Waymo's Sixth-Generation Robotaxi: The Future of Autonomous Vehicles [2025]

The autonomous vehicle industry just hit a major inflection point. After years of refinement, testing, and iteration, Waymo announced that its sixth-generation robotaxi system is ready to carry passengers. This isn't just another incremental update. It represents a fundamental shift in how self-driving cars scale from proof-of-concept experiments to actual mass-market transportation.

Here's the thing: everyone knew Waymo was ahead. The company operates robotaxi services across multiple cities, has logged more autonomous miles than any competitor, and has built something that actually works reliably. But there's a massive difference between running a service in one city with a limited fleet and scaling that operation globally. The sixth-generation system bridges that gap.

Waymo's been working on this technology for seven years, accumulated over 200 million miles of real-world testing across more than 10 major cities, and learned hard lessons about what actually works versus what looks good in a demo. The new system reflects those lessons. It uses fewer sensors than the previous generation, costs less to produce, and works in conditions where earlier Waymo vehicles struggled. It's designed for "high-volume production," which is corporate speak for "we're finally ready to build thousands of these things."

The stakes couldn't be higher. Other competitors are pushing forward. Tesla is betting everything on a camera-only approach. Aurora Innovation is focused on trucking. Cruise, once owned by General Motors, struggled and ultimately scaled back operations. Waymo's move to production-ready vehicles with a clear path to manufacturing scale positions it as the leader at a critical moment.

But what exactly makes this generation different? Why can Waymo finally say it's ready to build these at scale? And what does this mean for the future of urban transportation? Let's break down the sixth generation in detail.

The End of the Jaguar I-Pace Era

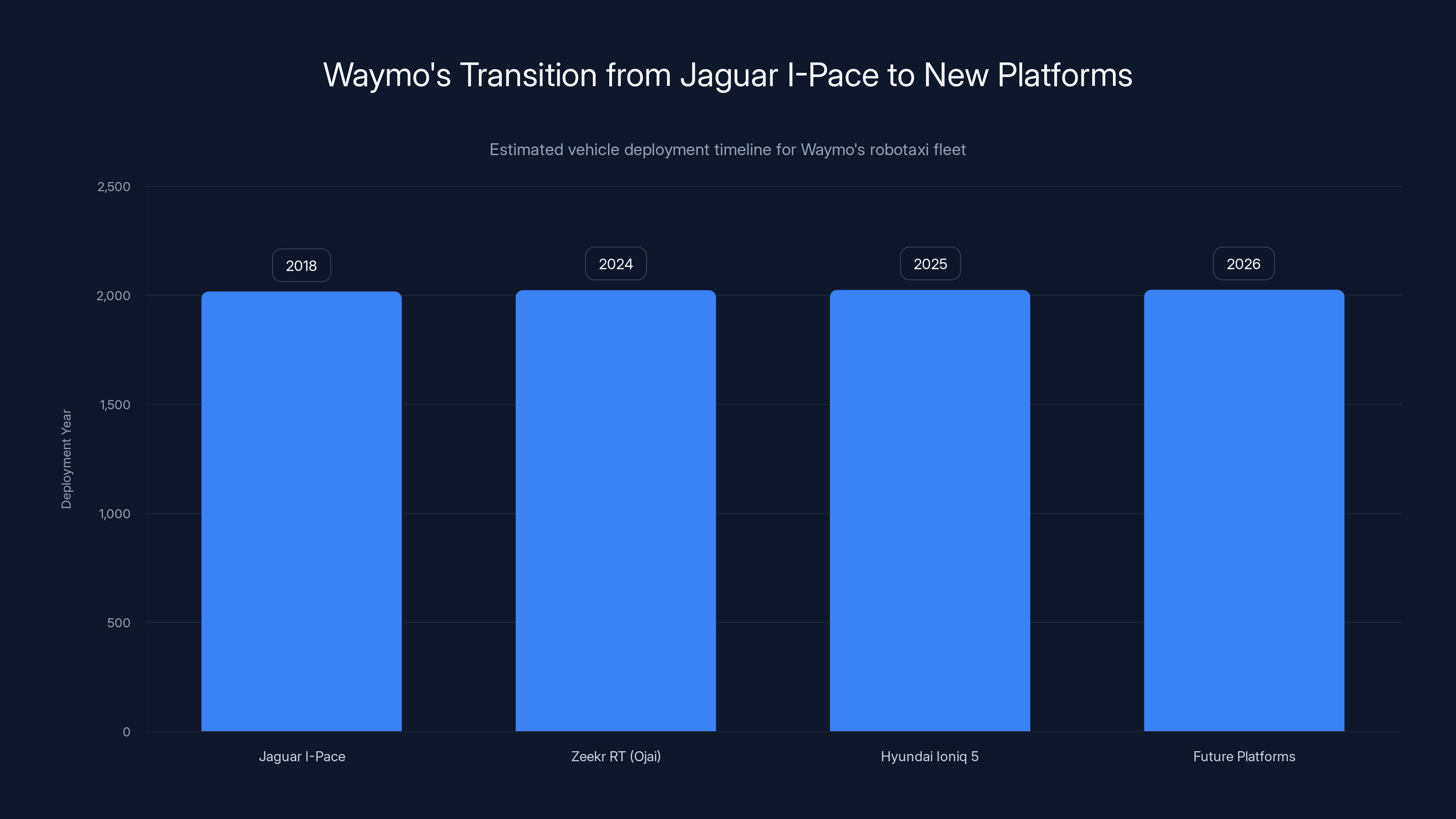

Waymo's current robotaxi fleet runs on Jaguar I-Pace vehicles equipped with the fifth-generation autonomous driving system, which launched in March 2020. These sleek electric vehicles became the iconic face of Waymo's service. Passengers recognized them. They looked futuristic. But there was a fundamental problem: Jaguar discontinued the I-Pace at the end of 2024.

This forced Waymo's hand. You can't scale a robotaxi business when your vehicle platform is being phased out. The company couldn't just keep making the same cars forever. So the entire sixth-generation system was designed from the ground up to work across multiple vehicle platforms, which is actually harder than it sounds.

Waymo needed vehicles that weren't already in high demand from consumers, had enough interior space for autonomous taxi operations, could accommodate custom sensor arrays, and had manufacturers willing to collaborate on retrofitting. The Jaguar worked because it was already an electric vehicle with decent range, but finding replacement vehicles with those characteristics isn't trivial.

The solution came through partnerships with manufacturers who saw autonomous vehicles as a future market. The Zeekr RT minivan, rebranded as Ojai when used by Waymo, became the first vehicle for sixth-generation deployment. Follow that with the Hyundai Ioniq 5, another electric vehicle with suitable dimensions and design flexibility. Waymo's in talks with Toyota and other manufacturers about future platforms.

The transition also signals something important about the robotaxi business model. This isn't about finding the perfect vehicle and sticking with it. It's about building a system flexible enough to work across different manufacturers, dimensions, and designs. That flexibility is what enables scaling. If your autonomous driving system only works in one car, you're limited to that car's supply chain and production capacity.

Waymo's 200 million miles of testing vastly exceed the average driver's lifetime mileage, highlighting extensive real-world validation. Estimated data.

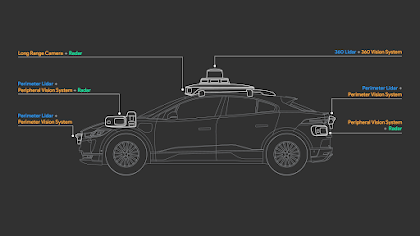

Sensor Architecture: Fewer Cameras, Same Capability

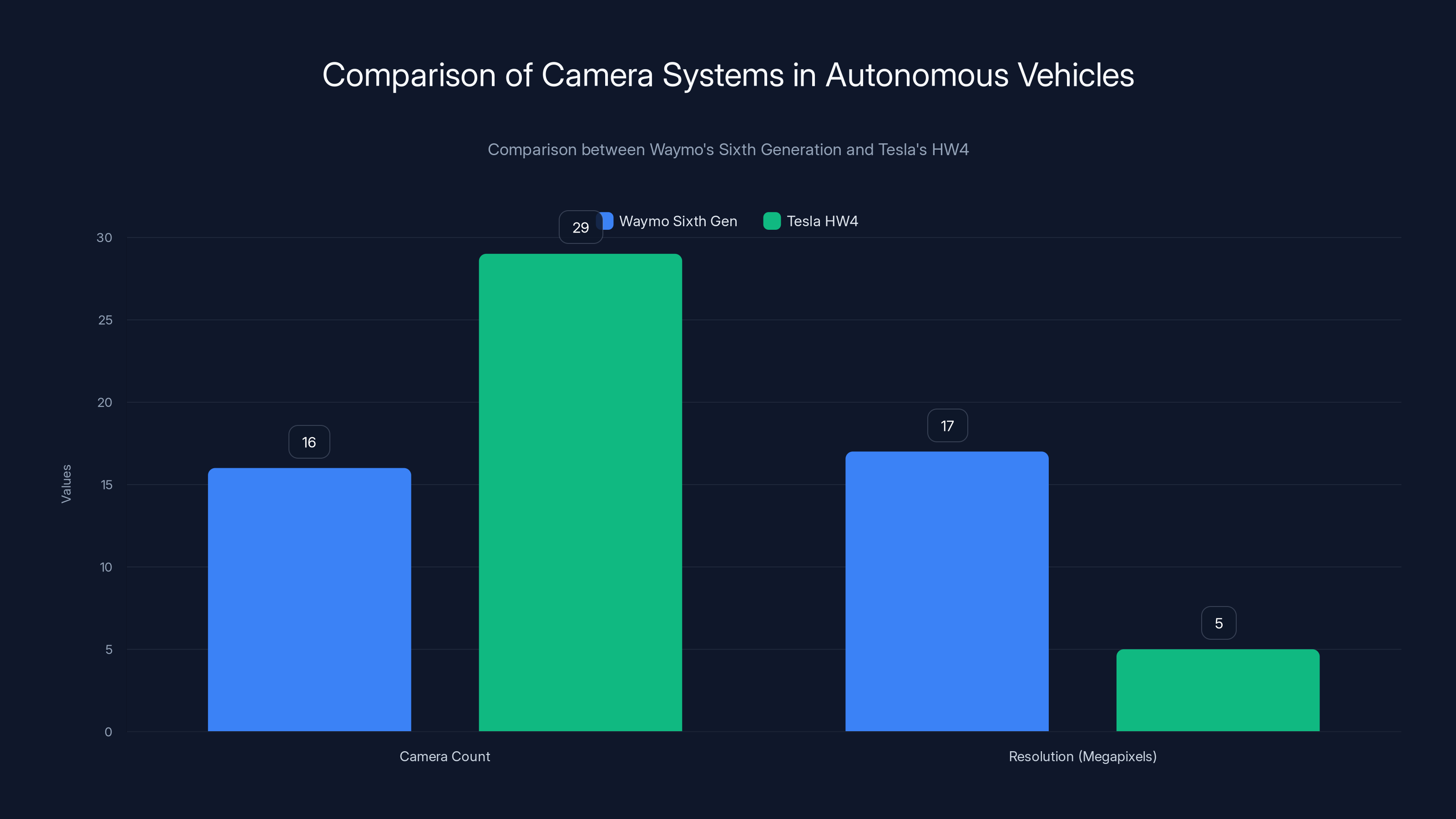

One of the most striking changes in the sixth generation is the reduction in camera count. The fifth-generation system used 29 cameras. The sixth generation uses just 16. That's a 45% reduction in one of the most critical sensor types.

How is that possible? Higher resolution and better placement. The new system uses 17-megapixel cameras that Waymo calls "imagers." These aren't just incremental improvements over previous versions. They capture millions of data points for incredibly sharp images, giving the vehicle's AI system more information from each sensor, even with fewer total sensors.

For context, Tesla's current Hardware 4 (HW4) vehicles use 5-megapixel Sony IMX963 cameras. That's a 3.4x resolution difference per camera. More megapixels means more pixels to work with for object detection, lane identification, and reading traffic signs. It's the difference between recognizing that something is a pedestrian and being able to distinguish whether that pedestrian is holding something in their hand.

Reducing camera count matters for several reasons. Fewer cameras mean fewer cable runs, less weight, lower manufacturing complexity, and reduced cost. In a mass-production scenario, cutting cameras from 29 to 16 might save thousands of dollars per vehicle across the supply chain. That's the kind of cost reduction that makes a robotaxi business model work at scale.

But Waymo didn't compensate for fewer cameras by becoming vision-only like Tesla. Instead, the sixth generation introduces new lidar systems.

Lidar: Short-Range Sensors for Precision and Weather

Lidar (Light Detection and Ranging) is a technology that shoots laser pulses and measures how long they take to bounce back, creating a 3D map of the environment. The fifth generation had lidar, but the sixth generation has reengineered them for specific purposes.

The new lidar systems are strategically positioned around the vehicle and optimized for short-range detection. They're particularly good at identifying vulnerable road users—pedestrians, cyclists, people in wheelchairs, and anyone else who might be sharing the road with the vehicle. Lidar excels at this because it works by measuring distance directly, giving what Waymo calls "centimeter-scale range accuracy."

More importantly, lidar penetrates weather that defeats cameras. Heavy rain, snow, and fog scatter light, making camera images blurry or useless. Lidar pulses cut through those conditions better because they operate in the infrared range and measure reflections rather than relying on visible light. As Waymo plans to expand into cities with extreme winter weather—places like Denver, Minneapolis, or Toronto—this capability becomes essential.

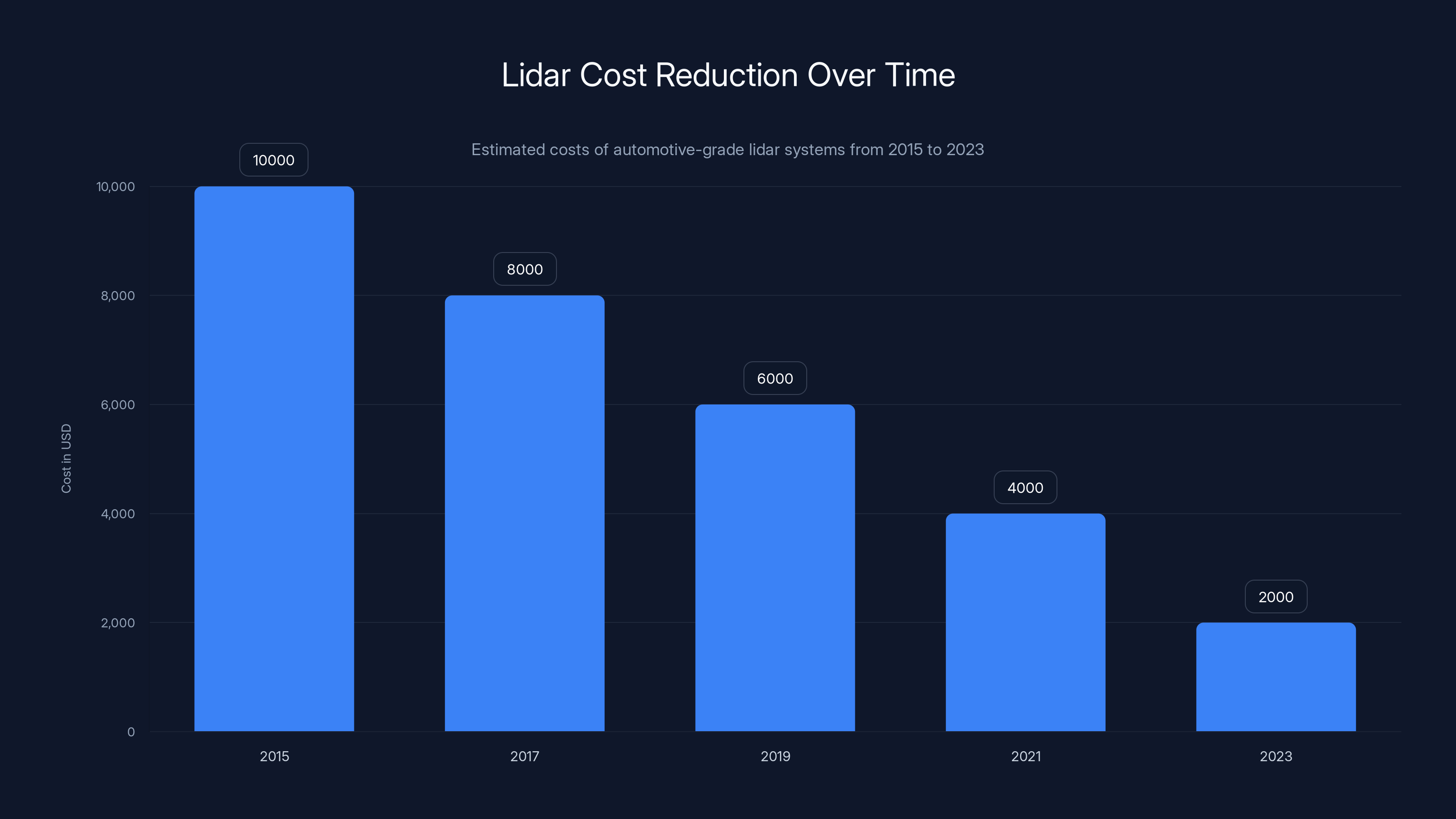

The cost reduction on lidar is also significant. Lidar used to be incredibly expensive. A single automotive-grade lidar could cost $10,000 or more. That's changed dramatically over the past few years as multiple manufacturers scaled production and technology improved. Waymo's new short-range lidar systems are considerably cheaper than earlier versions, and the reengineering for cost suggests they're extracting maximum value from each sensor.

The combination of high-resolution cameras and strategically placed lidar creates redundancy. If camera-based detection fails in adverse weather, lidar keeps working. If lidar has blind spots, cameras handle it. This multi-modal approach is central to Waymo's philosophy and directly contrasts with Tesla's camera-only approach.

The cost of automotive-grade lidar systems has decreased significantly from

Radar for Extreme Weather Conditions

Radar (Radio Detection and Ranging) is the oldest sensor technology in this list, dating back to World War II, but it remains surprisingly effective for autonomous vehicles. Radar uses radio waves instead of light or lasers, so it works in virtually any weather condition—rain, snow, fog, dust storms. If you can't see anything, radar often can.

The sixth generation includes improved radar systems specifically designed to handle extreme weather conditions. Waymo's engineering team reengineered the radar to provide better performance in situations where cameras and even lidar struggle. Snow accumulation on sensors, which is a real problem in winter climates, affects all sensor types, but radar is less dependent on clean optical surfaces.

Radar also provides velocity information. Unlike cameras and lidar that tell you what's there, radar tells you what's there and how fast it's moving. A car approaching from a side street, a cyclist weaving through traffic, a pedestrian stepping into the street—radar detects the motion. This is particularly valuable in complex urban environments where predicting what other road users will do is critical to safe autonomous driving.

The improvements to radar suggest Waymo learned something specific from testing in challenging weather conditions. It's not theoretical. It's based on real-world failures and refinement. That kind of iterative learning is why seven years of testing matters.

The Multi-Sensor Philosophy vs. Vision-Only Approaches

There's a fundamental disagreement in the autonomous vehicle industry about sensor architecture. Waymo believes you need multiple sensor types for robust, safe autonomous driving. Tesla, under Elon Musk's direction, believes that sufficiently advanced vision plus neural networks can accomplish everything you need.

Waymo's leadership articulated this directly. Satish Jeyachandran, VP of engineering, wrote: "Our experience as the only company operating a fully autonomous service at this scale has reinforced a fundamental truth: demonstrably safe AI requires equally resilient inputs." That's a careful statement. Waymo's claiming something important: they've built an actual business operating actual robotaxi services, and what they've learned is that redundancy in sensors matters.

The vision-only approach has theoretical appeal. Fewer sensors means simpler hardware, lower cost, and potentially faster decision-making. But there's a gap between theory and practice. In heavy rain or snow, cameras struggle. Tesla addresses this with more compute power and more training data, attempting to teach neural networks to work despite degraded inputs. Waymo's approach is to give the AI system multiple types of clean input so it doesn't have to hallucinate information from degraded signals.

Both approaches are being tested in real-world conditions. Waymo's approach has generated 200 million miles of actual autonomous operation. Tesla has billions of miles of data from vehicles with driver assistance features, but that's different from fully autonomous operation where the car makes all decisions without human oversight.

This isn't settled. But the fact that Waymo's designing for scale with multi-sensor redundancy suggests the company believes this approach works better for actually operating at production volume.

Vehicle Platforms: Zeekr Ojai and Hyundai Ioniq 5

The choice of vehicle platforms tells you a lot about what Waymo learned from the Jaguar experience. Both the Zeekr RT (Ojai) and Hyundai Ioniq 5 are electric vehicles, which makes sense. EVs have fewer vibrations than combustion engines, produce less heat (important when packing sensors), and have better visibility since there's no hood bulge hiding forward view. They're also increasingly common, so parts and maintenance are becoming standardized.

The Zeekr RT is particularly interesting because it's a minivan. Minivans have maximum interior space for passengers, which matters for a taxi service. They have good visibility from inside. They're not as "futuristic-looking" as the Jaguar, but they're practical. Waymo clearly prioritized function over aesthetics, which suggests increasing confidence that the technology is what matters, not the vehicle's appearance.

The Hyundai Ioniq 5 is a more conventional crossover design, slightly smaller and sportier. This diversity of platforms is the whole point. Waymo needed to prove the sixth-generation system works across different vehicle types, dimensions, and designs. Success here means Waymo can work with virtually any automotive manufacturer willing to collaborate.

The conversation with Toyota is particularly significant. Toyota is the world's largest automaker by most metrics. A partnership there would give Waymo access to manufacturing scale that would dwarf current production volumes. Toyota already has robotaxi experience through partnerships with other autonomous vehicle companies, so the company understands the market.

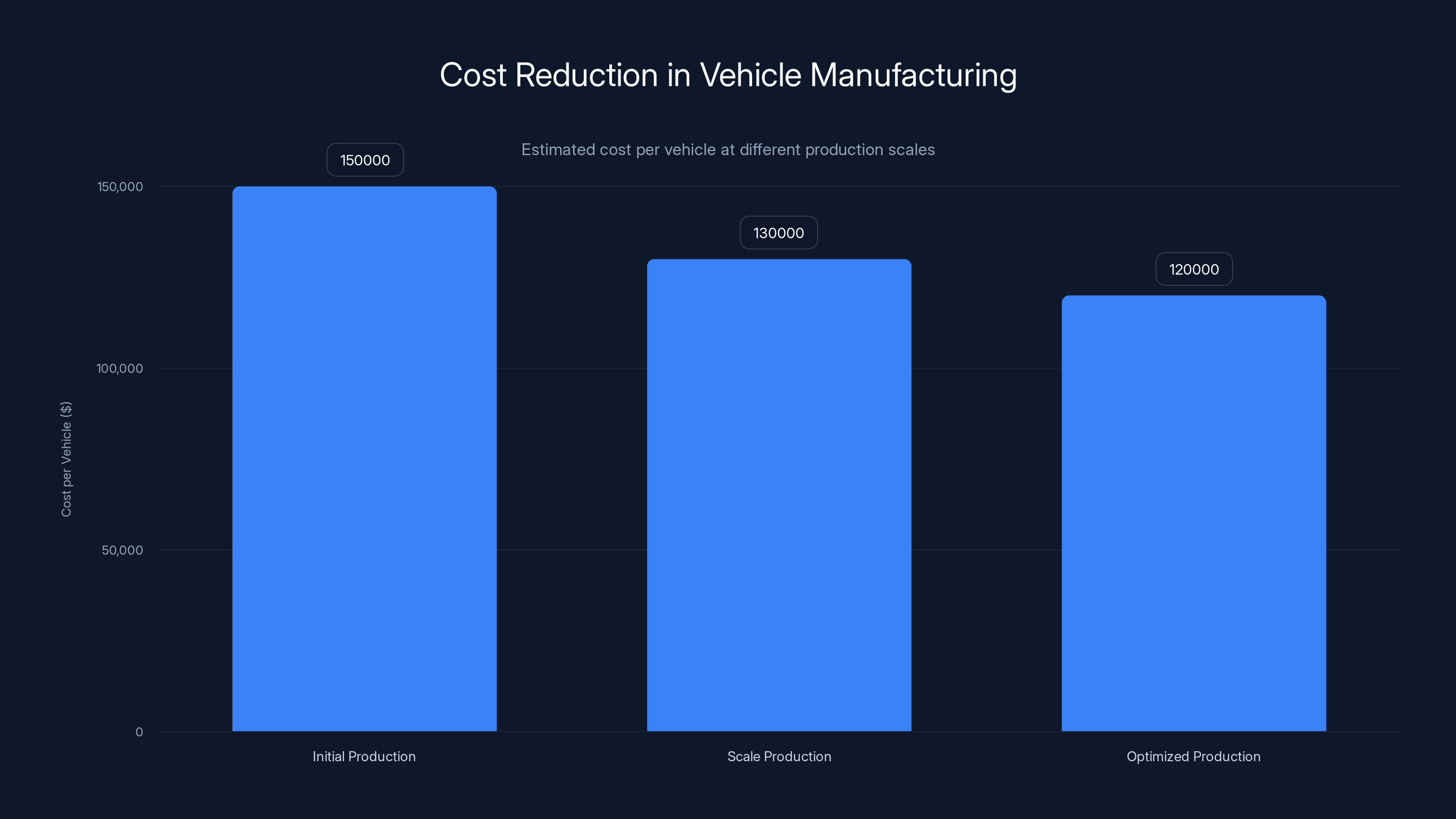

Estimated data shows significant cost reduction per vehicle as production scales from initial to optimized stages, highlighting the impact of manufacturing efficiency.

Testing and Validation: 200 Million Miles and Counting

Waymo's claims about readiness rest on specific numbers. Seven years of development. 200 million miles of testing. Operations in 10+ major cities. These aren't marketing figures. They're benchmarks against which you can evaluate the claim.

200 million miles is enormous. The average American driver accumulates roughly 12,000-15,000 miles per year. A single human lifetime of driving might be 500,000 to 1 million miles. Waymo's tested the sixth-generation system (and earlier generations) for 200 times that amount in urban environments with all their complexity.

More importantly, those miles were logged in diverse conditions. The testing included night driving, rain, snow, and dense urban environments with complex traffic patterns. It's not like Waymo tested in a controlled environment or perfect weather. Real-world validation across multiple cities and seasons is harder but far more valuable than controlled testing.

Testing across 10+ major cities means the system was validated in different traffic patterns, different road infrastructure, different weather regions, and different local driving cultures. A city like Phoenix has different weather challenges than Seattle. Los Angeles has different traffic patterns than San Francisco. That diversity of testing builds confidence in generalization.

The testing also included edge cases, which are situations that don't happen often but require correct handling. Pedestrians behaving unpredictably. Vehicles doing illegal maneuvers. Construction zones. Unusual road conditions. The rarer the edge case, the more testing you need to ensure your system handles it. Seven years allows for encountering even rare edge cases multiple times.

There's also a philosophical difference between testing a technology and operating a service. When you're testing, you can stop and log what happened. When you're operating, you have to make decisions in real-time that passengers depend on. Waymo's been doing the latter, which is harder and more revealing.

Cost Reduction and Manufacturing Efficiency

Scaling from hundreds of vehicles to tens of thousands requires dramatic cost reductions. Waymo's manufacturing partners need to produce "tens of thousands of units a year," which implies annual production volumes in the range of 20,000 to 50,000 or potentially more. That's not a boutique operation. That's automotive manufacturing scale.

Cost reductions come from multiple sources. Fewer cameras reduces sensor costs and integration complexity. Reengineered lidar and radar at lower costs comes from improved manufacturing processes and higher volume production. Vehicle platform partnerships mean Waymo isn't funding vehicle development; manufacturers are. Integration simplification means less custom hardware and more reliance on standard automotive systems.

There's also learning curve effects. The first few hundred units of anything are expensive. By the time you've manufactured thousands, you've found ways to eliminate waste, optimize processes, and source components more efficiently. Waymo's essentially saying they've reached the point where manufacturing at scale is possible and economically viable.

One financial reality that's often overlooked: robotaxi services operate on razor-thin margins per ride. The model only works if you can achieve high utilization rates (the vehicle is in revenue-generating service most of the time) and operate at relatively low cost per mile. A vehicle that costs

The sixth generation's design for manufacturing suggests Waymo's done the math and believes the economics work at production scale.

Expansion Strategy: 20 New Cities in 2026

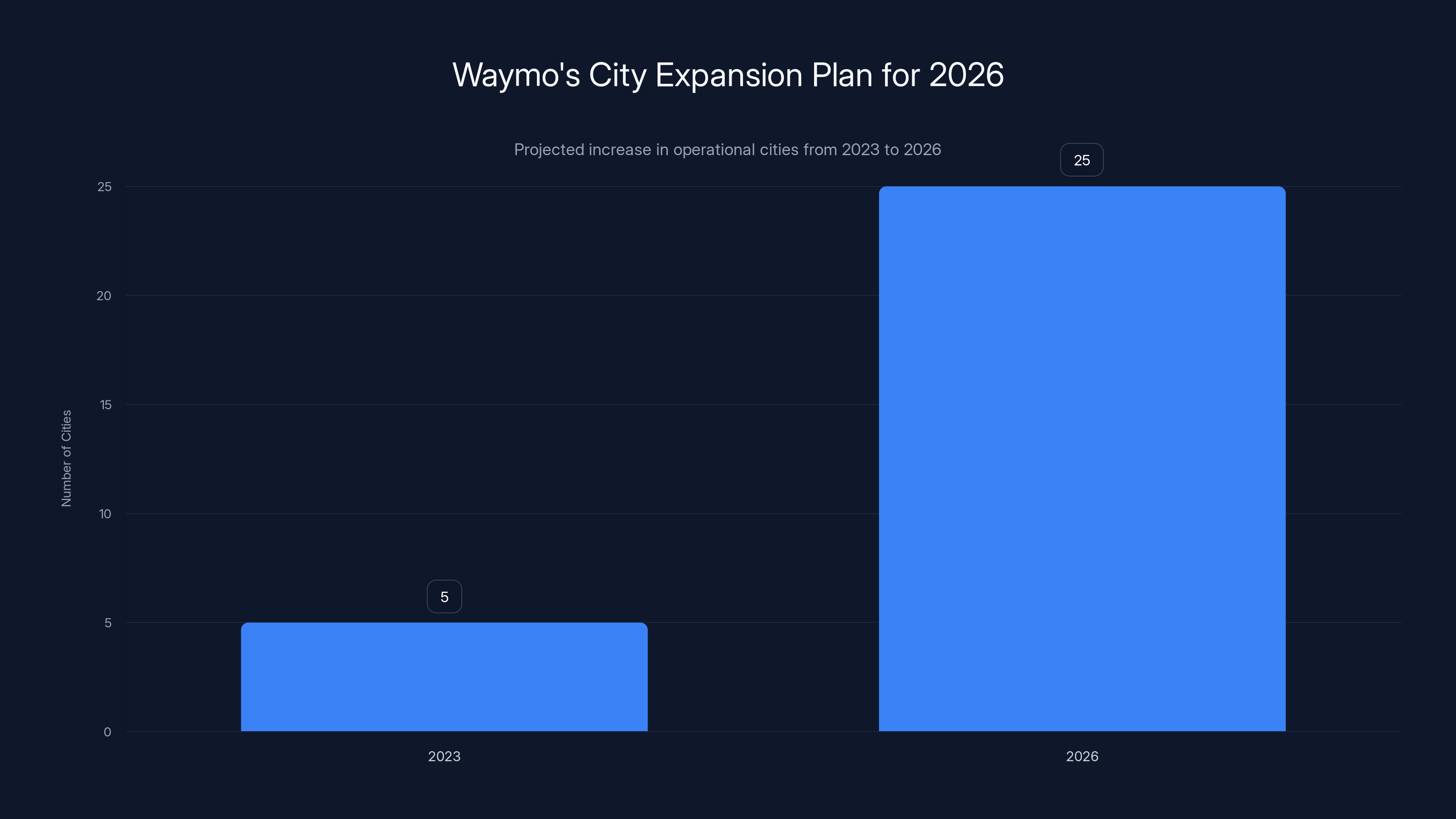

Waymo's planning to expand to 20 new cities in 2026. That's an aggressive timeline. Current operations span San Francisco, Los Angeles, Phoenix, Las Vegas, and a few other markets. Adding 20 new cities means more than tripling geographic footprint in a single year.

This is only possible if:

-

The technology works across diverse environments. The sixth-generation system must handle different weather, traffic patterns, and road conditions. That's why testing across multiple climates matters.

-

Manufacturing can keep pace. Partner factories need to produce enough vehicles to support operations across 20 cities simultaneously.

-

Regulatory approval is achievable. Each city or state has different rules for autonomous vehicles. Waymo needs to navigate 20 different regulatory environments.

-

The business model is sound. Expansion only happens if the service is profitable or close to profitable in existing markets.

The 20-city plan suggests Waymo's confident on all these fronts. It's an enormous bet, but it's backed by operational experience. The company doesn't have to assume robotaxi services work; it knows they do because they're already operating them.

Geographic expansion also has competitive implications. More cities means more first-mover advantage. Passengers in those cities start using Waymo as their autonomous ride option. Network effects matter in transportation. The service becomes more convenient (lower wait times) as it operates in more places with more vehicles.

Waymo transitioned from the Jaguar I-Pace to new platforms like the Zeekr RT and Hyundai Ioniq 5 as the I-Pace was discontinued in 2024. Estimated data.

Comparison to Competitors

Waymo's not alone in the autonomous vehicle race, though it's in a stronger position than most. Aurora Innovation has focused on trucking rather than passenger vehicles, which is a different market with different requirements. Long-haul trucking is actually simpler than urban robotaxis in some ways (mostly highway driving in defined corridors) but harder in others (cargo liability, regulatory oversight).

Tesla's pursuing a different path: camera-only vehicles with extreme compute power. Tesla has an advantage in that every Tesla sold feeds data into the training pipeline. But Tesla hasn't yet deployed fully autonomous (no-driver) robotaxis at any significant scale. The company promised fully self-driving capability years ago, and while vehicles have improved, complete autonomy without driver attention remains elusive.

Cruise, once General Motors' subsidiary, had a significant robotaxi service running in San Francisco until a incident in late 2023 led to regulatory suspension and the eventual wind-down of operations. Cruise had vehicles on the road and actual passengers, but struggled to expand beyond that initial deployment.

Avis operates Waymo vehicles for robotaxi service in some locations, which actually helps Waymo's position. The rental car company's distribution and infrastructure support Waymo's expansion without Waymo having to build all that itself.

International competitors exist too, but the North American market is where Waymo has established its lead. The company's combination of proven service operation, diverse testing, and now a sixth-generation system optimized for scale puts it significantly ahead.

The Safety Philosophy: Redundancy and Validation

Waymo's engineering philosophy centers on safety through redundancy and extreme validation. This isn't cutting corners or rushing to deployment. It's the opposite. The company's willing to wait years, accumulate massive amounts of testing data, and only expand when confident.

The multi-sensor approach directly supports this. If one sensor type fails, others compensate. If one vehicle behavior is incorrect, the system has checks to catch it. This layered approach to safety is expensive and complex, but it's also proven reliable at actual operating scale.

Validation includes simulation as well. Waymo's tested sixth-generation behavior in simulated scenarios that can't be tested in the real world. How does the vehicle respond to a pedestrian running into traffic? How does it handle a vehicle cutting it off? Simulation allows testing thousands of edge cases and different configurations without real-world risk.

The company also builds in fallback mechanisms. If the autonomous system encounters something completely unexpected, the vehicle can pull to the side and stop. A human can take over remotely or the vehicle can summon a tow truck. These aren't ideal scenarios, but they're enormous improvements over a vehicle that simply crashes when confused.

Economic Implications: The Future of Urban Transportation

If Waymo successfully scales to 20 cities and beyond, the economic implications for transportation are huge. Robotaxi services could reduce the cost per mile of urban transportation. They could reduce parking demand (a vehicle that's always in use doesn't need to park). They could improve road safety by eliminating human driver error.

They could also disrupt existing transportation markets. Uber and Lyft operate with human drivers, which is an enormous labor cost. Robotaxis eliminate that cost, making the service far more economically attractive. But this also disrupts millions of jobs.

Public transit might face competition from robotaxis if the price is competitive enough. In some scenarios, a robotaxi could be cheaper than a monthly transit pass. In others, public transit remains more efficient for high-density corridors.

The commercial vehicle market is also affected. Delivery drivers, truck drivers, and other transportation-related jobs could be automated. That's far in the future, but it's where the technology is heading.

None of this happens without solving the autonomous vehicle problem. Waymo's sixth-generation system advancing to passenger trips and expansion to multiple cities is a major step toward that solution.

Waymo's sixth generation uses fewer cameras with higher resolution compared to Tesla's HW4, achieving a 45% reduction in camera count while maintaining high data quality. Estimated data.

Real-World Testing: Lessons Learned

Seven years of testing in real cities teaches lessons that simulation and controlled testing never can. Weather impacts sensors in unexpected ways. Pedestrians behave less predictably than you might assume. Road conditions vary. Local traffic culture matters.

For example, Waymo probably discovered that rain accumulates on sensors in specific patterns depending on vehicle speed and angle. That's not something you can easily predict. You have to experience it. Snow that melts and refreezes creates icing that affects sensor performance differently than fresh snow. Different cities have different road surface conditions, pavement quality, and markings.

The pedestrian behavior learning is particularly interesting. Human pedestrians are incredibly complex. Some predictably follow rules. Others are unpredictable. Delivery workers on bikes have different patterns than commuters. School zones have entirely different dynamics. Waymo's accumulated knowledge about these patterns across 200 million miles is genuinely valuable.

This experiential knowledge is extremely difficult to replicate. You can't buy it. You can't read about it. You have to observe it across diverse conditions and cities. That's why Waymo's testing methodology matters. It's not just about miles driven; it's about diversity of conditions and accumulated pattern recognition.

The Path Forward: From Service to Scale

The transition from fifth to sixth generation represents Waymo moving from service operation to production orientation. The fifth generation was designed to provide a reliable robotaxi service. The sixth generation is designed to do that while also scaling to 10x current production volumes.

That shift in design philosophy is subtle but critical. When you're designing for 500 vehicles, you can afford more custom parts and labor-intensive assembly. When you're designing for 50,000 vehicles per year, you need to think about manufacturing efficiency, supply chain reliability, and cost reduction from day one.

Waymo's partnership approach also reflects scaling philosophy. Instead of Waymo building and selling vehicles, manufacturers build them with Waymo's autonomous system integrated. This is similar to how Intel's processor architecture works: Intel designs the chip, manufacturers make the hardware, and the value is in the design and software, not the manufacturing.

The next critical milestone is proof of scale. Can Waymo and its manufacturing partners actually produce thousands of vehicles per month? Does the autonomous system work reliably across all those vehicles? Can the robotaxi service expand to 20 cities without major operational issues?

If those milestones are achieved, the robotaxi industry transitions from experimental to established. Insurance models become standard. Regulatory frameworks become more consistent. The market matures.

Engineering Innovation: What Makes Sixth-Generation Different

The specific engineering improvements in sixth-generation are worth understanding in detail because they show how autonomous vehicle technology advances. It's not just "better AI." It's specific hardware choices, sensor placement, and system integration.

Camera Megapixel Increase

The jump from 5-megapixel to 17-megapixel cameras is roughly 3.4x improvement in resolution. That doesn't scale linearly to capability. More megapixels means more pixels available for neural networks to analyze. A pedestrian at 100 feet away becomes clearer. Traffic signs become more readable. Lane markings become more precise.

Higher megapixel cameras also allow for wider field-of-view lenses without losing detail. You can cover more area while maintaining the ability to read fine details. From a hardware perspective, 17-megapixel sensors exist in smartphones and mainstream cameras, so the cost is reasonable at scale.

Strategic Lidar Placement

The move from omnidirectional lidar to strategically placed short-range lidar suggests Waymo learned where lidar matters most. Short-range lidar is particularly useful for detecting pedestrians and cyclists close to the vehicle, where they're most critical to avoid. Placing them strategically around the vehicle (front, sides, rear) provides coverage without redundant overlap.

This is more efficient than previous designs where lidar might scan full 360 degrees regardless of relevance. Targeted placement reduces sensor count and cost while improving detection in critical zones.

Radar Reengineering for Weather

Radar improvements for extreme weather suggest specific testing challenges Waymo encountered. The fact that radar is being reengineered rather than simply added indicates it wasn't performing optimally in the fifth generation. Waymo identified issues and fixed them.

This is how you move from generation to generation when you have real operational data. You don't just add sensors. You fix the ones that aren't working well enough.

Waymo plans to expand from 5 to 25 cities by 2026, more than tripling its geographic footprint. Estimated data based on current and projected operations.

The Manufacturing Reality

Manufacturing autonomous vehicles at scale requires solving problems that don't exist when you're building a few hundred vehicles. Supply chain reliability becomes critical. If a sensor manufacturer can't provide consistent quality or predictable delivery, the entire production line suffers.

Quality control is more complex. Each vehicle needs to be calibrated so its sensors align and perform identically. Calibration drift over time requires monitoring and maintenance. At scale, you can't manually inspect each vehicle. You need automated testing that validates sensor performance in seconds.

Supply chain redundancy is essential. If you depend on one radar manufacturer and they have a production issue, your entire robotaxi production stops. Waymo likely has developed relationships with multiple suppliers for critical components, adding cost and complexity but ensuring continuity.

The partnership with manufacturers handles some of this. A company like Hyundai has existing supply chains for standard automotive components. Waymo's sensors integrate into that existing structure. This is more efficient than Waymo building its own manufacturing facility.

Regulatory Pathways and City Expansion

Expanding to 20 cities requires navigating 20 different regulatory environments. Each state and city has different rules for autonomous vehicles. Some require a remote operator to supervise. Some limit operating hours or geographic zones. Some require specific safety certifications.

Waymo's existing operations give it experience with these regulatory frameworks. The company knows how to work with regulators, demonstrate safety, and address concerns. That accumulated regulatory knowledge is harder to quantify than engineering, but it's equally important.

New cities likely become easier to enter once you've established presence in a few markets. Regulators see your actual operation, see that the technology works, and become more confident in approving expansion. The first city approval is hardest. The 20th is easier.

Some of the 20 new cities might be easier targets than others. Smaller cities might have less regulatory complexity than major metropolitan areas. Wealthy suburbs might be more receptive than dense urban cores. Waymo will likely prioritize cities based on regulatory friendliness combined with ridership potential.

Long-Term Vision: Beyond Robotaxis

Robotaxis are the near-term application, but Waymo's technology extends further. The sixth-generation system could eventually support delivery vehicles, shuttle services, and other transportation use cases. A vehicle that can navigate complex urban environments as a taxi can also deliver packages.

The learning from all those miles of testing extends beyond the specific vehicle platform. Waymo has learned how to perceive and navigate the world. That knowledge can be applied to different vehicle types and different use cases.

Long-term, autonomous vehicle technology could fundamentally reshape how we think about urban transportation. But that's years away. The immediate focus is proving the sixth-generation can scale to 20 cities and beyond.

Competitive Positioning in 2025 and Beyond

Waymo's position as of early 2025 is stronger than any competitor's. The company has operating services, proven technology, manufacturing partnerships, and a clear path to scale. The sixth-generation announcement cements that lead.

Tesla's still developing camera-only autonomous capability. When (or if) that works, Tesla will have advantages in manufacturing scale and market reach. But as of now, Waymo has a working commercial service.

Aurora's focused on trucking, which is a different market with different economics. Success in trucking doesn't automatically translate to passenger vehicles.

The international market is less developed. Chinese companies like Baidu and Pony.ai are building autonomous vehicle technology, but they face different regulatory environments and market dynamics than North America.

Waymo's advantage is proven execution. That's worth more than promising technology or superior funding. The company's shown it can build something that works, operate it safely, and iterate based on real-world feedback.

Key Challenges Ahead

Scaling from a few cities to 20 is ambitious. The challenges include:

- Supply chain execution: Manufacturers need to consistently produce quality vehicles at high volumes

- Regulatory approval: 20 different jurisdictions require 20 different regulatory approvals

- Operational scaling: Support infrastructure for vehicle maintenance, charging, repair needs to scale

- Competitive response: Competitors will accelerate their own programs in response to Waymo's announcement

- Insurance and liability: The commercial insurance framework for robotaxis is still developing

- Driver job displacement: Large-scale robotaxi deployment creates enormous pressure on driver employment

None of these are unsolvable, but they're all non-trivial. Waymo's experience in current markets helps, but scaling brings new complexity.

FAQ

What is Waymo's sixth-generation robotaxi system?

Waymo's sixth-generation autonomous driving system is the company's latest technology designed for autonomous vehicles after years of testing and refinement. It uses fewer sensors than the previous generation (16 cameras instead of 29) with higher resolution, improved lidar systems for weather conditions, and reengineered radar for safety. The system is designed to work across multiple vehicle platforms, starting with the Zeekr Ojai minivan and Hyundai Ioniq 5, and is optimized for high-volume manufacturing and production at scale.

How is the sixth-generation different from the fifth-generation system?

The major differences include reduced camera count from 29 to 16 thanks to higher 17-megapixel resolution (compared to 5-megapixel previously), strategically placed short-range lidar instead of omnidirectional systems, and reengineered radar specifically for extreme weather conditions. The sixth-generation was designed from the ground up for manufacturing efficiency and cost reduction, with the goal of production volumes of tens of thousands of vehicles per year. The entire system philosophy emphasizes scaling while maintaining safety through multi-sensor redundancy.

Why did Waymo need a new robotaxi system?

Waymo's fifth-generation system was deployed in the Jaguar I-Pace, which Jaguar discontinued at the end of 2024. With the vehicle platform ending production, Waymo had to redesign its autonomous system to work across multiple vehicle manufacturers and platforms. This constraint turned into an opportunity to design a system optimized for scale, cost reduction, and deployment across diverse climates and vehicle types.

How many cities will Waymo operate in by the end of 2026?

Waymo currently operates in approximately five major cities including San Francisco, Los Angeles, Phoenix, and Las Vegas. The company announced plans to expand to 20 new cities in 2026, which would bring total operations to roughly 25 cities. This represents more than a 5x expansion in geographic footprint in a single year, which depends on manufacturing capacity, regulatory approval, and operational scaling.

What vehicles does the sixth-generation system use?

The sixth-generation system is deployed in the Zeekr RT minivan (rebranded as Ojai for Waymo's service) and the Hyundai Ioniq 5 electric crossover. Waymo is in conversations with Toyota and other manufacturers about deploying the system in additional vehicle platforms. The multi-platform design is intentional, showing that the autonomous driving technology is separate from the vehicle hardware and can work across different manufacturers and designs.

How does Waymo's multi-sensor approach compare to Tesla's camera-only system?

Waymo uses high-resolution cameras, short-range lidar, and radar working together as an integrated system. Waymo's philosophy is that redundancy across multiple sensor types provides robustness in adverse weather and edge cases. Tesla's approach relies exclusively on cameras with neural networks doing all perception and decision-making. Waymo's claim is that seven years of real-world operation proves multi-sensor systems are more reliable. Tesla's advantage is that camera-only systems are cheaper and simpler, potentially easier to scale.

What does "high-volume production" mean for Waymo's plans?

Waymo states its sixth-generation system is designed for "high-volume production" with manufacturing partners capable of producing "tens of thousands of units a year." This likely means production volumes of 20,000 to 50,000+ vehicles annually, which is conventional automotive manufacturing scale. Current production is measured in hundreds of vehicles. High-volume production requires completely different manufacturing approaches, supply chains, quality control, and cost structures than experimental-scale manufacturing.

How much testing has Waymo done on the sixth-generation system?

Waymo has accumulated over 200 million miles of autonomous testing across its technology generations over seven years in more than 10 major cities. The sixth-generation specifically has been tested in diverse weather conditions, traffic patterns, and road infrastructure. This testing provides validation across real-world edge cases, different climates, and complex urban environments, not just in controlled conditions or perfect weather.

Conclusion

Waymo's announcement of the sixth-generation robotaxi system represents a significant inflection point in autonomous vehicle development. This isn't just another incremental improvement. It signals the transition from research and demonstration to actual production-ready technology designed for scale.

The engineering reflects hard-won lessons from seven years of real-world testing. Fewer cameras with higher resolution. Strategically placed lidar for specific use cases. Reengineered radar for weather. Every decision traces back to operational experience at a scale no other company has achieved.

The manufacturing focus is equally important. This is a system designed to be built by automotive manufacturing partners at tens of thousands of units per year. That requires different thinking than designing for a few hundred vehicles. Cost optimization, supply chain reliability, quality control automation, and production scheduling all matter in ways they don't when you're building small volumes.

The geographic expansion plan to 20 new cities in 2026 is ambitious, but it's backed by operational proof. Waymo doesn't have to assume robotaxi services work; it knows they do. The company has operated them profitably (or near-profitably) in existing markets and learned how to do it better with each iteration.

Competitors haven't disappeared. Tesla continues developing camera-only autonomous capability. Aurora focuses on trucking. But none have matched Waymo's combination of proven operation, diverse testing, and clear path to scale.

For the broader autonomous vehicle industry, the sixth-generation announcement is a statement: the technology works, and companies are ready to scale. That's the kind of milestone that transforms a research project into a market. The next few years will determine whether Waymo can execute on that ambition and whether the robotaxi future is real or another delayed promise.

Key Takeaways

- Waymo's sixth-generation system reduces camera count from 29 to 16 while using 17MP resolution (vs 5MP), achieving efficiency gains through sensor quality improvements.

- The system is designed for high-volume automotive production of tens of thousands of units yearly, marking transition from experimental to manufacturing-scale operations.

- Multi-sensor redundancy with cameras, lidar, and radar provides robustness in adverse weather and edge cases, contrasting with Tesla's camera-only approach.

- Seven years of testing accumulated 200 million autonomous miles across 10+ cities, providing validation across diverse real-world conditions and climates.

- Geographic expansion to 20 new cities in 2026 demonstrates confidence in technology and business model, with manufacturing partnerships enabling scale.

Related Articles

- Waymo's Fully Driverless Vehicles in Nashville: What It Means [2025]

- Waymo's Genie 3 World Model Transforms Autonomous Driving [2025]

- How Waymo Uses AI Simulation to Handle Tornadoes, Elephants, and Edge Cases [2025]

- Senate Hearing on Robotaxi Safety, Liability, and China Competition [2025]

- Waymo's Nashville Robotaxis: The Future of Autonomous Mobility [2025]

- Waymo's DC Regulatory Battle: Autonomous Vehicles Face Urban Complexity [2025]

![Waymo's Sixth-Generation Robotaxi: The Future of Autonomous Vehicles [2025]](https://tryrunable.com/blog/waymo-s-sixth-generation-robotaxi-the-future-of-autonomous-v/image-1-1770912420127.jpg)