Google's America-India Connect: Building the Internet's Physical Backbone

Most people don't think about what happens when they load a webpage or ask an AI a question. They don't picture the physical cables running under oceans, connecting continents, carrying that request across thousands of kilometers at the speed of light. But that infrastructure? It's become the most critical battlefield in the global AI race.

Google just announced something massive. It's called America-India Connect, and it's a subsea cable initiative that fundamentally reshapes how data flows between the United States, India, and the rest of the world. This isn't flashy. There are no press conferences with thousands of people cheering. But in terms of raw strategic importance, this matters more than most announcements in tech.

Here's the situation: India wants to become the global hub for AI development. Not just as a user base, but as a development powerhouse. To make that happen, you need infrastructure that can handle the computational loads of training and running massive AI models. You need cables that can push petabytes of data across continents without bottlenecks. Google understands this. So does everyone else.

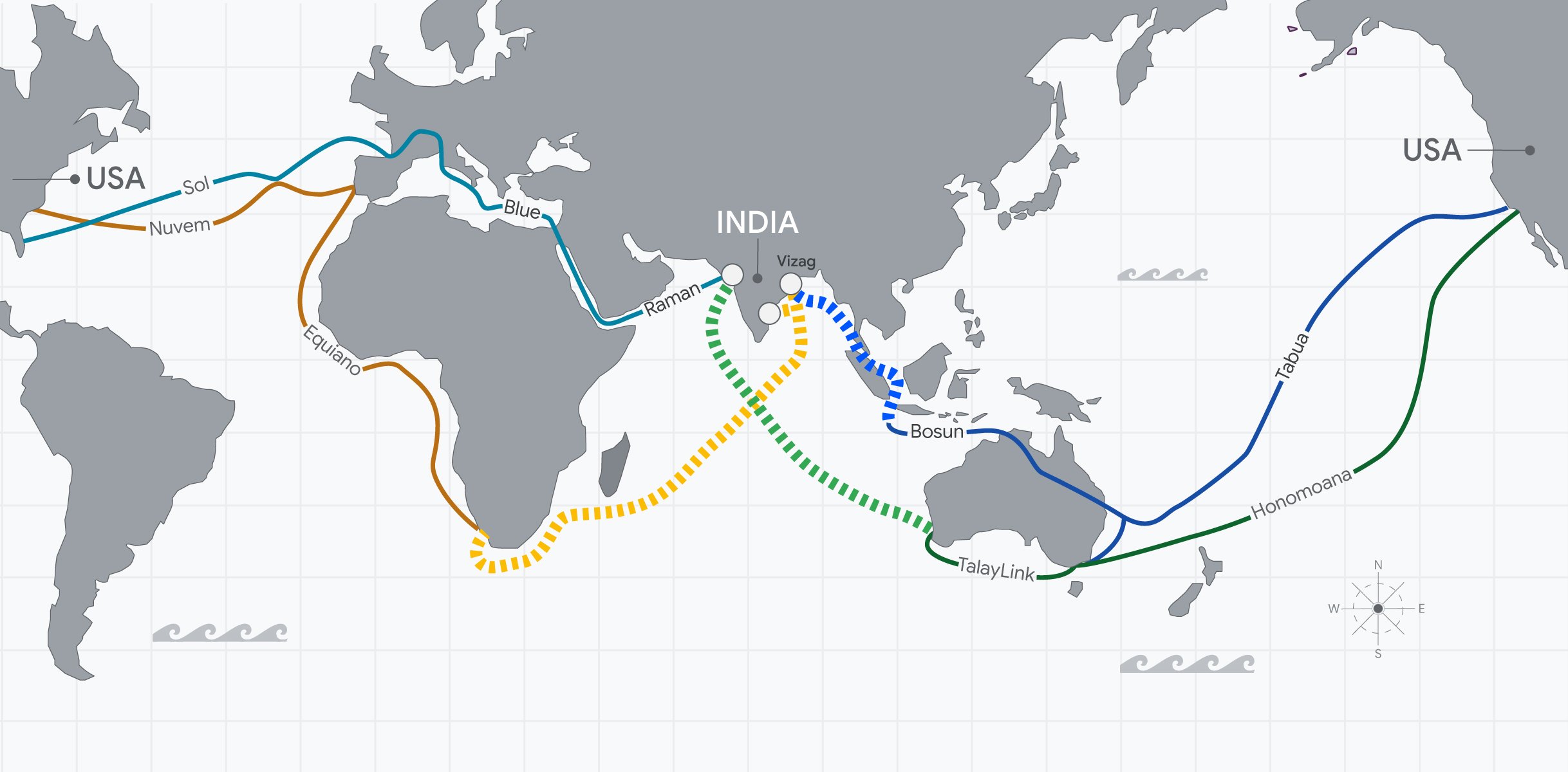

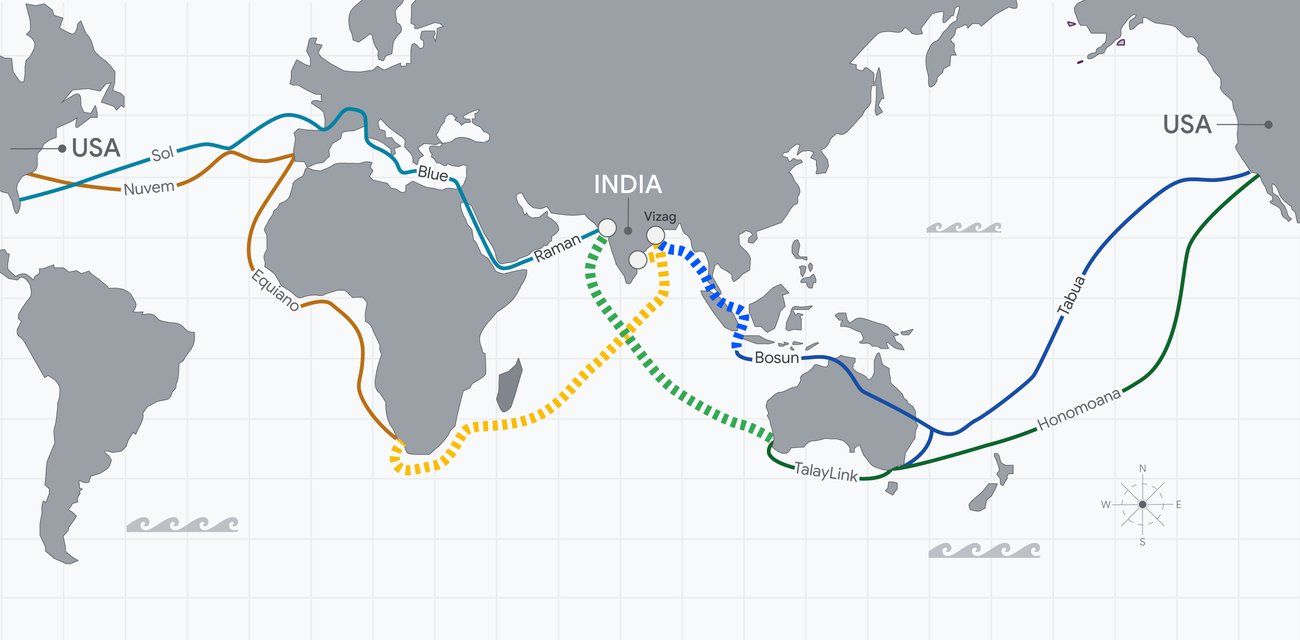

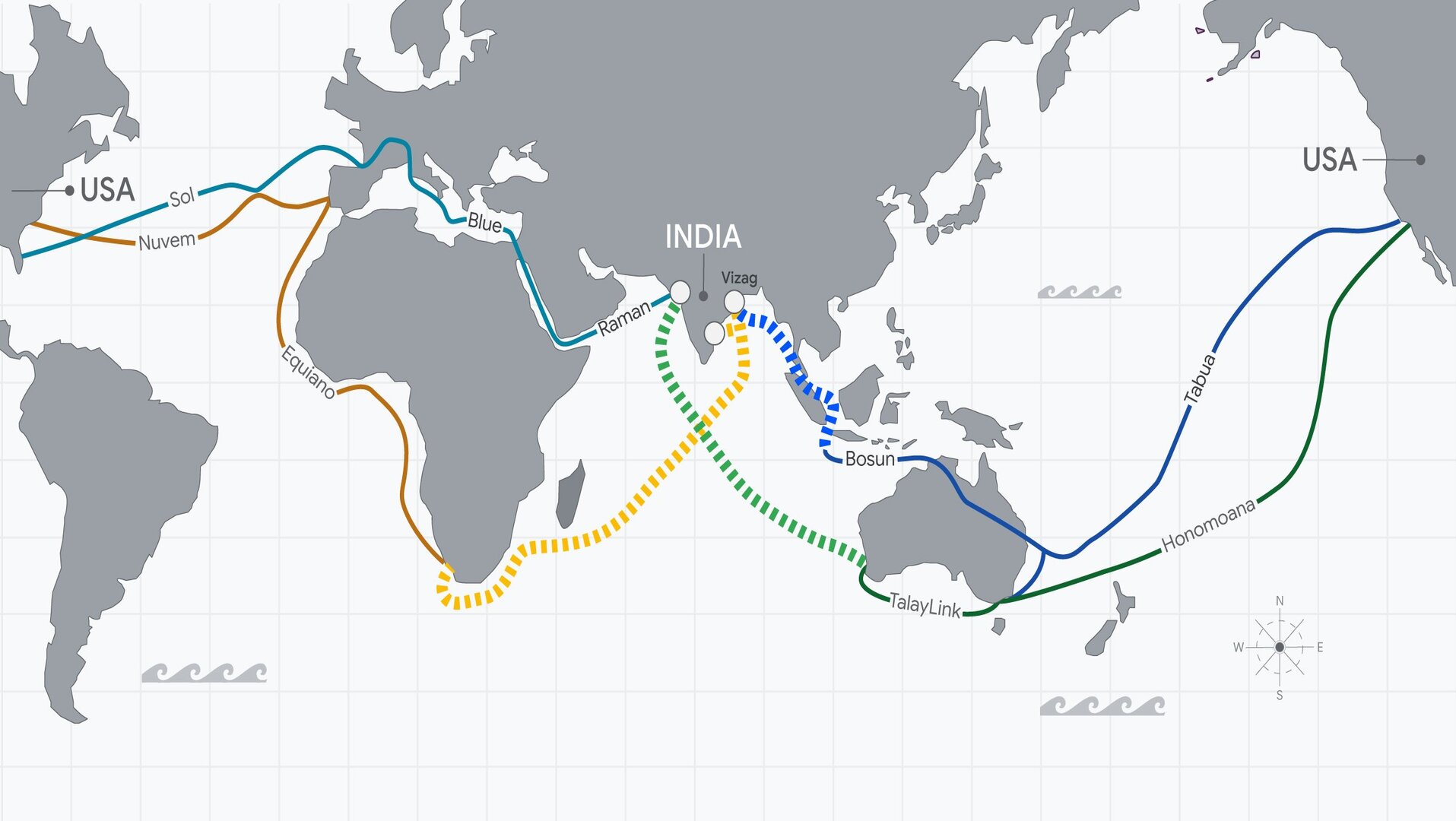

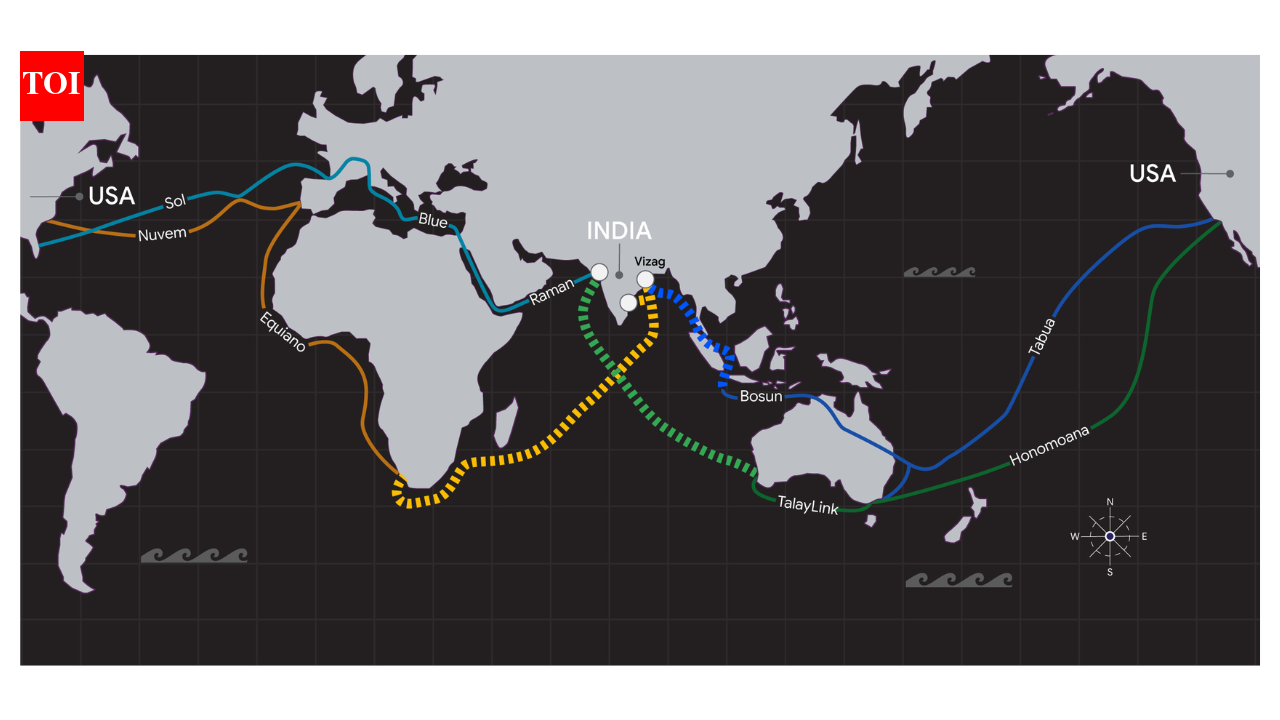

The America-India Connect initiative involves three new subsea cable paths connecting the United States and India through various Southern Hemisphere routes. It includes four strategic fiber-optic routes bolstering network resilience between these regions. A brand new international subsea gateway is being built in Visakhapatnam on India's east coast. Additional connections to Singapore, South Africa, and Australia increase redundancy and capacity across the entire system.

But here's what makes this interesting: this isn't just about faster internet speeds. It's about power. It's about which countries control the critical infrastructure of the next decade. It's about whether the AI divide widens or narrows. And it's absolutely about money.

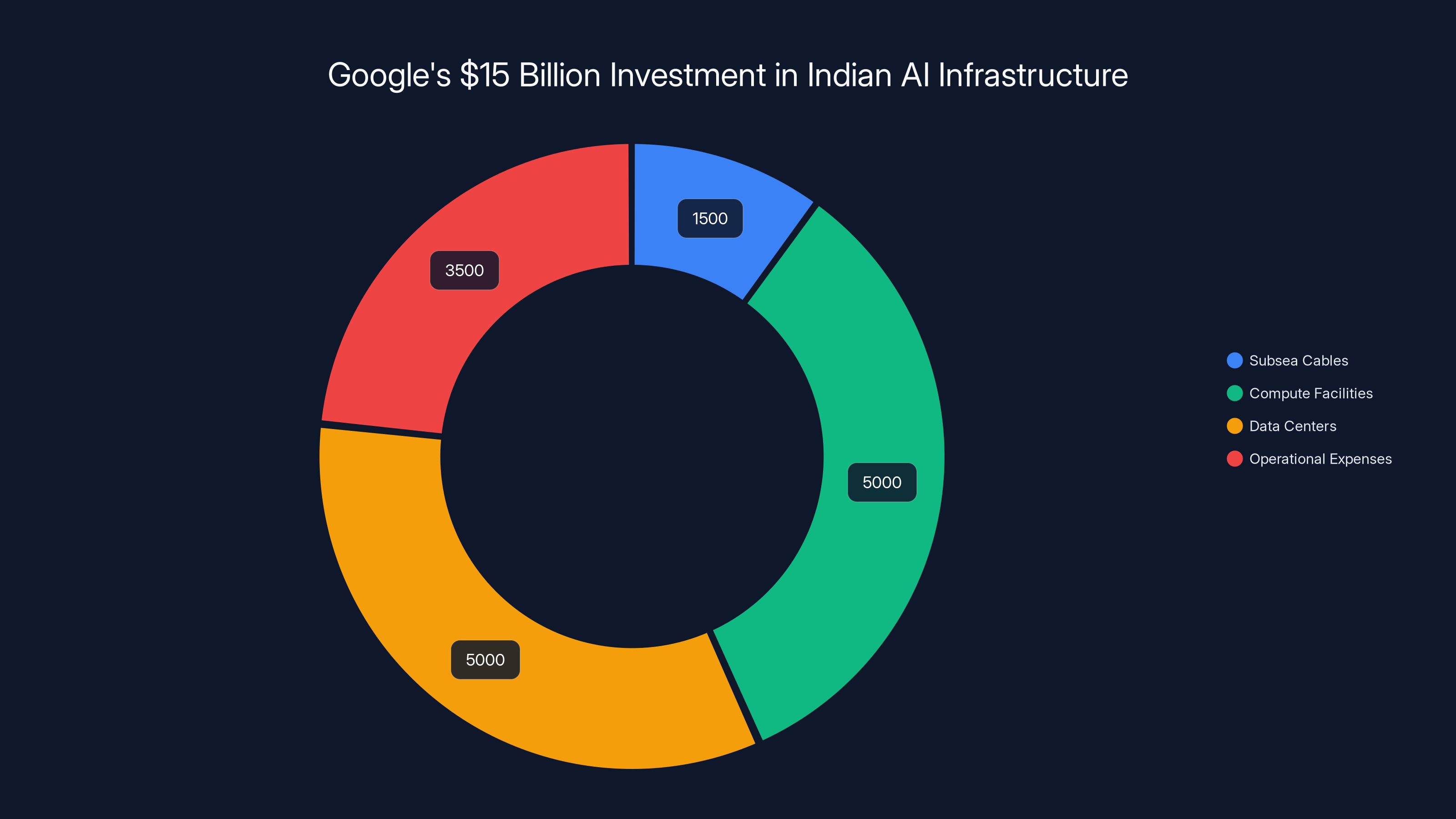

Google is anchoring this initiative with a $15 billion five-year investment in AI infrastructure across India. That includes building a massive AI hub right in Visakhapatnam, integrated directly with that new subsea gateway. They're not messing around.

Let's dig into what's actually happening, why it matters, and what it means for the future of global connectivity.

TL; DR

- America-India Connect adds three new subsea cable paths between the US, India, and Southern Hemisphere routes

- New Visakhapatnam gateway creates a second international entry point, diversifying traffic away from traditional hubs like Mumbai

- $15 billion Google investment in Indian AI infrastructure signals massive commitment to making India a development hub

- Network resilience improves through redundant routes via Singapore, South Africa, and Australia

- The stakes are geopolitical: control of digital infrastructure shapes which regions lead in AI development

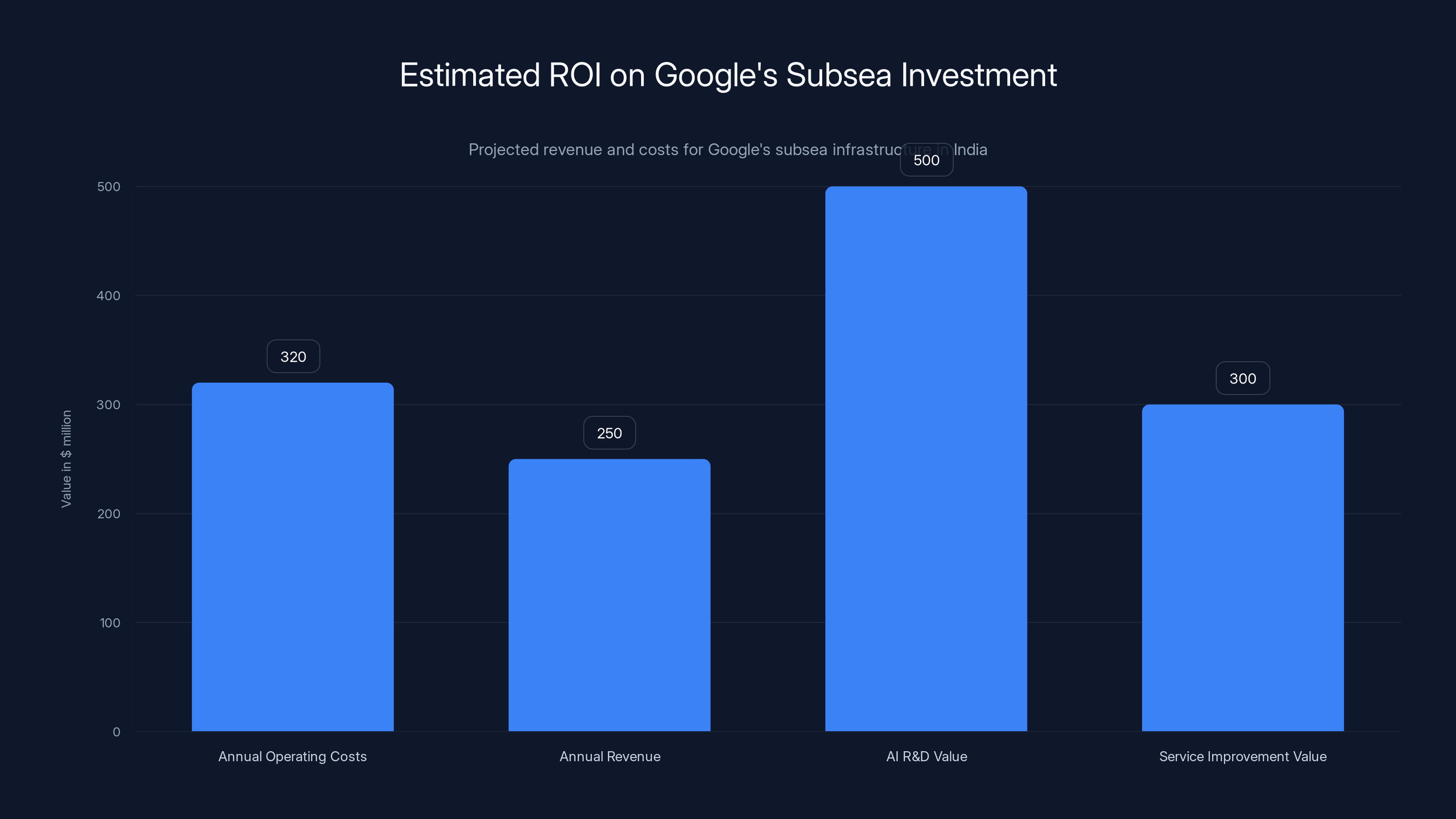

Google's subsea investment in India is projected to generate significant value beyond direct cloud service revenue, including AI R&D and service improvements. Estimated data.

Understanding Subsea Cables: Why They Matter More Than You Think

Subsea cables are the literal foundation of the modern internet. When you send an email to someone on the other side of the world, it travels through physical fiber-optic cables laid on the ocean floor. These cables move data at nearly the speed of light, carrying about 99% of international data traffic.

Most people imagine the internet as this ethereal cloud floating above us. It's not. It's physical. It's expensive. And it's becoming the most valuable real estate on Earth.

A single subsea cable can cost

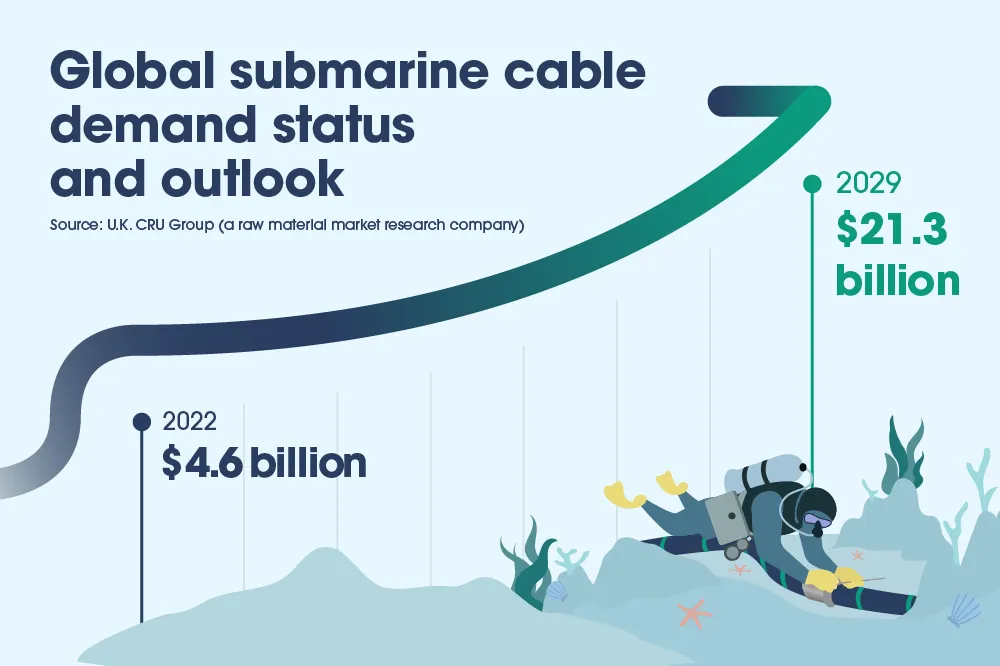

For decades, telecommunications companies owned and operated most subsea cables. They controlled the chokepoints. But starting in the mid-2000s, tech giants realized that relying on third-party infrastructure created risks. If your cloud services depend on cables you don't control, you're vulnerable to outages, congestion, and competitors getting priority access.

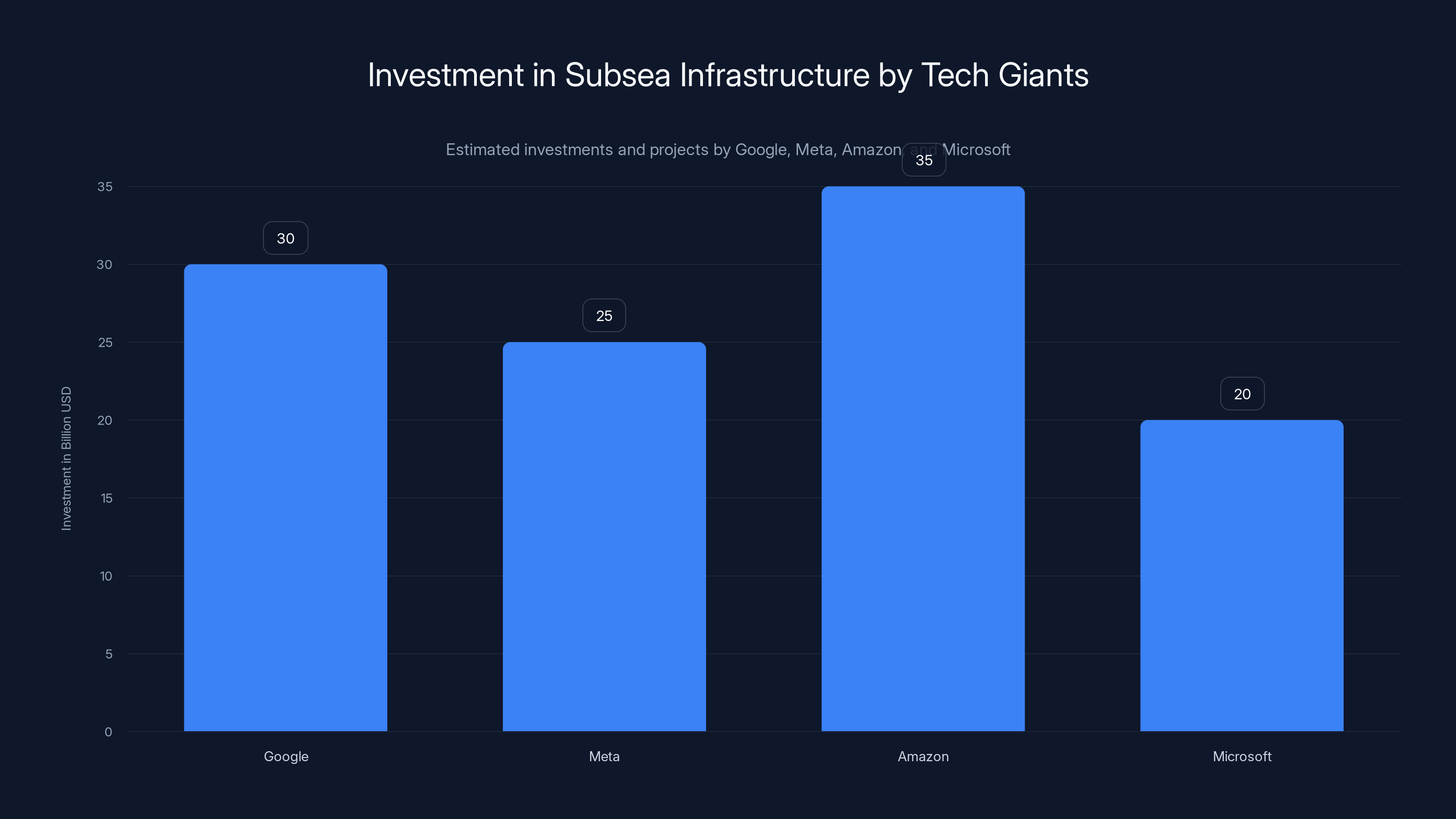

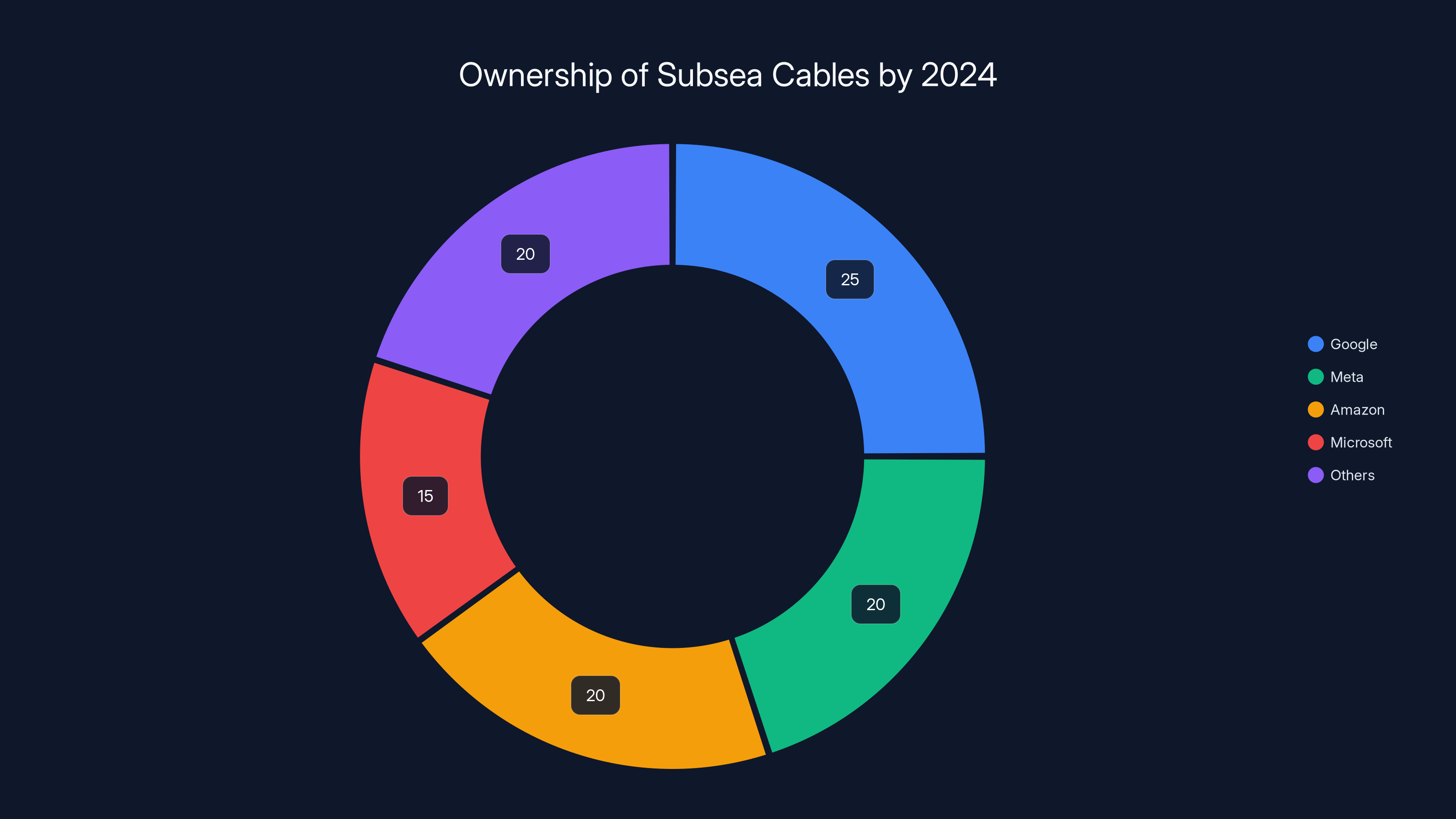

Google, Meta, Amazon, and Microsoft started building their own cables. By 2024, these tech companies had invested tens of billions into subsea infrastructure. They now own or co-own a huge portion of the world's international cables.

Why? Control. Speed. Redundancy. When you own the pipes, you guarantee that your data moves at maximum capacity. You don't compete with Netflix or financial firms for bandwidth. You route traffic however you want. And strategically, you can shape where data flows go.

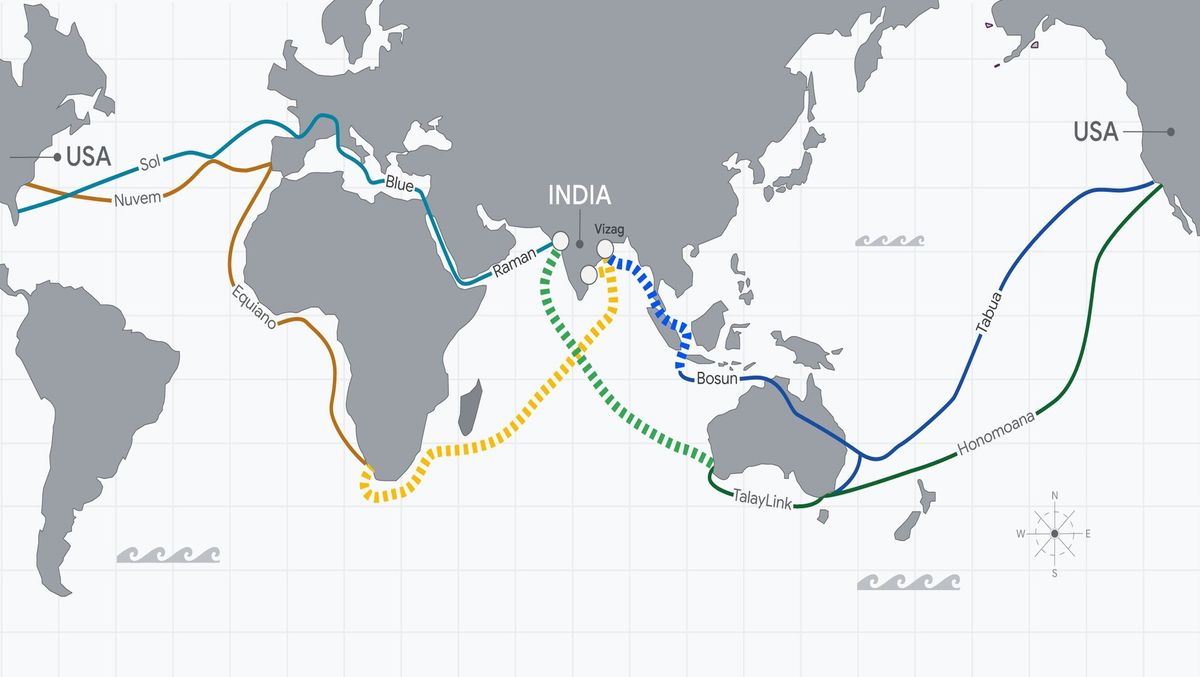

Google currently operates or co-owns cables including Blue, Raman, Sol, Equiano, and many others. These form a sprawling network connecting the Americas, Europe, Africa, and Asia. But America-India Connect fills a gap. There's been insufficient high-capacity direct routing between the US and India, and limited redundancy on those routes. That becomes a problem when demand for India-based services and AI infrastructure explodes.

The Strategic Geography of America-India Connect

Let's look at what routes America-India Connect actually establishes.

The initiative includes new fiber paths connecting Mumbai to Western Australia, and Visakhapatnam (on India's east coast) to key international hubs. Additional connections feed into Singapore, South Africa, and Australia. When you map this out, you see something interesting: the new cables follow established maritime trade routes, just converted into digital highways.

Historically, data from the US West Coast heading to India had to route through existing cables with limited capacity. Adding direct paths through Australia creates geographic diversity. Instead of all traffic funneling through the same choke points, data can take multiple routes. If one cable has issues, traffic reroutes automatically. This is network resilience, and it's crucial for both performance and reliability.

The Visakhapatnam gateway is particularly significant. Mumbai and Chennai have been India's traditional international gateways for decades. Adding a third major gateway on the east coast spreads the load. It reduces congestion at existing entry points. It also strengthens India's position as a central hub in Asia-Pacific regional networks.

From a geopolitical angle, India gains leverage. Instead of being a peripheral node in global networks, it becomes a junction point. Traffic between Middle East and Australia might route through Visakhapatnam. Data moving between Africa and Southeast Asia could pass through Indian infrastructure. This increases India's strategic importance and creates opportunities for domestic technology companies.

Google's investment in the America-India Connect initiative includes

Why Visakhapatnam Became the Hub

Visakhapatnam wasn't a random choice. It's India's busiest port by cargo volume. It already has the infrastructure, docking facilities, and engineering expertise to handle major international connectivity projects. It sits on India's east coast, positioned perfectly for routing traffic to and from Southeast Asia, Japan, and Australia.

But the deeper reason Google chose this location relates to India's broader AI ambitions. The company is building a massive AI computing hub in Visakhapatnam with what Google describes as "large-scale computing capacity". This isn't just a data center. It's a research and development facility where AI models can be trained, tested, and deployed. Direct connection to the new subsea gateway means minimal latency when moving training data or inference results.

Consider the difference: if your AI facility connects through a gateway 500 kilometers away, you add latency. You lose efficiency. Data has to travel further, taking longer to reach processing centers. When you build the gateway right next to your compute hub, that goes away. You get microseconds, not milliseconds, of delay. For AI workloads that process massive datasets, that efficiency compounds quickly.

Google's $15 Billion Bet on India

The subsea cables are just the transportation layer. Google's larger commitment involves $15 billion over five years specifically for AI infrastructure in India. This covers compute resources, data centers, research facilities, and yes, the physical infrastructure like subsea gateways and fiber-optic routes.

Why is Google investing this aggressively in India specifically? Several reasons converge.

First, India has 1.4 billion people. That's massive market potential for AI-powered services, whether search, cloud computing, productivity tools, or emerging applications. Second, India produces enormous amounts of training data. Social media, e-commerce, government records, and consumer behavior data exist in unprecedented scale. Companies building AI models need diverse, representative data. Indian data provides perspectives and patterns missing from predominantly Western datasets.

Third, India has technical talent at massive scale. The country produces roughly 1.5 million engineers annually. Many of the world's top AI researchers either come from India or have Indian heritage. Building research facilities in India attracts this talent while keeping costs lower than equivalent US-based facilities.

Fourth, India's government has aggressively courted tech companies. The country offers tax incentives for cloud providers that keep data within Indian borders. This aligns with India's data sovereignty goals while making it financially attractive for companies like Google to invest.

Finally, strategic competition. If Google doesn't build this infrastructure, Amazon, Microsoft, or Chinese companies will. The global AI race means whoever controls the most capable infrastructure in key regions wins. Google is essentially racing against everyone else to establish dominance.

The Existing Google Cable Network

Before diving deeper into America-India Connect, understanding Google's existing subsea cable portfolio shows the scale of their ambition.

Google owns or co-owns cables spanning essentially every major continent. The Blue cable connects the US East Coast to the UK and Spain, handling massive transatlantic traffic. The Raman cable connects the UK to India, providing crucial bandwidth for Indian operations. The Sol cable connects Spain and Portugal with the US via Bermuda, adding Southern Atlantic capacity.

The Equiano cable is particularly notable. It stretches 20,000 kilometers along the African coast, connecting Portugal to South Africa with multiple landing points. This seems strange until you realize Google isn't just serving US customers. Google has data centers across Africa, and African markets represent enormous growth potential. Equiano ensures that data flowing through African infrastructure can reach compute resources without routing through distant choke points.

Each cable represents a multi-year investment. Google funds portions, shares ownership with other companies or telecom providers, and commits to long-term capacity agreements. The goal is to build redundant paths. If the Blue cable experiences issues, transatlantic data can reroute through alternate cables. This redundancy is non-negotiable for a company providing cloud services to millions of customers.

America-India Connect fits into this broader network as a critical missing piece. It addresses a bottleneck that's becoming increasingly problematic as AI infrastructure demand grows.

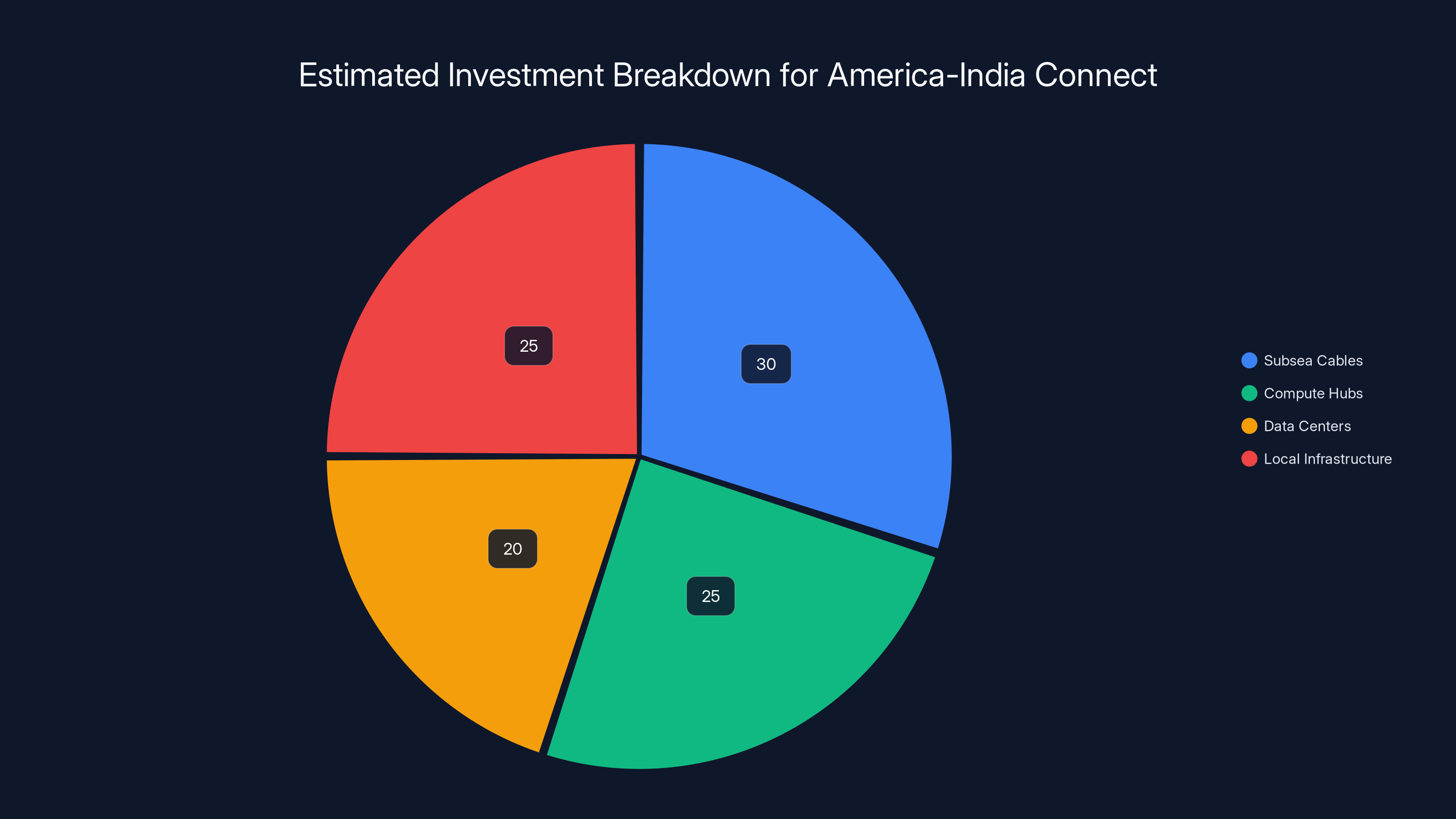

The America-India Connect project involves significant investment in subsea cables, compute hubs, data centers, and local infrastructure, with subsea cables being the largest component. Estimated data.

Data Centers and Compute Hubs: The Missing Piece

Subsea cables alone don't build infrastructure. They need something at both ends. That's where compute hubs and data centers come in.

Google's announcement includes building substantial computing capacity in Visakhapatnam. This isn't just a small office with a few servers. The company describes it as a facility capable of handling "large-scale computing". For AI applications, that means GPUs, TPUs (Google's custom chips), and massive distributed computing resources.

When Amazon, Microsoft, and other cloud providers announce new data center regions, they're usually adding about 10-20 megawatts of power capacity. A truly massive facility might reach 100+ megawatts. Google's vague language about "large-scale" likely means gigawatt-scale infrastructure. A gigawatt can power a city of 750,000 people. It's an enormous commitment.

Why such massive capacity for India? Because AI model training at scale requires absurd amounts of compute. Training a state-of-the-art language model might consume 1,000 megawatt-hours of electricity. Training multiple models simultaneously across different architectural approaches quickly consumes gigawatts. Google isn't just building capacity for inference (running trained models). They're building capacity for research and development.

Having this compute capacity in India enables several strategic outcomes. Researchers and engineers in India can access cutting-edge computing resources without exporting data across continents. Models trained on Indian data can be refined and improved locally. Indian startups and enterprises can lease capacity for their own AI projects, building an ecosystem around Google's infrastructure.

But there's a critical dependency: the subsea cables must have sufficient bandwidth to move data in and out efficiently. A gigawatt data center connected to undersized internet pipes becomes useless. This is why America-India Connect is so crucial. It ensures the compute hub in Visakhapatnam can actually receive and send data at the speeds required for AI operations.

The AI Divide: Why Infrastructure Matters for Equity

Here's something people rarely discuss: AI capability concentrates where infrastructure concentrates.

If you're a startup trying to build an AI product, you need compute resources. If those resources are only available in the US at premium prices, you can't compete unless you're well-funded. If compute becomes available locally at reasonable costs, you can build something. This has cascading effects on which regions produce AI innovation.

The global AI divide refers to how access to AI tools and capabilities concentrates in wealthy, tech-advanced regions. Companies in developed countries have easy access to cloud AI services, trained models, and compute resources. Companies in developing regions face higher costs, worse latency, and limited options.

Google and other companies claim that investments like America-India Connect reduce this divide. By making compute and connectivity available in India at scale, companies there can build AI products competitively. Researchers can conduct cutting-edge AI research without relocating. Students can access learning resources and compute for education.

It's a compelling narrative. But there's another angle: companies like Google profit from building this infrastructure. They don't do it primarily for altruism. They do it because India represents massive opportunity and because ensuring India-based AI development happens on Google's infrastructure benefits Google strategically.

Still, from a practical standpoint, infrastructure investment benefits whoever can access it. An Indian AI startup gets better access to compute resources. That's real. Whether they access it through Google's cloud, a local provider using Google's infrastructure, or direct investment doesn't change the fundamental outcome.

Regulatory Complexity and Geopolitical Tensions

Building subsea cables sounds straightforward. It's not. Each cable must navigate:

Coastal jurisdiction regulations across multiple countries. India has strict rules about who can operate telecom infrastructure. The government reviews applications, sometimes for years. China famously blocks infrastructure projects that might give Western companies strategic advantage. The US reviews foreign investments in critical infrastructure through CFIUS (Committee on Foreign Investment in the United States).

Environmental concerns come next. Laying cables disturbs marine ecosystems. Operators must conduct environmental impact assessments, identify sensitive areas, and establish protection protocols. Some nations restrict activities during breeding seasons or in protected zones.

Strategic competition has become explicit. When Google wanted to build Pacific Light Cable, a cable between Los Angeles and Hong Kong, the project stalled for years because the US government blocked the Hong Kong landing point. Officials worried about data security and strategic advantage flowing to China.

Capacity agreements determine what bandwidth allocations each investor gets. If Google invests most in a cable, they get priority access. Other investors or carriers get what's left. These negotiations are complex and politically sensitive.

Landing rights are perhaps most critical. A subsea cable exists to connect two places. Both endpoints must grant permission for the cable to land, connect to local infrastructure, and cross territorial waters. Missing a landing right anywhere along a 20,000 kilometer route kills the entire project.

For America-India Connect specifically, Google likely navigated:

India's Department of Telecom, which controls landing rights and often moves slowly.

US Federal Communications Commission approval for the American landing points.

Australia's government, whose cooperation is needed for the Mumbai-Australia route.

Singapore and South Africa for their respective landing points.

Possibly maritime authorities in each country for routing approvals.

Each negotiation takes time. Each can introduce delays. The fact that Google announced America-India Connect publicly suggests they've cleared major regulatory hurdles, though implementation could still take years.

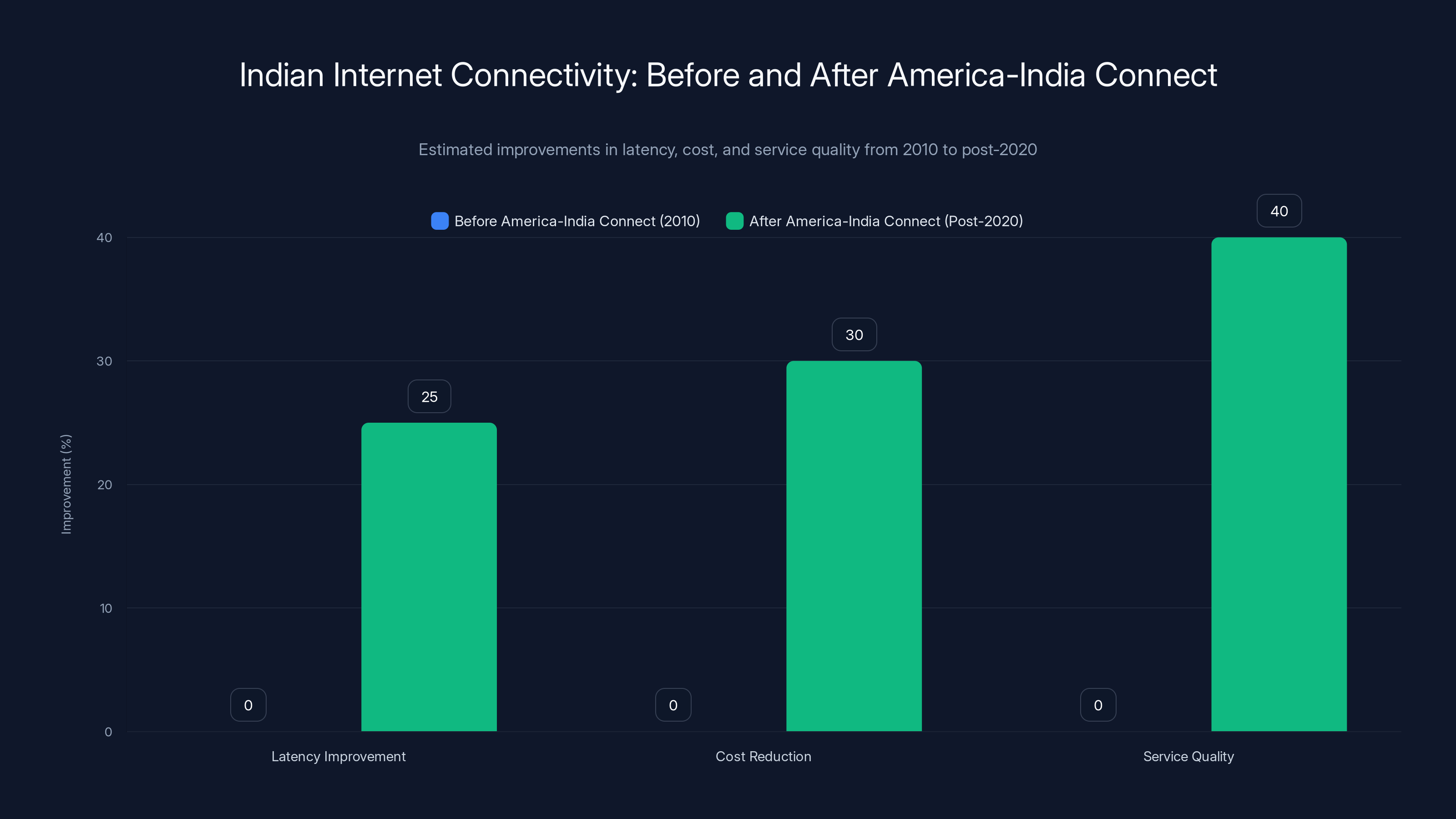

Estimated data shows significant improvements in Indian internet connectivity post-America-India Connect, with up to 30% reduction in latency and cost, and 40% better service quality.

Capital Requirements and Economic Implications

Building subsea cables costs serious money. A modern high-capacity cable spanning continents typically costs

America-India Connect involves multiple cables across various routes. Conservative estimates suggest

How does that make economic sense? Subscription revenue from cloud services eventually covers it. But there's a lag. Google builds expensive infrastructure, operates at losses initially as capacity exceeds demand, then eventually scales usage to profitability. Large corporations can stomach multi-year negative returns on infrastructure because the long-term potential is enormous.

Smaller telecom companies can't. This is why hyperscale tech companies now control global infrastructure. They have capital, patience, and global reach that traditional telecom operators lack. This represents a fundamental shift in who controls internet infrastructure.

Economically, this matters because:

Internet service providers in India will eventually need to purchase capacity from these cables. Google controls the supply, giving them pricing power. Rates might be competitive initially to encourage adoption, but over time, India's internet backbone depends on foreign-owned infrastructure.

Governments understand this. This is partially why India insists foreign cloud providers locate data centers domestically. It reduces dependence on foreign infrastructure for critical services.

Workers and economic development benefit from building and maintaining infrastructure. Laying subsea cables employs engineers, electricians, project managers, and support staff. Building compute facilities involves construction, ongoing operations, and maintenance jobs. This represents real economic activity and employment.

But as automation increases, ongoing employment might be limited. A data center running efficiently needs fewer staff than traditional industries. A subsea cable, once installed, needs minimal maintenance.

Competition From Other Tech Giants

Google isn't alone in investing in subsea infrastructure. Meta, Amazon, and Microsoft are equally aggressive.

Meta (Facebook) recently completed the 2 Africa cable, stretching 180,000 kilometers along the African coast. Like Google's Equiano, it serves both Meta's infrastructure needs and establishes Meta's strategic presence in Africa. The cable includes landing points in 16+ African nations.

Amazon operates several cables and is heavily invested in expanding AWS infrastructure globally. The company announced $35 billion investment in India, rivaling Google's commitment. This includes compute capacity, data centers, and supporting infrastructure.

Microsoft is building Azure infrastructure across India and Southeast Asia. The company uses partner telecom companies to operate some cables, giving Microsoft bandwidth access without full ownership.

This competition is fierce. When Google announces Visakhapatnam investment, Amazon and Microsoft immediately consider counter-moves. When Meta invests in Africa, Google quickly follows. The goal is to establish infrastructure dominance in high-growth markets.

For developing nations, this competition is actually beneficial. Countries can play companies against each other, negotiating better tax terms, data sovereignty agreements, and infrastructure commitments. India explicitly leverages this, offering tax incentives conditional on data localization, essentially forcing companies to compete for favorable terms.

Technological Evolution: From 10G to 400G and Beyond

Subsea cable capacity increased dramatically. Older cables from the 1990s-2000s carried terabits per second. Modern cables carry 200+ terabits per second. This isn't just incremental improvement. It's exponential growth in throughput.

How? Optical technology improvements. Modulation schemes carrying more information per photon. Wavelength division multiplexing, where a single fiber carries hundreds of different colors of light, each carrying data independently. Error correction, where cables automatically detect and fix transmission errors, allowing slightly dirtier signals while maintaining reliability.

Google's cables incorporate cutting-edge optical technology. The Raman cable connecting the UK to India uses 600 terabit-per-second capacity across its fiber pairs. That's roughly 600 million simultaneous video calls.

But cable technology continues advancing. Within five years, 800-1000 terabit-per-second cables will become standard. This creates interesting dynamics. Cables installed today represent massive capital investment, but they'll seem dated within a decade. Operators must choose: keep running older cables, upgrade technology (complex on ocean-bottom infrastructure), or replace them entirely.

Google avoids this by designing cables with upgradeable optical terminals. The fiber itself stays on the ocean floor for 25 years. But the equipment at landing stations (the amplifiers, switches, and transmission gear) can be replaced every few years as technology improves. This maximizes lifespan while keeping pace with technology evolution.

For India specifically, this means early investment in modern cables gives long-term advantage. The infrastructure built today will handle 5-10x capacity improvements without replacement.

Tech giants are investing heavily in subsea infrastructure, with Amazon leading with a $35 billion investment in India. Estimated data based on known projects.

Security, Sovereignty, and Data Protection

Subsea cables raise serious security and sovereignty concerns.

Data traveling through cables is potentially vulnerable to interception. Governments and intelligence agencies can potentially tap cables with specialized equipment. This isn't theoretical. Revelations about NSA surveillance programs included details about submarine cable tapping.

For India specifically, data sovereignty means data must remain within Indian borders (or at least not transit through unfriendly countries). This is partly why companies must build data centers in India and store data locally. You can't guarantee security if data transits cables you don't control through countries with whom you have adversarial relationships.

America-India Connect addresses some of this by establishing dedicated capacity under Google's control, directly connecting US and Indian infrastructure. The cable doesn't route through other countries (or minimizes such routing). This reduces exposure to interception by unrelated governments.

But it doesn't eliminate concerns. The US government, through law and court orders, can compel Google to provide data. Indian users sending data through US-owned infrastructure must trust that Google resists inappropriate requests. This tension between corporate control and national security never fully resolves.

From India's perspective, owning and operating their own cables provides maximum security. But building independent cable infrastructure requires capital and technical expertise most countries lack. Using Google's infrastructure is a trade-off: better connectivity and lower costs, but reduced sovereignty and independence.

This is why India also invests in domestic fiber networks and encourages companies like Jio (Reliance's telecom arm) to build proprietary infrastructure. Diversity of routes and providers provides security through redundancy.

The Role of AI Training Data

Why does Google care so much about India specifically? Partially because of the people and compute, yes. But also because of data.

Training state-of-the-art AI models requires billions of data points. These come from:

Text: Books, articles, websites, social media posts, customer service interactions, government documents. The diversity of languages, topics, and perspectives in the training data shapes model capabilities and biases.

Images: Photographs, diagrams, videos, screenshots. Models need visual data to understand the world.

Structured data: Databases, spreadsheets, government records, sensor readings. This data trains models for specific tasks.

India produces extraordinary volumes of data. With 1.4 billion people increasingly online, social media platforms, e-commerce sites, and government digital services generate petabytes annually. This data is valuable for training models that understand:

Indian languages. English-language models work well for English. But 600+ languages exist in India. Training data for Hindi, Tamil, Telugu, Kannada, and others helps models serve Indian users better.

Indian contexts. Models trained predominantly on Western data develop Western biases. A model trained to recognize objects might fail on Indian cultural contexts, cuisine, clothing, or architectural styles. Indian data corrects these biases.

Indian economic behavior. E-commerce, payments, business practices differ between India and the West. Models trained on Indian transaction data understand Indian commerce better.

By building infrastructure in India, Google gains efficient access to this data. Instead of exporting data across continents for processing, they process it locally. This saves bandwidth, improves latency, and reduces costs.

It also builds relationships with Indian data providers and companies. When Google operates infrastructure in India, local companies more readily partner with Google, feed data into Google's systems, and build on Google's platforms. The ecosystem effect compounds.

Future Roadmap: What Comes After America-India Connect

America-India Connect isn't Google's final infrastructure play. It's one step in an ongoing expansion.

Investors and analysts speculate about next moves. Likely candidates include:

Additional Asian gateways: Capacity bottlenecks exist between Southeast Asia and India. Additional cables from India to Thailand, Vietnam, or Indonesia would alleviate congestion.

African expansion: Google's Equiano cable covers the coast, but interior Africa remains poorly connected. Overland fiber routes from coastal cities inland would extend coverage.

Arctic routes: As climate change opens Arctic passages, cables along Arctic routes could provide shorter paths between North America, Europe, and Asia.

Private cable networks: Instead of co-owning cables with other companies, Google might fund 100% proprietary cables serving only Google's infrastructure. Meta and Amazon are exploring similar strategies.

Next-generation technology: The tech industry continues developing cables that can transmit terabits per second. Google will upgrade cables to adopt these technologies, maintaining technological advantage.

Beyond cables, future infrastructure includes edge computing nodes, CDN optimizations, and local data center networks. Google's strategy increasingly moves toward globally distributed compute, where processing happens close to users rather than centralized in giant facilities.

But this requires connectivity. Subsea cables are foundational. Without them, distributed infrastructure can't function.

By 2024, tech giants like Google, Meta, Amazon, and Microsoft are estimated to own or co-own a significant portion of subsea cables, ensuring control over data flow and reducing dependency on third-party infrastructure. (Estimated data)

Implications for Global Internet Governance

As tech companies build more infrastructure, internet governance dynamics shift.

Historically, telecommunications companies and government bodies controlled internet infrastructure. Regulators had significant power. Tech companies were users of infrastructure provided by others.

That's inverted. Now tech companies are the primary builders and operators. Governments struggle to regulate infrastructure controlled by foreign corporations.

This creates tensions. Governments want:

Data localization: Data from citizens should remain within borders. Tech companies want geographic flexibility, but governments impose restrictions.

Security: Infrastructure shouldn't depend on countries with adversarial relationships. This leads to pressure for diverse routing and local ownership.

Sovereignty: Nations want some control over connectivity. Exclusive dependence on foreign-owned infrastructure feels uncomfortable to policymakers.

Tech companies counter that their infrastructure improves global connectivity, enables services, and ultimately benefits everyone. The infrastructure companies build serves their business interests, but the public goods created are real.

This debate plays out country by country. India is increasingly assertive about data sovereignty and infrastructure independence. Europe demands data protection and privacy compliance from companies like Google. The US reviews foreign investment in infrastructure. China excludes Western companies from its internet backbone entirely.

America-India Connect sits in the middle of these tensions. It's Google's infrastructure serving Google's interests. But it also improves Indian connectivity and gives India strategic leverage by making the nation a hub.

Case Study: Comparing Indian Internet Connectivity Before and After

To understand America-India Connect's impact, consider how Indian connectivity has evolved.

In 2010, India had limited subsea cable capacity. The Raman cable provided crucial connectivity but was insufficient for growing demand. Latency for Indian users accessing US-based services was high, sometimes exceeding 200 milliseconds. Download speeds were poor, especially international content.

From 2015-2020, multiple cables landed in India. Google's Raman received upgrades. New cables added capacity. Costs fell, speeds improved, and services became competitive with other regions.

But bottlenecks remained at traditional landing points. All traffic concentrated at Mumbai and Chennai. Peak hours caused congestion. Redundancy was limited. If one cable experienced issues, no alternative routes existed.

America-India Connect changes this by:

Adding a third major international gateway at Visakhapatnam, spreading load and reducing congestion at Mumbai and Chennai.

Providing direct US-India connectivity, eliminating the need to route through intermediate hubs in Europe or the Middle East.

Increasing total capacity available to Indian infrastructure by multiple terabits per second.

Establish redundancy through multiple Southern Hemisphere routes, so single points of failure don't cripple connectivity.

The practical effect: Indian users experience faster load times for US services. AI services running on Google's Indian infrastructure access data and compute resources more efficiently. Indian startups building AI products have better access to cloud resources. Internet reliability improves.

It's hard to quantify exactly without data, but aggregate effects probably include:

10-30% improvement in US-India latency as direct cables reduce distance and routing complexity.

Significant cost reductions for bandwidth, as competition increases and capacity grows.

Better service quality for streaming, video calls, and other latency-sensitive applications.

Enabling of new applications previously impractical due to connectivity constraints.

Building Global Infrastructure: Why Tech Companies Lead

You might wonder: why doesn't India build its own subsea cables? Or other developing countries? The answer involves capital, expertise, and strategic vision.

Subsea cable projects require:

Enormous upfront capital:

Specialized expertise: You need oceanographers, engineers who understand optical transmission, international law experts, and project managers. This expertise concentrates at large tech companies that run globally.

Ability to absorb losses: A cable might not generate positive returns for 5-10 years. Only companies with massive cash flows and patient capital can wait.

Strategic vision: Smaller companies optimize for immediate profitability. Large tech companies think in 10-20 year timeframes and accept losses if long-term position strengthens.

Relationships and influence: Building cables requires navigating complex international regulations. Tech companies have relationships with governments, regulators, and other industry players enabling this.

India is changing this somewhat. The government supports telecom companies like Jio in building infrastructure. But even with support, Indian companies are junior partners with Google and other tech giants in most cable projects. Co-ownership is common, but sole ownership by Indian companies remains rare.

This asymmetry is part of why Indian policymakers worry about infrastructure independence. As long as foreign companies own critical infrastructure, India depends on those companies' cooperation and compliance with Indian regulations.

There's no easy solution. Building independent infrastructure is expensive and complex. Using foreign-owned infrastructure is cheap but risky. Most countries accept a middle ground: encourage foreign investment while also building some domestic capacity.

Economic Modeling: ROI on Subsea Investment

Let's roughly model the economics of America-India Connect to understand whether Google's investment makes sense.

Assume Google invests $1.5 billion in subsea cables and related infrastructure.

Assume the facility in Visakhapatnam has 500 megawatts of power consumption (reasonable for large data center).

Assume electricity costs roughly $50 per megawatt-hour in India (reasonable estimate).

Annual power costs: 500 MW × 8,760 hours ×

Add operations, maintenance, and staff: $100 million per year.

Total annual operating cost: roughly $320 million.

Now revenue. Google doesn't publicly disclose cloud pricing, but AWS and Azure rates are public. A large enterprise cloud commitment might cost $50-100 million annually for a major customer. But that's retail. Google operates its own infrastructure at lower cost.

Assuming Google monetizes through cloud services at rates slightly below market, they might generate $200-300 million annually in revenue once fully utilized. That covers operating costs but doesn't recover capital investment quickly.

But that's incomplete. This infrastructure serves Google's own operations, not just cloud sales. Visakhapatnam helps with:

AI research and development: Google trains models, improves algorithms, and develops next-generation AI technology. This research creates products worth billions.

YouTube, Search, and other service improvements: Better Indian infrastructure means better service quality for Indian users, driving more engagement and ad revenue.

Strategic positioning: By establishing infrastructure dominance in India, Google makes it harder for competitors to enter the market. Amazon and Microsoft must now compete against an entrenched player with homegrown infrastructure.

Data advantages: Access to Indian data and local research talent creates product and algorithm improvements applying globally.

When you factor in these strategic benefits, the $15 billion investment starts looking like prudent spending rather than excessive. Google estimates the investment will pay returns through improved products, expanded market reach, and strategic dominance. It's not just about cloud service revenue.

Challenges and Uncertainties

Despite clear strategic rationale, America-India Connect faces challenges.

Regulatory delays: Government approval in multiple countries could take longer than expected. Indian regulators move slowly on infrastructure decisions. If approval takes 3-5 years instead of 1-2, costs increase and competitive dynamics shift.

Geopolitical complications: US-India relations could deteriorate. If tension increases, the US might restrict technology exports to India or block infrastructure projects. Conversely, India might restrict Google's operations if nationalism rises.

Technological disruption: What if quantum computing or other technology makes current fiber-optic infrastructure obsolete? Unlikely in the next decade, but possible. It would impact the value of current investments.

Environmental concerns: Laying cables disturbs marine ecosystems. Environmental groups might oppose projects, causing delays or requiring expensive mitigation measures.

Financial pressure: If economic recession hits, Google might defer infrastructure spending. Even companies with enormous cash flows become cautious during downturns.

Competing infrastructure: If satellite internet (Starlink, Amazon Kuiper, etc.) becomes viable for high-capacity data transfer, traditional subsea cables become less valuable. This seems unlikely but shouldn't be dismissed.

These aren't deal-breakers. Google has managed worse obstacles. But they're real risks that could impact outcomes.

India's Broader AI Ambitions

Understanding America-India Connect requires understanding India's broader strategy for becoming an AI hub.

The Indian government released an National AI Strategy outlining goals for 2020-2030. Key objectives include:

Making AI accessible across government services, healthcare, agriculture, and education.

Building domestic AI research capability, reducing dependence on Western research.

Creating Indian AI companies and startups that compete globally.

Developing ethical AI frameworks aligned with Indian values.

Google's investment aligns with this strategy. By building infrastructure, research facilities, and supporting development, Google helps India achieve these goals while positioning Google as the default cloud provider for Indian AI development.

This isn't accidental. Google likely coordinated with Indian government, aligning corporate investment with national strategy. Both parties benefit: India gets infrastructure and investment, Google gets market position and strategic advantage.

Other companies recognize this. Amazon and Microsoft are equally engaged with Indian government, proposing competing infrastructure investments and research partnerships. The competition benefits India, as each company must offer increasingly favorable terms.

The Ripple Effects: Ecosystem Implications

When Google announces billion-dollar infrastructure investment and compute hub, secondary effects ripple through India's tech ecosystem.

Data center operators now know Google is serious about India. They invest in their own facilities, knowing demand will grow. Realizing India is a growing market, investors fund startups building data center software, cooling systems, and operations tools.

AI researchers see opportunity. Universities attract better faculty. Startups get funding. Top talent that previously moved to Silicon Valley might now stay in India if career opportunities exist.

Telecom companies like Jio, Airtel, and others benefit from increased network demand. They invest in local capacity. Competition intensifies, potentially driving down costs for internet users.

Cloud startups building on top of Google's infrastructure grow faster. Easier infrastructure access means lower startup capital requirements, enabling more companies to start.

Government agencies see tech infrastructure investments as solving problems. They adopt cloud services, contribute data for AI training, and benefit from improved services.

But there are downsides too. Market concentration increases as Google becomes the dominant infrastructure provider in India. Smaller competitors struggle to compete against Google's scale and capital. Data dependence on foreign companies increases, creating some sovereignty concerns.

These trade-offs are real, but most analysts argue the benefits outweigh costs, at least in the medium term.

Looking Ahead: 2030 and Beyond

What does internet infrastructure look like in 2030 if America-India Connect succeeds as planned?

Likely scenario: India becomes a major hub in global AI infrastructure. Visakhapatnam rivals Singapore or California as a research and compute center. Indian AI researchers and companies compete globally, no longer primarily depending on Western infrastructure.

India's latency to global services improves dramatically. The gap between US and India in terms of service speed narrows. This matters for emerging applications like AR/VR, autonomous systems, and real-time AI.

Diversity of infrastructure increases. While Google dominates, other companies build competing infrastructure. Indian government invests in government-operated cables and facilities. The result is redundancy and resilience.

Other developing regions follow India's example. Governments and tech companies negotiate infrastructure investment, realizing that connectivity enables economic development. This global competition for infrastructure investment benefits developing countries through better bargaining power.

But risks exist. If US-China tensions escalate, infrastructure becomes militarized. Countries divide into competing blocs with separate infrastructure. Internet fragmentation increases. Or if climate change makes equatorial regions unstable, cable routes shift, and entire regions face connectivity disruption.

Most likely: a middle path where infrastructure continues expanding globally, but under increasing geopolitical tension. Growth continues but with more complexity and fragmentation than the pre-2020 internet.

Key Takeaways and Conclusion

America-India Connect represents far more than a single infrastructure project. It's Google's massive bet that India becomes central to global AI development. It's India's positioning itself as a tech hub, not just a market or service provider. It's evidence of how fundamental infrastructure is becoming to economic and technological power.

The subsea cables themselves are just fiber-optic tubes carrying light. But the light they carry represents data, computation, and economic value. Control over these pipes matters. This is why tech companies invest billions. This is why governments care deeply.

For India specifically, the investment accelerates development timelines. Instead of India gradually building infrastructure independently, Google's capital jumpstarts the process. Indian researchers, startups, and companies get immediate access to world-class resources.

For Google, the investment buys market position in the world's fastest-growing major economy. It establishes infrastructure dominance before competitors consolidate their position. It demonstrates commitment to India in ways that build relationships with government and local partners.

For global internet users and AI development broadly, diversified infrastructure is beneficial. Heavy concentration of compute and connectivity in California and Virginia drives costs up and creates single points of failure. Distributing infrastructure globally improves resilience, reduces latency for users everywhere, and enables development hubs beyond the US.

The next five to ten years will show whether America-India Connect succeeds in meeting its ambitious goals. Infrastructure projects routinely face delays, cost overruns, and regulatory complications. But if Google executes successfully, India's position in global AI development shifts fundamentally.

That's what's actually at stake. Not faster internet speeds, though that matters. Not cheaper cloud services, though that helps. But which regions lead in AI development over the next decade. And that shapes everything that follows.

FAQ

What exactly is the America-India Connect initiative?

America-India Connect is Google's subsea cable and infrastructure project establishing new high-capacity fiber-optic routes between the United States and India through multiple Southern Hemisphere paths. The initiative includes three new subsea cable paths, four strategic fiber-optic routes providing network redundancy, and a new international subsea gateway in Visakhapatnam. Combined with Google's broader $15 billion five-year investment in Indian AI infrastructure, it represents Google's commitment to making India a major global AI hub.

Why did Google choose Visakhapatnam as the gateway location instead of traditional hubs like Mumbai?

Visakhapatnam offers several strategic advantages. It's India's busiest port by cargo volume, providing existing infrastructure and engineering expertise for major connectivity projects. Geographically, it sits on India's east coast, positioned optimally for routing traffic to Southeast Asia, Japan, and Australia. Most importantly, Google is building a large-scale AI compute hub in Visakhapatnam, and locating the subsea gateway there minimizes latency when moving training data and computation results, maximizing operational efficiency for AI workloads.

How much will subsea cables cost, and how does that fit into the $15 billion investment?

Modern high-capacity subsea cables spanning continents typically cost

How do subsea cables work technically, and why does capacity matter for AI applications?

Subsea cables are fiber-optic tubes laid on the ocean floor that carry data as light pulses traveling at near light speed. Modern cables use wavelength division multiplexing, where different colors of light, each carrying independent data streams, transmit simultaneously. High-capacity cables achieve 200+ terabits per second throughput. AI applications require massive bandwidth for moving training datasets (which can exceed terabytes), uploading inference requests, and downloading model results. Insufficient cable capacity creates bottlenecks, limiting performance and efficiency.

What is the AI divide, and how does America-India Connect help address it?

The AI divide refers to how access to advanced AI capabilities, computational resources, and development tools concentrates in wealthy, tech-advanced regions, primarily the United States. Startups and researchers in developing regions face higher costs and limited access, reducing competitive capacity. America-India Connect helps by establishing large-scale compute capacity in India at costs lower than US alternatives, enabling Indian companies and researchers to build AI products competitively and reducing dependence on US-based infrastructure.

Why does Google invest this heavily in India specifically rather than other developing markets?

India offers multiple advantages for Google's AI ambitions. The nation has 1.4 billion people representing massive market potential. India produces roughly 1.5 million engineers annually and hosts many world-class AI researchers. The country generates enormous volumes of diverse data from social media, e-commerce, and government digital services, valuable for training AI models that understand Indian contexts and languages. Additionally, the Indian government actively courts tech investment through tax incentives and data sovereignty frameworks, making India financially attractive for tech infrastructure investment.

Are there security risks with having critical infrastructure controlled by foreign companies?

Yes, security and sovereignty concerns are legitimate. Data transmitted through cables can theoretically be intercepted. Governments can compel companies to provide data through legal processes. For India, having foreign-owned infrastructure reduces independence and creates strategic vulnerabilities. This is why India also invests in domestic fiber networks and encourages companies like Jio to build proprietary infrastructure. A diversified infrastructure portfolio reduces dependence on any single foreign company while maintaining access to advanced global infrastructure.

How does America-India Connect compete with satellite internet options like Starlink?

Satellite internet offers advantages for areas lacking ground infrastructure but currently lacks the bandwidth and latency characteristics of subsea cables for high-demand applications. Satellite has higher latency (typically 600+ milliseconds) compared to subsea cables (20-100 milliseconds) and faces capacity limitations. For AI infrastructure requiring massive data transfer and low latency, subsea cables remain superior. However, satellite internet is rapidly improving, and if technology dramatically advances, it could eventually complement or reduce dependence on undersea infrastructure.

What timeline should we expect for America-India Connect implementation?

Typically, subsea cable projects take 2-5 years from approval to full operation. Regulatory approval varies significantly by country—India sometimes takes years for decisions, while other nations move faster. Google's announcement suggests they've cleared major regulatory hurdles, but implementation likely spans 3-5 years. The compute hub construction similarly takes years. Full operational capacity probably won't arrive until 2027 or later, though phased rollout may provide partial capacity earlier.

How does America-India Connect impact internet users in India practically?

Practical benefits for Indian users include faster load times for US-based services, improved video streaming quality with reduced buffering, better reliability for cloud services as redundant routes reduce single points of failure, and lower costs for internet services as competition increases with more available capacity. AI services running on Google's Indian infrastructure will have better performance. However, benefits depend on whether Indian internet service providers effectively leverage the new capacity and whether competition drives cost reductions.

Final Thoughts on Global Infrastructure and Geopolitical Realities

The announcement of America-India Connect might seem like a straightforward tech infrastructure project. In reality, it's a strategic positioning move in the global AI competition. Google is signaling that India matters, investing billions to ensure its dominance in the region.

For India, this represents opportunity and dependency simultaneously. The infrastructure drives development, attracts talent, and enables companies to compete globally. But it also deepens reliance on a foreign company for critical resources.

That tension defines modern tech infrastructure. The most advanced systems globally are controlled by private companies for profit. This drives innovation and efficiency but creates concentration of power. Whether this is sustainable long-term remains an open question.

What's certain: infrastructure matters. It shapes what's possible. By controlling where data flows and how compute resources are distributed, companies like Google shape the future of technology and business. America-India Connect is another move in that grand chess game.

India is awake to this reality. The nation is building its own capacity, setting its own rules, and negotiating hard with foreign companies. The result likely isn't Indian independence from foreign infrastructure but rather a more balanced relationship where India has leverage and options.

The internet of 2030 will be more diverse and distributed than today's, with multiple hubs, competing infrastructure, and complex geopolitical dynamics. America-India Connect is preparing for that future.

Related Articles

- Google Gemini 3.1 Pro: AI Reasoning Power Doubles [2025]

- Gemini 3.1 Pro: Google's Record-Breaking LLM for Complex Work [2025]

- Vibe-Coded Music Apps: How AI is Rebuilding the iTunes Future [2025]

- Russia's Telegram Ban Disrupts Military Operations in Ukraine [2025]

- OpenAI's 100MW India Data Center Deal: The Strategic Play for 1GW Dominance [2025]

- VMware Customer Exodus: Why 86% Still Want Out After Broadcom [2025]

![Google's America-India Connect: Reshaping Global Internet Infrastructure [2025]](https://tryrunable.com/blog/google-s-america-india-connect-reshaping-global-internet-inf/image-1-1771681015172.jpg)