RAM Price Hikes & Global Memory Shortage: What's Happening Right Now

Your next laptop is going to cost more. Your new phone? Same story. Gaming console upgrade? Prepare your wallet. And it's all because of something most people never think about: RAM.

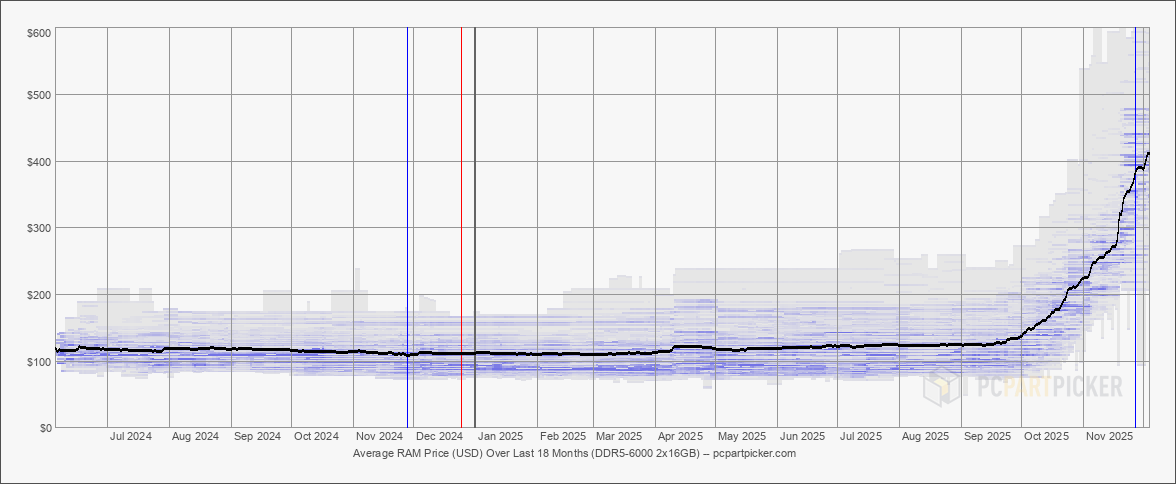

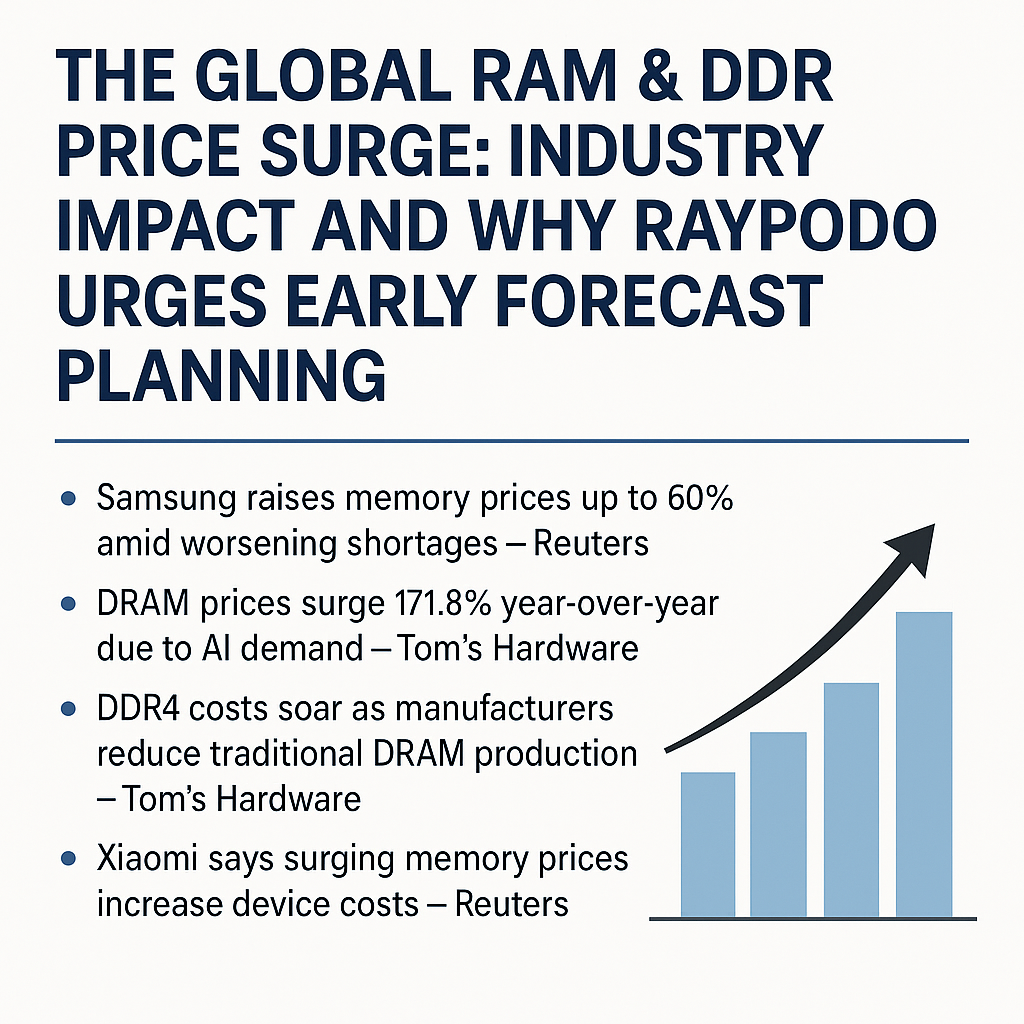

Yes, the random access memory that makes your computer actually work is experiencing a perfect storm. AI companies are hoarding it for data centers, manufacturers are struggling to keep up with demand, and prices are climbing faster than you'd think possible. We're talking about memory modules that cost less than $20 just a year ago now hitting triple digits.

Here's the thing: this isn't some temporary blip. Analysts predict this shortage could drag on well into 2027. That means if you're planning to buy a laptop, phone, or any tech with RAM inside, you're going to feel the pinch sooner rather than later.

I've been tracking this closely, and the situation is way more complex than "memory costs more now." There's a fascinating (and frustrating) story here about supply chains, AI's insatiable appetite for computing power, and how a few companies control the world's memory production.

Let's break down what's actually happening, why it matters to you, and what it means for the tech industry's future.

TL; DR

- RAM prices have exploded: Memory modules cost 5-10x more than a year ago, with some premium models jumping from under 100

- AI is the culprit: Companies like Open AI, Google, Meta, and Anthropic are buying up massive quantities of DRAM for their data centers

- Three companies control supply: Samsung, SK Hynix, and Micron make the vast majority of the world's RAM, and they're prioritizing AI companies over consumers

- Everything's getting more expensive: Smartphones, laptops, gaming consoles, and even small devices are facing price increases as manufacturers pass costs downstream

- This will last years: The International Data Corporation predicts shortages could persist until 2027 or beyond

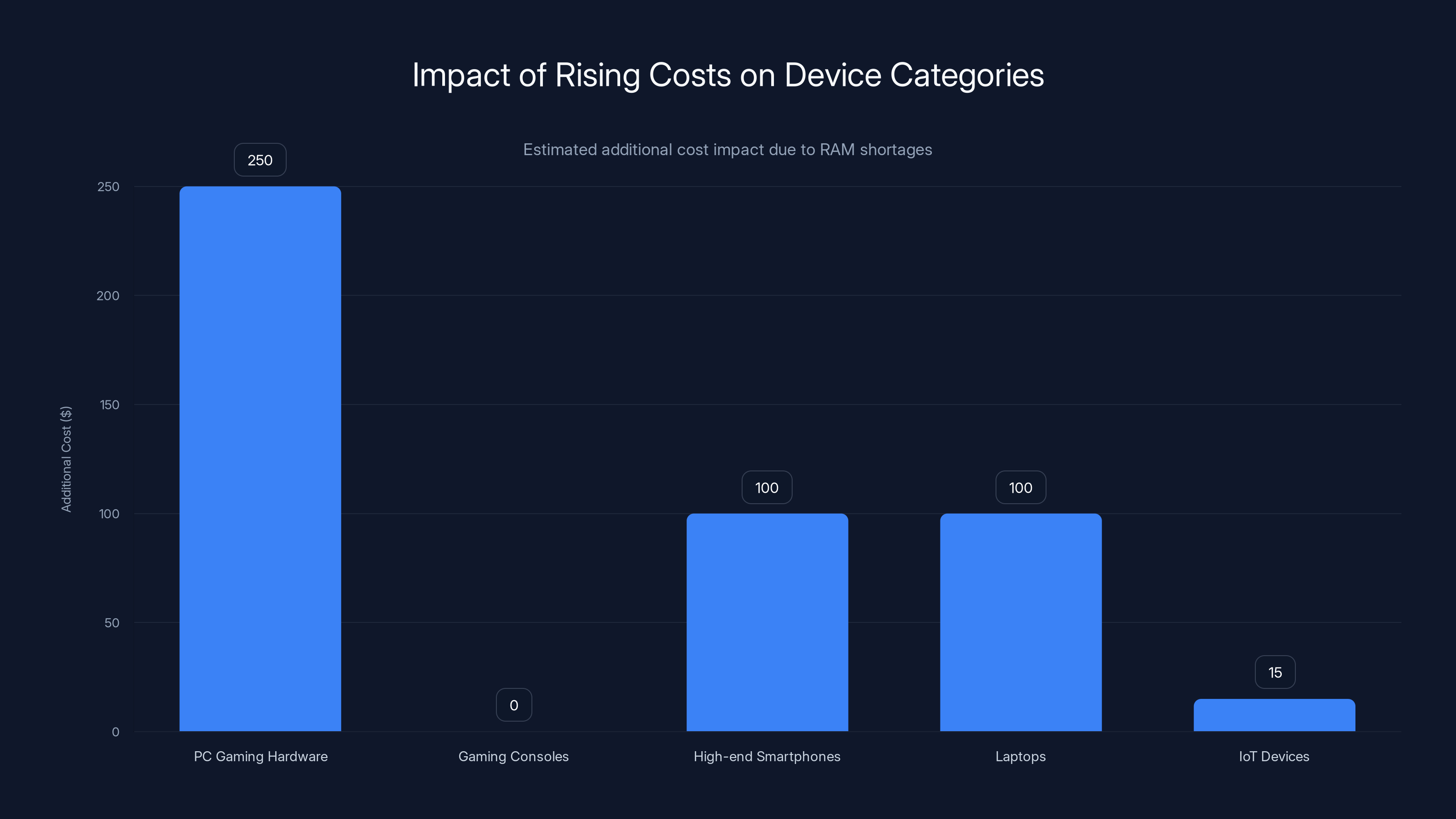

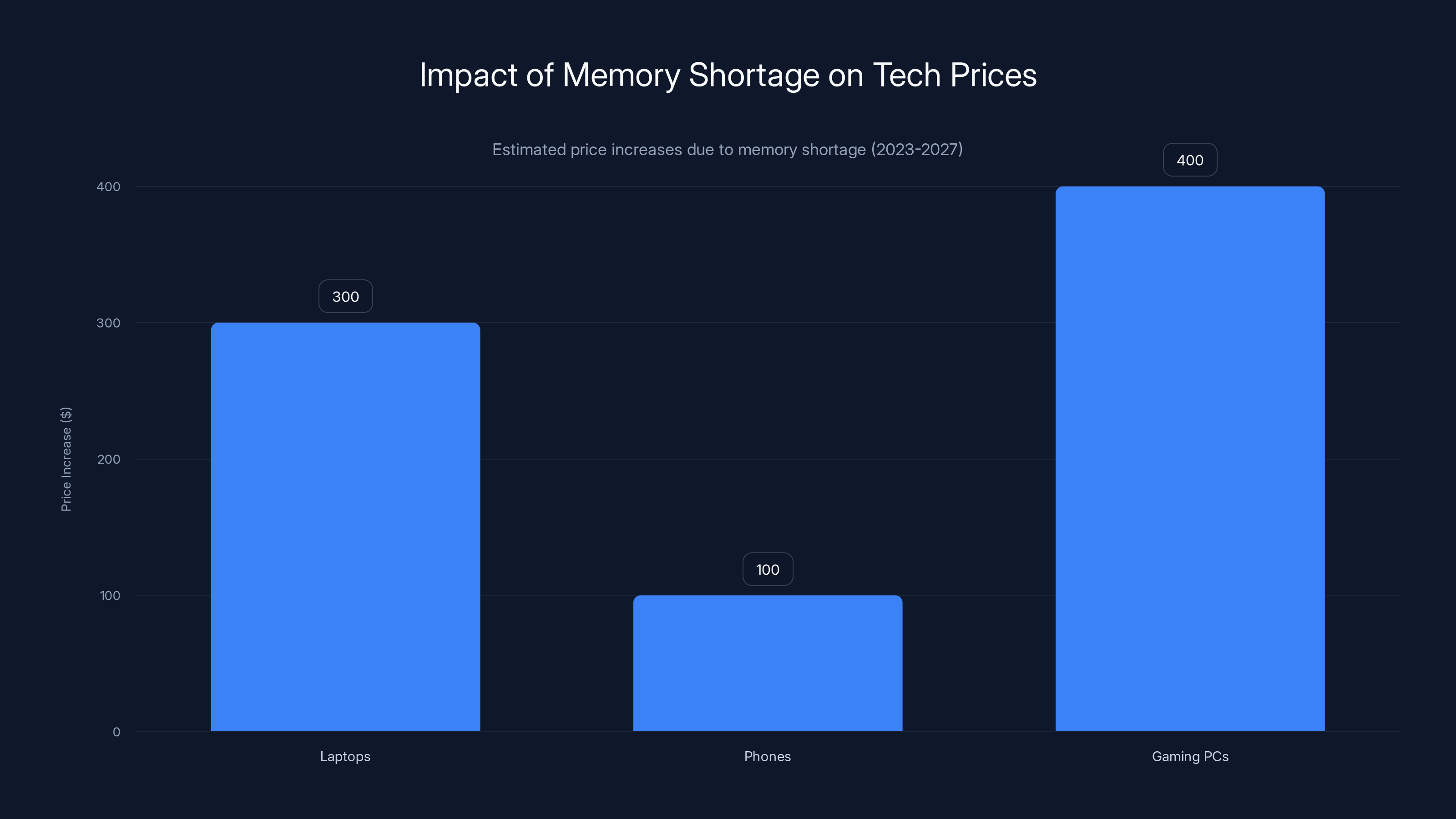

PC gaming hardware faces the highest additional costs due to RAM shortages, with an estimated $250 increase. IoT devices, while less affected in absolute terms, see significant percentage increases. (Estimated data)

The AI Boom Is Consuming RAM at Unprecedented Rates

Let's start with the obvious culprit: artificial intelligence. The explosive growth of AI has created an insatiable demand for computing resources, and that demand is fundamentally reshaping the global memory market.

Data centers running large language models like Chat GPT, Claude, and Gemini require massive amounts of DRAM. We're talking about systems with hundreds of gigabytes, sometimes terabytes, of memory just to handle inference and model serving. When Open AI runs Chat GPT at scale, it's not using a normal computer. It's using specialized hardware with absurd amounts of memory.

The numbers here are staggering. A single large language model inference cluster can require more DRAM than thousands of consumer computers combined. And that's just one model from one company. Now multiply that across Open AI, Google, Meta, Microsoft, Anthropic, and dozens of smaller AI startups burning through venture capital to build their own infrastructure.

These companies aren't being frugal about it, either. They're buying whatever capacity they need because the alternative—running out of memory and not being able to serve customers—is unacceptable. A service outage costs millions. Underbidding on DRAM is just a cost of doing business.

The result: Memory makers like Samsung, SK Hynix, and Micron made a logical business decision. Why sell memory to computer makers at regular margins when you can sell it to hyperscalers at much higher prices? The profit per gigabyte is substantially better, and the customer relationships are more stable.

Consumer demand dropped relative to enterprise demand, and the market shifted. This isn't malice. It's economics. It's what happens when demand from trillion-dollar companies outweighs demand from everyone else.

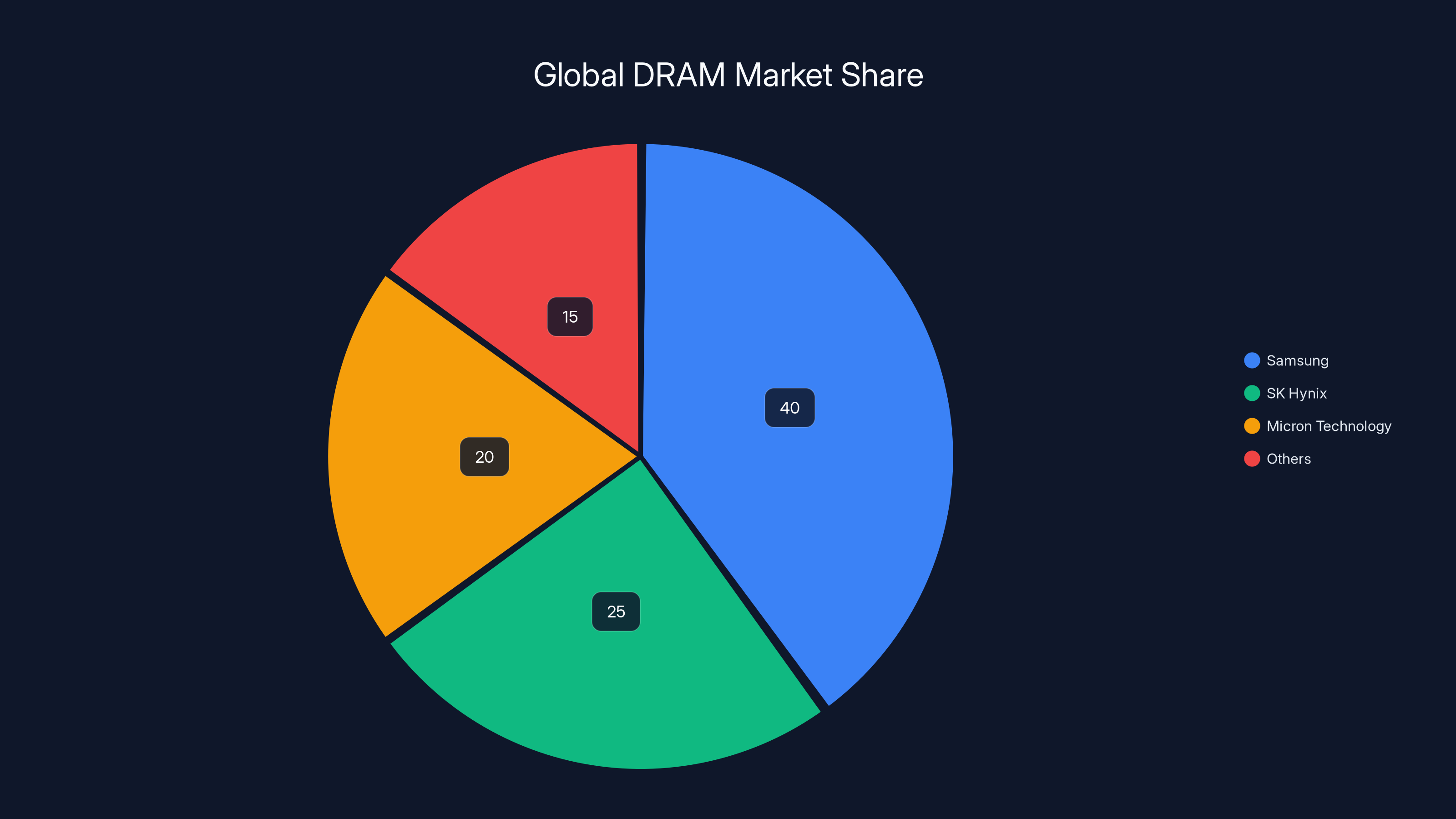

Samsung leads the global DRAM market with a 40% share, followed by SK Hynix and Micron Technology. The remaining 15% is controlled by other smaller players. (Estimated data)

How RAM Is Distributed Across Every Device You Own

Here's what most people don't realize: RAM isn't just in your computer. It's everywhere. And that's making this shortage catastrophic in ways that extend far beyond the PC gaming community.

Laptops and desktops: This is the most obvious one. Your Mac Book, your Windows machine, your gaming rig—all of it contains DRAM. A typical laptop uses 8-16GB. A gaming desktop might have 32-64GB. When memory prices spike, manufacturers have two choices: absorb the cost or pass it to customers.

Smartphones: Modern phones contain 8-12GB of RAM in flagship models. That's a lot of expensive memory. And here's the thing: phone makers have razor-thin margins. They can't just absorb a 400% cost increase on a component. That gets passed to you at checkout.

Gaming consoles: Play Station 5 and Xbox Series X both use custom DRAM configurations. When memory costs go up, console manufacturers feel it immediately.

Smart TVs: Even your TV has RAM. The processor needs memory to run the software, handle apps, and buffer streaming content. Not as much as a computer, but it adds up.

Cars: Modern vehicles have increasingly sophisticated computer systems, and they all require memory. Everything from infotainment systems to autonomous driving features needs RAM.

Solid-state drives (SSDs): This one catches people off guard. SSDs use DRAM for their controller caches. Your fast NVMe drive has memory built into it.

Networking equipment: Routers, switches, and other networking gear all need memory.

The point is clear: there's basically no electronic device worth more than $100 that doesn't contain some amount of DRAM. When memory prices explode, it creates a chain reaction across the entire consumer electronics industry.

The Three Companies That Control Global Memory Production

Understanding this shortage requires understanding who actually makes RAM. The answer is surprisingly concentrated: three companies dominate global DRAM production.

Samsung is the largest, controlling roughly 40% of the global DRAM market. They're a massive conglomerate with diversified revenue streams, so DRAM is just one part of their business. But it's a crucial part. Samsung's memory division generates tens of billions in annual revenue.

SK Hynix is the second-largest player, with roughly 25% market share. The South Korean company is deeply integrated into the semiconductor industry and supplies memory to everyone from Apple to PC makers.

Micron Technology rounds out the trio with roughly 20% market share. The American company is the smallest of the three, but still has enormous influence over global memory pricing.

Everyone else combined controls maybe 15% of the market. This is an oligopoly, plain and simple. Three companies determine the world's memory supply, pricing, and allocation.

During good times, this oligopoly is manageable. Competition between the three keeps prices from getting ridiculous. But when demand shifts dramatically—like it has with AI—the oligopoly becomes a chokepoint. These three companies can't suddenly triple their capacity. Building a new chip fab takes years and costs billions.

So what happened instead? They made strategic decisions about who deserves their limited supply. AI companies paying premium prices won the allocation lottery. Everyone else waits in line.

The calculus is brutal: A hyperscaler paying

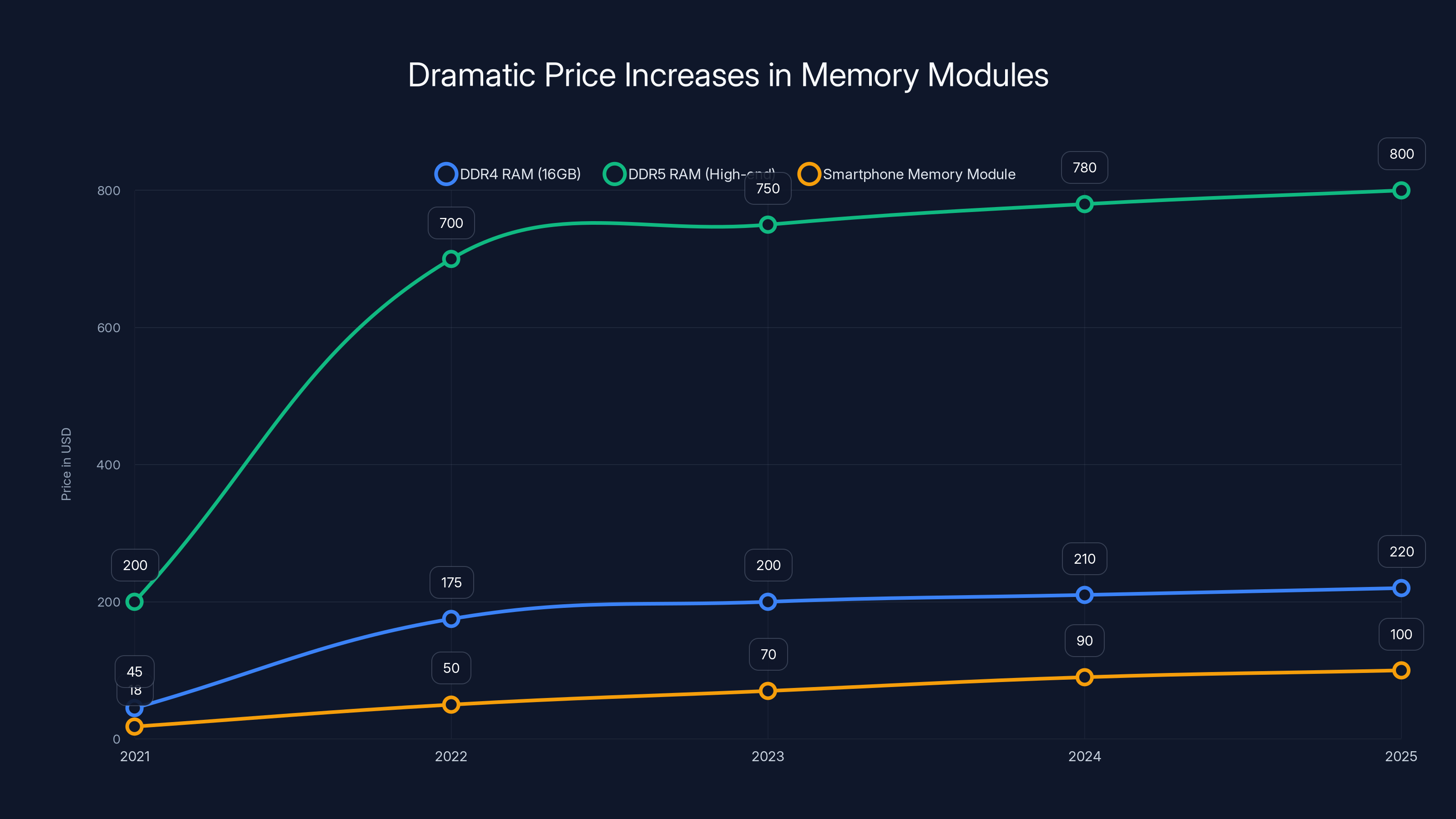

Memory module prices have surged dramatically, with DDR4 RAM increasing by 300-400% and DDR5 RAM by 3-4x since 2021. Smartphone memory modules are expected to rise by 500% by 2025. Estimated data for future years.

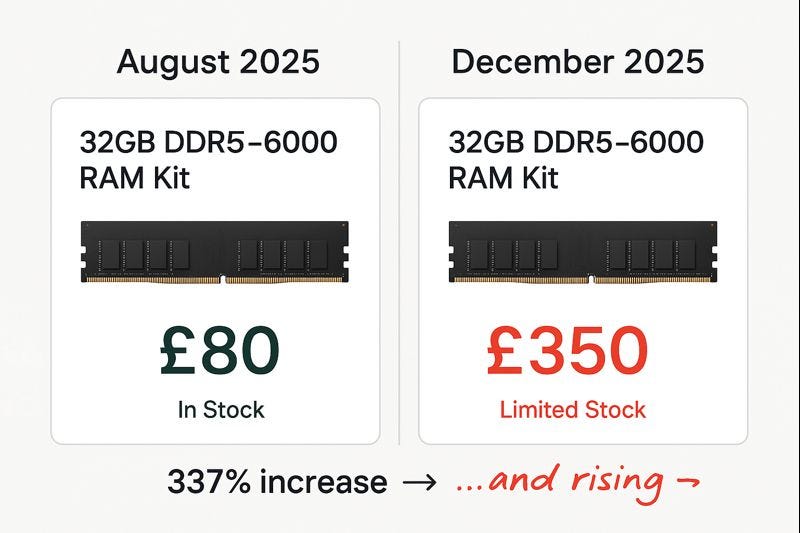

Specific Price Increases: The Numbers Are Shocking

Let's look at concrete numbers, because the price increases are genuinely staggering.

A year ago, you could buy 16GB of DDR4 RAM for around

For flagship smartphones, the situation is even worse. According to Carl Pei, CEO of Nothing, memory modules that cost less than

PC builders have been feeling this pain the longest. High-end DDR5 memory kits that were

Micron's decision to discontinue its Crucial brand for consumers is instructive. The company said it's focusing its consumer memory production through "different channels," meaning selling directly to laptop and phone manufacturers instead of retail. Translation: there's more money in bulk deals with device makers than in consumer retail.

These aren't speculative numbers either. These are documented price points from retail channels, manufacturer announcements, and supply chain analysis. The increases are real, and they're happening right now.

Historical comparison: The last significant memory shortage was in 2017-2018, when DRAM prices roughly doubled. This shortage is potentially worse. We're seeing 5-10x increases on some products.

Which Devices Are Hit Hardest By Rising Costs

Not all devices are affected equally by this RAM shortage. Some categories are getting absolutely hammered, while others have more flexibility.

PC gaming hardware: This is ground zero for the shortage's impact. Custom PC builders are facing the worst scenario: prices for all components are up, but RAM increases are particularly brutal. A typical gaming PC build might have absorbed a $200-300 premium in RAM costs alone. Many builders are being priced out of the market or having to compromise on specifications.

Gaming consoles: Sony and Microsoft already locked in their pricing for PS5 and Xbox Series X, so they're absorbing the memory cost increases as margin pressure. Future generation consoles will definitely be more expensive, but the current generation is somewhat insulated.

High-end smartphones: Flagship phones are seeing the biggest pressure. When you're already charging

Laptops: This is a tricky market. Premium laptops from Apple, Dell, and Lenovo are passing costs to consumers. But budget laptop markets are being squeezed harder. A

Io T devices: Smaller devices with modest RAM requirements are less affected in absolute terms, but the percentage impact can be significant. A smart speaker with

Enterprise and servers: Data center operators are actually less concerned about cost than consumer electronics makers. They care more about capacity and performance. This is part of why they're winning the allocation competition.

Framework and Raspberry Pi have already announced price increases. Dell, Asus, Acer, Xiaomi, and Nothing have warned about upcoming price hikes. The wave of consumer-facing price increases is just beginning to roll out.

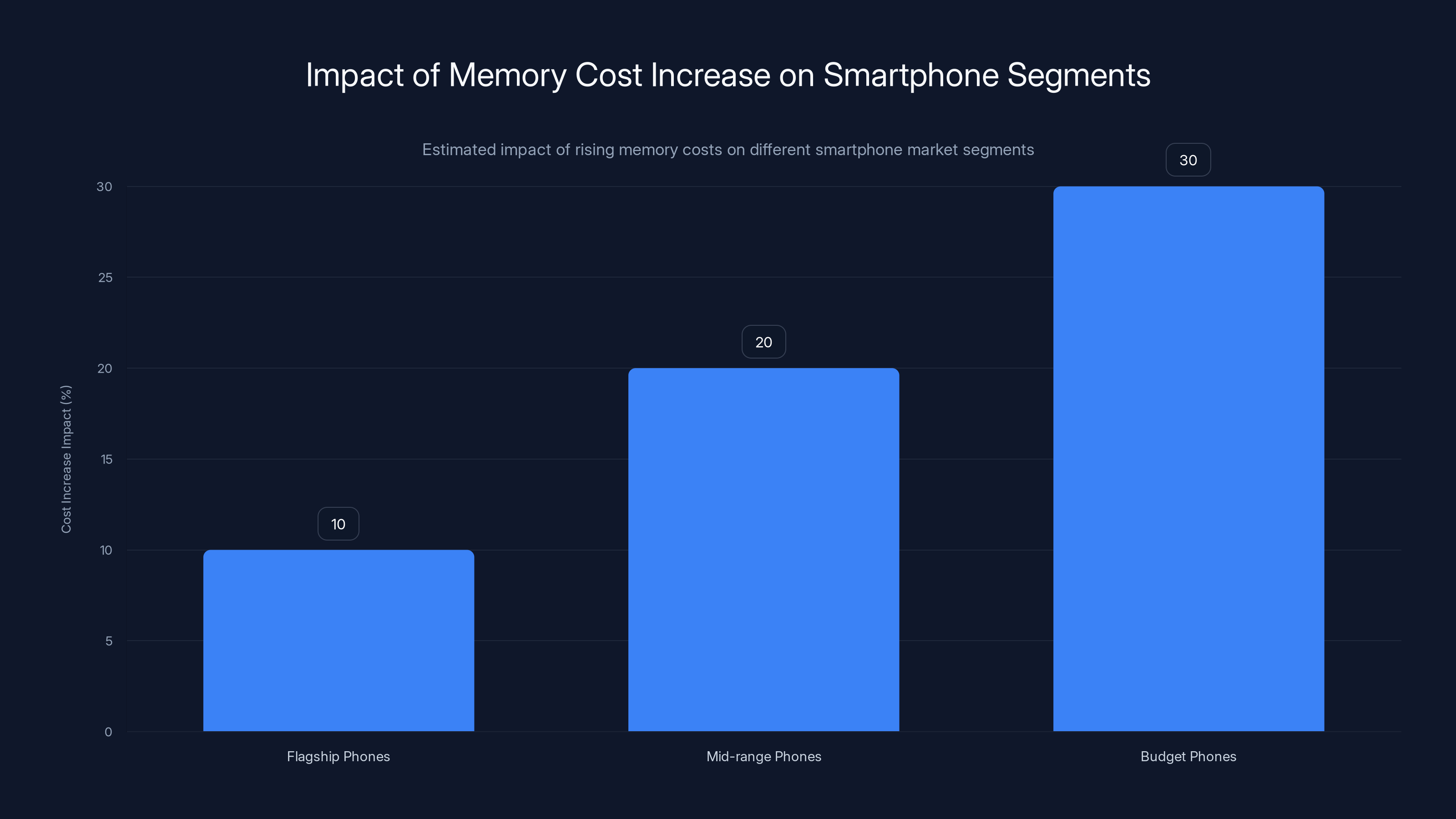

Estimated data shows that budget phones face the highest impact from rising memory costs, with a potential 30% increase, compared to 10% for flagship phones.

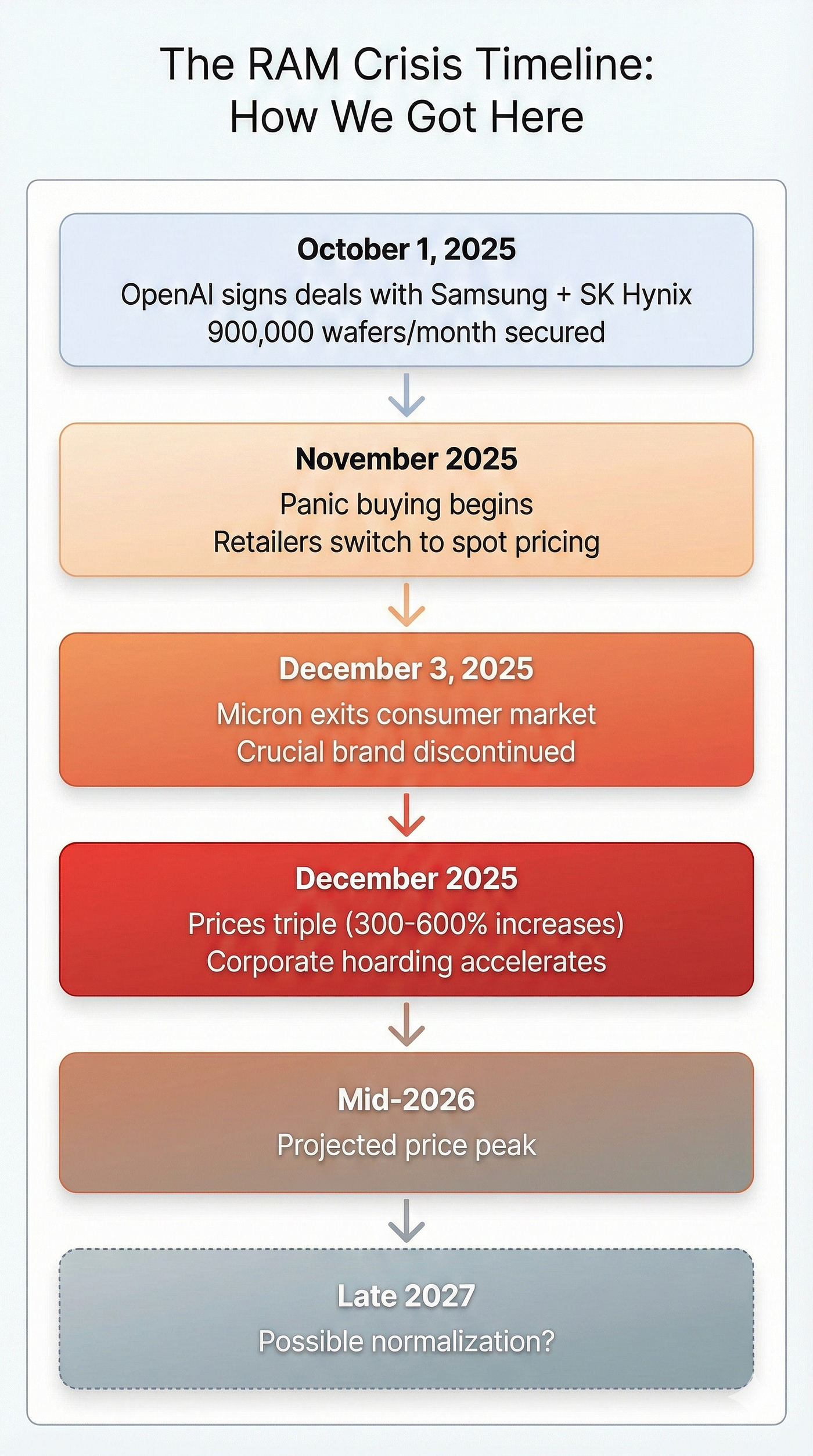

When Will This Shortage End? Analyst Predictions

Here's the question everyone's asking: when does this get better?

The answer is depressing. Most analysts, including the International Data Corporation (IDC), predict that the shortage could persist well into 2027. That's not next quarter. That's 1-2 years away at minimum.

Here's why it's so hard to fix quickly. Memory manufacturers can't just flip a switch and produce more DRAM. Building a new semiconductor fab is a multi-year, multi-billion-dollar project. Samsung, SK Hynix, and Micron all have expansion plans, but those plants take 3-4 years to come online. The shortage won't be fixed until 2026 at the earliest, and that's only if everything goes perfectly.

Secondarily, there's no guarantee that new capacity will prioritize consumer products. If AI demand continues accelerating, new fabs might be allocated to hyperscalers immediately. There's a scenario where consumer prices stay elevated even as total capacity increases.

A potential path to relief exists, but it's complicated:

- AI infrastructure spending peaks (possibly in 2026)

- Hyperscalers complete their buildouts and demand stabilizes

- Memory manufacturers shift focus to consumer products

- New fabs come online and increase total capacity

- Prices gradually decline (2026-2027)

But this assumes AI spending stays on its current trajectory and doesn't accelerate further. If the trend intensifies—which seems likely given how much money companies are investing in AI—this timeline could extend.

Most conservative estimates suggest prices won't return to 2023 levels until 2027-2028. In other words, we're looking at a 3-4 year elevated-price environment for memory. That's a long time to be patient.

Impact On Laptop and PC Pricing

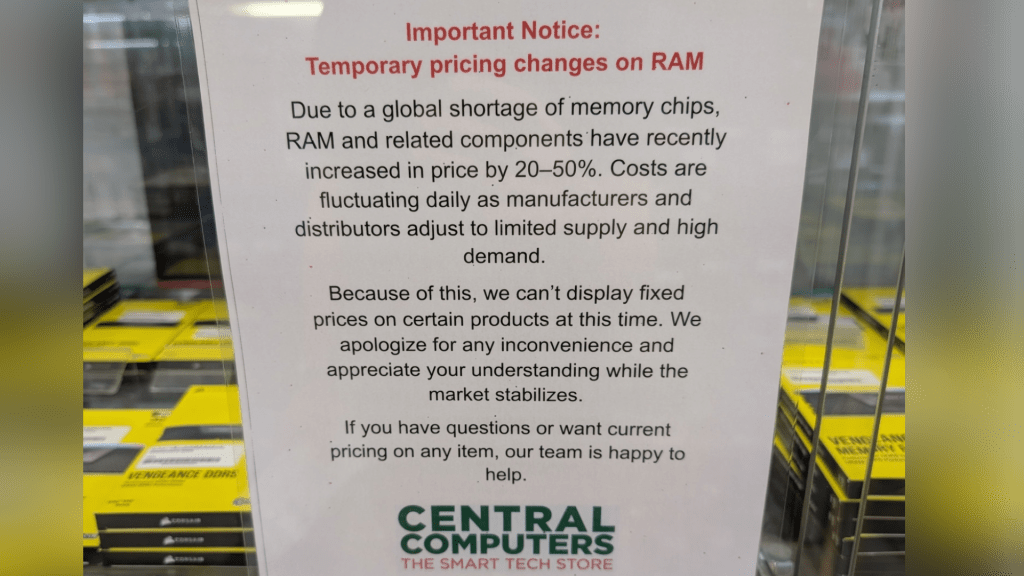

Laptop manufacturers are starting to feel the pain, and they're passing it along to consumers.

A typical laptop uses 16GB of RAM as standard, with 32GB becoming increasingly common in professional models. Two years ago, that 16GB cost a manufacturer roughly

Manufacturers have three options: absorb the cost (hurting profits), raise prices (risking sales), or reduce specifications (compromising quality). Most are choosing some combination of the three.

Dell's response: The company has warned about upcoming price increases across its consumer and commercial lines. Dell can't absorb these costs indefinitely. Its margins aren't that thick.

Apple's situation: Interestingly, Apple has more flexibility than most. The company controls its own chip designs through Apple Silicon, which includes integrated memory controllers and optimizations. But Apple still needs DRAM, and even Apple's enormous scale can't escape supply chain physics.

Asus and Acer: Both companies have warned about price increases for 2025. Gaming laptops are particularly affected because they typically come with higher-end memory configurations.

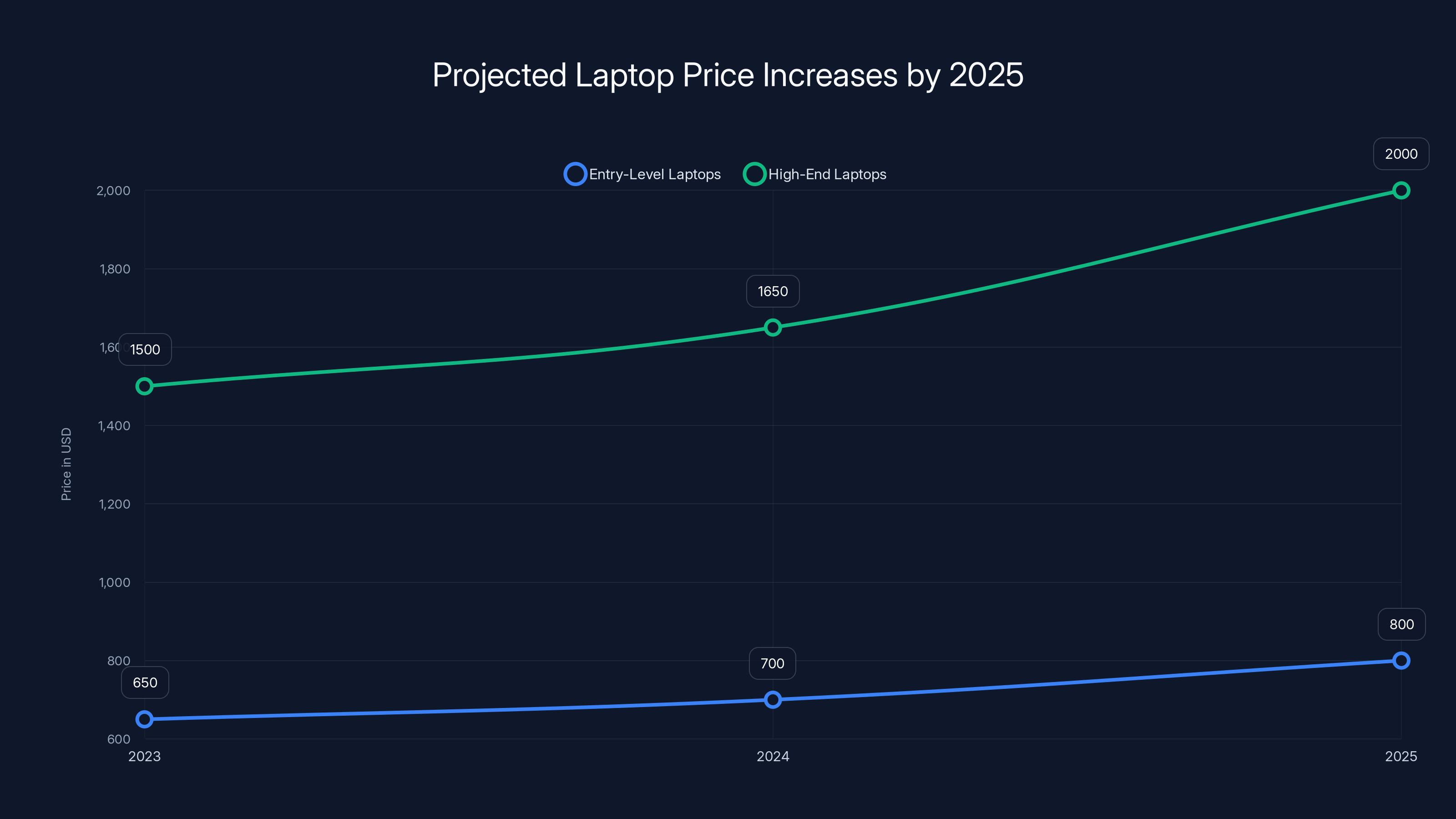

The practical impact is clear: if you were thinking about upgrading your laptop in 2025, expect to pay more. Entry-level models that were

This is creating a secondary effect: people are holding onto their existing machines longer. If your 2021 laptop still works fine, and upgrading means paying a 30% premium, you'll probably wait. This reduced demand should eventually help ease the shortage, but in the short term it just means manufacturers sell fewer units at higher prices.

Estimated data shows significant price increases for tech products due to the memory shortage, with gaming PCs seeing the highest hike.

Smartphone Market Pressure: From Flagships to Budget Models

Smartphones are experiencing acute pressure from rising memory costs, though the impact varies dramatically by market segment.

Flagship phones from Apple, Samsung, and the like use 8-12GB of RAM as standard. That's expensive memory—the highest-end DRAM dies fabricated with cutting-edge processes. When costs increase 5-10x, the impact is immediate.

Cal Pei's statement about Nothing's pricing is representative of the broader market. When memory costs jump from

The budget phone market is getting squeezed harder. A budget Android phone might retail for

The likely outcomes:

- Flagship phones get more expensive (already happening)

- Mid-range phones start disappearing as they become uncompetitive

- Budget phones get lower base RAM configurations

- Some manufacturers pull out of certain markets entirely

Apple's i Phone is in an interesting position. The company controls its A-series processors and has significant influence over its supply chain. But even Apple can't escape the laws of supply and demand. Expect i Phone pricing to increase alongside general market pressure.

One nuance: some phone makers might start offering base models with less RAM. Instead of 8GB standard, we might see 6GB in budget models. This saves money but potentially compromises user experience, especially as apps become more memory-intensive.

Gaming Industry Collateral Damage

The gaming industry is experiencing a perfect storm of cost increases, and memory is just one part of a larger problem.

PC gaming hardware: This is where the pain is most acute. GPUs have been volatile for years (remember the mining boom?), and now RAM is on a cost explosion trajectory too. A typical gaming PC that cost

Pre-built gaming systems from brands like NZXT, Corsair, and Alienware are getting noticeably more expensive. Custom builders are seeing the same effects. The community is frustrated, and many people are delaying upgrades indefinitely.

Console gaming: This is more complicated. Current generation consoles (PS5, Xbox Series X) came to market in 2020 at locked prices. Manufacturers absorbed the recent cost increases as margin pressure. But that strategy only works if they're still selling at volume—and supply has been constrained by other factors too.

Future console generations will definitely be more expensive. Don't expect PS6 or Xbox Series Z to launch at

Gaming monitor and peripheral prices: This is a secondary effect. Monitors don't use as much RAM as systems, but higher-end gaming monitors with local dimming, high refresh rates, and built-in processing have seen modest price increases.

Game development impact: Higher hardware costs might also impact game development economics. If development teams expect fewer people to upgrade to high-end hardware, they might optimize for lower specifications. This could actually be good for game quality across the board—fewer 4K-focused, memory-intensive games.

The gaming industry has weathered tech cycles before. But the combination of GPU costs, memory costs, and economic uncertainty is creating genuine headwinds for enthusiast hardware purchases.

Estimated data shows entry-level laptop prices could rise from

The Manufacturing Supply Chain Complexity

Understanding why memory makers can't just "make more" requires understanding the insane complexity of modern semiconductor manufacturing.

A DRAM fab doesn't just make one type of memory. It makes DDR3, DDR4, DDR5, LPDDR4, LPDDR5, and various specialized memory types. Switching production between these types isn't instant. You need to retool equipment, reprogram lithography systems, and restart the entire manufacturing process.

Each process node (5nm, 7nm, etc.) requires different manufacturing equipment and procedures. Migrating production to more advanced nodes can increase yield (more good chips per wafer) but requires capital investment and process qualification time.

Here's the reality: Samsung, SK Hynix, and Micron are already running at maximum capacity. Every fab is running 24/7. They're not holding back production intentionally. They're already producing as much as physically possible given their current equipment and facilities.

So the allocation decisions aren't about willingness. They're about pricing and contracts. Hyperscalers are willing to pay premium prices and sign long-term contracts guaranteeing volume. That's the kind of certainty memory makers want. Consumer electronics makers, by contrast, have unpredictable demand and tighter margins.

Building new capacity takes time:

- Year 0-1: Planning, land acquisition, facility design

- Year 1-2: Construction of the fab building

- Year 2-3: Equipment installation and process development

- Year 3-4: Ramping production and yield optimization

- Year 4+: Full production capacity

This timeline means fab decisions made today won't produce memory until 2027-2028. Memory makers did make investments in new capacity, but those investments were made before the AI boom accelerated demand. There's a massive lag between identifying the shortage and bringing new capacity online.

Government and Industry Responses

Policymakers and industry leaders are starting to pay attention to the memory shortage, though meaningful solutions remain distant.

U. S. government initiatives: The CHIPS Act provided funding to encourage domestic chip manufacturing. But memory production is capital-intensive and commodity-based. It's not particularly attractive to American companies or policymakers compared to designing more sophisticated chips.

Memory production is still concentrated in South Korea (Samsung, SK Hynix) and Japan (Kioxia, Nanya), with Micron as the only major American player. Any push to bring memory manufacturing back to the U. S. would require massive subsidies and would take years to show results.

Industry working groups: Memory manufacturers, device makers, and hyperscalers are supposedly in talks about fair allocation. But these discussions have limited impact. Companies operate in their own financial interest.

Market responses: The most interesting responses are market-driven. Some companies are trying to redesign products to use less memory. Others are exploring alternative memory technologies like NAND Flash or emerging technologies.

But here's the truth: no technology currently available is a 1:1 substitute for DRAM. NAND is too slow. Other memory types have different trade-offs. For the foreseeable future, DRAM is the only practical solution for certain use cases.

Strategic stockpiling: Some large companies are probably stockpiling memory. Buy more than you need now, secure supply for the next couple years. This accelerates the shortage for everyone else but makes business sense individually.

The reality is that markets solve these problems through price signals and time, not through policy intervention. Prices will eventually discourage demand enough that supply catches up. This might take a year or two, but it will happen.

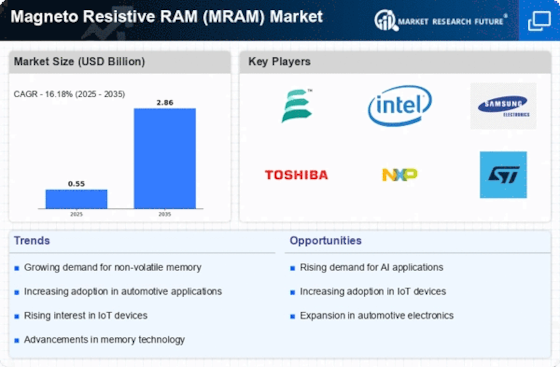

Emerging Memory Technologies and Their Limitations

There's always discussion about whether alternative memory technologies could solve the shortage. The answer is basically: not yet, and probably not for several years.

HBM (High Bandwidth Memory): This is a stacked memory technology used in AI accelerators and high-end GPUs. It offers significantly more bandwidth than traditional DRAM but at much higher cost. HBM is part of AI data center solutions but doesn't help consumer devices much.

MRAM (Magnetoresistive RAM): This emerging technology is non-volatile (keeps data without power) and potentially much cheaper than DRAM in the long term. But it's not production-ready at consumer scale. We might see it in 5-10 years, not today.

NAND Flash: People sometimes suggest using faster NAND as a substitute for DRAM. But NAND has write-cycle limitations (it wears out) and different performance characteristics. It's not a swap-in replacement.

Re RAM (Resistive RAM): Another emerging technology that's still years away from commercial production.

The uncomfortable truth is that DRAM has been optimized for 30+ years. It's cheap, fast, and reliable. Any alternative technology would need to match or exceed DRAM's performance while being cheaper and available in massive quantities. That's an extraordinarily high bar.

Memory makers are investing in DRAM successor technologies, but commercialization is still years away. In the medium term (2025-2027), DRAM will remain the only practical solution for memory-intensive applications.

How Consumers Should Navigate This Market

If you need to buy devices with memory in the next 6-12 months, here's what you should know:

For PC builders: Postpone if possible. If you must upgrade, buy off-the-shelf systems rather than custom builds. Integrated memory costs will be reflected in both equally, but pre-built systems sometimes benefit from volume discounts that offset some increases.

For laptop buyers: Expect price increases across the board. Mid-range and high-end laptops have bigger increases than budget models. Consider waiting until Q3 2025 or later if your current machine is acceptable.

For smartphone buyers: Flagship phones are getting more expensive. Budget and mid-range options might be your best value proposition right now. Older generation flagships (2023-2024 models) are starting to drop in price as new, more expensive models launch.

For enterprise buyers: Your negotiating power is much greater than consumers'. Approach memory suppliers about volume pricing and multi-year contracts. Lock in prices before further escalation.

For gaming console buyers: Current generation consoles are available at locked prices. If you're considering a PS5 or Xbox Series X, now's not a bad time. Future generation consoles will be significantly more expensive.

General advice: Buy memory-intensive devices sooner rather than later if you were planning to buy anyway. Each quarter brings higher prices. If you can postpone non-essential purchases, do so.

Long-Term Industry Implications

This shortage is going to reshape the tech industry in subtle but important ways.

Memory will become a luxury component: Right now, companies are fighting to find ways to reduce memory usage or live with less memory. This will accelerate development of more efficient software and more sophisticated memory management.

AI hardware requirements will drive standards: As AI becomes more critical, memory capacities will be determined by what hyperscalers need, not what consumers want. This could actually benefit consumers in the long run (more standardization) or hurt them (designing for AI requirements rather than consumer use cases).

Regional market fragmentation: Memory availability might differ significantly between regions. Some manufacturers might prioritize domestic or regional supply. This could lead to different product offerings in different markets.

Business model shifts: Some companies might move toward memory-less or memory-light designs. Cloud-first products that do processing elsewhere instead of locally. This could actually improve battery life and form factors.

Competitive consolidation: Smaller computer makers might struggle with cost increases. We could see consolidation in the laptop and gaming markets as weaker players get squeezed out.

Price premium normalization: Once the shortage ends, prices might not return to 2023 levels. Memory as a component might simply cost more than it used to, reflecting true production economics rather than pre-shortage commodity pricing.

This shortage is a stress test for the industry. We'll probably see some companies manage it better than others. Those winners will gain market share. Those losers might disappear.

What This Means for Your Next Device Purchase

Here's the bottom line: if you need a device with memory in the next 12-18 months, you're going to pay more than you would have two years ago.

That sucks. It's not fair. The shortage isn't your fault. But it's the market reality you're working with.

The consoling thought is that this is temporary. The shortage won't persist forever. By 2026-2027, prices should start normalizing. By 2028, we might look back on 2025 pricing with the same disbelief we now have about mining-era GPU prices.

But between now and then? Buckle up. Device prices are going up. Component costs are rising. Manufacturers are passing costs to consumers. This will be reflected in everything from flagship i Phones to budget gaming laptops to smart home devices.

The question isn't whether prices will go up. They already have, and they will continue rising in many segments. The question is whether you need to upgrade now or can wait out the shortage and buy at better prices in a year or two.

For most people, waiting is the better option. Your current device is probably fine. The upgrade you're considering will still be available (and cheaper) in 2026. The hype around the latest features will fade. Battery degradation is manageable.

But if you genuinely need to upgrade—your device is broken, too slow, or unsupported—do it sooner rather than later. Waiting risks paying even more.

FAQ

What exactly is DRAM and why is it so important?

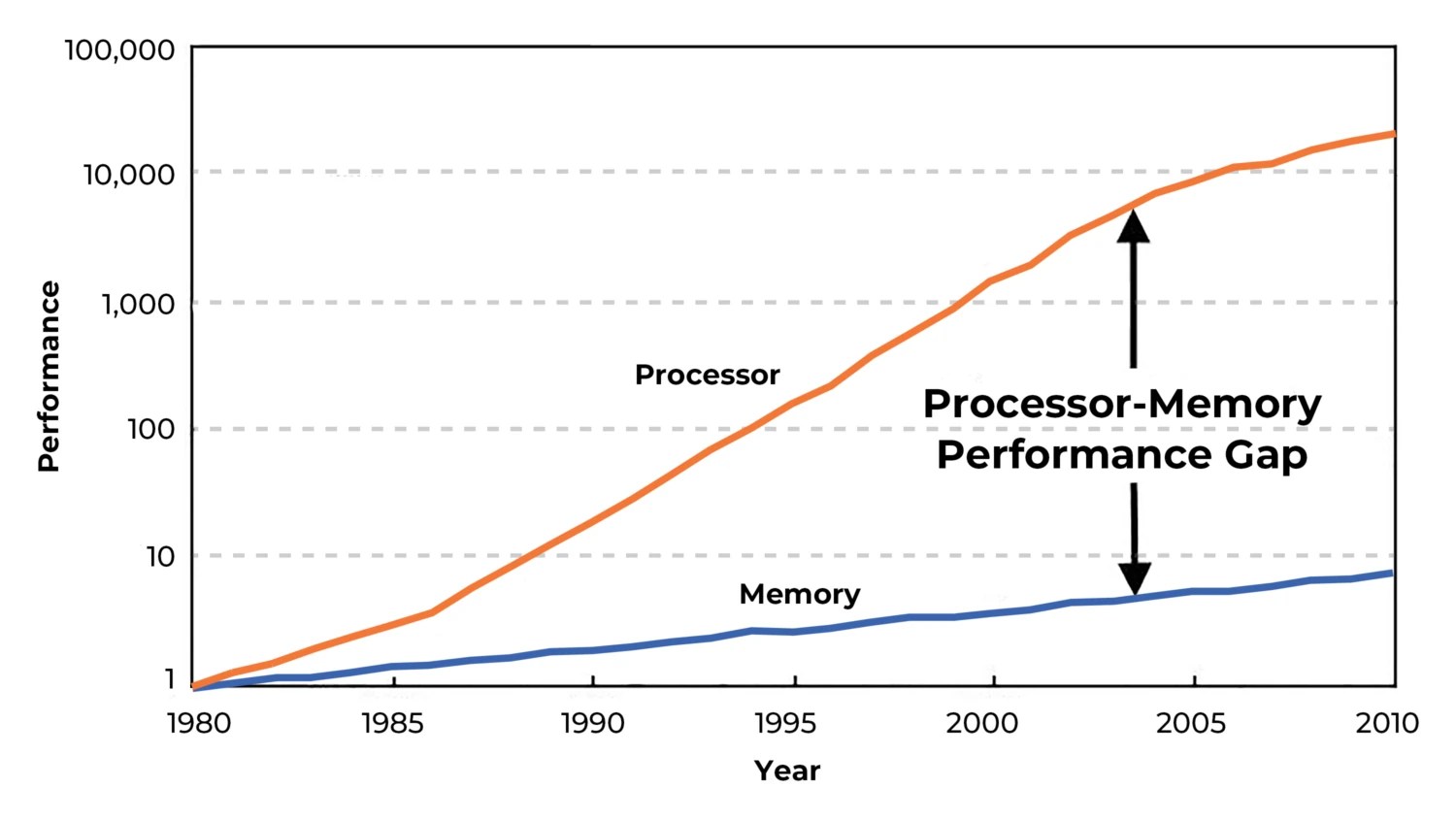

DRAM (Dynamic Random Access Memory) is the fast, temporary memory your computer uses to run programs and store active data. Unlike storage drives that retain data when powered off, DRAM loses everything when you unplug the device. But it's significantly faster than storage, which is why every computing device needs it. Without DRAM, modern computing simply wouldn't work at any practical speed.

Why can't memory manufacturers just make more RAM to fix the shortage?

Memory manufacturing requires semiconductor fabs that cost $10-20 billion to build and take 4-5 years to construct and bring to production. Memory makers are already running at maximum capacity with their existing facilities. You can't just flip a switch and increase production overnight. New fabs take years to plan, build, and begin producing chips. The fabs that would address today's shortage won't come online until 2026-2028.

How much will memory costs actually impact device prices?

It depends on the device, but the impact is substantial. For laptops and desktops, memory price increases could add

Will prices ever return to 2023 levels?

Probably not completely, but they will decline significantly. Most analysts expect prices to peak in early 2026 and then gradually decline through 2027-2028 as new manufacturing capacity comes online and AI demand stabilizes. However, memory might simply cost more than it did pre-shortage. This is the new normal, not a temporary state.

Which devices are most affected by the memory shortage?

PC gaming hardware and high-end laptops are most affected because they use the highest-capacity memory modules. Smartphones are experiencing significant pressure, especially flagship models. Budget devices are less affected in absolute dollar terms but face more severe percentage cost increases. Enterprise and data center products are actually getting priority allocation because hyperscalers pay premium prices.

Should I buy a new device now or wait for prices to drop?

If your current device works acceptably, waiting until 2026 could save you significant money. But if your device is broken, unsupported, or genuinely too slow for your needs, buying now is reasonable. Waiting risks paying even more as prices continue rising through 2025. The sweet spot for buying is probably Q3-Q4 2026 when prices have started declining but supply is still constrained.

Why are AI companies getting priority for memory allocation?

Memory manufacturers have limited production capacity. They sell to whoever pays the highest prices, and hyperscalers building data centers for AI are willing to pay premium prices and sign multi-year contracts. From a business perspective, this makes complete sense. A guaranteed $50 billion contract from Open AI is more valuable than unpredictable consumer demand.

Could alternative memory technologies like NAND Flash replace DRAM?

Not in the short term. NAND Flash is slower, has different write-cycle limitations, and can't fully replace DRAM's functionality. Emerging technologies like MRAM or Re RAM show promise but won't be commercially available at scale for 5+ years. DRAM will remain the standard solution for memory-intensive applications for the foreseeable future.

Is this shortage affecting used device prices?

Interestingly, yes. Used devices from 2023 and earlier, which have older (and still cheaper) memory, are becoming more valuable because they offer better value than new devices. If you're price-sensitive, exploring the used market might offer significant savings compared to buying new.

What can governments do to address this shortage?

Governments can offer subsidies or incentives for building new memory manufacturing capacity domestically, but this is a long-term solution that won't help for 3-5 years. In the short term, there's not much policy can do. Market forces (higher prices reducing demand, manufacturers investing in new capacity) will eventually resolve the shortage. Government intervention would likely slow that process more than help it.

Conclusion

We're in the middle of the most significant memory shortage since 2017-2018, and unlike that previous shortage, this one isn't likely to resolve quickly. The culprit is straightforward: artificial intelligence's explosive growth has created demand that's completely overwhelming consumer-focused memory supply.

Three companies—Samsung, SK Hynix, and Micron—control essentially all global DRAM production. They're running at maximum capacity. They can't make more memory without building new fabs, which takes years. Meanwhile, they can sell their limited output at premium prices to hyperscalers building AI data centers. From their perspective, this is a fantastic market position.

For everyone else—consumers, device manufacturers, gaming enthusiasts—it's a nightmare. Prices are up 5-10x on some products. That translates to laptops costing

The uncomfortable truth is that this situation will persist well into 2026 or even 2027. New manufacturing capacity is coming, but it's years away. AI demand might continue accelerating, which would delay relief even further. We're locked into an elevated-price environment for the medium term.

What does this mean for you? If you need to buy tech in the next 12 months, expect to pay more than you would have a few years ago. If you can wait, 2026-2027 looks better. If you absolutely must upgrade now, do it sooner rather than later—waiting just means higher prices.

This shortage will reshape the tech industry. Companies will optimize for lower memory usage. Some players will struggle with cost increases. Regional markets might fragment. But eventually, new supply will come online, demand will stabilize, and prices will normalize.

In the meantime, keep your current devices a bit longer, budget extra for tech purchases, and understand that you're experiencing a genuine supply chain crisis—not hype, not speculation, but actual physics and economics playing out in real time.

Key Takeaways

- RAM prices have increased 5-10x in the past year due to AI companies hoarding DRAM for data centers.

- Three companies—Samsung, SK Hynix, and Micron—control ~85% of global DRAM production and are prioritizing lucrative hyperscaler contracts.

- Memory shortage will persist until 2026-2027 as new manufacturing capacity takes 4-5 years to build and come online.

- Consumer devices including laptops, smartphones, and gaming consoles are experiencing steep price increases as manufacturers pass component costs downstream.

- Budget products face higher percentage cost impacts, while enterprise customers benefit from negotiating leverage and priority allocation.

Related Articles

- The End of Cheap Phones: Why Prices Are Rising 30% in 2025

- Micron Kills Crucial Brand: What It Means for RAM Consumers [2025]

- Framework Desktop PC Price Hike: Why RAM Costs Are Crushing PC Builders [2025]

- China's Technological Dominance: The Chinese Century Explained [2025]

- OpenAI's $10B Cerebras Deal: What It Means for AI Compute [2025]

- Copper Shortage Crisis: How Electrification Is Straining Global Supply [2025]

![RAM Price Hikes & Global Memory Shortage [2025]](https://tryrunable.com/blog/ram-price-hikes-global-memory-shortage-2025/image-1-1768486130506.jpg)