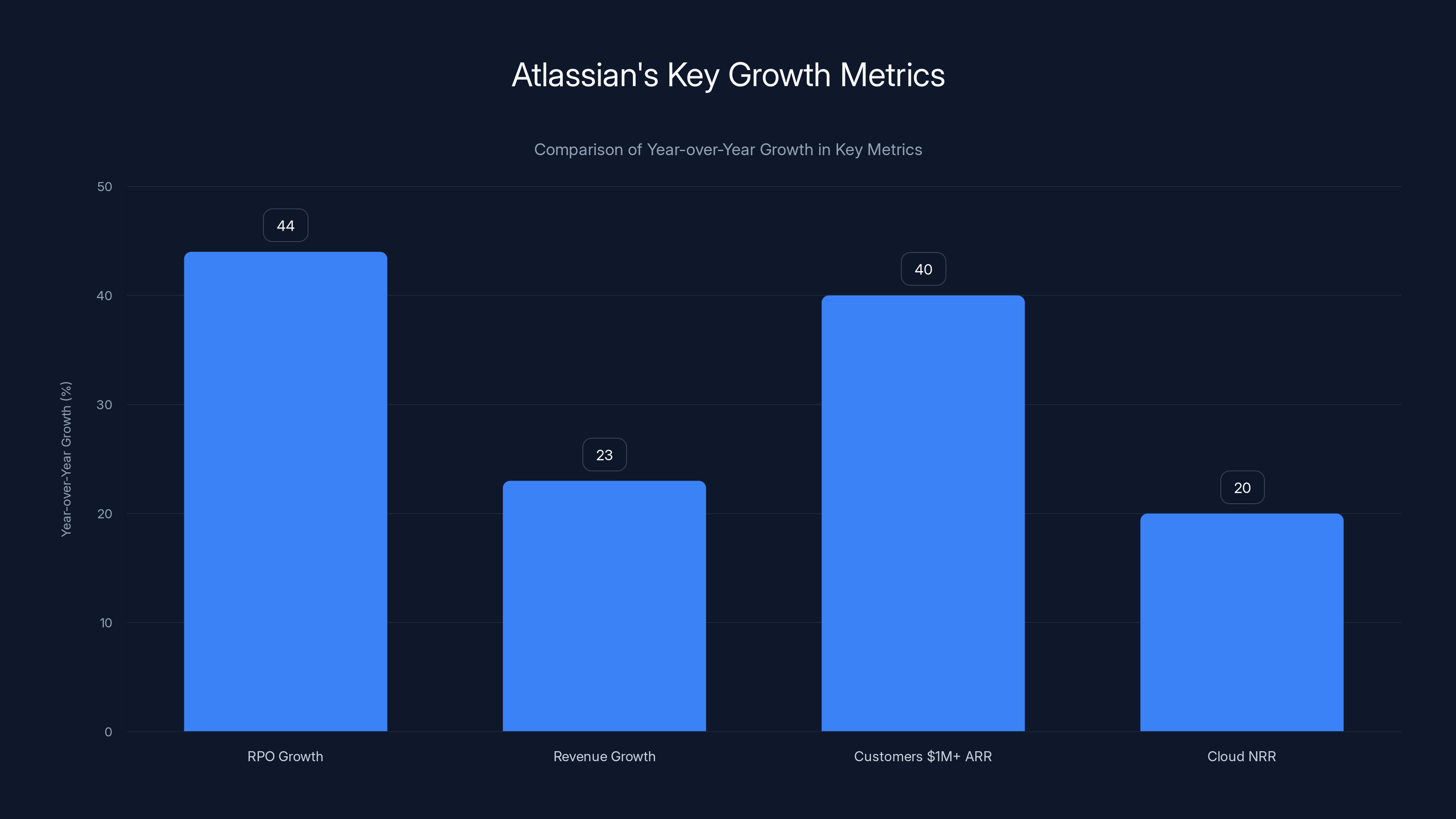

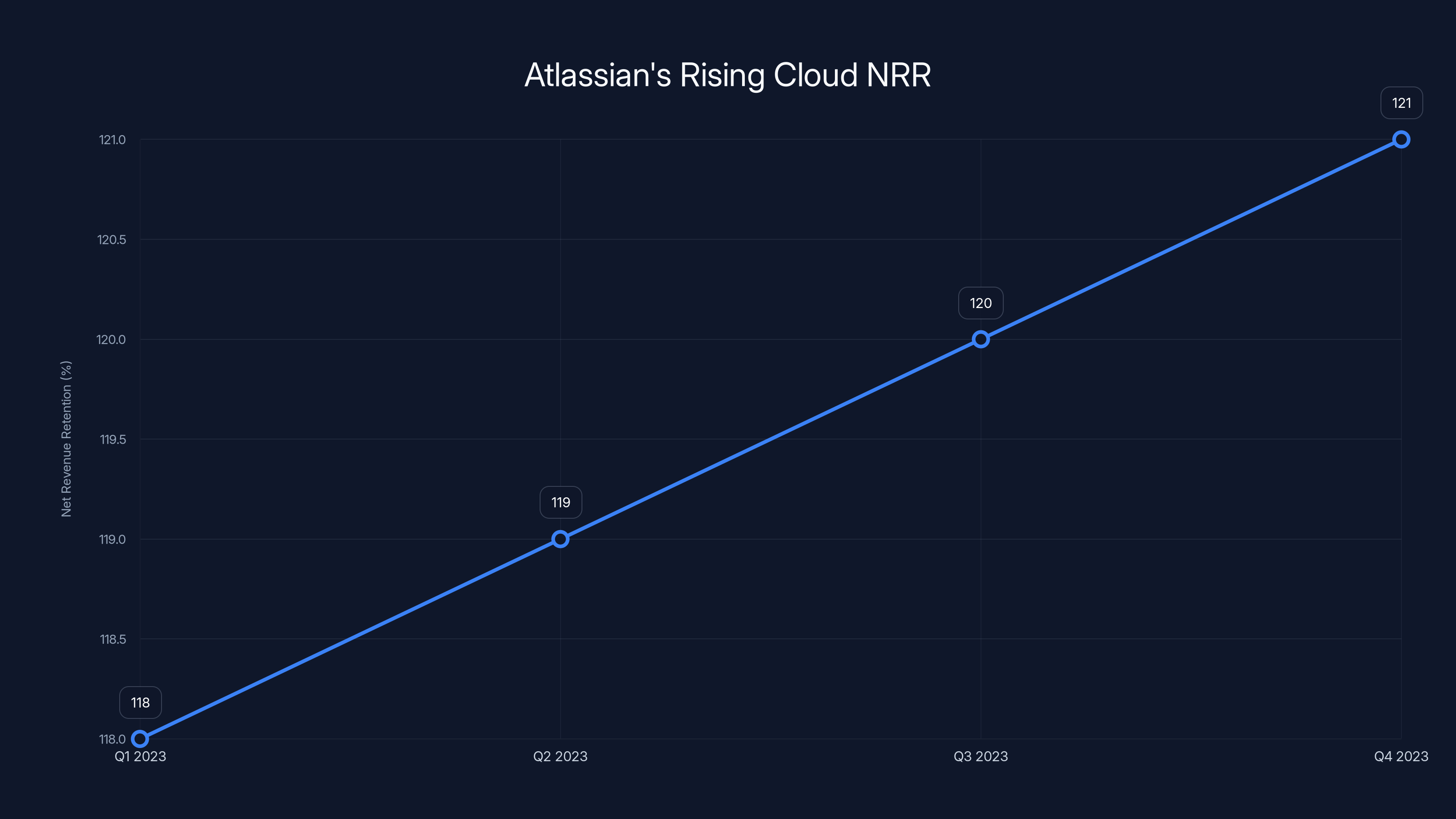

Atlassian's Remaining Performance Obligations (RPO) grew by 44% YoY, significantly outpacing revenue growth at 23%. The number of customers generating $1M+ ARR increased by 40%, while Cloud Net Revenue Retention (NRR) expanded by 20% YoY. Estimated data for Cloud NRR growth.

TL; DR

- RPO Growth Crushing Revenue Growth: Remaining Performance Obligations hit $3.8 billion, up 44% YoY, while revenue grew only 23%. This signals customers are committing to longer, larger contracts and indicates accelerating enterprise momentum.

- Enterprise Motion Is Now The Engine: Over 600 customers generating 1M+ ACV deal volume nearly doubled, with major enterprises like Audi, Reddit, United Airlines, and Royal Caribbean standardizing on Atlassian across entire organizations.

- Cloud NRR Expanding at Scale: Net Revenue Retention hit 120%+ and is rising for the third consecutive quarter at over 800M+ in net organic expansion annually without signing new customers.

- Market Valuation Completely Detached from Fundamentals: Stock down 70% while enterprise metrics are accelerating, RPO is surging, and the customer base is generating unprecedented expansion revenue. The market is pricing in disruption that isn't showing up in the numbers.

- The Real Story: Atlassian isn't facing existential AI threats. It's becoming more strategic to enterprise customers while maintaining a bottoms-up self-serve engine that still drives growth and profitability.

1. The RPO Explosion: Why 44% Growth Matters More Than 23% Revenue Growth

If you only read one section of this analysis, read this one. Remaining Performance Obligations is the number that almost everyone overlooks, and it's the single most important metric in Atlassian's quarter.

Here's what happened: RPO hit

Revenue growth is 23%. RPO growth is 44. That's not a coincidence. That's a signal.

Understanding RPO: The Hidden Backlog of Future Revenue

RPO represents contracted future revenue that hasn't been recognized yet. It's essentially the company's backlog. When a customer signs a three-year deal, the entire dollar value goes into RPO. As Atlassian delivers the service each month, it pulls that dollar amount down and recognizes it as revenue.

Here's why this matters: when RPO growth significantly outpaces revenue growth, it tells you customers are signing longer contracts and paying bigger numbers upfront. They're not just renewing annually anymore. They're committing further out.

At a $6B+ annual revenue business, this is unusual. Most companies at this scale see RPO growth compress. The math is brutal: to maintain the same percentage RPO growth on a larger revenue base, you need exponentially more absolute dollars of new commitments. Atlassian is actually accelerating through that headwind.

Management explicitly noted that customers are committing not just through 2026, but through 2027, 2028, and 2029. That's the behavior of a company that's become strategic and mission-critical to its customers, not a company facing disruption.

The Enterprise Shift Hiding in the RPO Numbers

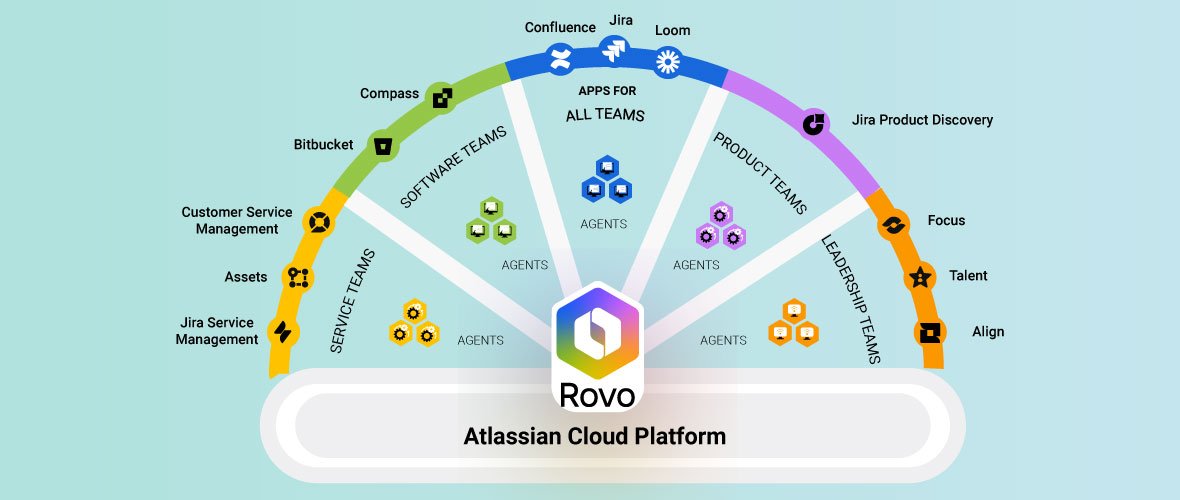

Where's all this incremental RPO coming from? Primarily from the enterprise side. Atlassian started as a completely bottoms-up, self-serve, developer-driven company. Jira, Confluence, Bitbucket: all tools that engineers loved and bought without asking IT permission.

That distribution model is still working. Atlassian still has 350,000+ customers, including 80% of the Fortune 500, through their self-serve channels.

But something else is happening now. Enterprises aren't just discovering Atlassian through developer adoption anymore. They're standardizing on it across entire organizations. Service Cloud grew 60% YoY specifically because enterprises are buying Atlassian's products for IT service management, not just software development teams.

When the IT director at Goldman Sachs or Microsoft or Ford decides to standardize on Atlassian across the whole company, that's a three-year, five-year commitment. That customer is now worth

That's what's flowing into RPO.

Current RPO vs. Total RPO: The 12-Month Signal

There are two RPO numbers to watch: total RPO and current RPO. Current RPO is the portion recognized within 12 months. Total RPO includes everything beyond that.

Current RPO at 30% growth is solid. It suggests that Atlassian will continue to recognize strong revenue growth over the next year. But the fact that total RPO is growing even faster (44%) tells you that the company is loading up even longer-term commitments beyond the next 12 months.

This is the difference between a company that's retaining customers and a company that's securing their future. Atlassian is doing both.

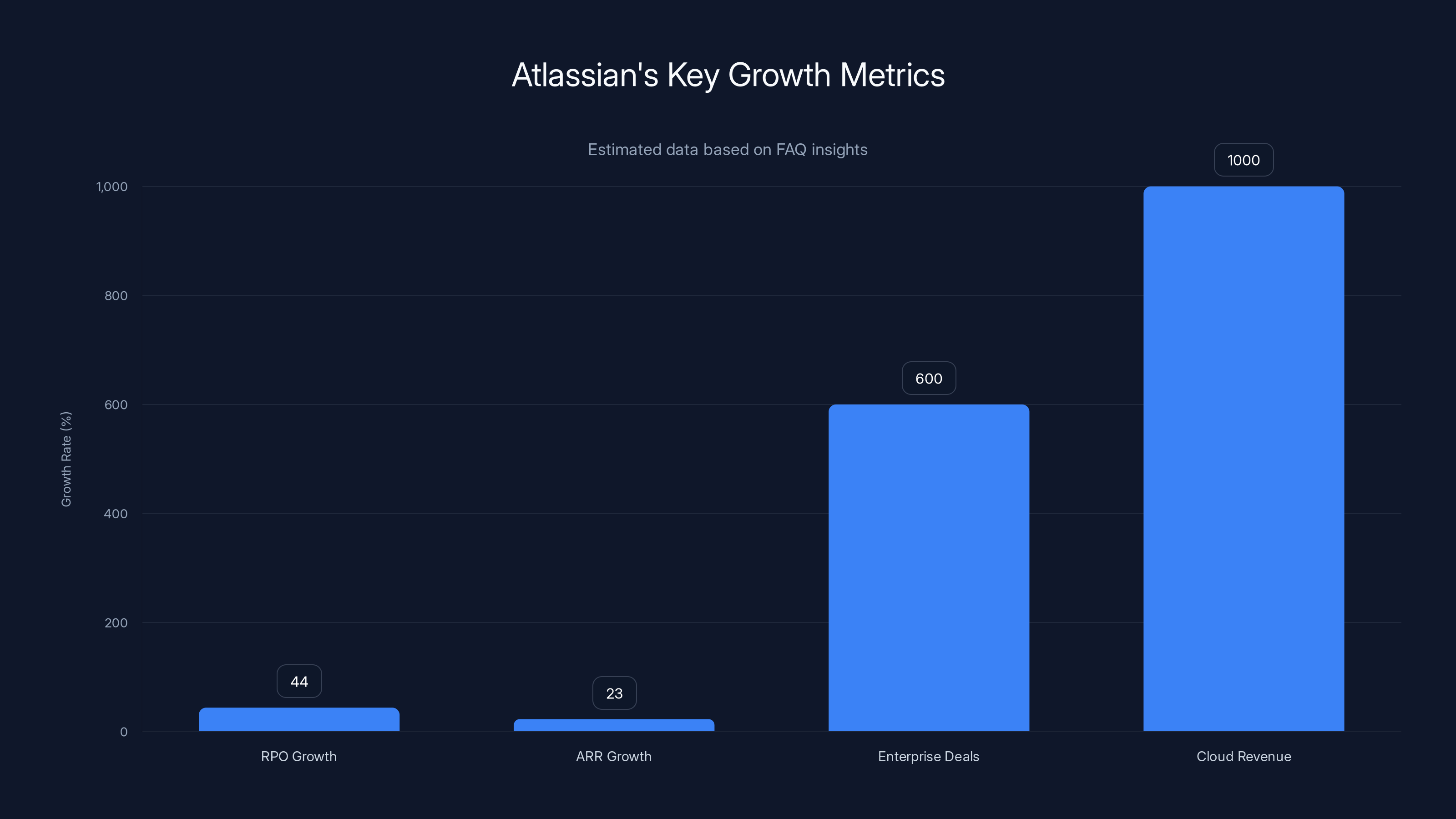

Atlassian's RPO growth is at 44% YoY, ARR growth at 23%, with over 600 enterprise deals and $1B in cloud revenue, indicating strong market confidence and future revenue predictability. Estimated data.

2. The Enterprise Inversion: From Developer Tools to C-Suite Platforms

Atlassian's founding narrative is embedded in every venture capital pitch about bottoms-up SaaS. Engineers install Jira because it's the best issue tracker. Engineering managers adopt Confluence because it's the best wiki. These tools spread organically, without sales teams, without enterprise deals, without asking permission from IT or finance.

It's a beautiful model. It's also limited.

Because once every developer in the world is using your tool, growth has to come from somewhere else. Either you monetize developers more aggressively (raising prices), or you move upmarket. Atlassian chose to move upmarket.

But here's what's fascinating: they're doing it without killing the bottoms-up engine.

The 600-Customer Inflection Point

Atlassian now has over 600 customers generating $1 million or more in annual recurring revenue. That number grew 40% year-over-year. Let's think about what that means.

A company paying $1M per year for Atlassian products isn't an anomaly anymore. It's part of the normal customer base. Most of those companies are paying that because they've standardized across multiple Atlassian products (Jira, Confluence, Service Cloud, Bitbucket, Jira Service Management) across multiple teams and departments.

Think about Reddit. Reddit runs on Jira for engineering. They use Confluence for documentation. They use Service Cloud for IT operations. They use Bitbucket for code hosting. Across engineering, product, IT, maybe legal and compliance: suddenly you're at $1M+ annually. For an enterprise like Reddit with thousands of employees, that's actually economical.

When you multiply that across 600+ customers, it's a massive revenue engine.

Record $1M+ ACV Deals: Nearly 2x Growth

The number of deals where the Annual Contract Value exceeds $1 million nearly doubled year-over-year. Doubled. Not "grew 30 percent" or "grew 50 percent." Nearly doubled.

These are enterprise transformation deals. These are the kind of contracts where an enterprises' procurement team is involved, where the CIO is signing off, where there's a multi-month implementation process, and where the customer is betting that Atlassian's platform is going to support their core business operations.

Management mentioned specific deal logos: Workday, Publicis Groupe, Synchrony. But in their latest reporting, they highlighted much bigger names. Audi. Reddit. United Airlines. Royal Caribbean. Roblox. Air France-KLM. Domino's. Harper Collins.

These aren't small companies experimenting. These aren't engineering teams buying point solutions. These are enterprise-wide platform bets.

Service Cloud Leading the Enterprise Charge

Service Cloud, Atlassian's IT service management and customer support platform, grew 60% year-over-year in Q2. That's not revenue growth across all products. That's a single product line growing 60%. That's faster than the company-wide growth rate.

Why does that matter? Because Service Cloud is inherently an enterprise product. You don't use Service Cloud for a five-person startup. You use it when you have actual IT operations, when you have support tickets, when you have incident management processes. Service Cloud is what gets the CIO and the CISO to the table.

When Service Cloud is the fastest-growing product line, it means enterprise adoption is accelerating. The bottoms-up developer adoption model is still working (Jira is still huge), but the upmarket motion is actually driving incremental growth velocity.

350,000 Customers + 80% of the Fortune 500: The Rare Combination

Most companies have to choose. You can either have breadth (lots of small customers) or depth (fewer large customers). Atlassian has both.

350,000 total customers means the self-serve, bottoms-up engine is still firing. These are mostly developers, small teams, small companies paying hundreds or thousands per month.

80% of Fortune 500 means the big enterprise motion is working too. These are Fortune 500 companies with 600+ employees where Atlassian is a mission-critical platform.

Retaining both motions simultaneously is harder than it sounds. It requires maintaining separate product experiences, separate sales processes, separate support models. Most companies drop one in pursuit of the other. That Atlassian is growing both simultaneously is genuinely remarkable.

3. Cloud NRR Above 120% and Rising: The Expansion Flywheel

Net Revenue Retention is the metric that separates great SaaS companies from good ones. It measures how much revenue you're generating from existing customers through expansion, upsell, and cross-sell, minus churn.

If your NRR is 100%, you're replacing all the customers you lose by expanding with existing customers. If it's above 100%, you're actually growing revenue from existing customers faster than you're losing them to churn.

Atlassian's cloud NRR is now above 120%. And here's the thing nobody expected: it's been rising for three consecutive quarters.

The Scale Problem That Atlassian Is Solving

Most software companies experience NRR compression as they scale. Here's why: NRR as a percentage gets harder to maintain as your revenue base grows.

Say you have a customer paying

Now say you have a customer paying

At

To maintain 120%+ NRR while generating that much absolute expansion dollars is genuinely hard. Most companies can't do it. Atlassian is not only doing it, it's accelerating.

Where Is Expansion Coming From?

The expansion is flowing through multiple channels:

-

Product expansion within existing customers: A team that started with Jira is now buying Confluence, Service Cloud, and Jira Service Management. That's cross-sell expansion.

-

User expansion: Existing customers are adding more users. As Atlassian products become more central to how organizations work, more departments get access.

-

Tier expansion: Customers start on a lower tier and move to higher tiers as they need more features, more seats, more support.

-

Geographic expansion: Customers who started with Atlassian in North America are expanding to Europe, Asia, other regions.

-

Department expansion: A tool that started in engineering is now used in product, IT, legal, HR. Atlassian is becoming more horizontal within its customers.

All of that is included in that 120%+ NRR number.

Three Quarters of Acceleration: Not a Blip

One quarter of NRR growth could be a blip. Two quarters could be timing. But three consecutive quarters of NRR expansion? That's a trend.

This tells you that expansion economics are actually improving as Atlassian gets larger and more strategic. Customers are finding more ways to use the platform. The value they're getting is increasing. They're willing to pay more.

This is the opposite of the narrative about mature SaaS companies facing inevitable churn and compression. Atlassian is expanding faster, not slower, as it matures.

The $800M Organic Expansion Engine

Let's put a number on this because it's important: at

That's the size of a large independent SaaS company. Atlassian is essentially growing a new company's worth of revenue every year from customers it already has.

That's not what a company facing disruption looks like. That's what a company becoming increasingly central to its customers looks like.

4. The Cloud Inflection: $1B in Quarterly Cloud Revenue

Atlassian just reported its first-ever $1 billion cloud quarter. This isn't just a milestone—it's an inflection point.

For context, Atlassian has been running a huge server business (on-premise) for years. Server was the legacy, the cash cow, the source of most revenue. Cloud was the future, but it required customers to migrate, to change their processes, to trust their data to Atlassian's infrastructure.

For years, Server was larger than Cloud. Cloud was growing faster, but from a smaller base.

Now Cloud is the dominant business. It's growing at 23% (the company-wide growth rate), but from a base that's larger than Server ever was. Server is being wound down.

Server to Cloud Migration: The Hard Transition Done

The transition from on-premise to cloud is one of the hardest transitions a software company can execute. It requires:

-

Building cloud infrastructure: Atlassian had to build secure, scalable, multi-tenant cloud infrastructure. This is expensive and requires different architecture than on-premise software.

-

Migrating existing customers: Server customers have years of customizations, data, integrations. Migrating them to cloud is not trivial. Some never move.

-

Managing two businesses simultaneously: While migrating to cloud, Atlassian had to maintain the server business, fix server bugs, release server patches. Managing two codebases is expensive.

-

Overcoming customer resistance: Many enterprises prefer on-premise software for security, compliance, and data residency reasons. Convincing them to move to cloud takes time and sometimes requires feature parity and compliance certifications.

Atlassian executed this transition cleanly. Cloud is now the dominant business. Server is in rundown mode. The migration is essentially complete.

When that's done, profitability typically improves because you're no longer maintaining two separate products and sales motions.

Cloud's Margins Are Better Than Server

On-premise software is cheap to build once but expensive to support. Every customer has a different infrastructure, different integrations, different customizations. Support costs can be brutal.

Cloud software has high upfront infrastructure costs but much lower per-customer support costs. All customers run the same version on shared infrastructure. Updates are instant, not customer deployments. Problems affect everyone or no one—there are fewer one-off issues.

As Atlassian's revenue shifts from Server to Cloud, gross margins and operating margins should improve. That hasn't fully shown up yet because Atlassian is still investing in infrastructure and handling the transition costs.

But over the next 2-3 years, as the Server business continues to shrink and Cloud continues to dominate, profitability should expand significantly.

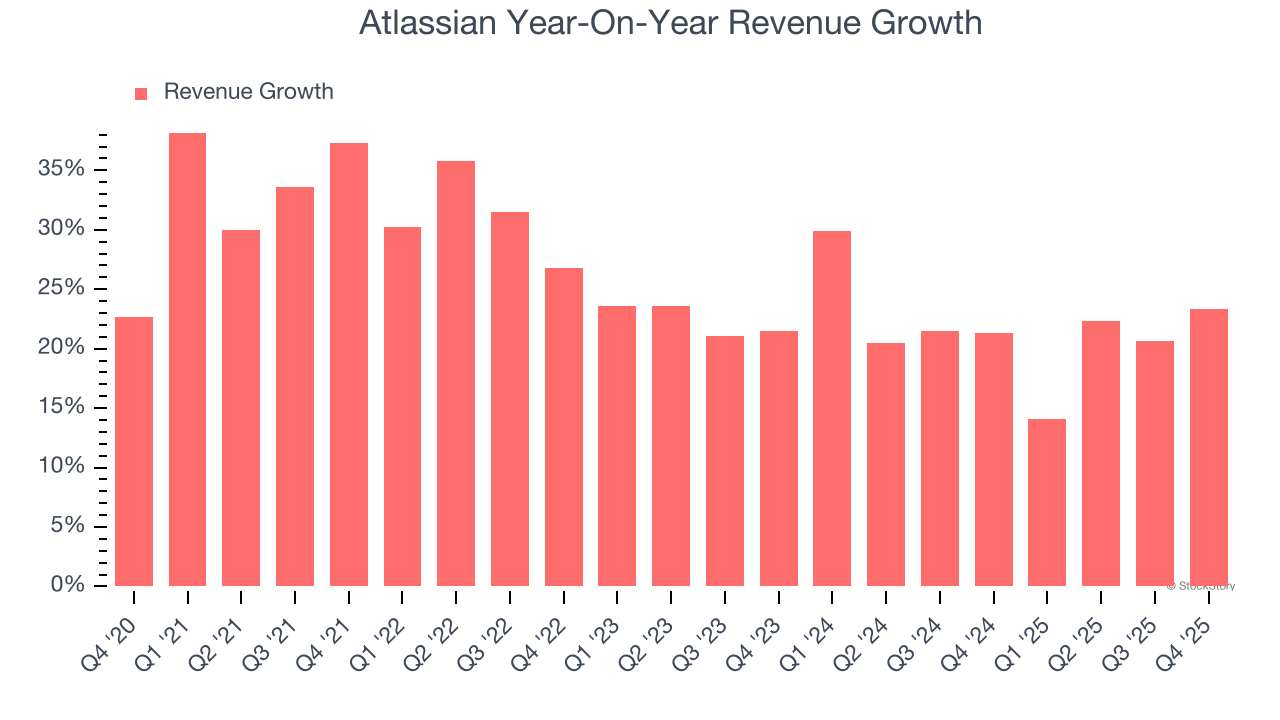

The 23% Cloud Growth Rate

Cloud is growing at exactly the company-wide growth rate: 23%. That might sound slow compared to hypergrowth SaaS companies, but at $4.3 billion in ARR, 23% is genuinely healthy.

For context:

- Salesforce, a $40B+ company, grows in the 10-15% range

- ServiceNow, a $25B+ company, grows in the 20-25% range

- Microsoft Office 365 cloud subscriptions grow in the 10-15% range

Atlassian is in that elite company tier for growth rate at scale. That 23% isn't a slowdown. It's the reality of very large enterprise software businesses.

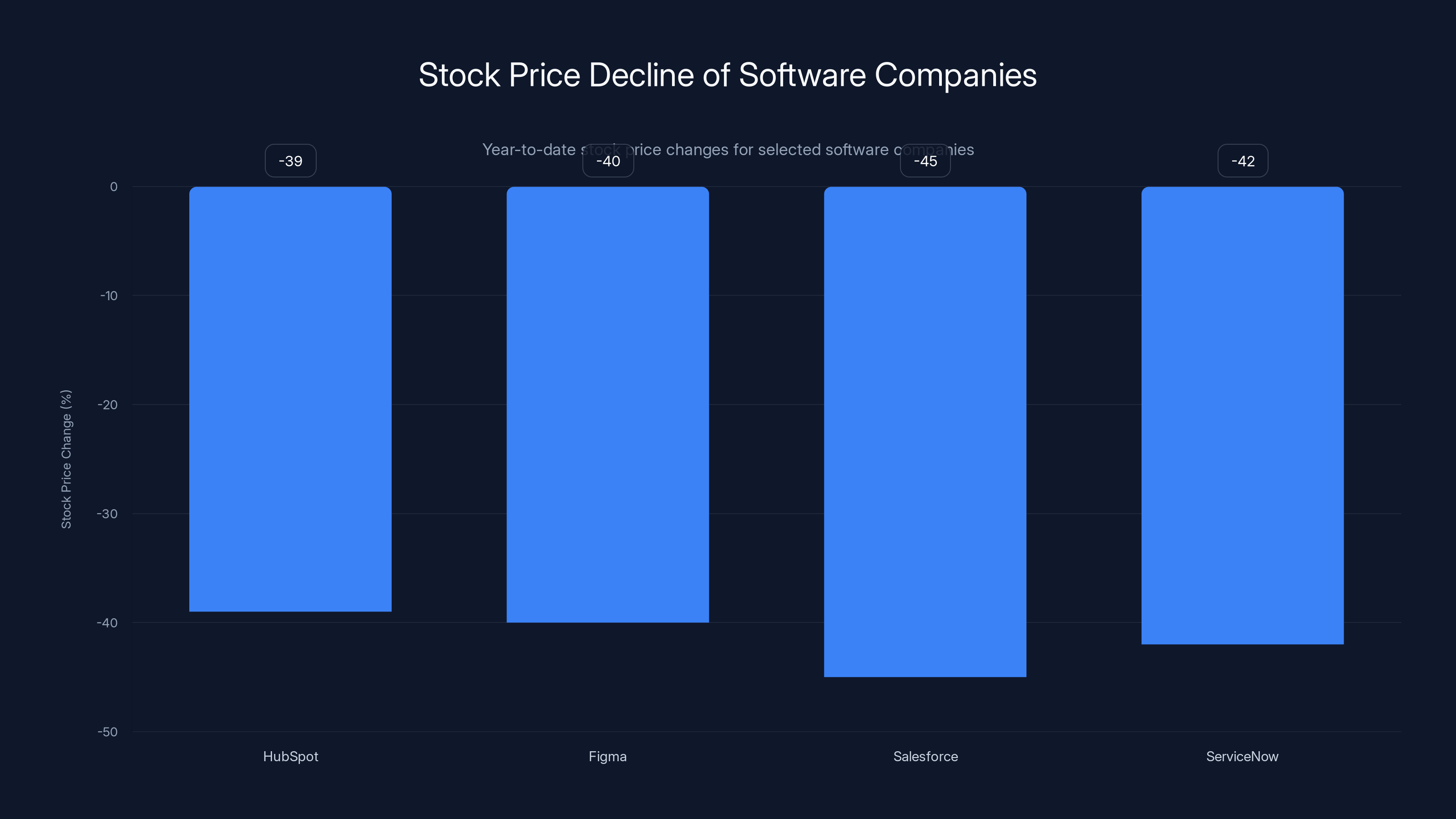

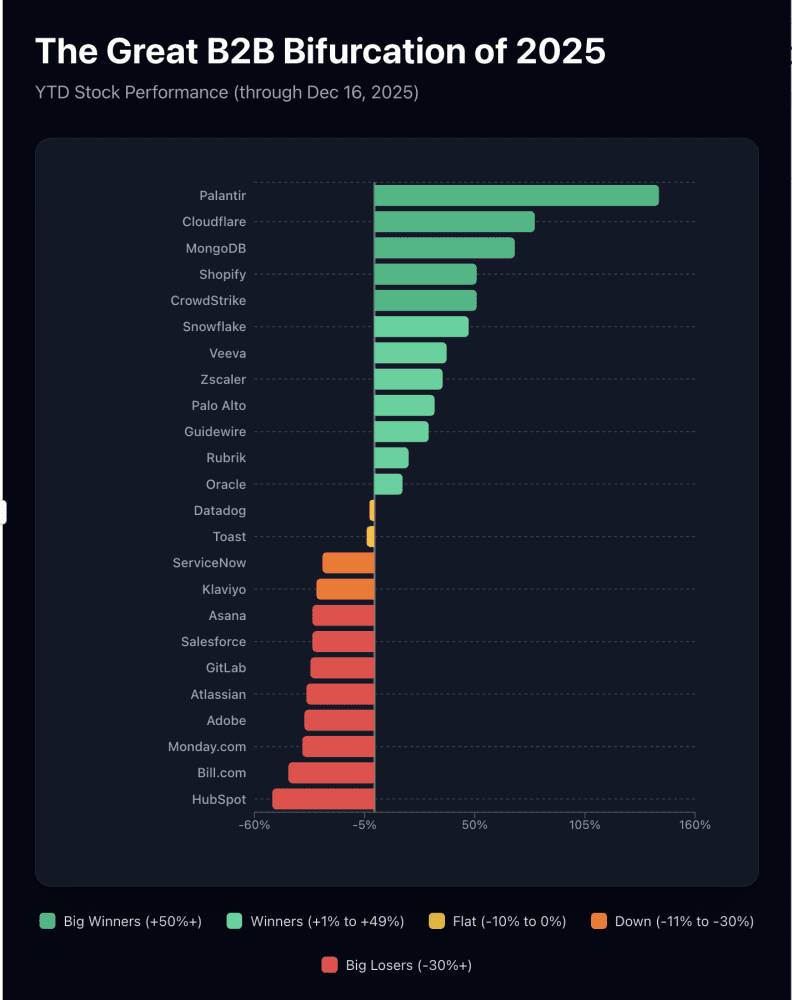

Software companies have seen significant declines in stock prices, with Figma and HubSpot both down around 40% YTD. Estimated data based on narrative.

5. The Stock Price Disconnect: Why the Market Is Completely Wrong

Here's the thing that doesn't make sense: all of these metrics are accelerating or holding strong, yet the stock is down 70% from its peak.

What's the bear case? AI will replace all software. Customers will switch to AI agents instead of Atlassian. The software market is dead.

Except it's not showing up in the numbers. Revenue is still growing 23%. RPO is accelerating. NRR is expanding. Enterprise deals are doubling. And yet the stock is priced as if the company is going bankrupt.

The AI Panic That Isn't Supported by Evidence

Every software company's stock has been hammered in the past 18 months. HubSpot is down 39% YTD. Figma is down 40%. Salesforce is down significantly. ServiceNow is down.

The narrative is that AI will displace all of these companies. Customers will use Chat GPT or Claude or Gemini instead of paying for expensive software.

But Atlassian doesn't show AI displacement risk. They show the opposite:

- RPO is accelerating (customers are committing longer)

- Enterprise customers are doubling down (600+ at $1M+)

- NRR is expanding (existing customers are using more)

- Cloud is at peak momentum (the modern version of the platform)

None of that looks like a company losing customers to AI disruption.

Valuation: 4x Forward Revenue Is Cheap

Atlassian is trading at approximately 4x forward revenues. For context:

- Microsoft trades at 10-15x forward revenues

- Salesforce trades at 8-10x forward revenues

- ServiceNow trades at 10-12x forward revenues

- Datadog trades at 12-15x forward revenues

- Elastic trades at 8-12x forward revenues

All of these companies have lower growth rates than Atlassian. All of them trade at higher multiples. Atlassian at 4x forward revenues is either a screaming bargain or the market knows something we don't.

Given that the fundamentals are accelerating, not decelerating, it's looking more like a bargain.

The Maturity Argument (Weak)

One argument is that Atlassian is "just a mature company" and doesn't deserve a premium valuation. Fair. Most mature SaaS companies trade at 5-8x forward revenue.

But Atlassian is still growing at 23% at a $6B+ run rate. That's not mature. That's still high-growth. Most mature companies grow in the single digits.

Also, the cloud NRR expansion and RPO acceleration suggest the business is accelerating, not maturing. Mature companies usually see these metrics compress.

Profitability Isn't Being Valued

Here's another thing the market isn't pricing in: Atlassian is profitable. And growing. At the same time.

Most SaaS companies have to choose: grow fast and burn cash, or be profitable and grow slowly. Atlassian is doing both. That's rare.

Operating leverage from the server-to-cloud transition, from the sales organization becoming more efficient, from cloud margins improving: all of that is coming.

In 2-3 years, Atlassian could be growing 20%+ and running at 30-40% operating margins. That would be a legitimately elite profile for a $6B company.

That's not priced in at 4x forward revenues.

6. Remaining Performance Obligations Deep Dive: The Real Growth Engine

We touched on RPO earlier, but it deserves a deeper look because it's the number that most completely contradicts the "Atlassian is doomed" narrative.

How RPO Actually Works: Mechanics

When Atlassian sells a customer a three-year contract for

- Deal closed: $3 million goes into RPO immediately

- Year 1: The company recognizes 1 million

- Year 2: The company recognizes another 1 million

- Year 3: The company recognizes the final $1 million and RPO hits zero

At any point in time, RPO = future contracted revenue not yet recognized.

Why does this matter? Because RPO is forward-looking. Current RPO tells you what revenue is committed for the next 12 months. Total RPO tells you what's committed beyond that.

If RPO is growing faster than revenue, it means customers are signing longer, bigger contracts. They're committing further into the future.

The 44% Growth in Context

Atlassian's total RPO hit $3.8 billion, up 44% year-over-year. That's nearly double the revenue growth rate.

To put this in perspective:

- **3.8 billion in contracted future revenue

- **6.4 billion per year in recognized revenue

- Combined annual visibility: Between the ARR and current RPO, Atlassian has massive revenue visibility

With

For a mature, enterprise-focused company, that's a huge moat against uncertainty.

Current RPO Growth (30%) Is the 12-Month Signal

Current RPO—the portion recognized in the next 12 months—grew 30%. That's still below the total RPO growth of 44%, which means customers are signing longer contracts than they did a year ago.

Think about it this way:

- Year ago: Customers were signing mostly 1-2 year contracts

- Now: Customers are signing mostly 2-3 year contracts

- Future: The longer contracts will flow through as "current RPO" in future years

So even if Atlassian doesn't sign a single new customer, the current RPO growth of 30% alone would drive revenue growth of roughly 25-30% next year.

That's before any new logo growth, before any expansion with existing customers, before any price increases. Just from longer contract terms flowing through.

The Backlog Is Built for Years Ahead

This is what's extraordinary: Atlassian is building a revenue backlog that extends multiple years into the future. In an environment where most software companies are struggling with churn and short contract terms, Atlassian is getting customers to commit through 2028 and 2029.

That's what changes a company from "growing but vulnerable" to "structurally strong." Once customers have committed to pay for years, they've essentially reduced their switching risk. The switching costs of moving away from Atlassian are much higher if you're locked in through 2029.

7. Enterprise Momentum: From "Developers Love This" to "CFOs Are Buying This"

Atlassian was born from a simple insight: developers are willing to pay for tools that solve their problems better. The company built some of the most beloved developer tools on the planet: Jira, Confluence, Bitbucket.

But at $6B+ in ARR, you can't grow 20%+ per year just by selling more to developers. There are only so many developers in the world, and most of them already know about Atlassian.

The only way to grow is to move upmarket. And that's exactly what's happening.

Major Enterprise Logos: The New Normal

Look at the latest deal logos Atlassian highlighted:

- Audi: A $60B+ automotive company

- Reddit: A $10B+ social media company

- United Airlines: A $50B+ global airline

- Royal Caribbean: A $20B+ cruise company

- Roblox: A $10B+ metaverse gaming company

- Air France-KLM: A $30B+ airline group

- Domino's: A $15B+ pizza company

- Harper Collins: A multi-billion dollar publishing company

These aren't tech companies buying a developer tool. These are mainstream enterprises across industries (automotive, hospitality, airlines, retail, publishing) standardizing on Atlassian as their work management platform.

That's a fundamental shift in market positioning.

Service Cloud Enabling the Enterprise Move

The reason these enterprise logos matter is that many of them aren't buying Atlassian for software development. They're buying Atlassian for IT service management, customer support, team collaboration, and work management.

Service Cloud is the product that enables that. It's not a developer tool. It's a platform tool.

When Royal Caribbean buys Atlassian, they're not buying it so the engineering team can manage code repositories. They're buying it so IT can manage incidents, so operations can manage tickets, so departments can collaborate on projects.

Service Cloud growing 60% YoY is the proof that enterprise IT buyers (not developers) are becoming a meaningful revenue contributor.

$1M+ ACV Deals Nearly Doubled

We mentioned this earlier, but let's think about the implications. When Atlassian signs a $1M+ ACV deal with Audi or United Airlines, that's not a single-team purchase. That's a company-wide platform purchase.

Audi with 100,000+ employees is buying Atlassian for teams across engineering, operations, quality assurance, manufacturing, supply chain, and IT. United Airlines is buying Atlassian for flight operations, crew management, engineering, IT, and customer support.

These deals are huge. They're multimillion-dollar commitments. They're strategic to the enterprise. They're also very sticky because they touch so many parts of the organization.

The Installed Base Acceleration

Here's what matters for long-term growth: once you have 600+ customers at $1M+ ARR, you have a large installed base of mission-critical deployments. These customers are expanding, not shrinking. They're adding more use cases, more departments, more data.

In 3-5 years, Atlassian could have 1,000+ customers at $1M+ ARR. At that scale, growth from account expansion alone could be 15-20% per year.

That's before any new logo growth, before any product innovation, before any AI features. Just from expanding within the existing base.

Atlassian's Cloud NRR has been rising steadily over the past year, reaching over 120% in Q4 2023. This indicates strong revenue growth from existing customers, defying typical NRR compression at scale. (Estimated data)

8. The Bottoms-Up Engine Still Works (And Why That's Important)

Here's a risk that nobody talks about: as Atlassian moves upmarket, does it cannibalize the bottoms-up self-serve business? Does the self-serve engine slow down as the company focuses on enterprise sales?

The answer appears to be no. The bottoms-up business is still working.

Atlassian still has 350,000+ customers, including 80% of the Fortune 500. That's a much larger customer base than any of its competitors. That breadth matters.

Why 350,000 Customers Still Matters

Most SaaS companies have to choose: be a land-and-expand company (small customers that expand to large customers) or be an enterprise-focused company (large customers only).

Atlassian is doing both. It has 350,000 customers for the land part (breadth) and 600+ at $1M+ for the expand part (depth).

Why is that valuable? Because it means:

-

Distribution optionality: New product features can be sold through both channels. Atlassian doesn't need to rely on sales teams to scale.

-

Data advantage: 350,000 customers means enormous amounts of data about how teams work, what features matter, what workflows are common. That data is valuable for product development.

-

Switching costs: If you're using Jira as a developer and then Confluence for documentation and then Atlassian moves upmarket and you discover Atlassian also does IT service management, you're already locked in. Switching costs are high.

-

Pricing power: When a small customer grows into a medium customer and then into an enterprise, they're already happy with Atlassian. They'll pay more for the same product because the switching costs are high.

The Self-Serve Machine

One of Atlassian's superpowers is that it doesn't need sales teams to acquire customers. The product spreads through word-of-mouth, through developer communities, through organic channels.

That means the cost of acquisition is low relative to other enterprise software companies. When your CAC is low and your LTV is high, margins can be extraordinary.

As Atlassian matures, as cloud margins improve, and as the self-serve channel remains effective, operating leverage is going to expand significantly.

9. Why the Market Got This Wrong: The AI Panic Narrative

If the fundamentals are accelerating—RPO up 44%, enterprise momentum strong, NRR expanding—why is the stock down 70%?

The answer is that the market created a narrative about AI eating the lunch of all software companies, and that narrative became more important than the facts.

Here's what happened:

The Chat GPT Disruption Theory

When OpenAI released Chat GPT, venture capital and Wall Street became convinced that AI would displace most software companies. Why pay for Salesforce when Chat GPT could write SQL queries? Why pay for Figma when AI could generate designs? Why pay for Atlassian when AI agents could manage your workflow?

There was a logic to the argument. But it ignored one thing: the companies best positioned to win from AI are the ones with the most customers, the most data, the most distribution.

Small, capital-efficient, API-based companies that already own relationships with customers are not the ones vulnerable to disruption. They're the ones best positioned to add AI features on top of their existing platform.

Atlassian isn't competing against Chat GPT. Atlassian is competing against other work management platforms. And in that competition, Atlassian is winning.

The Macro Panic

Another narrative driving the stock down is the general macro panic about interest rates, inflation, and recession. When bonds offer 5% yields with no risk, investors become less willing to pay high multiples for growth stocks.

That's real. That's happening. But it doesn't explain a 70% drop when the fundamentals are accelerating.

Most of the 70% decline happened because of the AI panic narrative, not the macro environment. When the narrative changed, investors decided to exit positions based on fear rather than based on fact.

The Analyst Downgrade Cascade

Once the stock started falling, the analyst community rushed to downgrade estimates. Analysts don't want to look stupid, so they justify selling by downgrading. This creates a cascade:

- Stock falls on fear narrative

- Analysts downgrade

- Stock falls more

- Investors assume analysts know something

- More selling

But the analyst downgrades were based on the same fear narrative, not on new information about the business.

10. Structural Strengths That Are Being Ignored

Beyond the quarterly metrics, Atlassian has some structural advantages that the market is completely undervaluing.

Network Effects Through Shared Workflows

Atlassian products create network effects within organizations. Once a company standardizes on Jira and Confluence and Bitbucket, those tools become how the company works. Switching away means retraining thousands of employees, migrating data, rebuilding workflows.

For a company with thousands of employees and millions of issues and documents in Atlassian, switching costs are in the millions of dollars. That's a moat.

Data Advantages

With 350,000+ customers and billions of data points about workflows, project management, team collaboration, and software development, Atlassian has unprecedented insight into how teams work.

That data is valuable for:

- Product development: Understanding which features matter, which workflows are common, where customers get stuck

- AI and analytics: Building AI features that are actually useful because they're based on real workflow data

- Benchmarking: Atlassian can tell customers how they compare to peers, which drives value realization

The Cloud Transition Creates Operating Leverage

As Server revenue shrinks and Cloud revenue grows, Atlassian's operating leverage improves. Cloud has better margins, better unit economics, better retention.

The transition is mostly complete. In 3-5 years, profitability should expand dramatically.

Market Share Concentration

Atlassian owns a disproportionate share of the work management/collaboration software market. Combined with product excellence and network effects, that means competitors face an uphill battle to gain share.

Market concentration creates pricing power and reduces competitive risk.

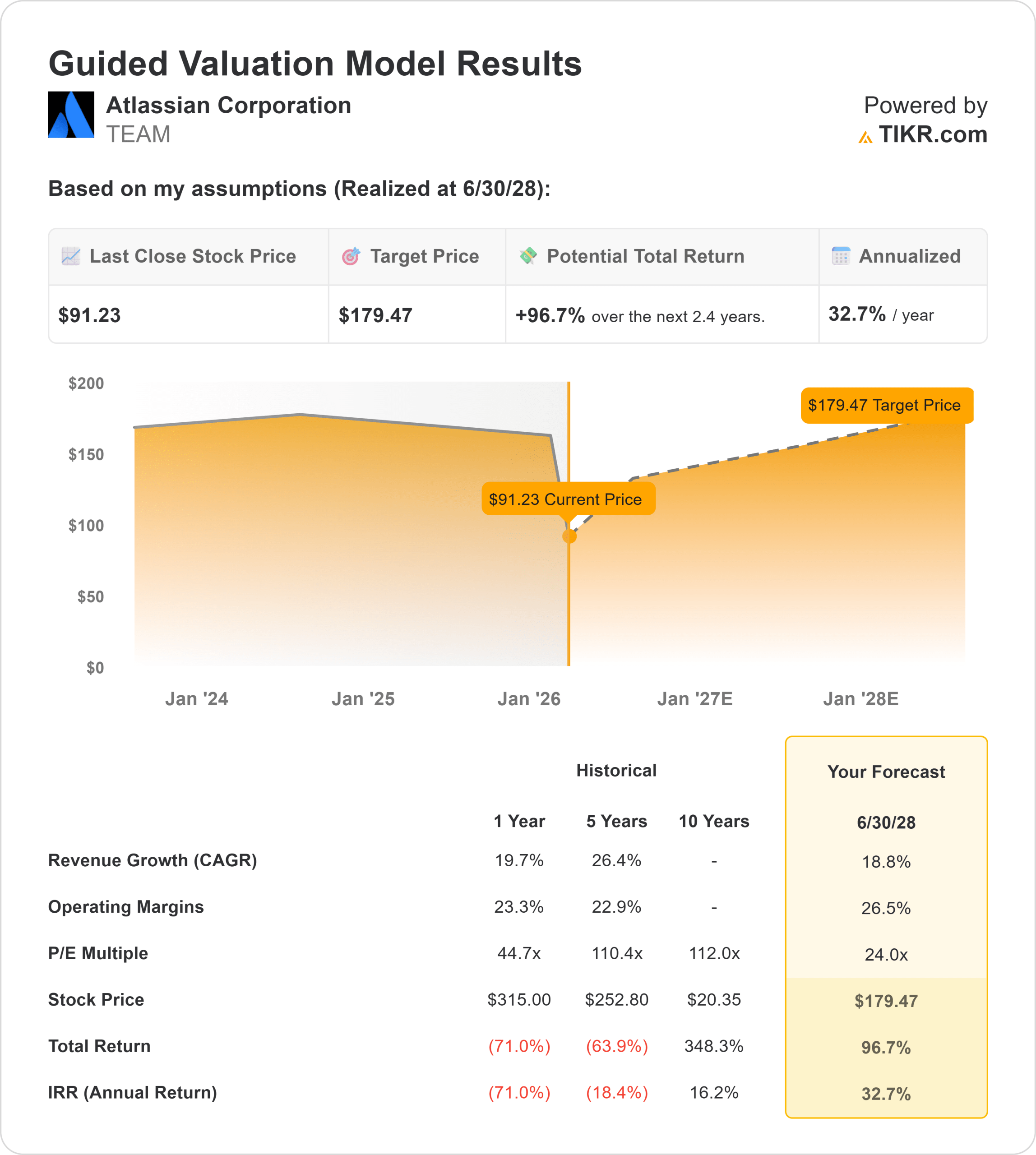

The Bull case projects Atlassian's stock price to reach

11. Forward-Looking Catalysts: What's Coming

Beyond the current results, there are several catalysts that could drive the stock higher over the next 2-3 years.

AI Feature Development

Atlassian has been quiet about AI. The company hasn't hyped AI features the way competitors have. But you can be sure they're building.

Once Atlassian releases AI features that genuinely improve how teams work (AI-powered sprint planning, intelligent issue assignment, automated documentation generation), those features will drive expansion within the existing base.

With 350,000 customers and 600+ at $1M+, even modest AI monetization (a few hundred per customer) would add hundreds of millions in revenue.

Market Share Gains from Competitors

Atlassian's competitors are struggling. Asana, Monday.com, Notion: all are smaller, less profitable, less well-positioned to invest in AI and product development.

Atlassian will likely gain market share from these competitors over the next 3-5 years. That market share gain will accelerate growth.

Vertical-Specific Expansion

Right now, Atlassian's upmarket success is mostly horizontal (selling across departments). But there's opportunity to build vertical-specific solutions.

Imagine Atlassian for Financial Services (with compliance features). Atlassian for Healthcare (with HIPAA features). Atlassian for Government (with Gov Cloud features).

Vertical expansion could unlock entirely new market segments.

International Expansion

Atlassian is strong in North America and growing in Europe. But Asia, particularly China and India, represents a huge opportunity that's still underpenetrated.

As Atlassian expands internationally, it will access billions of new potential customers.

12. The Profitability Path: Operating Leverage Is Coming

Atlassian is profitable today, but operating margins are not as high as they will be. The company is still investing in cloud infrastructure, still hiring for enterprise sales, still burning cash on R&D.

But the underlying unit economics are strong. Over the next 3-5 years, here's what's likely to happen:

Cloud Migration Complete → Margin Expansion

Once Server is gone and Cloud is 100% of the business, support costs decline significantly. Cloud has much higher gross margins.

Server might be 40-50% gross margin. Cloud is typically 70-80% gross margin. The transition alone could add 5-10 percentage points to company gross margins.

Sales Efficiency Improves

As enterprise motion matures and bottoms-up self-serve continues, Sales and Marketing as a percent of revenue should decline. The company should get more efficient at acquiring customers.

R&D Leverage

Atlassian is investing heavily in product development. But those investments are mostly fixed costs. As revenue grows, R&D as a percent of revenue declines.

G&A Leverage

General and administrative costs don't scale linearly with revenue. As Atlassian grows, G&A as a percent of revenue will decline.

Combined Operating Margin Impact

Today, Atlassian is running at roughly 20-25% operating margins. With the above factors, the company could reach 35-45% operating margins within 3-5 years.

At $10 billion+ in revenue (assuming continued growth) with 35-40% operating margins, Atlassian becomes an elite-tier profitable enterprise software company.

13. Risks and Challenges: What Could Go Wrong

Not everything is rosy. There are real risks that could derail the thesis.

AI Could Actually Displace Atlassian

The bear case is that AI agents or other AI-native solutions could replace Atlassian. If customers decide to use Chat GPT or Claude or custom AI agents instead of Atlassian, that would be existential.

But there's no evidence of that happening. If anything, Atlassian customers are expanding, not churning. If AI replacement was a real risk, we'd see it in churn rates, and we don't.

Macro Downturn Leads to Budget Cuts

If the economy enters a significant recession, enterprises cut IT budgets. Even strategic software gets reduced. That could impact new logo growth and expansion velocity.

However, Atlassian is mission-critical to most customers. It's how they manage work. Budget cuts would likely hit less critical tools first.

Competitive Pressure

Microsoft, Google, and Amazon all have collaboration and project management tools. They could decide to compete more aggressively with Atlassian.

But Atlassian's advantages (existing customer base, network effects, product excellence) are hard to overcome. Direct competition from tech giants hasn't materially impacted Atlassian historically.

Regulatory Risk

Atlassian operates globally and stores customer data. Data privacy regulations (GDPR, DPA, etc.) could increase compliance costs or create operational challenges.

But Atlassian has navigated these challenges before. This is a known risk, not a surprise.

Atlassian's strong financial performance contrasts sharply with its stock price, which is down 70% from its peak despite robust revenue growth.

14. Valuation Math: What Should Atlassian Trade At?

Let's do some basic valuation math to understand if 4x forward revenue is cheap or expensive.

The DCF Approach

Assume:

- Current revenue: $6.4B

- Growth rate: 20% for next 3 years, then 15% for years 4-5, then 10% steady state

- Operating margin: Reaches 35% by year 5

- Terminal growth rate: 3%

- Discount rate: 8% (reasonable for a mature, profitable company)

Year 1:

Year 2:

Year 3:

Year 4:

Year 5:

Operating income (assuming margins ramp from 25% to 35%):

Year 1:

Year 2:

Year 3:

Year 4:

Year 5:

Free cash flow (assuming 75% of operating income converts to FCF):

Year 1:

Year 3:

Year 5: $3.53B

Terminal value:

PV of cash flows (discounted at 8%):

Year 1:

Year 2:

Year 3:

Year 4:

Year 5:

Terminal value:

Total enterprise value:

With roughly 400M shares outstanding, that's roughly $147 per share.

Atlassian is trading at $98, which is about 67% of this DCF value.

That suggests the stock is undervalued by roughly 33-50% based on fundamental assumptions about growth and margins that are pretty conservative.

The Comparable Companies Approach

Look at how similar companies are valued:

- ServiceNow (22% growth, 45% operating margins): 12x forward revenue

- Datadog (30% growth, 25% operating margins): 14x forward revenue

- Elastic (25% growth, breakeven margins): 10x forward revenue

- Salesforce (8% growth, 20% operating margins): 9x forward revenue

Atlassian (23% growth, 25% operating margins): 4x forward revenue

Based on the comparable company set, Atlassian should trade at 9-11x forward revenue, not 4x.

That suggests significant upside, even if the bear case is partially right.

15. The Market Efficiency Question: Why Isn't This Reflected in the Price?

If Atlassian is genuinely undervalued, why isn't the stock higher? Why is the market leaving money on the table?

There are a few theories:

Theory 1: The Market Is Right, and I'm Wrong

Possible. Investors who sold Atlassian 70% lower might have private information or better analysis than I do. The market might be correctly pricing in AI disruption, macro weakness, or competitive risk.

But the fundamentals (RPO accelerating, enterprise deals doubling, NRR expanding) don't support that narrative.

Theory 2: The Market Hates Growth Stocks at 5% Rates

Possible. In 2022-2023, when bond yields spiked to 5%, investors fled growth stocks en masse. The P/E multiples in the software sector compressed dramatically.

Atlassian got caught in that compression. As rates stabilize and the market re-rates growth stocks, the multiple could re-expand.

Theory 3: Institutional Investors Don't Understand the Metrics

Possible. Most institutional investors follow analyst reports. Most analysts downgraded Atlassian based on the AI panic narrative, not based on careful analysis of RPO, NRR, and enterprise metrics.

Once a few smart investors realize that the narrative doesn't match the reality, capital will flow back in.

Theory 4: Insider Selling and Overhang

Possible. If company insiders are selling, it can create negative sentiment. If large shareholders (like VC firms) are dumping shares, it creates supply overhang.

Eventually, supply/demand dynamics adjust, and the price recovers.

16. Three Scenarios: Bull, Base, and Bear Cases

Let's outline three scenarios for where Atlassian could go from here:

Bull Case: Back to $250-300

Assumptions:

- AI features drive 2-3% expansion revenue lift

- Market re-rates software multiples upward

- RPO acceleration continues

- Operating margins expand faster than expected

- Market share gains from competitors

Path to value: Stock trades at 9-10x forward revenue on 25%+ growth and 40%+ margins. That's $250-300.

Timeframe: 3-5 years

Probability: 40%

Base Case: $150-180

Assumptions:

- Growth remains 20-23% for next 3 years

- Margins expand to 30-35%

- Market re-rates to 6-7x forward revenue (slightly above where it is now)

- AI features are incremental, not transformational

- Some competitive pressure but Atlassian holds market share

Path to value: Stock trades at 6-7x forward revenue on fundamental business performance. That's $150-180.

Timeframe: 2-3 years

Probability: 50%

Bear Case: Stays $80-100

Assumptions:

- Growth declines to 15% as the market matures

- AI competition captures meaningful market share

- Operating margins don't expand as expected

- Macro downturn impacts growth

- Market continues to price software at 3-4x forward revenue

Path to value: Stock stays at 4x forward revenue on lower growth and lower margins. That's $80-100.

Timeframe: Ongoing

Probability: 10%

17. What This Means for Enterprise Software

Atlassian's situation is a microcosm of what's happening across enterprise software.

The Good News: Best Companies Are Getting Better

Atlassian's metrics show that the best software companies are accelerating, not decelerating. Enterprise deals are getting bigger. NRR is expanding. Upsell is accelerating.

This suggests that enterprise software isn't dead. It's actually winning in the enterprise.

The Bad News: Market Doesn't Care Right Now

But the market is punishing all growth stocks, regardless of fundamental strength. That's creating tremendous opportunity for patient investors.

Companies with strong unit economics, expanding NRR, and accelerating enterprise motion are being valued like distressed assets. That's irrational.

The Opportunity: Picking Winners in a Compressed Multiple Environment

In environments where multiples are compressed, the winners are the companies with the best fundamentals that can maintain growth and profitability through the cycle.

Atlassian has that profile. So do a few other enterprise software companies. Those are the ones to own.

18. The Bottom Line: What's Really Going On

Here's the real story of Atlassian:

The company is not facing existential AI disruption. The company is not a mature, slowing business. The company is not losing customers to cheaper alternatives.

Instead, Atlassian is:

- Moving upmarket successfully while maintaining bottoms-up self-serve

- Building longer customer commitments (RPO up 44%)

- Expanding within existing customers (NRR at 120%+ and rising)

- Completing the cloud transition with first $1B cloud quarter

- Priced at a discount to peers with slower growth

The market is wrong. The narrative about software being dead doesn't match the fundamentals. And investors who have the conviction to buy when the narrative is negative are likely to be rewarded handsomely.

Atlassian at 4x forward revenue is not a dying company. It's a company that the market has temporarily lost faith in, and that loss of faith is creating opportunity.

FAQ

What is Remaining Performance Obligations (RPO), and why does it matter?

RPO represents contracted future revenue that hasn't been recognized yet. When a customer signs a three-year deal, the entire dollar value enters RPO and is gradually recognized as revenue over the contract term. It matters because RPO growth that exceeds revenue growth indicates customers are signing longer, larger contracts, which signals confidence in the product and future revenue predictability.

How is Atlassian growing 23% at $6.4B in ARR when most mature software companies slow down?

Atlassian is growing faster than expected because it's successfully executing an upmarket motion (moving from developer tools to enterprise platforms) while maintaining its original bottoms-up self-serve business. Enterprise deals are accelerating (600+ customers at $1M+ ARR), RPO is surging (44% YoY), and cloud adoption is at peak momentum. The combination creates what looks like a growth acceleration despite the company's scale.

Why is Net Revenue Retention above 120% and still rising when most companies see NRR compress at scale?

Most companies see NRR compression because it becomes harder to find expansion opportunities at larger customer revenue levels. Atlassian is different because customers are standardizing on multiple Atlassian products (Jira, Confluence, Service Cloud, Bitbucket) across multiple departments and geographies. As Atlassian becomes more mission-critical and horizontal within customer organizations, expansion opportunities actually increase rather than decrease.

What does the $1B cloud quarter mean for Atlassian's future growth?

The first $1B cloud quarterly revenue marks the inflection point where cloud becomes the dominant business and server enters permanent decline. Cloud typically has better gross margins (70-80% vs. 40-50% for server) and lower support costs. As server shrinks and cloud grows, operating margins should expand significantly. Additionally, cloud revenue is more predictable and sticky, improving long-term business quality.

Why is the stock down 70% if the fundamentals are accelerating?

The stock is down 70% primarily due to a macro narrative that AI will displace all software companies, combined with sector-wide compression of software multiples from 15-20x to 7-10x forward revenue. The market has priced in disruption that isn't showing up in the fundamentals (RPO growing 44%, enterprise deals doubling, NRR expanding). Once the market reconciles the disconnect between narrative and reality, the stock is likely to re-rate higher.

Is Atlassian vulnerable to competition from Microsoft Teams, Google Workspace, or Amazon?

While these companies have collaboration and productivity tools, they haven't displaced Atlassian in the project management and issue tracking space where Atlassian is dominant. Atlassian's advantages include an existing large customer base (350,000+ customers), network effects within organizations, data insights from billions of workflows, and superior product focus in its core areas. Direct competition from tech giants hasn't materially impacted Atlassian growth historically.

What are the main risks to the bull case?

Main risks include: (1) macro downturn leading to enterprise budget cuts, (2) real competitive pressure from vertical-focused solutions, (3) slower-than-expected cloud migration creating longer drag on margins, (4) new product (AI features) not resonating with customers, and (5) continued market-wide compression of software multiples regardless of fundamental strength. However, current fundamentals suggest these risks are already partially priced in at 4x forward revenue.

How long until Atlassian's operating margins expand significantly?

Most of the margin expansion should come over the next 2-3 years as the server-to-cloud transition completes and Atlassian is running 100% on cloud infrastructure. Cloud has much higher gross margins, and support costs decline. Combined with operating leverage from sales, R&D, and G&A on a larger revenue base, operating margins could expand from current 20-25% to 35-40% within 3-5 years.

What Comes Next for Atlassian

Atlassian's story isn't over. In fact, the most interesting chapter might just be beginning. The market is temporarily distracted by AI fears and macro worries. But when investors refocus on fundamentals—when they see RPO accelerating, when they see enterprise customer wins, when they see NRR expanding, when they see cloud margins improving—the narrative will shift.

The question isn't whether Atlassian will recover. It's when. And for investors willing to buy when the market is panicking, the recovery could be quite rewarding.

Atlassian is a company with accelerating enterprise motion, expanding customer economics, and a market that has temporarily lost faith in it. That's not a situation that stays mispriced forever.

Use Case: Create data-driven presentations and reports to track SaaS metrics like RPO, NRR, and enterprise growth in minutes

Try Runable For FreeKey Takeaways

- RPO growth of 44% signals customers are signing longer, larger contracts and committing further into the future—contradicting the AI disruption narrative

- Enterprise motion is accelerating with 600+ customers at 1M+ ACV deal volumes nearly doubling YoY

- Cloud NRR hit 120%+ and is rising for three consecutive quarters, generating $800M+ in net organic expansion annually from existing customers

- Stock trading at 4x forward revenue while growing 23% and expanding NRR is mispriced compared to peer valuations of 9-14x forward revenue

- Market narrative about AI disruption doesn't match fundamentals, creating significant opportunity for investors buying during the panic

Related Articles

- Meridian AI's $17M Raise: Redefining Agentic Financial Modeling [2025]

- Complyance Raises $20M Series A: How AI Is Reshaping Enterprise Compliance [2025]

- Salesforce Halts Heroku Development: What It Means for Cloud Platforms [2025]

- Europe's Sovereign Cloud Revolution: Investment to Triple by 2027 [2025]

- Larry Ellison's 1987 AI Warning: Why 'The Height of Nonsense' Still Matters [2025]

- OpenAI Frontier: The Complete Guide to AI Agent Management [2025]

![Atlassian Stock Down 70% Despite 23% Revenue Growth: Why Markets Miss the Real Story [2025]](https://tryrunable.com/blog/atlassian-stock-down-70-despite-23-revenue-growth-why-market/image-1-1770824509178.jpg)