India's Sarvam Launches Indus AI Chat App: What It Means for AI Competition [2025]

Introduction: India's AI Moment Has Arrived

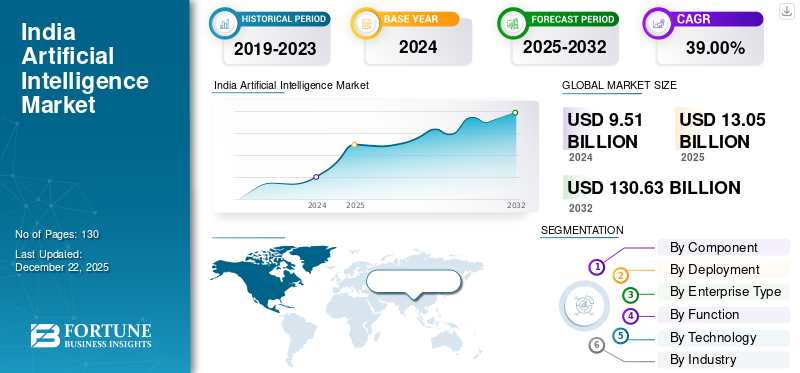

India just became impossible to ignore in the global AI race. While most people think of AI adoption as a Silicon Valley story, the reality is that India has quietly become one of the world's largest markets for artificial intelligence. When OpenAI CEO Sam Altman announced that Chat GPT has surpassed 100 million weekly active users in India alone, it wasn't just a number. It was a signal that the world's most populous country has become ground zero for AI competition.

Into this heated landscape stepped Sarvam with something that matters more than you might think at first glance: Indus, a homegrown chat application built on an Indian AI model. This isn't just another Chat GPT competitor. It's a statement about sovereignty, infrastructure control, and the emerging multi-polar world of artificial intelligence.

Here's what makes this moment critical. For the first time, a serious Indian AI company has launched a consumer-facing product that can compete directly with Chat GPT, Claude, and Google Gemini. Indus isn't just available in India's primary languages. It's built specifically for Indian users, Indian contexts, and Indian use cases. That's different.

The timing matters too. As governments worldwide grapple with AI regulation and data sovereignty concerns, a working alternative to American and European AI platforms becomes strategically valuable. India's government has been pushing for domestic AI capabilities. Companies are starting to ask whether relying entirely on foreign AI infrastructure makes sense. Sarvam's Indus answers that question with a working product.

But here's the tension. Indus launches with real limitations. You can't delete chat history without nuking your entire account. The reasoning feature can't be disabled. Compute capacity is constrained. It's still in beta, which means the experience is unpolished. This is what happens when an ambitious startup launches before perfecting everything. But momentum beats perfection when you're building a movement.

We'll walk through what Indus actually is, why Sarvam built it, what it means for India's AI ecosystem, and whether this startup can sustain momentum against the world's richest tech companies. By the end, you'll understand why this app matters far beyond India's borders.

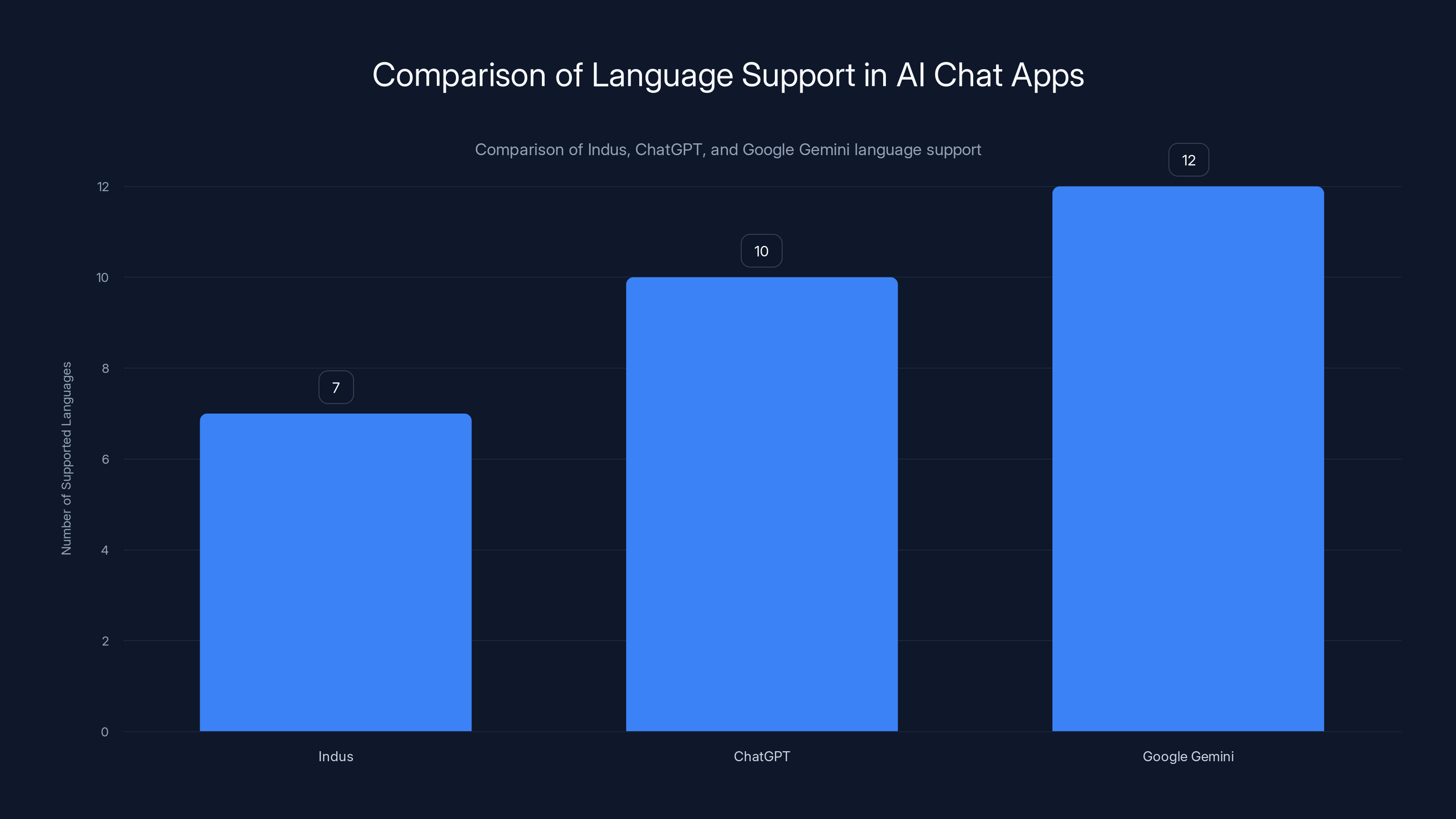

Indus supports 7 languages, focusing on Indian languages, compared to ChatGPT's 10 and Google Gemini's 12, which are more globally oriented. Estimated data.

TL; DR

- Sarvam launches Indus: A new chat app powered by the company's 105-billion-parameter Sarvam 105B model, available on web and mobile

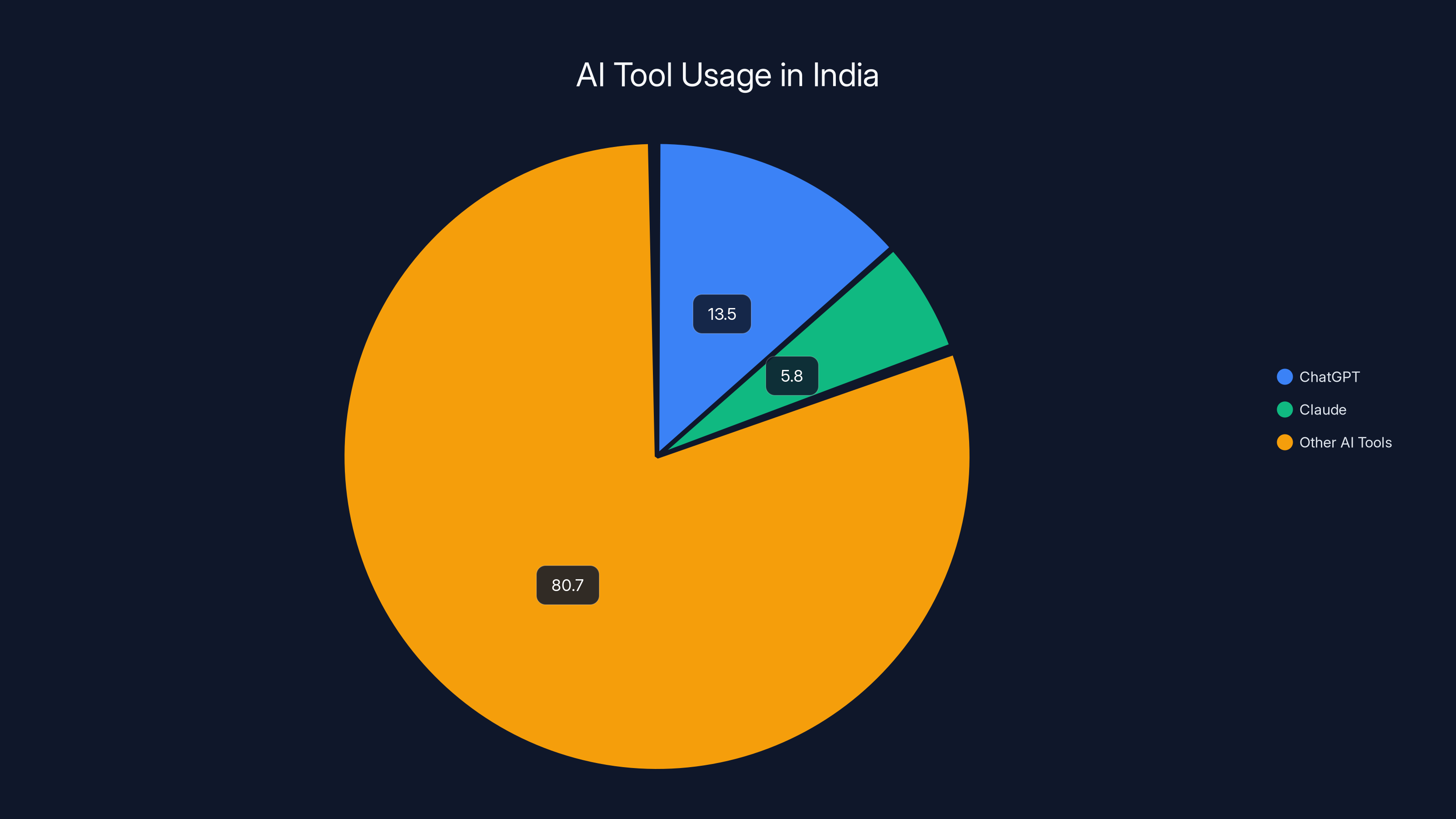

- India's AI boom: Chat GPT has 100+ million weekly active users in India; Claude accounts for 5.8% of global usage (second only to the U. S.)

- Current limitations: No chat history deletion without account deletion, mandatory reasoning feature, limited compute capacity

- Strategic partnerships: Already collaborating with HMD (Nokia feature phones), Bosch (automotive AI), signaling broader ambitions beyond chat

- Funding firepower: Sarvam has raised $41 million from Lightspeed Venture Partners, Peak XV Partners, and Khosla Ventures

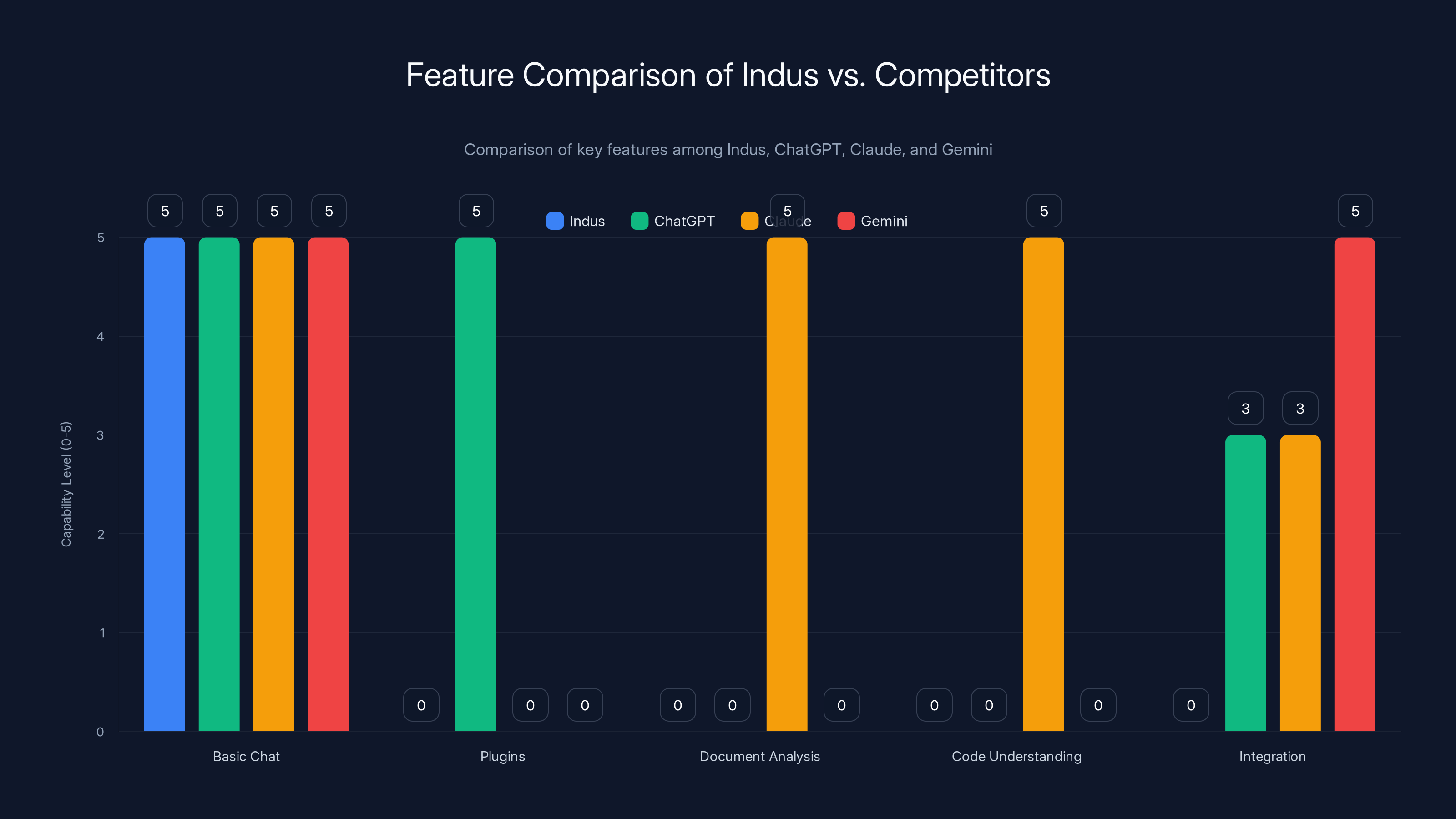

Indus matches competitors in basic chat capabilities but lacks in specialized features like plugins and integrations. Estimated data based on feature descriptions.

Who Is Sarvam and Why Does It Matter?

The Founding Vision

Sarvam was founded in 2023 with a singular obsession: building AI models that actually work for India. This sounds obvious until you realize that most large language models are trained primarily on English text and optimized for English-speaking audiences. When these models encounter Indian languages, regional contexts, or local use cases, their performance degrades noticeably. An Indian user asking a question in Tamil, Telugu, or Hindi gets worse results than an English speaker asking the same question.

The founders saw this gap and decided to fill it. Sarvam means "complete" in Sanskrit, and the name signals the company's ambition. They're not trying to clone Chat GPT for the Indian market. They're building AI infrastructure that treats India as a first-class user, not an afterthought.

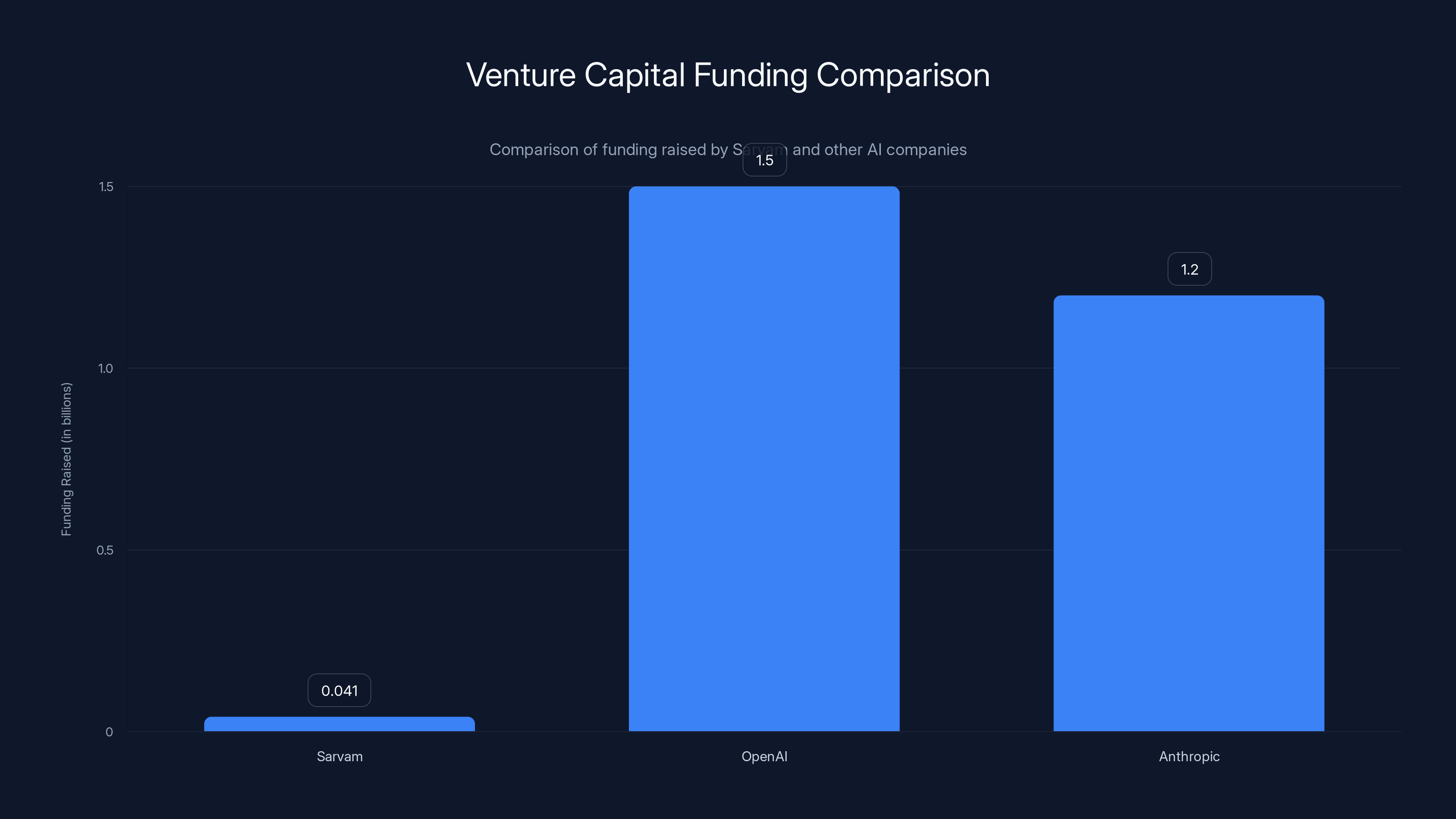

What separates Sarvam from the dozens of other "Indian AI" startups that have launched in the past three years is execution. The company has raised $41 million from serious venture capital firms including Lightspeed Venture Partners, Peak XV Partners, and Khosla Ventures. That kind of funding buys credibility and, more importantly, it buys talent and compute.

Sarvam is founded by people who spent years at organizations like Open AI and major Indian tech companies. They understand both the technical requirements of building competitive models and the specific needs of Indian users. That combination is rare.

The Broader Ecosystem Play

What's interesting about Sarvam is that Indus isn't just a chat app. It's the public face of a much larger infrastructure play. The company is simultaneously building enterprise AI solutions, exploring hardware partnerships (like with HMD for Nokia feature phones), and working on automotive AI with Bosch. The chat app is the consumer-facing wedge into a much deeper strategy.

This matters because it shows Sarvam isn't trying to win by out-marketing Chat GPT. Instead, the company is building multiple layers of the AI stack. A user might first experience Sarvam through the Indus app. But eventually, an enterprise might integrate Sarvam's models into their customer service chatbots. Or a feature phone manufacturer might use Sarvam's models to bring AI to billions of phones in India that have never had access to Chat GPT or Claude.

That's how you build a defensible position against better-funded competitors. You don't compete on funding or brand awareness. You compete by solving specific problems that the incumbent competitors are ignoring.

The Indus Chat App: What It Actually Does

Core Functionality and Interface

Indus works like most modern chat interfaces. You open the app, type a question, and get a response. You can ask follow-up questions, and the model maintains context within your conversation thread. The experience is familiar because every major chat app in 2025 works roughly the same way.

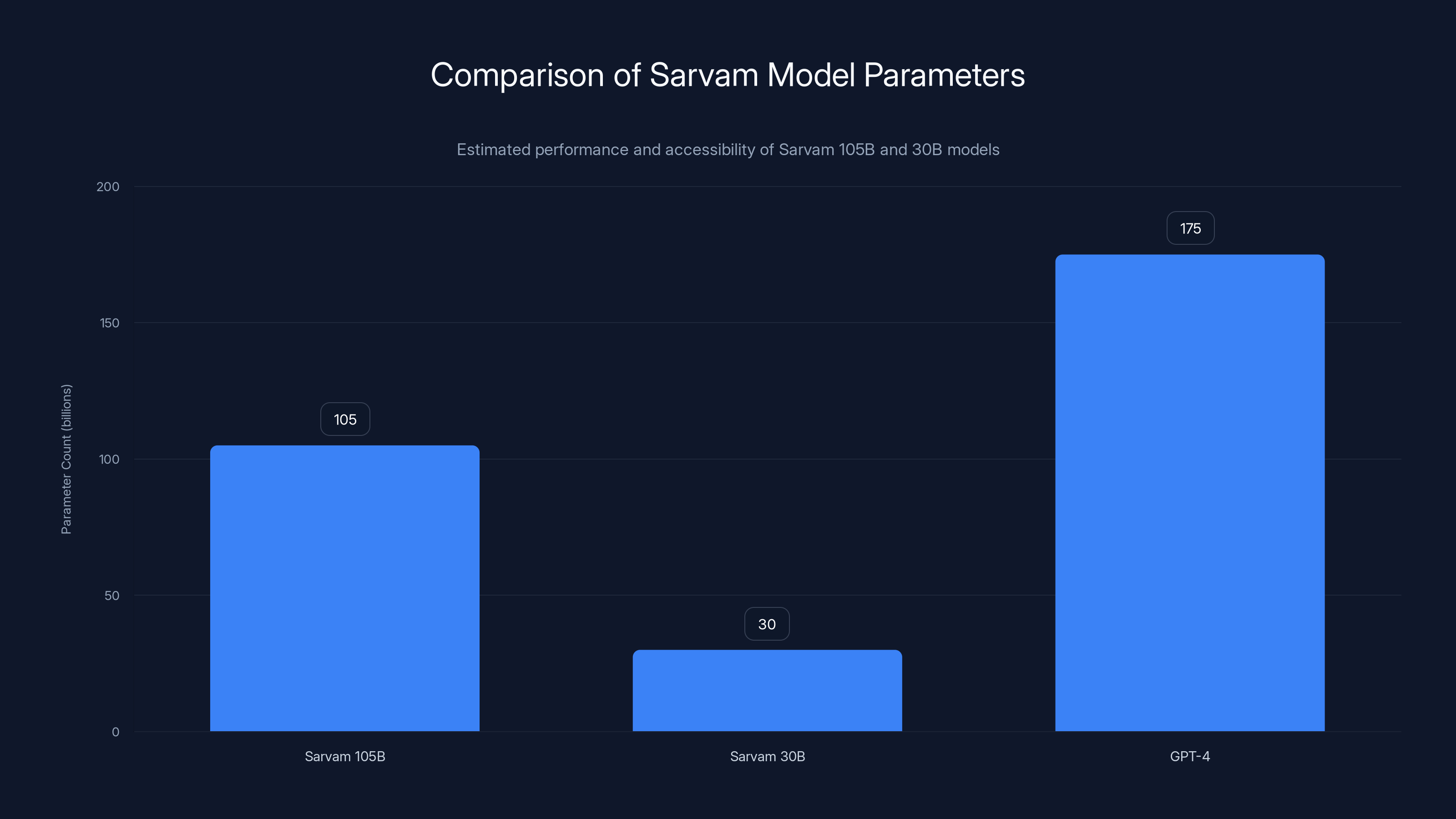

What differentiates Indus isn't the basic interface. It's what happens under the hood. The app is built on Sarvam's 105-billion-parameter model, which the company announced just before launching the chat interface. For context, a 105 billion-parameter model is substantial. Open AI doesn't publicly share the exact size of GPT-4, but estimates suggest it's likely in the trillion-parameter range. So Sarvam's model is smaller in terms of raw parameter count, but parameter count is a blunt instrument for measuring model capability.

What actually matters is whether the model is fine-tuned and trained on data that's relevant to your use case. Sarvam trained its models with a focus on Indian languages, regional contexts, and localized knowledge. A model trained specifically for Tamil language tasks will outperform a massive general-purpose model on Tamil language tasks, even if the general-purpose model has more parameters.

The Indus interface includes a "reasoning" feature that shows users the model's thinking process as it works toward an answer. This is similar to what Open AI offers with o 1 models. Seeing the reasoning process can be helpful for understanding how the model arrived at its conclusion. But here's the problem: users can't turn it off.

Language Support and Regional Focus

This is where Sarvam's focus becomes concrete. Indus supports multiple Indian languages including Hindi, Tamil, Telugu, Kannada, Malayalam, Marathi, and English. The quality of these implementations varies. Support for major languages like Hindi and Tamil is sophisticated. Support for less widely spoken languages is more basic, which is realistic for a startup launch.

Language support matters more than it sounds. A significant portion of India's population, particularly in rural and semi-urban areas, has limited English proficiency. By supporting regional languages, Sarvam opens AI access to demographics that Chat GPT largely ignores. An Indian farmer using Tamil can now get agricultural advice from an AI model that understands Tamil idioms, local crops, and regional climate patterns. That's not a marginal use case.

The training data for these language models also reflects regional knowledge. Sarvam trained its models on Indian news sources, government documents, educational materials, and public data sources. This means the model has better context for questions about Indian governance, Indian current events, Indian education systems, and Indian culture.

Current Limitations and Constraints

Indus launches with several meaningful limitations that deserve honesty. First, users cannot delete individual chats without deleting their entire account. This is a privacy issue. If you have sensitive conversations in Indus and want to clear just those chats, you can't. You have to nuke your entire account and start fresh. Sarvam has flagged this as something they're working on, but at launch, it's a real constraint.

Second, the reasoning feature cannot be disabled. For some use cases, reasoning is helpful. For others, it's just extra latency. Users have no choice. They get reasoning whether they want it or not. This might seem like a minor annoyance, but it reflects a product that hasn't been deeply refined yet.

Third, Sarvam is rolling out Indus on limited compute capacity. The company warned users in early communications that "access may be restricted as it gradually expands its compute capacity." This means if Indus gets more popular than expected, you might hit a waitlist. This is a real concern for a startup competing against companies like Open AI, which has virtually unlimited cloud infrastructure.

Indus aims for 15 million MAU, with a strong DAU of 5 million and a retention rate of 70%. Subscription pricing is estimated between $5-10/month. Estimated data.

India's AI Market: The Battleground Heats Up

Usage Metrics That Reveal the Opportunity

Let's start with the numbers because they're stunning. Chat GPT has 100 million weekly active users in India. For context, India's total internet user base is around 750 million people. That means roughly 13-14% of India's internet population is actively using Chat GPT weekly. That's a higher percentage than the global average.

Claude, made by Anthropic, accounts for 5.8% of global Claude usage, second only to the United States. Given that Claude is newer than Chat GPT, this growth rate in India is remarkable. It suggests that Indian users are actively trying different AI tools and that language and cultural fit actually matter.

These numbers tell a story. India isn't adopting AI as an American afterthought. India is adopting AI as a primary market. This creates space for domestic alternatives because user preferences are still forming. Unlike in the United States, where Chat GPT has become the default, Indian users are still experimenting. Some prefer Claude. Some are curious about other options. Into that space, Sarvam launches Indus.

Government Policy and Strategic Incentives

Indian government policy is pushing aggressively toward domestic AI capabilities. This isn't just about technology. It's about sovereignty. India's tech sector has been built partly on outsourcing and services for Western companies. The country's leadership sees AI as an opportunity to own the entire stack, not just provide labor.

When companies in India build an AI product, they get subtle advantages. Government contracts might prefer Indian AI solutions. Tax incentives exist in certain states for AI research. Universities have increased funding for AI programs. None of this is dramatic, but collectively, it creates tailwinds for Indian AI startups.

Sarvam benefits from these tailwinds. But the company can't rely on protectionism alone. The global AI market is competitive enough that a protected market isn't enough. Indus has to be genuinely good at what it does.

Competitive Landscape and Market Dynamics

Indus isn't the only Indian AI chat app. But it's the first one with serious funding, serious technical talent, and serious technical infrastructure behind it. Other companies have launched chat apps, but they often lack one of these three elements.

The competitive set includes global giants and smaller competitors. Chat GPT dominates overall. Google's Gemini offers tight integration with Google services that many users value. Claude has built a devoted user base around its safety and reasoning capabilities. Microsoft's Copilot leverages the Office ecosystem.

Into this, Sarvam brings focus. Indus doesn't try to be everything to everyone. It tries to be the best chat app for Indian users who want an alternative to Western AI companies. That's a more defensible positioning than "we built a Chat GPT clone."

The Technology Behind Sarvam 105B and 30B Models

Model Architecture and Scale

Sarvam announced two new models alongside Indus: the 105B (105-billion-parameter) model powering Indus, and a 30B (30-billion-parameter) model designed for more resource-constrained applications.

Understanding model size requires context. A 105-billion-parameter model is large enough to handle complex language tasks but small enough to run on consumer GPUs with reasonable optimization. This is intentional. Sarvam is building models that can run in India's current infrastructure, not models that require billion-dollar data centers. A 30B model is even more accessible. It can run on a single powerful workstation.

For enterprises and governments in India that want to run AI models locally without sending data to American servers, these model sizes are practical. The tradeoff is that smaller models have lower capabilities than massive models like GPT-4. But the gap is smaller than you might expect, especially for tasks in Indian languages.

Training Data and Language Capabilities

The quality of a language model depends far more on training data than on parameter count. Sarvam built its models on data that includes Indian languages, regional contexts, and local knowledge. The company partnered with Indian institutions and data sources to gather training materials.

This focus on Indian data has trade-offs. The model will perform better on Indian-specific tasks and worse on tasks dominated by English-language internet culture. Ask Sarvam's model about an obscure American TV show reference, and it might miss context that Chat GPT would catch. Ask it about Indian agriculture, Indian government systems, or Indian business practices, and it will likely outperform.

This is actually ideal for Sarvam's positioning. The company isn't trying to win globally. It's trying to win in India. Focusing training data on India makes the model better for the target market.

Inference Speed and Cost Structure

One advantage of slightly smaller models is inference speed. Smaller models can generate responses faster than larger models because they require less computation. For interactive chat applications, this matters. Users notice latency.

Cost structure is also different. Running a 105B-parameter model costs less than running GPT-4. This allows Sarvam to either offer Indus at a lower price point or accept lower margins while building market share. The company has indicated that Indus will have a freemium model, though pricing details weren't fully disclosed at launch.

Estimated data shows ChatGPT leads with 13.5% of India's internet users, followed by Claude at 5.8%. Other AI tools make up the remaining 80.7%.

Strategic Partnerships: Beyond the Chat App

HMD and Nokia Feature Phones

Sarvam's partnership with HMD to bring AI to Nokia feature phones is a long-term bet on a different vision of AI adoption. Billions of people in India use feature phones, not smartphones. These devices have limited processing power and limited data connectivity. Standard AI models can't run on them.

Sarvam's strategy is different. By building smaller, more efficient models, the company can bring AI capabilities to feature phones through a hybrid approach. The phone doesn't run the entire model locally. Instead, it runs a lightweight interface that sends requests to Sarvam's servers and gets back responses optimized for low-bandwidth connections.

This matters because it opens AI access to demographics that global AI companies are largely ignoring. A farmer in rural India with a feature phone can now access agricultural AI without upgrading to a smartphone. That's a market of hundreds of millions of people.

Bosch and Automotive Applications

The Bosch partnership signals Sarvam's ambitions in enterprise and specialized applications. Automotive companies need AI for multiple use cases: driver safety systems, predictive maintenance, in-vehicle voice assistants, and autonomous driving research.

Sarvam's localized models are valuable for these applications in the Indian market. A voice assistant that understands Hindi and Indian English is more useful in Indian cars than a voice assistant that only understands American English. Predictive maintenance models trained on data from Indian roads and Indian vehicles will outperform global models on Indian-specific use cases.

These partnerships aren't distractions from Indus. They're the seeds of a larger business. Indus gets consumer awareness and directional data about what users need. The enterprise partnerships generate revenue and refine the models based on real-world constraints.

How Indus Compares to Global Competitors

Feature Parity with Chat GPT and Claude

As a basic chat interface, Indus can do what Chat GPT and Claude do. You ask questions. You get answers. You can have multi-turn conversations. The basic experience is competitive.

Where it lags is in specialized capabilities. Chat GPT offers plugins that connect to external services. Claude offers document analysis and code understanding that many developers value. Google's Gemini integrates tightly with Google's ecosystem.

Indus, at launch, is a pure chat application. No plugins, no advanced reasoning modes, no tight integrations. This is typical for a new product. Specialized capabilities come later as the team gets feedback and can justify the engineering effort.

Pricing and Accessibility

Sarvam hasn't finalized pricing for Indus, but early signals suggest the company will use a freemium model. The free tier will have limitations (probably response limits or feature restrictions), and a paid tier will offer higher limits and advanced features.

This is the standard playbook in AI chat. Chat GPT is free with limitations, or $20/month for unlimited access. Claude offers a similar structure. By matching this pricing model, Sarvam makes Indus immediately familiar to Indian users who have already tried competitors.

One advantage Sarvam might have is lower operational costs. Running a 105B model costs less than running GPT-4. If Sarvam's infrastructure is efficient, the company could potentially offer the paid tier at a lower price point than Chat GPT Plus. But this depends on how much Sarvam wants to prioritize profitability versus market share.

Language and Regional Advantages

This is where Indus has a clear advantage. Chat GPT supports multiple languages, but it was built for English-first users. Gemini is more multilingual by design, but even Google's models are primarily trained on English data.

Indus was built with regional Indian languages as a first-class concern from day one. This isn't a feature added later. It's foundational. A Tamil speaker using Indus will get better results than using Chat GPT because the model was trained with Tamil in mind.

The magnitude of this advantage is real but not unlimited. Open AI can improve Chat GPT's performance on Indian languages quickly if the company prioritizes it. Advantage usually goes to whoever has the most data and the most computing power. But right now, in 2025, Indus has a window of superiority for Indian language tasks.

The Sarvam 105B model is designed for complex tasks with a parameter count of 105 billion, while the 30B model is more accessible for resource-constrained applications. Both models are tailored for Indian infrastructure and tasks. Estimated data.

The Funding Story: Why Venture Capital Is Betting on Sarvam

Capital Raised and Investor Confidence

Sarvam has raised $41 million to date. For context, that's meaningful funding, but it's dwarfed by what companies like Open AI have raised (billions) or what Anthropic has raised (billions). So why did major venture capital firms like Lightspeed Venture Partners, Peak XV Partners, and Khosla Ventures back Sarvam?

The first reason is market size. India's AI market is huge and still underpenetrated. Chat GPT has 100 million weekly active users in a country of 1.4 billion people. That's already impressive, but there's room for growth. If Sarvam can capture even a fraction of the growing Indian AI market, the return on a $41 million investment could be substantial.

The second reason is technical credibility. Sarvam's founders have track records in AI development. The company has shipped working models and demonstrated the ability to train and optimize AI systems for specific use cases. That's rarer than it sounds in the startup world.

The third reason is strategic positioning. As governments worldwide become concerned about AI sovereignty, funding a domestic AI company becomes politically popular. Indian venture capital firms especially are aware that supporting Indian AI companies has cultural and political support. This isn't cynical. It's just how incentives work.

Runway and Burn Rate Implications

With

But this calculation assumes relatively flat burn. As Indus grows and Sarvam needs to scale infrastructure, burn rate will increase. More compute costs money. More employees cost money. Sarvam will likely need follow-up funding within 18-24 months as the company scales.

The question isn't whether Sarvam needs more funding. It's whether the company can prove enough traction to raise that funding at favorable terms. Indus needs to grow its user base, demonstrate engagement, and show that users aren't just trying the app once but coming back.

Building AI Infrastructure for India: Broader Implications

Why Sovereign AI Matters

Sovereign AI sounds like jargon, but it's practically important. When a country relies entirely on foreign AI companies for its AI infrastructure, it accepts several constraints. First, data sovereignty. When you use Chat GPT, your data goes to American servers. This raises concerns about privacy, jurisdiction, and corporate control.

Second, economic value. The profits and intellectual property from AI stay with the company that built it. If India's AI market is entirely served by Open AI, Anthropic, and Google, the economic value of that market accrues to those American companies.

Third, control. If a government wants to regulate AI in ways that are specific to its market, it's easier to regulate a domestic company than to impose constraints on foreign companies.

Sarvam's existence as a significant AI company headquartered in India addresses these concerns. It's not about rejecting global AI. It's about having a choice.

The Multi-Polar AI Future

We're moving toward a future where multiple regions have domestic AI capabilities rather than a world dominated by a handful of American companies. China has its own AI companies. Europe is funding its own AI initiatives. India is doing the same.

This shift is healthy for competition. When users have choices, companies innovate faster. When companies have regional competitors, they're more responsive to local needs. A world with only Open AI is a world with less innovation than a world with Open AI, Sarvam, and a dozen other serious competitors.

Sarvam's success matters not because it's going to replace Chat GPT globally. It matters because it's building a different kind of AI company that serves a different market in a different way.

Sarvam has raised $41 million, significantly less than OpenAI and Anthropic, which have raised billions. Estimated data for OpenAI and Anthropic.

Challenges Sarvam Faces: The Reality Check

Compute and Infrastructure Costs

Building and running large language models is expensive. The most expensive part is compute. Training a 105-billion-parameter model requires significant GPU or TPU resources. Running inference at scale requires constant investment in infrastructure.

Sarvam has $41 million. Open AI has raised billions. This funding disparity matters when it comes to infrastructure. If Indus suddenly becomes massively popular, can Sarvam scale the infrastructure fast enough to serve users? Or will users hit waitlists like they did when Chat GPT launched?

The company seems aware of this constraint. Early communications warned about limited compute capacity. This is honest, but it's also a weakness. Users might switch to Chat GPT if Indus can't serve them when they want to use it.

Talent Retention and Poaching

Servam has hired top talent from Indian tech companies and international AI labs. But the company is competing for talent against Open AI, Anthropic, Google, and Meta.

These large companies can offer salaries, stock options, and resources that a startup can't match. Over time, retaining the best engineers becomes harder. This isn't a crisis yet, but it's a real concern for any AI startup competing against better-funded incumbents.

Market Crowding and Competition

Indus isn't entering an empty market. Chat GPT is already everywhere in India. Google Gemini is integrated into Android phones that billions of Indians use. Claude is available on the web for anyone with an internet connection.

Sarvam needs to convince users to switch or to add Indus as an additional app. The value proposition is real (better for Indian languages and Indian contexts), but it's not immediately obvious to a casual user.

What Success Looks Like for Indus

User Metrics and Engagement Targets

For Indus to be considered successful, certain metrics need to hit certain targets. The most important metrics are monthly active users (MAU), daily active users (DAU), and retention rate.

A realistic first-year target might be 10-20 million MAU in India. That's less than 1% of India's internet-using population, but a good start for a new product. If engagement is strong (high DAU/MAU ratio and low churn), that's a sign the product is sticky.

Retention is often more important than acquisition for startups. It doesn't matter if you get 100 million users if 90% never come back. Sarvam needs to build a product that users want to use repeatedly.

Revenue Model and Path to Profitability

Indus will likely generate revenue through some combination of freemium subscriptions, enterprise licensing, and API access. The freemium model (free tier with limitations, paid tier with unlimited access) is standard in AI chat. Chat GPT Plus is

Enterprise licensing is where the real money is. Businesses want to integrate AI into their applications. Sarvam could license its models to companies that want to avoid using Open AI's APIs for data sovereignty or cost reasons. This market is potentially larger than the consumer market.

Path to profitability depends on achieving sufficient scale. Right now, Sarvam is in investment mode. The company is spending money to build products and user base, not to generate profit. In 2-3 years, profitability becomes important. If Sarvam can't show a path to profitability by then, funding becomes harder.

Market Share Goals and Realism

What percentage of India's AI market can Sarvam realistically capture? That depends on how you define the market. If it's the chat app market, Chat GPT probably has 70-80% share. Sarvam capturing 5-10% would be a success.

If the market includes enterprise AI and licensed models, the pie is bigger and Sarvam's share could be higher. An enterprise that wants sovereign AI infrastructure might choose Sarvam over Open AI even if Open AI's model is technically superior.

Realism requires acknowledging that Sarvam is unlikely to become larger than Open AI. The goal isn't to win globally. The goal is to win in India and in specific use cases where Sarvam has advantages. That's a more achievable target.

The Regulatory Landscape for AI in India

Government Stance and Policy Support

India's government has been supportive of domestic AI development. The country released an AI policy framework emphasizing responsible AI innovation. The government is also investing in AI infrastructure and education.

This creates tailwinds for Sarvam. Government contracts might preference domestic AI solutions. Tax incentives might favor Indian AI companies. But regulatory support is fragile. It can change based on political leadership or based on incidents involving AI safety.

Sarvam needs to stay on the good side of regulation. This means being transparent about how Indus works, respecting user privacy, and building safety measures into the product.

Data Privacy and Localization Requirements

India has been moving toward data localization requirements. The India data protection law, still being finalized, will likely require that certain types of data stay within India. This could be an advantage for Sarvam. By keeping data on Indian servers, Sarvam automatically complies with localization requirements.

This is strategically smart. As regulation tightens around data privacy, companies that are already compliant have an advantage. Foreign companies might need to change their infrastructure. Sarvam built its infrastructure with Indian requirements in mind from the beginning.

How Indus Fits Into Runable's AI Automation Ecosystem

Platforms like Runable are building comprehensive AI automation solutions that developers and teams can use to create presentations, documents, reports, and other content programmatically. While Sarvam's Indus is focused on conversational AI chat for consumers and enterprises, tools like Runable represent the broader evolution of AI-powered productivity.

What's interesting is that these tools serve complementary rather than competing purposes. Indus might help an Indian user get information through a chat interface. But that user might use Runable to automatically generate reports from that information, create presentations for a meeting, or produce marketing documents. The AI ecosystem is becoming modular. Users choose different AI tools for different tasks.

For Indian developers building applications that need AI capabilities, having both local options like Sarvam and global options like Runable provides flexibility. They can use Sarvam for language understanding and local knowledge, and use Runable for document generation and workflow automation.

The Roadmap: What's Next for Sarvam and Indus

Near-Term Priorities (Next 6 Months)

Sarvam needs to fix the product limitations that constrain the current experience. The ability to delete individual chats without deleting the entire account should be a priority. The ability to disable the reasoning feature should follow. These are quality-of-life improvements that make the product more usable.

Scaling compute capacity is another urgent priority. As users join and try Indus, they'll hit the compute limits the company warned about. Managing the waitlist and scaling gradually is better than having angry users trying to use the service and failing. But the company needs to communicate the expansion timeline clearly.

Medium-Term Strategy (6-18 Months)

During this period, Sarvam needs to prove that Indus can grow its user base and achieve meaningful engagement metrics. The company also needs to launch enterprise versions of Indus and API access for developers who want to build on Sarvam's models.

The partnership with HMD to bring AI to feature phones should move into the implementation phase. If that works, it opens a completely different market.

Long-Term Vision (18+ Months)

Sarvam's long-term vision appears to be building a complete AI infrastructure layer for India. Indus is the consumer-facing product. But Sarvam also needs to build the models, the infrastructure, the partnerships, and the ecosystem that make India's tech sector less dependent on foreign AI companies.

This is ambitious. But ambition is necessary when you're competing against much larger companies.

Key Takeaways: What This Launch Means

For Indian Users

Indian users now have a domestic alternative to Chat GPT and Google Gemini. This is meaningful. Indus will likely provide better results for questions in Indian languages and about Indian-specific topics. For many Indian users, this is the first time they have a choice between a global AI company and a local competitor.

For India's Tech Ecosystem

Sarvam's success would be a statement that India can build world-class AI companies. The narrative has been that Indian tech is strong in services and outsourcing, but that AI innovation happens in Silicon Valley and Beijing. Sarvam is challenging that narrative.

For Global AI Competition

Sarvam's launch signals that the global AI market is becoming multi-polar. Different regions are building their own AI companies. This increases competition, which is good for users and for innovation overall. No single company or country will dominate AI indefinitely.

For AI Sovereignty Globally

Sarvam's success proves that it's possible for smaller countries to build competent AI infrastructure rather than relying entirely on American companies. This creates a template for other countries and regions that want more independence in AI development.

FAQ

What is Sarvam's Indus chat app?

Indus is a conversational AI chat application powered by Sarvam's 105-billion-parameter language model. It supports multiple Indian languages including Hindi, Tamil, Telugu, Kannada, Malayalam, and Marathi, in addition to English. The app is available on web and mobile platforms and currently operates in beta with limited compute capacity. Indus includes a reasoning feature that shows users the model's thinking process as it generates responses.

How does Indus differ from Chat GPT and other global AI chat apps?

Indus is specifically built for Indian users and Indian languages. While Chat GPT and Google Gemini support multiple languages, they were designed primarily for English-speaking audiences. Sarvam trained its model with a focus on Indian languages, regional contexts, and local knowledge, making it more accurate for questions about Indian governance, culture, agriculture, and regional topics. The technical architecture is also optimized for India's infrastructure and data sovereignty concerns.

What are the limitations of Indus at launch?

Indus currently has several constraints. Users cannot delete individual chat histories without deleting their entire account. The reasoning feature cannot be disabled, which some users find adds unnecessary latency. Most importantly, Sarvam has limited compute capacity, so users may encounter waitlists as the service scales. The company has indicated it will gradually expand access over time as infrastructure grows.

How is Sarvam funded and how long can it sustain operations?

Sarvam has raised

What is India's market opportunity for AI chat applications?

India represents one of the fastest-growing AI markets globally. Open AI reports that Chat GPT has more than 100 million weekly active users in India, second only to the United States in total usage. Claude reports that India accounts for 5.8% of global usage, the second-largest market after the U. S. This suggests strong demand for AI services and willingness among Indian users to try different platforms, creating space for domestic alternatives.

What does Sarvam's partnership with HMD and Bosch mean for the broader product strategy?

These partnerships indicate that Sarvam's ambition extends far beyond consumer chat applications. By partnering with HMD to bring AI to Nokia feature phones, Sarvam targets the hundreds of millions of feature phone users in India who don't have access to smartphones. The Bosch automotive partnership signals enterprise expansion. These initiatives suggest Sarvam is building a complete AI infrastructure layer for India rather than just a consumer product. Success here would generate revenue while building deeper moats around the company's core AI capabilities.

How does government policy in India support companies like Sarvam?

India's government has been actively supporting domestic AI development through policy frameworks, tax incentives in certain states, increased university funding for AI research, and preference for domestic AI solutions in government contracts. These policies create tailwinds for Indian AI startups and reflect a broader strategic goal of building sovereign AI infrastructure rather than relying entirely on foreign providers. However, this support could shift based on political leadership or AI safety incidents, so maintaining regulatory compliance remains important.

What is the realistic market share Sarvam could capture in India's AI market?

Realistic projections suggest Sarvam could capture 5-10% of India's chat app AI market, which would be a significant achievement given competition from Chat GPT (which likely holds 70-80% share) and Google Gemini. However, the larger opportunity lies in enterprise AI licensing and models. Businesses seeking sovereign AI infrastructure or avoiding foreign platforms could drive substantially higher market share in that segment. Sarvam's success depends on moving beyond consumer chat into these higher-value segments.

How will Indus be priced and monetized?

While Sarvam hasn't finalized pricing details, early indicators suggest a freemium model similar to Chat GPT, where basic access is free with limitations, and a paid tier provides unlimited access. Given Sarvam's lower infrastructure costs (running a 105B model is cheaper than running GPT-4), paid access might be priced lower than Chat GPT Plus's $20/month. Enterprise licensing for businesses that want to integrate Sarvam's models into their applications is expected to be a significant revenue stream. API access for developers may also generate revenue.

What does Indus's launch mean for India's broader AI ecosystem?

Indus demonstrates that India can produce world-class AI companies capable of competing directly with global leaders. This challenges the narrative that AI innovation is primarily a Silicon Valley or Beijing phenomenon. Success here creates a template for other regions and countries to build independent AI capabilities. For India specifically, Indus's success would signal that the country can move beyond being a service and outsourcing hub to building innovative AI-first companies.

Conclusion: India's AI Independence Movement

Sarvam's launch of Indus isn't just a product announcement. It's a statement about India's place in the global AI economy. For years, the AI narrative has been dominated by American companies like Open AI and Anthropic, with China building its own alternatives. India has been largely left out of this conversation, treated as a market to be served rather than a place where innovation happens.

Sarvam is attempting to change that script. The company is building AI infrastructure owned and controlled by Indians, optimized for Indian users, and capable of competing with the world's best. This matters for practical reasons (Indian users get better experiences in Indian languages) and for strategic reasons (India develops technological sovereignty and economic value from its own AI).

The road ahead is challenging. Indus launches with real limitations. Sarvam faces competition from vastly larger and better-funded companies. Scaling compute capacity and retaining talent against richer competitors will be difficult. The market for AI chat is already crowded, and switching costs for users are low.

But here's what's in Sarvam's favor. The founding team has technical credibility. The funding is real. The market opportunity is enormous. User sentiment about creating alternatives to American tech companies is positive in India. And most importantly, Sarvam is solving real problems that global companies are ignoring.

The next 18 months will determine whether Sarvam becomes a significant player in India's AI ecosystem or becomes just another startup with a good idea but insufficient execution. Watch the user growth metrics. Watch whether the company successfully scales compute. Watch whether enterprises start licensing Sarvam's models. These are the signals that will tell you whether India's AI independence movement is real.

For now, Indus represents possibility. It's proof that domestic alternatives to American AI companies are technically feasible. Whether that possibility becomes reality depends entirely on Sarvam's execution. The ambition is clear. The funding is in place. The market is waiting. What happens next is up to Sarvam.

For teams and developers looking to integrate AI into applications, having choices matters. Using Runable for document generation, presentation creation, and workflow automation, combined with Sarvam's Indus for language understanding and conversational capabilities, gives you flexibility to choose the best tool for each use case rather than being locked into a single global provider. This modular approach to AI infrastructure is the future.

India's AI moment is here. Sarvam is making a serious bet that the country is ready for it. Whether that bet pays off will be one of the more interesting stories in tech over the next two years.

Related Articles

- The OpenAI Mafia: 18 Startups Founded by Alumni [2025]

- G42 and Cerebras Deploy 8 Exaflops in India: Sovereign AI's Turning Point [2025]

- Google Gemini 3.1 Pro: AI Reasoning Power Doubles [2025]

- AWS 13-Hour Outage: How AI Tools Can Break Infrastructure [2025]

- Can We Move AI Data Centers to Space? The Physics Says No [2025]

- Gemini 3.1 Pro: Google's Record-Breaking LLM for Complex Work [2025]

![India's Sarvam Launches Indus AI Chat App: What It Means for AI Competition [2025]](https://tryrunable.com/blog/india-s-sarvam-launches-indus-ai-chat-app-what-it-means-for-/image-1-1771637819359.jpg)