Epic and Google's $800M Secret Deal: What It Means for Android

Last year, when a federal judge revealed that Epic Games and Google had struck a confidential deal worth $800 million over six years, the gaming and tech worlds collectively blinked. A partnership that was supposedly secret had just become public record in a San Francisco courtroom. And the implications? They're still unfolding.

This wasn't just any business agreement. The deal tied directly to the epic (pun intended) legal battle between Epic Games and Google over app store practices on Android, one of the most consequential antitrust cases facing the tech industry. The settlement arrangement that emerged from the broader litigation was partly contingent on this mysterious partnership actually happening. Judge James Donato had questions about whether Epic was getting something valuable enough to soften its demands for broader Android ecosystem reforms.

What makes this story fascinating isn't just the dollar amount—it's the silence around it. Both Epic and Google fought hard to keep the details buried. The judge only dragged them into the light because he worried the deal might constitute a "quid pro quo" that could undermine the entire settlement's credibility. If Epic was being bought off with a lucrative services contract, how could the judge trust that the company was negotiating in good faith on behalf of developers?

Let's dig into what actually happened here, why it matters, and what it reveals about the future of Android and mobile app distribution.

The $800 Million Question: Breaking Down the Deal

When Judge Donato first mentioned the "

Specifically, Sweeney testified that Epic had "decided against Google" in previous years for certain infrastructure or software needs, but in this new arrangement, the company would be "using Google at market rates." That's a significant strategic shift for a company that's famously competitive and protective of its technological independence.

The catch? Sweeney refused to fully explain what services Epic was actually buying. He started to reference how "Epic's technology is used by many companies in the space Google is operating in to train their products," suggesting Google wanted access to Unreal Engine for AI training purposes. Then he hit pause: "Sorry, I'm blowing this confidentiality."

That moment revealed the tension at the heart of this whole arrangement. The companies clearly have a business deal they believe is valuable and strategic. But they've also treated the specifics like classified military intelligence. The judge only extracted fragments of information through direct questioning.

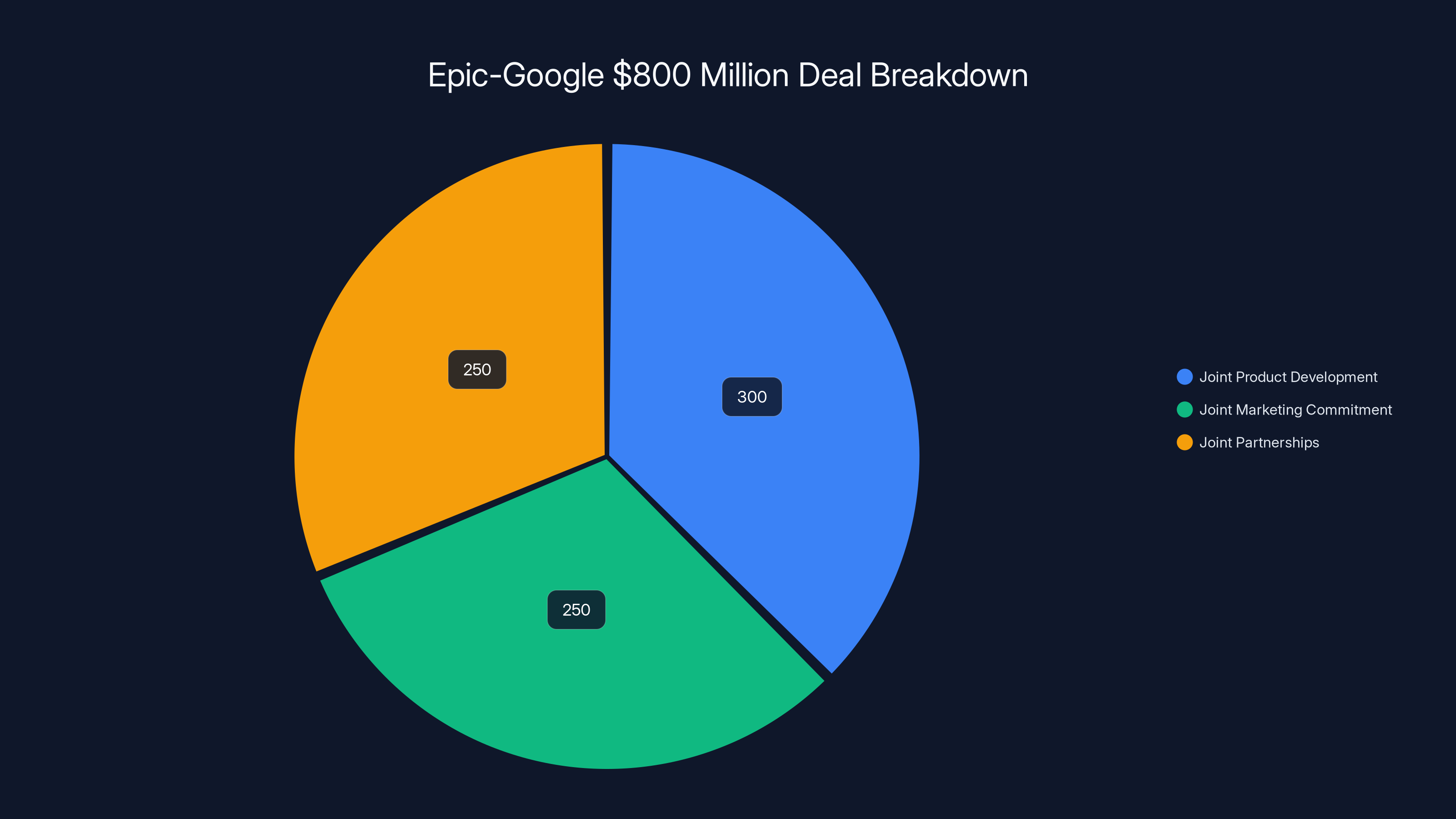

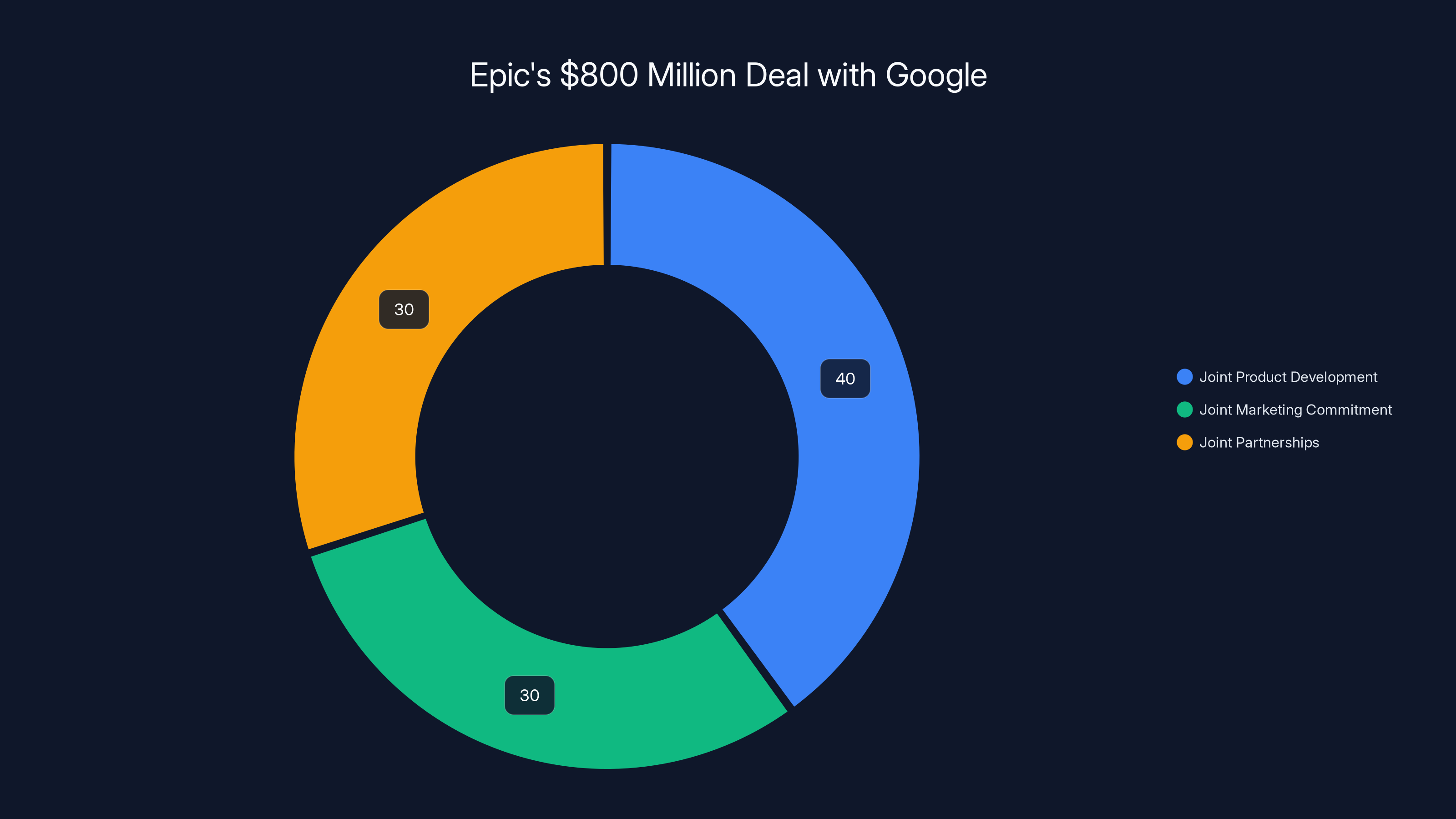

What we do know: the deal involves "joint product development, joint marketing commitment, and joint partnerships." Google apparently plans to use "Epic's core technology" more directly than before. In return, Epic gets money flowing to its bottom line. But characterizing it as a simple vendor relationship doesn't capture the full picture.

The timing is everything here. This deal was apparently contingent on the settlement agreement moving forward. If the judge had rejected the broader antitrust settlement, the $800 million partnership would likely never happen. That's why the judge worried it might influence Epic's negotiating position. Would Epic fight as hard for other developers if it already had a massive cash infusion waiting in the wings?

Estimated allocation of the $800 million deal suggests a balanced focus on product development, marketing, and partnerships. Estimated data.

The Antitrust Context: Why This Deal Matters So Much

You can't understand the significance of the Epic-Google partnership without understanding what Epic has been fighting for over the past two years. The company launched its lawsuit against Google (and separately against Apple) over app store practices, arguing that the tech giants maintain illegal monopolies over how apps are distributed and how payments are processed on their platforms.

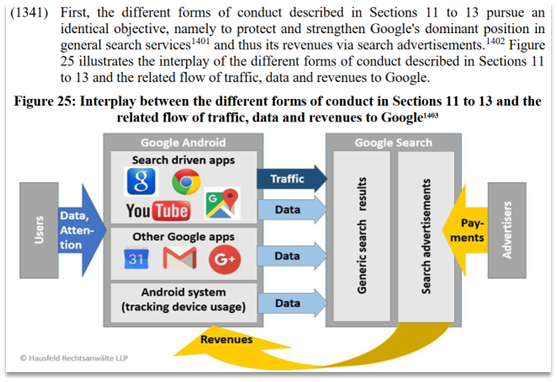

In the Android case specifically, Epic argued that Google's app store practices violated antitrust law by:

- Forcing developers to use Google Play's billing system and taking a 30% commission

- Preventing alternative app stores from competing fairly

- Using exclusionary contracts with manufacturers

- Leveraging its control of Android itself to advantage Google Play

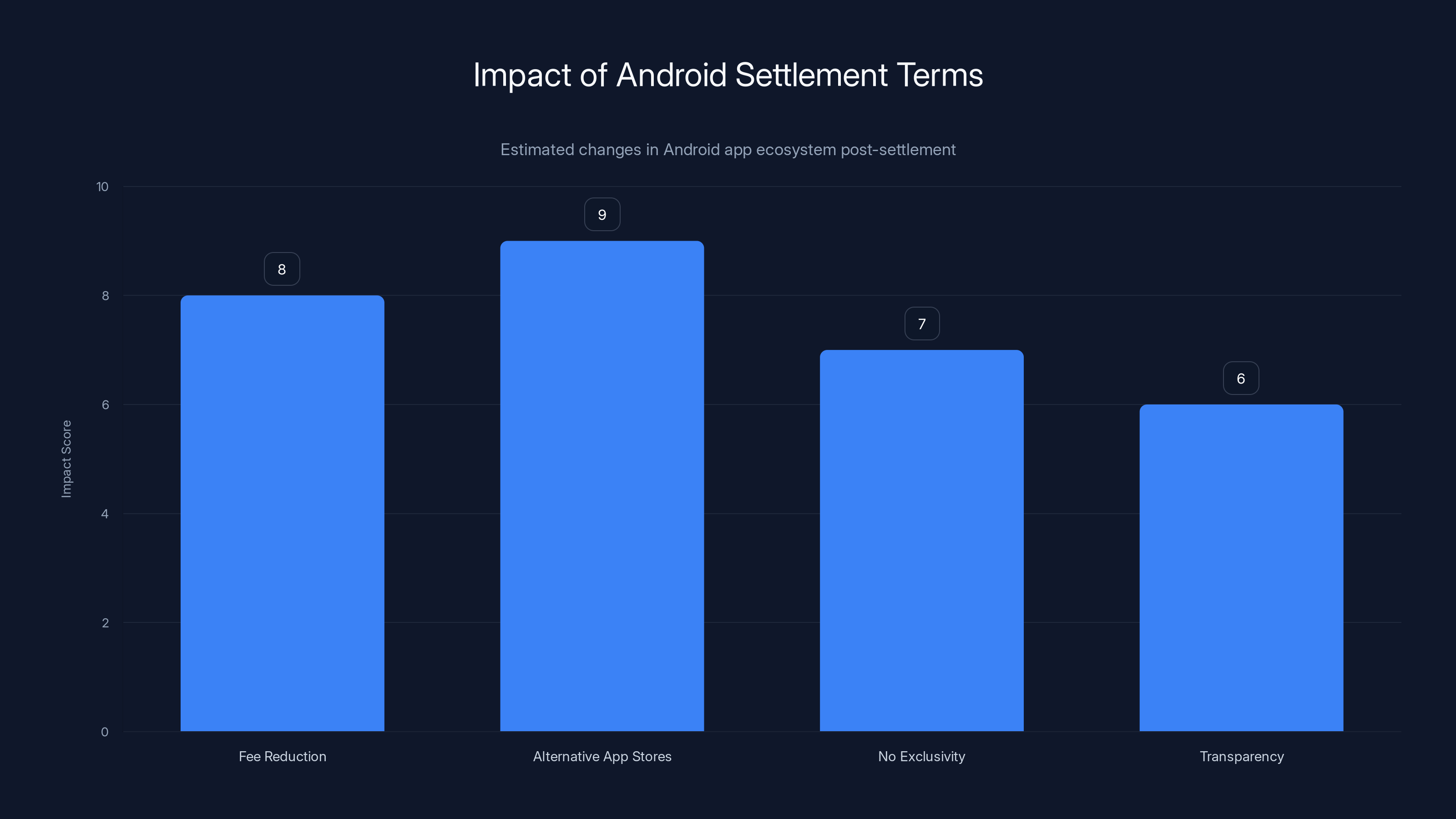

The settlement that emerged from Epic's lawsuit requires Google to make significant changes. The company must reduce its app store fee from 30% to 15% for most developers (matching what Apple offers). It must allow alternative app stores to be installed with a single tap. It must stop requiring exclusivity deals with phone manufacturers.

These are seismic changes to how Android works. If enforced, they fundamentally reshape the mobile app ecosystem. Smaller developers get breathing room. Companies like Samsung, One Plus, and other phone makers can build competing app stores. Fortnite itself could return to Android without going through Google Play.

But here's where the $800 million deal gets sticky. If Epic has already secured a multibillion-dollar payday from Google in the form of services and partnership value, does the company still care whether those broader reforms actually stick? Would Epic potentially weaken its oversight of Google's compliance? Might the company be less aggressive about enforcing the settlement terms?

Judge Donato's skepticism was founded in real precedent. Tech companies have used financial partnerships to resolve regulatory disputes before. A company that receives money might become less motivated to enforce provisions that harm the company writing the checks.

The settlement terms are expected to significantly impact the Android ecosystem, with the introduction of alternative app stores having the highest potential impact. Estimated data.

Tim Sweeney's Defense: "I Don't See Anything Crooked Here"

When Judge Donato pressed the issue directly, asking whether the partnership could constitute a "quid pro quo" arrangement that softened Epic's demands, Sweeney pushed back hard. His response was characteristically blunt: "I don't see anything crooked about Epic paying Google off to encourage much more robust competition than they've allowed in the past."

That framing is crucial. Sweeney isn't denying the strategic value of the deal. He's arguing that the deal is actually aligned with competition, not opposed to it. From his perspective, Epic spending $800 million with Google represents a massive transfer of wealth to Google, not the other way around. Epic is literally paying for the privilege of using Google's services. That's not a bribe; that's a business transaction.

Moreover, Sweeney pointed out that the Epic Games Store won't receive any special treatment on Android as a result of this deal. The settlement terms apply equally to Epic's store and to any other third-party store. Epic isn't getting preferential status. It's just paying Google for services like everyone else.

But Sweeney also made a revealing admission: he expects the settlement and the business deal to be intrinsically linked. He told Judge Donato that he considers them "an important part of Epic's growth plan for the future." That's not the language of separable transactions. That's the language of a package deal.

The question becomes: would Epic have pursued the Android settlement as aggressively if it hadn't secured the $800 million partnership in parallel? We'll never know for certain, but the fact that Sweeney framed them as connected suggests the answer might be no.

What Services Is Google Actually Buying?

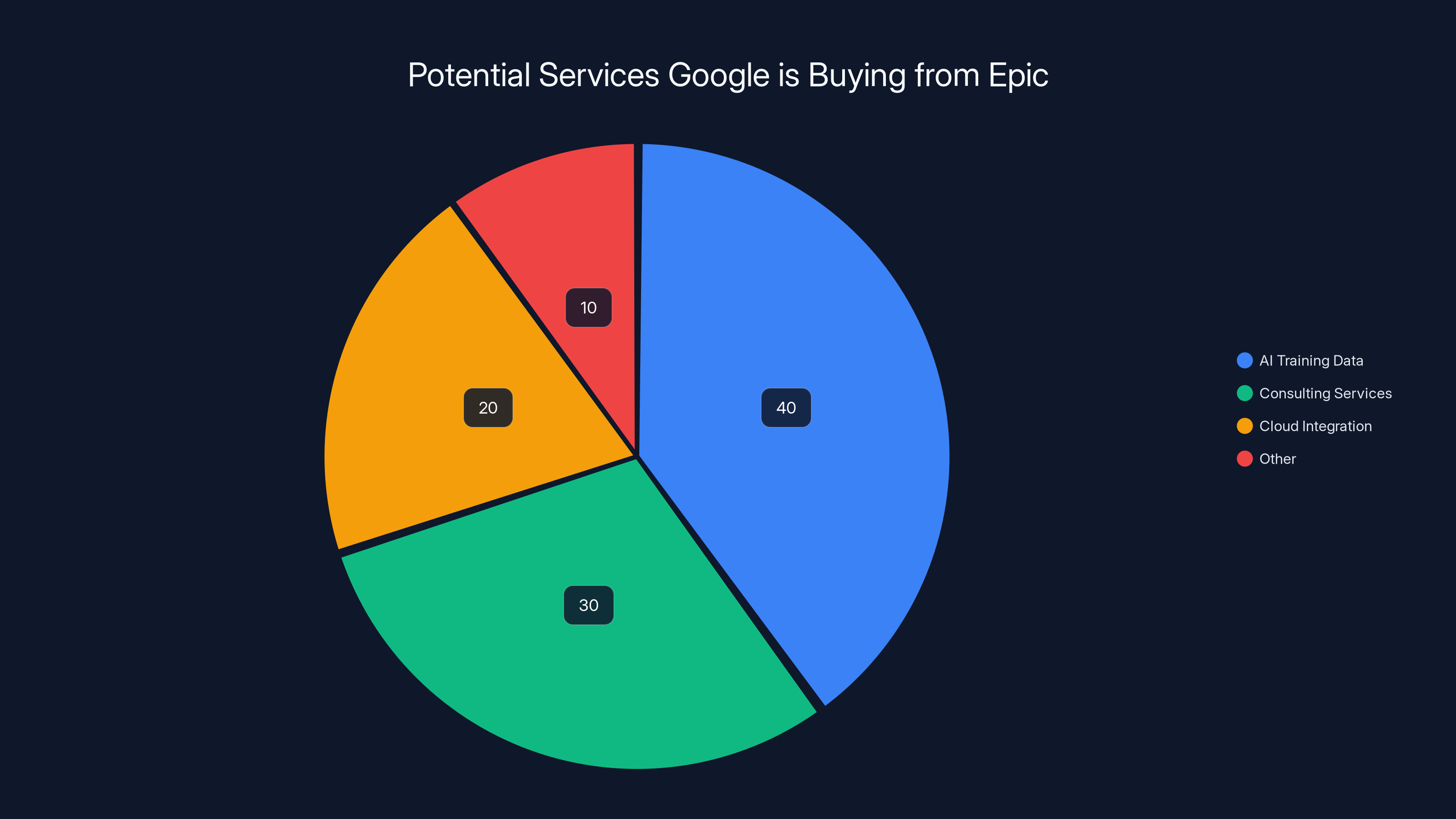

One of the most frustrating aspects of this entire situation is that neither company has disclosed what Epic is actually providing to Google in exchange for $800 million. We have fragments. We have implications. We don't have clarity.

Sweeney's incomplete sentence about AI training is the most illuminating hint we have. "Epic's technology is used by many companies in the space Google is operating in to train their products," he started, before catching himself. In 2025, "the space Google is operating in" increasingly means artificial intelligence. Google is investing heavily in generative AI, from Gemini to Vertex AI to internal research projects. The Unreal Engine, with its massive installed base and years of simulation data, could be extraordinarily valuable for training AI models.

Consider what Unreal Engine contains: millions of 3D models, materials, physics simulations, animation data, and code repositories from professional game studios, film productions, and architectural visualization companies. All of that could be extremely useful for training AI systems that need to understand visual data, physics, and spatial relationships.

Google might be licensing access to Unreal Engine data for AI training purposes. Or it might be paying Epic for consulting services to help integrate Unreal Engine more deeply with Google Cloud infrastructure. Or it could be a combination of both, wrapped in the broader partnership framework.

What's clear is that Google wanted something from Epic badly enough to commit

Estimated data suggests Google might be investing heavily in AI training data (40%) and consulting services (30%) from Epic, with smaller allocations for cloud integration and other services.

The Precedent Problem: Why Judges Care About Hidden Deals

Judge Donato's skepticism wasn't arbitrary. It was rooted in decades of antitrust jurisprudence. When companies settle litigation while simultaneously entering into side agreements, regulators and judges worry about several things:

First, there's the collusion concern. If Company A sues Company B, then they settle the lawsuit and suddenly enter into a lucrative partnership, it might look like they were colluding all along. Maybe the lawsuit was theater designed to extract concessions from other competitors, while the plaintiff and defendant secretly profit together.

Second, there's the dilution concern. Settlements are only effective if the plaintiff company continues to monitor and enforce them. If that company has been enriched by the defendant in a side deal, its incentives to enforce shift. A $100 million annual payment might be worth more to Epic than the benefits of actually enforcing the Android settlement.

Third, there's the regulatory concern. When the Department of Justice or state attorneys general investigate a settlement, they want to understand whether it genuinely benefits the market or whether it's just a way for two companies to make peace while extracting value from everyone else. A secret deal looks like the latter.

Historically, antitrust judges have required companies to disclose these kinds of arrangements specifically to prevent them from undermining settlements. The more valuable the side deal, the more scrutiny the judge applies.

The Settlement Terms: What Actually Has to Change on Android

Despite the concerns about Epic's motivations, the settlement agreement itself is substantial. Google agreed to implement several major reforms:

Fee Reduction: Google will reduce its app store commission from 30% to 15% for most developers earning up to $1 million annually, and maintain 30% for earnings above that. This matches Apple's App Store pricing structure and creates competitive pressure on both platforms to adjust their fees.

Alternative App Stores: Android devices will allow users to install alternative app stores (like Samsung Galaxy Store, Amazon Appstore, or Epic Games Store) with a single tap. Previously, these required buried settings adjustments that most users never discovered. This makes it actually possible for third-party app stores to compete on equal footing.

No Exclusivity Requirements: Google can no longer require phone manufacturers to exclusively use Google Play. Samsung, One Plus, Motorola, and others can now pre-install competing app stores without forfeiting their relationship with Google.

Transparency Requirements: Google must provide regular reports on its compliance with these terms. The settlement includes specific enforcement mechanisms and penalties for violations.

These aren't cosmetic changes. They fundamentally restructure Android's app ecosystem. A developer could now choose to distribute exclusively through Samsung Galaxy Store if they wanted to, avoiding Google's 15% commission entirely. A user could install Fortnite directly from Epic Games Store if they preferred to do so.

For the mobile industry, this is equivalent to breaking up a major part of Google's business model. The app store is one of Android's most valuable components. Being forced to allow alternatives and reduce fees cuts directly into Google's revenue.

Estimated data: The $800 million deal between Epic and Google is divided into joint product development, marketing, and partnerships. This strategic shift allows Epic to leverage Google's services while maintaining its technological independence.

The Broader Implications: What This Deal Signals

The existence of the hidden $800 million deal tells us something important about how tech companies actually operate. They're not naturally inclined toward transparency or open competition. When forced to settle litigation, they look for ways to benefit themselves while making the settlement look good on paper.

It also reveals the asymmetry of power in tech regulation. Epic Games, despite being a major developer, needed to spend $800 million to negotiate a settlement that arguably benefits the entire mobile development community. Smaller developers don't have that option. They either accept the existing terms or get sued individually, which is economically impossible.

For Google, the deal represents a bet that maintaining a good relationship with Epic is worth $800 million over six years. That makes sense strategically. Epic controls Unreal Engine and Fortnite, two of the most important properties in interactive entertainment. Having good relations with Epic is valuable to Google's broader technology ambitions in gaming and AI.

But it also means that Epic—despite nominally fighting for all developers—has cut a separate deal that benefits itself specifically. Other game studios don't get $800 million partnerships with Google. They just get the reduced fees from the settlement.

The Counterfactual: What If the Deal Didn't Exist?

Consider the hypothetical: if Judge Donato had rejected the settlement because of concerns about the hidden deal, what would have happened next?

Epic and Google would likely have continued fighting in court. The trial would have lasted months or years. Both companies would have spent hundreds of millions on litigation. Eventually, one side would have won decisively, likely resulting in even more dramatic changes to the Android ecosystem—or alternatively, a victory for Google that would have preserved the status quo.

The reason Epic and Google probably settled is that both sides faced significant litigation risk. Epic was gambling that a jury would side with them on antitrust grounds. Google was gambling that it could defend its app store practices. Both probably preferred a negotiated settlement to the uncertainty of trial.

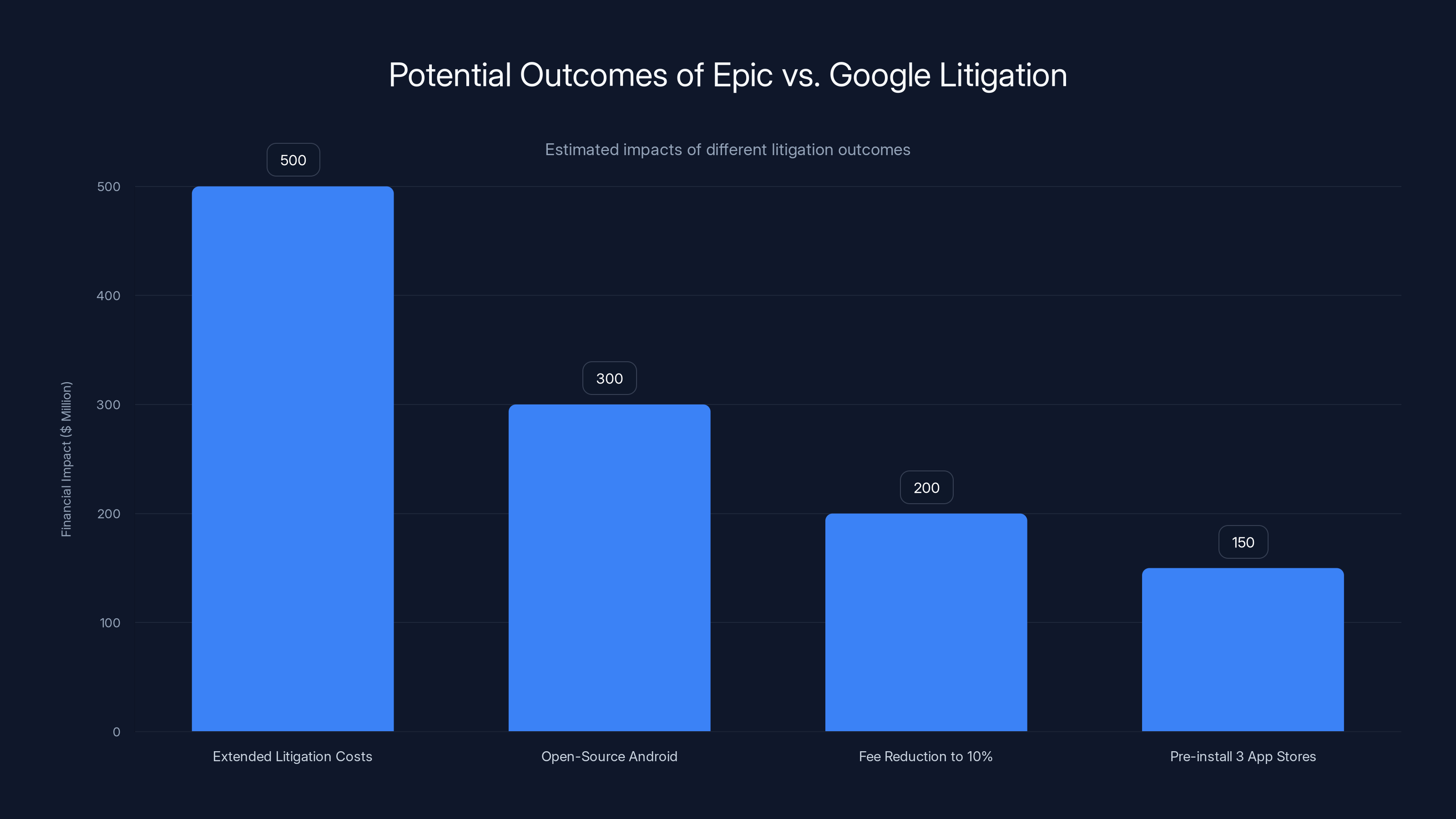

But what if the settlement had included even more dramatic concessions? What if Google had agreed to open-source parts of Android? What if the fee reduction had gone to 10% instead of 15%? What if Google had agreed to pre-install three alternative app stores instead of allowing just one extra tap?

The $800 million deal is, in a sense, what Epic extracted in exchange for not pushing for those more radical outcomes. It's the price of peace—paid directly to Epic by Google.

Estimated data shows potential financial impacts of various outcomes if the settlement had not occurred. Extended litigation could have cost both parties $500 million.

The AI Angle: Why This Matters for the Future

If our speculation about AI training data is correct, the Epic-Google deal represents something larger than just a settlement side deal. It's evidence that tech companies view developer tools and game engines as critical infrastructure for AI development.

Unreal Engine isn't just a gaming tool anymore. It's used for architectural visualization, film production, autonomous vehicle simulation, and increasingly, for generative AI training. Google's interest in access to Epic's assets suggests the company wants to leverage gaming technology for AI purposes.

This has massive implications. It means:

-

Developer Tools Become Strategic Assets: Companies like Epic that control important developer platforms will have outsized leverage in negotiations with larger tech companies.

-

Data Becomes More Valuable: The 3D models, physics simulations, and animation data that game developers create become valuable training material for AI systems.

-

Consolidation Incentives Increase: Larger companies have more incentive to acquire or partner with tool companies to access their data and technology.

-

Open Source Becomes Critical: Developers should consider what portions of their work are being used for AI training and ensure they have appropriate licensing.

The Epic-Google deal is probably a preview of many more partnerships between developer tool companies and AI-focused tech giants over the next few years.

Regulatory Scrutiny: Will Other Cases Follow?

One outcome of the Epic-Google settlement is increased regulatory scrutiny on similar arrangements. The Department of Justice and state attorneys general are watching this case closely. If they determine that the hidden deal undermined the settlement, it could set a precedent for more aggressive oversight of tech company partnerships.

Already, there are rumblings. California's Attorney General has been critical of arrangements that might reduce incentives for companies to enforce pro-competitive terms. The Federal Trade Commission has indicated that it's watching settlement compliance closely.

For other tech companies facing antitrust litigation, the Epic case provides a cautionary tale. Side deals that look reasonable to the parties involved might face intense scrutiny from regulators. Going forward, companies might need to be more transparent about the business arrangements that run parallel to legal settlements.

This could actually be a positive development for the broader tech ecosystem. Transparency forces companies to justify their arrangements on the merits, rather than hiding them behind confidentiality agreements. A company that's genuinely interested in competition can afford to be open about its business deals. A company that's worried about how those deals will look probably shouldn't enter into them.

What This Means for Developers: The Real Impact

If you're an independent game developer or app creator, the Epic-Google deal affects you primarily through the settlement terms, not through any direct relationship with Epic. You get the benefit of:

- Lower fees on Google Play (15% instead of 30% for the first $1 million)

- The ability to use alternative app stores more easily

- Reduced control from Google over how you distribute your app

Those are real advantages. They lower your costs and expand your options. Over a three-year period, a successful app might save hundreds of thousands of dollars in commission fees due to the lower rate structure.

But you're probably not going to see the $800 million that Google and Epic extracted as part of their deal. That value stays with them. The settlement levels the playing field somewhat, but it doesn't eliminate the advantage that large, well-capitalized companies have over smaller competitors.

What might matter more in the long run is whether Google actually complies with the settlement terms. If the company finds ways to work around the spirit of the settlement while technically obeying it, the benefits to smaller developers could be limited. This is where regulatory enforcement becomes crucial.

The Precedent for Future Settlements

From a legal perspective, the Epic-Google deal establishes that companies can't hide side agreements when they settle antitrust cases. Judge Donato's willingness to drag the deal into the open sets expectations for future settlements. Companies will need to disclose these arrangements to judges, who can then evaluate whether they undermine the settlement's integrity.

This could make settlements harder to achieve in the short run, since companies will have less ability to sweeten the pot with hidden deals. But it should also make settlements more trustworthy when they do happen, since judges can evaluate the full picture.

For the tech industry, which has increasingly relied on settlements to resolve antitrust disputes, this represents a tightening of requirements. Companies can't just negotiate public commitments while making private side arrangements. They need to either integrate the benefits into the settlement itself or accept that judges will scrutinize them heavily.

Looking Forward: What Happens Next

The settlement agreement requires Google to implement these changes immediately and over time, with compliance reporting due annually. Epic and Google will need to coordinate on how the $800 million partnership actually works, since it apparently wasn't fully finalized at the time of the hearing.

Judge Donato made clear that he'll be monitoring this closely. He suggested that he might revisit the settlement if evidence emerges that Google isn't complying or that Epic isn't enforcing the terms. That oversight is crucial. Without it, settlements become meaningless pieces of paper that allow companies to claim victory while changing nothing.

For other developers and companies watching from the sidelines, the message is clear: if you're going to challenge tech giants on antitrust grounds, you'd better have the resources to fight for years and the leverage to extract value from them. Most companies don't. That's why the broader question of antitrust enforcement remains vital. Settlements between major companies tell us something about what's possible, but they don't solve the underlying problem of concentrated power in tech.

The $800 million deal is fascinating precisely because it reveals how much value is at stake when the distribution and payment systems for software are controlled by a single company. Google obviously thought it was worth a huge payout to keep Epic as a partner. That's actually the most telling thing about the whole arrangement.

The Unreal Engine's Rising Importance

There's another angle worth considering: the deal highlights how valuable Unreal Engine has become to Google's business ambitions. Tim Sweeney built a tool that's so important to modern software development that Google is willing to pay hundreds of millions of dollars to access it more directly.

This wasn't always the case. For most of Unreal Engine's history, it was primarily a gaming tool. But over the past decade, Epic has successfully positioned it as critical infrastructure for spatial computing, AI training, film production, and enterprise visualization. Companies from automotive to architecture now depend on Unreal Engine for critical work.

That positioning gives Epic enormous leverage. Google needs access to the technology and the data it represents. Epic, for its part, is happy to monetize that leverage through strategic partnerships. The settlement itself becomes almost secondary to the underlying business deal, which is arguably more valuable to both parties.

For game developers specifically, this means Unreal Engine remains a bet-your-business platform. Epic has demonstrated that it can negotiate effectively with the largest tech companies in the world. That's good news if you're building on Unreal. It means the platform has staying power and the backing of a company that can fight for its interests.

The Broader Android Ecosystem Impact

Beyond the immediate implications for Epic and Google, the settlement will reshape the Android ecosystem more broadly. Alternative app store operators like Samsung, Amazon, and others now have a much clearer path to pre-installation on devices. Users will have easier access to alternatives to Google Play.

This creates genuine competition for the first time. Stores will need to differentiate themselves through better developer terms, better user experience, better curation, or other advantages. That competition should benefit both developers and users.

But it also creates fragmentation risk. Developers now have to think about whether to target Google Play, Samsung Galaxy Store, Amazon Appstore, and Epic Games Store separately. Each store might have different requirements, different terms, different tooling. That complexity is a cost that smaller developers will feel acutely.

Google will likely respond by making Google Play more attractive. Better tools, better discoverability, better support for developers. The company has resources to improve the developer experience in ways that smaller competitors can't match. So while competition theoretically improves the ecosystem, the actual outcomes will depend on execution and enforcement.

FAQ

What is the Epic-Google $800 million deal?

The deal is a six-year partnership between Epic Games and Google where Epic will spend approximately $800 million purchasing services from Google. According to court testimony, the arrangement includes "joint product development, joint marketing commitment, and joint partnerships," with suggestions that Google wants access to Unreal Engine technology for AI training and other purposes. The specific details remain largely confidential, though pieces were revealed during antitrust settlement hearings.

How does the $800 million deal relate to the antitrust settlement?

Judge James Donato determined that the business partnership is directly connected to Epic and Google's settlement of the antitrust lawsuit. It appears that the deal wouldn't happen unless the settlement is approved and implemented. This created concerns that Epic might have been incentivized to soften its demands for broader Android ecosystem reforms in exchange for the lucrative partnership with Google.

What are the main changes Google must make under the Android settlement?

Google must reduce its app store commission from 30% to 15% for developers earning up to $1 million annually, allow alternative app stores to be easily installed on Android devices with a single tap, eliminate exclusivity requirements with phone manufacturers, and provide regular compliance reports. These changes fundamentally reshape how the Android app ecosystem operates and create genuine competition for Google Play.

Why did Judge Donato question whether this was a "quid pro quo" arrangement?

A quid pro quo occurs when one party provides a benefit (like regulatory concessions) in exchange for another benefit (like a lucrative business deal) in a way that suggests collusion or corruption. The judge worried that Epic might have agreed to less-demanding settlement terms because it already had the $800 million partnership waiting in the wings. This could undermine the settlement's credibility and suggest that Epic wasn't genuinely fighting for all developers.

What services is Epic paying Google $800 million for?

Neither company has fully disclosed what services Epic is purchasing. The only hint comes from Tim Sweeney's incomplete testimony about Epic's technology being "used by many companies in the space Google is operating in to train their products," suggesting possible AI training applications. The services likely involve infrastructure, cloud services, and potentially licensing of Unreal Engine technology for Google's own applications.

How will this settlement affect independent game developers?

Smaller developers will benefit from lower fees on Google Play (15% instead of 30% for the first

Could this deal prevent Google from violating the settlement later?

The risk is actually the opposite. If Epic has been enriched by a hidden partnership with Google, the company might be less motivated to enforce settlement compliance or to sue Google again if violations occur. Judge Donato's scrutiny was designed to address this exact concern. Ongoing regulatory monitoring will be necessary to ensure the settlement actually delivers on its promises.

What does this mean for the mobile app ecosystem going forward?

The settlement creates genuine competition in app distribution for the first time on Android. Alternative app stores like Samsung Galaxy Store and Epic Games Store now have clear paths to pre-installation and user visibility. This should improve the negotiating position of developers, increase fee competition, and create more options for consumers. However, fragmentation across multiple app stores could increase complexity for developers.

Why is the Unreal Engine so valuable to Google?

Unreal Engine is used by millions of developers worldwide and contains massive amounts of 3D data, physics simulations, and animation assets. In an era where AI training requires huge datasets of visual and spatial information, access to Unreal Engine's data and technology represents significant value. Google's interest in the partnership suggests the company wants to leverage these resources for AI development and other strategic purposes.

Will other tech companies face similar scrutiny for hidden settlement deals?

Very likely. Judge Donato's willingness to drag the Epic-Google partnership into the open has set expectations for transparency in future settlements. The Department of Justice and state attorneys general are watching this case closely. Companies facing antitrust litigation will now face greater pressure to disclose side agreements and justify them on competitive merits rather than hiding them behind confidentiality.

Key Takeaways

- Epic and Google's $800 million six-year partnership was revealed to be contingent on their antitrust settlement, raising concerns about whether Epic was incentivized to soften its demands

- The deal involves Epic paying Google for services that likely include access to Unreal Engine for AI training purposes, though specific details remain confidential

- Google must now reduce app store fees from 30% to 15% for the first $1 million in developer revenue and allow alternative app stores to be installed with a single tap

- The hidden partnership establishes a precedent: companies can no longer hide side agreements when settling antitrust cases, as judges will demand disclosure and review

- Smaller developers benefit from lower fees and expanded distribution options, but Epic's $800 million payday demonstrates the leverage advantage that major players have in tech negotiations

Related Articles

- Epic vs Google Settlement: What Android's Future Holds [2025]

- Meta's Child Safety Case: Evidence Battle & Legal Strategy [2025]

- UK VPN Ban Explained: Government's Online Safety Plan [2025]

- FTC Meta Monopoly Appeal: What's Really at Stake [2025]

- UK Social Media Ban for Under-16s: What You Need to Know [2025]

- Setapp Mobile iOS Store Shutdown: What It Means for App Distribution [2026]

![Epic and Google's $800M Secret Deal: What It Means for Android [2025]](https://tryrunable.com/blog/epic-and-google-s-800m-secret-deal-what-it-means-for-android/image-1-1769119540508.jpg)