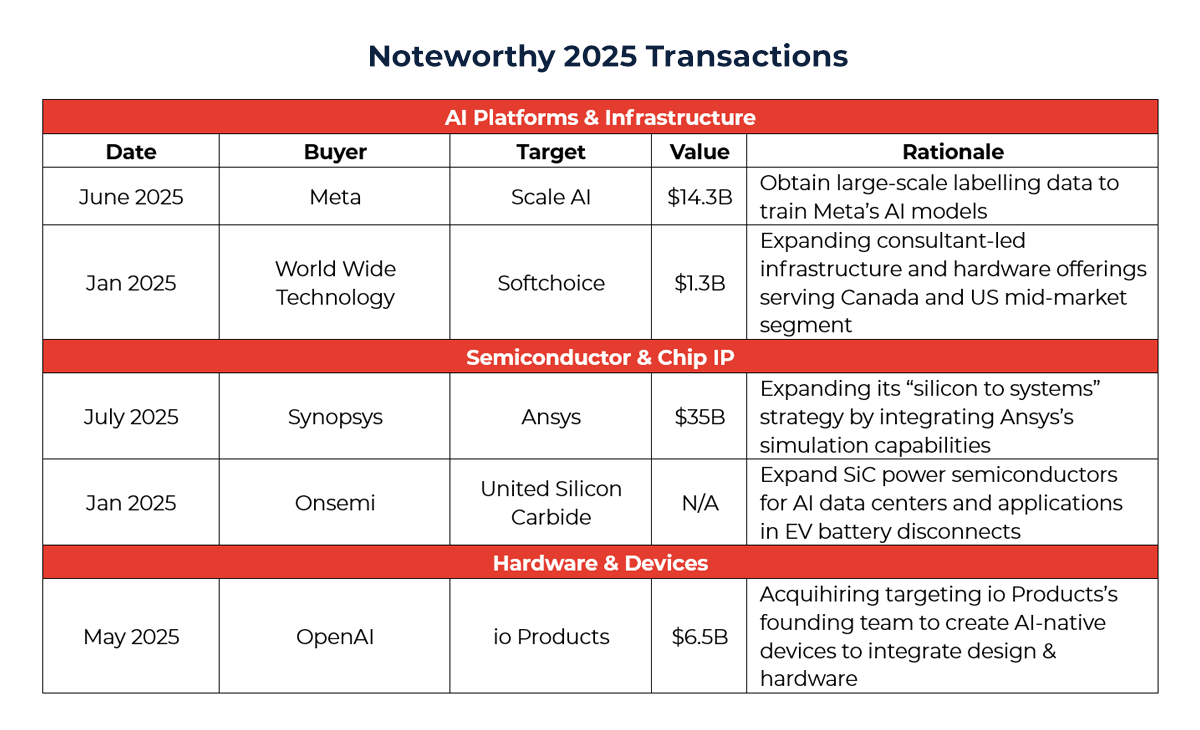

Reddit's Acquisition Strategy for 2025: Why Adtech & AI Matter

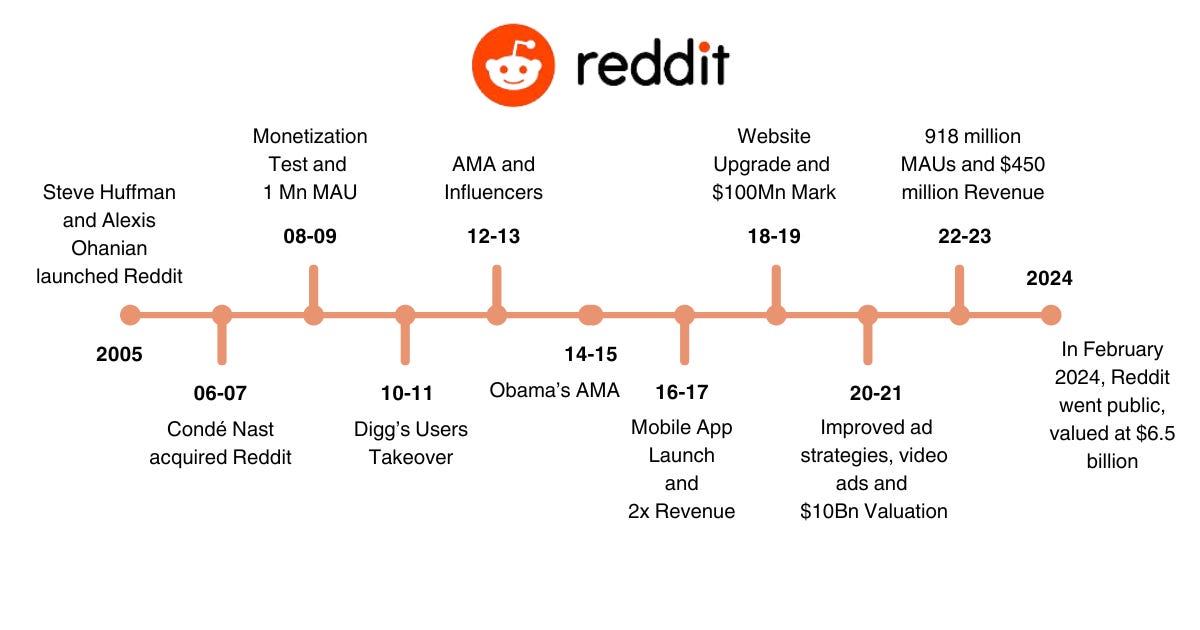

Reddit just made something crystal clear during its fourth-quarter earnings call: the company isn't done buying. In fact, the platform is accelerating its pursuit of strategic acquisitions across multiple verticals, with adtech remaining a core focus while AI capabilities emerge as an increasingly important target. According to Business Wire, Reddit's recent financial results underscore its commitment to expanding through acquisitions.

What makes this moment interesting isn't just that Reddit wants more deals. It's how the company approaches acquisition strategy. Rather than trying to build everything in-house, Reddit has deliberately chosen to "tuck in" proven technologies and teams, a strategy that's saved the company enormous amounts of development time and, more importantly, accelerated its monetization capabilities. As reported by CNBC, this approach has been pivotal in enhancing Reddit's competitive edge.

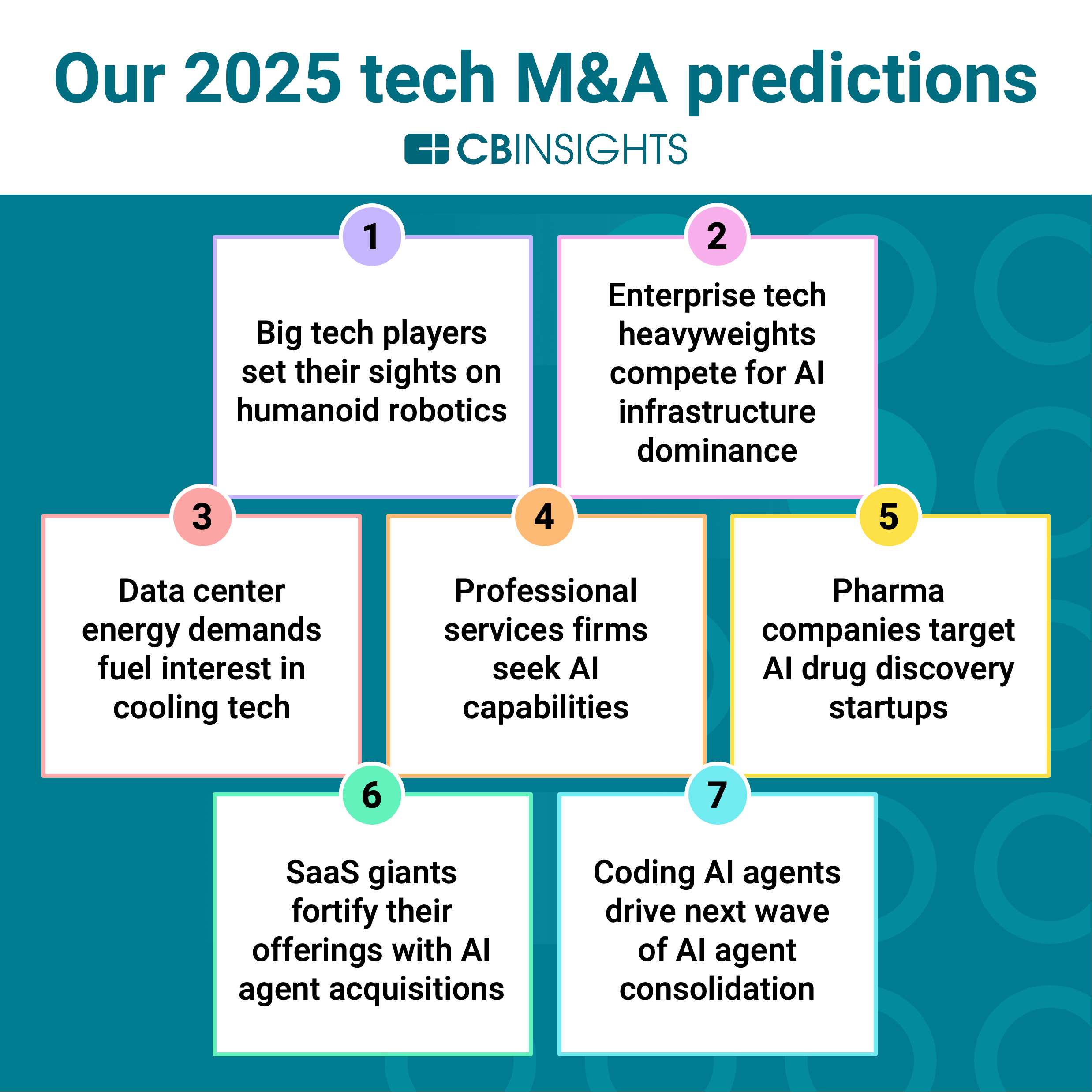

For investors, founders, and anyone tracking the tech industry's M&A landscape, Reddit's public commitment to continued acquisitions signals something bigger: the consolidation of digital advertising infrastructure, the race for AI-powered search capabilities, and the ongoing challenge of scaling community platforms profitably. Let's break down what Reddit actually said, what it means for the company's future, and why this matters for the entire adtech ecosystem.

TL; DR

- Reddit is hunting for M&A targets across adtech, AI, and complementary capabilities that scale with its 121.4 million daily active users, as highlighted in Social Media Today's report.

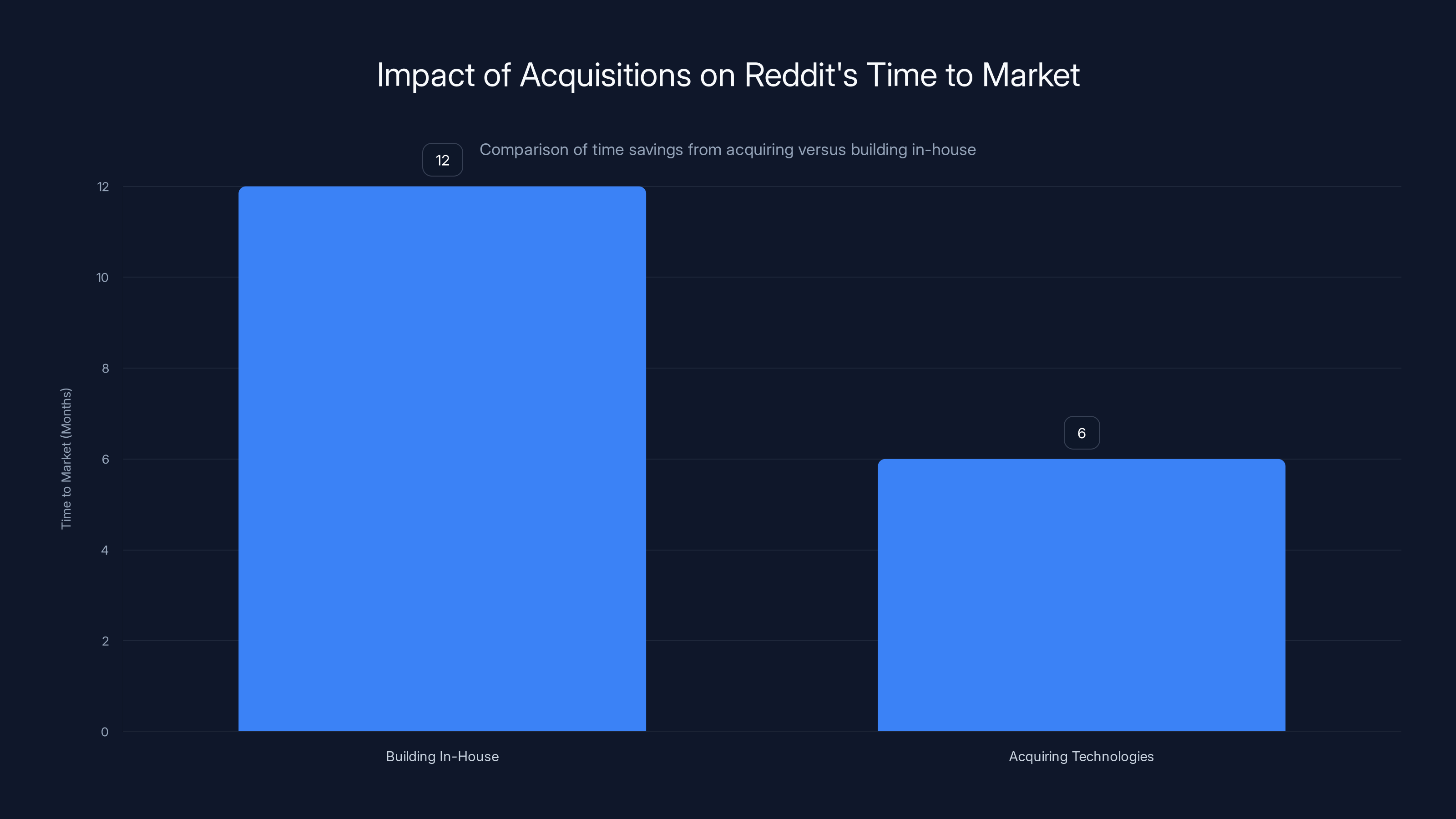

- Acquisition strategy saves time: Tucking in proven technologies saves 6-12 months of development and delivers working products immediately.

- Adtech remains core: Reddit's recent acquisitions (Memorable AI, Spell, Spiketrap) have directly improved ad targeting and monetization.

- AI search is next frontier: With its AI search product generating future revenue potential, Reddit may target AI-focused startups, as discussed in TechBuzz.

- "Spectrum of opportunities" approach: Reddit isn't limiting itself—any capability that leverages scale or grows the user base is fair game.

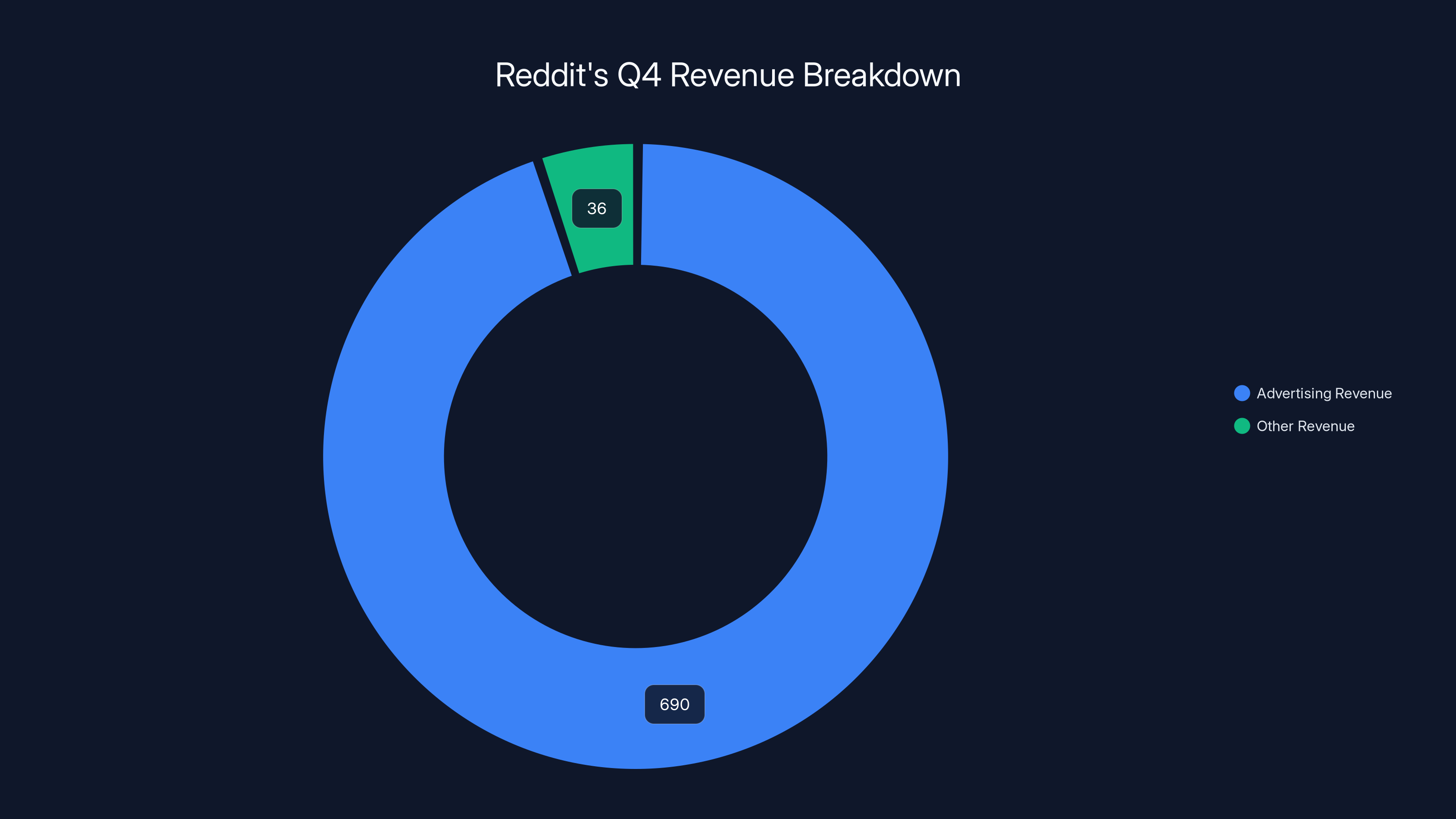

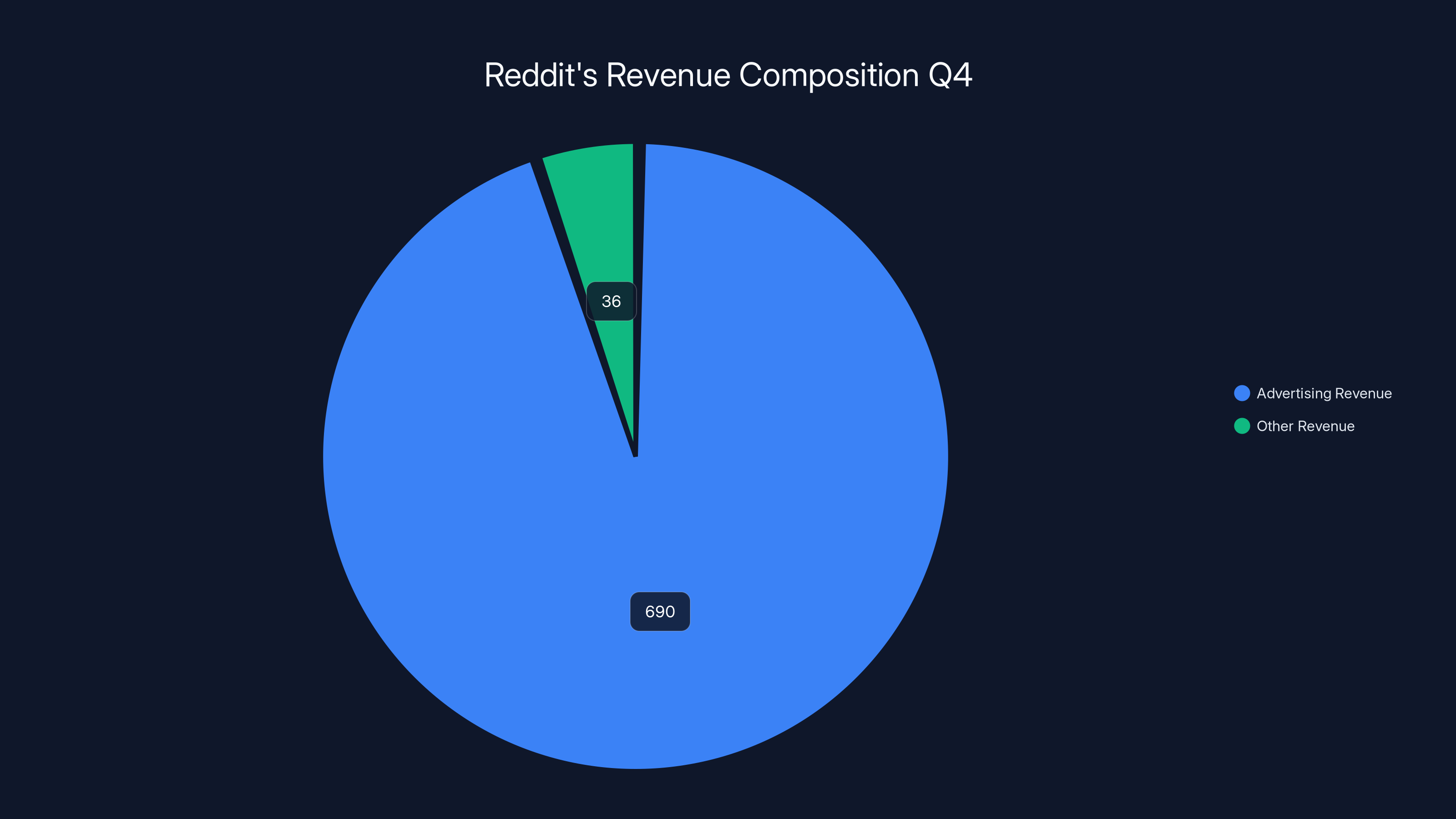

Advertising accounted for 95% of Reddit's Q4 revenue, highlighting its critical role in the company's business model.

What Reddit Actually Said on the Earnings Call

Let's start with the specifics. During the Q4 earnings call, Reddit's CFO Andrew Vollero made it clear: the company is shopping for businesses. But not just any businesses. Vollero outlined a framework that reveals exactly what Reddit is hunting for. This was further elaborated in Business Wire's coverage.

First, the company wants acquisitions that can leverage Reddit's scale. This is crucial. When you're running a platform with 121.4 million daily active users, acquiring a small adtech tool becomes exponentially more valuable. Deploy that tool across Reddit's entire user base, and suddenly a niche product becomes a competitive advantage. A company optimizing ads for 10,000 daily users isn't the same as a company optimizing ads for 121 million daily users.

Second, Reddit wants companies that can grow its user base directly. This is less about acquiring technology and more about acquiring an audience or a new product line that attracts new users. Think category expansion. If Reddit acquired a company in a completely different space, that acquisition might bring new users who'd never considered Reddit before.

Vollero was explicit about this philosophy. "We're looking to buy capabilities, technologies, and companies," he said. And when pressed for more details, he doubled down: "I probably wouldn't overthink the scaled opportunities. I would just look at it as sort of a spectrum of opportunities."

This isn't a heavily constrained acquisition strategy. It's deliberately broad. Reddit is saying: if it works at our scale, we're interested.

Acquiring proven technologies allows Reddit to reduce time to market by up to 6 months compared to building in-house, enhancing their competitive edge in adtech. (Estimated data)

Why Adtech Remains Reddit's Acquisition Sweet Spot

For all the talk of "spectrum of opportunities," let's be honest: Reddit's acquisition history tells a very specific story. The company has been ruthless about building out its advertising capabilities through acquisitions. And the results speak for themselves.

In 2024 alone, Reddit acquired Memorable AI, a company designed specifically to enhance advertising creative optimization. Before that, the company scooped up Spell (an AI platform for machine learning), Spiketrap (ad targeting), Oterlu (ML-powered moderation), and Meaning Cloud (machine learning and text analytics). Notice a pattern? Nearly all of these acquisitions point in the same direction: building a more powerful advertising platform, as noted in IndMoney's analysis.

Reddit's CFO was explicit about why this strategy works. "Our adtech team in particular has been adept at 'tucking in' acquired technologies," Vollero explained. The phrase "tucking in" deserves attention. It's not a hostile takeover model. It's not burning down what a company built and rebuilding from scratch. Instead, Reddit identifies proven technologies, integrates them into its infrastructure, and leverages scale immediately.

The time savings alone justify this approach. According to Vollero, acquiring proven technologies saves Reddit "six months to market" or even "twelve months to market" compared to building similar capabilities in-house. Think about what that means: a feature that would normally take 12 months to develop and ship gets to users in a matter of weeks or months. For an advertising platform competing with Google, Meta, and Amazon, that's enormous.

Moreover, you're not just getting a piece of software. You're acquiring a proven product that already works. It's not theoretical. It's not a prototype. It's battle-tested code that came from a company that's been using it successfully. That dramatically reduces the risk of shipping something broken or inadequate.

Reddit's Q4 numbers bear this out. The company generated

The Spectrum of Opportunities: How Broad Is Reddit's M&A Appetite?

Here's where things get interesting. Vollero could have said, "We're only interested in adtech acquisitions." That would have been simple. Instead, he explicitly said Reddit isn't "ruling anything off the table."

This matters. It means Reddit is keeping its options open. Adtech is a priority. But it's not the only thing Reddit is hunting for. The company is looking at a "spectrum of opportunities," which in corporate speak means: we'll look at almost anything, but it needs to fit certain criteria.

What are those criteria? Let's break them down:

Criterion 1: Scale leverage. Does the technology become more powerful when applied to Reddit's 121 million daily users? If you're building a moderation tool, deploying it across Reddit's massive community instantly makes you better. You're processing billions of pieces of content monthly. Your algorithms learn faster. Your patterns get detected earlier. Scale creates value.

Criterion 2: User base growth. Does the acquisition bring new users to Reddit or expand into categories where Reddit currently has weak presence? This is about category expansion and network effect. If Reddit bought a commerce platform, it could suddenly become a shopping destination. If it bought a dating app, it could compete in that category.

Criterion 3: Unproven potential. Vollero noted that "while adtech acquisitions have been what worked in the past, the company is not ruling anything off the table." Translation: past success doesn't constrain future thinking. If something looks promising and fits the scale criteria, Reddit will consider it.

This framing is crucial because it tells us something about how Reddit thinks about its future. The company isn't betting everything on advertising remaining its core revenue engine forever. It's exploring possibilities.

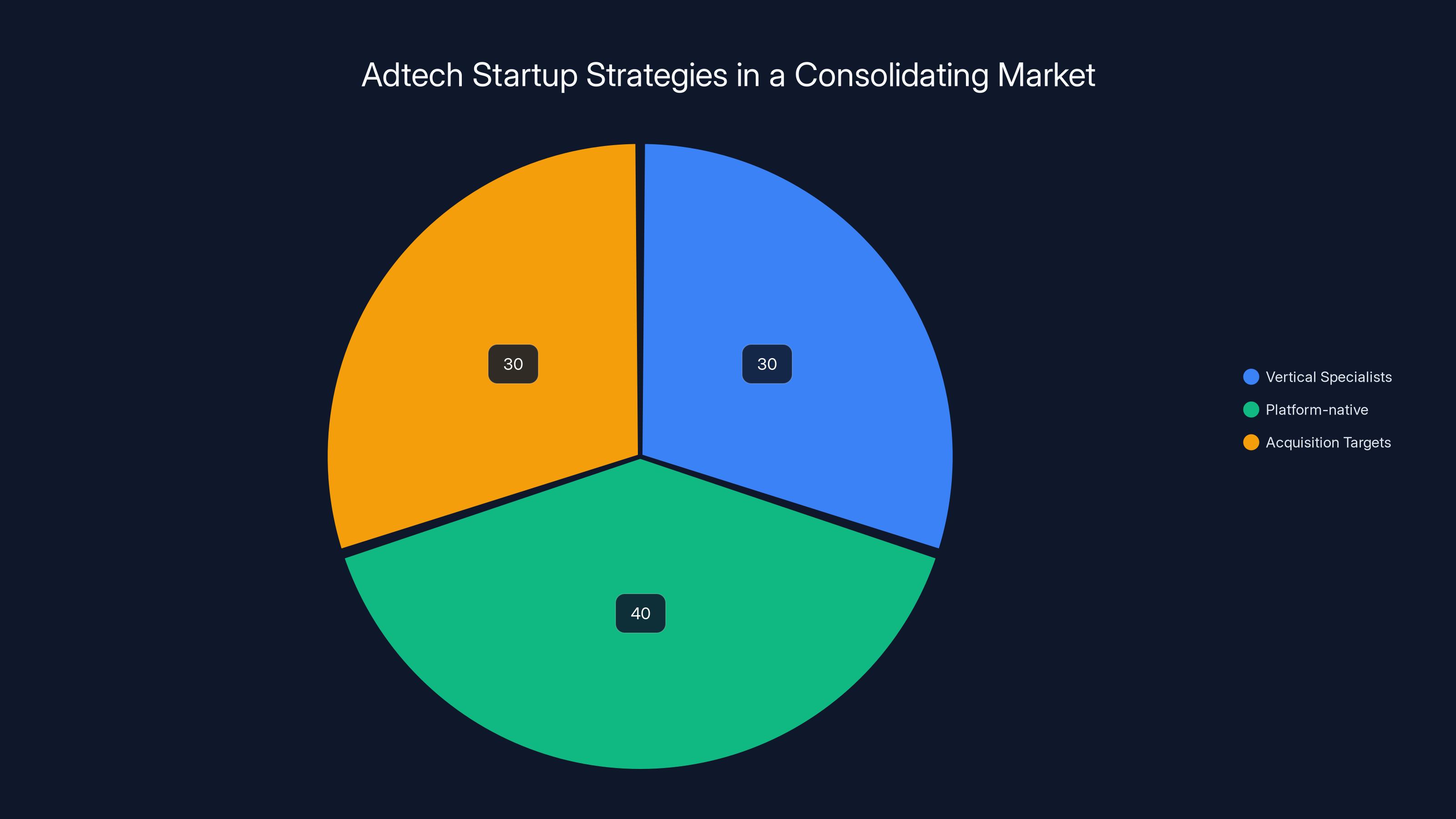

Estimated data suggests that adtech startups will focus on being platform-native or acquisition targets, with fewer pursuing vertical specialization.

AI Search: Reddit's Next M&A Frontier?

Here's something that didn't get enough attention during the earnings call coverage: Reddit mentioned its AI search product as a future revenue opportunity. This is significant. Why? Because it opens the door for AI-focused acquisitions.

Reddit currently operates an AI search engine. It's not Google. It's not trying to be Google. But it's a genuine alternative search interface powered by AI that sits on top of Reddit's massive database of user-generated discussion content. The company sees revenue potential here, as discussed in TechBuzz.

Now think about what capabilities that AI search product needs to compete:

- Better natural language understanding

- Faster inference speeds

- Improved relevance ranking

- Better source citation and attribution

- Enhanced content summarization

- Real-time knowledge updates

- Cross-community search optimization

Every single one of these could theoretically be improved through acquisition. Want faster inference? Acquire an optimization startup. Want better natural language understanding? There are dozens of NLP startups building exactly that. Want better source attribution? That's a data structure problem that some smart engineers have already solved.

The fact that Vollero mentioned AI search as a future revenue opportunity without explicitly saying "we'll acquire companies for this" is telling. It's him laying groundwork. It's the setup before the punchline. Over the next 12-24 months, if Reddit starts talking about AI search revenue, expect M&A in that space.

This is important for founders building AI companies. Reddit is actively signaling that it's interested. The company has already shown it will acquire AI platforms (Spell). Proven AI startups solving real problems should be having conversations with Reddit's business development team.

The Acquisition Track Record: What Reddit Has Actually Bought

To understand where Reddit is heading with acquisitions, look at where it's been. The company's actual purchase history is revealing.

Memorable AI (August 2024): This was Reddit's most recent major acquisition. Memorable AI is a startup that uses machine learning to predict how well ad creative will perform before you run campaigns. For advertisers, this is gold. Test creative variations instantly without burning media budget. For Reddit, this means advertisers can optimize faster, spend more confidently, and ultimately spend more money on the platform.

Spell (2022): An AI platform designed to boost Reddit's machine learning capabilities. This is infrastructure. This is the bones of better algorithms. Spell helps Reddit build better recommendation systems, better content ranking, better personalization.

Spiketrap (2022): Focused specifically on improved ad targeting. Better targeting means higher ROI for advertisers, which means they increase budgets. This is pure monetization play.

Oterlu (2022): A machine learning moderation tool. On the surface, this might seem unrelated to revenue. Actually, it's crucial. Better moderation means healthier communities. Healthier communities mean more engagement. More engagement means more advertising impressions and better pricing power.

Meaning Cloud (2022): Machine learning and text analytics. This is about understanding what Reddit users are actually discussing. Content understanding powers everything from content recommendation to ad matching to trend detection.

Notice what's conspicuously absent from Reddit's acquisition list: doesn't the company have any brand-name acquisitions? No Instacarts. No Notion acquisitions. Everything Reddit has bought is infrastructure-focused or capability-focused. Nobody outside the tech community has heard of Memorable AI or Spell. That's intentional. Reddit isn't acquiring for press. It's acquiring for capability and leverage.

This tells us what to expect going forward: more infrastructure-focused acquisitions. More companies solving specific technical problems. More smaller, specialized teams rather than large brand acquisitions.

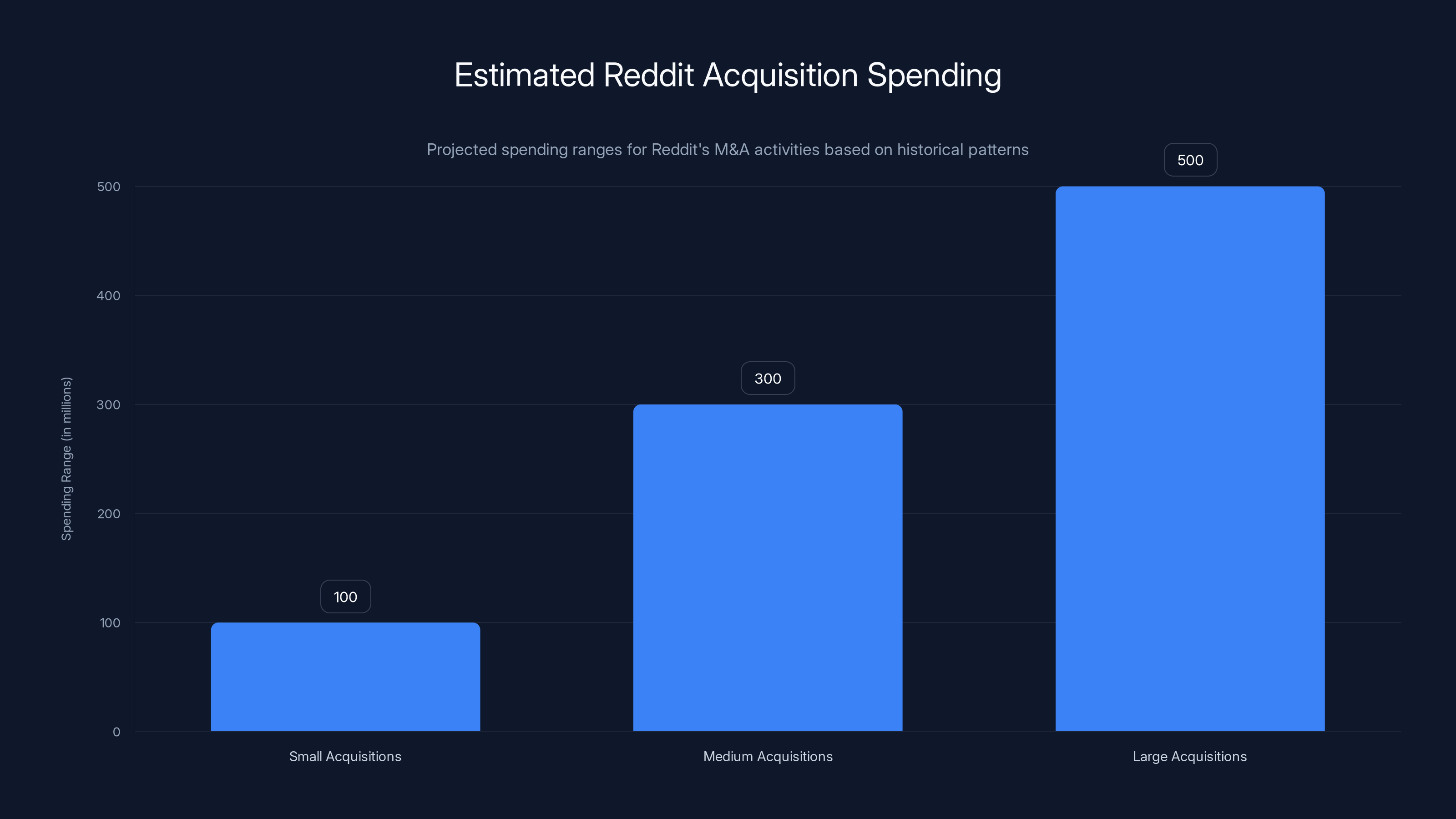

Reddit is likely to focus on smaller acquisitions, spending between

The M&A Playbook: How Reddit Actually Integrates Acquisitions

Here's something founders need to understand if they're thinking about selling to Reddit: the company has a specific playbook for acquisitions, and it's not always obvious from the outside.

Vollero revealed this playbook in a few key phrases. First, the company looks for "capabilities, technologies, and companies." Not products that will ship to users independently. Technologies that will be embedded into Reddit's existing products.

Second, the integration process is deliberately fast. Six to twelve months of time saved means Reddit isn't doing endless integration planning. The company acquires a team, gets them up to speed on Reddit's infrastructure quickly, and ships the capability.

Third, Reddit looks for "proven products." This is critical. The company wants to acquire things that already work, not bets on what might work someday. A proven product is lower risk and immediately valuable.

Fourth, the integration philosophy is "tucking in," not creating separate business units. You're not becoming a Linked In-owned tool with your own brand. You're becoming part of Reddit's platform. Your technology gets absorbed. Your team likely stays and becomes Reddit's team. The product becomes a feature.

For a founder, this matters because it tells you exactly what Reddit wants: working technology with a small, capable team that can operate embedded within a much larger organization. It doesn't want brand acquisitions. It doesn't want to acquire a standalone product that'll ship to users under a new name. It wants to acquire specialized capabilities that make Reddit's core product better.

Why Adtech Is Still the Primary Focus (Even If It's Not the Only Focus)

Let's be clear about something: Reddit said it's open to acquisitions across a spectrum of opportunities. But adtech remains the proven winner in its acquisition strategy. Vollero didn't say this because he loves advertising. He said it because the numbers work.

Reddit's business model depends almost entirely on advertising revenue.

- Attract more advertisers

- Help existing advertisers spend more

- Deliver better ROI so advertisers stay and increase budgets

- Improve the efficiency of serving ads

Every adtech acquisition Reddit has made directly supports one or more of these objectives. Memorable AI helps advertisers predict creative performance, which increases spend. Spiketrap improves targeting, which increases ROI. Spell builds better ML capabilities, which improve everything about Reddit's ad tech stack.

For Vollero to say the company is open to non-adtech acquisitions while also highlighting the success of adtech is a specific message: adtech will remain a priority, but we're not blinkered to other opportunities.

What might those other opportunities look like? Based on what Vollero said, they'd need to either:

- Leverage Reddit's scale (something that becomes exponentially more valuable at 121 million daily users)

- Grow Reddit's user base (bringing in new audiences or new categories)

- Support the AI search product (infrastructure, data, algorithms)

- Improve community engagement (which indirectly supports advertising)

Commerce? Possible. Dating? Maybe. Payments? Potentially. But these would only make sense if they brought significant user growth or leveraged scale in meaningful ways.

Advertising accounted for 95% of Reddit's Q4 revenue, highlighting its critical role in the company's financial strategy.

The Competitive Angle: Why This Matters for the Tech Ecosystem

Reddit's acquisition announcement isn't just about Reddit. It's a signal to the entire adtech ecosystem that consolidation is accelerating. Platforms are actively shopping for capabilities. The era of independent adtech startups might be narrowing.

Think about what's happened in adtech over the last five years:

- Google acquired Fitbit (health data, audience insights)

- Amazon has been quietly building out its ad business with dozens of acquired capabilities

- Meta acquired infinite companies to build out Ads Manager

- Tik Tok built its own ad tech stack in-house

- Reddit is now explicitly hunting for adtech acquisitions, as reported by TechCrunch.

What does this tell you? Platforms don't want to buy ad-serving software. They want to buy capabilities that make their ad products better. They want audience understanding, creative optimization, performance prediction, targeting intelligence. They don't want to use third-party ad servers. They want to own their stack top to bottom.

For an adtech startup, this is both opportunity and warning. Opportunity: if you're building something that makes ads perform better on a specific platform, you're an acquisition target. Warning: building independent ad tech that relies on agencies or advertisers is increasingly hard when platforms are buying the best talent and technology.

This is why the best adtech startups in the next few years will either be:

- Vertical specialists: Solving a specific problem for a specific type of advertiser or industry

- Platform-native: Built specifically to extend one platform's capabilities

- Acquisition targets: Built specifically to get acquired by a platform

The era of horizontal, platform-agnostic ad tech tools is ending. Platforms are consolidating. And they're explicitly hunting.

Future M&A Targets: What Reddit Might Actually Acquire

Given Reddit's stated criteria and proven track record, what might we actually see Reddit acquire in the next 12-24 months?

In adtech, the company might look for:

- Creative optimization startups (better than Memorable AI's current capabilities)

- Audience data and insights platforms (better advertiser targeting)

- Attribution and measurement platforms (helping advertisers understand ROI)

- Real-time bidding or programmatic advertising improvements

- Video advertising optimization (Reddit is increasingly focused on video)

In AI and search, Reddit might pursue:

- NLP and language model improvements (better search and recommendations)

- Real-time knowledge base systems (keeping search results current)

- Cross-community recommendation engines (improving content discovery)

- Data infrastructure for processing massive amounts of community data

In community and engagement, Reddit could acquire:

- Moderation and safety tools (better than Oterlu's current capabilities)

- Community analytics platforms (helping mods understand their communities)

- Engagement optimization tools

- Creator monetization platforms

Dark horse candidates:

- E-commerce or marketplace tools (if Reddit wants to become a shopping destination)

- Payment infrastructure (supporting creator payouts or tipping)

- Data analytics platforms (understanding trends in communities)

But here's the thing: Vollero's framing suggested Reddit might surprise everyone. "Not ruling anything off the table" means if a company is proven, capable, and can leverage scale, Reddit will listen.

The Financial Implications: M&A Budget and Capacity

Reddit just went public in March 2024. Which means the company now has capital and access to capital markets for acquisitions. But how much is Reddit likely to spend on acquisitions?

We don't have explicit guidance. Vollero didn't announce an M&A budget. But we can infer from context. Reddit has been acquiring startups at a steady pace—multiple deals per year. Most of these appear to be small acquisitions (sub-$100 million range based on public reporting, though some figures aren't disclosed).

Given Reddit's market cap and balance sheet, the company could theoretically do a few larger acquisitions (

What this means: if you're running a startup, Reddit is a realistic acquisition target. The company is actively shopping, focused on smaller deals, and moving relatively quickly. The acquisition process at Reddit appears to be faster than at larger tech companies.

How This Affects Reddit's Competitive Position

Let's step back and think strategically. Why is Reddit aggressively pursuing M&A now?

The simplest answer: because the company is still figuring out how to compete at scale. Reddit went public recently. The company is profitable. But it's still far behind Meta and Google in advertising revenue. Meta makes

To grow advertising revenue faster than it can grow organically, Reddit needs to:

- Attract new advertisers who weren't using Reddit before

- Help current advertisers spend more by improving ROI

- Improve the speed of innovation so features ship faster than competitors

- Build capabilities that Google and Meta don't have

Acquisitions support all four. Acquiring Memorable AI attracts advertisers interested in creative optimization. Acquiring Spell and Spiketrap helps current advertisers get better ROI. Tucking in these technologies ships capabilities faster than building them. And collectively, they're building capabilities specifically optimized for Reddit's use case.

This is smart strategy. Rather than trying to out-engineer Meta or out-data Google, Reddit is building a specific advantage: an advertising platform optimized for community-driven discovery. You can't compete with Meta's 3 billion users or Google's 8 billion searches per day. But you can compete on relevance by leveraging Reddit's specific advantage: the most authentic, human-to-human discussion and recommendations anywhere.

M&A is how Reddit accelerates this advantage. Every acquisition is a bet that this specific capability will help Reddit serve community-focused advertisers better.

What Founders Should Know About Selling to Reddit

If you're running a startup that might be acquisition target, here's what Reddit's earnings call told us about how the company evaluates acquisitions:

First, build something proven. Reddit doesn't want bets. It wants products that work. Have paying customers. Have retention metrics. Have revenue. Show metrics that matter: DAU growth, revenue growth, customer acquisition cost, lifetime value.

Second, focus on specificity over breadth. Reddit acquired Memorable AI specifically for creative prediction, not a general-purpose creative tool. Be domain-specific. Be the best at one thing, not mediocre at many things.

Third, think about scale. How does your technology improve when applied to 121 million daily users instead of 121,000? Does it? If it does, emphasize that in any conversation with Reddit. If it doesn't, you might not be what they're looking for.

Fourth, have an acquisition-ready team. Reddit values small, capable teams. Your team shouldn't be bloated. It should be focused. You should be able to describe what each person does and why they're critical to the product.

Fifth, understand your integration path. Vollero talked about "tucking in" technologies. If you're acquired, how does your product fit into Reddit's infrastructure? Is it a feature on top of existing products? Is it core infrastructure? Have thought through this.

Sixth, show path to monetization. Reddit's acquisition strategy is explicitly about monetization. How does your product help Reddit make more money? Be able to answer that directly.

The Broader Market Implications: Platform Consolidation and Startup Dynamics

Reddit's acquisition strategy is part of a broader trend: platforms are eating adtech. What does this mean for startups, investors, and advertisers?

For startups: The independent adtech business is getting harder. Your best exit is increasingly acquisition by a platform rather than IPO or sustained independence. Focus your product on being acquisition-ready.

For investors: If you're backing adtech companies, understand that the liquidity event might be acquisition rather than IPO. Price your rounds accordingly. Think about potential acquirers early.

For advertisers: Expect faster innovation as platforms acquire capabilities directly. But also expect lock-in as platforms own their entire advertising stack. You'll get better tools on Meta and Google and Reddit, but you won't be able to use best-of-breed tools across platforms easily.

For employees: If you work at an adtech startup that might get acquired, understand the integration path. Will you be "tucked in" (likely to stay, likely some integration risk) or acquired for your data/customers (higher integration risk)? Different scenarios have different employment outcomes.

This consolidation isn't necessarily bad. It actually accelerates innovation in some ways. Platforms can invest more heavily in capabilities when they own the full stack. But it does change the landscape for independent adtech companies.

Key Takeaways: What This Earnings Announcement Actually Means

Let's synthesize everything from Reddit's earnings call into clear takeaways:

Takeaway 1: Reddit is serious about M&A. This isn't speculation or opportunistic. It's stated strategy. The company is going to spend capital on acquisitions. This is part of the growth plan.

Takeaway 2: Adtech remains the primary focus. Everything Reddit has acquired points to advertising. And Vollero's comments underscore that adtech acquisitions work. They're staying focused on the core business.

Takeaway 3: But Reddit is open to other opportunities. The "spectrum of opportunities" language is important. If you're building something that scales with Reddit or brings users, they'll talk to you. Don't count yourself out.

Takeaway 4: Speed to market matters. The fact that Vollero emphasized saving 6-12 months tells you Reddit values velocity. Faster iteration beats perfect execution. Acquisition is how they achieve this.

Takeaway 5: AI is the next frontier. Reddit mentioned AI search as a future revenue opportunity. That's the signal for AI-focused acquisitions to come.

Takeaway 6: The adtech consolidation is real. Platforms are buying capabilities. The era of independent adtech is narrowing. If you're in that space, think acquisition.

FAQ

What is Reddit's M&A strategy?

Reddit's M&A strategy focuses on acquiring "capabilities, technologies, and companies" that either leverage its 121.4 million daily active users at scale or help grow its user base. The company prioritizes "tuck-in" acquisitions of proven technologies that can be integrated quickly into Reddit's existing products, particularly its advertising platform. Rather than building everything in-house, Reddit acquires specialized solutions that work and can be deployed across its massive platform to accelerate time-to-market.

How does Reddit integrate acquired companies?

Reddit uses a "tuck-in" integration approach where acquired technologies are embedded directly into existing Reddit products rather than operated as standalone services. The company's adtech team is particularly experienced at this process, often taking acquired technologies to market in 6-12 months rather than the typical 12-18 months for in-house development. This integration philosophy means acquired teams usually become part of Reddit's permanent organization, contributing to Reddit's core products rather than launching new products under an acquired brand.

Why does Reddit focus on adtech acquisitions?

Reddit depends almost entirely on advertising revenue, which accounted for

Could Reddit acquire companies outside of adtech?

Yes. While adtech is the proven focus, Reddit explicitly stated it's "not ruling anything off the table" in its M&A strategy. Any acquisition that either leverages Reddit's scale (becomes more valuable with 121 million daily users) or brings significant user growth is potentially interesting to the company. This could theoretically include commerce, creator tools, AI infrastructure, or other verticals that complement Reddit's core platform.

How much money is Reddit likely to spend on acquisitions?

Reddit hasn't announced a specific M&A budget. However, based on the company's acquisition history, it appears to prefer multiple smaller acquisitions ($50-150 million range) rather than few large acquisitions. Given Reddit's recent IPO and current market capitalization, the company has capital available for both approaches. The pace of acquisitions suggests Reddit will continue making deals at a steady cadence throughout 2025.

What makes a company attractive to Reddit as an acquisition target?

Redddit looks for several specific characteristics: proven products with real customers and usage data, small capable teams rather than large organizations, technologies that become more powerful at Reddit's scale, clear integration paths into Reddit's existing products, and demonstrated monetization potential. The company particularly values acquisitions that can save time-to-market and ship working products quickly, which is why proven technologies are prioritized over emerging products or prototypes.

The Bottom Line: Why Reddit's M&A Ambitions Matter

Reddit's earnings call announcement about acquisitions might sound like routine corporate speak. In reality, it's a clear signal about how the company plans to compete in the next chapter of its growth.

For a platform that went public last year, growing fast enough to satisfy investors while competing against Meta and Google is genuinely difficult. Reddit can't out-engineer Google. It can't out-data Meta. But it can be smarter about acquiring specific capabilities that make its platform better at what it does uniquely: facilitating authentic human discussion and discovery.

Every acquisition is a bet. Memorable AI is a bet that better creative prediction helps advertisers spend more. Spell is a bet that better ML helps with every aspect of the platform. Spiketrap is a bet that better targeting improves ROI and attracts advertisers.

Vollero's comments suggest these bets are paying off, which is why Reddit is doubling down. The company sees a formula that works: identify proven technology, acquire the team and product, integrate quickly, and leverage scale. It's working in adtech. It's working for monetization. And the company is explicitly open to applying this formula to other areas.

For founders, this is opportunity. Reddit is actively shopping. For advertisers, this means better tools are coming. For investors, this is a signal that M&A remains a viable exit for adtech startups. For the broader tech industry, this is another data point in platform consolidation: the era of independent, horizontal tools might be narrowing, and the era of platform-specific, vertical solutions is beginning.

Reddit's M&A strategy isn't flashy. It's not acquiring household names or pursuing massive, transformational deals. It's methodically building a better advertising platform, one proven technology at a time. That might be boring. But boring is often how you win.

Related Articles

- Why Loyalty Is Dead in Silicon Valley's AI Wars [2025]

- Why Samsung's Galaxy S26 Faces Massive Hype Crisis [2025]

- The ARR Myth: Why Founders Need to Stop Chasing Unrealistic Growth Numbers [2025]

- Mundi Ventures' €750M Kembara Fund: Europe's Deep Tech Revolution [2025]

- Google Hits $400B Revenue Milestone in 2025 [Full Analysis]

- Resolve AI's $125M Series A: The SRE Automation Race Heats Up [2025]

![Reddit's Acquisition Strategy for 2025: Why Adtech & AI Matter [2025]](https://tryrunable.com/blog/reddit-s-acquisition-strategy-for-2025-why-adtech-ai-matter-/image-1-1770404762217.jpg)