Disney's New Leadership: A Shift From Corporate Tradition to Ground-Level Expertise [2025]

Walt Disney didn't start with streaming services or financial modeling. He started by understanding what made people happy in person—what made them feel magic. For decades, that hands-on philosophy got lost as the company grew into a sprawling entertainment behemoth with interests in everything from cruise ships to sports networks.

Then something unexpected happened. Disney's board made a decision that rippled through the industry: they elevated a leader from the parks division to the CEO role. Not a finance guy from corporate. Not a streaming strategist fresh off a Silicon Valley exit. Someone who spent years understanding the operational heartbeat of Disney's most profitable segment.

This shift signals a fundamental rethinking of what Disney actually is—and what it could become. For guests, employees, and investors, this matters more than it might seem at first.

The person taking this role brings something most recent Disney CEOs didn't have: direct responsibility for delivering magical experiences to millions of people in real time. They've navigated supply chain nightmares, managed impossible labor costs, recovered from the pandemic shutdown, and done it all while keeping guests engaged enough to spend $200 on a single day's admission.

That's a different skill set than optimizing streaming subscriber churn or negotiating content licensing deals. And Disney's board apparently believes those skills are exactly what the company needs right now.

Let's break down what this actually means: why it happened, who's affected, and what you might actually experience differently the next time you visit a Disney property or open the Disney+ app.

The State of Disney: Why the Board Wanted a Change

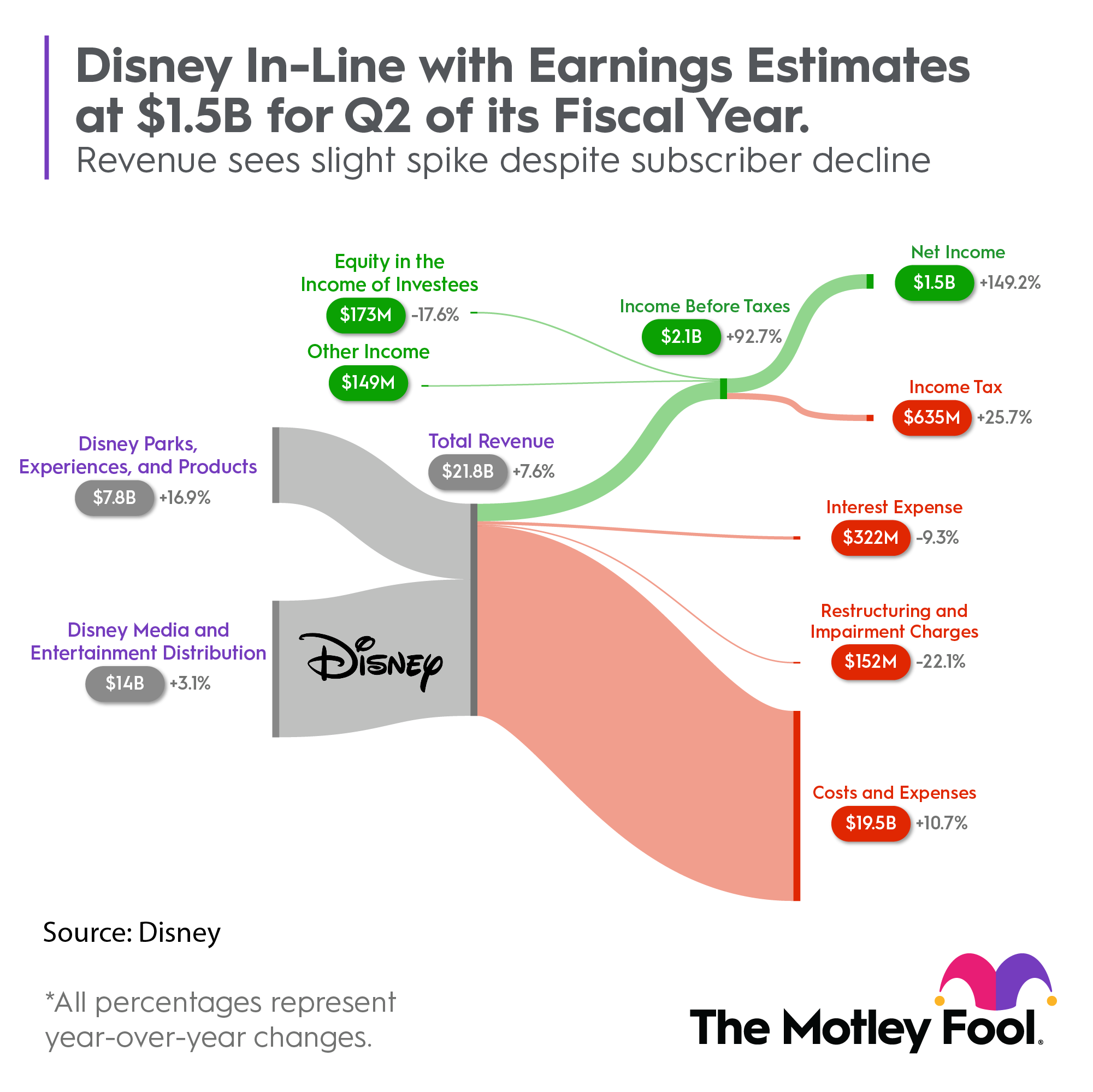

Disney has been in a weird spot. The company prints money from theme parks—those operations generated roughly $28 billion in revenue in recent years, with operating margins above 30%. That's incredible. But streaming has been a disaster, with Disney+ bleeding subscriber money despite having content libraries that would make most competitors weep.

The previous CEO strategy was essentially this: use the parks to fund streaming ambitions. Push aggressive pricing on Disney+, bundle it with Hulu, sacrifice short-term profitability for market share and scale. It didn't work the way leadership hoped. Subscribers plateaued, churn increased, and investors started asking harder questions about whether Disney's streaming bet was actually working.

Meanwhile, the parks kept performing. Even with inflation crushing consumer budgets, people still saved up for Disney vacations. Even with prices that now average $150+ per day for park admission, attendance remained strong. The parks division wasn't just profitable—it was loyal, predictable, and growing.

So the board's logic becomes clearer: maybe what Disney needs isn't more financial engineering or more content volume. Maybe it needs someone who understands that guests are willing to pay premium prices for experiences that feel special, personal, and genuinely thoughtful. Someone who grasps that magic doesn't scale through algorithms. It scales through consistency, attention to detail, and caring about whether people feel seen.

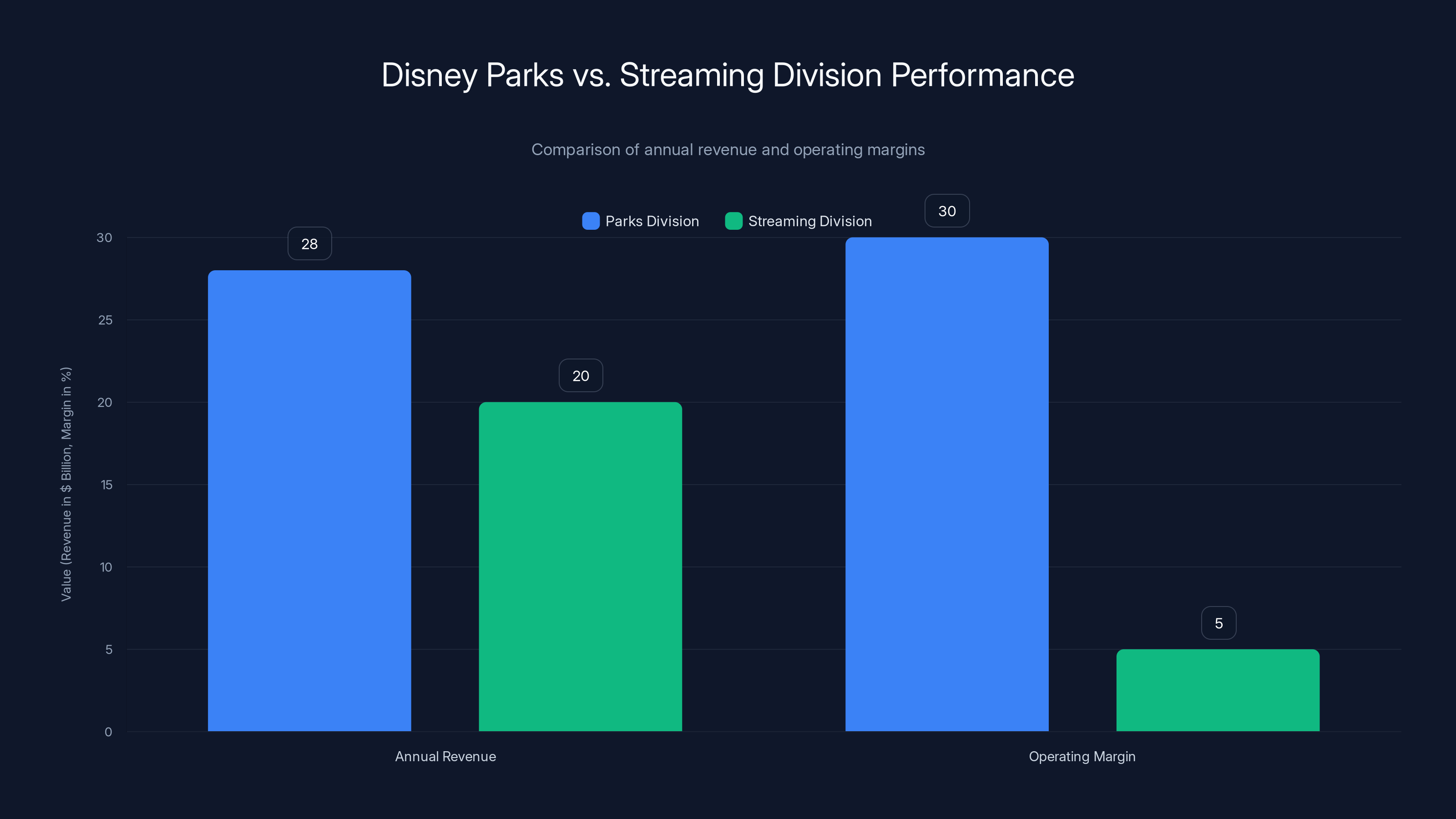

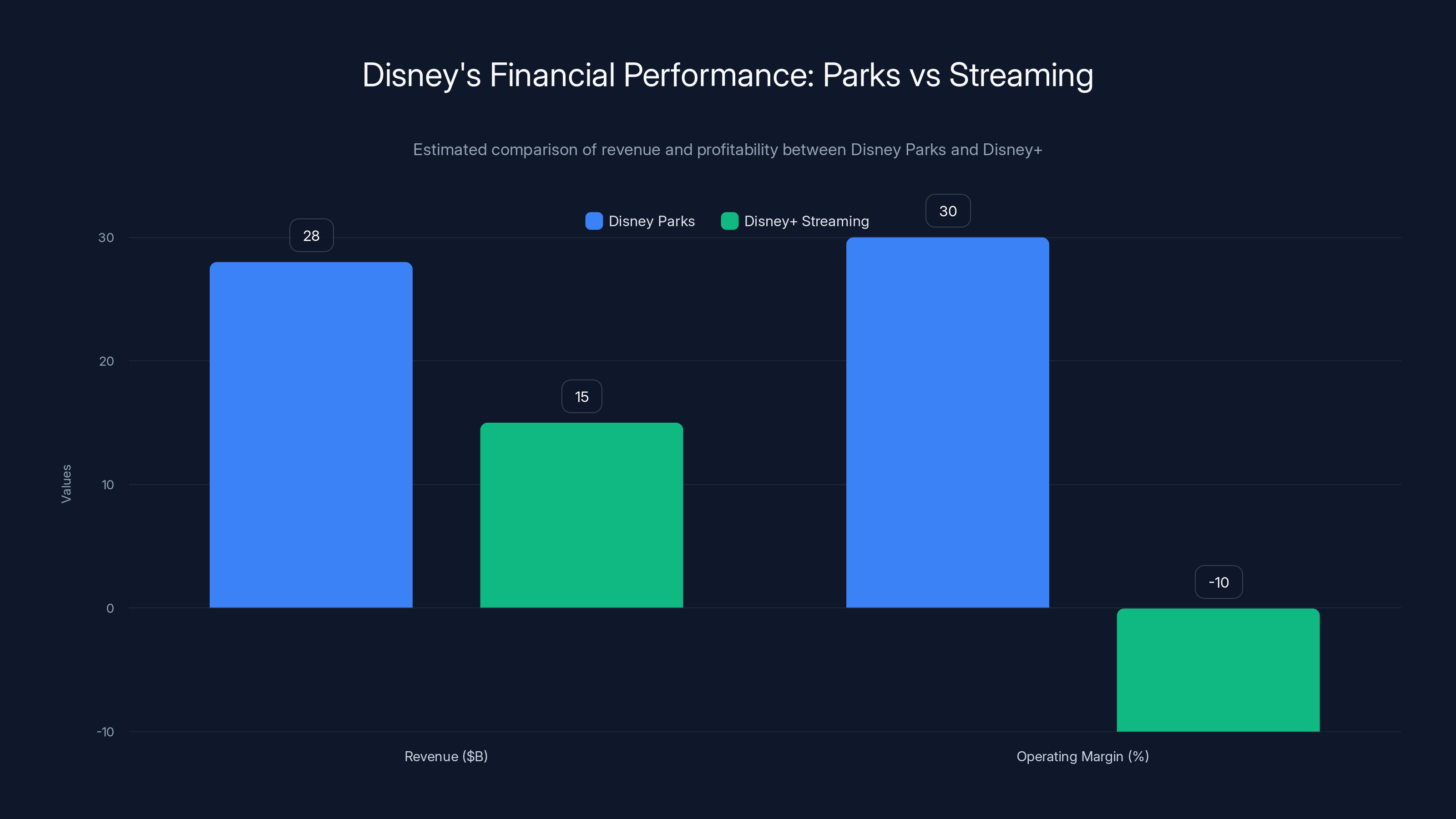

Disney's parks division significantly outperforms the streaming division in both revenue and operating margins, highlighting the strength of physical experiences over digital content. Estimated data for streaming division.

Who Leads Disney Now: Understanding the Background

The new CEO's background is in operations and real estate—they've run Disney's biggest geographic division, overseeing resorts, parks, cruises, and the operational infrastructure that keeps millions of guests moving through these properties every year. They've dealt with vendors, unions, local governments, permit agencies, and the Byzantine complexity of running massive physical operations in multiple countries simultaneously.

This is someone who understands that "customer experience" isn't a marketing slogan. It's the outcome of ten thousand small decisions made by hourly employees under stress, outdoors, in weather, during peak seasons. It's knowing that a single bad interaction with a Cast Member can ruin a $4,000 family vacation. It's understanding that consistency matters more than novelty.

They've also navigated crisis management at scale. The pandemic shutdown of theme parks forced them to rethink operations, labor strategy, and how to rebuild guest confidence. They managed the post-COVID reopening when demand massively exceeded capacity. They've lived through inflation hitting labor costs, supply chain disruptions, and the challenge of raising prices without destroying guest sentiment.

That's different from most Disney CEOs of recent history, who came from entertainment backgrounds (film, TV, streaming) or finance backgrounds (investment banking, cost optimization). This person speaks the language of operational excellence, not just content acquisition or financial derivatives.

Disney Parks generated significantly higher revenue and operating margins compared to Disney+ streaming, highlighting the board's focus on stable, profitable segments. Estimated data.

How This Could Change Your Disney Experience

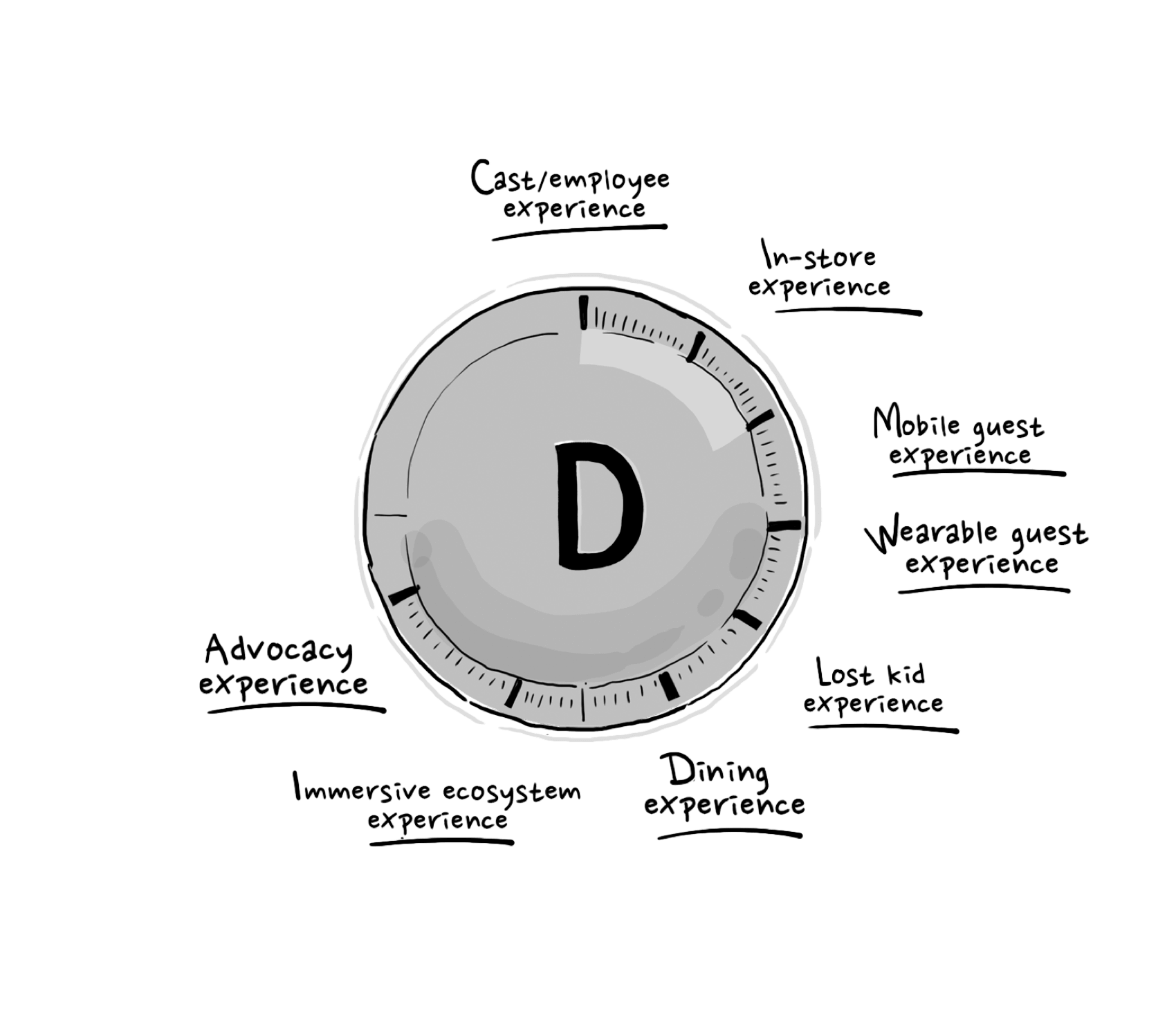

Direct theme park guests will probably notice changes first. Parks have historically been run with a relatively independent budget from Disney's corporate strategy—they're profitable enough to maintain themselves. But when the parks leader becomes the CEO, you can expect increased coordination between the parks and other Disney properties.

That means several practical shifts:

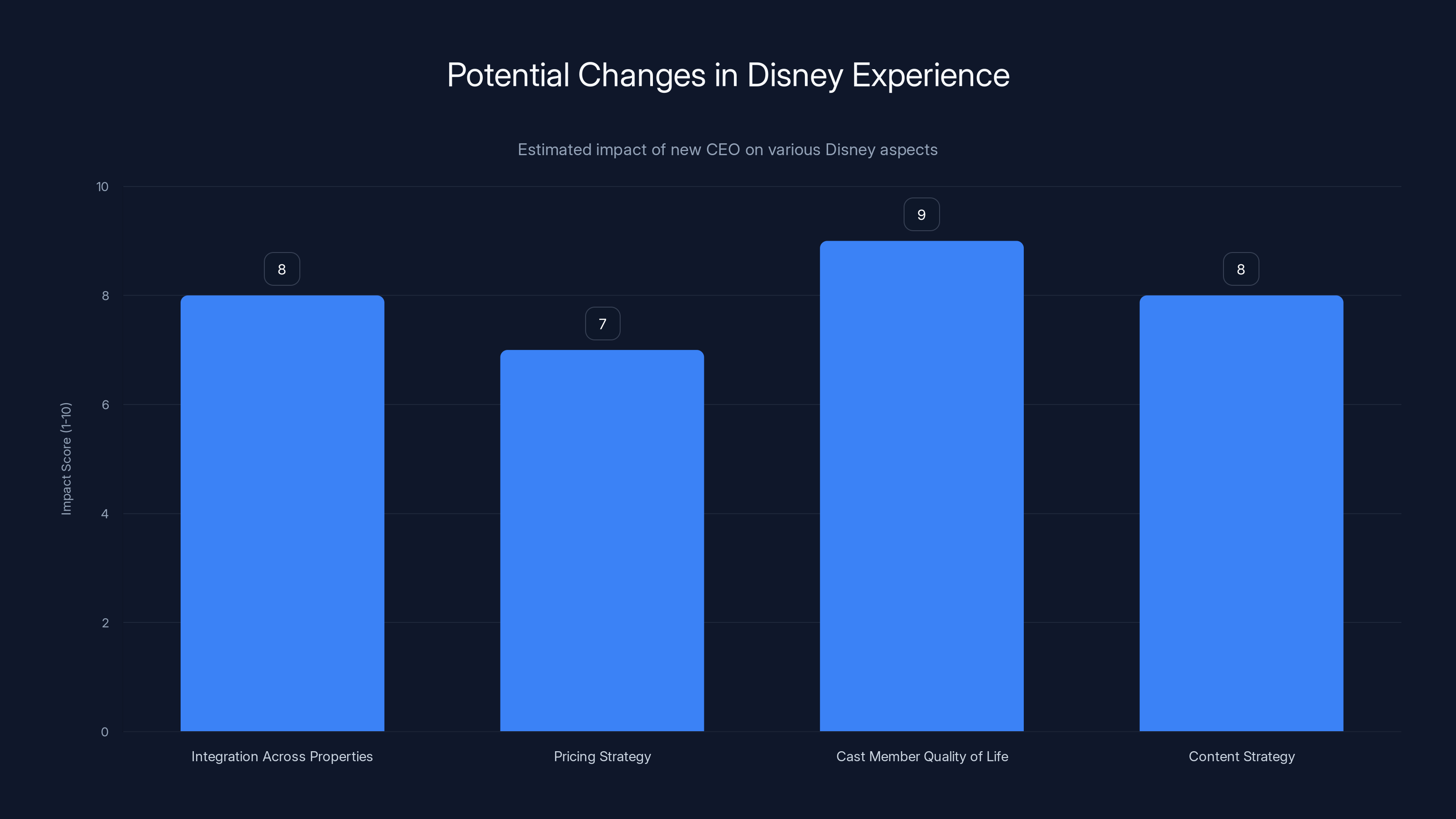

Integration across properties becomes more intentional. Your Disney+ subscription, your Disney vacation plans, and your merchandise purchases could all become parts of a more connected ecosystem. Instead of these being separate business units competing for revenue, expect seamless integration. Book a Disney World vacation, and your Disney+ content might update with park maps, dining reservations, and character interactions timed to your visit.

Pricing strategy might actually become more thoughtful. A parks executive doesn't maximize revenue by charging until the market breaks—they understand that guest sentiment matters for long-term loyalty. That doesn't mean prices drop. But pricing for value and experience quality might replace pricing for short-term extraction. Annual pass holders, for example, might see better value propositions.

Quality-of-life improvements for Cast Members could accelerate. Someone who's managed payroll across multiple parks understands that good people are hard to find and harder to keep. Labor costs are your biggest operational expense in hospitality. The most cost-effective way to improve guest experience is happy Cast Members. Expect potential investment in wages, scheduling flexibility, and training.

Content strategy probably shifts. Instead of greenlighting every IP expansion possible, expect more intentional connections between streaming content and physical experiences. New Marvel series tied to new theme park lands. Star Wars shows coordinated with park updates. Content that makes people want to visit properties, not just consume more streaming hours.

Technology integration could finally accelerate in ways that actually matter to guests. The parks executive has probably seen every tech solution Disney tested—from mobile ordering to virtual queues to AR experiences. They know which ones worked and which wasted money. Expect smarter deployment of technology that actually solves guest problems, not technology for technology's sake.

The Streaming Question: What Changes at Disney+

This is the biggest wildcard. Disney+ has been a failure by streaming standards—it's profitable now, but it gained subscribers through bundling and price increases, not content strength or engagement. Industry reports suggest Disney+ has struggled with churn rates exceeding competitors, despite having the strongest IP portfolio in entertainment.

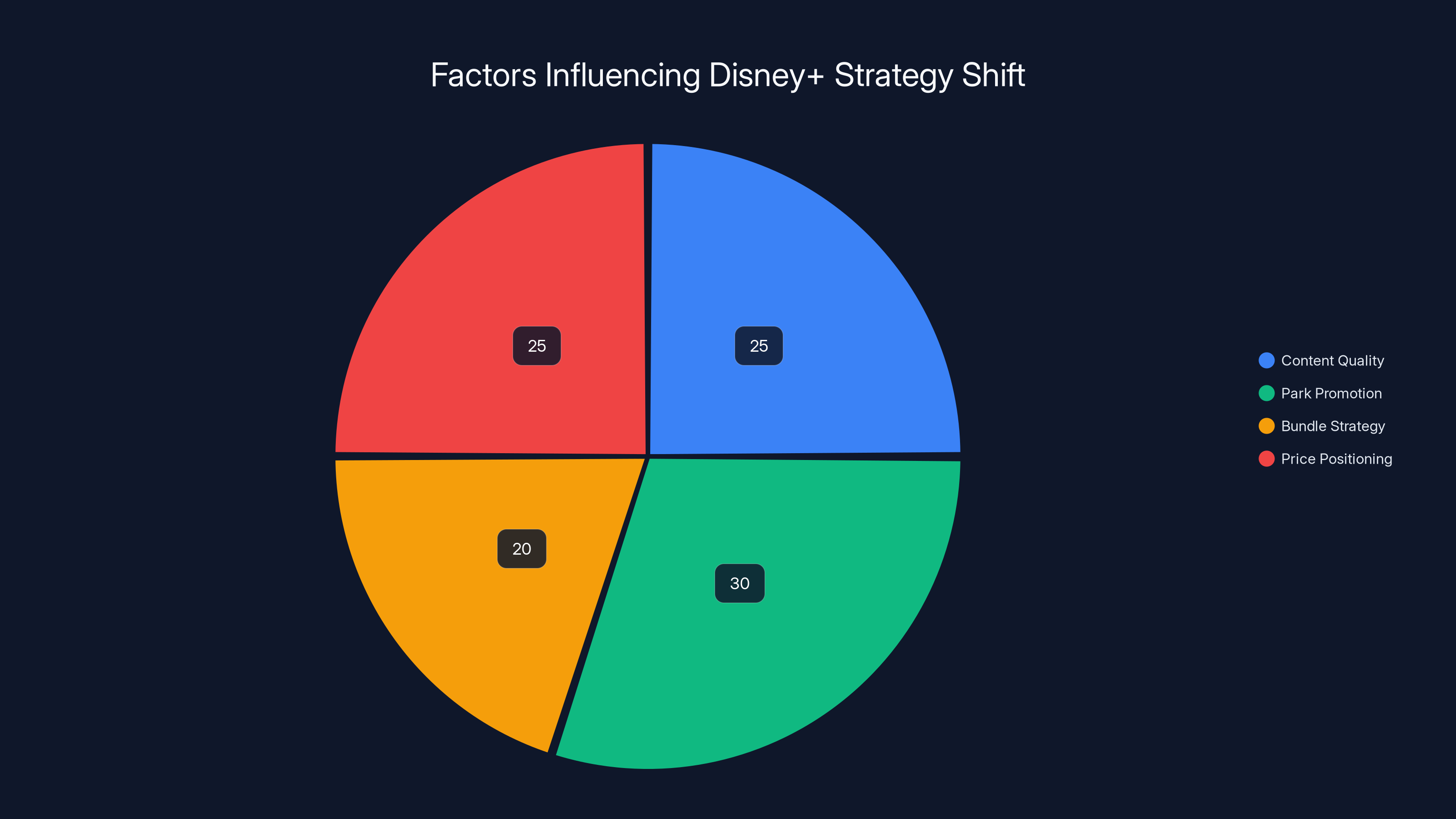

A parks-focused CEO might view streaming completely differently. Instead of a direct competitor to linear TV and theatrical releases, streaming becomes promotional infrastructure for the parks. The question shifts from "how many Disney+ subscribers can we get" to "how can streaming drive traffic to parks and merchandise."

This could mean:

Smaller, more frequent content drops instead of massive originals designed purely for streaming metrics. Series tied to park seasons and events. Content that makes sense as part of a broader Disney experience, not just as entertainment in isolation.

Higher admission standards for what actually gets greenlit. A parks executive would probably kill projects that don't drive meaningful engagement or brand value. That could actually improve Disney+ quality by eliminating the mediocre middle.

Bundle reconsideration. The Hulu/Disney+/ESPN+ bundle made sense from a streaming perspective (cross-sell). But a parks CEO might view streaming as secondary to the actual experience. The pricing strategy could shift away from bundling and toward making Disney+ genuinely compelling on its own merits.

Price positioning might actually stabilize. Someone used to hospitality pricing understands that guests accept premium prices when they perceive premium value. Instead of aggressive price increases driving churn, expect more stable pricing with actual content quality improvements justifying the cost.

The new CEO's leadership is expected to significantly enhance integration, pricing strategy, cast member satisfaction, and content strategy, with each aspect scoring high on potential impact. Estimated data.

Implications for Disney's Stock and Investors

Wall Street initially reacted with skepticism when the announcement came. Investors wanted a streaming expert or finance wizard, not an operations person. But the thesis actually makes sense if you understand Disney's fundamental problem.

Disney doesn't need growth—parks are already pushing maximum capacity. Disney doesn't need cost-cutting—the company is already profitable. Disney needs operational excellence and strategic alignment. Those are things a parks executive actually delivers.

The stock market rewards clarity and consistency. A parks-focused strategy is clear: maximize the value and desirability of Disney properties (physical and digital), price for long-term guest loyalty rather than short-term extraction, and let streaming serve the parks instead of competing with them.

Expect investor pressure on streaming metrics to ease. That's actually bullish, because it removes pressure for unsustainable subscriber growth and lets Disney make decisions based on profitability and brand health instead of vanity metrics.

How This Affects Employees Across Disney

Cast Members in the parks will probably feel the most direct impact. A CEO from their division understands their working conditions intimately. They've probably walked that job themselves at some point—Disney promotes from within in the parks. That cultural continuity could translate to serious investment in hourly worker treatment.

The bigger question is how corporate and entertainment employees experience the transition. A parks-focused leadership might deprioritize some of the entertainment initiatives that don't connect clearly to the parks ecosystem. That could mean restructuring in departments that aren't as directly aligned with the new strategy.

But there's also an upside: clarity. Instead of competing priorities from multiple strategic visions, divisions now know where they stand relative to the parks-first strategy. That actually enables better planning and decision-making at middle management levels.

Disney+ strategy may shift focus from subscriber growth to enhancing park promotion and content quality. Estimated data.

The Broader Industry Shift This Represents

Disney isn't the only entertainment company facing this question: what's actually valuable in this industry? Netflix discovered that engagement metrics matter more than subscriber numbers. Amazon figured out that streaming is loss-leader territory for keeping Prime memberships sticky. Apple realized you can't out-content Netflix, so don't try.

Disney is learning that physical experiences are actually more defensible and valuable than digital content in a saturated streaming world. That's a recognition that some things still can't be commodified. A trip to Disney World creates memories that matter. A Disney+ show is just one option among thousands.

This shift could trigger similar moves across hospitality and entertainment. Expect other companies to reconsider whether digital transformation means abandoning physical experiences or enhancing them. Disney's bet is that the answer is enhancement.

Historical Precedent: When Disney Listened to Operations

Walt Disney himself came from animation, but he understood operations intimately. He walked Disneyland constantly, noticing what worked and what didn't. He drove decisions based on guest behavior, not theoretical models. The original park was successful because it was obsessed with operational detail and guest satisfaction.

Then professional management took over, and those habits eroded. Financial optimization became the priority. Strategic decisions happened in boardrooms, not on park floors. Wall Street loved the efficiency gains and margin improvements—until the company developed an identity crisis about what it actually was.

Bringing operations-focused leadership back to the top isn't a retreat to the past. It's a correction. Modern Disney has tools, scale, and technology Walt never had. But it needs his operational obsession paired with 21st-century capabilities.

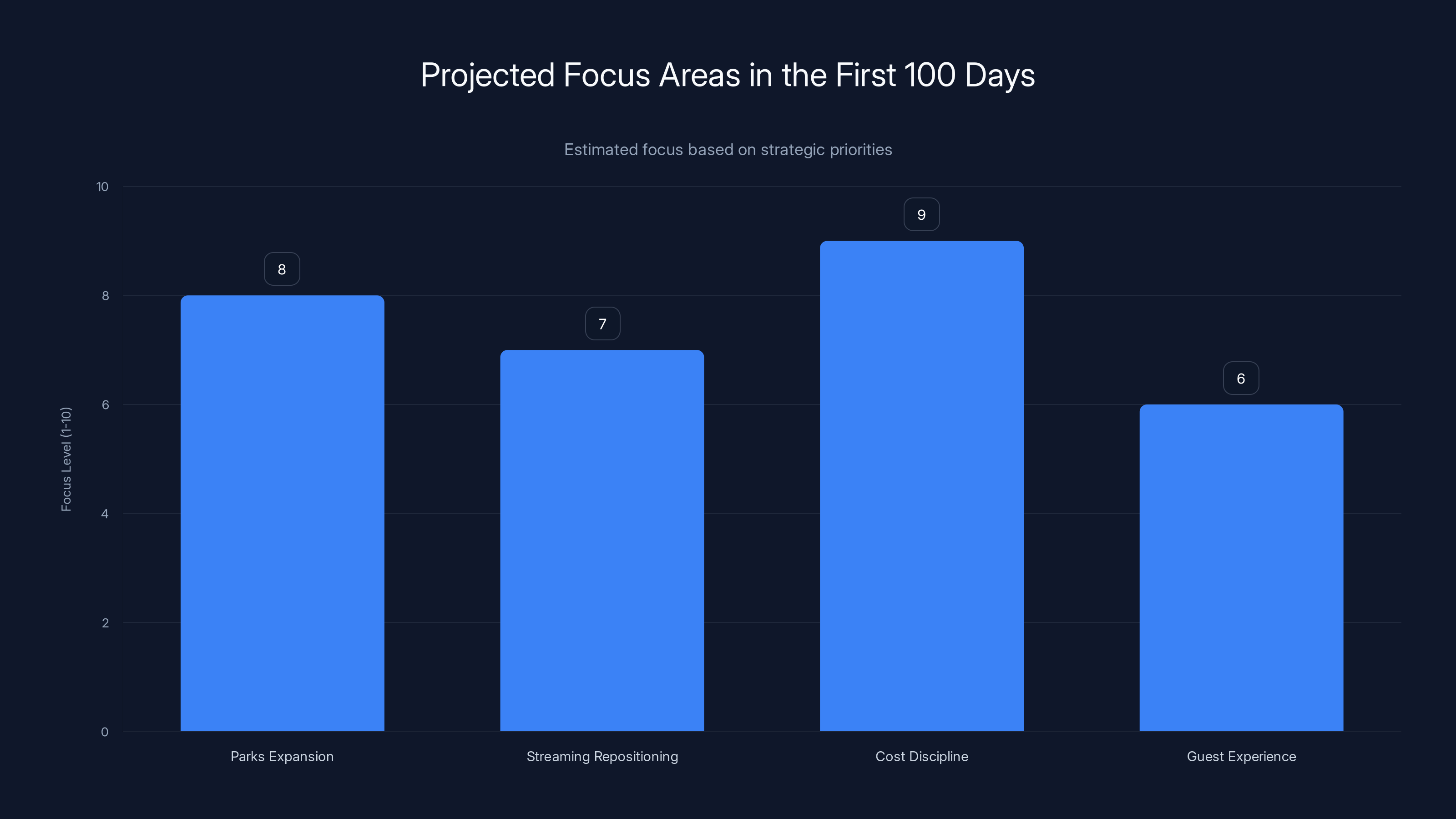

Estimated data suggests the new CEO will prioritize cost discipline and parks expansion, with significant attention to streaming repositioning.

Competitive Positioning: Where Disney Stands Now

Netflix leads streaming but is losing content advantage as competitors catch up. Amazon's entertainment is a rounding error in their business. Apple treats TV as a loss leader. HBO Max is profitable but shrinking subscriber growth. Disney has the strongest IP portfolio and the only meaningful physical property empire in entertainment.

A parks-focused strategy actually gives Disney a competitive moat that tech companies can't replicate. You can't build a theme park as quickly as you can launch a streaming service. You can't clone the organizational capability that runs a $40 billion parks operation. That's defensible competitive advantage.

This CEO change signals Disney's confidence that their real value isn't in being the next Netflix. It's in being something Netflix can never be: a platform that delivers experiences across digital and physical simultaneously, with intellectual property that matters enough to drive travel, spending, and loyalty.

The First 100 Days: What You'll Actually See

In the immediate term, expect announcements around strategic focus and operational priorities. The new CEO will probably confirm that parks expansion continues, that streaming gets repositioned as supporting infrastructure rather than primary strategy, and that cost discipline applies to everything that doesn't drive core guest value.

You might see organizational announcements—executives aligned with the previous streaming-first strategy possibly moving on, new leadership in key divisions that report to the parks CEO. Internally, the message will emphasize unity of purpose and operational excellence.

Guest-facing changes will take longer. Theme parks operate on seasonal planning cycles, investment timelines, and construction schedules that don't shift quickly. But expect the tone and direction to become clear relatively fast. New announcements will probably emphasize guest experience and value rather than financial metrics.

Streaming changes could accelerate faster—subscriber-focused metrics might loosen, content strategy might shift, and pricing might stabilize. The bundle could be reconsidered. New series might get greenlit based on theme park compatibility rather than standalone streaming appeal.

The Risk: Can Operations Expertise Translate to Corporate Strategy?

There's a legitimate concern: does excellence at running established operations translate to strategic vision for an evolving company? Theme parks are about executing a known formula at scale. Corporate strategy is about anticipating change and positioning for futures you can't yet predict.

A parks executive has probably seen every possible innovation in hospitality and venue operations. They've tested AR, VR, mobile technology, dynamic pricing, and everything else. But do they have the vision to see where entertainment goes next, globally, across multiple mediums?

That's the real test. If the new CEO simply optimizes Disney's existing business model without anticipating how media consumption, travel patterns, and guest expectations will evolve, the strategy could work short-term but fail long-term.

But there's also a counter-argument: the previous strategy of betting everything on streaming failed. Sometimes the better choice is executing brilliantly at what you're good at, rather than chasing trends you don't understand. A parks executive gets that.

Looking Forward: What 2025 and Beyond Could Hold

Disney under new leadership probably focuses on three things: maximizing parks profitability and capacity, repositioning streaming as supporting infrastructure, and integrating the broader Disney ecosystem (merchandise, digital, physical, entertainment) around the parks as anchor experience.

That means investment in popular parks, expansion of high-margin experiences (premium dining, character interactions, special events), and careful management of pricing to maintain guest sentiment. Streaming gets simpler—fewer projects, more intentional content, better integration with park experiences.

International expansion probably accelerates. Disney has proven the parks model works globally. A parks-focused CEO probably sees significant opportunity in Asia and Europe, particularly as emerging middle classes can afford premium experiences.

The broader entertainment industry is watching closely. If Disney's parks-first strategy succeeds—if guest sentiment stays strong despite premium pricing, if streaming becomes profitable through operational integration rather than subscriber growth, if the company can maintain cultural relevance while being selective about what gets greenlit—expect other companies to follow.

That could signal a fundamental shift in how entertainment companies think about value. Less about capturing eyeballs, more about creating genuine experiences. Less about scale, more about loyalty. Less about growth metrics, more about profitability and brand health.

Quick Takeaway: Why This Matters to You

If you visit Disney parks, expect experiences that feel more intentional and higher quality, potentially at prices that stabilize rather than spike dramatically every year. If you watch Disney streaming, expect fewer projects but higher quality, and better integration with physical experiences. If you own Disney stock, expect a company with clearer strategic direction and more realistic growth assumptions.

Most importantly, Disney is making a statement that some value can't be extracted, optimized, or digitized. Some things still matter because of the experiences they create, the memories they build, and the ways they bring people together. In a world obsessed with growth hacking and engagement metrics, that's actually a pretty interesting bet.

FAQ

What is Disney's new leadership structure?

Disney appointed a new CEO who comes directly from the parks and experiences division after years of operational leadership in that segment. This represents a significant shift from previous CEOs who typically came from entertainment, streaming, or finance backgrounds. The promotion signals Disney's belief that operational excellence and parks expertise should drive company-wide strategy.

How did the parks division perform compared to streaming?

Disney's parks division generates approximately $28 billion annually with operating margins exceeding 30%, making it the company's most consistently profitable segment. In contrast, Disney+ struggled with subscriber churn and profitability challenges despite massive content investments. The performance gap highlighted that physical experiences generate stronger loyalty and premium pricing power than digital content alone.

What changes might Disney guests experience at theme parks?

Guests could see improved operational consistency, better Cast Member service due to wage and scheduling investments, more intentional technology integration that solves actual problems, and potentially more stable pricing strategies focused on long-term loyalty rather than short-term revenue extraction. Park expansions will likely continue as this leadership understands their profitability and strategic value.

How could this affect Disney+ and streaming content?

Streaming content strategy might shift to become more intentional and integrated with theme park experiences, with fewer but potentially higher-quality projects. Expect streaming to function as promotional infrastructure for the parks rather than competing as a standalone business. Pricing strategies might stabilize and become less aggressive, focusing on sustainable profitability rather than subscriber growth metrics.

Why would Disney choose operations expertise over streaming expertise?

Disney's board recognized that the streaming market is saturated and that the company's strongest competitive advantage lies in its physical properties and operational capability. A parks-focused CEO brings deep understanding of what drives guest loyalty, operational excellence, and premium pricing power—capabilities that can't be easily replicated by tech companies entering entertainment.

What does this mean for Disney employees outside the parks?

Employees in streaming and entertainment divisions may experience restructuring if their work doesn't align clearly with the parks-first strategy. However, the new direction provides clarity about corporate priorities and could streamline decision-making. Cast Members in parks divisions should benefit most directly from increased investment and operational focus from someone who understands their working conditions intimately.

Could this strategy fail, and what would that look like?

The risk exists that operations expertise doesn't translate well to broader corporate strategy and anticipating industry changes. If the new CEO optimizes existing operations without adapting to evolving media consumption and travel patterns, Disney could succeed short-term but struggle long-term. However, the previous streaming-focused strategy already failed, so a pivot to proven strengths carries lower risk than continuing down that path.

How does this competitive positioning compare to Netflix and other streamers?

Unlike Netflix, Amazon, Apple, or HBO Max, Disney has a unique competitive advantage: a massive, profitable, and defensible physical property empire. By repositioning streaming to support parks rather than compete with them, Disney leverages capabilities competitors can't easily replicate. This creates a genuine moat that pure digital companies will struggle to match.

What timeline should we expect for changes?

Organizational announcements and strategic confirmations will likely come within the first 100 days. Streaming content and pricing changes could shift within months. Guest-facing park improvements take longer due to planning cycles and construction timelines, but expect directional clarity relatively quickly through announcements about new experiences and expanded attractions.

Why didn't previous Disney leadership prioritize parks-first strategy?

Previous leadership came from entertainment and finance backgrounds where maximizing streaming subscribers and digital revenue seemed like the future of media. They underestimated how valuable physical experiences remain in a saturated digital world. This new leadership recognizes that some competitive advantages (theme parks, IP loyalty, memorable experiences) can't be commodified and actually represent Disney's strongest positioning for the future.

What This Means: The Bigger Picture

Disney's leadership change represents something bigger than corporate shuffling. It's a statement that execution and guest loyalty matter more than chasing every shiny trend. That consistency and quality create more value than novelty and scale. That some experiences can't be copied by Silicon Valley disruption.

For guests, that probably means better experiences. For employees, more focus on your actual working conditions. For investors, a clearer strategy and more realistic growth assumptions. For the industry, a signal that physical experiences still matter in a digital world.

Walt Disney started by understanding what made people happy in person. After decades of corporate optimization, his company is returning to that first principle—not as nostalgia, but as competitive strategy. That's actually wise.

Key Takeaways

- Disney's new CEO comes from parks operations, signaling a shift away from streaming-first strategy toward parks-focused leadership

- Parks division generates $28B+ annually with 30%+ operating margins, vastly outperforming Disney+ subscriber revenue

- Guest experiences likely improve through better operational consistency, Cast Member investment, and technology integration focused on value

- Disney+ strategy will probably reposition as supporting infrastructure for parks rather than competing as standalone streaming business

- This represents broader industry recognition that physical experiences and operational excellence create more defensible competitive advantage than digital content alone

Related Articles

- Star Wars' New Leadership Team: Can They Revive The Franchise? [2025]

- Josh D'Amaro Becomes Disney's New CEO: What It Means [2025]

- Melania Documentary Cost Controversy: What the $75M Price Tag Really Reveals [2025]

- Netflix vs. Paramount: The $108B Streaming War Reshaping Hollywood [2025]

- Prime Video's The Wrecking Crew: How Amazon Toned Down Violence [2025]

- How Microdrama Apps Became a Billion-Dollar Industry [2025]

![Disney's Parks CEO Becomes Company Leader: What Changes for Guests [2025]](https://tryrunable.com/blog/disney-s-parks-ceo-becomes-company-leader-what-changes-for-g/image-1-1770251820887.jpg)