The Rise of Intelligent Warehouse Automation: Why Gather AI Matters Now

Warehouses are broken. Not in the sense that they don't work—they work fine for moving boxes from A to B. But they're inefficient in ways that cost companies millions annually. Misplaced inventory, slow manual audits, cold storage compliance failures, and workflow bottlenecks hemorrhage money every single day. Most warehouse management systems rely on humans to spot these problems. People scan barcodes. People check expiration dates. People walk freezers in minus-20-degree conditions.

Then Gather AI showed up and asked a simple but radical question: what if the warehouse could watch itself?

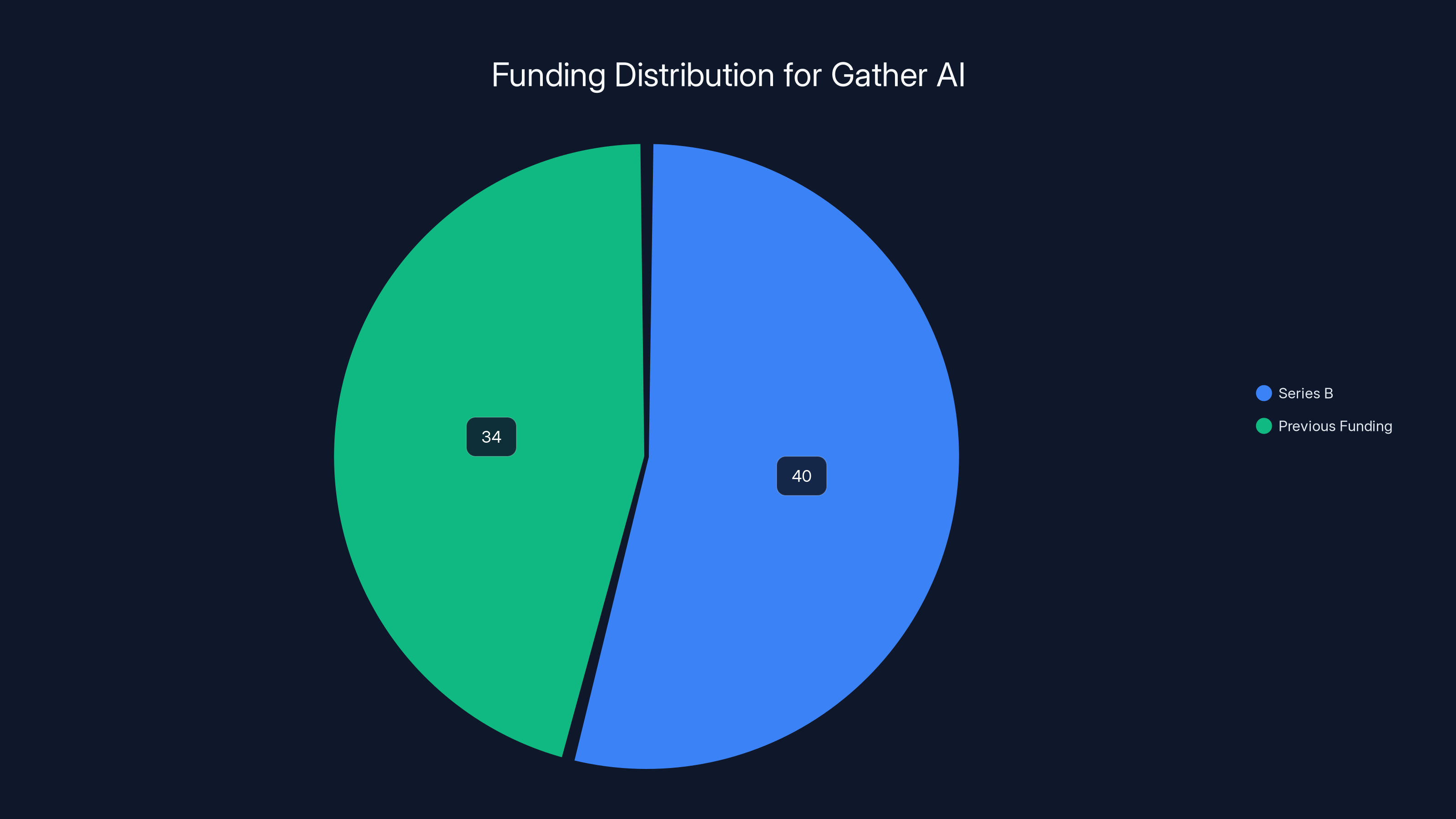

The startup just raised $40 million in Series B funding, led by Smith Point Capital, the venture firm founded by former Salesforce co-CEO Keith Block. It's a vote of confidence that signals something important: warehouse automation is about to get way smarter than anyone expected. But this isn't just another AI camera company slapping computer vision on a drone and calling it innovation. Gather AI built something genuinely different.

The difference comes down to curiosity. Their system doesn't passively scan what's in front of it. Instead, it actively seeks out specific problems: missing barcodes, damaged goods, misplaced stock, workflow inefficiencies, safety hazards. It investigates. It reports. It learns. The drones flying around your warehouse aren't just recording—they're thinking about what they see and deciding what to check next.

This matters because the warehouse industry has been waiting for automation that actually understands context. You can throw all the AI you want at a problem, but if it doesn't know what to look for, it becomes noise. Gather AI solved that with a philosophy rooted in robotics research from Carnegie Mellon University and refined over nearly a decade in real warehouses.

The funding milestone is significant for another reason: it validates embodied AI as the next frontier in enterprise automation. Unlike large language models that exist in chat windows and web apps, embodied AI systems physically interact with the real world. They move. They explore. They discover. Warehouse drones represent the first wave of this shift into production environments at scale. This article breaks down what Gather AI actually does, why their approach works differently, and what it means for the future of logistics automation.

TL; DR

- $40M Series B Led by Salesforce Veteran: Keith Block's Smith Point Capital led the round, validating the warehouse AI space with serious capital from enterprise-focused investors

- Embodied AI, Not Just Computer Vision: Gather's drones actively seek problems rather than passively scan, using classical Bayesian techniques combined with neural networks to avoid hallucination issues

- Already Profitable with Major Customers: Kwik Trip, Axon, GEODIS, and NFI Industries are running Gather AI systems in production, with total funding now at $74 million

- Multi-Year Ph D Pedigree: Four Carnegie Mellon Ph D founders built autonomous helicopters before creating Gather, giving them 9+ years of embodied robotics experience

- The Tech Works in Harsh Environments: Unlike humans and standard computer vision, Gather systems operate in freezers, cold storage, and low-light conditions where people shouldn't be

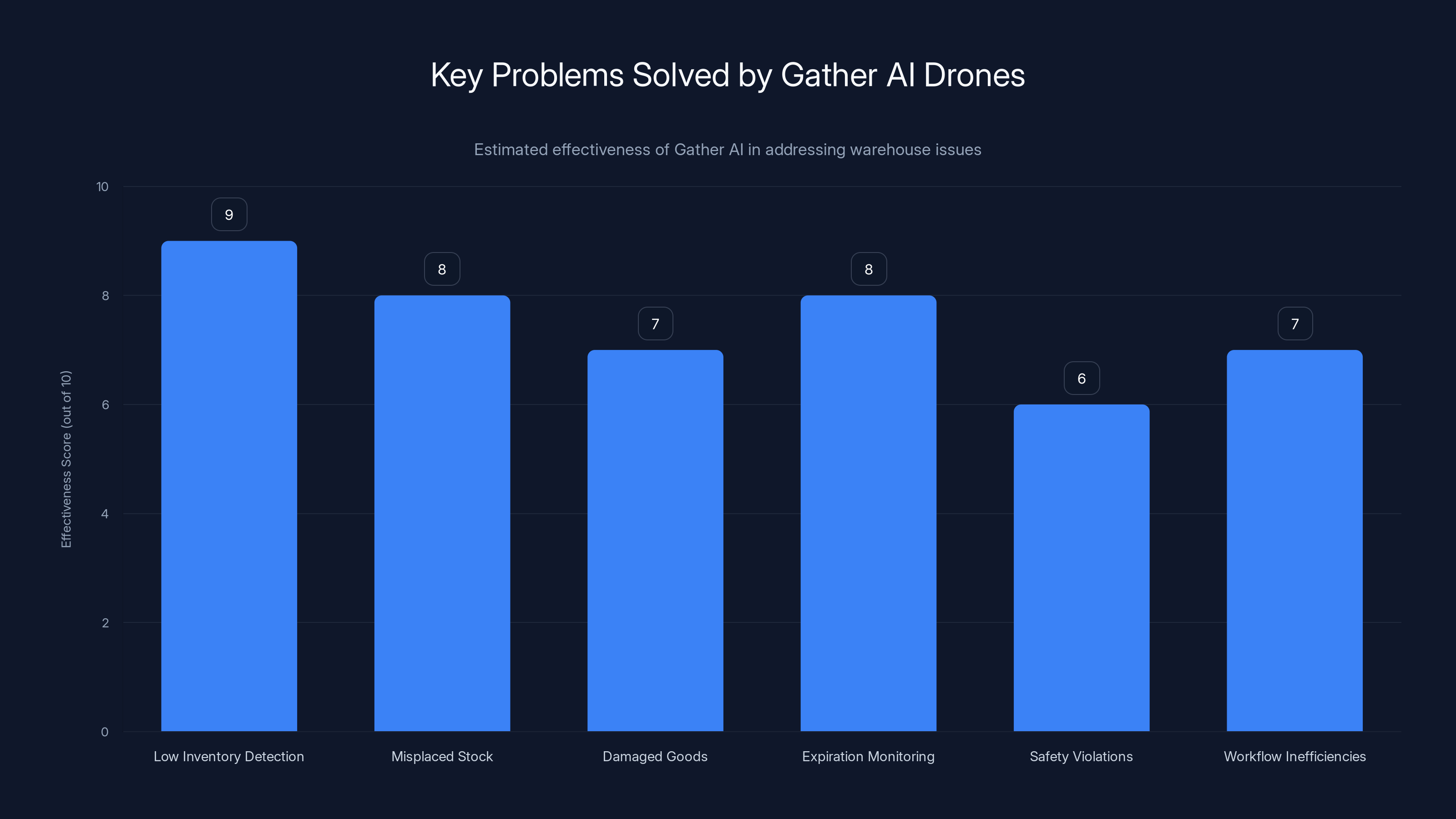

Gather AI drones are highly effective in detecting low inventory and misplaced stock, with scores of 9 and 8 respectively. Estimated data based on typical warehouse challenges.

Understanding Embodied AI: The Difference Between Watching and Seeking

When most people hear "AI warehouse solution," they picture static cameras recording footage and an algorithm crunching video feeds. That's passive surveillance turned automated. Gather AI does something fundamentally different, and understanding why requires a brief detour into AI philosophy.

Traditional computer vision systems work like a photographer. They point a camera at something and describe what they see. Does the image contain a box? A barcode? Text? They're reactive. They process what's already there. Embodied AI systems work more like a detective. They have a hypothesis. They move to test it. They gather evidence. They adjust their next action based on what they find.

This is the core of what makes Gather's technology different. Their drones don't fly around warehouses on random patrol. Instead, they're programmed to be curious about specific things: barcodes that don't scan, boxes in the wrong location, expiration dates approaching their limits, inventory counts that don't match system records. The system has a goal, and it investigates to reach that goal.

Sankalp Arora, the CEO and co-founder, explained it during interviews around the funding announcement: "My Ph D work focused on how to make different kinds of flying robots curious. So they're curious about boxes and barcodes and workflows." That's not poetic language. It's a description of how the system actually works.

The algorithm layer underneath this is where Gather really diverges from the generative AI crowd. Their underlying technology predates the large language model boom. It's built on classical Bayesian techniques—probability-based methods that teach machines to interpret visual data using prior knowledge and data—combined with neural networks. This hybrid approach matters enormously.

Bayesian systems don't hallucinate the way LLMs do. An LLM might confidently tell you there's a purple elephant in your warehouse when there isn't one. A Bayesian system with neural network enhancement might miss the purple elephant if the lighting is weird, but it won't fabricate one. The system only reports what it can reasonably infer from evidence. For warehouse operations where incorrect data can trigger the wrong inventory adjustments, this reliability difference is everything.

The practical result is that Gather's drones can operate in environments where humans struggle and where other automation fails. Freezers at minus-20 degrees Fahrenheit don't bother them. Dark storage areas where cameras typically need special infrared modes work fine. Wet environments that would damage most electronics or create reflective glare on camera lenses are manageable. The system still sees the problem.

Estimated data shows that with strategic expansion and customer acquisition, Gather could achieve $50 million in annual revenue with 500 customers.

How Gather AI Actually Works: The Technical Reality

Let's get specific about what these drones actually do when they're flying around a warehouse, because the implementation matters as much as the philosophy.

Gather deploys two types of hardware. First, fixed cameras mounted on moving equipment like forklifts. These cameras are off-the-shelf components—no proprietary hardware required. Second, autonomous drones that fly around the warehouse on programmed paths. These drones also use standard components. The magic happens in the software layer that coordinates the hardware, processes the visual data, makes decisions about where to look next, and logs findings back into the warehouse management system.

When a drone launches, it has parameters. It knows which SKUs to prioritize. It knows which sections of the warehouse to focus on. It knows what problems to investigate. Maybe inventory of a fast-moving product is running low. Maybe an expiration date on a medical supply batch is approaching. Maybe a safety audit flagged a particular zone for compliance checking. The drone's job is to investigate those specific concerns.

As the drone flies, it captures visual data. The Bayesian system processes this data in real time. When it identifies something relevant to its parameters—a barcode, expiration date, damage, occupancy level, case count—it flags the data point. But here's where it differs from simple detection: the system also decides what to investigate next.

Let's say a drone discovers three boxes in the wrong section. The system doesn't just report that and return to base. It analyzes the scenario: are these boxes part of a larger misplacement? Are they blocking access to other inventory? Are they damaged? The drone's next investigation might move to the adjacent shelves to check context. This is the "curious" behavior in action.

The system learns over time. If certain types of damage are correlated with specific suppliers, the algorithm strengthens its attention to shipments from those suppliers. If particular workflow patterns tend to precede inventory errors, the system becomes more vigilant during those patterns. The learning isn't happening through retraining the model constantly. Instead, it's embedded in how the Bayesian framework uses prior knowledge to make probability-based decisions.

Once the drone completes its investigation, the data gets integrated into the warehouse management system. A manager doesn't get a 2-hour video file to sort through. Instead, they get a structured report: "Box 47823 appears to be in section D when records show section B. Recommend visual verification." Actionable insight, not raw data.

The entire flow happens with minimal human intervention. A drone operator doesn't remotely control each movement. Instead, operators set parameters and monitor overall system health. The system operates autonomously within those parameters, making hundreds of micro-decisions about where to investigate based on the probabilistic models running in the background.

The Founding Team: Why Ph D-Level Robotics Matter

You can't understand why Gather AI's approach works without understanding who built it. The company was founded in 2017 by four Ph D students from Carnegie Mellon University's Robotics Institute. They weren't warehouse experts. They were roboticists who had spent years teaching flying machines to navigate, learn, and make decisions autonomously.

Specifically, the founders built one of the first autonomous helicopters and tested it on FBI training grounds in Quantico. This wasn't simulation. This was real hardware operating in complex, real-world environments where failure meant actual crashes. The constraints of that work—making autonomous systems that don't hallucinate, that operate reliably in unpredictable conditions, that learn from limited data—directly shaped how Gather approaches warehouse automation.

Keith Block, the venture investor leading this funding round, is also a Carnegie Mellon trustee. His connection to the university meant he could deeply understand the pedigree of the founding team. When Arora described their first meeting with Block at a logistics conference, he noted: "It took Keith and his team five minutes to get what we're doing." That's not because Block is an AI expert. It's because he recognized the deep technical foundation that made the approach credible.

This team composition matters because warehouse automation tends to attract two types of founders: enterprise software people without robotics experience, and roboticists without enterprise sales experience. Gather has both. The founders understand how to build reliable autonomous systems because that's their Ph D research. But they've also spent nine years iterating with actual warehouse customers, which forced them to make the technology practical rather than theoretical.

The continuity of the founding team is also notable. This isn't a situation where the original researchers moved on and a different team took over. The same people who designed the autonomous helicopter logic are running the warehouse automation company. That architectural consistency matters for technical coherence.

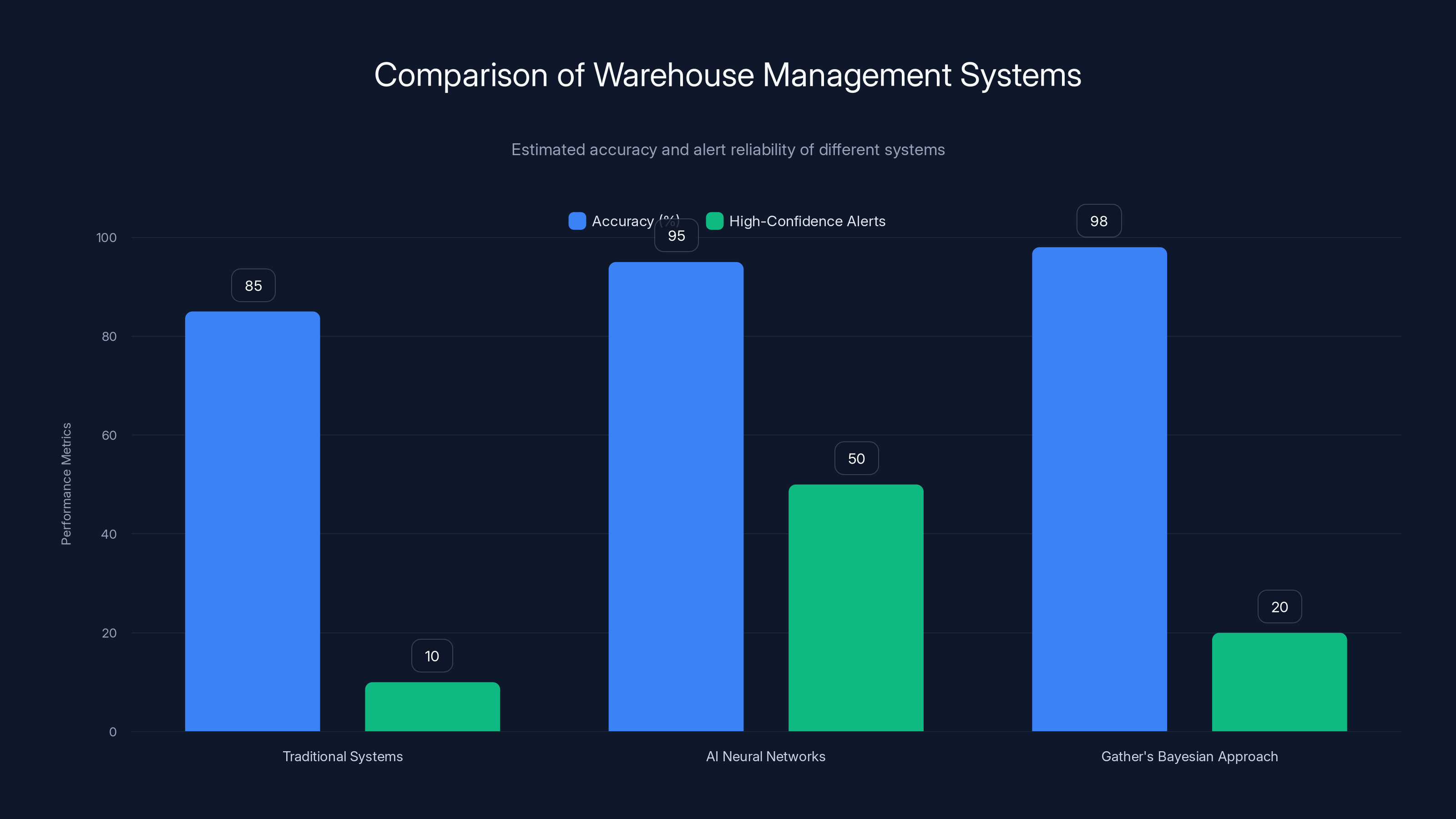

Gather's Bayesian approach offers higher accuracy and more reliable alerts compared to traditional systems and AI neural networks. Estimated data based on industry insights.

Why Major Warehouses Are Adopting Gather Now

Gather's customer roster tells you something important. Companies like Kwik Trip (a regional convenience store and gas chain with complex logistics), Axon (which handles law enforcement technology), GEODIS (one of the world's largest logistics providers), and NFI Industries (another logistics heavyweight) aren't early adopters playing with experimental tech. They're pragmatic operators running mission-critical operations.

Why are they switching to Gather? The answer isn't that warehouse automation didn't exist before. It's that the alternatives had real limitations.

Traditional warehouse management systems excel at tracking inventory if humans scan items correctly. They don't excel at discovering when humans didn't scan something, or scanned it wrong, or placed it in the wrong location. That's where the blind spots are. Correcting those blind spots meant hiring more staff to manually audit shelves. That's expensive, slow, and in cold storage environments, genuinely uncomfortable.

The other computer vision companies applying AI to warehouses typically use end-to-end neural networks. These systems can work, but they suffer from the hallucination problem. In a warehouse with thousands of items, false positives multiply. A system that's 95% accurate might still flag 50 non-existent problems per day in a large operation. That creates noise that warehouse managers learn to ignore, which defeats the entire purpose.

Gather's Bayesian approach avoids this trap. It's more conservative in what it reports, but what it does report tends to be accurate. For a warehouse manager drowning in operational chaos, a system that gives you 20 high-confidence alerts beats a system that gives you 200 alerts where you trust maybe 10.

The financial impact is significant. A single misplaced pallet in a high-value operation might cost $5,000 to track down manually. Multiply that by dozens of incidents per month, and you're looking at six-figure monthly losses in a medium-sized warehouse. If Gather's system catches even 50% of these incidents, the ROI is immediate.

The Funding: Why $40 Million and Why Now

A $40 million Series B is substantial but not outrageous in today's venture landscape. The significance lies in who's backing it and what it signals about the market.

Keith Block co-led Salesforce through periods of explosive growth. He understands enterprise software, sales cycles, and how to scale B2B companies. Smith Point Capital, the fund he created post-Salesforce, explicitly targets operational software that solves supply chain and logistics problems. Gather AI is precisely the kind of company that matches this thesis.

The fact that this round was oversubscribed—meaning more investors wanted in than the company wanted to take—reflects a shift in how the venture community views warehouse automation. Five years ago, the narrative was that robots would take over warehouses. Amazon's use of robotics became the default mental model. But a different opportunity emerged: augmenting human-operated warehouses with smarter observation systems.

Robots that can pick and sort items turn out to be extremely expensive and require completely reorganized warehouse layouts. Drones that can observe and report on existing operations fit into current workflows with minimal disruption. The ROI timeline is shorter. The capital requirement per customer is lower. The market opportunity is actually larger because most warehouses can't afford full robotic reorganization.

With

Other investors in previous rounds included Bain Capital Ventures, XRC Ventures, and Hillman Investments. This is a respectable investor group—Bain Capital is one of the larger venture firms with deep enterprise contacts, which helps with customer acquisition. The diversity of the investor base suggests this isn't a one-person fund backing the company. It's multiple institutional investors validating the same thesis.

The $40 million Series B round constitutes over half of Gather AI's total funding, highlighting the strategic importance of this recent investment phase.

Embodied AI as the Next Computing Frontier

Why does this funding matter beyond warehouse automation? Because Gather AI represents the first wave of embodied AI systems moving into commercial production at scale.

For the past few years, the AI industry has been almost entirely focused on large language models: systems that take text input and produce text output. These systems are powerful for certain tasks, but they're fundamentally decoupled from the physical world. When an LLM hallucinates, it's a text hallucination. When a warehouse system hallucinates, it's a physical error that costs real money.

Embodied AI is different because it forces reality-checking. A warehouse drone can't hallucinate a box that isn't there—or rather, it can theoretically try, but the next human who walks the warehouse will instantly disprove it. This feedback loop makes embodied AI systems self-correcting in ways that pure language models aren't.

Gather AI won this self-correction through Bayesian probability methods, not through LLM scaling. This is important because it suggests that the next wave of AI deployment won't be about making language models bigger. It'll be about applying appropriate techniques (sometimes classical, sometimes neural) to specific problems. Bayesian methods for warehouse vision. LLMs for summarization. Reinforcement learning for optimization. Different tools for different jobs.

In December 2025, Gather won the Nebius Robotics Award for Vision AI and Streaming Video Analytics. Nebius is a Netherlands-based company providing AI infrastructure. The award recognizes the company's achievements in practical robotics vision systems. It's not a huge award in the way that raising $40 million is, but it's symbolic: the infrastructure companies powering AI are starting to recognize embodied systems as the frontier worth investing in.

This shift has implications across industries. Factories could use similar systems to spot production anomalies. Retail stores could use them to catch pricing errors or out-of-stock items. Hospitals could use them to track equipment and supplies in sterile environments where manual checking is expensive. The warehouse use case is just the first implementation. Once Gather proves the model works at scale, the total addressable market expands dramatically.

The Competitive Landscape: Why Gather Stands Out

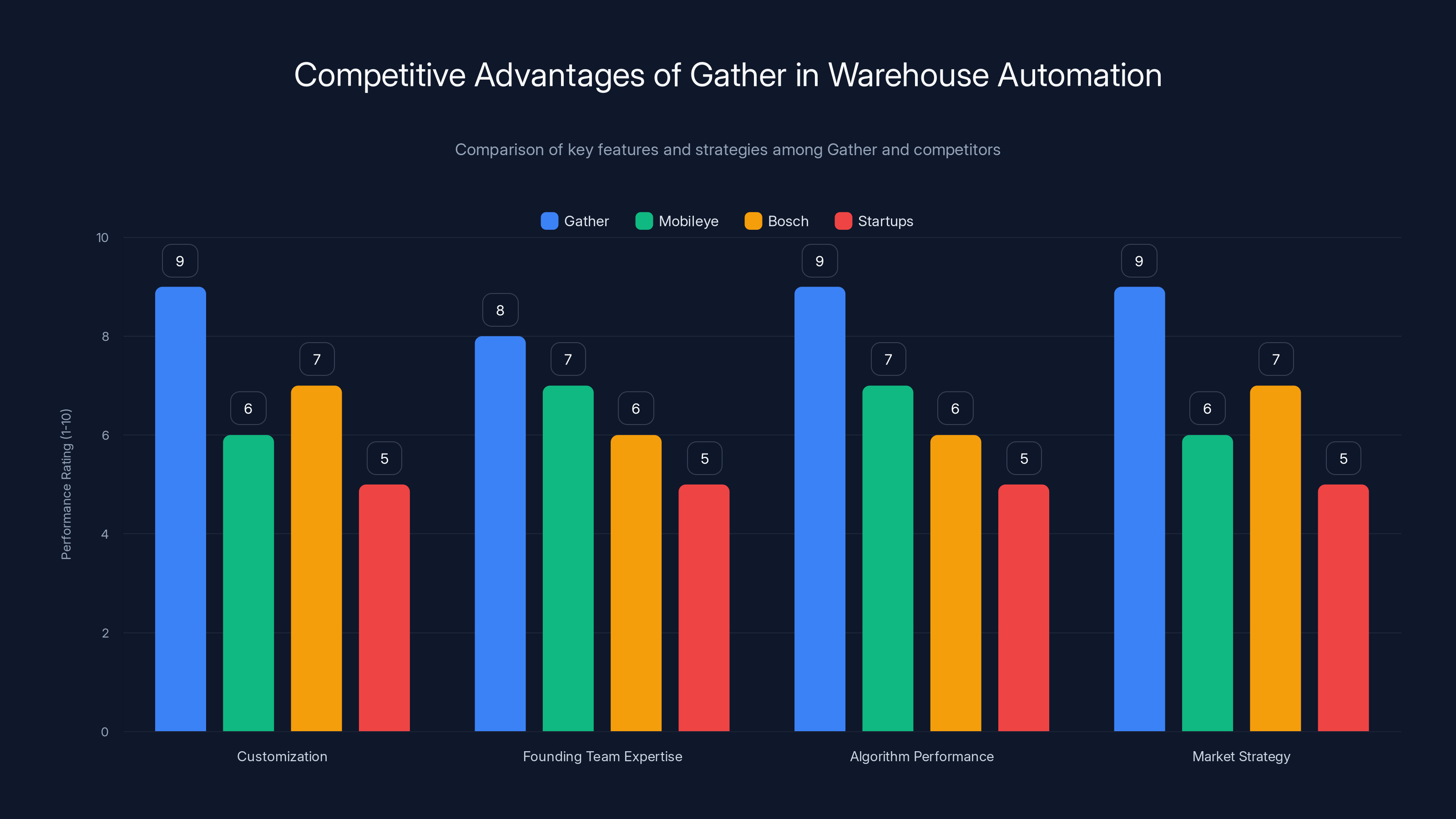

Gather isn't alone in the warehouse automation space. Companies like Mobileye (an Intel subsidiary), Bosch's logistics division, and various startups have all invested in warehouse vision systems. So why is Gather attracting the venture capital and the Fortune 500 customers?

First, Gather's embodied approach means their systems learn from what the warehouse actually looks like, not just from training data. A system trained on thousands of hours of generic warehouse footage might miss the specific ways your warehouse operates. Gather's system learns your specific workflows, your specific inventory problems, your specific challenges. This customization isn't expensive in the sense of requiring custom software. It's just the system adapting to reality.

Second, Gather's founding team brings robotics credibility. Other warehouse automation companies often come from computer vision or logistics backgrounds. They understand cameras and warehouses but not how to build reliable autonomous systems that operate in unpredictable real-world environments. Gather's founders understand both, because they've been solving that problem since before the company existed.

Third, the Bayesian approach actually outperforms neural network approaches on warehouse-specific tasks. This is counterintuitive in an era of neural network dominance, but it's true. The probabilistic framework works better when you have clear, bounded problems ("is this a barcode?") versus fuzzy, open-ended problems ("summarize this article").

Fourth, Gather has a customer-first go-to-market strategy rather than a technology-first strategy. They didn't build a platform and then look for customers. They built a specific solution to a specific problem (warehouse inventory accuracy) and expanded from there. This customer obsession shows in the types of companies they've attracted: not tech-native startups, but pragmatic logistics companies with real problems to solve.

Gather leads in customization, expertise, algorithm performance, and market strategy, making it a preferred choice in warehouse automation. Estimated data based on industry insights.

Vertical Expansion: Beyond Warehouses

With Series B funding in place, Gather will likely expand beyond warehouse management into adjacent verticals. The core technology—autonomous drones that actively investigate specific problems—applies to any large, complex physical space.

Cold storage facilities are an obvious near-term expansion. Pharmaceutical companies store temperature-sensitive inventory in warehouses where human workers can only spend limited time. Gather's drones solve the problem of continuous, low-cost monitoring of these expensive materials. A single batch of specialty pharmaceuticals might be worth millions. Catching degradation early is worth enormous sums.

Manufacturing facilities represent another expansion vector. Factories have inventory, work-in-progress (WIP) tracking, equipment maintenance requirements, and safety compliance checks. All of these are audit-intensive. All of them could benefit from autonomous systems that observe continuously and report anomalies.

Retail could be an intriguing market if Gather can miniaturize their drones. Retail stores don't have the square footage of warehouses, but they have more frequent inventory changes. A drone system that autonomously checks shelf facings, identifies out-of-stock items, and spots misplaced inventory could save retailers massive amounts on labor.

The key constraint on vertical expansion is go-to-market complexity. Warehouses are Gather's native market. The sales process, the customer psychology, the regulatory environment, the technical requirements—all are understood. Moving to new verticals requires new domain knowledge. Gather will likely expand deliberately, targeting the closest adjacent verticals first (cold storage, manufacturing) before pushing into retail or other segments.

The Role of Large Language Models in Warehouse Operations

Here's a question worth asking: if large language models are so powerful, why doesn't Gather use them?

The answer reveals something important about AI in enterprise. LLMs excel at tasks where you're trading off speed and precision for flexibility. You ask them to summarize a report. You ask them to write marketing copy. You ask them to explain a concept. They're useful because they can handle ambiguous inputs and produce reasonable outputs across diverse scenarios.

Warehouse automation is the opposite. The inputs are precise (visual data from specific sensors), and the desired outputs are extremely specific ("is this barcode readable? yes or no?"). An LLM adds no value here. It would be like hiring a philosophy professor to tell you whether a light switch is on. Yes, they could do it, but it's overkill and they might actually get it wrong in weird edge cases.

Gather's approach of using Bayesian techniques with neural network enhancement is actually more sophisticated than simply slapping LLMs onto a problem would be. It shows a maturity in thinking that says: use the right tool for the job, not the fanciest tool available.

This principle will likely define the next phase of enterprise AI. The hype around generative AI will fade. Companies will realize that most enterprise problems don't require generation—they require reliable, specific answers to well-defined questions. Bayesian systems, classical machine learning, specific neural architectures—these tools will remain dominant for the majority of business problems.

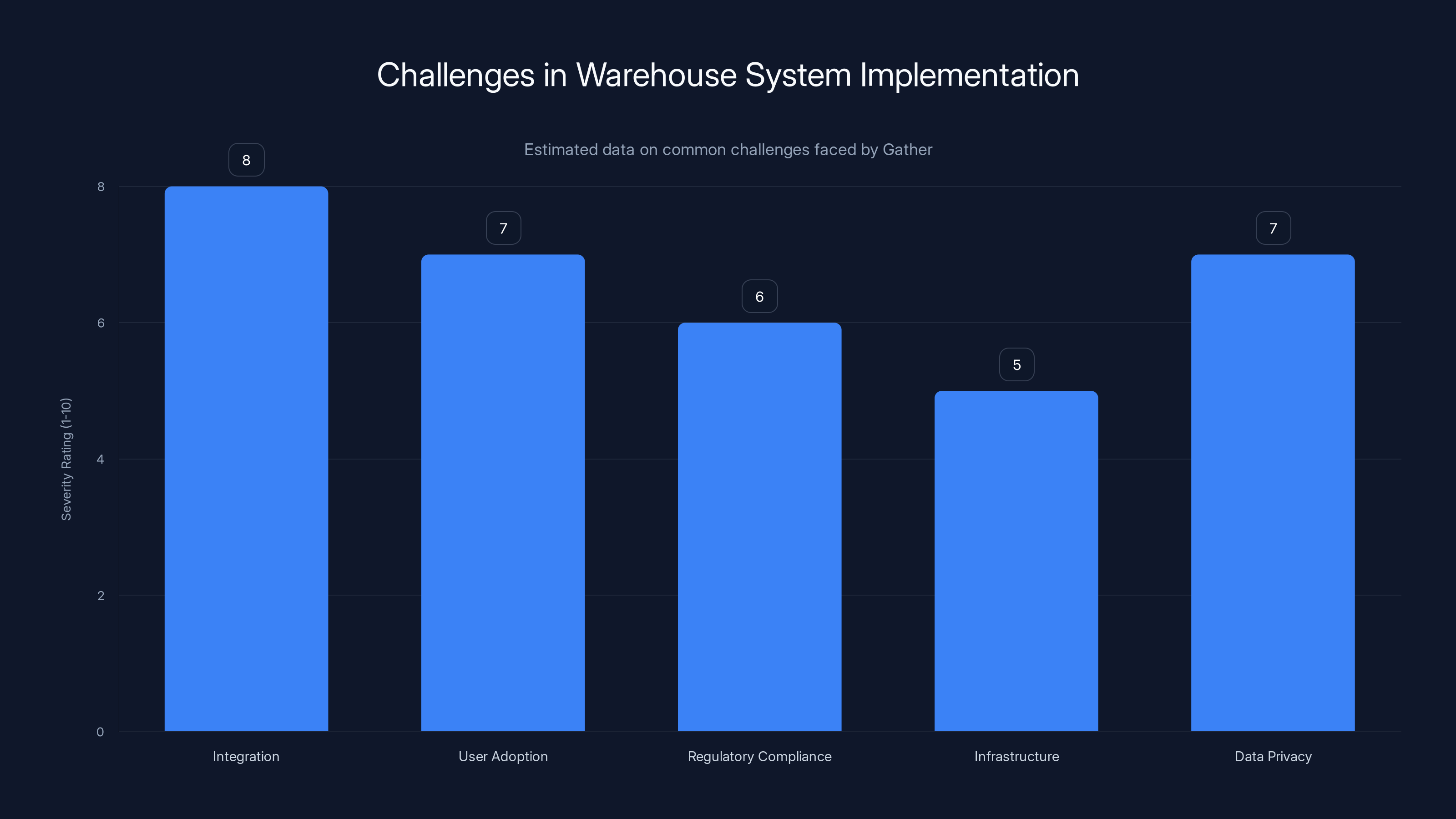

Integration and user adoption are the most severe challenges in implementing Gather's system in warehouses. Estimated data.

Implementation Challenges and How Gather Solves Them

Deploy any new system in an operational warehouse and you immediately hit implementation realities that technology optimists often ignore.

First, integration. Most warehouses run management systems from companies like SAP, Oracle, or custom-built legacy systems. Getting Gather's data into these systems requires APIs or data connectors. Some warehouses have good APIs. Others have systems so old that APIs don't exist. Gather has had to build multiple integration paths. This is unglamorous work, but it's essential.

Second, user adoption. It doesn't matter how smart the system is if warehouse staff don't trust it. "The computer says there's a missing pallet in zone C" needs to feel credible to the people who work there. If they check zone C, don't find anything, and the computer is wrong—trust erodes instantly. Gather's approach of being conservative in what it reports helps here. Warehouse staff would rather have 20 accurate alerts than 200 alerts that include 180 false positives.

Third, regulatory compliance. If you're operating in food or pharmaceuticals, you need to document your processes. When a drone discovers an inventory error, who's responsible for investigating? How do you document the drone's findings in your compliance records? Gather has built features specifically designed for regulated industries.

Fourth, infrastructure requirements. Warehouses need wifi to operate the drones and communicate findings. Some older warehouses have spotty wifi. Gather has to work with IT teams to upgrade infrastructure. The drone hardware is off-the-shelf, but the deployment still requires technical coordination.

Fifth, data privacy. Modern warehouse systems collect location data on products. In some jurisdictions, this data is treated as sensitive. Gather works with warehouses to ensure their systems comply with data protection regulations. This is boring but essential work that often determines whether a deal closes.

Gather solves these challenges not through revolutionary innovation, but through deep domain knowledge. They understand what makes warehouse operations tick. They've iterated with customers enough to anticipate problems. This is why the customer logos on their website are Fortune 500 logistics companies, not exciting startups. The exciting startups don't have existing systems to integrate with. The big companies do, and solving that problem is where the real value lies.

Financial Model and Path to Profitability

With

The venture math here is interesting. Gather's Series B valuation (assuming standard dilution) is likely in the

How do they get there? The most straightforward path is geographic expansion and vertical expansion. The company currently operates primarily in North America. Expanding into Europe and Asia doubles the addressable market. Adding cold storage, manufacturing, and retail could triple it again.

The pricing model is likely usage-based or deployment-based. A warehouse of 50,000 square feet with one drone might cost

The path to profitability isn't magical. It's execution: acquire customers, retain them, expand into adjacent segments, achieve scale. The funding validates that investors believe Gather can execute this plan.

Industry Impact: Why This Matters Beyond Gather

A $40 million funding round for a warehouse AI company might seem niche. But it signals something broader about how the enterprise technology market is evolving.

For twenty years, enterprise software meant databases, ERPs, and cloud platforms. The next wave is about physical automation and observation. Warehouses, factories, retail stores—the spaces where real economic activity happens—have been undergeneralized in software. Most warehouse operations run on systems built in the 1990s with features bolted on continuously.

Gather represents a new category: physical intelligence systems. Systems that observe the real world, understand problems, and surface actionable insights. This category is nascent but growing. Over the next decade, expect dozens of startups tackling specific verticals with embodied AI systems similar to Gather's architecture.

What's important about Gather's approach is that it proves embodied AI doesn't require science fiction technology. You don't need bipedal humanoid robots or advanced manufacturing. You need standard drones, off-the-shelf cameras, solid software, and domain expertise. That combination is more accessible than most people realize.

For warehouse operators, the implication is clear: expect your industry to transform over the next 5-10 years. Not with dramatic layoffs of warehouse staff (the jobs themselves are still necessary), but with a massive shift in what the job entails. Instead of manually scanning every item, staff will verify computer findings. Instead of walking every shelf every week, continuous automated monitoring will flag issues. This is efficiency improvement, not automation replacement.

Looking Forward: The Next Five Years

If Gather executes on this funding, what should the company look like in 2030?

Most likely: 300+ employees, $100+ million annual revenue, operations in 10+ countries, presence in 3-4 verticals (warehouses, cold storage, manufacturing, possibly retail). They'll have been copied by larger logistics and software companies. Some of those copies will work, some won't. Gather's advantage will be that they built the market and understand it deeply.

Possible alternative: acquisition by a larger logistics or technology company. Companies like Flex, Schneider Electric, or even Amazon might find Gather valuable as a strategic addition to their existing warehouse operations offerings. An acquisition at $2-3 billion would be a strong outcome for investors and founders.

Less likely but possible: Gather becomes the embedded vision standard for warehouses the way that Docker became the container standard for software. This requires maintaining technical leadership and cultural credibility, which is possible but requires continued investment in research and engineering.

Whatever path they take, the company has proven the concept. Embodied AI systems can work in production. They can solve real business problems. They can attract enterprise customers and venture capital. That validation is what makes this funding round significant beyond just the dollar amount.

How Traditional ERP Systems Are Adapting

SAP, Oracle, and other traditional warehouse management software vendors are watching Gather closely. They have massive installed bases—thousands of warehouses running their systems. The risk is that an upstart like Gather becomes so good that warehouses switch to new systems because of superior AI capabilities.

Their response has been predictable: acquire bolt-on capabilities or build them internally. SAP has invested in logistics visibility. Oracle has built supply chain planning features. But building embodied AI is not easy. It requires robotics expertise, which most enterprise software companies don't have.

This creates an opportunity for Gather to become the de facto standard for warehouse AI before the incumbents catch up. Usually, this window is 3-5 years. If Gather uses it well, they'll achieve customer lock-in that's difficult to dislodge.

For warehouse operators evaluating systems, the message is clear: the next generation of warehouse software will be separate from traditional ERPs. You'll use SAP or Oracle for transaction management and reporting. You'll use Gather or competitors for physical observation and problem detection. Integrating these will be a growth area for consulting companies and systems integrators.

Challenges Remain: Why This Isn't Solved Yet

For all the progress, warehouse automation still faces real obstacles.

The biggest is scale and consistency. Gather works brilliantly in 10-20 large, well-organized warehouses. Scaling to 100+ warehouses with different layouts, different management cultures, different products is hard. Each warehouse is unique. The same drone configuration that works for a food distributor might not work for an automotive parts supplier. Gather has to solve customization without blowing up the business model.

Another challenge is competition. Larger companies will enter this space. When they do, they'll have advantages: existing customer relationships, bigger sales teams, more capital for R&D. Gather's moat is expertise and customer trust. That's defensible but not invincible.

A third challenge is regulatory uncertainty. As autonomous systems become more prevalent, governments will eventually regulate them. How many drones can fly in a warehouse? What certifications do operators need? What liability framework applies if something goes wrong? These questions are unanswered.

Finally, there's the human factors challenge. Warehouse workers might view autonomous systems as threats. Labor unions might push back. Workplace safety regulations might impose restrictions. Gather has to navigate these social dynamics carefully.

None of these challenges are insurmountable, but they're all real. The company won't succeed just by building good technology. It has to execute across product, sales, implementation, and organizational domains.

FAQ

What exactly is embodied AI, and how does it differ from other types of AI?

Embodied AI refers to artificial intelligence systems that physically interact with the real world through sensors and actuators (like drones or robots) rather than existing purely in software. Unlike large language models that operate through text interfaces, embodied AI systems like Gather's warehouse drones observe their environment, make decisions about what to investigate next, and adapt their behavior based on real-world feedback. This physical grounding makes embodied systems self-correcting because hallucinations and errors are immediately disproven by reality.

How do Gather AI's drones avoid the hallucination problems that plague large language models?

Gather uses Bayesian probability methods combined with neural networks rather than end-to-end neural networks or large language models. Bayesian systems rely on probability-based reasoning with prior knowledge, which means they only report findings that are statistically justified by the evidence they've observed. A Bayesian system won't confidently report a missing item unless it has strong evidence for that claim. This conservative approach prevents the confident false positives that plague pure language models, making warehouse managers trust the alerts because they're accurate.

What specific problems can Gather AI actually solve in a warehouse?

Gather's system discovers and reports on low inventory situations, misplaced stock, damaged goods that need removal, upcoming expiration dates on time-sensitive products, occupancy issues that violate safety standards, and workflow inefficiencies that lead to errors. The system logs these findings directly into warehouse management systems so staff can take action. For example, if a pallet of products is placed in the wrong storage section, Gather's drones investigate and report it, allowing managers to correct the location before it causes a picking error or inventory audit failure.

Why is Keith Block's investment significant beyond just the capital amount?

Keith Block co-led Salesforce's explosive growth and understands enterprise software sales, scaling, and execution at the Fortune 500 level. His firm, Smith Point Capital, specifically targets supply chain and logistics software companies. When someone with Block's track record leads a $40 million funding round, it signals to the market that this company has cracked a real problem in an important industry. His involvement likely brings customer introductions and strategic guidance that matter more than the capital itself.

How does Gather AI integrate with existing warehouse management systems that companies already use?

Gather works with warehouse management systems by exporting findings through APIs when available, or through structured data exports (CSV, JSON) when legacy systems don't have modern APIs. The company has built integration capabilities for major ERP systems like SAP and Oracle, but custom integration work is often required depending on the specific warehouse system in use. This integration challenge is one reason implementation takes time and consulting services are required.

What is the typical cost of implementing a Gather AI system in a warehouse?

While Gather doesn't publicly state pricing, the deployment model is typically usage-based or volume-based monthly subscriptions. A medium-sized warehouse (50,000-100,000 square feet) with one autonomous drone would likely cost between

How many people does Gather currently employ, and how are they distributed across functions?

As of the funding announcement, Gather has approximately 60 employees. Based on typical startup distributions, the company likely has engineering and product teams focused on the drone software and Bayesian algorithms, customer success teams managing the deployed systems, sales and business development focused on new warehouse customers, and operations teams handling deployment and technical support. The exact breakdown wasn't disclosed, but engineering-heavy startups in robotics typically allocate 40-50% of staff to engineering roles.

Can Gather's technology work in challenging warehouse environments like freezers and cold storage?

Yes, this is actually one of Gather's key competitive advantages. The drone hardware and computer vision systems operate in freezers at minus-20 degrees Fahrenheit, low-light storage areas, and wet environments where traditional cameras struggle. Humans can only spend limited time in these environments, making continuous automated monitoring particularly valuable. Cold storage facilities for pharmaceuticals and specialty foods are a near-term expansion target for the company because the value proposition is especially strong in these conditions.

What is the difference between how Gather AI and a traditional computer vision security camera monitor warehouses?

Traditional security cameras record footage passively and require humans to review it (or use simple detection algorithms that flag motion or people). Gather's system is actively intelligent—it decides where to look next based on what it's investigating. If a drone discovers products in the wrong section, it investigates adjacent areas to understand the scope of the misplacement. A security camera would just record what's in its fixed field of view. This active investigation is what Gather means by "curious" drones.

Conclusion: The Warehouse AI Inflection Point

Gather AI's $40 million Series B funding isn't just a startup milestone. It's a marker of an inflection point. The warehouse industry—one of the oldest, most conservative segments of the economy—is starting to embrace AI systems that work differently from everything that came before.

For a decade, automation discussions in warehouses centered on robots that pick and sort items. Those are still coming, but they're capital-intensive and require complete warehouse reorganization. The smarter play, as Gather proved, is augmenting existing operations with continuous intelligent observation. Drones that fly autonomously, think about problems, and surface insights. Cameras that don't just record but actively investigate. Software that learns what your specific warehouse looks like and adapts accordingly.

The founding team's robotics pedigree, the customer validation from Fortune 500 logistics companies, the investor backing from enterprise software veterans—these all point to a company that has cracked something real. They didn't just build a cool AI system. They built a system that solves actual business problems in actual warehouses run by actual companies with real profit pressures.

The next five years will be critical. Gather needs to expand beyond warehouses into adjacent verticals. They need to navigate competition from larger companies entering the space. They need to scale their team and operations without losing the technical excellence and customer obsession that got them here. Most startups fail at this. Gather has the capital and the team to succeed, but execution will determine the outcome.

For warehouse operators, the implication is that stasis is no longer an option. Your competitors will eventually adopt systems like Gather's. Whether you want to lead or follow that transition is a strategic choice. For investors, the lesson is that embodied AI—systems that physically interact with the real world rather than exist in software—represents a frontier market with enormous potential. Warehouse automation is just the beginning.

Gather AI showed what's possible when you take robotics expertise into enterprise software, when you build for customer problems rather than technology hype, and when you refuse to be constrained by what everyone expects AI systems to look like. That combination is rare. That's why this funding round matters.

Key Takeaways

- Gather AI raised $40M Series B led by Keith Block's Smith Point Capital, validating warehouse automation as a major venture opportunity

- The company uses Bayesian probability methods combined with neural networks instead of LLMs, avoiding hallucination problems that plague generative AI in enterprise settings

- Four PhD founders from Carnegie Mellon built embodied AI systems (autonomous helicopters) before creating warehouse drones, giving them deep robotics expertise that distinguishes them from computer vision competitors

- Fortune 500 logistics companies (Kwik Trip, GEODIS, NFI Industries, Axon) are already deploying Gather's systems in production, proving the market problem is real and the solution works at scale

- Embodied AI—systems that physically interact with reality rather than existing in software—represents the next computing frontier beyond language models, with warehouse automation as the first high-volume production application

Related Articles

- Physical Intelligence: Building Robot Brains in 2025 & Beyond

- How AI and Nvidia GB10 Hardware Could Eliminate Reporting Roles [2025]

- Claude Opus 4.6: 1M Token Context & Agent Teams [2025 Guide]

- Fundamental's $255M Series A: How AI Is Solving Enterprise Data Analysis [2025]

- AI Chatbot Ads: Industry Debate, Business Models & Future

- Apple's AI Monetization Challenge: Strategy Analysis & Industry Outlook

![Gather AI's $40M Funding: Why Curious Warehouse Drones Change Logistics [2025]](https://tryrunable.com/blog/gather-ai-s-40m-funding-why-curious-warehouse-drones-change-/image-1-1770646033506.jpg)