Meridian AI's $17M Raise: Redefining Agentic Financial Modeling [2025]

The spreadsheet has ruled financial analysis for four decades. Excel dominates because it's flexible, auditable, and familiar. But it's also brutally inefficient. Financial analysts spend hours building models, copying formulas, checking calculations. The human cost is astronomical.

Then AI arrived. Everyone assumed AI would simply automate spreadsheets. Build an agent inside Excel, let it generate formulas, watch the magic happen. Dozens of startups tried exactly that. Most failed because AI's fundamental weakness became immediately obvious: spreadsheets demand precision, but AI delivers probability.

Now a company called Meridian is trying something radically different. Instead of forcing AI into Excel's constraints, they're building a completely new workspace. An IDE for financial modeling. One that combines agentic AI with traditional tooling to create something neither approach achieves alone.

On Wednesday, they announced

This isn't just another AI startup trying to disrupt a tired market. It's a fundamental rethinking of how financial modeling should work in an age where AI can think but humans must trust.

TL; DR

- Meridian raised 100M valuation to build an IDE-based agentic spreadsheet platform that combines AI with traditional financial modeling tools

- The problem it solves: Traditional spreadsheets take hours; manual Excel agents hallucinate; Meridian balances speed with auditability through hybrid agentic + deterministic approaches

- Key differentiator: Unlike Shortcut AI and competitors, Meridian operates as a standalone workspace similar to Cursor, not embedded in Excel, allowing better integration with external data sources

- Team expertise: Combines AI researchers from Scale AI and Anthropic with banking veterans from Goldman Sachs, addressing the specific requirements of financial institutions

- Early traction: Already signed enterprise contracts with Decagon and Off Deal, demonstrating product-market fit before full launch

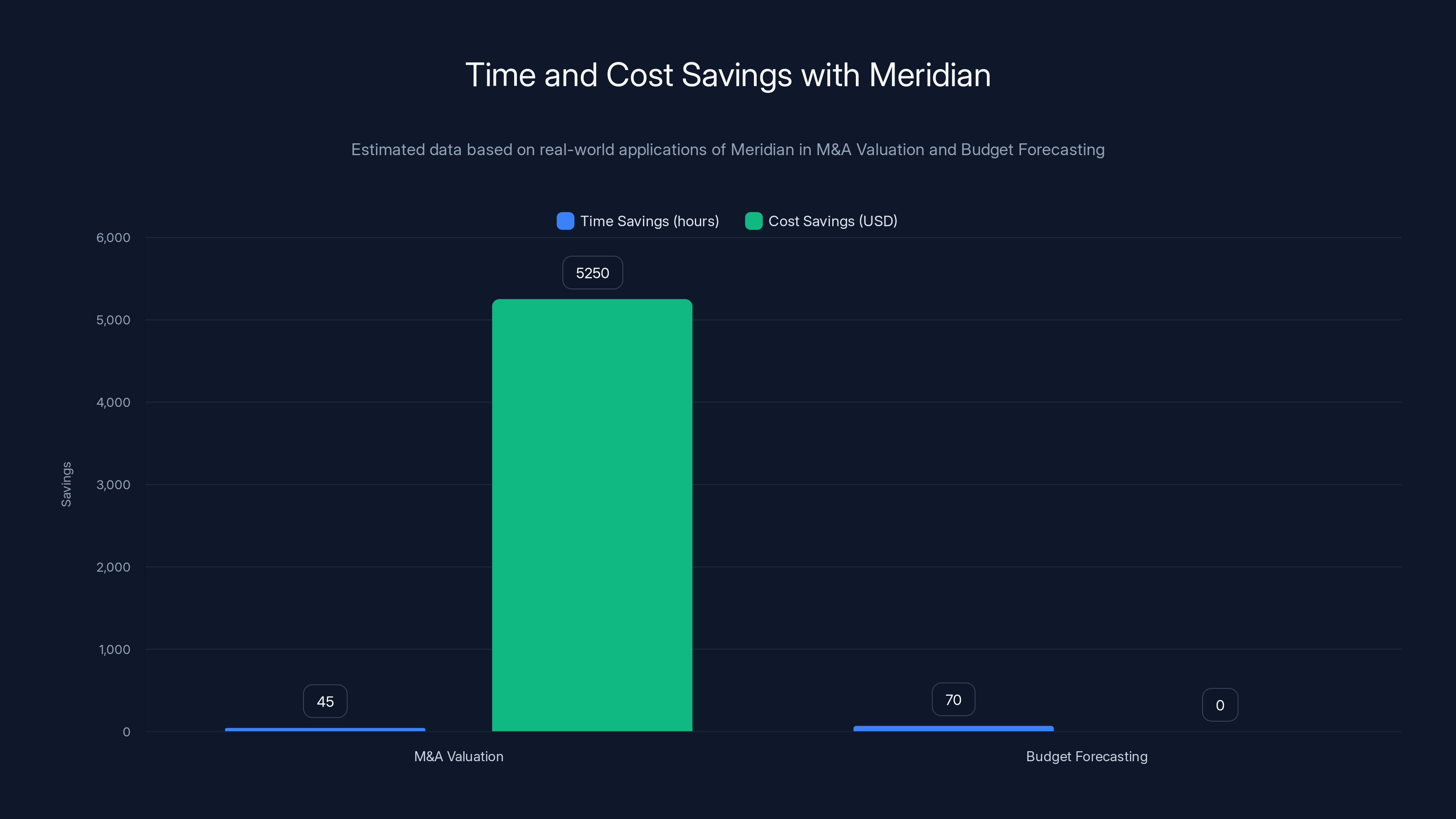

Meridian significantly reduces time and costs in M&A Valuation and Budget Forecasting, saving up to 45 hours and $5,250 per M&A deal. Estimated data.

The Broken Promise of Excel Agents

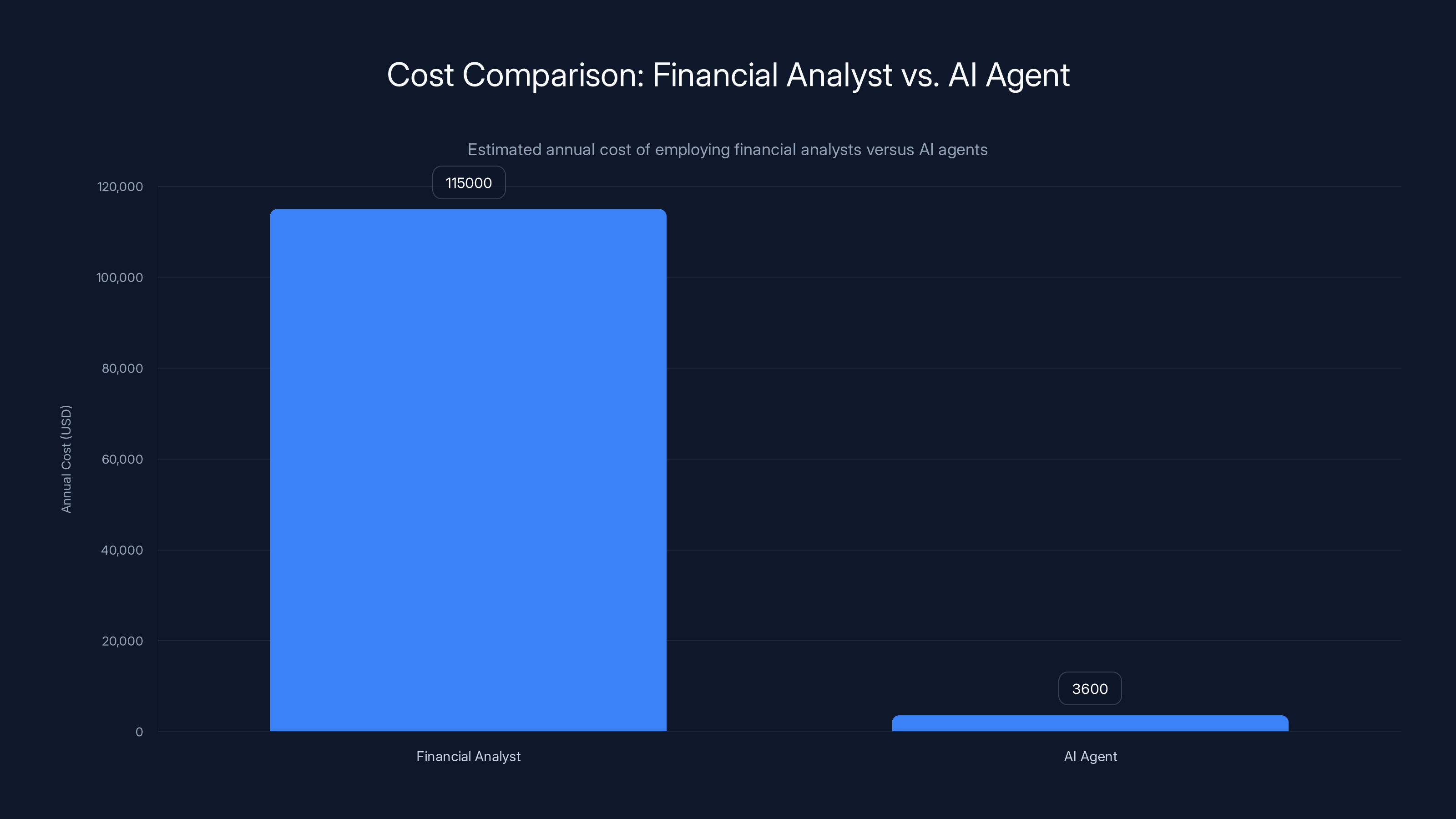

When generative AI burst onto the scene, everyone saw the same opportunity: spreadsheets are tedious, expensive, error-prone. An AI agent could generate formulas, populate cells, build entire models in seconds. The economics were seductive. A single financial analyst costs

But reality punched back hard.

Excel agents started appearing in 2023. Shortcut AI built an agent directly into Excel. Others followed with similar approaches: embed AI into the familiar interface, let users ask natural language questions, get back populated cells. In theory, perfect. In practice, disaster.

The fundamental issue isn't technical. It's epistemological. Excel is a system of record. When you open a spreadsheet, you expect reproducibility. Run the same formula twice, get the same answer. This is non-negotiable in finance. A $5 million valuation model that differs by 0.3% between runs isn't a feature. It's a liability.

Large language models don't work that way. They're probability machines. Ask GPT-4 to generate a formula that calculates compound annual growth rate, and it might give you the correct CAGR function. Ask it again with identical inputs, you might get a slightly different interpretation. Sometimes it hallucinates intermediate steps. Sometimes it includes references to cells that don't exist.

For personal productivity, this is fine. For financial modeling at Goldman Sachs, it's unacceptable. Banks need to know exactly how every number was derived. They need to audit models months later and trace the logic. They need to present models to clients and explain every assumption.

This is where every Excel agent hits a wall. The tension between AI's stochastic nature and finance's deterministic requirements is fundamental. You can't fix it by just trying harder.

Why the IDE Approach Changes Everything

Meridian's insight is elegant: stop trying to make AI fit into Excel's constraints. Instead, build something new that borrows Excel's best parts while adding what Excel can never be.

Cursor demonstrated this with code. Traditional IDEs tried to embed AI as a feature. Cursor made AI central to the entire experience. You write code. AI suggests completions. You modify them. AI explains the implications. The whole workflow integrates AI without surrendering human control.

Meridian applies the same logic to financial modeling. The workspace looks nothing like Excel. It's more like Cursor, more like a modern development environment than a spreadsheet. This seemingly small decision unlocks massive flexibility.

First, it solves the data integration problem. Excel's strength is being self-contained. You manually enter data, build formulas, create outputs. This works great for small models. At scale, it's a nightmare. Financial models need to pull data from multiple sources: databases, APIs, CRM systems, accounting software. Excel can do this, but it's clunky. Connections break. Formulas reference external sources that change.

Meridian's IDE approach means these integrations are first-class citizens. The agent can reference external data sources directly. It can trigger API calls, query databases, pull live pricing data. The model stays current without manual updates.

Second, it enables hybrid execution. The IDE can run mixed code. Some parts are pure AI: the agent generates an outline for what the model should calculate. Some parts are deterministic: traditional formulas and logic gates. Some parts are conditional: the system flags when AI uncertainty exceeds acceptable thresholds, requiring human review.

This hybrid approach is the real innovation. It's not "replace humans with AI." It's "let AI handle the creative parts, lock down the computational parts, make humans review the critical parts." This is how financial modeling should work.

Third, it makes auditability practical. In a traditional spreadsheet, tracing how a number was derived requires clicking through cells, finding precedents, understanding formulas written months ago by someone who's left the company. It's torture.

In an IDE designed for auditability, you click a number and the system shows you: the formula used to calculate it, the inputs that fed that formula, where those inputs came from, what assumptions were made, what AI agent generated what logic. Full lineage. Instant.

From a compliance perspective, this is enormous. Financial institutions face increasing scrutiny over model risk management. Regulators want to understand models. Auditors need to verify models. Clients need transparency. Meridian's architecture makes this possible.

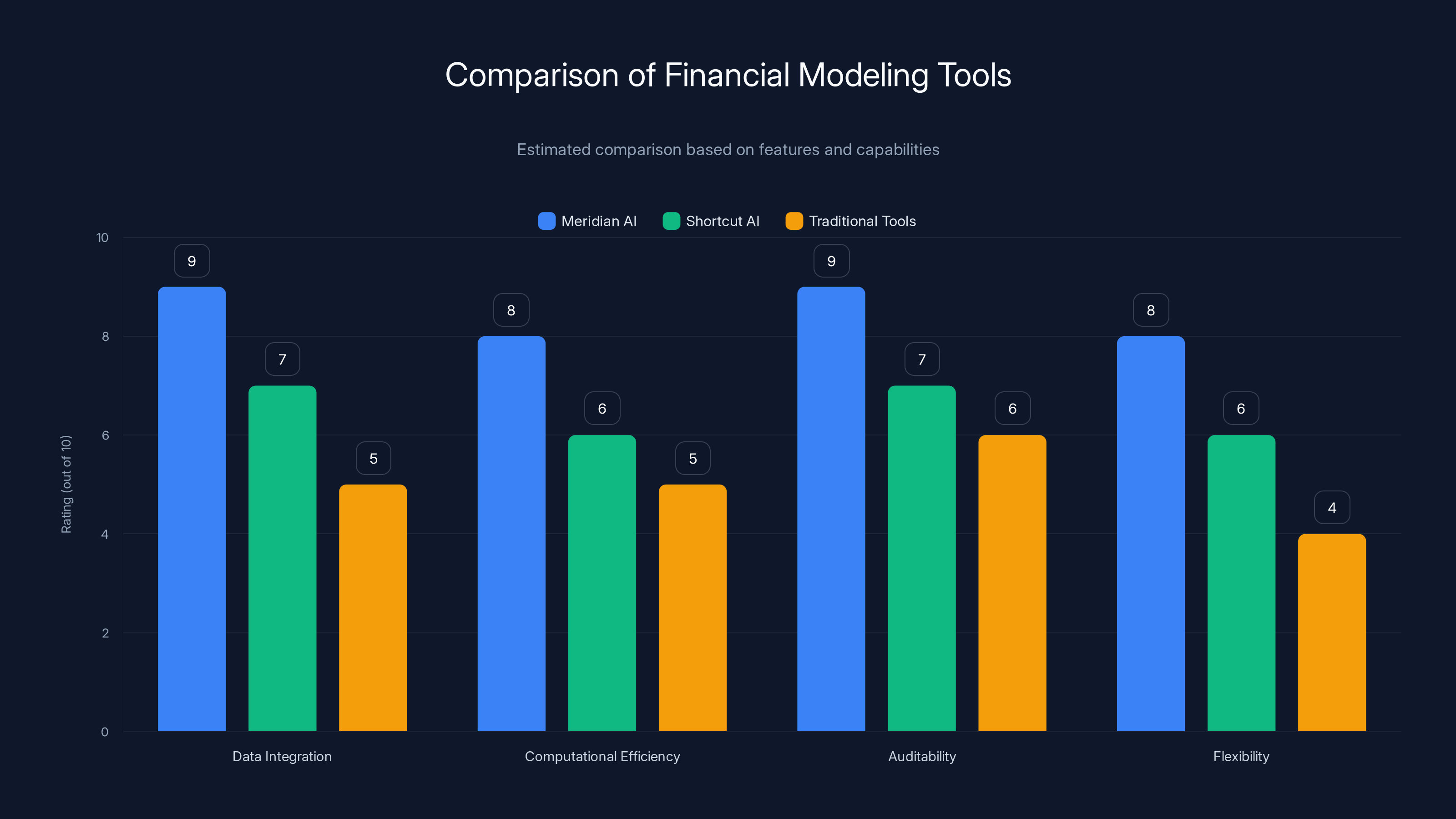

Meridian AI excels in data integration and auditability compared to Shortcut AI and traditional tools, offering a more efficient and flexible solution. (Estimated data)

The Determinism Problem: Why It Nearly Killed the Category

Let me be direct: this is hard. Really hard.

CEO John Ling frames it this way in interviews. Take ten software engineers at Google, ask them to add a feature to an app, you'll get ten completely different implementations. That's fine. Code quality matters, but alternative implementations with the same outcome are acceptable.

Take ten financial analysts at Goldman Sachs, ask them to build a valuation model, you'll get ten nearly identical workbooks. Same structure. Same formulas. Same assumptions. Different data produces different outputs, but the logical framework is deterministic.

This is the opposite of how AI works. AI systems are trained on patterns. They generate responses based on probability. The same input can produce different outputs depending on temperature settings and random seeds. For a spreadsheet? Unacceptable.

Meridian's team spent significant effort solving this. The solution isn't magical. It's pragmatic.

First, they constrain the AI's output space. Instead of asking an LLM to generate arbitrary formulas, the agent works within a bounded set of allowed operations. It can choose from a library of verified functions. It can combine them in specific ways. This reduces hallucination dramatically because the AI isn't generating novel formulas; it's selecting from a curated set.

Second, they implement logic verification. When the AI generates a formula or calculation approach, the system automatically checks it. Does this formula reference cells that exist? Do the data types match? Are there circular references? The verification layer catches errors before they propagate.

Third, they use multi-stage confirmation. Critical calculations aren't generated once by AI and trusted. The AI suggests an approach. A second system verifies it. A human reviews it. Only then does it become part of the model. This sounds slow, but it's faster than debugging a broken model later.

The result is a mixture of agentic AI and conventional tooling. This hybrid approach minimizes hallucinations without sacrificing the speed advantages of AI. Ling describes it as removing "the doubt layer right from the LLM process." You know exactly how the logic flows. You see exactly where assumptions come from.

This required recruiting people who understand both sides deeply. The team includes alumni from Scale AI and Anthropic (the AI expertise) combined with financial veterans from Goldman Sachs (the domain knowledge). This combination is rare. Most AI startups lack financial rigor. Most fintech companies lack AI sophistication. Meridian has both.

The Market Opportunity: Why Now?

Financial modeling is expensive and inefficient at scale. How expensive? The median salary for a financial analyst in the US is approximately

Now calculate the labor cost of building financial models. A complex valuation model for an M&A deal might take 40 to 60 hours of analyst time. That's

If AI could compress 50 hours of work into 5 hours, that's a

This is why the market moved so quickly toward Excel agents. The economics are undeniable.

But there's another factor: the competitive intensity in financial markets. Asset managers build models to price securities. Investment banks build models for client advisory. Corporate finance teams build models for strategic planning. Every institution doing serious financial work depends on models.

The difference between a good model and a great model can be millions of dollars in investment returns or transaction value. This creates intense demand for model builders. And intense scarcity. Not every analyst can build sophisticated models. The skill is rare.

AI reduces that scarcity. If an average analyst can now build models that previously required a senior analyst, that's transformational. If a team of five can do the work that previously required ten, that's competitive advantage.

Meridian's timing is perfect because the market has spent three years learning what doesn't work with AI in finance. Users learned they can't just trust LLM-generated formulas. Enterprises learned they need auditability. Regulators started asking questions about model risk. Meridian comes in with solutions to all three problems.

The company signed $5 million in contracts in December. That's real traction. Not early adopter enthusiasm. That's actual financial institutions saying: we will pay for this solution. We believe it solves our problem.

Architecture Deep Dive: How Meridian Actually Works

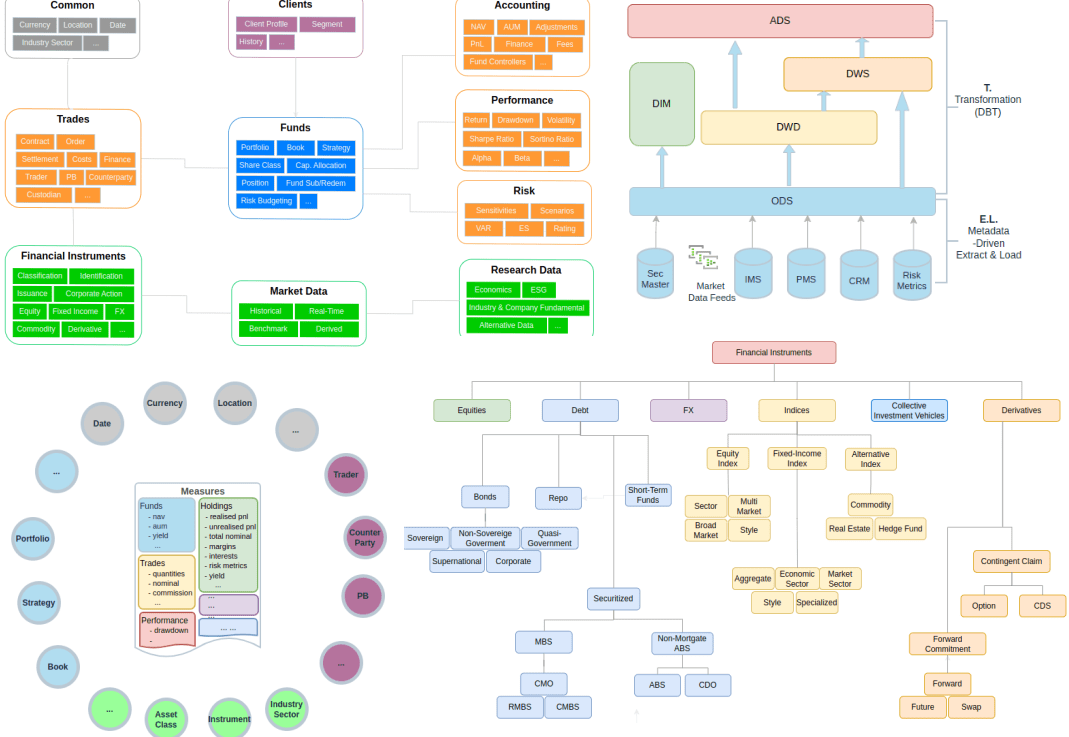

The technical architecture reveals why this approach is smarter than embedded AI agents.

Traditional Excel agents operate as plugins or add-ins. They run within Excel's constraints. They can only access data available to Excel. They generate formulas that Excel understands. The advantage: users never leave familiar territory. The disadvantage: they inherit all of Excel's limitations.

Meridian operates as a standalone workspace. Think of it like this: you're not building a spreadsheet, you're building a financial model in a professional development environment that happens to output spreadsheets.

This architectural choice enables three critical capabilities.

First: External Data Integration

The model can connect to multiple data sources. Live pricing feeds. Database tables. API endpoints. The agent can reference this external data directly in calculations. A valuation model doesn't need to have historical stock prices manually pasted into cells. It connects to a data feed, pulls current prices, and uses them.

This sounds simple. In Excel, it's nightmarish. External connections break. Data refresh intervals don't align. Formulas fail silently when sources become unavailable. In Meridian's architecture, data integration is built in from day one.

Second: Computational Efficiency

Spreadsheets calculate cell by cell. Every change triggers recalculation. This works fine for models with thousands of cells. At tens of thousands of cells, performance degrades. At hundreds of thousands, it becomes unusable.

Meridian uses a computational graph underneath. Instead of recalculating everything, it identifies dependencies and updates only affected nodes. This is how modern data systems work (think Spark, Dask, Airflow). It allows massive models to stay responsive.

Third: Auditability and Versioning

Every calculation in Meridian is logged. Who ran it. When. What inputs were used. What assumptions were made. What AI agent generated what logic. This creates a complete audit trail.

Versioning is also first-class. You can branch a model. Try different assumptions. Compare results. Merge branches. This is how software development works. It should be how financial modeling works. Excel makes this painful (different files, manual tracking, endless confusion). Meridian makes it natural.

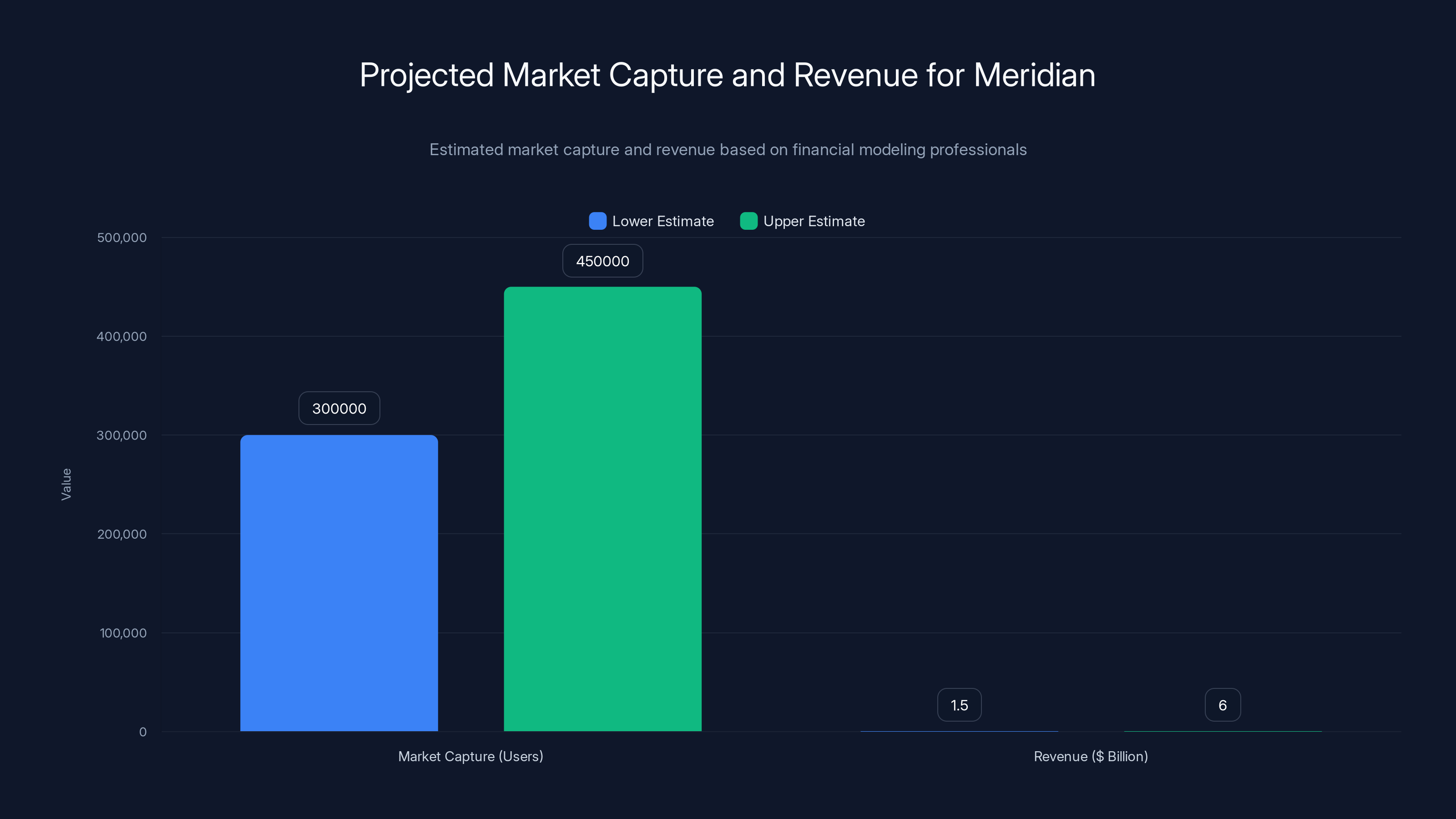

Meridian aims to capture 2-3% of the North American enterprise segment, translating to 300,000-450,000 users and

Team and Expertise: Why This Matters

Financial modeling is a domain where expertise is non-negotiable. You can't fake understanding how banks actually work. You can't guess at what enterprise clients need.

Meridian's team bridges an unusual gap.

There's the AI side. Founders and early employees from Scale AI (a data labeling company that became an AI infrastructure company) and Anthropic (one of the most respected AI research labs). These people understand large language models deeply. They understand how to build systems that use AI safely and reliably.

Then there's the finance side. Veterans from Goldman Sachs, one of the most demanding financial institutions on Earth. These people understand what it means to build models that matter. They understand regulatory requirements. They understand why financial institutions trust only what they can audit.

This combination is almost impossibly rare. Most AI startups would struggle to hire someone with deep Goldman Sachs experience. Most fintech companies don't have founders who spent years at Anthropic.

Why is this combination essential? Because you need both to solve the actual problem.

AI people understand how to make large language models useful. But without domain expertise, they'll build things that sound impressive but don't solve real problems. Fintech people understand the domain. But without AI expertise, they'll underestimate what's possible or build systems that aren't actually intelligent.

Meridian avoided both traps. The team genuinely understands both the AI possibilities and the financial constraints. This is visible in their approach. The system isn't "let AI do everything and hope." It's "let AI handle what it's good at, lock down what needs to be deterministic, make humans review what matters."

This is pragmatism. This is how you build products that enterprises actually adopt.

Funding and Validation: What $17M Signals

A

Andreessen Horowitz doesn't just write checks. The firm does extensive diligence. They understand software deeply. A16z partner taking a lead position on a financial modeling startup sends a signal: the market opportunity is real and the team is credible.

QED Investors specializes in fintech and financial infrastructure. When QED backs a company, it means financial institutions are genuinely interested. FPV Ventures focuses on enterprise software. Litquidity Ventures invests in financial technology.

This isn't a random assortment of investors. It's a coordinated group of investors who collectively understand the market, the problem, and what it takes to win. The syndicate is more valuable than the capital.

The fact that the company already signed $5 million in contracts before the announcement is even more significant. This isn't theoretical demand. This is actual institutions committing actual money.

Meridian isn't pre-revenue or pre-product. The product exists. Real customers are paying. The round is funding growth and product expansion, not proving the concept works.

This matters because financial modeling is a conservative market. Enterprises don't adopt new tools casually. They require proof. Meridian provided proof.

The Competitive Landscape: Who Else Is Trying This

Meridian isn't alone in recognizing that AI plus spreadsheets is a giant market. Several companies are attacking the same problem from different angles.

Shortcut AI built an agent directly into Excel. It operates within Excel's constraints, which is both a strength (users don't need to learn a new interface) and a weakness (it inherits Excel's architectural limitations). Shortcut raised significant funding and has traction, but the embedded-agent model has ceiling effects.

Deepit and similar tools focus on automating specific spreadsheet tasks: data cleaning, formula generation, chart creation. They're useful for individual contributors but not designed for enterprise financial modeling.

Numerai and other quantitative finance platforms use AI for model building but in a completely different context (asset pricing, not financial analysis).

What differentiates Meridian? The IDE approach. By building a completely new workspace instead of retrofitting into Excel, Meridian sidesteps the constraint issues that plague competitors. You get the flexibility of AI plus the rigor required by finance. You get the power of external data integration. You get auditability by design, not as an afterthought.

The IDE model also changes the competitive dynamics. It's harder to copy than an Excel plugin. It requires deep expertise in both AI and finance. It requires substantial engineering effort. This creates a moat around Meridian's approach.

Will Meridian face competition? Absolutely. Will that competition matter? Only if competitors solve the determinism and auditability problems that Meridian's architecture naturally addresses. That's harder than it sounds.

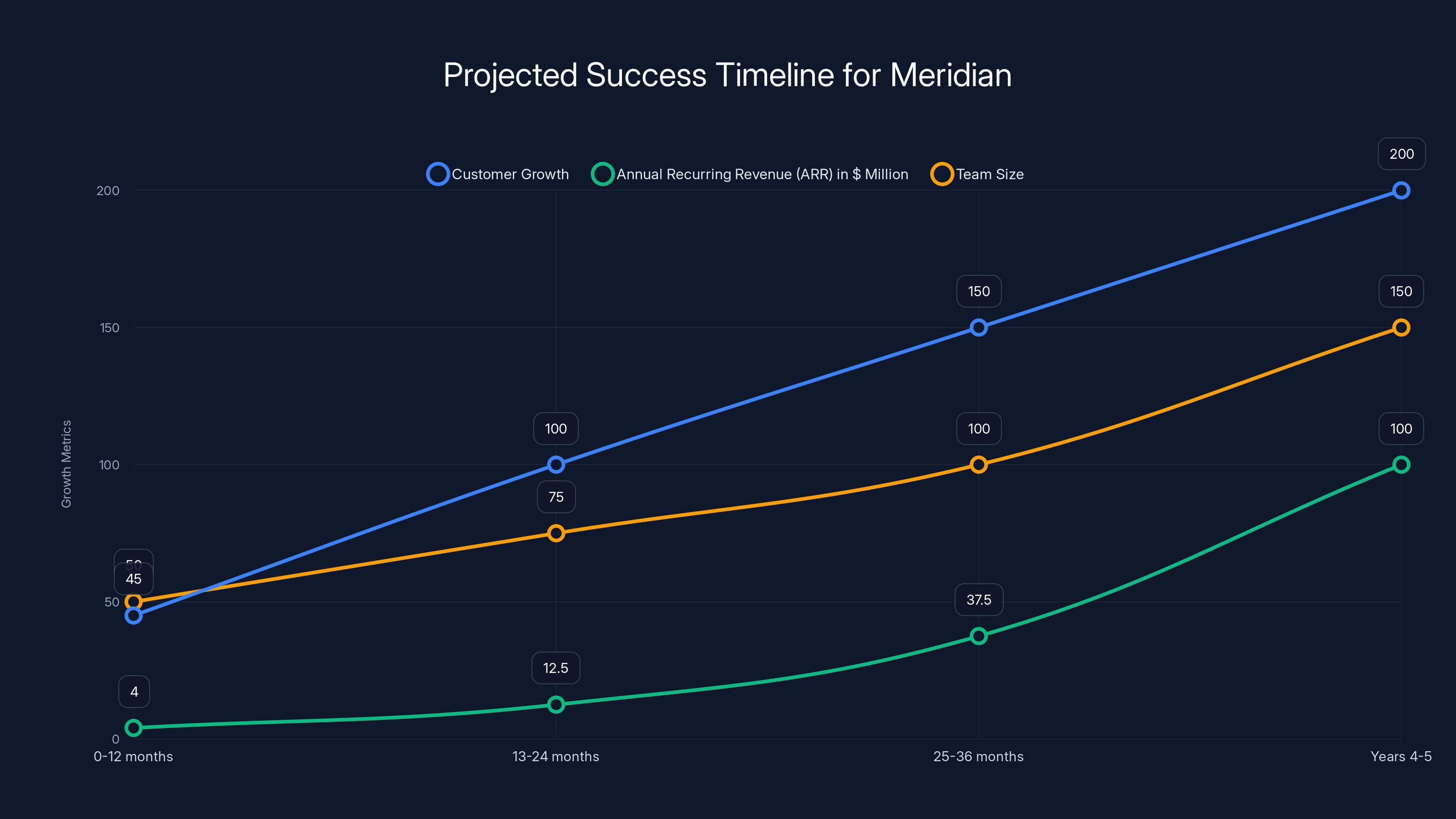

Estimated data shows Meridian's success trajectory with customer base, ARR, and team size expanding significantly over 5 years, assuming excellent execution.

Real-World Applications: Where This Actually Gets Used

Let's move past abstractions and talk about actual use cases.

Scenario One: M&A Valuation

A mid-market bank is valuing a target company for a potential acquisition. The traditional approach: analysts spend 50-80 hours building a financial model. They gather historical financials. They interview the seller's management team. They make assumptions about growth, margins, discount rates. They build spreadsheets that pull all this together.

With Meridian: the agent gathers historical data automatically from the company's filings (SEC data, Bloomberg, etc.). It suggests reasonable assumption ranges based on comparable companies. An analyst reviews and adjusts assumptions. The model runs automatically. Sensitivity analysis happens with a click instead of spending four hours on manual calculations.

Time savings: 40-50 hours. Cost savings:

Scenario Two: Budget Forecasting

A corporate finance team builds annual budgets and quarterly reforecasts. This involves pulling data from multiple sources: historical actuals, departmental plans, macro assumptions, constraints from CFO guidance.

The traditional approach: finance business partners build separate models. These get consolidated in a master model. Inconsistencies emerge. Recycles begin. The process takes weeks.

With Meridian: you define the sources (existing ERP systems, databases, macro data feeds). The agent builds the consolidation logic. You set parameters and constraints. The system forecasts automatically. Changes to inputs flow through instantly.

Time savings: 60-80 hours per cycle. Cycle time drops from 4-6 weeks to 2-3 weeks.

Scenario Three: Credit Analysis

A bank's credit team evaluates loan applications. They need to assess borrower financial health, compare to peer benchmarks, stress-test under adverse scenarios, determine risk rating.

The traditional approach: credit analysts manually review financial statements, build models, perform analysis. Each analyst develops their own approach. Consistency is poor. Time requirement is 15-20 hours per application.

With Meridian: the system ingests borrower financials automatically. It builds comparison models against peer benchmarks (Meridian connects to financial data feeds). It stress-tests under various scenarios automatically. An analyst reviews and makes the final judgment call.

Time savings: 12-15 hours per application. A 20-person credit team processing 200 applications per year saves 2,400-3,000 analyst hours annually.

These aren't theoretical benefits. They're economic realities that drive adoption.

The Regulatory and Risk Management Angle

There's a regulatory dimension to this that doesn't get discussed enough.

Banks face strict requirements around model risk management. The Federal Reserve and other regulators issued guidance (SR 11-7 in the US) requiring banks to validate and document their models. Models must be tested. Results must be independently verified. Change logs must exist.

Spreadsheets are, frankly, terrible at this. Excel files lack built-in documentation. Version control is manual. Change tracking requires discipline (which is often lacking). Audit trails don't exist. When regulators ask "how did you arrive at this number," and you're forced to trace through 47 nested Excel formulas written by someone who left the company, you're in trouble.

This is where Meridian's architecture shines. By design, the system provides what regulators demand: complete auditability, version control, change logs, documentation, verification checkpoints.

Meridian isn't just solving an efficiency problem. It's solving a compliance problem. In regulated industries, this matters enormously. It's the difference between adoption friction and rapid scaling.

Banks are increasingly scrutinizing model risk. This regulatory environment is tailwinds for a solution that makes models auditable and verifiable.

Growth Projections and Market Size

What's the addressable market here?

There are roughly 4.5 million financial analysts in the US according to Bureau of Labor Statistics data. That's just financial analysts, not including all the people who do financial modeling as part of their job (accountants, controllers, investment analysts, risk managers).

Broadly, there are probably 10-15 million people globally whose primary job involves financial modeling or analysis. Most work in enterprises large enough to have teams of modelers.

If Meridian captures 2-3% of the enterprise segment in North America within 5 years, that's 300,000+ users. At an average annual contract value of

These numbers aren't fantasy. They're conservative given the addressable market.

Meridian's

A financial analyst costs significantly more annually (

The Product Roadmap: What's Coming

Meridian is currently focused on Excel compatibility. You build your model in Meridian, and it can export to Excel. This is essential for adoption because enterprise financial workflows are often constrained by Excel compatibility requirements.

Future roadmap likely includes:

Native integrations with enterprise financial systems: SAP, Oracle, Net Suite. Not just data connections, but bi-directional workflows. Change a model assumption, it updates the connected system.

Collaborative features beyond what Excel offers. Real-time multi-user editing with conflict resolution. Comment threads on assumptions. Approval workflows. These seem like nice-to-haves until you realize financial teams are often highly distributed.

AI augmentation that deepens over time. As the system learns from customer usage patterns, it gets better at suggesting assumptions, identifying anomalies, flagging risky calculations. The AI gets smarter with more data.

Industry-specific templates for different financial workflows: project finance models, real estate models, insurance reserve models, etc. These would accelerate adoption by eliminating startup effort for common use cases.

Regulatory reporting integration. Financial institutions need to report models and assumptions to regulators. Building this into the platform would be valuable.

Each roadmap item increases value for enterprises. Each one makes switching costs higher, making churn less likely.

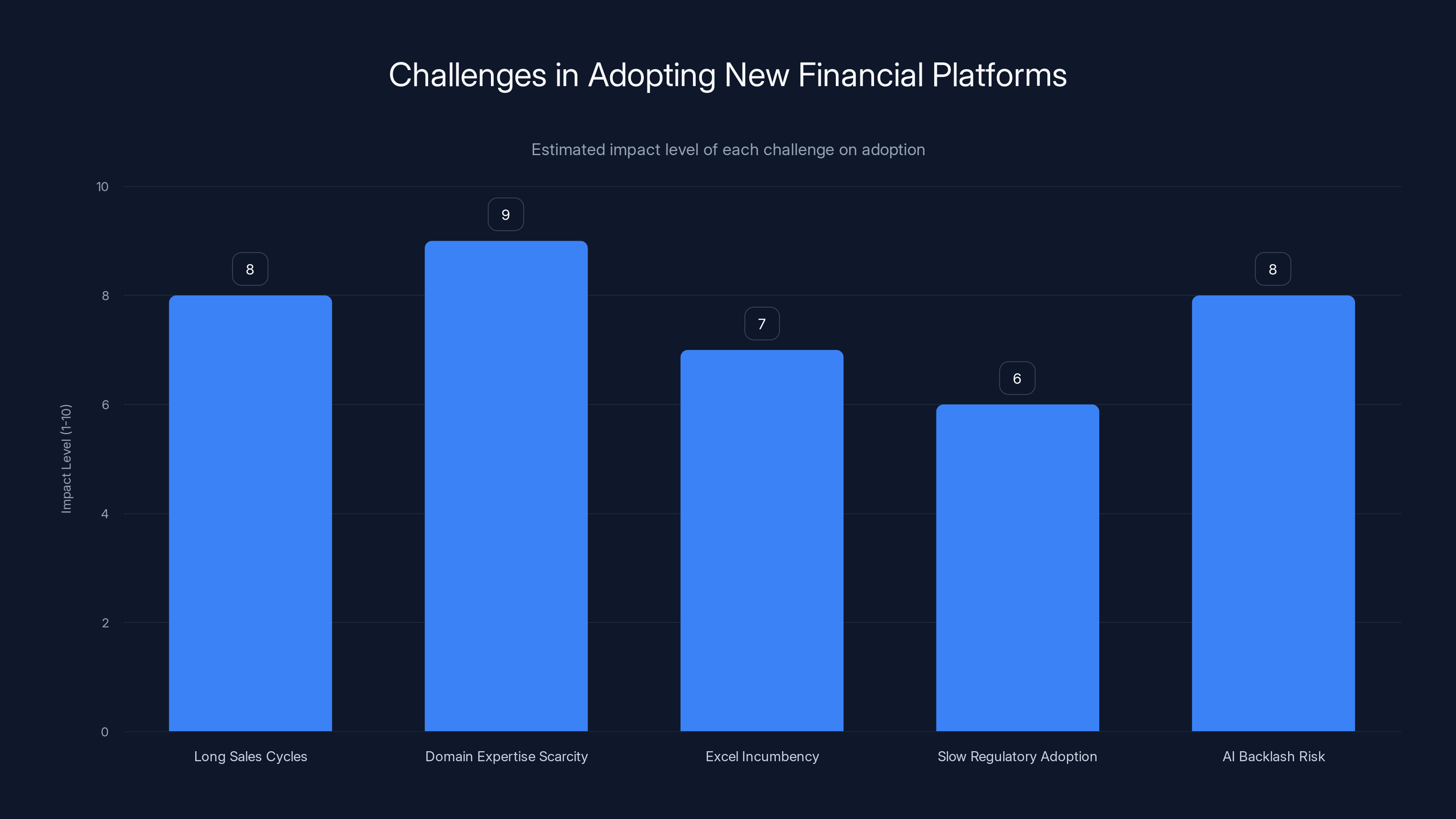

Challenges and Realistic Constraints

Let me be honest about what makes this hard.

First: Sales cycles are long

Enterprises don't adopt new financial modeling platforms casually. Sales cycles in this market are typically 6-12 months. Complex deals take longer. Meridian's $5 million in signed contracts probably represents 10-20 customers, not hundreds. Scaling to a material revenue base will take years, not months.

Second: Domain expertise is the bottleneck

Building a product that financial institutions truly trust requires deep financial domain knowledge. This talent is scarce and expensive. Every engineer with both strong financial knowledge and strong AI skills is in high demand. Building a team of 50-100 people with this combination will be difficult.

Third: Excel is a massive incumbent

Excel isn't winning because it's technically superior. It's winning because it's the standard. Everyone knows it. Everyone has files in it. Corporate policy often mandates it. Convincing an organization to standardize on Meridian instead of Excel is an organizational change management challenge, not just a technology problem.

Fourth: Regulatory adoption moves slowly

While regulatory requirements create tailwinds for auditability, actually proving to regulators that your system meets their requirements takes time. You need regulatory approvals. You need to establish track record. You need to pass external audits. This isn't quick.

Fifth: Potential for AI backlash

If an LLM-based system produces a calculation error that costs a customer millions, the backlash will be severe. The system needs to be bulletproof. This requires over-engineering, which is expensive and time-consuming.

These challenges are real. They don't make the business impossible. They just make success harder than it might appear. Meridian's strong team (scale, Anthropic, Goldman Sachs backgrounds) suggests they understand these challenges and have strategies to address them.

Competitive Advantages and Moats

What prevents every other company from just building the same thing?

Technology moat: The hybrid AI plus deterministic approach is non-trivial to replicate. It requires understanding both AI limitations and financial requirements deeply. The patent landscape might also create protection (though financial software patents are often weak).

Network effects: As more financial institutions standardize on Meridian, integration becomes easier. Banks want tools that talk to each other. Early adopters create gravity that pulls in later entrants.

Data moat: Over time, Meridian will have anonymized data about financial modeling patterns. What assumptions do different industries use? What formulas work best for specific use cases? This data becomes increasingly valuable and harder for competitors to replicate.

Team moat: The combination of AI expertise and financial expertise is rare. Building an equivalent team is hard. Merging teams with different cultures is harder.

Customer switching costs: Once a financial institution has migrated models to Meridian, recreating them elsewhere is expensive. They've also built processes around the platform. Switching costs increase over time.

None of these moats is impenetrable. But together they create barriers that prevent copy-cat competitors from immediately replicating success.

Domain expertise scarcity and long sales cycles are the most significant challenges in adopting new financial platforms, with impact levels estimated at 9 and 8 respectively. (Estimated data)

The Broader Implications: How This Changes Financial Services

Meridian isn't just solving one problem. It's part of a broader transformation in how financial analysis happens.

The pattern is clear: AI is augmenting knowledge work in specific domains where domain expertise is both scarce and valuable. Law firms use AI for contract review. Medical practitioners use AI for diagnostics. Financial analysts will increasingly use AI for modeling.

But the pattern also shows that effective AI requires domain constraints. Unconstrained AI hallucinating in finance is dangerous. Constrained AI operating within domain-specific guardrails works.

Meridian represents the mature approach to this problem. It's not "replace analysts with AI." It's "make analysts vastly more productive by handling rote work, automating verification, and providing intelligent suggestions." This creates value for both the institution (costs drop, quality improves) and the analyst (their job becomes more interesting, fewer hours on tedious tasks).

Over time, this ripples through financial services. The analysts that companies want to hire are those who can use AI effectively. Those who can design sophisticated models. Those who can make judgment calls that AI cannot. The analysts that companies don't want are those doing pure mechanical work.

This creates upward pressure on analyst quality. It also creates pressure on compensation (competition increases, supply of capable modelers increases). It creates pressure on institutions to retool how they hire and develop talent.

Meridian is riding this wave. The wave is broader than any one company. But the company best positioned to capture value is the one that truly understood the problem.

Investment Thesis: Why This Round Will Look Prescient

Looking back at successful infrastructure bets, the pattern is consistent: investors back companies solving problems that affect many institutions with high cost. Financial modeling fits perfectly.

The investors backing Meridian clearly see this. A16z sees AI infrastructure opportunities. QED sees financial services transformation. Andreessen Horowitz generally has a strong track record betting on infrastructure companies that become critical to their industries.

If Meridian executes well:

- Year 2: Expand enterprise customer base from 20-30 to 100-150 customers. Focus on US banks and asset managers. Annual recurring revenue reaches $15-25 million.

- Year 3: Expand internationally (UK, Europe, Asia). Product becomes the standard for mid-market and large financial institutions. ARR reaches $50-80 million.

- Year 4-5: Company is large enough to consider IPO or acquisition. If executed well, the company could be valued at 2 billion.

For investors who bet at $100 million valuation, a 5-10x return (which is entirely plausible if execution is strong) would validate their thesis. A16z and others aren't writing this check hoping for a modest return. They expect potentially massive return if the company wins.

Whether they're right depends on execution. But the thesis is sound.

Lessons for Other Startups in Adjacent Spaces

Meridian's approach offers lessons beyond just financial modeling.

The first lesson: domain-specific AI matters more than general AI. Building AI products that integrate with highly specialized workflows (finance, law, medicine) requires understanding those workflows deeply. Startups that combine genuine domain expertise with AI expertise have structural advantages over startups that just apply AI generically.

The second lesson: auditability and explainability are features, not bugs. In regulated industries, transparency isn't nice-to-have. It's essential. Product architecture should be designed for auditability from day one, not bolted on later.

The third lesson: solve the trust problem first. Before worrying about scale, make sure institutional customers genuinely trust your system. In financial services, trust is everything. You can't overcome trust deficits with marketing.

The fourth lesson: long sales cycles are okay if your product is genuinely valuable. Meridian isn't expecting rapid viral adoption. Enterprise financial modeling tools naturally have long sales cycles. The company is designing for it (6-12 month sales cycles, large contract values) rather than fighting it.

These lessons apply to other infrastructure plays, not just financial modeling. Understanding them gives you a framework for evaluating startups in domains where domain expertise meets AI.

The Unresolved Questions

No technology startup emerges from stealth without open questions.

Will AI auditability remain practically feasible as models scale?

Currently, Meridian uses deterministic verification and bounded AI. As models become more complex, maintaining practical auditability gets harder. The company will need to innovate continuously on this front.

Can they build a moat in a world of increasingly capable open-source models?

Open-source LLMs are getting better constantly. Will financial institutions increasingly prefer to build custom solutions rather than relying on proprietary platforms? This is speculative, but it's a real long-term risk.

Will Excel really decline?

Excel has been declared dead for twenty years. It never dies. Meridian's bet is that Excel's limitations for enterprise financial modeling are sufficient to create a market for alternatives. This seems reasonable, but path dependency is real. Many institutions are too invested in Excel to switch.

What happens in a recession?

During downturns, enterprises cut software spending. Financial modeling tool spending might see reduced growth. But Meridian's efficiency gains (

None of these are fatal questions. But they're real enough that investors and customers should be thinking about them.

Timeline: What Success Looks Like

Assuming Meridian executes well, here's what success trajectories might look like.

Next 12 months: Expand from current customer base (10-20 customers) to 40-50 customers. Focus on North American banks and asset managers. Get to

Months 13-24: Hit product-market fit benchmarks (ARR growth rate of 10-15% Mo M). Expand to 100+ customers. Get to $10-15 million ARR. Establish industry reputation through case studies and speaking engagements.

Months 25-36: International expansion (UK, Europe). Vertical expansion beyond banking into insurance, real estate, PE. ARR reaches $25-50 million. Consider strategic partnerships with ERP vendors (SAP, Oracle).

Years 4-5: Scale toward $100+ million ARR. Evaluate strategic options: continue as independent company, prepare for IPO, or accept acquisition offer from enterprise software company.

This timeline assumes excellent execution. Slower execution would extend all of these timelines by 12-24 months. Faster execution could compress them.

The important thing is that Meridian has enough capital to fund this growth without needing to raise constantly. $17 million seed is sufficient for 18-24 months of runway at current burn rate, even with growth. Series A should be straightforward if the company hits its targets.

FAQ

What is Meridian AI, and how does it differ from other financial modeling tools?

Meridian is an IDE-based (Integrated Development Environment) platform for agentic financial modeling that combines AI with traditional deterministic tools. Unlike competitors such as Shortcut AI that embed agents directly into Excel, Meridian operates as a standalone workspace similar to code editor Cursor. This architectural approach enables superior data integration, computational efficiency, and auditability while maintaining the flexibility of AI-driven modeling.

How does Meridian solve the "non-determinism" problem that plagued earlier AI spreadsheet tools?

Meridian uses a hybrid approach that combines agentic AI with deterministic verification. The system constrains the AI's output space to a curated library of verified functions, implements automatic logic verification to catch errors, and uses multi-stage confirmation for critical calculations. This means users know exactly how every calculation flows and where assumptions originate, removing the uncertainty that plagued earlier LLM-based solutions.

What are the key benefits of using Meridian for enterprise financial modeling?

Meridian delivers multiple benefits: it reduces financial modeling time from hours to minutes by automating data integration and formula generation; it improves auditability by providing complete lineage for every calculation; it enables external data integration from databases and APIs rather than manual entry; and it provides better computational efficiency for large-scale models through graph-based computation instead of cell-by-cell recalculation.

Who founded Meridian, and what is their relevant expertise?

The founding team combines AI researchers from Scale AI and Anthropic with banking veterans from Goldman Sachs. This rare combination ensures both deep technical AI expertise and profound understanding of financial domain requirements. This blend of backgrounds allows the company to build products that are simultaneously technically sophisticated and practically suited to financial institution needs.

How much funding did Meridian raise, and who invested?

Meridian raised

What are realistic use cases for Meridian in financial institutions?

Practical applications include M&A valuation (reducing model build time from 50-80 hours to 10-20 hours), corporate budget forecasting (compressing 4-6 week cycles to 2-3 weeks), credit analysis (reducing per-application time from 15-20 hours to 3-5 hours), and scenario modeling. The efficiency gains translate directly into labor cost savings of

How does Meridian address regulatory requirements around model risk management?

Meridian's architecture provides comprehensive model governance features including complete audit trails, version control, change logs, and documentation by design. This directly addresses regulatory requirements like SR 11-7 guidance (for US banks) by making models transparent, verifiable, and defensible to regulators. The system's auditability makes regulatory compliance significantly easier than traditional spreadsheet-based approaches.

What competitive advantages does Meridian have over other AI modeling startups?

Meridian's primary advantages include its IDE architecture (enabling external data integration and computational efficiency), its hybrid AI plus deterministic approach (solving the hallucination problem), its focus on auditability by design, and its exceptional team with both deep AI and deep financial services expertise. These combine to create structural advantages that are difficult for competitors to replicate quickly.

Is Meridian compatible with Excel, and why does this matter?

Yes, Meridian can export models to Excel format, which is critical for enterprise adoption. Despite predictions of Excel's demise, it remains the institutional standard for financial work. The ability to generate Excel-compatible outputs means institutions can integrate Meridian into existing workflows without forced migration, reducing adoption friction significantly.

What is the addressable market for Meridian, and what are growth projections?

There are approximately 4.5 million financial analysts in the US, with tens of millions of people globally performing financial modeling. If Meridian captures just 2-3% of the enterprise segment in North America within five years, that represents 300,000+ users. At enterprise pricing of

Conclusion

Meridian's emergence from stealth with

For the past three years, every AI startup claimed to be reinventing finance, legal services, or software development. Most failed because they didn't grapple with the actual constraints of their domains. They applied general-purpose AI to specialized problems and wondered why adoption stalled.

Meridian is different. The team understands financial analysis deeply. They understand AI's limitations honestly. They built a system that respects both constraints. The result is pragmatic, not flashy. It solves real problems for real institutions.

The spreadsheet isn't going anywhere. Excel will dominate financial work for decades. But the way people use spreadsheets is about to change. AI will do more of the mechanical work. Humans will focus on judgment calls and strategic decisions. The tools enabling this transition will become critical infrastructure.

Meridian looks positioned to become one of those critical tools. Not because it's perfect. Not because it will dominate the entire financial software market. But because it solves a specific problem better than anything else available: making financial modeling faster, more auditable, and more trustworthy.

For financial institutions drowning in modeling work, for analysts spending weeks on repetitive calculations, for CFOs fighting to automate budget processes, Meridian offers something genuinely valuable. That value is worth investment. That value is worth enterprise adoption.

The next chapter in financial software is being written. Meridian is holding the pen.

If you're building financial modeling tools, working in fintech infrastructure, or managing teams that do financial analysis, Meridian's approach is worth studying. The company just raised $17 million because the problem is real and the solution works. That rarely happens by accident.

Meridian's playbook for domain-specific AI plus deterministic verification can inform how you approach AI integration in any specialized field where trust and accuracy matter more than speed alone. The company proved that you can have both. That insight alone is worth more than the funding announcement.

Key Takeaways

- Meridian raised 100M valuation to build an IDE-based agentic spreadsheet platform that addresses auditability and determinism problems plaguing earlier Excel agents

- The company combines AI agents with deterministic verification to reduce financial modeling time from hours to minutes while maintaining enterprise-grade auditability and compliance requirements

- Unlike Shortcut AI and competitors that embed agents in Excel, Meridian's standalone IDE architecture enables superior external data integration, computational efficiency, and regulatory compliance

- The founding team uniquely combines AI expertise from Anthropic and Scale AI with financial domain expertise from Goldman Sachs, creating structural advantages in building domain-specific AI products

- With $5M in signed contracts before announcement and expanding enterprise customer base, Meridian demonstrates genuine product-market fit in a market where financial institutions face severe labor constraints and rising analyst costs

Related Articles

- Thomas Dohmke's $60M Seed Round: The Future of AI Code Management [2025]

- AI Rivals Unite: How F/ai Is Reshaping European Startups [2025]

- OpenAI's Responses API: Agent Skills and Terminal Shell [2025]

- Observational Memory: How AI Agents Cut Costs 10x vs RAG [2025]

- Deploying AI Agents at Scale: Real Lessons From 20+ Agents [2025]

- Harvey's $11B Valuation: How Legal AI Became Silicon Valley's Hottest Startup [2025]

![Meridian AI's $17M Raise: Redefining Agentic Financial Modeling [2025]](https://tryrunable.com/blog/meridian-ai-s-17m-raise-redefining-agentic-financial-modelin/image-1-1770820715877.jpg)