How Tem Is Remaking Electricity Markets With AI

The electricity market is broken. Not broken like your phone is broken. Broken like a Rube Goldberg machine is broken—it works, technically, but it takes five unnecessary steps to accomplish something that should take one.

Energy costs money to generate, money to transport, and money to trade. But somewhere between the power plant and your business, somewhere in the chaos of intermediaries, margin-takers, and legacy systems, that cost balloons. A solar farm generates electricity at one price. By the time it reaches a manufacturing plant, the price has multiplied—not because the electricity itself cost more to produce, but because six different companies took a cut.

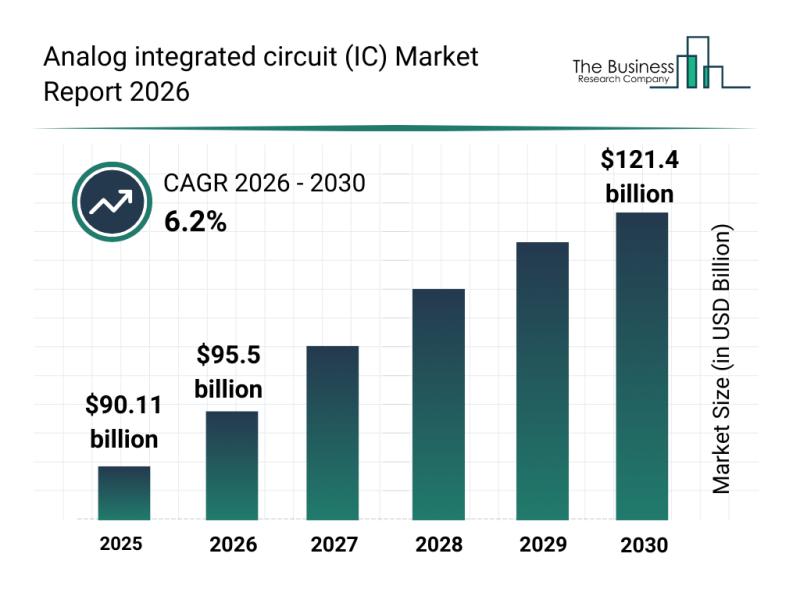

Tem, a London-based startup, thinks AI can fix that. The company has built what it calls a "transaction engine" that uses machine learning and large language models to match electricity generators with consumers, cutting out the middlemen and the opaque pricing that comes with them. In February 2025, Tem closed a

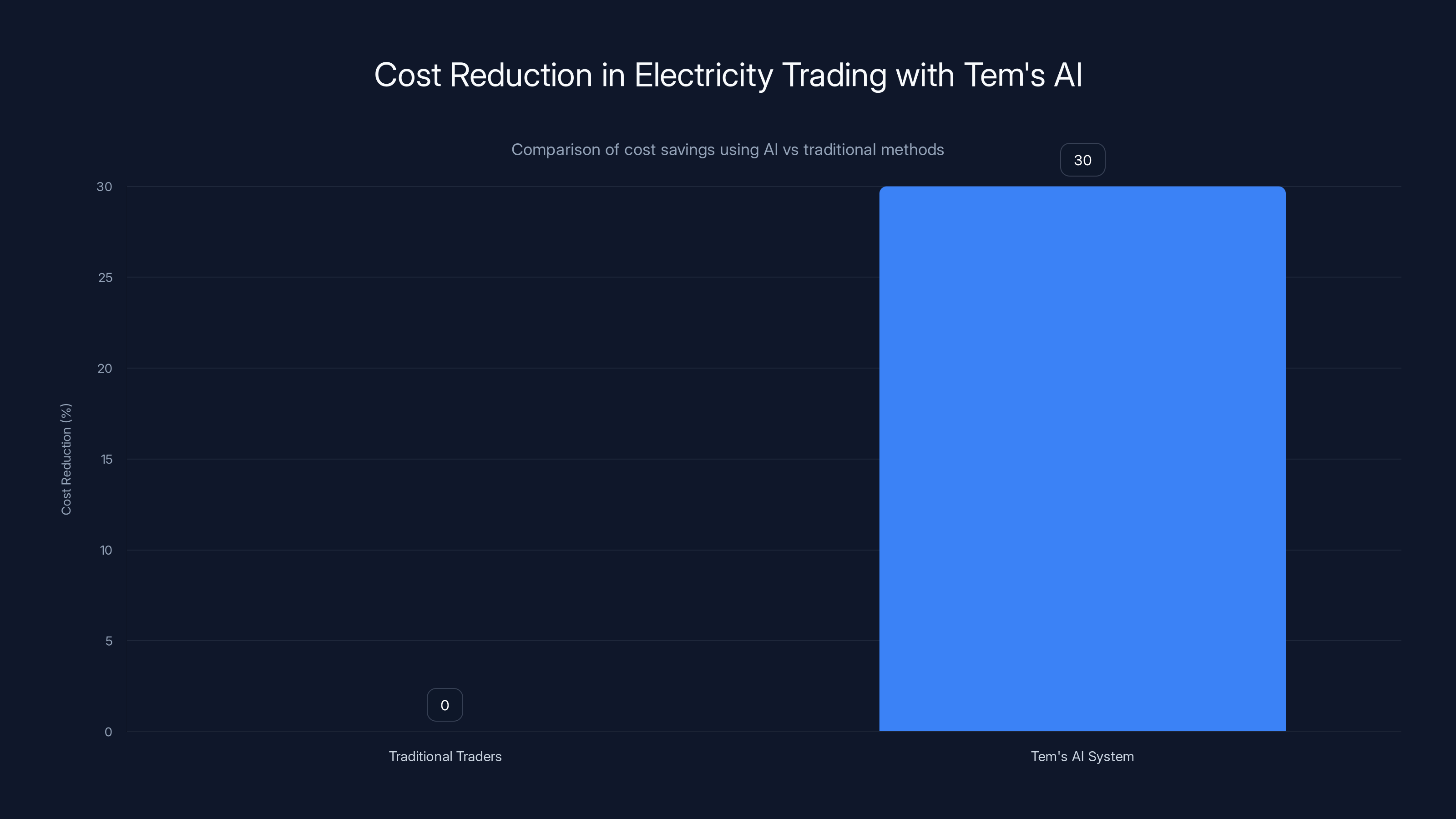

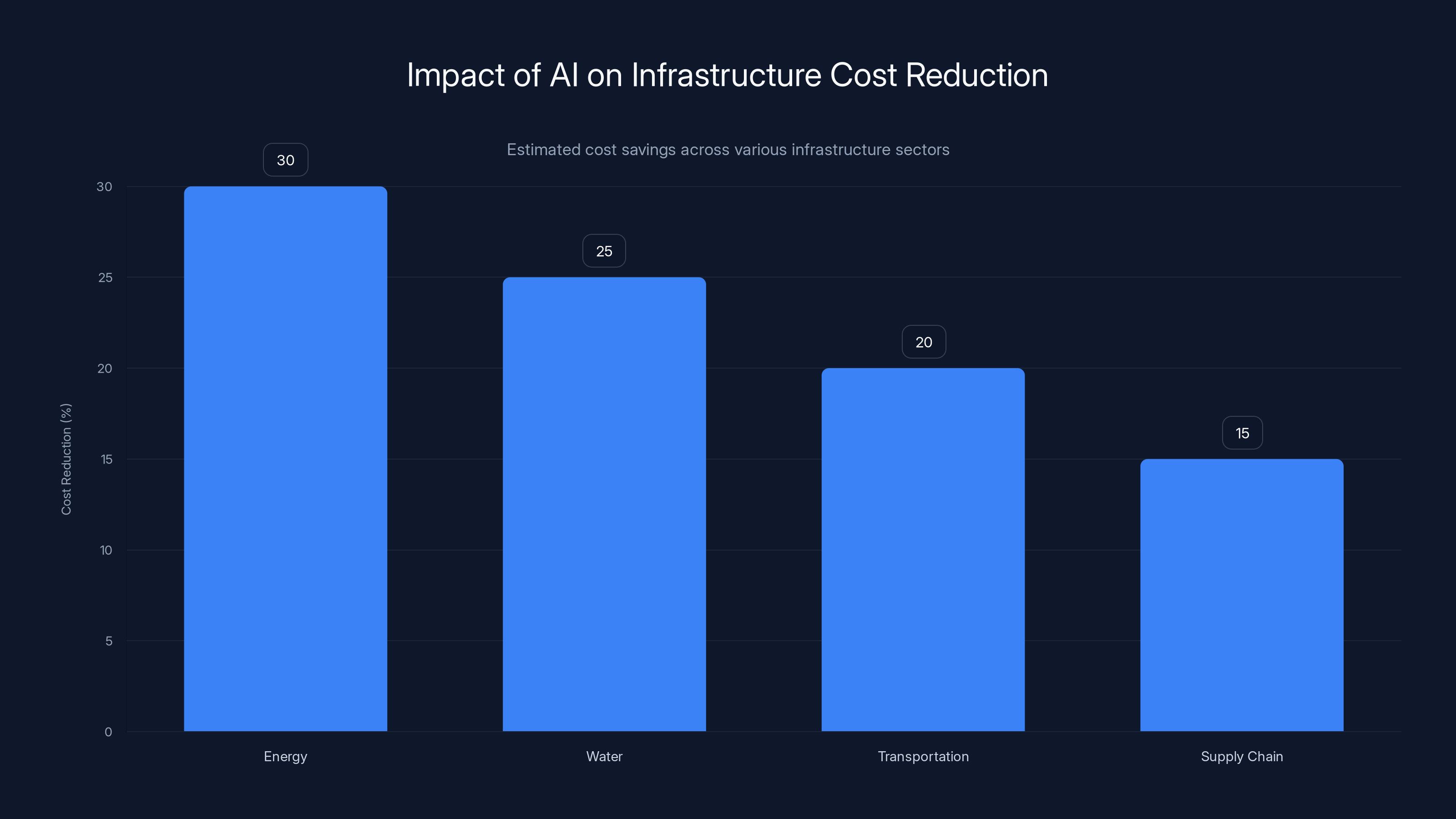

But here's what makes this interesting. Tem isn't some theoretical AI startup built on hype. The company already has 2,600 business customers across the U.K., and it's already proven that AI can squeeze costs down by roughly 30% compared to traditional energy traders. Now, with $75 million in the bank, it's taking aim at Texas and Australia. This is a story about how AI isn't just changing tech—it's remaking fundamental infrastructure that every business depends on.

TL; DR

- AI-powered marketplace: Tem built a transaction engine that uses machine learning to match electricity buyers and sellers, cutting out 5-6 intermediaries

- Real savings: Customers report up to 30% reductions in energy bills compared to traditional energy traders

- Proven traction: 2,600+ business customers in the U.K., including Boohoo Group, Fever-Tree, and Newcastle United FC

- Major funding: 300M+

- Expansion play: Tem plans to expand to the U.S. (starting with Texas) and Australia, positioning itself as infrastructure (like AWS or Stripe) rather than just a retailer

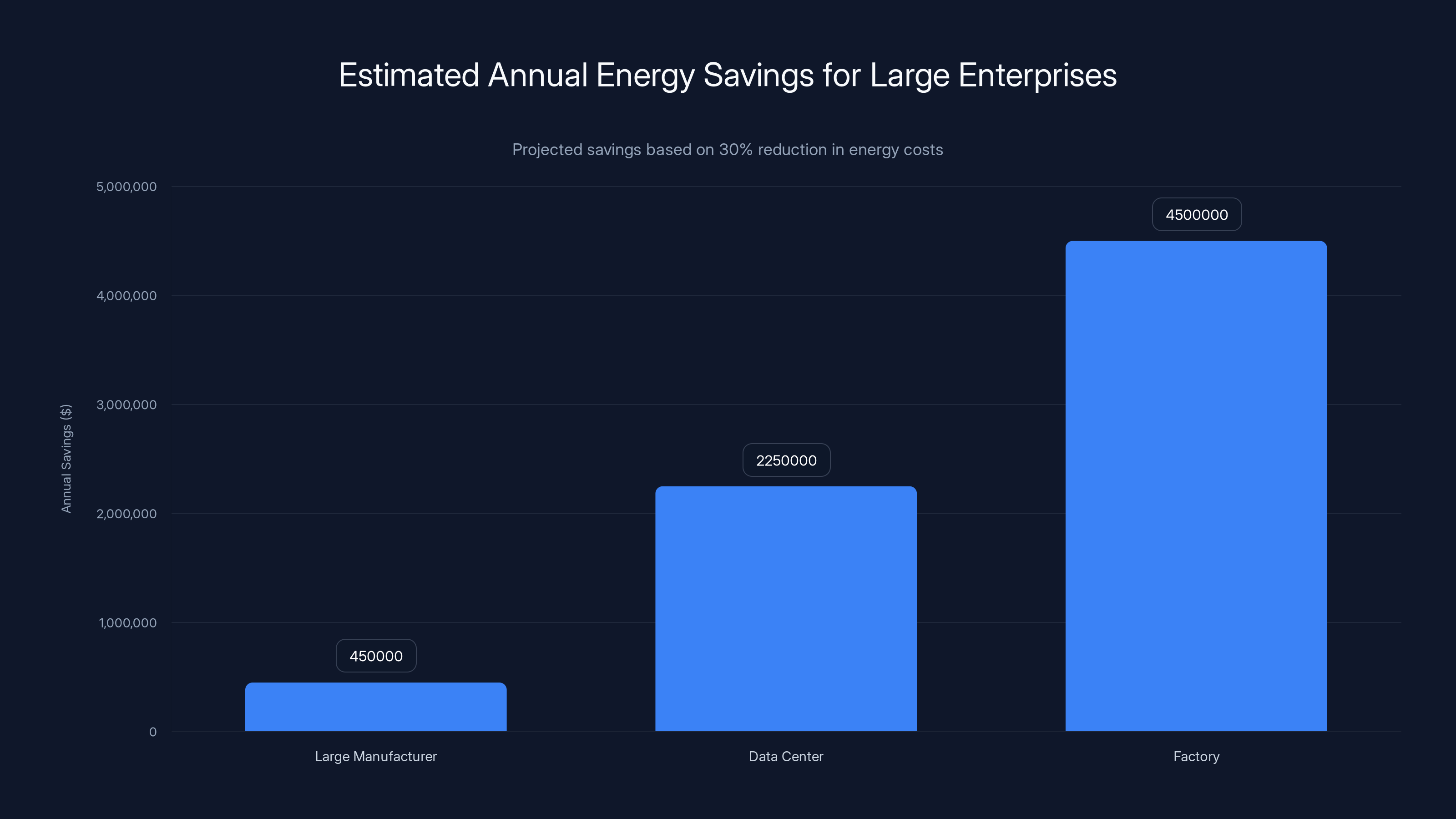

Estimated data shows significant annual savings for large enterprises switching to Tem, with a 30% reduction in energy costs translating to millions in savings.

Why Energy Markets Are Broken (And Why AI Matters)

Imagine buying a coffee. You walk into a café. You order. You pay. The barista hands you coffee. That's one transaction.

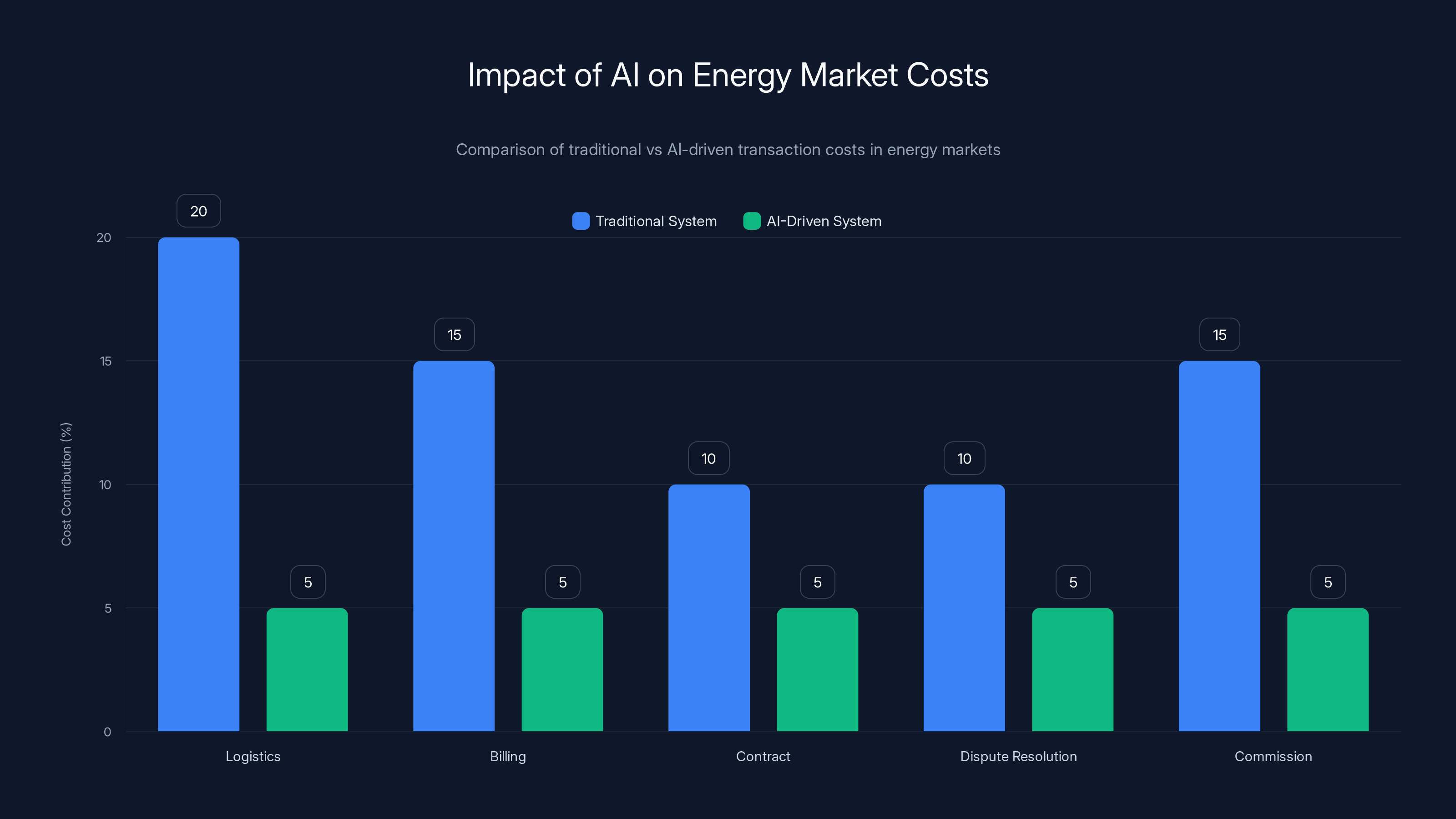

Now imagine the barista is in a different building from the espresso machine. Between them are five intermediaries. Each one takes a cut. One handles logistics. One handles billing. One handles the contract. One handles dispute resolution. One takes a commission just for being in the middle. By the time your coffee reaches you, the markup has tripled—not because the coffee is better, but because everyone in the chain needed to get paid.

That's energy markets.

Electricity is a unique commodity. It can't be stored at scale (not yet, anyway). It moves at the speed of light from generator to consumer. But the financial transactions around it move at the speed of bureaucracy. A coal plant generates electricity. A broker handles it. A trader looks at it. A logistics company routes it. Another broker handles the settlement. By the time energy reaches a business, the price has been marked up multiple times, each markup justified because someone did work or took on risk.

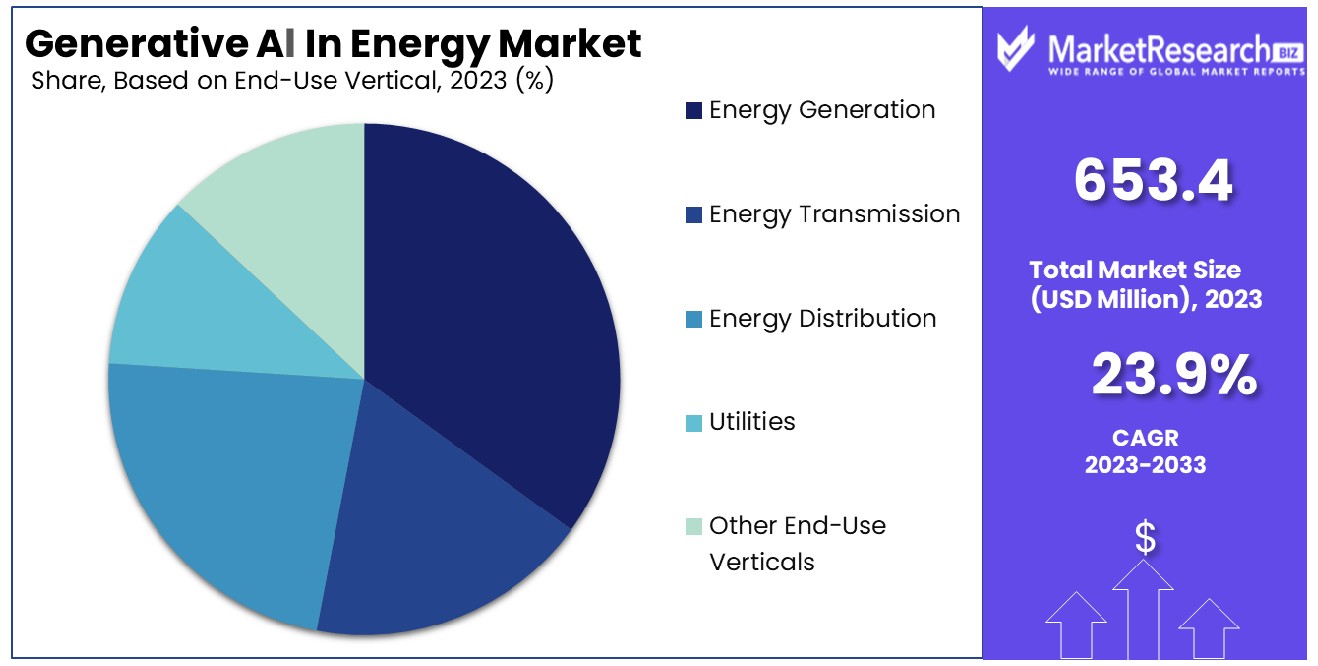

But here's the problem: most of that work is now automatable. The risk assessment? A machine learning model can do it better than a human. The routing decisions? An algorithm can optimize that. The settlement? That's just data processing. The price prediction? That's literally what large language models were trained to do.

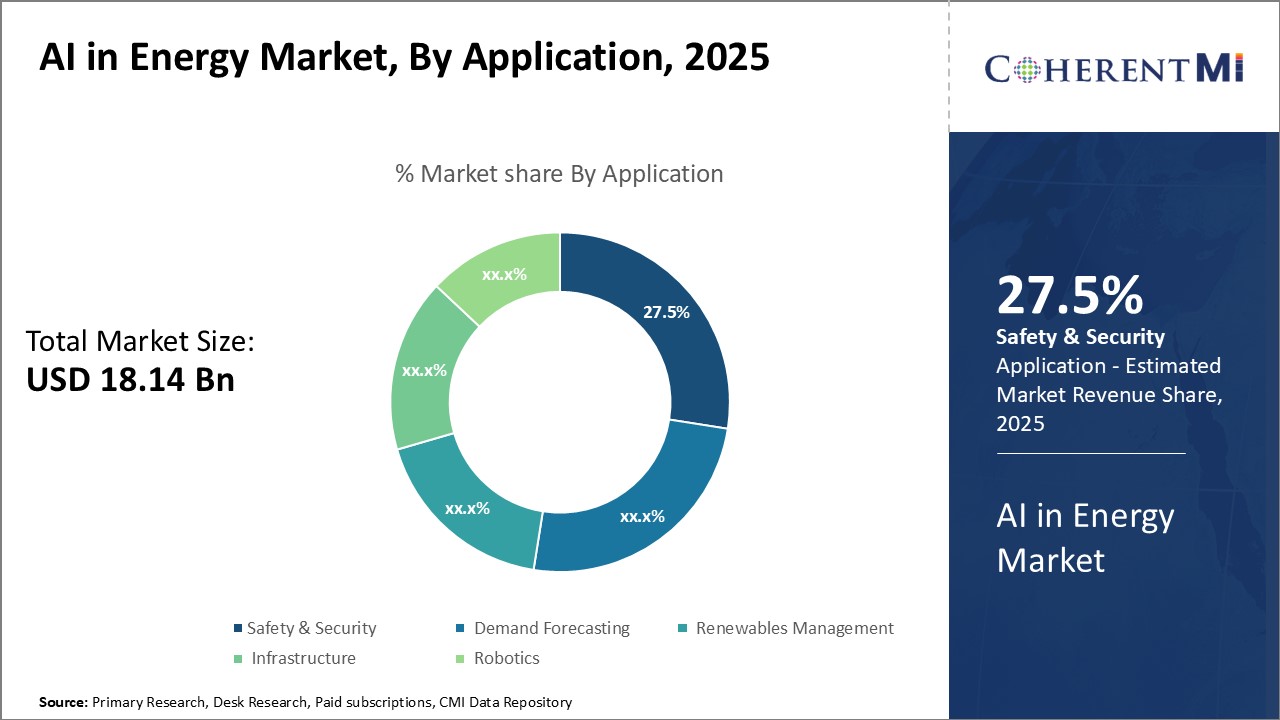

Tem realized this and built a platform called Rosso. Rosso is the transaction engine. Instead of a chain of intermediaries, you have one system—powered by AI—that handles matching, pricing, risk assessment, and settlement all at once. No humans taking cuts. No disparate systems creating friction. Just software doing what software does best: processing information faster and cheaper than humans can.

This is why the $75 million matters. Tem isn't raising because the idea is interesting. Tem is raising because the idea is already working.

AI-driven systems like Rosso can significantly reduce transaction costs in energy markets by automating processes traditionally handled by multiple intermediaries. Estimated data.

The Two-Business Model: Rosso and RED

Tem operates in a counterintuitive way. Most startups build a product and sell it. Tem built a product (Rosso) and then built a customer (RED) to prove it works.

When the company started, it tried to sell Rosso directly to existing utilities. That went nowhere. Energy companies are risk-averse. They don't adopt new infrastructure because some startup tells them it'll save money. They need proof. They need someone else to do it first.

So Tem built RED, a "neo-utility." RED is a utility company that doesn't own power plants or transmission lines. Instead, RED uses Rosso to buy electricity from generators and sell it to businesses. It's a marketplace disguised as a utility. And it works—RED has grown faster than the company expected, which is why it's become the priority.

But this is actually genius strategy. Here's why.

RED generates customer demand. Those 2,600 business customers? They're all on RED. They're all using Rosso without knowing it. They just know they're paying less for electricity. That user base is proof of concept. It's case studies. It's evidence that the AI-powered matching actually delivers savings.

Meanwhile, Rosso sits in the background, the infrastructure layer. And that's the long-term play. The CEO, Joe Mc Donald, has been explicit about this. RED is never going to capture the entire market—it shouldn't, because that would be a monopoly. But Rosso doesn't care who owns the customer. It doesn't care who owns the generation. It just needs to be the transaction layer.

This is exactly how AWS works. Amazon Web Services doesn't care if you're a startup or a Fortune 500 company. It doesn't care if you're building a video streaming app or a banking system. AWS just wants to be the infrastructure underneath everything. Tem has the same ambition for energy.

The difference is timing. AWS came after the cloud had already been validated by others. Tem is trying to be first—it's using RED to prove the energy cloud works, then opening Rosso to others. That's harder, riskier, but potentially more valuable.

How AI Actually Cuts Costs in Energy Markets

Let's get specific about how the AI works, because this is where the value actually lives.

Energy prices move constantly. Every 30 minutes in the U.K., grid operators set a new wholesale price based on supply and demand. That price is public. But the prices you pay as a business? Those are negotiated, bundled, forecasted. A human trader looks at dozens of factors: historical prices, weather patterns, grid demand, renewable generation forecasts, fuel costs, and makes a decision about whether to buy now or wait.

Humans are not great at this. Humans use heuristics. They're anchored to past prices. They overweight recent events. If there was a fuel shortage last month, they assume it'll happen again. If it was cheap last week, they assume it'll be cheap next week. They're also constrained by information processing. A trader can look at maybe 50 data points before their brain overloads. Reality has thousands.

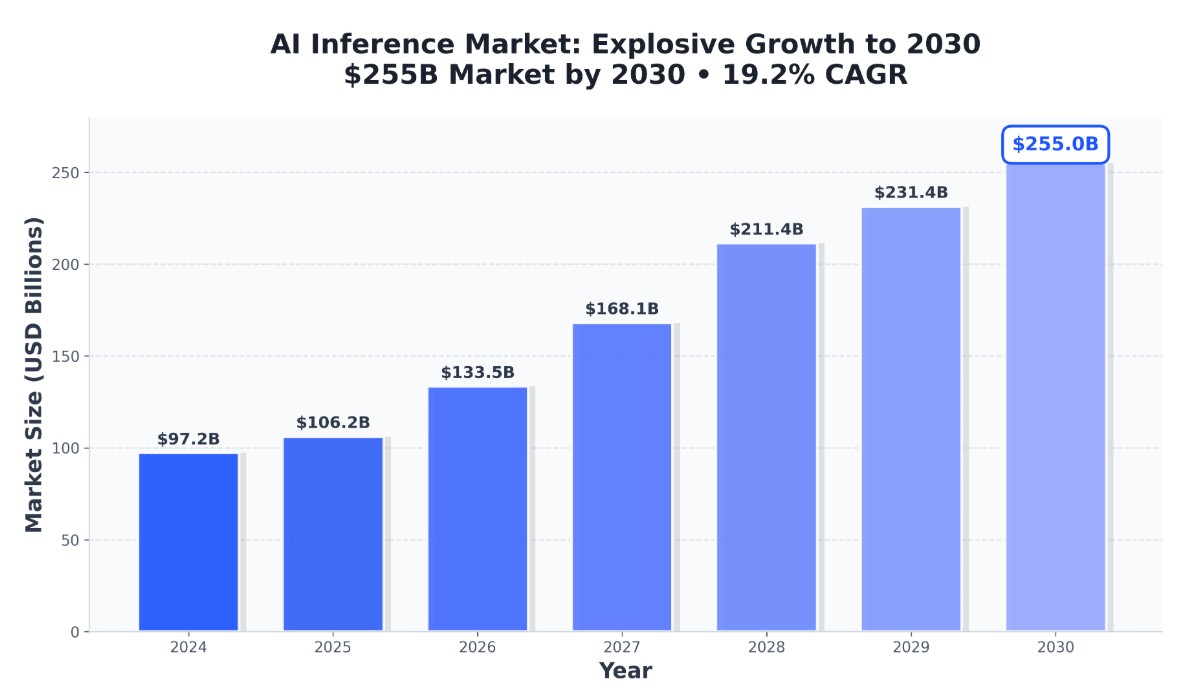

AI has no such constraints. Tem's system can process millions of data points. Temperature forecasts for every region. Historical consumption patterns for similar businesses. Renewable generation predictions. Grid stress indicators. Geopolitical events affecting fuel supply. All of it, simultaneously, running through a model that's been trained on years of energy market data.

The result is better price prediction. If you can predict prices better than the market average, you can time your purchases. Buy when prices are going to spike. Sell when prices are going to drop. For a business consuming electricity continuously, that's a permanent cost reduction.

But there's a second layer. Tem's AI doesn't just predict prices. It predicts supply and demand. Renewable generators have supply that's variable (the sun doesn't always shine, the wind doesn't always blow). But that variability is predictable. You can forecast solar generation 24 hours out with 80%+ accuracy just by looking at weather data. When you know generation is going to be high tomorrow, you can schedule consumption, or buy energy in advance at lower prices.

A third layer is contract optimization. Energy contracts are complex. They have minimum purchase requirements, ratchet clauses, time-of-use variations, and penalty clauses. Most businesses don't fully understand their contracts. Most don't know if they're being penalized for using energy when prices are high, or if they have flexibility they're not using. Tem's system reads your contract, models your consumption, and tells you how to use energy optimally given the financial incentives baked into your deal.

Then there's the matching layer. In traditional markets, you find a counterparty through brokers. Those brokers take time and margin. In Tem's system, matching is automated. A solar farm has excess generation at 2 PM. A data center has high consumption at 2 PM. The system pairs them automatically, at a price that's better for both than either could get on the open market.

Add these layers together—better price prediction, supply forecasting, contract optimization, and instant matching—and you get 30% cost reductions. That's not hyperbole. That's what the company is actually delivering to real customers.

Tem's AI system reduces electricity trading costs by approximately 30% compared to traditional methods, highlighting significant efficiency gains.

The Series B: What $75 Million Unlocks

Lightspeed Venture Partners led the round. They're not a climate fund. They're a tier-one tech investor. That's significant because it signals something important: Tem isn't being funded as a climate company or an energy company. It's being funded as a software and infrastructure company.

The round was oversubscribed, meaning more investors wanted in than Tem had available shares. That happens when a company has proven product-market fit and a clear path to scale. Tem had that. It had paying customers. It had profitability. It had retention rates that would make a SaaS company jealous (energy customers don't churn, they're locked in by contracts).

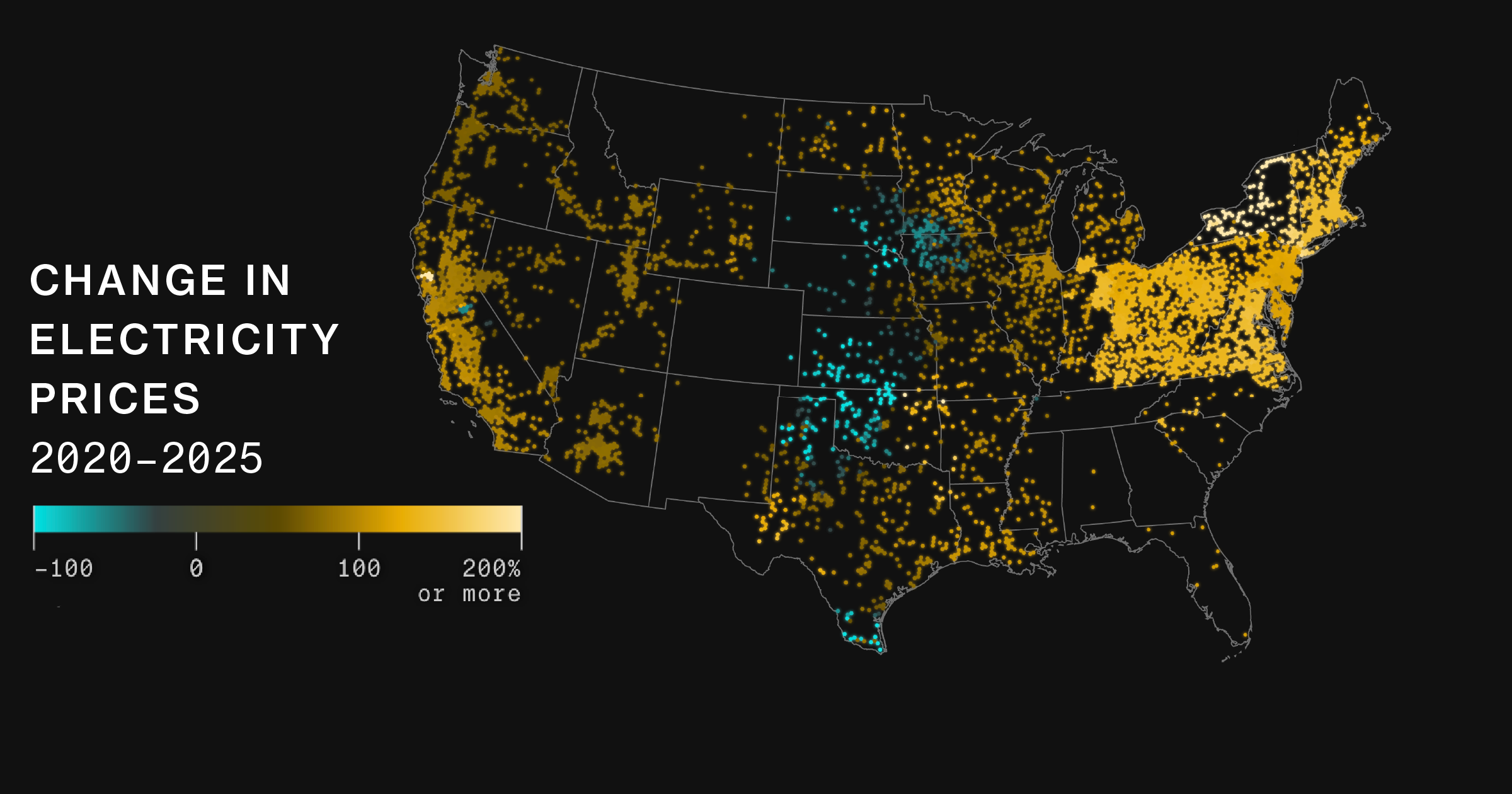

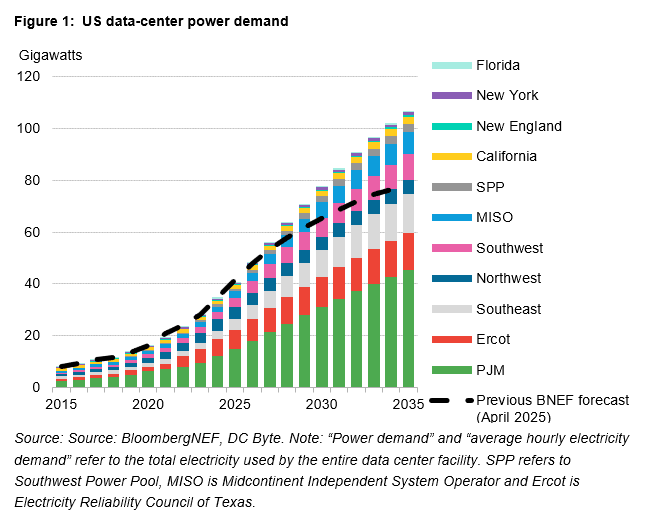

The capital goes to three things. First, expansion to the U.S., starting with Texas. Texas is the perfect test market. It's the second-largest electricity market in the U.S. It has deregulated energy markets in most regions, which means retail competition exists. It has huge renewable generation (Texas produces more wind energy than any state). And it has large energy consumers desperate for cost savings. If Tem can work in Texas, it can work anywhere in the U.S.

Second, expansion to Australia. Australia is interesting because it's ahead of the curve on renewable energy integration. It has high electricity prices (some of the highest in the world). It has a deregulated retail market. And it's a smaller market than the U.S., so Tem can dominate faster.

Third, and most importantly, the capital goes to building Rosso as an independent platform. Right now, RED is the only utility using Rosso. That's fine for now, but it's a constraint. Tem can't grow Rosso faster than RED grows, because RED is the only customer. With new capital, Tem can hire sales teams, build partnerships, license Rosso to other utilities and energy retailers. That's the path to becoming infrastructure instead of just a retailer.

This is where the valuation matters. $300 million for a company with 2,600 customers might sound high. But those customers are high-quality. They're sticky (long contracts). They generate recurring revenue. And they're just the base. If Rosso becomes the transaction layer for major portions of the U.K., Australian, and U.S. energy markets, the company's real value compounds.

Consider that Stripe is now valued at $95 billion for providing transaction infrastructure for payments. Tem is trying to do the same for energy. The market size is enormous. If Tem can capture even 2-3% of transaction volume in the markets it operates, it could be a multi-billion-dollar company.

Real Customers, Real Results: Case Study Evidence

Tem's customer list includes some impressive names. Boohoo Group, the fast-fashion retailer, is a customer. Fast-fashion has massive energy consumption (manufacturing, logistics, warehouses). Fever-Tree, the premium tonic water brand, is a customer. Manufacturing and bottling is energy-intensive. Newcastle United, the English soccer club, is a customer. Running a stadium and training facilities is expensive energy-wise.

These aren't small businesses or pilot customers. These are brands with serious energy budgets. If they've switched to Tem, it means RED's pricing beat their previous providers significantly enough to justify switching (and switching energy providers is annoying).

What does 30% savings actually mean in real terms? For a large manufacturer consuming 10,000 MWh per year at an average rate of

For a data center consuming 50,000 MWh per year at the same rate, it's

But here's what's important about these customers: they validate the technology. Boohoo, Fever-Tree, and Newcastle United are sophisticated organizations. They have finance teams. They do cost analysis. They don't switch suppliers because of marketing hype. They switch because the economics are undeniable.

That validation is worth more than the capital. It's proof that AI-powered energy matching actually works in the real world, at scale, with real businesses, generating real savings. For Tem's Series B investors, that's the real deal.

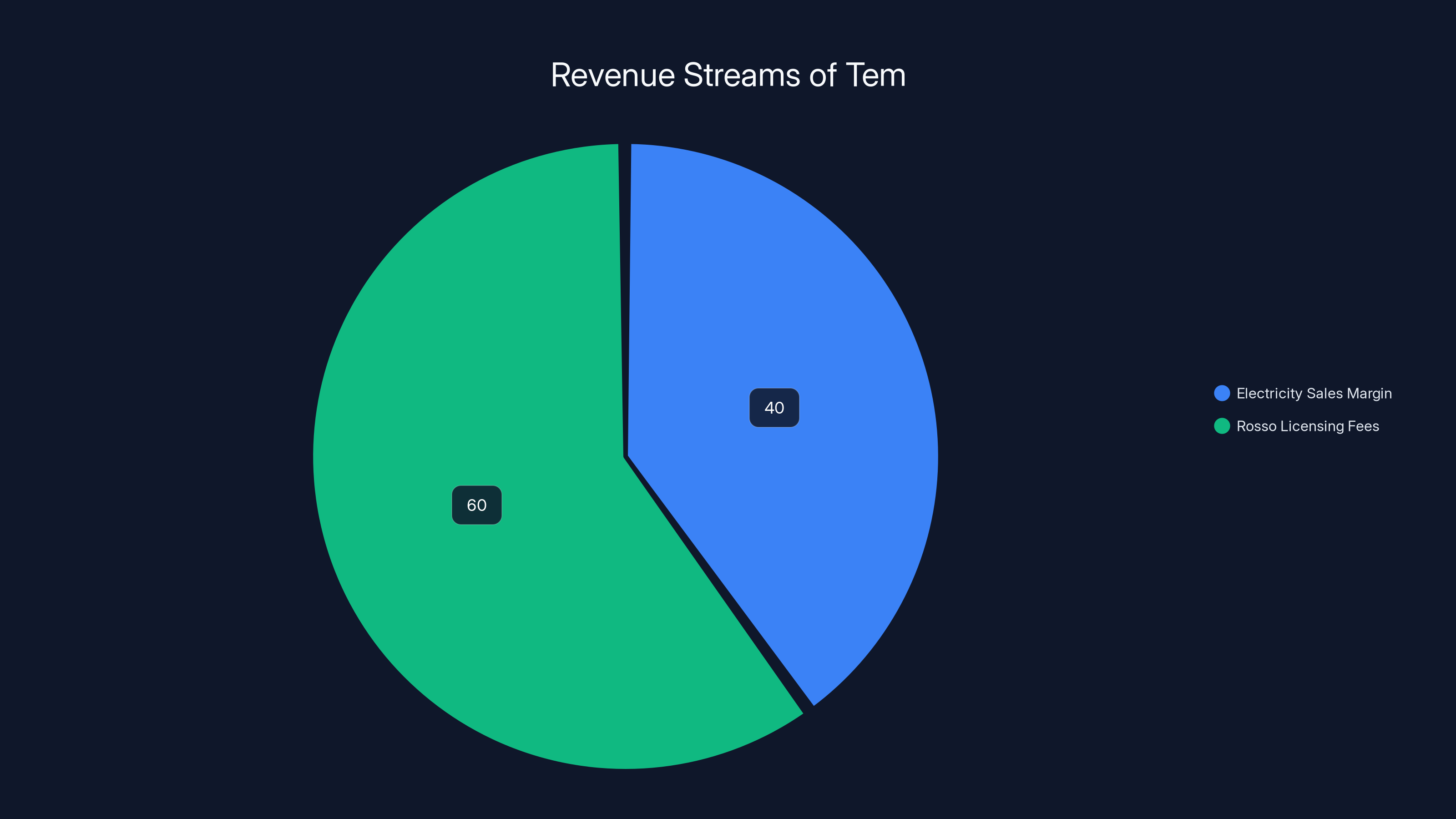

Tem's revenue is estimated to be primarily driven by licensing fees from its Rosso platform, which is more scalable and profitable than traditional electricity sales.

Why Texas Is the Beachhead

Texas energy markets are unique. Most of the U.S. operates under regulated utility monopolies. You don't get to choose your electricity provider. The state says "this company owns the grid in your area," and that's that. Utilities have incentives to keep costs low, but they also have guaranteed returns, so there's no real competitive pressure.

Texas is different. Most of Texas (except for Austin and a few other areas) is served by ERCOT, the Electric Reliability Council of Texas. ERCOT runs a deregulated energy market. Businesses can choose their power retailer. Retailers compete on price. It's the only part of the U.S. with true competitive energy retail, which means it's the only part of the U.S. where a company like Tem can actually operate.

The U.S. market is also massive. The U.K.'s total electricity consumption is about 300 TWh per year. The U.S. is about 4,000 TWh per year. If Tem can apply its model to even a fraction of that, the addressable market is enormous.

But Texas is also a beachhead for a different reason. Energy is political. The U.S. is currently in the middle of policy debates around renewable energy, grid modernization, and climate action. Different states have different rules and different incentives. Texas is conservative on climate policy but pragmatic on cost. If Tem can win on pure economics (which it can—30% savings is undeniable), it doesn't need to win a policy argument. It just needs to show up and cut costs.

Once Tem has success in Texas, expanding to California (which has high electricity prices), New York (aggressive renewable mandates), or other deregulated markets becomes easier. But Texas is the proof of concept for the U.S. market.

The Infrastructure Play: Why Rosso Matters More Than RED

Here's the thing most people get wrong about Tem. They think RED is the company. RED is the utility. RED is what customers use. That's not quite right.

RED is a vehicle. It's a way to prove that Rosso works. But RED will never be the biggest part of Tem's business. Here's why.

RED currently operates in the U.K. It has 2,600 customers. That's meaningful, but it's a tiny fraction of the U.K. energy retail market. There are millions of businesses and households. Even if RED grew to 100,000 customers, it would still be a niche player.

Rosso, on the other hand, could become the rails that the entire energy market runs on. Imagine if every energy retailer in the U.K. used Rosso's infrastructure to match buyers and sellers. Imagine if every utility company used Rosso to optimize its trading. Instead of 2,600 customers, Rosso would be touching millions of transactions.

Here's the math. Suppose the U.K. energy market handles 1 trillion pounds in transactions per year (ballpark). If Rosso captures 0.5% of transactions and takes a 0.1% fee on each, that's 500 million pounds in annual revenue. That's a multi-billion-dollar business just from fees.

Tem's CEO has been explicit about this. The long-term vision isn't for RED to be a major utility. It's for Rosso to be infrastructure. It's for other utilities, other retailers, other traders to license Rosso because it works better than their in-house systems. It's AWS, not AWS's retail cloud services.

This is also why the capital from Lightspeed matters more than the specific amount. Lightspeed invests in infrastructure companies, not in retail plays. It invested in Stripe because Stripe is infrastructure for payments. It's now investing in Tem because Tem is infrastructure for energy. The capital is going to build Rosso as a standalone product that can be licensed and integrated by others.

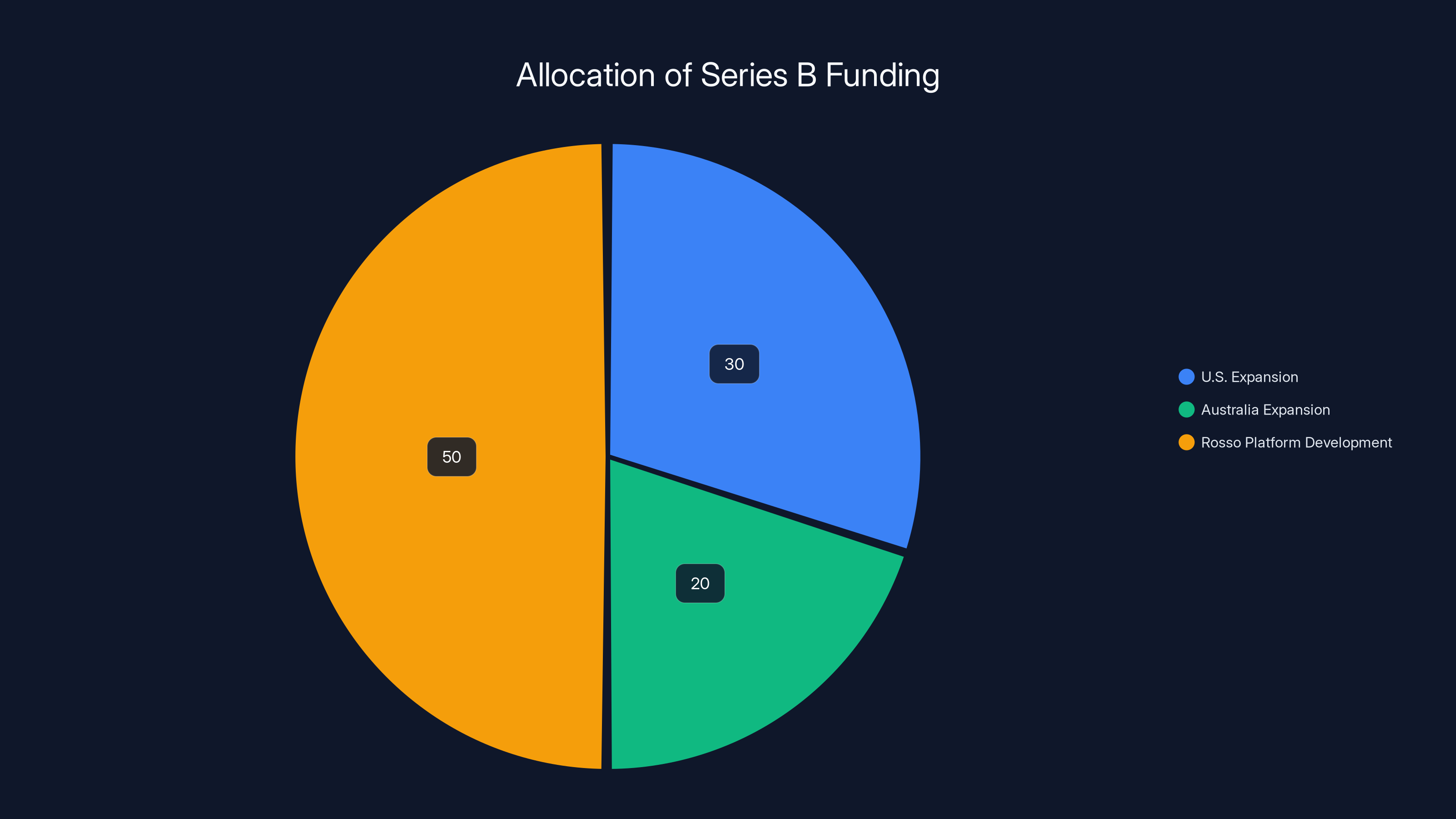

Estimated data: Majority of the $75 million funding is allocated to developing the Rosso platform (50%), followed by U.S. (30%) and Australia (20%) expansions.

The Competitive Landscape: Who Else Is Doing This?

Tem isn't the only company trying to apply AI to energy markets. But it might be the only one doing it right.

There are startups trying to optimize individual business energy consumption. There are startups building better forecasting tools. There are startups trying to automate demand response (where businesses agree to use less energy during peak times in exchange for lower rates).

But most of those are point solutions. They optimize one piece of the problem. Tem is going after the entire system. It's saying that the real value isn't in micro-optimizing consumption. It's in macro-restructuring the market.

There are also established energy trading firms. These companies have been optimizing energy trades for decades. But they use old technology. Their algorithms are from the 1990s. Their infrastructure is fragmented across dozens of systems. They're encumbered by legacy code, legacy processes, and legacy business models. Tem has none of that. It was built from scratch with modern AI and modern infrastructure.

The advantage is speed and cost. Tem's system can make trading decisions in milliseconds. Older trading firms need seconds or minutes. Tem's system can scale to millions of transactions. Older firms are constrained by human traders. Tem doesn't have humans. It has algorithms.

That advantage compounds. As Tem gets more data (more transactions, more price points, more forecasts), its models get better. As they get better, customers choose Tem more. As more customers choose Tem, it gets even more data. That's a virtuous cycle that's very hard for competitors to match.

The Regulatory Risks (And Why They Matter Less Than You'd Think)

Energy is heavily regulated. Every transaction Tem conducts happens inside a regulatory framework. In the U.K., that's OFGEM (the Office of Gas and Electricity Markets). In the U.S., it's the Federal Energy Regulatory Commission (FERC) and various state regulators. In Australia, it's the Australian Energy Market Commission.

This could be a huge problem. One regulation change and Tem's entire business could be at risk.

But there's a reason Tem isn't as worried about this as you'd expect. Tem's model is fundamentally pro-market and pro-consumer. Regulators care about three things: grid stability, consumer protection, and market efficiency. Tem delivers on all three. It stabilizes the grid (better forecasting means less need for expensive reserve capacity). It protects consumers (more transparency, lower costs, no hidden intermediaries). It improves market efficiency (prices become more efficient, less waste).

Compare that to entrenched interests. Traditional energy traders make money by keeping markets opaque. Regulators don't like that—it leads to consumer complaints and calls for investigation. Tem's approach is the opposite. Tem makes money by making markets transparent. That's something regulators want.

So while regulatory risk exists, it's not asymmetric. Most regulatory changes would actually benefit Tem. New rules requiring market transparency would help. Rules requiring utilities to demonstrate cost efficiency would benefit Tem (which enables efficiency). Rules encouraging renewable energy integration would help (Tem handles renewable integration well).

The real risk isn't regulatory change. The real risk is that Tem's model is so good that politicians decide to cap energy company profits or mandate that utilities use Tem-like systems. But that's not a risk for Tem specifically—it's actually a huge win. If regulators mandate that utilities use AI-powered optimization, Tem becomes the obvious choice.

AI applications in infrastructure can lead to significant cost reductions, with energy seeing potential savings of up to 30%. Estimated data.

How This Scales Beyond Energy

Tem's model is specific to energy, but the principles scale to other commodities. Any market that has intermediaries, inefficient pricing, and matching problems could theoretically be disrupted by AI-powered transaction engines.

Water markets could work this way. Water is like electricity—it needs to flow continuously, pricing is opaque, intermediaries take cuts. The same technology that works for electricity could work for water.

Telecom networks could be restructured this way. Instead of a carrier owning the network and selling bandwidth directly, you could have an AI-powered marketplace matching content providers with network capacity. Prices would be more efficient, everyone would benefit.

Freight and logistics could work this way. Trucks need loads. Shippers need trucks. Brokers sit in the middle taking margins. An AI system could match them in real-time, at better prices, with less friction.

Even financial markets could benefit, though they're more efficiently priced already (that's not an accident—they've had 30 years of technology optimization and trillion-dollar incentives).

The point is that Tem isn't just a company. It's proving a pattern. It's proving that AI can restructure markets that humans thought were already optimized. Once that pattern is proven, it gets replicated.

The Path to IPO (And Why Tem Might Get There)

Tem's CEO was explicit. The company wants to go public eventually. That's a long way off (probably 5-10 years), but the trajectory suggests it's plausible.

Here's why. Tem has the three things that lead to IPO: product-market fit (proven by 2,600 paying customers), path to profitability (the CEO said the company could have bootstrapped), and clear scaling opportunity (massive markets in the U.S. and Australia). Those are rare.

Tem also has institutional backing from sophisticated investors. Lightspeed is a tier-one VC firm. The fact that they led the round says the company has cleared some basic competence tests.

The valuation of

If Tem can maintain 40-50% year-over-year growth (very plausible given that it's moving from a

And when Tem goes public, it won't be as "an energy startup." It'll be as "an infrastructure company for energy markets," which will generate a very different valuation multiple.

What This Means for Energy Costs and the Future

If Tem succeeds—and the evidence suggests it will—it changes energy economics. It doesn't change physics. The sun won't shine brighter, the wind won't blow harder. But the financial flows around energy become vastly more efficient.

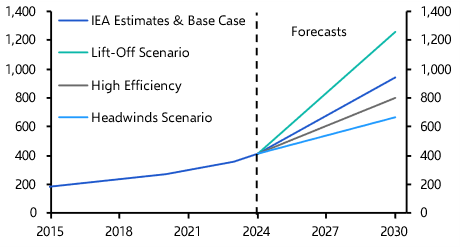

Businesses pay less for electricity. That money flows back to generators (who get paid more directly, without intermediary markups). The grid operates more efficiently (better demand forecasting means less need for expensive reserve capacity). Renewable energy becomes more economical (better matching between variable supply and flexible demand).

Over a decade, a 30% cost reduction in energy markets ripples through the entire economy. Manufacturing becomes more competitive. Data centers become cheaper to run. Heating and cooling buildings costs less. Chemical production improves margins. Agricultural processing becomes more efficient.

Those ripples compound. Companies that save $1 million per year in energy costs reinvest that money. They hire people. They expand. They fund new projects. That's not just moving money around. That's unlocking economic activity that was previously constrained by energy costs.

The other ripple is renewable energy. Right now, renewable energy can be cheaper than fossil fuels from a generation cost perspective, but integration costs are high. You can't store solar at scale. You can't predict wind. The costs of managing that variability are substantial. But AI-powered matching solves that. If you can optimally match variable renewable supply with flexible consumption, renewable energy becomes vastly more competitive. You're not paying for battery storage or grid upgrades. You're just paying for better software.

That's why companies like Lightspeed invest in Tem. They're not betting on Tem's revenue. They're betting on Tem unlocking a massive amount of economic value in energy markets, and capturing a meaningful slice of that.

The Technology Behind the AI: What's Actually Running

Tem is built on machine learning and large language models, but it's not just throwing generic AI at the problem. The specific architecture matters.

Price prediction requires time series forecasting. That means models that can look at historical price data, identify patterns, weight recent data more heavily than old data, and make probabilistic forecasts. Tem likely uses LSTM networks or transformer models trained on years of U.K. energy price data. These models don't just predict "the price will be higher tomorrow." They predict probability distributions. "The price has an 80% chance of being between

Demand forecasting requires different models. You need to predict how much electricity businesses will consume based on weather, time of day, day of week, and external events. These are typically handled by gradient boosting models (like XGBoost or LightGBM) trained on consumption data. The advantage of these models is they can handle nonlinear relationships and interactions (e.g., "on Mondays after it rains, consumption is usually X% higher").

Contract optimization requires natural language processing and entity extraction. Reading an energy contract, understanding the terms, identifying hidden financial incentives—that's NLP work. Large language models are good at this, but Tem probably didn't just use ChatGPT. They likely fine-tuned models on energy contracts specifically. Generic LLMs know what contracts are, but Tem's model knows what energy contracts are, which is more useful.

Matching and routing requires optimization algorithms. Given supply and demand, find the set of transactions that maximizes efficiency or profit while respecting constraints (grid capacity, contract terms, regulatory rules). This is usually handled by integer linear programming or constraint satisfaction algorithms. It's not glamorous AI, but it's essential infrastructure.

The entire system runs on modern cloud infrastructure (likely AWS or Google Cloud). Tem needs to handle millions of transactions per day, so it's probably using Kubernetes for container orchestration, Apache Kafka or similar for event streaming, and a mix of SQL and NoSQL databases depending on specific use cases.

This is not "just an LLM." It's a full-stack system architecture where AI components are integrated into a larger whole. That's harder to build than just training a big model, but it's also harder to compete with once it exists.

Investment Thesis: Why This Round Was Oversubscribed

When a funding round is oversubscribed, it means demand exceeded supply. More investors wanted in than Tem had available shares. That happens for specific reasons, and understanding them is important.

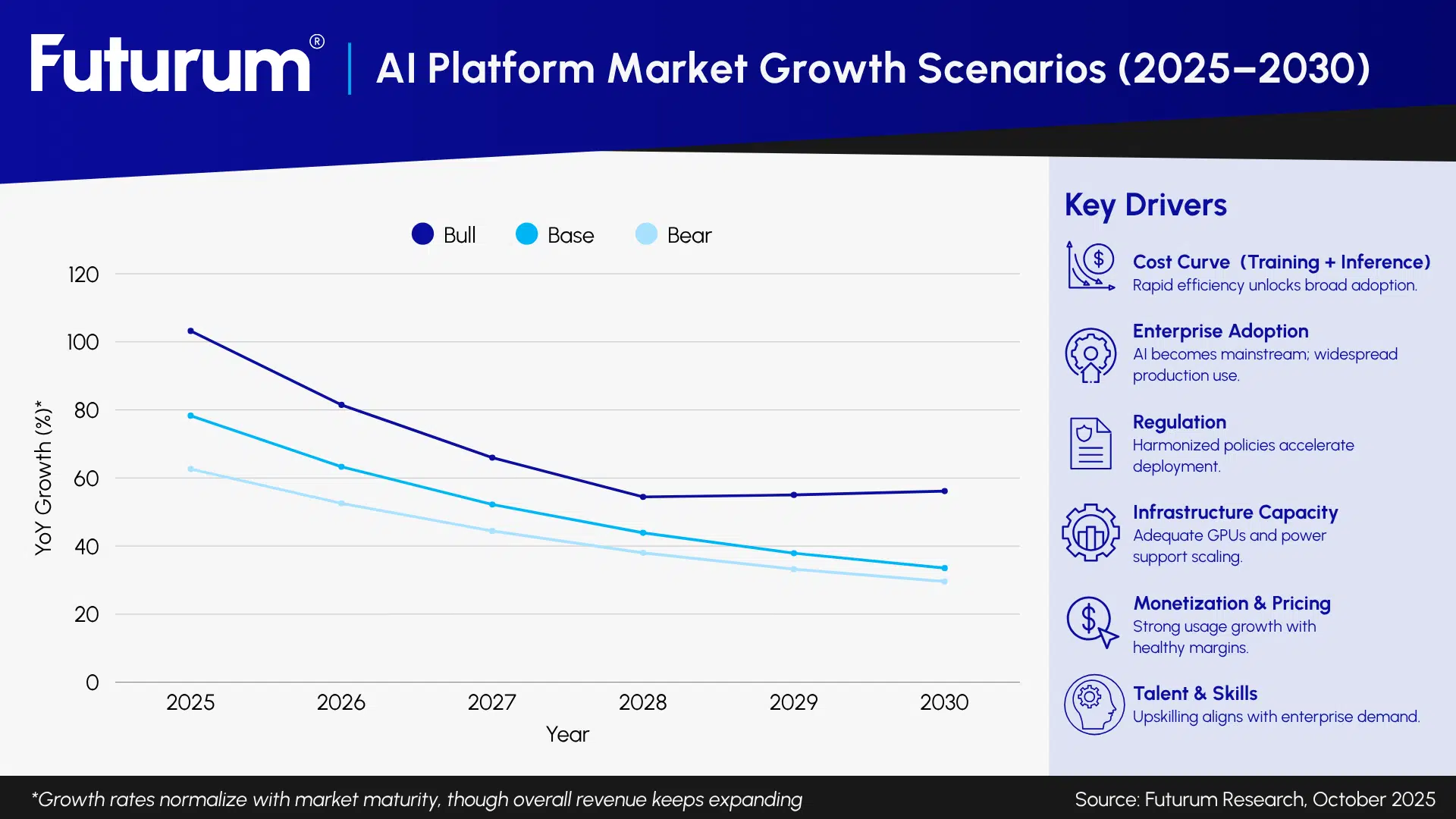

First, market timing. Energy prices are at historic highs in most developed markets. The U.K. has experienced severe energy crises. Australia faces similar issues. U.S. energy costs are rising. Investors see companies demanding solutions and budgets available to buy them. That's tailwind.

Second, technology validation. Five years ago, large language models weren't good enough for specific domain applications. They were fun research projects. Now they're proven. Investors see generative AI as proven technology, not hype. Tem isn't asking them to bet on unproven AI—it's asking them to bet on AI solving a real problem in a domain where it clearly works. That's different.

Third, customer economics. Tem has 2,600 paying customers. That's real revenue. The company is probably at or near profitability. Investors in early-stage companies usually accept losses, but they don't like companies that are unprofitable by choice. Tem is profitable because its unit economics work. That's rare and valuable.

Fourth, regulatory moat. Once Tem becomes the standard infrastructure for energy market transactions, it's very hard to dislodge. Regulators don't like changing critical infrastructure (the switching costs are too high). Competitors can't easily copy (data advantages compound). This creates a durable competitive advantage. Investors love that.

Fifth, scale potential. The U.K. market is proven. The U.S. and Australia markets are 10-50x larger. That's not just more revenue. That's a path to building a company worth tens of billions of dollars. That's the kind of return investors in venture capital seek.

Combine these factors and oversubscription makes sense. Investors see a company with product-market fit, proven technology, real economics, clear scaling opportunities, and potential regulatory moats. They want in.

Risks and Wildcards: What Could Go Wrong

Tem's situation is good, but it's not risk-free. Several things could go wrong.

Regulatory rejection. If regulators in the U.S. or Australia decide that Tem's model isn't allowed, the expansion fails. This is low probability but high impact. Most likely scenario: specific regulations designed to prevent what Tem does. Less likely scenario: outright prohibition. Tem's model is too pro-consumer and pro-efficiency for most regulators to ban it, but stranger things have happened.

Competition from incumbents. Existing energy companies have deep pockets. If Tem proves the model works, they could build copycat systems. They'd have advantages (existing customer base, brand trust, regulatory relationships) and disadvantages (legacy technology, slow decision-making, existing business model they don't want to cannibalize). Tem could win or lose this. It depends on execution speed.

Technology moats eroding. Tem's advantage today is that it has better AI. But AI is moving fast. In two years, the AI techniques Tem uses might not be proprietary anymore. They might be commoditized. In that case, Tem's advantage shifts from technology to scale (more data = better models). That's still an advantage, but it's less defensible. The risk is that AI advances make Tem's specific technical advantages obsolete faster than expected.

Market consolidation. Major utilities and energy companies have been consolidating. If the U.K. energy market consolidates around 3-4 major players, those players could refuse to adopt Rosso and instead build in-house versions. Tem would be locked out. This is especially a risk in the U.S., where energy companies are already massive.

Renewable energy oversupply. If renewable energy becomes so cheap and abundant that prices collapse, Tem's value prop changes. Matching becomes less critical if energy is essentially free. This is a "good problem to have" (cheap energy is good for society), but it could hurt Tem's business. Real probability: low in the next 5 years, moderate probability in 10+ years.

Economic recession. If business energy consumption crashes during a recession, Tem's revenue drops. Energy markets are cyclical. That's not specific to Tem, but it's a risk. Real risk: moderate. Recession is eventually inevitable, and Tem's business would suffer.

These risks are real, but none are existential on their own. Tem is building a business in a massive market with real economics. The downside is to become a profitable mid-size company. The upside is to become a multi-billion-dollar infrastructure company. That's an asymmetric bet. Most investors would take it.

The Broader Implication: AI Eating Infrastructure

Tem is one example of a larger pattern: AI companies targeting infrastructure markets. The pattern looks like this:

Identify an infrastructure market that's either (1) hasn't modernized in 20+ years or (2) has modular problems that AI can solve better than legacy systems. Apply AI to that specific problem. Suddenly, you've got 30% cost reductions or 5x efficiency improvements. Deploy to scale. Become infrastructure.

Pay less attention to companies trying to replace human decision-makers entirely. Pay more attention to companies that automate specific, well-defined subproblems within larger systems.

Tem is automating the matching and pricing subproblems in energy markets. It's not replacing humans entirely. It's removing the need for humans to do pricing and matching, which frees up the system to be vastly more efficient.

We'll see this pattern repeated. In supply chains, in logistics, in manufacturing scheduling, in legal contract review, in financial trading. Everywhere you have legacy systems making decisions based on incomplete information and human limitations, AI can step in and do better.

Tem is just first.

FAQ

What is a transaction engine in energy markets?

A transaction engine is a software system that automates the process of matching electricity buyers with sellers and executing transactions. Tem's Rosso platform uses machine learning and large language models to predict prices, forecast supply and demand, optimize contracts, and match counterparties automatically. Instead of energy companies relying on human traders and brokers to negotiate transactions, the transaction engine handles it all with AI, reducing costs and complexity.

How does Tem make money if it offers 30% discounts?

Tem makes money through two mechanisms. First, its utility company RED generates margin on every kilowatt-hour of electricity it sells to customers (margin is lower than traditional suppliers, but volume makes up for it). Second, Tem plans to license Rosso to other utilities and energy companies as infrastructure, charging transaction fees (likely 0.1-0.5% per transaction). The second model is more scalable and profitable, which is why Tem positions itself as infrastructure-first, not retail-first.

Why does AI specifically help with electricity trading?

AI helps because electricity trading involves predicting prices and matching buyers and sellers in near real-time based on dozens of variables (weather, time of day, consumption patterns, renewable generation, grid conditions). Humans can't process all these variables simultaneously. AI models can predict prices better than humans, forecast renewable supply accurately, optimize complex contracts, and execute transactions instantly. The result is more efficient pricing and lower costs for everyone.

Is Tem's model sustainable, or is it just arbitraging inefficiency?

Tem's model is sustainable because it addresses fundamental inefficiencies in energy markets, not temporary arbitrage opportunities. The inefficiencies come from legacy infrastructure (systems built 20-40 years ago), information asymmetries (traders don't have perfect information), and agency problems (intermediaries taking cuts without adding value). As long as energy markets have these structural problems, AI-powered solutions that solve them will create value. Tem is valuable even if other companies eventually compete—it's still better than the status quo.

What happens to traditional energy traders if Tem succeeds?

Traditional energy traders will face pressure to modernize or consolidate. Some will adopt AI to stay competitive. Some will acquire companies like Tem. Some will go out of business. This is not specific to energy—it's what happens whenever a new technology makes an old business model obsolete. The human energy traders won't all lose their jobs immediately; they'll transition to higher-level strategy and relationship work. But the volume of energy traded by humans will decrease over time, which means fewer traders overall.

Can Tem's model work in regulated electricity markets (not deregulated like Texas)?

Not initially. Tem's model requires competitive retail energy markets where businesses can choose suppliers. In regulated markets with utility monopolies, there's no choice. However, this is changing. More states and countries are deregulating energy retail (opening it to competition). As they do, Tem can expand. In the long term, if Tem proves its value, regulators might create special exceptions or deregulate specific market segments to allow companies like Tem to operate. Regulatory change usually follows technological proof of concept.

What's the difference between Tem's Rosso and Stripe or AWS?

All three are infrastructure plays, but they operate in different markets. Stripe builds payments infrastructure (handles transactions, settlements, compliance). AWS builds cloud computing infrastructure (handles computing, storage, networking). Rosso builds energy transaction infrastructure (handles matching, pricing, settlement for electricity). The business model is similar: charge transaction fees or usage fees, scale globally, build data advantages over time. The difference is market size and starting advantage. AWS started when cloud was being invented. Stripe started when payments were becoming digital. Rosso is starting when energy markets are being digitized.

How will Tem expand to the U.S. if energy markets are fragmented by state?

Tem will start in deregulated wholesale and retail markets (ERCOT in Texas, parts of the Midwest, parts of the Northeast). These are the markets where retail competition exists. It will build relationships with utilities and energy retailers in these regions, license Rosso to them, and grow that way. As more states deregulate, Tem expands. The U.S. regulatory landscape is messy, but there's enough deregulation already (and more coming) that Tem has a clear path to scale without needing to change national policy.

Could big tech companies (Google, Amazon, Microsoft) build something like Tem?

Technically, yes. They have the AI expertise. The difference is motivation and focus. These companies care about their core businesses (Google: search and ads, Amazon: retail and cloud, Microsoft: software and cloud). They're not motivated to dominate energy trading infrastructure. If they did try, they'd probably acquire Tem rather than build from scratch (faster, captures customers, acquires team). Tem's advantage isn't secret technology that nobody else could build. It's focus, timing, and the data advantage of being first. By the time a big tech company would decide this is worth doing, Tem would already be too entrenched.

Final Thoughts: The Bet on Infrastructure

Tem's $75 million Series B isn't just capital for expansion. It's validation that AI-powered infrastructure for unglamorous but essential systems is the next big thing. It's not flashy. You don't see it in consumer products. But it affects everything.

Energy is the ultimate infrastructure. Everything depends on it. Electricity prices affect manufacturing costs, which affect consumer prices. They affect competitiveness for businesses. They affect national economic growth. Any company that can cut energy costs by 30% while keeping the same quality isn't just saving money—it's unlocking economic activity that was previously impossible.

Tem isn't the last company to apply this pattern. As AI matures, you'll see the same model applied to water markets, transportation logistics, supply chain optimization, and dozens of other unglamorous but essential infrastructure systems. The winners in the next decade won't be companies that replace humans with AI. They'll be companies that use AI to restructure legacy infrastructure that's been broken for 20+ years.

Tem is one of the first. Watch it.

Key Takeaways

- Tem's $75M Series B validates AI-powered restructuring of legacy infrastructure markets that haven't been modernized in 20+ years

- The company delivers 25-30% cost reductions by using machine learning to eliminate 5-6 intermediaries in traditional energy supply chains

- Tem operates a two-business model: RED (neo-utility proving the concept) and Rosso (infrastructure engine for other utilities to license)

- The addressable market is massive: U.K. is 800B, and deregulated retail markets are expanding in both regions

- Long-term value is in Rosso becoming infrastructure (like AWS or Stripe) rather than RED remaining a boutique retailer

Related Articles

- Resolve AI's $125M Series A: The SRE Automation Race Heats Up [2025]

- AI Data Centers Drive Historic Gas Power Surge [2025]

- Data Centers & The Natural Gas Boom: AI's Hidden Energy Crisis [2025]

- Redwood Materials $425M Series E: Google's Bet on AI Energy Storage [2025]

- The Hidden Terawatt: Why 1TW of Geothermal Power Is Being Ignored [2025]

- Type One Energy Raises $87M: Inside the Stellarator Revolution [2025]

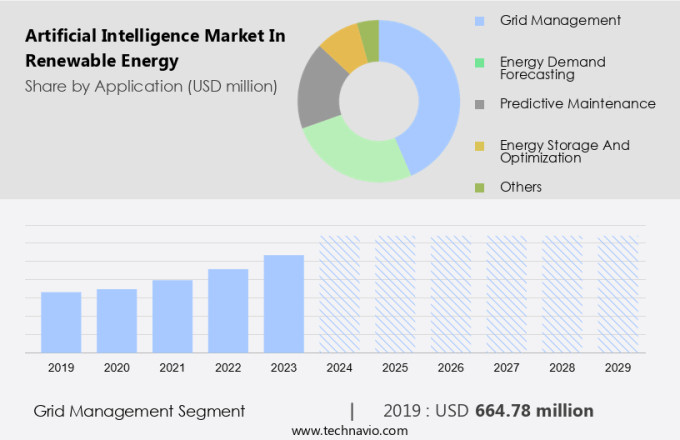

![How Tem Is Remaking Electricity Markets With AI [2025]](https://tryrunable.com/blog/how-tem-is-remaking-electricity-markets-with-ai-2025/image-1-1770695046049.jpg)