Freeform's $67M Series B: How AI Is Revolutionizing Laser-Based Metal Manufacturing

Here's the thing about manufacturing in 2025: it's stuck in a decades-old playbook. Traditional metal printing systems are slow, expensive, and frankly terrible at scaling. That's exactly the problem two rocket engineers from Space X decided to fix.

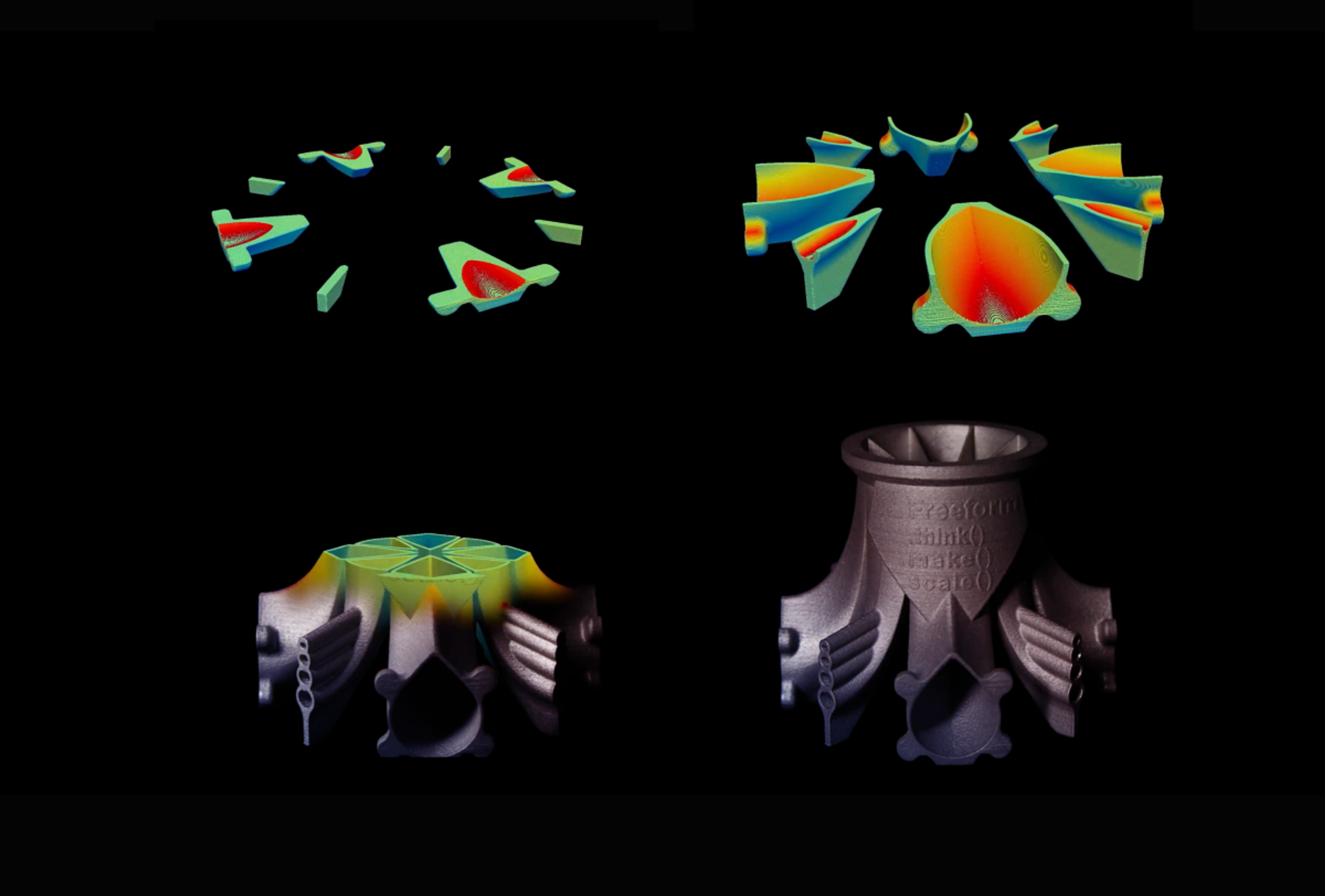

Freeform just raised $67 million in Series B funding, and they're not trying to make a better version of existing technology. They're building something fundamentally different. The company's upcoming Skyfall platform uses hundreds of lasers instead of dozens, processes thousands of kilograms of metal parts daily instead of hundreds, and runs on AI systems that learn and optimize in real time.

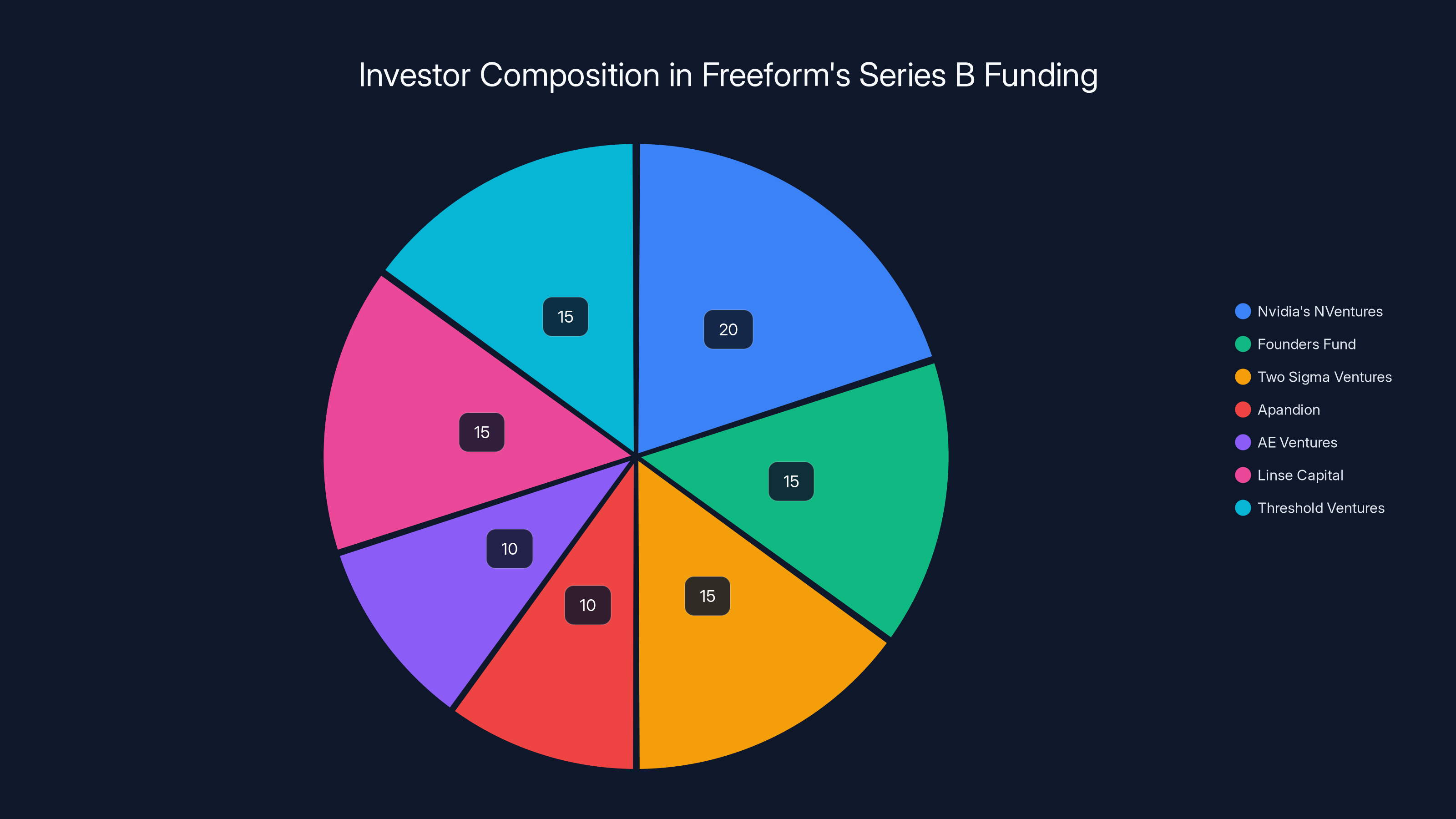

What makes this interesting isn't just the funding amount—it's who's investing and why. You've got Nvidia putting serious money behind this, alongside traditional VC powerhouses like Founders Fund and Two Sigma Ventures. That combination tells you something: this isn't a nice-to-have improvement. This is foundational infrastructure for how physical products get made in the next decade.

Let's break down what Freeform is actually doing, why it matters, and what this means for manufacturing as an industry.

The Problem With Manufacturing as It Exists Today

Manufacturing hasn't changed much since the Industrial Revolution got rolling. You design something, build tooling, set up assembly lines, and hope you got it right. When you need to change anything—a design tweak, a new material, a different batch size—you're looking at weeks or months and potentially six or seven figures in new equipment.

That's fine if you're making millions of identical cars. It's a nightmare if you're making specialized components: aerospace brackets, medical implants, defense parts, custom manufacturing for cutting-edge hardware.

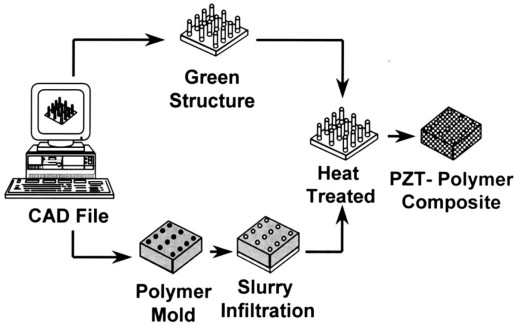

The metal printing systems that exist today promise to solve this. You design something in CAD, hit print, and parts come out the other end. In theory, it's revolutionary. In practice, it's slow and unreliable.

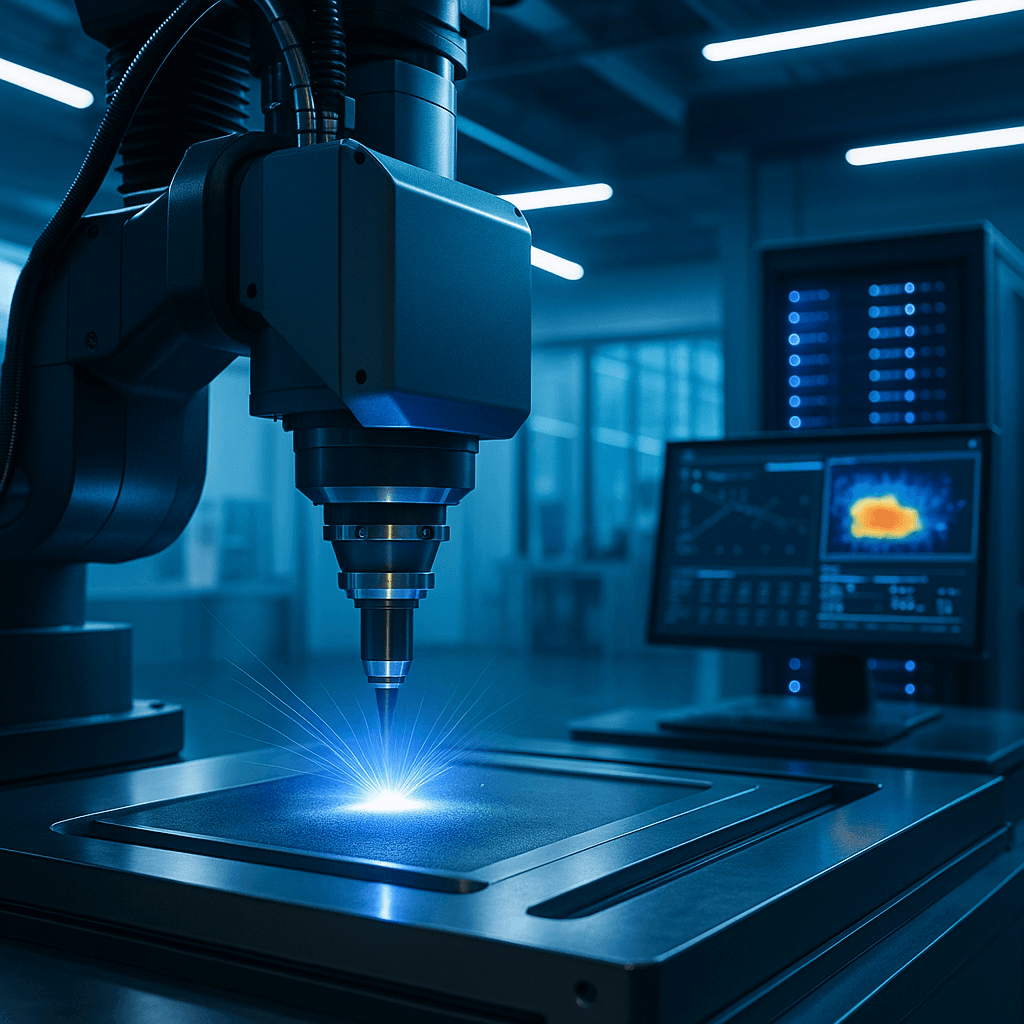

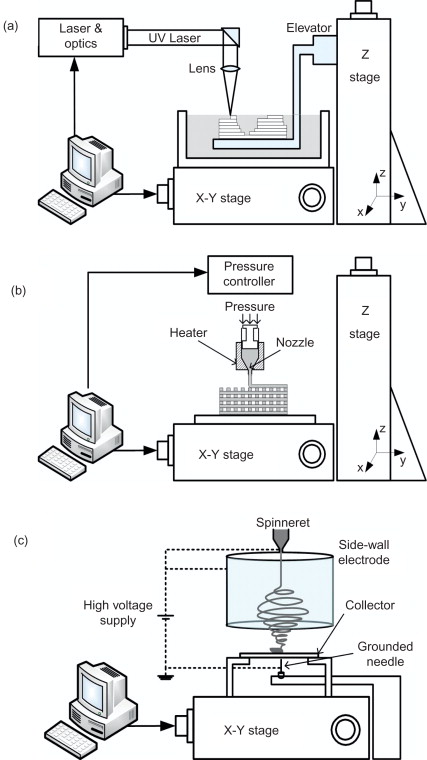

Traditional laser-based metal printing (additive manufacturing) works by fusing metal powder together with a laser. One laser. It traces patterns on a metal platform, fuses powder particles, and builds up layers. Print quality depends on thousands of variables: powder composition, laser power, scan speed, thermal dynamics, environmental humidity. Get any of them wrong and your part is garbage.

The throughput is abysmal. A system might produce a few hundred kilograms of finished parts per month. For industrial scale, that's basically decorative.

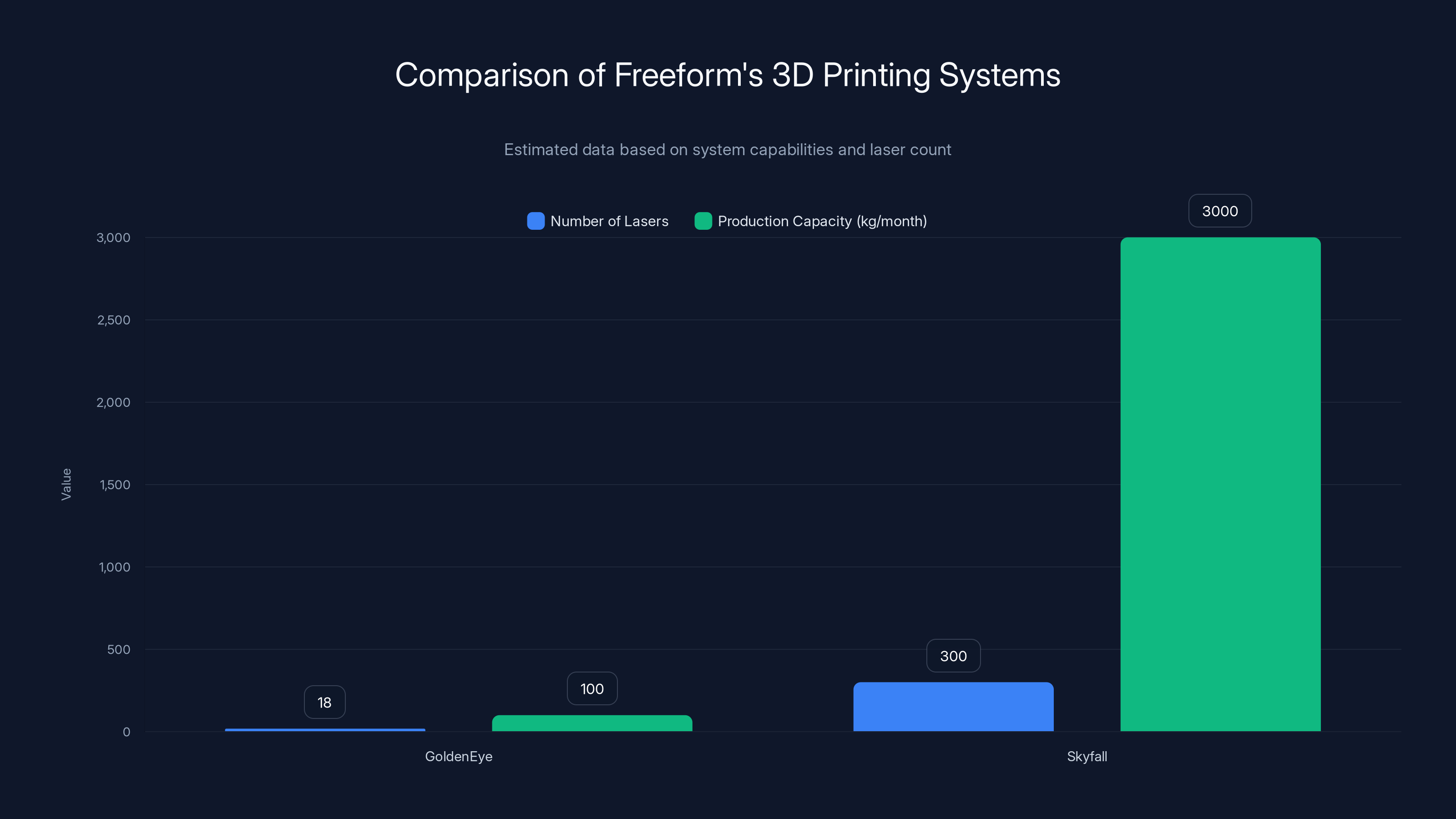

Skyfall significantly increases production capacity with hundreds of lasers, compared to GoldenEye's 18 lasers. Estimated data highlights the scale of improvement.

Enter Freeform: Starting From First Principles

Erik Palitsch and Thomas Ronacher met at Space X, where they were designing rocket engines. They both experienced the frustration firsthand. You need a custom part for a rocket component, and the only options are: wait months for traditional manufacturing, or buy a metal printer that costs millions and learn to operate it yourself.

Instead of trying to improve existing systems, they started from scratch in 2018 with a radical question: what if we designed this entirely for software control?

Traditional metal printers are mechanical systems with some software bolted on. Freeform flipped that. They built a machine that's fundamentally AI-native, with hardware designed around what software could do with it.

Their current system, called Golden Eye, uses 18 lasers working in parallel. Instead of one laser tracing patterns for hours, you've got 18 working simultaneously. More throughput, faster iteration, but here's the key: multiple synchronized lasers create vastly more complex thermal dynamics. You can't control that with manual tweaking. You need AI.

The Skyfall system they're building now scales this to hundreds of lasers. The complexity multiplies. That's where the H200 GPU clusters come in.

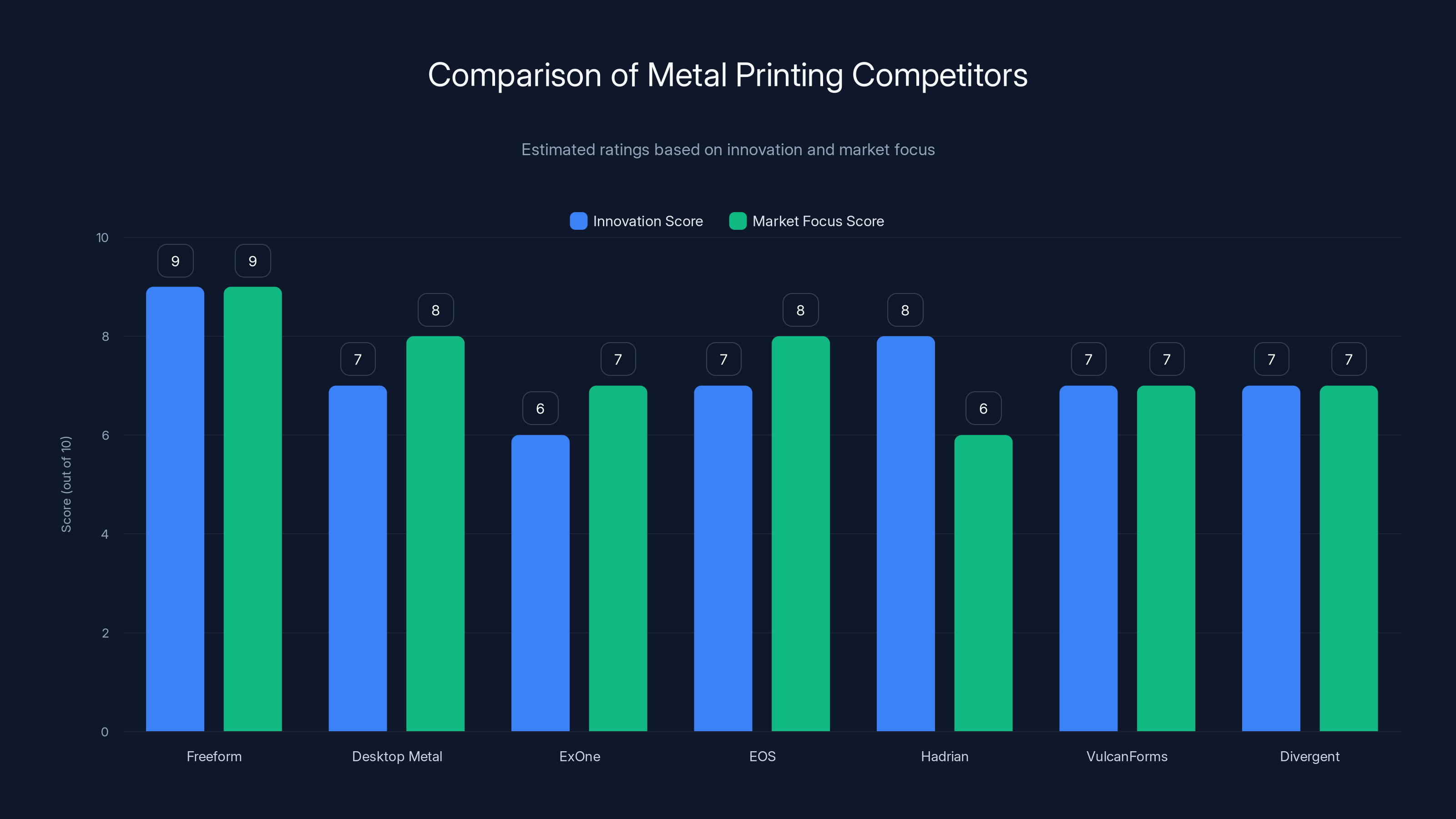

Freeform leads in innovation with a score of 9, attributed to its data-driven architecture and broad market focus. Estimated data based on industry analysis.

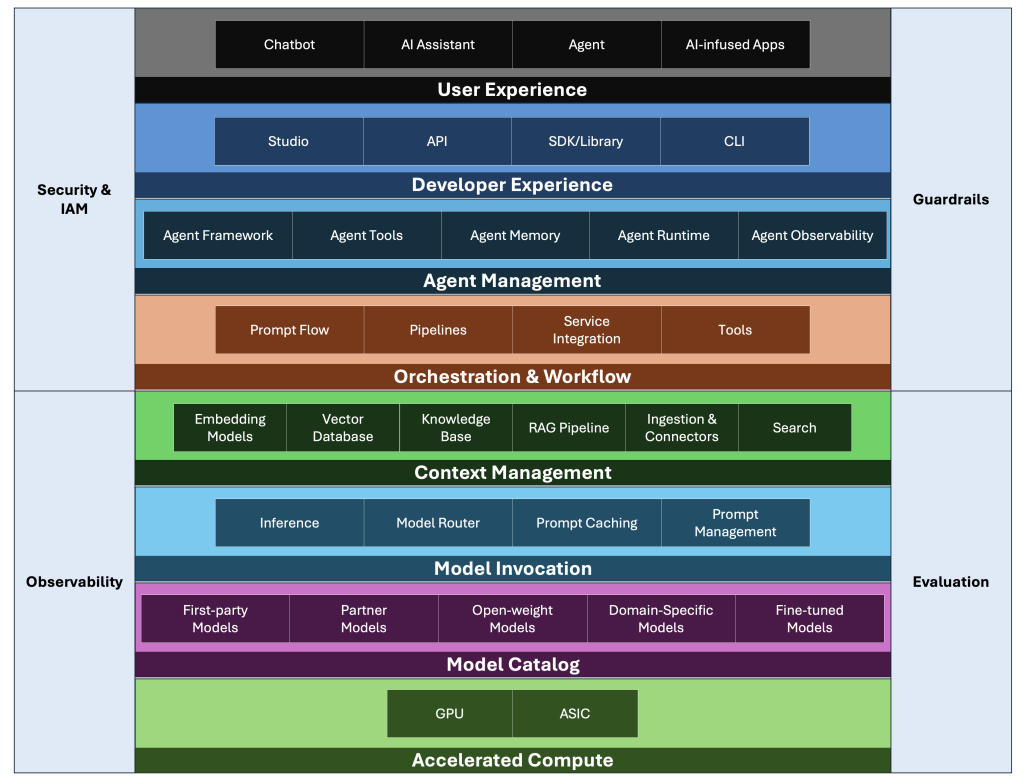

The AI-Native Manufacturing Stack

When Palitsch told Tech Crunch "we're the only manufacturing company with H200 clusters in a data center on site," he wasn't bragging. Well, maybe a little. But he was highlighting something fundamental about Freeform's approach.

H200s are Nvidia's latest flagship data center GPUs. They're designed for parallel computation at massive scale. Most manufacturing companies don't have data centers at all. They have machines on a factory floor. Freeform has sensors in their machines feeding real-time data into GPU clusters that are running physics-based simulations.

Here's what that actually means: as the machine prints, thousands of sensors measure temperature, laser power feedback, powder distribution, part geometry. All of that streams into the GPU cluster. The system runs physics simulations predicting how the next layer will fuse, identifies potential defects before they happen, and adjusts laser power, positioning, and timing in real time.

That's not conventional manufacturing. That's a closed-loop AI system optimizing a physical process in real time, learning from every single part that comes out of the machine.

Cameron Kay, Freeform's head of talent, said "we have more meaningful data on the physics of the metal-printing process than any company in the world." That's probably true. Traditional manufacturers don't even collect that data. Freeform has been accumulating it from hundreds of "mission-critical" parts already delivered to customers.

More data means better models. Better models mean faster iteration. Faster iteration means you can discover optimizations that purely mechanical approaches would never find.

Skyfall: The Next Generation

Golden Eye uses 18 lasers. Skyfall will use hundreds. That's not a linear improvement.

With more lasers, you can process more area simultaneously. But you also create overlapping heat zones, material interactions, and thermal stresses that are exponentially more complex to model and control. You can't solve that with rule-based logic. You need machine learning.

Freeform's vision is to produce thousands of kilograms of finished metal parts daily. For context, current industrial metal printers produce maybe 50-200 kilograms monthly. Scaling up 10x or 20x isn't just running the current process faster. It's a fundamentally different engineering problem.

The throughput increase enables new applications. Right now, metal printing is used for custom, low-volume, high-value parts. With Skyfall's capacity, you start approaching volumes where metal printing becomes cost-competitive with traditional manufacturing for medium-volume applications.

Imagine being able to print 10,000 aerospace brackets per month. Or 50,000 medical implants. Or custom automotive components in quantities that make traditional tooling uneconomical. That's the scale Freeform is building toward.

The investor composition in Freeform's Series B funding highlights a mix of traditional deep-tech backers and newer funds with a focus on frontier technology. Estimated data.

The Funding and Its Backers: What It Signals

A $67 million Series B is substantial, but not shocking for hardware startups in 2025. What's interesting is the investor composition.

You've got Nvidia's NVentures investing. That's not a generic venture fund. That's Nvidia saying "we think this company will use enough of our chips that investing in them is a hedge on our business." Nvidia's already providing GPU clusters to Freeform. They're betting on the company's success for revenue and market development.

Founders Fund and Two Sigma Ventures are traditional deep-tech backers. They've funded companies that transformed industries. Their presence suggests they believe Freeform is solving a real, large problem.

Apandion, AE Ventures, Linse Capital, and Threshold Ventures round out the syndicate. That's a mix of established VCs with manufacturing expertise and newer funds betting on frontier technology.

The valuation Tech Crunch reports (around $179 million post-funding) is reasonable for a company with working hardware, delivering parts to customers, and raising this much capital. But Freeform didn't disclose the actual figure, which is standard for hardware companies avoiding valuation scrutiny.

What matters more than the valuation is the signal this raises: manufacturing as a category is getting serious venture attention. Companies like Hadrian, Vulcan Forms, and Divergent have all raised hundreds of millions for similar visions. The capital is flowing because the problem is real and the market opportunity is enormous.

Manufacturing as Software: The Broader Trend

Freeform isn't operating in isolation. They're part of a broader movement treating physical manufacturing like a software problem.

Traditional manufacturing companies separate software from hardware. Freeform integrates them. The machine learning isn't an afterthought—it's the core of the system architecture.

This parallels what happened in computing. In the 1980s, hardware and software were mostly separate concerns. One company made the computer, another made the software. Now they're inseparable. Apple designs hardware and software together. Tesla does the same. Nvidia started as a chip company but became a software and systems company.

Manufacturing is following that path. Companies that treat the machine as a data platform—where the hardware is optimized for collecting and processing sensor data—will outcompete companies that just bolt software on top of mechanical systems.

Freeform's H200 clusters aren't a luxury. They're essential infrastructure for their business model. The machine generates enormous amounts of data. That data has to be processed and learned from in real time to maintain quality and optimize throughput. That requires massive compute.

Over time, as machine learning models improve, the advantage compounds. Their models get better, which means fewer defects, which means faster iteration, which means more data for better models. It's a virtuous cycle that's hard for competitors to match.

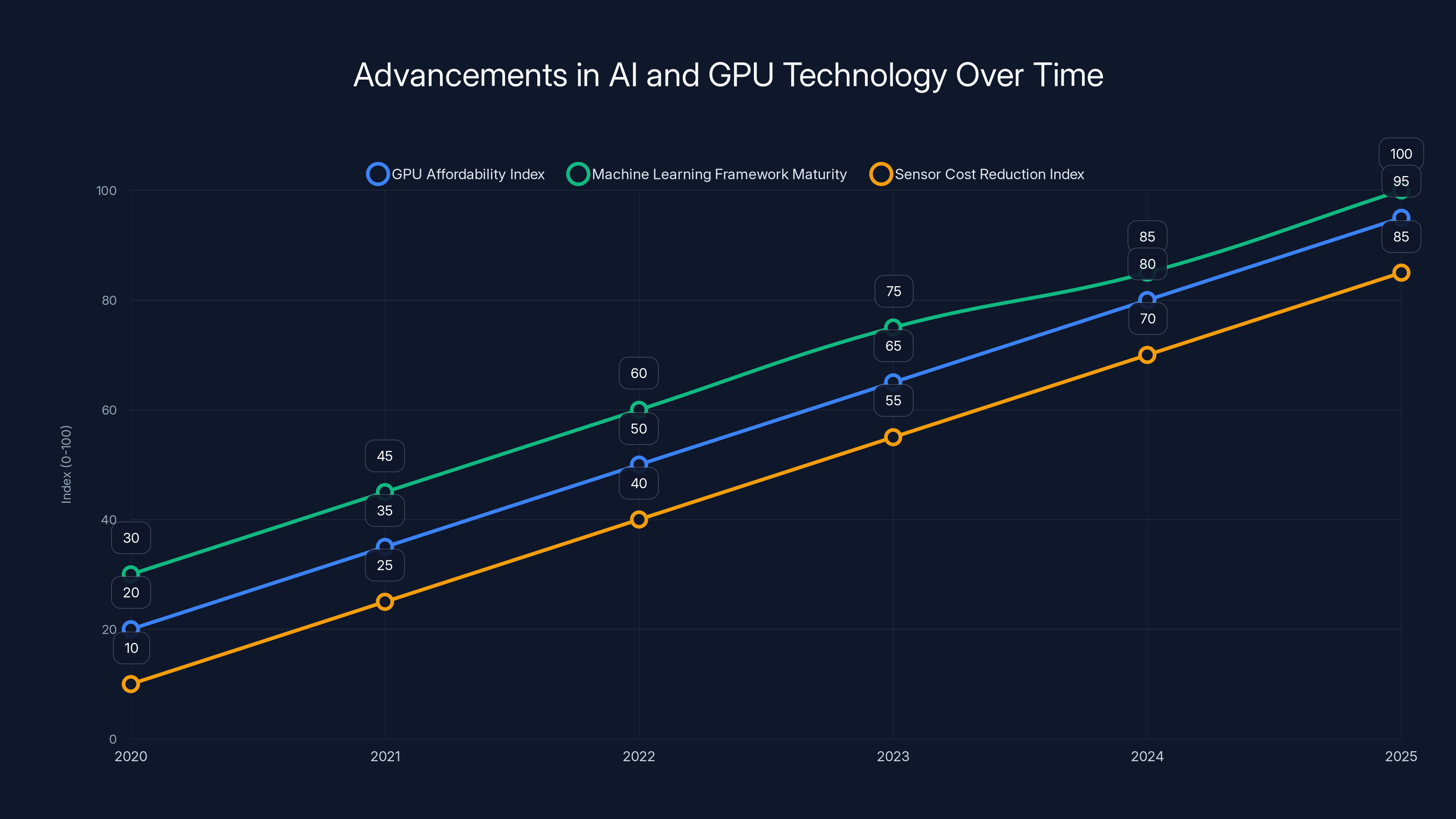

The line chart illustrates the rapid advancements in GPU affordability, machine learning framework maturity, and sensor cost reduction from 2020 to 2025, making AI-native manufacturing feasible. Estimated data.

Real-World Impact: What Does This Enable?

Freeform is deliberately quiet about their current customers—they won't disclose names—but they've confirmed delivering "mission-critical" parts to buyers. That's aerospace, defense, medical device language. When you say a part is mission-critical, you mean failure isn't an option.

That tells you Freeform's technology works. You don't bet your life on a technology that's still experimental. The fact that they're already delivering parts that matter means they've solved quality problems that kill most metal printing startups.

Once Skyfall comes online, the applications expand dramatically. Current constraints are volume and cost. Metal printing today is maybe 2-3x more expensive than traditional manufacturing for most parts, and you can only make small volumes economically. With thousands of kilograms daily production, those constraints disappear.

Consider aerospace manufacturing. Boeing and Airbus need tens of thousands of brackets, fastener inserts, and complex geometries for every aircraft. Traditional manufacturing involves separate machines and assembly steps. Metal printing could consolidate that. One bracket instead of three separate parts bolted together. That's weight reduction, fewer failure points, and lower manufacturing cost.

Defense and military applications are similar. Custom alloys, complex geometries, low-volume specialized parts. Metal printing is already used, but volume is limited. Skyfall could change that equation.

Medical devices are another huge market. Custom implants, surgical instruments, diagnostic devices—all demand small runs with high precision. Metal printing is ideal, but current throughput limits commercialization. Faster, cheaper metal printing opens up mass customization in medicine.

Even consumer applications become possible at scale. Lightweight titanium components for high-end bicycles, watches, automotive parts. If you can print metal parts for less than traditional manufacturing, you start competing in markets that seemed impossible before.

The Competition and Why Freeform Might Win

Freeform isn't alone in the metal printing space. Desktop Metal, Ex One, and EOS have been printing metal for years. Hadrian raised $1.6 billion for defense-focused automated manufacturing. Vulcan Forms and Divergent are well-funded competitors.

But here's why Freeform might be different. Most competitors are improving existing technology. They've got better lasers, faster hardware, software that's more user-friendly. Freeform is changing the fundamental approach.

Desktop Metal and EOS are great at what they do, but they're constrained by their architecture. They design hardware first, then bolt on software. Their systems run algorithms developed in universities and research labs. They're good algorithms, but they're not learning from real production data in real time.

Freeform's architecture is inverted. The hardware is designed to generate data. The software learns from that data continuously. The machine improves itself.

Hadrian is focused on a specific market (defense automation) and specific use case (low-mix, high-volume production). That's a huge market, but it's a niche. Freeform is building a general-purpose platform that can print thousands of different parts at scale. That's harder, but the addressable market is bigger.

The real advantage, though, is the talent and focus. Palitsch and Ronacher come from Space X, where they learned to think about manufacturing at extreme scale and precision. They're not trying to incrementally improve existing systems. They're building something that doesn't exist yet.

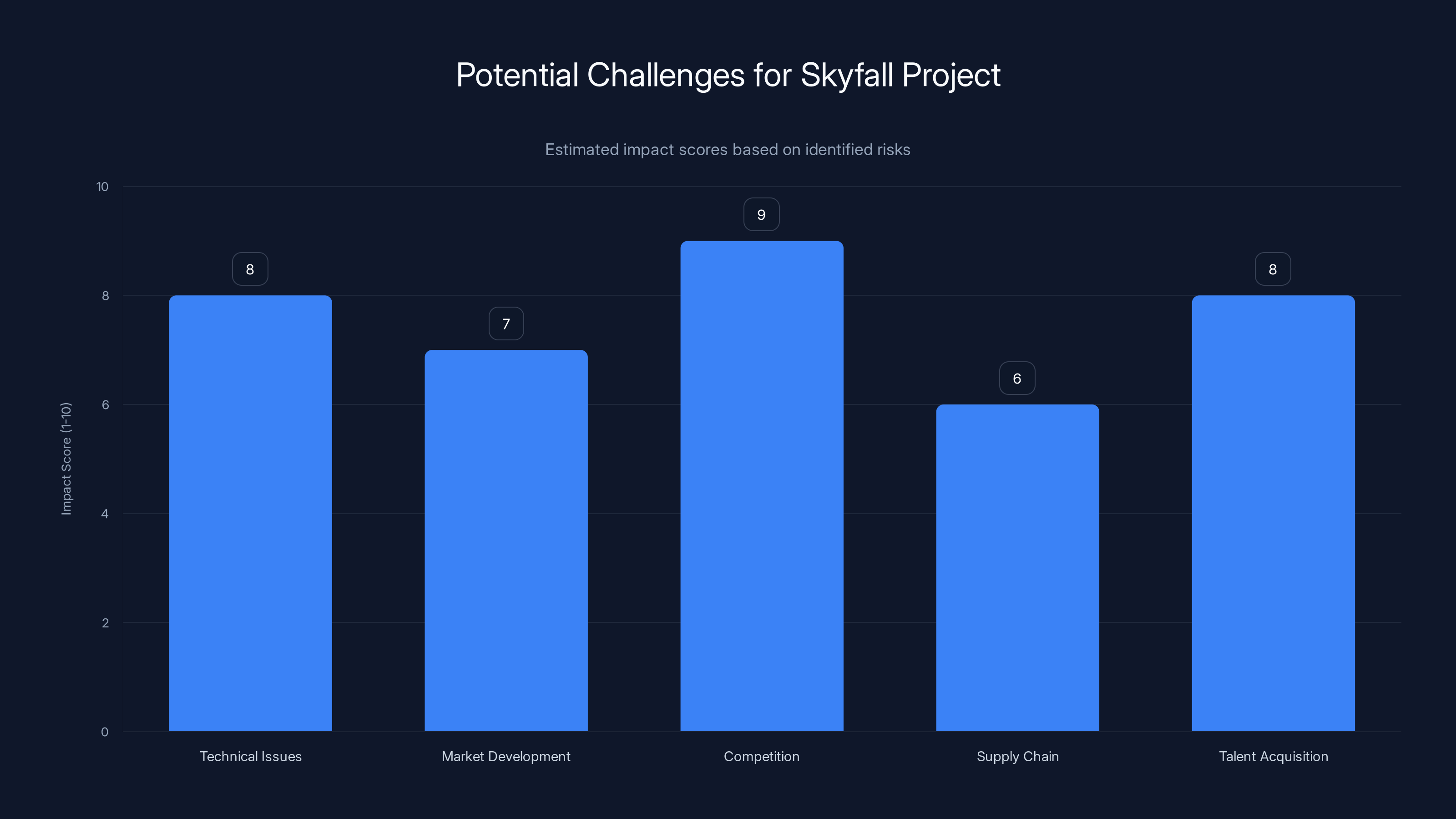

The chart estimates the impact of various challenges facing the Skyfall project, with competition and technical issues posing the highest risks. Estimated data.

The Role of AI and GPUs: Why This Timing Matters

Freeform couldn't have existed five years ago. The GPU technology, the machine learning frameworks, the sensor costs—none of it was ready.

In 2020, you couldn't afford to put H200 clusters in a manufacturing facility. The chips didn't exist. GPU costs were prohibitive for anything but the largest companies. Machine learning models for complex physics were research-grade, not production-ready.

Now, in 2025, all of that is mature enough to be practical. Nvidia's pushing GPU capacity. Generative AI has driven investment in data infrastructure. Machine learning frameworks handle manufacturing applications. Sensor costs have plummeted.

Timing matters in hardware. Tesla couldn't have built the Model S in 2005. The battery technology, computer chips, and software stack weren't ready. Freeform is launching at exactly the moment when AI-native manufacturing becomes possible.

This is also why Nvidia invested. They don't just make chips. They recognize that manufacturing is becoming a GPU-intensive business. Every advanced manufacturing system will need accelerated computing. Investing in Freeform is investing in the market for Nvidia's products.

Scaling and Execution: The Hard Part

Raising $67 million is easy compared to deploying a working system at scale. Freeform now has to build Skyfall, move it into a facility, solve manufacturing problems they haven't encountered yet, and deliver parts to customers reliably.

Hardware companies are notoriously harder to scale than software companies. You can push a software update. You can't push a firmware update that fixes thousands of customer machines if it breaks something. You own that failure.

The company is planning to hire 100 new employees and expand their facility. That's hiring people fast in a specialized field (manufacturing engineering, machine learning, materials science). It's possible but difficult. The wrong hires kill companies.

They also have a "contract backlog," which means customers are waiting for Skyfall to deliver. That's good news—you have revenue waiting—but it's also pressure. If Skyfall has problems, you disappoint customers who've already committed budget.

The history of manufacturing hardware is littered with startups that had great technology but couldn't scale. Freeform has to avoid becoming one of them.

The Broader Manufacturing Transformation

Freeform is one company, but they're part of a bigger shift in how manufacturing works.

For decades, manufacturing was outsourced to companies that had scale advantages: China, Vietnam, Mexico. Labor was cheap, infrastructure was built, costs were lower. Now that dynamic is breaking.

AI and automation are making precision manufacturing economically feasible anywhere. You don't need thousands of workers anymore. You need engineers and machines. That's repatriating manufacturing to developed countries and smaller companies.

Freeform is enabling this. With AI-native manufacturing, a company in Boston can make precision metal parts as efficiently as a factory in Shenzhen. That changes where products get made, who makes them, and the speed of iteration.

Combine this with other trends: AI-designed components, generative design optimization, real-time quality control. In five years, manufacturing is fundamentally different. You design something Monday, iterate based on simulations and early prototypes, and have optimized production running by Friday.

Challenges Ahead: What Could Go Wrong

There are real risks. The most obvious: Skyfall doesn't work as promised. You can't scale from 18 lasers to hundreds without hitting problems nobody predicted. Control systems get unstable. Thermal dynamics behave differently than simulations predicted. The GPU cluster can't keep up. These are real engineering problems.

Second, the market might not develop as fast as expected. Enterprise customers are conservative. Metal printing has a reputation as experimental technology. Convincing Boeing or Airbus to depend on your system for critical parts takes years, not months.

Third, competition is real. Established manufacturing equipment companies have capital, relationships, and expertise. If they decide metal printing matters, they can throw enormous resources at it. Freeform would be competing against companies with $10 billion revenue and global sales forces.

Fourth, supply chain. Hundreds of lasers require components from suppliers. If any critical component becomes unavailable, production stops. Hardware startups live and die on supply chain management.

Finally, talent. Freeform needs world-class engineers in machine learning, manufacturing, materials science, and systems engineering. Hiring and retaining that talent while scaling is hard. One key engineer leaving can derail a project.

The Long-Term Vision: Where This Goes

If Freeform executes—and that's a big if—they're building a platform that changes manufacturing fundamentally.

In ten years, precision metal printing at scale could be as common as injection molding is now. Companies could design custom parts in CAD, send them to a printing facility (could be local, could be shared across multiple customers), and receive finished parts in days.

That enables new business models. Companies stop maintaining inventory of specialized components. They print on demand. That reduces capital requirements, waste, and supply chain risk.

It also enables customization. Medical implants designed for specific patients. Aerospace components optimized for specific aircraft. Automotive parts tailored for regional climates. Batch size becomes irrelevant.

The software layer becomes increasingly important. The machine is just hardware. The AI models running on GPU clusters are the actual product. Companies that can collect data, train models, and continuously improve those models will dominate.

Freeform understands this. They're not trying to build the best laser printer. They're building a software-hardware system that uses AI to optimize physical manufacturing. That's a much bigger vision.

Investment Implications: What Freeform's Success Would Mean

If Freeform becomes a $1 billion+ company (which the funding trajectory suggests is the goal), it validates a thesis: AI-native manufacturing is a category that investors should care about.

We'd likely see more funding flow to similar companies. Not just metal printing—also composite manufacturing, ceramic printing, advanced materials. Any manufacturing process that's complex, data-rich, and amenable to AI optimization becomes interesting.

We'd also see acquisitions. Larger manufacturing equipment companies buying startups to add software and AI capabilities. GE, Siemens, and others have massive installed bases of aging equipment. They need to add software layers to stay relevant.

Equally important: we'd see shifts in where manufacturing happens. If AI and automation reduce labor costs and quality improves, manufacturing becomes less about finding cheap locations and more about access to infrastructure, talent, and capital. That could reshore some manufacturing to the US and other developed countries.

Why This Matters Now (And Why You Should Care)

If you're in hardware, manufacturing, or logistics, Freeform is relevant because they're signaling where capital and attention are flowing. AI-native manufacturing is becoming a real category.

If you're investing, Freeform's success or failure is a leading indicator for whether manufacturing can be software-transformed like every other industry. That's a multi-trillion-dollar question.

If you're building products, Freeform's platform could fundamentally change your manufacturing costs and speed. In five years, your competitors might be using systems like Skyfall to iterate faster and optimize designs in ways you can't match.

Most importantly, Freeform represents a shift in how we think about building things. For the past 50 years, manufacturing meant scale, automation, and efficiency within a fixed process. Freeform is showing us a future where manufacturing is adaptive, optimized by AI, and capable of rapid iteration like software development.

That's not just interesting from a business standpoint. It's fundamental to how humans will make things in the 21st century.

What's Next for Freeform

The $67 million gives them runway to build Skyfall, get it into a production facility, and start delivering parts to customers. That's probably 18-24 months of intense work.

If that goes well, we'll probably see them raise a Series C at a much higher valuation. Once Skyfall proves itself with real customers, institutional investors will line up.

Over the next three to five years, the real story is execution. Can they scale? Can they build a manufacturing operation that actually works? Can they keep hiring and retain the talent they need? Can they build enduring customer relationships?

Those are harder questions than raising capital. But if they execute, Freeform could be defining the future of manufacturing. And that's worth paying attention to.

FAQ

What exactly is Freeform's laser manufacturing technology?

Freeform develops AI-native metal 3D printing systems that use multiple synchronized lasers to fuse metal powder into precise components. Their current Golden Eye system uses 18 lasers, while their upcoming Skyfall platform will use hundreds of lasers to dramatically increase production capacity. The technology is differentiated by its AI-driven real-time optimization, where GPU clusters process sensor data from manufacturing and make adjustments to improve quality and throughput.

How does the Skyfall system improve upon Golden Eye?

Skyfall scales from 18 lasers to hundreds of lasers, enabling production of thousands of kilograms of metal parts daily instead of hundreds per month. This increase in throughput isn't just a linear improvement—it requires solving exponentially more complex thermal dynamics, thermal stresses, and material interactions. The system uses AI models trained on physics simulations to manage this complexity in real time, something traditional manufacturing approaches cannot achieve.

Why is GPU computing essential to Freeform's approach?

GPU clusters enable real-time processing of massive amounts of sensor data from the printing machines. Freeform runs physics-based simulations and machine learning models that predict defects before they occur, optimize laser power and positioning, and learn from every part produced. This level of computational intensity requires high-performance accelerated computing, which is why Freeform has H200 GPU clusters in their facility—something nearly no other manufacturing company currently does.

What kind of parts can Freeform print?

Freeform specializes in mission-critical precision metal components for industries like aerospace, defense, and medical devices. They're currently delivering parts to customers but won't disclose specific applications or customers. The technology can produce custom brackets, complex geometries, specialized alloys, and geometries that would be difficult or impossible with traditional manufacturing.

How does Freeform's approach differ from competitors like Desktop Metal or EOS?

While competitors like Desktop Metal and EOS have been printing metal longer and have established customer bases, Freeform approaches the problem differently. Most competitors design hardware first and add software afterward. Freeform designs hardware specifically to generate and process manufacturing data, with AI optimization as the core function. This AI-native architecture is harder to replicate than incremental hardware improvements, giving Freeform a potential long-term advantage.

What does the Series B funding ($67 million) enable Freeform to accomplish?

The funding allows Freeform to complete development of the Skyfall platform, build a production facility to manufacture it, hire approximately 100 new employees, and scale manufacturing to meet customer demand. The company has a backlog of contracts waiting for Skyfall's higher throughput, so the capital directly enables revenue growth and customer delivery. The funding also supports expansion of their GPU infrastructure and machine learning research.

Why is Nvidia investing in Freeform specifically?

Nvidia's investment signals they believe manufacturing will become increasingly GPU-intensive as companies adopt AI-native approaches. By investing in Freeform, Nvidia is hedging on future demand for their chips in manufacturing applications. As more companies follow Freeform's model, they'll need GPU clusters, driving long-term revenue for Nvidia. It's a classic venture capital strategy of investing in potential customers.

What are the biggest risks to Freeform's success?

Key risks include: technical challenges scaling from 18 lasers to hundreds (thermal control, system stability), slow adoption by conservative enterprise customers, competition from established manufacturing equipment companies with more capital, supply chain disruptions for critical components, and talent acquisition and retention during rapid scaling. Hardware companies have a high failure rate during scale-up, and Freeform isn't immune to these challenges.

Could Freeform's technology be disruptive to traditional manufacturing?

Potentially, yes. If Freeform successfully scales, metal printing becomes faster and cheaper than traditional manufacturing for many applications. This could reshore manufacturing to developed countries (labor becomes less important than technology access), enable on-demand manufacturing with minimal inventory, and allow rapid customization. However, adoption in conservative industries like aerospace takes years, so disruption, if it happens, will be gradual.

What does Freeform's success mean for the broader manufacturing industry?

Success would validate that AI-native manufacturing is a viable category deserving significant investment. It would likely trigger more funding for similar companies in composite printing, ceramic manufacturing, and other complex processes. It would also accelerate acquisitions where larger manufacturing companies buy startups to add software and AI capabilities. Long-term, it signals a fundamental shift in how physical products get designed and built in the 21st century.

When will Freeform's Skyfall system be available to customers?

Freeform hasn't provided specific timelines, but based on typical hardware development cycles, Skyfall is likely 18-24 months away from full production deployment. The company is hiring rapidly and expanding facilities, suggesting they're in active development. Given they already have a customer backlog waiting, deployment will likely happen as soon as the system proves reliable.

How does Freeform's technology compare to traditional manufacturing methods like machining?

Traditional machining is fast and precise for simple geometries but creates waste (chips and scrap metal) and requires tooling for each design variation. Metal printing produces near-zero waste and can create complex internal geometries impossible with machining. However, printing was historically slower and more expensive per unit. As Freeform scales, printing becomes competitive or superior on both cost and speed for medium-volume custom production, while machining remains superior for high-volume commodity parts.

Key Takeaways

- Freeform raised $67M Series B to develop Skyfall, an AI-native metal 3D printing system with hundreds of synchronized lasers, enabling 10-20x higher throughput than current systems

- Unlike competitors, Freeform's architecture is AI-first: hardware designed to generate data, with GPU clusters running real-time physics simulations and continuous learning

- Nvidia's investment signals a major shift toward GPU-intensive manufacturing, positioning AI-native systems as the future of precision production

- Skyfall could scale metal printing from hundreds of kg/month to thousands daily, making custom manufacturing economically competitive with traditional production

- Manufacturing is moving from batch-and-wait to software-optimized, data-driven systems—fundamentally changing where and how products get built globally

Related Articles

- Tungsten 3D Printing Breakthrough: What You Need to Know [2025]

- China's Humanoid Robots Dominate TV, Outpacing Tesla Optimus [2025]

- Amazon's Blue Jay Robotics Project Failure: What Went Wrong [2025]

- MSI Vector 16 HX AI Laptop: Local AI Computing Beast [2025]

- Heron Power's $140M Bet on Grid-Altering Solid-State Transformers [2025]

- Blackstone's $1.2B Bet on Neysa: India's AI Infrastructure Revolution [2025]

![Freeform's $67M AI-Powered Laser Manufacturing Revolution [2025]](https://tryrunable.com/blog/freeform-s-67m-ai-powered-laser-manufacturing-revolution-202/image-1-1771508261086.jpg)