How a New $50M Fund Is Betting Big on B2B Marketplace Digitalization

Sonia Nagar and Adam Koopersmith spotted something most venture capitalists missed. After spending years inside Pritzker Group—one of the most successful family offices in America—they noticed a pattern. The biggest exits of the past decade weren't just category winners. They were category creators. Uber didn't just beat taxi services. Airbnb didn't just compete with hotels. Instacart didn't just optimize grocery shopping. These companies didn't win by making existing systems 5% better. They won by fundamentally digitizing entire industries that hadn't been touched by the internet yet.

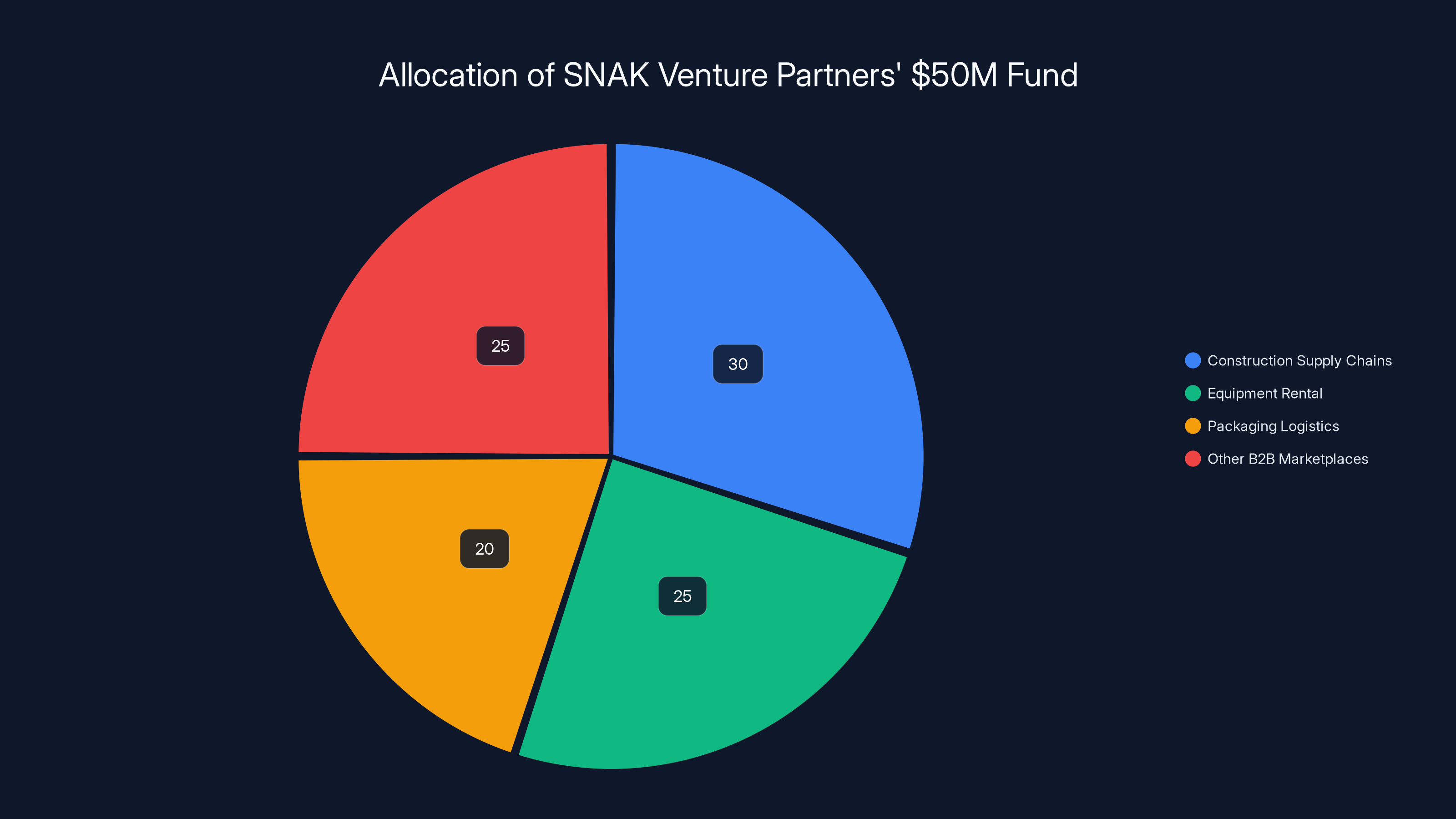

So when they launched SNAK Venture Partners in early 2026, they did something bold. They raised a $50 million debut fund specifically to back B2B marketplaces in industries that still operate like it's 1995. Not flashy consumer apps. Not AI tooling. Not yet another crypto play. Instead, they're targeting what Nagar calls the "white space"—construction supply chains, equipment rental, packaging logistics, and dozens of other trillion-dollar industries where digitalization hasn't really happened yet.

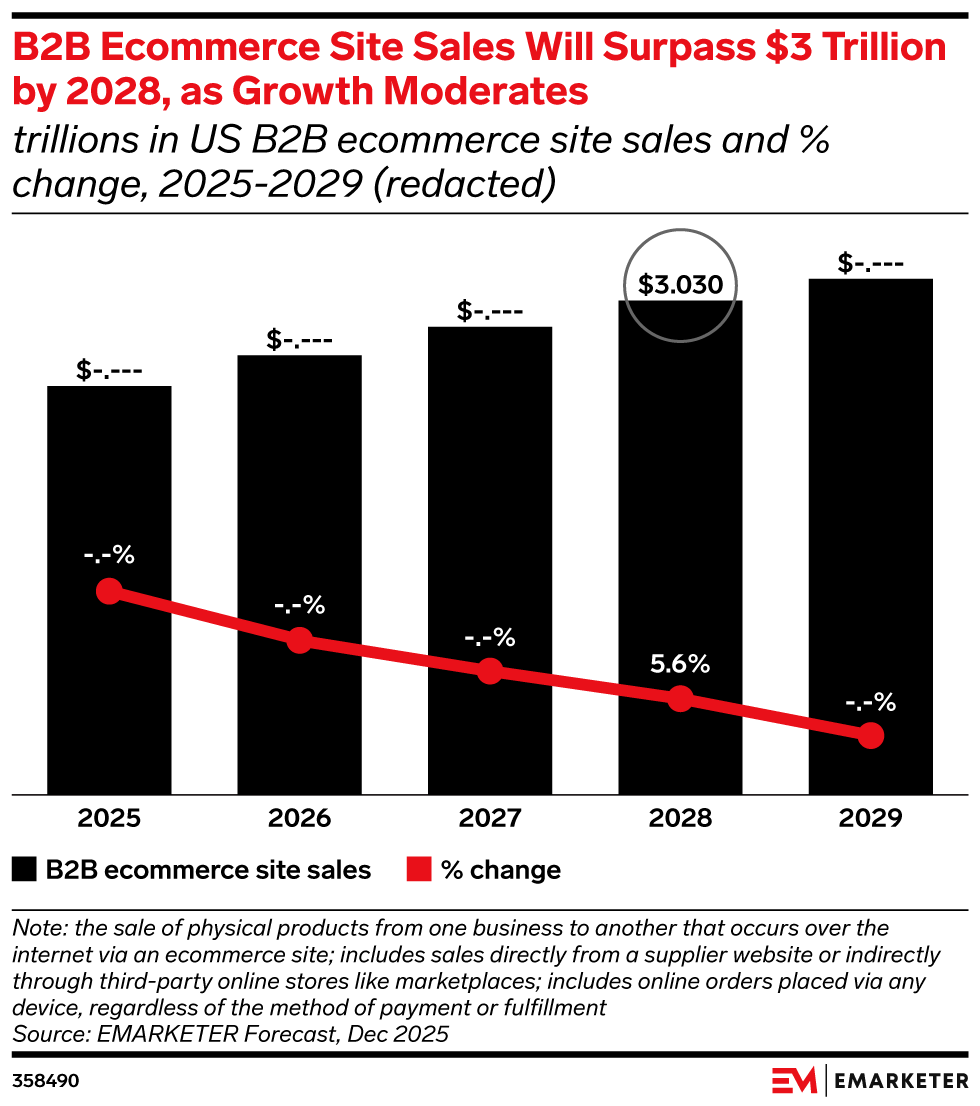

The fund closed oversubscribed, backed by heavy-hitting LPs including Pritzker Group itself, the State of Illinois Growth and Innovation Fund, and executives from marketplace companies like Favor Delivery and Retail Me Not. They've already deployed capital into six companies. And they're planning to write 20 checks total, ranging from

This matters more than it might seem. While Silicon Valley chases AI and consumer apps, an entirely different market is waking up to the possibility that digital marketplaces might actually be the next trillion-dollar opportunity. And SNAK is betting billions on it.

Here's what you need to know about why this fund matters, who's behind it, and what it signals about the future of venture capital.

TL; DR

- Fund Size & Anchor: SNAK Venture Partners raised $50 million in their debut fund, anchored by Pritzker Group, and oversubscribed from day one

- Investment Thesis: Targeting B2B vertical marketplaces in industries that haven't digitized yet (construction, supply chain, equipment rental, logistics)

- Capital Deployment: Writing 2M seed checks into approximately 20 companies over the next 3–4 years

- Founders' Background: Sonia Nagar (former Amazon and Retail Me Not executive) and Adam Koopersmith (20-year Pritzker Group veteran) built the fund on their experience backing Backlot Cars and Tickets Now

- Early Bets: Already invested in six companies including Big Rentals (equipment rental) and Repackify (packaging logistics)

- Location Strategy: Based in Chicago with a geographic-agnostic approach to finding overlooked founders outside Silicon Valley and NYC

The SNAK Fund's LP base is diversified with Pritzker Group as the anchor, complemented by the State of Illinois Growth Fund and marketplace executives. Estimated data.

The Rise of Vertical Marketplaces: Why Now?

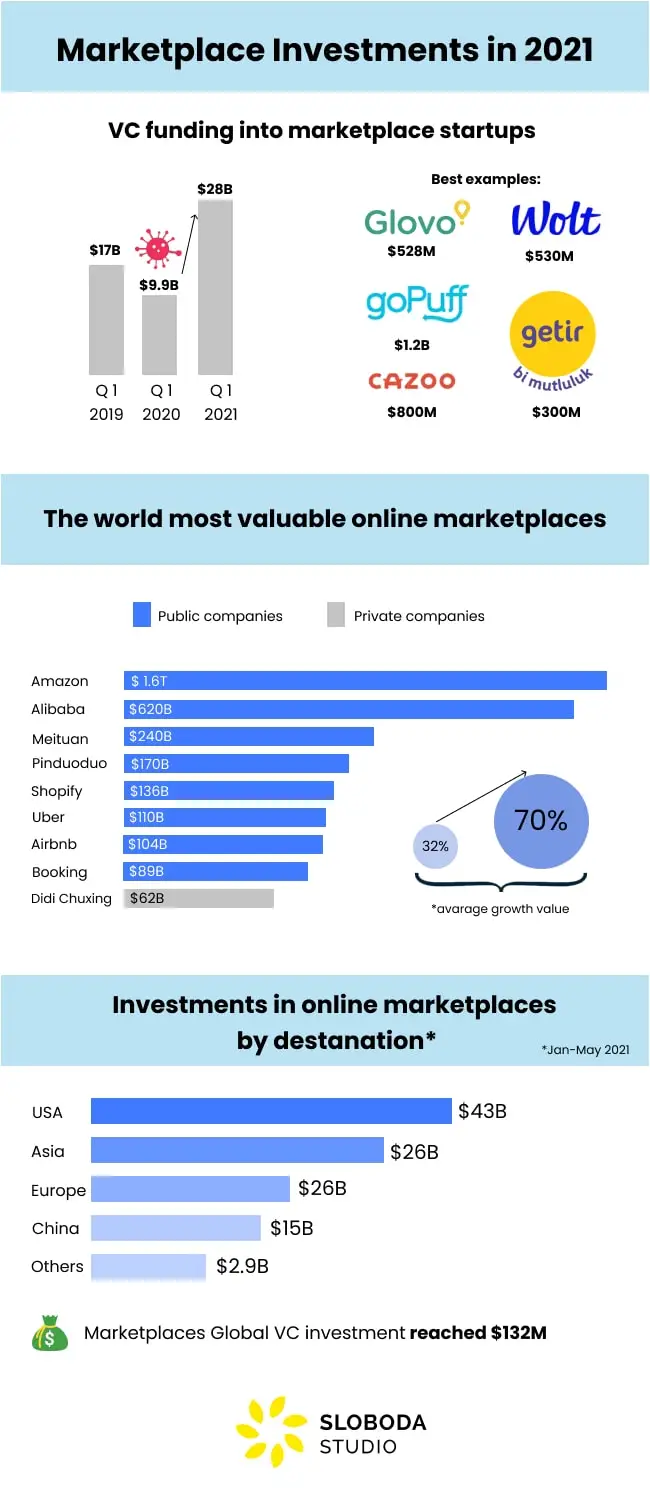

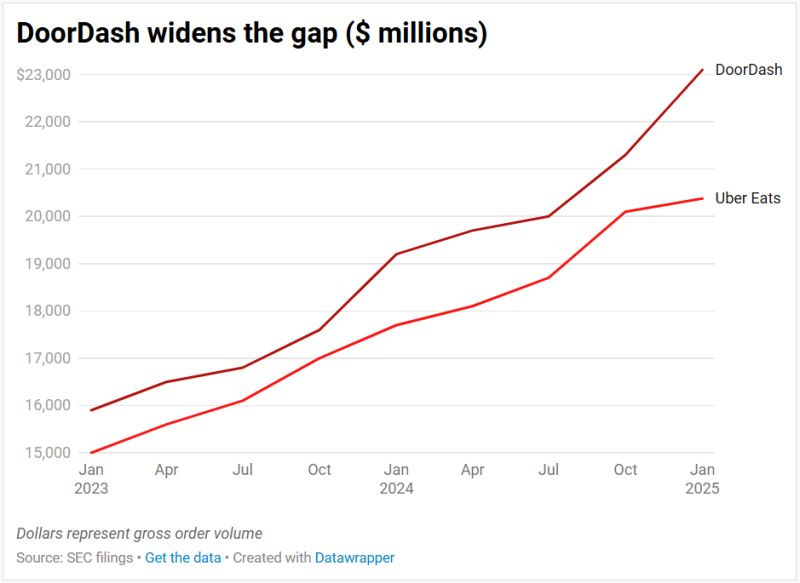

The timing for SNAK's thesis feels almost too perfect. Over the past decade, venture capital has chased consumer marketplaces obsessively. Uber went from idea to $70 billion valuation in eight years. Airbnb raised billions before IPO. Door Dash, Instacart, and Lyft all followed similar trajectories. These wins created a feedback loop: success breeds imitators, imitators attract capital, capital builds more clones.

But here's what most venture funds missed. Those massive consumer marketplace wins weren't proof that all marketplaces are gold mines. They were proof that digitizing analog industries creates asymmetric returns. Each of these companies didn't just build software. They replaced an entire system. Uber didn't just make hailing a cab easier. It replaced the decades-old dispatch infrastructure that power brokers, corporations, and regulators had been optimizing for 50 years. Airbnb didn't just add inventory. It created a new asset class out of underutilized residential real estate.

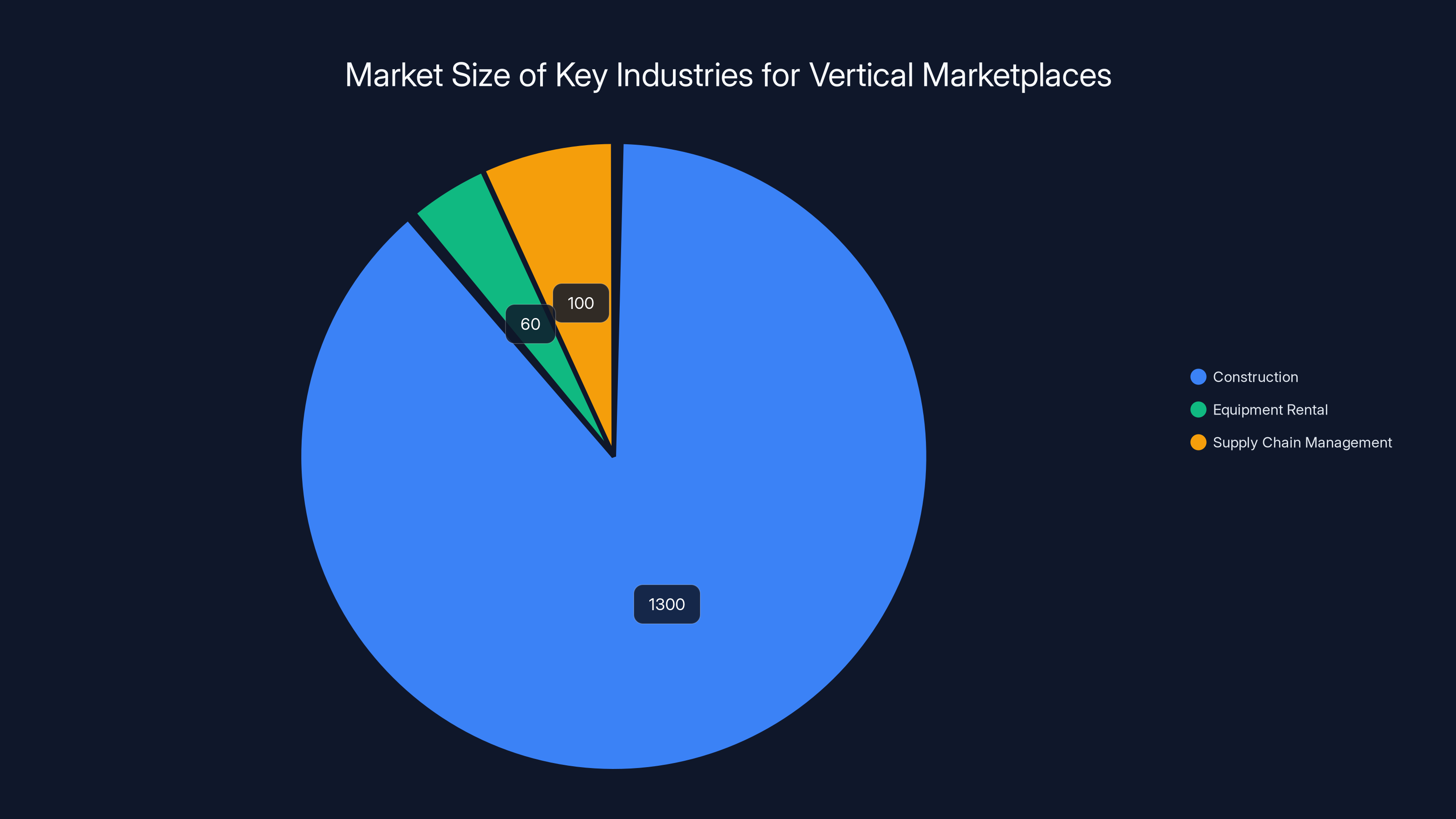

The scale is staggering when you think about it. Construction alone is a

Nagar articulates this perfectly in conversations with investors: "Most of those wins were in consumer, which tends to be faster-moving than large enterprises. We think there's a ton of white space to double down and focus on B2B marketplaces." The key insight isn't that B2B is inherently better than B2C. It's that B2B verticals with high transaction volume, fragmented supply chains, and significant operational friction are exactly where marketplace software can create enormous value.

What's changed in the last 18 months? First, fintech infrastructure. Building a marketplace in 2026 is radically easier than it was in 2016. Payment processing, identity verification, compliance automation—all of this is now modular, API-first, and relatively cheap. Second, founder comfort. The pandemic accelerated digital adoption across traditionally analog industries by 5–7 years. A construction company that swore it would never use software now has developers on staff. Third, data. With enough transaction history, AI can now automate matching (supplier to buyer), pricing, and quality assessment in ways that weren't possible before.

So SNAK's thesis boils down to this: The next generation of multibillion-dollar exits won't come from making Uber more efficient. They'll come from finding the next industry that's still completely analog and building the Uber of that space.

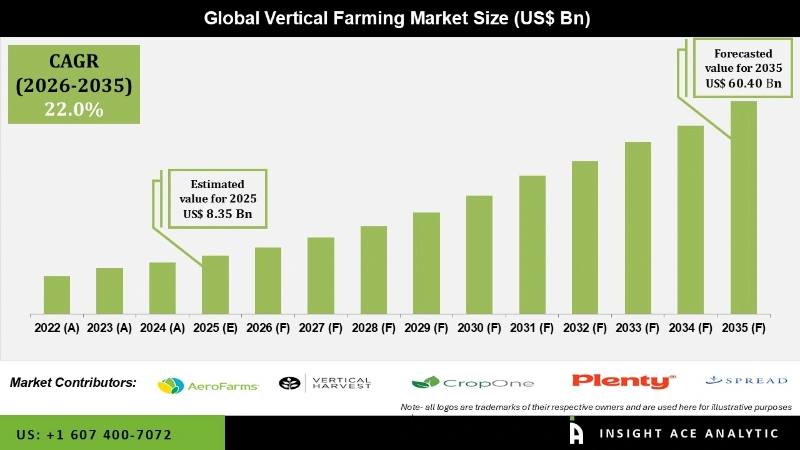

BigRentals and Repackify could save billions by reducing inefficiencies in equipment rental and supply chain logistics, respectively. Estimated data.

Meet the Founders: How They Got Here

Sonia Nagar's journey reads like a masterclass in vertical expertise. In 2009, when Amazon was expanding beyond books, Nagar helped launch Amazon's apparel division. Think about that timeline. She was building marketplace infrastructure for fashion and textiles at a time when most people still didn't understand why anyone would buy clothes online. She watched the mechanics of inventory, returns, seller relationships, and logistics play out at scale in one of the most complex verticals imaginable.

After Amazon, she moved to Retail Me Not as head of mobile. This wasn't just a side gig. Retail Me Not is a marketplace for deals and discounts—it's smaller than Uber or Airbnb, but it's still a functioning marketplace with real unit economics, seller relationships, and operational complexity. While at Retail Me Not, she saw both the consumer side and the merchant side of digital transactions. She understands what it takes to make both sellers and buyers want to show up.

Then came Pritzker Group. For the past several years, Nagar has been inside one of America's most successful family offices, directly involved in evaluating and supporting marketplace investments. She didn't just observe deals. She helped lead investments into companies like Backlot Cars (a marketplace for used vehicles) and saw what it takes to make a marketplace succeed in a capital-intensive, traditionally offline industry.

Adam Koopersmith brings a different flavor of expertise. He spent 20 years at Pritzker Group—two decades of watching investments succeed and fail, of understanding what separates a marketplace that returns 3x from one that returns 10x. He sits on the boards of multiple marketplace companies, which means he's not just observing. He's helping founders make operational decisions. He knows where the friction points are in scaling a marketplace from 5 employees to 50 to 500.

That combination is powerful. Nagar brings domain knowledge across multiple vertical marketplaces. Koopersmith brings capital allocation experience and operational governance. Together, they're not making theoretical bets about which industries should be disrupted. They're making informed bets based on years of watching what actually works.

What's also telling is why they felt empowered to launch their own fund. Nagar mentions this directly: "It felt like the timing was right and there was support within the firm to go do this." This isn't a case of two frustrated employees going rogue. This is a case of a family office recognizing that some of its best people had a differentiated thesis, and rather than lose them to another firm, doubling down on that thesis with a dedicated fund. That's a signal about conviction. Pritzker Group didn't just anchor this fund—they essentially said, "We believe in this so much we're willing to let you go build it independently."

The $50M Fund: Size, Structure, and LP Base

Raising

Why is that important? Oversubscription signals LP conviction. In early 2025 and 2026, capital is not abundant. Most first-time managers who tried to raise were struggling. The fundraising environment was marked by higher skepticism toward new funds, more due diligence, tougher terms. For SNAK to close an oversubscribed round in that environment means their thesis resonated with sophisticated capital allocators.

The LP base is equally revealing. Yes, Pritzker Group is the anchor. But the fund also counts the State of Illinois Growth and Innovation Fund as an LP, along with executives from marketplace companies like Favor Delivery and Retail Me Not. That last group is particularly interesting. Operating executives from successful marketplaces making direct investments into a fund focused on marketplaces—that's not luck. That's smart capital building network effects around itself.

The investment strategy is straightforward but disciplined. SNAK plans to write

The deployment timeline—3 to 4 years—is also smart. It's not aggressive enough to create panic ("we have to deploy $50M in 18 months"), but it's tight enough to maintain focus and momentum. Most funds have 10-year lives. Investing the capital over 3–4 years means they're spending the remaining 6–7 years on exits, follow-on investments, and board support.

Six companies have already received funding. Big Rentals and Repackify are the named examples. Big Rentals is digitizing equipment rental—power tools, heavy machinery, construction equipment—which is a fragmented $60 billion market where most transactions still happen via phone calls to local vendors. Repackify is digitizing packaging logistics, helping companies optimize reusable packaging across supply chains. Both are targeting industries where a 10% efficiency gain translates to millions in annual savings.

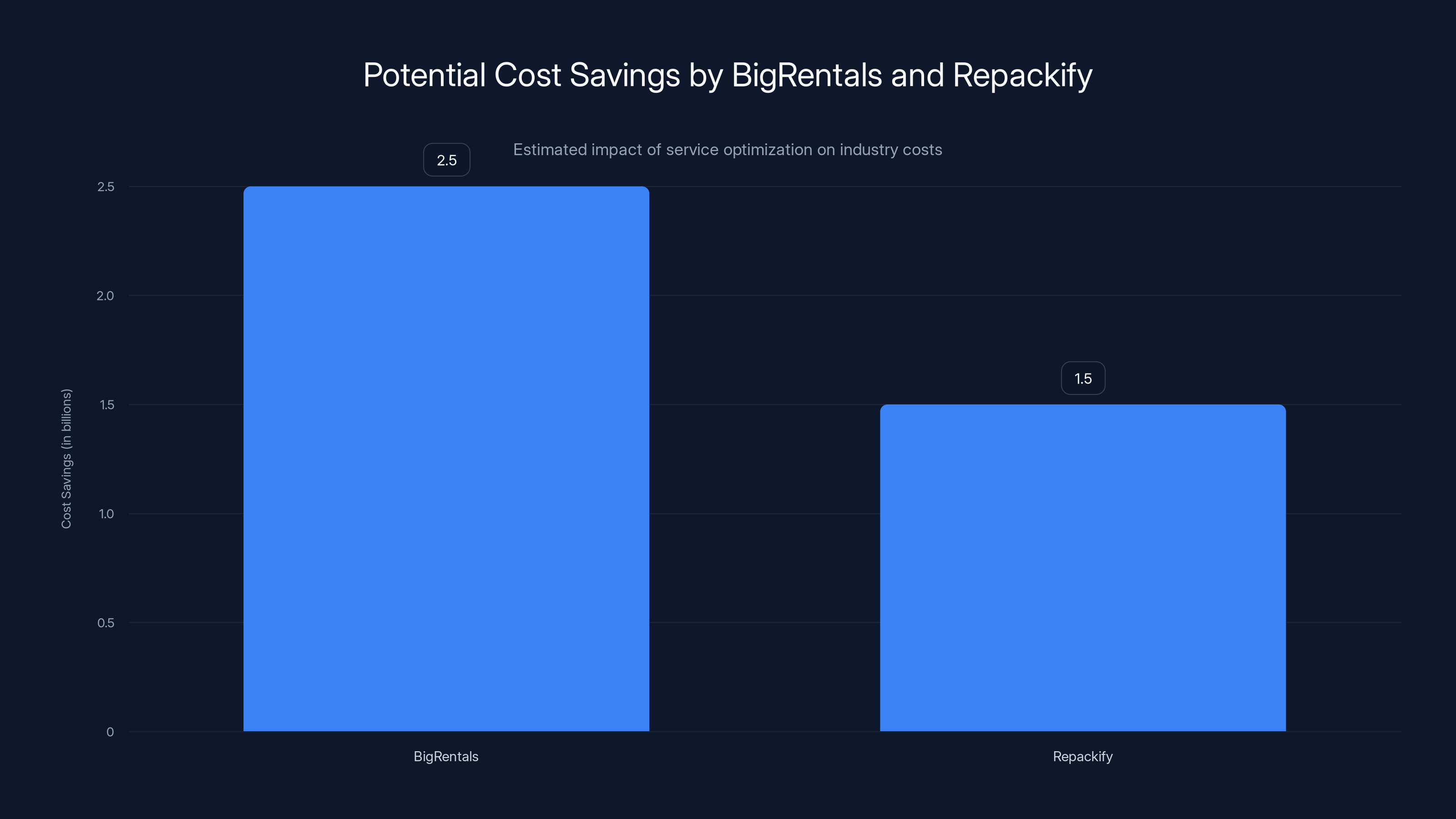

SNAK Venture Partners is strategically allocating their $50M fund across various B2B marketplaces, with a significant focus on construction supply chains and equipment rental. (Estimated data)

Early Bets: Big Rentals and Repackify

Big Rentals is a perfect example of SNAK's thesis in action. Equipment rental is massive but completely fragmented. If you need a crane, you call Regional Equipment Company in your area. If you need scaffolding, you call a different company. If you need power tools, you call yet another vendor. There's no aggregation, no standardization, no transparency on pricing across vendors. A contractor might be overpaying by 20–30% simply because they don't know competitor pricing.

Big Rentals is building the Uber of equipment rental. They're aggregating vendor inventory into a single platform. They're standardizing pricing. They're handling logistics. They're financing for contractors who need extended rental periods. It's not revolutionary software engineering. But it's addressing a structural inefficiency that costs the industry billions annually.

The unit economics work. If Big Rentals can reduce friction by even 10%, that's worth billions to contractors, vendors, and financing providers. And unlike consumer apps, Big Rentals isn't competing on user experience or whimsy. They're competing on whether they can reduce total cost of ownership for contractors. That's a clearer, more defensible thesis.

Repackify operates in a similar space but targets supply chain logistics. Reusable packaging is a $15 billion industry. Companies use plastic bins, crates, and containers to ship products. But managing those containers—cleaning them, tracking them, optimizing their flow through the supply chain—is labor-intensive and inefficient. Most companies have dozens or hundreds of containers floating through their networks with no real visibility into where they are or when they'll return.

Repackify is building logistics software to track, route, and optimize reusable packaging. It's less flashy than Big Rentals but potentially more defensible. Every supply chain in the world has this problem. The margins are substantial if you can reduce logistics costs by even 5%. The switching costs are high once you're embedded in a company's operations.

Both of these investments reflect SNAK's thesis: Find industries with high transaction volume, fragmented vendors, significant operational friction, and low digital penetration. Build the marketplace that connects fragmented supply and demand and extracts value through efficiency.

The LP Story: Why Pritzker Group Backed the Fund

Pritzker Group isn't a typical venture capital firm. It's a family office—meaning it manages the wealth of the Pritzker family, one of the wealthiest families in America. Family offices operate differently than traditional VC funds. They have longer time horizons, more patient capital, and less pressure to return multiples on every investment within a specific timeframe.

But Pritzker Group has also been actively investing in companies for decades. They backed Backlot Cars, an online marketplace for used vehicles. They backed Tickets Now, which was eventually acquired by Ticketmaster. They have experience with marketplace investing and understand what it takes to scale these businesses.

When Nagar and Koopersmith came to Pritzker Group with the idea for SNAK, the response was essentially: "We like this thesis so much we're going to anchor your fund." That's different from just being an LP. That's saying, "We believe in you, we believe in this strategy, and we're willing to underwrite the fund ourselves."

The oversubscription also tells a story about LP conviction. Yes, family offices and endowments like to diversify their LP bases. But the fact that they could raise more capital than they were targeting suggests real demand for a fund focused on B2B vertical marketplaces. That demand is likely coming from LPs who've watched consumer marketplace valuations flatten or decline in recent years and are looking for new categories to deploy capital into.

The presence of the State of Illinois Growth and Innovation Fund is also strategic. State-level economic development funds have a mandate to back companies in their home state and create jobs. SNAK is based in Chicago, so having Illinois as an LP benefits both parties. SNAK gets stable, patient capital with long time horizons. Illinois gets exposure to a fund that will build high-growth companies in the state. That alignment of incentives is worth more than just capital—it's worth attention and network.

Executives from Favor Delivery and Retail Me Not investing directly is perhaps the smartest part of the LP base. These are people who've built marketplaces, who understand unit economics, who've dealt with supply-side issues, and who've scaled operations. Their capital comes with embedded knowledge. When SNAK portfolio companies hit challenges, those LPs aren't just passive investors. They're potential advisors and strategic partners.

Construction dominates with a $1.3 trillion market size, highlighting significant potential for vertical marketplaces. Estimated data.

Why Chicago? The Geographic Play

SNAK is based in Chicago, not San Francisco or New York. This would normally be seen as a weakness. The venture capital industry clusters in a few cities for good reason: that's where the talent, the exits, the successful exits, and the LP relationships concentrate. But SNAK is reframing geography as an advantage, not a weakness.

Nagar articulates this clearly: "We're finding these overlooked founders in places where maybe other funds aren't looking. People perceive that as a disadvantage; we view it as an advantage. We can get to everybody very fast."

There's actual logic here. Some of the best founders in vertical marketplaces aren't in Silicon Valley. They're in places like Columbus (equipment rental founders), Pittsburgh (manufacturing founders), Houston (energy sector founders), or Atlanta (logistics founders). These founders understand their industries deeply because they grew up in them or worked in them. They're not Bay Area transplants trying to apply consumer app playbooks to B2B verticals.

Being based in Chicago also gives SNAK a different network. The Midwest has a deep bench of operations-focused entrepreneurs and executives. There's less of the hype-driven culture that permeates Silicon Valley. There's more focus on unit economics, profitability, and actual business fundamentals.

The speed argument also makes sense. If you're in Chicago and you get a deal flow from all over the country, you need to be efficient. You can't spend three weeks in San Francisco meeting teams. You have to evaluate quickly, decide quickly, and move quickly. That speed can actually be an advantage when recruiting founders—they're getting clarity on whether you're serious about backing them rather than being strung along in endless coffee meetings.

This geographic arbitrage has been attempted before, but most funds that tried it failed because they couldn't attract A-tier talent to non-coastal cities. SNAK's advantage is that they're not trying to attract top VC talent to Chicago. They're trying to find overlooked founders outside tech hubs and back them with capital and operational support. That's a fundamentally different thesis.

The Venture Landscape in 2025-2026: Why This Fund Matters Now

To understand why SNAK's fund is significant, you need to understand what happened to venture capital in 2024–2025. The peak of the AI hype cycle created a valuation explosion. Every fund suddenly needed AI exposure. Every founder suddenly needed "AI-powered" in their pitch deck. Capital flowed into generative AI companies, AI infrastructure, and AI applications with almost zero price sensitivity.

But the market corrected. Some AI companies were overvalued. The infrastructure advantage nobody talked about was that building AI applications is absurdly expensive. Training costs money. Inference costs money. Fine-tuning costs money. The unit economics weren't always there. And more fundamentally, most AI applications were solutions looking for problems, not the other way around.

Parallel to the AI hype, the consumer marketplace category faced headwinds. Uber, Door Dash, Lyft—the companies that defined marketplace success—all went through extended periods where growth slowed and profitability became harder to achieve. The gig economy faced regulatory scrutiny. Labor costs rose. The narrative shifted from "move fast and break things" to "show us the unit economics."

Into this environment, SNAK's thesis is a breath of fresh air. It's not chasing the hottest category. It's not pretending that any problem can be solved with more compute. It's targeting mature, well-understood problems in industries with clear economics, large addressable markets, and structural tailwinds toward digitalization.

The broader VC market has also shifted toward larger, more established funds that can make bigger bets at later stages. The middle has been squeezed. First-time fund managers, in particular, have struggled to raise unless they have exceptional pedigree. SNAK's advantage is that Nagar and Koopersmith do have exceptional pedigree—they're not first-time investors pretending to have experience. They have decades of relevant operating and investment experience.

The other trend that benefits SNAK is the professionalization of verticalized venture. A decade ago, the idea of a fund that focused exclusively on B2B marketplaces might have seemed too narrow. Today, specialized thesis-driven funds are becoming the norm. LPs appreciate clarity of thesis. They appreciate deep expertise in a specific category. They appreciate founders who share the LP's focus. SNAK benefits from this trend toward specialization.

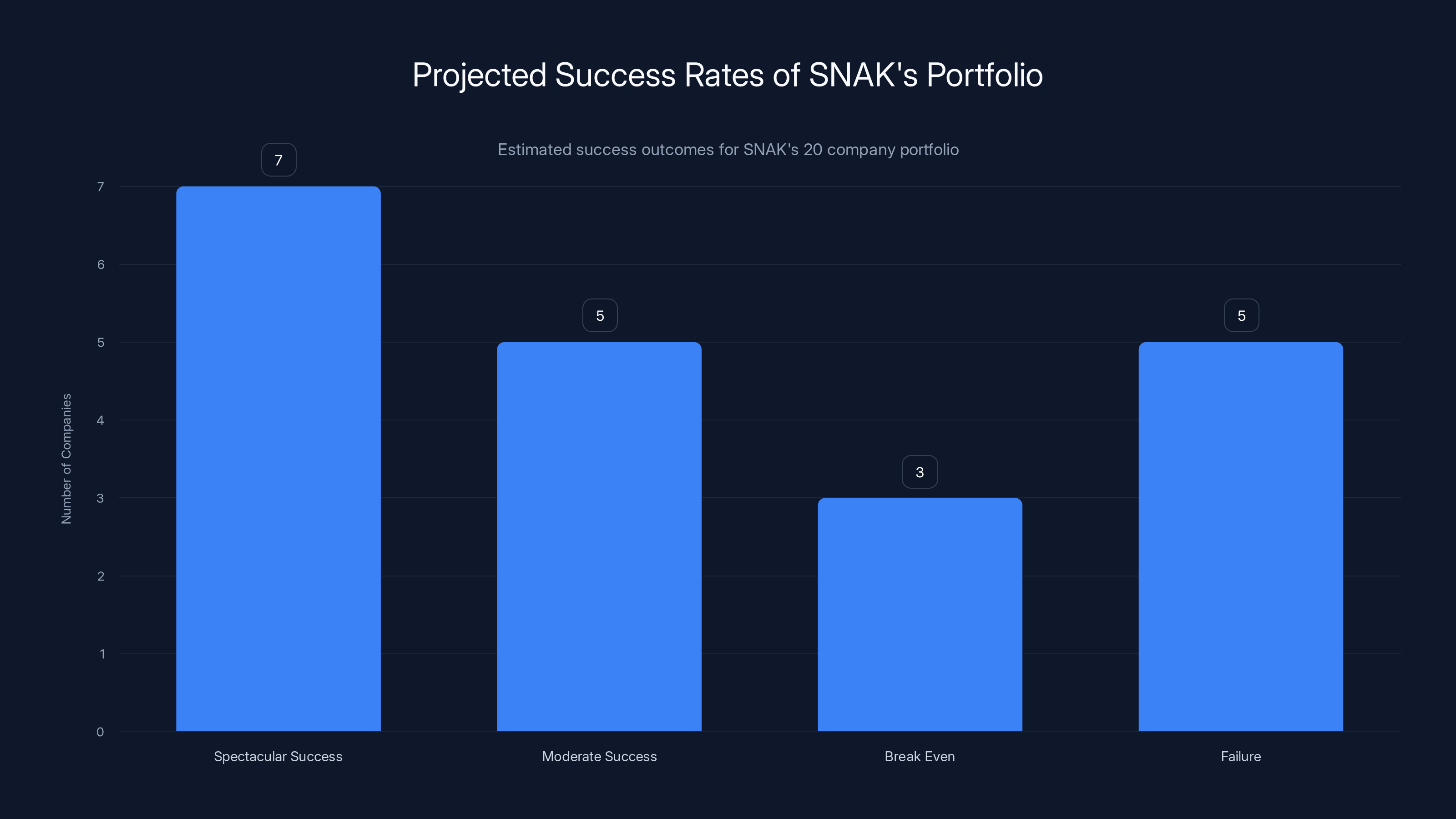

Estimated data shows SNAK anticipates 7 companies to succeed spectacularly, 5 to have moderate success, 3 to break even, and 5 to fail. This strategy aims for a balanced portfolio with high potential returns.

Deployment Strategy: 2M Checks Into 20 Companies

SNAK's check size and investment count signal specific strategic choices. Writing

The check size is deliberately in the seed range. Most seed rounds in 2025 are

This positioning is smart for several reasons. First, it means SNAK isn't competing with growth-stage funds for companies that are already working. Second, it means the valuation math is more favorable—they can own meaningful equity percentages at these valuations. Third, it means they're identifying winners early, which compounds returns. A company that raises a

The number 20 is also intentional. It's not 50 (which would be too much for a $50M fund to support meaningfully). It's not 5 (which would be too concentrated). 20 allows for portfolio diversification while maintaining depth. If 7–8 of the 20 companies succeed spectacularly, the fund returns multiples. If only 1–2 succeed, the fund barely breaks even. This is typical venture math, but SNAK's thesis is that vertical marketplaces have higher success rates than typical startups because the markets are well-defined, the problems are structural, and the founders have deep domain expertise.

The 3–4 year deployment timeline also matters. It means SNAK is thoughtfully deploying capital rather than rushing to put it to work. They can afford to be selective. If a founder comes in with a mediocre thesis, SNAK can pass. They're not desperate to deploy because they have a clear timeline. This selectivity is valuable—it attracts better founders and increases the probability that capital is deployed into high-conviction bets.

The Marketplace Category: Why Vertical Beats Horizontal

Nagar makes a compelling observation when discussing historical marketplace winners: "If you look at the biggest venture wins over the last decade, those are five of the top 10 outcomes in venture." She's referring to Uber, Airbnb, Instacart, Door Dash, and Lyft. All are marketplaces. All raised billions. All achieved massive valuations.

But here's the nuance that SNAK's thesis hinges on: Most of those companies are actually horizontal marketplaces that became vertical winners. Uber started as peer-to-peer ride-sharing (horizontal—anyone can drive, anyone can ride) but became the dominant way people book transportation. Airbnb started as home-sharing (horizontal) but became the dominant platform for short-term lodging. Instacart started as grocery delivery (horizontal—could theoretically deliver from any store) but became the essential platform for grocery convenience.

They won by being horizontal (low barriers to getting both supply and demand) but concentrated in a specific vertical (transportation, lodging, groceries). They went deep and won.

SNAK is betting on a different pattern: vertical marketplaces that become category standards. Instead of starting horizontal and narrowing, they're starting vertical and expanding. Big Rentals isn't trying to be a marketplace for everything. It's trying to be the marketplace for equipment rental. Repackify isn't trying to be a marketplace for everything. It's trying to be the marketplace for packaging logistics.

There's an advantage to this approach. In a vertical marketplace, you understand the buyer, the seller, the transaction, and the economics at a level that's hard to match from a horizontal position. You know what questions a contractor asks when renting equipment. You know what vendors care about. You know the seasonal patterns, the regulatory requirements, the financing mechanics. Horizontal players are always learning the vertical. Vertical players are learning the software.

This creates defensibility. Once a vertical marketplace reaches scale in its vertical, it's hard to displace. The switching costs are high. The data advantage is significant. The network effects work in your favor.

SNAK's thesis is that there are perhaps 100–200 verticals globally that are large enough to support billion-dollar marketplace companies but have fragmented suppliers, low digital penetration, and structural efficiency problems. They're betting that they can find and fund 20 founders who are going after 20 of these verticals.

The chart highlights the perceived difficulty of various challenges faced by B2B marketplaces, with 'Incumbent Resistance' rated as the most difficult. Estimated data.

Fintech Infrastructure as a Tailwind

One factor that's crucial to SNAK's thesis but doesn't get mentioned explicitly is the evolution of fintech infrastructure. Building a marketplace in 2026 is dramatically easier than it was in 2015, largely because payment processing, identity verification, and compliance infrastructure has been productized and modularized.

In the early days of Uber and Airbnb, those companies had to build their own payment systems, fraud detection, identity verification, and financial rails. It was expensive and complex. Today, all of that is available as APIs. Stripe handles payment processing. Plaid handles identity and banking integration. Vanta handles compliance. Twilio handles communications. Clerk handles authentication.

For a vertical marketplace like Big Rentals, the practical implication is huge. They don't need to spend 6 months building payment infrastructure. They can use Stripe. They don't need to build their own KYC system. They can use Plaid. They can focus on the actual marketplace logic—matching, pricing, logistics—rather than financial infrastructure.

This is a genuine tailwind that didn't exist 10 years ago. It means that early-stage marketplace companies can achieve product-market fit faster. It means they need less capital to get to Series A. It means more founders can pursue marketplace ideas because the technical bar is lower.

SNAK's thesis implicitly benefits from this trend. They're investing in a world where fintech is a commodity. The founders they back can focus on vertical domain expertise rather than financial engineering. That's a massive advantage.

The Challenge: Why B2B Marketplaces Are Harder Than They Seem

But here's the brutal honesty: B2B vertical marketplaces are harder than they sound. The reason Uber and Airbnb succeeded where thousands of other marketplaces failed isn't just that they were smart. It's that they had exceptional founders, exceptional product taste, and exceptional luck in timing.

Vertical marketplaces have specific challenges that SNAK founders will face:

The Cold Start Problem: B2B marketplaces require both supply and demand. But neither side has incentive to join until the other side is there. If Big Rentals launches in Portland with no contractors, vendors won't join. If it launches with no vendors, contractors won't join. SNAK portfolio companies will need to be creative about solving this chicken-and-egg problem.

Incumbent Resistance: Unlike consumer marketplaces, which often face no organized resistance from incumbents (there's no Taxi Operator's Association that can easily regulate Uber... well, until later), B2B marketplaces face entrenched competitors who have customer relationships, pricing power, and regulatory influence. A vendor in the equipment rental space might actively discourage customers from using Big Rentals because it threatens their margin structure.

Low Margins, High Volume Requirement: B2B transactions often have thin margins. A 2–3% take rate on equipment rental transactions means you need to process tens of millions of dollars in annual transaction volume to be profitable. That requires scale. It requires network effects. It requires time.

Trust and Vetting: In B2B, trust is currency. A contractor rents a drill from an unknown vendor through Big Rentals and it breaks? They're not going to blame Big Rentals—they're going to blame the vendor, and potentially Big Rentals for allowing the vendor on the platform. Vetting supply-side quality is crucial but expensive.

Customization Fatigue: B2B transactions are often customized. Every contractor's needs are slightly different. Every vendor has different terms. A marketplace that's too rigid fails to serve actual customer needs. A marketplace that's too flexible becomes bespoke software consulting, which doesn't scale.

SNAK's founders need to navigate all of these challenges. And Nagar and Koopersmith need to help them navigate it. That's not simple. But that's also why the returns are potentially so large. If a marketplace can overcome these challenges and achieve scale, it's defensible and valuable.

The Comparison: SNAK vs. Traditional Consumer VC

SNAK's strategy is pointedly different from traditional Silicon Valley VC funds. Traditional funds cast wide nets across many categories—AI, consumer apps, fintech, biotech, etc. They back founders they believe are smart, regardless of industry expertise. They believe that good process, good networks, and good growth frameworks apply across categories.

SNAK is the opposite. They have narrow category focus. They back founders who have deep industry expertise. They believe that understanding the specific vertical is more important than general startup playbooks.

This difference compounds over time. SNAK's portfolio companies will benefit from the fact that the fund managers have deep expertise in vertical marketplaces. When Big Rentals hits a challenge with vendor acquisition, they can get help from Koopersmith and the LP base who've dealt with vendor acquisition in other B2B marketplaces. When Repackify struggles with logistics optimization, they can tap into the network of supply chain experts.

Traditional funds can't do this as effectively. If a generalist fund backs 15 different companies in 15 different verticals, they can't have deep expertise in all of them. So they rely on the founders to figure it out, which is fine, but it's less valuable than having a fund manager who can say "here's exactly how we solved this problem in another portfolio company."

Over a 10-year period, this difference—having fund managers with deep vertical expertise—could easily add 0.5-1.0x to returns across the portfolio. And that's a massive edge.

The Bigger Trend: The Unbundling of Venture Capital

SNAK's fund is part of a larger trend in venture capital: the unbundling of fund models. For decades, venture capital was bundled. One firm would try to be good at early-stage and growth-stage. They'd try to cover many categories. They'd try to be in many geographies.

But the best venture returns have increasingly come from specialized funds. Benchmark made its returns from internet infrastructure companies. Founders Fund made returns from frontier technology. Greylock made returns from software. These weren't generalists—they were specialists who went deep.

In the 2020s, we're seeing this specialization accelerate. There are now funds focused specifically on Indian SaaS, climate tech, biotech, AI infrastructure, women founders, Latino founders, and on and on. The thesis is that specialization allows for better pattern matching, better networks, and better support.

SNAK fits perfectly into this trend. They're saying: "We're going to specialize in B2B vertical marketplaces. We're not trying to be generalists. We're going to go deeper than anyone else in this category."

If SNAK succeeds, it won't be because they're smarter than Sequoia or Benchmark. It'll be because they have more specialized knowledge about what makes vertical marketplaces succeed. And that specialization will compound over time as they back more winners and learn what works.

This also has implications for the LP side. LPs are increasingly comfortable backing specialized funds because they can hold them accountable on their thesis. If a specialized fund says "we're backing B2B vertical marketplaces," and then backs three SaaS companies and two consumer apps, LPs will push back. Specialization creates accountability.

What SNAK's Success Would Look Like

How do you measure whether SNAK's $50M fund was successful? The simple answer is: by the returns. But it takes time. Most of their companies won't exit for 5–10 years. Some might never exit. Some might fail. But here are some markers of success to watch for:

Portfolio Company Raises: Did SNAK's companies raise Series A funding at higher valuations than typical? If Big Rentals raises a

Cross-Portfolio Pattern: Are multiple SNAK portfolio companies following similar playbooks that suggest Nagar and Koopersmith's thesis is correct? If they have 5 portfolio companies all achieving certain metrics (e.g., $1M ARR) faster than non-SNAK cohorts, that validates the thesis.

Follow-on Fund: This is the ultimate signal. Can SNAK raise a second fund larger than the first one? If they can, it means LPs are convinced by the returns from the first fund. Raising a second fund at higher capital and higher terms would signal that SNAK's thesis actually works.

Exits: The obvious marker. Did any of SNAK's companies get acquired for meaningful amounts? Did any IPO? Did they return multiples on the fund?

Founder Network: Is SNAK attracting increasingly better founders to their thesis? If year one they back decent founders, but by year three they're backing founders who previously worked at Uber or spent 15 years in construction, the fund is succeeding at its positioning.

It'll take years to see these metrics. But they're worth tracking.

The Broader Implications: What SNAK Signals About Venture in 2026

Beyond SNAK itself, this fund says something interesting about venture capital's trajectory. For the past 3–4 years, venture has been obsessed with AI. Before that, it was obsessed with consumer apps. Before that, fintech. Each wave creates enormous valuations for the winners, then leaves a graveyard of companies that were trying to fit their idea into the category du jour.

SNAK's thesis is that the smartest capital isn't chasing the hottest category. It's identifying structural inefficiencies in large markets and backing founders who can fix them. Equipment rental is boring. Packaging logistics is boring. Supply chain optimization is boring. But these markets are massive, the problems are real, and the solutions can return billions.

That's a more mature way of thinking about venture. It's less about betting on technological revolutions and more about betting on market timing and founder quality. It's less about the next Uber and more about the next boring-but-profitable vertical marketplace that scales to a $1-5B exit.

If SNAK succeeds, we'll see more funds adopt similar theses. We might see specialized funds focused on healthcare supply chain marketplaces, industrial equipment marketplaces, agricultural supply chain marketplaces, and on and on. The category wouldn't be "marketplaces"—it would be "vertical marketplaces in unsexy industries."

That would represent a shift in venture capital from chasing hype to hunting for structural opportunities. And for entrepreneurs who understand their industries deeply, it would create significantly more funding opportunities.

FAQ

What exactly is SNAK Venture Partners?

SNAK Venture Partners is a newly launched venture capital fund focused specifically on backing B2B vertical marketplaces—digital platforms that solve supply and demand problems in specific industries like construction, equipment rental, and logistics. The fund was founded by Sonia Nagar and Adam Koopersmith, both with extensive experience at Pritzker Group, and raised $50 million in its debut round backed primarily by Pritzker Group itself.

Why did Sonia Nagar and Adam Koopersmith start SNAK?

Nagar and Koopersmith spotted a pattern from their work at Pritzker Group: the biggest venture exits of the past decade (Uber, Airbnb, Instacart) were all marketplaces that digitized previously analog industries. They recognized there were hundreds of similar industries still waiting to be digitized, and they wanted to focus exclusively on this category rather than continue at a generalist firm.

What is a vertical marketplace, and how is it different from a horizontal marketplace?

A vertical marketplace focuses on a specific industry or category (e.g., equipment rental, packaging logistics) while a horizontal marketplace serves many different categories (like Amazon or eBay). Vertical marketplaces are narrower but often more defensible because they develop deep expertise in a specific vertical's economics, workflows, and challenges.

How much capital does SNAK plan to deploy, and to how many companies?

SNAK plans to write

Why is SNAK based in Chicago rather than Silicon Valley?

Founders Nagar and Koopersmith view Chicago's location as an advantage rather than a disadvantage. They can identify overlooked founders in underserved geographies who have deep industry expertise but might not otherwise attract capital from coastal VC firms. This geographic approach also allows SNAK to move quickly and efficiently across all regions without traditional Silicon Valley overhead.

Who are SNAK's investors (LPs)?

The fund is anchored by Pritzker Group, and also counts the State of Illinois Growth and Innovation Fund as an LP. Additionally, executives from successful marketplace companies like Favor Delivery and Retail Me Not have invested directly, bringing operational expertise and networks to support portfolio companies.

What industries is SNAK targeting for investments?

SNAK is looking for industries with high transaction volume, fragmented suppliers, significant operational friction, and low digital penetration. Explicitly mentioned examples include construction supply chains, equipment rental, packaging logistics, and other "unsexy" B2B verticals that haven't been substantially digitized yet.

How is SNAK's thesis different from traditional venture capital funds?

Unlike generalist funds that back companies across many categories, SNAK specializes exclusively in B2B vertical marketplaces. This allows Nagar and Koopersmith to provide deep expertise, relevant networks, and specific operational guidance based on their years of experience in this specific category. The fund managers aren't learning the vertical—they already deeply understand it.

What is the success rate or expected return profile for SNAK?

SNAK hasn't disclosed specific return targets, but the fund is betting that vertical marketplaces in unsexy industries have higher success rates than typical startups because the problems are well-defined, the markets are massive, and founders often have deep domain expertise. Time will tell whether these bets pay off through future Series A rounds, profitable exits, and acquisitions.

How does fintech infrastructure help SNAK portfolio companies?

Building a marketplace in 2026 is far easier than in 2015 because payment processing (Stripe), identity verification (Plaid), compliance (Vanta), and communications (Twilio) are now available as modular APIs. This allows SNAK portfolio companies to focus on the actual marketplace logic and vertical domain expertise rather than building financial infrastructure from scratch.

Conclusion: The Next Decade of Vertical Marketplaces

SNAK Venture Partners' $50 million fund is more than just another venture vehicle. It's a signal that venture capital is maturing. The days of chasing every AI hype cycle or trying to be the next Uber in a trendy consumer category are fading. The smarter capital is hunting for structural opportunities in massive markets that have yet to be digitalized.

Nagar and Koopersmith have positioned themselves perfectly to capitalize on this shift. They have the experience, the networks, the capital, and the thesis. More importantly, they have the discipline. They're not trying to be everything to everyone. They're trying to be the best at one specific thing: backing founders who are building the next generation of B2B vertical marketplaces.

For entrepreneurs in construction, manufacturing, supply chain, equipment rental, or dozens of other unsexy but massive industries, SNAK's fund signals opportunity. There's now institutional capital specifically looking for founders like you—people with deep industry expertise who want to apply modern software to structural problems.

For venture capital as a whole, SNAK signals a return to fundamentals. Specialization is rewarded. Deep expertise is valued. Boring business models that actually work are celebrated. That's a healthier venture ecosystem than one obsessed with the next category du jour.

The fund's success won't be determined for years. Series A rounds will need to close at higher valuations. Companies will need to hit growth metrics. Eventually, exits will need to happen. But the thesis is sound. The timing is right. The founders are experienced. And the market opportunity is massive.

If even a few of SNAK's 20 portfolio companies become billion-dollar exits, it'll prove that there's enormous value still waiting to be captured in the industries nobody's talking about. And that might be the most important lesson venture capital learns in the next decade: sometimes the biggest opportunities aren't in the spotlight. Sometimes they're hiding in plain sight in the industries that still operate like it's 1995.

That's where SNAK is looking. And that's why this $50 million fund matters.

Key Takeaways

- SNAK Venture Partners raised a $50M oversubscribed debut fund anchored by Pritzker Group, backed by experienced operators Sonia Nagar and Adam Koopersmith

- The fund focuses exclusively on B2B vertical marketplaces in unsexy but massive industries like construction, equipment rental, and supply chain logistics

- SNAK is writing 2M seed checks into approximately 20 companies over 3–4 years, with BigRentals and Repackify as early examples

- Vertical marketplaces have higher success potential than typical startups because problems are structural, markets are well-defined, and founders often have deep domain expertise

- The trend toward specialized venture funds with deep vertical expertise signals a maturation of venture capital away from hype-driven categories

Related Articles

- Once Upon a Farm IPO 2025: What Investors Need to Know [2025]

- Peter Attia Leaves David Protein: Longevity Startup Drama Explained [2025]

- Nvidia's $100B OpenAI Gamble: What's Really Happening Behind Closed Doors [2025]

- Startup Battlefield 200 2026: Complete Guide to Apply & Win [2025]

- Skyryse's $300M Series C: Aviation's Autonomous Future [2025]

- Epstein Files Expose Peter Thiel's Silicon Valley Ties and Extreme Diet [2025]

![SNAK Venture Partners $50M Fund: Digitalizing Vertical Marketplaces [2025]](https://tryrunable.com/blog/snak-venture-partners-50m-fund-digitalizing-vertical-marketp/image-1-1770214077253.jpg)