The $1 Trillion Market That Never Went Digital

You'd think buying a car in 2025 would be seamless by now. But here's the reality: the automotive retail industry, worth over a trillion dollars annually, still operates like it's stuck in the 1990s. You call a dealer, haggle over price, wait in a finance office while someone tries to upsell you extended warranties, sign mountains of paperwork, and hope the vehicle inspection was actually thorough.

Companies like Carvana and CarMax tried fixing this over the past decade with digital marketplaces. They modernized the experience, sure. But they ultimately built better versions of the old system rather than reimagining it from the ground up. And when it comes to electric vehicles specifically, there's been almost no specialized retailer willing to focus entirely on EVs. That gap is exactly what Ever, a San Francisco-based startup, is trying to fill.

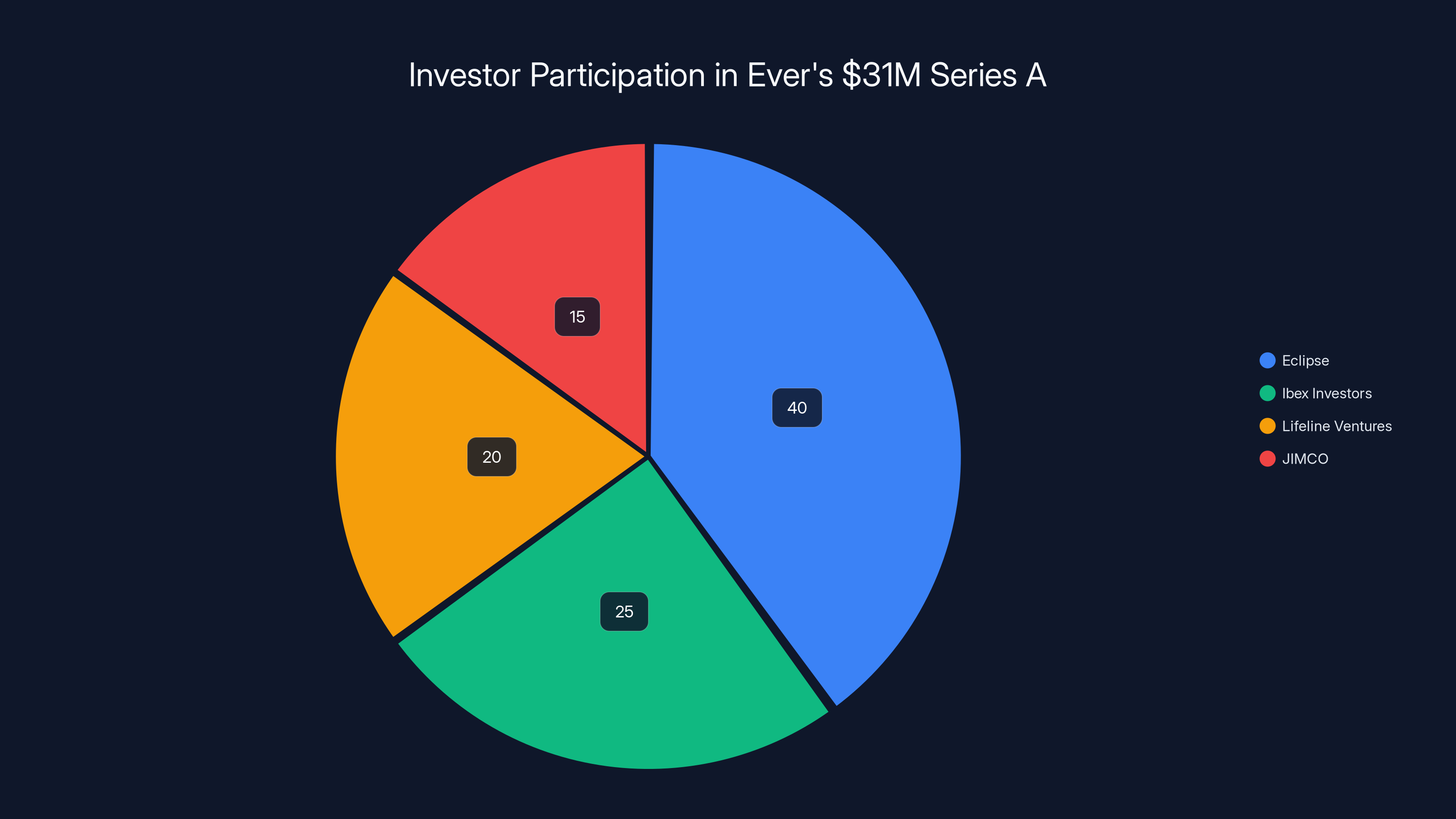

Ever just raised $31 million in Series A funding led by Eclipse, with backing from Ibex Investors, Lifeline Ventures, and JIMCO (the investment arm of Saudi Arabia's Jameel family, which was an early backer of Rivian). The company bills itself as "AI-native, full-stack auto retail" for electric vehicles. What that actually means is they're not bolting AI onto an outdated retail framework. They're building from scratch with AI orchestration at the core.

The distinction matters more than it sounds. And it reveals something critical about how industries actually get disrupted.

Why "Bolt-On AI" Fails in Auto Retail

There's a pattern in how industries resist change. When a new technology emerges, incumbents don't ask "what becomes possible now?" They ask "how can we keep doing what we're doing, but slightly faster?" They add a chatbot here, implement voice agents there, maybe throw in some scheduling automation. Jiten Behl, an investor at Eclipse who spent eight years leading teams at Rivian, calls these solutions "band-aids on a fundamentally broken system."

The auto industry has seen this movie before with electric vehicles themselves. Early EV attempts by legacy automakers weren't rethinking vehicle architecture from first principles. They took a combustion engine platform and retrofitted batteries and motors into it. The result? Compromised efficiency, mediocre range, and tradeoffs that wouldn't exist if the vehicle was designed for electric propulsion to begin with. Tesla and Rivian took a different approach: design everything assuming electric motors and battery packs from day one.

Retail is similar. Most automotive businesses today use dozens of point-solution tools that don't talk to each other. You've got CRM systems for customer management, separate inventory management software, appraisal tools, pricing engines, titling systems, and financing platforms. Each one handles one slice of the transaction, and humans have to manually move information between them. It's inefficient, error-prone, and expensive.

Ever's CEO Lasse-Mathias Nyberg describes the problem this way: buying or selling a car triggers "hundreds or thousands of different actions" that retailers need to perform. There are massive complexities on both sides of the transaction. Someone needs to appraise the vehicle (which involves checking its history, mechanical condition, market comps, and demand signals). Someone needs to price it competitively. The title needs to be handled correctly (which varies by state and has serious legal implications). Insurance needs to be arranged. Financing needs to be coordinated. The vehicle needs to be inspected and detailed. Photos and listings need to be created. And through all of this, the buyer and seller need a clear, single point of contact to answer their questions.

Traditional retailers handle this with more staff. Ever's bet is that you can handle it with orchestration AI that actually understands the entire process as one unified whole, not as isolated steps.

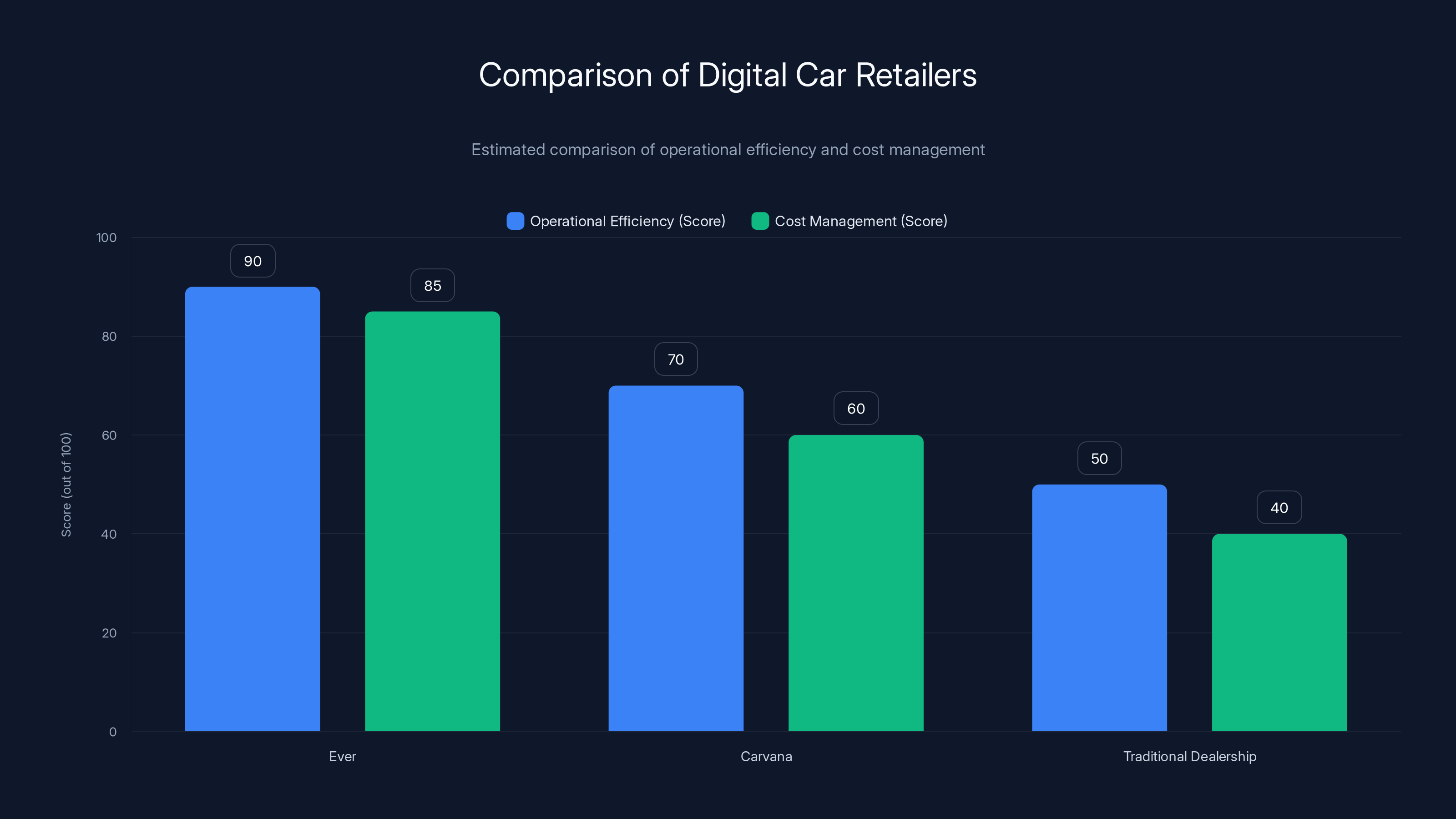

Ever's AI-native approach is estimated to provide higher operational efficiency and cost management compared to Carvana and traditional dealerships. Estimated data.

Ever's Orchestration Layer: The Operating System for Car Retail

At the heart of Ever is what Nyberg calls an "orchestration layer" or "operating system." Think of it less like a website and more like the nervous system of a car dealership. It's the thing that decides what needs to happen next, coordinates between different functions, and ensures nothing falls through the cracks.

Here's a concrete example of how this works. Let's say someone submits an offer to buy a 2023 Tesla Model 3 on Ever's platform. A traditional retailer's workflow might look like this:

- Sales rep receives notification (manually, via email or CRM alert)

- Sales rep logs into one system to check inventory status

- Sales rep opens another system to verify the vehicle hasn't been sold

- Someone runs an appraisal in a separate tool

- Someone plugs numbers into a pricing engine

- Results are compared to market comps (in yet another system)

- Sales rep creates a formal offer

- Customer receives offer via email, calls back to negotiate

- Process repeats

Ever's orchestration layer compresses this. When an offer comes in, the system immediately knows what needs to happen. It can run the appraisal, check market data, calculate pricing, and generate a competitive offer in minutes. If something's missing (like a vehicle history report), it triggers that automatically. If the timing suggests the customer might be shopping elsewhere, it can flag that for a sales rep to prioritize urgently.

Nyberg explained that much of what happens in auto retail is "deterministic." Appraisals follow specific rules. Titling has precise legal requirements. Market pricing follows predictable patterns. Most of today's solutions treat these as separate problems, each with its own tool and operator. Ever uses agentic AI to say: "We understand the entire process. We know these rules. And we can orchestrate everything as one coherent experience."

The company built this by starting in stealth mode in 2022. Nyberg and his team spent a year researching how car transactions actually work, mapping the complexities, identifying the friction points, and understanding which parts of the process could be automated versus which needed human judgment. What emerged was a digital-first retailer with AI orchestration at the core.

The efficiency gains are substantial. Nyberg claims Ever's sales team is two to three times more productive than traditional dealership sales teams. That's not just faster typing or better spreadsheets. It's the compounding effect of eliminating context switches, removing manual data entry, and automating the truly mechanical parts of the job.

Ever's orchestration layer significantly reduces the time taken for each step in the car retail process, improving efficiency and response time. Estimated data based on typical process durations.

The Hybrid Model: Digital First, But Not Digital Only

Ever isn't just an online marketplace like Carvana. It's building a hybrid model that combines digital efficiency with physical locations where people can see and test vehicles in person.

There's a reason for this. Electric vehicles are still new enough that a significant portion of potential buyers have never owned one. They want to sit in the driver's seat, feel the acceleration, understand the touchscreen interface, and kick the tires. For these customers, a purely digital experience is actually a disadvantage because they don't have the context to evaluate specs.

Physical locations also serve another purpose: they're inspection and preparation hubs. A customer might buy a car through the website, but it needs to be detailed, thoroughly inspected, photographed, and made ready for delivery. Having physical infrastructure lets Ever control quality and ensure every vehicle meets standards.

Where the hybrid model gets interesting is in how Ever uses AI to connect the two. You can browse inventory online, but when you want to see a car in person, Ever's system knows exactly which vehicles you've been researching, what your preferences are, what price range you're comfortable with, and what financing options make sense for you. When you arrive at the location, you're not starting from scratch with a salesperson who knows nothing about you. The experience is personalized and informed.

For sellers, the hybrid model works similarly. You can start the process entirely online by submitting photos and information about your EV. Ever's system appraises it using data from market comps and condition reports. You get an offer within minutes. If you want to maximize the price, you can have a specialist inspect it in person and potentially adjust the offer upward based on better-than-expected condition.

Why The Funding Matters: Investor Conviction

A $31 million Series A isn't enormous by venture standards, but the investors backing it are telling. Eclipse led the round. Jiten Behl, the partner at Eclipse who worked on Rivian's leadership team, has credibility in this space. He knows that consumer automotive is hard and that scaling a logistics-heavy business requires flawless execution. He wouldn't back Ever if he didn't believe the AI orchestration layer solved a real problem.

The co-investors are equally notable. Ibex Investors has backed multiple logistics and consumer marketplaces. Lifeline Ventures focuses on pre-seed and seed rounds in enterprise and consumer startups. And JIMCO, the Jameel family's investment arm, is significant because the Jameel family is one of the largest private investors in automotive (they backed Rivian early), which means they understand the sector's potential and challenges intimately.

What this tells us is that experienced automotive investors believe Ever is onto something that neither traditional dealers nor previous digital-first car companies (like Carvana) have figured out. The bet is that AI orchestration changes the unit economics of car retail enough to create a differentiated business.

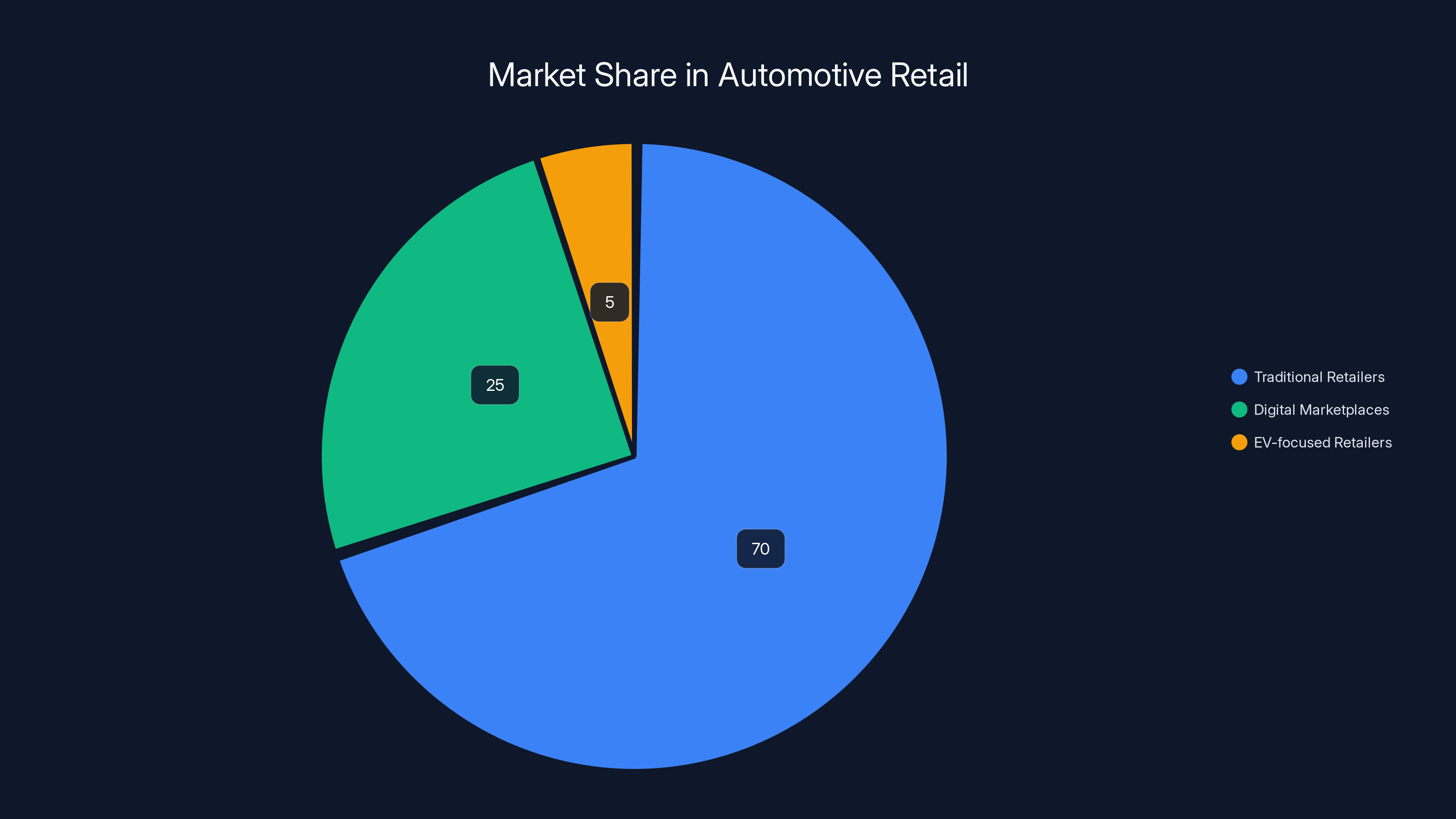

Traditional retailers dominate the automotive market with an estimated 70% share, while digital marketplaces hold 25%, and EV-focused retailers capture a small 5% slice. Estimated data.

The EV-Only Focus: Market Timing or Market Limitation?

One strategic decision Ever made is to focus exclusively on electric vehicles, at least for now. This isn't a permanent constraint. Nyberg said he hasn't ruled out selling used combustion vehicles eventually. But the current focus is deliberate.

The logic is sound: there's no specialist retailer laser-focused on used EVs. Traditional dealers treat them like any other used car. Carvana sells EVs, but they're mixed into a marketplace dominated by gas-powered vehicles. For someone shopping their first EV, this creates a problem. They have questions specific to electric vehicles: What's the real-world range in cold weather? How much does battery degradation matter? Are charging networks reliable? Most salespeople at traditional dealers can't answer these questions because they don't specialize in them.

Ever's thesis is that by focusing exclusively on EVs, they can develop real expertise. Their sales team becomes deeply knowledgeable about every EV model. Their operations team understands the specific logistics of EV sales (battery health verification, charging setup assistance, etc.). Their marketing speaks directly to EV-specific concerns rather than generic car-buying messaging.

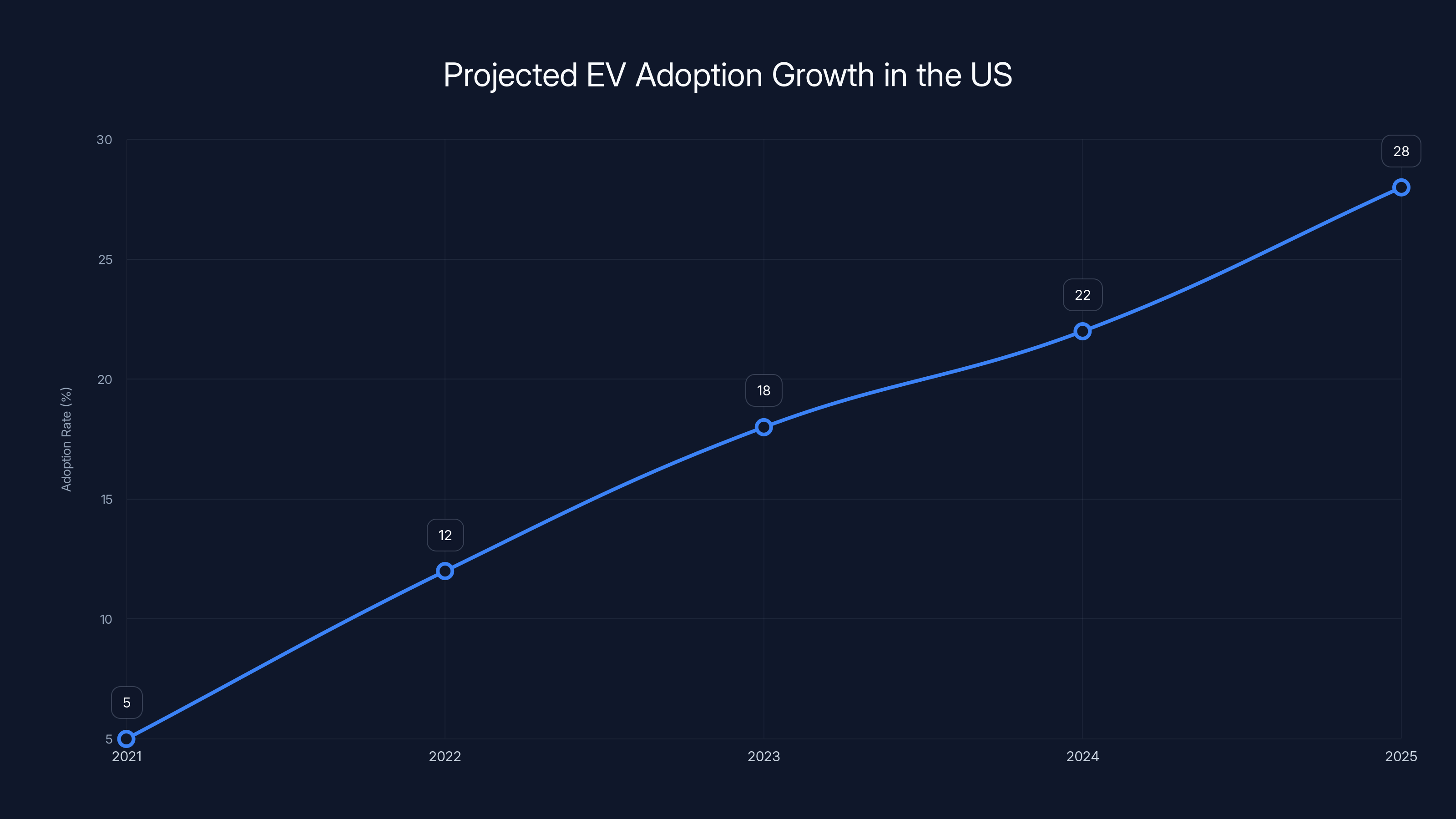

This is a calculated market timing bet. EV adoption in the US has cooled slightly in 2024-2025, but it hasn't stopped. The long-term trajectory still points toward electric propulsion becoming the default. And in that future, having a vertical specialist who understands EVs deeply becomes valuable.

The AI Advantage That Compounds Over Time

Here's the secret thing about AI-native businesses: the advantage gets better as you scale, not worse.

Imagine Ever continues growing and processes thousands of transactions per week. Each transaction is data. The orchestration layer learns patterns about which customers are most likely to complete purchases, which vehicles are hard to sell and need different pricing strategies, what conditions predict problems during inspections, and how supply and demand patterns vary by region and season.

A traditional retailer gains some of this knowledge too, but it's distributed. One salesperson might notice that sedan buyers are more price-sensitive than SUV buyers, but that insight stays in their head. Ever's system centralizes it, operationalizes it, and applies it automatically.

Over time, this compounds into something increasingly difficult to replicate. Ever's AI doesn't just handle transactions better. It actively gets better at predicting what customers want, what prices will clear inventory, and where to focus operational effort.

Traditional retailers can hire smarter people and implement better processes. But they can't turn their collective knowledge into an automated system the way an AI-native business can. The scale advantage is real.

Eclipse leads the investment with an estimated 40% share, indicating strong conviction in Ever's potential. Estimated data.

The User Experience Reality Check

Ever's early reviews have been mixed, which is worth mentioning. Some users praised how the platform simplifies EV buying. Others reported frustration getting in touch with the team or resolving issues.

Nyberg chalks this up to a learning experience from being in stealth mode and just ramping up operations. And that's honest. No one launches a marketplace at scale perfectly. You discover problems in production and fix them. What matters is whether the core orchestration model is sound and whether the team can execute at speed.

There's also a question about whether the market itself will cooperate. Buying a car is a high-stakes purchase. Even if Ever's system is better and cheaper, customers are inherently conservative. They want to know the company will still be around in five years if something goes wrong. They want to trust the refund or return process. They want assurances. That's not a tech problem to solve with better UX. It's a business trust problem that takes time to overcome.

How Ever Compares to Carvana, Car Max, and Vroom

The used car retail market already has major players. Understanding how Ever differs helps clarify the bet.

Carvana pioneered the all-digital car-buying experience. You browse online, complete the purchase entirely digitally, and the car is delivered. It's frictionless. But Carvana didn't have any technological moat beyond the website and logistics network. Once other retailers added online marketplaces, Carvana's advantage eroded. The company also struggled with unit economics and customer service at scale. The lesson: being digital-first isn't enough if you can't control costs.

Car Max operates massive used car lots and combines inventory scale with transparent pricing. Their advantage is supply and brand trust, not technology. They've been around for decades. That matters.

Vroom took a similar digital-first approach to Carvana. It's smaller and never achieved the same scale. Both Carvana and Vroom prove that digital-first auto retail is possible but also that it's operationally brutal.

Ever's claim is that by making the operations layer AI-native, they solve the unit economics problem that killed or weakened the previous generation. If that's true, it's a genuinely different bet. If it's not, Ever becomes another cautionary tale about the difficulty of selling cars online.

EV adoption in the US surged in 2022-2023 but is expected to continue growing steadily as mainstream buyers enter the market. Estimated data.

The Larger Trend: AI-Native vs. AI-Augmented Businesses

Ever is part of a larger pattern in how AI is reshaping industries. There's a difference between companies that add AI to existing processes and companies built from the ground up assuming AI will handle certain functions.

The former category is huge. Existing software companies are adding AI assistants. Marketing teams are using AI copywriting tools. Sales teams are using AI for lead scoring. These are AI-augmented businesses. The AI is valuable, but it's layered on top of existing systems and workflows.

The latter category is smaller but potentially more transformative. Companies like Ever, or in other domains, like new cloud-native data companies or AI-first customer service platforms, are built assuming AI orchestration is core. They can make design choices that purely AI-augmented companies can't because they're not constrained by legacy systems.

Over the next five to ten years, we'll see which approach creates more defensible, higher-margin businesses. My guess is that truly AI-native companies in complex, operationally intensive industries will win. And auto retail is complex and operationally intensive.

The EV Market Dynamics That Favor Ever

Electric vehicle adoption is following a predictable S-curve. It's not linear. Growth surges in certain demographics and geographies, then plateaus in others. Someone buying their first EV needs different support than someone trading in their second EV.

Ever's advantage here is focus. Their team understands the full spectrum of EV buyers and sellers. They know the top concerns at each stage of ownership. They've optimized the experience for EV-specific complexity like battery health, charging logistics, and range anxiety.

Meanwhile, traditional dealerships treat EVs as an afterthought. They don't have salespeople who specialize in them. Their service teams aren't trained on EV-specific maintenance. Their finance teams don't understand EV incentive programs and rebates properly. This creates an opening for a focused competitor.

That said, EV adoption growth has cooled in the US market. The surge that happened in 2022-2023 has moderated. But that doesn't mean the market is saturated. It means the easy wins (early adopters and enthusiasts) are gone and now you're selling to mainstream buyers who need more education and assurance. This is actually where Ever's model might be strongest because it's designed specifically to reduce friction for people who are curious about EVs but hesitant.

Scaling Challenges: What Could Go Wrong

Let's be realistic. Ever faces serious scaling challenges.

First, car retail is logistics-heavy. You need warehouses, inventory management, transportation networks, and trained technicians in multiple cities. This requires capital and operational excellence. Carvana learned this the hard way. They expanded too fast, had inventory disasters, and damaged their brand. Ever will need to scale carefully.

Second, customer acquisition cost in auto retail is high. You need marketing to reach potential buyers, and word-of-mouth is slow when individual customers buy one car every few years. Ever's efficiency in operations doesn't automatically translate to efficiency in customer acquisition.

Third, the market itself is uncertain. If EV adoption stalls permanently in the US (unlikely but possible), Ever's EV-only strategy becomes a liability. The company's flexibility to add combustion vehicles would be limited because they haven't built that expertise.

Fourth, there's the incumbent risk. If Traditional dealers and larger retailers decide to seriously invest in their digital operations, they have advantages: existing physical infrastructure, established brand trust, and deep relationships with finance partners. They could become competent at digital retail without Ever's AI advantage mattering.

The Broader Impact on Auto Retail's Future

What Ever is attempting is broader than just "selling used EVs online." It's a test of whether true AI-native business models can outcompete existing incumbents in capital-intensive industries.

If Ever succeeds and scales to significant market share, it will prove something important: that being fundamentally rearchitected for AI gives you an edge that's hard to replicate. Other retailers will try, but they'll be building AI into systems designed pre-AI. Ever got to start from scratch.

If Ever struggles, the lesson is different: AI operational efficiency isn't enough to overcome the capital requirements, incumbent advantages, and customer trust issues that plague auto retail.

Most likely, the truth is somewhere in between. Ever will likely succeed at becoming a meaningful player in used EV retail without becoming the Tesla of car retail. They'll prove the AI orchestration model works. But they probably won't revolutionize the entire industry because industry change requires more than better technology. It requires reaching scale, building brand trust, and overcoming structural economics.

But that's still a significant outcome. If Ever becomes a billion-dollar company focused entirely on used EV retail, that's meaningful. It means they've created a wedge in a trillion-dollar market. And wedges tend to grow.

What This Means for Other Industries

Ever is worth paying attention to not because used car retail is particularly interesting, but because it's a test case for a pattern that will repeat across industries.

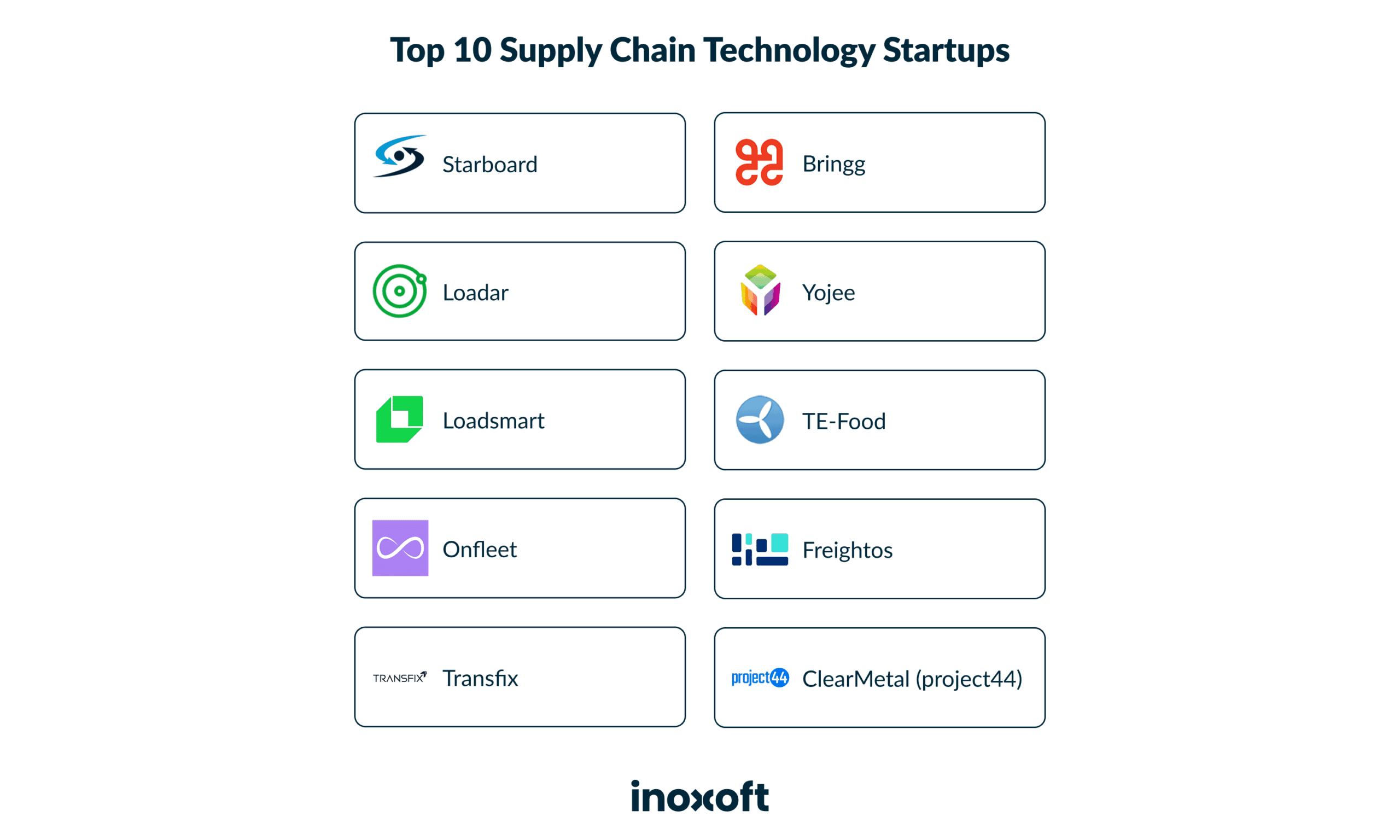

There are dozens of industries where the current operating model includes tons of manual coordination, rule-based processes, deterministic workflows, and point-solution software tools that don't integrate. Real estate, insurance underwriting, commercial lending, legal services, and supply chain management all fit this pattern.

In each of these domains, you could build an AI-native competitor that orchestrates the entire process differently. Whether that competitor succeeds depends less on whether the technology works and more on whether they can reach scale faster than incumbents can adapt.

Ever is watching this question closely. So should everyone building vertically-integrated AI-native businesses. The playbook is: find a complex, rule-based process with lots of manual coordination. Build an orchestration layer. Focus on one segment. Prove unit economics work. Scale carefully. Over time, the AI advantage compounds and becomes defensible.

It's not a guaranteed path to success. But it's a smarter path than just bolting AI onto existing systems and hoping something changes.

TL; DR

- Ever is building an AI-native auto retailer, not just adding AI features to traditional operations. The entire transaction orchestration is designed around agentic AI handling dozens of parallel processes simultaneously.

- The EV-only focus is strategic, not a limitation. By specializing entirely in electric vehicles, Ever becomes an expert retailer for a market that traditional dealerships still treat as an afterthought.

- $31M signals investor confidence that AI orchestration solves the unit economics problem that plagued Carvana and previous digital-first car retailers. Experienced automotive investors wouldn't back this without believing the model works.

- Scaling will determine success, not the technology alone. Ever needs to manage logistics, acquire customers efficiently, build brand trust, and maintain margins as they expand. These operational challenges are harder than building good software.

- The broader pattern matters: This is a test case for whether AI-native businesses can outcompete incumbents in capital-intensive industries by being fundamentally rearchitected from the ground up.

FAQ

What is an AI-native auto retail business?

An AI-native auto retail business is built from the ground up with artificial intelligence orchestration at its core, rather than adding AI features to traditional dealership or retail operations. Instead of using dozens of separate software tools that require human coordination, Ever's system uses AI to automatically manage the entire transaction workflow, from appraisal and pricing through title processing and delivery.

How does Ever's orchestration layer actually work?

Ever's orchestration layer functions like a nervous system for the entire car buying and selling process. When a customer submits an offer or a seller lists a vehicle, the system automatically determines what needs to happen next and coordinates across different functions. It runs appraisals, checks market data, calculates competitive pricing, verifies title status, and flags issues for human review—all in parallel rather than sequentially. This eliminates the context switching and manual handoffs that waste time in traditional retail.

What's the difference between Ever and Carvana or other digital car retailers?

Carvana focused on being a digital-first marketplace but didn't fundamentally rearchitect the operations layer. Ever's advantage is claiming to solve the unit economics problem through AI orchestration. Previous digital retailers struggled because operational costs remained high despite digital sales channels. Ever believes that automating the coordination layer between dozens of tools reduces labor costs enough to improve margins without sacrificing customer experience or speed.

Why does Ever focus exclusively on electric vehicles?

Ever's EV-only strategy allows the company to develop deep expertise that traditional dealerships lack. Their sales teams, service technicians, and marketing all specialize in EV-specific issues like battery health, charging logistics, and range anxiety. For a buyer shopping their first EV, this focused expertise is more valuable than a general marketplace where EVs are mixed with thousands of combustion vehicles.

What are the main risks to Ever's business?

Ever faces three significant challenges: first, auto retail is logistics-heavy and capital-intensive, requiring careful expansion to avoid the inventory and operational disasters that damaged Carvana's brand. Second, customer acquisition cost in car retail is high because buyers purchase infrequently, making marketing efficiency critical. Third, if EV adoption growth continues to moderate or stalls, Ever's focused strategy becomes a liability unless they expand to combustion vehicles, which they haven't optimized for.

How does Ever's $31 million Series A funding compare to other auto retail startups?

The $31 million raise is significant not because of the absolute dollar amount but because of who's backing it. Eclipse led the round with investors who have deep automotive expertise, including Jiten Behl from Rivian. This signals that experienced automotive investors believe Ever's AI orchestration model solves a real problem that previous digital car retailers couldn't solve. The backing from JIMCO (the Jameel family's investment arm, early Rivian backer) also indicates conviction from investors with real skin in the automotive game.

Could traditional car dealers just build AI systems like Ever's?

Traditional dealers could theoretically build similar AI systems, but they face a constraint Ever doesn't: legacy systems. Dealers operate with decades-old dealership management software, finance systems, and CRM platforms that weren't designed for AI orchestration. Retrofitting AI coordination into those systems is exponentially harder than building it from scratch. This is why truly disruptive technology often comes from new entrants rather than incumbents—they can make architectural choices the incumbents can't.

What's the realistic revenue potential for Ever?

If Ever captures even 5% of the used EV market in the US (which is only a fraction of the overall used car market), that would represent significant revenue. The used car market is worth roughly $400-500 billion annually in the US. If EVs eventually represent 30-40% of that market and Ever captures 5%, that's a multi-billion-dollar business. But getting there requires surviving the next 3-5 years without burning too much capital or damaging the brand.

Could the EV market downturn hurt Ever?

A temporary EV market slowdown probably helps Ever more than hurts. When growth is booming, traditional dealers can sell whatever they have. During plateaus, retailers who actually understand the category and can sell to skeptical mainstream buyers have an advantage. Ever's entire positioning is about making it easier for someone curious about EVs but hesitant to actually buy one. That's becoming more important, not less.

What would success look like for Ever in the next 3-5 years?

Success would mean becoming the recognized specialist in used EV retail, reaching profitability, and hitting something like 2-5% market share in used EV sales in major metros like California, Texas, and New York. They wouldn't need to dominate the entire market to be a billion-dollar success. They just need to prove the AI orchestration model works at scale while maintaining healthy unit economics and customer satisfaction.

The Bottom Line

Ever represents a specific bet about how AI changes competition in mature, complex industries. The bet isn't that AI will revolutionize everything (that's marketing speak). The bet is that building business operations from the ground up assuming AI orchestration will create better unit economics and customer experiences than bolting AI onto legacy systems.

For auto retail specifically, the answer is still unknown. But the next three to five years will tell us whether Ever's model works or whether auto retail's challenges (capital requirements, logistics complexity, customer trust issues) prove too hard for even a well-funded, well-led startup to overcome.

Either way, the experiment is worth watching. Because if Ever succeeds, you can expect hundreds of companies to try the same approach in other industries. And that could reshape how you experience buying everything from insurance to real estate to professional services.

The future of retail might not be more digital. It might be more orchestrated.

Key Takeaways

- Ever is built AI-native from day one, with orchestration managing the entire transaction workflow—not AI bolted onto legacy systems like Carvana attempted

- Focusing exclusively on used EVs lets Ever develop genuine expertise that traditional dealers, still treating EVs as afterthoughts, cannot match quickly

- The $31M Series A from Eclipse and other automotive-experienced investors signals conviction that AI orchestration finally solves the unit economics problem that killed previous digital retailers

- Success depends on executing logistics and scaling efficiently more than on having superior technology—operational excellence, not innovation, will determine if Ever survives

- The broader pattern: AI-native companies built from scratch in complex industries may create defensible advantages that AI-augmented incumbents struggle to replicate

Related Articles

- Complyance Raises $20M Series A: How AI Is Reshaping Enterprise Compliance [2025]

- Observational Memory: How AI Agents Cut Costs 10x vs RAG [2025]

- Toyota's Fluorite Game Engine: Redefining In-Car Graphics [2025]

- From AI Pilots to Real Business Value: A Practical Roadmap [2025]

- Sodium-Ion Batteries for EVs: Why They're Cheaper Than Lithium [2025]

- Digital Car Keys: The Future of Vehicle Access [2025]

![Ever's AI-Native EV Marketplace: How $31M Redefines Auto Retail [2025]](https://tryrunable.com/blog/ever-s-ai-native-ev-marketplace-how-31m-redefines-auto-retai/image-1-1770907086614.jpg)