How Rivian's Software Strategy Saved the Company in 2025

Rivian almost died as a hardware company. It could have been another cautionary tale, another well-funded startup that burned through billions and delivered a solid product that just couldn't move the needle financially. Then something unexpected happened in 2025: the company made more money from software than anyone saw coming.

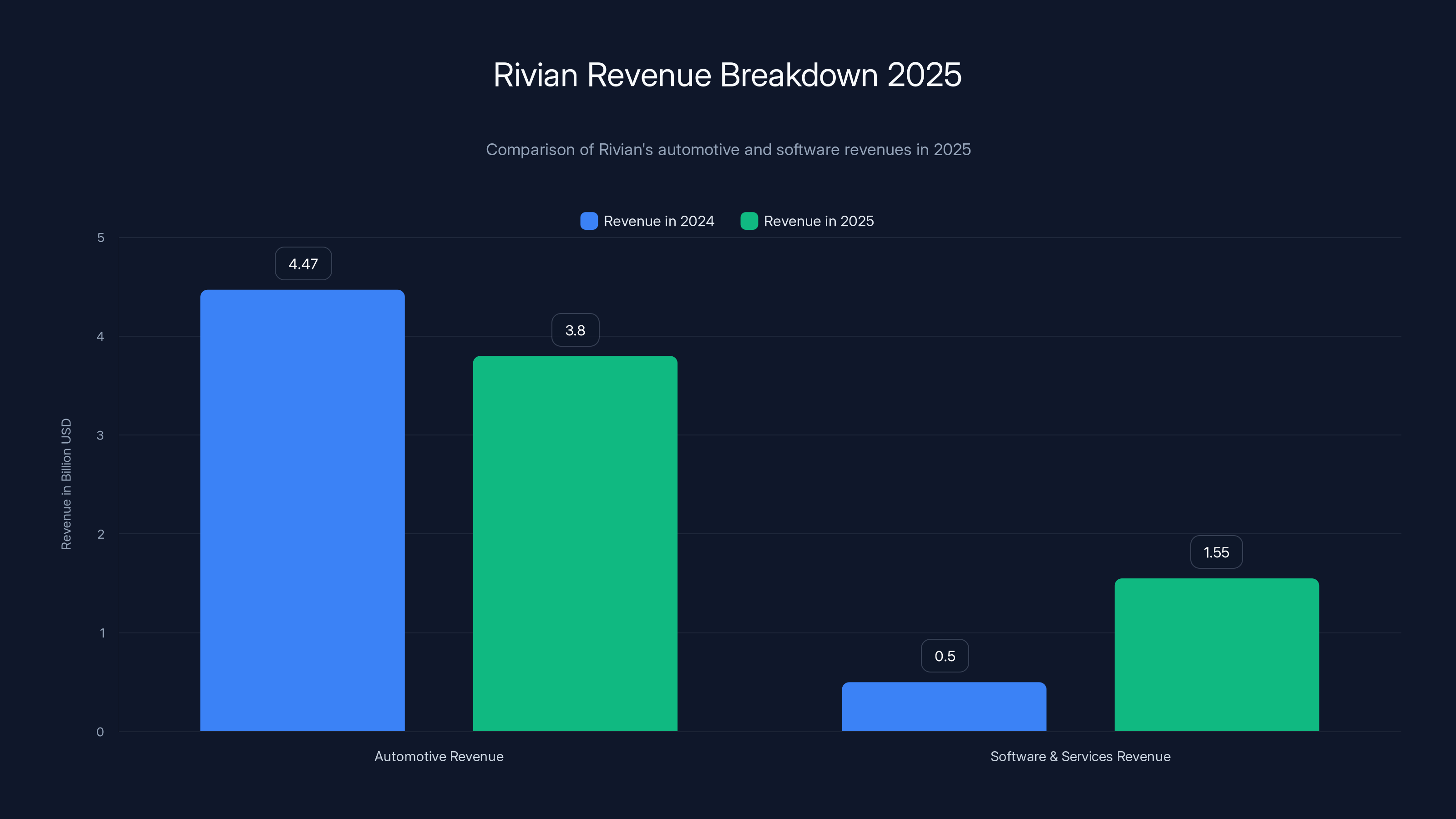

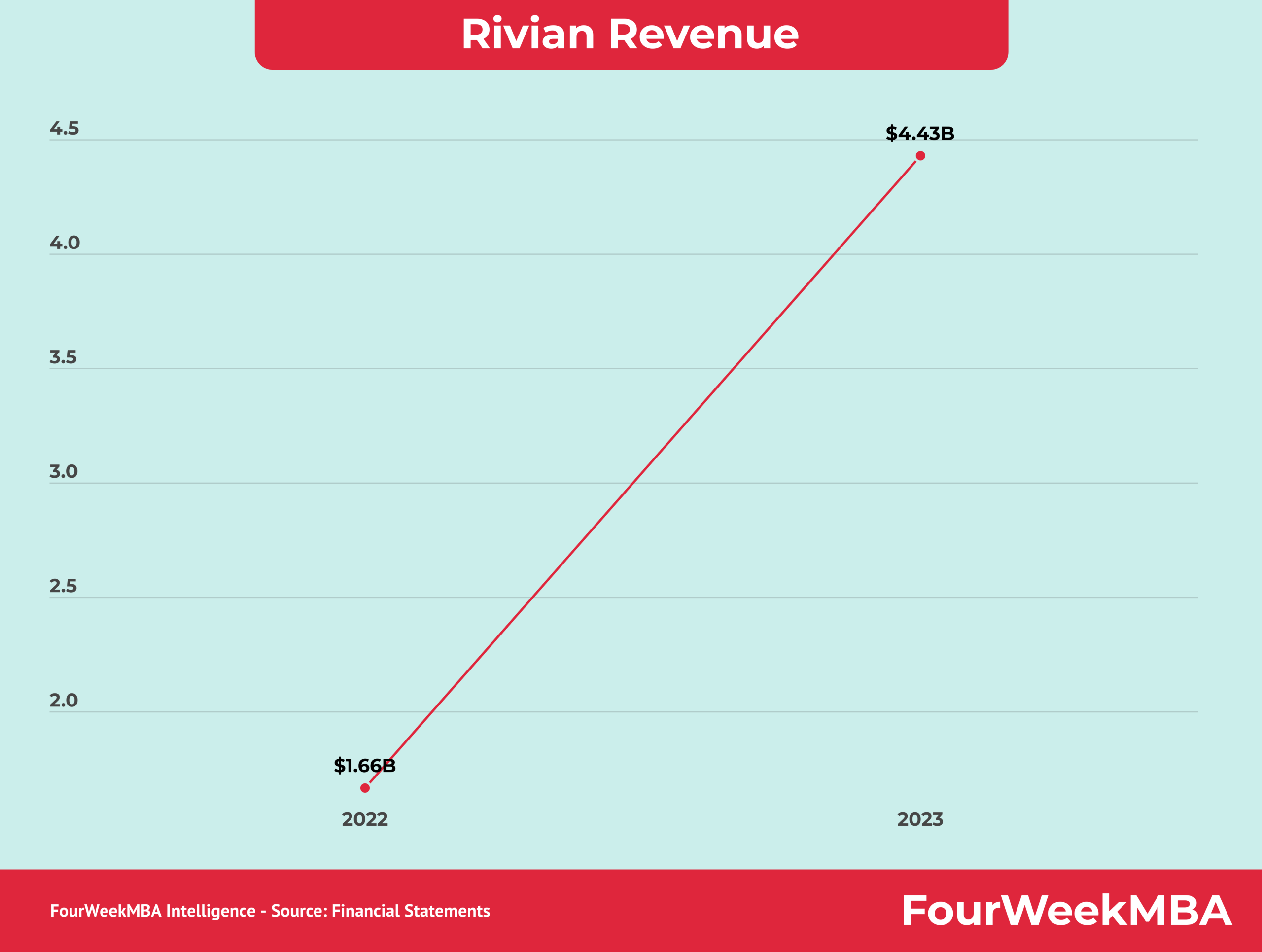

The numbers tell a remarkable story. Rivian reported

Software and services revenue exploded to $1.55 billion in 2025, growing more than threefold from the prior year. For a company burning through capital like most EV makers, this wasn't just a bright spot. It was a lifeline. And the company's Volkswagen Group technology partnership was responsible for most of that windfall.

This is the story of how Rivian transformed from a traditional automaker fighting for survival into a technology company that happens to make cars. It's a pivot that reveals something crucial about the future of the EV industry: the real money isn't in selling vehicles. It's in the software that runs them.

The Near-Death Experience Nobody Talks About

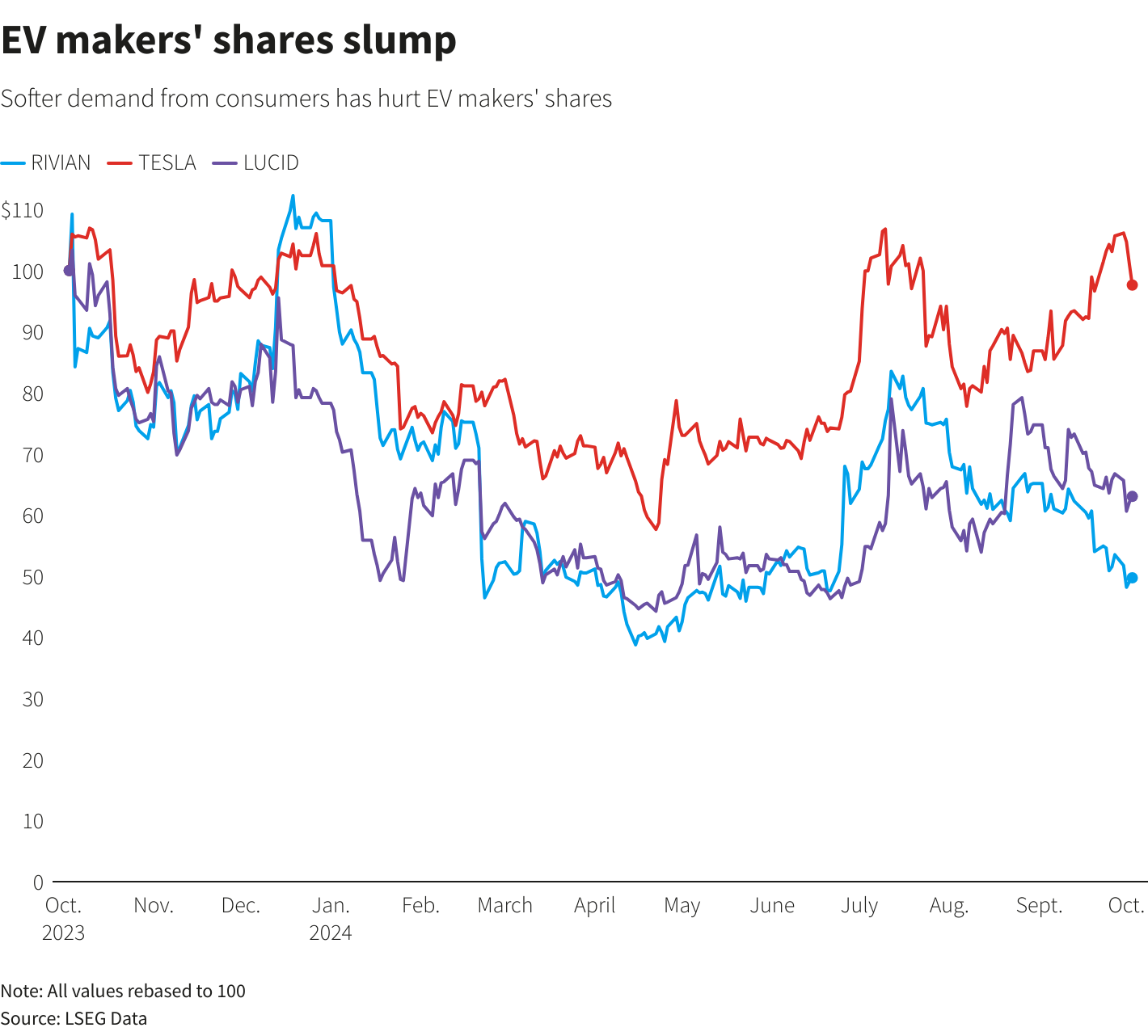

Let's be clear about where Rivian stood in early 2024. The company had burned through billions in development costs, delivered its flagship R1T truck and R1S SUV, and was still losing significant money on every vehicle produced. The automotive business model looked broken.

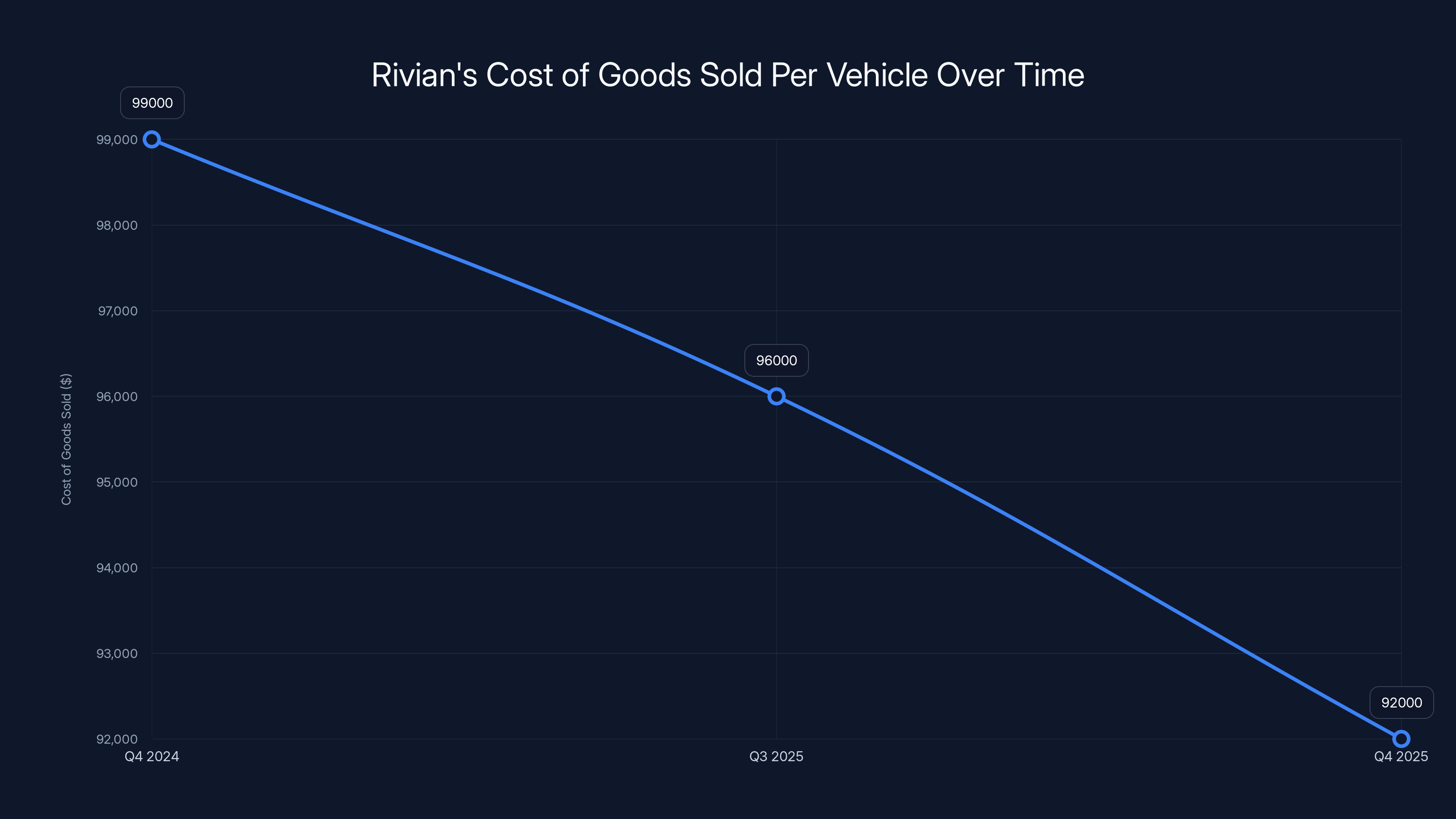

On a per-unit basis, Rivian was hemorrhaging cash. In the fourth quarter of 2024, the company's cost of goods sold per vehicle sat at

The company had already burned through more than $10 billion in capital. Traditional venture funding wasn't going to save them. Going public in 2022 at an inflated valuation was supposed to provide a runway, but the stock price had collapsed, and dilution concerns were mounting. Something had to change fundamentally, or Rivian would join the graveyard of failed EV startups.

Management understood this. The company needed cash flow that didn't depend on selling more vehicles. It needed revenue streams that weren't tied to manufacturing costs. It needed software.

Rivian's software and services revenue surged over threefold to

The Volkswagen Partnership: A Calculated Lifeline

In 2024, Rivian and Volkswagen Group announced a technology joint venture worth up to $5.8 billion. This wasn't a typical investment. It was structured as a series of milestone-based payments, with Rivian providing its electrical architecture and software technology stack to VW Group in exchange for capital.

The first payment came quickly. Rivian received $1 billion in the form of a convertible note in 2024, almost immediately upon announcement. This was validation from one of the world's largest automakers that Rivian's technology had real value. But more importantly, it was cash.

Then in 2025, something critical happened. Rivian hit the agreed-upon milestones. The company demonstrated that its software platform worked, that it could be integrated with VW vehicles, and that the partnership had genuine commercial potential. This triggered a $1 billion equity payment in July 2025.

By the end of 2025, Rivian had received

This structure is crucial. It gives Rivian predictable capital inflows for the next two years, which buys time to execute on the R2 launch and prove out the core automotive business. It's not a permanent solution, but it's a runway.

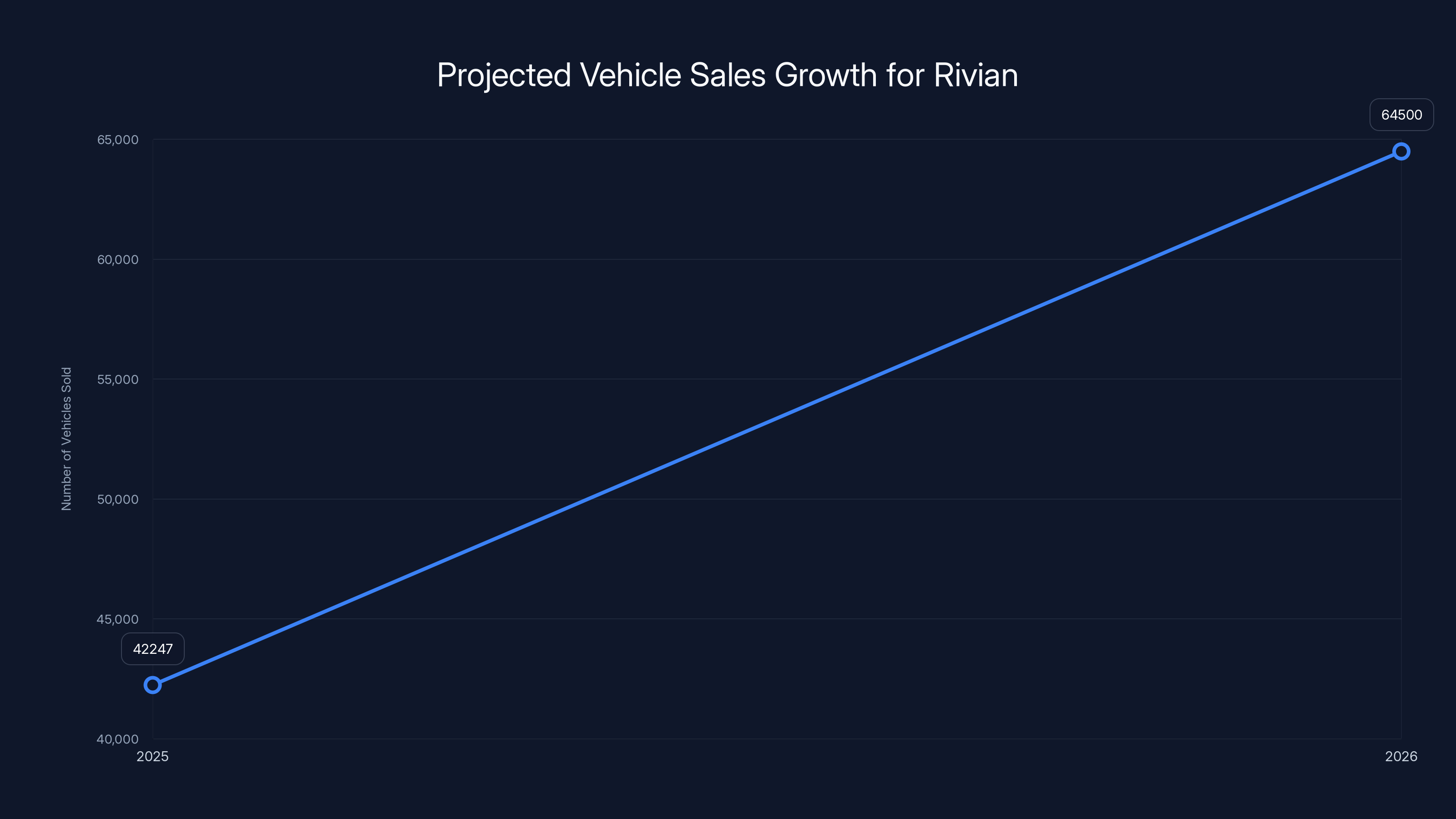

Rivian projects a 48-58% increase in vehicle sales from 2025 to 2026, driven by the launch of the R2 SUV. Estimated data based on company guidance.

How Software Revenue Actually Works at Rivian

The $1.55 billion in software and services revenue for 2025 needs to be understood in two parts, because Rivian's official guidance doesn't break them out clearly. The company mentions "services" which includes vehicle repair, maintenance, and trade-ins. But the bulk of the growth came from software.

Most of that software revenue comes from the VW Group relationship. Rivian is licensing its electrical architecture and software stack to Volkswagen, allowing the company to use these components in VW vehicles. This is essentially a licensing agreement with milestone-based payments.

But this licensing revenue model reveals something important: Rivian's software wasn't necessarily designed to be monetized this way initially. The company built a complete electrical and software architecture for its own vehicles because it had to. As an EV startup, Rivian couldn't rely on legacy automotive suppliers or existing platforms. Everything had to be custom-built from scratch.

That investment in custom technology created a differentiator. Once the architecture was proven in Rivian vehicles, it had value to other manufacturers. VW Group, which had made its own bets on electric platforms and software, could potentially benefit from Rivian's approach.

This is the inflection point. Rivian went from being a company that built software exclusively for its own products to a company that could monetize that software as a standalone asset. It's a fundamental shift in business model.

The software and services revenue in 2025 grew so dramatically not just because of the VW payments, but because Rivian booked the milestone achievements as revenue. The company hit contractual targets, delivered on technical requirements, and received the corresponding payments. This is different from traditional software licensing, where revenue is often recognized gradually over time.

The Cost of Goods Sold Problem and Why Software Matters

Here's the uncomfortable truth about Rivian's automotive business: it's still not profitable on a per-vehicle basis, but it's improving. In the fourth quarter of 2025, the company's cost of goods sold per vehicle dropped to

This improvement matters because it shows the company is learning. Manufacturing efficiency is improving. Supply chain costs are declining. The second-generation R1T and R1S are cheaper to build than the originals. These are the fundamentals that need to work for a traditional automaker.

But here's the problem: even at

This is where software revenue becomes critical. That $1.55 billion in software and services revenue has virtually zero marginal cost compared to automotive revenue. Once the software is developed and the architecture is proven, licensing it to partners like VW Group generates cash with minimal additional investment. This cash can be used to subsidize vehicle development, fund manufacturing improvements, and cover operating expenses.

The mathematics of the situation are actually straightforward. If Rivian can generate $400 million in annual software licensing revenue from VW Group and other partners, that's equivalent to the profit margin on selling thousands of additional vehicles at traditional automotive margins. The capital efficiency is incomparable.

Rivian's Q4 2025 total automotive cost of revenue was

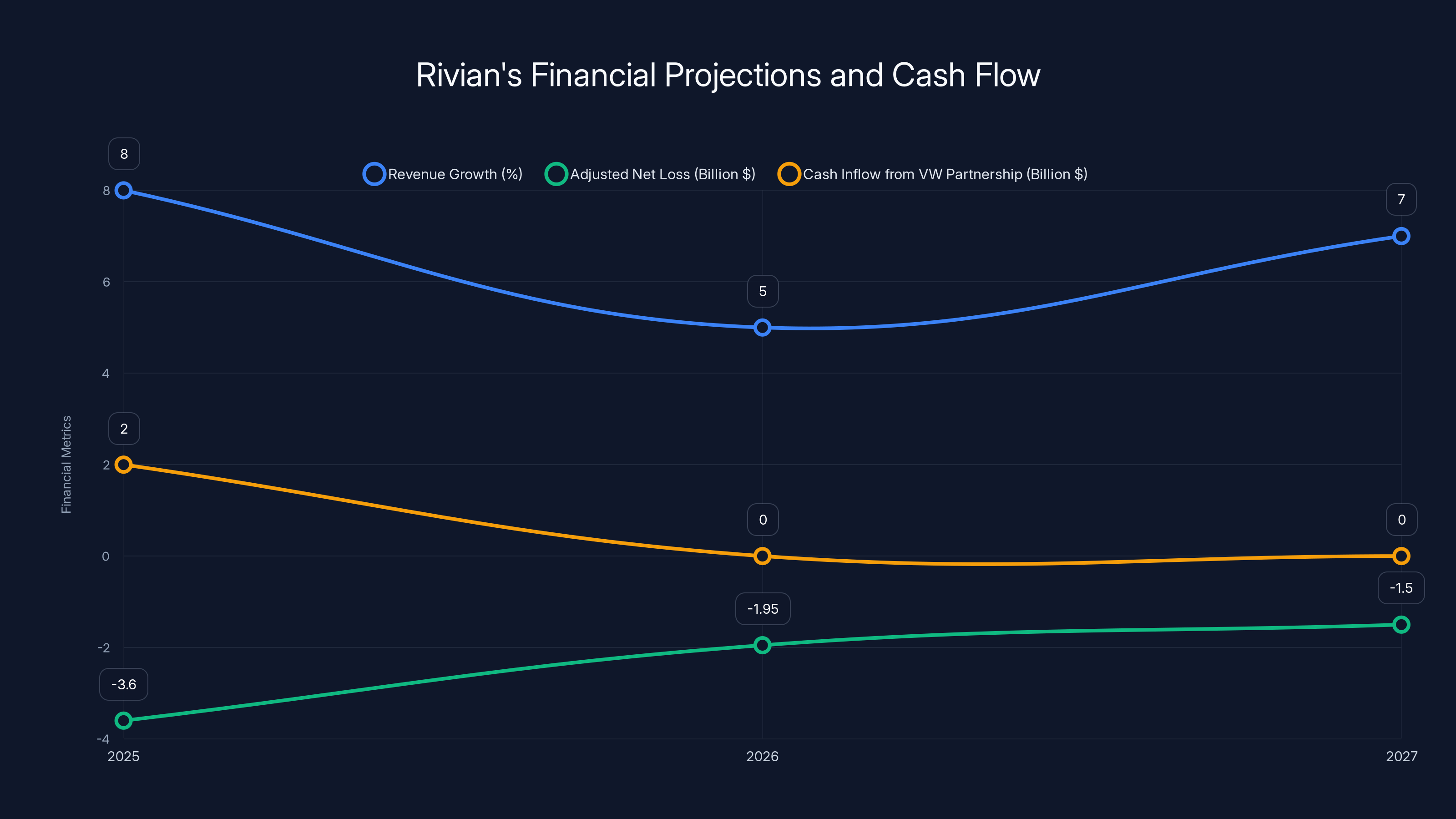

Rivian's financial outlook shows a challenging path with a significant adjusted net loss in 2025, but potential improvement by 2027. Estimated data highlights the importance of the VW partnership and operational efficiency.

The R2 Launch and the Path to Actual Profitability

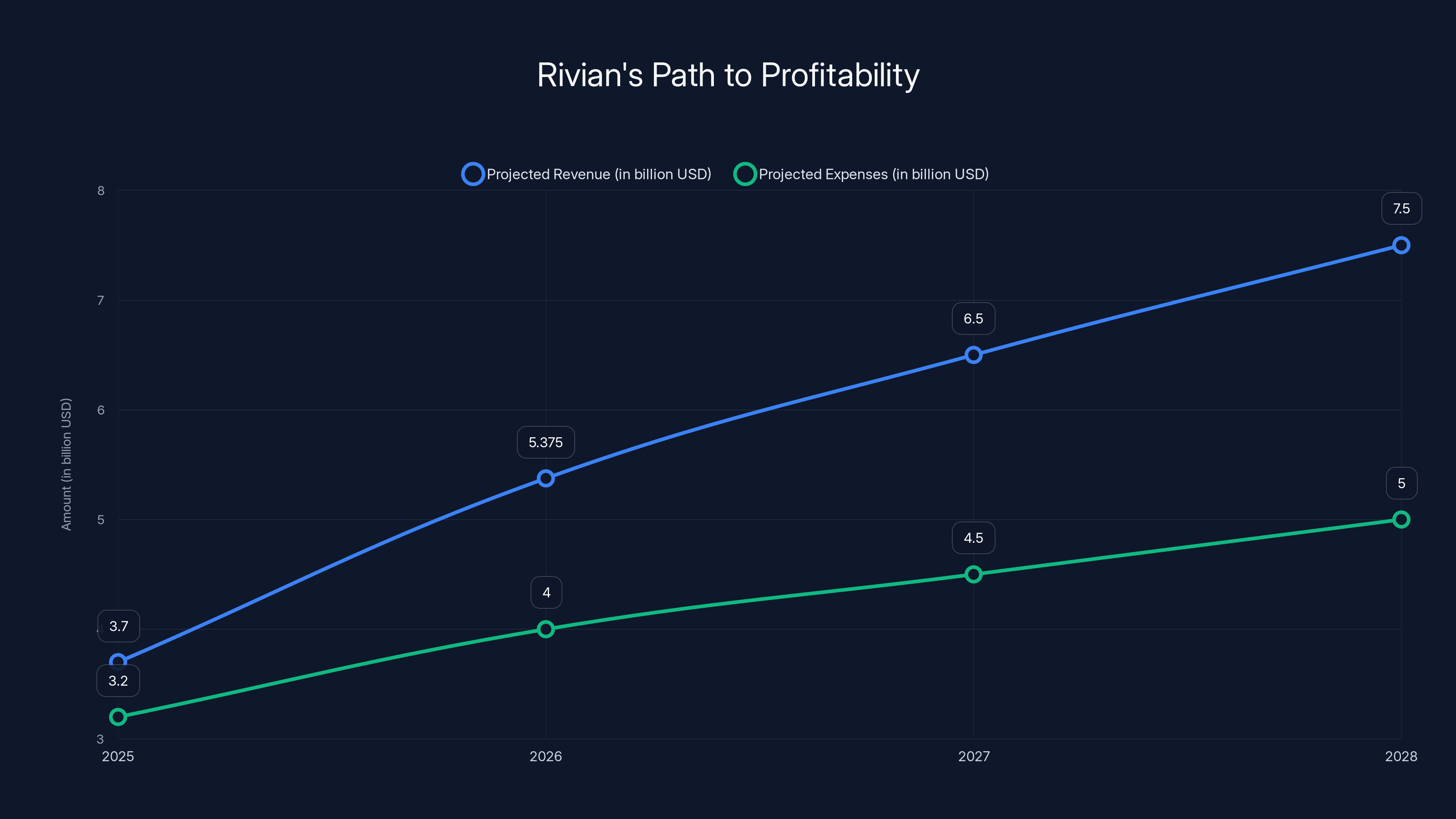

Software revenue is buying time, not solving the fundamental problem. Rivian still needs to prove it can build and sell profitable vehicles. The R2 SUV is supposed to be that proof point.

Rivian confirmed that the R2 will launch by June 2026. This is the company's second vehicle family and it's designed from the ground up to be cheaper to manufacture than the R1. The emphasis on "cheaper to build" is crucial because it signals that Rivian learned from the R1 experience.

The R1 was engineered with premium materials and complex manufacturing processes. It had to be. As a startup's first vehicle, it needed to be impressive enough to justify the $150,000+ price tag and generate buzz. But impressive doesn't mean profitable. Now, with the R2, Rivian is targeting a different market segment with vehicles priced lower, designed simpler, and built more efficiently.

Full specifications for the R2 are expected to be revealed on March 12, 2026, but the outline is clear. The company will initially launch dual-motor all-wheel drive variants. This suggests the design will prioritize efficiency over raw performance compared to the R1. Lower-cost components, simpler manufacturing processes, and faster production times are all part of the R2 equation.

Here's why the R2 matters for the profitability question. If Rivian can reduce COGS per unit to something like

Rivian's 2026 guidance assumes this happens. The company expects to deliver between 62,000 and 67,000 vehicles in 2026, up from 42,247 in 2025. That's a 48-58% increase in unit sales. For this to happen, the R2 needs to resonate with customers and the company needs to execute on manufacturing ramp without the kind of problems that plagued the R1 launch.

But even more importantly, the company needs to continue improving COGS. The quarterly improvement from Q3 to Q4 2025 shows the trend is positive. If Rivian can continue reducing per-unit costs while ramping production, the mathematics of the business start to work.

Cash Position and the 2026 Capital Requirements

Let's talk about the financial reality. Rivian is still burning through capital. The company reported a net loss of $3.6 billion in 2025. That's a staggering number, though it includes stock-based compensation and other non-cash charges.

For 2026, the company expects an adjusted net loss between

Rivian expects to receive

But there's a critical point here. The VW partnership payments are contingent on Rivian hitting milestones. The $1 billion of 2026 payments that's subject to winter testing completion could be at risk if the company doesn't deliver. This is why management emphasized on the earnings call that winter testing is "underway." They need to hit this milestone.

Capital expenditures for 2026 are expected to be between

The combination of

The cash situation is tight but manageable for one more year. By 2027, if the R2 is successful and the company approaches profitability, the need for external capital should decrease significantly.

Rivian's total revenue increased by 8% in 2025, driven by a tripling of software and services revenue, despite a decline in automotive revenue. Manufacturing costs per unit decreased but remain above selling prices. Estimated data.

Amazon and the Electric Delivery Van Strategy

Rivian's electric delivery van (EDV) for Amazon is often overlooked in discussions about the company's future, but it deserves attention. The EDV is a real business with a real customer (Amazon), and it's part of Rivian's growth story.

In 2025, the EDV contributed to Rivian's total vehicle deliveries of 42,247 units. The company expects EDV sales to grow in 2026, and management is planning new variants including an all-wheel drive version and larger battery pack options.

These variants are specifically designed for Amazon's use cases. Amazon operates massive logistics networks, and the EDV needs to serve different route profiles. Some Amazon delivery operations need lighter payloads with longer range. Others need higher payload capacity for regional distribution. The variants address these needs.

Here's why this matters strategically. Amazon is a captive customer, meaning Amazon is committed to buying a certain number of EDVs. This provides revenue visibility. Unlike consumer vehicles where demand fluctuates with market conditions, an Amazon order for 10,000 EDVs is largely a done deal.

The EDV is also simpler to manufacture than the consumer R1 or future R2. It's a commercial vehicle without the luxury appointments or consumer electronics features. The manufacturing complexity is lower, which means COGS should be more predictable and potentially lower than the consumer vehicles.

Rivian CEO RJ Scaringe mentioned on the earnings call that the company is "working really closely with Amazon in defining the requirements" for the new EDV variants. This suggests Amazon has input into the design, which is positive for adoption. If Amazon's operations teams are involved in designing the vehicles they'll be using, the fit will be better and future adoption will be stronger.

The EDV business won't save Rivian by itself, but it's a stable revenue stream with a committed customer that can help stabilize the overall business while the company works on the R2 launch.

The Profitability Question: Can Rivian Actually Achieve It?

The company is not currently guiding toward profitability for 2026. The adjusted net loss guidance of $1.8-2.1 billion makes that clear. But management is signaling that the trajectory is improving.

Let's do some back-of-the-envelope math. If Rivian delivers 65,000 vehicles in 2026 at an average selling price of

But then you have operating expenses. Rivian's operating expenses in 2025 were approximately $3.2 billion when you exclude cost of revenue. This includes R&D for future vehicle development, sales and marketing, and general corporate overhead. If this stays flat or grows only modestly, the company would still have significant operating losses.

For Rivian to achieve true GAAP profitability, several things need to happen simultaneously: R2 sales need to ramp, COGS per unit needs to continue declining, operating expenses need to be controlled, and software licensing revenue needs to remain strong. It's possible, but it requires execution on multiple fronts.

The 2027 outlook becomes critical. If the R2 is a success, deliveries are strong, and manufacturing efficiency continues to improve, Rivian could plausibly approach profitability in 2027 or 2028. If the R2 launch stumbles or demand for premium EVs slows, the company could face another capital crisis.

Rivian's cost of goods sold per vehicle decreased from

The Volkswagen Partnership as a Long-Term Strategy

The VW Group partnership is often discussed in the context of the immediate cash it provides, but it's worth considering its strategic importance beyond 2026.

Volkswagen Group owns multiple brands including Volkswagen, Audi, Porsche, and others. If Rivian's software and electrical architecture proves valuable to VW Group, the partnership could extend far beyond the current agreement. Imagine Audi using Rivian's software stack for a new generation of EVs, or Porsche adopting the architecture for its electric vehicles.

For Rivian, this creates a potential revenue stream that doesn't depend on the R2 being a massive commercial success. Even if the R2 underperforms, the company could continue generating licensing revenue from VW Group and potentially negotiate expanded partnerships with other OEMs.

But there's also a risk here. By licensing its software to VW Group, Rivian is giving a much larger competitor access to its technology. VW Group could potentially decide to develop their own equivalent architecture or modify Rivian's design extensively. The long-term competitive advantage of Rivian's software could erode over time.

This is the classic innovator's dilemma for a startup. Do you license your technology to larger competitors for immediate cash, knowing you might be helping them catch up to you long-term? Or do you insist on keeping the technology proprietary and risk running out of capital before you can fully monetize it yourself?

Rivian clearly chose the former strategy, and given the company's financial situation in 2024-2025, it was arguably the right call. A bird in hand (VW partnership money) is worth more than two in the bush (potential future licensing deals) when you're burning through billions in cash.

Software and Services Revenue: What's Really in That $1.55 Billion?

Rivian doesn't break out the exact split between software licensing and other services, but we can make some educated guesses based on the company's business model.

Software licensing to VW Group is clearly the primary driver of the growth. This is probably

Services revenue includes vehicle maintenance, repairs, and parts sales from Rivian's service network. The company has been building out service centers and establishing relationships with Tesla competitors and luxury EV buyers. This is probably

Vehicle trade-ins and resale services might account for another

The point is that the vast majority of the software and services growth is from the VW partnership, not from organic services revenue growth. This is important because it means the growth is somewhat artificial. Once the partnership milestones are completed, the revenue rate might normalize unless new milestones are achieved.

Rivian's guidance doesn't break out software revenue expectations for 2026, which is notable. This suggests management either expects software revenue to plateau or doesn't want to set specific expectations that might disappoint investors. Either way, it's a signal that the explosive growth in software revenue is probably not repeating in 2026.

Rivian's path to profitability depends on increasing revenue from vehicle sales and software, while controlling operating expenses. Estimated data shows potential profitability by 2028 if targets are met.

The Role of Regulatory Credits (or Lack Thereof)

One interesting detail buried in the earnings report is that regulatory credit sales fell $134 million in 2025 compared to 2024. This is a significant headwind for the company's revenue.

Regulatory credits are a quirk of automotive regulation. In the United States and many other countries, regulators set targets for average vehicle efficiency or emissions. If a manufacturer doesn't meet the targets, they either need to pay fines or buy credits from other manufacturers that exceeded the targets.

Tesla, for example, has generated billions of dollars in revenue over the years from selling regulatory credits to other automakers. For traditional manufacturers, Rivian included, regulatory credits are a form of subsidy from the government.

The decline in Rivian's regulatory credit revenue probably reflects a few factors. First, more EV manufacturers are now selling vehicles in significant volumes, which means there's less scarcity of credits. Second, Tesla's share of the market is declining as EV adoption accelerates and more competitors enter the space, which means fewer credits are being generated by manufacturers that are overperforming targets.

The $134 million decline is significant for a company that's trying to manage profitability. It suggests that Rivian can't rely on regulatory credits as a meaningful revenue source going forward. The company needs to achieve profitability through actual operational improvements and product success, not regulatory subsidies.

Investor Perspective: What the Numbers Really Mean

From an investor's standpoint, the 2025 results tell a nuanced story. Revenue growth of 8% is positive, but it's entirely driven by non-automotive sources. The core business contracted.

The software and services growth is impressive on the surface, but most of it comes from one customer (VW Group) on milestone payments that are back-loaded. Once those milestones are completed, the revenue source diminishes unless new milestones are achieved.

The adjusted net loss of

If the R2 launch stumbles, if COGS per unit doesn't improve as expected, or if component costs increase due to supply chain disruptions, Rivian could quickly exhaust its available capital. The company would need additional funding, which would further dilute existing shareholders.

On the positive side, the company has two years of capital visibility through the VW partnership, management has proven it can improve manufacturing efficiency (Q4 2025 COGS improvement), and the R2 launch provides an opportunity to target a new market segment with better economics.

The question for investors is whether Rivian can execute on the R2 launch and continue improving operational efficiency before the VW partnership capital runs out in 2027. If yes, the company has a viable path to profitability. If no, Rivian faces another capital crisis.

The Broader EV Industry Implications

Rivian's pivot to software revenue has broader implications for the EV industry. It suggests that traditional automakers are increasingly willing to license technology from EV startups rather than building everything in-house.

Volkswagen Group's decision to partner with Rivian instead of developing its own electrical architecture signals a shift in industry dynamics. Large legacy automakers realize that software and electrical architecture development takes years, and they're willing to pay startups to accelerate the process.

This creates opportunities for other EV startups. Any company that develops valuable software or electrical architecture could potentially license it to larger manufacturers. It's a more sustainable business model than trying to compete head-to-head with legacy OEMs on vehicle sales alone.

But it also means that successful EV startups might not need to become full-scale vehicle manufacturers. A company could develop world-class software and electrical architecture, license it to multiple OEMs, and achieve profitability without ever building cars at scale. This is a significant shift from the Tesla playbook.

Rivian is pursuing both paths simultaneously. The company is building vehicles (R1, R2, EDV) while also licensing software to VW Group. It's a hedged bet that increases the chances of long-term survival but also increases operational complexity.

What Comes Next: The 2026 Inflection Point

Rivian is at an inflection point. The 2025 results are positive, but they mask a company that's still fundamentally challenged on the automotive side. Software revenue is buying time, and the R2 launch needs to work.

The specific milestones to watch in 2026 are:

-

R2 Launch Execution: Does the company launch by June as planned? Are there manufacturing delays or quality issues?

-

R2 Demand: Do customers actually want the R2? Is it priced right to capture market share?

-

COGS Improvement: Do per-unit manufacturing costs continue to decline? If Q4 2025 improvements persist, profitability comes closer.

-

VW Partnership Expansion: Does the partnership extend beyond current terms? Are new customers added?

-

Cash Position: Does the company burn capital faster or slower than expected? Are additional fundraising rounds needed?

-

Operating Expense Control: Does the company hold the line on R&D and overhead spending?

If Rivian executes well on all these fronts, 2026 could be the year the company demonstrates a path to profitability. If execution stumbles, the company's financial position could deteriorate quickly.

The Bigger Picture: Software as a Differentiator

Ultimately, Rivian's story in 2025 is about the recognition that software matters. In the EV industry, where all vehicles are essentially computers on wheels, software is the key differentiator.

Rivian's electrical architecture and software stack are valuable not because they're proprietary in a traditional sense, but because they represent thousands of engineering hours of development and testing. The company solved problems that legacy automakers are still trying to figure out.

By monetizing this intellectual property through the VW partnership, Rivian is following the playbook of successful software companies. Instead of trying to capture all value through product sales, the company is licensing the underlying technology to other users.

This is what companies like Qualcomm do with chipsets, or Arm with processor architectures. The software and architecture become the platform, and vehicle manufacturers become customers.

If Rivian can successfully make this transition, the company's long-term prospects improve dramatically. Software licensing is a high-margin, capital-efficient business compared to automotive manufacturing. Rivian doesn't need to build vehicles at massive scale to be profitable if it can generate sufficient software licensing revenue.

The question is whether Rivian can make this work while simultaneously proving the core vehicle business is viable. That's the real challenge, and 2026 will be the critical year for answering it.

FAQ

How did Rivian increase revenue when vehicle sales declined?

Rivian increased total revenue to

What is the Volkswagen Group joint venture and why is it important?

The Volkswagen Group joint venture, announced in 2024, is an agreement where Rivian supplies its electrical architecture and software technology stack to Volkswagen Group in exchange for up to

Why is cost of goods sold per unit critical for Rivian's future?

Rivian's cost of goods sold per vehicle dropped from

What is the R2 and why does it matter for Rivian's 2026?

The R2 is Rivian's next-generation SUV launching by June 2026, designed to be cheaper to build and less expensive for customers compared to the R1 truck and SUV. The R2 targets a broader market segment and is expected to have better manufacturing efficiency and lower component costs. Rivian expects to deliver 62,000 to 67,000 vehicles in 2026, a significant portion of which should be R2 models. If the R2 achieves targeted cost reductions and generates strong customer demand, it could be the inflection point where Rivian's automotive business approaches profitability.

How much cash does Rivian have and how long can it operate?

Rivian expects to receive

Can Rivian actually achieve profitability?

Rivian can achieve profitability, but it requires execution on multiple fronts: the R2 launch must succeed commercially, cost per unit must continue declining, operating expenses must be controlled, and software licensing revenue must remain strong. The company is not yet guiding toward profitability, with expected adjusted losses of

What role do regulatory credits play in Rivian's business?

Regulatory credits contributed to Rivian's revenue in prior years but declined by $134 million in 2025, indicating this is a diminishing revenue source. These credits are generated when vehicles exceed efficiency or emissions standards and can be sold to other manufacturers. As more EV manufacturers enter the market and increase production, the scarcity and value of regulatory credits declines. Rivian can no longer rely on regulatory credit sales to subsidize losses and must achieve profitability through operational improvements and product success.

How does the Amazon electric delivery van business contribute to Rivian?

The electric delivery van (EDV) is a significant but often overlooked part of Rivian's business. Amazon is a captive customer committed to purchasing a substantial number of EDVs for its logistics operations. In 2026, Rivian plans to offer new EDV variants including an all-wheel drive version and larger battery pack options designed for specific Amazon use cases. The EDV business provides revenue visibility, simpler manufacturing compared to consumer vehicles, and helps stabilize overall company revenue while the R2 ramps. Management indicated the company is working closely with Amazon to refine EDV requirements for future launches.

What risks could derail Rivian's plan?

Several risks could derail Rivian's path forward: the R2 launch could be delayed or have quality issues, customer demand for the R2 could be weaker than expected, manufacturing costs might not decline as projected due to supply chain disruptions, the Volkswagen partnership could face challenges or not extend beyond current terms, additional capital raises could significantly dilute existing shareholders, or a downturn in the luxury EV market could reduce demand for Rivian vehicles. Any combination of these risks could force the company into another capital crisis by 2027.

How does Rivian's software strategy compare to traditional automakers?

Traditional automakers have historically developed software and electrical architectures in-house, but Rivian demonstrates a faster path by licensing proven technology from startups. Volkswagen Group's partnership with Rivian indicates that large OEMs recognize it's more efficient to license from specialists than build from scratch. This shift in industry dynamics creates opportunities for software-focused EV startups but also means that successful companies might license technology rather than compete on vehicle sales alone, representing a significant evolution from the Tesla model of vertical integration and in-house development.

TL; DR

-

Revenue Growth Masks Core Challenge: Rivian's total revenue grew 8% to

1.55 billion (up 3x), primarily from the Volkswagen Group technology partnership. -

The VW Partnership is a Lifeline: Rivian received

2 billion in 2026. This capital is critical because the company still loses money on every vehicle sold and reported a $3.6 billion net loss in 2025. -

Manufacturing Costs Are Improving but Not Profitable Yet: Rivian reduced per-unit manufacturing costs to **

99,000 in Q4 2024, but vehicles still sell below cost on average. The R2 SUV launching in June 2026 is designed to achieve true profitability through simpler manufacturing and lower component costs. -

2026 Is the Critical Test Year: The company expects to deliver 62,000 to 67,000 vehicles (up 48-58%), with the R2 accounting for most growth. Rivian must execute on the R2 launch, continue cost reductions, and control spending to avoid needing additional capital by 2027.

-

Bottom Line: Rivian is alive in 2026 because of software licensing, not vehicle sales. The company has a path to profitability but limited runway and virtually no margin for execution errors.

Note: This article represents analysis based on Rivian's 2025 financial results and public statements. The automotive industry is highly competitive and subject to market dynamics that could change rapidly.

Key Takeaways

- Rivian's 2025 revenue grew 8% to $5.38 billion despite 15% decline in automotive revenue, revealing a company saved by software licensing, not vehicle sales

- The Volkswagen Group technology partnership provided 2 billion more in 2026, giving the company critical runway until R2 profitability

- Rivian reduced per-unit manufacturing costs to 99,000 a year prior, but vehicles still sell below cost on average basis

- The R2 SUV launching June 2026 is engineered for profitability through simpler manufacturing and lower component costs than the premium R1

- Rivian expects 62,000-67,000 vehicle deliveries in 2026 (up 48-58%), but has limited capital runway and virtually no margin for execution errors

Related Articles

- Epstein's Silicon Valley Network: The EV Startup Connection [2025]

- Waymo's Sixth-Generation Robotaxi: The Future of Autonomous Vehicles [2025]

- 2027 Toyota Highlander Electric: 320-Mile Range & Features [2025]

- Rivian R2 Manual Door Release: Design Changes Explained [2025]

- AI.com's Super Bowl Bet: Inside Kris Marszalek's AI Agent Platform [2025]

- 2026 Lamborghini Temerario: The Hybrid Supercar Revolution [2025]