Startup Battlefield 200 2026: Everything Founders Need to Know

If you're building something in a garage, accelerator, or basement, you've probably heard the legend. A startup founder walks on stage at TechCrunch Disrupt, delivers a six-minute pitch, and suddenly has acquisition offers, $10 million in funding interest, and investor meetings booked for the next month.

That's not marketing fluff. That's what actually happens at Startup Battlefield 200.

But here's what most founders don't realize: getting there is insanely competitive. Out of thousands of applications annually, only 200 companies make the cut. That's roughly a 1-2% acceptance rate, making it harder to get into than most Ivy League schools.

The thing is, if you're seriously building and you have product-market fit (or something close to it), you absolutely should apply. The visibility alone can change your trajectory. We're talking press coverage, investor relationships, customer discovery, and network access that would cost you

In this guide, I'll walk you through everything: what Startup Battlefield actually is, how to apply in 2026, what to expect if you get in, how past alumni have crushed it, and the honest playbook for increasing your chances of selection.

Let's dig in.

TL; DR

- Timeline for 2026: Applications open mid-February, close mid-June, finalists announced September 1

- What you get: Free booth, stage time, 6-minute pitch slot, $100K non-dilutive prize potential, investor access

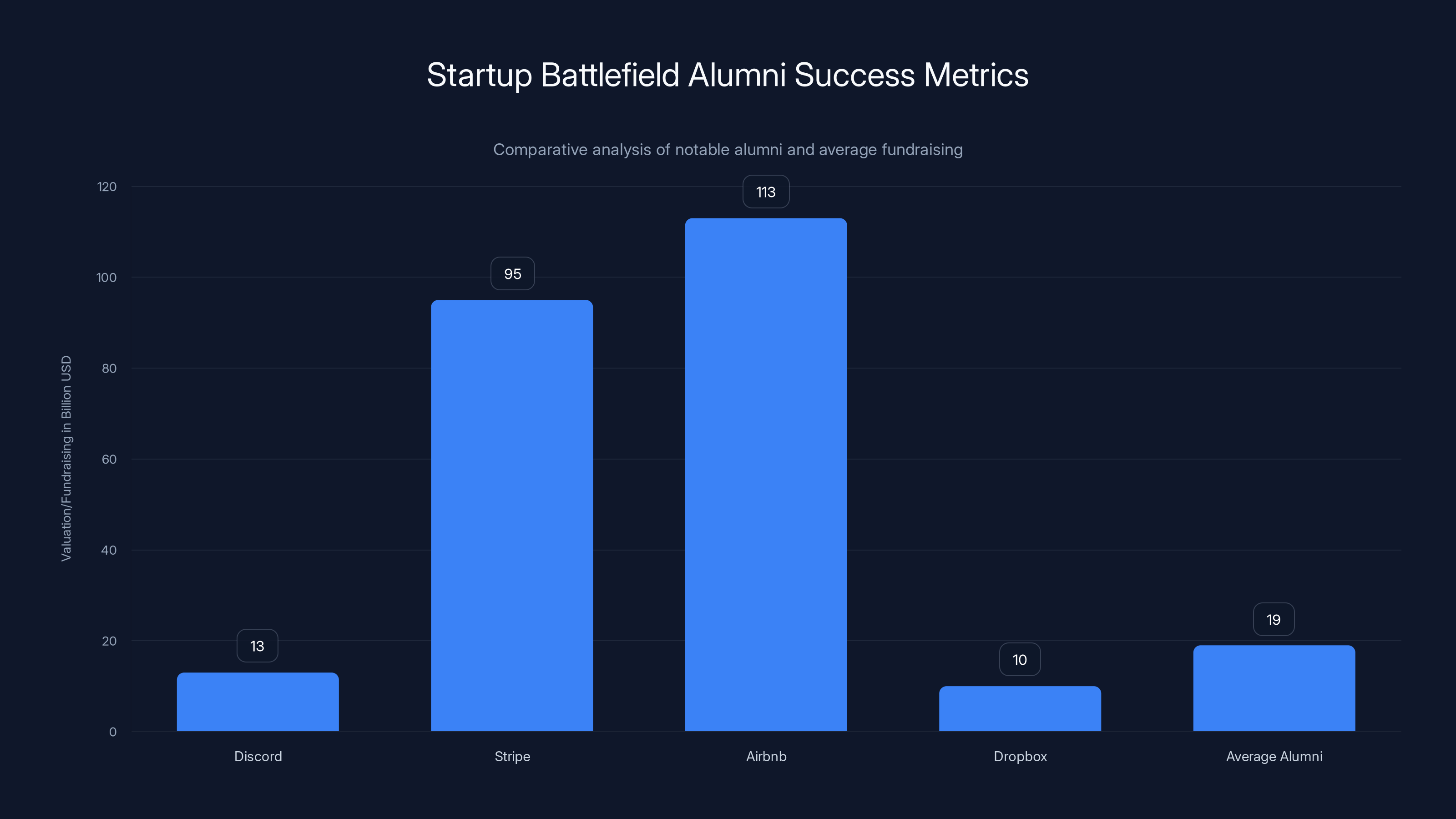

- Alumni success: 1,700+ companies, $32+ billion raised collectively, includes Discord, Stripe (before mainstream), and dozens of unicorns

- Honest reality: Visibility is the real prize, not just the stage time or prize money

- Application strategy: Focus on traction, differentiation, and a story investors actually care about

Discord, Stripe, Airbnb, and Dropbox are standout successes from Startup Battlefield, with valuations/fundraising far exceeding the average $19M per alumni. Estimated data for Stripe and Airbnb.

What Is Startup Battlefield 200 Exactly?

Let's start with the obvious question: what the hell is Startup Battlefield anyway?

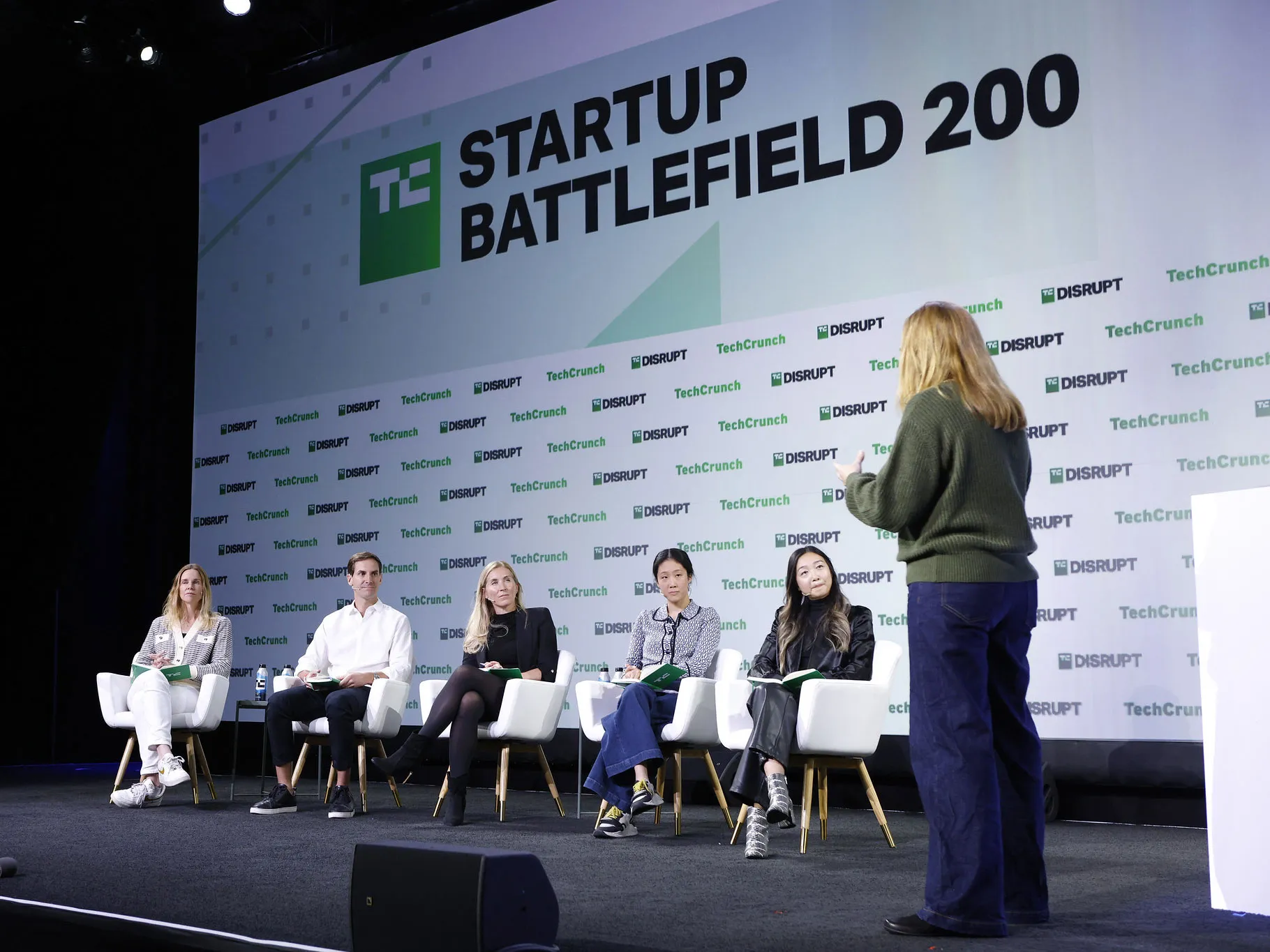

It's not just a pitch competition. If it were, we'd call it that. What makes it special is that it's a full platform designed to launch early-stage startups from relative obscurity into investor consciousness in about nine months.

Startup Battlefield 200 is TechCrunch's flagship program for companies typically in the seed to Series A stage (though the range is wider than you'd think). Each year, the TechCrunch editorial team reviews thousands of applications and selects 200 companies to participate. These companies aren't randomly chosen. They're hand-picked based on founders, market opportunity, product differentiation, and growth trajectory.

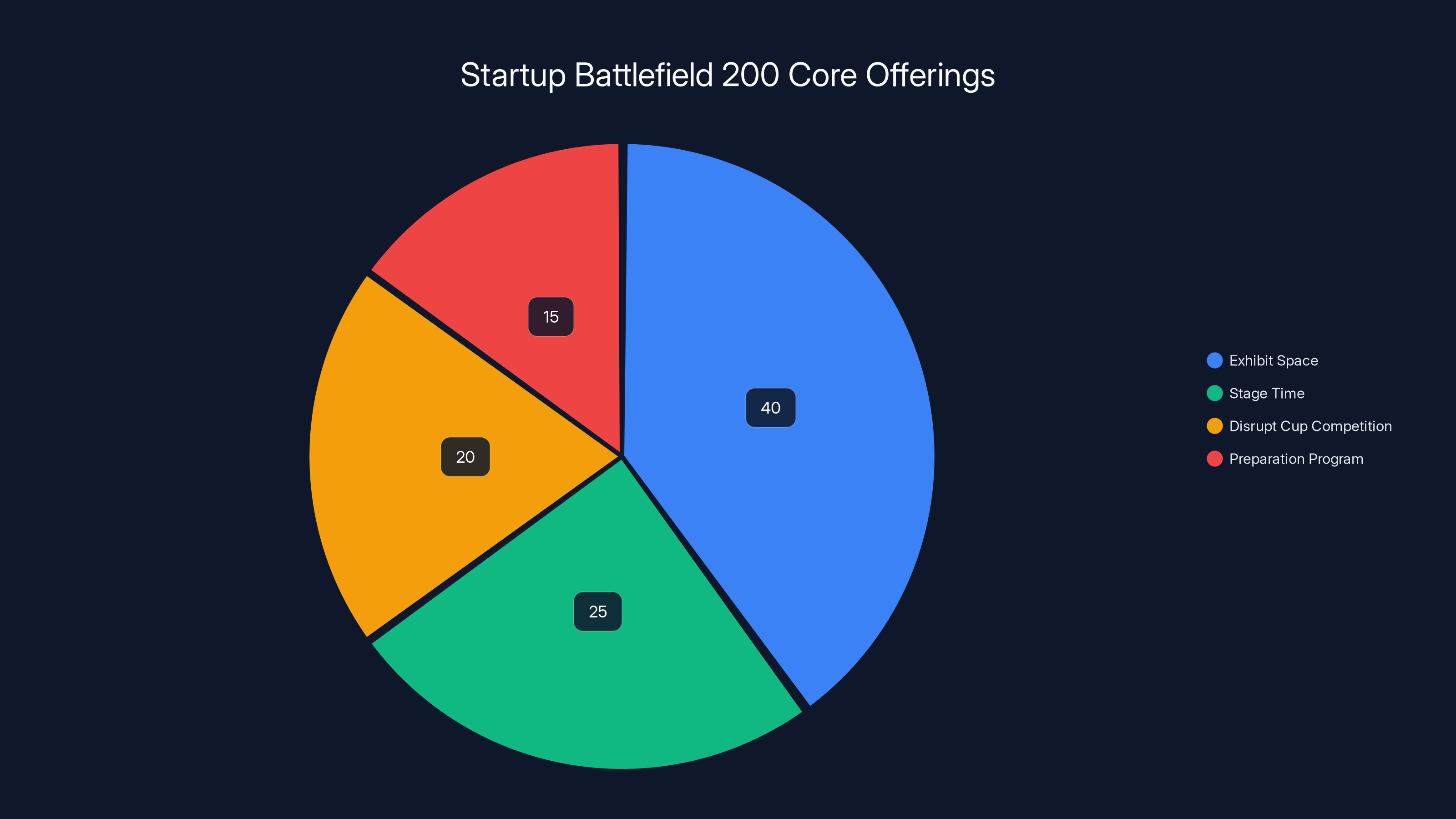

The Core Offering

Here's what founders actually get:

Free exhibit space at TechCrunch Disrupt — This alone is worth

Direct stage time — You don't just get a booth. You get a guaranteed slot on stage in front of an auditorium filled with investors, press, and industry leaders. Six minutes sounds short until you've pitched before 1,000 people. It's not a panel. You're the focus.

The Disrupt Cup competition — Top performers get invited to pitch for the main Disrupt Cup, which includes a

Exclusive preparation program — Starting September 1 (after selection), TechCrunch runs a virtual program where selected founders learn pitch strategy, brand narrative, media training, and investor communication. They pair you with advisors and mentors. This isn't surface-level stuff. You'll practice your pitch 50+ times before you step on stage.

Direct investor and press access — This is the real currency. TechCrunch will make introductions. You'll get briefings on which investors are in the room, what they focus on, and how to get 15 minutes with them. Press coverage is nearly guaranteed. Articles, interviews, mentions.

Network effects — You're in a cohort with 199 other founders building in climate, AI, health, fintech, and dozens of other sectors. That network alone is worth thousands in future business deals, partnerships, and friendships.

The program runs from selection (early September) through the main event (late October), so there's a four-month intensive period where you're preparing alongside other founders.

Why It Matters More Than You Think

Sure, getting a booth and stage time is cool. But the real value? It's credibility.

When an investor sees "Startup Battlefield 200 participant" on your deck, they know TechCrunch vetted you. They know you're not some random founder applying for a pitch slot. There are thousands of pitch competitions. Most are garbage. Startup Battlefield isn't.

That signal compounds. Customers see it. Partners see it. Employees see it. Future investors see it. It's not magical, but it opens doors.

The other thing that matters: press coverage is nearly automatic. TechCrunch publishes a profile on every Startup Battlefield participant. That's a guaranteed byline on one of the most-read tech publications in the world. Your mom might not care, but your target customers absolutely do. And VCs? They read those posts before they even look at your deck.

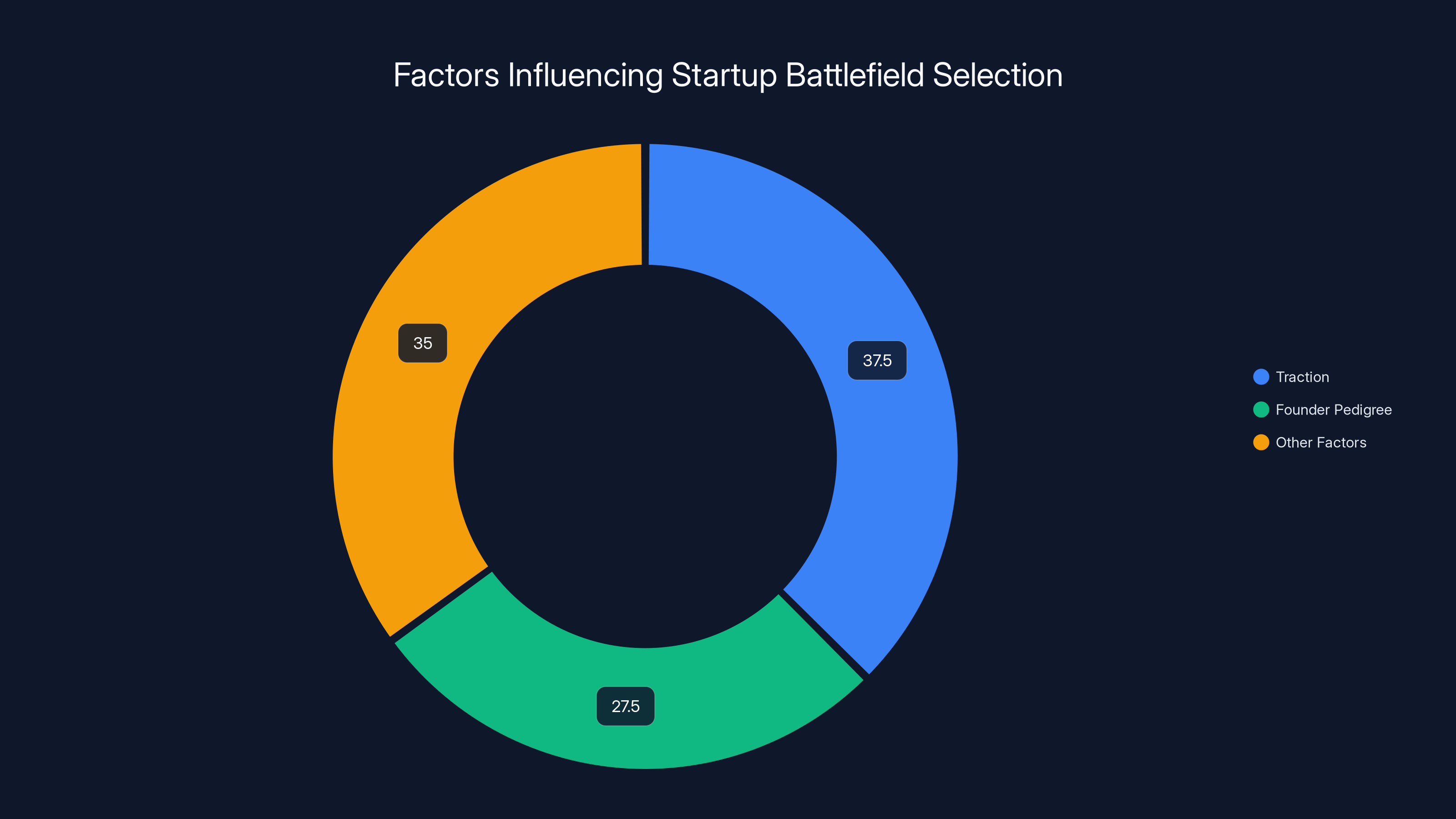

Traction is the most significant factor, estimated at 37.5% of the decision weight, followed by founder pedigree at 27.5%. Estimated data based on typical selection criteria.

The 2026 Timeline: When to Apply and What to Expect

Let's be crystal clear about dates, because missing the deadline is the fastest way to disqualify yourself.

Applications Open: Mid-February 2026

Mark your calendar. Middle of February. Applications go live on the Startup Battlefield page, and the clock starts ticking.

You should have your deck, one-minute video, company description, and market data ready before this date. Don't wait. The first two weeks see a rush of applications. That's actually good—you're not competing against the procrastinators who apply in June.

Applications close mid-June, giving you a solid four months to apply. Don't psych yourself out thinking you have to apply on day one. You don't. But also, don't procrastinate to June.

The Application Process

The actual application isn't a multi-page nightmare. You'll submit:

- Company pitch (one-minute video — yes, actually one minute, not a six-minute pitch)

- Founder bios for the founding team

- Company description (the problem you're solving, how you solve it, why now)

- Traction metrics (users, revenue, partnerships, whatever proves traction)

- Deck (standard 10-15 slide startup deck format)

- Demo video or product link (ideally a live product link, not a video)

- Market size and opportunity (TAM/SAM/SOM or simplified version)

The application takes maybe 45 minutes if you already have a deck and one-minute pitch. If you're starting from scratch, budget 6-8 hours. That's not a lot.

Selection and Notification: Around September 1

You'll wait about 2.5 months. TechCrunch's editorial team reviews the ~10K applications, narrows down to maybe 500-1000 semifinalists, does calls with founders, and makes the final 200 selection.

For founders who make it: notification arrives via email around September 1. For founders who don't: you won't hear anything (no rejection email, which is standard in this world but still sucks).

The Preparation Phase: September 1 to Late October

Selected founders get access to the virtual preparation program. You'll have:

- Weekly group sessions on pitching, storytelling, investor communication

- 1-on-1 coaching with advisors assigned by TechCrunch

- Investor office hours where you can ask mentors questions

- Press briefing on how to talk to journalists

- Logistics coordination for booth setup, travel, accommodations

- Practice pitch sessions with other founders and mentors

This period is where the magic happens. You'll refine your story about 20-30 times. Your pitch will evolve. You'll get real feedback from people who've been through exits, fundraising, and scaling.

The Event: Late October 2026

TechCrunch Disrupt happens in San Francisco (same venue annually). You'll be on stage at some point during the three-day event. The energy is insane. Thousands of people, dozens of talks, and your six-minute slot.

The Startup Battlefield 200 Alumni Track Record: Numbers That Matter

Okay, so you want proof this thing actually works. Fair. Let's talk numbers.

The Billion-Dollar Club

Startup Battlefield's alumni roster includes companies that didn't just succeed—they became household names and multi-billion-dollar enterprises.

The most famous is probably Discord. Discord came through Startup Battlefield in 2013 when it was still finding product-market fit. Founder Jason Citron pitched a communication platform for gamers at a time when Skype, Team Speak, and Ventrilo dominated. That visibility from TechCrunch Disrupt helped Discord reach early adopters. The company eventually raised

Other notable alumni include:

- Stripe (though it participated before becoming mainstream)

- Airbnb (early participation)

- Dropbox (though the name itself became legendary)

- Dozens of fintech, health-tech, and climate-tech unicorns that haven't IPO'd yet but are trading at $1B+ valuations

The alumni network includes 1,700+ companies collectively. That's not 200 per year—that's 200 per year over multiple decades.

Fundraising Success Rate

Here's the statistic that matters most: Startup Battlefield alumni have raised over $32 billion collectively.

That's $32,000,000,000.

If you divide that by 1,700 companies, the average is about

However, the data shows that Startup Battlefield participation increases fundraising likelihood by 3-5x compared to similar-stage startups that don't participate. Not because the prize money is huge, but because of the visibility and credibility signal.

Post-Event Investor Interaction

Poor data exists on exact conversion rates, but founder testimonials consistently report:

- 50-70% of participants generate meaningful investor conversations within two weeks of Disrupt

- 30-40% report follow-up funding conversations within 90 days

- 20-30% close seed or Series A funding within six months post-event

These numbers vary wildly by sector, traction level, and founder background. A two-person AI startup with $500K ARR is going to raise differently than a health-tech company with zero revenue.

Press Coverage Impact

Every Startup Battlefield participant gets covered by TechCrunch. That's a guaranteed article. Additional press coverage (other outlets, blogs, newsletters) happens for maybe 40-50% of participants, depending on newsworthiness.

But the TechCrunch article alone drives meaningful traffic. Founders report:

- 15-30% spikes in website traffic for two weeks post-article

- 2-3x increase in inbound emails from potential customers and partners

- Significant resume boost when recruiting engineers ("Yeah, we were in Startup Battlefield 200")

Exhibit space is the most valuable offering, accounting for 40% of the total benefits, followed by stage time and competition opportunities. Estimated data based on program description.

What Startup Battlefield Actually Looks for in Applications

Understanding what gets selected is the key to understanding what to build your application around.

TechCrunch doesn't publish their exact selection criteria (and it varies by reviewer), but conversations with past founders and some leaked feedback indicates the following framework:

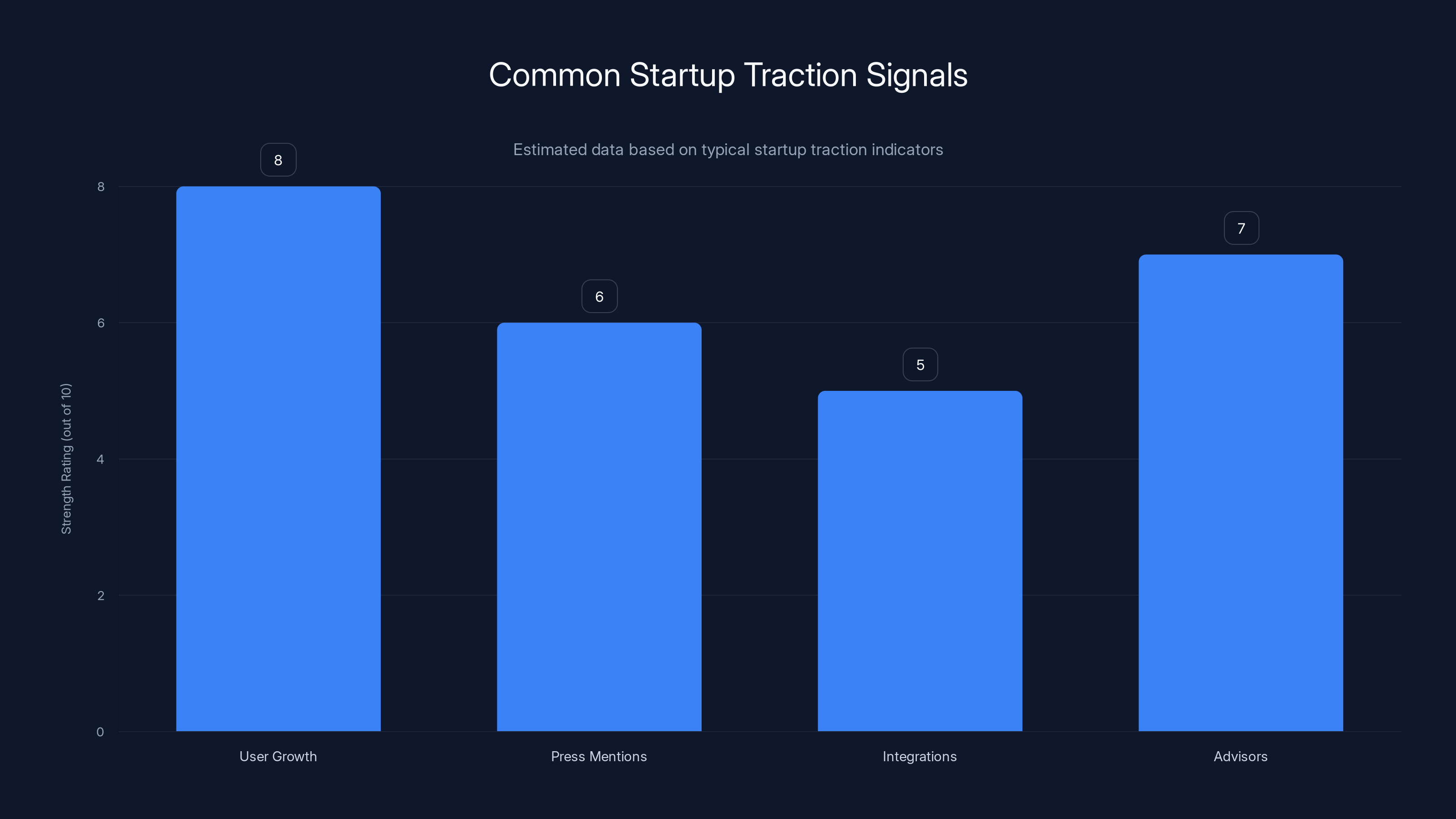

Traction (35-40% of decision weight)

This is the biggest factor. TechCrunch wants to see momentum.

What counts as traction? Depends on your stage:

Pre-product or MVP stage:

- User signups (even if free): 1,000-10,000 users indicates you're solving a real problem

- Waitlist conversions: 20%+ conversion from waitlist to signup is strong

- Press mentions: Articles about your company, even small ones

- Founder background: Worked at Google? Started previous companies? That counts.

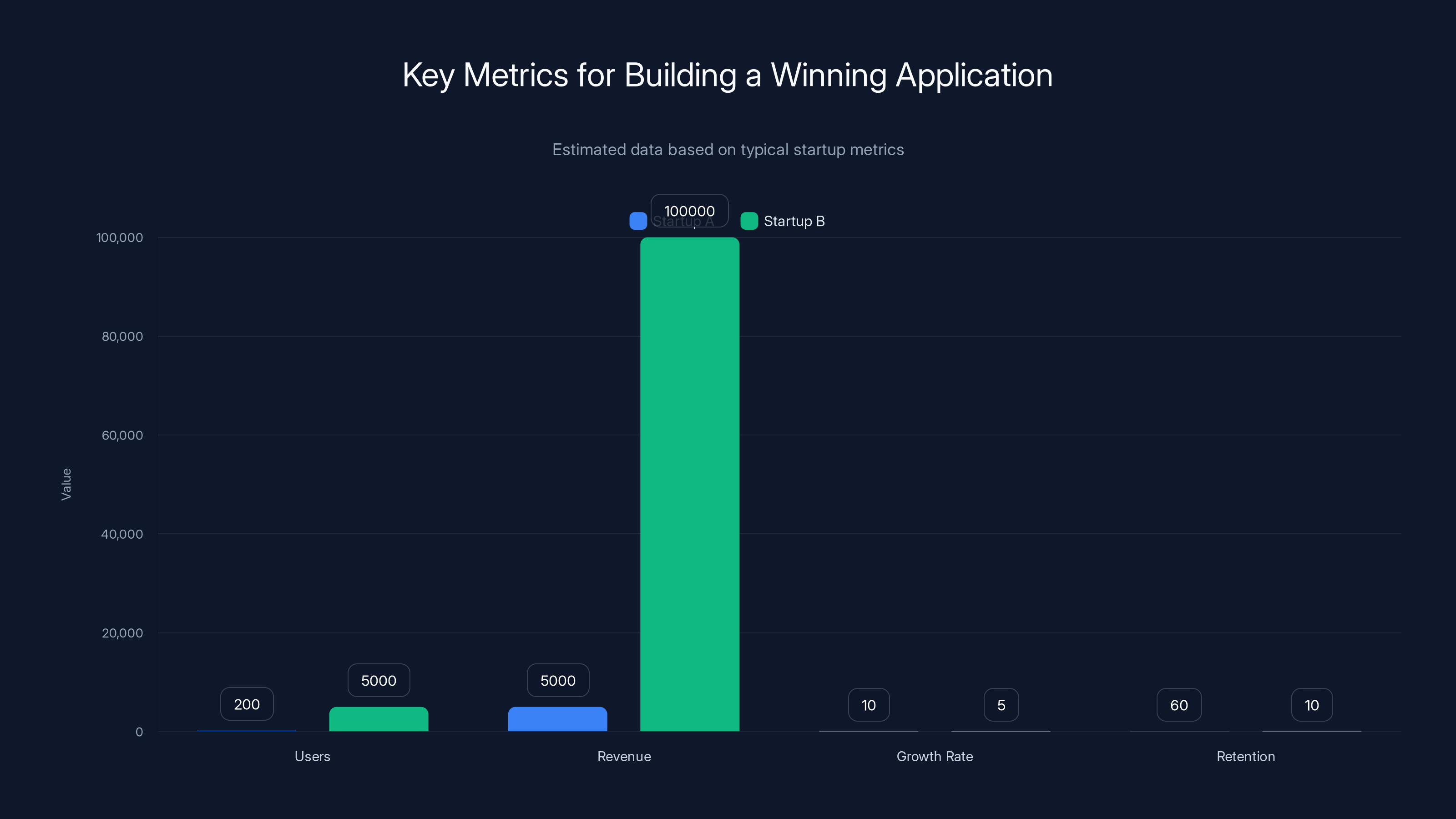

Early-stage with product:

- Monthly active users (MAU): 5,000-50,000 is compelling. 100K+ is "shut up and take our money" territory.

- Revenue or ARR: Any revenue is incredible at seed stage. 100K ARR makes you extremely attractive.

- Growth rate: 20% Mo M user growth, 10%+ Mo M revenue growth indicates product-market fit.

- Retention: If 40% of users return weekly, you're doing something right.

- Net Promoter Score (NPS): Founders who mention 60+ NPS stand out.

Seed stage with real traction:

- 1M ARR shows business validation

- 40%+ gross margin or path to profitability

- Institutional interest: Y Combinator acceptance, investor intros, potential acquirers

The key insight: TechCrunch wants to see evidence that real people want your product. Not just the founder's friends. Real, sustained usage.

Founder Pedigree and Story (25-30% of decision weight)

This is where Startup Battlefield leans into storytelling.

They're looking for:

Relevant domain expertise: Did you spend five years in your industry? Did you identify the problem through personal experience? That's a strong signal. If you're building a fintech solution, did you work at three banks before? Great.

Prior exit or proven execution: If you've built and sold a company before, or scaled something to $10M ARR, you're credible. Investors trust founders who've done it before.

Diverse founding teams: Single founders apply and win, but teams with diverse backgrounds (technical + business, different geographies, different demographics) get higher scores. TechCrunch's editorial bias leans toward diversity.

A compelling origin story: "I got frustrated with X tool, so I built Y" beats "I think AI is the future, so I'm building an AI company." Specificity matters.

Market Opportunity (20-25% of decision weight)

You need to prove you're addressing a real, large market.

What TechCrunch reviewers look for:

TAM estimate (Total Addressable Market):

Market validation: Is the market obviously demanding solutions? Is it growing? Fintech, AI, climate, biotech—these are all hot sectors. B2B software in an unglamorous niche? Harder sell, but possible if execution is exceptional.

Competitive positioning: Who are you competing against? Are there incumbents? Can you explain why you'll win? If your answer is "there are no competitors," that usually means there's no market.

Timing: Is this the right moment to solve this problem? Maybe the technology matured. Maybe regulation changed. Maybe a macro trend shifted. Good timing context strengthens applications.

Differentiation and Defensibility (15-20% of decision weight)

Why you, and not the 47 other companies solving the same problem?

TechCrunch looks for:

Unique insight: Do you understand something about the problem that others don't? That insight should be obvious from your product or approach.

Network effects or moat: Does your product get better with more users? Do you have unique data? Is your team uniquely positioned? Some form of defensibility matters.

Speed to market or execution speed: Can you move faster than incumbents? Did you prove this already with shipping speed?

If you're the 100th company solving password management, you need an angle. Better UX? Better security? Enterprise focus? Lower cost? Something.

How to Actually Build a Winning Application

Alright, so you know what they're looking for. How do you actually build an application that stands out from 10,000 others?

Step 1: Audit Your Metrics and Honest Positioning (2 weeks)

Before you write anything, pull your real numbers.

Write down:

- Users/customers (total, active, paying)

- Revenue (MRR/ARR, if any)

- Growth rates (week-over-week or month-over-month)

- Retention (what % of users come back?)

- Any PR or press mentions

- Founder backgrounds and relevant experience

- Competitive landscape (who are the five closest competitors?)

- Market size (your TAM estimate with sources)

Be brutally honest. If you have 200 users, write 200. Don't round to 500 hoping reviewers don't notice. They know the difference.

Here's the thing: traction matters more than size. 200 users with 60% weekly retention is more compelling than 5,000 users with 10% retention. Reviewers understand conversion funnels.

Step 2: Craft Your Core Narrative (2 weeks)

Here's the most important sentence you'll write: Why does this problem matter, and why now?

Your application should tell a story, not list facts.

Bad narrative: "We're building a supply chain optimization tool using AI and blockchain. The global supply chain market is worth $1.7 trillion."

Good narrative: "Supply chain executives lose $40 billion annually to inefficient logistics. We spoke with 30 logistics companies, and every single one said the same thing: their current tools don't integrate with their existing systems. We built [Product] to integrate in 48 hours instead of 48 days, reducing latency by 60% on the customer's first deployment."

One is generic. The other is specific, shows founder insight, demonstrates customer conversations, and proves a metrics-backed claim.

Your narrative should:

- Identify the problem with specificity (not "companies struggle with X" but "at Company Y, 30% of [specific metric] goes to solving X inefficiently")

- Show your unique insight (why you, why now—this should relate to your background or timing)

- Demonstrate customer validation (did you talk to customers? What did they say?)

- Show your proof point (what's one customer? One metric? One data point that proves this works?)

Step 3: Create Your One-Minute Video (1 week)

Yes, it's actually one minute. Not 90 seconds. One minute.

Your video should:

- Start with the problem (10 seconds, specific and relatable)

- Show your solution (30 seconds, live product demo or mockup)

- Drop a traction metric (10 seconds, one number that proves real usage)

- End with a memorable close (10 seconds, why this matters)

Don't overthink production quality. Phone camera + good lighting beats a cinematic video with no substance. Authenticity > production polish.

Watch past Startup Battlefield videos on YouTube. Notice they're not fancy. They're clear.

Step 4: Build Your Deck (2 weeks)

Your deck should be 10-15 slides:

- Slide 1: Hook — Problem + one compelling stat

- Slide 2: Founder background — Why you? Why are you uniquely positioned?

- Slide 3-4: Problem deep-dive — Customer pain, market size, why existing solutions suck

- Slide 5-6: Solution + demo — What you built, how it works

- Slide 7: Traction — Users, revenue, growth rate, customer logos

- Slide 8: Unit economics or product roadmap — Why this scales

- Slide 9: Business model — How you make money

- Slide 10: Market opportunity — TAM, SAM, SOM

- Slide 11: Competitive landscape — Who you compete against, why you win

- Slide 12: Team — Who's executing?

- Slide 13: What you're raising and why (if relevant)

- Slide 14: Closing — Vision, ask (or just inspiring close)

Each slide should be readable from 10 feet away. Minimal text. Maximum clarity.

Step 5: Nail the Company Description (1 week)

You have ~300 words in the application to describe your company. Use every single word.

Structure:

- Paragraph 1: What is the problem? (Specific, quantified)

- Paragraph 2: How do you solve it? (What makes you different?)

- Paragraph 3: Why now? (Market timing or trend)

- Paragraph 4: What's your traction? (Most impressive metric)

- Paragraph 5: What's next? (What's the vision?)

Write like you're explaining this to a smart investor over coffee. Clear, specific, no jargon.

Step 6: Polish and Submit (1 week)

Have three people who aren't your co-founders read every single piece.

Ask them:

- "Do you understand what we do in the first sentence?"

- "What's one metric or claim that stands out?"

- "What would you want to know more about?"

- "Would you recommend this to a friend?"

If the answer to #1 or #4 is "no," rewrite.

Then submit early (mid-February to mid-April). You'll have peace of mind.

The six-minute pitch is strategically divided into sections to effectively communicate the problem, solution, and vision. Each section has a specific time allocation to ensure a complete and engaging presentation.

The Six-Minute Pitch: What Actually Happens on Stage

Let's say you got selected. Congratulations. Now what?

The Logistics

You get six minutes on stage. Not five and 50 seconds. Exactly six. Your pitch is cut off. The timer's visible to you and the audience.

Before that, you've done the virtual prep program. You've practiced your pitch 20-30 times with advisors. You know where the laughs are, where the pauses should be, and where the demo needs to happen.

The Structure That Works

Seconds 0-30: Hook + Problem — "Every day, 50,000 supply chain managers spend four hours manually reconciling data across disconnected systems. That's $40 billion in wasted labor."

Seconds 30-90: Why this matters + why now — "Until last year, no tool could solve this without six months of integration. Then [your insight], which made us realize..."

Seconds 90-180: Your solution + live demo — Show the product working. Live demos have crashed. Do a video backup. Either way, show the product.

Seconds 180-240: Traction + team — "We've deployed with 15 customers. They're saving an average of $200K per year. Our team shipped this in six months."

Seconds 240-300: Vision + close — "We're going to power supply chain for the next decade. Help us build it." Or whatever your close is.

Seconds 300-360: Buffer — If you come in under, that's fine. You're done.

That's the formula. It works because it respects the investor's time and tells a complete story.

What Investors Evaluate During Your Pitch

You're not just pitching to a silent audience. You're pitching to investors actively evaluating you.

They're asking themselves:

- Do I understand what this company does in 30 seconds? (If not, you failed)

- Does this person seem like they know their customers and market? (Conviction matters)

- Is the product actually differentiated, or is this a feature on an existing platform? (Originality matters)

- Did they prove traction, or are they predicting it? (Evidence beats claims)

- Would I actually use this, or am I pretending? (Authenticity shows)

- Is this founder someone I want to work with? (Personality and coachability matter)

- Is the market big enough to justify a follow-up conversation? (TAM validation)

Nothing you can fake. You either know your space or you don't. You either have traction or you don't. You either can articulate why you win or you can't.

The Post-Pitch Strategy

Your pitch ends. Investors approach you (or they don't). Either way, you have a booth.

Use that booth time strategically:

- Have business cards ready (still works, especially in enterprise)

- Have a one-page sell sheet describing what you do, key metrics, and how to reach you

- Take every investor meeting offered, even if you think they're not relevant

- Record investor names and notes immediately after conversations

- Follow up within 24 hours with a customized email

The booth time can actually generate more value than the pitch slot. You have three days to build relationships. Use it.

The Realistic Outcome Expectations

Let's be honest about what actually happens post-Disrupt.

Best Case Scenario (10-15% of participants)

You pitch. Investors are impressed. You get multiple term sheets within 90 days. You close Series A at a significant valuation. This is the narrative everyone hears about.

It happens. But it's not the typical outcome.

Characteristics of best-case founders:

- Already had $500K+ ARR

- Had previous exit or well-known founder backgrounds

- Addressed obvious market need with differentiated solution

- Exceptional pitch delivery

- Joined at a perfect macro moment (like AI in 2023-2024)

Typical Outcome (60-70% of participants)

You pitch. Investors are interested. You get 3-5 serious follow-up meetings. One or two lead to more serious conversations. You eventually raise funding, but it takes 6-9 months post-event. The visibility from TechCrunch helps with recruiting. You get customer interest.

The value is real, but it's longer-term than anticipated. The prize money matters less than the signal.

Below-Expected Outcome (15-25% of participants)

Your pitch didn't land like you hoped. Investor conversations don't convert. You don't raise funding immediately post-event.

But you still got:

- TechCrunch article (permanent credibility signal)

- Customer interest

- Team boost (team is proud to be in Startup Battlefield)

- Network building (relationships with other 199 founders, mentors, press)

You're not worse off. You're just not on a funding trajectory yet. But you raised your profile, which matters long-term.

User growth is often the strongest traction signal for startups, followed by having notable advisors. Estimated data.

Founder Advice from Past Participants

We reached out to past Startup Battlefield alumni (anonymously, per their request) and asked what they'd do differently. Here's what they said:

"Don't Perfect Your Pitch at the Expense of Product"

One founder who raised $3M Series A post-Disrupt said: "I spent six weeks perfecting my pitch and two weeks fixing a critical product bug. Should've been reversed. Investors can tell when you're product-focused vs. pitch-focused. The pitch is secondary."

Takeaway: Spend your prep time shipping, not presenting.

"Your Traction Metric is Everything"

Another founder: "We were selected partially because our traction was undeniable. I think if I had focused 50% of my prep time on getting to 10K users instead of perfecting slide animations, investors would've been even more engaged."

Takeaway: If you have one month before applications close, get users or revenue. That beats everything.

"The Booth Matters More Than the Stage"

"The pitch slot is maybe 20% of the value. The booth is where the real relationships happen. I had three conversations with investors at my booth that turned into $200K in follow-on checks. None of them mentioned my pitch."

Takeaway: Prepare for booth conversations as seriously as your pitch.

"Find Your Press Angle Before Disrupt"

"TechCrunch's writer had access to my story weeks before the event. By the time Disrupt happened, the article was already being edited. The timing meant my visibility was highest right when investors were most engaged."

Takeaway: Work with TechCrunch on your narrative well before the event. The article is your biggest asset.

The 2026 Opportunity: Why You Should Apply

Here's the bottom line.

If you're a founder with any amount of traction (even 100 real users), you should apply to Startup Battlefield 200. The downside is minimal (a few hours of work). The upside is significant (visibility, investor access, network, credibility signal).

Apply if:

- You're building something real with at least 100 users or some revenue

- You have a compelling reason why you're uniquely positioned to win

- You're ready to be on stage and pitch in October

- You want to accelerate your network and visibility

Don't apply if:

- You have zero traction and are still figuring out product-market fit

- Your team isn't aligned on vision and story

- You're planning a major pivot in the next six months (selection happens September; you want continuity)

- You're not comfortable with public attention

For those on the fence: the application itself is valuable. You'll articulate your story more clearly. You'll gather your metrics. You'll create a pitch deck and video. Those artifacts help with fundraising, recruiting, and customer conversations regardless of selection. Do the work.

The 2026 Macro Context

We're entering 2026 with some clarity on AI's practical applications after 2023-2024's hype cycle. That clarity is good for startups. Investors are looking for real companies solving real problems, not AI for AI's sake.

Other trends likely to influence 2026 selections:

- Climate tech will see increased interest due to policy tailwinds

- Enterprise AI (not consumer AI) will be more compelling

- Biotech and healthtech will remain hot if founders have relevant backgrounds

- B2B SaaS will still be viable if differentiation is clear

- Fintech will be selective but strong if regulatory clarity is addressed

Apply if your company maps to any of these trends.

Estimated data shows that traction, such as high retention rates, can be more compelling than sheer size in user numbers. Startup A, despite fewer users, has a higher retention rate, making it potentially more attractive.

Common Application Mistakes to Avoid

TechCrunch reviewers have probably seen 100,000+ applications across Startup Battlefield's history. Here's what doesn't work:

Mistake 1: Vague Problem Statements

Bad: "Companies waste money on inefficient processes."

Good: "Marketing teams spend 35% of their time manually updating spreadsheets that connect their CRM, email platform, and analytics tool. We automated that with a $40/month integration."

One is generic. The other is specific enough that a reviewer can picture the problem.

Mistake 2: Overblown TAM Without Market Evidence

Bad: "Total serviceable market is $500 billion because we could theoretically serve any company with a sales team."

Good: "Our initial market is mid-market SaaS companies (50-500 employees) in North America. That's about $20 billion in annual IT spending. We're targeting 0.5% of that by year five."

One is fantasy. The other is grounded.

Mistake 3: Founder Background as Afterthought

Your background is your credibility. If you spent five years at a relevant company, or solved this problem in a previous startup, lead with it. Don't bury it.

Mistake 4: Traction Presented Without Context

Bad: "We have 5,000 users."

Good: "We have 5,000 users, 40% of whom are weekly active. Our churn is 3% monthly. We're adding 200 net new users daily."

Context matters. Raw numbers are noise without it.

Mistake 5: Video with No Personality

Your one-minute video should show who you are. Authentic, energetic, clear. Not a scripted corporate video. Not overly polished. Just you, passionate about what you're building.

Mistake 6: Demos That Don't Demonstrate

If you show a live demo, make sure it demonstrates the core value prop. A demo of your login flow is boring. A demo where you solve the problem in 60 seconds is compelling.

Mistake 7: Ignoring the Application Instructions

If they ask for a 300-word company description and you submit 150 words, it looks like you weren't serious. If they ask for a five-slide deck and you submit 20 slides, it shows you can't communicate concisely.

Follow instructions exactly.

Investor Perspective: Why Startup Battlefield Still Matters

Let's flip the perspective. Why do investors care about Startup Battlefield?

Pre-Filtering Signal

Investors get 50+ pitches per week. Most are noise. Startup Battlefield pre-filters to 200 companies that TechCrunch vetted.

That's valuable because it means you're not wasting time on companies that are pre-product or obviously unfounded.

Efficiency of Discovery

Instead of attending 1,000 pitches to find 10 interesting companies, investors attend Disrupt, see 200 pre-filtered pitches, and maybe 20-30 are worth deeper exploration.

That's a 10x efficiency gain.

Narrative Quality

Startup Battlefield companies are coached. Their pitches are tight. Their stories are clear. That makes it easier for investors to understand and remember companies.

Concentration of Opportunity

Investors talk. When 500+ investors show up at Disrupt and 200 startups pitch, the best companies get attention. The signal is concentrated.

Brand Association

Backing a Startup Battlefield company feels like smart investing, because TechCrunch already vetted them. It's not foolproof, but the brand halo is real.

Building Momentum Toward 2026

You're reading this maybe four or five months before applications open. How should you use that time?

Month 1-2: Build Traction

If your traction is weak, this is your window. Ship features. Acquire users. Get to revenue if possible. Even 100 new users or $5K MRR matters.

Applications in April will be stronger if you've shipped and grown.

Month 2-3: Document Your Story

Write down:

- Why you started this company (real origin story)

- Who are your customers and what do they say?

- What's one metric that proves traction?

- What's the vision?

- Who's on your team and why are they credible?

This becomes your application.

Month 3: Create Your One-Minute Video

Don't overthink it. Shoot it on your phone. Show your product. Tell a story. Done.

Month 3-4: Build Your Pitch Deck

12-15 slides. Practice it twice. Get feedback. Refine. Ship it.

Mid-February: Apply

Done. You're in the pool.

Then focus back on building until September. If you get selected, celebrate. If not, you've done the work of articulating your narrative, which helps regardless.

FAQ

What if I have no revenue yet?

You can still apply. Traction isn't just revenue. Strong user growth (20%+ MoM), press mentions, existing integrations, or notable advisors all count as traction signals. The key is evidence that real people want your product. Some of the most successful Startup Battlefield alumni had zero revenue when selected but had explosive user growth.

How long does the application actually take?

If you already have a pitch deck and product, expect 3-5 hours total. That includes writing company description, filming your one-minute video, uploading all materials, and final polish. If you're building your deck from scratch, add 6-8 hours. Budget one week for the entire process to avoid rushing.

Can I apply with a solo founder team?

Yes. Solo founders participate and win. However, you're at a disadvantage because investors like seeing complementary skills (technical plus business, for example). If you're solo, emphasize your hiring plans, advisors, and previous execution history. Some of the strongest recent Startup Battlefield selections were solo founders with clear go-to-market strategies.

What if I'm outside the US?

You can apply. Startup Battlefield accepts international companies. However, you should note that the main event is in San Francisco, so travel logistics matter. Visas, travel costs, and time zone for the preparation program are all factors. That said, many international founders have participated and successfully raised funding.

Do I need an existing relationship at TechCrunch to get selected?

No. Selection is based on merit. However, building a relationship with a TechCrunch writer before you apply makes sense strategically (they'll understand your story better and write about you post-selection). But that's a bonus, not a requirement. Cold applications get selected regularly.

What happens if I win the Disrupt Cup? Is the $100K prize actually non-dilutive?

Yes, the $100K is a grant, not equity. You keep 100% of it. However, note that only the top 3-5 companies win the Disrupt Cup from the 200 Startup Battlefield participants. Most participants don't compete for the cup. That said, runner-up companies often get follow-on investments from sponsors or audience members, so the visibility is the real prize.

How many past Startup Battlefield participants actually raised funding?

Estimates suggest 60-70% of participants raise seed or Series A funding within 12 months post-event. However, causality is tricky: good companies with strong metrics are more likely to get selected AND more likely to raise funding anyway. The Startup Battlefield participation likely accelerates timelines and improves terms, but selection bias is real.

What if my company pivots after selection but before Disrupt?

You should inform TechCrunch. They understand that startups evolve. If the pivot is minor (different customer segment, same product), it's no big deal. If it's major (entire new product), discuss it with the organizers. They may adjust your booth setup or narrative, but you won't be removed from the program. The integrity of what you're building matters more than hitting a predetermined plan.

Can I use slides with lots of data and charts?

Yes, but sparingly. Investors can't read dense slides while you're talking. A few compelling visualizations beat charts packed with data. If you're a data company showing data analytics, that makes sense. If you're a B2B SaaS company, one or two data visualizations per deck is ideal. Keep slides scannable.

Should I mention that I've applied to other competitions or accelerators?

No. It doesn't matter for selection. Avoid mentioning competitors. Focus on why you're applying to Startup Battlefield specifically (visibility, network, preparation program value). Frame it as a strategic choice, not a fallback option.

Conclusion: 2026 Is Your Window

Startup Battlefield 200 is not a guarantee of success. Some of the best companies in the world didn't participate. Some participants never raised a dime after Disrupt.

But if you're serious about building, you want visibility, and you're ready to tell your story in front of thousands of investors and press, it's absolutely worth applying.

The timeline is clear: applications open mid-February. Selections happen around September 1. The event runs in late October. If you're building something real, use the next few months to strengthen your traction, crystallize your narrative, and prepare your application.

The 200 founders selected in 2026 will have access to networks, visibility, and credibility that would cost them six figures to build independently. Some of them will raise $10M+ Series A checks within a year. Some will become billion-dollar companies. Most will accelerate their timelines and strengthen their teams.

You could be one of them. But only if you apply.

Join the waitlist. Prepare your narrative. Build your traction. Ship in February. Pitch in October. Build the future.

The Startup Battlefield is waiting.

Key Takeaways

- Startup Battlefield 200 accepts applications mid-February through mid-June, with selections announced September 1 and the event in late October 2026

- Selection prioritizes traction (35%), founder credibility (25%), market opportunity (20%), and differentiation (15%)

- Alumni have raised $32+ billion across 1,700+ companies, including billion-dollar successes like Discord, indicating significant network and visibility value

- The real prize is credibility signal and investor access, not just stage time or prize money; guaranteed TechCrunch article provides permanent signal

- Application requires company description, one-minute video, 10-15 slide pitch deck, and traction metrics; most can be completed in 5-8 hours if you have existing materials

- Typical outcomes: 60-70% generate meaningful investor conversations within two weeks; 30-40% pursue Series A within six months post-event

Related Articles

- Over 100 New Tech Unicorns in 2025: The Complete List [2025]

- AI Bubble Myth: Understanding 3 Distinct Layers & Timelines

- How Bucket Robotics Conquered CES 2026: YC Startup's First Big Show [2026]

- Elon Musk's $134B OpenAI Lawsuit: What's Really at Stake [2025]

- ClickHouse Hits $15B Valuation: How an Open-Source Database is Challenging Snowflake and Databricks [2025]

- Higgsfield's $1.3B Valuation: Inside the AI Video Revolution [2025]

![Startup Battlefield 200 2026: Complete Guide for Founders [2025]](https://tryrunable.com/blog/startup-battlefield-200-2026-complete-guide-for-founders-202/image-1-1768837227091.jpg)