Eleven Labs Reaches $11 Billion Valuation: A Historic Moment for AI Voice Technology

When you hear "AI startup unicorn," you might picture a company grinding away in a San Francisco garage, getting crushed by bigger competitors. But Eleven Labs just proved that narrative is dead. In early 2025, the voice AI company announced a Series C funding round that raised

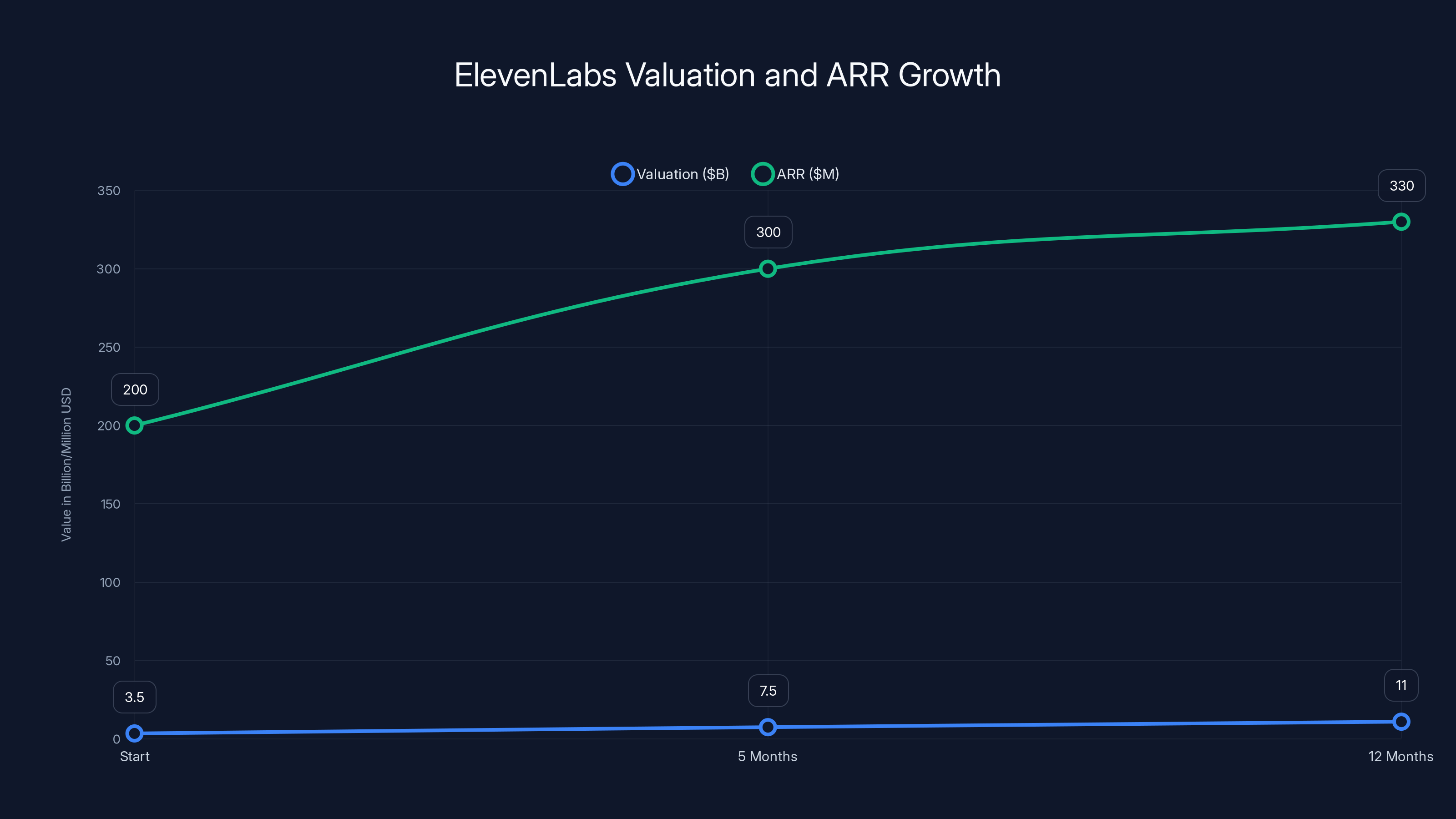

This wasn't some quiet funding announcement buried in a press release. The investment came with Sequoia partner Andrew Reed joining the board, signaling serious institutional confidence in the company's future. But what's even more striking is the velocity of this growth. In January 2025, Eleven Labs was valued at

The question everyone should be asking: How did Eleven Labs get here so fast? What's driving this valuation? And more importantly, what does this mean for the AI voice market, the startup ecosystem, and the future of voice-based AI applications?

The answer isn't luck. It's execution, market timing, and a product that solves a real problem at scale. Let's break down what happened, why it matters, and what comes next.

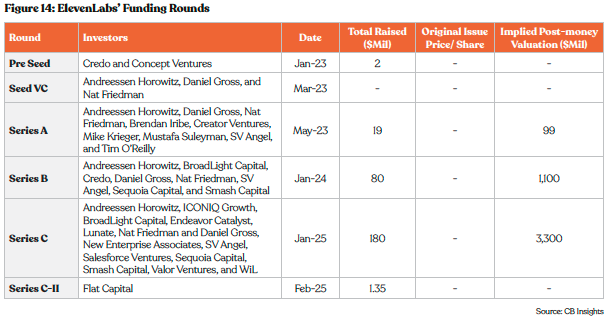

The $500 Million Raise: Who's Investing and Why

Sequoia Capital leading the round isn't random. The firm has a track record of betting on transformative technology platforms, from Apple to Google to Airbnb. Andrew Reed, the Sequoia partner on Eleven Labs' board, brings deep expertise in AI infrastructure and scaling. His presence signals confidence that Eleven Labs isn't just a tool, it's a platform with multi-billion-dollar potential.

But Sequoia wasn't the only heavyweight moving money around. Existing investors showed serious conviction by dramatically increasing their stakes. Andreessen Horowitz, already an investor, quadrupled its investment amount in this round. ICONIQ, which led the January funding round, tripled its stake. That kind of follow-on investment is rare and tells you something crucial: the company is delivering on its promises, not just making big claims.

New investors also came into the round, signaling broader appetite for voice AI infrastructure. Lightspeed Venture Partners, Evantic Capital, and BOND all participated. Some previous backers like Broad Light, Valor Capital, and AMP Coalition doubled down as well. The company also mentioned that additional strategic partners would be disclosed later in February, suggesting that some investors might be technology companies looking to integrate Eleven Labs into their products.

All told, Eleven Labs has raised over $781 million since inception. That's a war chest that puts them in serious company. By comparison, most AI startups would be thrilled with a few hundred million dollars lifetime. But Eleven Labs needed this capital for a specific reason: the company is scaling internationally and building new product categories.

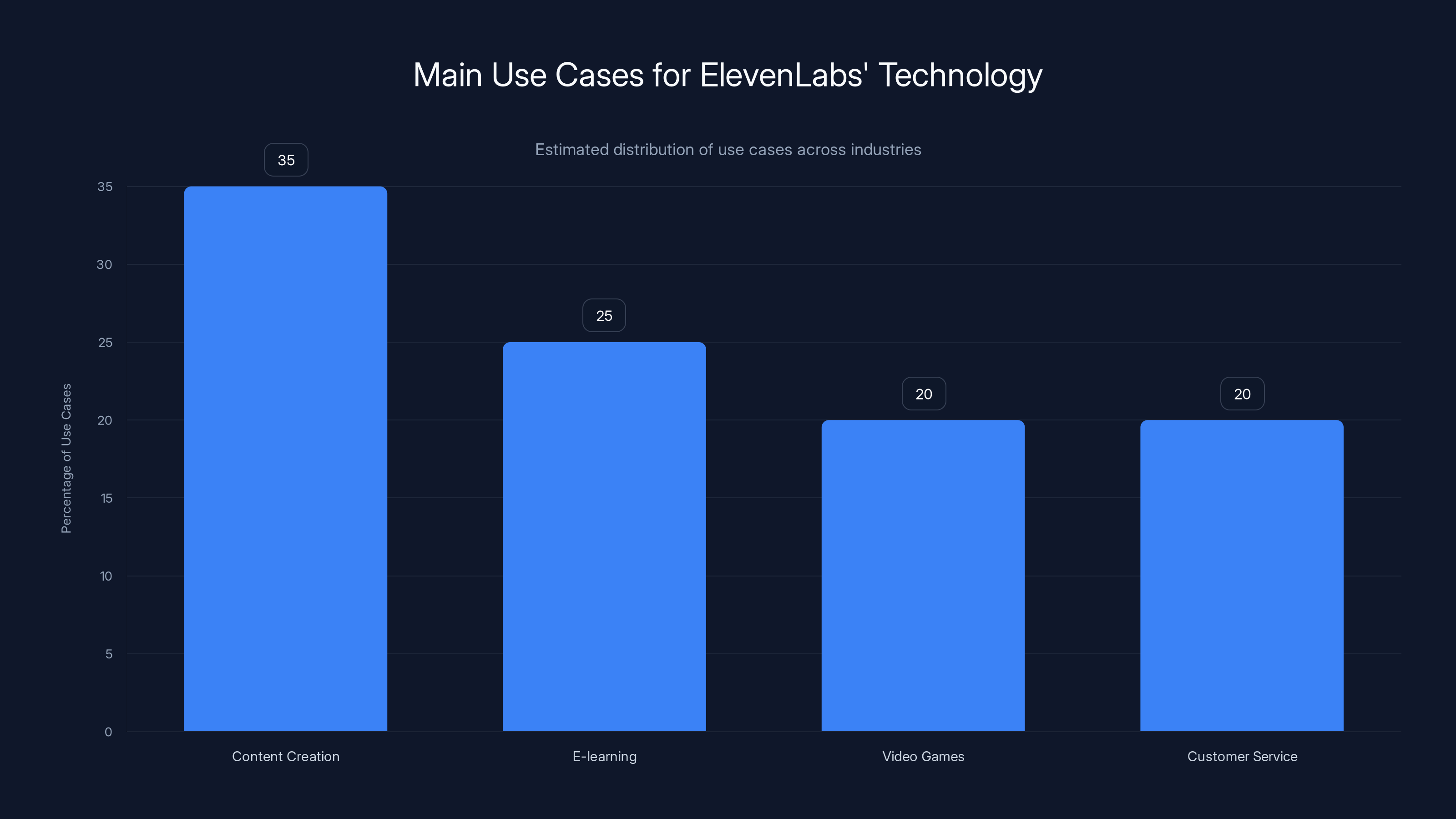

Content creation is the most popular use case for ElevenLabs' technology, followed by e-learning and video games. Estimated data.

The Valuation Explosion: From 11B in 12 Months

Let's talk about the number that's turning heads:

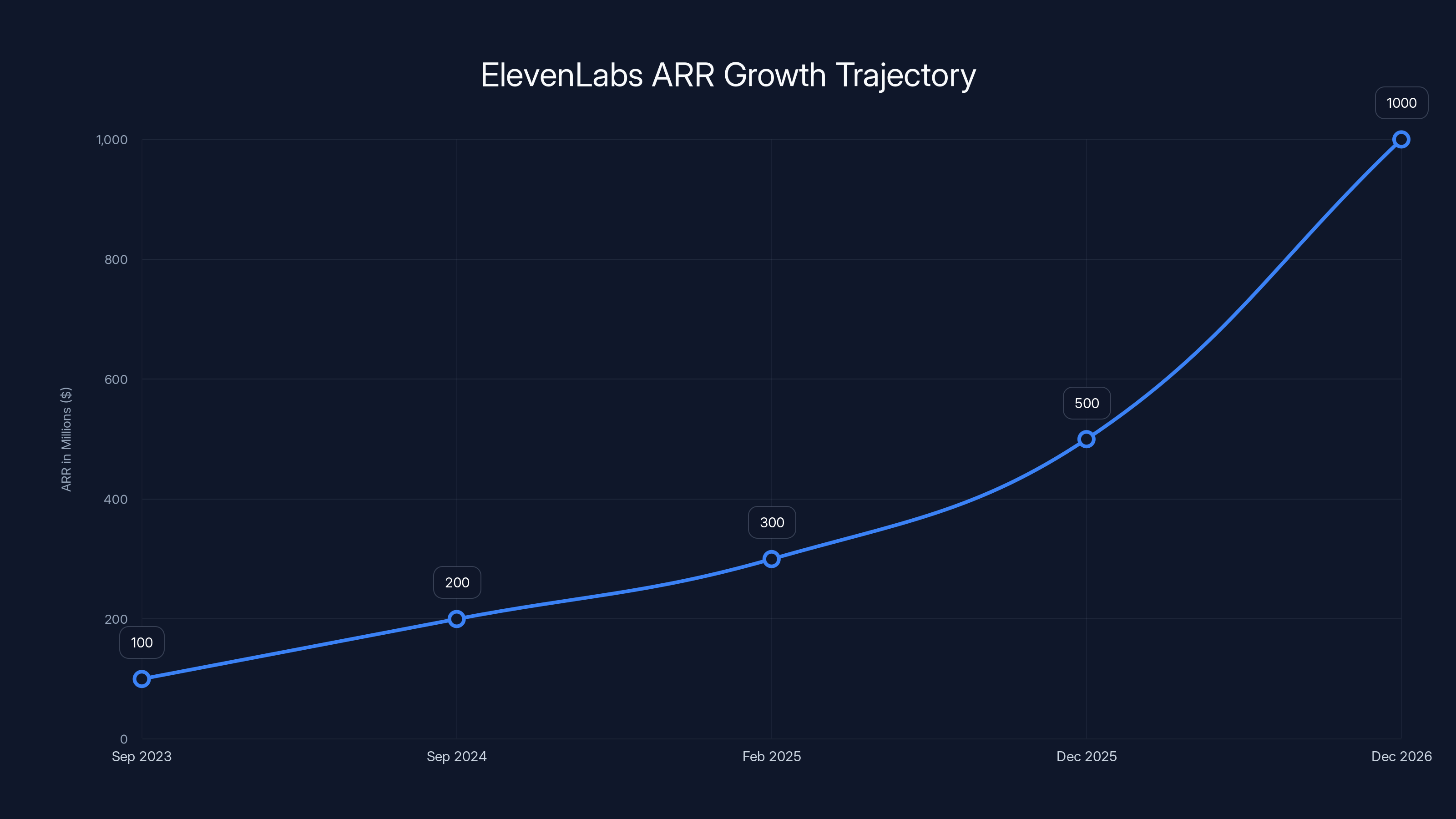

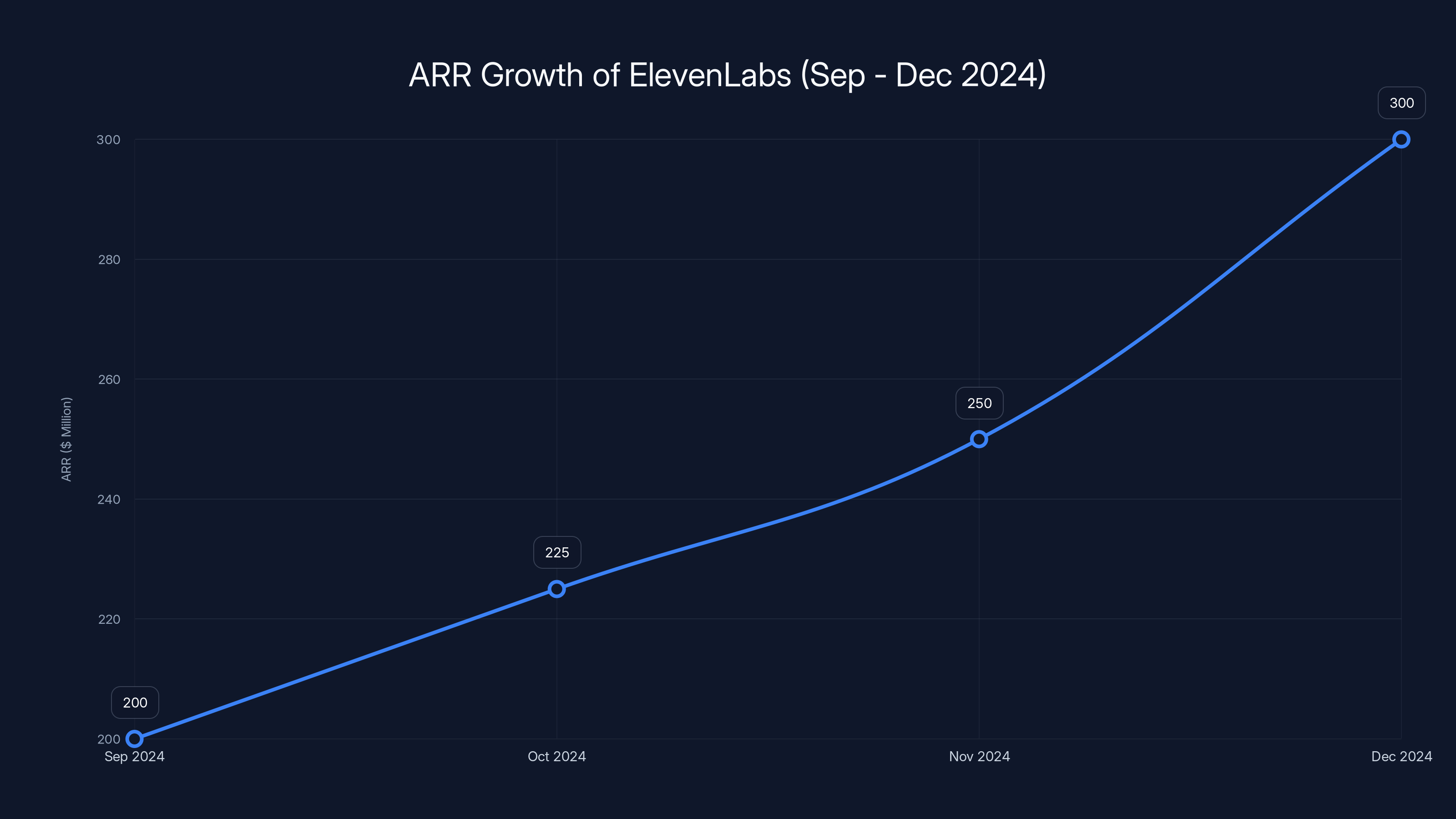

In Eleven Labs' case, it's the latter. The company closed 2024 with $330 million in annual recurring revenue (ARR). That's not projection. That's actual money coming in the door every single year. To put that in perspective, that's the kind of revenue run rate that took most SaaS companies a decade to reach. Eleven Labs got there in a few years.

The growth acceleration is even more impressive when you look at the ARR progression. In an interview with Bloomberg, CEO Mati Staniszewski revealed that Eleven Labs went from

When you run the basic math on the valuation relative to revenue, Eleven Labs is trading at roughly 33x ARR. For context, most SaaS companies trade at 8-12x ARR in the public markets. But Eleven Labs isn't a mature public company. It's a growth-stage startup in an emerging category with massive whitespace. Investors are paying a premium because they believe the company will be much larger in the future, and the revenue growth validates that thesis.

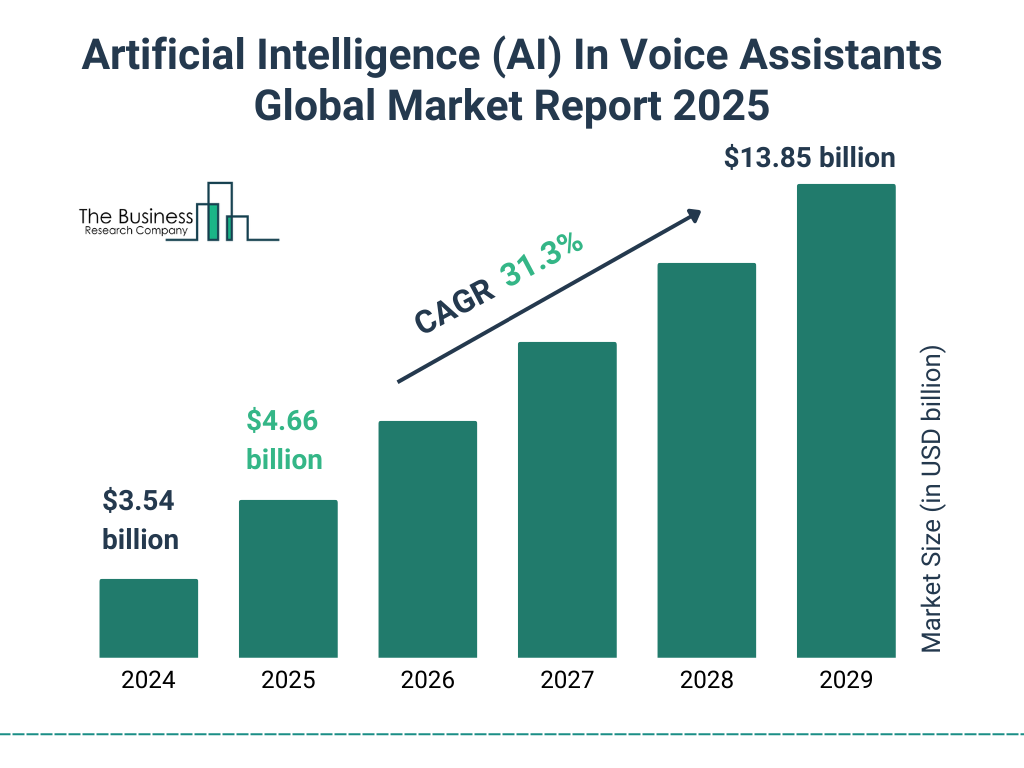

Here's the thing that makes this valuation defensible: the company isn't just growing revenue fast, it's doing it in a market that's still in the early innings. Voice AI is like mobile was in 2007. Everyone knew it would be huge, but most people underestimated the scope of that hugeness. Eleven Labs isn't just a tool for one use case. It's becoming infrastructure.

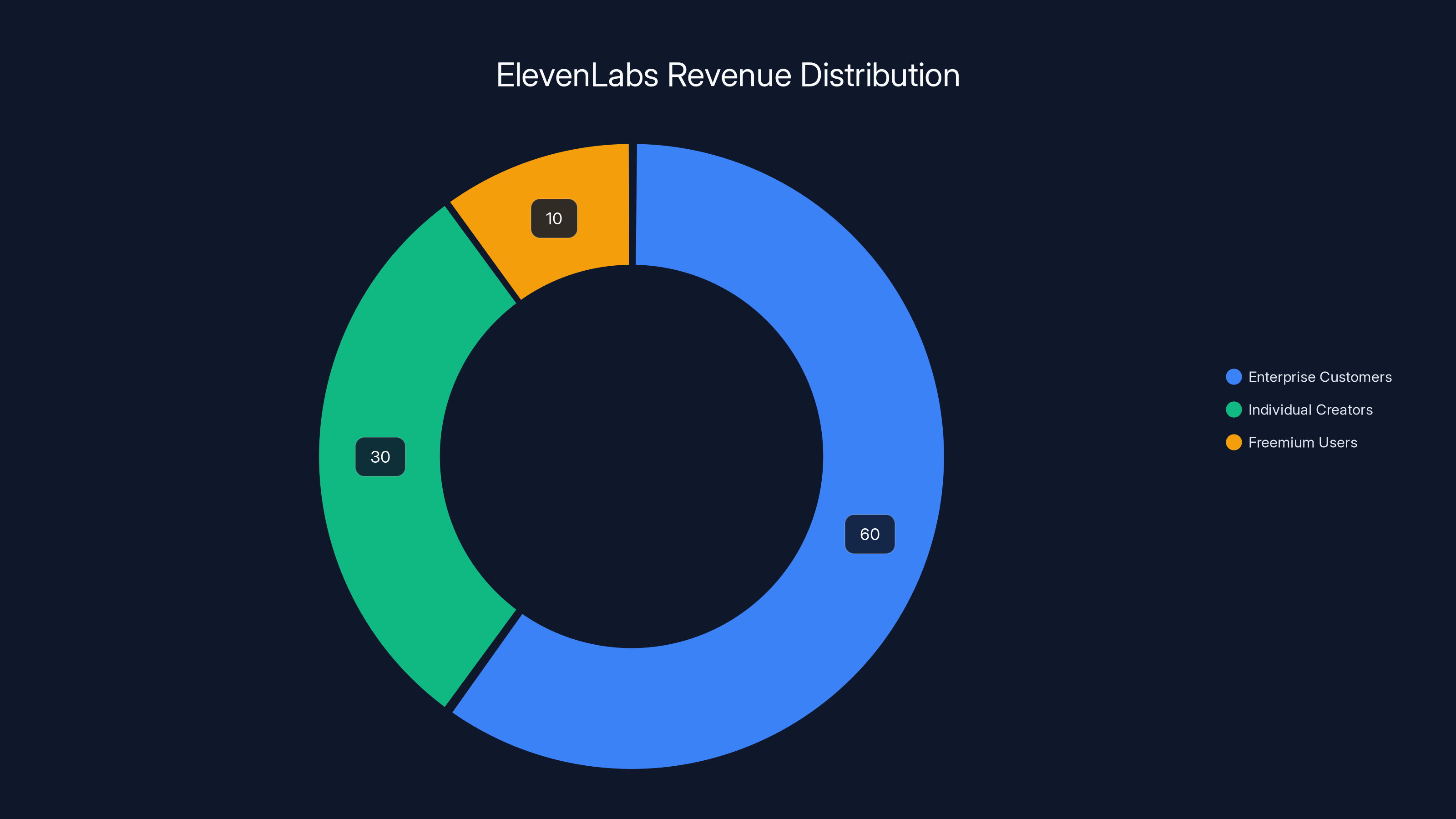

Estimated data shows that a significant portion of ElevenLabs' revenue likely comes from enterprise customers, followed by individual creators, with freemium users contributing indirectly through viral adoption.

Why Voice AI Matters: The Market Opportunity

Voice technology isn't new. Google has had voice search for years. Amazon has Alexa. Apple has Siri. But what's changed is the quality of voice synthesis and the ability to customize voices at scale. Traditional text-to-speech sounded robotic. Modern voice AI from Eleven Labs sounds genuinely human.

That's not a small thing. The difference between "this sounds like a robot reading a script" and "this sounds like a real person talking" is the difference between a tool nobody uses and a tool that becomes essential infrastructure. Eleven Labs cracked that problem. Their voices are natural enough that people use them for actual applications, not just novelty demos.

The market for voice AI applications is enormous. YouTube creators want voice-overs without hiring voice actors. Podcasters want to generate multiple variations of narration. Video game developers want natural NPC dialogue. E-learning platforms want multilingual course narration. Customer service companies want human-sounding AI agents. The list goes on.

There's also a scale advantage nobody's talking about. Training custom voice models used to require thousands of samples and months of work. Modern Eleven Labs technology lets you create a convincing voice model with a few minutes of audio. That democratization of voice creation is what transforms voice AI from a premium feature into standard infrastructure.

Investors see this opportunity. That's why rival voice AI companies are raising significant capital. In January 2025, Deepgram, another voice AI platform, raised

The Product Roadmap: Moving Beyond Voice

Here's where it gets interesting. Eleven Labs isn't staying in the voice lane. CEO Mati Staniszewski has made it clear that the company is exploring agents that go beyond voice. In January 2025, Eleven Labs announced a partnership with LTX to produce audio-to-video content. That's a significant expansion. It means Eleven Labs isn't just creating voices, it's creating complete media experiences.

Think about what that means practically. A creator uploads a script. Eleven Labs generates a natural voice reading that script. Then the platform automatically generates video to match the audio. Suddenly you've got a complete content production pipeline that used to require hiring directors, cinematographers, and editors. That's a $100 million problem that becomes a few-hundred-dollar software solution.

The company is also hinting at agent capabilities beyond voice. In the AI world, "agents" means autonomous systems that can make decisions and take actions. An AI voice agent might not just read content, it might answer questions, handle customer service, or conduct interviews. The implications are massive.

Staniszewski has indicated that Eleven Labs might explore video generation more deeply. There's a reason. Video is where the biggest content creation market is. YouTube creators, TikTok producers, filmmakers, and marketers are all desperate for tools that make production faster and cheaper. If Eleven Labs can crack video the way they've cracked voice, the company becomes truly transformational.

The funding announcement specifically mentioned that money will go toward "research and product development, along with expansion in international markets like India, Japan, Singapore, Brazil, and Mexico." That's key. The biggest growth opportunity for voice AI isn't in the US. It's in emerging markets where voice interfaces are leapfrogging traditional interfaces. An Indian farmer using voice AI to access agricultural information is a use case that doesn't exist with traditional UIs. That's the whitespace investors see.

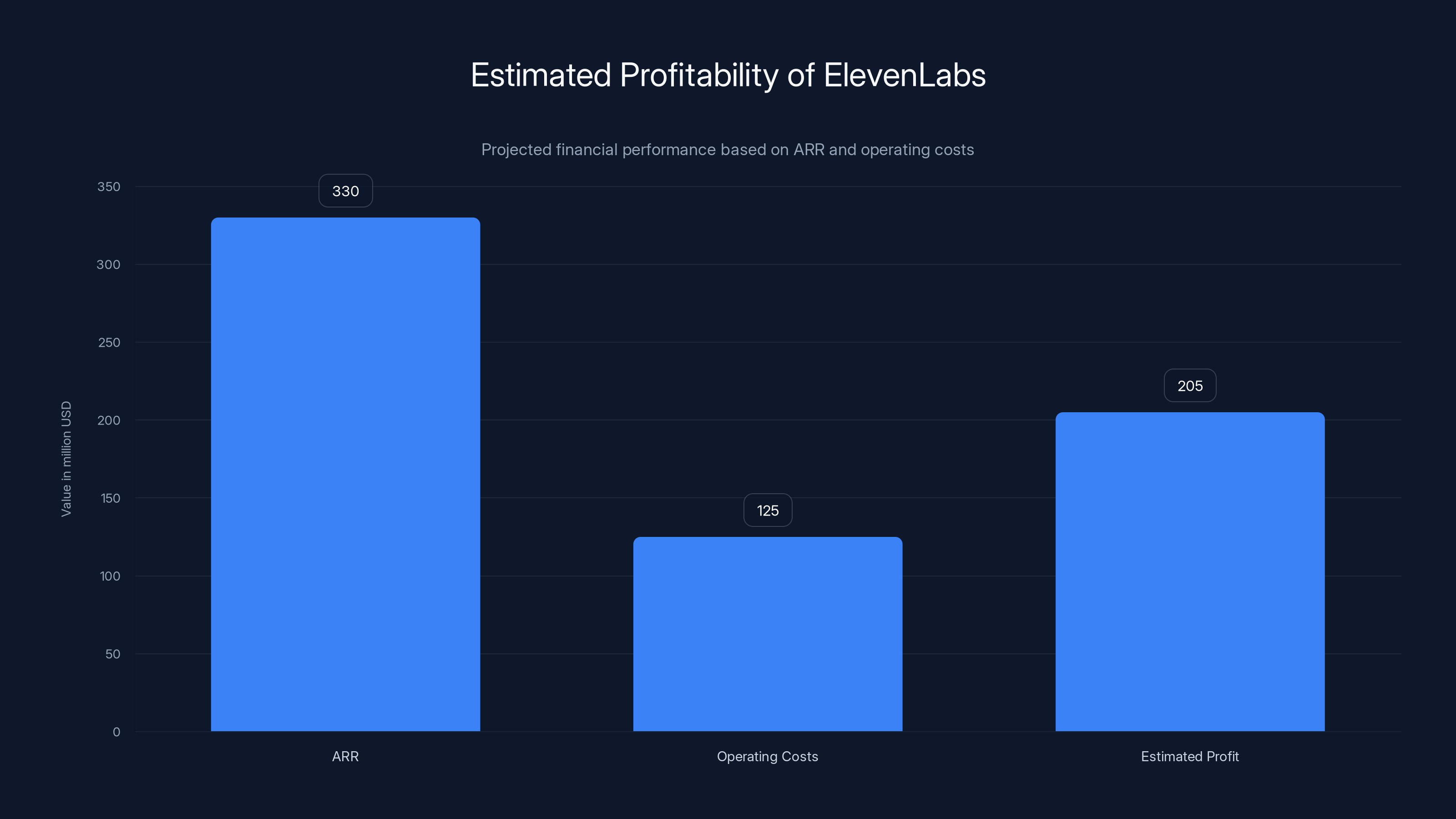

Estimated data suggests ElevenLabs could be operating at breakeven or with small profits, with ARR significantly exceeding operating costs. Estimated data.

The Competitive Landscape: Who Else Is Playing

Eleven Labs isn't alone in the voice AI market, but they're in the lead. The competitive landscape has a few key players, each with different strengths.

Deepgram, as mentioned, is a legitimate competitor. The company raised serious capital and has good technology, but hasn't achieved Eleven Labs' scale. Google also hired talent from Hume AI, a voice model company, signaling that big tech is taking voice AI seriously and building in-house. Google has the advantage of scale and existing distribution but hasn't focused on voice AI the way Eleven Labs has.

Microsoft is playing in this space too through its Copilot efforts, but Microsoft's approach is more about integrating voice into existing services rather than building voice as a standalone platform. Amazon's Alexa team exists, but Amazon's voice strategy has always been tied to device hardware, not software-as-a-service.

That leaves Eleven Labs in a unique position. It's the pure-play voice AI company that's closest to becoming the dominant platform. It's not encumbered by existing business models or legacy products. It can optimize entirely for voice AI excellence. That focus is why investors are paying $11 billion for the company.

The International Expansion Strategy

The funding announcement emphasized international expansion. Specifically, the company mentioned India, Japan, Singapore, Brazil, and Mexico. That's not random geographic selection. Those are markets with massive growth potential in voice-first applications.

India is a no-brainer. With over 1.4 billion people, many of whom prefer voice interfaces to text, India is where voice AI will reach critical mass first. A voice interface for agricultural information, banking, or education in India solves real problems for millions of people. Eleven Labs entering the Indian market aggressively could position them as the infrastructure layer for an entire generation of voice-first applications.

Japan and Singapore represent mature markets where adoption might be faster. Brazil and Mexico are large Latin American markets with similar opportunities to India. By focusing on these regions with dedicated teams and localized voices, Eleven Labs is betting that the next wave of voice AI adoption happens outside the US.

There's also a revenue arbitrage angle. Pricing enterprise AI tools based on usage is standard in the US, but in emerging markets, the same revenue might come from higher volume of lower-value transactions. A company doing a thousand small voice generations per day generates more revenue than a thousand companies doing one voice generation per month. At scale, that flips the economics entirely.

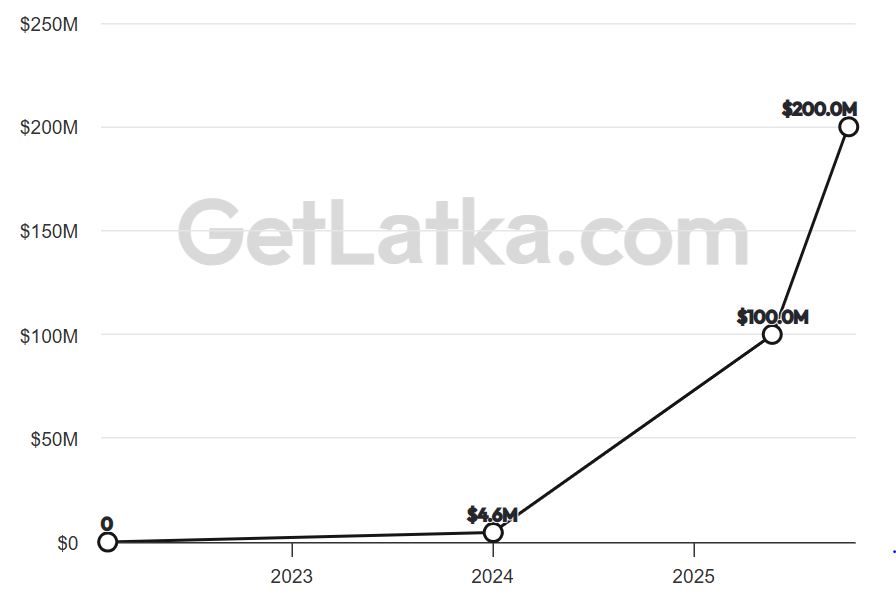

ElevenLabs' ARR has shown rapid growth from

Financial Performance: The $330 Million ARR Story

Let's dig into the numbers because they're genuinely impressive. Eleven Labs closed 2024 with $330 million in annual recurring revenue. For a company in business for fewer than five years, that's exceptional.

Here's why ARR matters more than funding raised. Funding is future potential. ARR is current reality. When a company has

The growth trajectory is what investors obsess over. The company hit

When a company's revenue is accelerating, especially in a market as new as voice AI, valuations can expand dramatically because investors use top-down projections. If Eleven Labs keeps this growth trajectory, the company could hit

That's not speculation. That's the actual math. Investors are paying

The Business Model: How Eleven Labs Makes Money

Understanding Eleven Labs' business model is crucial to understanding why investors are so excited. The company operates a classic SaaS model with a freemium tier and paid plans.

The free tier gets people in the door. Users can generate a certain amount of voice content per month at no cost. For hobbyists and casual creators, this is enough. It's also perfect for viral adoption. Every creator using the free tier is essentially an advertiser for the paid product.

The paid tiers kick in when you need more volume or access to advanced features. Enterprise customers, with high-volume voice generation needs, pay premium prices. At scale, this model has exceptional unit economics. The marginal cost of generating one more voice file is nearly zero. The infrastructure is already built. So each additional paying customer is almost pure margin.

That's why the $330 million ARR is so meaningful. Not all of that revenue is equal. Some comes from high-volume enterprise customers paying millions per year. Some comes from individual creators paying tens of dollars per month. But the weighted average gross margin is probably in the 70-80% range, which is exceptional for any software company.

Venture investors think in terms of margin expansion. Right now, with international expansion underway, Eleven Labs is probably spending heavily on operations, sales, and support. But as the company scales, those costs per revenue dollar decrease. That's when profitability happens. Investors betting on Eleven Labs are betting that the company reaches

ElevenLabs' valuation surged from

Why Investors Are Convinced: The Narrative

Venture capital is part investment, part narrative. The numbers matter, but investors also need to believe the story. The Eleven Labs story is compelling because it hits several key narrative elements.

First, there's the founder story. Mati Staniszewski isn't a first-time founder learning on the job. He built Eleven Labs with a clear vision and has executed systematically. Every major announcement signals deliberate strategy, not random product additions.

Second, there's the market narrative. Voice AI is moving from novelty to necessity. Five years ago, nobody was using voice AI seriously. Today, millions of creators depend on it. Five years from now, voice AI will be everywhere. Investors love being early in a market shift like that.

Third, there's the competitive narrative. Eleven Labs isn't competing against Google or Amazon directly. It's positioning itself as the infrastructure layer underneath all the applications those companies might build. Infrastructure companies that become standard win. That's the belief here.

Fourth, there's the international expansion narrative. Silicon Valley investors love when US startups go global. The idea that Eleven Labs could become the voice AI standard in India, Brazil, and Southeast Asia is tremendously exciting. That's not additive growth, that's multiplicative.

Finally, there's the execution narrative. Most startups promise moon-shot products and then disappoint. Eleven Labs has a track record of building what they say they'll build, achieving product-market fit, and scaling revenue. That's not exciting, but it's absolutely reassuring to investors who've been burned before.

The Broader AI Startup Ecosystem

Eleven Labs' success is part of a broader trend in AI startups. Capital is flowing to companies that have found a specific problem and built the best solution. It's not flowing equally to all AI startups. It's concentrating at the top.

This round raises questions about how the AI startup ecosystem is evolving. Is there room for multiple players in voice AI, or is this winner-take-most? The current evidence suggests winner-take-most. Eleven Labs is raising at

There's also a question about talent allocation. The best engineers want to work at the most successful company. Eleven Labs raising at $11 billion means they can offer meaningful equity packages. That attracts top talent. Top talent builds better products. Better products win more customers. Customers drive revenue. Revenue drives valuation. It's a virtuous cycle that's hard to break once it starts.

For other AI startups, the Eleven Labs example is both encouraging and sobering. Encouraging because it shows that if you build something genuinely valuable, capital will follow. Sobering because it shows that the capital follows the winner, not spread evenly across the category.

ElevenLabs achieved a significant ARR growth from

Revenue Acceleration and Unit Economics

One metric worth breaking down is the ARR growth rate. Eleven Labs went from roughly

Why is this growth possible? Because the unit economics work. When the cost to acquire a customer is

For a SaaS company, achieving this level of unit economics while maintaining that growth rate is genuinely rare. It's the difference between a good company and a world-beating company. That's what Eleven Labs has achieved.

The Profitability Question

One thing not mentioned in most reporting on this funding round is the path to profitability. At

If Eleven Labs is already profitable or near-profitable while growing 100%+ year-over-year, that changes the calculus on the valuation. This becomes less about betting on future profitability and more about valuing current cash generation. That's a more defensible valuation story.

We don't have official confirmation of profitability, but the trajectory and the fundraising suggest the company has extremely strong unit economics and is likely generating significant cash flow despite heavy international expansion spending.

Strategic Partnerships and Integration Points

The funding announcement mentioned that Eleven Labs will disclose some additional investors in February that are likely strategic partners. What does that mean? It means Eleven Labs is probably partnering with larger technology companies or media platforms that want to integrate voice AI into their products.

Imagine YouTube integrating Eleven Labs voice into its creation tools. Imagine TikTok offering Eleven Labs voices for video creation. Imagine Discord baking voice generation into its platform. Each of those partnerships would be a massive distribution channel. They'd also validate Eleven Labs as the infrastructure of choice for voice generation.

Strategic partnerships are how startups scale beyond their own go-to-market. They're also how startup technology becomes invisible infrastructure that billions of people use without knowing about it. If Eleven Labs can get its voices embedded in the platforms where creators work, the company becomes functionally indispensable.

The Video Generation Play

The partnership with LTX for audio-to-video content is the most forward-looking signal from Eleven Labs. Video generation is harder than voice generation. Video quality expectations are higher. Rendering video requires more computation. Integration into workflows is more complex. But video is also where the money is. Professional video production is a multi-billion dollar industry.

If Eleven Labs can automate video production the way it's automated voice generation, that's not a 10x market opportunity, that's a 100x market opportunity. That's also why investors are comfortable paying $11 billion for the company today. The voice business is worth billions. The video business could be worth tens of billions.

The LTX partnership is a validation that video is coming. It's also a signal that Eleven Labs understands that voice without video is incomplete. The future of content creation is integrated: voice, video, editing, distribution, all in one platform. Eleven Labs is positioning itself to own that stack.

Risks and Challenges Ahead

No analysis is complete without discussing risks. Eleven Labs faces several legitimate challenges.

First, there's regulation. Voice cloning technology raises privacy and fraud concerns. Regulators in the EU, US, and Asia will eventually develop rules around voice synthesis. That could add friction to the product or limit use cases. Eleven Labs needs to get ahead of this.

Second, there's the large tech company risk. Google, Microsoft, Meta, and Apple all have enough capital to build voice AI competitive with Eleven Labs. If any of them prioritize it, they could catch up quickly. Eleven Labs' advantage is focus and speed. They can't afford to lose either.

Third, there's the market adoption risk. Voice AI adoption depends on enough compelling use cases existing. So far they do. But if adoption stalls or pivots to a different technology, Eleven Labs' growth could slow.

Fourth, there's the talent retention risk. Rapid scaling requires hiring fast. Hiring fast, when everyone's competing for the same talent, is expensive and difficult. Eleven Labs needs to hire thousands of people to support international expansion and new product development. That's a management challenge.

Finally, there's the execution risk. The company is now much larger after this funding. Larger companies move slower. Decisions take longer. If Eleven Labs loses its speed advantage while scaling, competitors could catch up.

These are real risks, but none are insurmountable if management executes well. The company has a track record of execution, so that's encouraging.

What This Means for Voice AI as a Category

Eleven Labs' valuation is a signal about the future of voice AI. It says that voice is not a peripheral feature anymore. It's a primary interface. It's infrastructure. Companies are building on top of it. Billions of people will use it without thinking about it.

That shift from novelty to infrastructure is significant. It means voice AI companies stop being startups and become technology incumbents. They stop being disruptors and become the foundation that new disruption is built on.

Eleven Labs reaching $11 billion in valuation is the moment where voice AI becomes undeniable as a category. It's not the endpoint. It's the beginning. The company will probably be worth hundreds of billions within a decade if it executes on the vision.

That's what investors see when they value the company at $11 billion. They're not paying for what the company is today. They're paying for what it will become. And based on current growth and product vision, that bet makes sense.

The Path Forward: What's Next for Eleven Labs

The next phase for Eleven Labs is international expansion and product expansion. Specifically, the company needs to:

First, execute the international expansion. Building teams in India, Japan, Singapore, Brazil, and Mexico is non-trivial. Different markets have different voice preferences, regulatory requirements, and sales motions. Getting these right will determine whether the company can truly become global or if it remains primarily a US story.

Second, ship the video generation product. The audio-to-video partnership is proof of concept. The company now needs to develop full video generation capabilities. This is hard. It's also essential if the company wants to stay ahead of competitors.

Third, build enterprise sales. A lot of Eleven Labs' revenue today probably comes from individual creators and smaller teams. Enterprise customers paying millions per year are less numerous but more stable. Building an enterprise sales motion takes time and different skills than consumer sales.

Fourth, maintain product-market fit while scaling. Scaling often means building processes and overhead that slow down product development. Eleven Labs needs to scale operations while maintaining its speed advantage.

Fifth, prepare for regulation. As voice AI becomes more powerful and more widely used, regulation is coming. The company should engage with policymakers proactively to shape reasonable rules rather than fight rules that come later.

If Eleven Labs executes on these five things, the company will be substantially larger five years from now. The $11 billion valuation might even look like a bargain in hindsight.

Conclusion: A Milestone Moment

Eleven Labs raising

But valuations are ultimately bets on the future. The real question is whether Eleven Labs executes on the ambition reflected in that valuation. The company has a strong track record of execution. It has product-market fit. It has revenue. It has international expansion plans. It has a visionary leadership team.

What it doesn't have yet is proof that it can execute at scale across multiple product categories and multiple geographies. That's the challenge ahead. That's also what will determine whether the $11 billion valuation proves prescient or excessive.

For founders building in voice AI or adjacent categories, the Eleven Labs example is encouraging. It shows that if you build something genuinely valuable, solve real problems, and achieve sustainable growth, capital will follow. For investors, it's a validation that voice AI is real, big, and worth betting on. For the broader technology industry, it's a signal that the next wave of interfaces and experiences will be increasingly voice-first.

The story of Eleven Labs is just beginning. The $11 billion valuation is not the destination. It's just a milestone on a much longer road.

FAQ

What exactly does Eleven Labs do?

Eleven Labs is a voice AI company that specializes in text-to-speech technology, voice cloning, and voice synthesis. The platform allows creators, developers, and enterprises to generate natural-sounding speech in multiple languages and voices. Users can either select from a library of pre-built voices or create custom voices by uploading a few minutes of audio samples. The technology has reached a level of sophistication where the generated speech sounds genuinely human rather than robotic, making it suitable for real-world applications like video narration, audiobook production, podcast generation, customer service automation, and interactive media experiences.

How does Eleven Labs' voice generation technology work?

Eleven Labs uses deep learning models trained on extensive audio datasets to understand how voices work across different languages, emotions, and speaking styles. When you input text, the system processes it through its neural network, which predicts how the words should be pronounced and which acoustic features should be applied. The system then generates the actual audio waveforms that sound like natural human speech. For voice cloning specifically, the model learns the unique characteristics of a specific person's voice from audio samples and can then generate new speech in that person's voice with remarkably high fidelity, even if the original samples are short.

What are the main use cases for Eleven Labs' technology?

Eleven Labs serves dozens of use cases across different industries and user types. Content creators use it to generate voiceovers for YouTube videos, TikTok content, and podcasts without hiring voice actors. E-learning platforms use it to create narration for courses in multiple languages, making education more accessible. Video game developers use it for NPC dialogue and character voices, which can be generated dynamically based on in-game events. Customer service companies use it to power AI customer service agents that sound human and can handle phone calls or chat interactions. News organizations use it to generate audio versions of articles. Accessibility applications use it to help people with speech disabilities communicate. Publishers use it to create audiobooks without expensive studio recording. The breadth of applications shows that voice generation has moved from novelty to essential infrastructure across multiple industries.

Why is Eleven Labs valued at $11 billion?

Eleven Labs commands an

How does Eleven Labs compete against Google, Microsoft, and other large technology companies?

Eleven Labs competes against larger companies through focus and specialization. Google, Microsoft, Meta, and Amazon all have voice AI capabilities, but voice is not their primary focus. These large companies build voice AI to enhance existing products like search, virtual assistants, or productivity tools. Eleven Labs, by contrast, focuses exclusively on voice synthesis and voice AI. This focused approach allows the company to innovate faster, respond to customer needs more quickly, and build the best voice products rather than adequate voice features. Additionally, Eleven Labs' developer-friendly API and cloud-based delivery model make it easier for third-party developers and creators to build on top of Eleven Labs' technology. Large companies are often slower to adopt external platforms because they prefer building in-house, while startups and individual creators love third-party platforms that solve specific problems well. Finally, Eleven Labs is attacking the market from below, starting with individual creators and small companies and working upward to enterprises, while large companies often attack from above and struggle to move downmarket.

What is annual recurring revenue (ARR) and why is it important?

Annual recurring revenue is the value of subscription contracts expected to be received over one year, assuming all customers stay and no new customers are added. It's a key metric for SaaS companies because it indicates the sustainable revenue base of the business. Unlike total revenue, which can include one-time sales or highly volatile transaction volumes, ARR shows predictable, recurring income. For Eleven Labs, the

Will Eleven Labs need to worry about regulation of voice cloning technology?

Yes, regulation is coming and Eleven Labs will need to navigate it carefully. Voice cloning technology creates legitimate privacy and fraud concerns. Someone could clone a person's voice without permission and use it for impersonation, fraud, or creating misleading content. Regulatory bodies in the EU, US, and Asia are already developing frameworks for synthetic voice content. The EU's AI Act, in particular, has provisions about AI-generated audio and voice. Eleven Labs is likely already investing in responsible AI practices, watermarking, and consent mechanisms to address these concerns proactively. Companies that get ahead of regulation and build responsible practices into their products often emerge stronger, as regulation creates barriers to entry for competitors. However, overly restrictive regulation could slow adoption in certain use cases, which represents a real risk to the company's growth trajectory.

What is the international expansion strategy and why does it matter?

Eleven Labs is expanding into India, Japan, Singapore, Brazil, and Mexico as part of its growth strategy. These markets matter for several reasons. India has a massive population with growing digital adoption and strong preference for voice interfaces over text interfaces. Brazil and Mexico represent large Latin American markets where voice-first applications could unlock new use cases. Japan and Singapore are mature markets with high tech adoption. By expanding into these markets, Eleven Labs is diversifying revenue away from the US and positioning itself to capture growth in regions where voice AI adoption might be fastest. Additionally, these markets have different regulatory environments, language requirements, and cultural preferences, so success requires genuine local presence, not just translated products. The ability to expand internationally is a significant growth catalyst and was highlighted specifically in the funding announcement as a key use of capital.

What does the partnership with LTX mean for Eleven Labs' future?

The partnership with LTX for audio-to-video content creation signals that Eleven Labs is expanding beyond voice-only applications into complete content creation workflows. Audio-to-video generation means that when someone uses Eleven Labs to create a voice narration, the platform can automatically generate video to accompany that audio. This bundling of voice and video creation could dramatically expand the company's addressable market and stickiness. Video production is a larger market than voice production, and offering integrated voice-and-video creation could make Eleven Labs more valuable to creators. This partnership is also a signal that the company is thinking about the complete creator workflow rather than just voice in isolation. Future partnerships might bundle video, editing, music, and distribution into a complete creative platform. If Eleven Labs can execute this vision, the company becomes more than a voice API provider and becomes a platform for end-to-end content creation.

How sustainable is Eleven Labs' growth rate?

Eleven Labs' current growth rate is impressive but might not be sustainable at the same pace forever, though the company could grow at elevated rates for years. The company is in a greenfield market where voice AI adoption is still ramping. New use cases are being discovered constantly. The company hasn't saturated existing markets. International expansion is still early. These factors suggest growth could remain strong for several more years. However, as the company gets larger, growing by 100% becomes increasingly difficult in absolute terms. A company growing from

What could derail Eleven Labs' success?

Several factors could slow or stop Eleven Labs' growth. Regulatory crackdown on voice cloning could restrict use cases. Large technology companies building competitive voice AI could catch up. Slower-than-expected adoption in international markets could disappoint investors. The company could struggle to scale operations while maintaining culture and innovation speed. Key talent departures could slow product development. Market saturation in the creator economy could slow new customer acquisition. A shift in how people interact with AI (away from voice and toward other interfaces) could reduce demand. However, most of these risks are manageable with good execution. The fundamental market for voice AI is sound, the company has execution credibility, and the product is genuinely valuable. As long as management navigates the next few years well, Eleven Labs should continue growing successfully.

Key Takeaways

- Eleven Labs raised 11B valuation from Sequoia Capital, tripling its value in 12 months

- The company achieved $330M annual recurring revenue with 100%+ growth acceleration in late 2024

- Voice AI has moved from novelty to essential infrastructure across content creation, accessibility, and enterprise automation

- International expansion into India, Japan, Singapore, Brazil, and Mexico represents the next major growth catalyst

- Video generation partnerships signal Eleven Labs' expansion beyond voice into complete content creation workflows

Related Articles

- Nvidia's $100B OpenAI Gamble: What's Really Happening Behind Closed Doors [2025]

- Alexa+: Amazon's AI Assistant Now Available to Everyone [2025]

- SNAK Venture Partners $50M Fund: Digitalizing Vertical Marketplaces [2025]

- Take-Two's AI Strategy: Game Development Meets Enterprise Efficiency [2025]

- Positron's $230M Series B: The AI Chip Challenger Nvidia Should Fear [2025]

- Space-Based AI Compute: Why Musk's 3-Year Timeline is Unrealistic [2025]

![ElevenLabs $500M Funding: AI Voice Company Hits $11B Valuation [2025]](https://tryrunable.com/blog/elevenlabs-500m-funding-ai-voice-company-hits-11b-valuation-/image-1-1770221498699.jpg)