Click House Hits $15B Valuation: How an Open-Source Database is Challenging Snowflake and Databricks

There's a quiet revolution happening in the data analytics world, and most people working in enterprise IT haven't noticed it yet. A Russian-born database company spun out from search giant Yandex just five years ago has hit a $15 billion valuation. That's not just impressive—it's a signal that the data infrastructure market is fundamentally shifting.

What's fascinating is that Click House isn't trying to be Snowflake or Databricks. It's not racing to match their feature-by-feature. Instead, it's approaching the problem from a completely different angle. The company built an open-source database that processes massive datasets—exactly what AI agents and modern machine learning pipelines need. Then they monetized it by providing managed cloud services, not licensing fees.

The result? Annual recurring revenue growing more than 250% year-over-year. Customers including Meta, Tesla, Capital One, Lovable, Decagon, and Polymarket have already voted with their wallets. This isn't a trend among startups anymore. Fortune 500 companies are betting their data infrastructure on Click House.

What we're looking at here is a masterclass in how to disrupt an entrenched market. Snowflake and Databricks built their empires on proprietary technology and enterprise sales teams. Click House is doing something different—building something so good that people want to use it, then charging them for the convenience of not running it themselves. That's a fundamentally different business model, and it's working at scale.

Let's unpack what's really happening here, why this matters for the broader data infrastructure space, and what this means for everyone building with databases in 2025.

TL; DR

- Click House raised 15B valuation, a 2.5x increase from May's $6.35B, signaling serious enterprise adoption

- ARR growing 250%+ year-over-year through open-source database plus managed cloud services model, not licensing

- Competing with Snowflake and Databricks by offering superior performance for OLAP workloads and AI agents at lower total cost

- Backed by top-tier investors including Dragoneer, Bessemer Venture Partners, and Khosla Ventures

- Open-source advantage drives adoption, while managed services monetization scales revenue

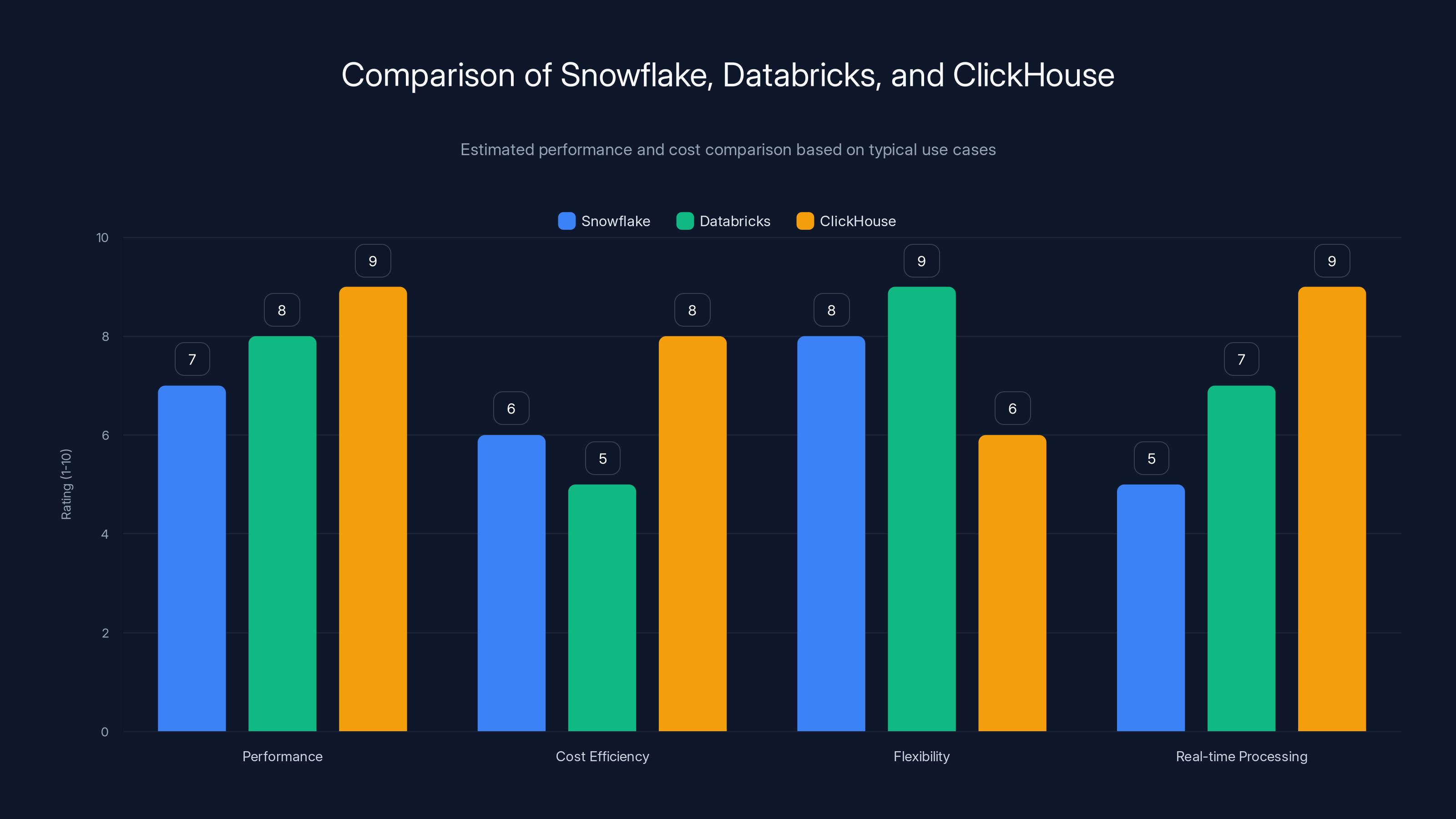

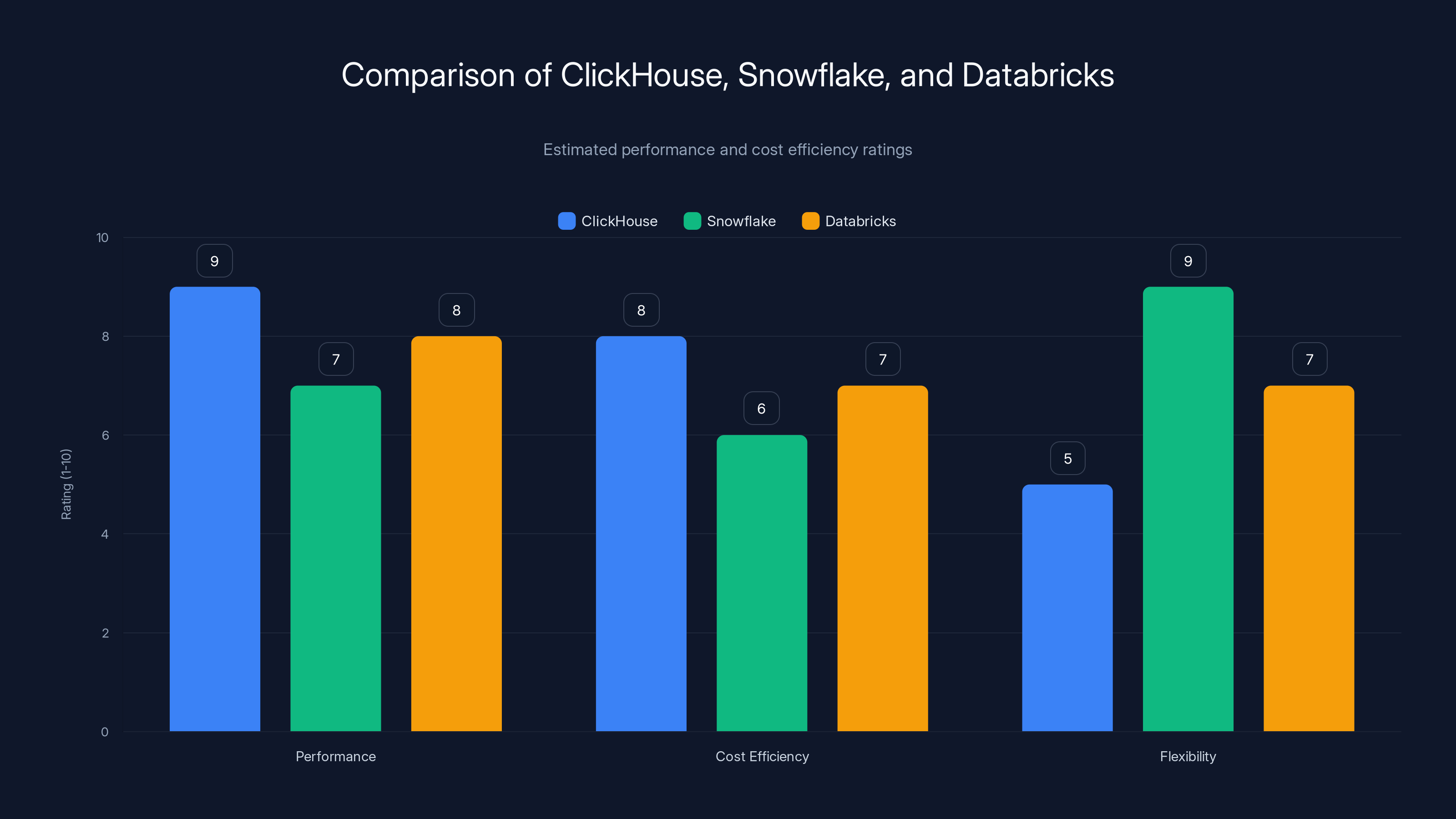

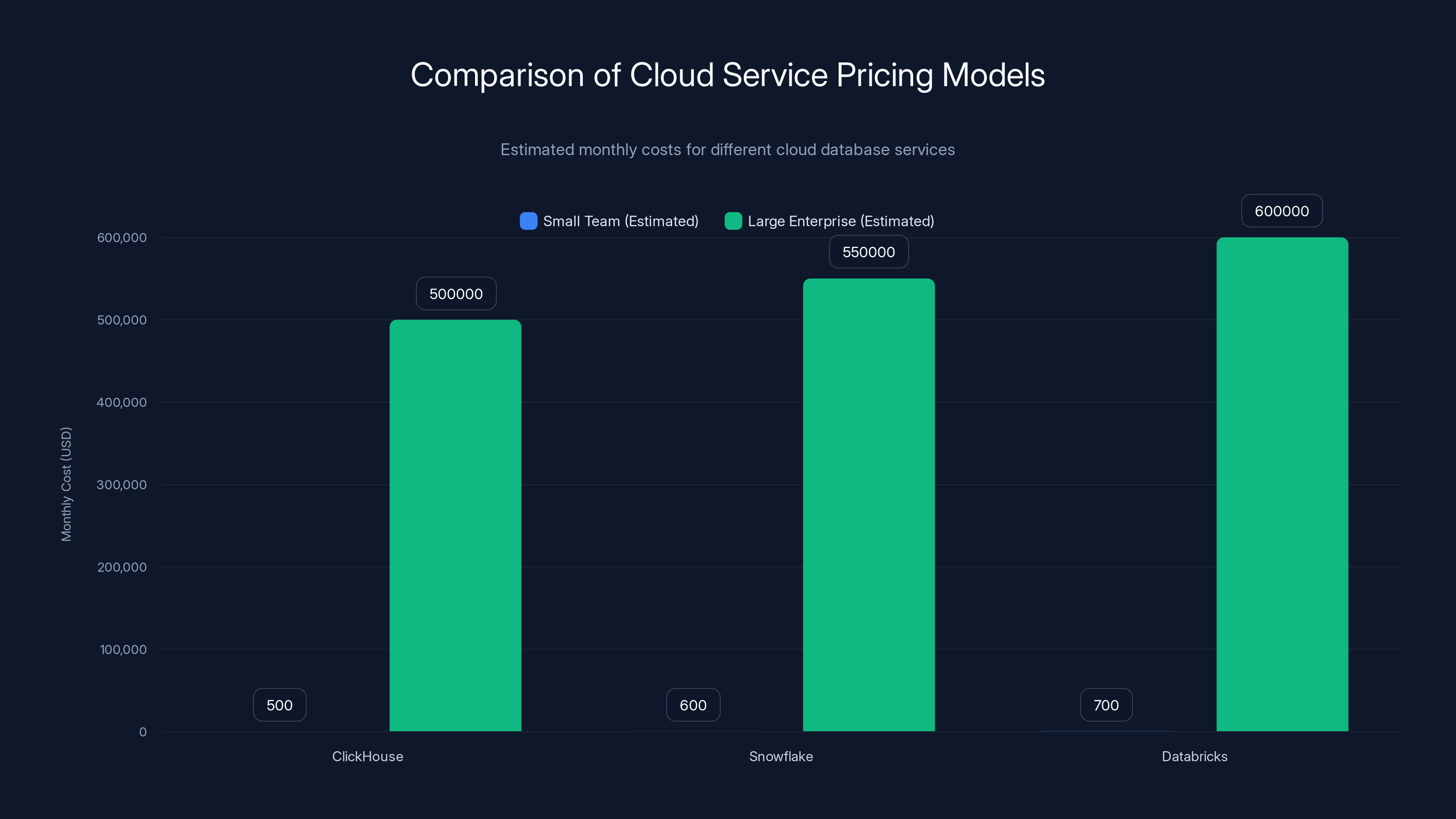

ClickHouse excels in performance and cost efficiency, especially for real-time processing, while Snowflake and Databricks offer more flexibility and features for complex analytics. Estimated data based on typical use cases.

The Open-Source Database That Became an Enterprise Powerhouse

Click House's journey is unusual in Silicon Valley because it doesn't follow the typical startup script. The company didn't start with a pitch deck and a problem statement. It started as an internal tool at Yandex, the Russian search giant that operates something like the Cyrillic version of Google. Engineers at Yandex built Click House because they had a specific problem: analyzing user behavior across billions of events in real-time required a database that could handle massive columns of data with exceptional speed.

When Yandex spun out the company in 2021, Click House came with something most startups have to build from scratch: battle-tested production code. The database had already processed petabytes of data in one of the world's highest-traffic search engines. It wasn't theoretical. It was proven.

That's a massive advantage. Most databases start as research projects. Click House started as proven infrastructure that needed to scale outside a single company.

The open-source nature of Click House is crucial to understanding its success. In the traditional database market, you have proprietary solutions from Snowflake, Databricks, and others. These are closed systems. You buy their platform. You're locked in. You run their architecture their way. With Click House, the source code is public. Anyone can audit it, modify it, run it however they want. For security-conscious enterprises and data teams that have learned painful lessons about vendor lock-in, this is genuinely liberating.

But here's where Click House gets clever: the open-source model isn't a sacrifice. It's the distribution channel. By making the database open source, Click House solved its customer acquisition problem. Engineers try it. They like it. They convince their companies to use it. Then, instead of worrying about managing clusters themselves, companies upgrade to Click House Cloud—the managed service version.

It's the same playbook that made Kubernetes dominant in container orchestration. Give away the core technology. Charge for the operational convenience. The math works because managing distributed databases is hard, and most companies would rather pay for someone else to handle it.

Why AI Agents Need Click House's Architecture

The timing of Click House's valuation spike isn't random. It coincides with the explosion of AI agents in production. Understanding why requires understanding how AI agents process data differently than traditional applications.

AI agents need to make decisions based on massive amounts of context. An AI customer service agent needs to understand the complete history of a customer: every support ticket, every purchase, every interaction with the product. That's not just a few kilobytes of data. It's potentially megabytes or gigabytes of context per customer, multiplied across millions of customers.

Traditional databases like Postgre SQL or My SQL are optimized for row-based storage and fast lookups. They're designed for transactional systems—"find me the customer with ID 12345." They're excellent at that. But asking a traditional row-based database to aggregate information across millions of rows for every agent query? You'll hit a wall fast.

Click House is fundamentally different. It's a columnar database, meaning it stores data organized by column rather than by row. When your AI agent needs to know "how much has this customer spent in the last 90 days," Click House doesn't need to read every single row for that customer. It reads only the spending column, across all customers, and aggregates in milliseconds.

For AI agents processing real-time streams of events—every API call, every user action, every system metric—this performance difference isn't academic. It's the difference between a system that works and a system that doesn't. When you're running millions of AI agent queries per day, each shaving 500ms off query time adds up to hours of computational savings.

This is why Meta, Tesla, and Capital One have adopted Click House. These aren't companies dabbling in AI. These are organizations running production AI systems at massive scale. They chose Click House because it was the right tool for the job.

ClickHouse excels in performance and cost efficiency for high-volume analytics, while Snowflake offers greater flexibility. Estimated data based on typical use cases.

The Competitive Landscape: Snowflake vs. Databricks vs. Click House

To understand Click House's threat to the incumbents, you need to understand the different approaches each company takes.

Snowflake, which went public in 2020 and currently trades at around $200 billion market cap, built its empire on a simple insight: cloud storage is cheap, compute is flexible, so you should separate the two. Their architecture lets you store data in cheap S3 buckets and spin up compute resources on-demand. It's elegant. It works. For many enterprises with traditional analytics workloads, Snowflake remains the gold standard.

But Snowflake's strength is also its constraint. The separation of storage and compute adds latency. For real-time analytics and streaming workloads, that latency becomes problematic. Snowflake is optimized for overnight batch jobs and dashboard refreshes, not millisecond-level decision making.

Databricks, the more recent entrant backed by Andreessen Horowitz, took a different approach. They built on top of Apache Spark and added governance, warehousing, and AI features on top. Databricks is genuinely powerful for data scientists and machine learning engineers. It's the platform where data engineers run complex transformations and ML engineers train models. It's a complete data platform.

Here's the issue: Databricks is also expensive. Their pricing is usage-based, and when you're running heavy computational workloads, those bills can surprise you. Their target customer is the sophisticated data organization with a large team, multiple use cases, and budget to match.

Click House approaches this differently. It's fundamentally a database, not a platform. It doesn't try to be everything. It does one thing: process massive analytical datasets incredibly fast. It doesn't charge licensing fees based on compute consumption. Instead, it offers a managed cloud service with predictable pricing. The open-source version lets you run it however you want, wherever you want, for free.

For companies building AI systems, processing real-time event streams, or running analytics at massive scale, Click House often wins on pure performance and cost. For enterprises that need a complete data platform with governance, security, and integrated ML features, Databricks might be more appropriate. Snowflake remains strong for traditional data warehousing.

The three aren't really competing directly. They're competing for different use cases and different customers. But Click House's growth suggests it's winning in the categories where it competes.

The Langfuse Acquisition: Doubling Down on AI

Click House's announcement that it acquired Langfuse in parallel with this funding round tells you exactly where the company's head is pointed. Langfuse is an observability platform for AI applications. It helps developers track, evaluate, and debug the performance of large language models and AI agents.

Why does this matter? Because the acquisition positions Click House as more than just a database company. It's building an ecosystem around production AI systems.

When you deploy an AI agent, you need visibility. You need to know: What prompts are performing well? Where are failures happening? How much are your inference costs? Langfuse solves that problem. It's like X-Ray for AI applications.

By acquiring Langfuse, Click House is saying: we'll be your database for storing all the data your AI agents generate, and we'll help you observe and optimize those agents. It's a vertical integration play that makes sense from a product perspective.

This acquisition also suggests that Click House sees its immediate growth coming from AI applications, not traditional analytics. Building product integrations that make AI teams stickier is strategic.

For engineers using Lang Chain's Lang Smith (which serves a similar function), this announcement creates pressure. If you're using Lang Smith for observability and Click House for your database, you now have integrated solutions that talk to each other better. That's a small but real competitive advantage.

The Economics of Open-Source at Scale

Click House's business model is mathematically elegant, and understanding it explains why the company is growing so fast.

Traditional enterprise software companies have a problem: customer acquisition costs money (sales teams, marketing, events), and once you acquire a customer, they're stuck with you (vendor lock-in). The economics work, but they're brutal. You need to spend heavily to acquire customers, then extract as much value as possible from them to justify those expenses.

Click House flipped the model. The open-source database serves as free marketing. Engineers download it, try it, like it. No sales team needed. Then, when they want to run it in production without managing infrastructure, they pay for Click House Cloud.

The unit economics are superior. Customer acquisition cost is nearly zero because the distribution channel is built-in. The product itself is the marketing.

And the ARR growth of 250%+ tells you that conversion from open-source user to paying customer is working. Not every company using open-source Click House upgrades to the cloud service, but enough do to generate substantial recurring revenue.

This is why the $400 million round makes sense. Click House is demonstrating that their growth model is repeatable and scalable. They're not projecting future growth; they're demonstrating it in real-time. The valuation reflects investors' confidence that the business can continue this trajectory.

Compare this to Snowflake, which requires expensive sales processes to close enterprise deals. Snowflake has to convince CIOs and procurement teams to adopt their platform. Click House just has to build something developers love, then offer them a convenience option to not run it themselves.

ClickHouse offers predictable pricing with estimated costs of

Performance: The Numbers That Matter

When we talk about Click House being a "challenger" to Snowflake and Databricks, the performance differences are real and measurable.

Let's look at some concrete scenarios. Suppose you're running an analytics query across 100 million rows of user behavior data, aggregating by geography and device type. On traditional row-based databases, you'd typically see query times in the 10-30 second range. On Snowflake, depending on your cluster size and query optimization, you might see similar times. On Click House, the same query executes in 200-500 milliseconds.

That's not a 2x improvement. That's a 20-100x improvement.

Now, in traditional analytics use cases where queries run overnight, this doesn't matter much. But for AI agents making decisions in real-time, or for interactive dashboards where users are waiting for results, it's the difference between a system that works and one that doesn't.

The reason for this dramatic difference is architectural. Click House is a columnar database optimized for OLAP (analytical) workloads. Every decision in the codebase is optimized for reading millions of rows and aggregating columns quickly. Snowflake uses a different architecture (cloud-native separation of compute and storage) that trades some analytical performance for flexibility in resource management.

Here's the caveat: if you're doing transactional workloads (lots of individual row writes and reads), Click House performs poorly. It's not designed for that. Postgre SQL or My SQL would be better choices. Click House only wins if your workload is analytical.

But for the use cases where Click House does compete—analytics, metrics, event streams, AI agent training data—the performance advantage is so dramatic that it often becomes the dominant choice once adopted.

This is reflected in customer choices. Tesla doesn't choose Click House because it's fashionable. They choose it because processing the massive amount of telemetry and sensor data from their vehicles requires a system that can handle extreme query volumes at low latency. Capital One doesn't use Click House for fraud analytics because they want to be trendy. They use it because the performance and cost profile allow them to analyze risk in real-time rather than as a batch process.

The Yandex Inheritance: Battle-Tested Code

One thing that separates Click House from many startup databases is its pedigree. Most database startups have to build from scratch and hope their architecture scales. Click House inherited a codebase that had already proven itself at massive scale inside one of the world's largest tech companies.

Yandex, for context, is a Russian search engine that processes billions of queries daily. For a search company, understanding user behavior is critical. How are users searching? What are they clicking on? How are rankings performing? All of that data flows through Click House.

Before the company was even spun out, Click House had proven it could handle petabyte-scale workloads reliably. That's not something most startups can claim. It's not something you achieve through theoretical optimization. It's achieved through years of production hardening, bug fixes, and performance tuning.

When Meta, Tesla, and Capital One evaluate new database technologies, they're risk-averse. They want to know: has this been proven in production at scale? Click House could honestly answer yes. It had been running production systems at Yandex for years.

This is a massive competitive advantage that's hard to overstate. It compressed Click House's path from startup to enterprise-grade system by probably five years. The company didn't have to solve the "will this hold up under real-world load" question. It came with the answer.

Customer Wins and Market Validation

The customer list for Click House reads like a hall of fame of modern tech companies: Meta, Tesla, Capital One, Lovable, Decagon, and Polymarket.

Let's look at what each of these deployments likely represents.

Meta (formerly Facebook) runs one of the largest advertising systems in the world. Their infrastructure needs to process billions of events per day—user actions, ad impressions, conversions. Click House likely powers analytics that drive real-time decision making about ad delivery and optimization. When Meta adopts a new infrastructure component, they're not testing. They're committing to something they believe will scale to their needs.

Tesla's adoption is particularly interesting. Tesla generates massive amounts of telemetry data from vehicles in the field. Every car sends data about performance, battery health, autopilot behavior. Click House likely powers the systems that ingest, analyze, and drive insights from that data. For a company where data-driven decisions directly impact vehicle safety and performance, the choice of database infrastructure is critical.

Capital One is a financial services company. Regulatory requirements and risk management demand that data systems be reliable, auditable, and performant. Capital One's adoption of Click House likely reflects confidence that the system meets those requirements. It also suggests that the cost savings versus their previous solution were compelling enough to justify the engineering migration effort.

Lovable and Decagon are more recent, smaller companies, but they represent the forward-looking edge of AI development. If you're building AI products, you likely need a database optimized for the data volumes and query patterns that AI systems generate. These companies chose Click House early, which suggests they're building AI-first architectures from the start.

Polymarket is a prediction market platform. Prediction markets generate massive amounts of transaction and event data. Real-time analytics on betting markets are crucial to the business. Click House's ability to handle high throughput and low-latency queries makes sense for this use case.

What's remarkable about this customer list is the diversity. These aren't all startups. Meta and Capital One are trillion-dollar-scale enterprises. They have the resources to build their own database systems if they wanted to. They chose Click House because it solved their problems better than alternatives.

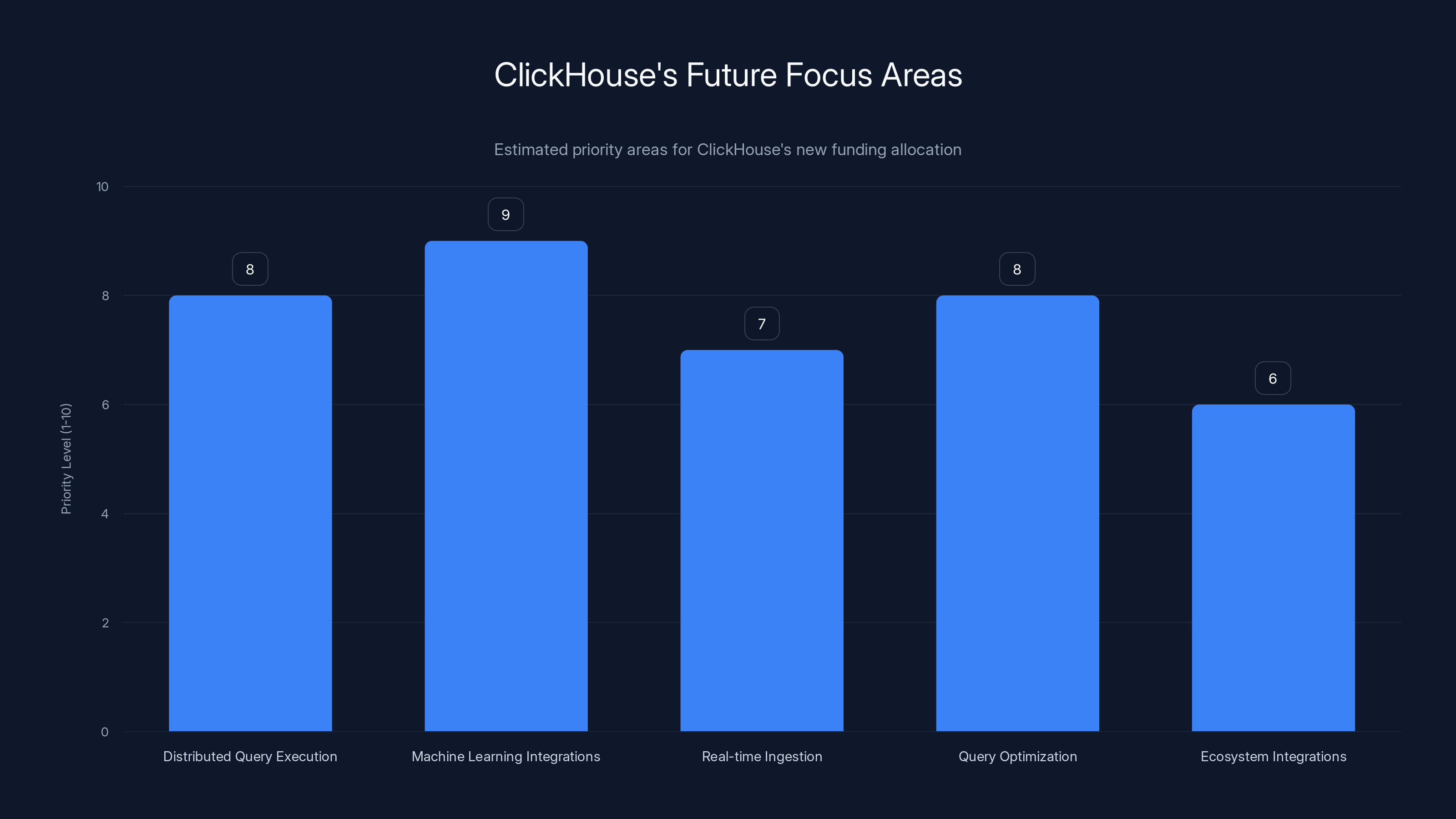

Estimated data suggests ClickHouse will prioritize machine learning integrations and query execution improvements to enhance AI capabilities and maintain performance advantages. Estimated data.

Cloud Services as the Monetization Engine

Understanding how Click House monetizes is crucial to understanding why the valuation makes sense. The business model is deceptively simple.

The open-source Click House database is free. Anyone can download it, deploy it, and run it. This drives adoption because the barrier to entry is zero. But deploying and managing a distributed database is hard.

There are operational challenges. You need to handle replication, failover, backups, security, monitoring, and performance tuning. You need on-call engineers who understand the system deeply. You need to plan for growth and capacity. Most companies don't have the expertise or desire to do this internally.

Click House Cloud solves this by providing a managed service. You create an account, specify your resource requirements, and Click House handles everything else. Backups are automatic. Scaling is seamless. Security patches are applied without downtime. Monitoring is built-in.

The pricing is straightforward: you pay for the compute and storage you use. A small team might pay

Compare this to Snowflake's model, where customers can face surprise bills if queries are inefficient. Or Databricks, where compute costs scale aggressively with usage. Click House's cloud pricing is more predictable, which appeals to finance teams worried about unexpected bills.

The 250%+ ARR growth reflects the fact that this model works. Customers are adopting the open-source database and converting to paying cloud customers at rates that exceed the historical growth patterns of software companies.

Why? Because the value proposition is compelling. You get a database that performs better than alternatives, an open-source version you can run yourself if needed, and a cloud service that eliminates operational headaches. For a company running analytics at scale, the ROI calculation often comes down to: cost of running Click House Cloud versus cost of employing database engineers to manage an on-premise or self-managed cloud solution. Click House Cloud usually wins.

The Competitive Threat to Incumbents

Snowflake and Databricks should be watching this closely, though they likely already are.

Snowflake faces a particular challenge. Their entire value proposition has been "use our cloud-native data warehouse, it's simpler than your legacy systems." Click House offers something potentially more powerful: a database that's not just easier to use than legacy systems, but fundamentally more performant for analytical workloads.

Snowflake's response will likely be twofold. First, they'll double down on their governance, security, and ecosystem features—areas where Click House is less mature. Second, they'll optimize their performance. But fundamentally, they're unlikely to match Click House's raw speed because their architecture prioritizes other things (separation of compute and storage, multi-tenant efficiency).

Databricks faces a different threat. Databricks' strength is being a complete data platform. Click House is just a database. But for teams that want a really good database plus best-of-breed solutions for other parts of the data stack, Click House might be a more modular choice. Combined with Langfuse (their new acquisition), Click House is becoming less of a point solution and more of a platform.

The real competitive dynamic to watch is whether Click House can build out the ecosystem faster than Databricks, while remaining simpler and more performant than Snowflake. That's a hard balance to strike.

Investor Thesis: Why Dragoneer and Others Believed in Click House

When Dragoneer Investment Group leads a $400 million round, it's worth understanding what they see.

Dragoneer is a growth-focused investor. They typically come into rounds when companies are already demonstrating substantial revenue and growth but haven't yet gone public. They're betting on scale, not on unproven concepts.

The fact that Dragoneer led this round (with major participation from Bessemer Venture Partners, GIC, Index Ventures, Khosla Ventures, and Lightspeed) tells you these are not contrarian bets. These are consensus bets from some of the most sophisticated data infrastructure investors in the world.

What's their thesis? Probably something like this: data volumes are growing exponentially. AI is driving new use cases for real-time analytics. Current solutions (Snowflake, Databricks) are expensive and not always the best fit for new workloads. Click House is demonstrating that an open-source approach combined with managed services can scale. The open-source nature drives adoption with minimal CAC. The managed service drives recurring revenue. The growth rates prove the model works. The only question is: how big can this get?

History suggests their thesis is sound. Similar dynamics played out with Kubernetes, Postgre SQL, and other open-source infrastructure projects. The companies that manage those projects and provide commercial services end up becoming substantial businesses.

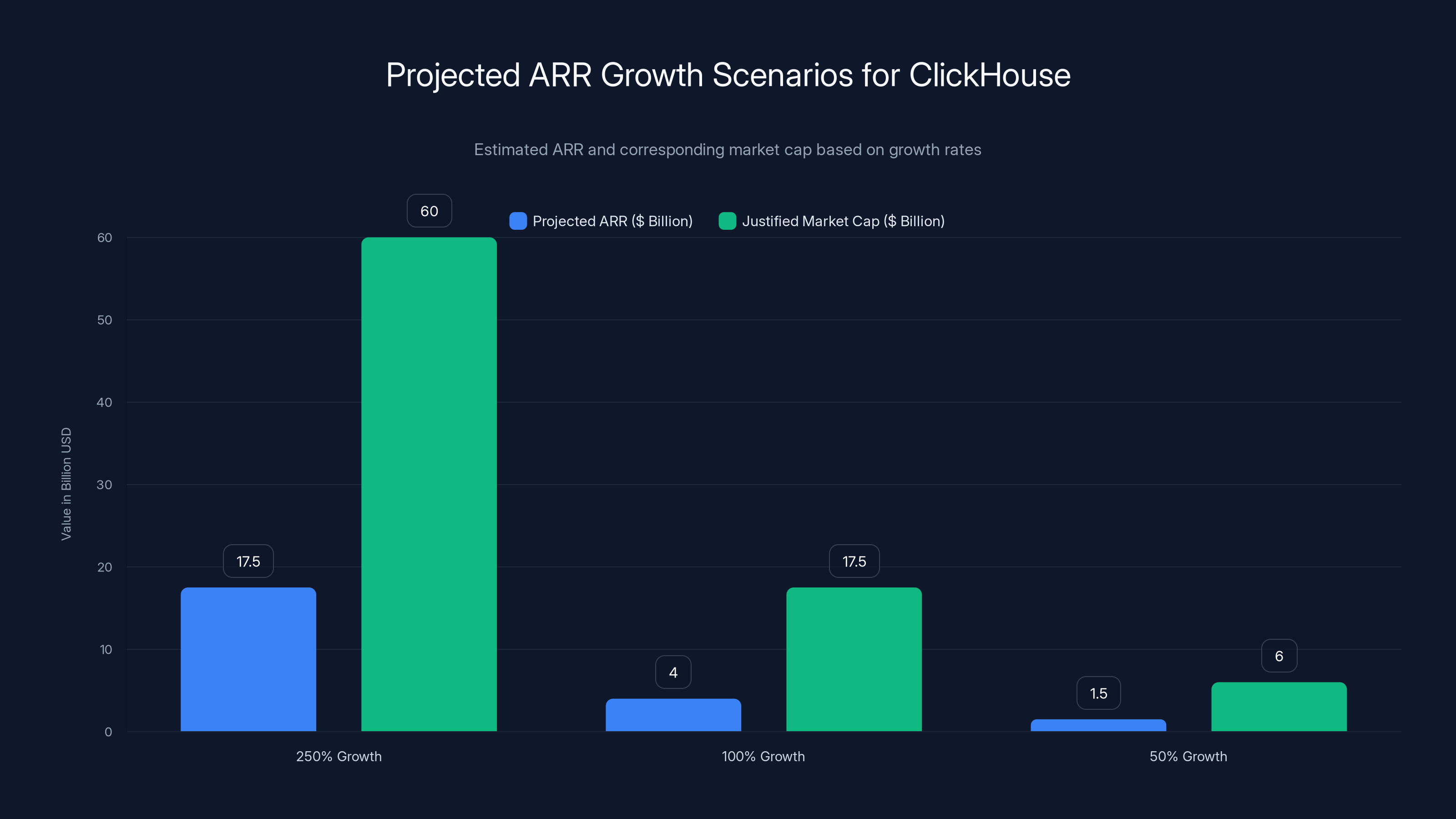

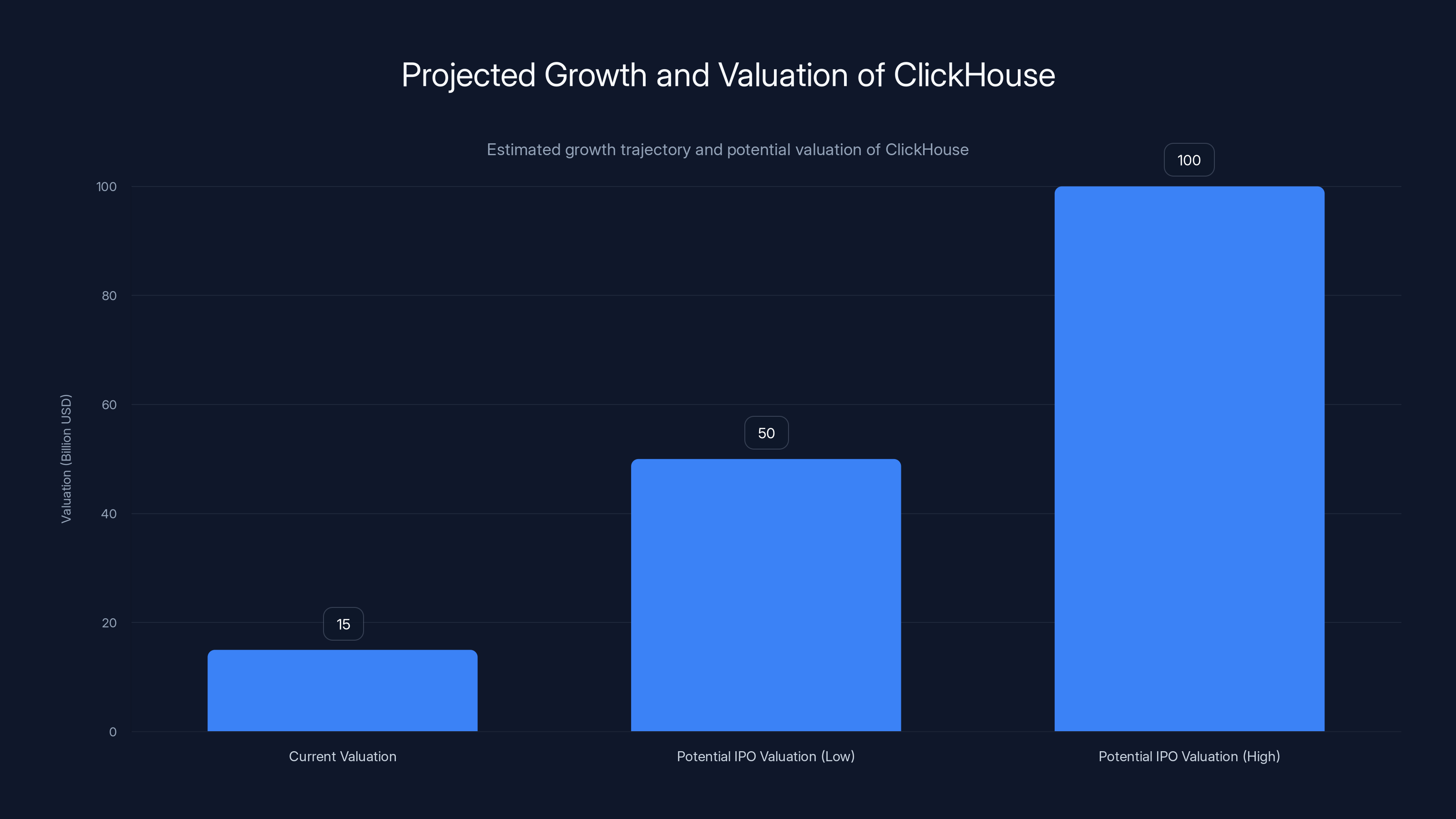

From an investor perspective, Click House at

If Click House continues its current growth trajectory, a future IPO at $50-100 billion market cap isn't implausible. That would represent a 3-7x return for current investors. For growth funds, that's a standard outcome.

Estimated data shows that with 250% growth, ClickHouse could justify a

Technical Deep Dive: Why Column Store Architecture Matters

For those who want to understand why Click House is technically superior for certain workloads, let's dig into the architecture.

Traditional databases like Postgre SQL and My SQL store data in rows. When you create a record, all the information for that record is stored together. This is efficient for transactional workloads where you frequently read or update a complete record. But it's terrible for analytical queries where you're reading one or two columns across millions of records.

Columnar databases like Click House store data organized by column. All values for the salary column are stored together, separately from the department column, separately from the hire_date column. When you run an analytical query, the database only needs to read the columns relevant to your query.

This creates a cascade of performance benefits. First, less data is read from disk (lower I/O). Second, the data in a single column often has high compression ratios (numbers in a column are often similar to each other, so they compress well). Third, the CPU can perform SIMD (single instruction, multiple data) operations on columnar data much more efficiently than on row-based data.

The math is stark. On a query involving 100 columns where you access 5, a row-based database must read all 100 columns for every row it examines. A columnar database reads only the 5 relevant columns. In a 100-million-row table, that's potentially a 20x reduction in I/O. Combine that with compression, and you get the 20-100x speedup we discussed earlier.

The tradeoff is that writes and transactional updates are slower in columnar databases. If your workload involves thousands of individual record updates per second, columnar isn't the right choice. But for analytical workloads where you're writing data in batches and reading it in complex patterns, columnar is dramatically superior.

Click House's implementation of this is particularly sophisticated. They've added compression algorithms, distributed query execution, and distributed storage handling that allows Click House clusters to operate seamlessly across multiple machines.

Enterprise Security and Compliance Considerations

When evaluating Click House for enterprise use, security and compliance are legitimate concerns for IT departments. Here's what enterprises need to consider.

Being open-source is actually an advantage for security. The source code is auditable. Security researchers have reviewed it. There's no hidden backdoors or security theater. For companies with strict security requirements, open-source is increasingly preferred because they can see exactly what code they're running.

Click House Cloud has built enterprise security features: encryption at rest and in transit, VPC isolation, role-based access control, audit logging. These are table-stakes for an enterprise data platform, and Click House has implemented them.

Compliance is area where Click House is still catching up to Snowflake. Snowflake has extensive certifications (SOC 2, HIPAA, PCI DSS, etc.) and a mature compliance program. Click House is working toward this but isn't at parity yet. For healthcare companies or financial institutions with strict compliance requirements, this might still tilt them toward Snowflake.

Gatekeeping features like column-level encryption and row-level security are also more mature in Snowflake and Databricks than in Click House. Enterprises that need granular control over who can see what data might find Snowflake's capabilities more complete.

But the trajectory is clear: Click House is building out enterprise features. Within a year or two, the gap will narrow substantially. For companies evaluating new data infrastructure today, the compliance story might matter. For companies evaluating in 2026-2027, it likely won't be a differentiator.

The Global Data Infrastructure Market Context

Click House's $15 billion valuation makes more sense when you consider the broader market.

The global data warehousing market was estimated at around $20-25 billion in 2024. The broader analytics and BI market (including tools like Tableau, Looker, and others) is substantially larger. Within this context, Click House's valuation suggests investors believe they can capture a meaningful percentage of that market.

Snowflake currently has a market cap (when publicly traded) that has fluctuated but hovers around $200-250 billion in recent years. That's not necessarily a ceiling for Click House, but it's the scale they're aiming for.

What's interesting is that many of these markets are not zero-sum. Click House taking market share from Snowflake might mean Click House handles the analytics layer while Snowflake handles governance and data discovery. Or Click House is adopted for new AI-driven use cases that expand the total market.

The valuation also reflects the fact that software infrastructure is extremely valuable. If Click House can establish itself as the default database for certain use cases (real-time analytics, AI applications, event streaming), the financial value of that position is enormous. Every company building analytics or AI systems eventually needs a database. If Click House becomes the standard choice for that, the market size is effectively unlimited.

Estimated data suggests ClickHouse could see a 3-7x return for investors if it reaches a

Integration with the Broader Data Stack

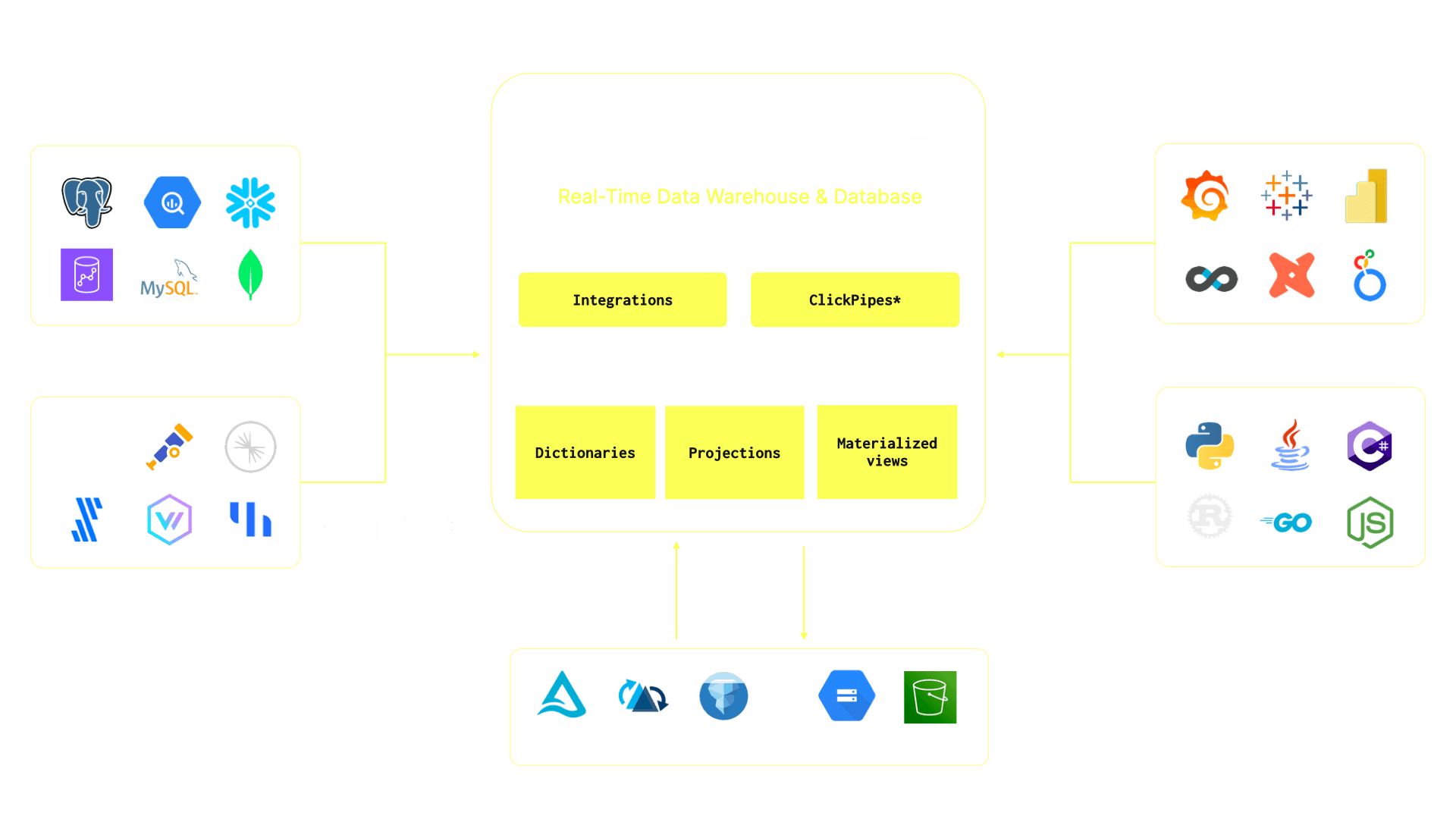

Click House doesn't exist in isolation. It needs to integrate with the rest of the data infrastructure that modern companies depend on.

Snowflake is powerful partly because it's become the center of many data stacks. You feed data into Snowflake from various sources, you run transformations in Snowflake or dbt, and you build dashboards and reporting on top of Snowflake. It's the hub.

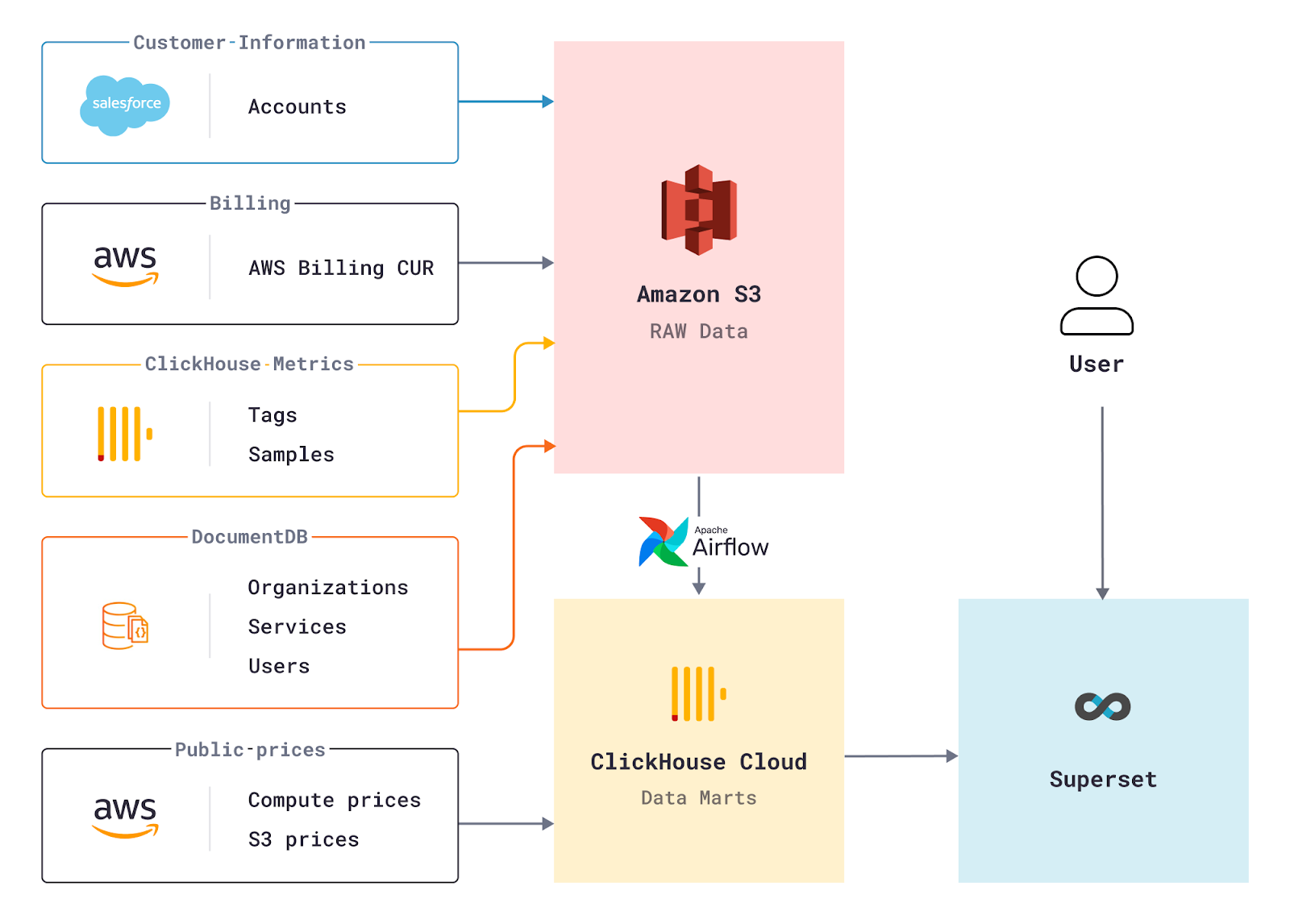

Click House needs to integrate with that same ecosystem, but as a database layer rather than a complete platform. This means strong integrations with ETL tools (Airflow, dbt, Fivetran, Stitch), BI tools (Tableau, Looker, Superset), and data discovery tools (Data Hub, Collibra).

The good news: Click House has these integrations. The ecosystem has recognized that Click House is here to stay and has built support for it. But Snowflake still has deeper integrations in many cases because they have more resources and have been in the market longer.

The acquisition of Langfuse suggests Click House is thinking about vertical integration in specific areas (observability) where it can provide significant value to customers.

Looking ahead, expect Click House to selectively build or acquire products that solve problems for their target customers (data engineers, analytics engineers, AI teams) rather than trying to be a complete platform like Databricks.

The Road Ahead: What's Next for Click House

With a

The most important question is: what are their priorities? Given the Langfuse acquisition, it seems like Click House is betting on AI as their near-term growth driver. That makes sense. AI applications need databases optimized for the access patterns and data volumes that AI systems generate.

What Click House probably won't do is try to become Databricks. They won't build a complete ML platform. They'll remain a database, but they'll expand the ecosystem around it. Expect more acquisitions in observability, governance, and data integration.

Snowflake and Databricks should expect Click House to be increasingly competitive in their bread-and-butter use cases. For real-time analytics and AI applications, Click House will win on performance and cost. For traditional data warehousing with complex governance requirements, Snowflake might maintain an advantage. For complete data platforms, Databricks has an edge.

But the competitive pressure is real, and it's only increasing.

From a technology perspective, the Click House team will likely focus on:

- Distributed query execution improvements to handle even larger clusters

- Machine learning integrations to make Click House a better choice for training AI models

- Real-time ingestion enhancements to support streaming workloads

- Query optimization to maintain speed advantage even as the product matures

- Ecosystem integrations to make it easier to move data in and out of Click House

These are all areas where they can maintain technical differentiation from larger, older platforms.

Lessons for Data Infrastructure Entrepreneurs

Click House's success offers several lessons for anyone building in the data infrastructure space.

First, open-source as distribution works at scale. Databricks, which also built on open-source (Spark), is massive. Kubernetes is used by millions of companies. The companies that create open-source infrastructure and build commercial services around it often win.

Second, solve a real performance problem. Click House isn't winning because of marketing. It's winning because it's genuinely faster for certain workloads. Performance is a feature that sells itself.

Third, inherited scale helps. Click House came out of Yandex with battle-tested code. If you're starting from scratch, you need to be willing to spend years proving your system works under real load. Click House skipped that phase.

Fourth, simplicity wins. Click House's value proposition is simple: fast database for analytics. It's not a complete platform. That simplicity makes it easier to understand, easier to reason about, and easier to integrate into existing stacks.

Fifth, timing matters. Click House emerged right as AI applications started demanding different database characteristics than traditional analytics. If they'd emerged five years earlier, the timing wouldn't have been as good.

For engineers building databases or data infrastructure, these are the patterns to watch and potentially replicate.

The Valuation: Is $15B Justified?

Worth asking directly: is $15 billion a reasonable valuation for Click House, or is this frothy investor money chasing AI hype?

The honest answer is: it depends on your assumptions about growth and scale.

If Click House can continue growing ARR at 250% year-over-year for another 2-3 years, that implies ARR in the

If growth slows to 100% annually, the terminal ARR might be only

The only way the valuation is significantly overpriced is if Click House is overestimating their current ARR, or if growth slows to 50% or lower. Both are possible, but given the company's track record and customer list, unlikely.

Compare to Databricks, which is rumored to be worth

The verdict: $15 billion is a reasonable valuation for a company with Click House's growth profile and market opportunity. It's not a bargain, but it's not obviously overpriced either.

How Runable Fits Into the Data Infrastructure Landscape

For teams building on top of data infrastructure like Click House, automating workflows and documentation becomes increasingly important. As your data systems become more complex, generating reports, dashboards, and automated analysis from raw data becomes a bottleneck.

This is where Runable becomes relevant. Runable enables teams to automate the creation of reports, presentations, and documents directly from data systems like Click House. Instead of manually writing reports or dashboards, you can define automated workflows that extract insights from your database and generate presentation-ready reports and slides.

For data teams using Click House, this means: query your Click House database, let Runable automatically generate a visual report or presentation from the results, and distribute to stakeholders. It's the missing piece between your database and your business users.

Use Case: Automatically generating weekly analytics reports from your Click House database in 5 minutes instead of spending hours in Excel

Try Runable For FreeConclusion: A New Leader in Data Infrastructure

Click House hitting a $15 billion valuation is significant not because of the number itself, but because of what it represents: a fundamental shift in how data infrastructure is built and distributed.

For decades, the database market was dominated by large, expensive, proprietary systems. Oracle, then Snowflake, then Databricks. Each was powerful but costly and complex.

Click House proved that you could build something radically faster, more powerful for certain use cases, and more affordable. You could release it as open-source, building a global community of users. Then you could monetize by providing the managed service that most organizations ultimately want.

The data infrastructure market is large enough that multiple approaches can coexist. Snowflake will remain dominant for traditional data warehousing. Databricks will remain the choice for complete ML-focused data platforms. But Click House is establishing itself as the database for AI applications, real-time analytics, and performance-sensitive workloads.

For companies evaluating new data infrastructure in 2025, Click House deserves to be on your shortlist. For investors, the $15 billion valuation seems reasonable given the company's growth and market opportunity. For engineers, Click House represents a masterclass in how to build distributed systems and how to succeed in an entrenched market through technical excellence and smart distribution.

The database wars aren't over. In fact, they're just getting started.

FAQ

What is Click House and why is it different from Snowflake or Databricks?

Click House is an open-source columnar database designed for OLAP (Online Analytical Processing) workloads that require extremely fast queries across massive datasets. Unlike Snowflake, which separates compute and storage to provide flexibility, or Databricks, which offers a complete data platform, Click House focuses purely on being the fastest database for analytics. It achieves this through columnar storage architecture, which allows it to process queries 20-100x faster than traditional row-based databases for analytical queries. Click House makes money through its managed cloud service, not by licensing the database itself.

How does Click House's pricing model work and is it cheaper than Snowflake?

Click House offers a two-tier approach: the open-source database is completely free to download and deploy yourself, while Click House Cloud provides a managed service where you pay for compute and storage based on actual usage. This is generally cheaper than Snowflake for high-volume analytical workloads because Click House's compute is more efficient. However, Snowflake may be cheaper if you have unpredictable workloads where you need flexibility, because Snowflake can spin up resources on-demand. The actual comparison depends on your specific query patterns and data volumes.

Why is the Langfuse acquisition important for Click House?

Langfuse is an observability platform that helps developers monitor, debug, and optimize AI applications. By acquiring Langfuse, Click House is positioning itself as an end-to-end solution for AI teams: Click House provides the database to store all data your AI agents generate and require, while Langfuse provides visibility into how those agents are performing. This vertical integration makes Click House more sticky for AI teams and positions the company beyond just being a database vendor. It signals that Click House sees AI as their primary growth market.

Which companies are using Click House and should we trust it for production?

Click House customers include Meta, Tesla, Capital One, Lovable, Decagon, and Polymarket. These are not experiments—Meta and Capital One are running mission-critical analytics systems on Click House. The fact that Fortune 500 companies with massive infrastructure teams have chosen Click House over building custom solutions is a strong validation of its reliability and performance. Click House inherited proven code from Yandex, so it came with battle-tested stability from day one, unlike many other startups.

Will Click House eventually compete with Snowflake and Databricks directly?

Click House is already competing with Snowflake in the analytics database space, and the competition is real. However, they're not trying to be complete replacements. Snowflake has advantages in governance, security compliance, and ecosystem integrations. Databricks has advantages for machine learning teams needing a complete platform. Click House will win for real-time analytics and AI applications where pure performance matters most. As Click House matures and adds more enterprise features, expect it to take share from Snowflake in specific use cases, but both platforms will likely coexist in large enterprises.

What does the $15B valuation mean for Click House's future?

The

How does Click House handle security and compliance for enterprise customers?

Click House Cloud includes enterprise security features like encryption at rest and in transit, VPC isolation, role-based access control, and audit logging. Being open-source is actually a security advantage because the code is auditable and transparent. However, Click House's compliance certification matrix is less comprehensive than Snowflake's—they don't yet have all certifications like HIPAA or comprehensive PCI compliance. For heavily regulated industries, Snowflake currently has more complete compliance features, though Click House is rapidly adding them. Most enterprises can run on Click House safely, but those in healthcare or heavily regulated financial services should verify certifications against their requirements.

What types of workloads is Click House optimized for versus those where it performs poorly?

Click House excels at: analytical queries across massive datasets, real-time event stream processing, time-series analytics, and AI agent data. It struggles with: transactional workloads with frequent individual record updates, complex updates to existing data, and workloads requiring row-level security. The fundamental architecture (columnar, immutable) that makes it fast for analytics makes it poor for transactional systems. For this reason, Click House is used alongside databases like Postgre SQL, not as a replacement for them in all cases.

Key Takeaways

- Click House's $15 billion valuation validates the open-source-plus-managed-services model for data infrastructure

- The 250%+ annual recurring revenue growth demonstrates genuine customer adoption, not just venture capital hype

- Performance advantages (20-100x faster for analytical queries) give Click House a real technical edge over Snowflake

- Acquisitions like Langfuse show Click House is building an ecosystem around AI applications

- Companies like Meta and Tesla choosing Click House proves it's production-ready for mission-critical workloads

- The competitive dynamics with Snowflake and Databricks suggest all three databases will coexist by dominating different use cases

- Click House's trajectory mimics successful open-source infrastructure companies (Kubernetes, Postgres), suggesting significant upside potential

Related Articles

- Higgsfield's $1.3B Valuation: Inside the AI Video Revolution [2025]

- Type One Energy Raises $87M: Inside the Stellarator Revolution [2025]

- SkyFi's $12.7M Funding: Satellite Imagery as a Service [2025]

- Over 100 New Tech Unicorns in 2025: The Complete List [2025]

- Harmattan AI Defense Unicorn: $200M Series B, Dassault Aviation [2025]

- SandboxAQ Executive Lawsuit: Inside the Extortion Claims & Allegations [2025]

![ClickHouse Hits $15B Valuation: How an Open-Source Database is Challenging Snowflake and Databricks [2025]](https://tryrunable.com/blog/clickhouse-hits-15b-valuation-how-an-open-source-database-is/image-1-1768603218582.jpg)